Want it delivered daily to your inbox?

-

Stiglitz: The Causes of and Responses to Today’s Inflation

https://rooseveltinstitute.org/wp-content/uploads/2022/12/RI_CausesofandResponsestoTodaysInflation_Report_202212.pdfBIS: The global foreign exchange market in a highervolatility environment

https://www.bis.org/publ/qtrpdf/r_qt2212f.pdfHow does the Consumer Price Index account for the cost of housing?

https://www.brookings.edu/blog/up-front/2022/05/18/how-does-the-consumer-price-index-account-for-the-cost-of-housing/See important disclaimers at the bottom of the page.

-

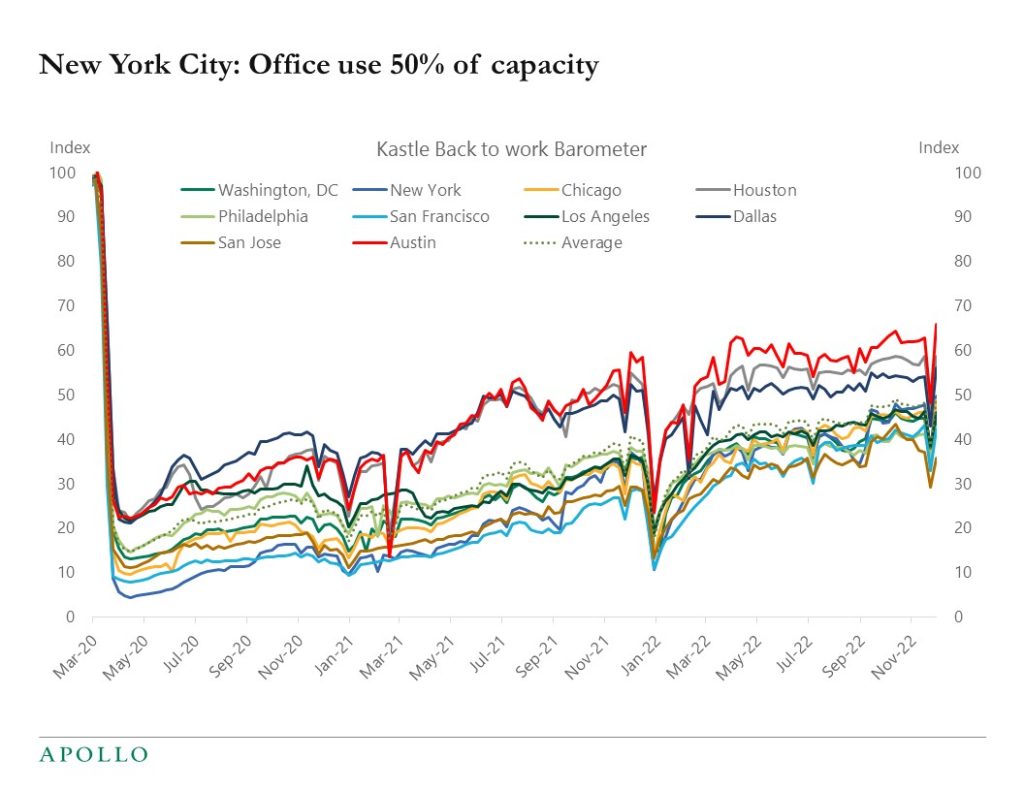

The weekly data for office occupancy rates shows that New York City office use after Thanksgiving reached a post-pandemic high of 50% of capacity, see chart below. Our collection of daily and weekly indicators for the US economy is available here.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

