Want it delivered daily to your inbox?

-

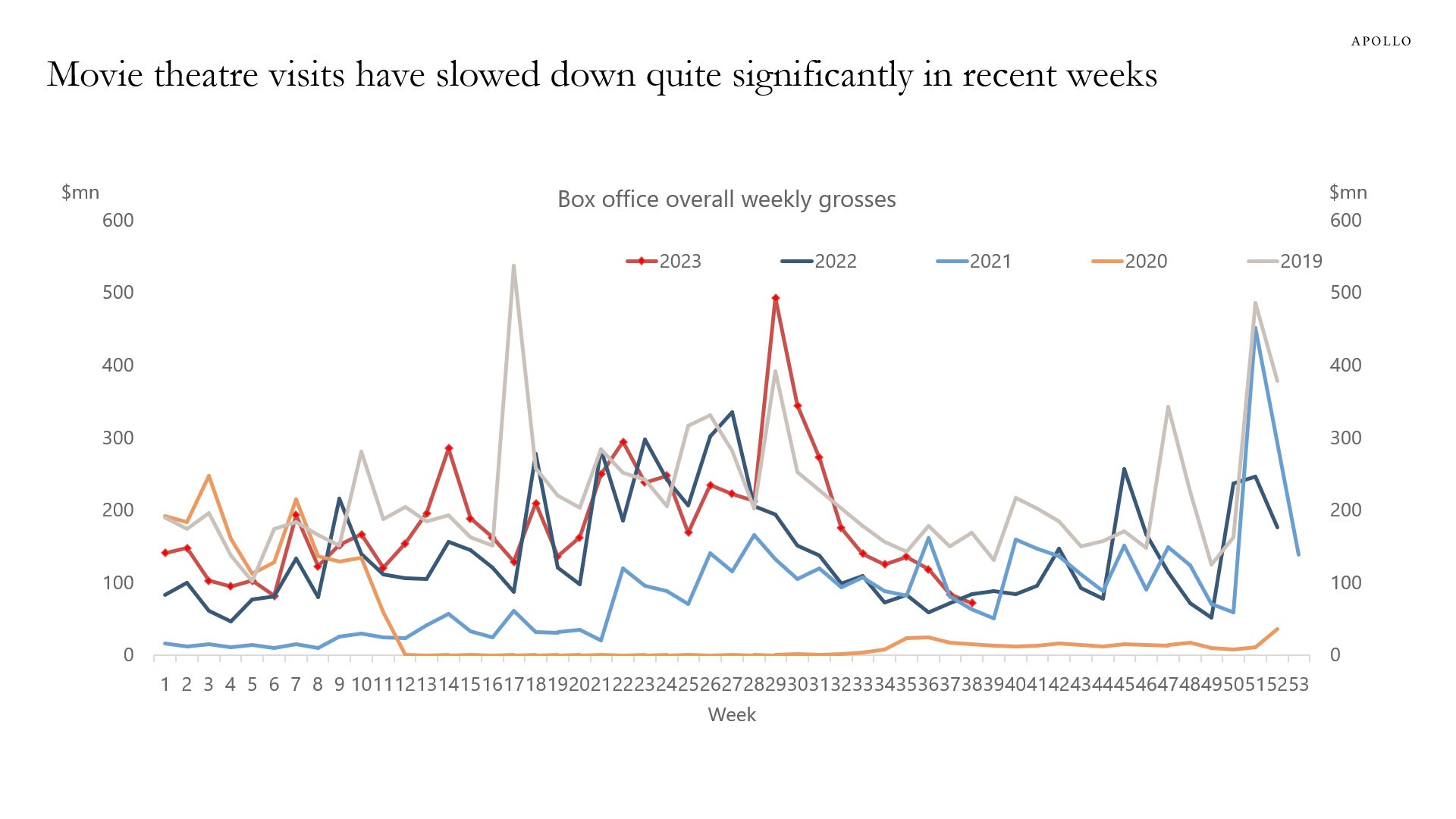

The number of people going to the movies has in recent weeks slowed down more than the usual seasonal pattern, see chart below.

Consumer services make up two-thirds of consumer spending, and watching for signs of a slowdown in consumer spending in the service sector is critical for markets.

Source: Boxofficemojo.com, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

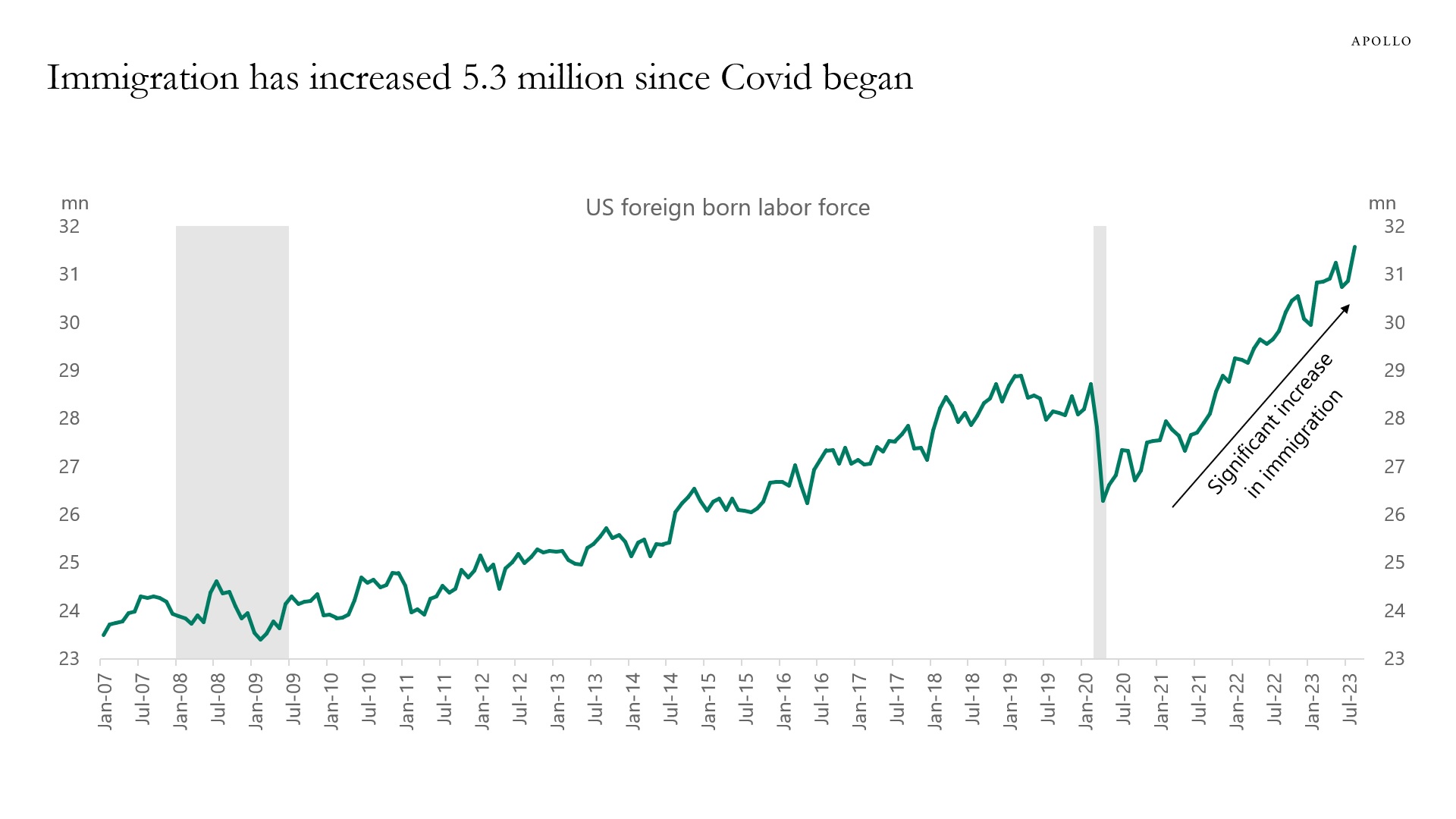

The number of foreigners in the labor force has increased by more than 5 million since April 2020, and a rise in immigration puts downward pressure on wage growth and hence inflation, see chart below.

