Want it delivered daily to your inbox?

-

The “Fed pivot” on December 13 to a dovish stance underscored the rapidly shifting outlook for both growth and inflation. Markets have reacted in kind. But the bottom line is that going into 2024, we still see upside risks to inflation, downside risks to growth, and expect rates to stay higher and for longer than the rest of the market does.

We published our consolidated views in my newest white paper, 2024 Economic and Capital Markets Outlook: What’s Next After the “Fed Pivot”? You can download it here.

I will also be discussing the contents of the paper and my views in detail in an Apollo Academy class today, Dec. 20, at 11:00 ET (eligible for a CE credit). Register here.

See important disclaimers at the bottom of the page.

-

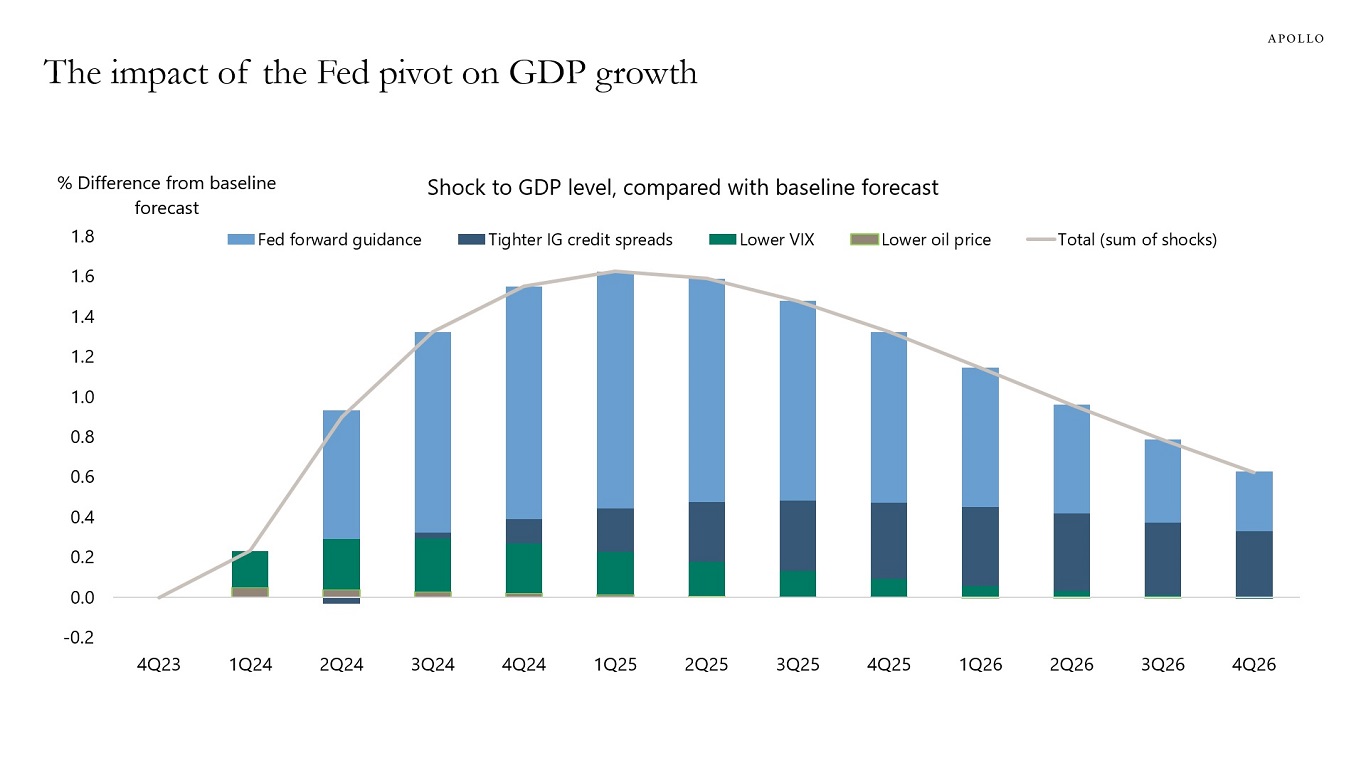

Last week, the Fed went from expecting another 25-basis point hike to now expecting 75-basis point cuts in 2024, and the chart below quantifies the impact of this 100-basis point pivot on the economy. At the same time, the market now expects 150 basis points in Fed cuts in 2024, and 10-year interest rates have declined by 100 basis points since they peaked at 5% in October.

The Fed pivot combined with a one standard deviation decline in VIX, a 60-basis point tightening in IG spreads since March, and a $20 decrease in oil prices since September will boost GDP growth by 1.5% over the coming quarters, see chart below.

The CBO estimates that potential growth in the US is 2%, so a 1.5% boost to GDP is significant. Stronger GDP growth will boost demand for housing, labor, airlines, hotels, restaurants, and goods, which ultimately will put renewed upward pressure on inflation.

The conclusion for markets is that the Fed pivot last week complicates the Fed’s goal of getting inflation back to 2%, and as we enter 2024, the pendulum will soon swing back from a dovish Fed to a more hawkish Fed.

Source: Bloomberg SHOK, Apollo Chief Economist. Note: $20 oil price decline, 60bps tighter IG spreads, 1std decline in VIX, and 100bps lower rates via changed Fed forward guidance. See important disclaimers at the bottom of the page.

