Want it delivered daily to your inbox?

-

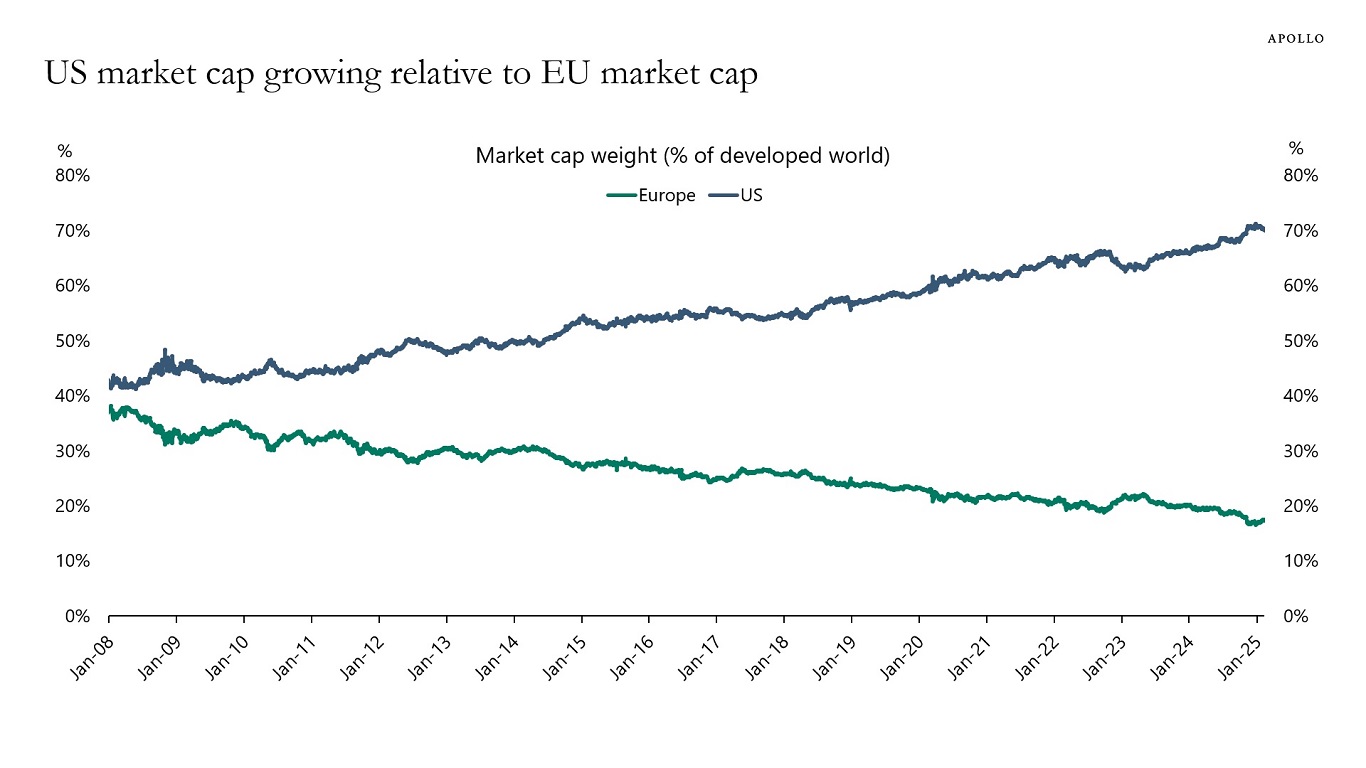

Global equity investors are not only highly concentrated in tech stocks, they are also highly concentrated in US stocks, see chart below. It goes against page one in the finance textbook, which says that investors should be diversified.

Source: MSCI, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

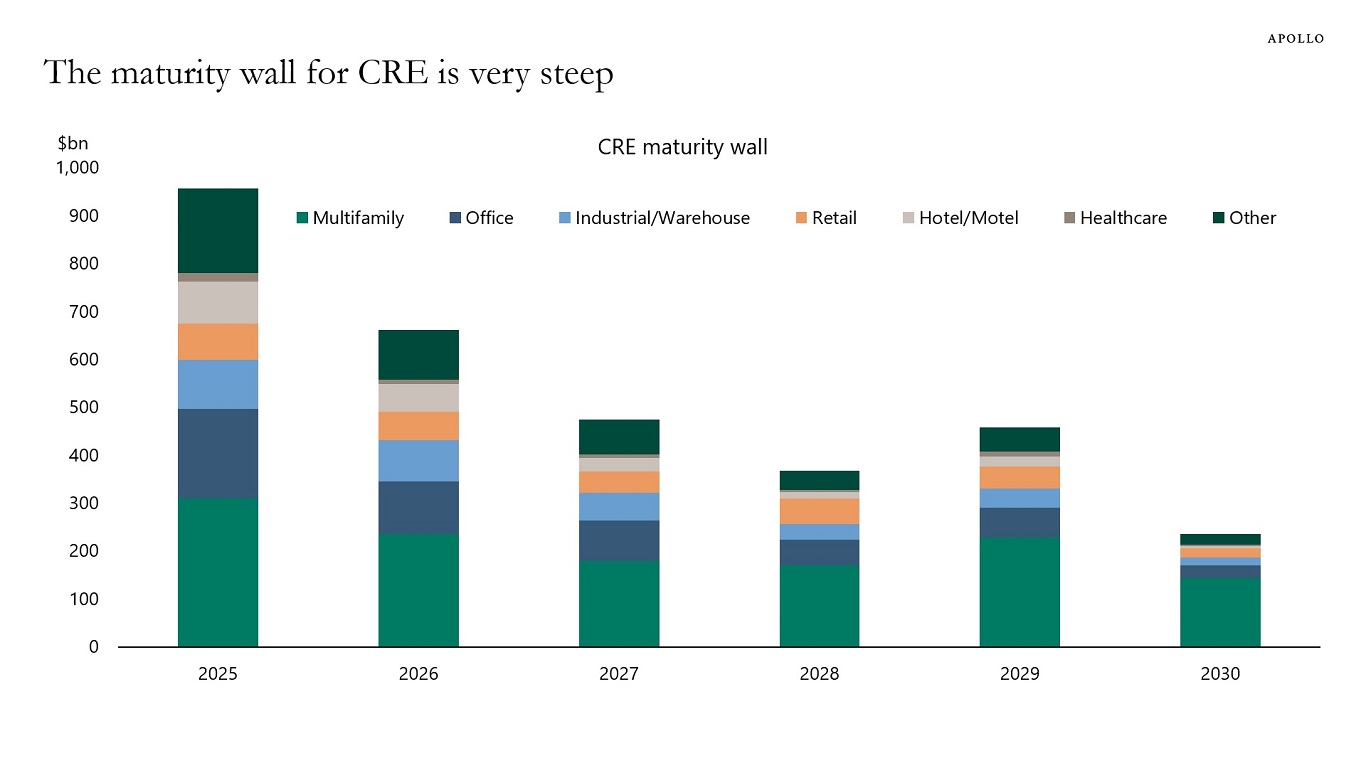

Rates higher for longer continues to be a headwind to the outlook for CRE, see chart below.

Source: Mortgage Bankers Association, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

The incoming economic data remains strong. But we are starting to worry about the downside risks to the economy and markets from: 1) the impact of DOGE layoffs and contract cuts on jobless claims and 2) persistently elevated policy uncertainty weighing on capex spending decisions and hiring decisions.

