Want it delivered daily to your inbox?

-

The financial system is changing, and our chart book shows that:

1) Public and private markets are converging,

2) Public markets can be safe and risky, and private markets can be safe and risky, and

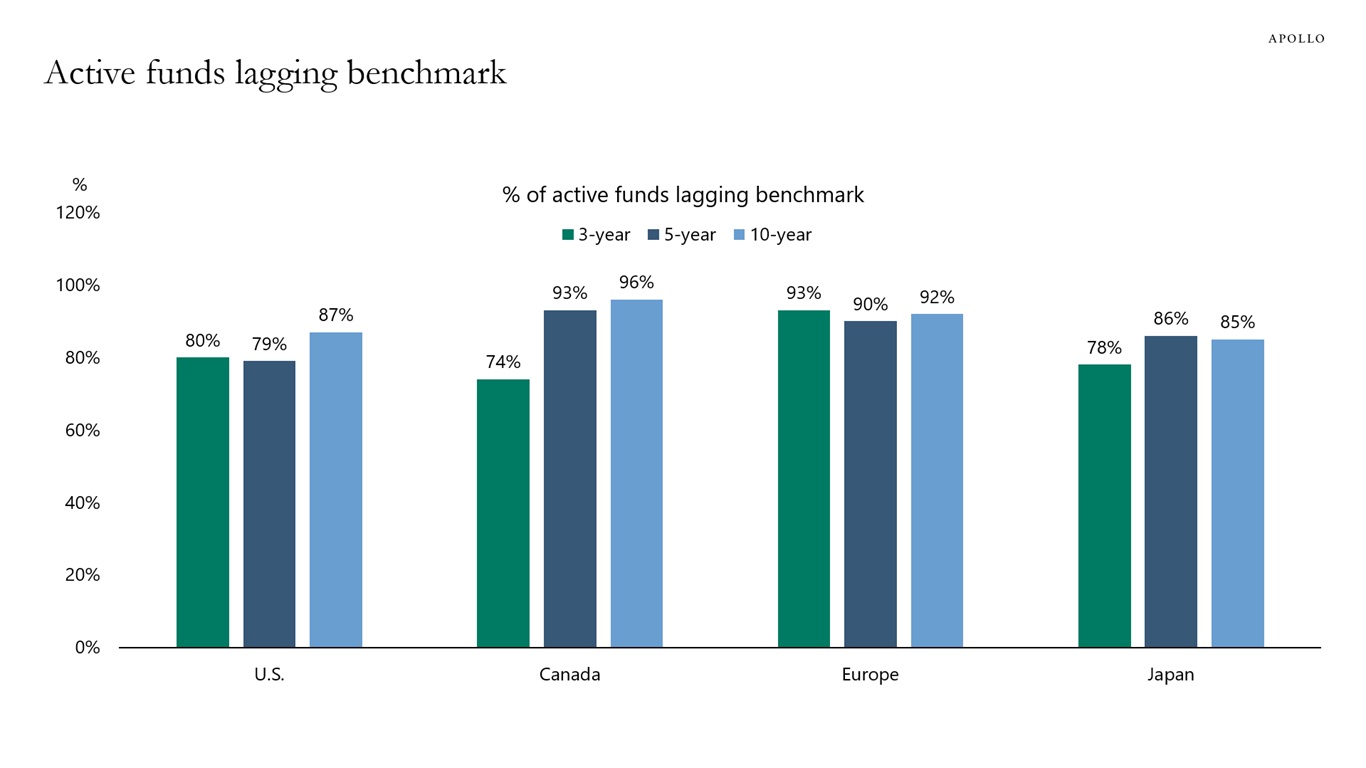

3) Roughly 90% of active managers of public equity and public fixed income underperform their benchmark indexes.

