Want it delivered daily to your inbox?

-

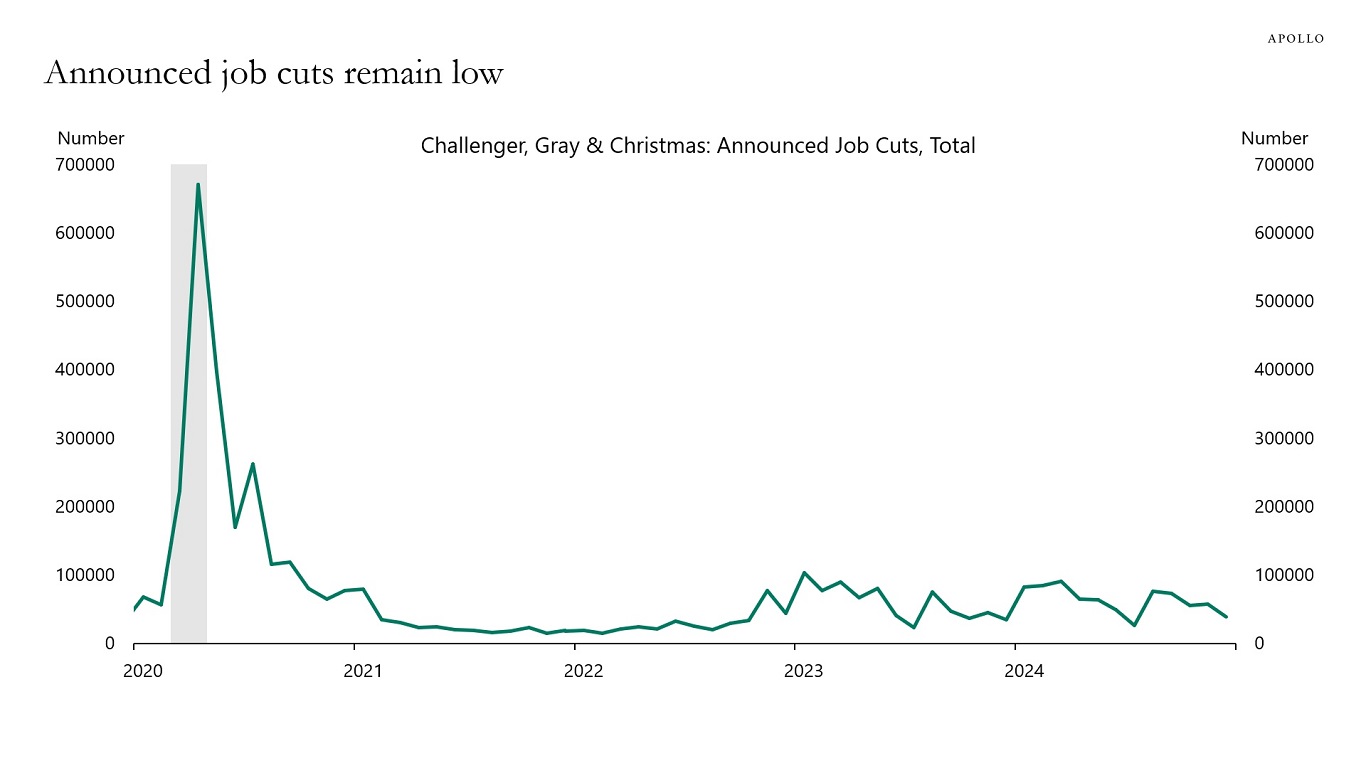