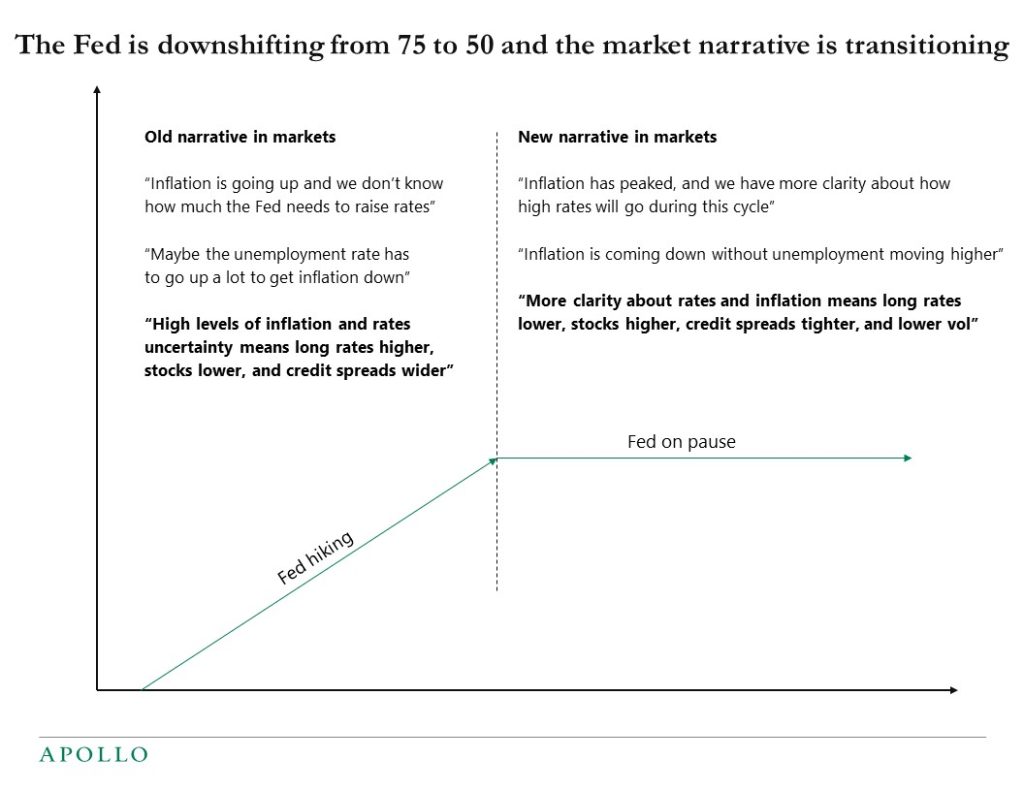

As the Fed starts to approach the peak in the Fed funds rate, the market narrative is changing from “there is a high level of uncertainty about inflation and how high rates will go” to “inflation has peaked and we have a better idea about where rates will peak during this cycle,” see chart below. This ongoing transition in the market narrative has important consequences for rates, credit, and equity markets, including levels of implied and realized vol.

Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

-

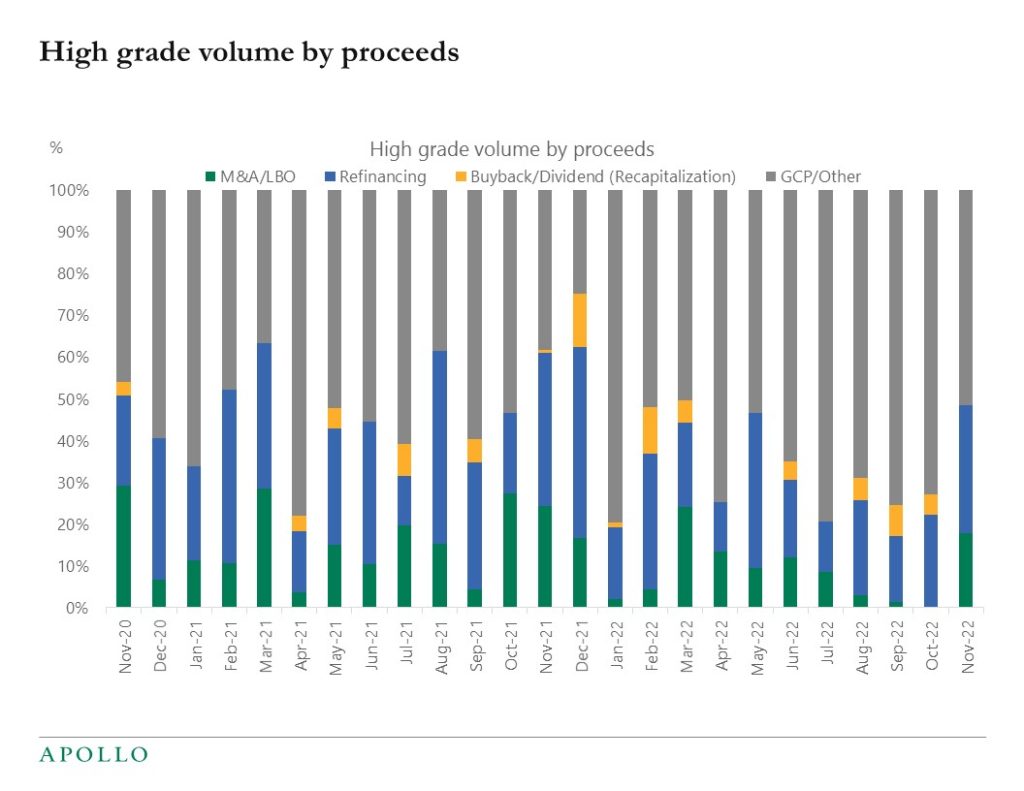

The Fed has clearly communicated that they want to downshift next week from 75bps to 50bps, and as we approach the peak in the Fed funds rate, we should begin to see capital markets reopen again, and in November there was a significant increase in investment grade refinancings and M&A/LBOs, see chart below.

