Want it delivered daily to your inbox?

-

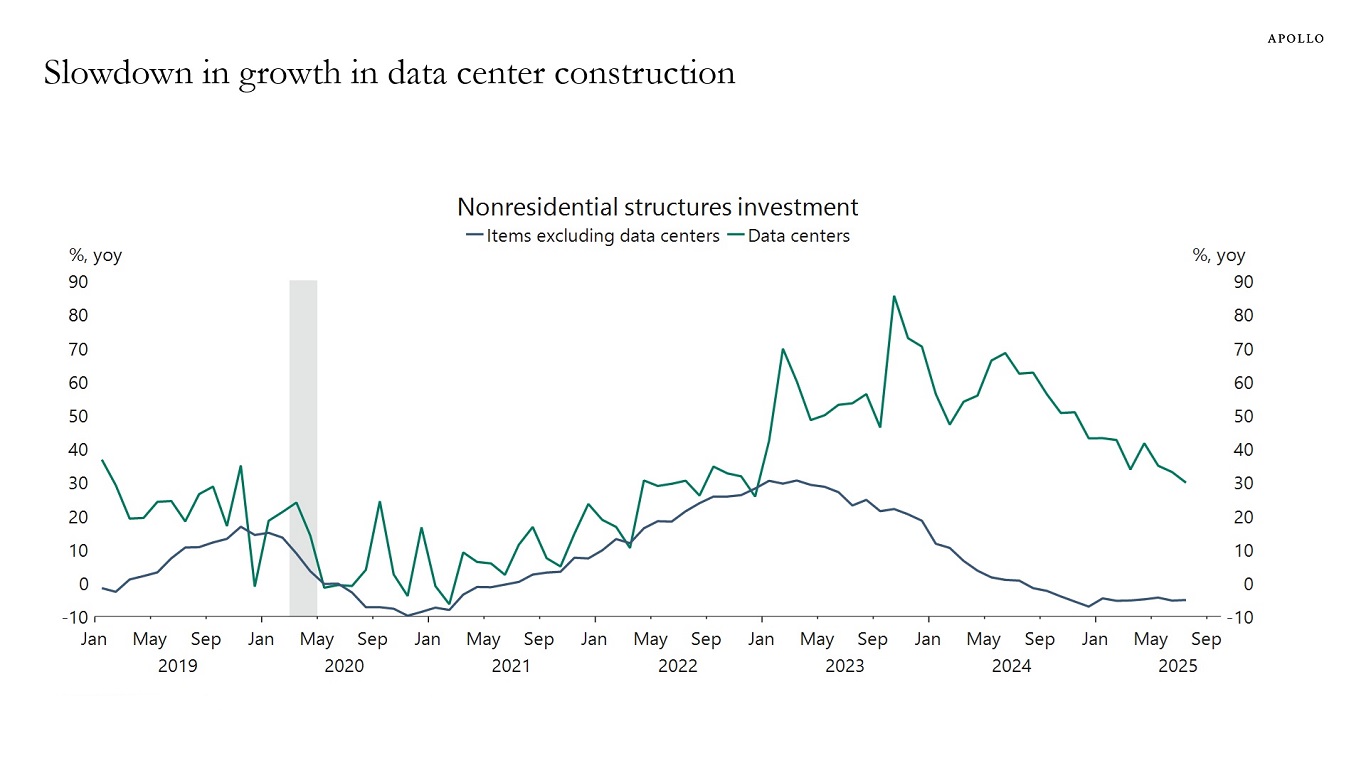

There is still strong growth in data center construction, but the current growth rate at 30% is lower than the 80% observed two years ago, see chart below.

Sources: US Census Bureau, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

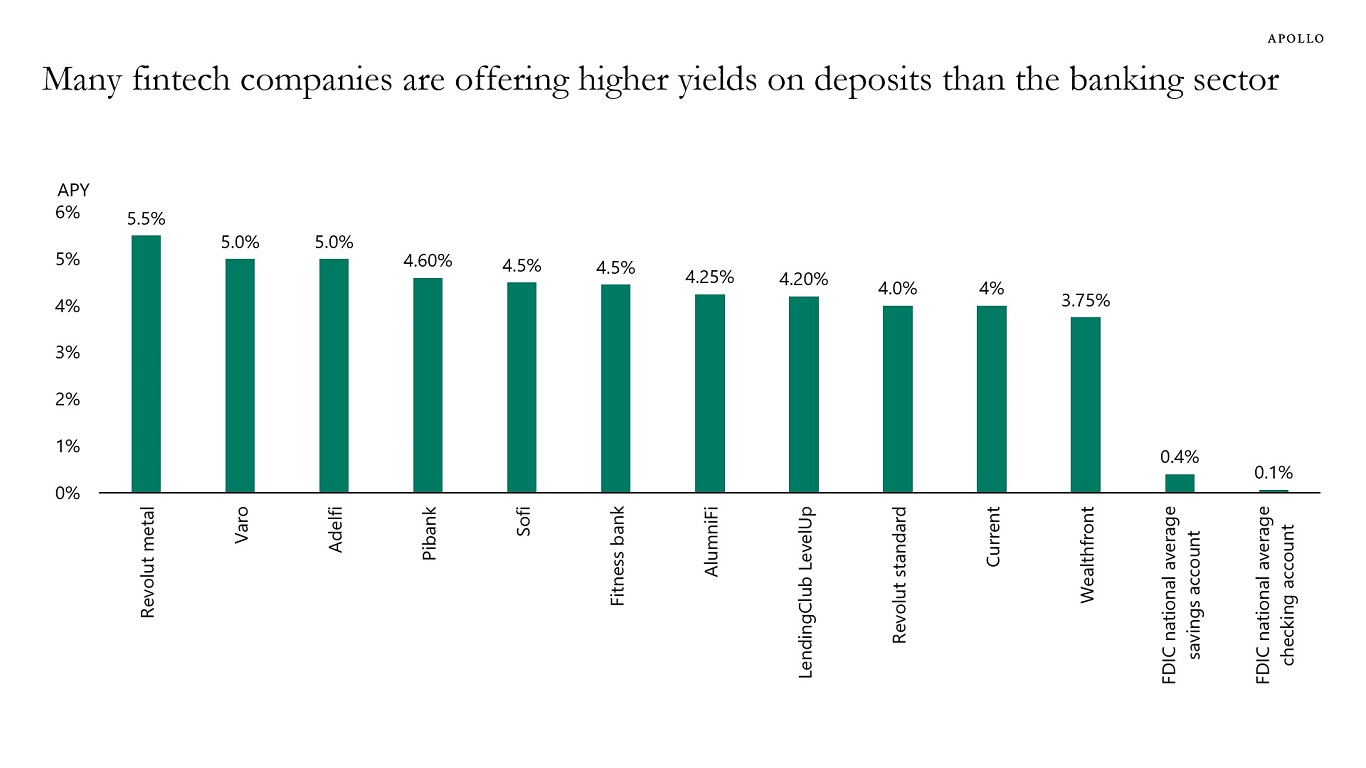

Yield levels on deposits in many fintech companies are dramatically higher than yield levels on deposits in the banking sector, see chart below. It is a fundamental imprudence in banking to finance long-horizon assets with short-term liabilities.

