Want it delivered daily to your inbox?

-

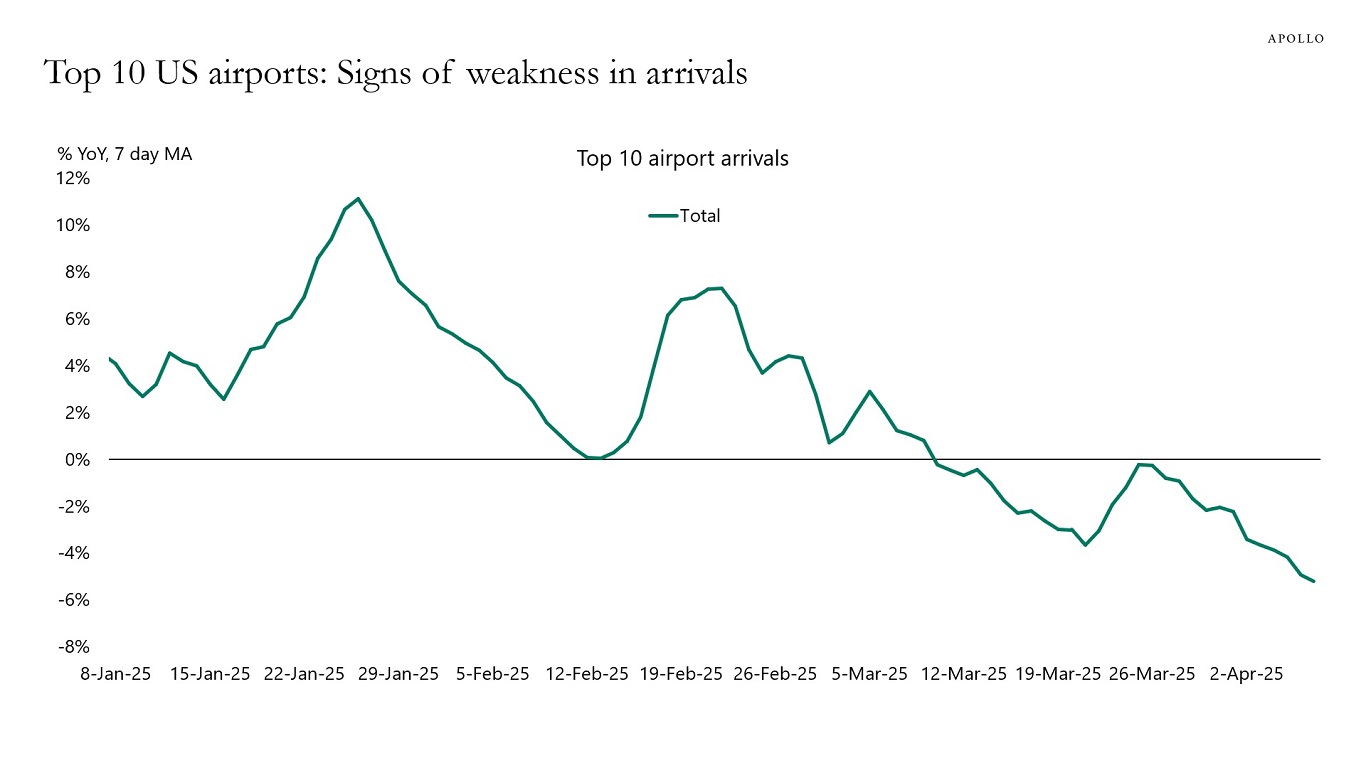

Daily data of the number of arrivals at the top 10 airports in the US has shown a rapid decline since late February, see chart below. This is likely a mix of declines in business travel, tourism, and government travel.

Note: Airports included are ATL, LAX, DFW, MIA, ORD, DEN, IAD, SFO, MCO, and JFK. Sources: CBP, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

The textbook would be saying that when the stock market is going down, long-term interest rates should also be going down.

But this is not what is happening at the moment, see chart below.

What could be the reasons why long-term interest rates are moving higher when the stock market is moving lower?

1) With the yen, euro, and Canadian dollar strengthening at the same time, this could be foreigners selling US Treasuries.

2) With the VIX at elevated levels around 50, there is a lot of hedging activity going on, and it could, therefore, be risk reduction among large asset managers managing rates, credit, and equities.

3) With almost $1 trillion in the basis trade, it could be an unwinding of the basis trade among levered hedge funds.

The answer is likely some combination of these three forces.

Note: Data starts from January 2020. Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

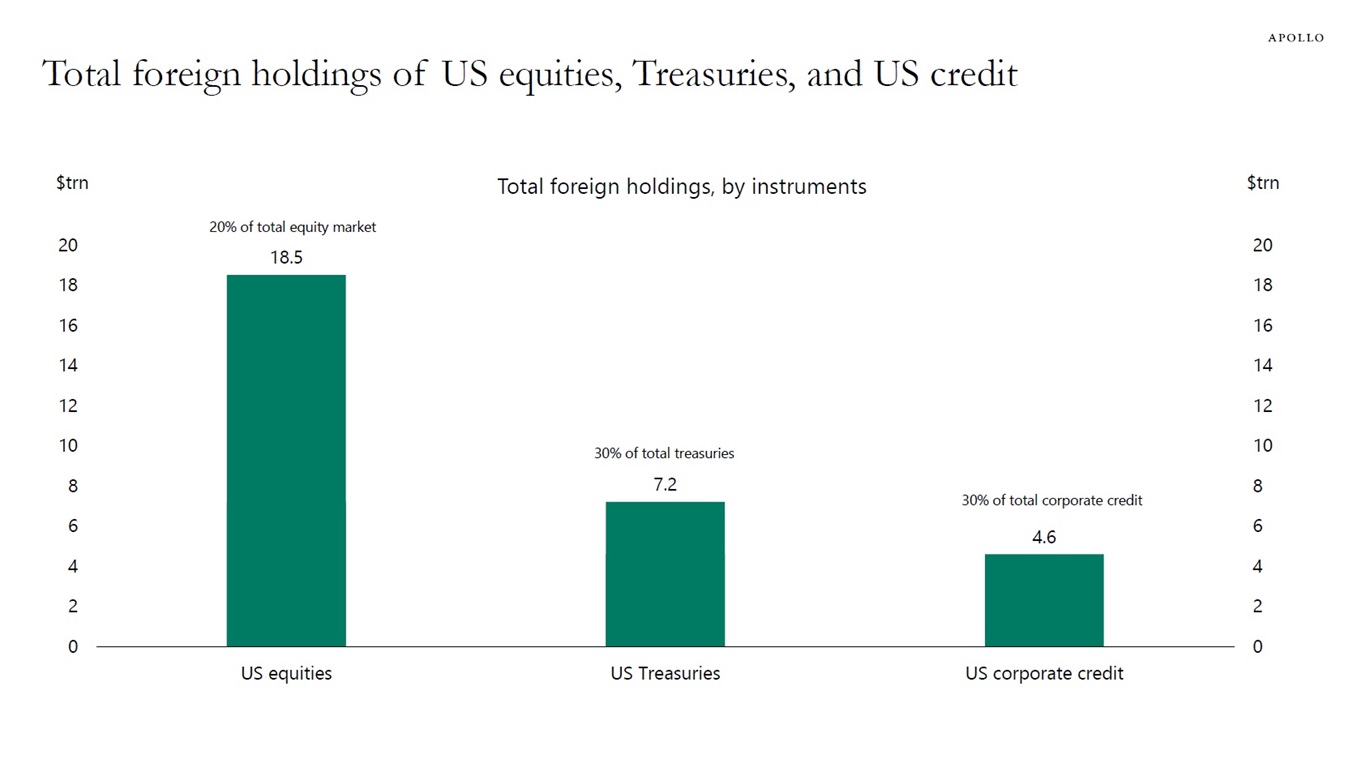

Foreigners own $19 trillion in US equities, $7 trillion in Treasuries, and $5 trillion in US credit, see chart below.