-

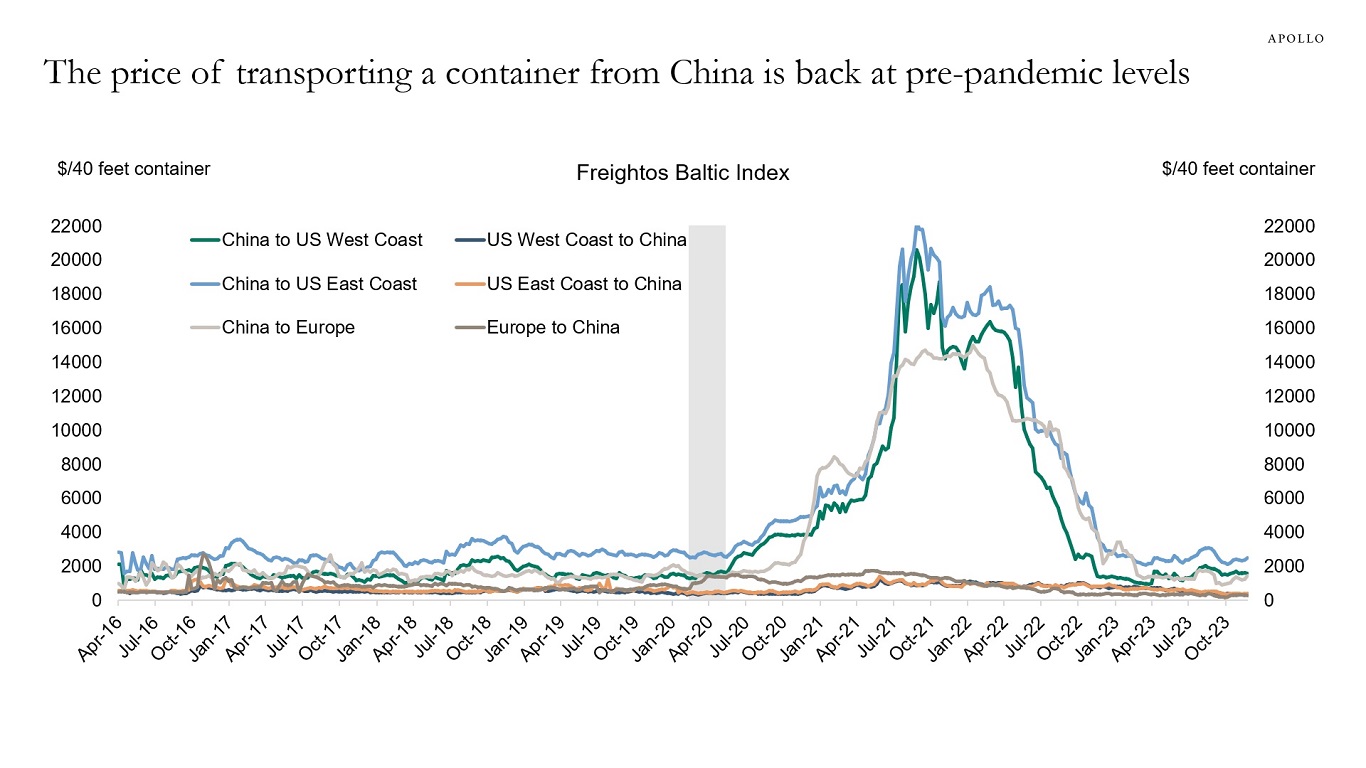

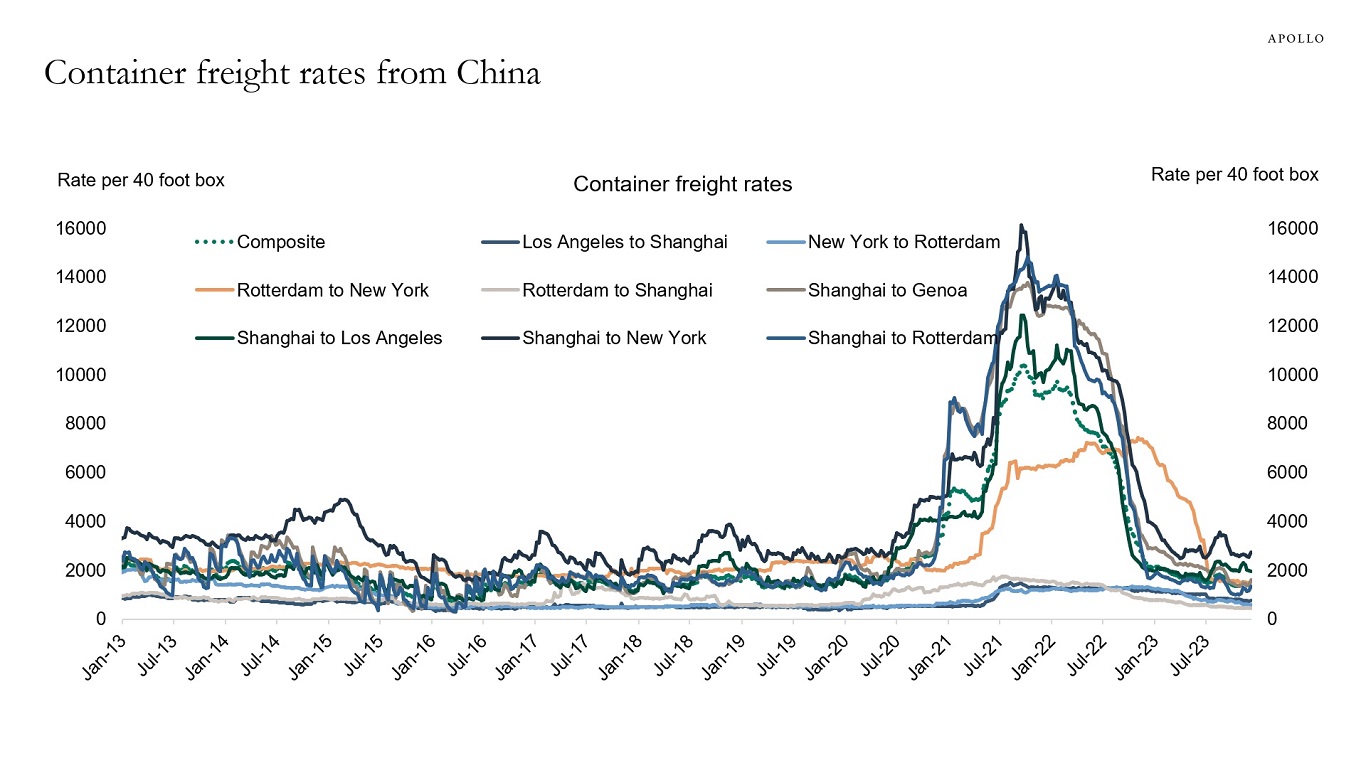

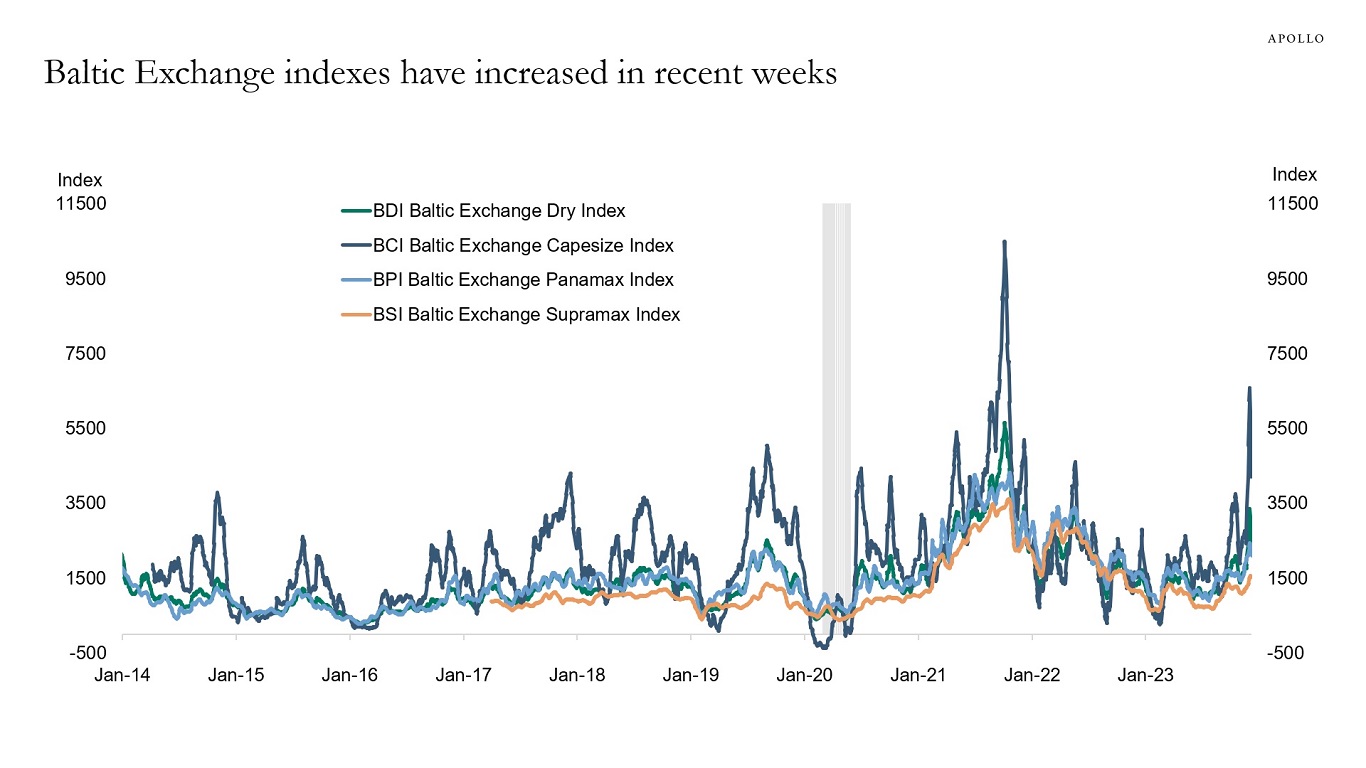

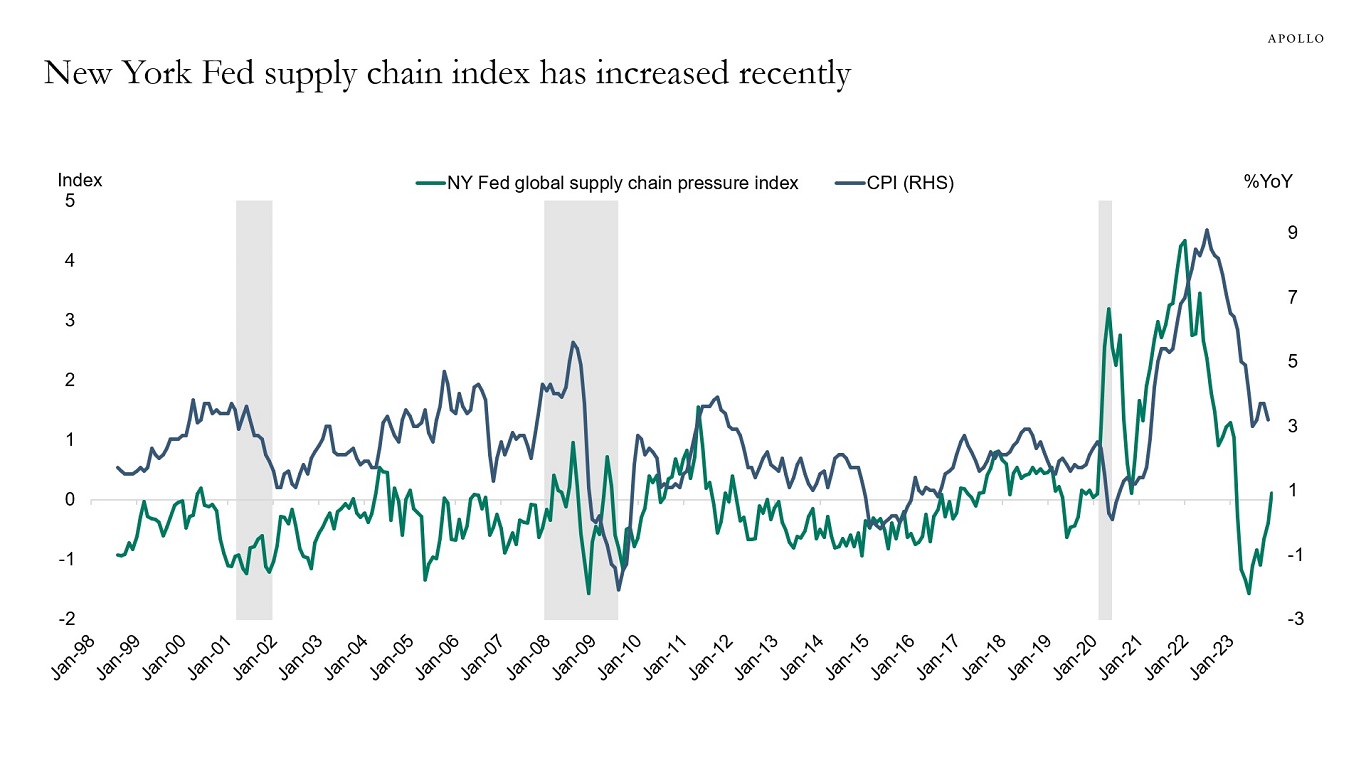

All supply chain indicators are now back near 2019 levels, see charts below and in this chart book.

Source: Freightos, Bloomberg, Apollo Chief Economist

Source: WCI, Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: NY Fed, BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