Source: Apollo Chief Economist

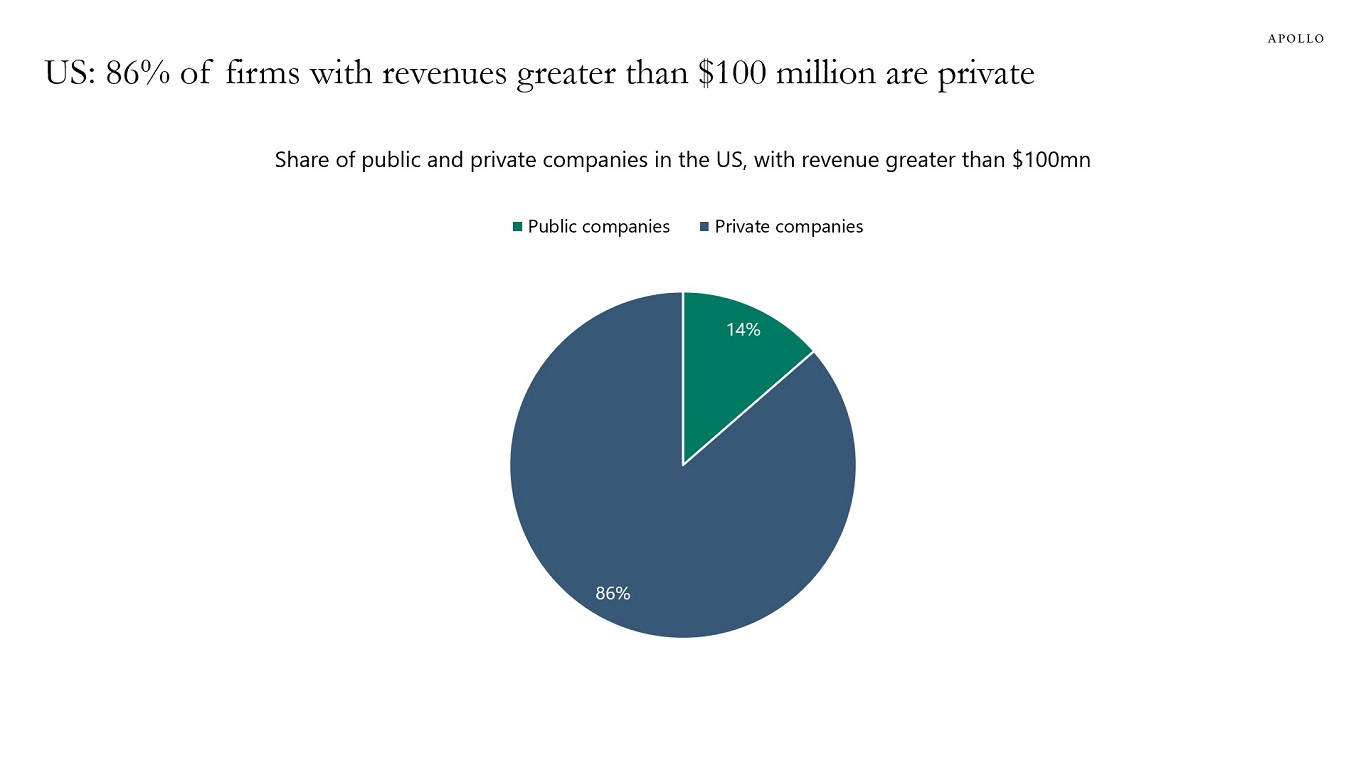

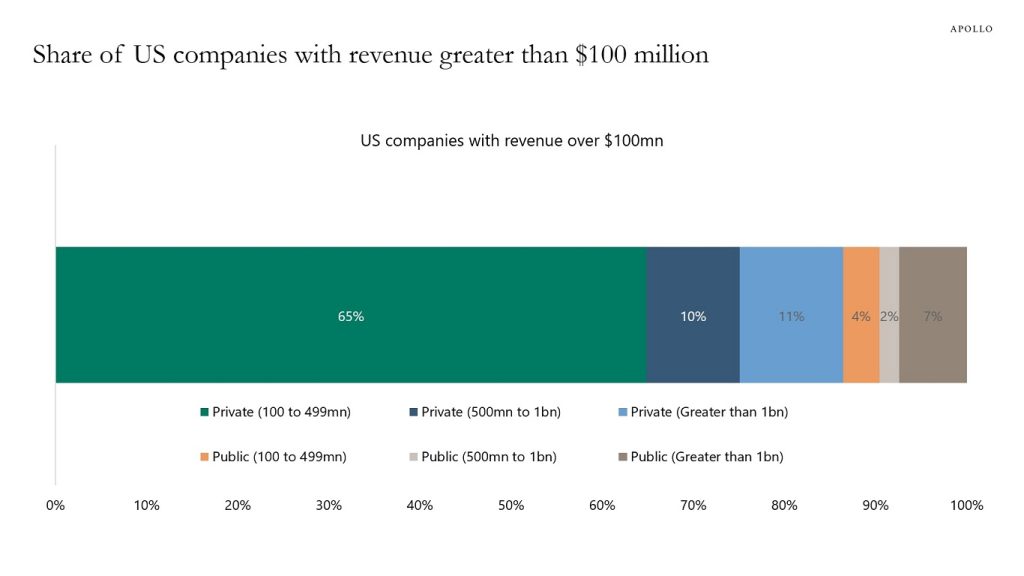

Note: For companies with last 12-month revenue greater than $100mn by count. Source: S&P Capital IQ, Apollo Chief Economist

Source: S&P Capital IQ, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, S&P SPIVA, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Many commercial real estate (CRE) loans are five-year maturities, which means that CRE loans that were underwritten when the Fed funds rate was zero in 2020 and 2021 have to be refinanced in 2025 and 2026. This gives the maturity wall a downward sloping shape for CRE, with a lot of refinancings over the next few years. This is different from investment grade (IG), high yield (HY), and leveraged loans, where the maturity walls are spread over time; most companies that refinanced in 2020 and 2021 at very low interest rates do not have to refinance in the near future.

The bottom line is that the maturity wall is front-loaded for CRE, back-loaded for HY and loans, and flat for IG, see chart below. The IG bars are taller in the chart because IG is a much bigger asset class.

With rates higher for longer, what matters for markets is the profile of the maturity wall, i.e., is it downward sloping, upward sloping, or flat.

Source: ICE BofA, Bloomberg, PitchBook LCD, MBA, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

