Want it delivered daily to your inbox?

-

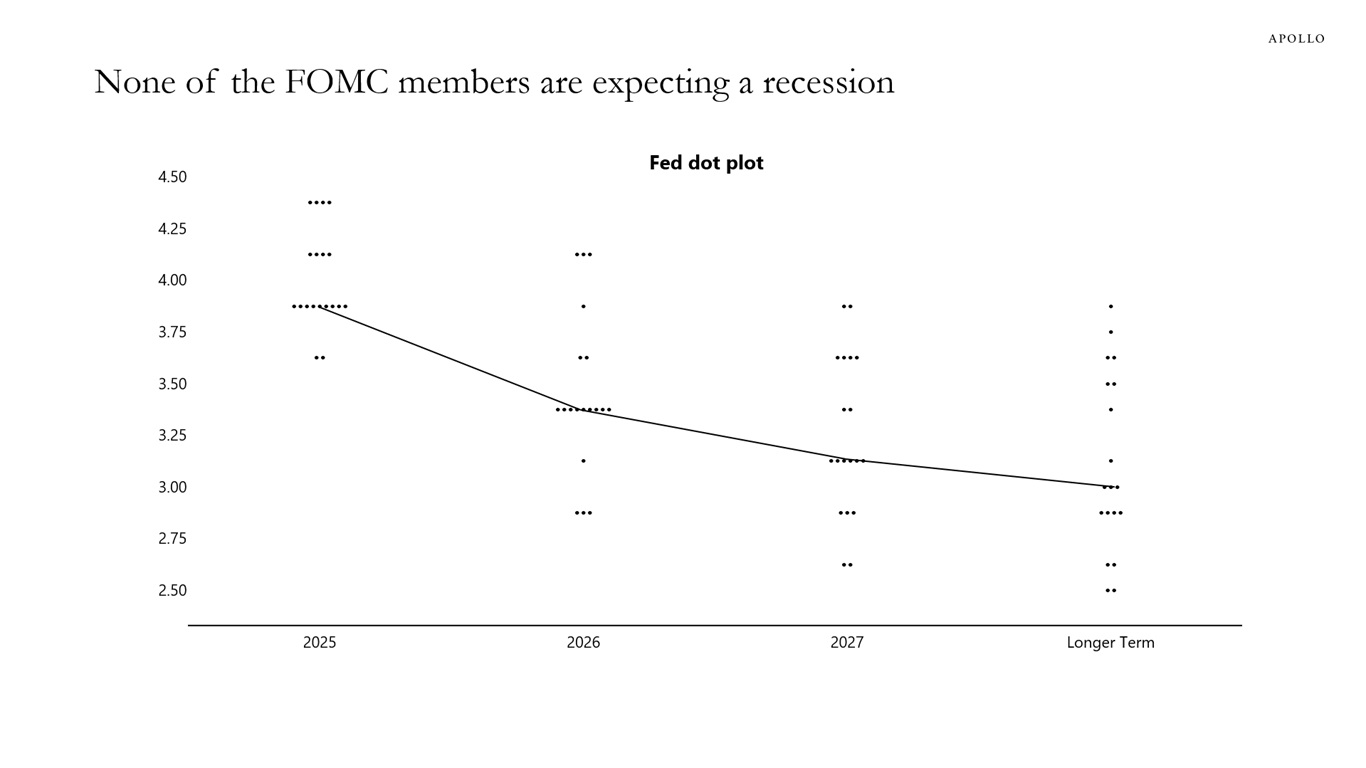

The chart below shows individual FOMC members’ forecast of where they think interest rates will be over the coming years. The degree of disagreement on the committee is remarkable, with one FOMC member saying that in 2026, the Fed funds rate will be almost 4%, and other FOMC members saying that they think interest rates in 2026 will be just above 2.5%.

The dot plot also shows that there is debate about where the Fed funds rate will be in the long run, also with a range between 2.5% and 4%. Perhaps most importantly, none of the FOMC members are predicting a sharp decline in the Fed funds rate to zero, telling the market that nobody on the FOMC is expecting a recession.