Source: S&P LCD, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

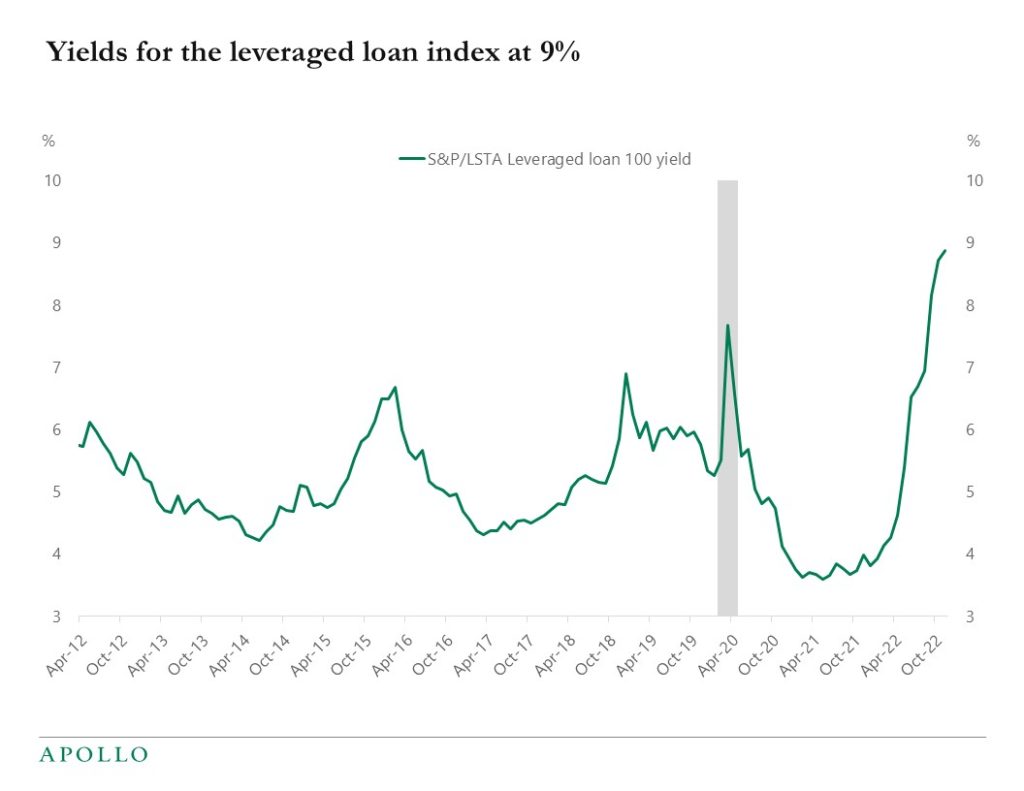

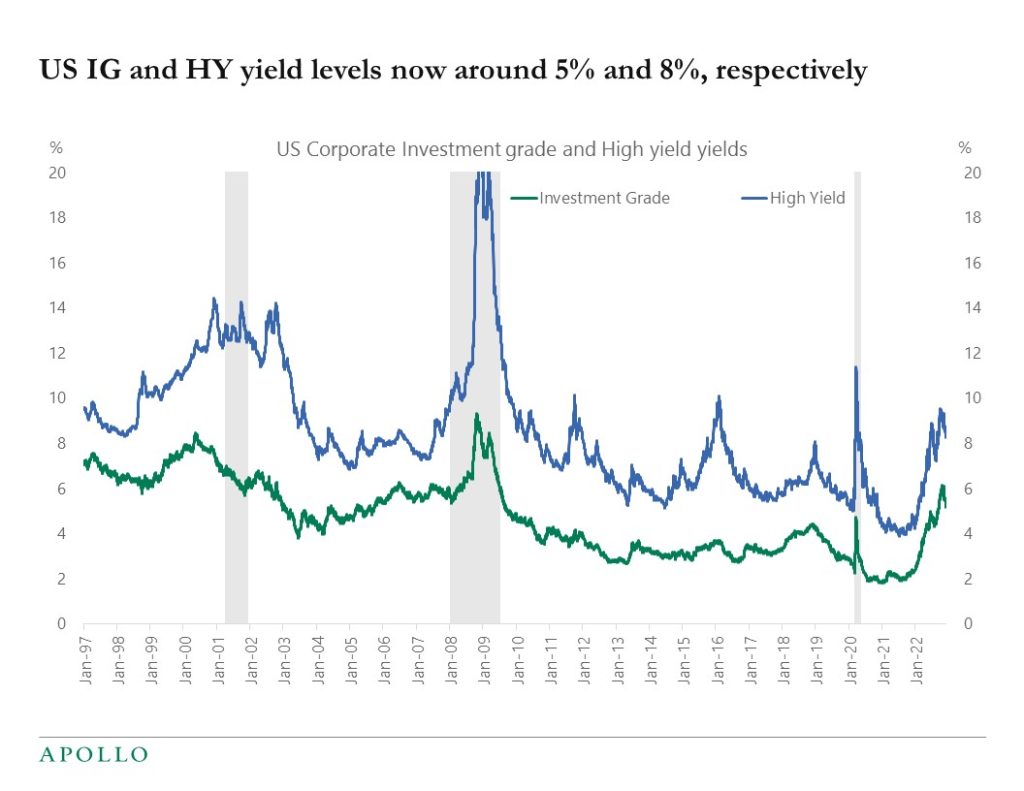

Our latest credit market outlook presentation is available here.

Source: LCD Comps, Apollo Chief Economist

Source: ICE BofA, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