That corresponds to 20% of US equities, 30% of Treasuries, and 30% of credit outstanding.

Sources: Federal Reserve, MacroBond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

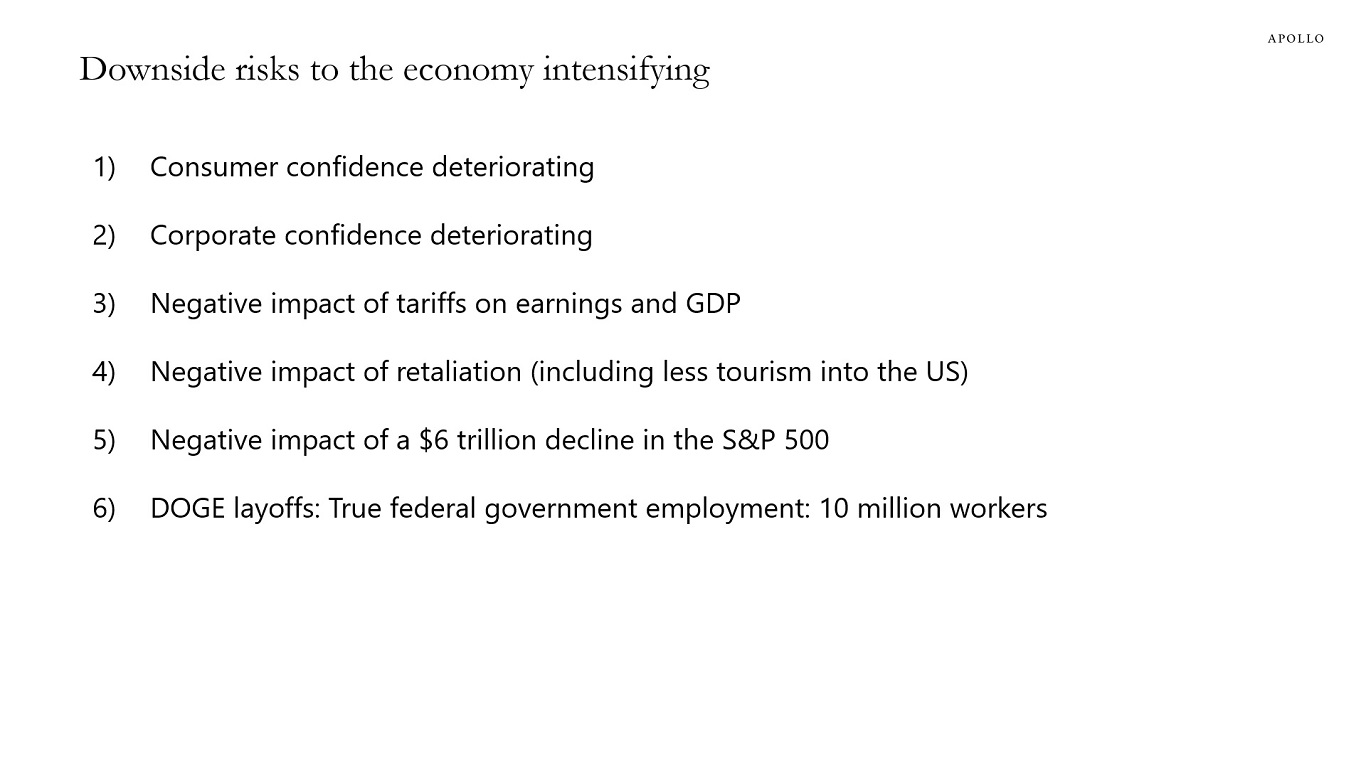

As tariffs are implemented, they will have negative consequences for corporate earnings over the coming months. Combined with uncertainty about retaliation, lower consumer sentiment, lower corporate sentiment, and the negative wealth effect of the $10 trillion decline in the stock market, we continue to worry about downside risks to markets and the economy.

We will be discussing these headwinds to growth and recent developments in Washington, DC and financial markets on a conference call today at 9:00 am EDT. You can register here, and the chart book we will be using is available here.

Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Something very unusual happened in financial markets yesterday. Long-term interest rates went up 20 basis points despite stocks going down. One potential reason for the move higher in rates is an unwind of the basis trade.

The basis is the difference in price between a Treasury security and a Treasury futures contract with similar characteristics.

The source of this price difference is demand and supply imbalances in Treasury markets, or arbitrage limitations for regulatory reasons.

In the basis trade, hedge funds put on leveraged bets, sometimes up to 100 times, with the goal of profiting from the convergence between the futures price and the bond price, as the futures contract approaches expiry.