Sources: FOMC, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

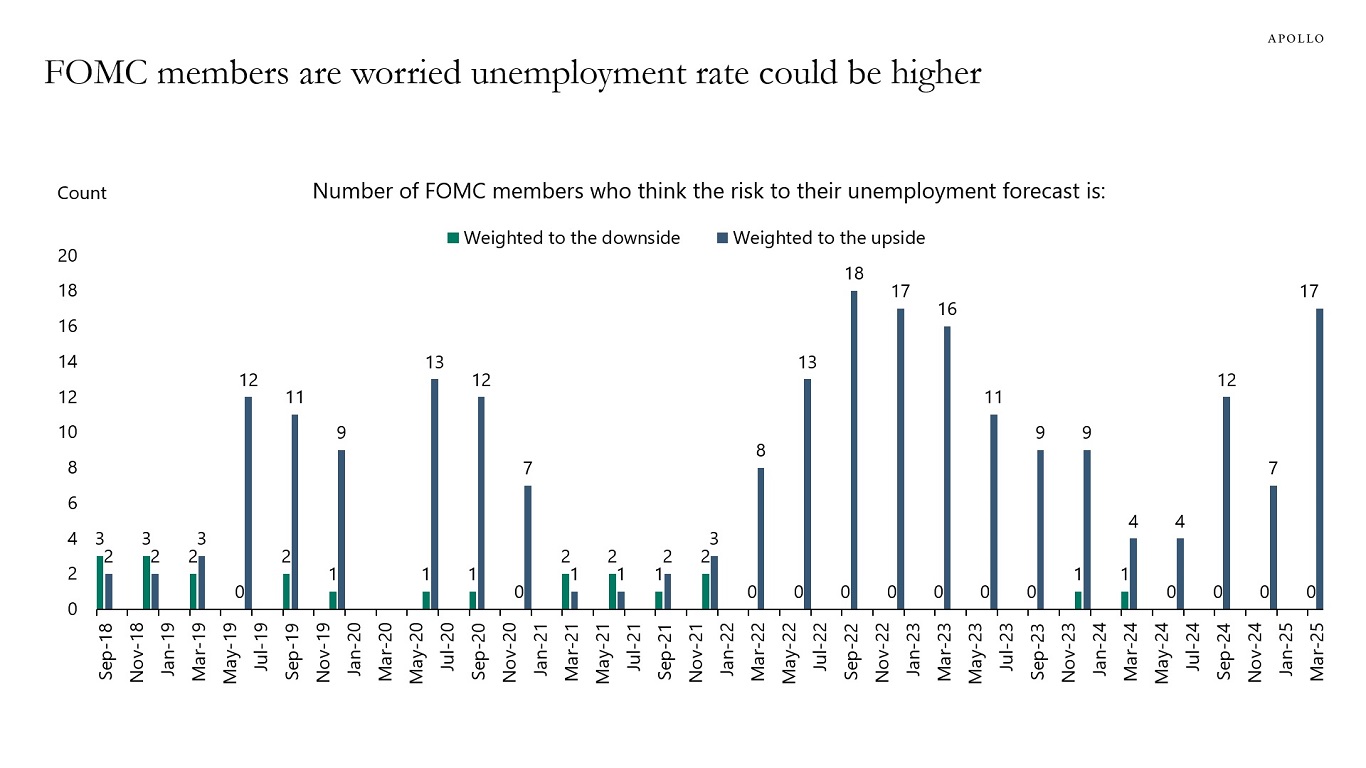

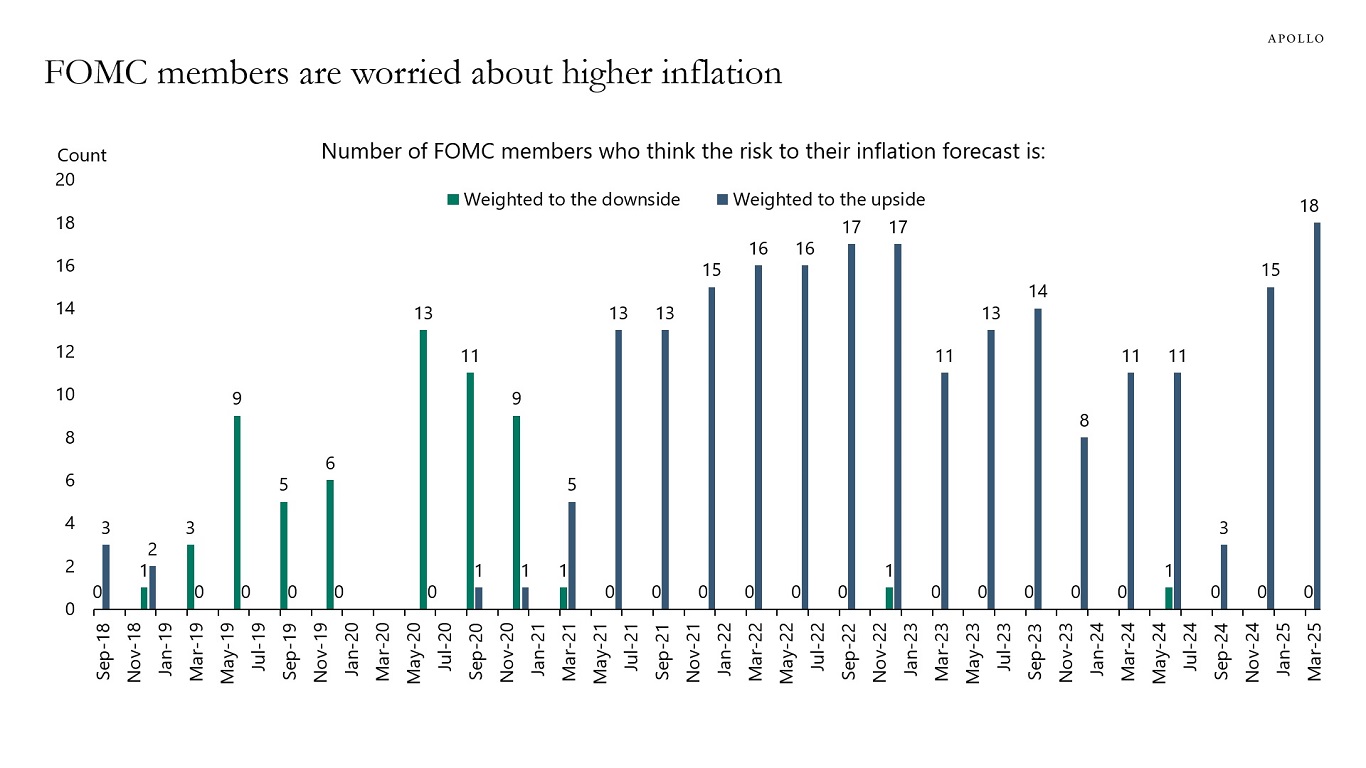

When FOMC members are asked about the risks to their outlooks, they respond that they are worried about upside risks to unemployment and inflation, see charts below.

In other words, the Fed is worried that the ongoing stagflation shock is going to intensify further.

Sources: Federal Reserve Board, Bloomberg, Apollo Chief Economist

Sources: Federal Reserve Board, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

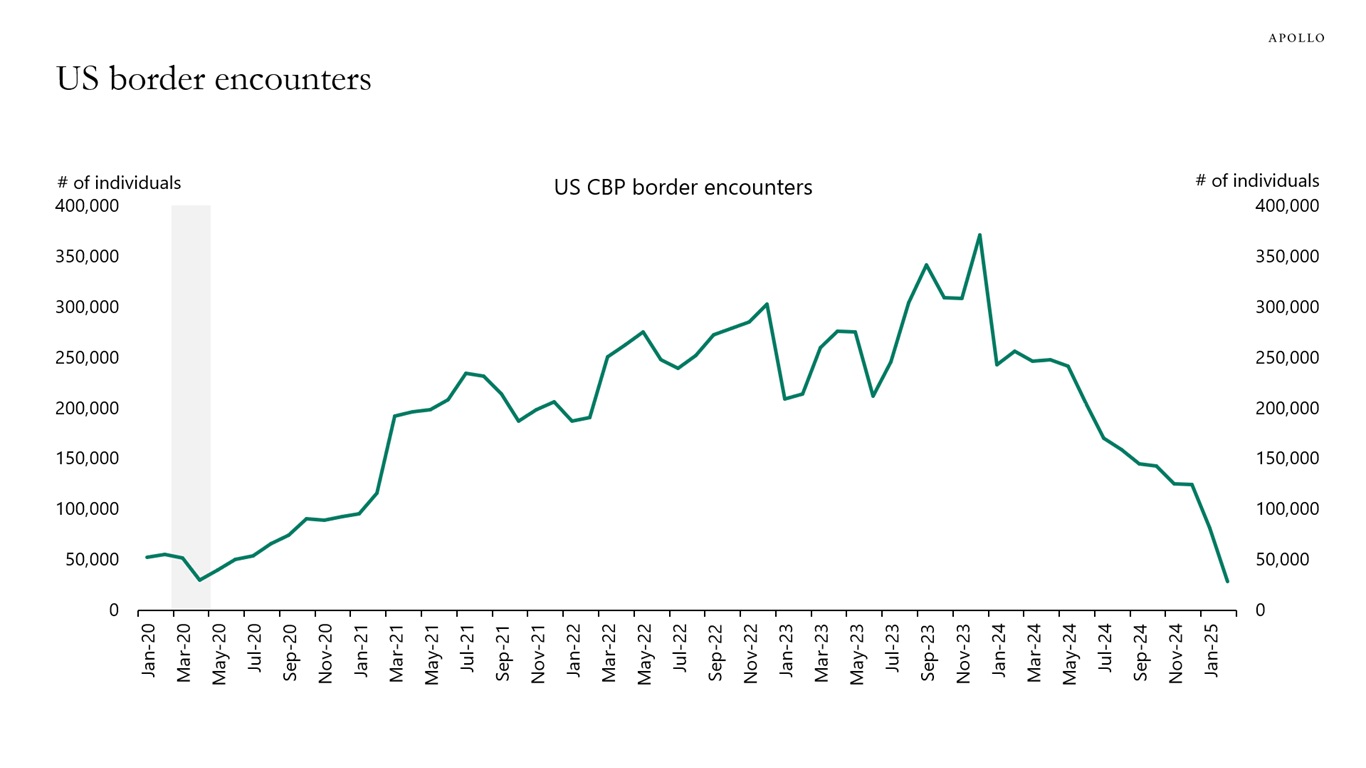

A US border encounter is defined as a law enforcement encounter with a person who unlawfully crossed the border between ports of entry or a person who entered at a port of entry but is inadmissible.

The chart below shows that there were almost zero border encounters in February 2025. The sharp decline in immigration in recent months will have very significant implications for nonfarm payrolls in March, April, and May because it could lower the population growth-consistent nonfarm payroll estimate to 60,000, down from as much as 200,000 in 2024.

Put differently, the ongoing sharp decline in immigration will automatically result in a sharp decline in nonfarm payrolls over the coming months.