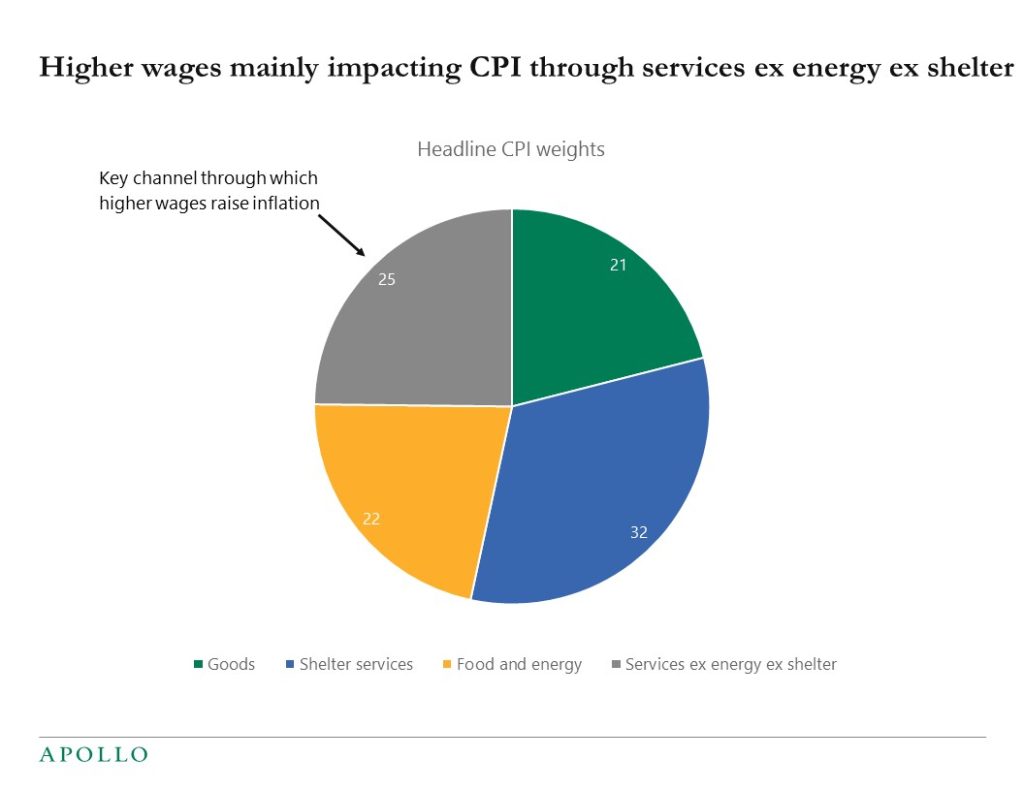

Wage inflation has a weight of 25% in the CPI basket via Services ex-energy ex-shelter. The transmission channel is that higher wages in consumer services such as restaurants and hotels increase the price of eating out and staying at hotels.