Specifically:

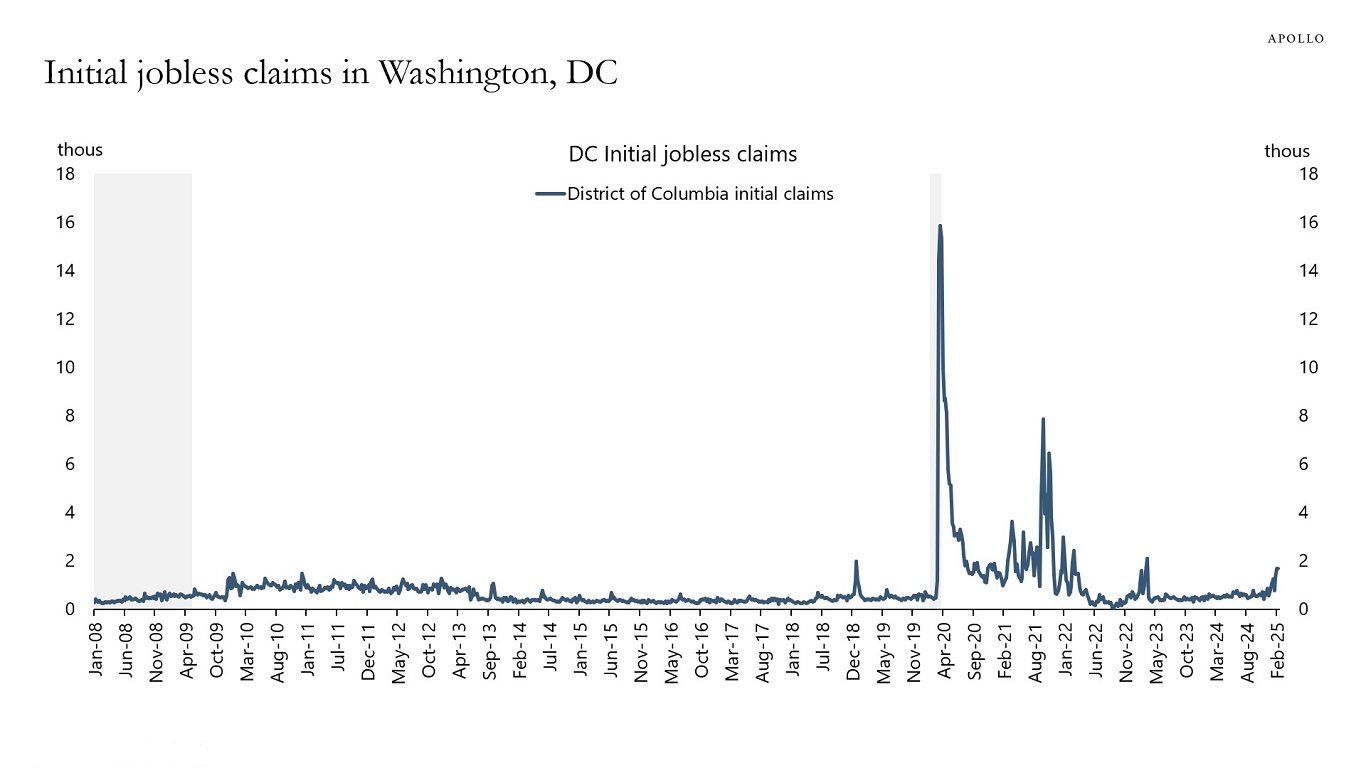

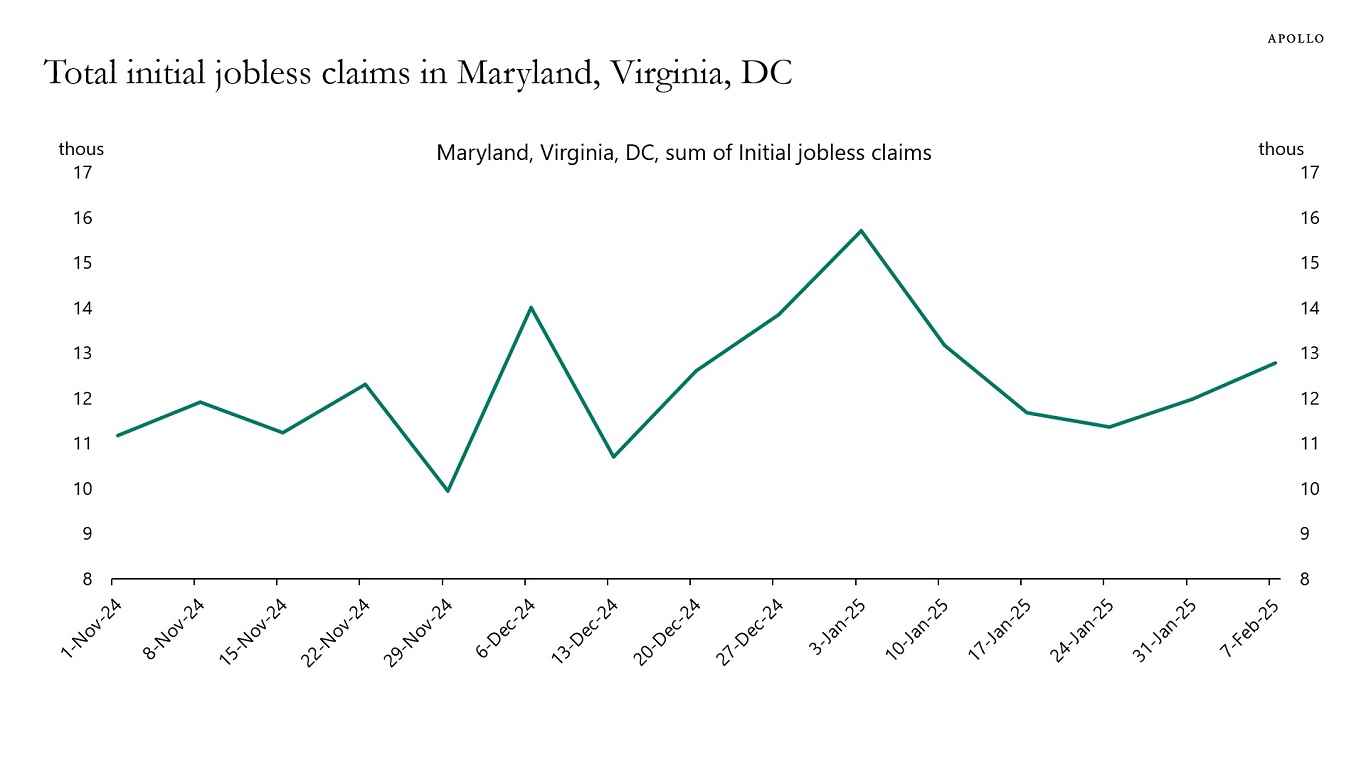

1) The consensus expects total DOGE-related job cuts to be 300,000, and the number of people filing for unemployment benefits has been rising in Washington, DC, but not in Virginia, Maryland, and Washington, DC combined, see the first two charts. Total employment in the United States is 160 million, with 7 million unemployed. Also, about 5 million people change jobs every month. In that context, 300,000 federal jobs lost is not much. However, studies show that for every federal employee, there are two contractors. As a result, layoffs could potentially be closer to 1 million. Any increase in layoffs will push jobless claims higher over the coming weeks, and such a rise in the unemployment rate is likely to have consequences for rates, equities, and credit.

