The US economy has been the envy of the world for decades—the biggest economy in the world with strong economic performance and open access for the rest of the world to consumers, investments, and capital markets.

The US is also the freest trading market in the world (2nd freest considering just financial friction/1st considering financial and non-financial barriers), and the administration is not wrong to want to adjust the terms of trade to position the US fairly and to insist on a level playing field for US consumers.

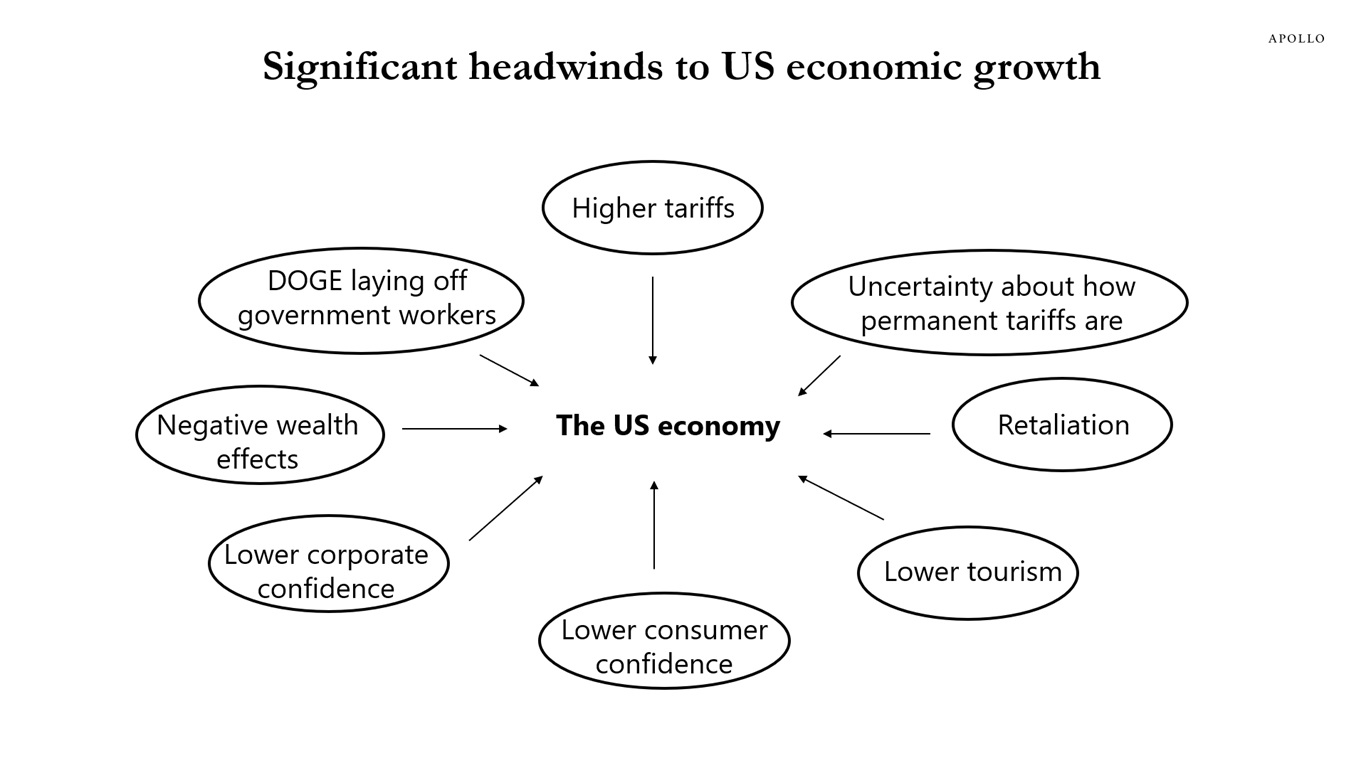

However, tariffs have been implemented in a way that has not been effective, and there is now a 90% chance of what can be called a Voluntary Trade Reset Recession (“VTRR”), see the first chart below.

The administration inherited an economy with strong growth, 4% unemployment, positive hiring, and a substantial tailwind from investments. US and international investors are building infrastructure, next-generation factories, and data centers. The Inflation Reduction Act increased capex, and the US was poised for a substantial increase due to energy supply additions, increased defense production, and deregulation.