Source: US Customs and Border Protection (CBP), Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

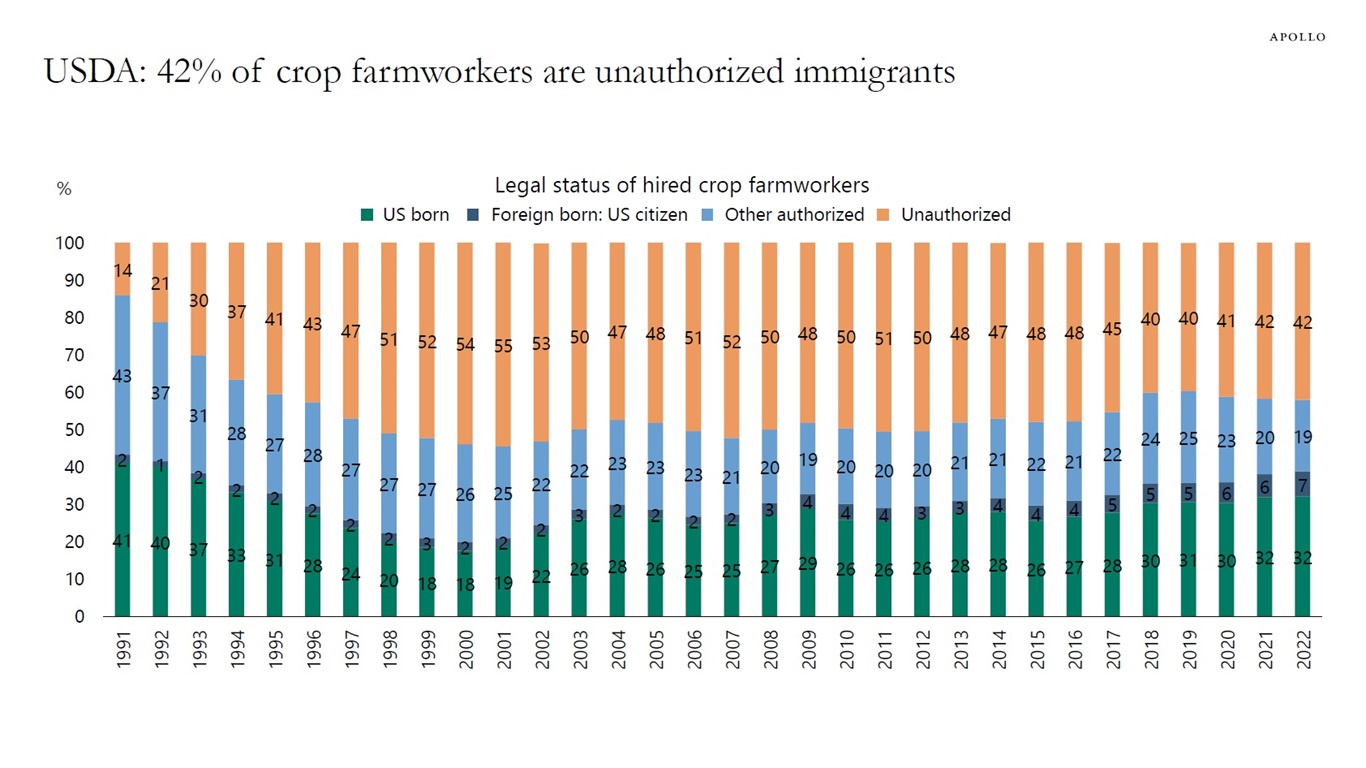

USDA data shows that 42% of crop farmworkers are not authorized to work in the US, see chart below and here. A crop farmworker is an agricultural laborer who performs tasks involved in growing and harvesting crops like vegetables, fruits, grains, and nuts, including planting seeds, weeding, irrigating, harvesting, sorting, and packing the produce.

Source: USDA, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

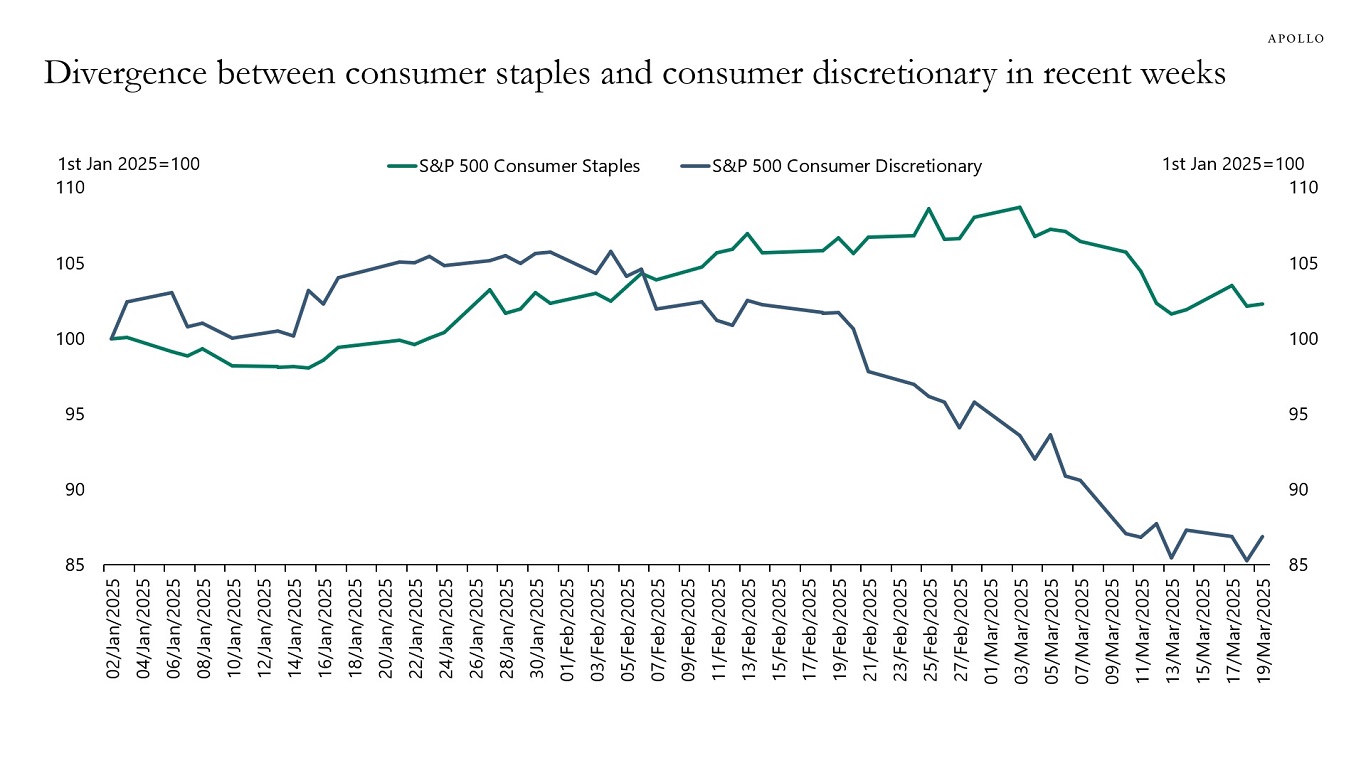

The S&P 500 basket of stocks for consumer discretionary companies has declined significantly in recent weeks, suggesting that investors are starting to worry about future consumer spending on big-ticket items such as cars, washing machines, and mobile phones, see chart below.

