Want it delivered daily to your inbox?

-

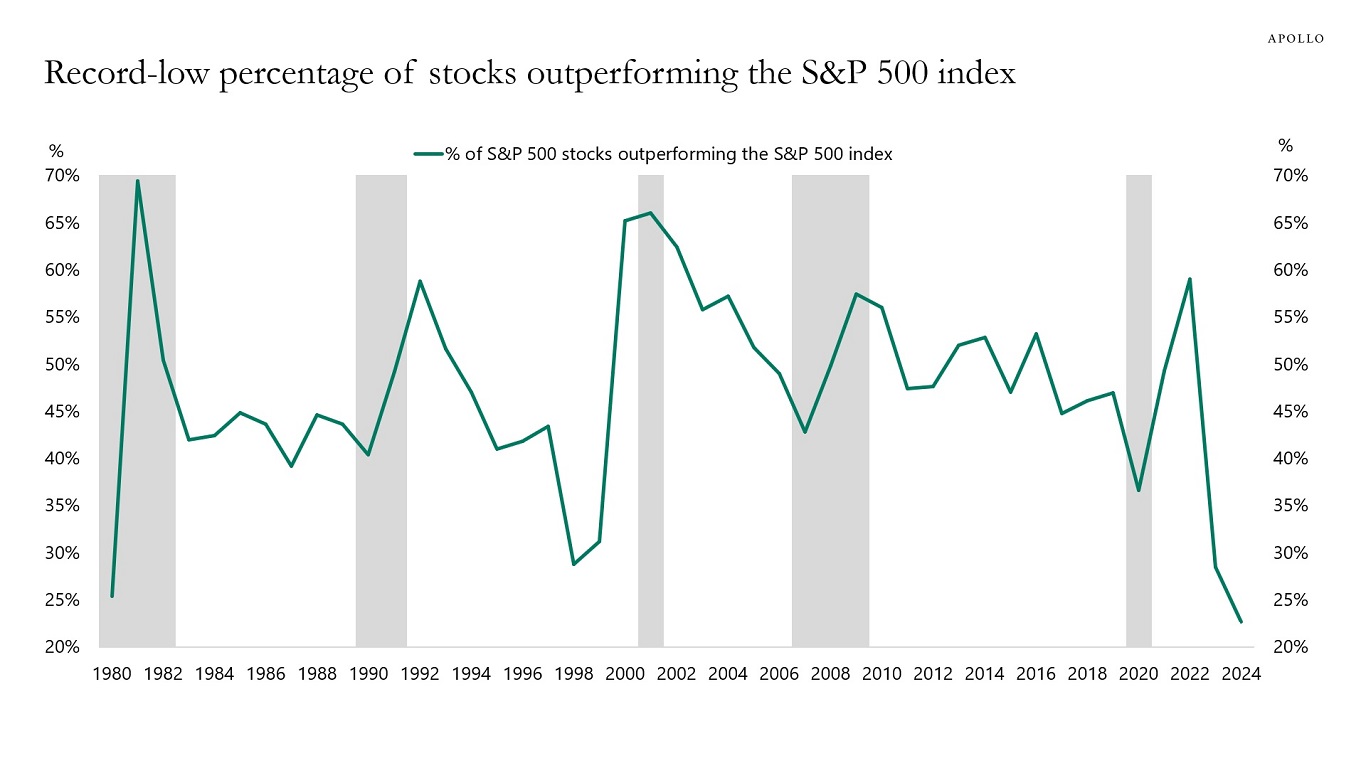

Another way to illustrate the extreme concentration in the S&P 500 is to look at the record-low percentage of component stocks outperforming the index, see chart below. This chart shows that stock picking in the S&P 500 essentially boils down to whether you like tech or not.

Source: Bloomberg, Apollo Chief Economist. Note: Annual data is from January 1 to December 31 for each year. The 2024 data is as of July 2, 2024 (year-to-date). See important disclaimers at the bottom of the page.