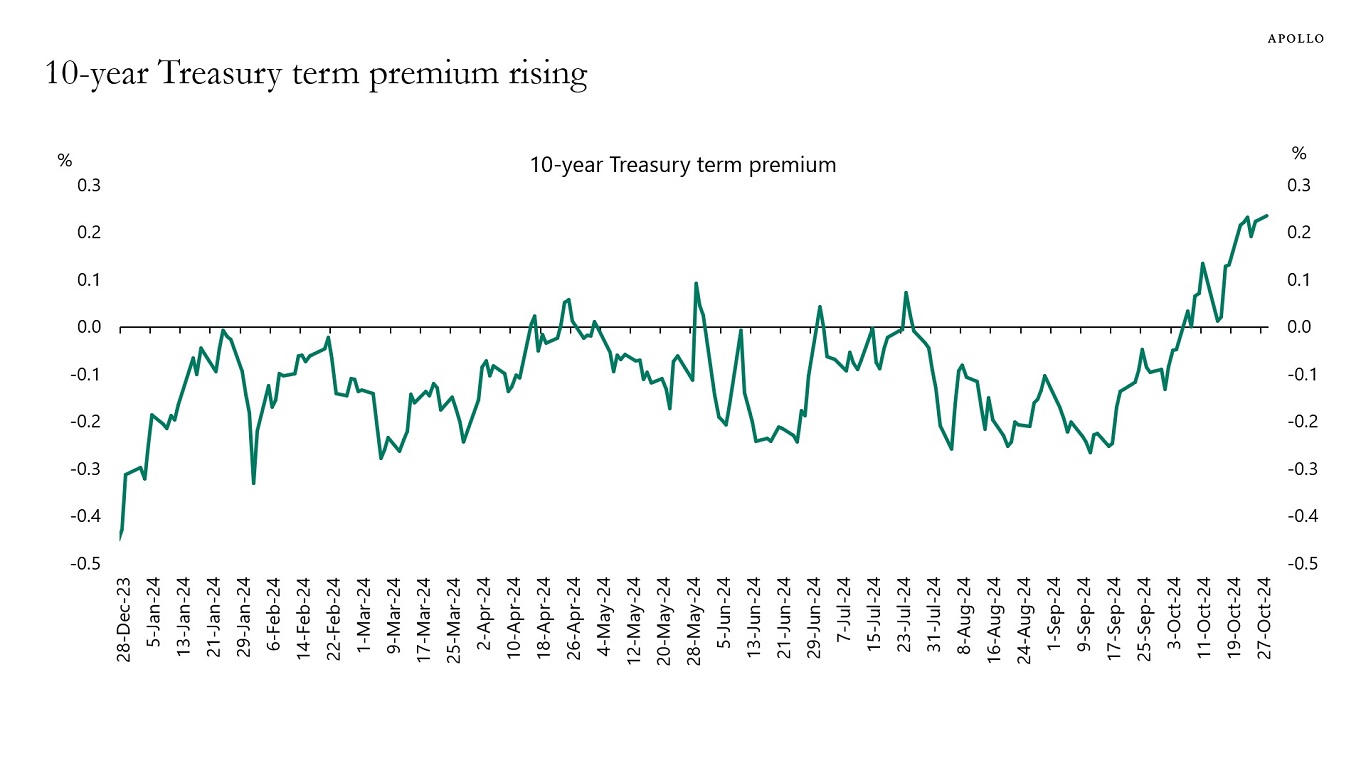

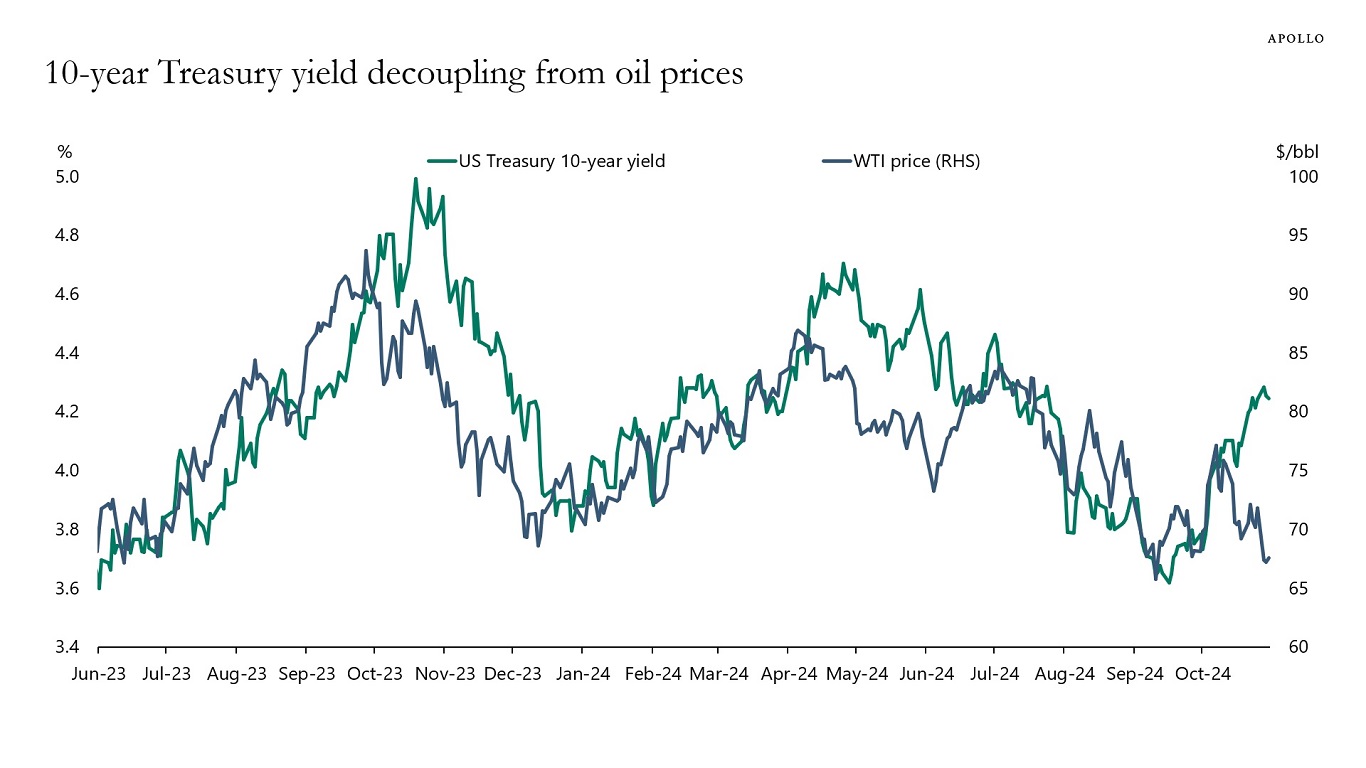

The two charts below show that US long rates are disconnecting from Fed expectations and oil prices. Despite the market still expecting five Fed cuts over the coming 12 months, long rates are moving higher. And despite oil prices falling, long rates are moving higher. This suggests that long rates are rising because of emerging worries about fiscal sustainability.

Note: New York Fed economists Tobias Adrian, Richard Crump, and Emanuel Moench (or “ACM”) present Treasury term premia estimates for maturities from one to 10 years from 1961 to the present. ACM further estimate fitted yields and the expected average short-term rates for the same set of maturities. The analysis is based on a five-factor, no-arbitrage term structure model. Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

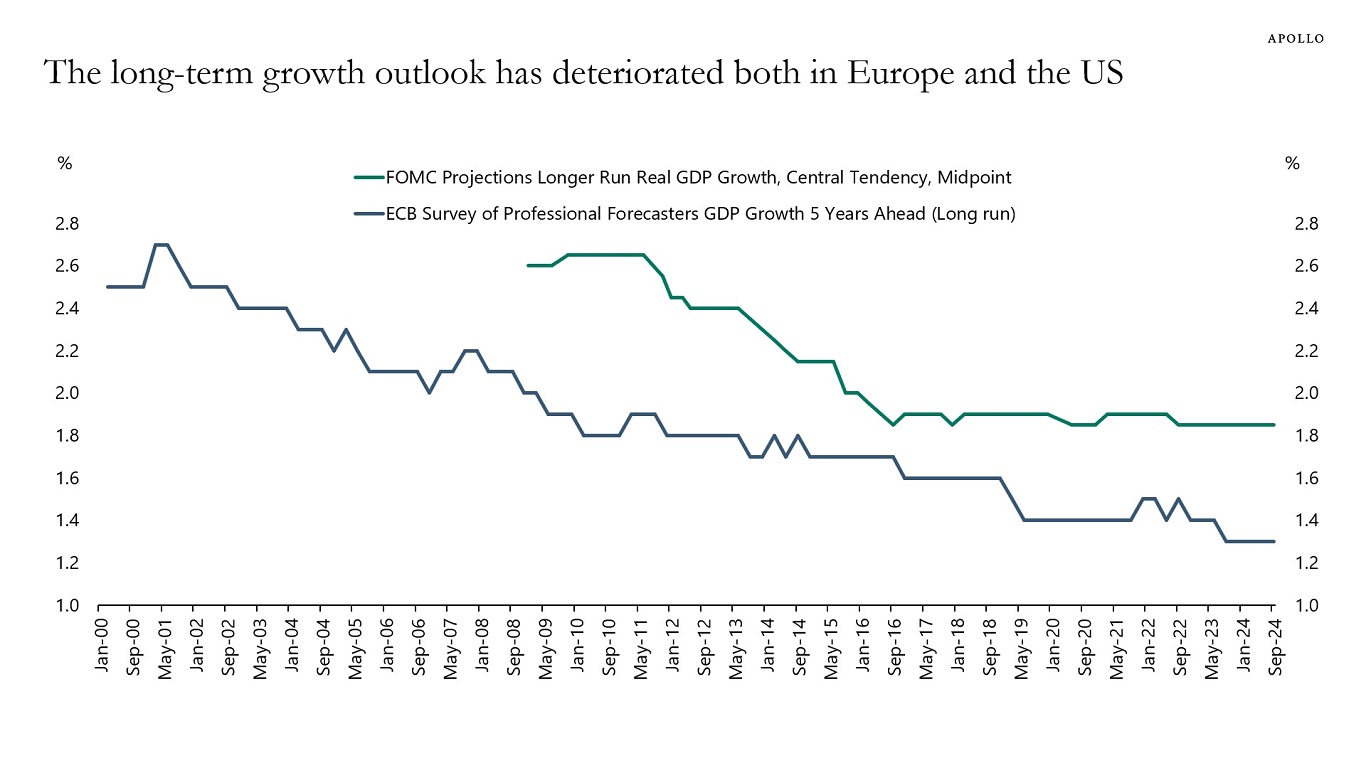

The long-term growth outlook for Europe has deteriorated steadily over the past 20 years, see chart below.