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

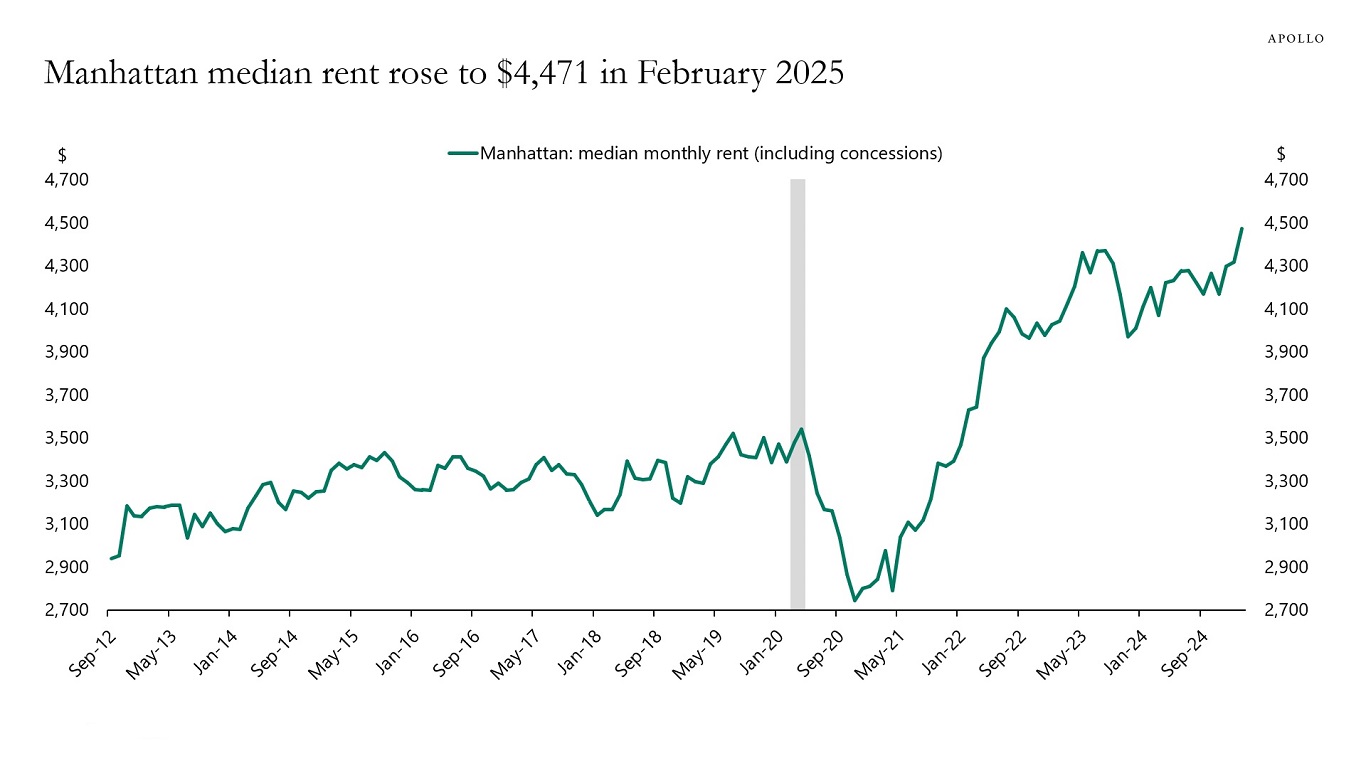

Apartment rents in Manhattan have started to increase again, with the median rent reaching a record high of $4,471 in February, see chart below.

Sources: Elliman, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

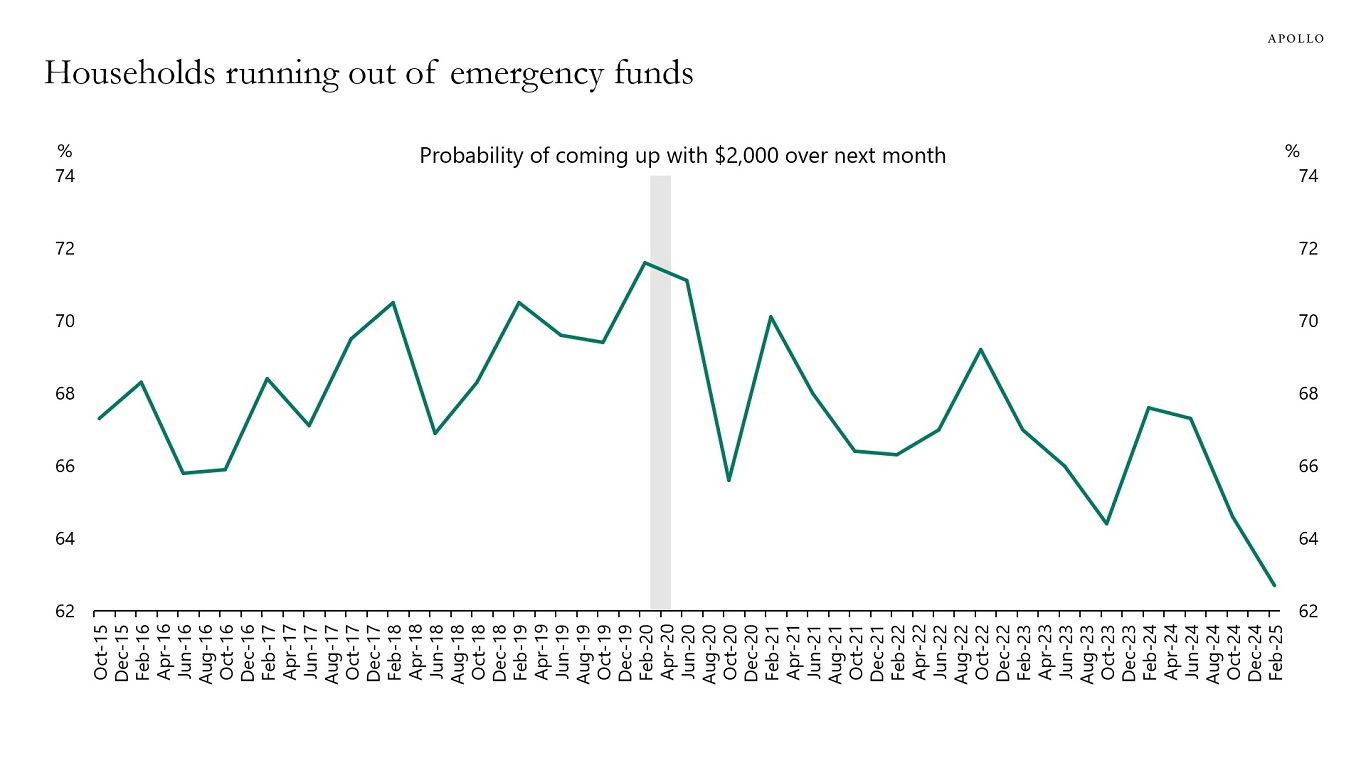

Data from the Fed shows that households’ ability to come up with $2,000 for an emergency expense within the next month is at the lowest level since the survey started in Q4 of 2015. Taking into account that the CPI level today is 35% higher than in 2015, the situation is even worse.

Sources: SCE, Federal Reserve Bank of New York, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