Sources: Revolut, Varo Bank, Adelfi, Pibank, Sofi, FitnessBank, AlumniFi, LendingClub, Current, Wealthfront, FDIC, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

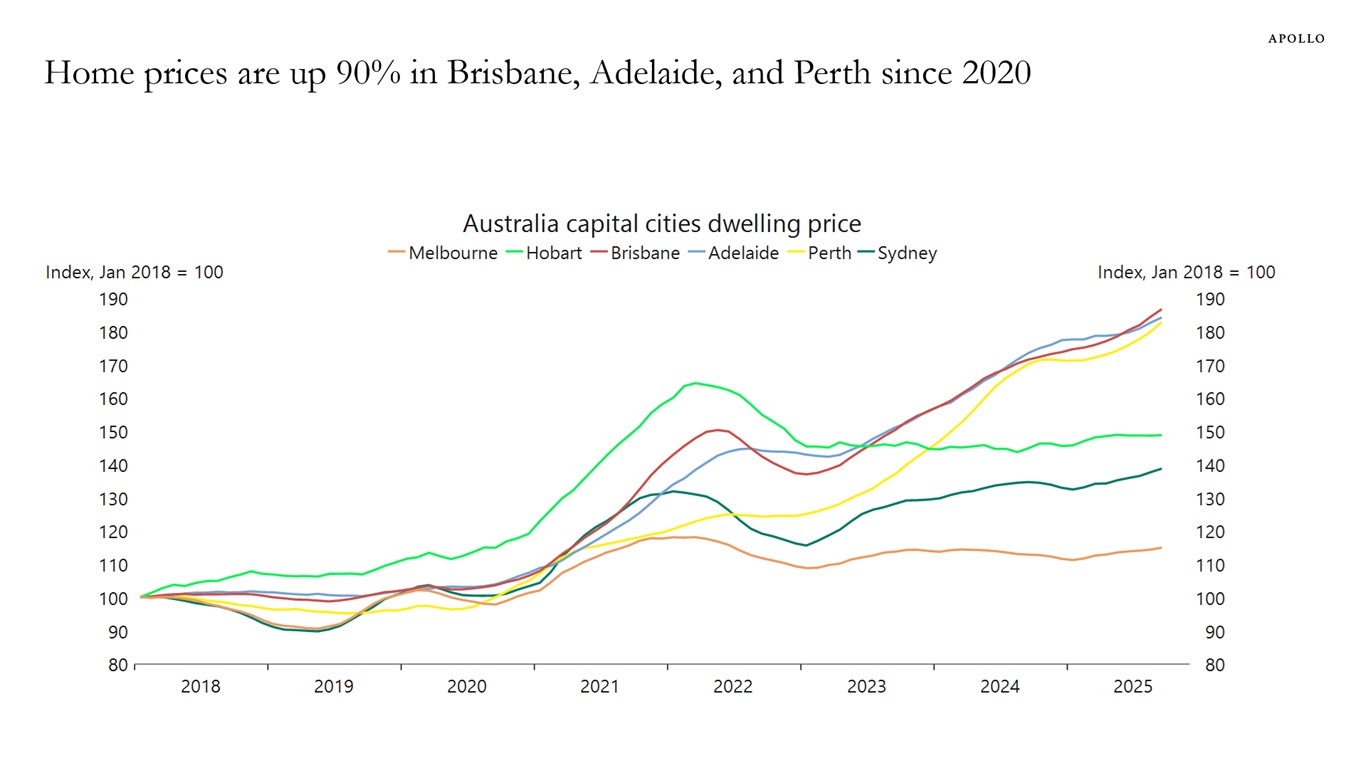

House prices in Brisbane, Adelaide and Perth are up roughly 90% since 2020, see chart below. Home prices in Sydney are up “only” 40% over the same period.

Sources: Cotality Australia, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