The impact of higher wage inflation on the remaining 75% of the CPI index is more complex, see chart below.

With wages having a limited weight in the CPI basket, it is entirely possible to have higher wage inflation for a period while consumer price inflation is coming down as supply chains get better, rent inflation declines, car price inflation declines etc. In other words, the 25% of the CPI basket that is directly impacted by wages may be rising while at the same time, inflation in the remaining 75% of the basket is declining.

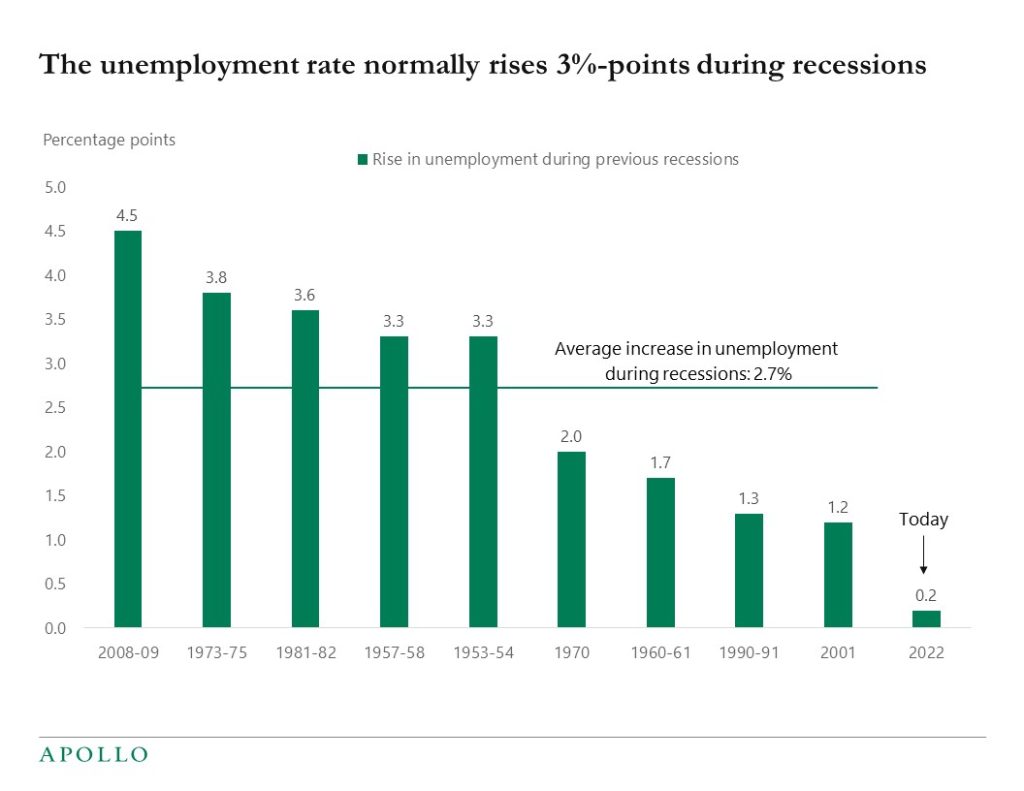

The bottom line is that with inflation currently at 7.7% and declining rent inflation, declining car price inflation, declining transportation inflation, declining import price inflation, and elevated inventory levels, we may not need a dramatic amount of demand destruction and a significant increase in the unemployment rate for inflation to come down to the Fed’s 2% inflation target.

In short, with inflation declining and the labor market remaining solid, the probability of a soft landing is rising.

Source: BLS, Haver Analytics, Apollo Chief Economist. Note: Weights as of October 2022. Goods also includes traditional commodities See important disclaimers at the bottom of the page.