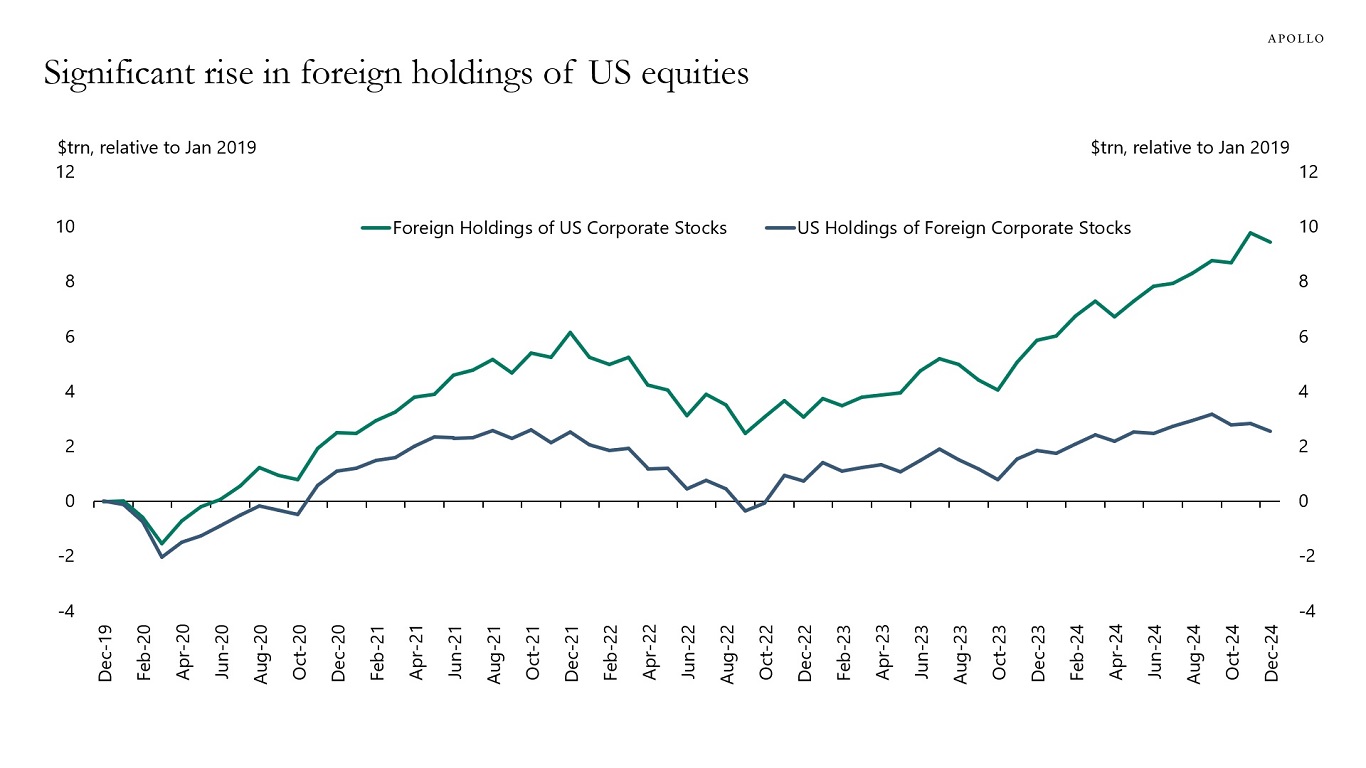

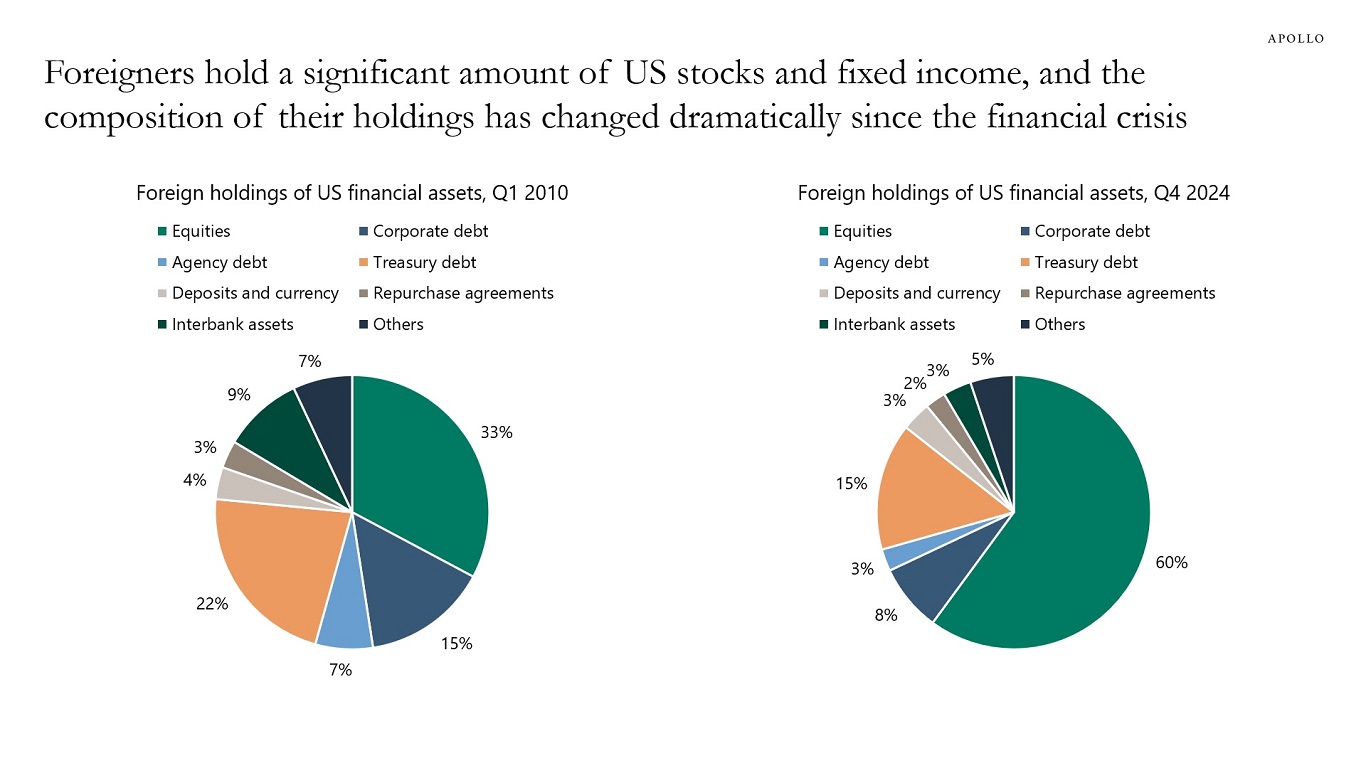

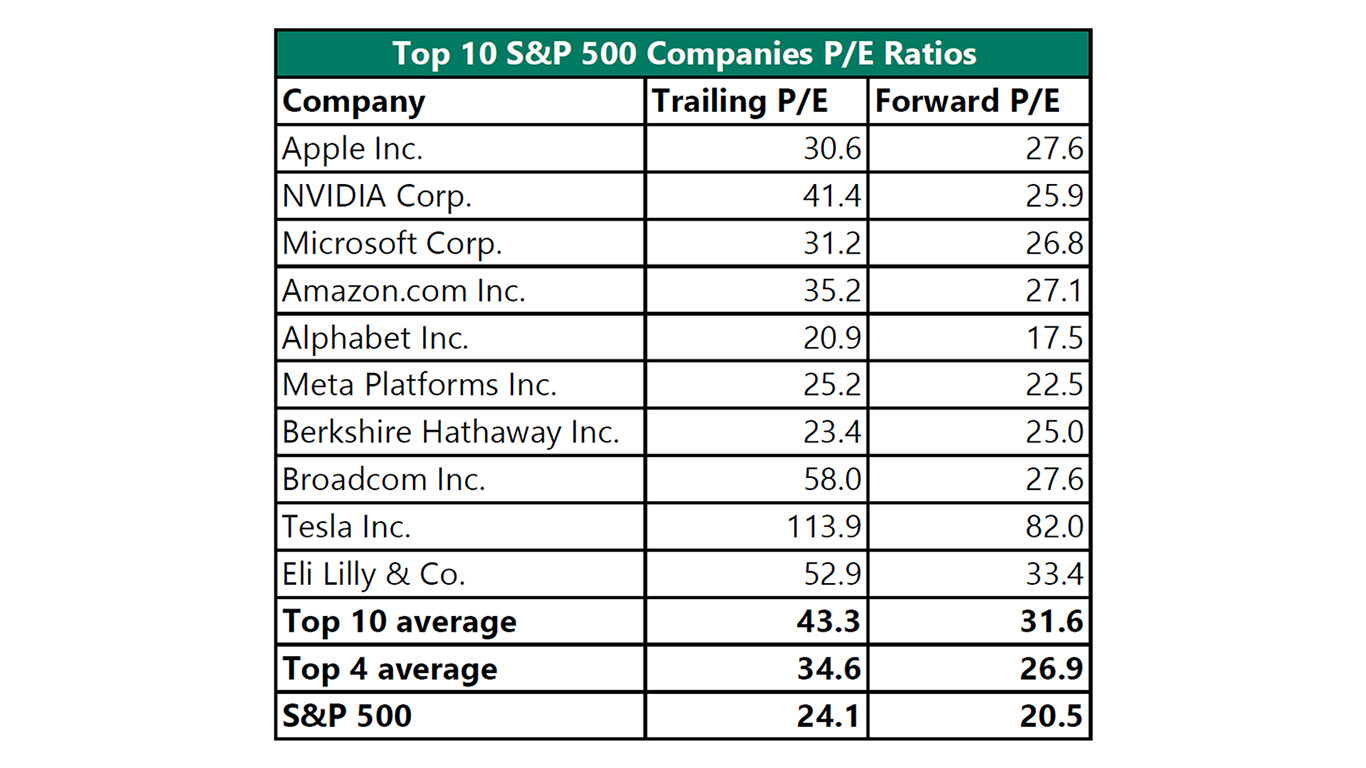

There have been significant inflows from abroad into US equity markets, see the first chart below, and foreign investors are now significantly overweight US equities, see the second chart below. Combined with the dollar’s decline and the ongoing overvaluation of the Magnificent 7, see the third chart, the downside risks to the S&P 500 as a result of foreigners selling are significant.