The long-term growth outlook for the US has also softened. But since 2016, it has been stable at just below 2%.

Source: ECB, FRB, Haver Analytics, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

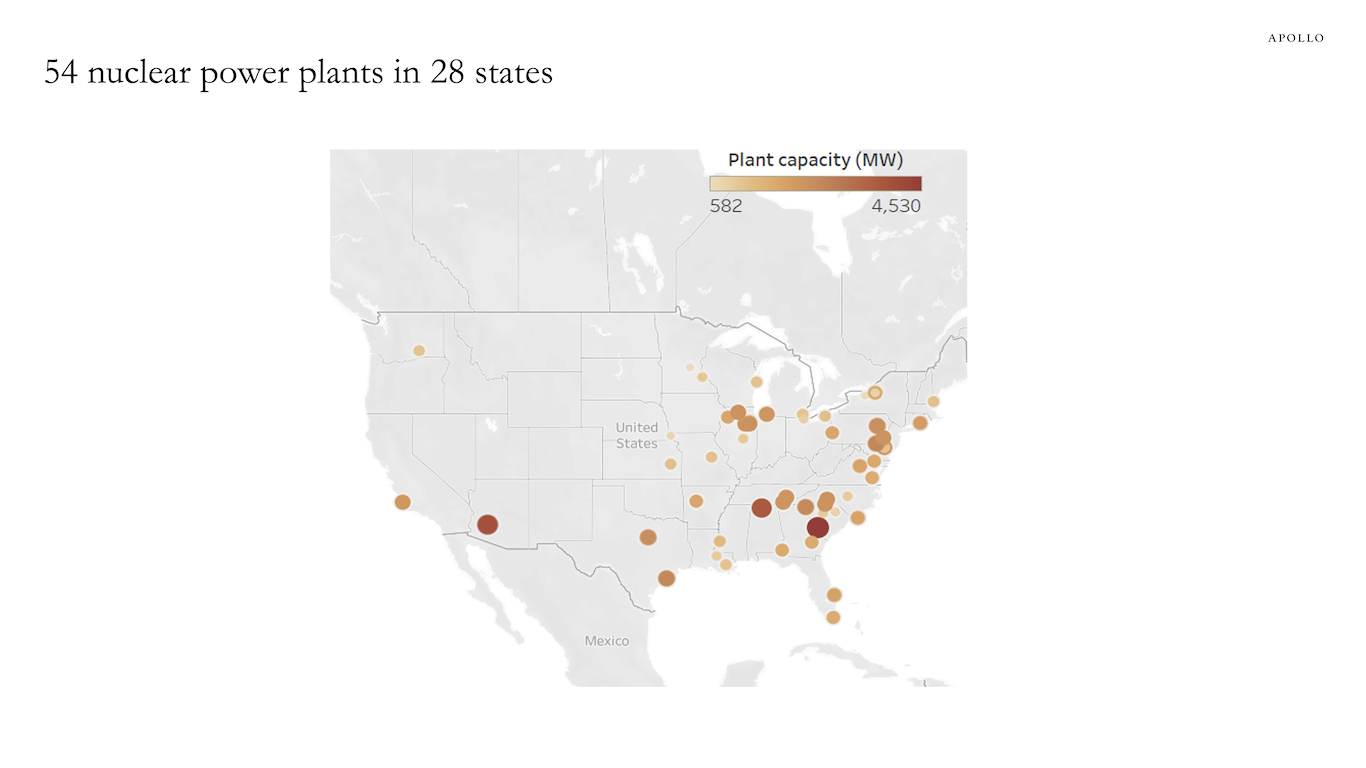

Data centers need a lot of energy, and there is more talk about nuclear power playing a bigger role. There are currently 54 nuclear power plants in 28 states, see map below.

Source: EIA, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

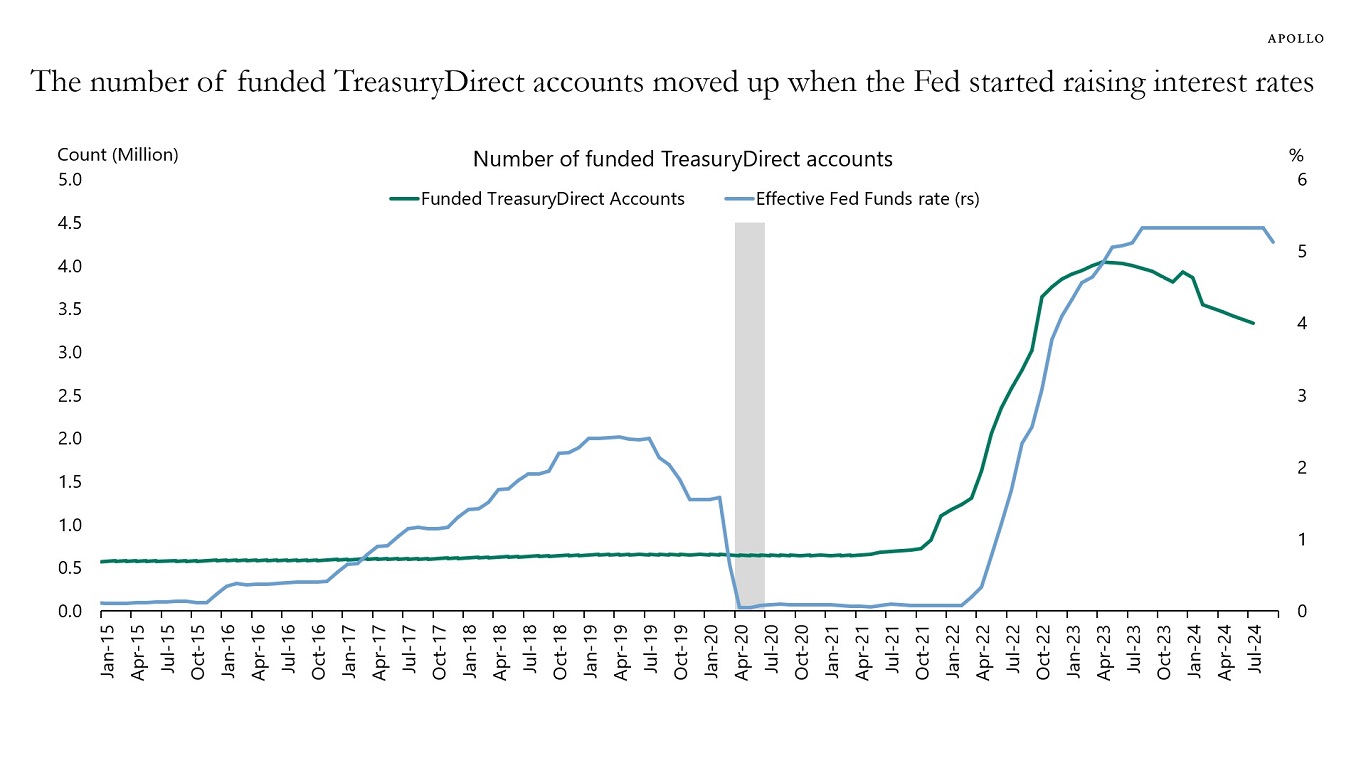

US households are savvy. When the Fed funds rates was zero, the number of households with a TreasuryDirect account, where you can buy and sell US government bonds, was about 700,000, see chart below. But once the Fed started raising interest rates, the number of households with a TreasuryDirect account increased to 4 million. Even before the Fed started cutting, the number of accounts started declining.