-

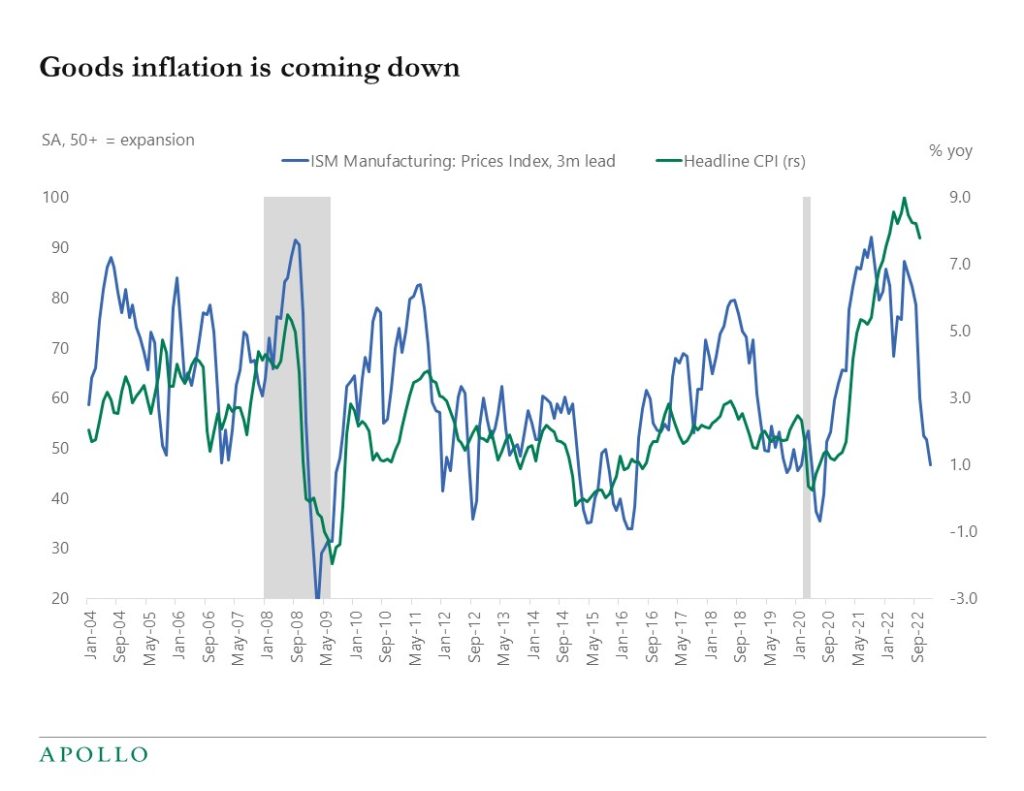

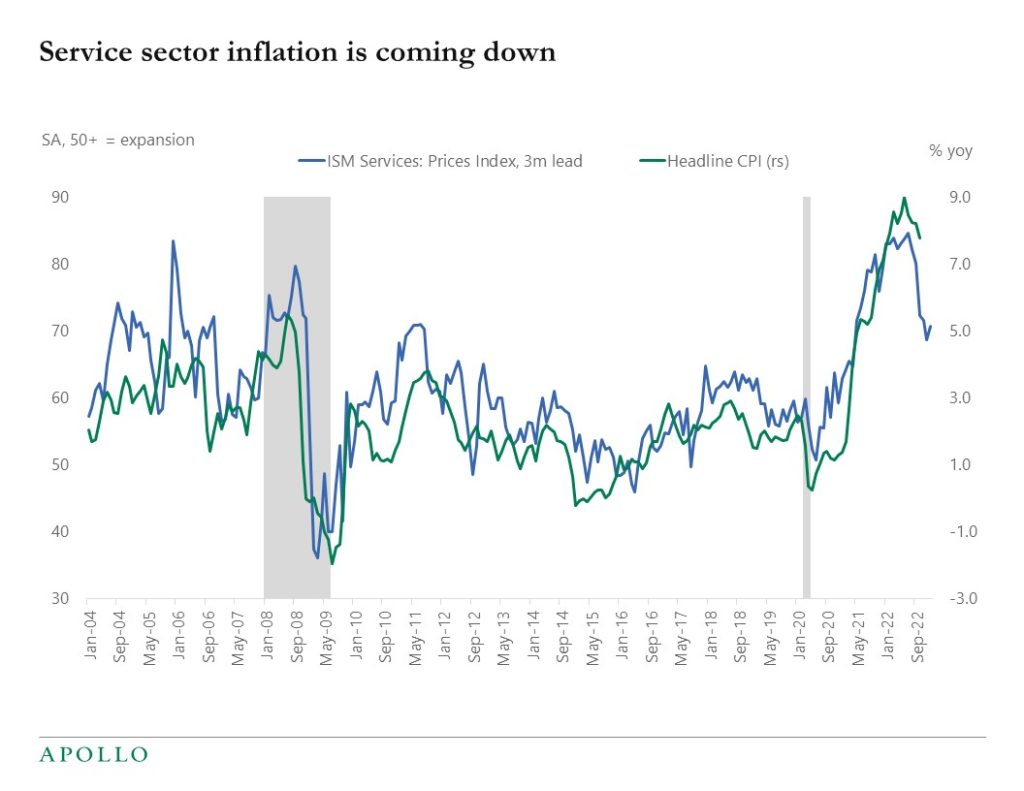

Inflation is coming down without a major increase in the unemployment rate, see charts below. That is the definition of a soft landing.