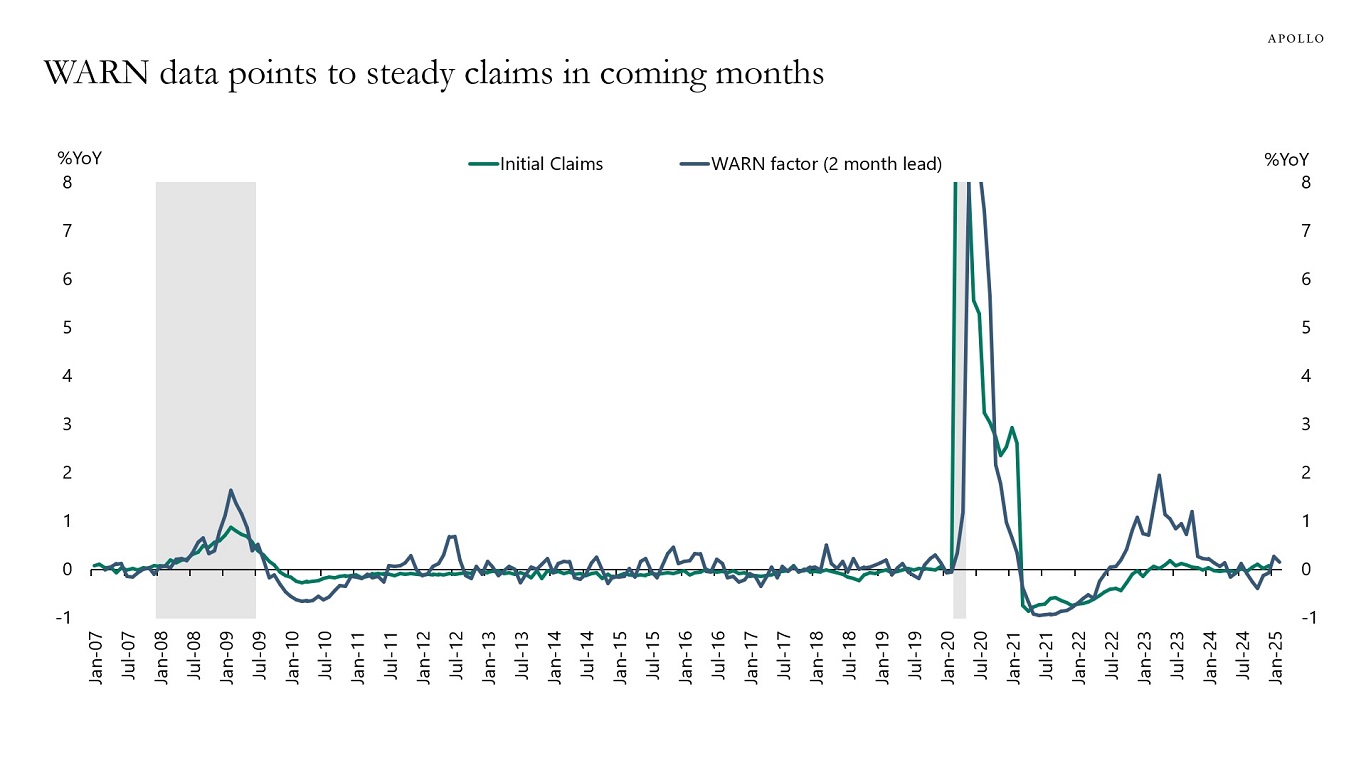

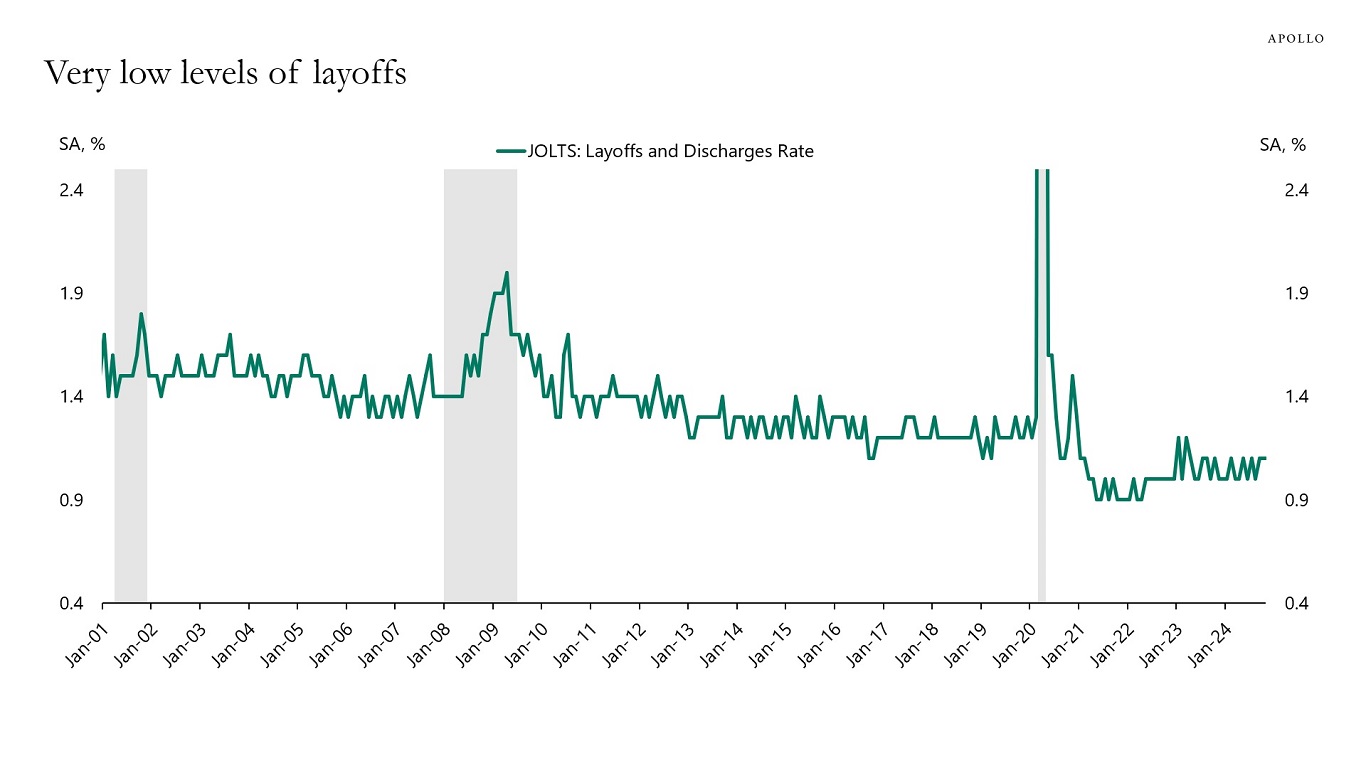

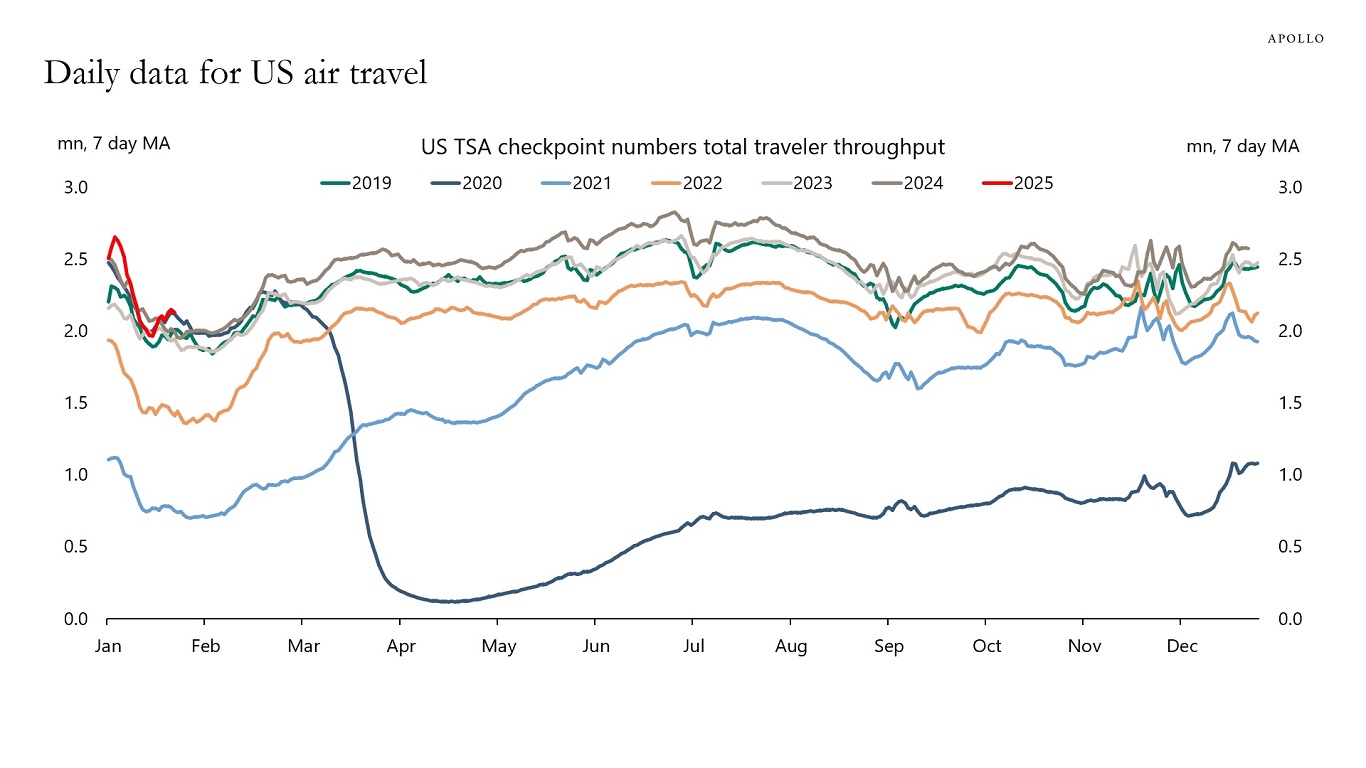