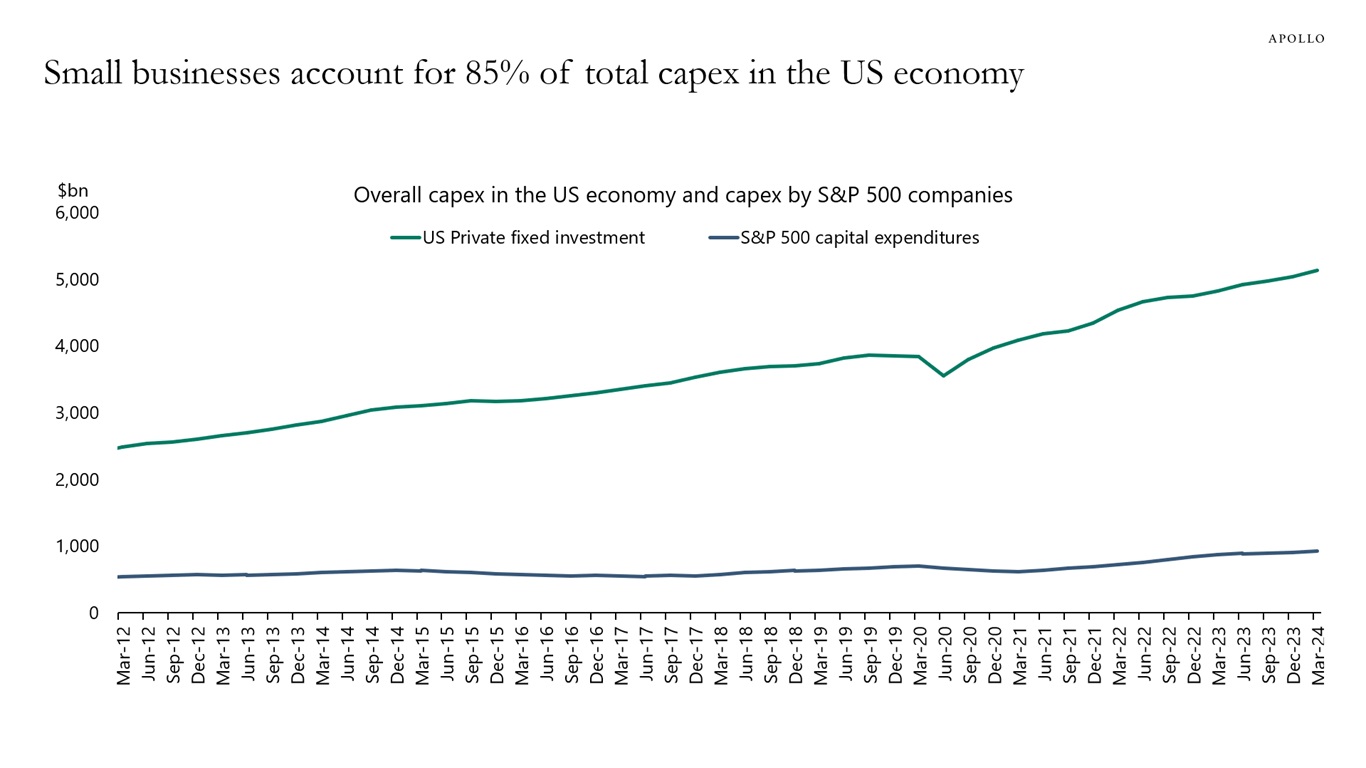

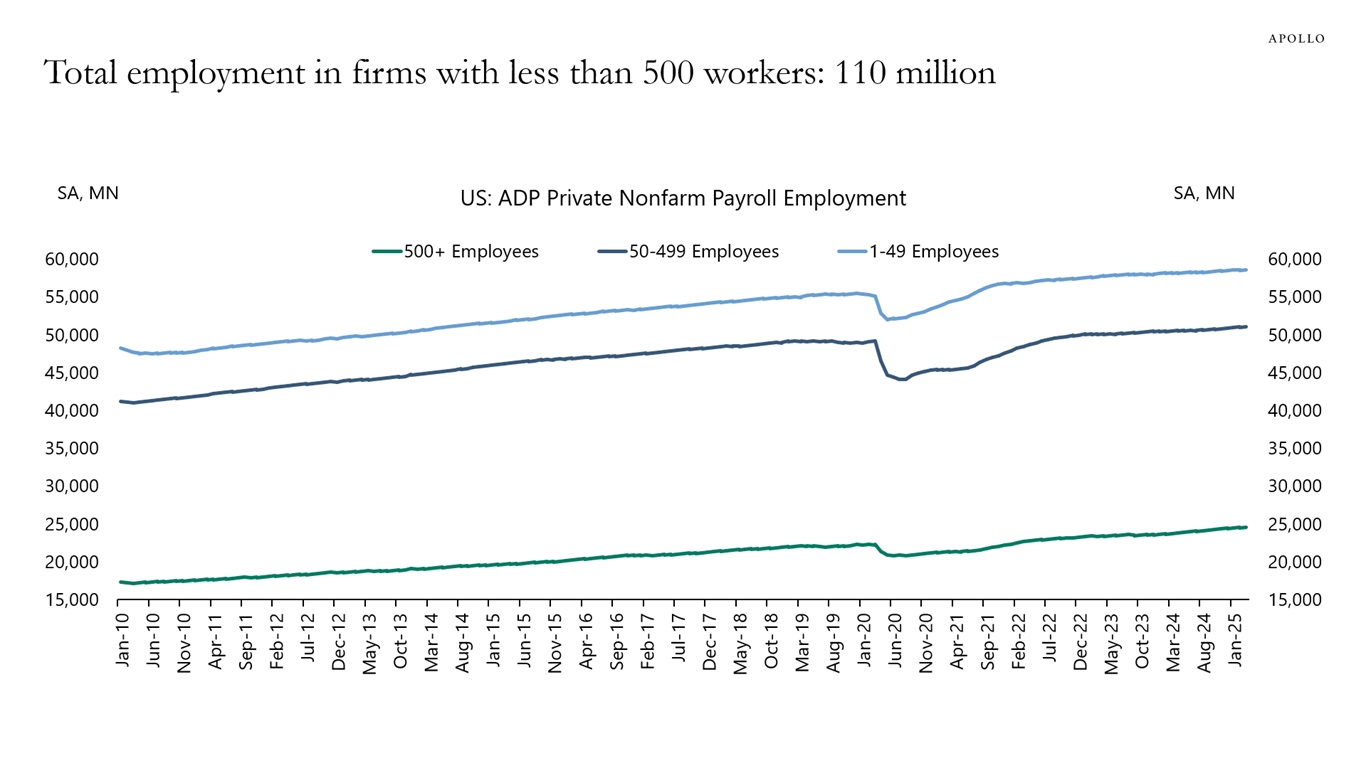

But implementing extremely high tariffs overnight hurts many businesses; particularly small businesses because the tariff must be paid by the business when the imported goods arrive in the US. Small businesses that have for decades relied on a stable US system will have to adjust immediately and do not have the working capital to pay tariffs. Expect ships to sit offshore, orders to be canceled, and well-run generational retailers to file for bankruptcy.

To make exceptions for large businesses that have the flexibility and resources to handle unforeseen expenses but not small businesses does not make sense. The challenges for small- and medium-sized enterprises are now a macro problem for the US economy, where small businesses account for more than 80% of US employment and capex, see the second and third chart below.

One way to quantify the coming negative impact on GDP is to compare the current tariff increase with the tariff increase observed during the trade war in 2018. During the 2018 trade war with China, the US average tariff rate increased from 2% to 3%, and studies show (here and here) that the impact on GDP was between 0.25% and 0.7%. Using the smallest of these estimates for the current tariff increase from 3% to 18% shows that the negative impact on GDP in 2025 could be almost 4 percentage points, not including additional non-linear effects because of the current increase in uncertainty for consumer spending decisions and business planning.

What can be done to avoid a recession? It is not too late to modify the course. For Mexico and Canada, there is a unique opportunity for the US to move first and get an agreement where labor, capital, and natural resources can be efficiently used in the North American economy. For any country that reduces tariffs to zero, the 10% tariff could stay in place, giving 180 days to negotiate non-tariff barriers, at which time, if agreed, the 10% is removed. For China, one approach could be to keep tariffs in place on autos, solar, and other strategic product groups. For all other products from China, tariffs can be gradually phased in over a period of, say, 18 or 24 months.

The bottom line: If the current level of tariffs continues, a sharp slowdown in the US economy is coming.