This week, jobless claims declined, GDP was revised higher, and personal income was higher than consensus expected. Our daily and weekly indicators continue to show no signs of a slowdown, see our chart book.

Or, from a markets perspective, if the economy is about to enter a recession and the unemployment rate is about to go up, why is Walmart’s stock price trading at an all-time high?

With this backdrop, let’s quantify what Fed cuts will do to the economy.

The Fed is saying that monetary policy is restrictive and the Fed funds rate needs to normalize and come down to r-star, which they estimate to be around 3%.

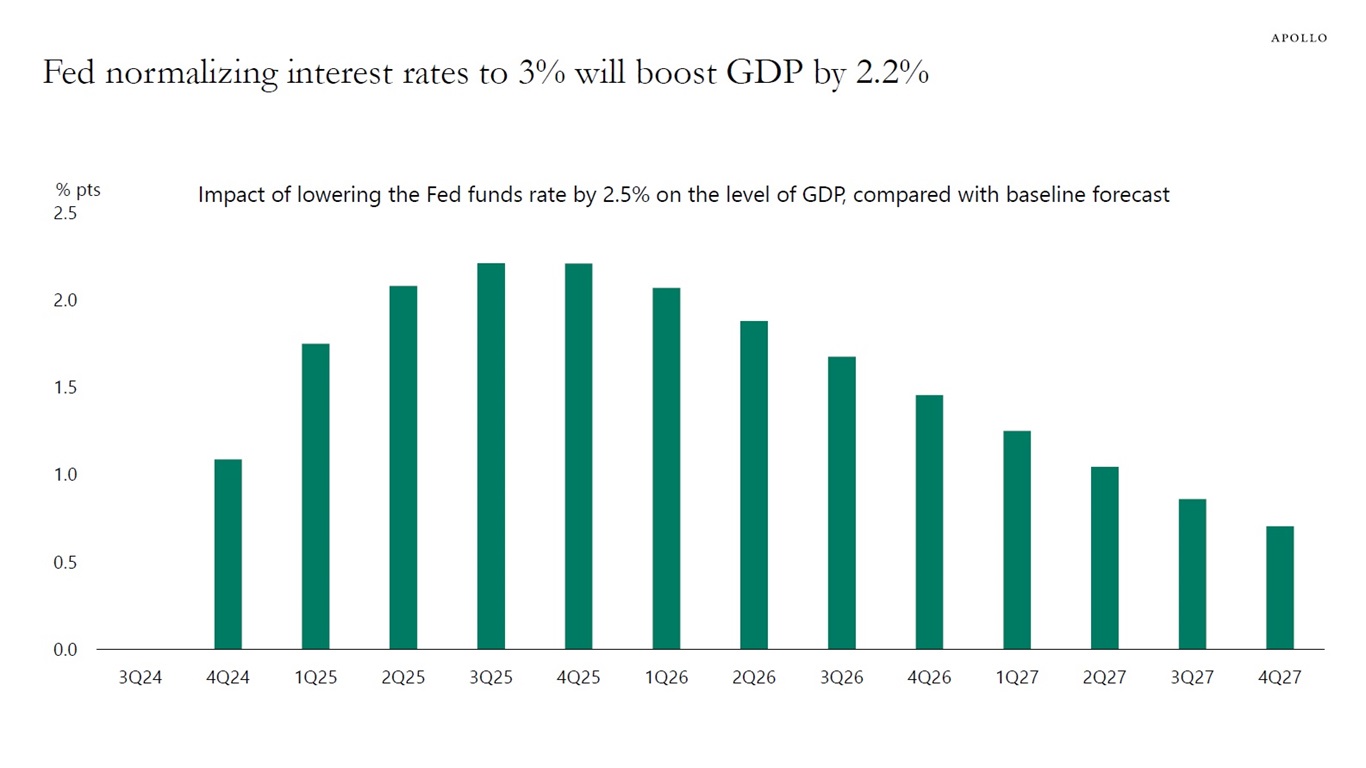

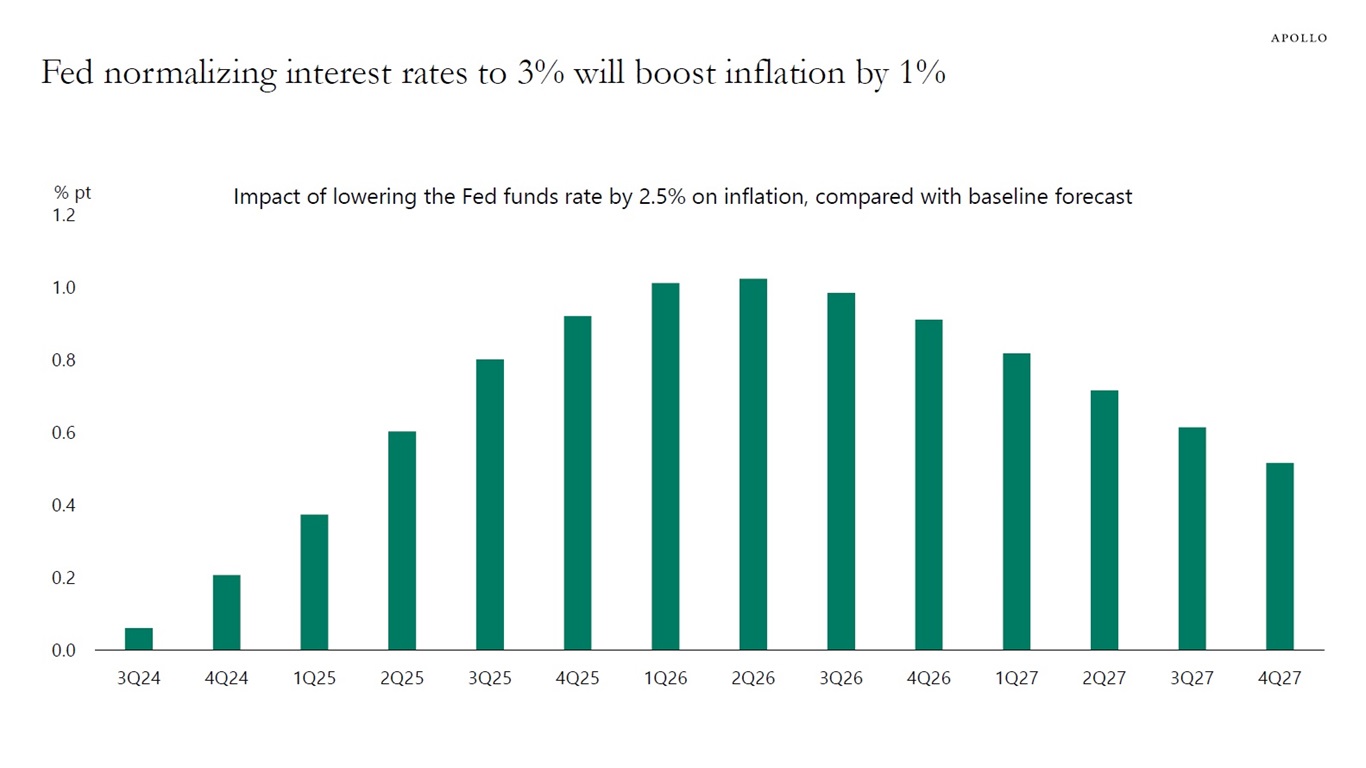

We ran a simulation on a simplified version of the Fed’s model for the US economy, FRBUS, to quantify what the normalization of interest rates means for GDP and inflation.

Assuming a 100bps cut to the Fed funds rate this year and an additional 150bps in forward guidance about more cuts coming will boost GDP by 2% and inflation by 1%, see simulations below.

In short, the current excitement about a dramatic amount of rate cuts is ignoring the significant positive effects these cuts will have on the stock market, credit spreads, consumer spending, capex spending, corporate earnings, and inflation.

Combined with a continued strong tailwind to the economy from fiscal policy and massive investments in AI, the risks are rising that Fed cuts are going to boost stock prices and tighten credit spreads and trigger a reacceleration in GDP and inflation, see again simulations below.

The bottom line is that the r-star framework is missing what “normalizing interest rates” means for the economy, and this is particularly problematic when the Fed funds rate is significantly higher than the model-calculated terminal policy rate.