Want it delivered daily to your inbox?

-

What are the arguments for a strong February employment report?

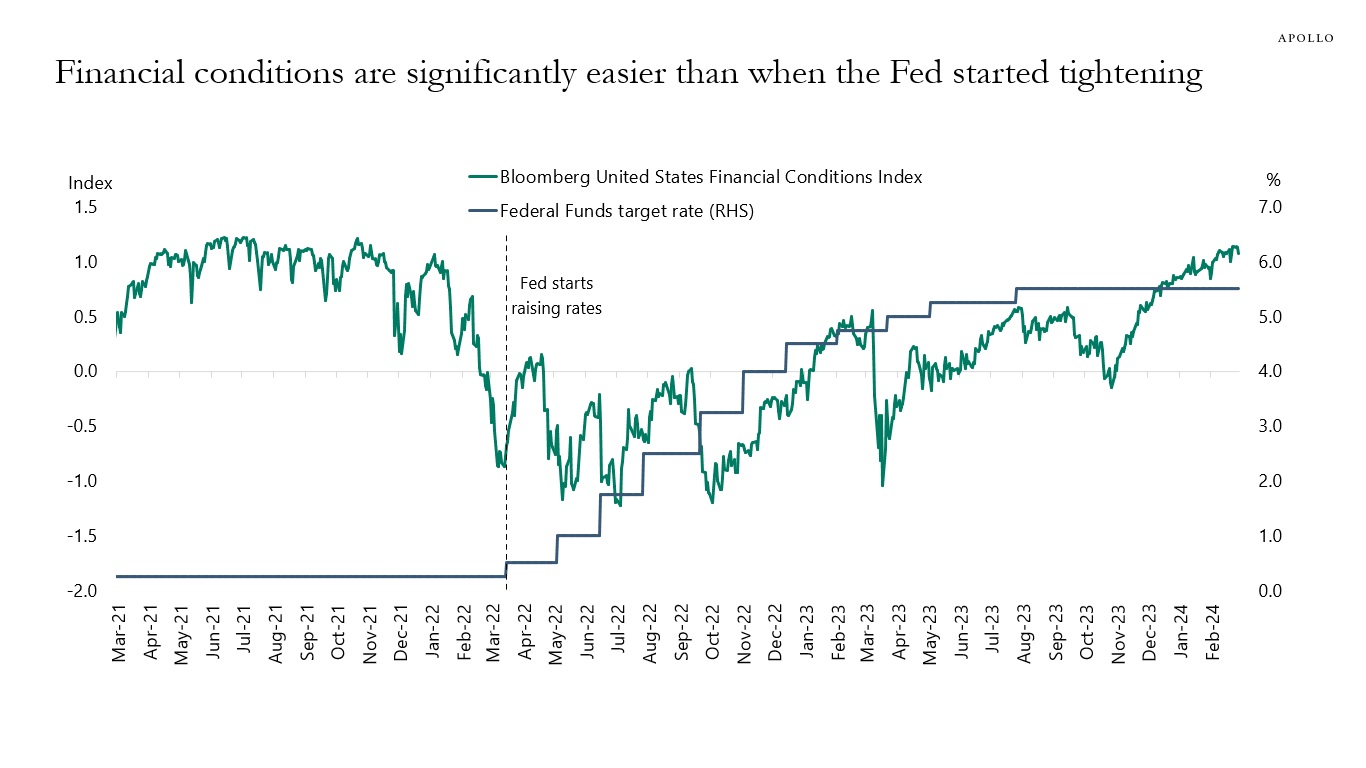

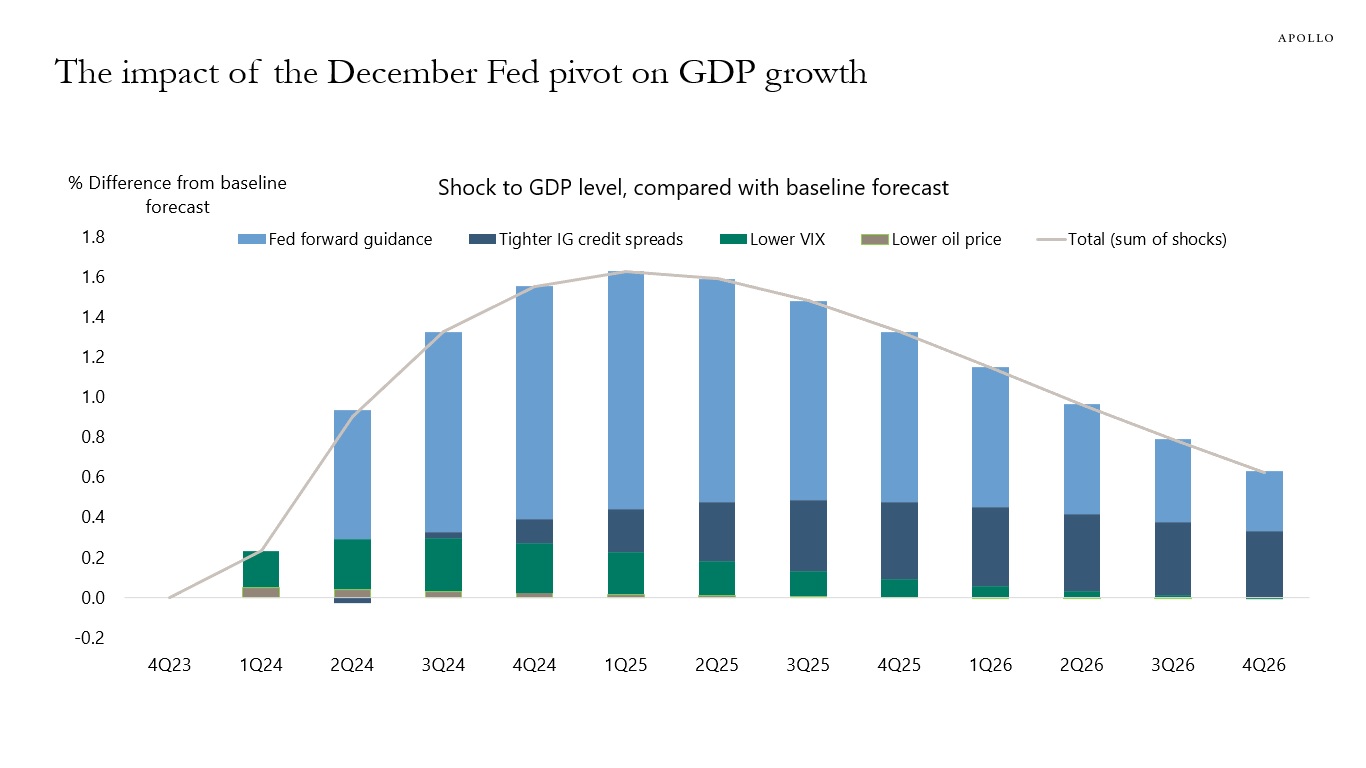

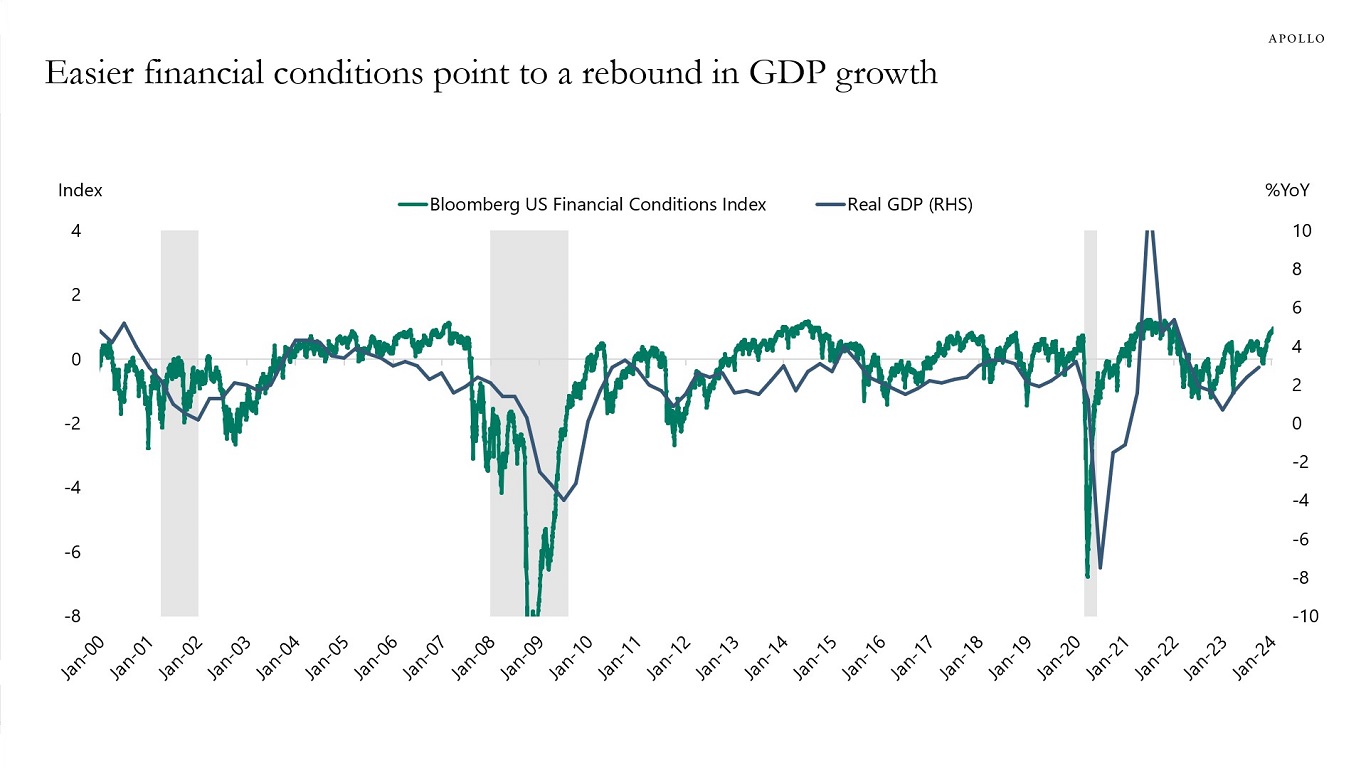

1) Financial conditions have eased dramatically since the December FOMC meeting, with the S&P 500 at all-time highs and very tight IG and HY spreads. Significant wealth effects and lower borrowing costs are a major tailwind to consumer spending and capex spending, see the first and second charts.

2) Jobless claims remain very low, around 200,000, and the economy remains surprisingly resilient, with households and firms having locked in lower interest rates during Covid, see the third and fourth charts.

3) The fiscal deficit is running at a high 6% of GDP for an expansion, driven by the CHIPS Act, IRA, and Infrastructure Act, and associated positive effects on manufacturing construction, energy investments, and infrastructure investments.

4) The employment-to-population ratio is almost a full percentage point lower than pre-Covid, and immigration continues to be strong, suggesting there is still more upside potential to employment.

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg SHOK, Apollo Chief Economist. Note: $20 oil price decline, 60 bps tighter IG spreads, one standard deviation decline in VIX, and 100 bps lower rates via changed Fed forward guidance.