-

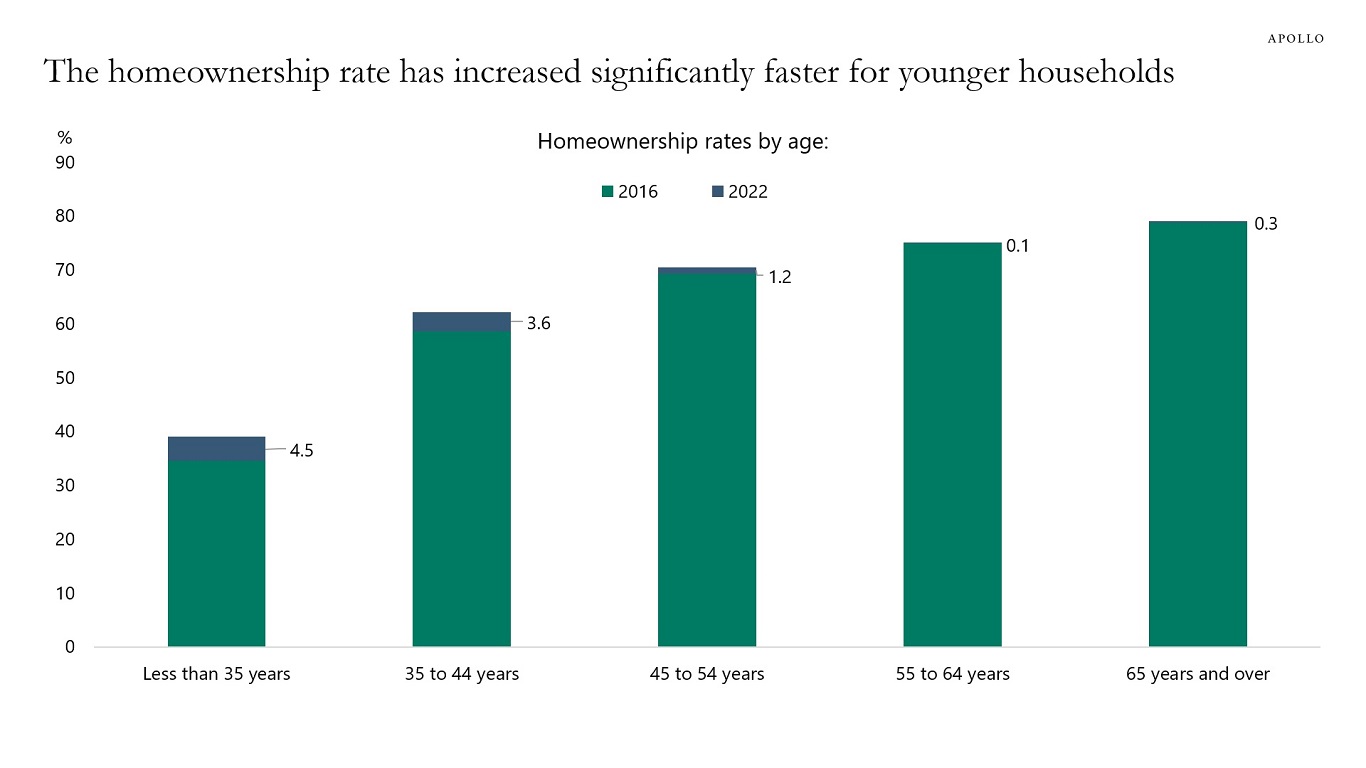

The homeownership rate has in recent years increased much more for younger households, see chart below.

Source: US Census Bureau, Current Population Survey/Housing Vacancy survey, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

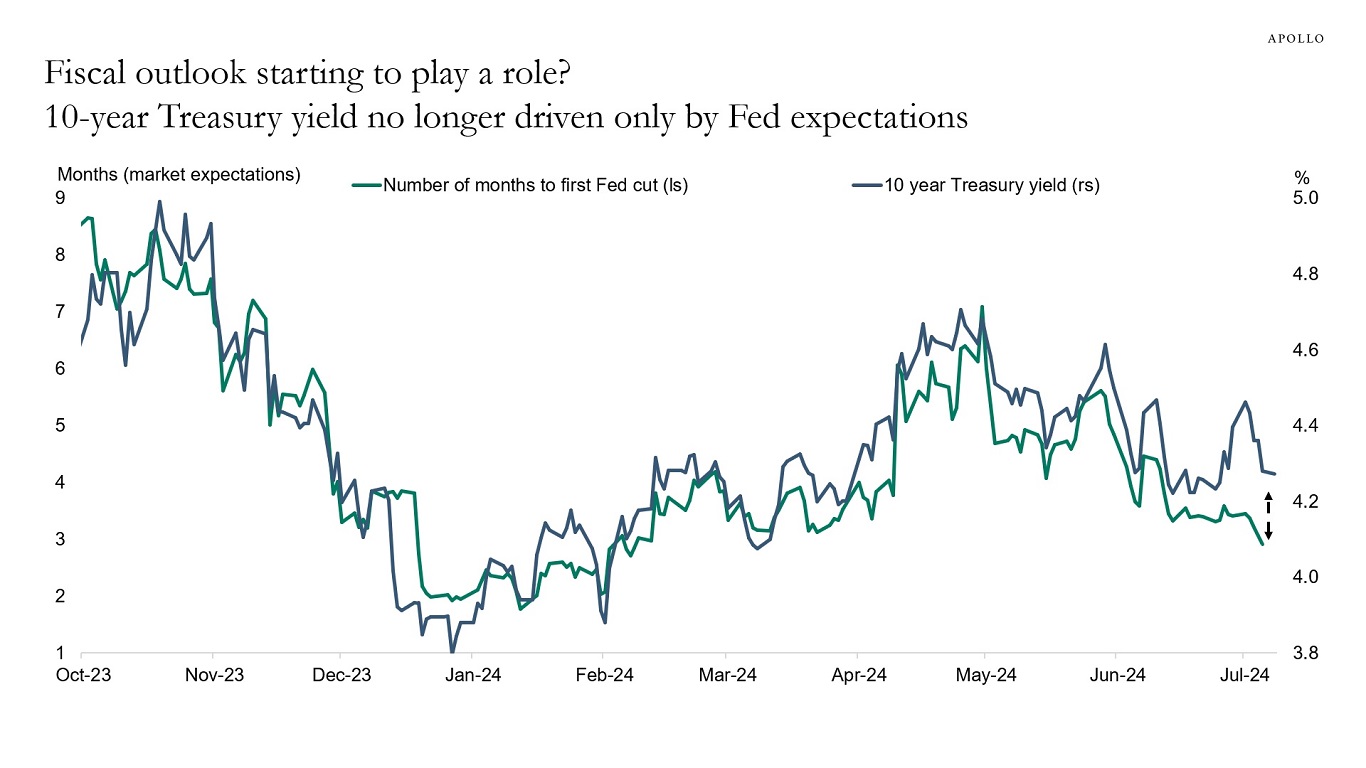

In rates markets, there is a tug-of-war between a slowing economy arguing for lower rates versus the structural forces putting upside pressures on inflation and rates (i.e., deglobalization, energy transition, more restrictions on immigration, more defense spending, and significant fiscal challenges).

So far, 10s have been moving around one-to-one with Fed expectations, see chart below. But in recent weeks, a gap has opened up, suggesting that other factors, perhaps including the fiscal outlook, are beginning to play a role for long rates.

Source: Bloomberg, Apollo Chief Economist. Note: The indices used from Bloomberg are MSM1UT Index and GT10 Govt. See important disclaimers at the bottom of the page.