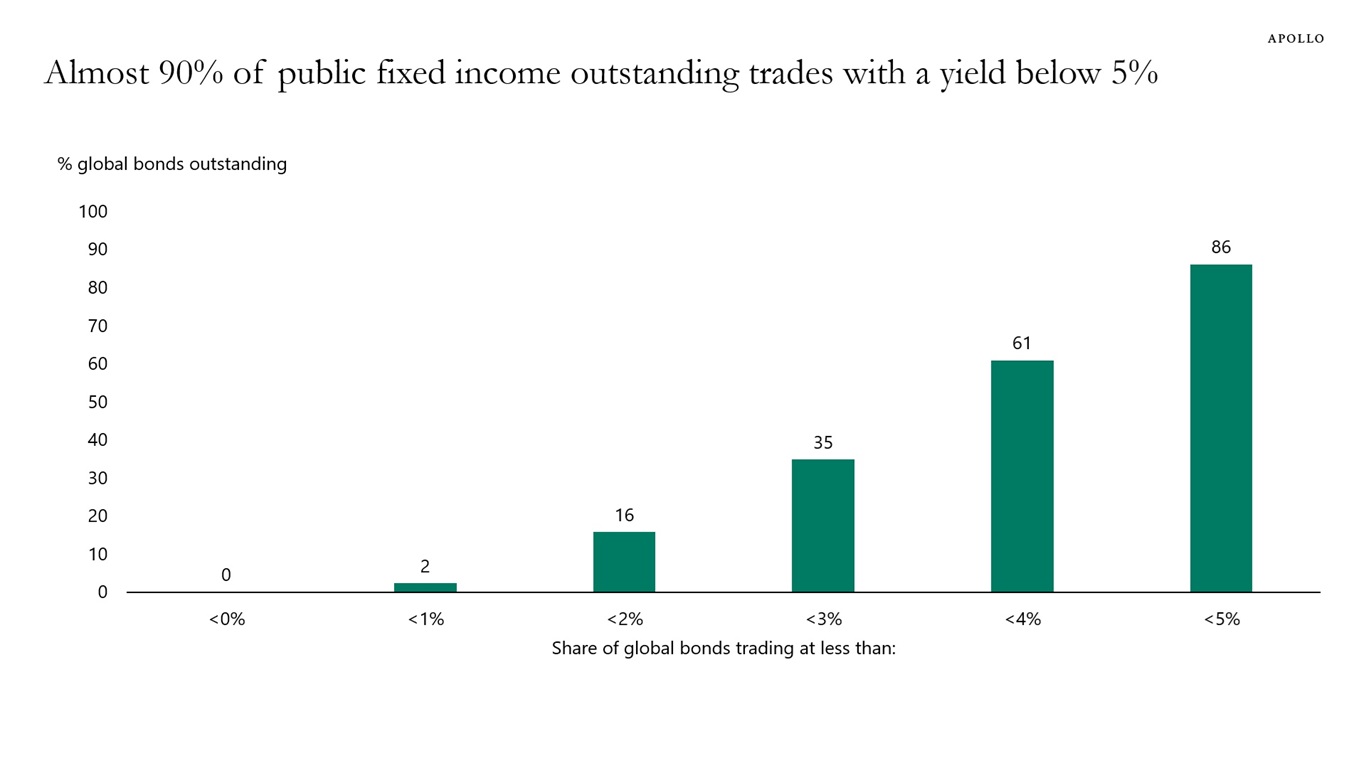

Almost 90% of all public fixed income outstanding in the world trades at a yield below 5%, see chart below.

With inflation at 3%, the real return for investors in public fixed income is a meager 2% or less.

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

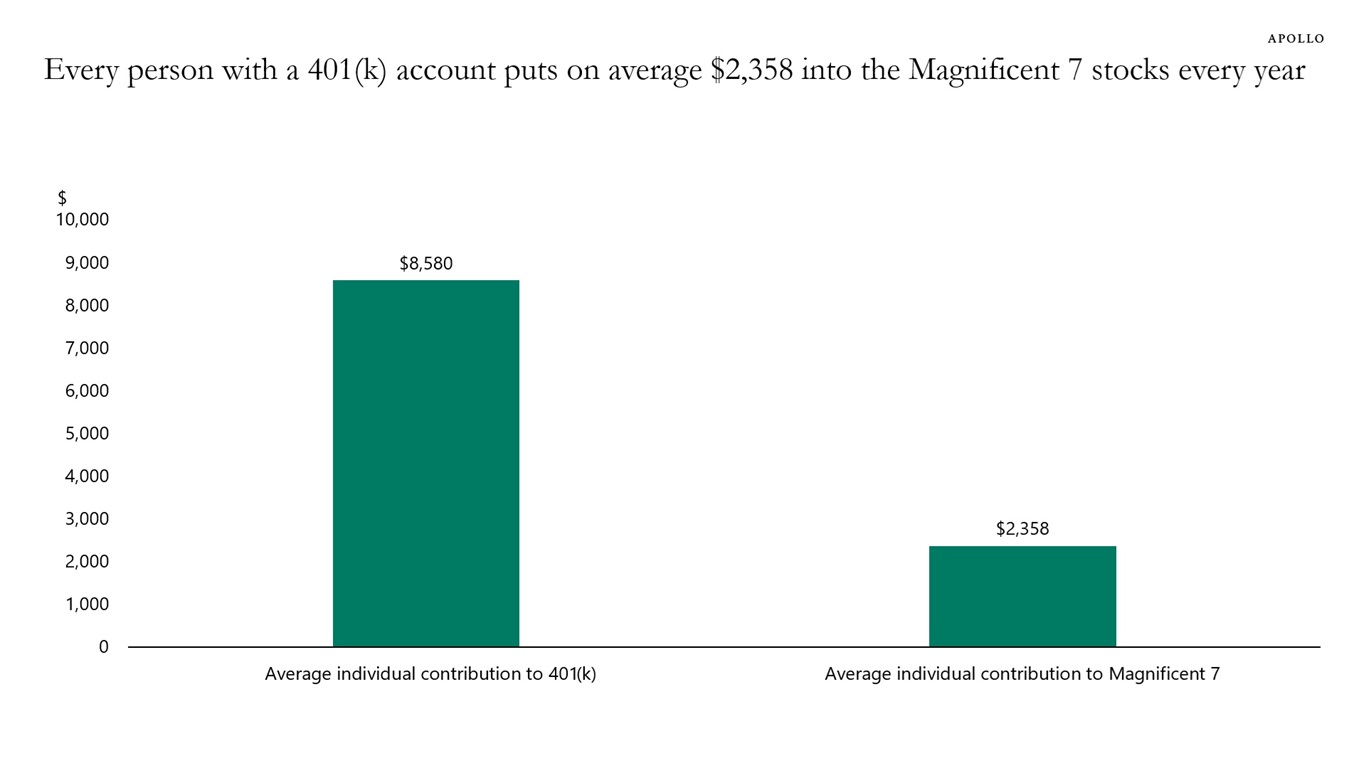

US workers contribute on average around $8,500 to their 401(k) accounts every year, and with 71% of 401(k) assets allocated to equities—and the Magnificent Seven having a weight of almost 40% in the S&P 500—the bottom line is that each worker in the US puts an estimated $2,300 into the Magnificent Seven stocks every year, see chart below.

This is passive money going into the Magnificent Seven regardless of whether their outlook is good or bad.

Note: Average salary is $60,000 and combined average contribution rate is 14.3% and 71% of 401(k) assets are allocated to equities. Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