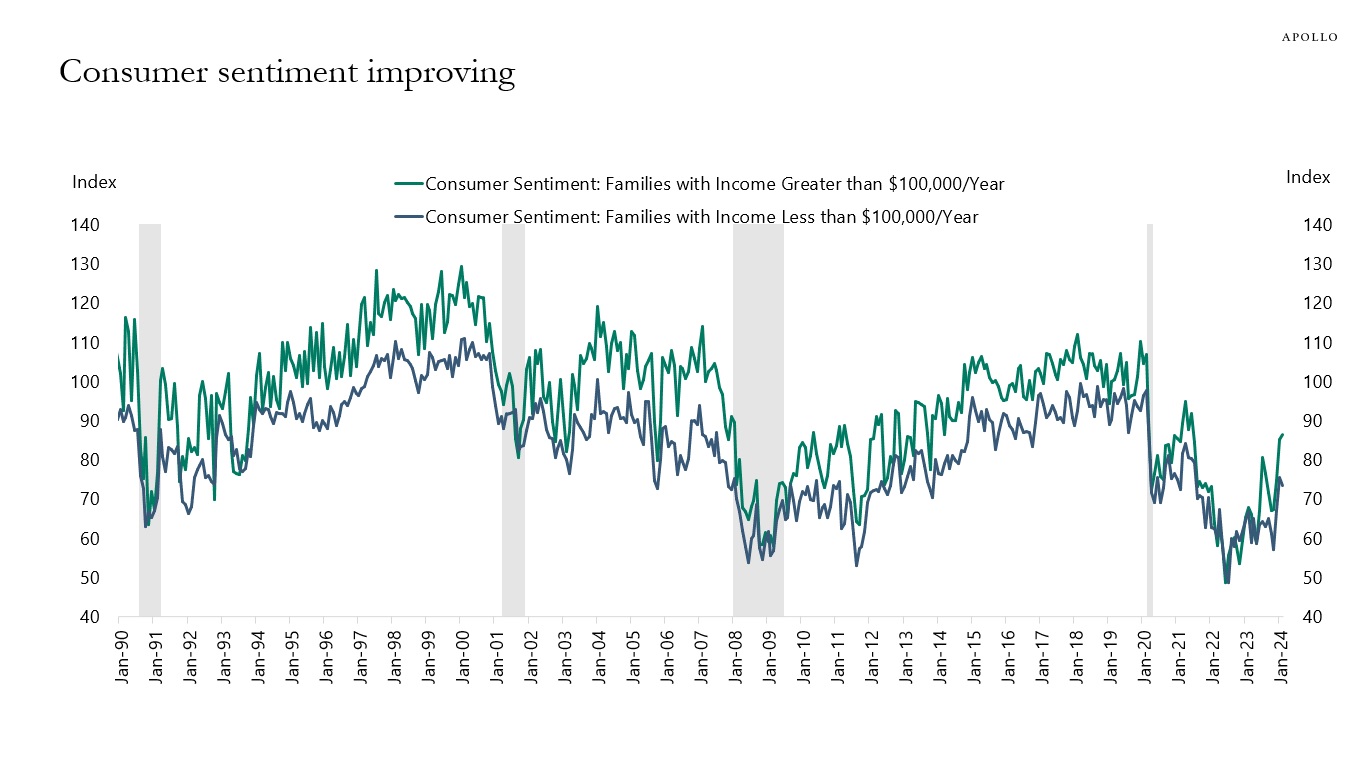

Source: University of Michigan, Haver Analytics, Apollo Chief Economist

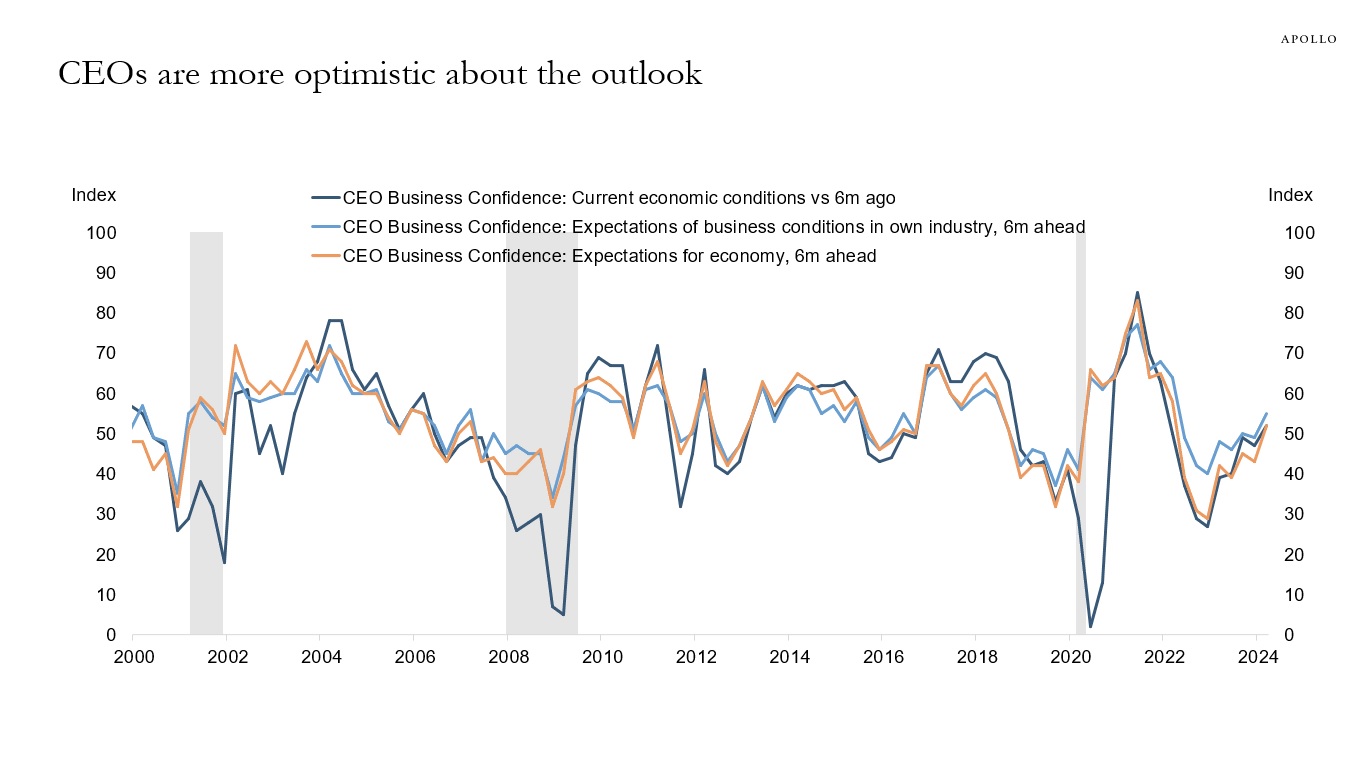

Source: The Conference Board, Haver, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

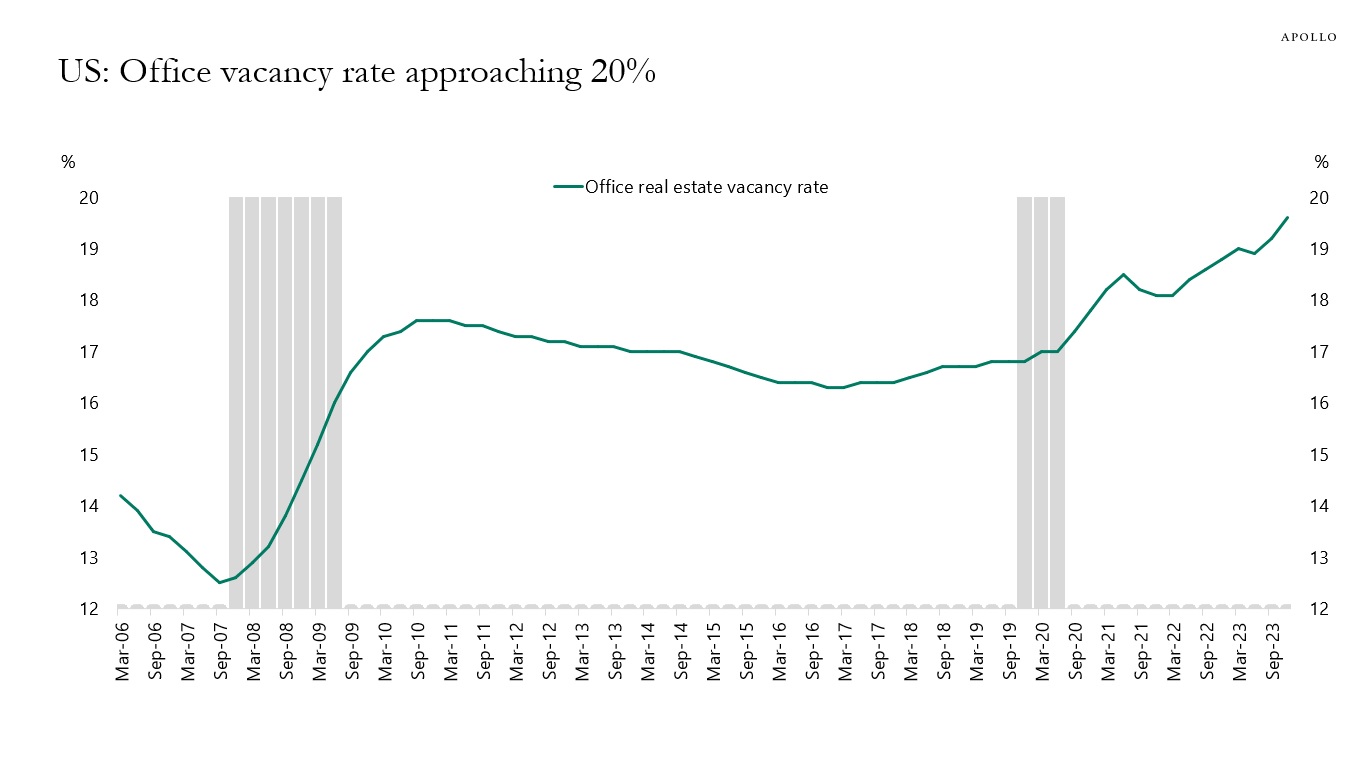

The vacancy rate for US office is approaching 20%, see chart below. And this is in a strong economy with a strong labor market. If the unemployment rate starts rising because of the lagged effects of Fed hikes, the office vacancy rate will increase even more.

Source: REIS data, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

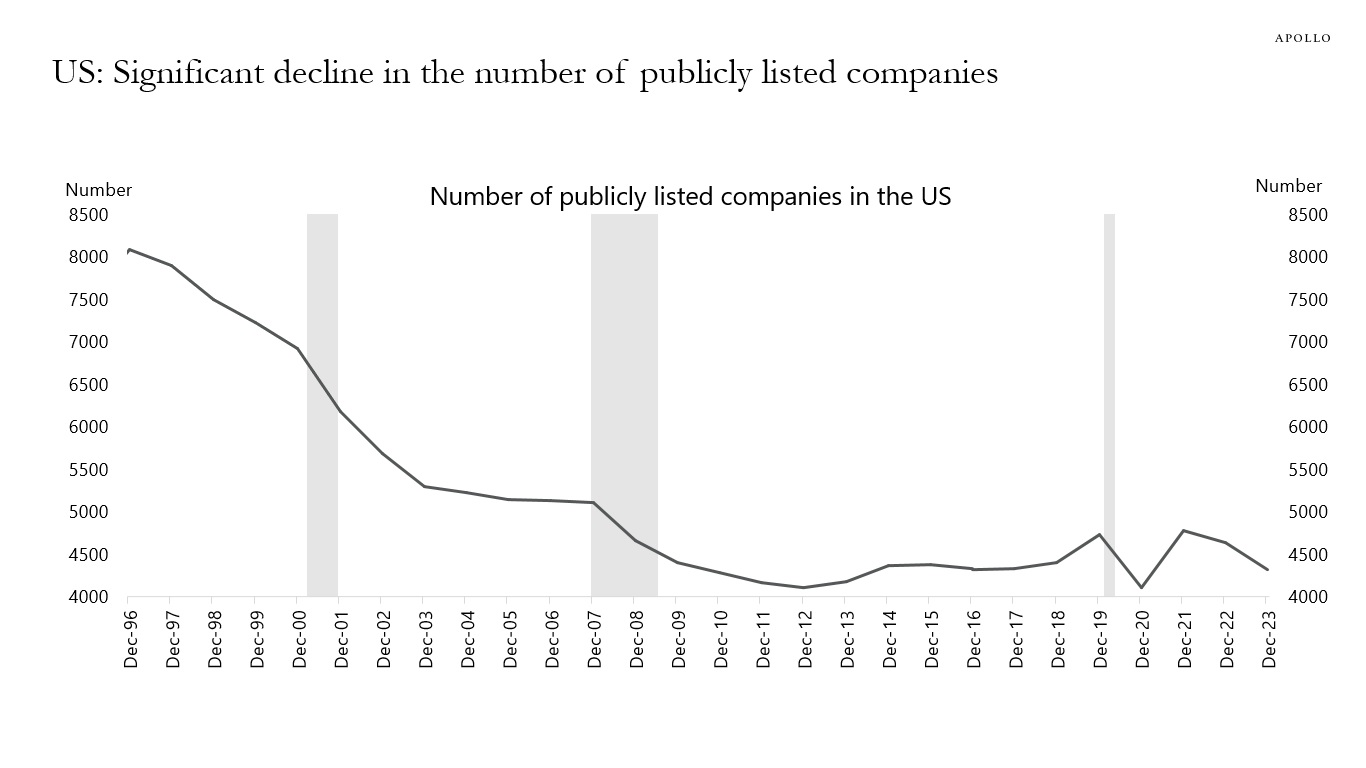

The number of publicly listed companies has declined 50% since the mid-1990s, see chart below.