Source: BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

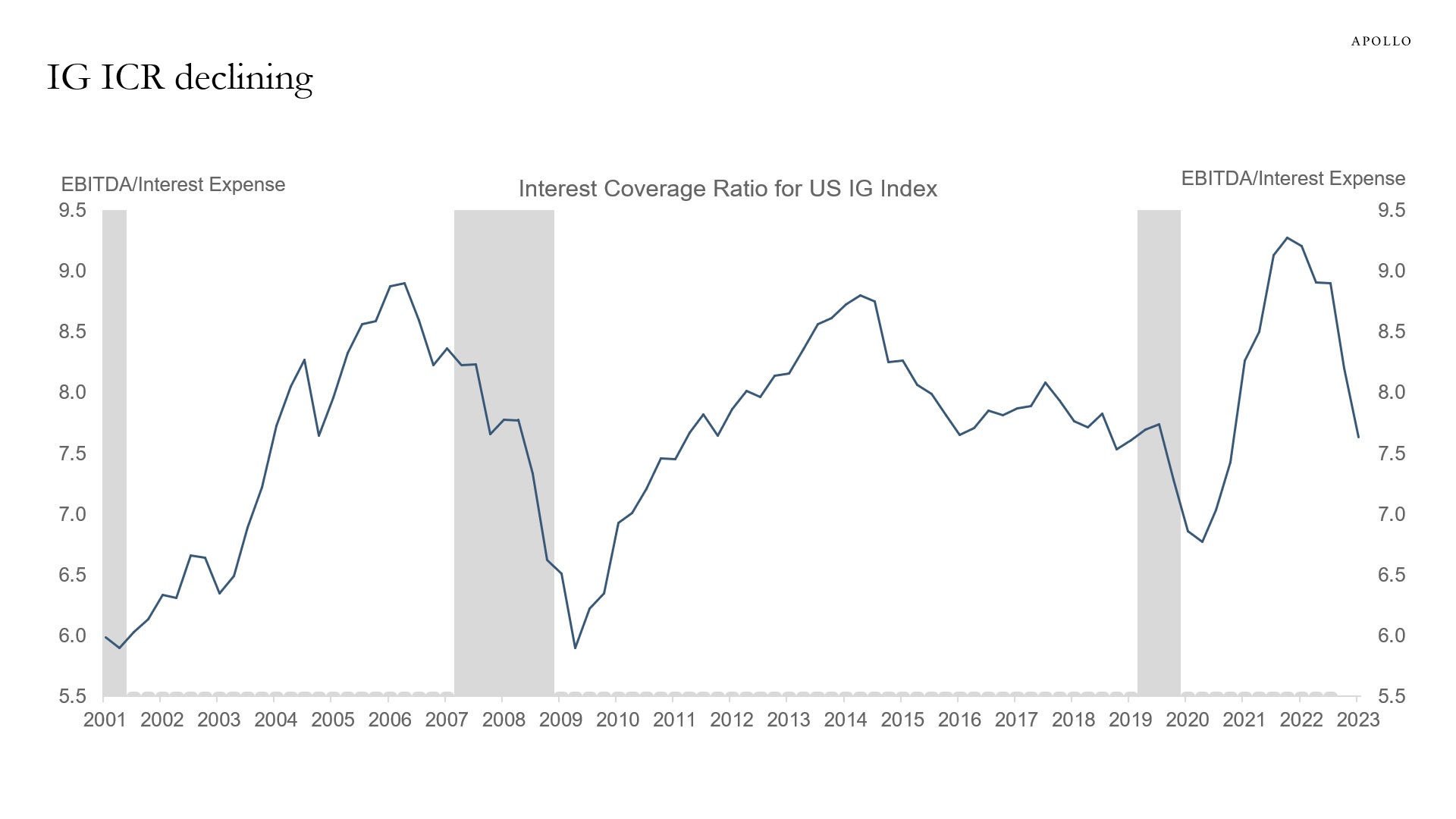

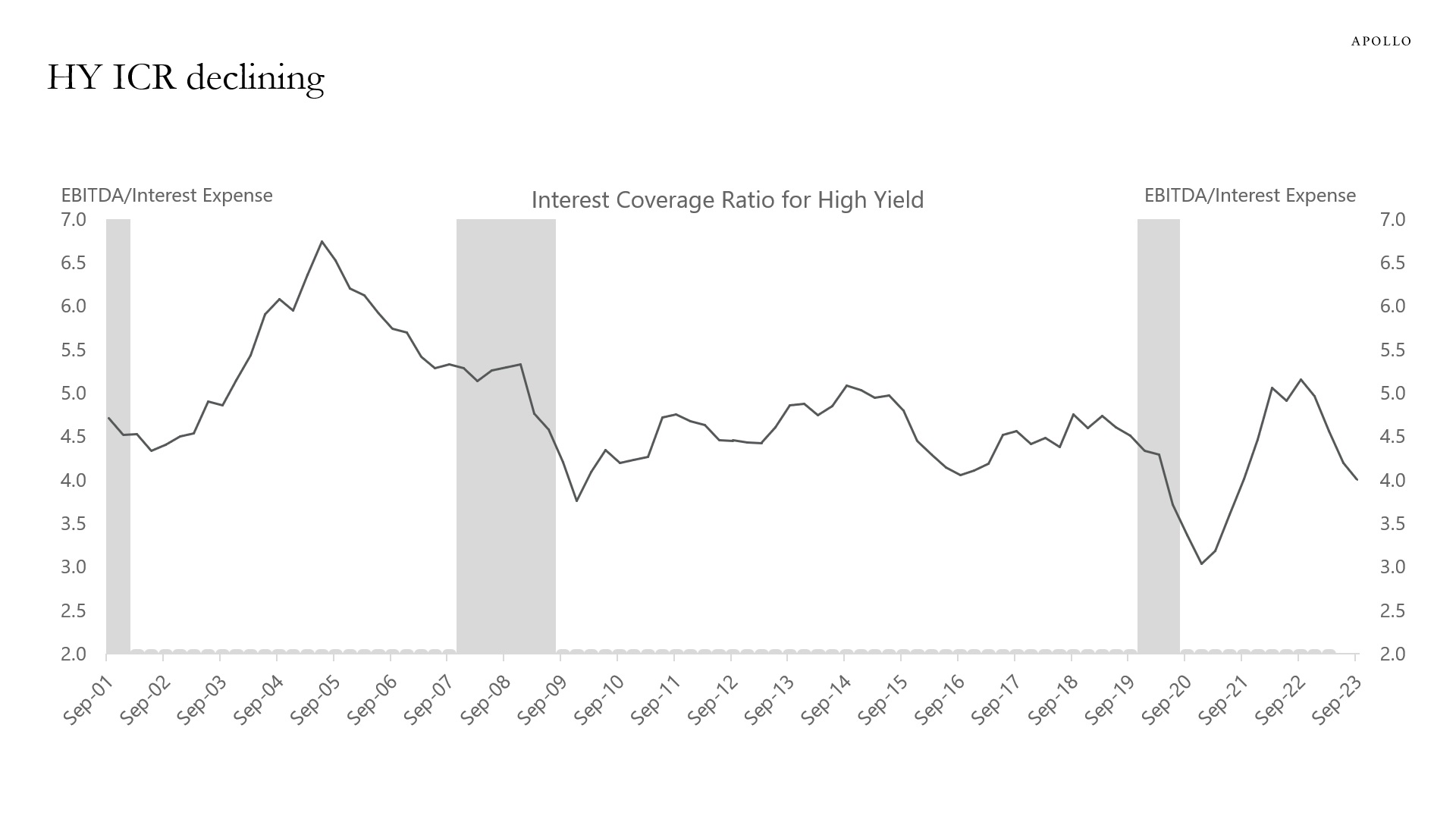

Interest coverage ratios for September show that Fed hikes continue to have a more and more negative impact on the economy.

Specifically, with the Fed funds rate at 5.5%, we are significantly above the Fed’s 2.5% estimate of neutral, and as a result, monetary policy is biting harder and harder, and the incoming data continues to weaken.

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

The quality of the incoming economic data continues to deteriorate, see chart below.

For example, the response rate to the Current Employment Survey, which collects data on nonfarm payrolls, is below 50%, and the response rate to the JOLTS survey, which collects data on job openings, is around 30%.

The implication for markets is more adjustments, more revisions, and ultimately more volatile data.