-

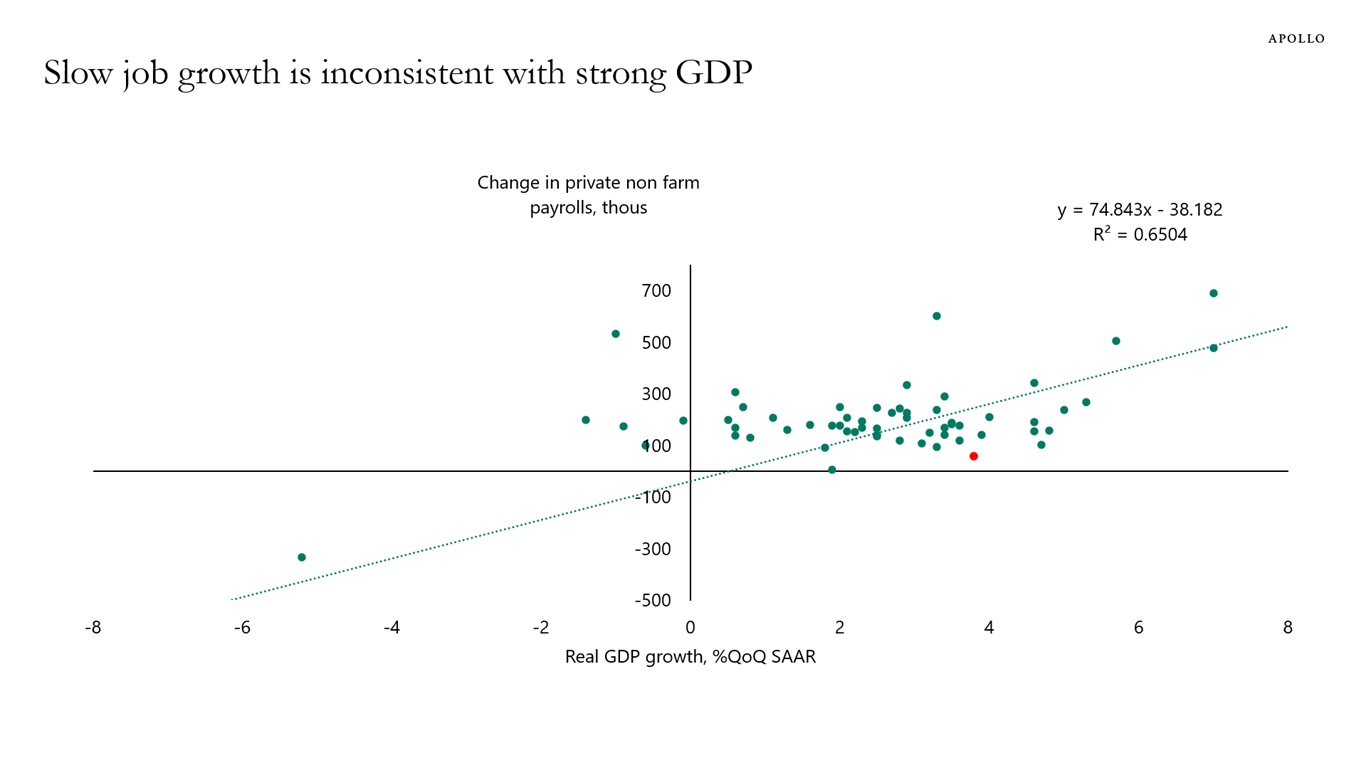

There are three reasons why job growth is slow: 1) Lower immigration, 2) AI implementation and 3) fewer government jobs.

Specifically:

The first chart below shows that at the current level of GDP growth, nonfarm payrolls should be 263k every month.

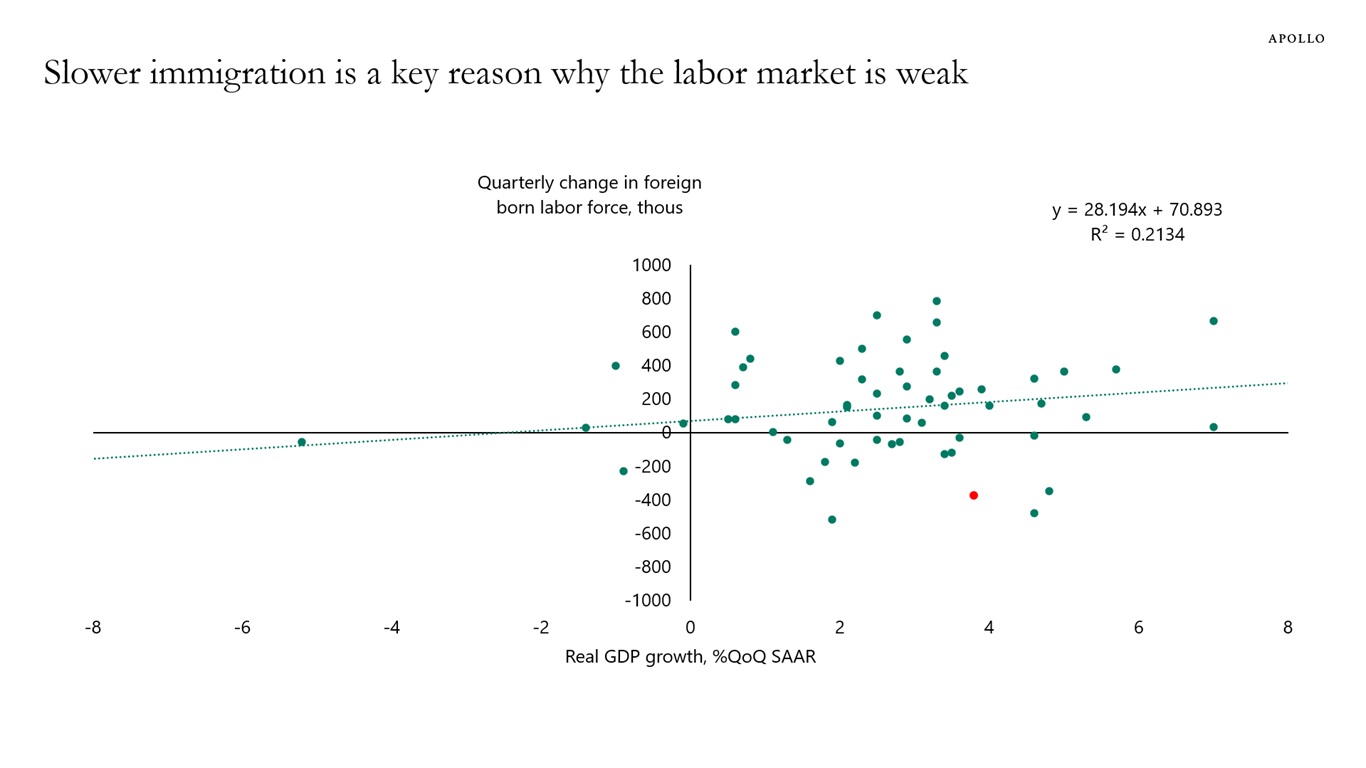

The second chart indicates that a key reason for the slow job growth is that the growth rate in the foreign-born labor force has been significantly weaker than normal. Fewer people looking for jobs means fewer people get hired.