Source: WDI, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

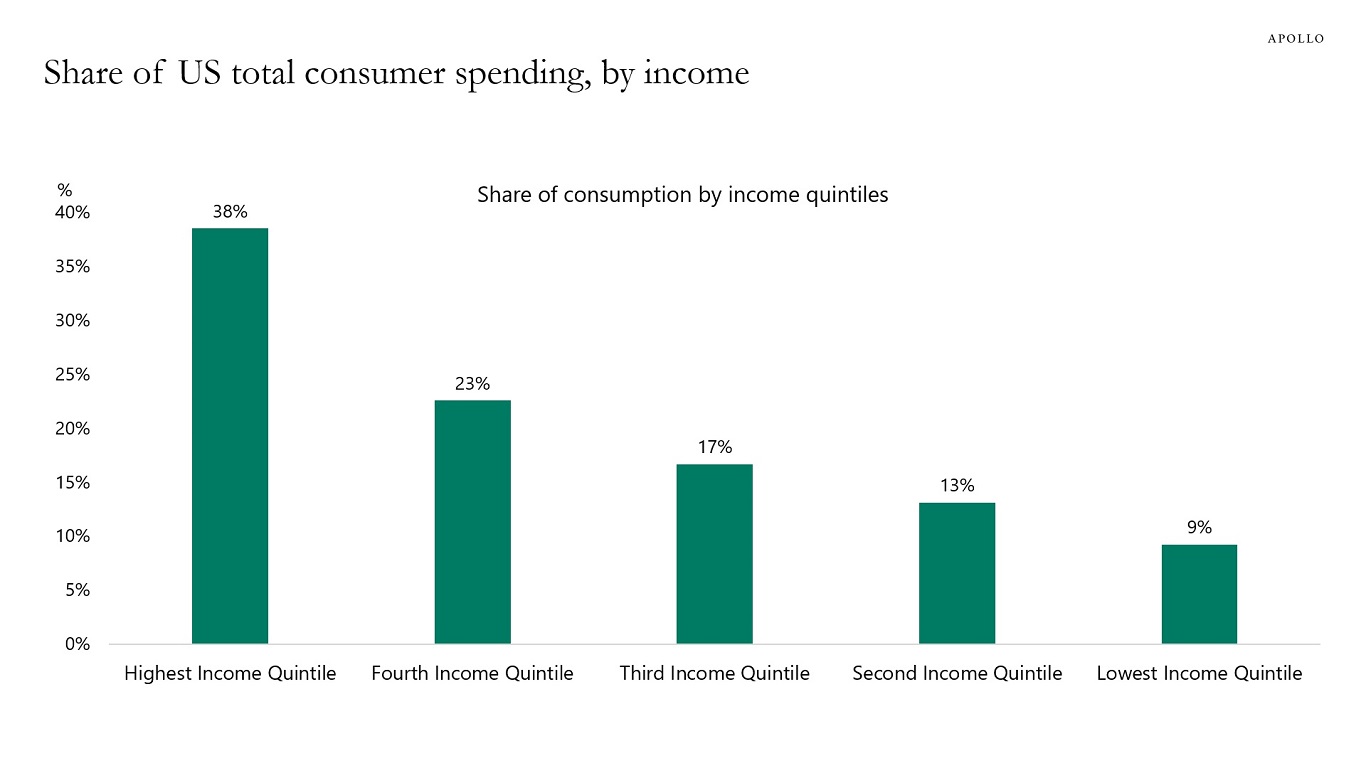

The top 20% of incomes account for almost 40% of consumer spending, see chart below.

Source: Consumer Expenditure Survey, Haver Analytics, Apollo Chief Economist (Latest data includes 2021.) See important disclaimers at the bottom of the page.

-

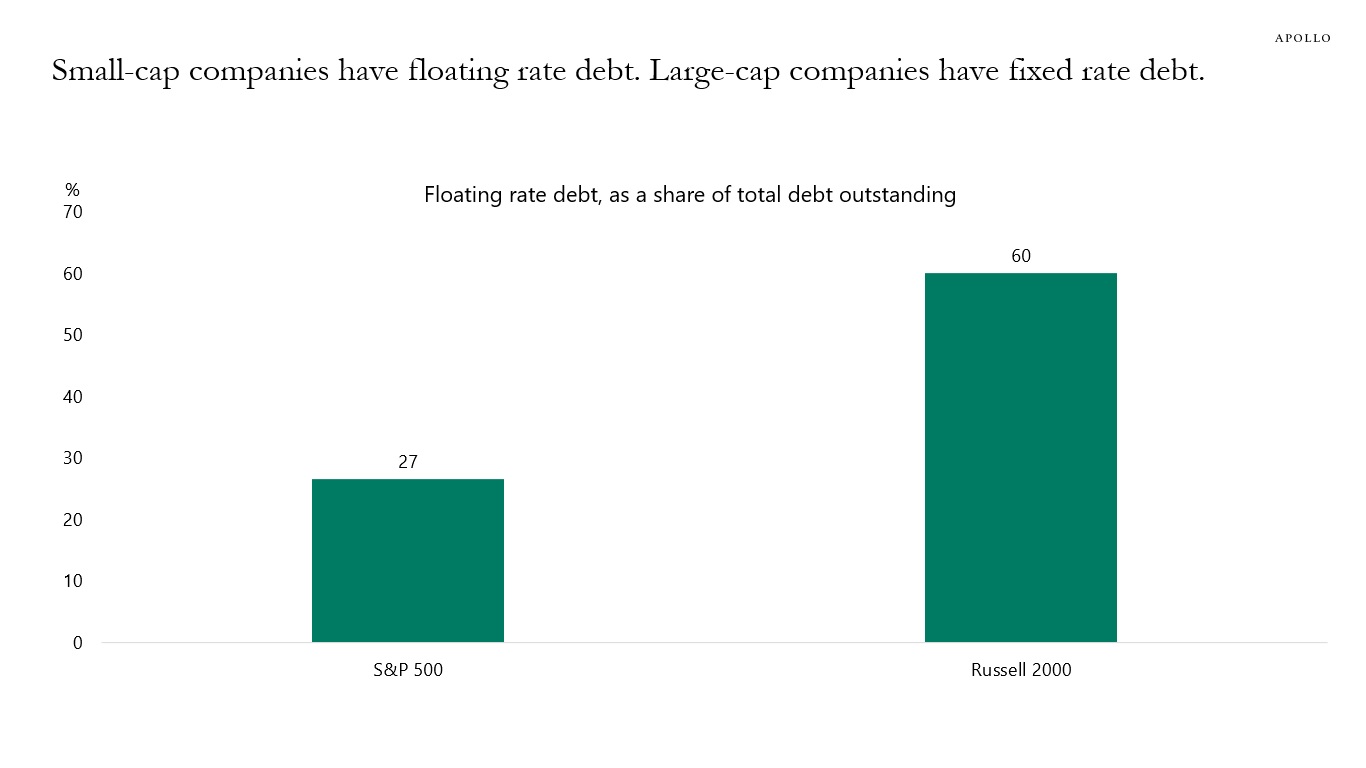

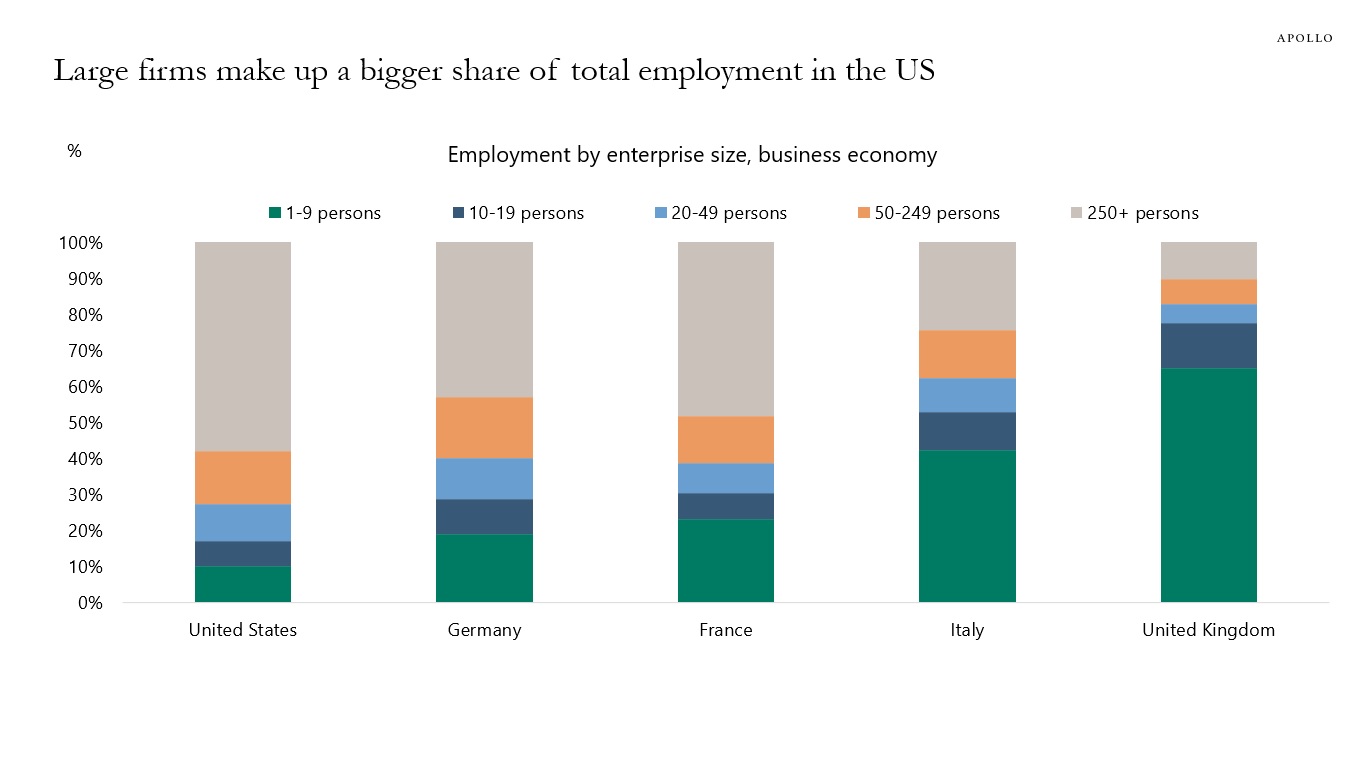

The US economy is dominated by larger companies, and larger companies generally have fixed rate debt. This is likely a key reason why Fed hikes are having a more limited impact on the economy.

Source: Bloomberg, Apollo Chief Economist. Note: Excludes financials and from SRCH<GO> function on Bloomberg.

Source: OECD, Apollo Chief Economist. Note: Data as of 2020 or latest available. See important disclaimers at the bottom of the page.

-

The market came into 2023 expecting a recession.

The market went into 2024 expecting six Fed cuts.