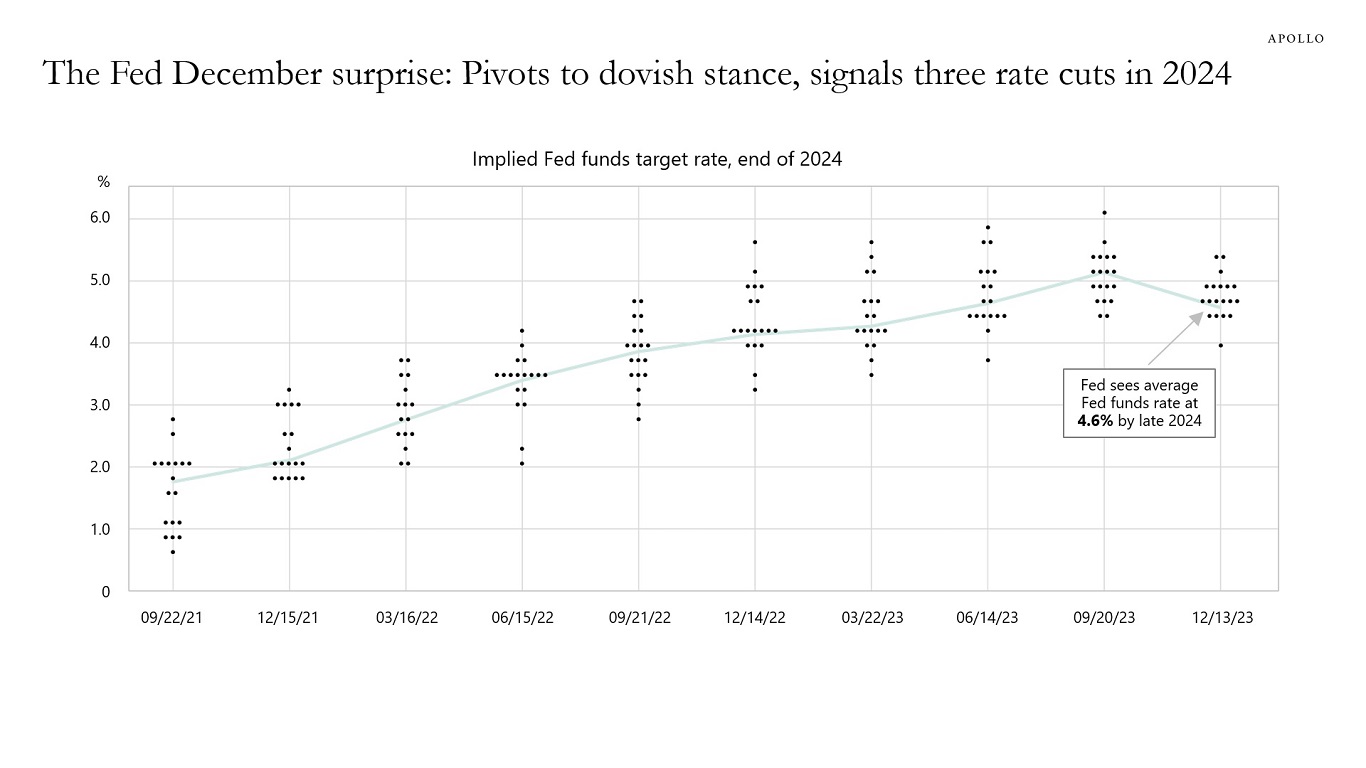

FOMC members have since 2021 steadily been revising up their forecasts for where they think the Fed funds rate will be by the end of 2024, see chart below. This changed at their meeting earlier this week, where the Fed signaled that they now see interest rates in 2024 lower than they thought in September.

This pivot in communication, however, does not suggest that the inflation problem has been solved. Looking into 2024, there are upside risks to inflation (from a recovering housing market and easier financial conditions) and downside risks to growth (from the lagged effects of Fed hikes on consumers, firms, and banks).

The bottom line is that they may have pivoted their communication, but the Fed is not yet out of the woods, and the upside risks to inflation and downside risks to growth remain significant.

I will discuss the Fed pivot and our outlook for markets in 2024 in detail in an Apollo Academy class on Wednesday, December 20 at 11 am (eligible for 1 CE credit). Register today.

Source: Bloomberg, Federal Reserve Board. Data as of December 14, 2023. See important disclaimers at the bottom of the page.