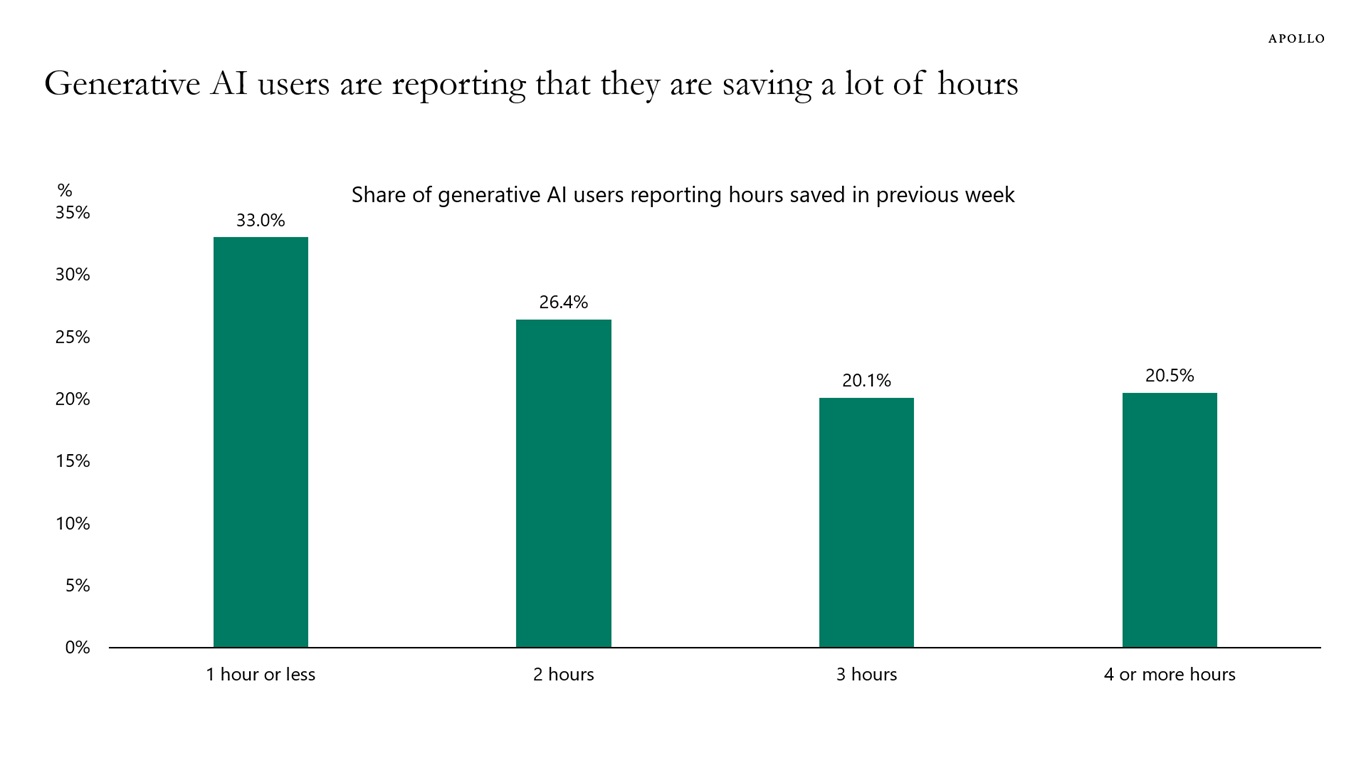

The third chart indicates that AI implementation is likely improving productivity.

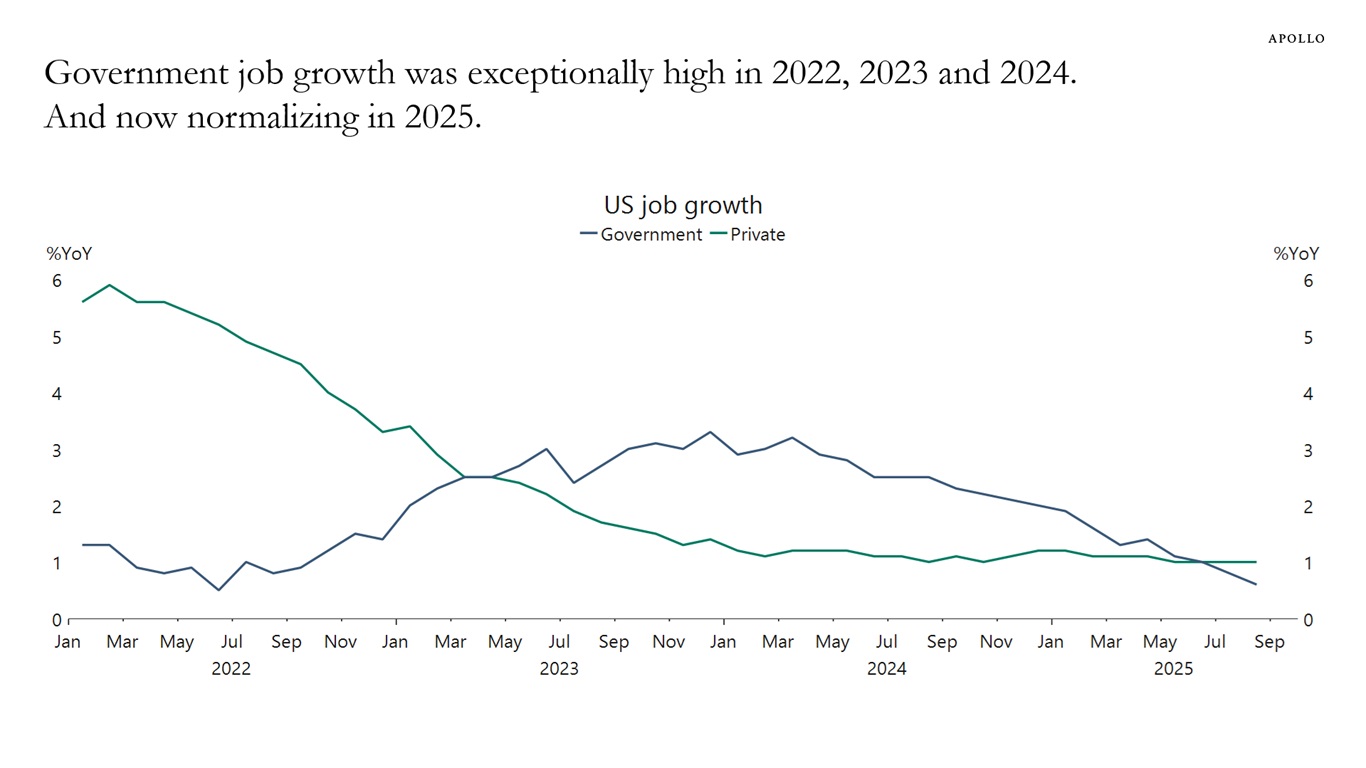

The fourth chart shows that government job growth was artificially high in 2022, 2023 and 2024. Combined with DOGE, government job growth is now returning to more normal levels.