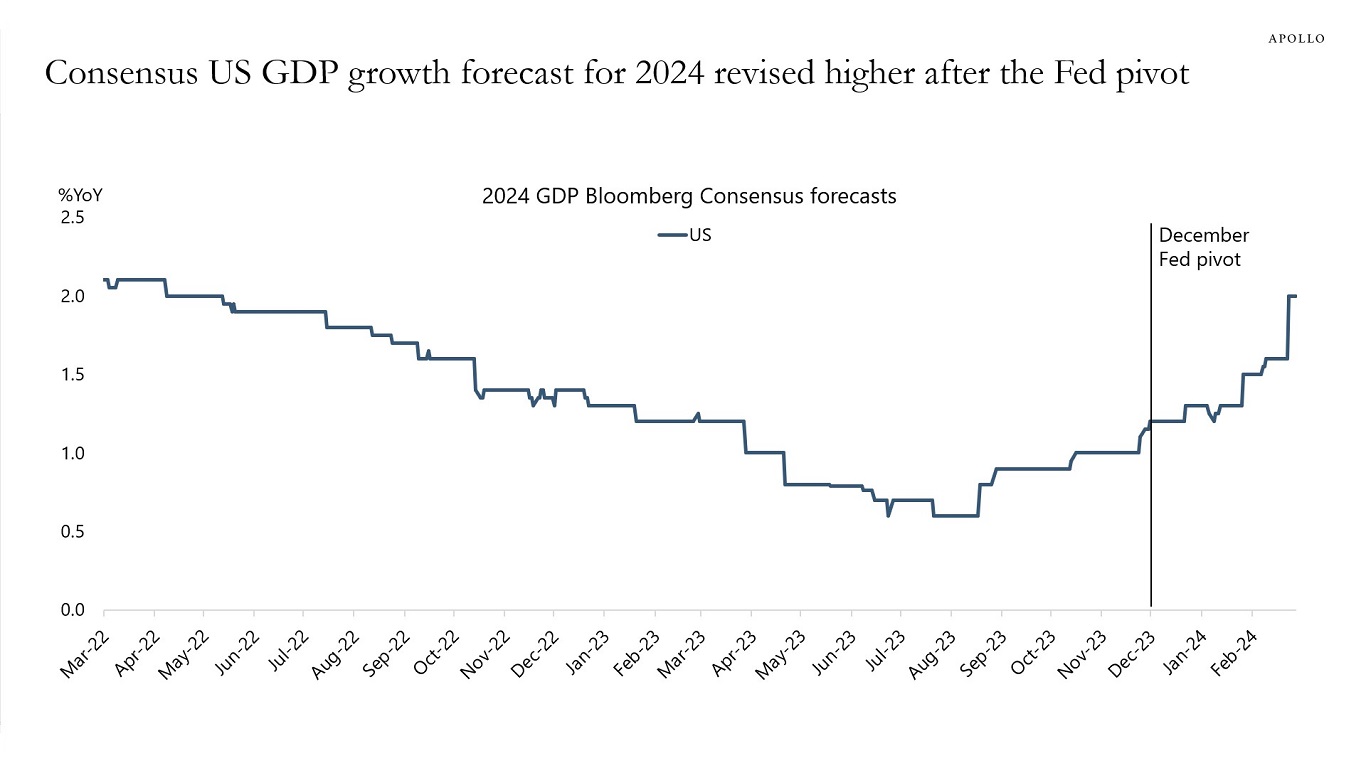

The reality is that the US economy is simply not slowing down, and the Fed pivot has provided a strong tailwind to growth since December.

As a result, the Fed will not cut rates this year, and rates are going to stay higher for longer.

How do we come to this conclusion?

1) The economy is not slowing down, it is reaccelerating. Growth expectations for 2024 saw a big jump following the Fed pivot in December and the associated easing in financial conditions. Growth expectations for the US continue to be revised higher, see the first chart below.

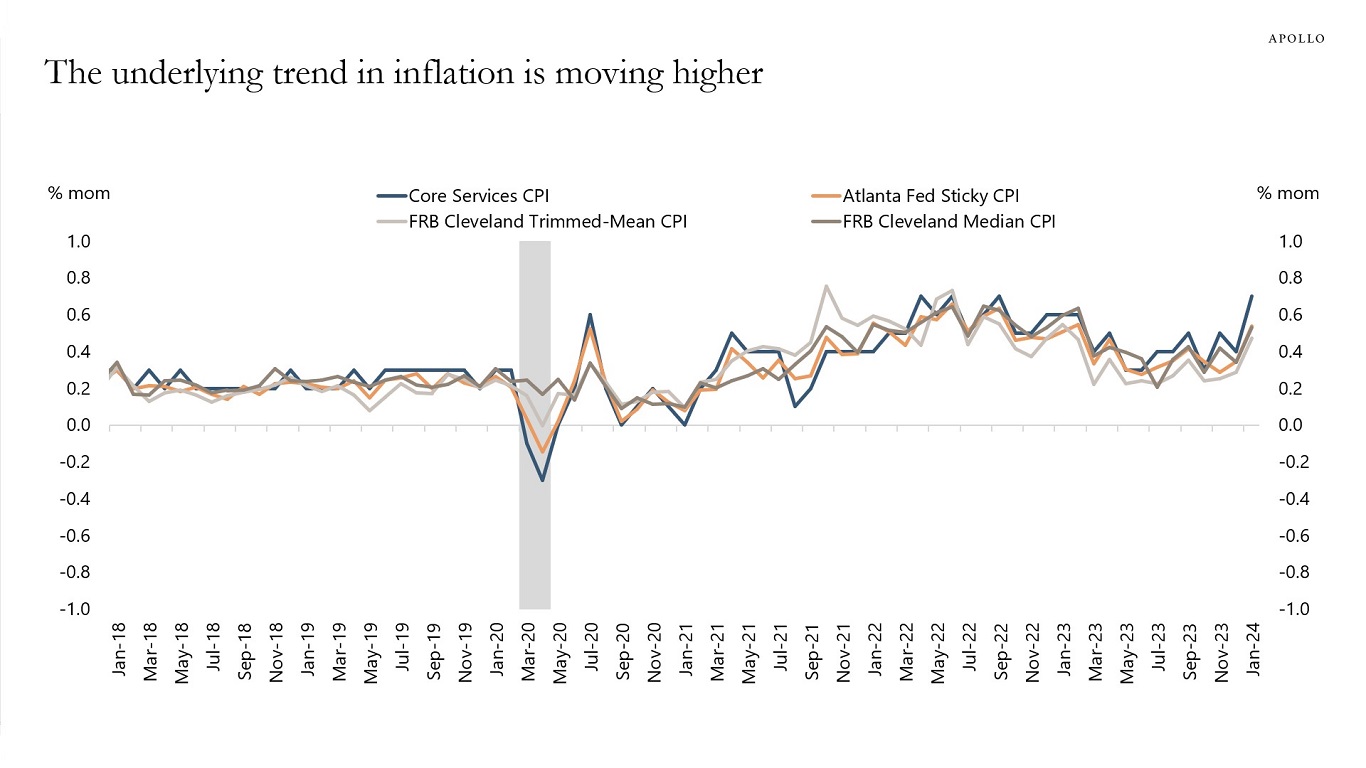

2) Underlying measures of trend inflation are moving higher, see the second chart.

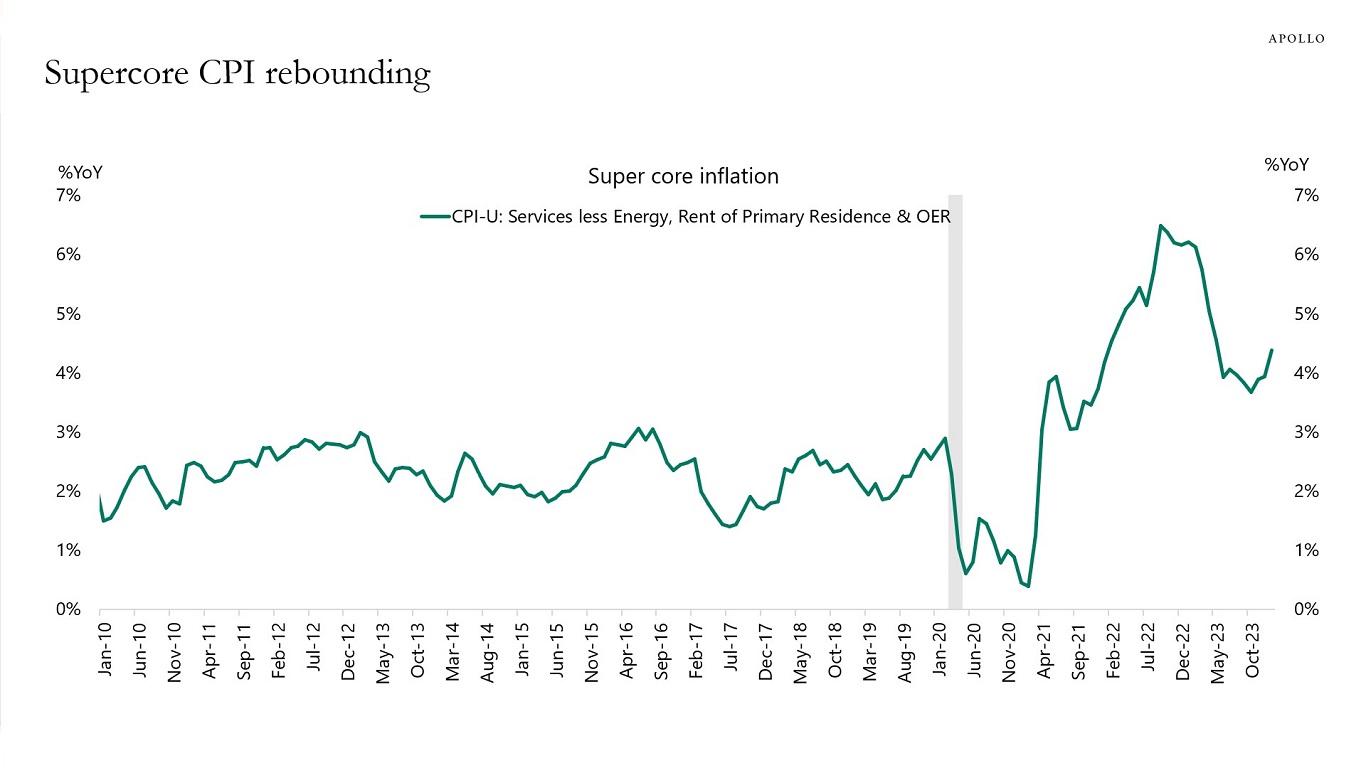

3) Supercore inflation, a measure of inflation preferred by Fed Chair Powell, is trending higher, see the third chart.

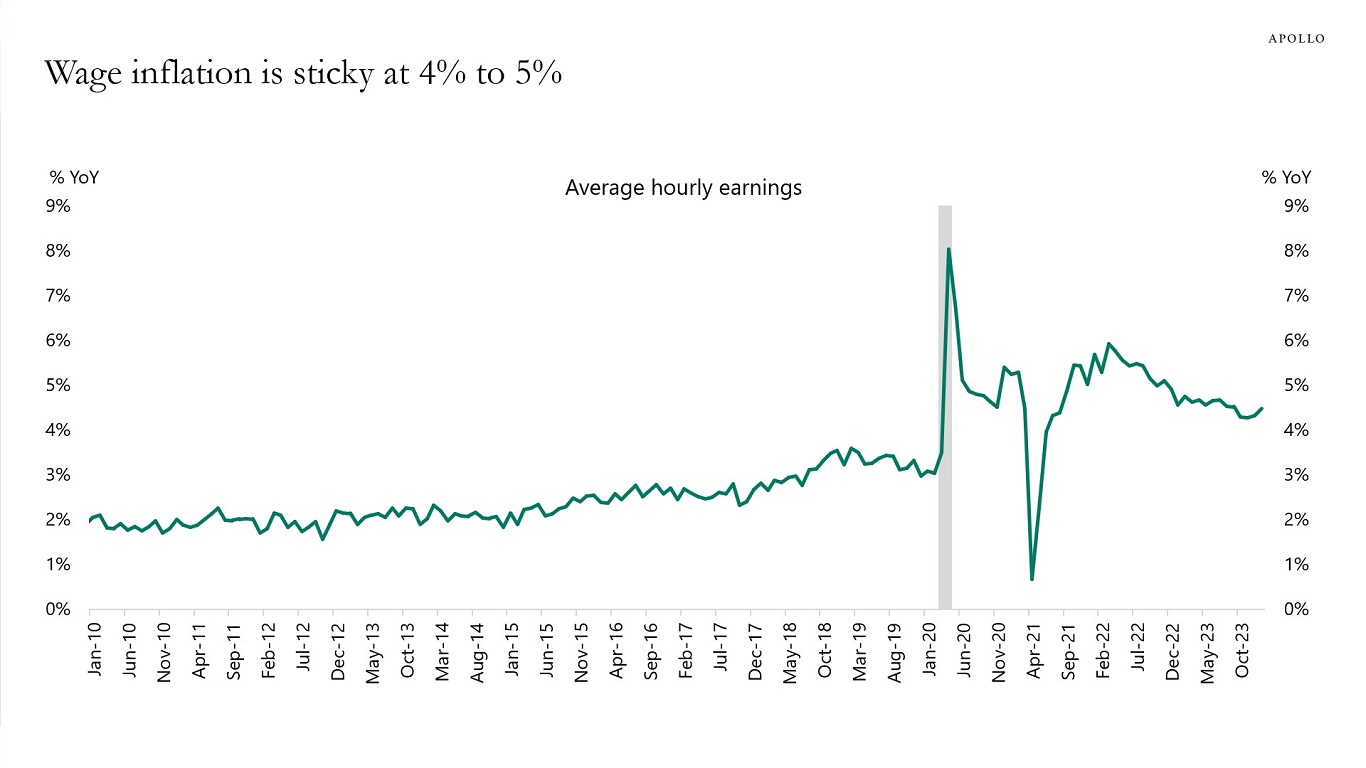

4) Following the Fed pivot in December, the labor market remains tight, jobless claims are very low, and wage inflation is sticky between 4% and 5%, see the fourth chart.

