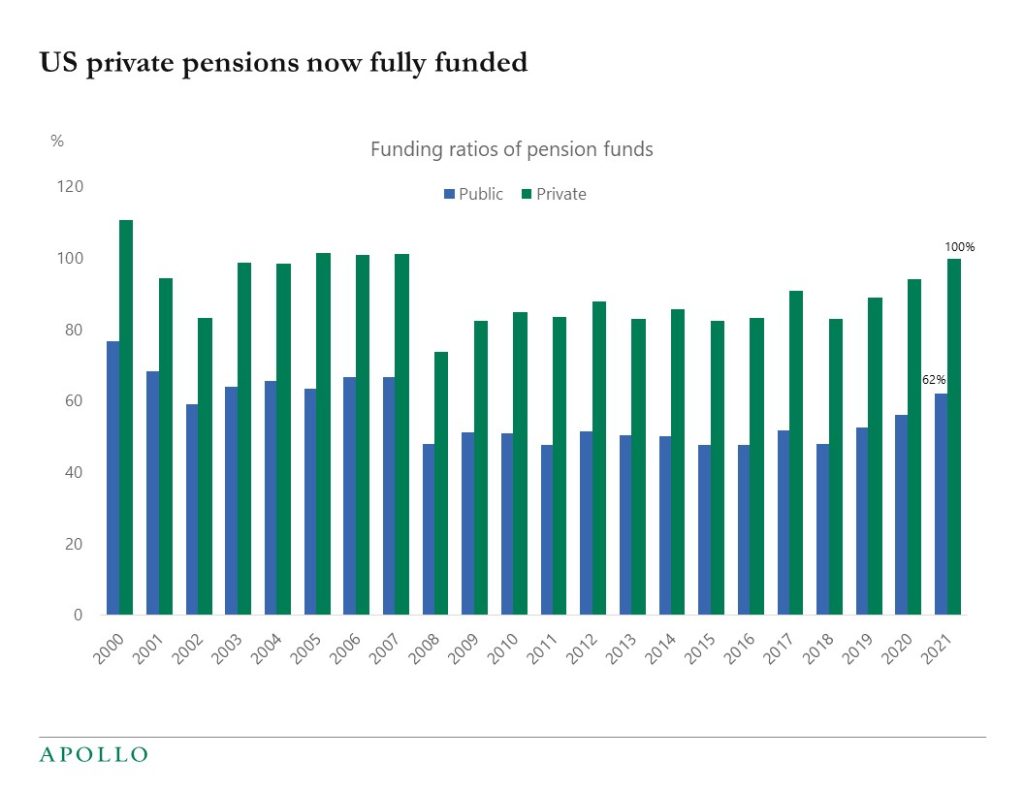

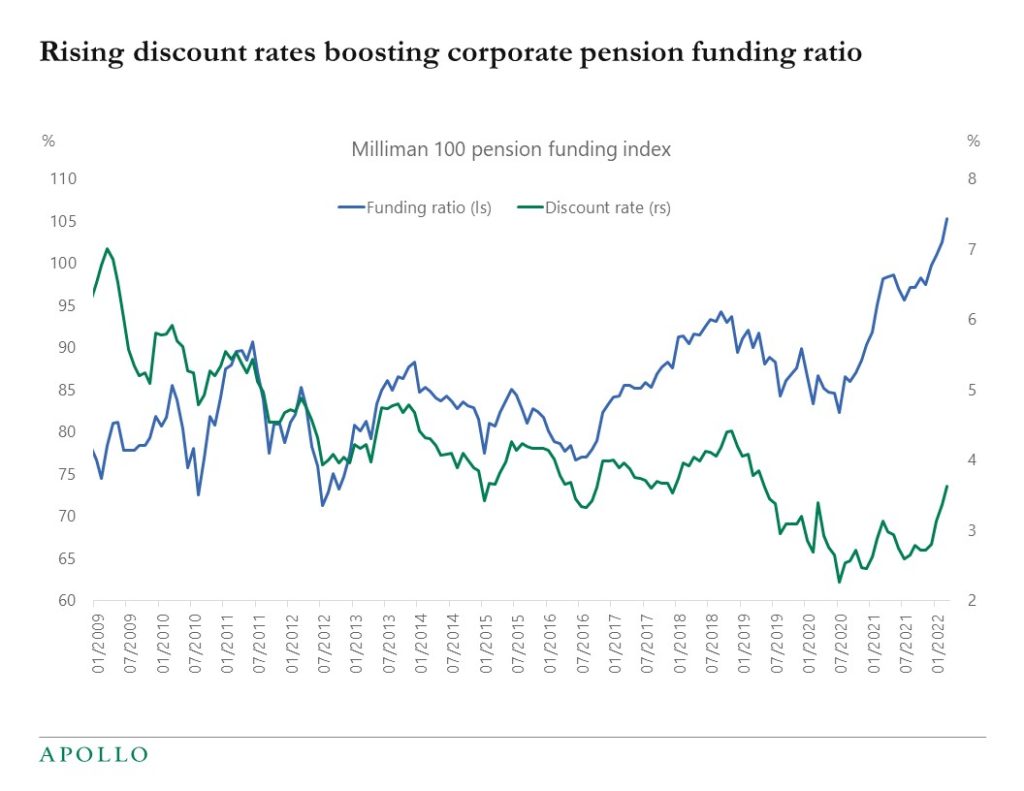

Rising stock prices and rising discount rates have increased the funding ratio of private and public pension funds, see charts below.

For the first time in 15 years, private pension funds have assets and expected cash flows matching future liabilities.

With the funding ratio reaching 100%, pension funds are de-risking and locking in gains in stock prices and buying rates and also high-grade credit to lock in yields.

The bottom line is that rising funding rates are creating significant demand for fixed income as yields move higher.

A different way to look at it is that as the Fed stops doing QE, another buyer, namely pensions, is stepping in to buy fixed income.

And such significant structural buying makes it harder for the Fed to achieve the desired tightening in financial conditions.