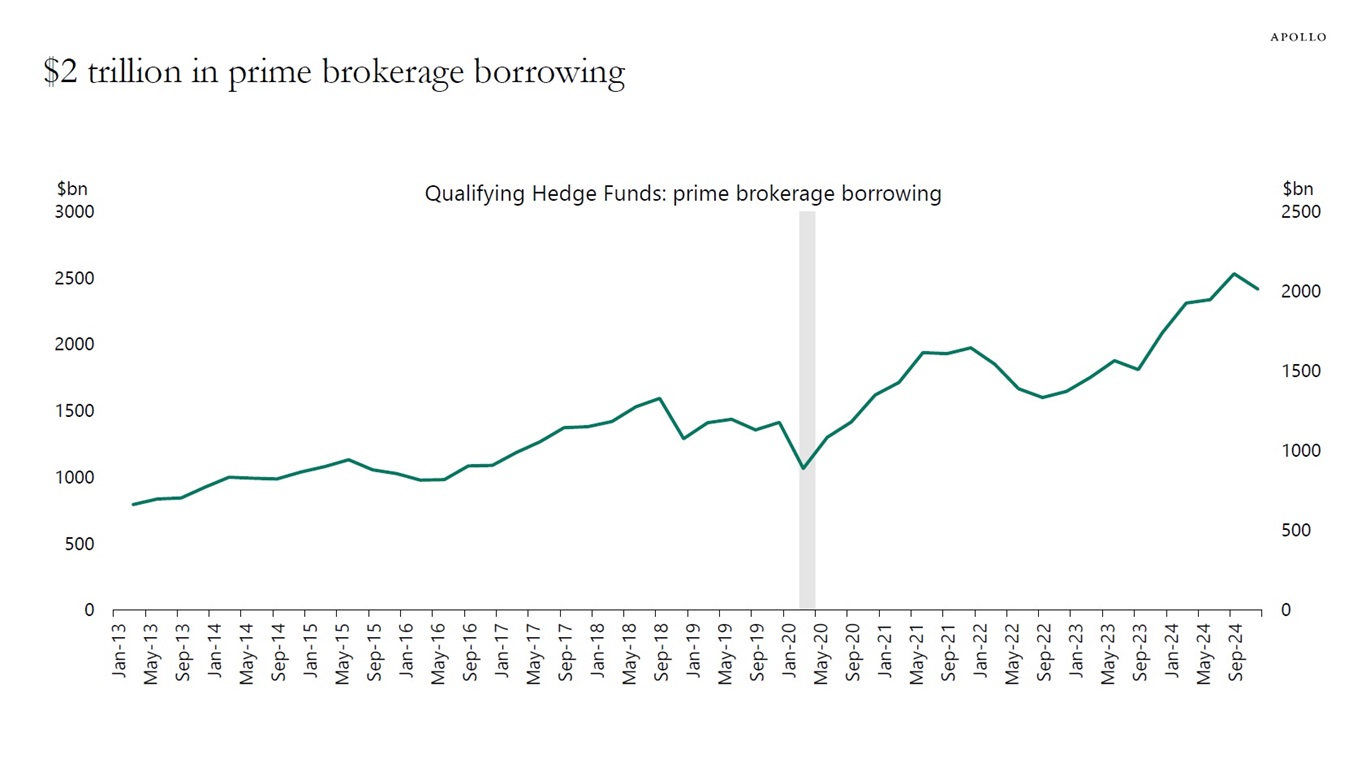

How big is the basis trade? It is currently around $800 billion and an important part of the $2 trillion outstanding in prime brokerage balances. It will continue to expand as US government debt levels continue to grow, see charts below.

Why is this a problem? Because the cash-futures basis trade is a potential source of instability. In case of an exogenous shock, the highly leveraged long positions in cash Treasury securities by hedge funds are at risk of being rapidly unwound. Such an unwind would have to be absorbed, in the short run, by a broker-dealer that itself is capital-constrained. This could lead to a significant disruption in market functions of broker-dealer firms, such as providing liquidity to the secondary market for Treasuries and intermediating the market for repo borrowing and lending. For example, during Covid, the Fed was at the peak buying $100 billion in Treasuries every day.

In addition, if the supply of Treasuries grows further, for example, because of a growing budget deficit or the Fed doing quantitative tightening, it will potentially depress Treasury prices, hurting the long leg of the trade, and stress repo funding, as dealers have limited balance sheet capacity.

The bottom line is that the large and growing cash-futures basis trade, driven by leveraged hedge fund positions in Treasuries, poses a risk due to potential market disruptions and liquidity issues, especially in the event of an exogenous shock or increasing Treasury supply.

Sources: Commodity Futures Trading Comm, Bloomberg, Apollo Chief Economist

Note: The data are aggregated responses to SEC Form PF question 43. Only responses from Qualifying Hedge Funds are included. Sources: Data for the US Office of Financial Research, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

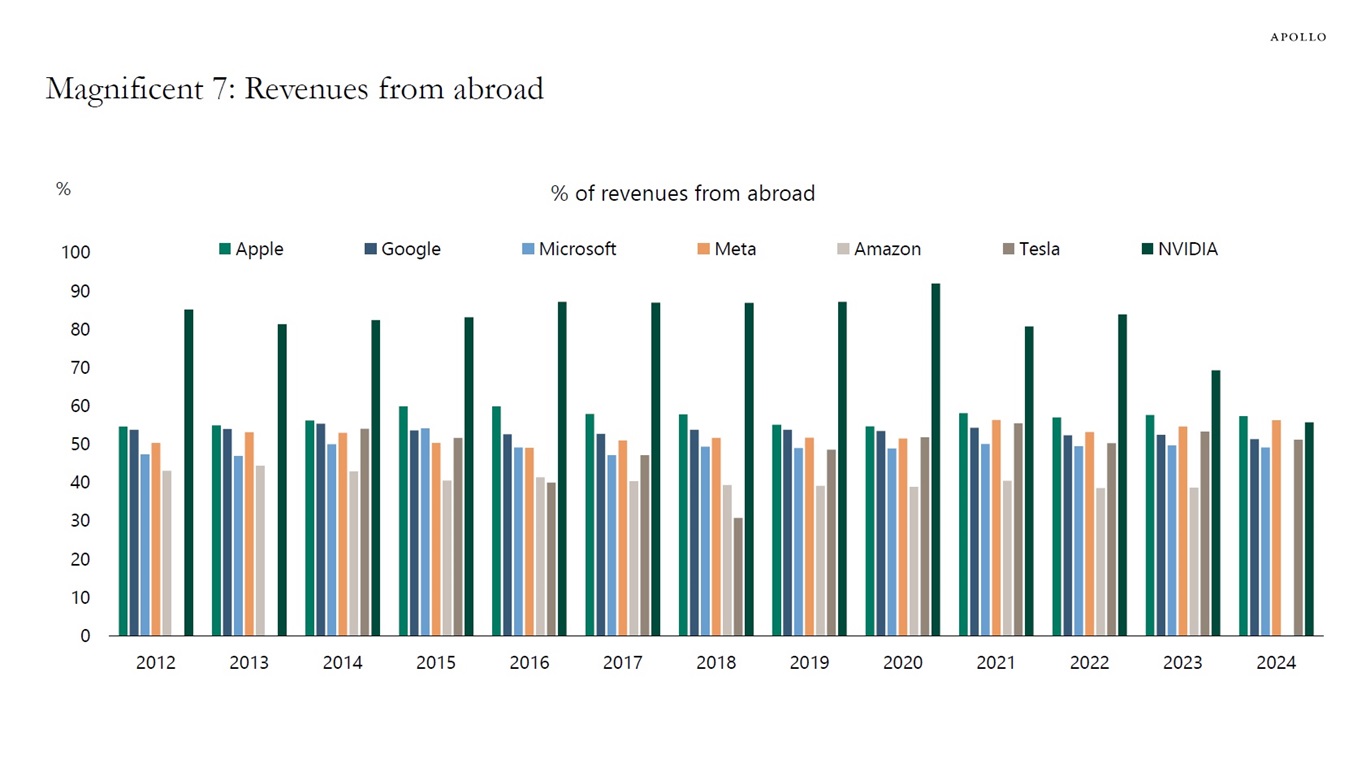

Roughly 50% of earnings in the Magnificent 7 come from abroad, see chart below. That is higher than for the S&P 500, where the share is 41%.

With trade making up a bigger share of GDP in the rest of the world than in the US, the trade war will have a disproportionately more negative impact on the rest of the world.

As a result, the Magnificent 7 will be hit harder on their global earnings than other S&P 500 companies. Their earnings could be even more negatively impacted if Europe retaliates in the form of a digital services tax.

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Our daily and weekly indicators for the US economy are available here, and the conclusion is that the hard data is still doing okay, but there are signs of weakness emerging.