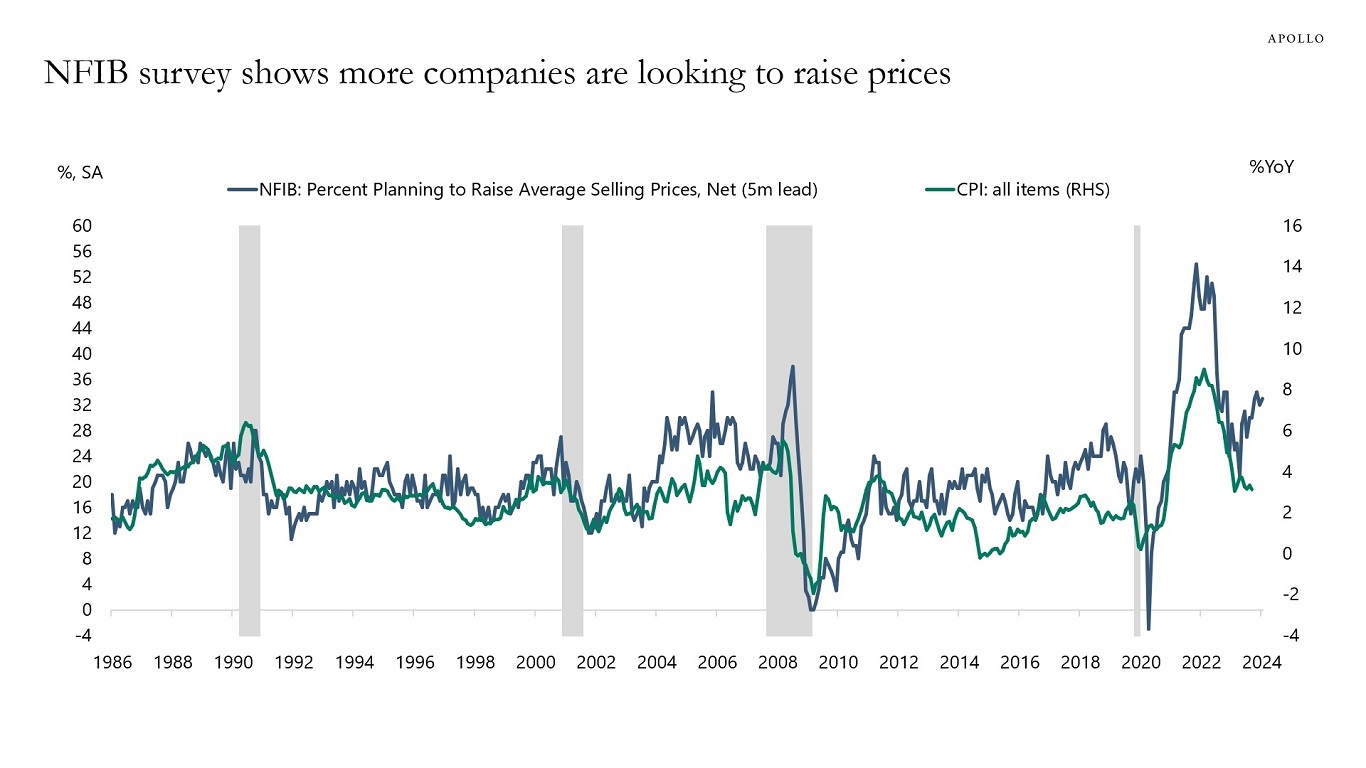

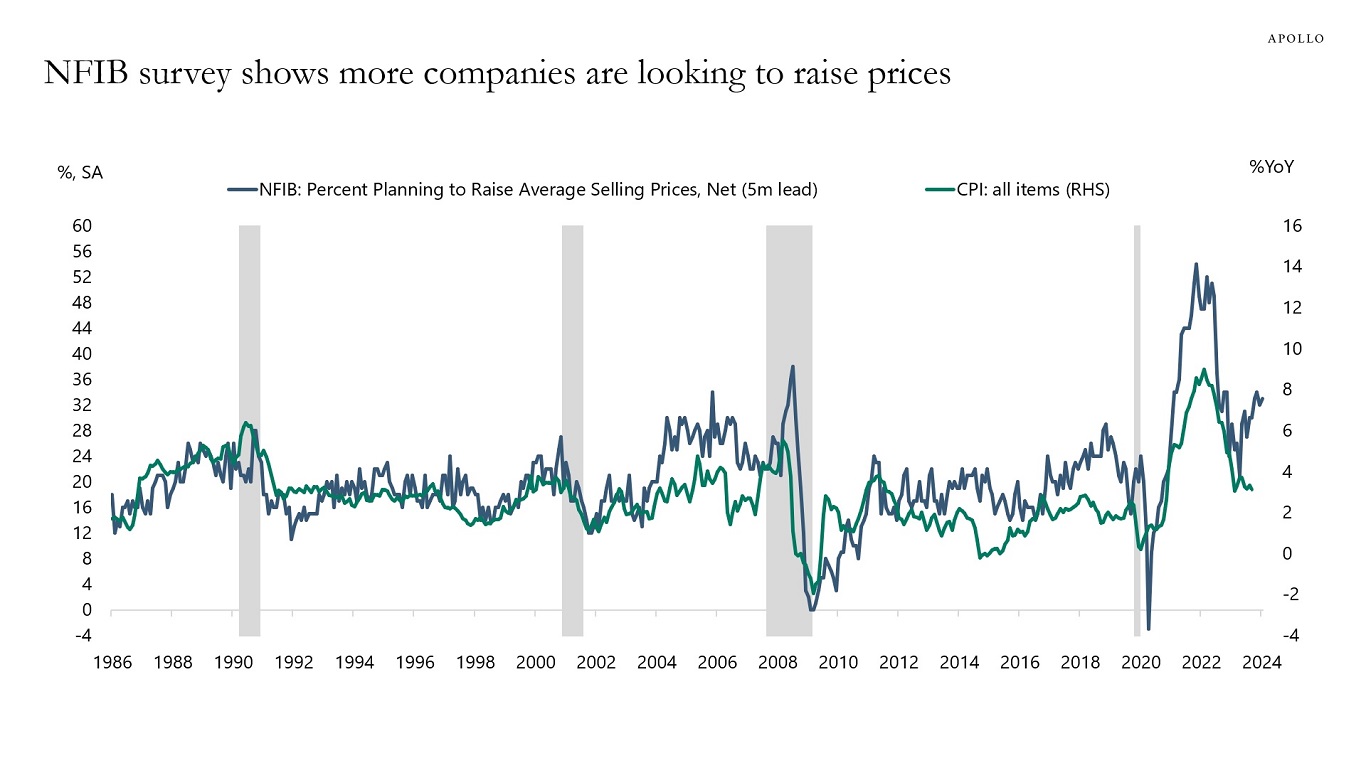

5) Surveys of small businesses show that more small businesses are planning to raise selling prices, see the fifth chart.

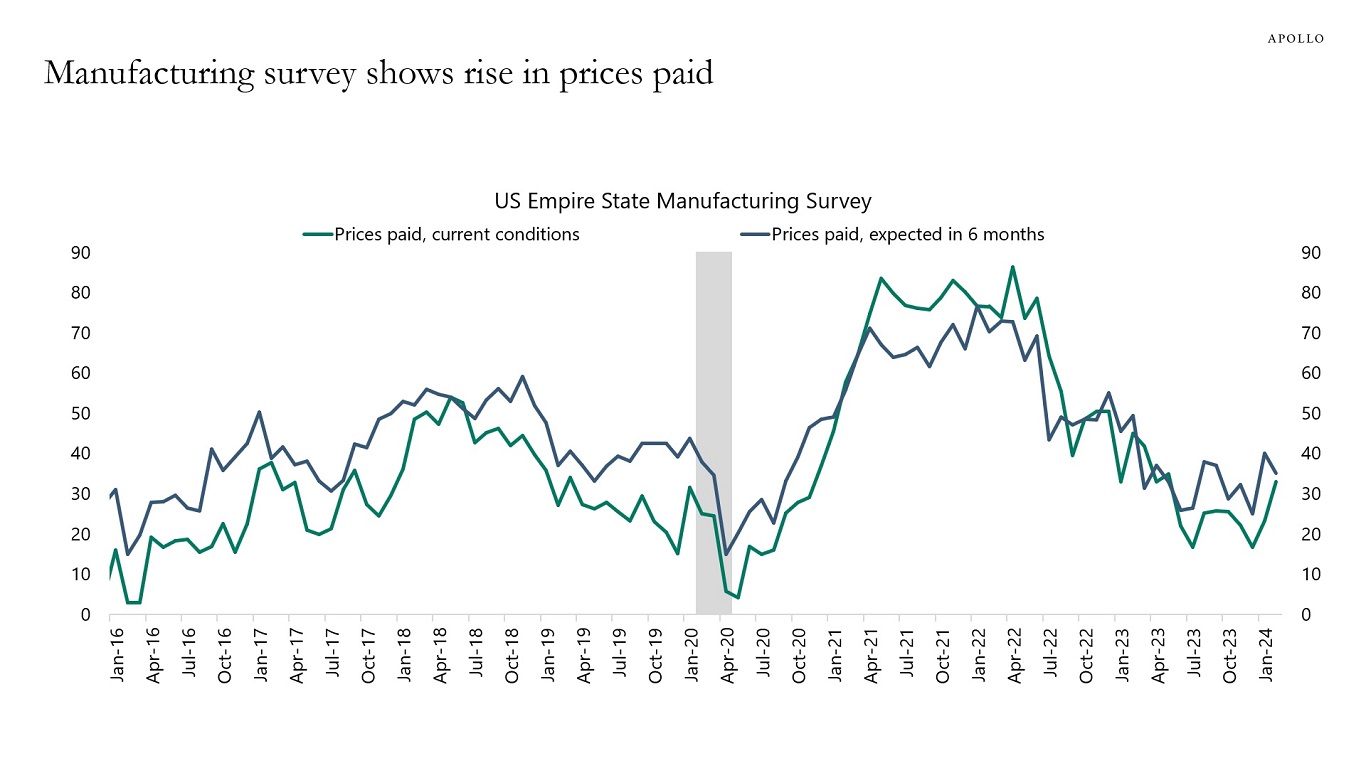

6) Manufacturing surveys show a higher trend in prices paid, another leading indicator of inflation, see the sixth chart.

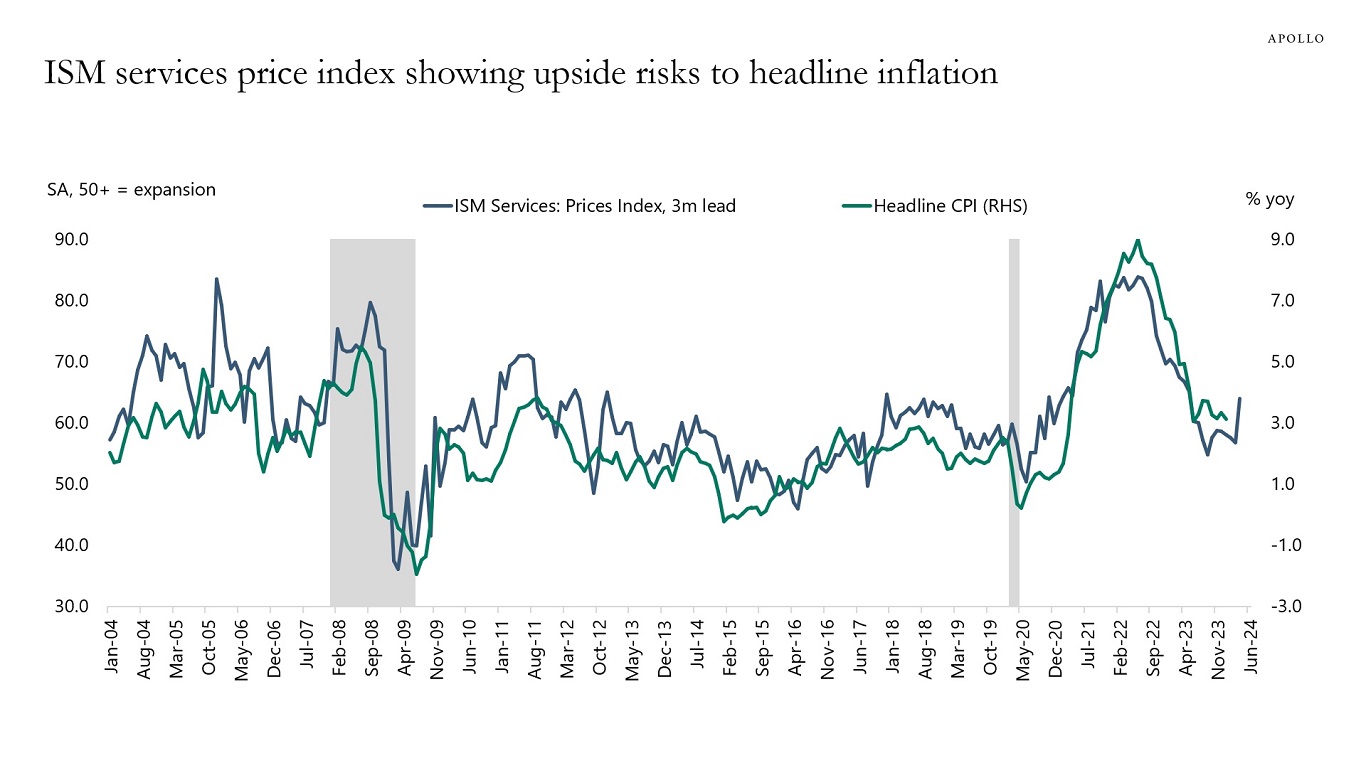

7) ISM services prices paid is also trending higher, see the seventh chart.