Source: BLS, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

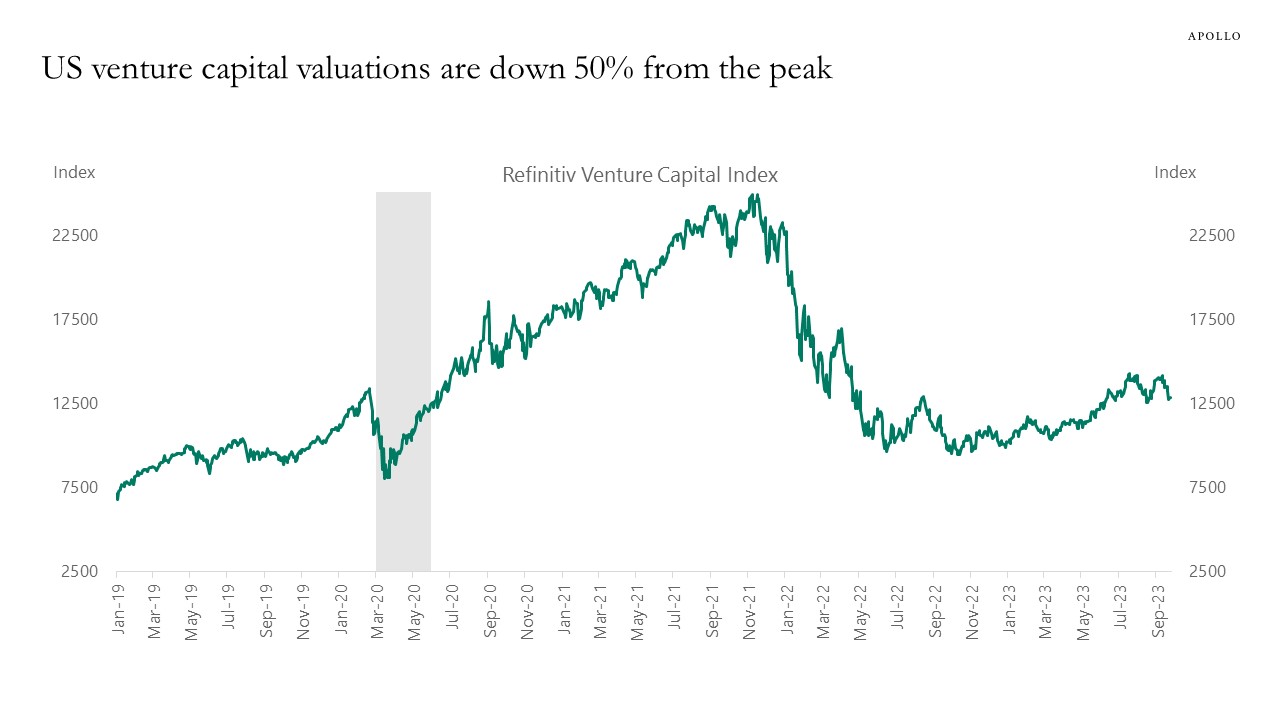

As the costs of capital have normalized, venture capital valuations have declined by 50%, see chart below.

Source: Bloomberg, Apollo Chief Economist. Note: The Refinitiv Venture Capital Index is designed to measure the value of the US-based venture capital private company universe in which venture capital funds invest. See important disclaimers at the bottom of the page.

-

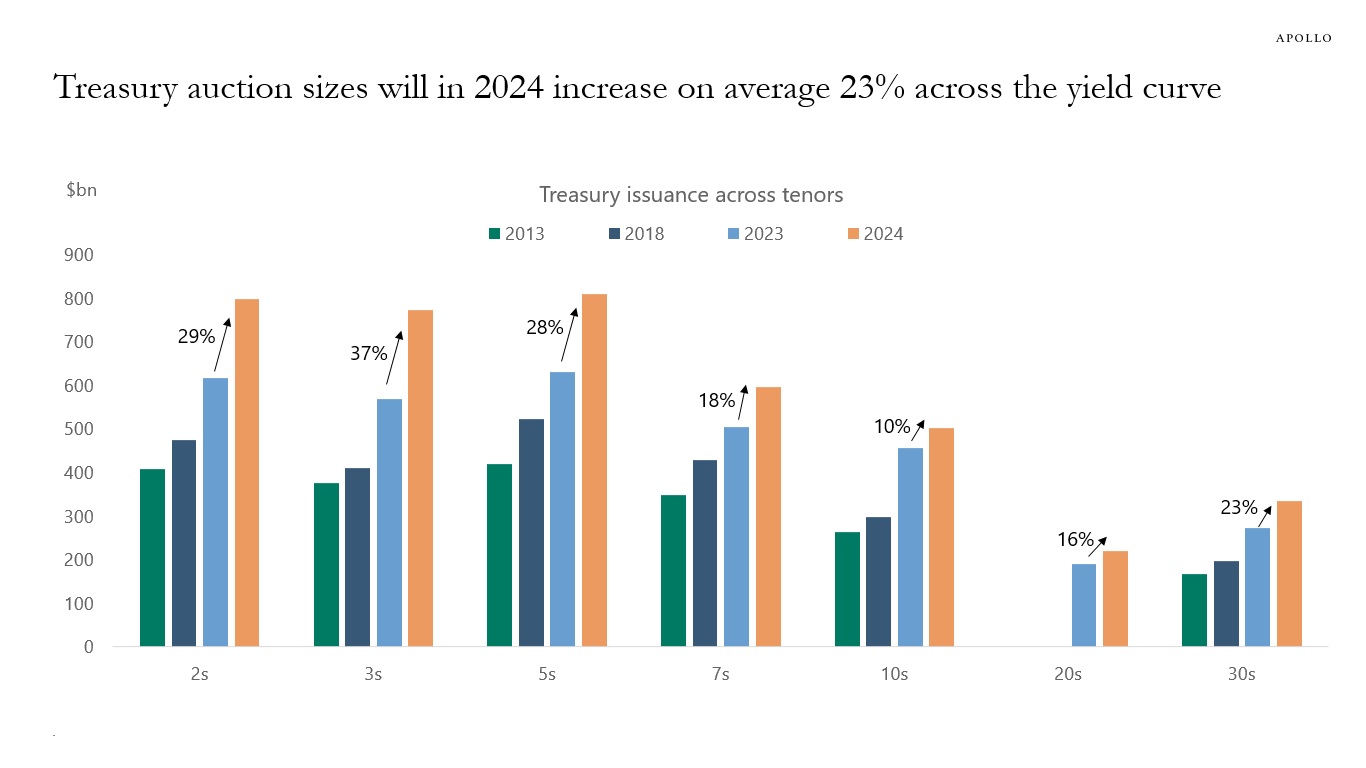

Treasury auction sizes will increase on average 23% in 2024 across the yield curve, see chart below. This forecast comes from the Treasury Borrowing Advisory Committee’s neutral issuance scenario.

The 37% increase in issuance of 3-year notes and the 28% increase in issuance of 5-year notes will in 2024 stress-test demand for Treasuries in the belly of the curve. In particular, if the Fed next year will start cutting rates and wants to soften financial conditions.

This dramatic growth in the supply of the risk-free asset is “pulling dollars away” from other fixed-income assets, including investment grade credit, as investors substitute away from spread products toward Treasuries.

With the ongoing significant increase in the supply of Treasuries, investors in credit markets need to spend some time on signs of demand and supply imbalances in the Treasury market.

The bottom line is that the world only saves a limited amount of dollars every year, and the significant growth in the size of the Treasury market is at risk in 2024 of crowding out demand for other types of fixed income.

Source: SIFMA, TBAC, Haver Analytics, Apollo Chief Economist. Note: Estimates from September 2023 to December 2024 from the TBAC neutral issuance scenario. See important disclaimers at the bottom of the page.

-

The Fed is in the process of cooling the economy down. The whole idea with raising interest rates is for us to buy fewer cars, spend less on our credit cards, and to build fewer factories.

The Fed’s ultimate goal is to get inflation back to their 2% inflation target. But with core PCE inflation currently at 3.9%, we are not there yet.

The desired slowing of the economy could come this Friday when we get the employment report for September.

The consensus expects 165,000 jobs in September, which is down from 400,000 jobs a year ago and 600,000 when the Fed started raising rates in March 2022.

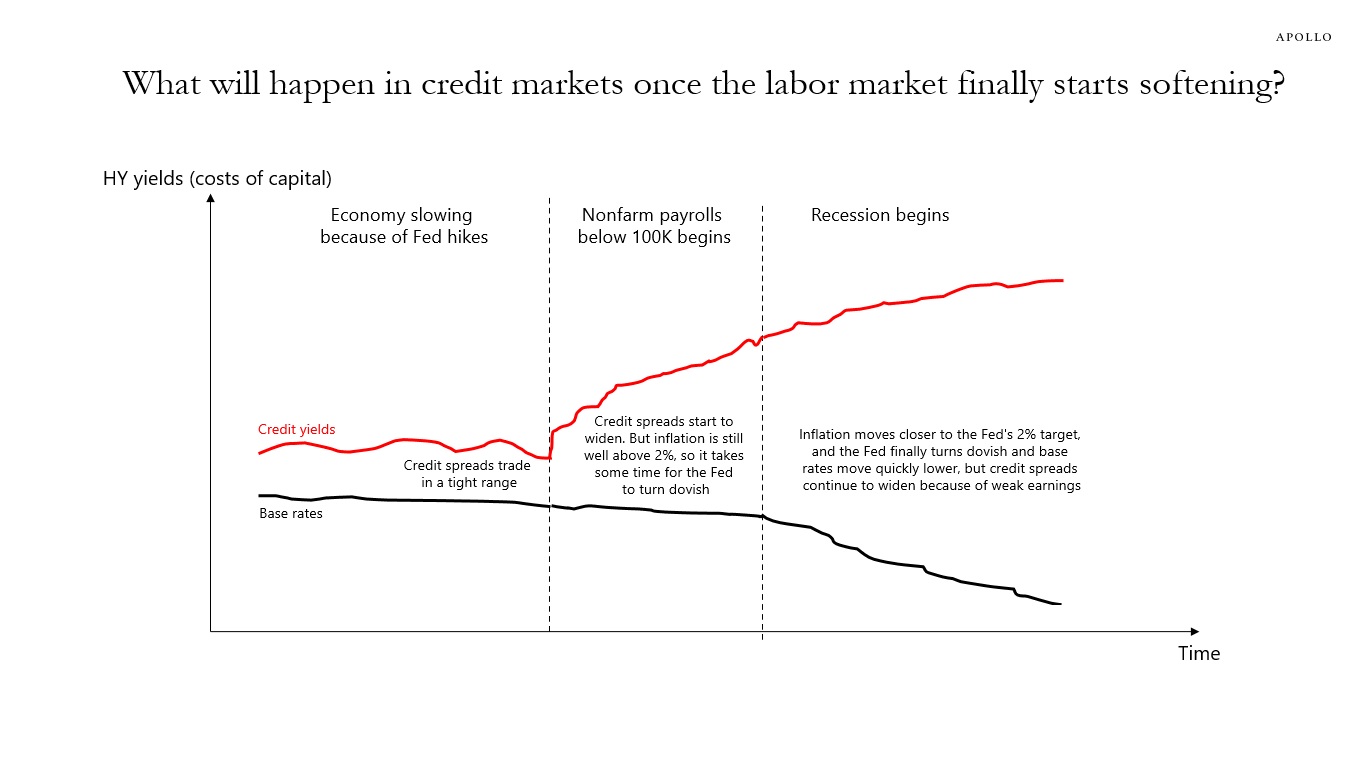

What will happen in credit markets over the coming months once nonfarm payrolls finally move below the level consistent with population growth, namely, 100,000 jobs created each month?