Specifically:

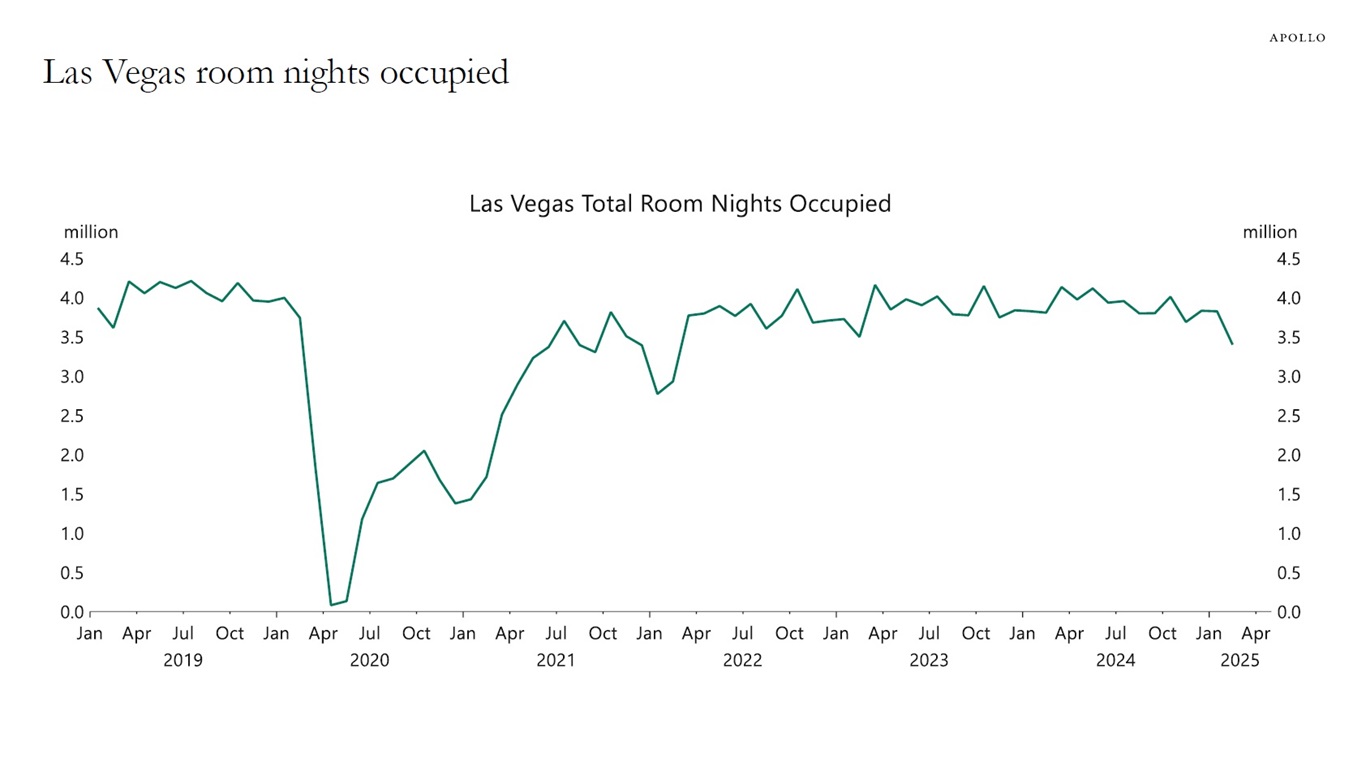

– Las Vegas visitor volumes and total room nights occupied have started to decline, see the first two charts.

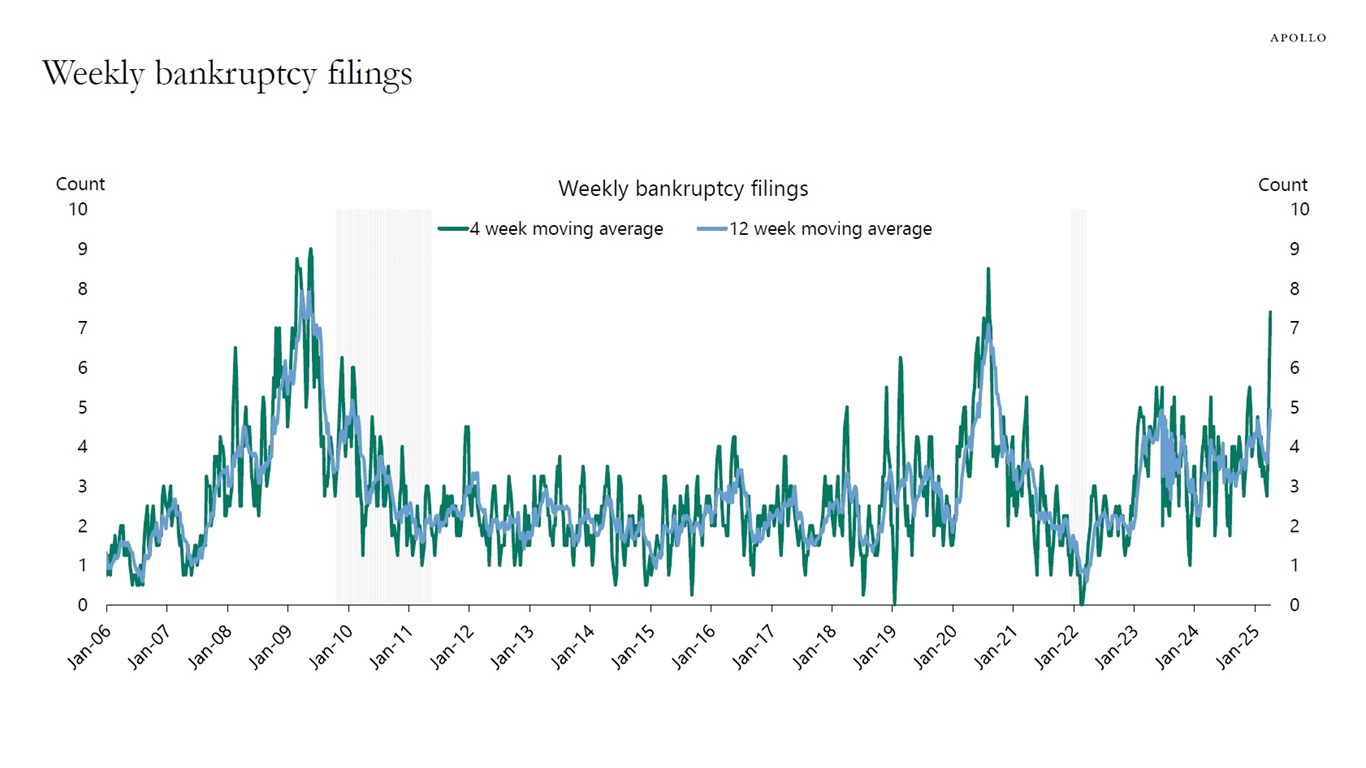

– Weekly bankruptcy filings are moving higher, see the third chart.

– Weekly data for movie theatre visits is weak, see the fourth chart.