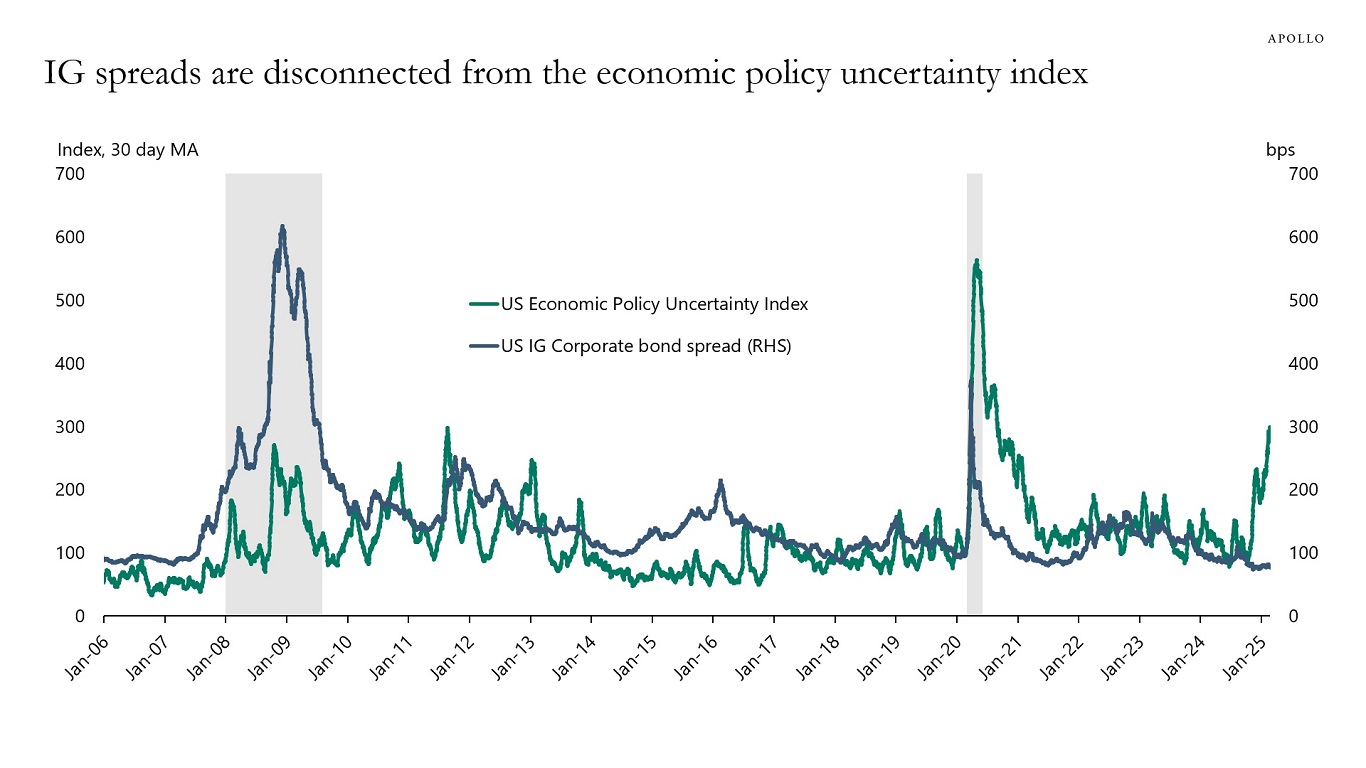

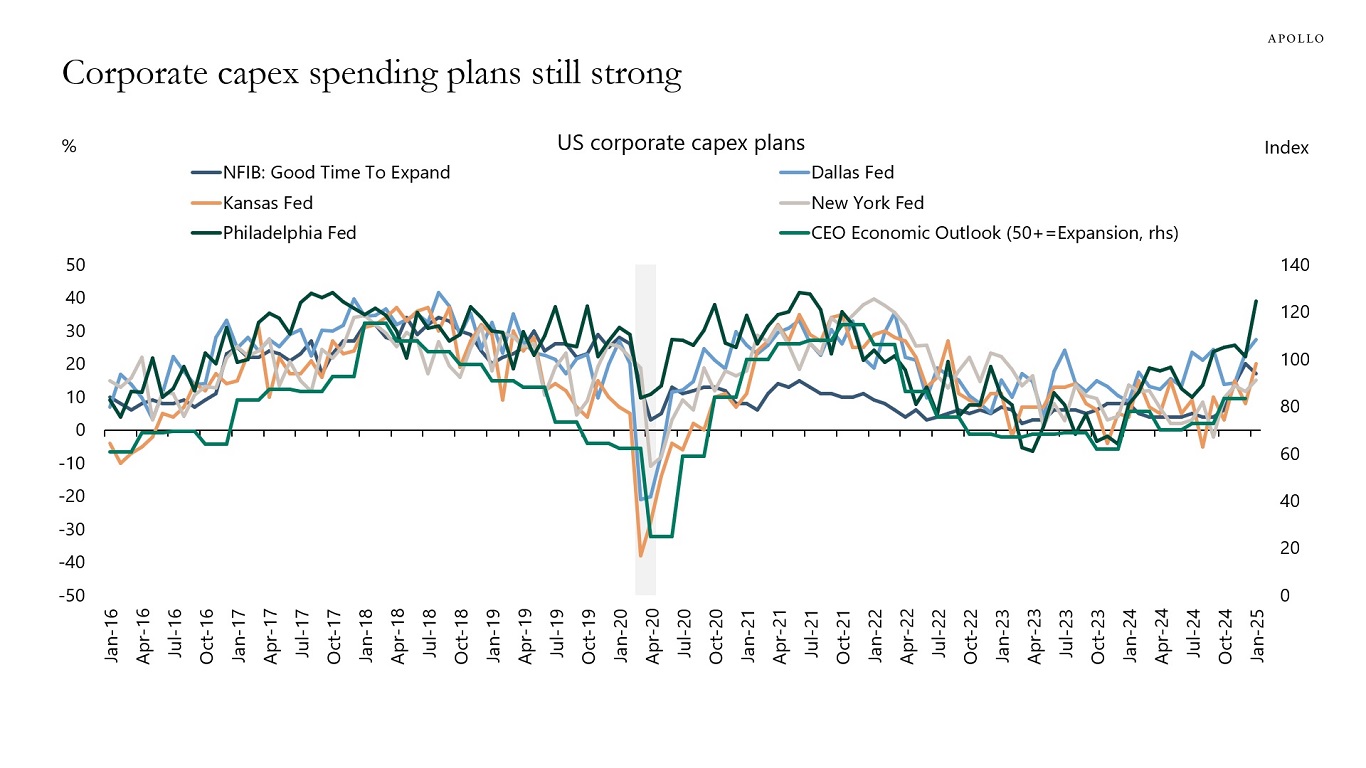

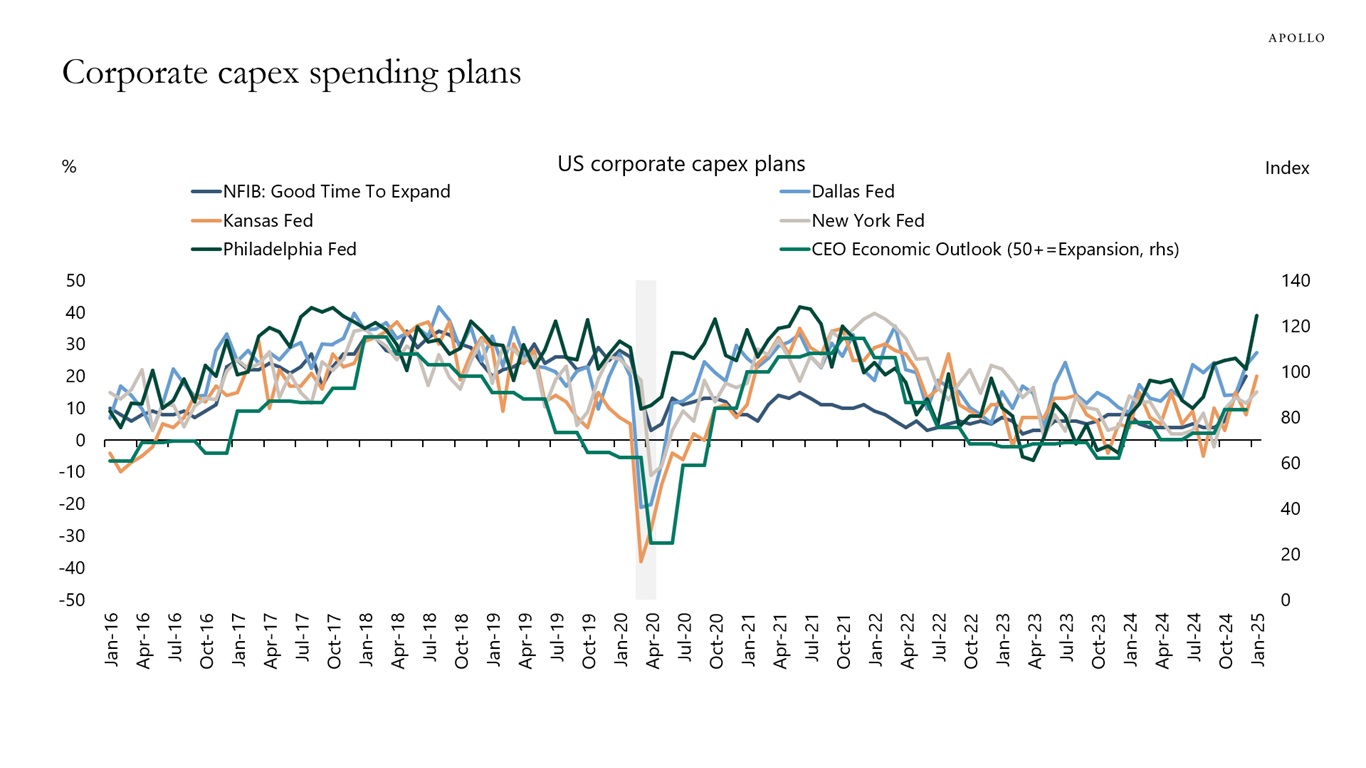

2) Credit spreads have not responded the way they normally do to rising policy uncertainty. Economic policy uncertainty is spiking higher, but credit spreads are not widening, see the third chart. The question is if persistently elevated policy uncertainty will begin to have a negative impact on capex spending and hiring decisions.

The bottom line is that the incoming data remains strong, see the fourth chart. But the near-term downside risks to the economy and markets are growing.