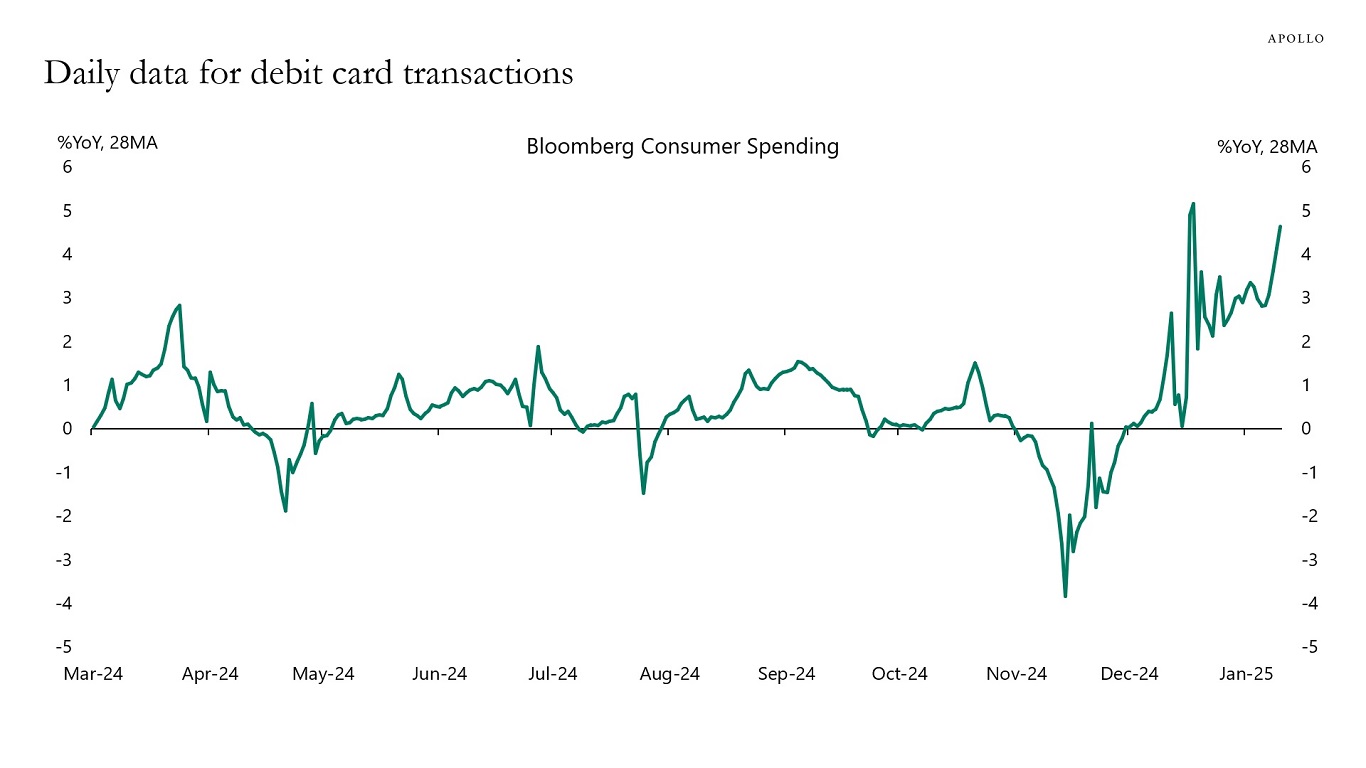

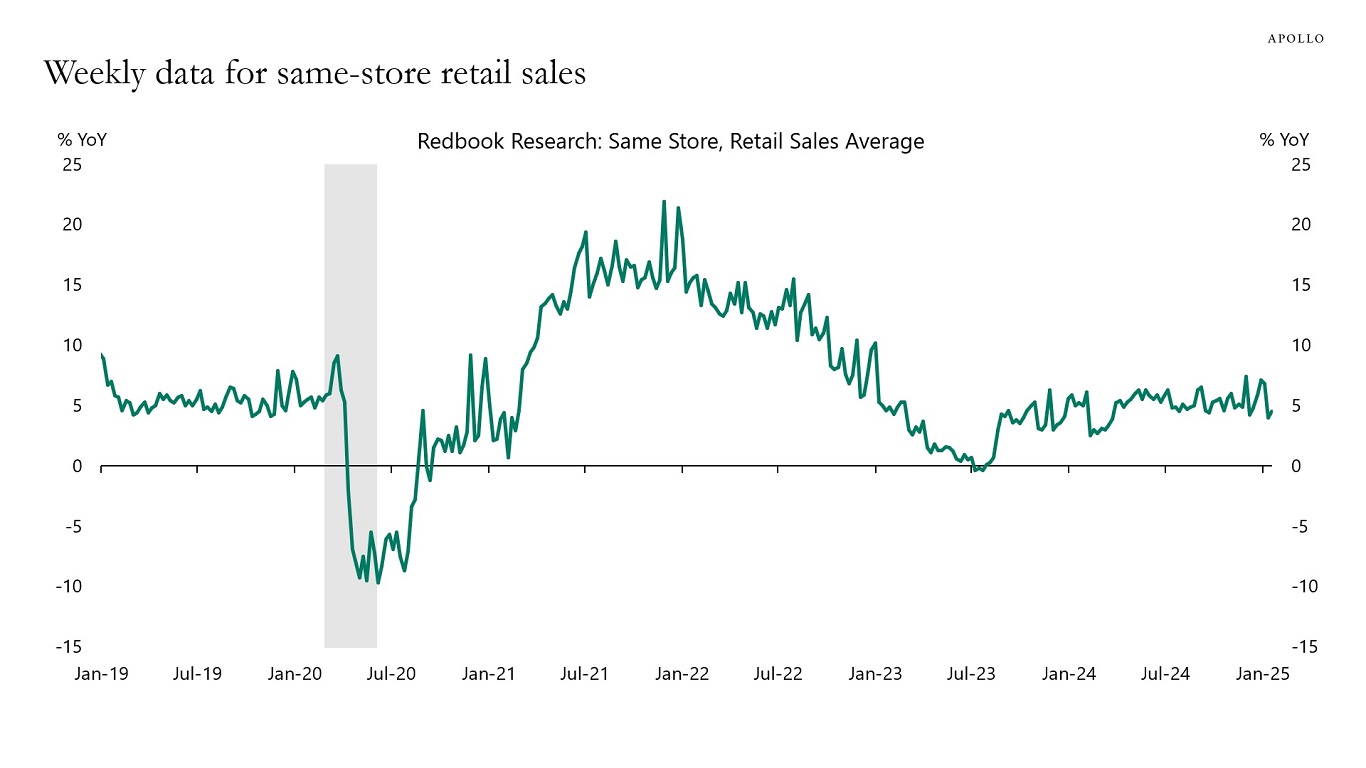