Source: BLS, Apollo Chief Economist

Source: ISM, BLS, Haver Analytics, Apollo Chief Economist

Source: ISM, BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

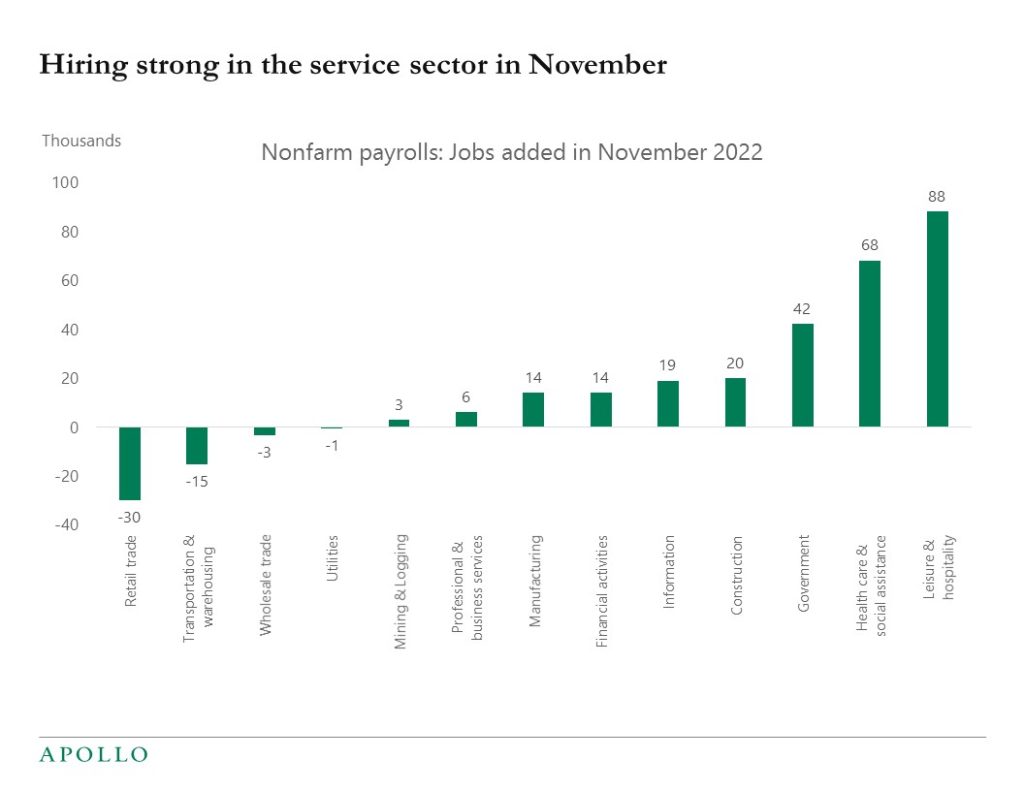

The November employment report shows that wage inflation is increasing in the service sector and declining in the goods sector, and most of the jobs created in November were in Leisure and hospitality, see chart below and our chart book available here.