Our chart book with daily and weekly indicators for the US economy is available here.

Source: US Department of Labor, Bloomberg, Apollo Chief Economist

Source: US Department of Labor, Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: Business Roundtable; NFIB; Federal Reserve Bank of Philadelphia, Dallas, New York, Kansas, and Richmond; Apollo Chief Economist See important disclaimers at the bottom of the page.

-

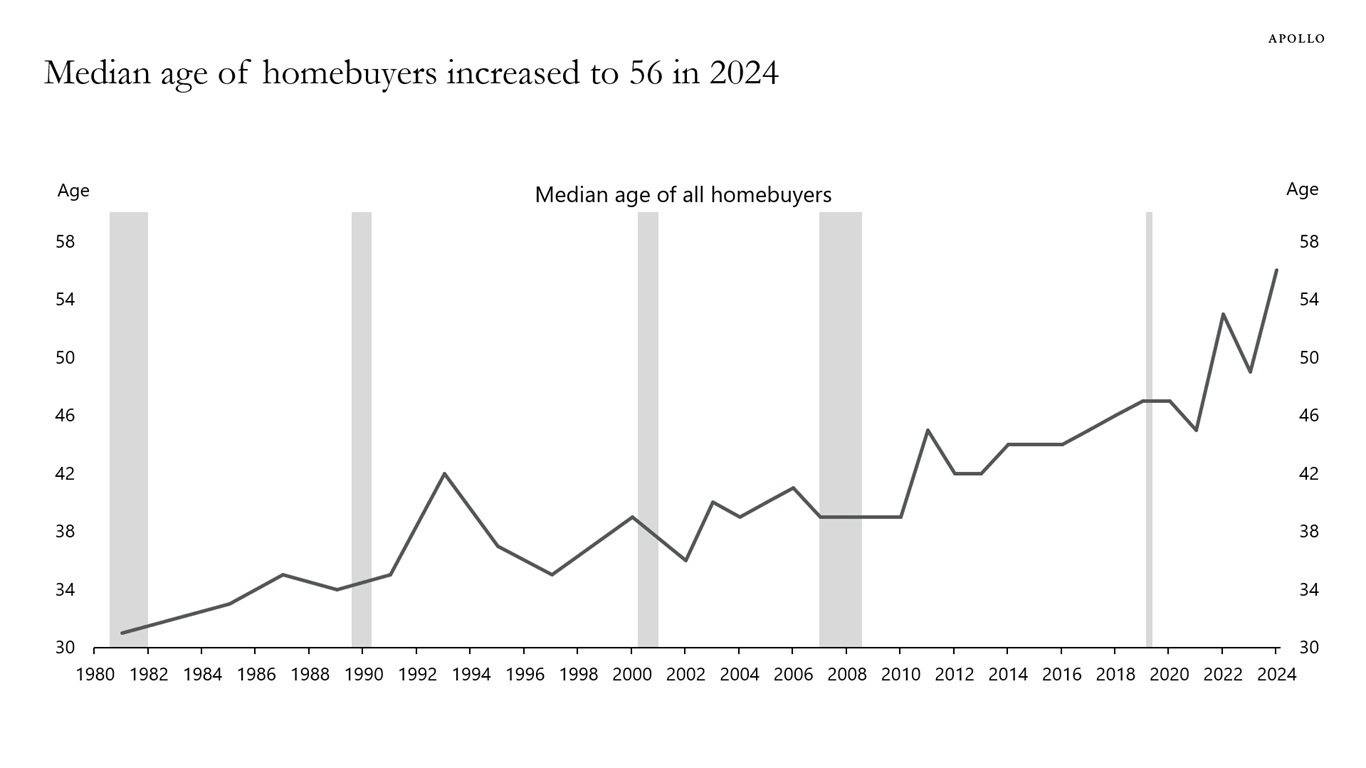

Rising home prices and high mortgage rates have pushed the median age of homebuyers to a record-high 56 years old in 2024, up from 45 in 2021.

In 1981, the median age of homebuyers was 31 years old, see chart below.