-

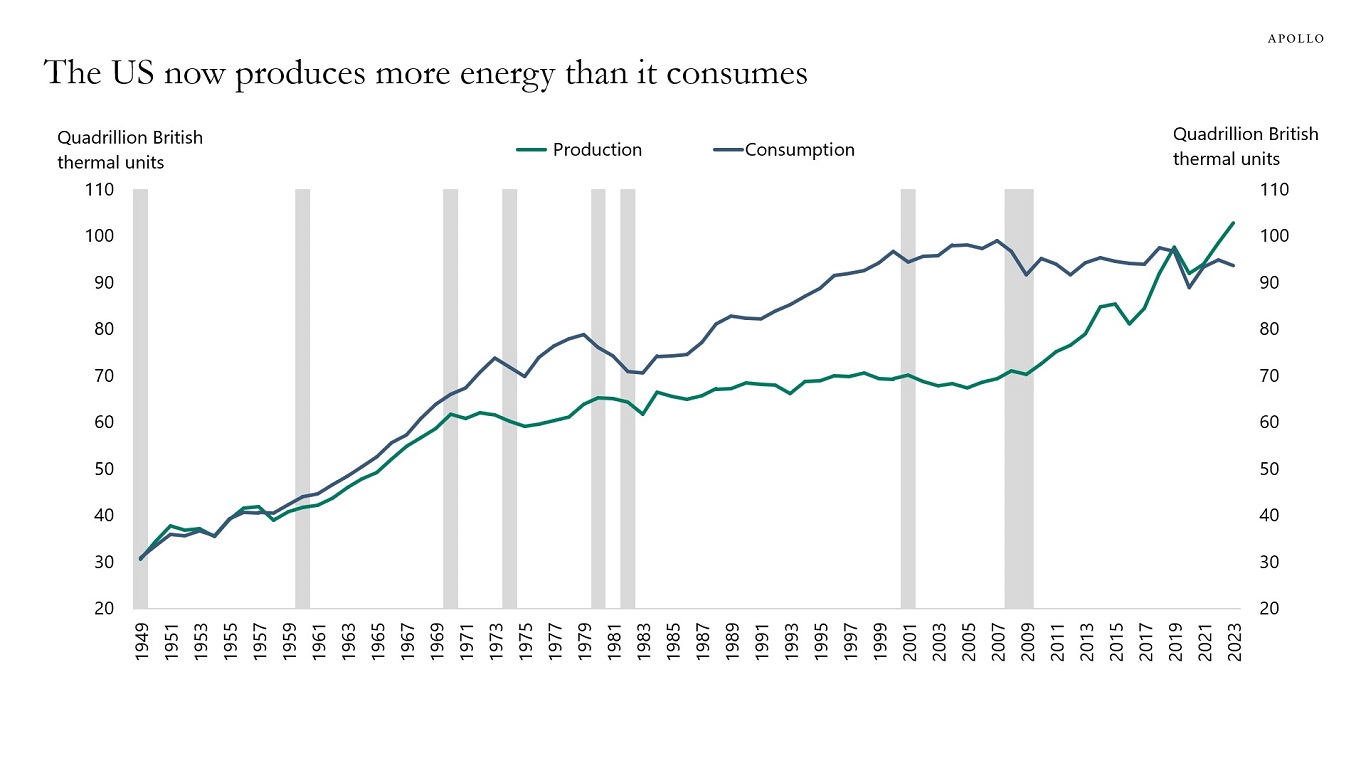

For the first time in more than 60 years, US energy production is now higher than US energy consumption, see chart below.

Note: Primary energy production and consumption. Source: US Energy Information Administration, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

There are 2.3 million firms in the US with more than five employees. Investors and the media spend a disproportionate amount of time on a fraction of these, namely the S&P 500 companies (see chart below).

The bottom line is that the US economy consists mainly of privately owned firms—companies that need equity and debt financing to generate jobs and economic growth.