Once nonfarm payrolls start moving below 100,000, credit spreads will widen because investors will take it as a sign that corporate earnings are about to slow down, see illustration below.

But with core PCE inflation at 3.9%, the Fed cannot turn dovish because it will look like the Fed no longer cares about inflation, which raises the risk of inflation expectations becoming unanchored. As a result, the Fed will continue to be hawkish even as the unemployment rate starts moving higher.

Once the recession finally begins, the Fed can turn dovish and start to lower base rates. But the costs of capital will not decline because at that time corporate earnings will be slowing, and therefore, credit spreads will likely be widening further.

The bottom line is that even if we get weak data and the Fed, after a few soft prints in nonfarm payrolls, starts turning dovish, the costs of capital will move higher. In short, the Fed controls the base rate but doesn’t control credit spreads, and that is the reason why a soft landing is unlikely.

Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

-

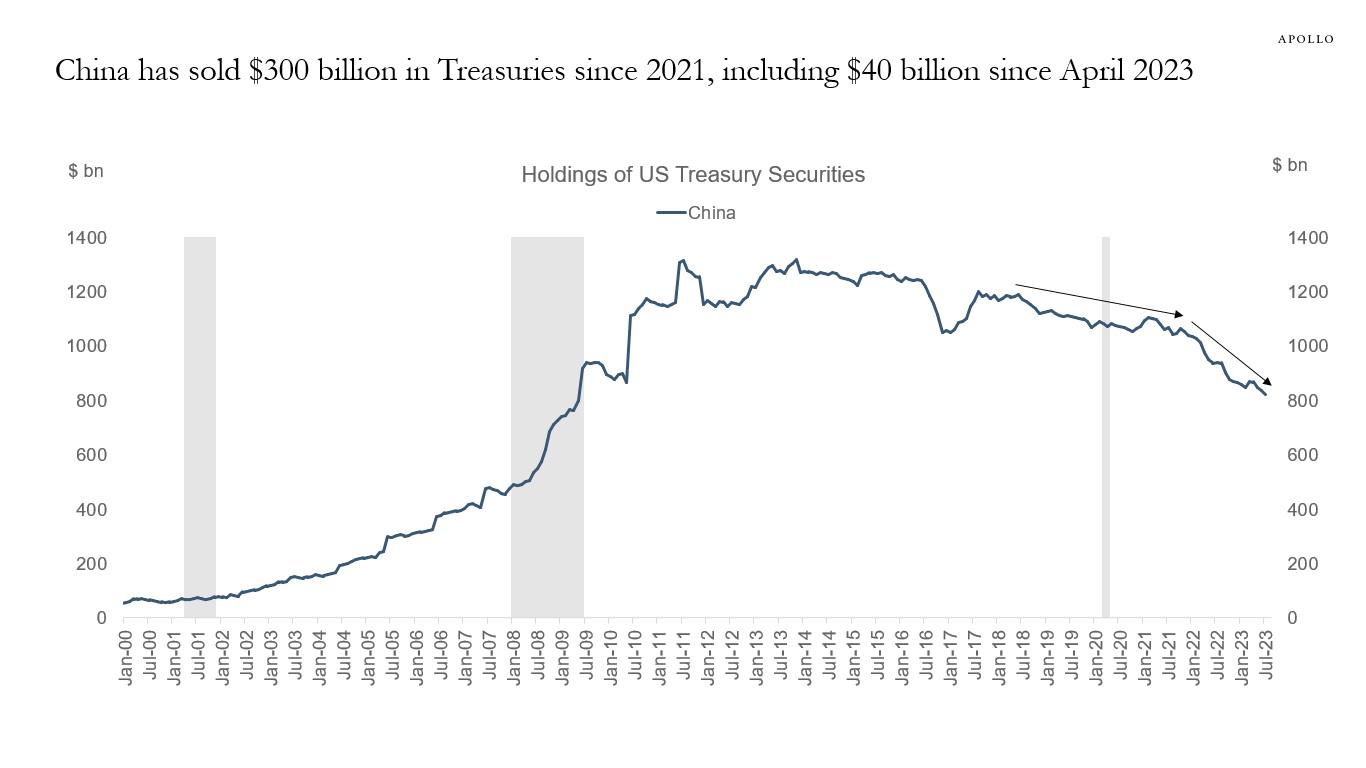

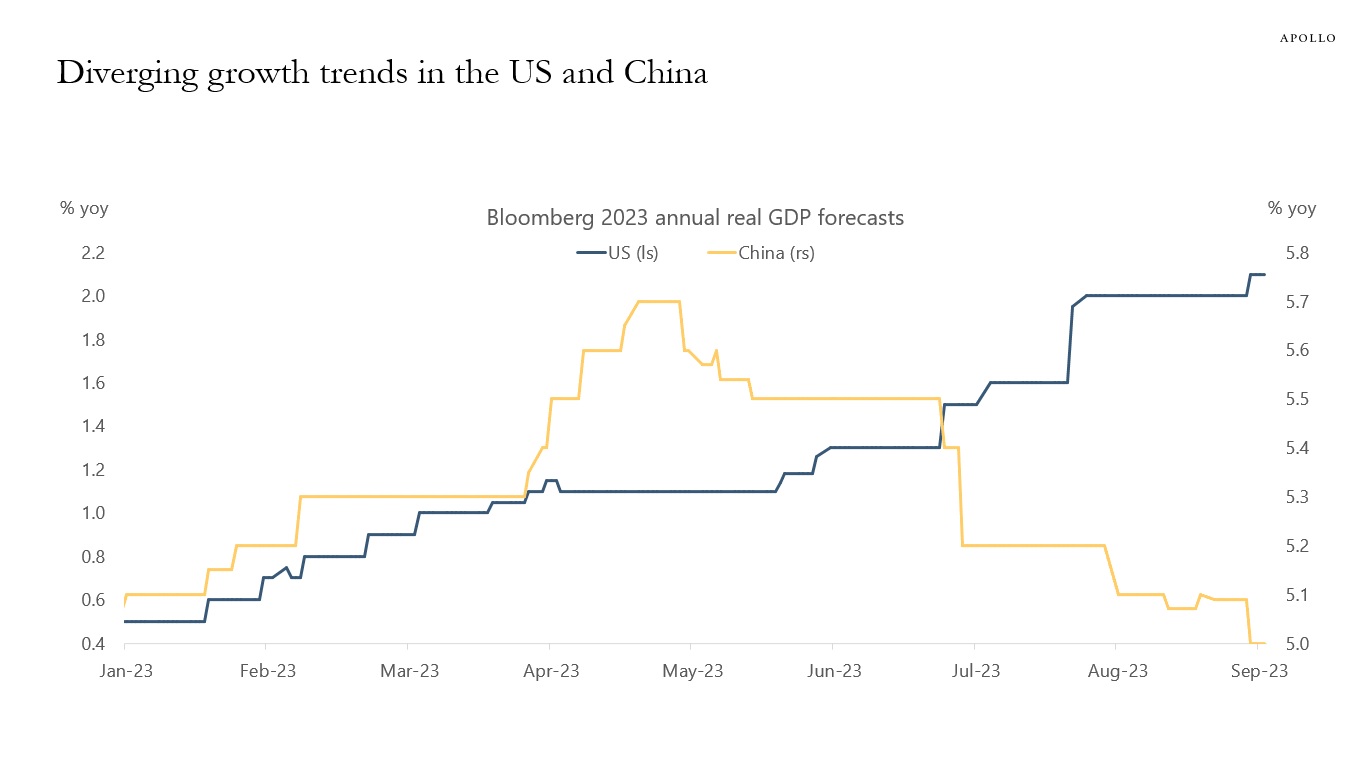

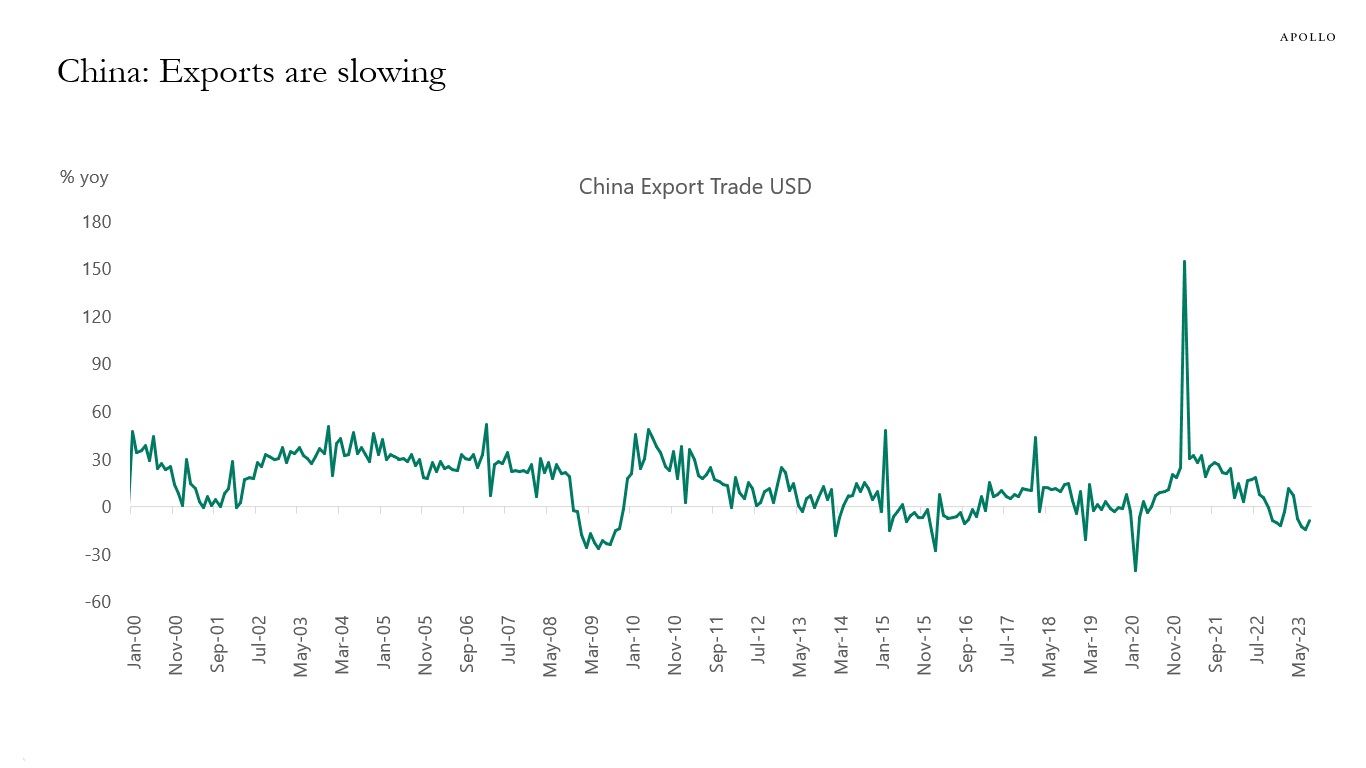

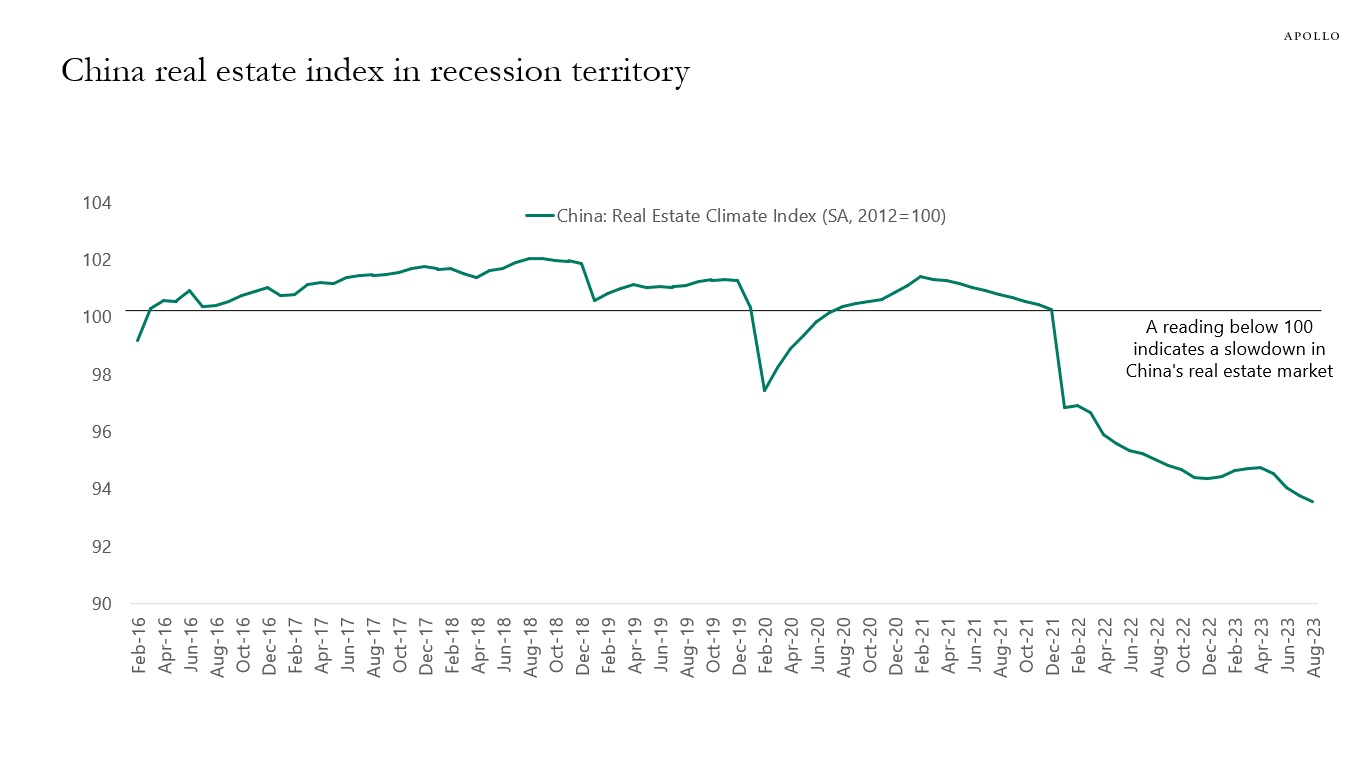

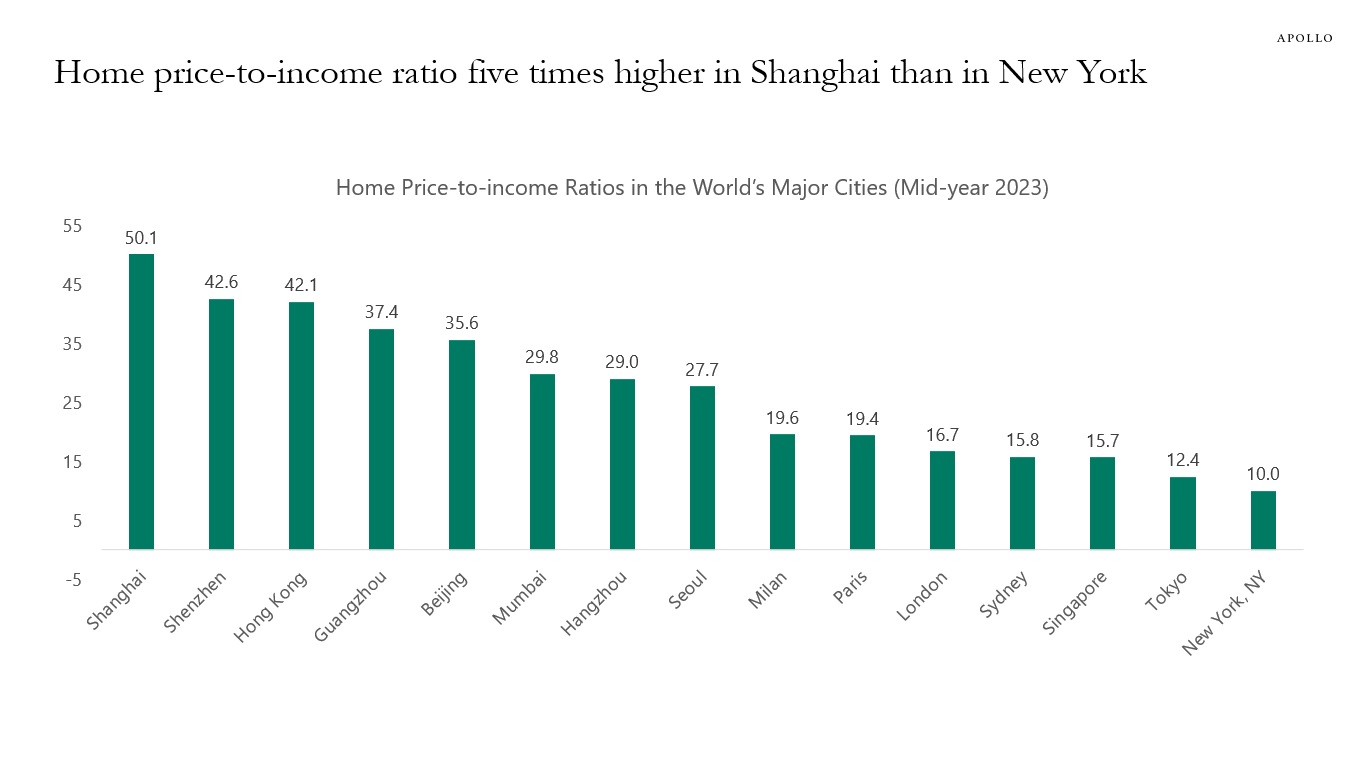

Maybe China is behind the rise in US long rates. Growth in China is slowing for cyclical and structural reasons, and Chinese exports to the US are lower. As a result, China has fewer dollars to recycle into Treasuries. In fact, China has been selling $300 billion in Treasuries since 2021, and the pace of Chinese selling has been faster in recent months, see charts below and the presentation available here.

If slowing growth in China is a source of higher US rates—together with the US sovereign downgrade, Fed QT, Japan YCC exit, and rising US Treasury issuance—then a bad US employment report on Friday may not result in dramatically lower rates.