Source: NAR Profile of Home Buyers and Sellers, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

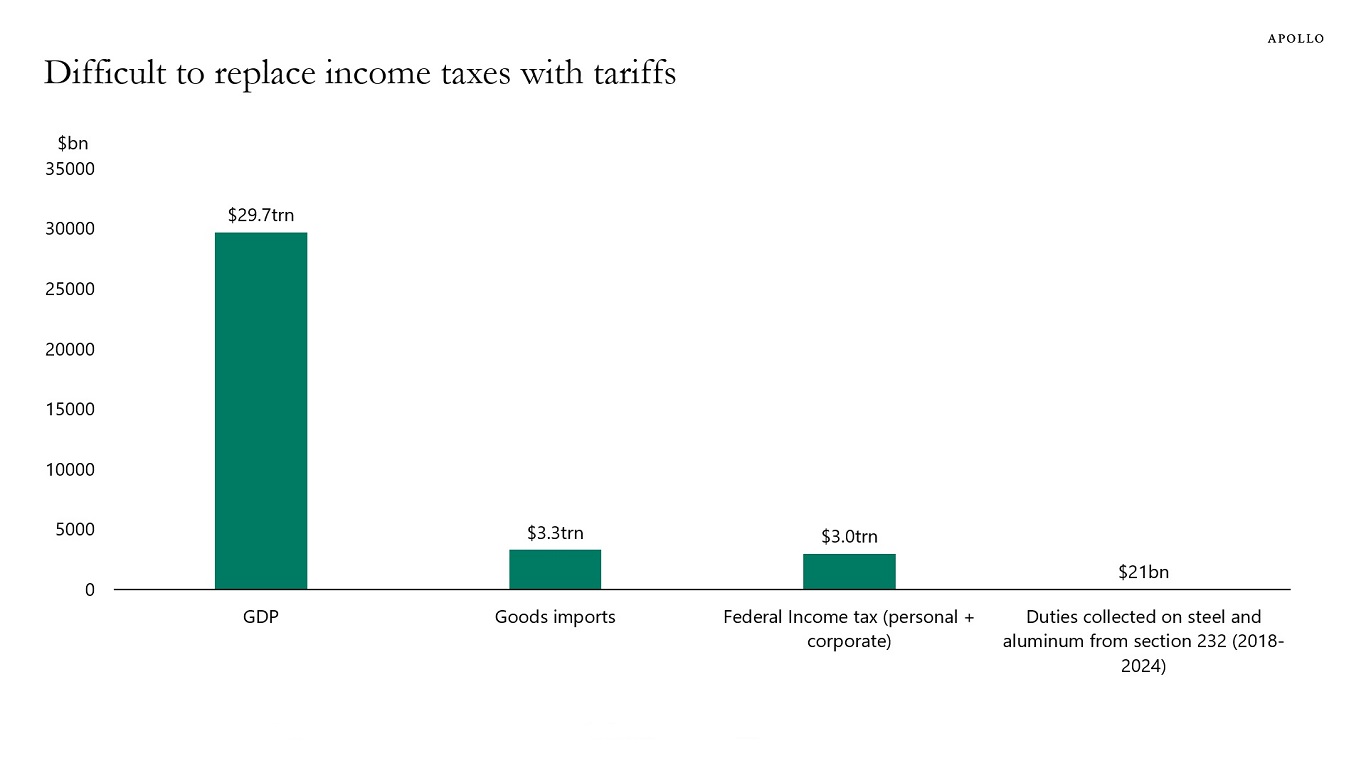

Total revenue raised from income taxes is currently around $3 trillion, and total imports into the US are also around $3 trillion, see chart below.

This means that tariffs would have to be at least 100% on all imported goods for tariffs to replace income taxes.

The challenge is that it is unclear what will happen to sales if all imported products double in price. Given higher prices result in lower sales, it may require as much as 200% tariffs on all imported goods for the total tariff revenue to replace income taxes.

In addition, such a scenario would also involve significantly higher prices of cars, computers, electronics, imported medicine, clothing, shoes, imported energy, etc. for US consumers.

The bottom line is that it is challenging to replace income taxes with tariffs, and higher tariffs will have implications for consumer prices and consumer demand for imported goods.

Note: Data for 2024 for GDP, goods imports, and income tax. Source: BEA, OMB, Haver Analytics, US Customs and Borders Protection, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

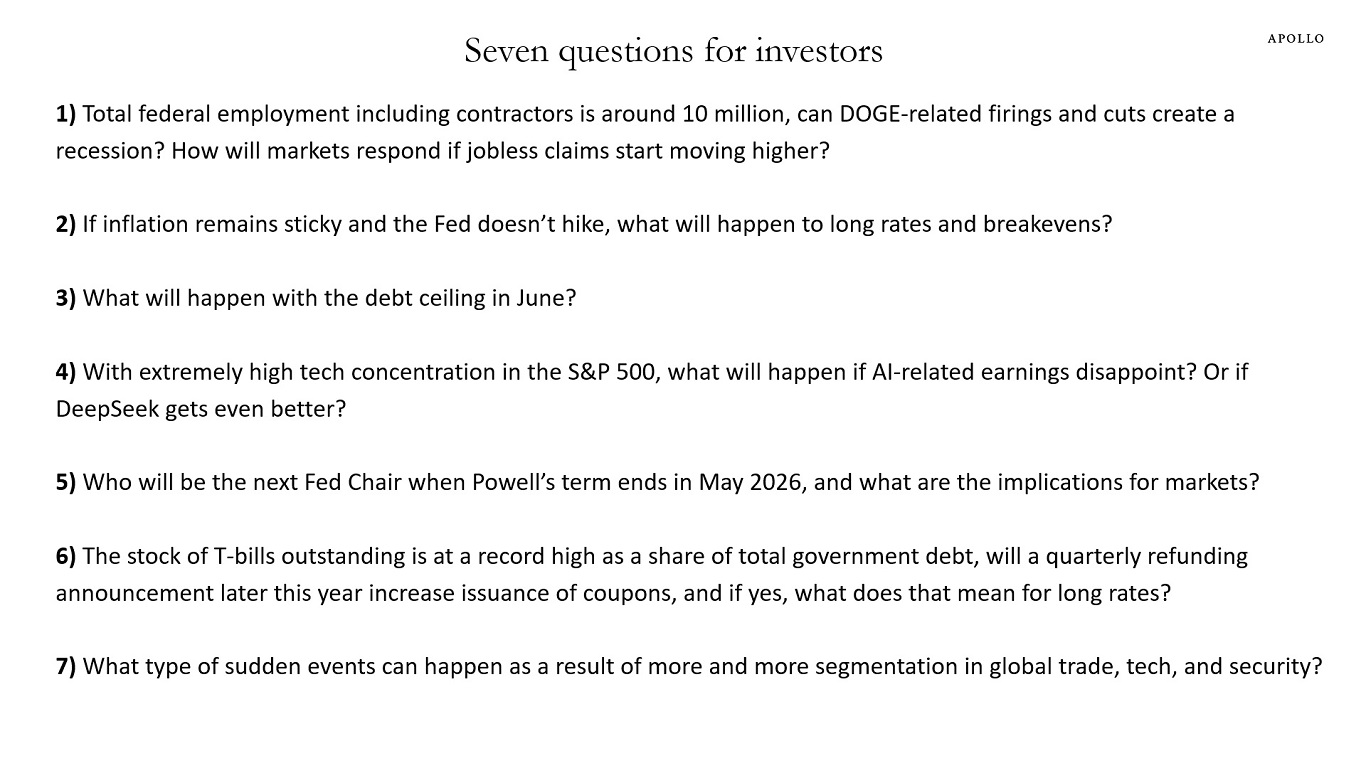

Below are some questions I have been getting from clients recently. All risk managers should be asking themselves these questions.

Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

-

We are watching the weekly data for the number of people who file for unemployment benefits in Washington DC, Maryland, and Virginia, and any impact federal government layoffs may have on nationwide jobless claims, see chart below. This data comes out every Thursday at 8:30 a.m. ET.

Source: US Department of Labor, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

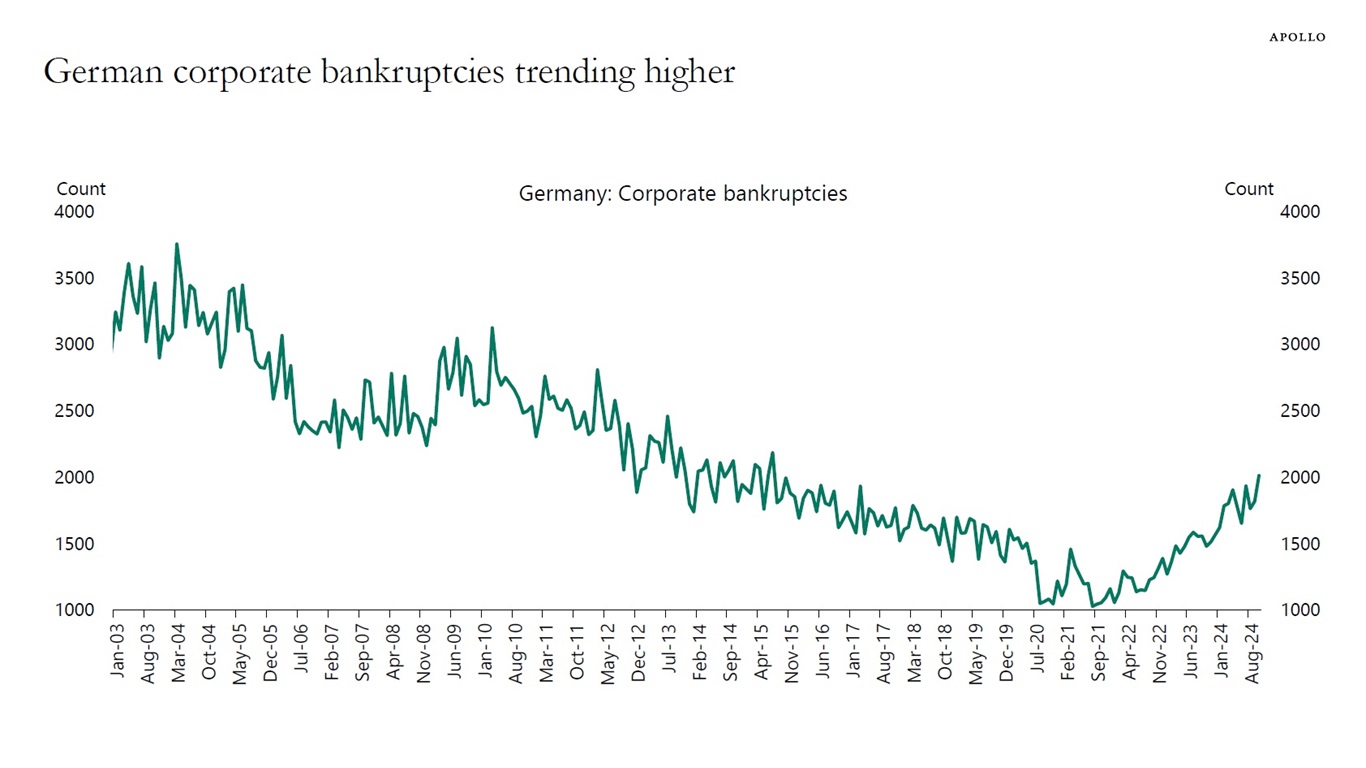

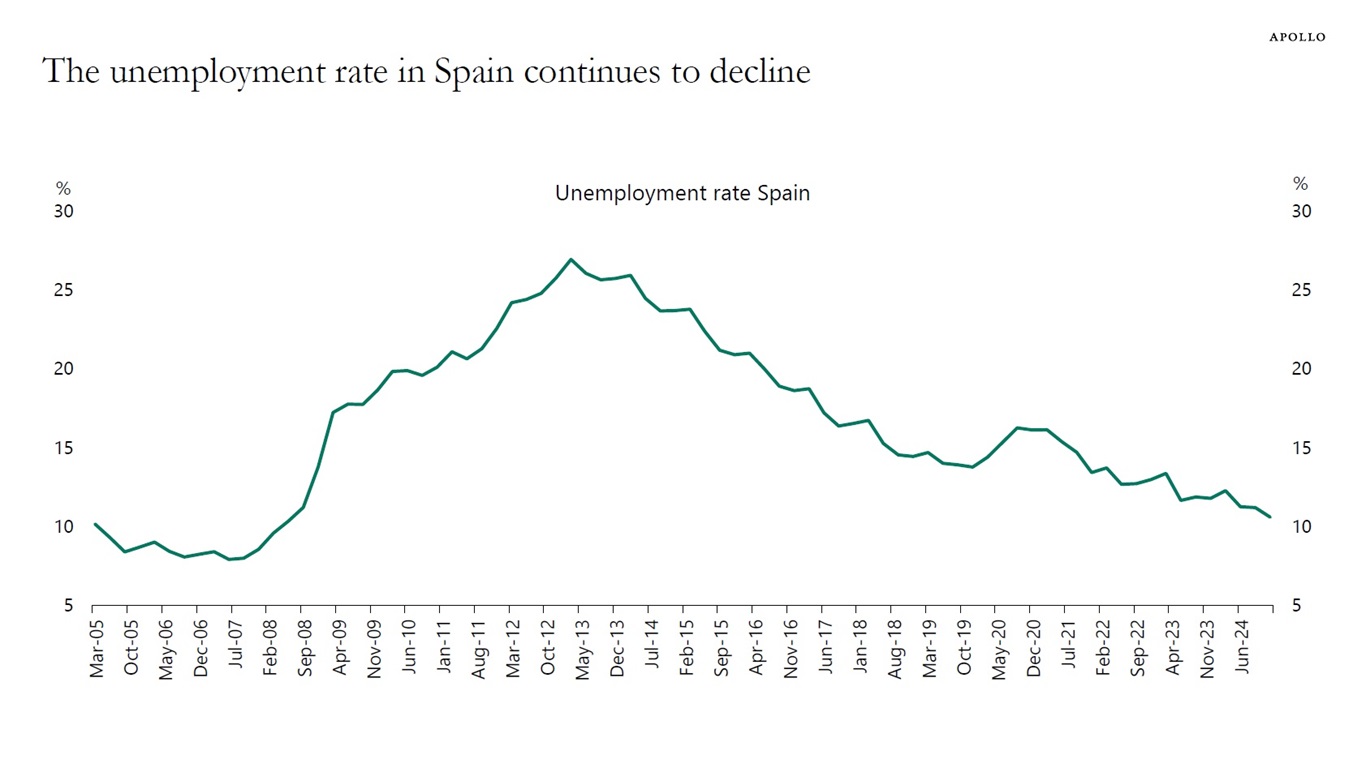

The outlook for Spain continues to improve, and the outlook for Germany continues to deteriorate, see charts below.