The bottom line is that the weak labor market is not due to weaker labor demand, but rather to weaker labor supply because of immigration, AI implementation and a normalization of job growth in the public sector.

In short, slow job growth is not the result of a slowing economy. Because if it were, then GDP, consumer spending and capex spending would also be slowing.

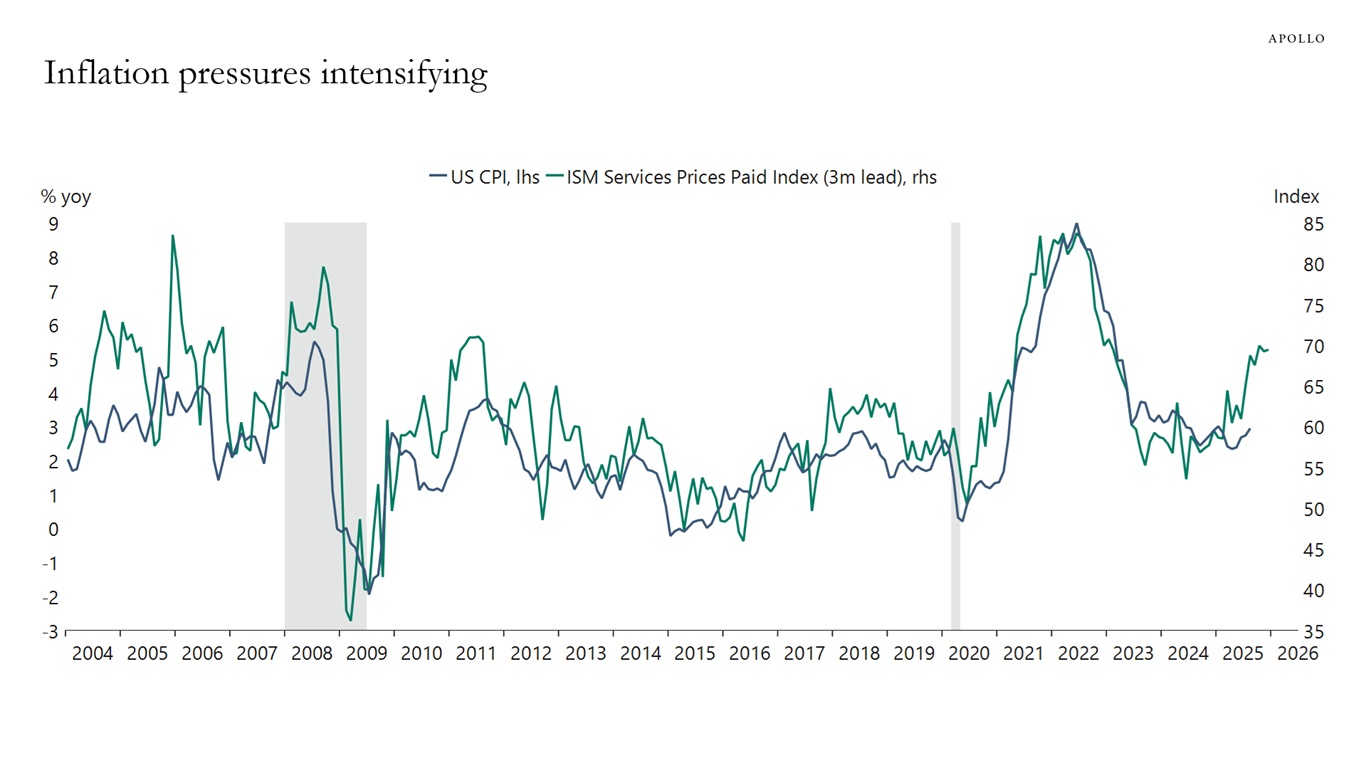

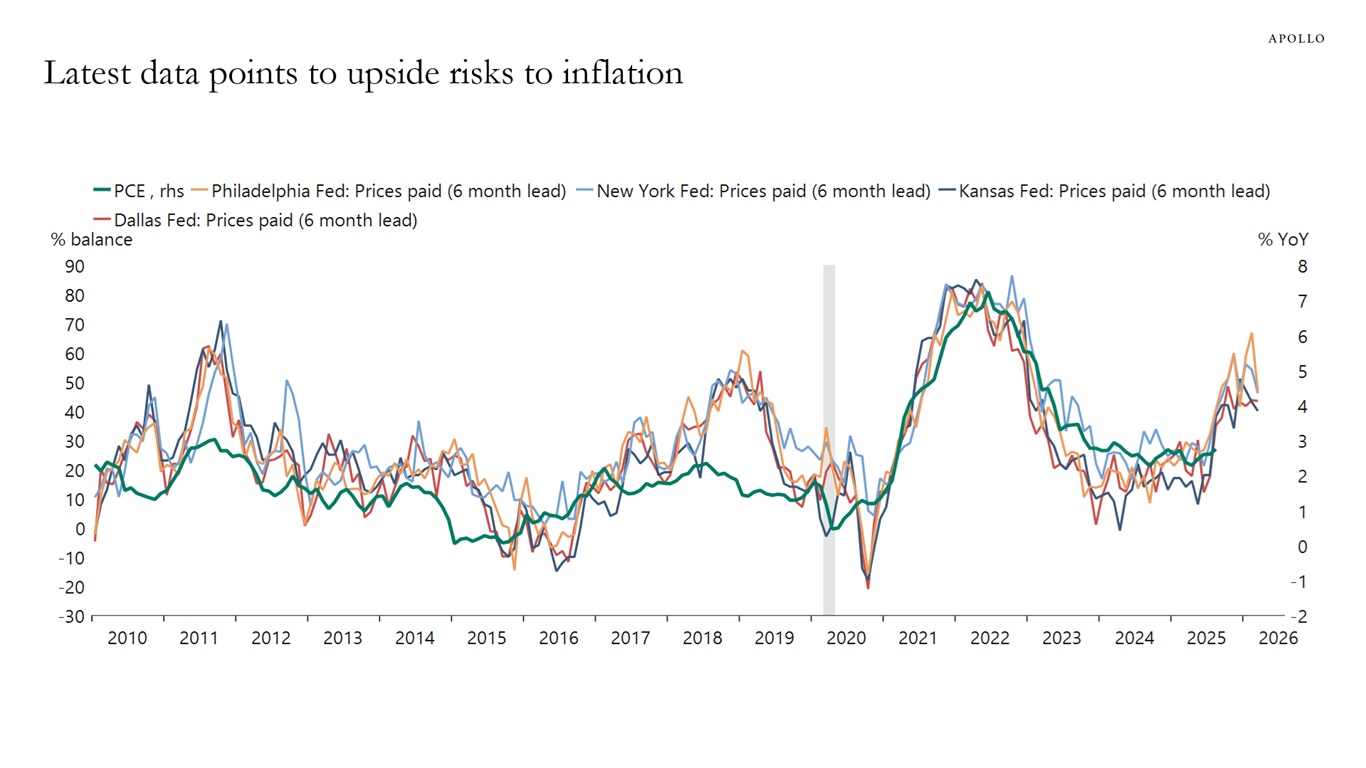

The conclusion is that the Fed should focus less on the slowdown in job growth and more on the ongoing uptrend in inflation, see the fifth and sixth charts.

Sources: BEA, BLS, Haver Analytics, Apollo Chief Economist

Sources: BEA, BLS, Haver Analytics, Apollo Chief Economist

Note: Survey from November 2024. Sources: The Impact of Generative AI on Work Productivity | St. Louis Fed, Apollo Chief Economist

Sources: US Bureau of Labor Statistics (BLS), Macrobond, Apollo Chief Economist