The bottom line is that the cost of capital will likely stay permanently higher for reasons that have little to do with the business cycle, and it was the period with essentially zero interest rates from 2008 to 2020 that was unusual.

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: NBS, Haver, Apollo Chief Economist. Note: A reading above 100 indicates economic growth and a reading below 100 indicates a slowdown in China’s real estate market.

Source: Numbeo, Apollo Chief Economist. Note: Price to Income Ratio is the basic measure for apartment purchase affordability. It is generally calculated as the ratio of median apartment prices to median family disposable income, expressed as years of income.

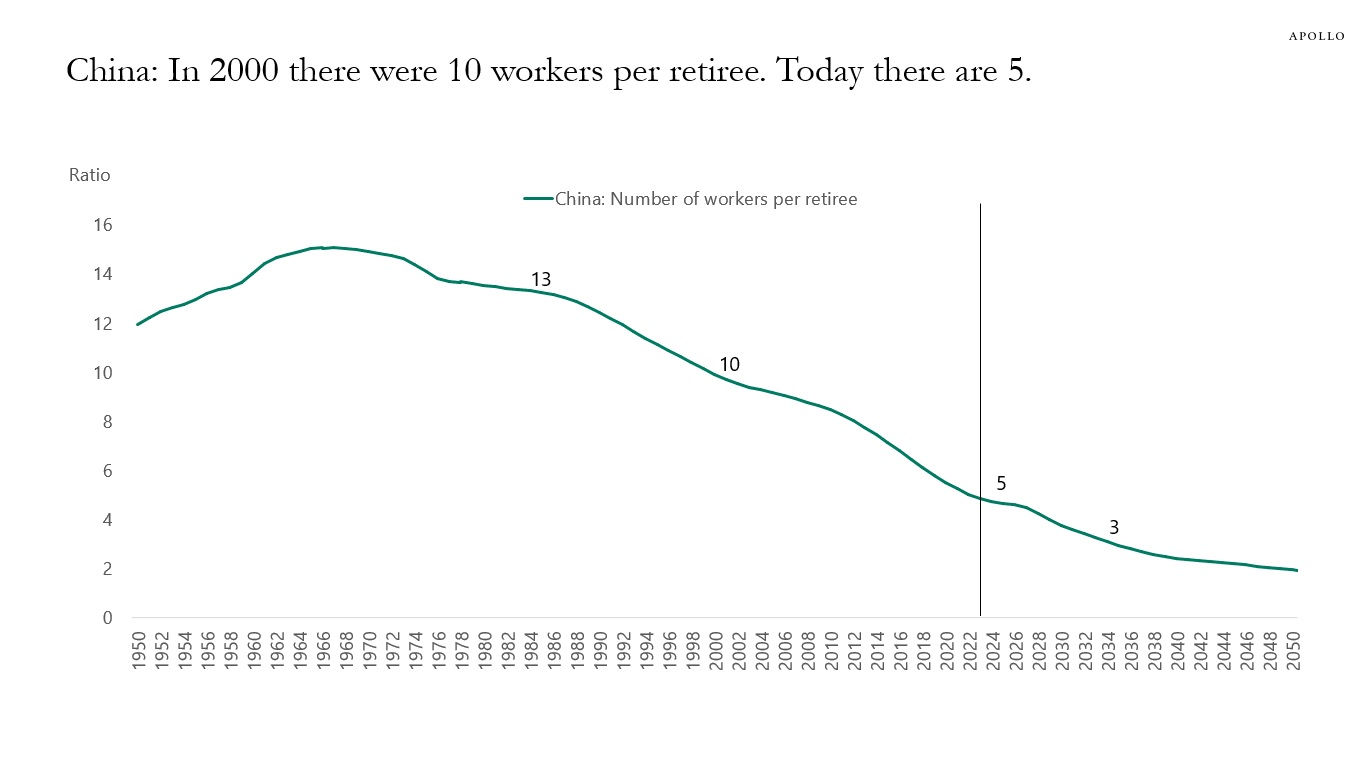

Source: UN, Haver, Apollo Chief Economist

See important disclaimers at the bottom of the page.

-

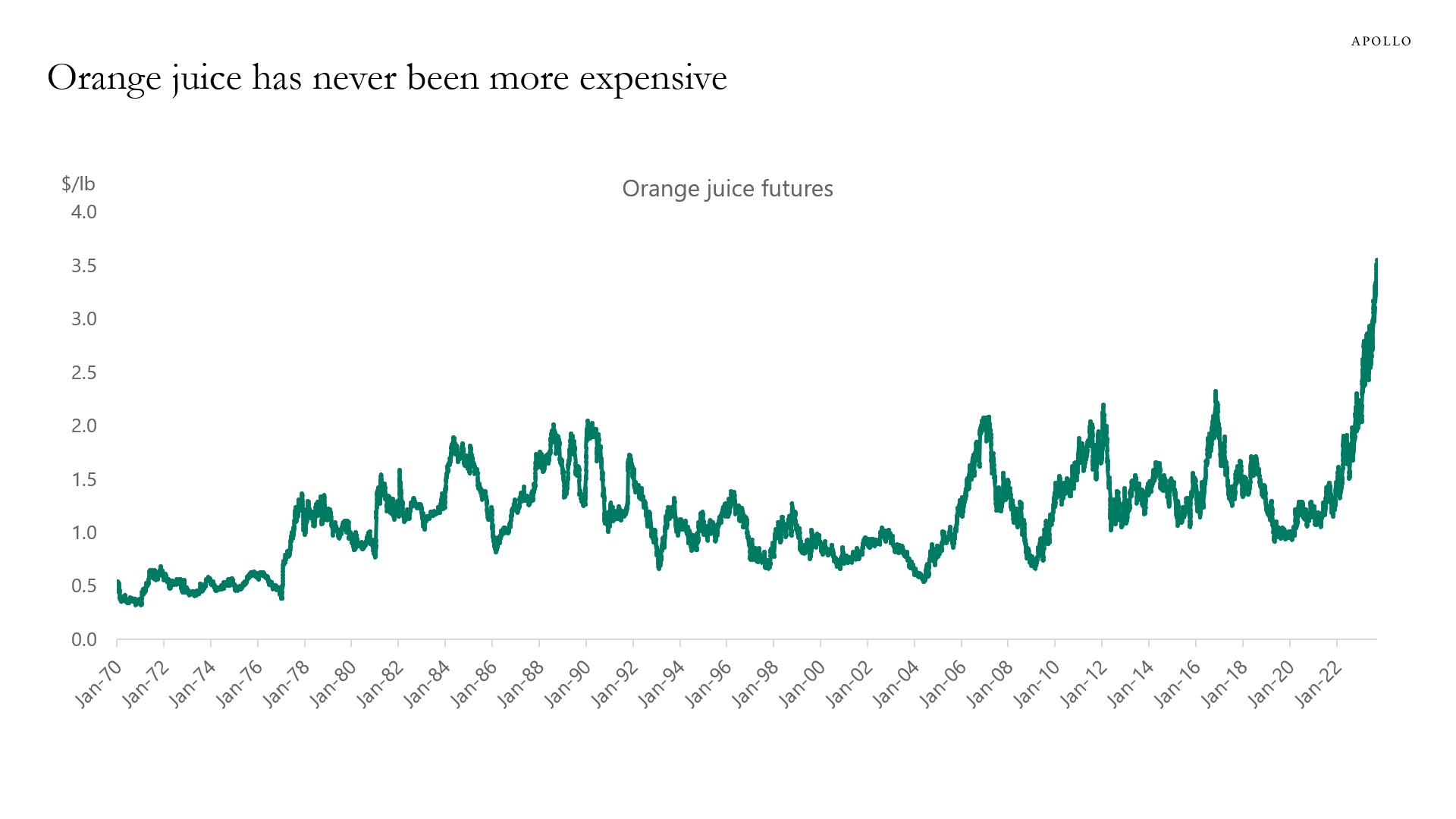

Bad weather has pushed the price of orange juice to the highest level ever, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