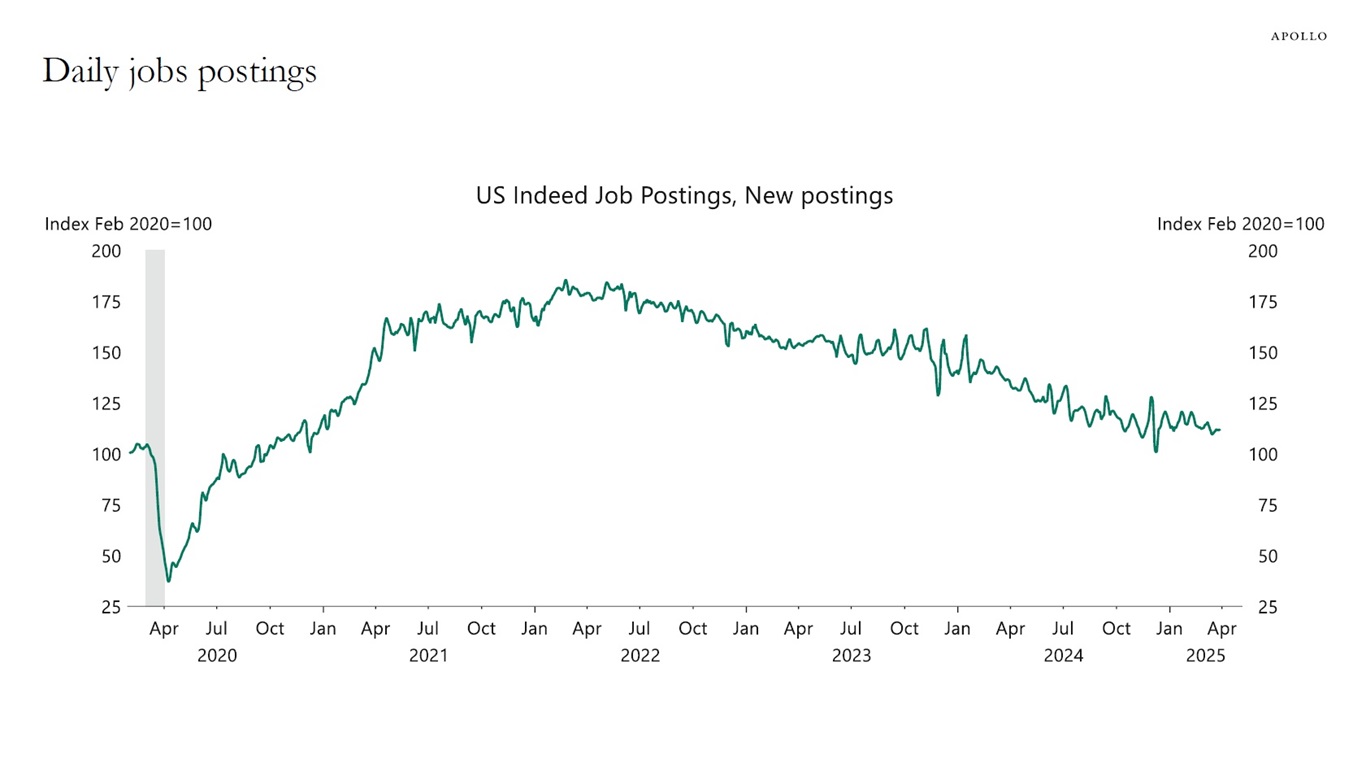

– Daily data for job postings has been weaker in recent weeks, see the fifth chart.

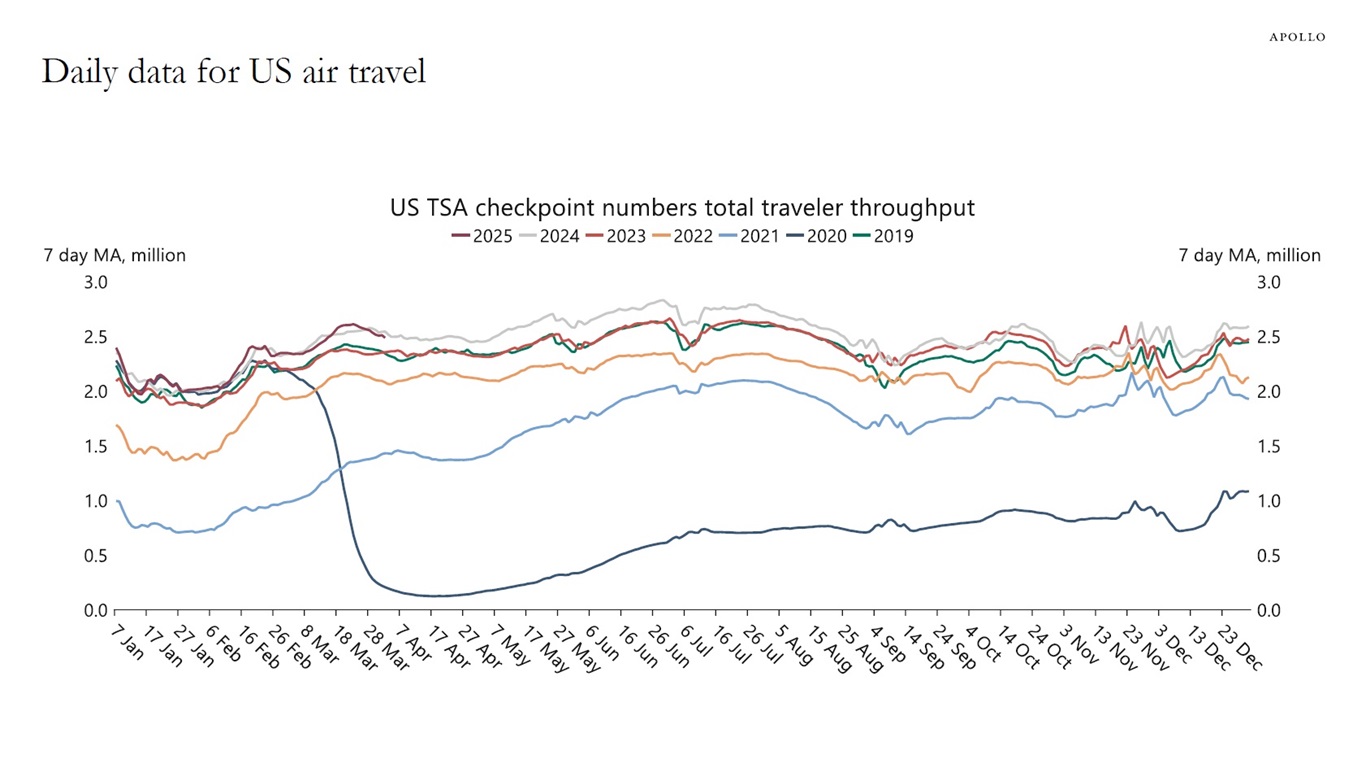

– Daily TSA travel data is slightly weaker than at this time last year, see the sixth chart.