Source: Census, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

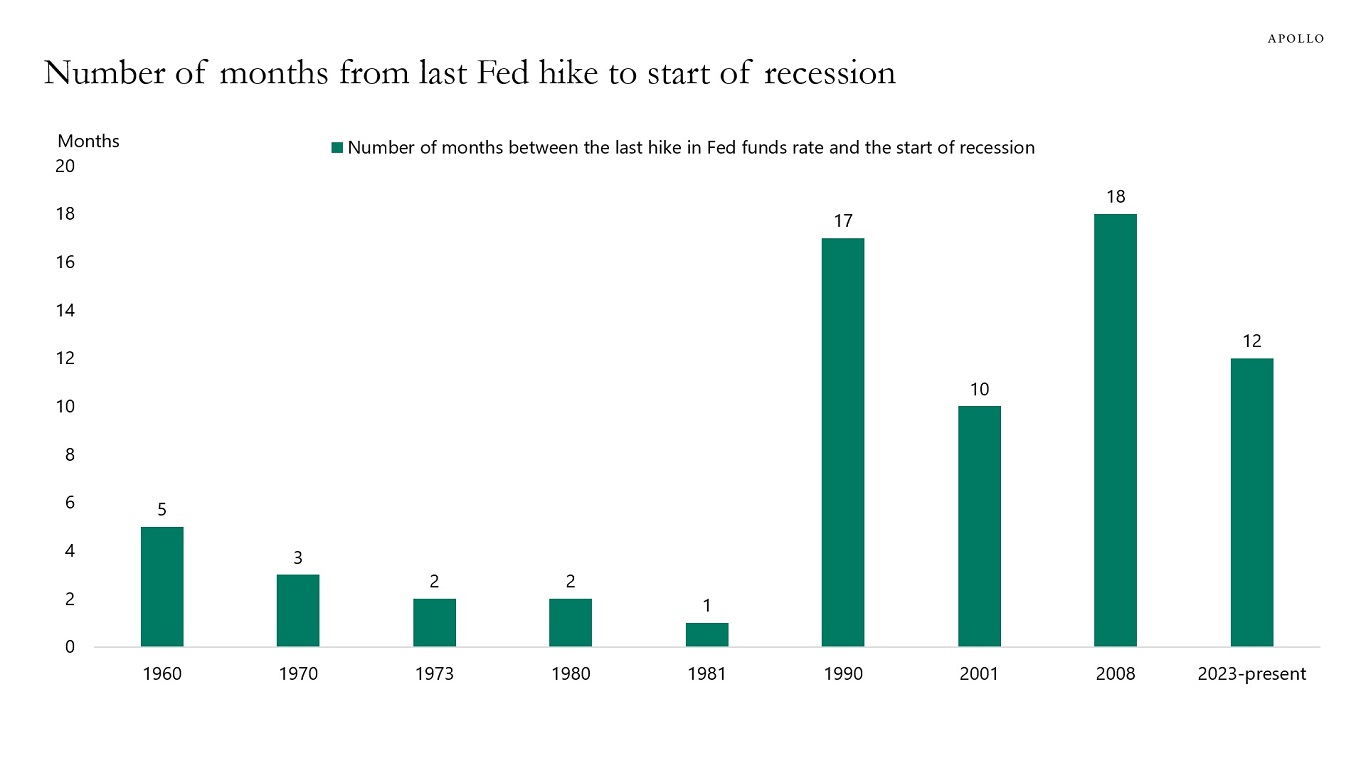

The idea behind the Fed raising interest rates is to slow the economy down in order to slow down inflation. Normally, when the Fed stops raising rates, it ultimately causes a recession within 18 months, see chart below.

The last Fed hike was in July 2023, and using this historical relationship, we should see a recession before the end of 2024.

But we are likely to break this 18-month record during this cycle because of the continued strong tailwinds to growth from easy fiscal policy and easy financial conditions.

In short, the US economy continues to power ahead, driven by easy fiscal policy, a dovish Fed, and AI investments and AI wealth gains.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

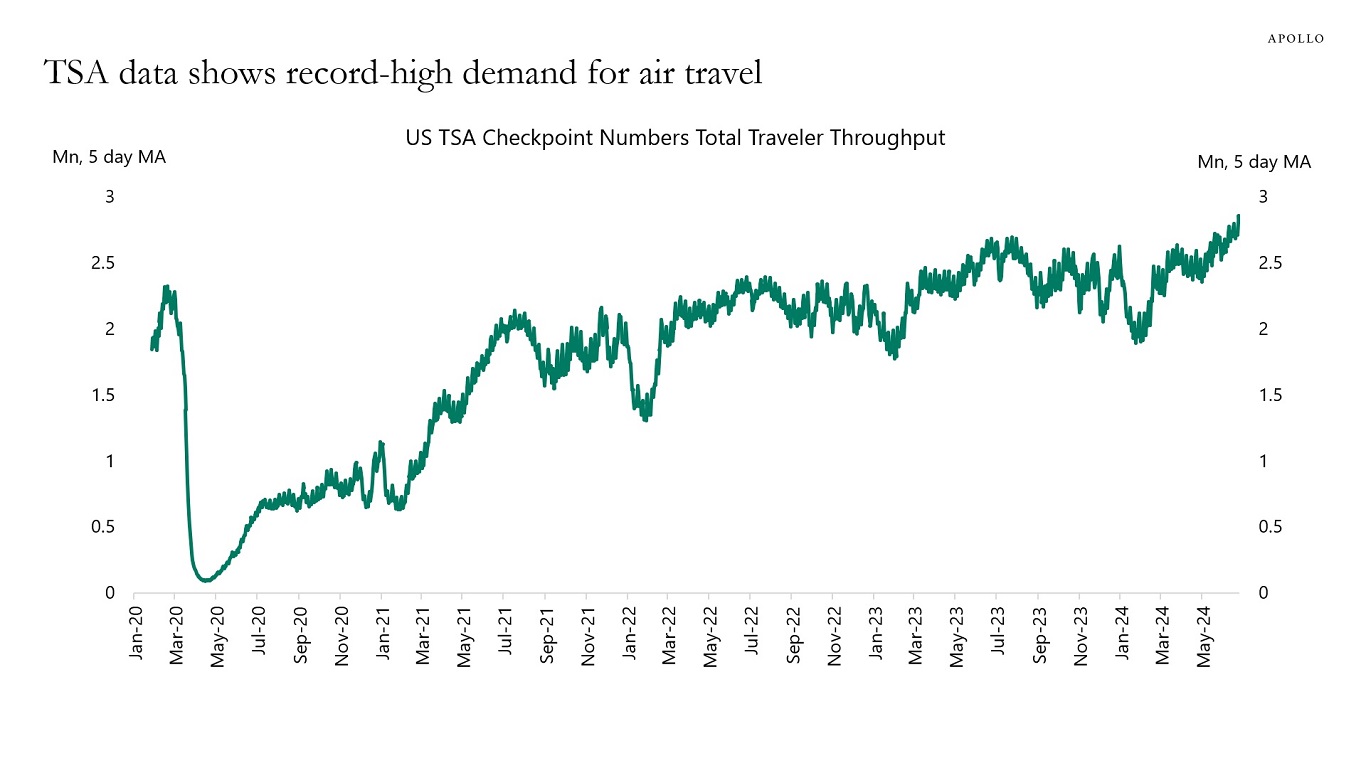

The TSA has daily data for the number of people scanning their boarding pass with a TSA agent, and it continues to show no signs of the economy slowing down, see chart below.