Source: German Federal Statistical Office, Bloomberg, Apollo Chief Economist

Source: INE, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

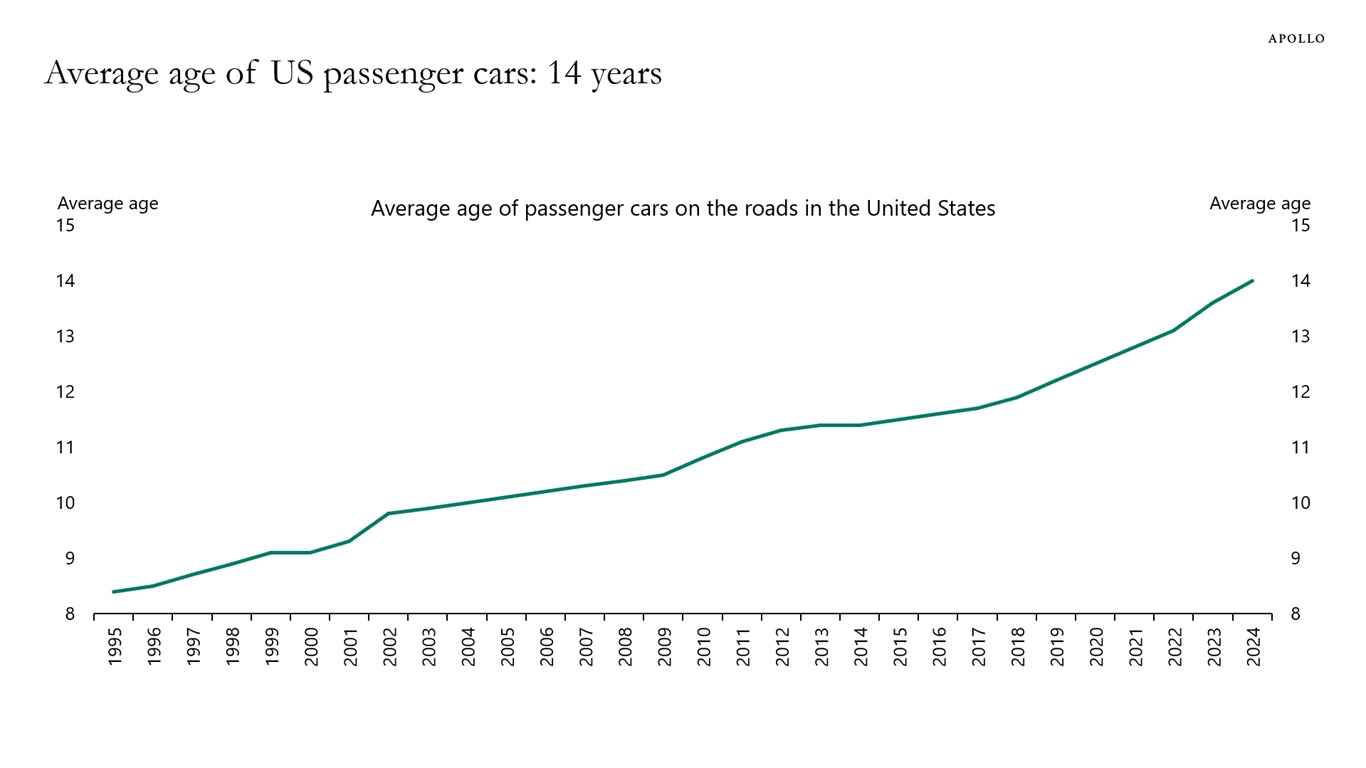

The average age of passenger cars on the roads in the US continues to rise, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