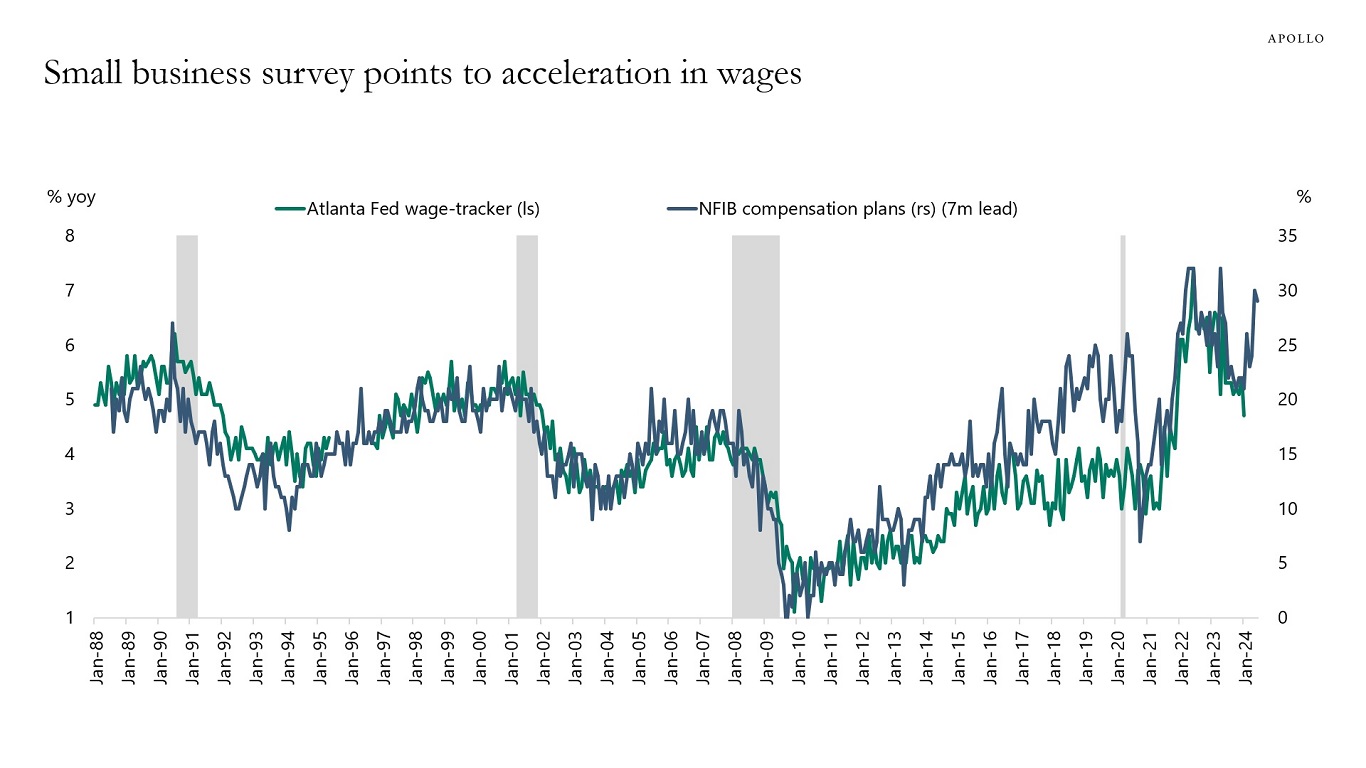

8) Surveys of small businesses show that more small businesses are planning to raise worker compensation, see the eighth chart.