Combined with the $6.5 trillion currently in money market funds, the key question is what households will do with their Treasury holdings and money market holdings as the Fed continues to cut interest rates.

The most likely outcome is a steeper curve whereby households will withdraw money from the front end of the curve and put it into credit and other higher-yielding fixed income assets.

Source: US Treasury Department, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

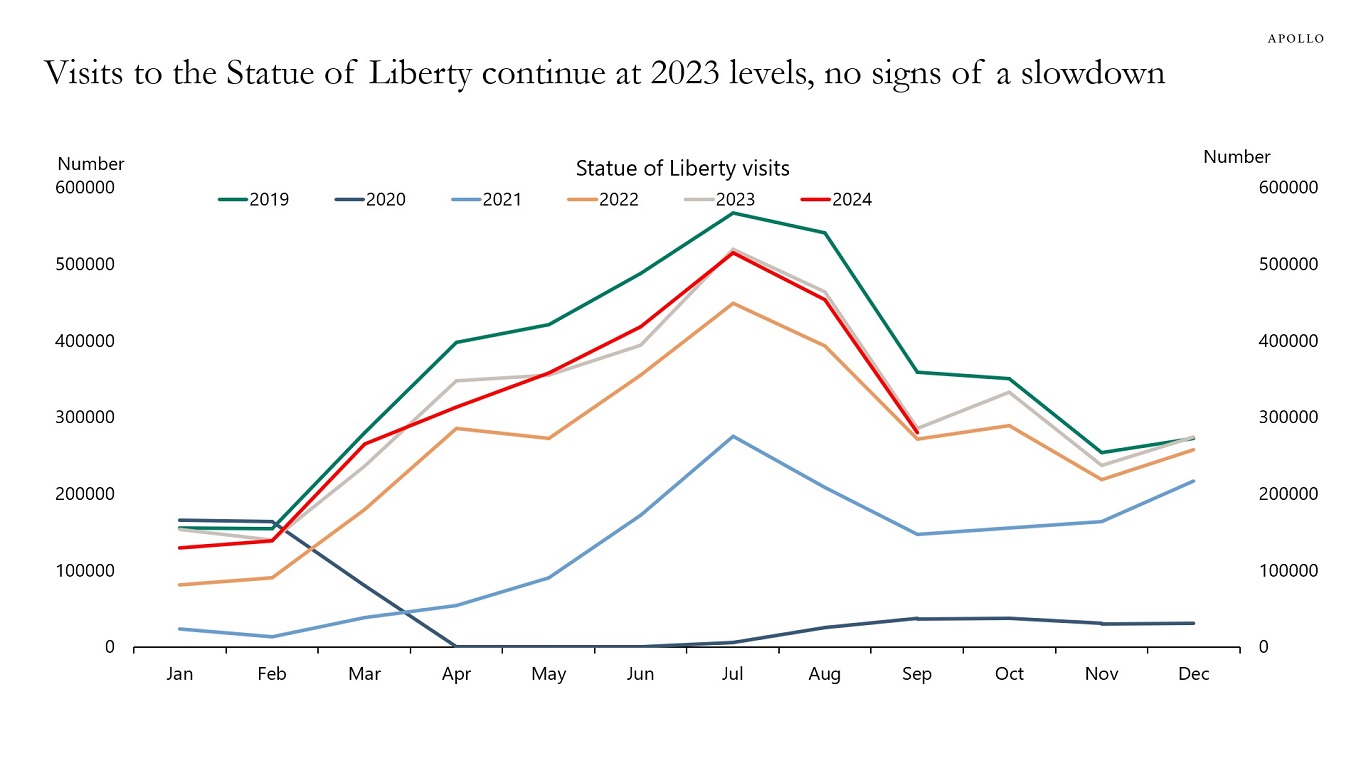

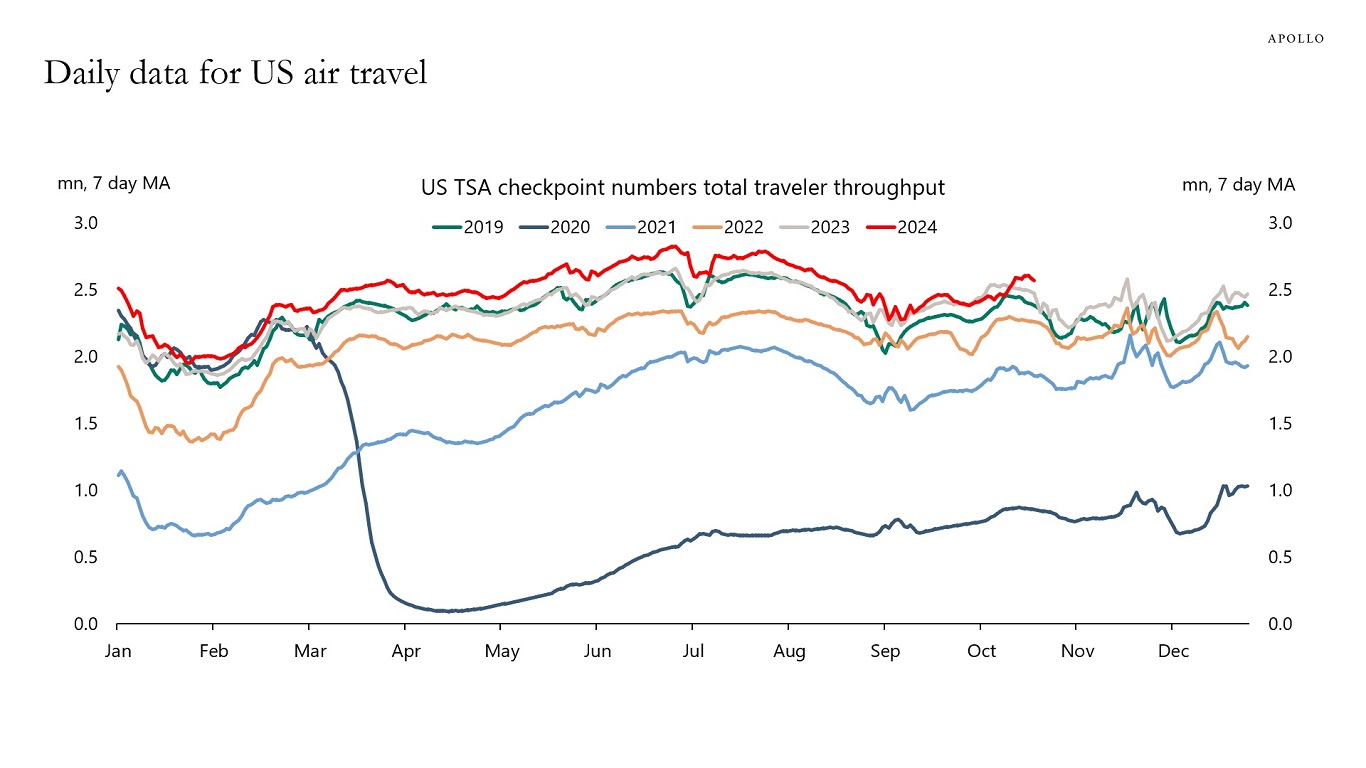

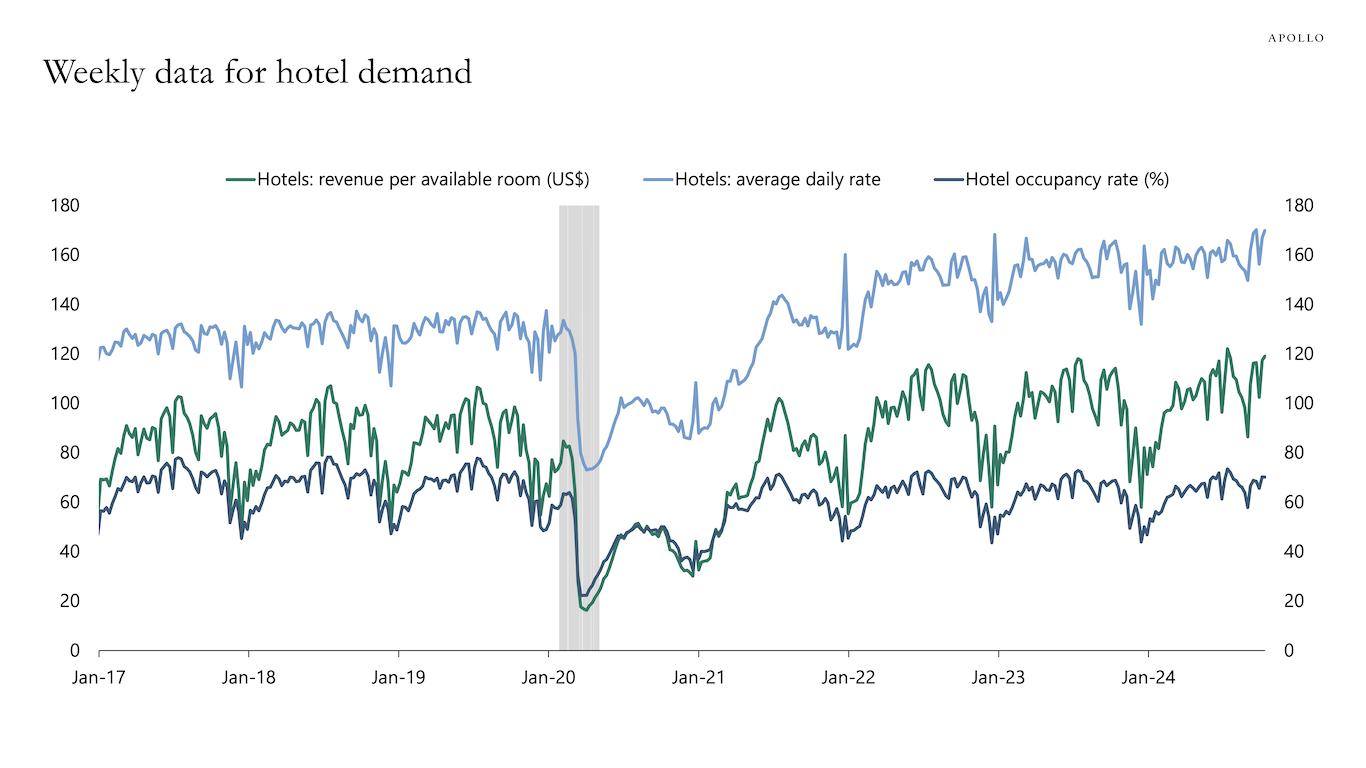

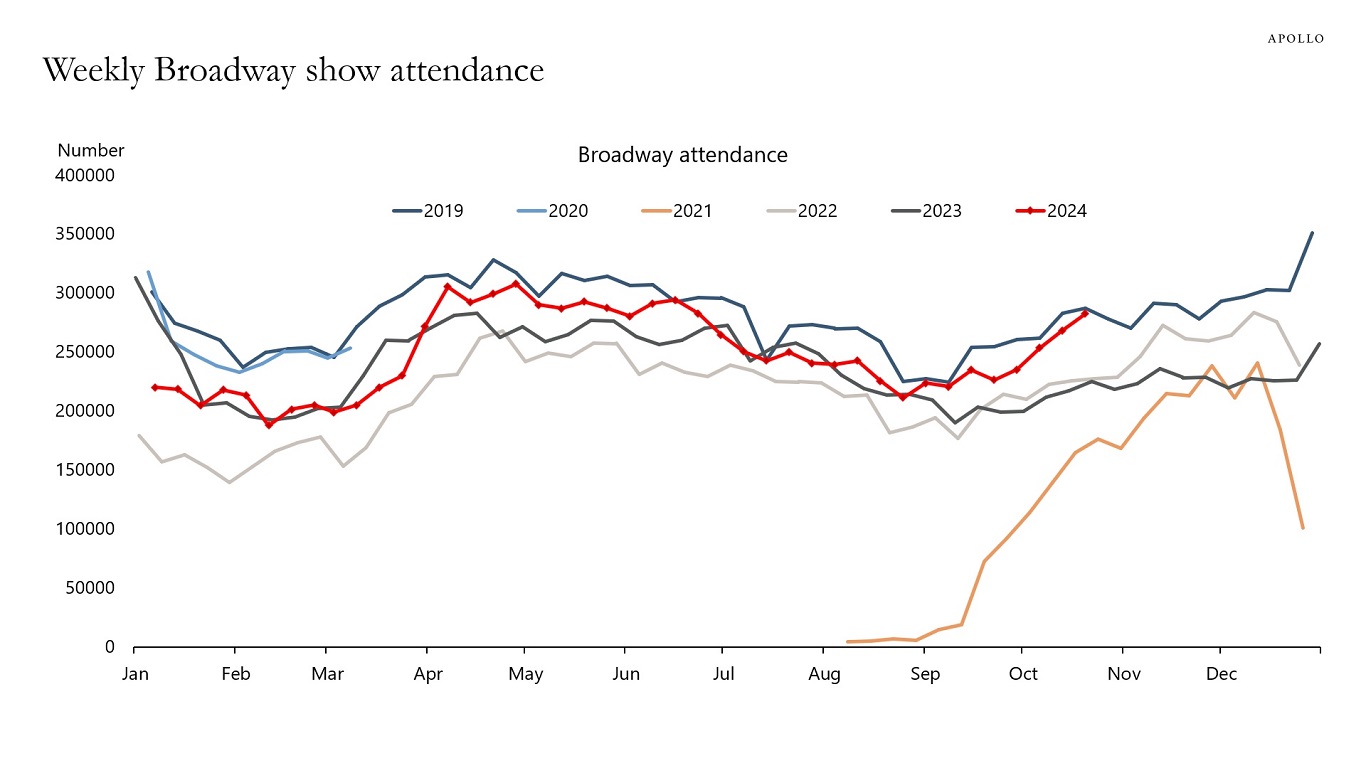