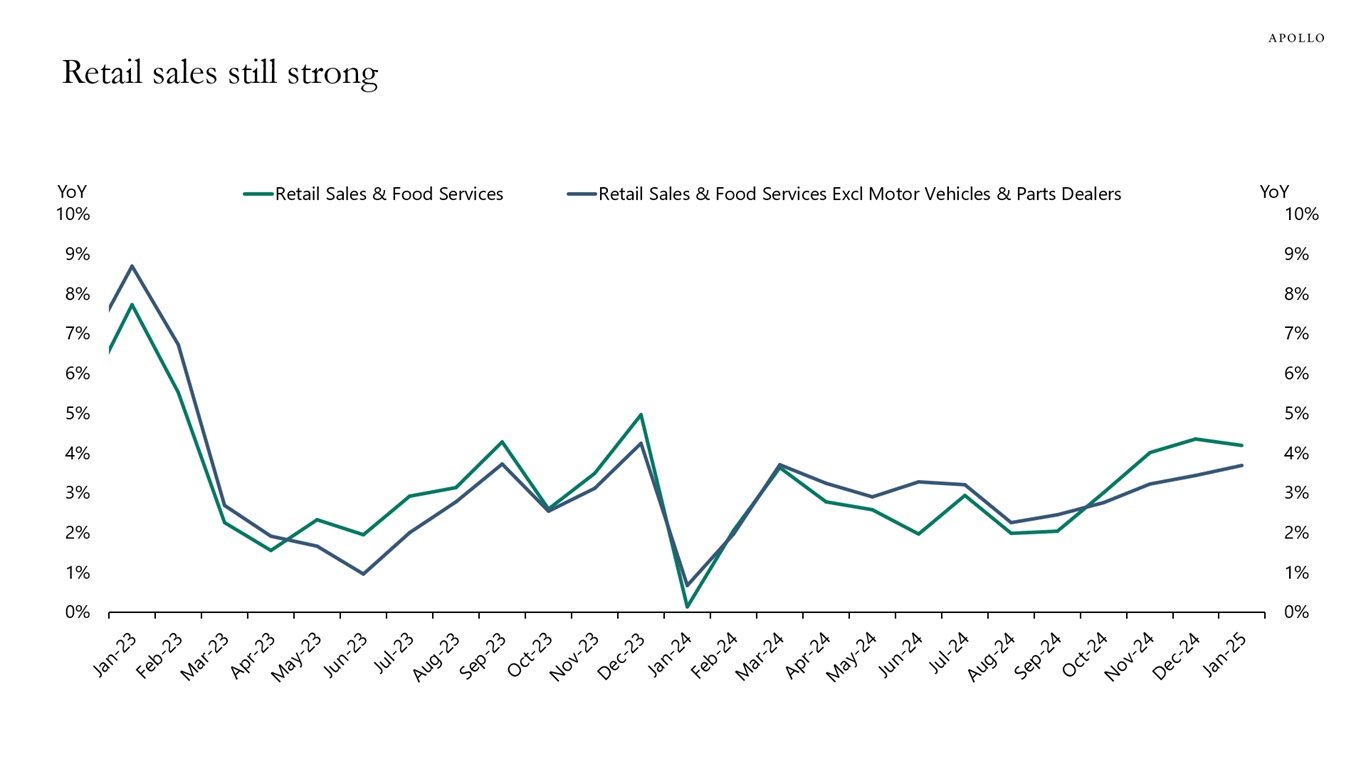

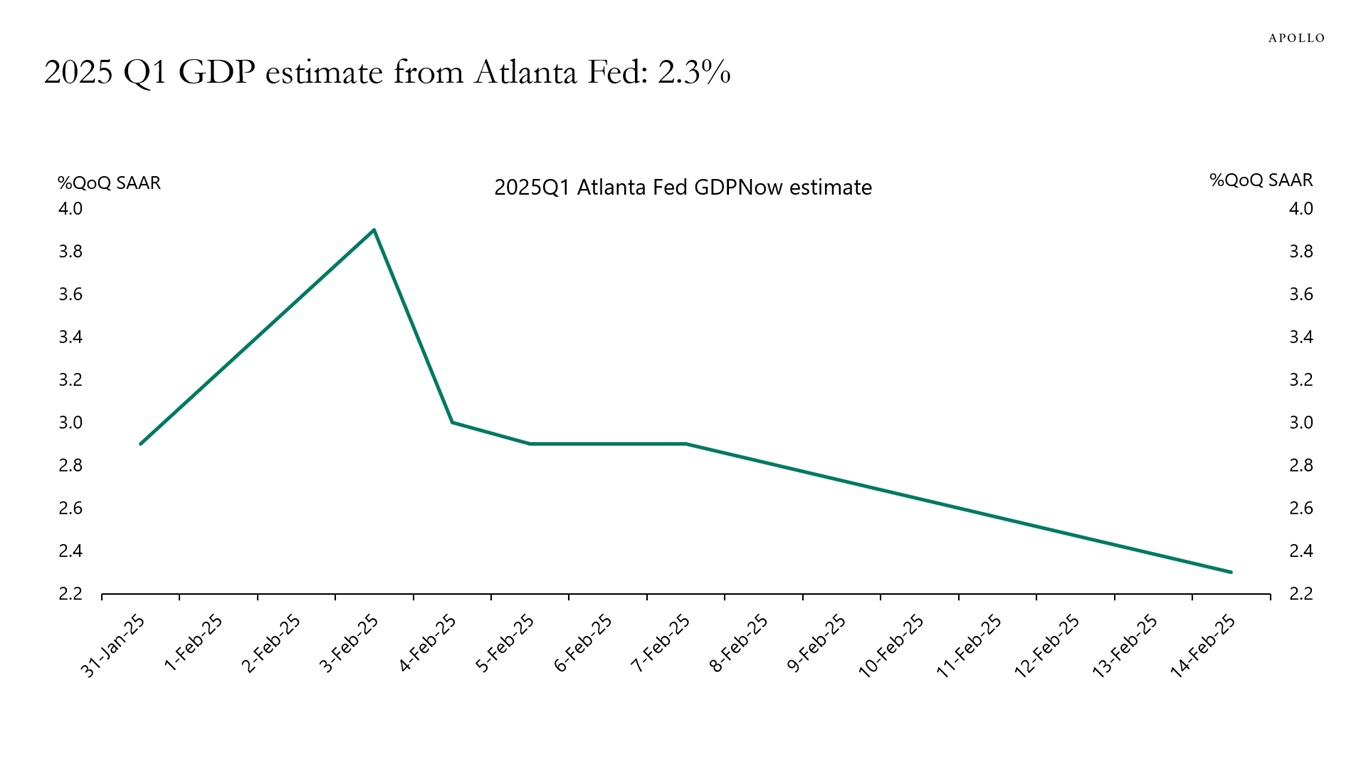

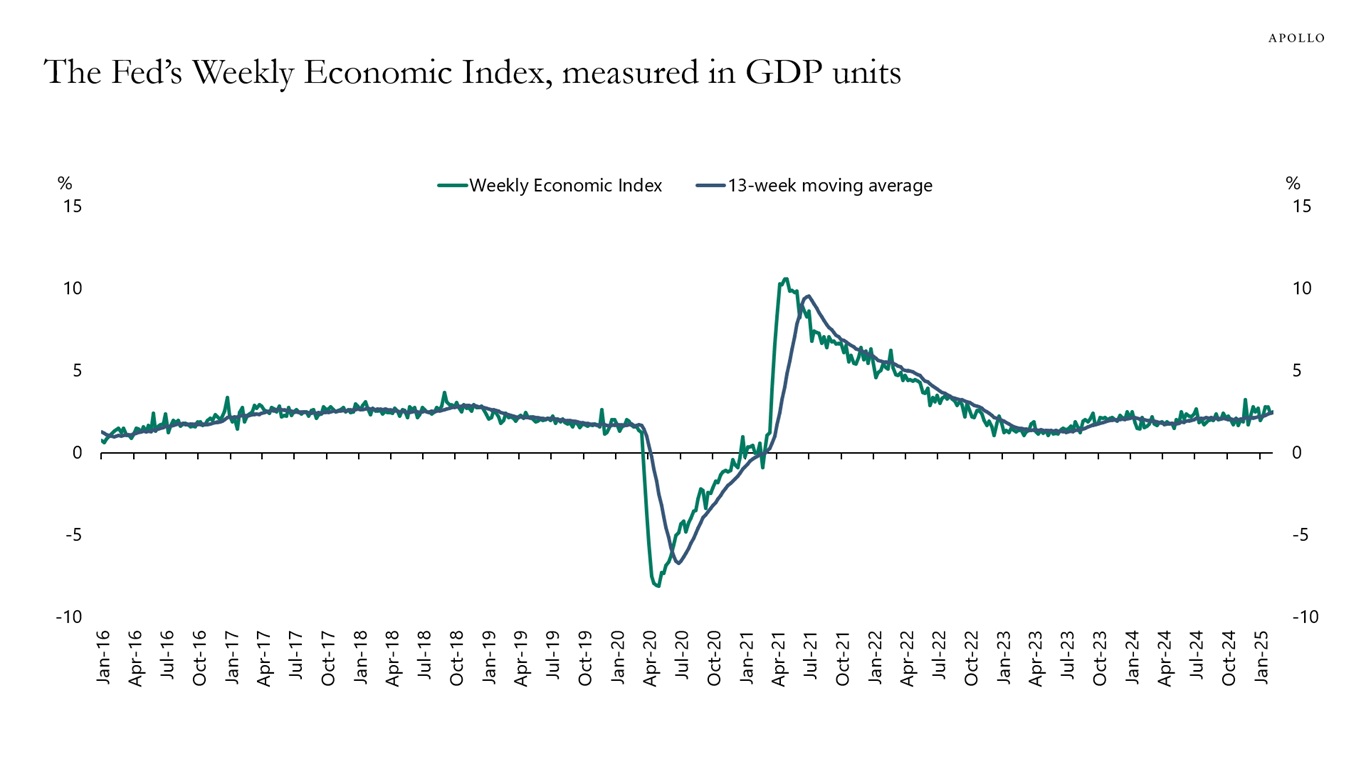

The data this week shows that the economy remains strong.

Consumers are in good shape, and year-over-year retail sales show steady growth, see the first chart below. Capex spending plans are improving, see the second chart, and the Atlanta Fed GDP estimate for first quarter GDP and the Dallas Fed weekly estimate for GDP are at 2.3% and 2.5%, respectively, see the third and fourth chart.

We are carefully monitoring trade war uncertainty, but so far, there are no signs that it is having a negative impact on the incoming data, see the fifth chart.

Source: Census Bureau, Haver Analytics, Apollo Chief Economist

Source: Business Roundtable; NFIB; Federal Reserve Bank of Philadelphia, Dallas, New York, Kansas, and Richmond; Apollo Chief Economist

Source: Federal Reserve Bank of Atlanta, Haver Analytics, Apollo Chief Economist

Source: Federal Reserve Bank of Dallas, Bureau of Economic Analysis, Apollo Chief Economist

Source: PolicyUncertainty.com, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.