Sources: US Treasury, Haver Analytics, Apollo Chief Economist

Note: Figures may not sum to 100% due to rounding. Sources: Federal Reserve Board, Haver Analytics, Apollo Chief Economist

Note: The Magnificent 7 consists of Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

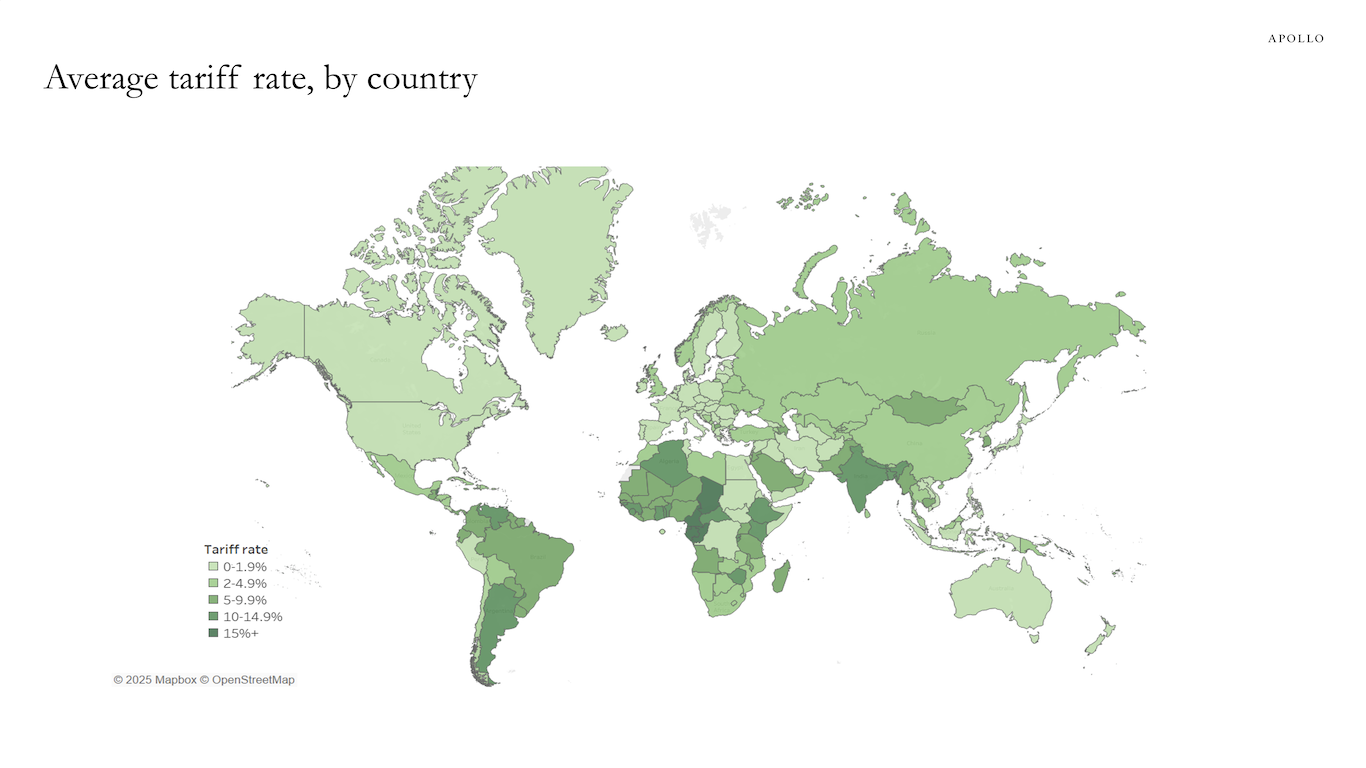

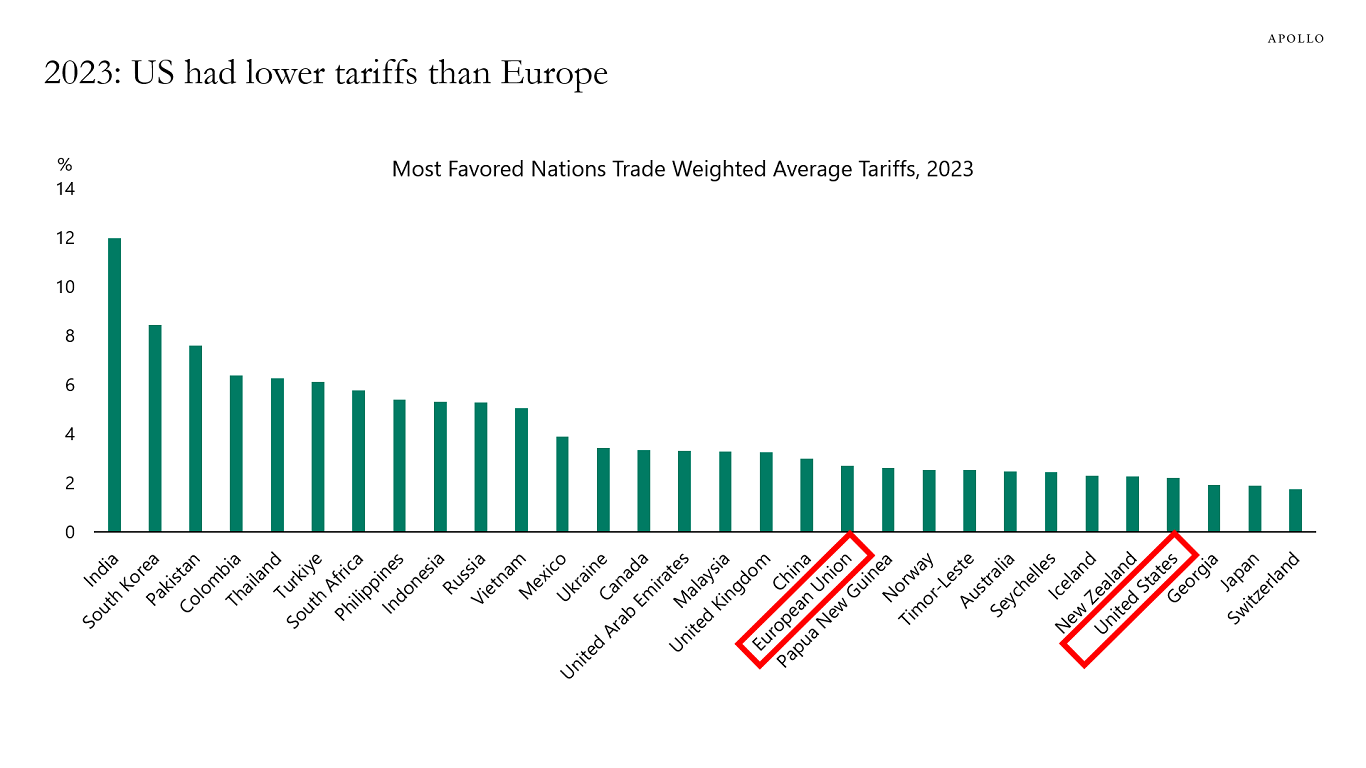

In 2023, the US had the lowest tariff levels in the world, lower than the European Union, Canada, Mexico, and China, see the first two charts below.