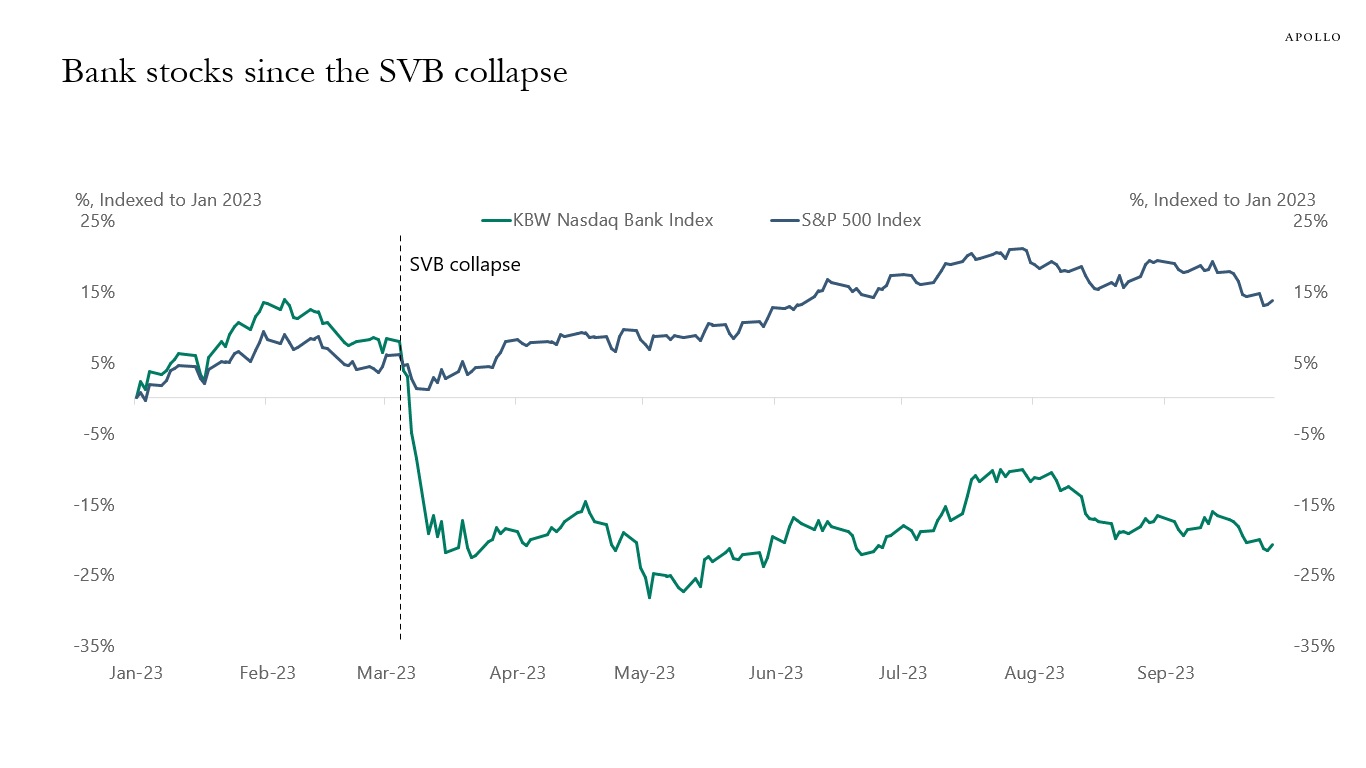

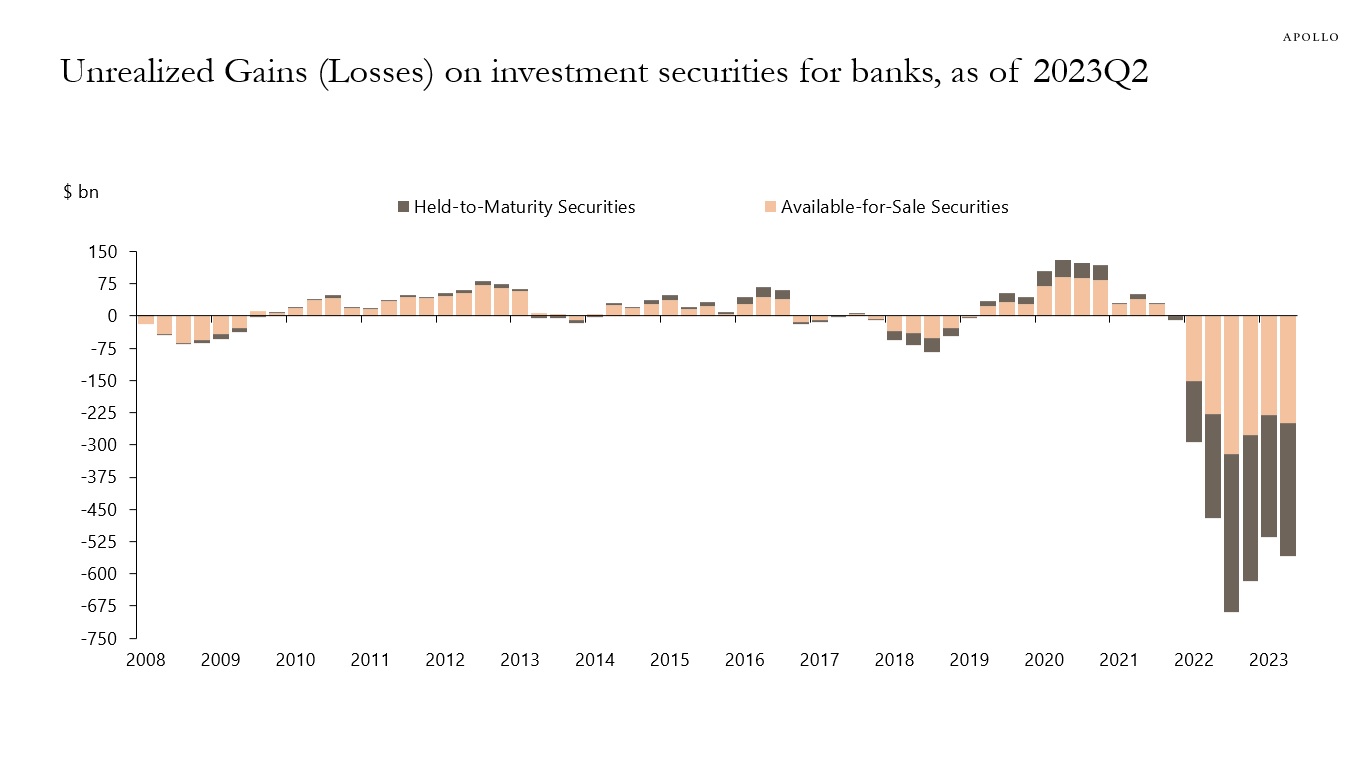

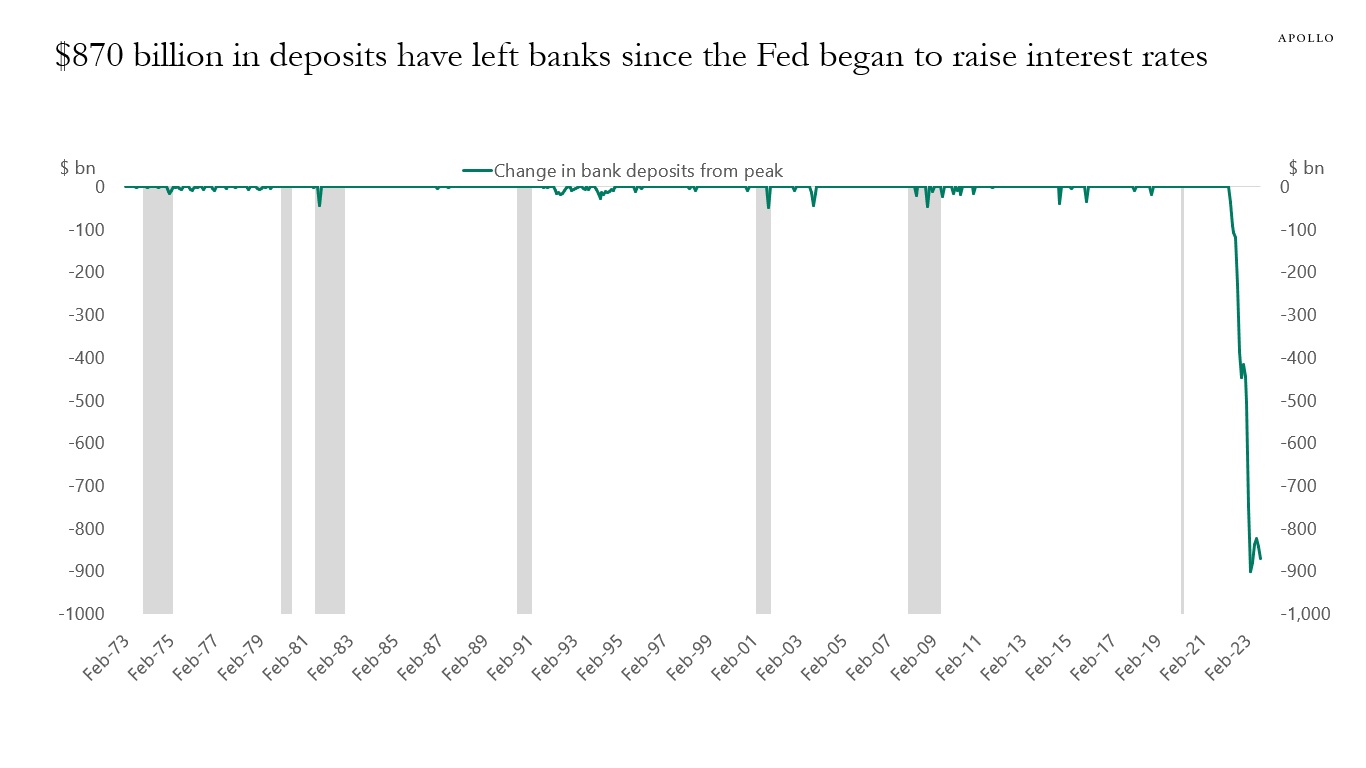

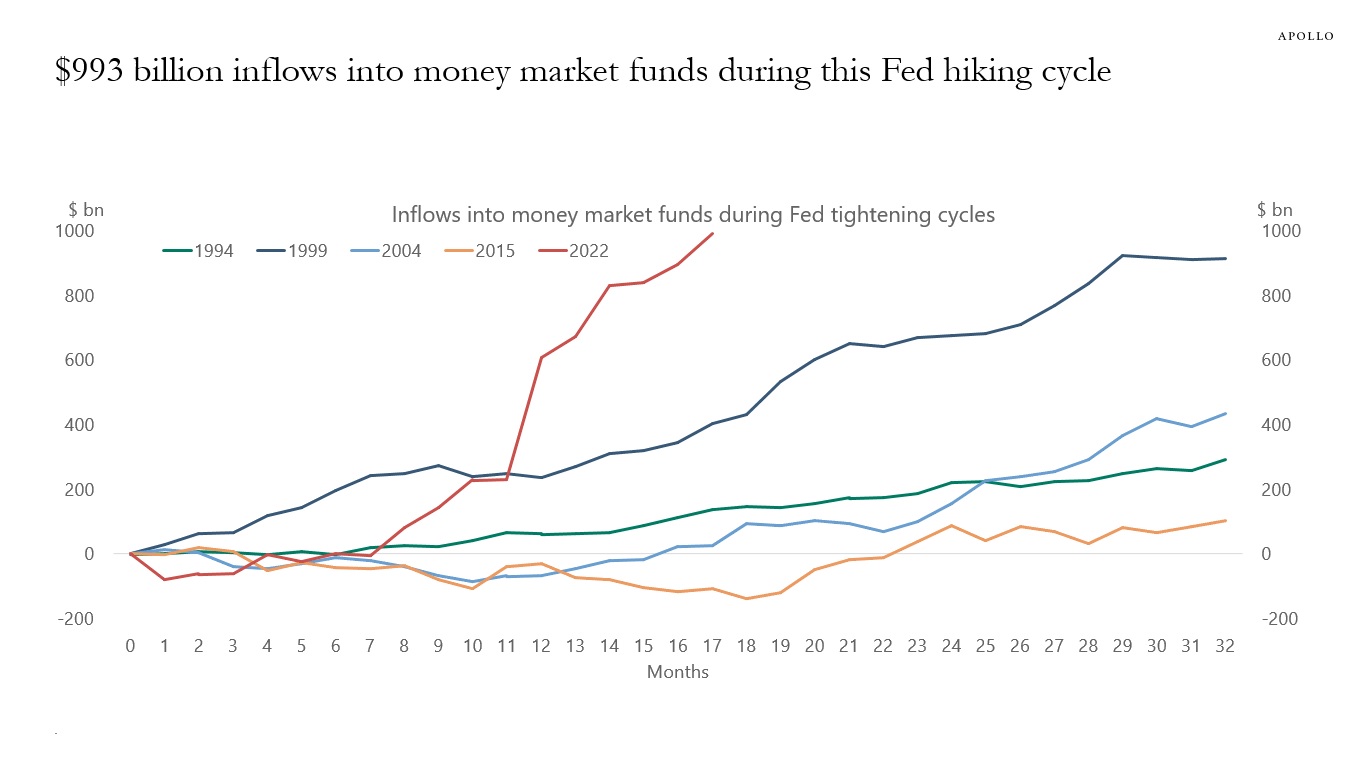

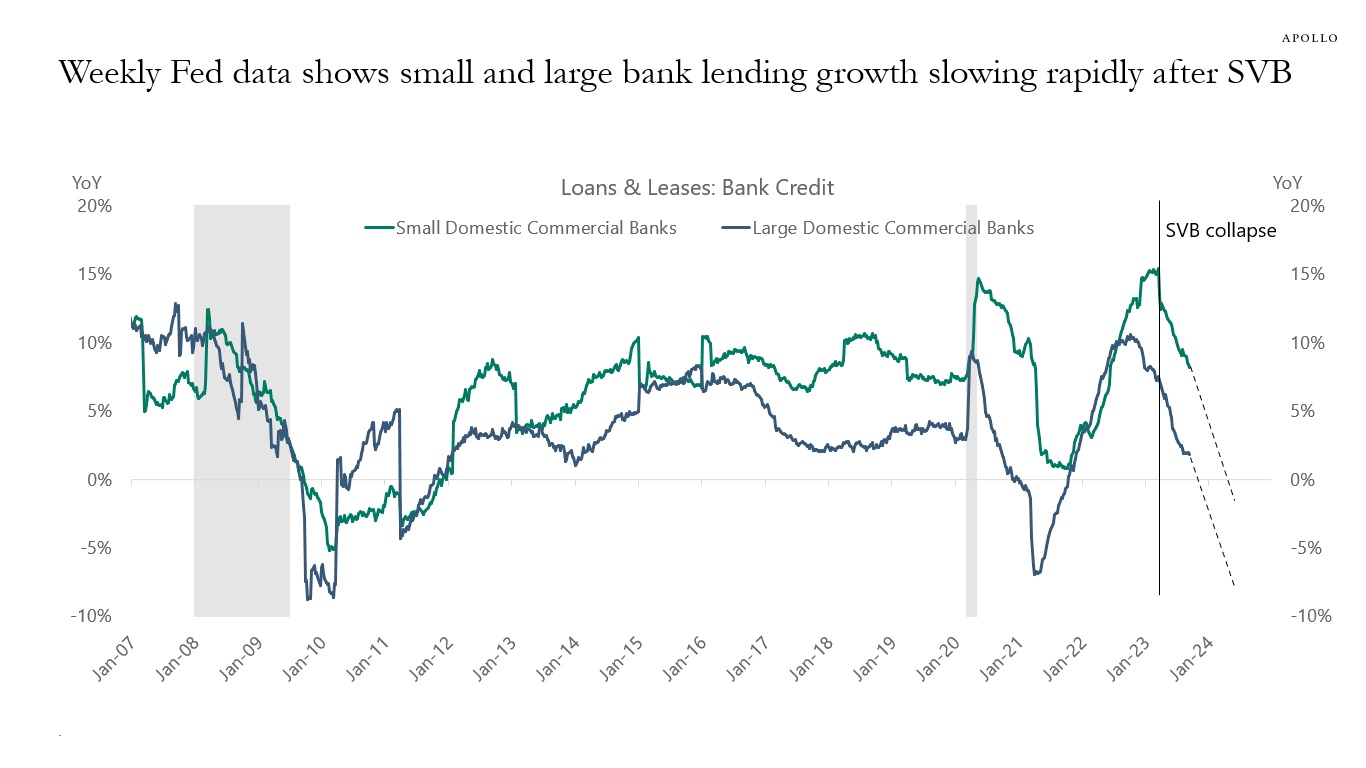

Our updated banking sector chart book is available here.

Source: Bloomberg, Apollo Chief Economist

Source: FDIC, Apollo Chief Economist

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist. Note: March data as of May 10, 2023. Peak is defined as the month before monthly outflows turn negative.

Source: FRB, ICI, Bloomberg, Apollo Chief Economist

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.