Sources: Institute for Supply Management (ISM), US Bureau of Labor Statistics (BLS), Macrobond, Apollo Chief Economist

Sources: Federal Reserve Bank of Dallas, Federal Reserve Bank of Kansas City, Federal Reserve Bank of New York, Federal Reserve Bank of Philadelphia, US Bureau of Economic Analysis (BEA), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

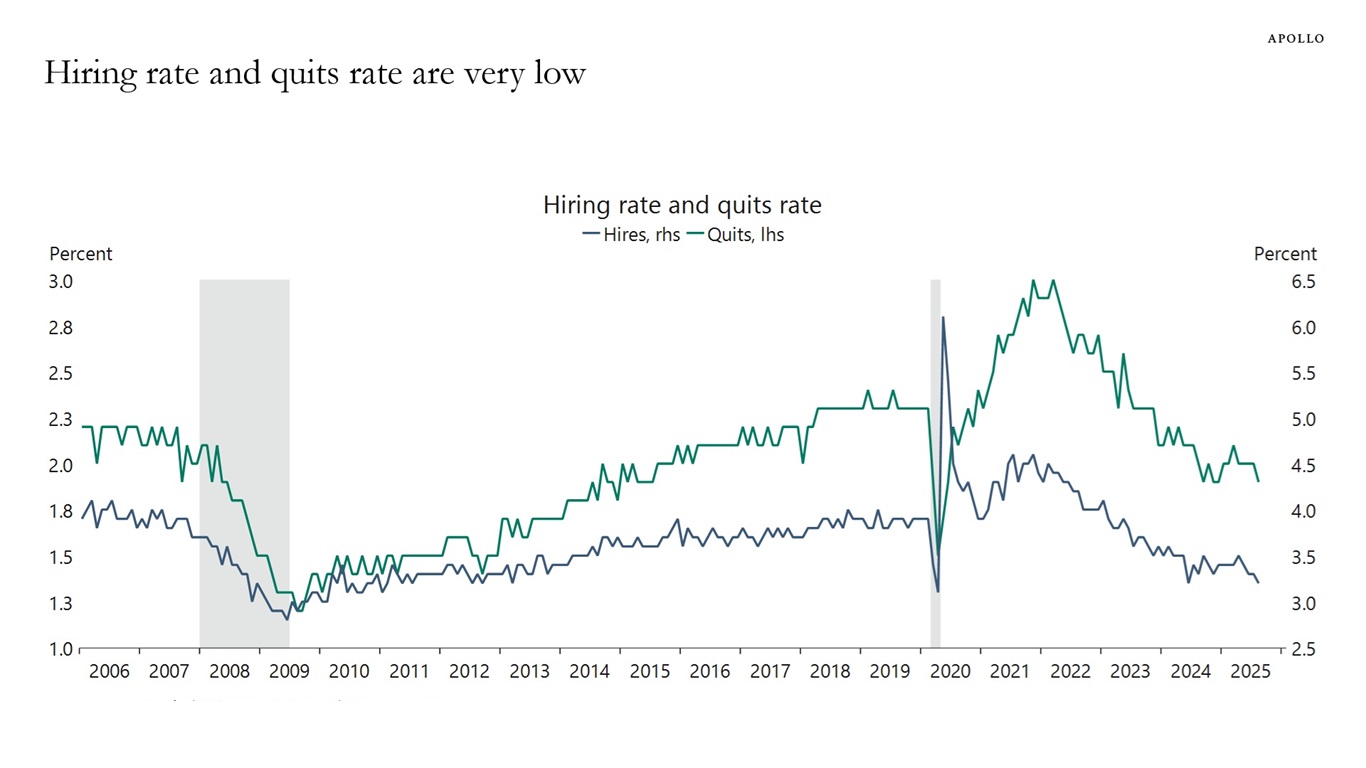

The hiring rate measures the number of hires during the entire month as a percentage of total employment, and it is currently at recessionary levels, see chart below.

Similarly, the quits rate measures the number of employees who voluntarily left their jobs during a month, expressed as a percentage of total employment, and the quits rate is also low.

Combined with a declining number of job openings, rising unemployment, and slower job growth, the bottom line is that the labor market is at a standstill, where workers are not getting hired or voluntarily changing jobs.