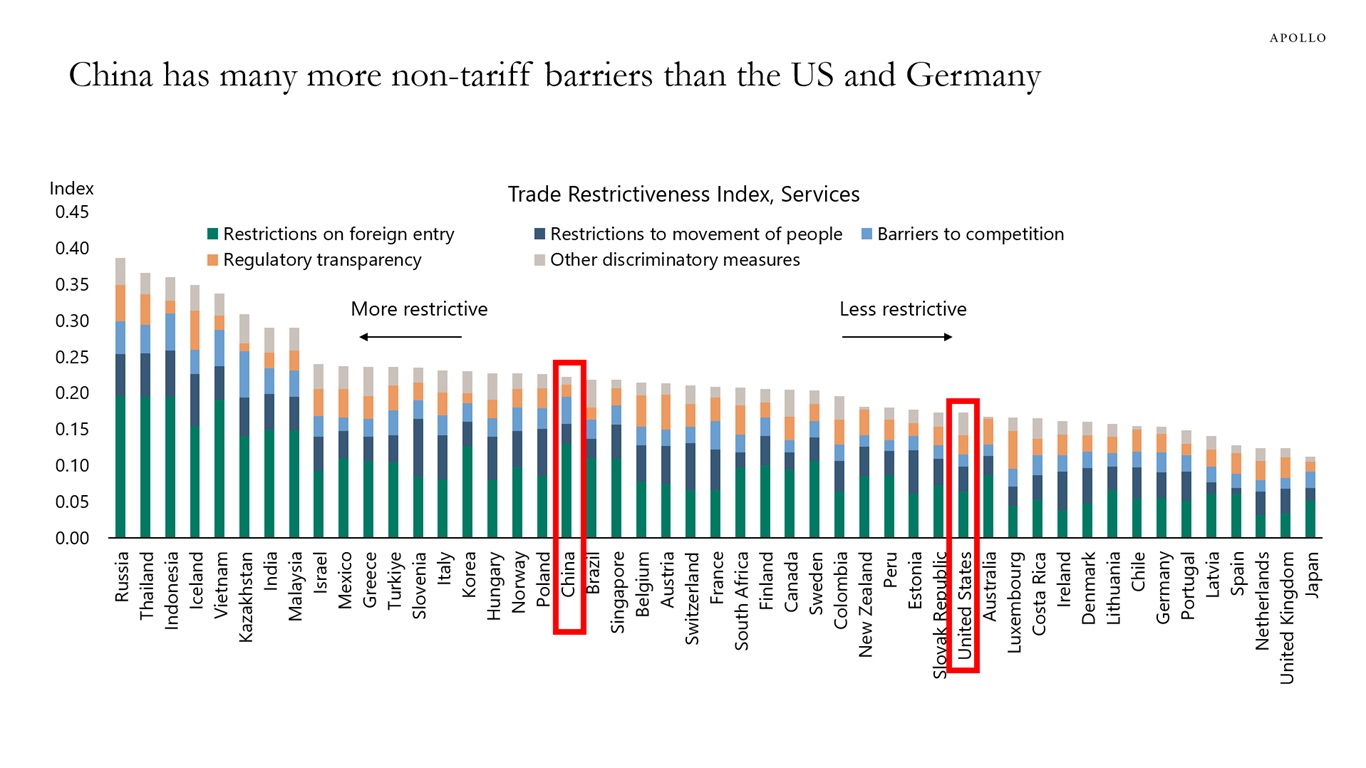

The US also has fewer non-tariff barriers than China, Mexico, Canada, and many European countries, see the third chart below.

When some countries have lower barriers to trade, the gains from trade are not distributed evenly, and the US is currently investigating tariffs and non-tariff barriers with individual countries.

The bottom line is that the purpose of the trade war is to create a more level playing field so that the benefits from trade are more evenly distributed, including to the US manufacturing sector.

Data as of 2022. Sources: World Bank, Apollo Chief Economist

Sources: WTO, Haver Analytics, Apollo Chief Economist

Data as of 2024. Sources: OECD, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