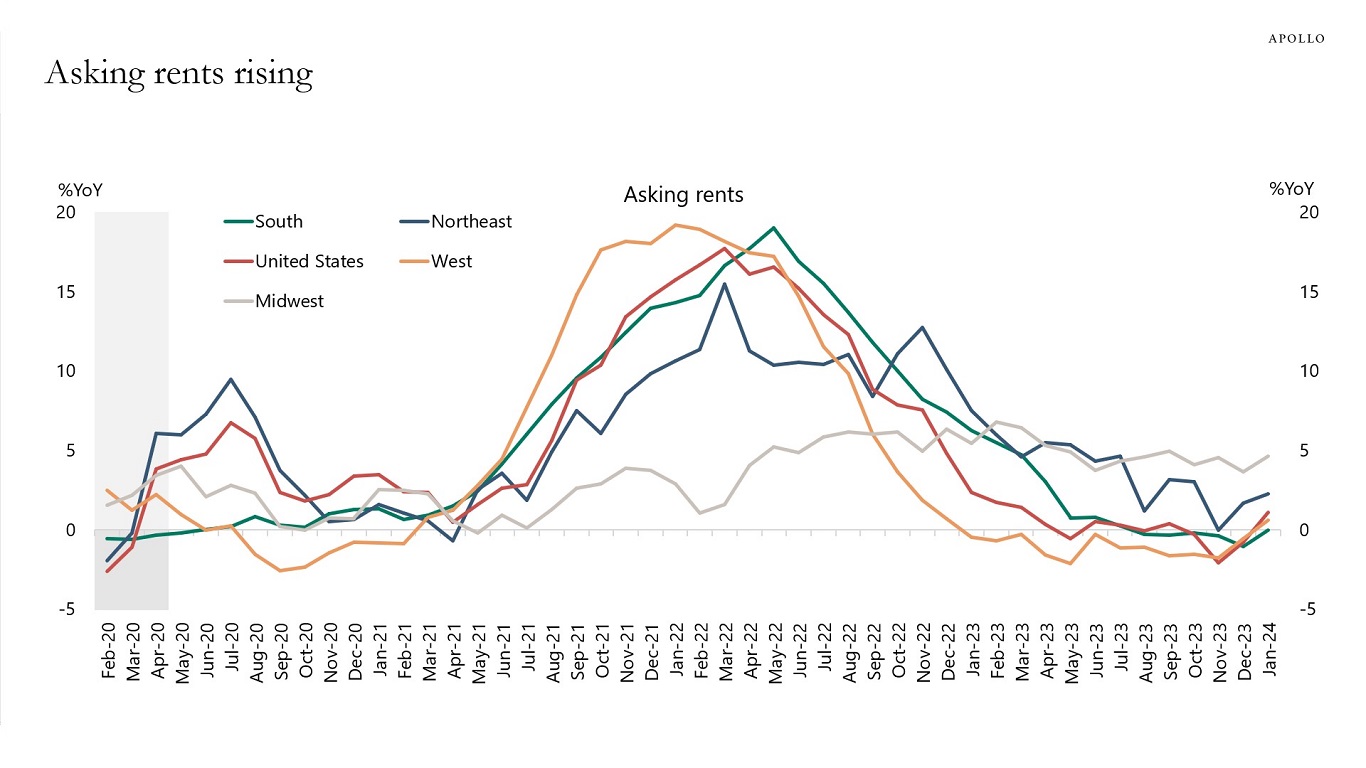

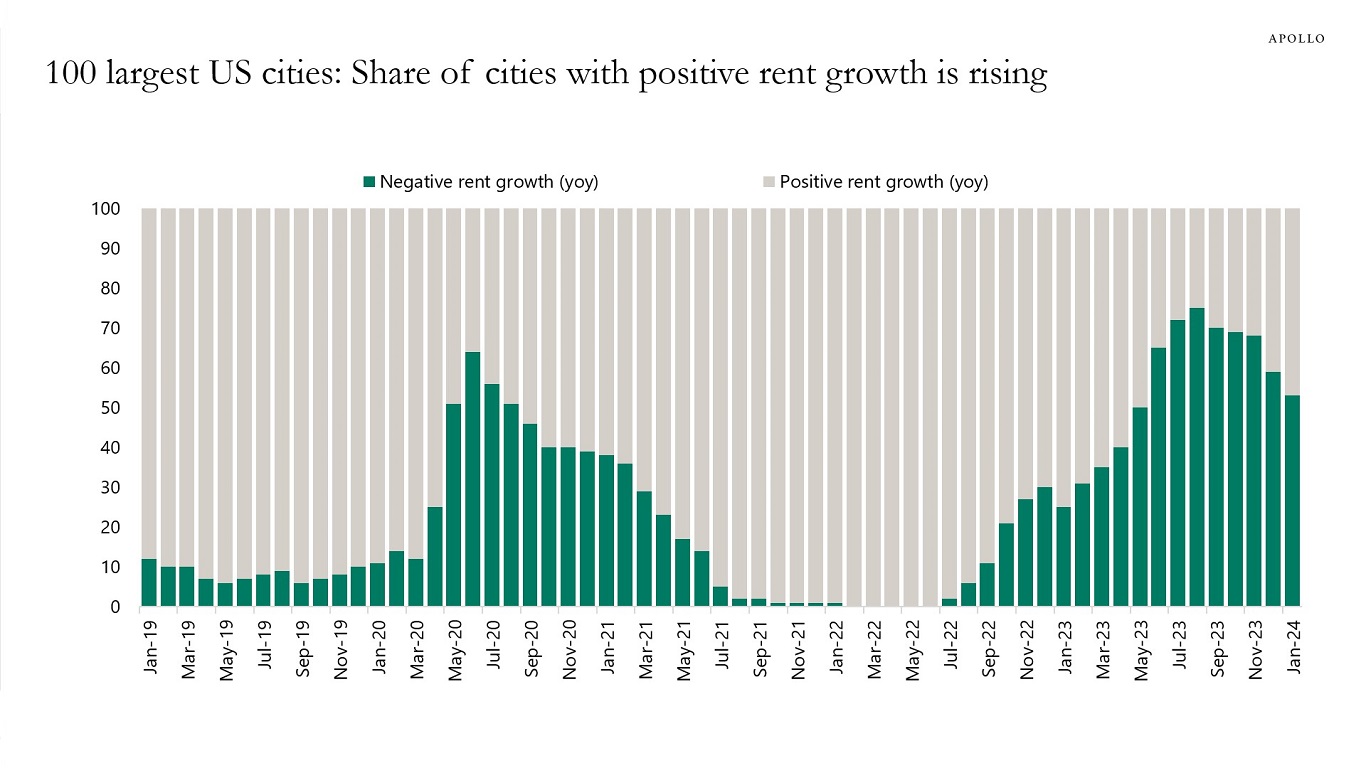

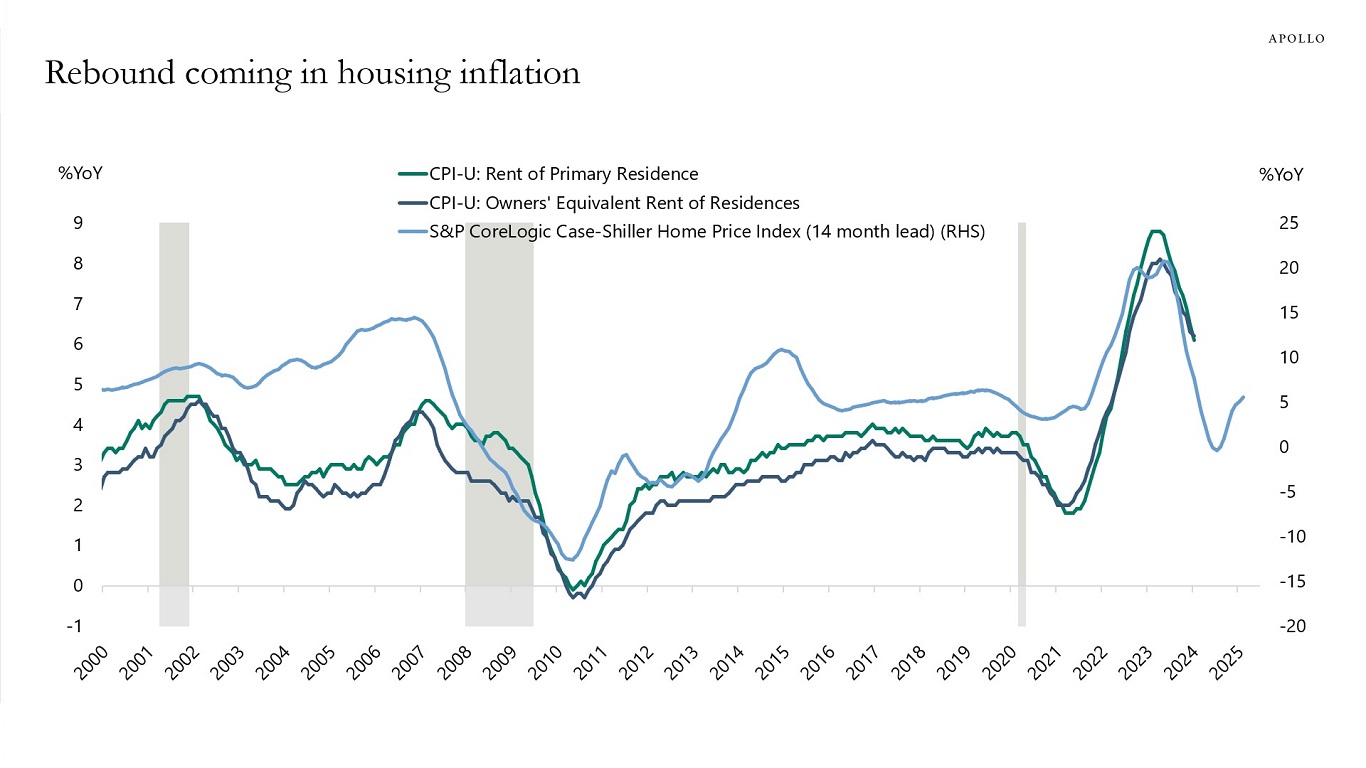

9) Asking rents are rising, and more cities are seeing rising rents, and home prices are rising, see the ninth, tenth, and eleventh charts.

10) Financial conditions continue to ease following the Fed pivot in December with record-high IG issuance, high HY issuance, IPO activity rising, M&A activity rising, and tight credit spreads and the stock market reaching new all-time highs. With financial conditions easing significantly, it is not surprising that we saw strong nonfarm payrolls and inflation in January, and we should expect the strength to continue, see the twelfth chart.

The bottom line is that the Fed will spend most of 2024 fighting inflation. As a result, yield levels in fixed income will stay high.

Source: Bloomberg, Apollo Chief Economist

Source: BLS, Cleveland Fed, Atlanta Fed, Haver Analytics, Apollo Chief Economist

Source: BEA, Haver Analytics, Apollo Chief Economist

Source: BLS, Apollo Chief Economist

Source: NFIB, BEA, Haver Analytics, Apollo Chief Economist

Source: FRBNY, Bloomberg, Apollo Chief Economist

Source: ISM, BLS, Haver Analytics, Apollo Chief Economist

Source: FRB of Atlanta, NFIB, Haver Analytics, Apollo Chief Economist. Note: NFIB: Net percent planning to raise worker compensation in next three months (SA, %).

Source: Rent.com, Apollo Chief Economist

Source: Apartmentlist.com, Apollo Chief Economist

Source: Haver Analytics, BLS, S&P, Apollo Chief Economist

Source: BEA, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

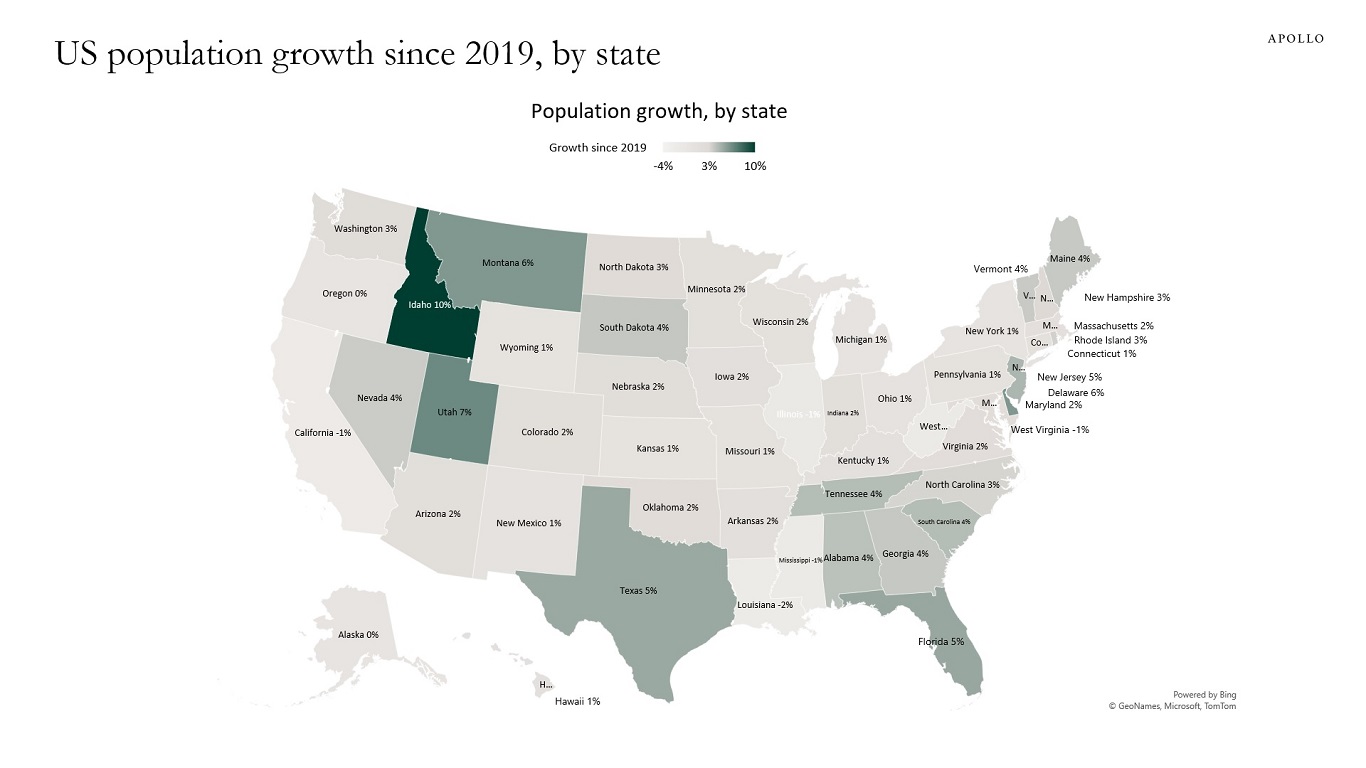

During the post-Covid period, US population growth has been the fastest in Idaho, Utah, Montana, Texas, Florida, and New Jersey, see map below.

See important disclaimers at the bottom of the page.

-

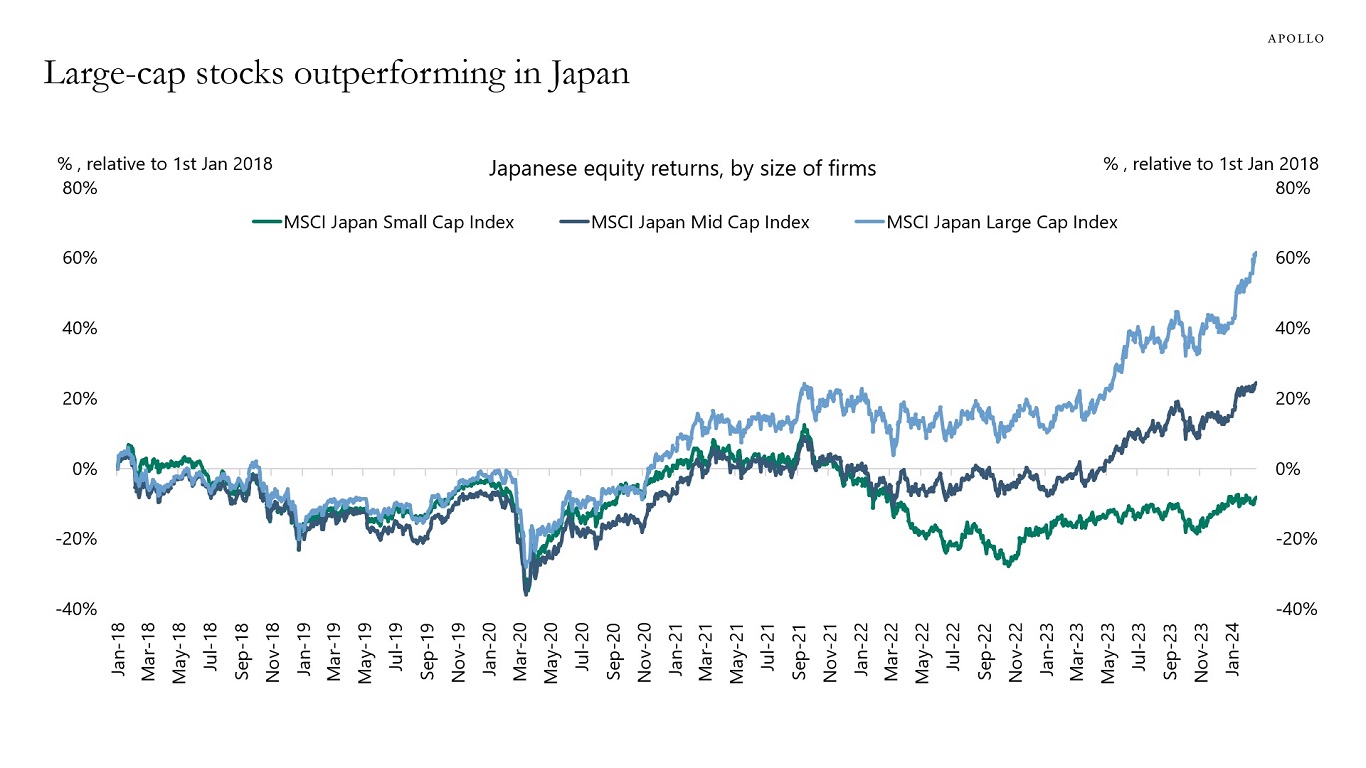

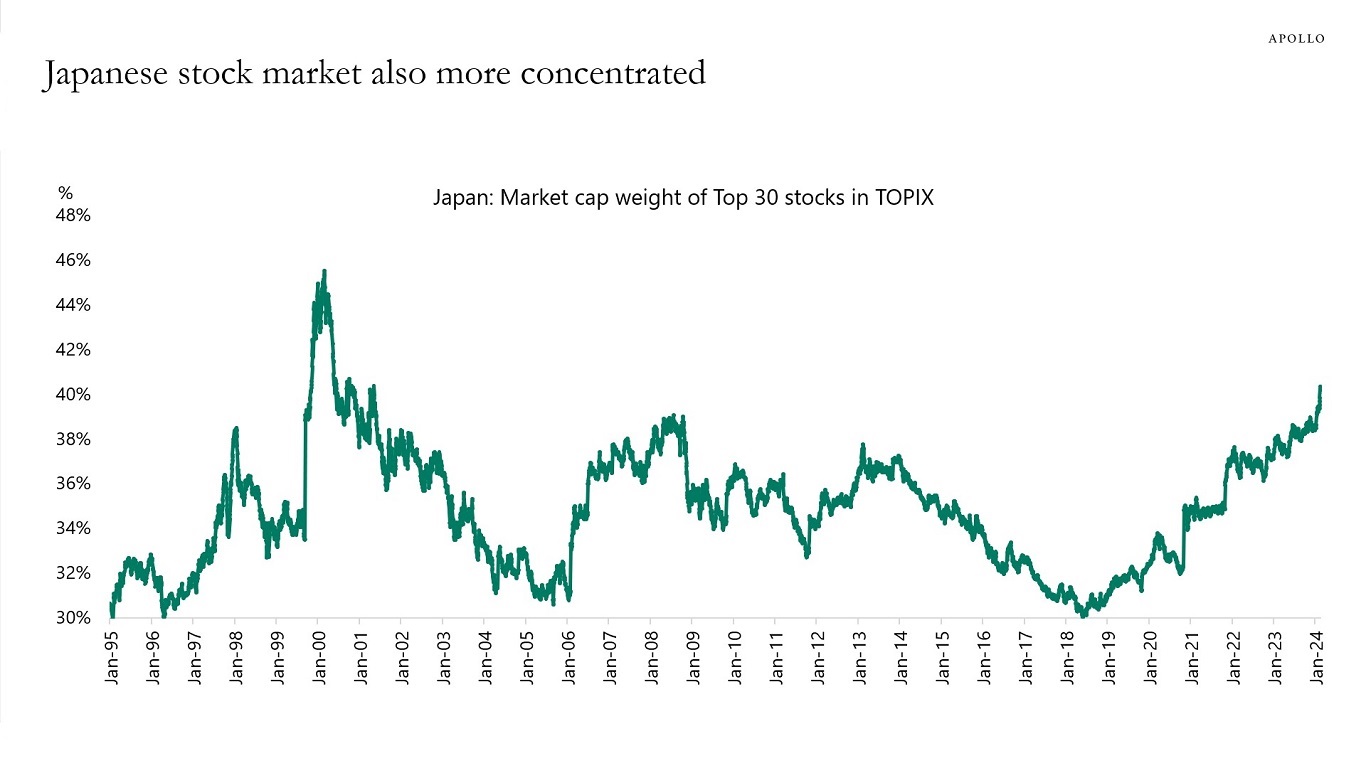

The global rise in stock prices is driven mainly by large-cap firms, not only in the US and Europe but also in Japan, see charts below.