Source: Transportation Security Administration, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

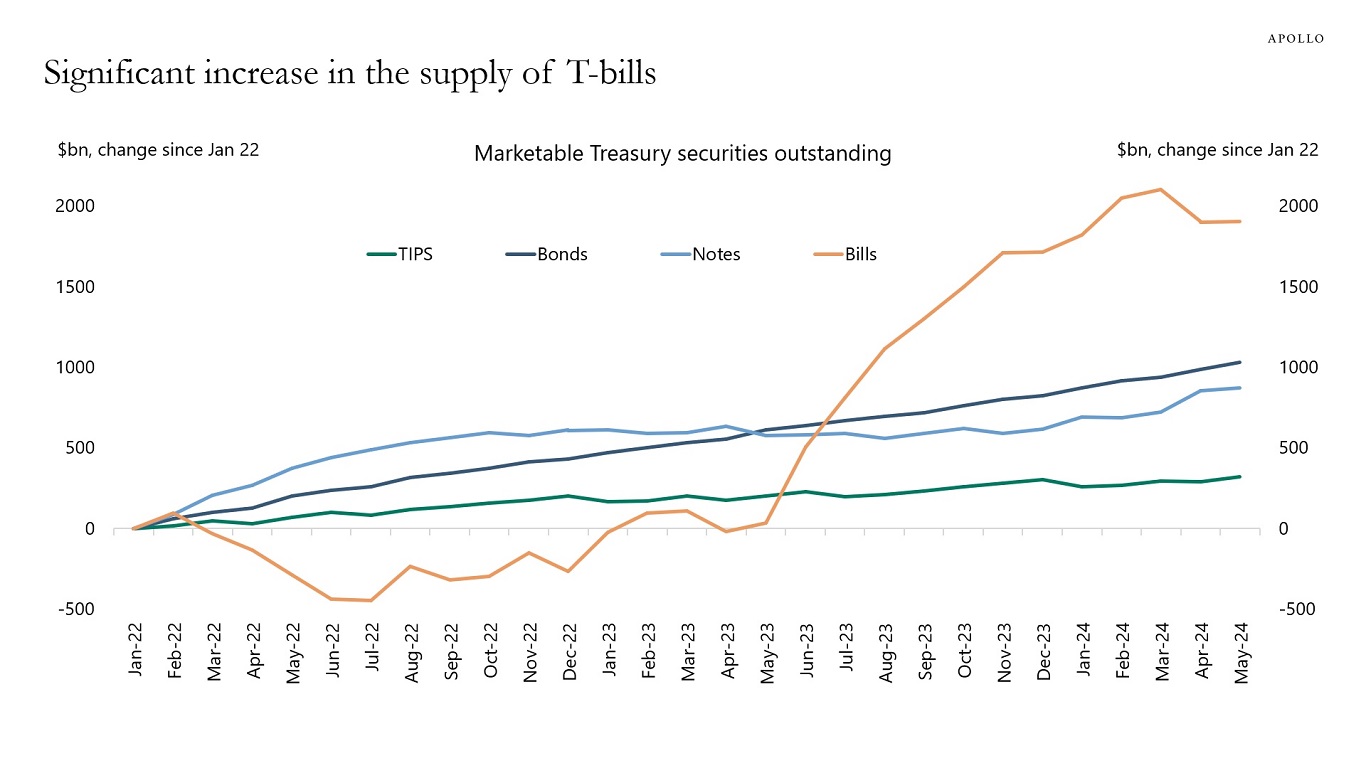

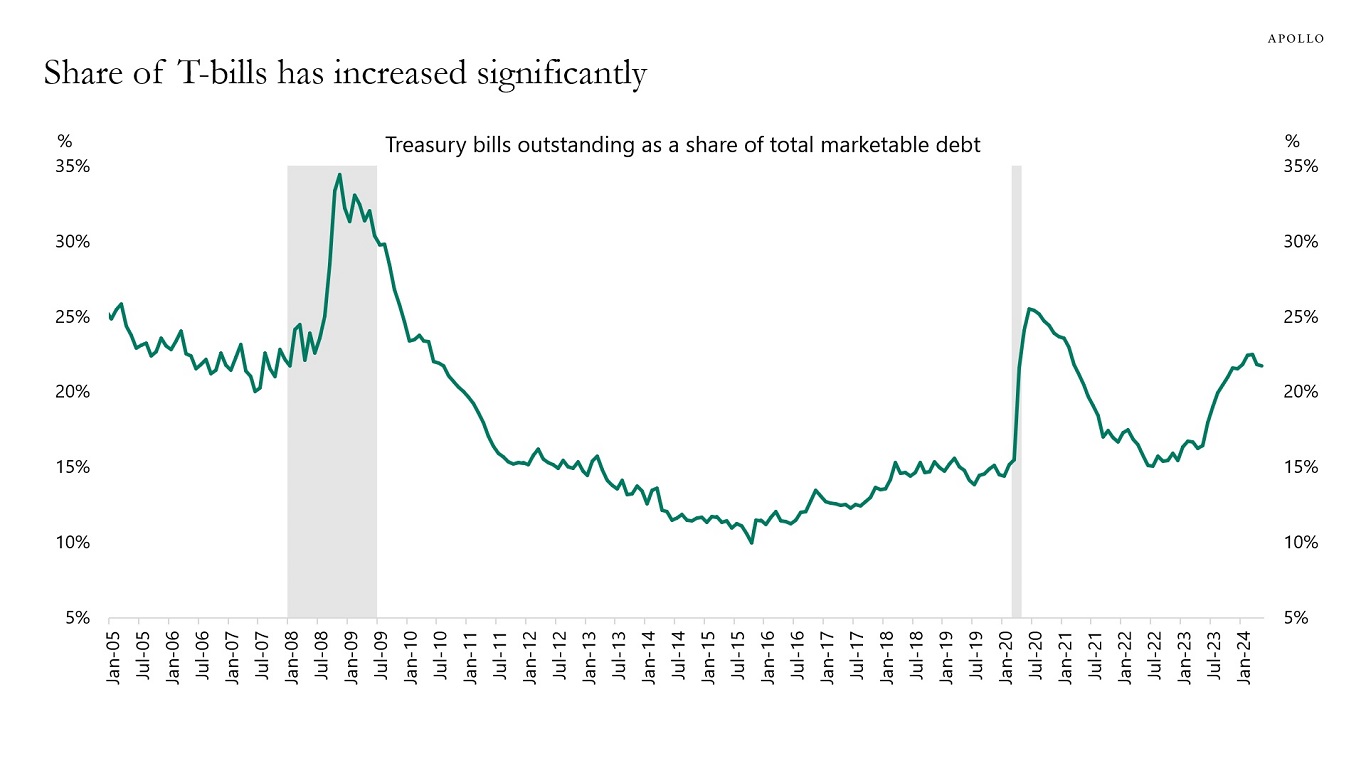

The supply of T-bills has increased by $2 trillion over the past 12 months, and the share of T-bills outstanding as a share of total debt outstanding has trended significantly higher over the same period, see charts below.

Why is the rapid growth in the supply of T-bills a problem? Because a big increase in supply requires a big increase in demand. Growing the amount of T-bills outstanding while the Fed at the same time is doing QT increases the risk of an accident in funding markets, which is what we saw in repo markets in September 2019.