The US consumer is not slowing down. Visits to the Statue of Liberty continue at 2023 levels. Consumer spending remains healthy with air travel strong, hotel spending robust, and Broadway show attendance solid. Retail sales for September were strong at 1.7% year-over-year, and continue to be supported by strength in weekly same-store retail sales data. The US consumer continues to do well, driven by solid job growth, strong wage growth, and high stock prices and home prices.

See our chart book with daily and weekly indicators for the US economy.

Source: irma.nps.gov, Apollo Chief Economist

Source: TSA, Bloomberg, Apollo Chief Economist

Source: STR, Haver Analytics, Apollo Chief Economist

Source: Internet Broadway Database, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

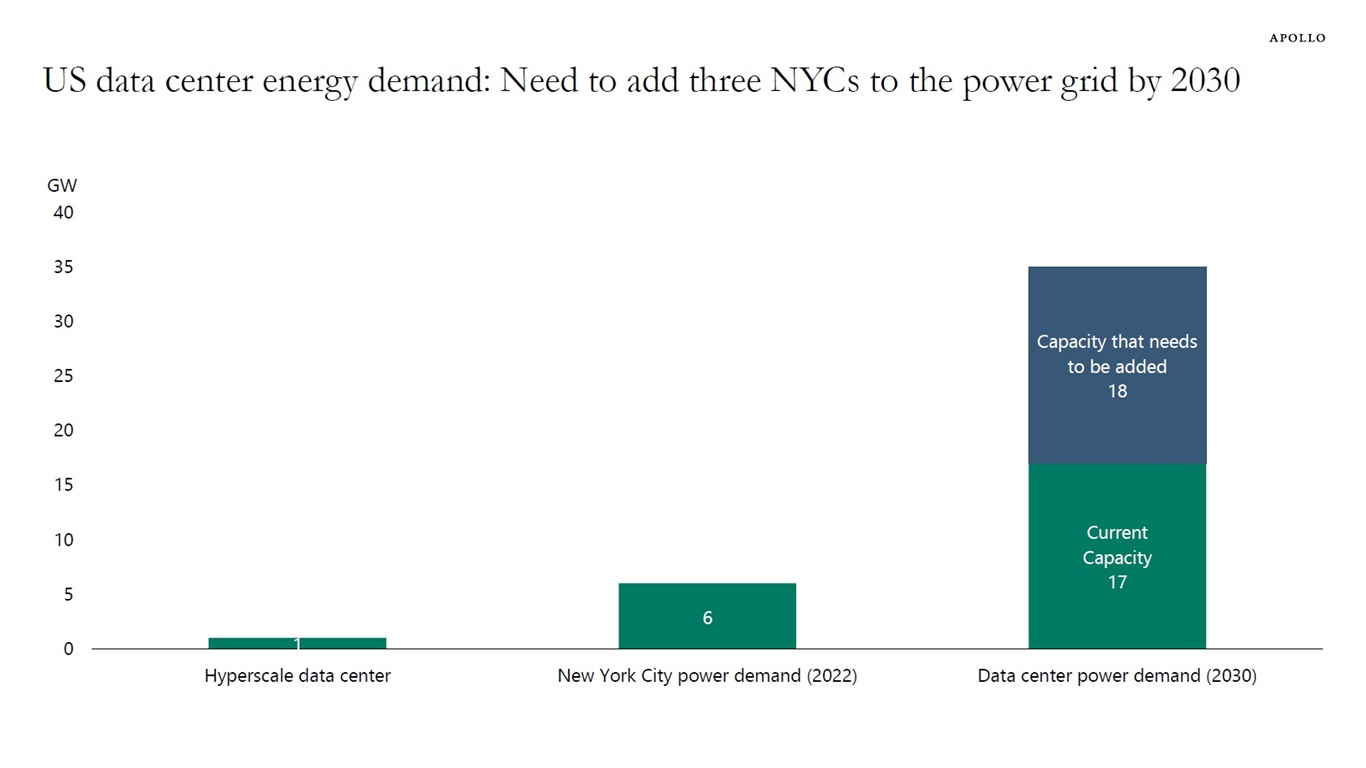

The power need for the largest hyperscale data centers is currently 1 GW, and estimates show that 18 GW of additional power capacity will be needed to service US data centers by 2030.

For comparison, the total power demand for New York City is currently around 6 GW.

In other words, there is a need to add three NYCs to the US power grid by 2030.

Note: Current capacity as of 2022, Why invest in the data center economy | McKinsey, Systems – NYC Mayor’s Office of Climate and Environmental Justice, Data Center Power: Fueling the Digital Revolution, US data center power consumption to double by 2030 – DCD. Source: NYISO 2022, McKinsey, Nextgen, datacenterknowledge.com, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