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

The NFIB survey of small businesses asks 10,000 firms if they plan to increase selling prices over the next three months. The recent acceleration in the share of firms saying yes suggests that CPI inflation could increase over the coming months, see chart below.

Source: NFIB, BEA, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

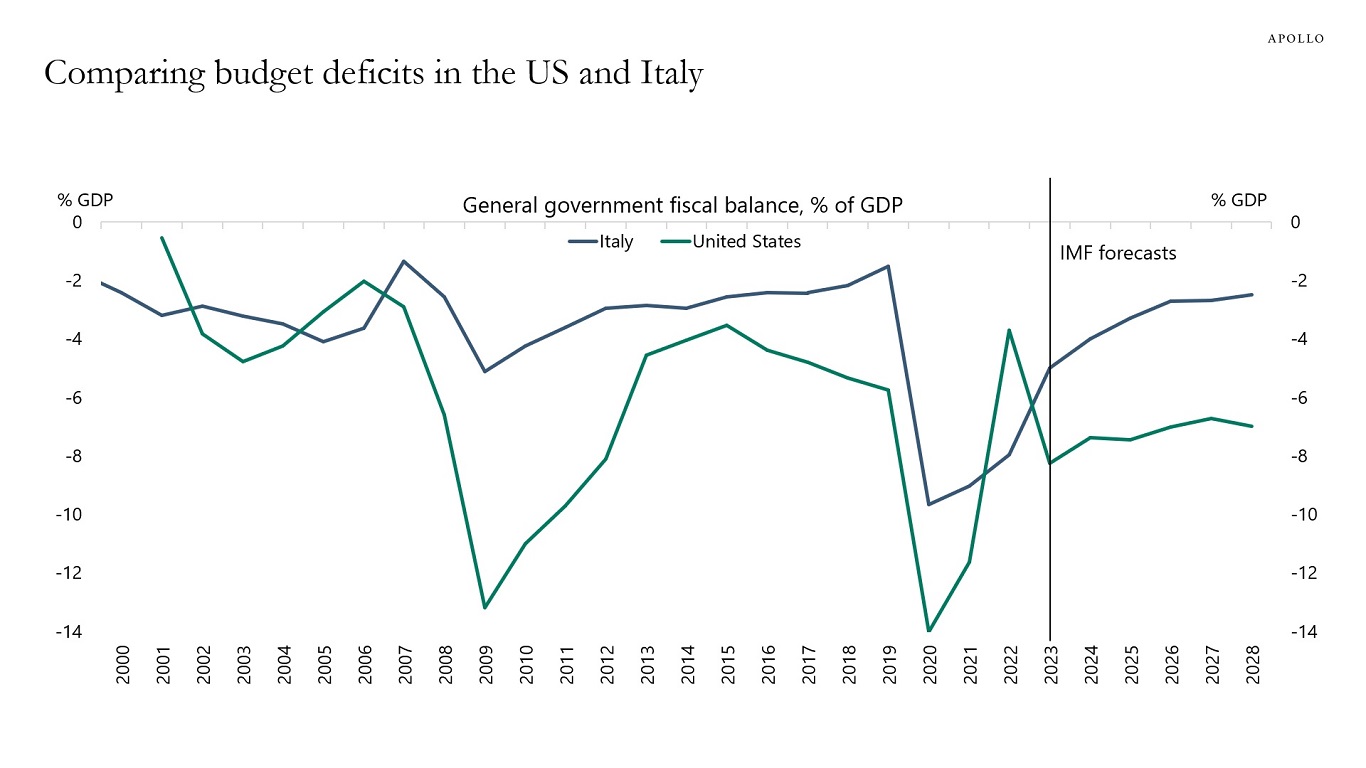

The government budget deficit is bigger in the US than in Italy, see the first chart.

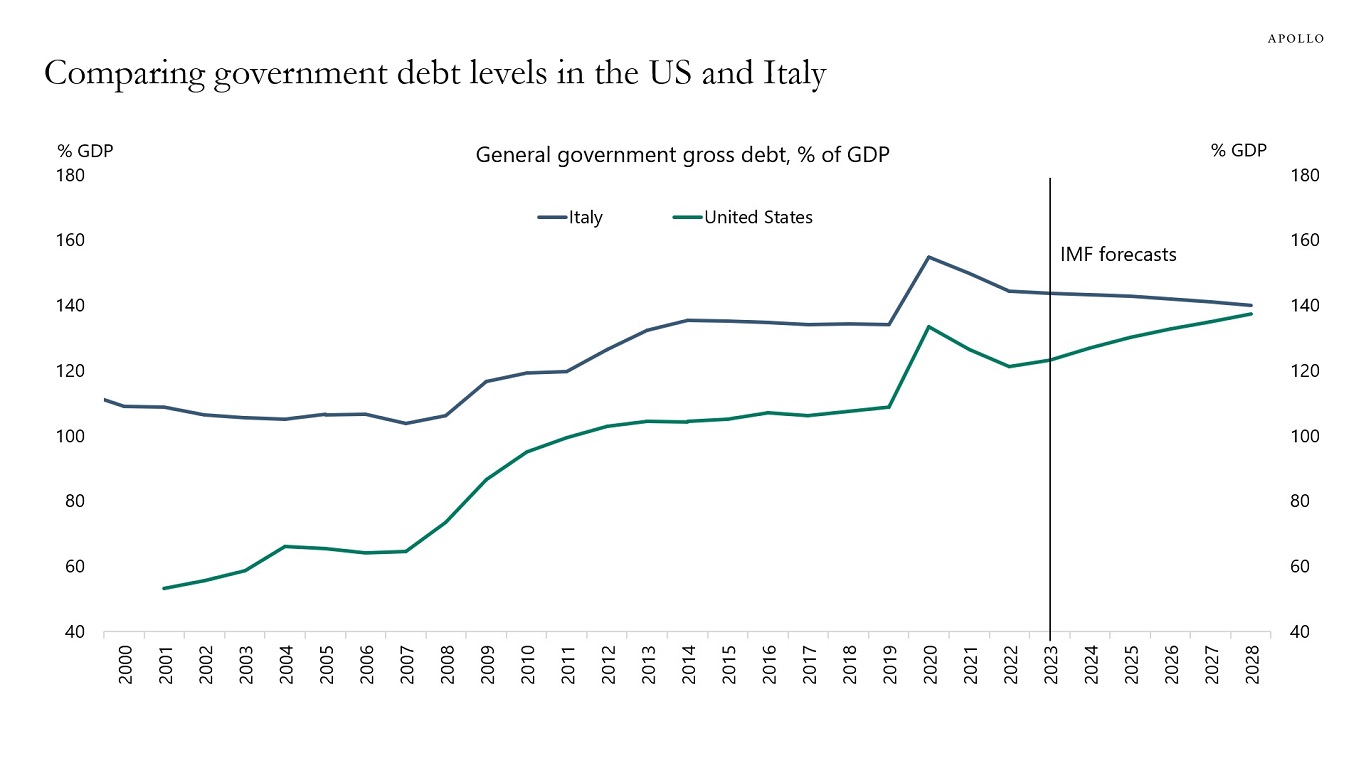

Government debt levels are currently higher in Italy than in the US, but according to IMF forecasts, they are converging over the coming years, see the second chart.

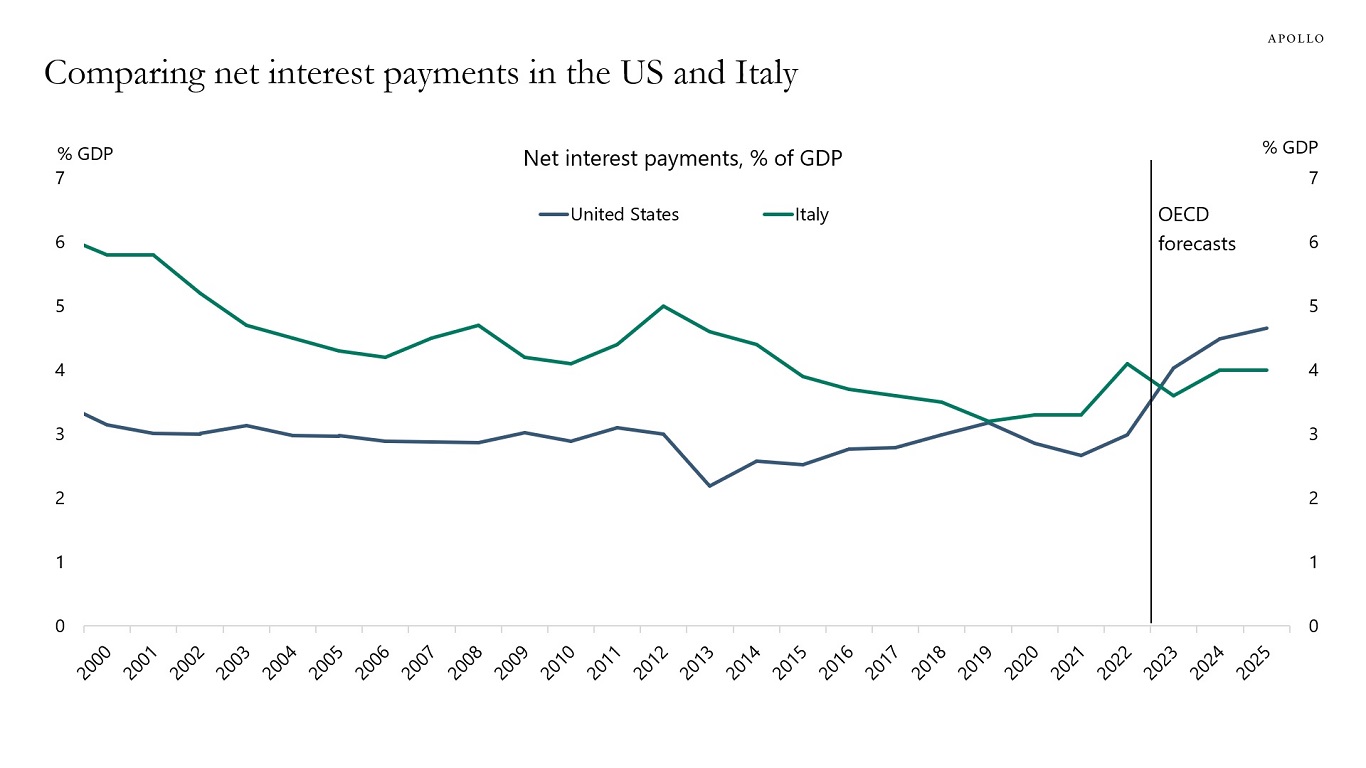

Government net interest payments are similar in the US and Italy, see the third chart.

Despite these similarities, Italy has a BBB rating, and the US has a AAA rating.

If the US continues on the fiscal trajectory forecasted by the CBO, the risks are rising that the US will be downgraded later this year.

Source: IMF, Haver Analytics, Apollo Chief Economist

Source: IMF, Haver Analytics, Apollo Chief Economist

Source: OECD, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.