In other words, the strong growth in the supply of T-bills will require a continued increase in demand from banks, money market funds, and households. If the Fed starts cutting rates, say, in September, we could see lower appetite for T-bills from households and money market funds, which ultimately would put upward pressure on short rates because of the big supply of T-bills not being met by similar strong demand.

Source: Treasury, Haver Analytics, Apollo Chief Economist

Source: Treasury, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

With the Japanese yen rising above 160 and 10-year JGB yields approaching 1.1%, we’ve updated our chart book looking at Japanese demand for US Treasuries.

There are five conclusions:

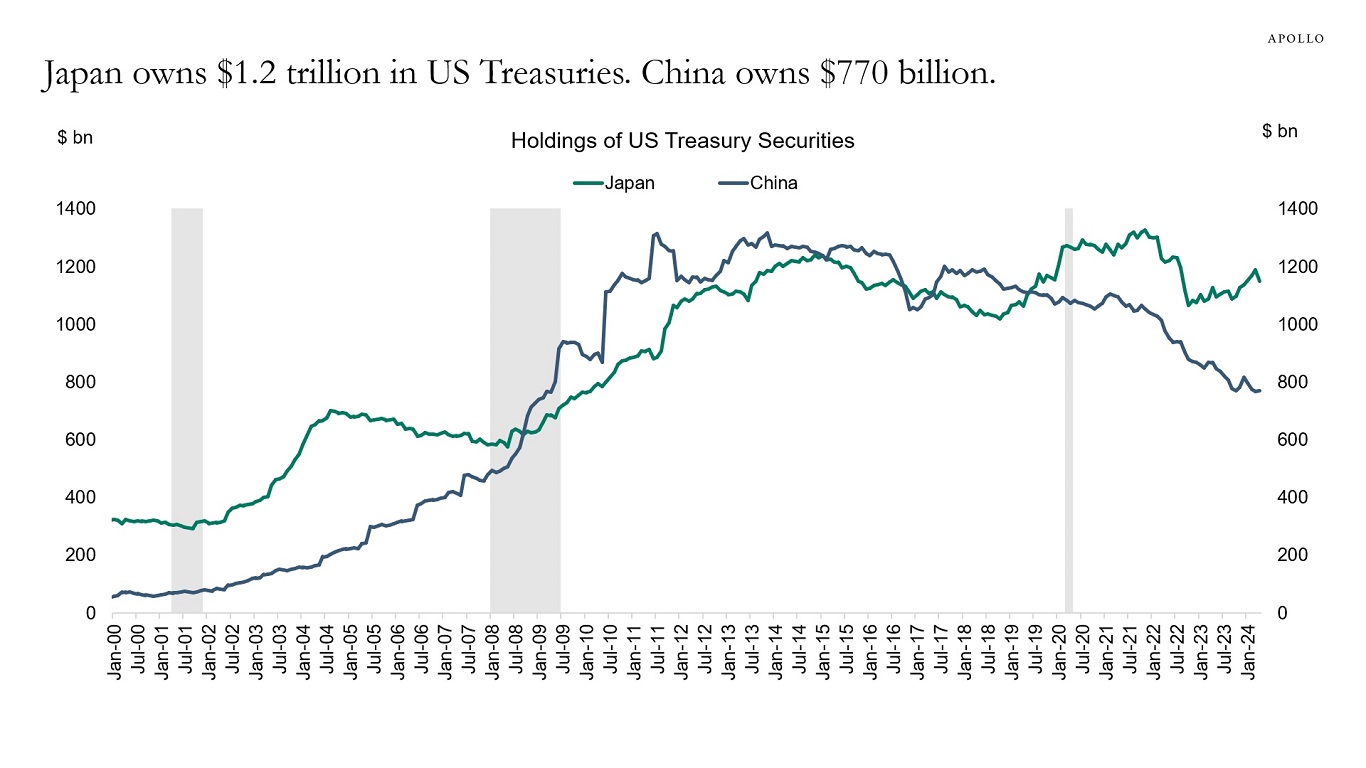

1) Japan is the biggest foreign holder of US Treasuries, holding $1.2 trillion. This is more than China’s $770 billion, see the first chart.