Sources: US Bureau of Labor Statistics (BLS), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

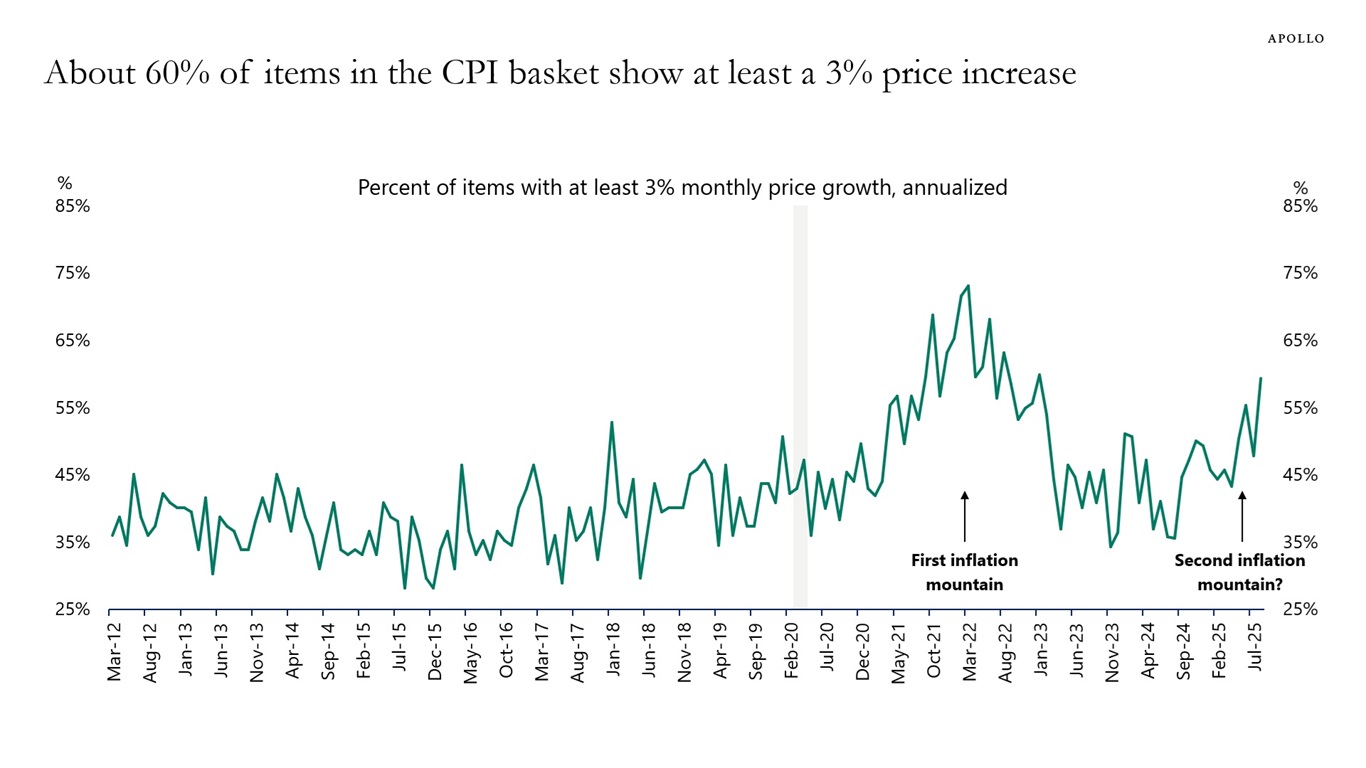

Looking at annualized month-over-month growth rates shows that 60% of items in the CPI basket are growing faster than 3%, see chart below. Is a second inflation mountain emerging?

Sources: BLS, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

We have put together a 75-page chart book with private sector data to monitor during the shutdown, and it is available here. We will update and publish this going forward as long as the shutdown continues.

See important disclaimers at the bottom of the page.

-

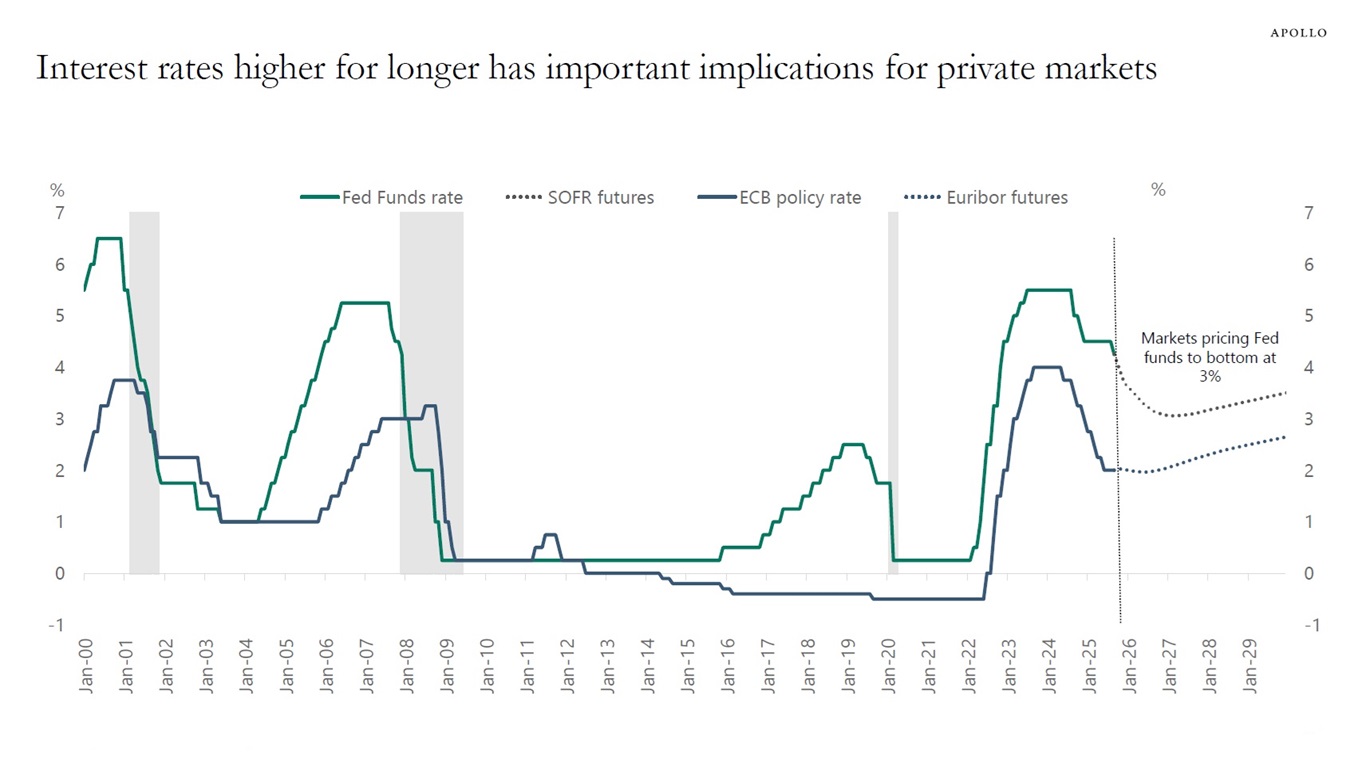

We have updated our outlook for private markets, it is available here.

Sources: Bloomberg, Apollo Chief Economist

Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.