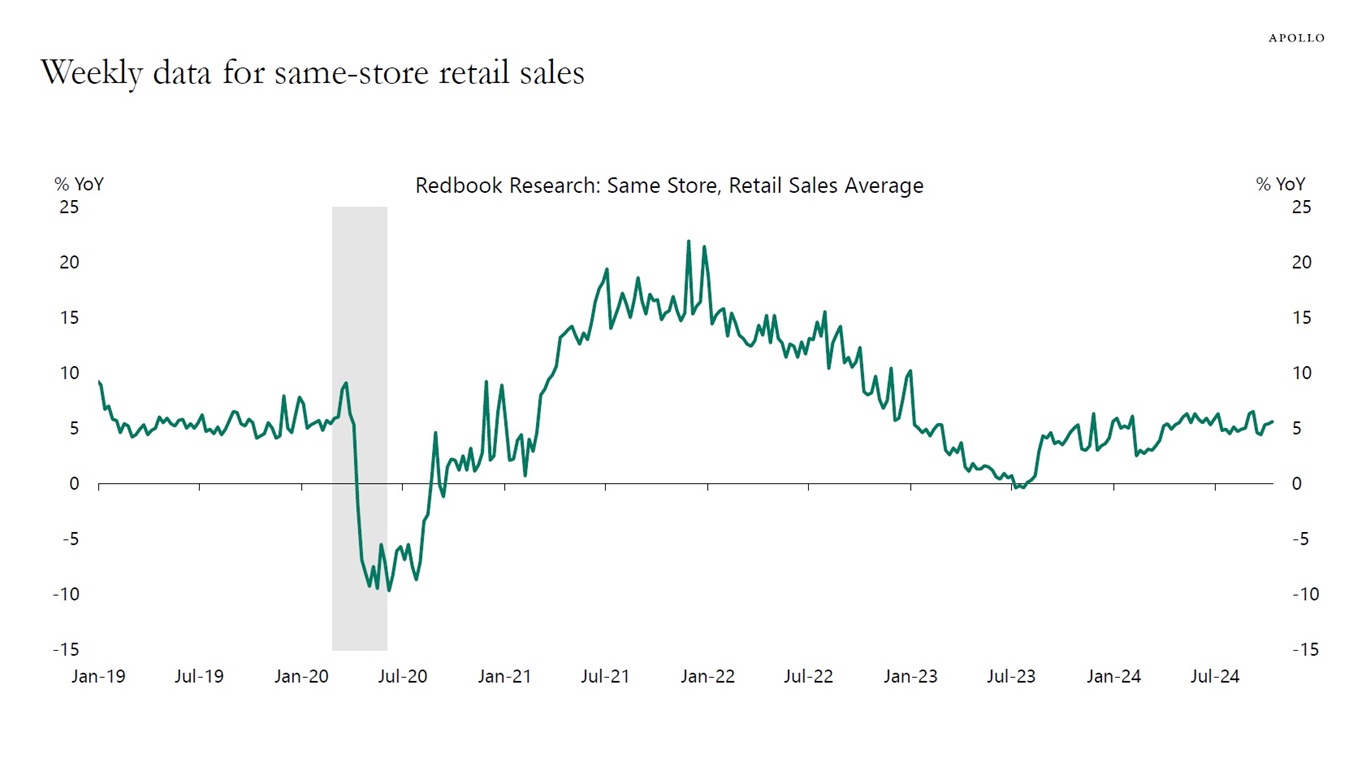

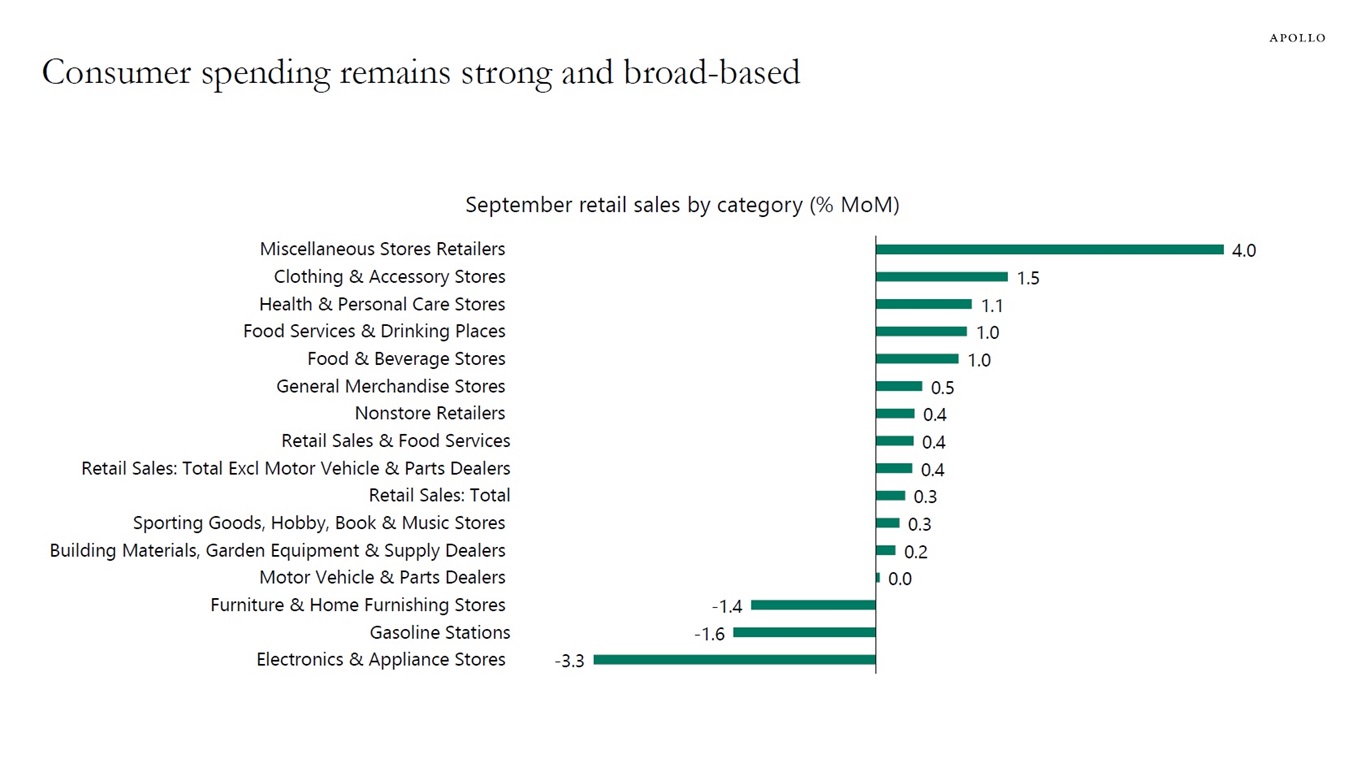

This week we got data for retail sales for September and the first two weeks of October, and it shows that the US consumer continues to do well, driven by solid job growth, strong wage growth, and high stock prices and home prices, see the first two charts below.

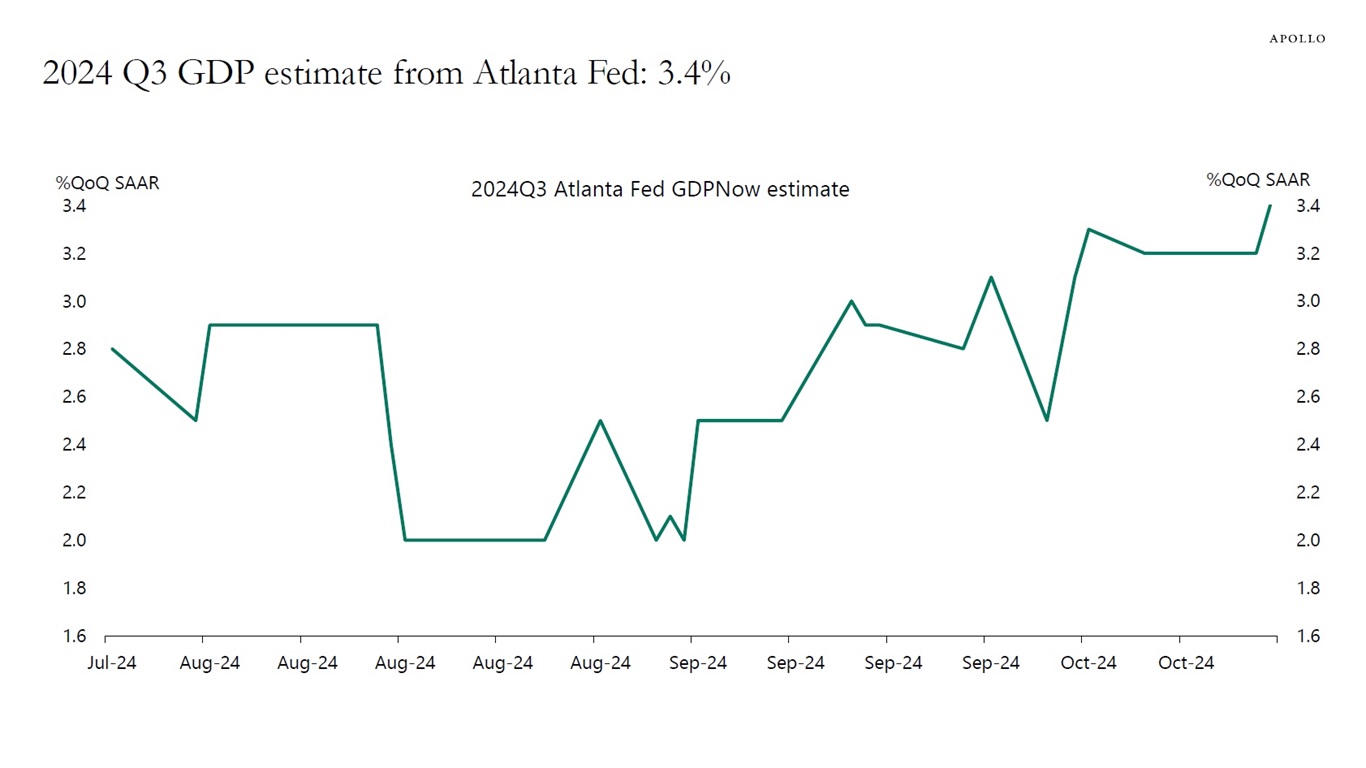

With the Atlanta Fed GDP estimate for the third quarter currently at 3.4%, the bottom line is that the expansion continues, see the third chart.

Why is the incoming data so strong? Because the list of tailwinds to the economy keeps growing:

1) A dovish Fed

2) High stock prices, high home prices, and tight credit spreads

3) Public and private financing markets are wide open

4) Continued support to growth from the CHIPS Act, the IRA, the Infrastructure Act, and defense spending

5) Low debt-servicing costs for consumers with locked-in low interest rates

6) Low debt-servicing costs for firms with locked-in low interest rates

7) Geopolitical risks easing

8) US election uncertainty will soon be behind us

9) Continued strong spending on AI, data centers, and energy transition

10) Signs of a rebound in construction order books after the September Fed cut

These 10 tailwinds are increasing the likelihood that the Fed will have to reverse course at its November meeting.

In short, the no landing continues.

See our chart book with daily and weekly indicators for the US economy.