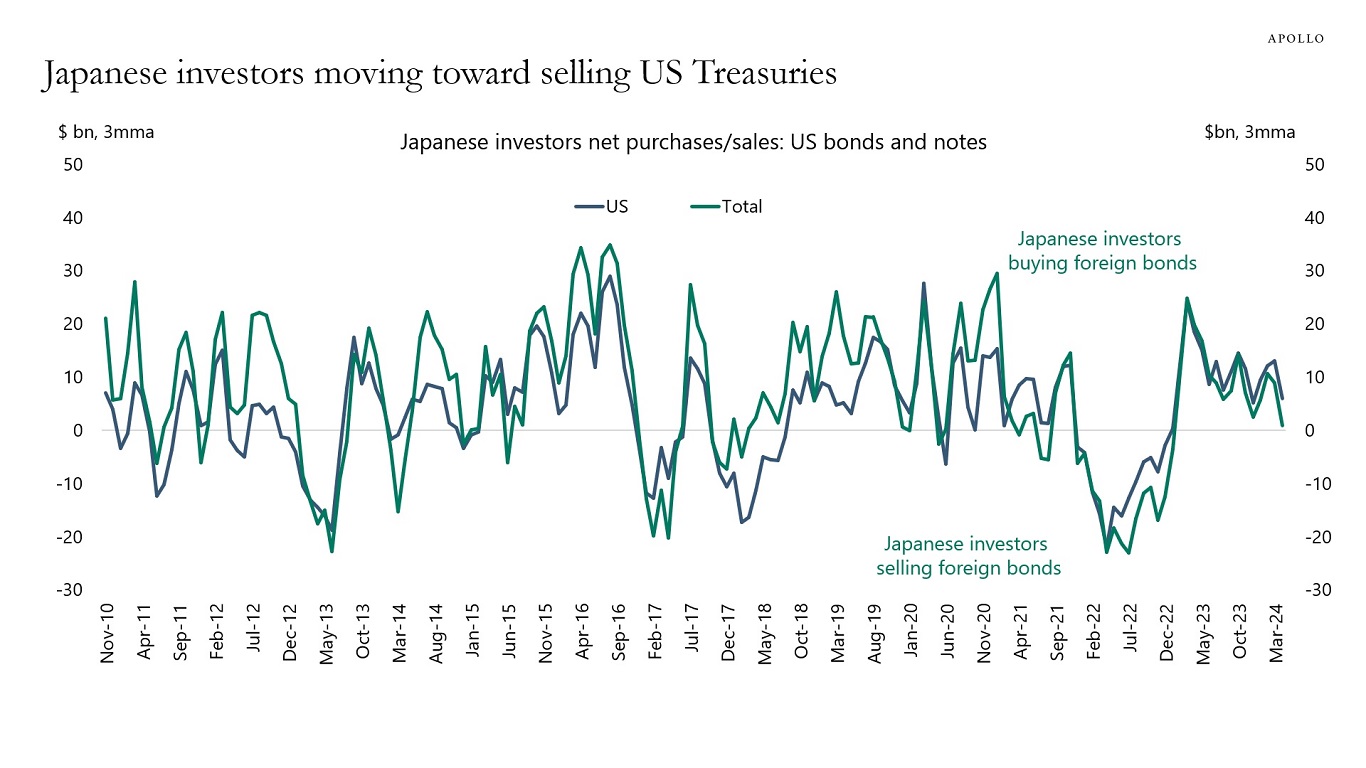

2) The three-month moving average of Japanese net purchases of US Treasuries is declining, suggesting that Japanese investors are repatriating money from abroad and taking money home to buy Japanese assets, see the second chart.

3) A simple econometric model forecasting the USD/JPY exchange rate shows that based on the current interest differential between the US and Japan, the USD/JPY exchange rate should currently be 140, see the third chart below. In other words, with Japanese yields rising relative to US yields, the yen should be appreciating, which is the opposite of what has happened.