-

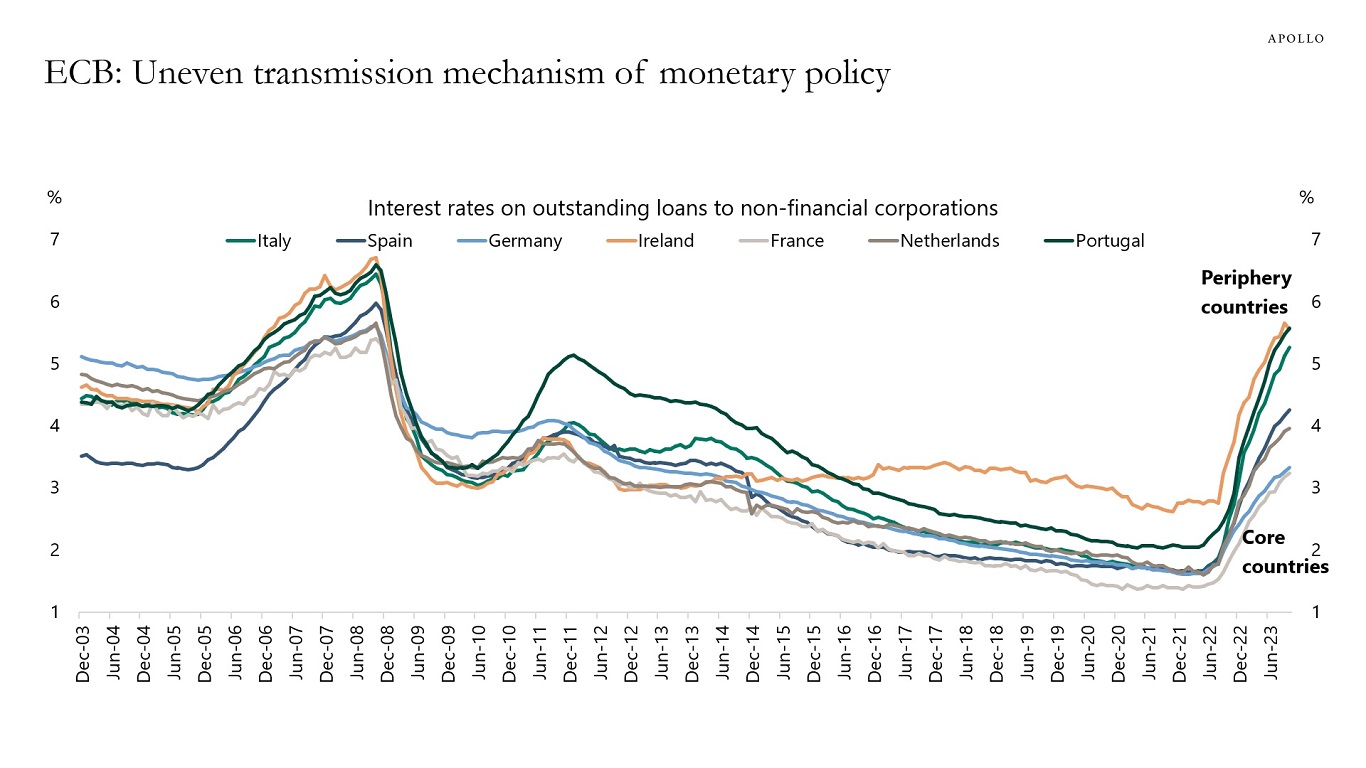

Data from the ECB shows that ECB rate hikes have had a very uneven impact on euro area countries with interest rates for firms increasing much more in periphery countries than in core countries.

For example, interest rates on outstanding loans to non-financial corporations in Ireland and Portugal are currently around 5.6% versus 3.3% in Germany and France, see chart below.

The bottom line is that ECB rate hikes negatively impact the periphery more than the core.

Source: ECB, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

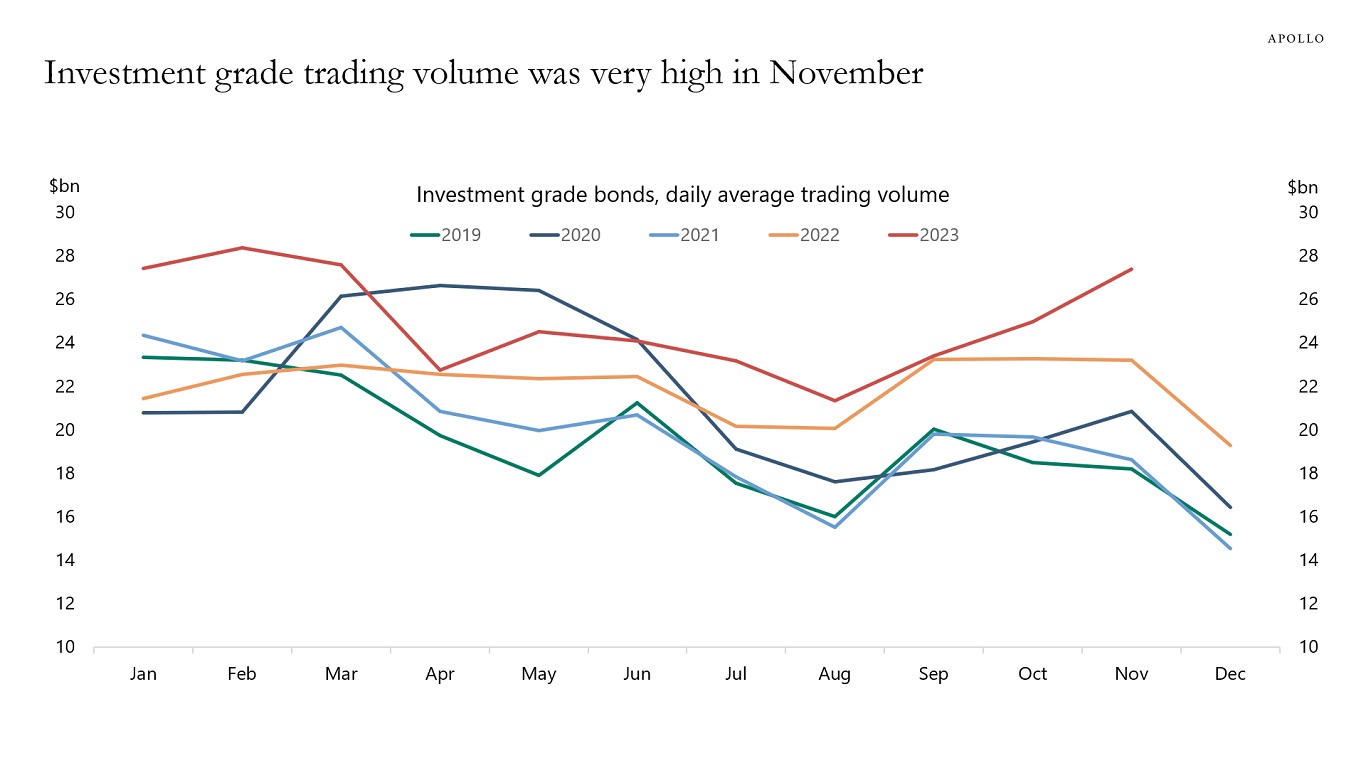

Trading volume in investment grade bonds was at post-Covid highs in November and significantly above 2019 levels, see chart below.