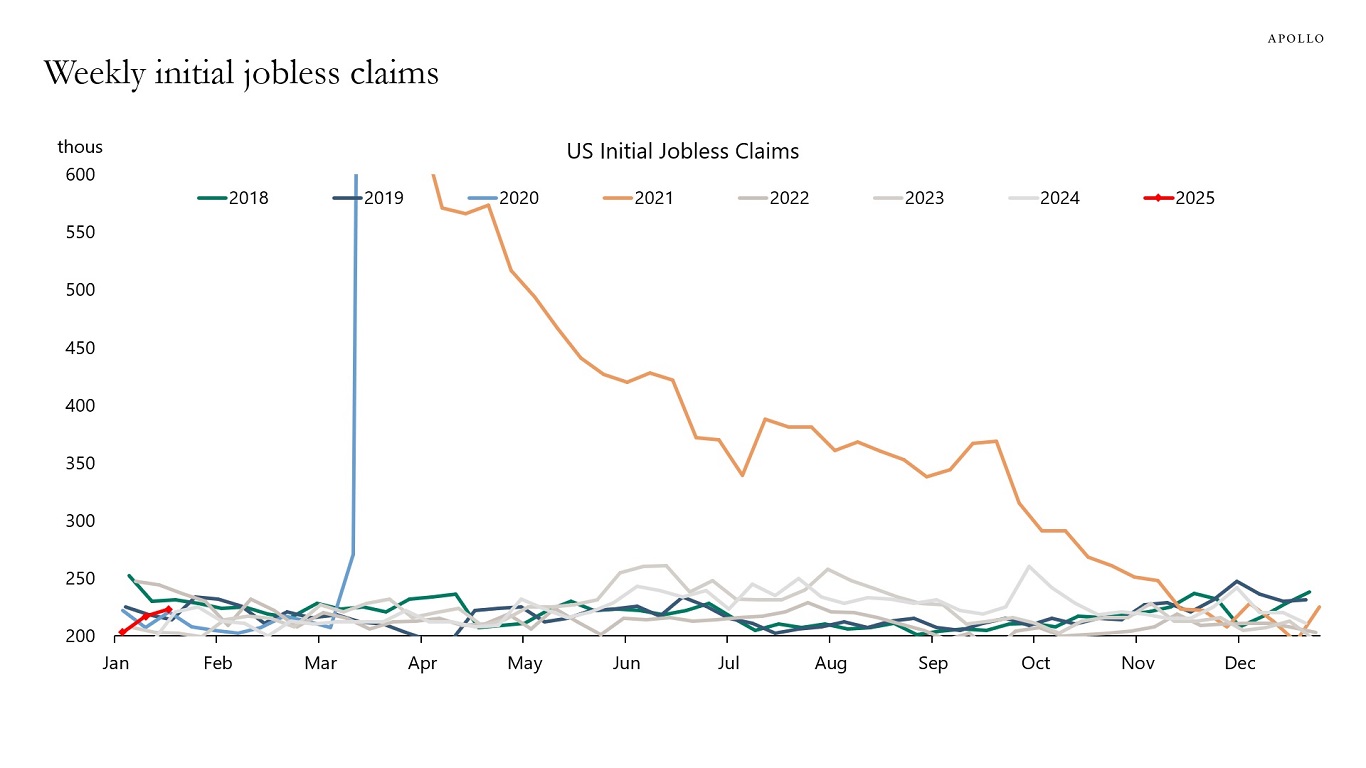

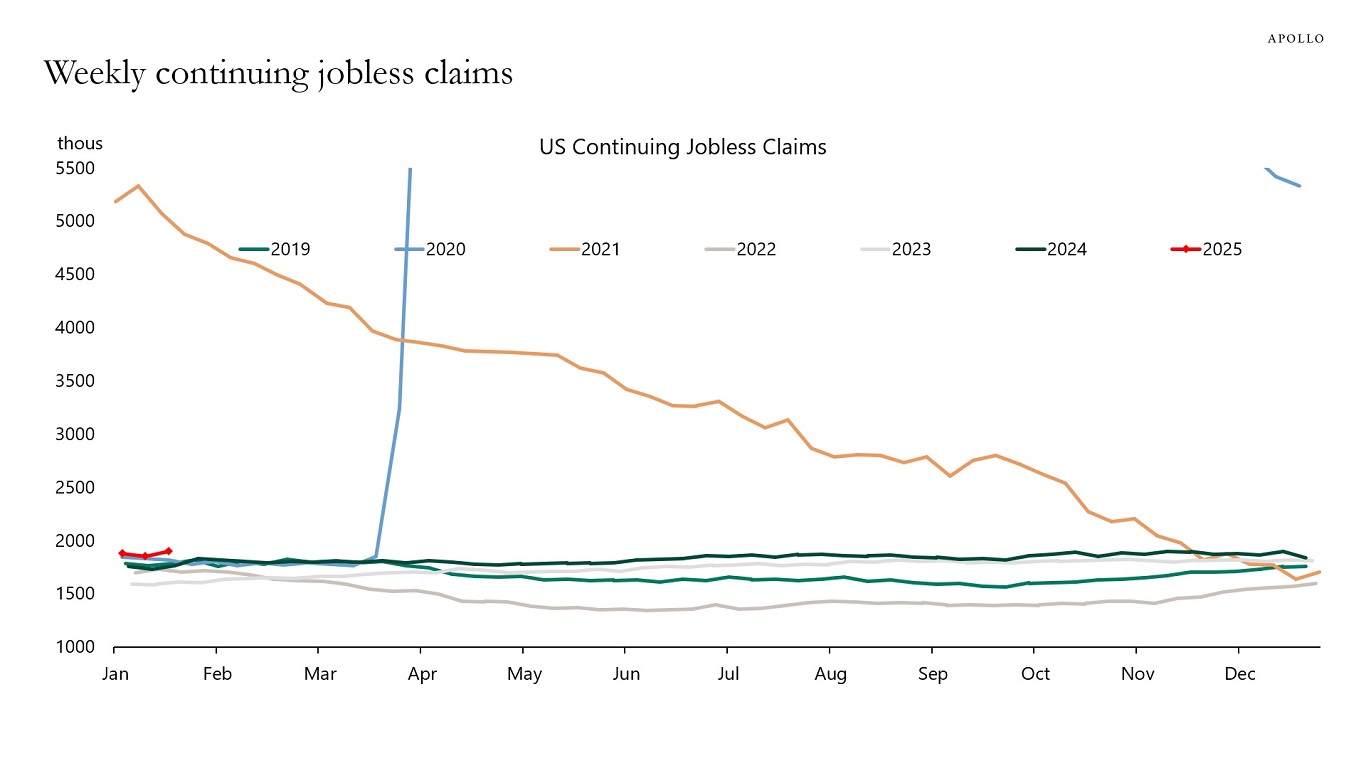

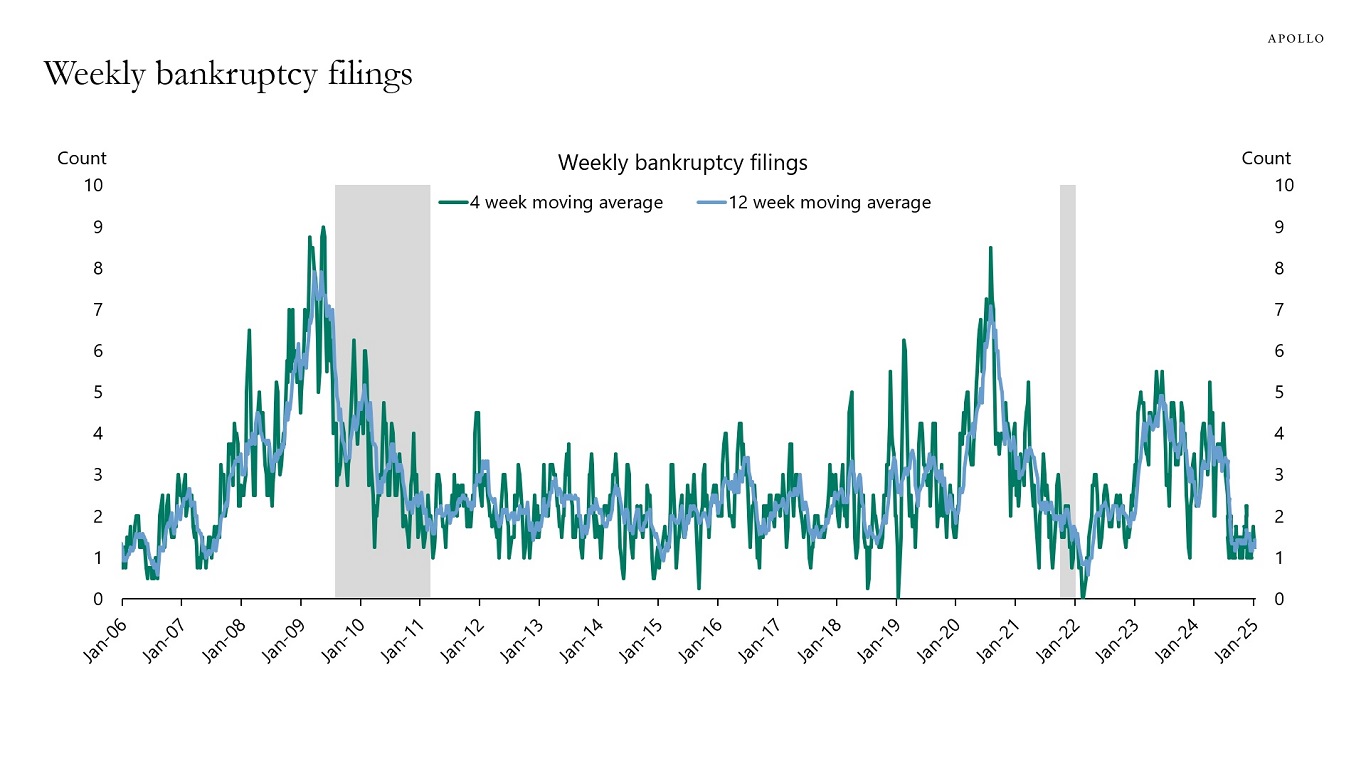