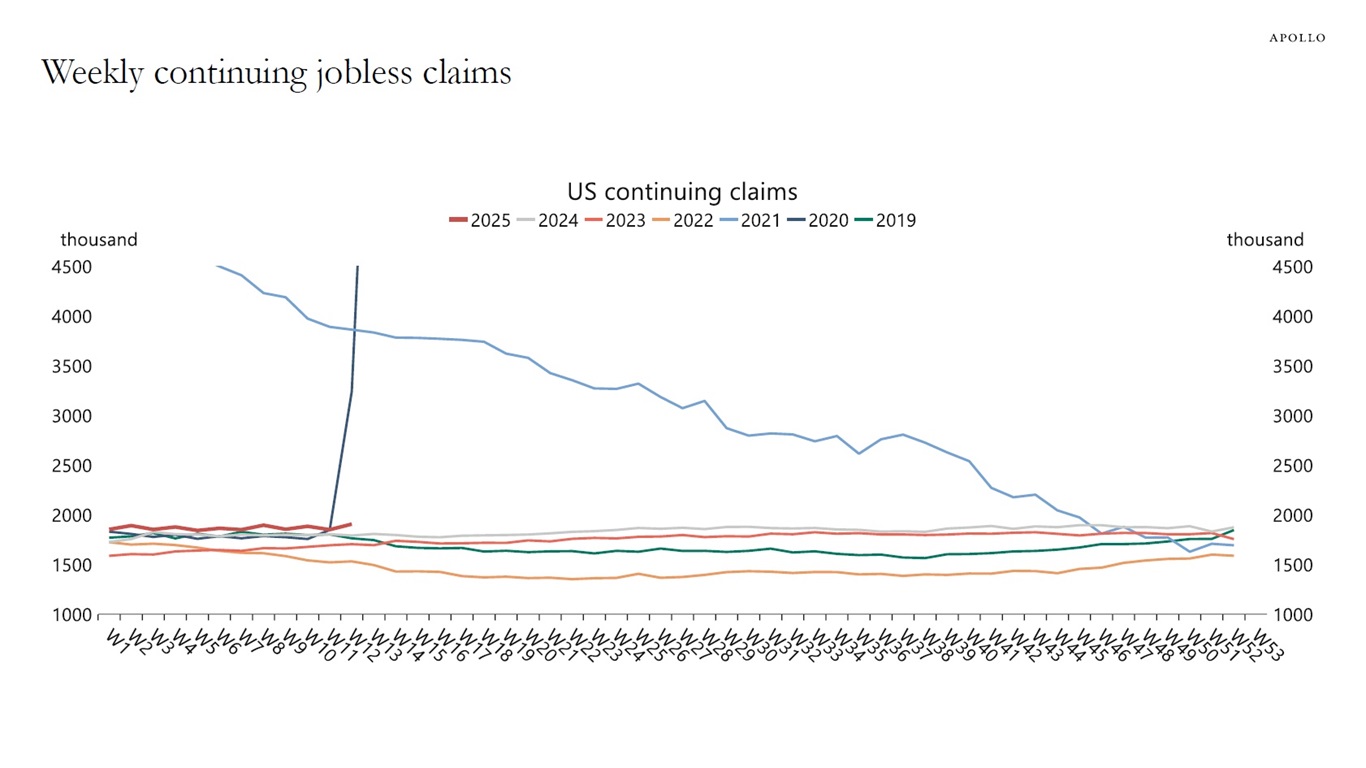

– Continuing claims are moving higher, see the seventh chart.

Sources: Bloomberg, Macrobond, Apollo Chief Economist

Sources: Bloomberg, Macrobond, Apollo Chief Economist

Note: Filings are for companies with more than $50mn in liabilities. For week ending on April 4, 2025. Sources: Bloomberg, Apollo Chief Economist

Sources: Boxofficemojo.com, Apollo Chief Economist

Sources: Indeed, Bloomberg, Macrobond, Apollo Chief Economist

Sources: US Department of Homeland Security, Macrobond, Apollo Chief Economist

Sources: US Department of Labor, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

The chart book we used during our conference call yesterday is available here.

Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

-

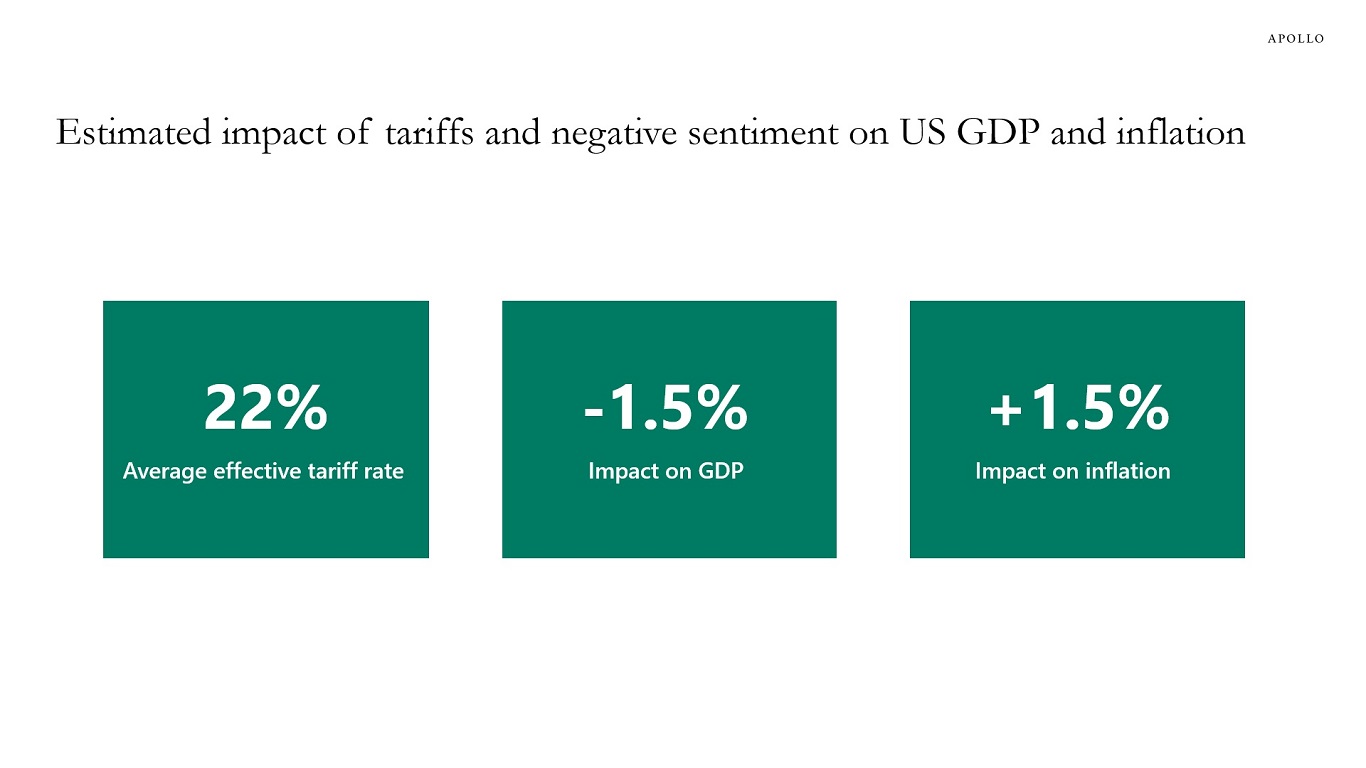

The table below shows our estimates of the impact on US GDP and inflation of tariffs and the decline in consumer sentiment and corporate sentiment.

Whether we will have a recession or not depends on the duration of this shock. If these levels of tariffs stay in place for several months and other countries retaliate, it will cause a recession in the US and the rest of the world.