Source: FINRA TRACE, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

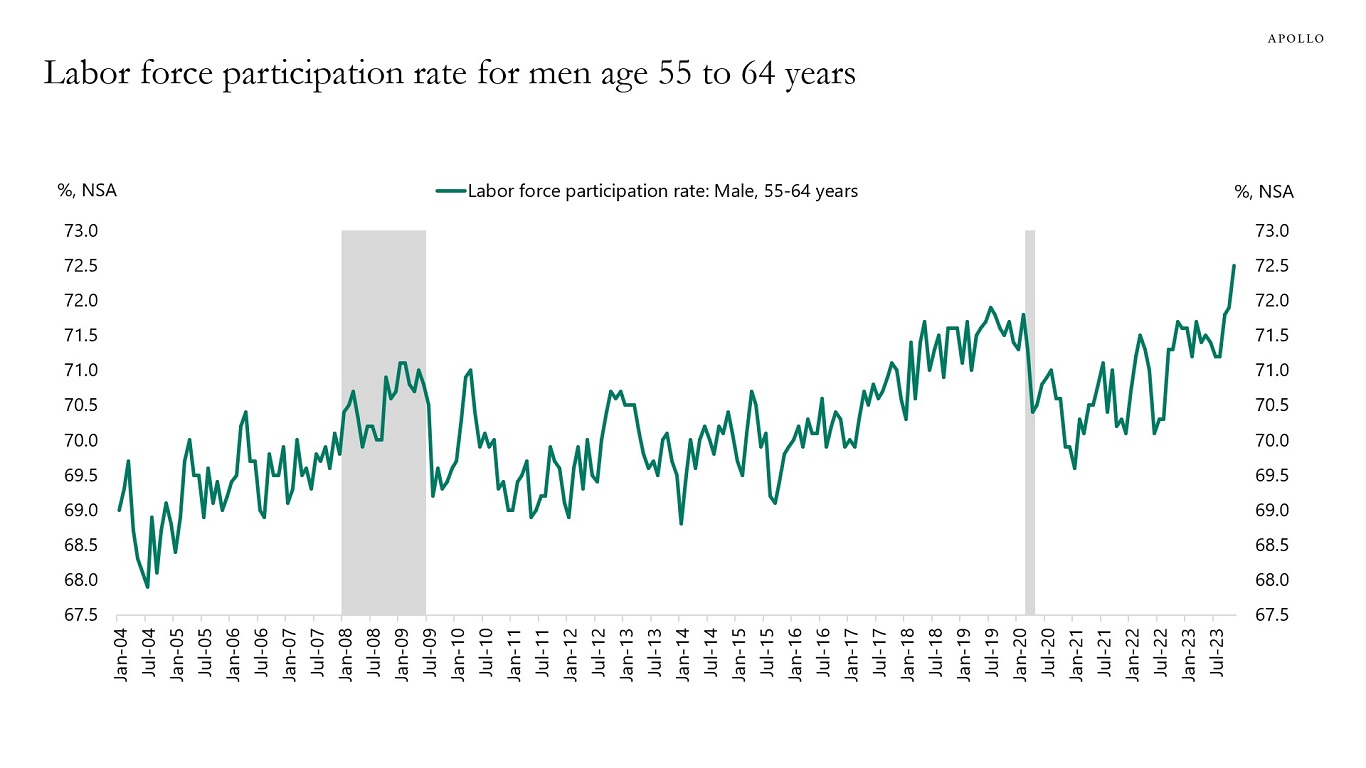

In recent months, we have seen a significant increase in the number of men age 55 to 64 joining the workforce, see chart below.