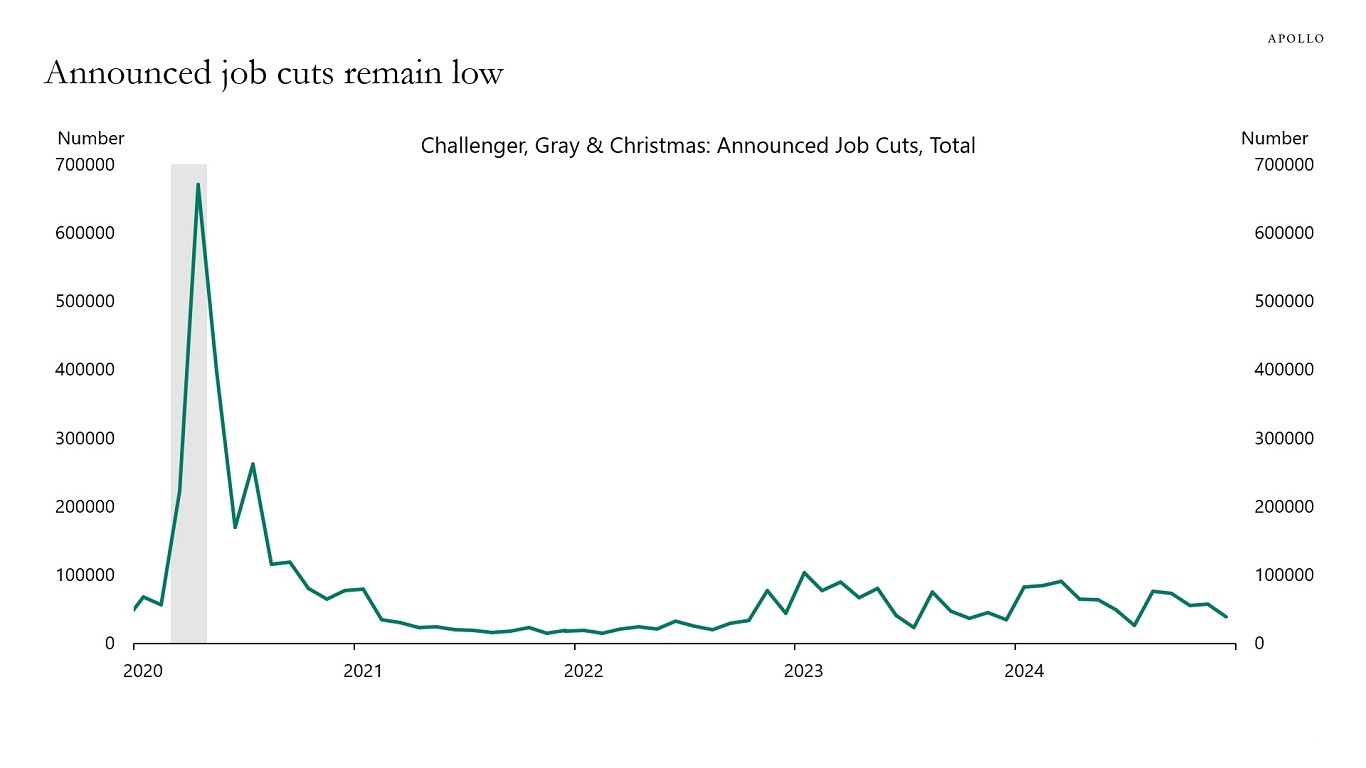

The incoming data shows that weekly same-store