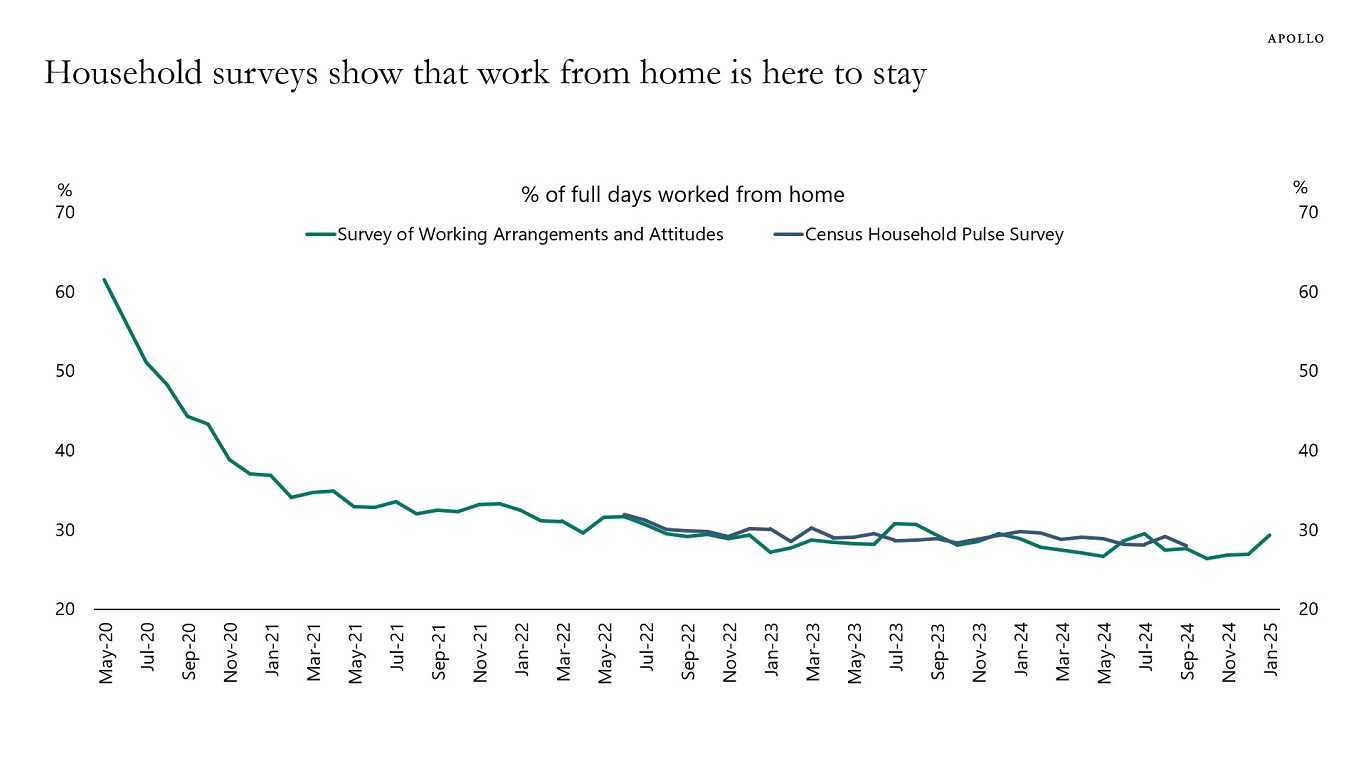

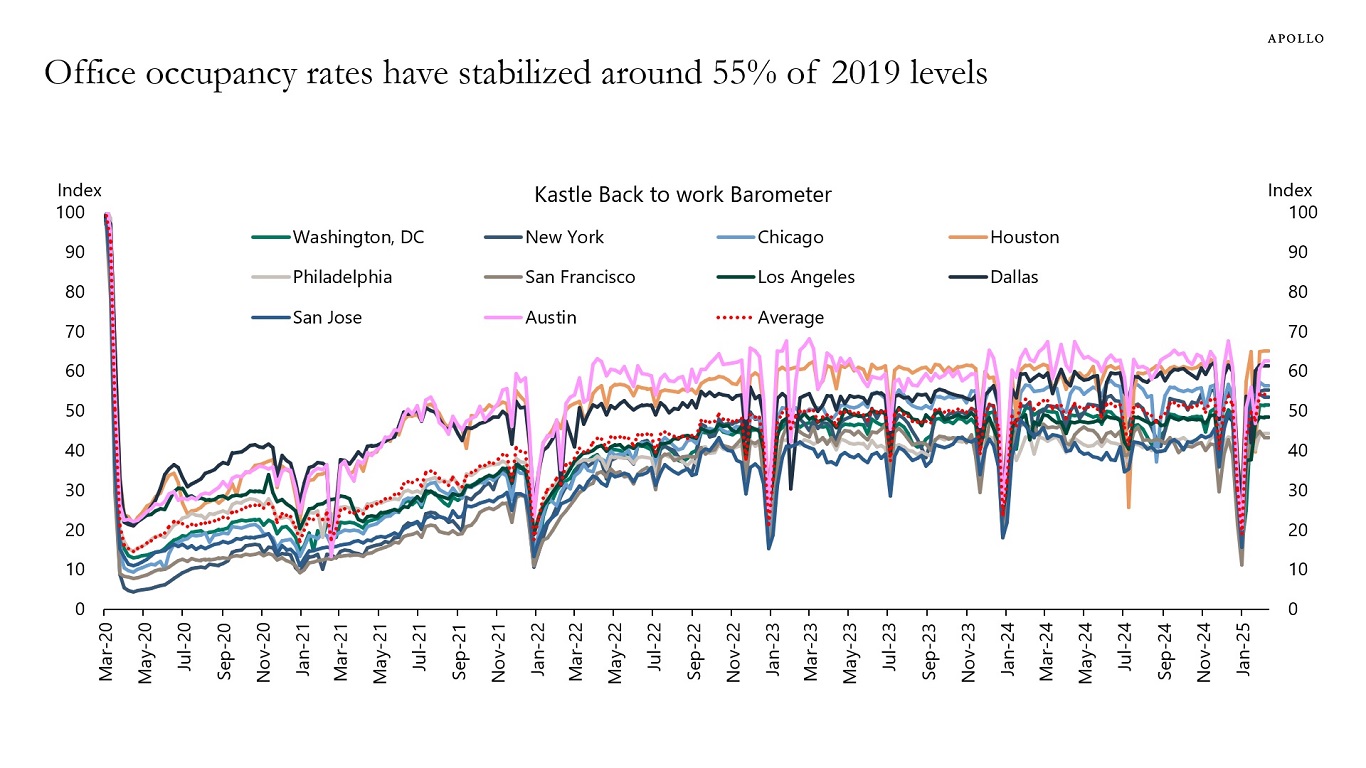

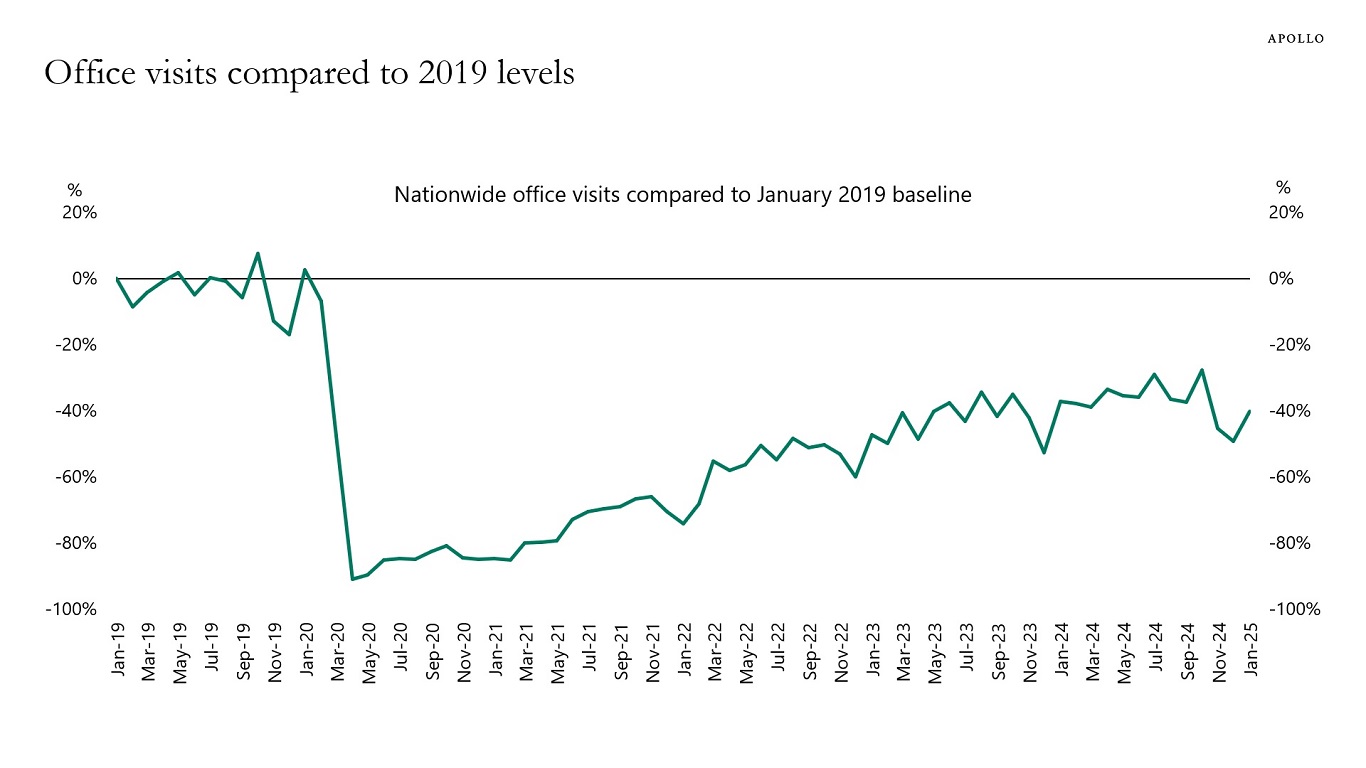

Household surveys, entry swipes, and location data show that work from home has become a new permanent feature of the labor market, with all indicators moving sideways since 2023, see charts below.

Source: US Census Bureau; WFH Research; Barrero, Jose Maria, Nicholas Bloom, and Steven J. Davis, 2021 – “Why working from home will stick,” National Bureau of Economic Research Working Paper 28731 (WFH Research | Survey of Working Arrangements and Attitudes); Apollo Chief Economist

Note: Kastle Systems Back-to-Work Barometer is a weekly report that tracks office occupancy rates across 10 major US cities by analyzing aggregated and anonymized building access data. Source: Kastle Systems, Apollo Chief Economist

Note: The office building index analyzes foot traffic data from over 700 office buildings across the country. It only includes commercial office buildings and commercial office buildings with retail offerings on the first floor. It does not include mixed-use buildings that are both residential and commercial. Source: Placer.ai Blog Location Intelligence & Foot Traffic Blog, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.