Source: BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

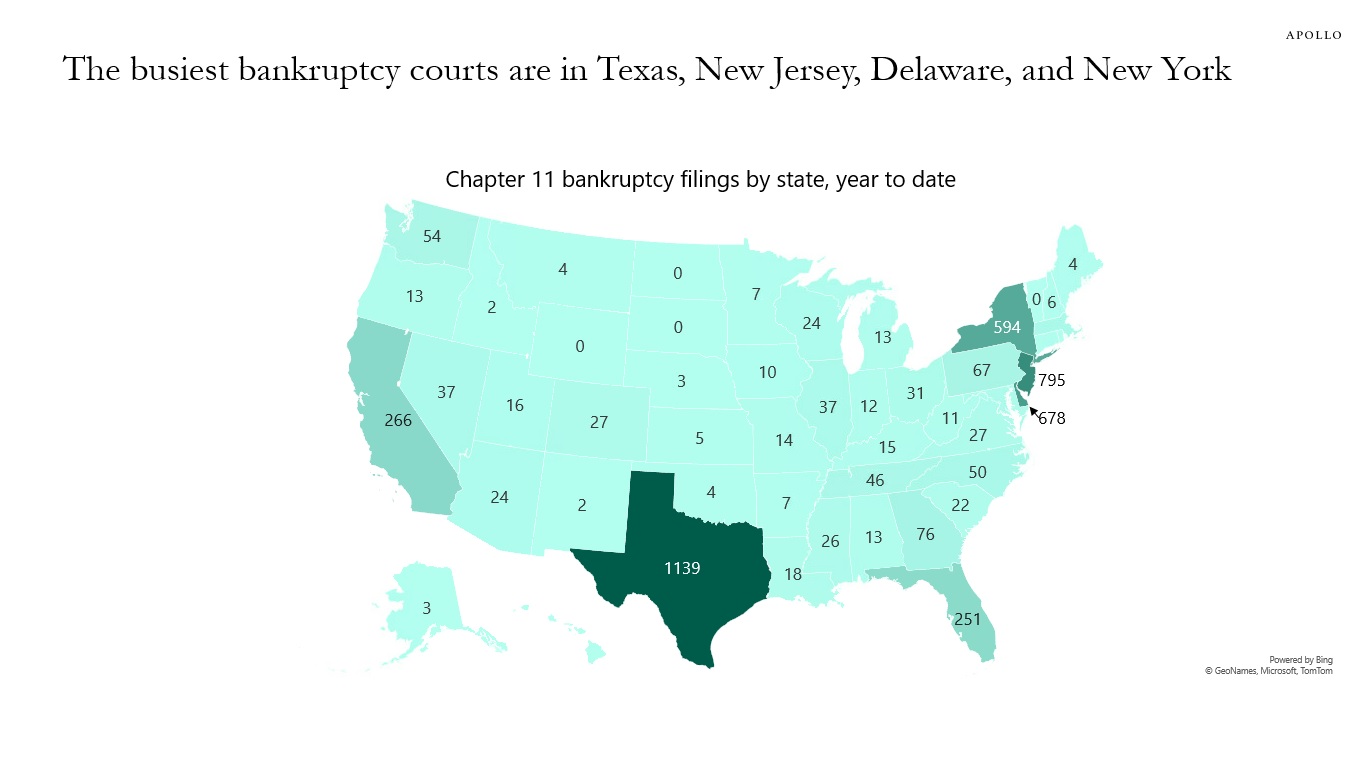

There are more Chapter 11 bankruptcy filings in Texas, New Jersey, Delaware, and New York than in other states, see map below.

Source: Epiq bankruptcy, Apollo Chief Economist. Data from January 1, 2023 to December 8, 2023. See important disclaimers at the bottom of the page.

-

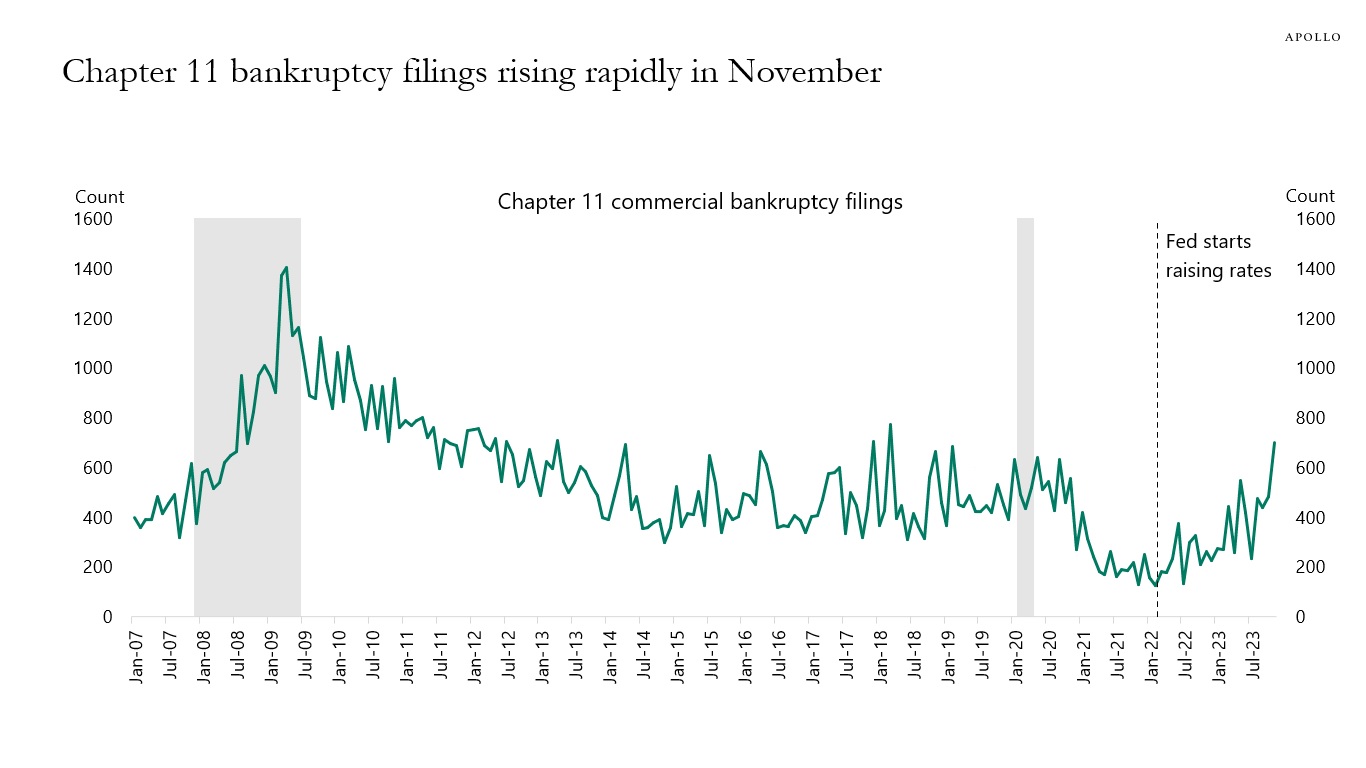

Data for November shows that Chapter 11 bankruptcy filings are trending higher, and Fed hikes continue to bite harder and harder on highly leveraged firms with little or no cash flows in tech, growth, and venture capital, see chart below.

Source: Epiq bankruptcy, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

This chart book looks at recent developments in private equity, PE deal activity, private credit, real assets, secondaries, middle markets, and venture capital.

See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.