We will be discussing the outlook for the economy and markets on a conference call today at 9 am EDT, you can register here.

Note: Includes Chinese tariffs from February and March, Canada and Mexico non-USMCA compliant goods tariffs from March, Steel, Aluminum and Auto imports and reciprocal tariffs on all countries announced in April. Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

-

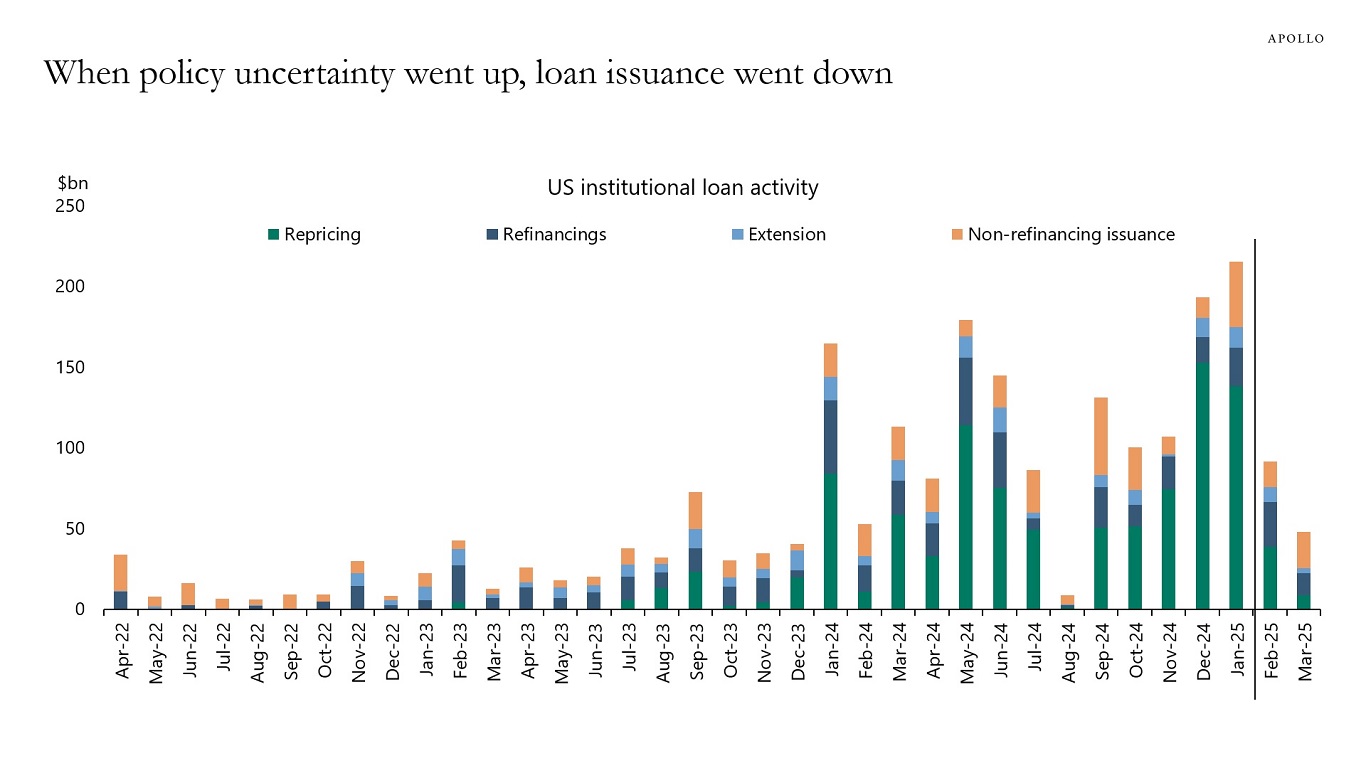

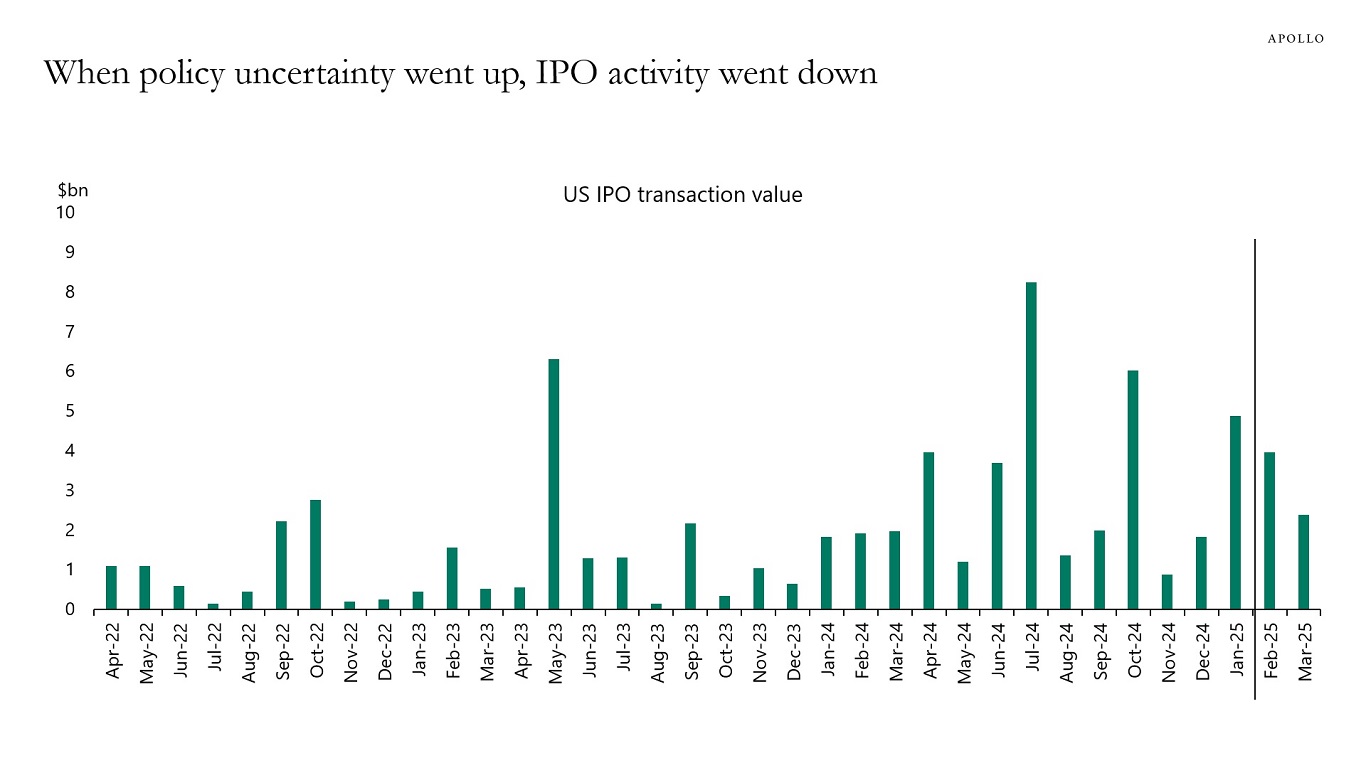

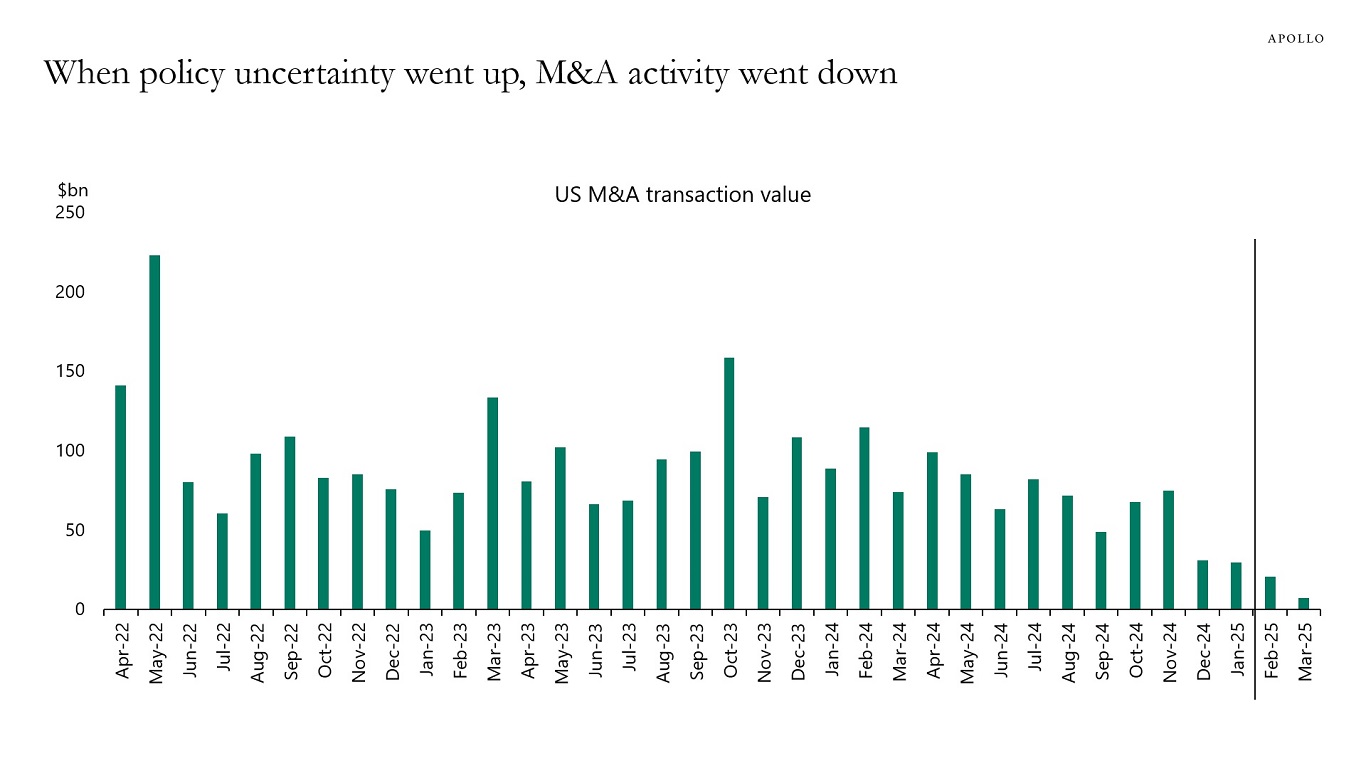

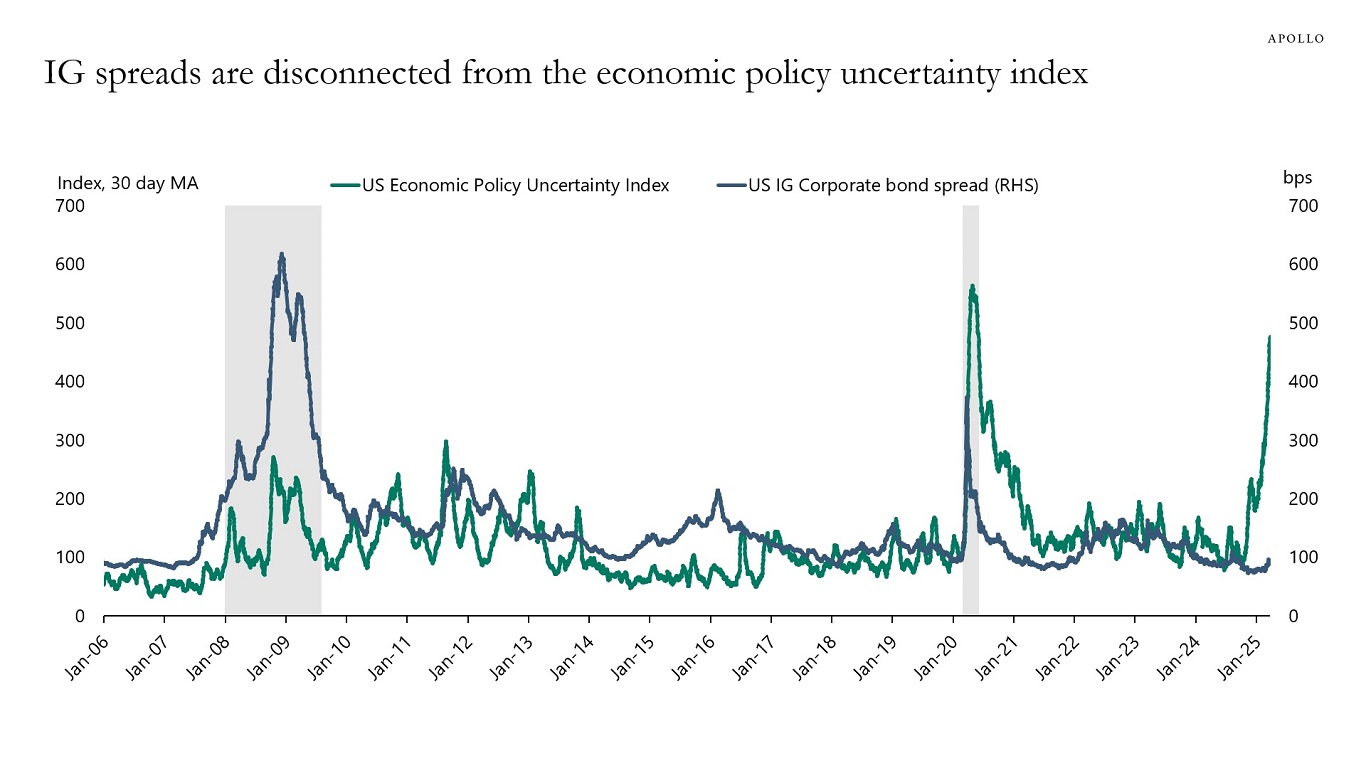

When policy uncertainty went up, capital markets activity started slowing down, with a decline in loan issuance, IPO activity, and M&A activity, see charts below.

Note: Reflects repricings and extensions done via an amendment process only. Sources: PitchBook LCD, Apollo Chief Economist

Note: Data shows completed IPO transactions. Sources: S&P Capital IQ, Apollo Chief Economist

Note: Data shows completed M&A transactions. Sources: S&P Capital IQ, Apollo Chief Economist

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.