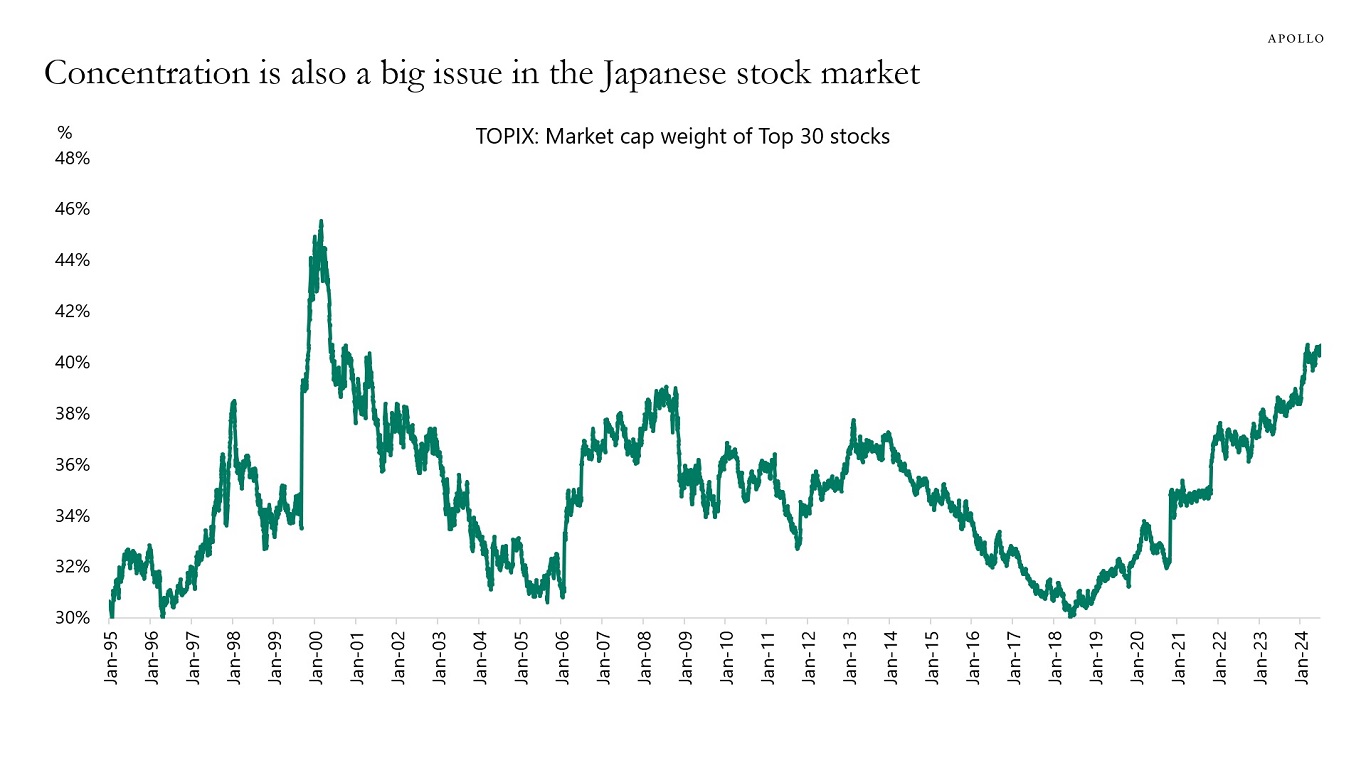

4) Concentration is also a major challenge for the Japanese stock market, with the 30 biggest stocks in the TOPIX now making up 40% of the index, see the fourth chart.

5) The latest data shows that tourism into Japan is at record-high levels, likely driven by the cheap yen, see the fifth chart.

Source: Bloomberg, Apollo Chief Economist

Source: Ministry of Finance Japan, Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: Japan National Tourism Organization, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

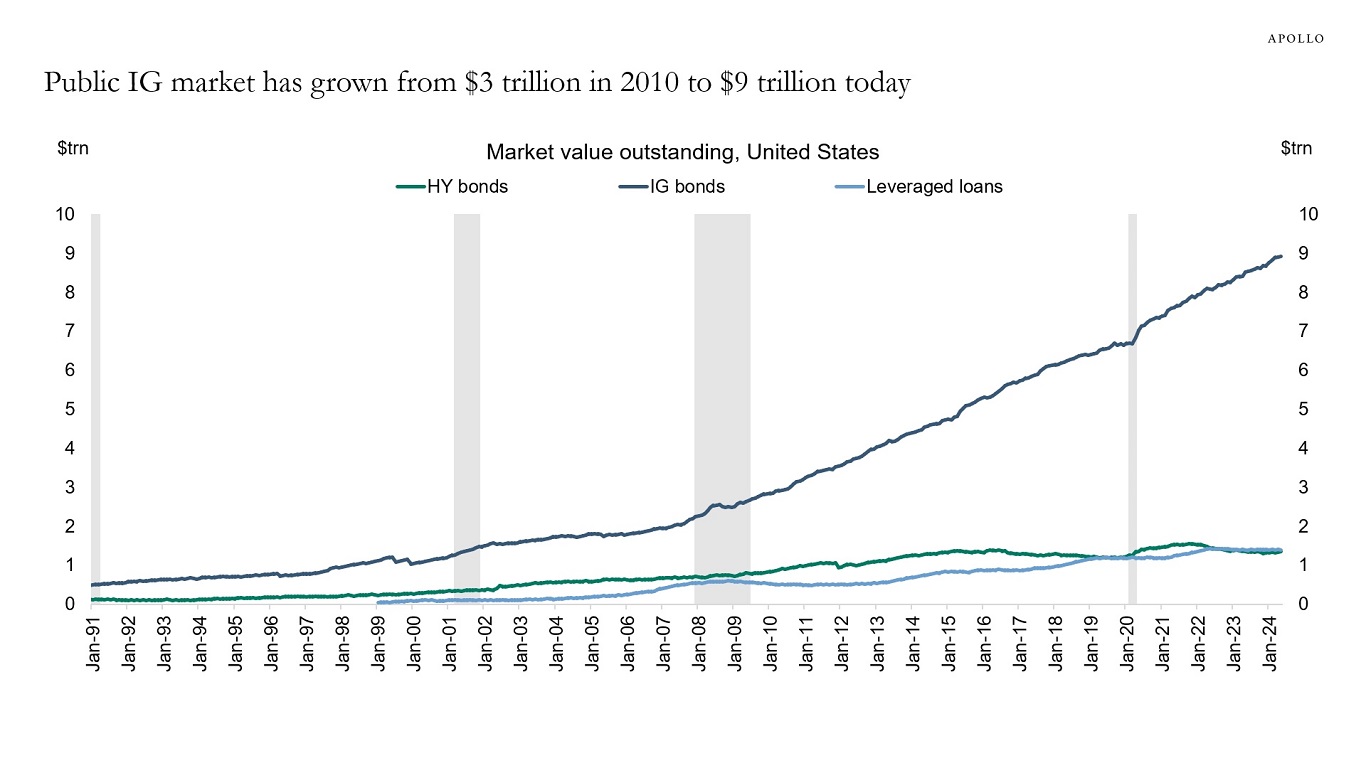

The market value of all US corporate IG bonds outstanding has increased from $3 trillion in 2010 to $9 trillion today, see the first chart.

Over the same period, the private credit market has grown by $800 billion.

The bottom line is that public IG markets have since 2010 grown eight times faster than private credit, see the second chart.

In short, when discussing growth in private credit it is important to also consider the growth in public credit over the same period.

Source: ICE BofA, Bloomberg, PitchBook LCD, Apollo Chief Economist. Note: Ticker used for HY is H0A0 Index, for IG it is C0A0 Index, and for loans it is SPBDALB Index.

Source: ICE BofA, PitchBook, Preqin, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.