Source: BLS, Haver, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

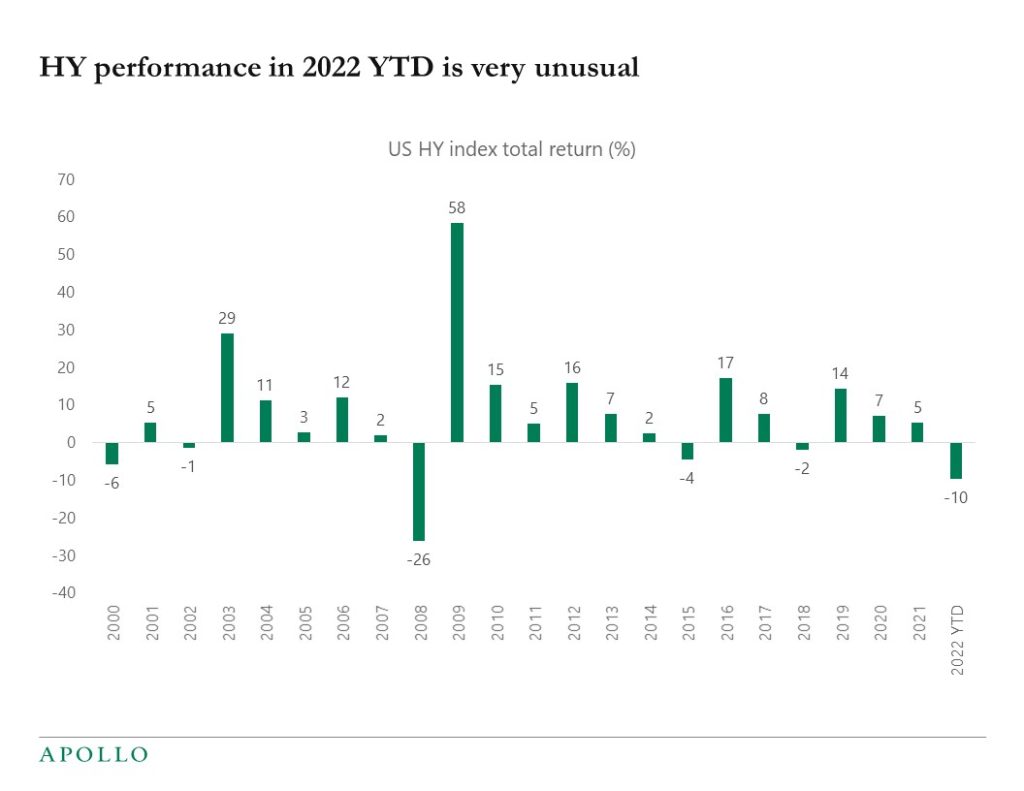

The US corporate high yield total return index is down 10% so far in 2022, and high inflation and rising rates have significantly impacted bond market returns. The average total annual return in high yield from 2010 to 2020 was 8%, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

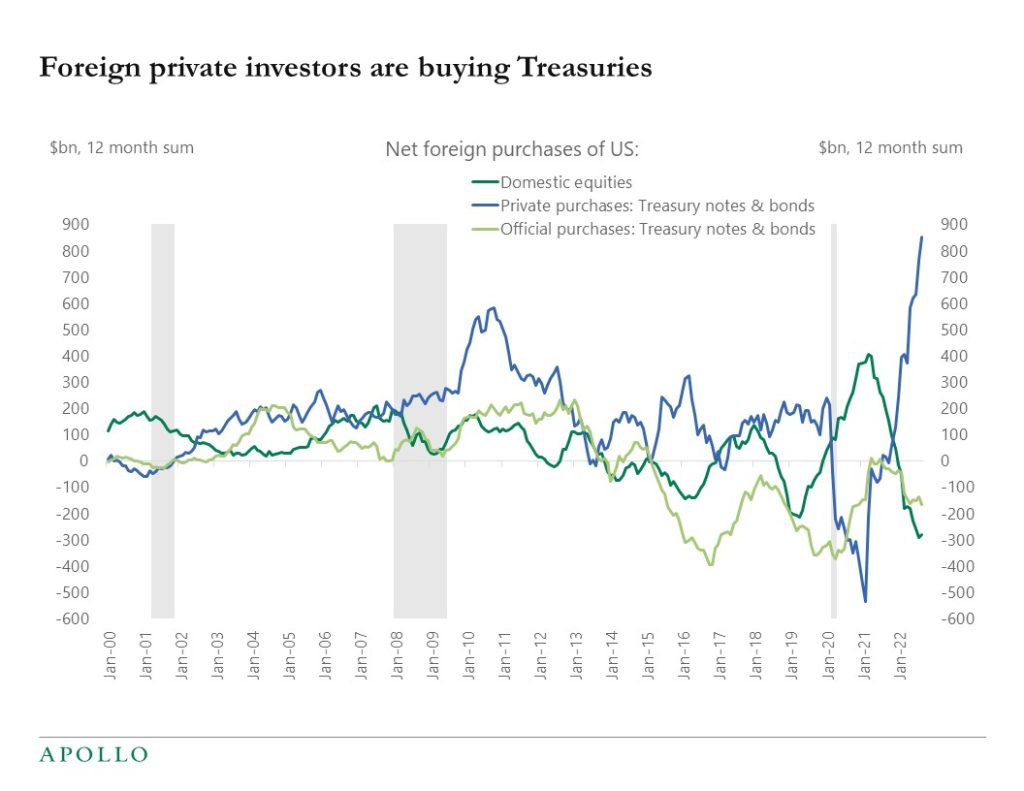

Foreign private investors are buying a lot of Treasuries at the moment, see chart below. Foreign central banks, on the other hand, are big sellers of Treasuries. And foreigners, more broadly, are big sellers of US equities.

Source: Treasury, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.