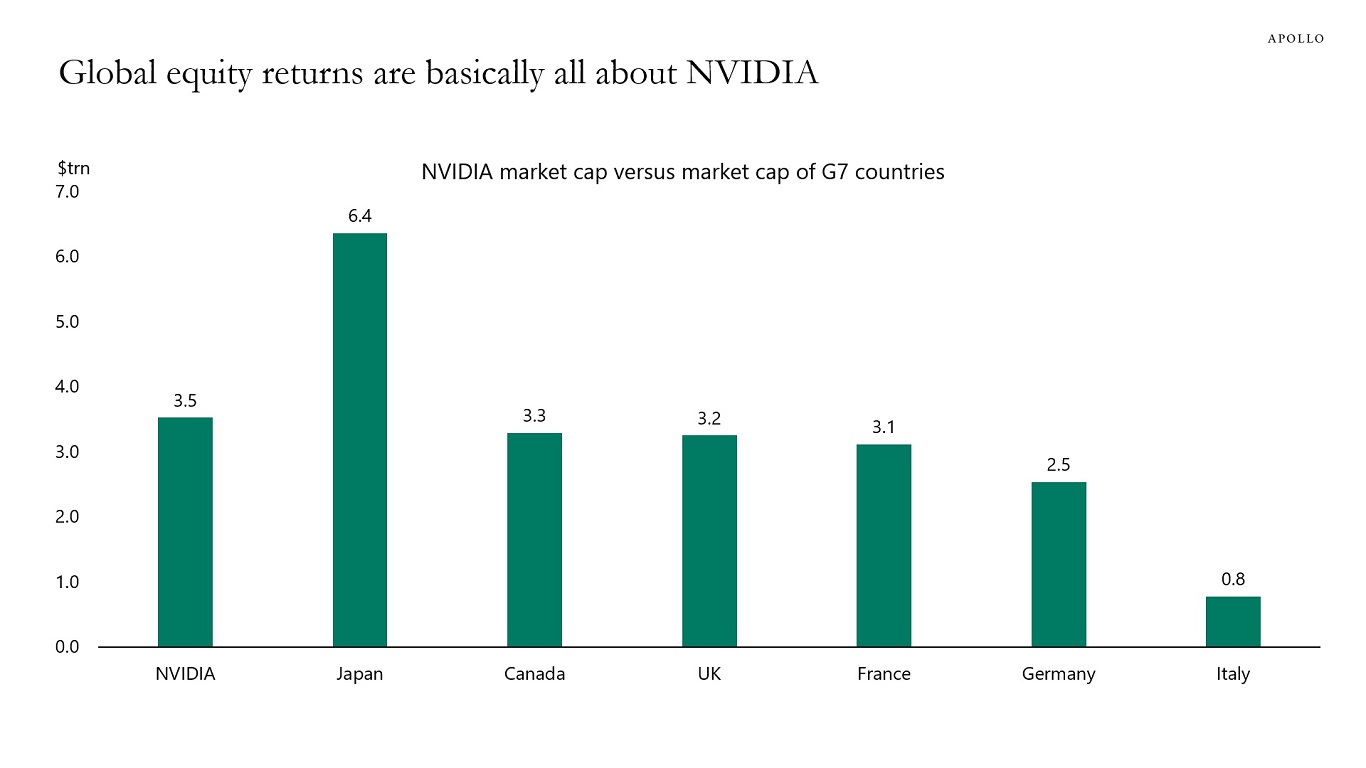

NVIDIA is now bigger than the total market cap of five of the G7 countries, see chart below. And foreigners own 18% of the US stock market.

The bottom line is that global equity markets, including retirement allocations to equities, are basically leveraged to NVIDIA.

Let’s hope the value of NVIDIA doesn’t decline significantly.

The idea that public markets are safe and retirement savings in public markets are safe is misguided.

Some investments in public markets are safe, and some are risky.

Same for private assets. Some private investments are safe, and some private investments are risky.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

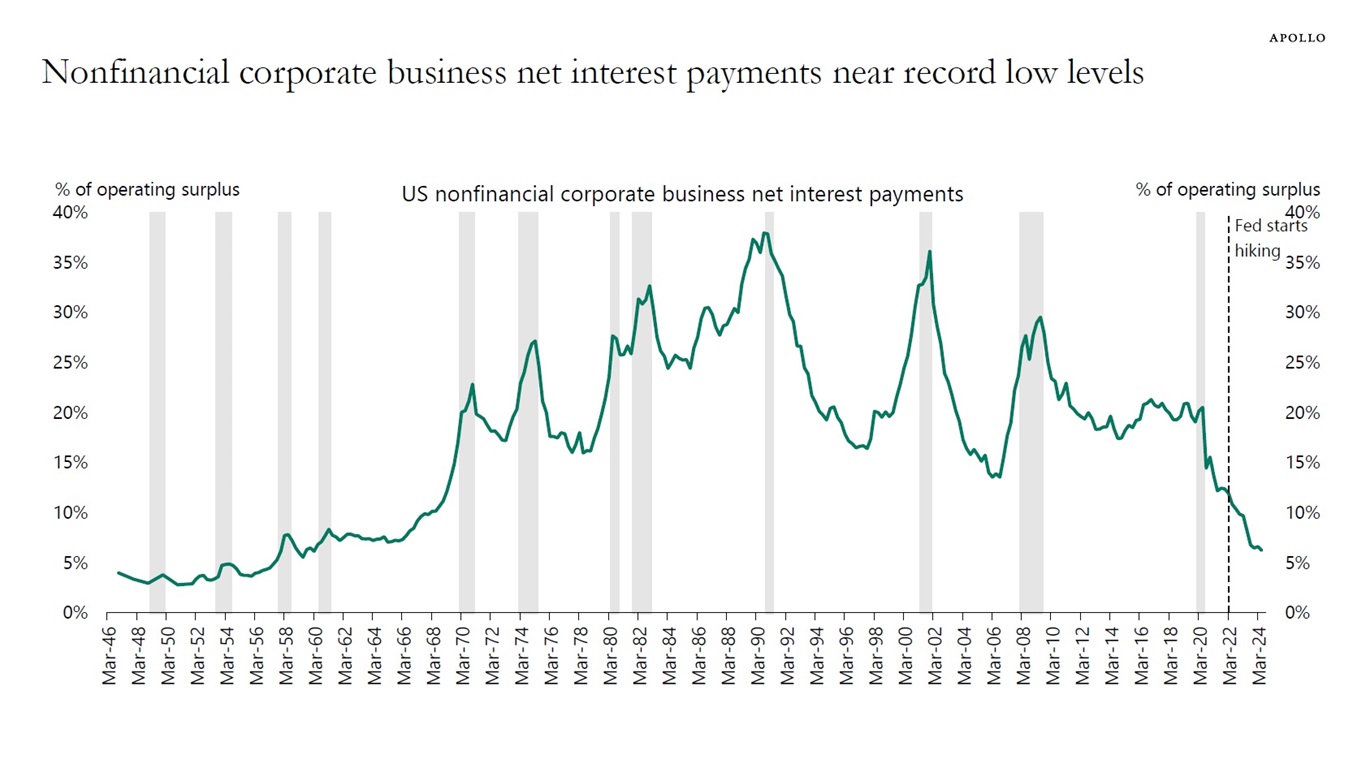

The chart below shows that Fed hikes have not had the desired effects on firms. You would normally expect that when interest rates go up, corporates see an increase in debt-servicing costs.

But because of locked-in low interest rates combined with strong corporate earnings, net interest payments as a share of operating surplus have been going down, see chart below.

The bottom line is that not only have Fed hikes had a limited negative impact on consumers because of locked-in low mortgage rates. Fed hikes have also had a very small impact on corporates because of locked-in low interest rates and rising earnings.

In short, the transmission mechanism of monetary policy has been much weaker than the economics textbook would have predicted. This is because consumers and firms locked in low interest rates during the pandemic.

As a result, the economy never slowed down when the Fed raised rates. And now the Fed is cutting, boosting asset prices and growth in consumer spending and capex spending further.

To be sure, firms with weak earnings, weak revenue, and weak cash flows have been hit by Fed hikes. But the aggregate outcome seen in the chart below shows that from a macro perspective the negative effects of Fed hikes on corporates have been small.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.