retail sales are strong, daily debit card spending data is strong, daily TSA air travel data is strong, the JOLTS layoff rate is very low, WARN notices are low, jobless claims are low, and announced job cuts are very low.

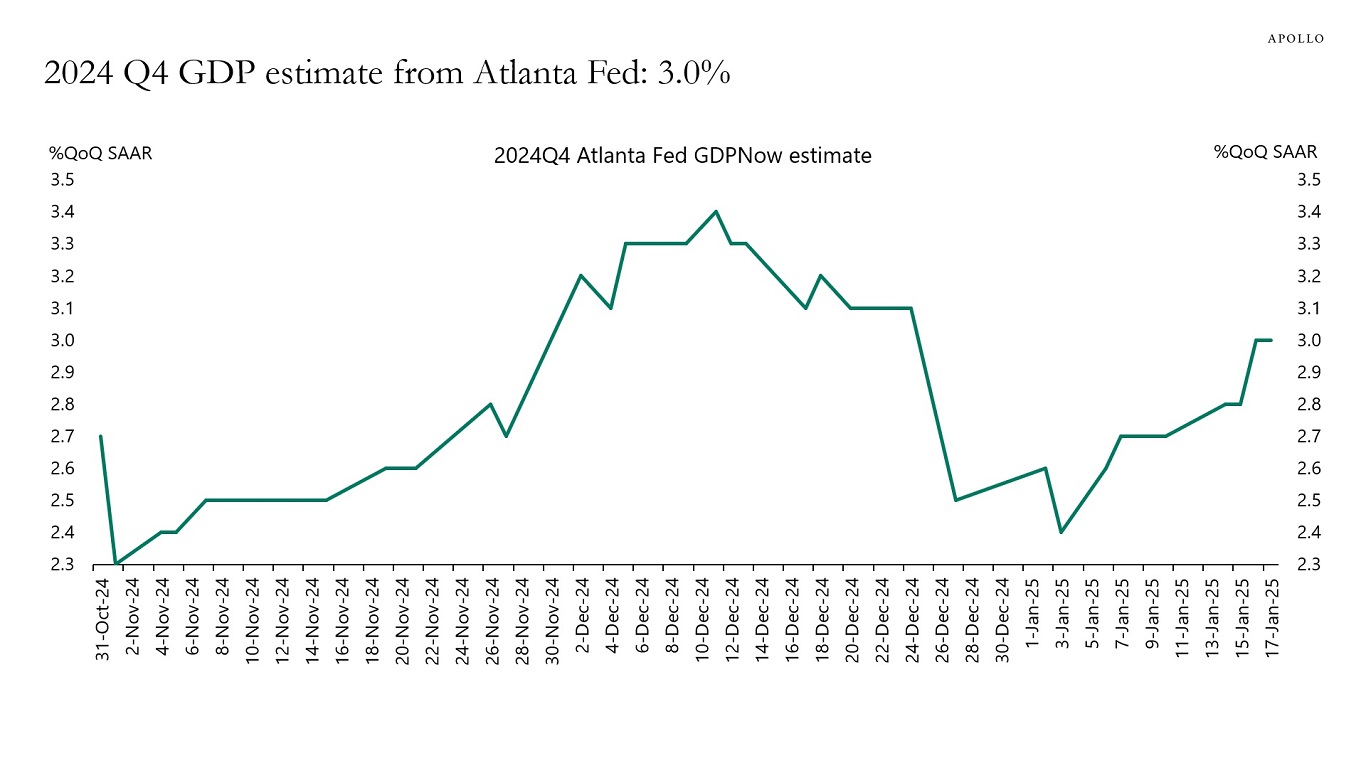

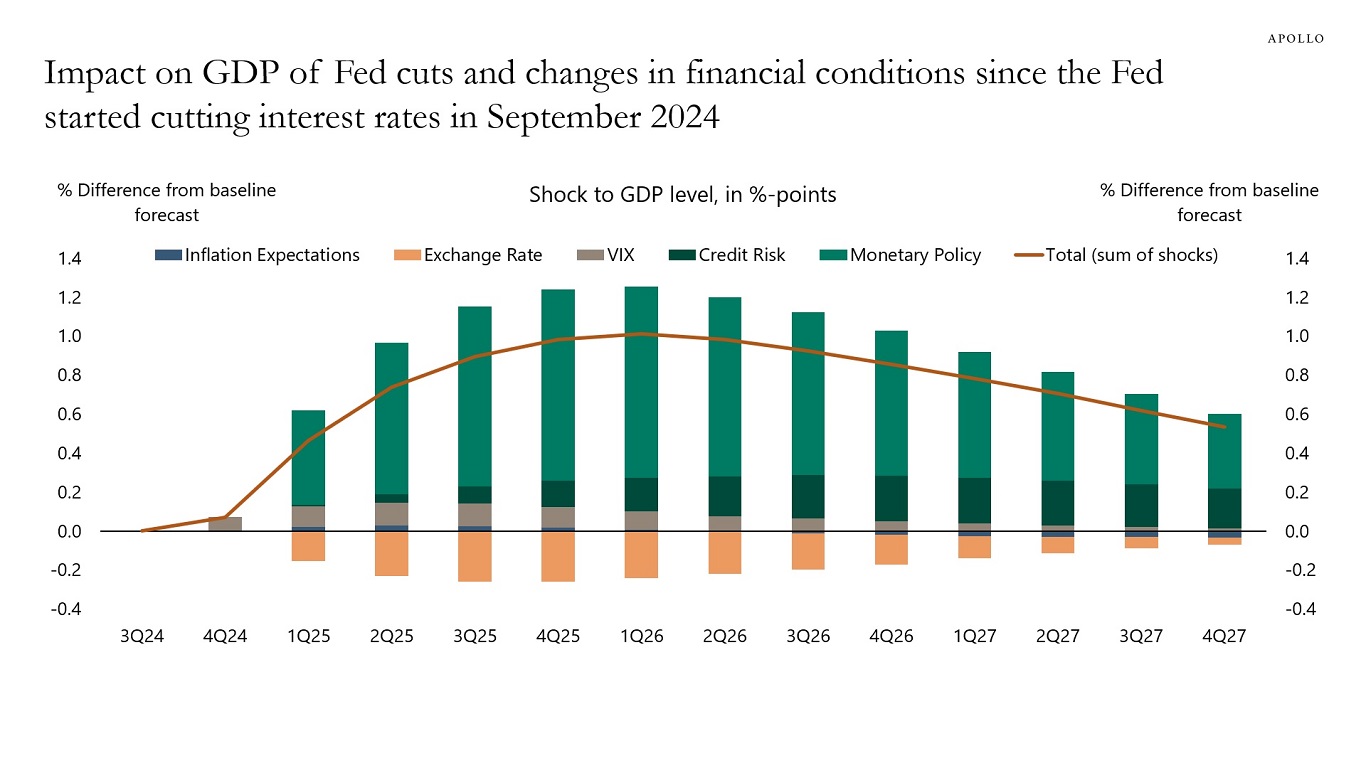

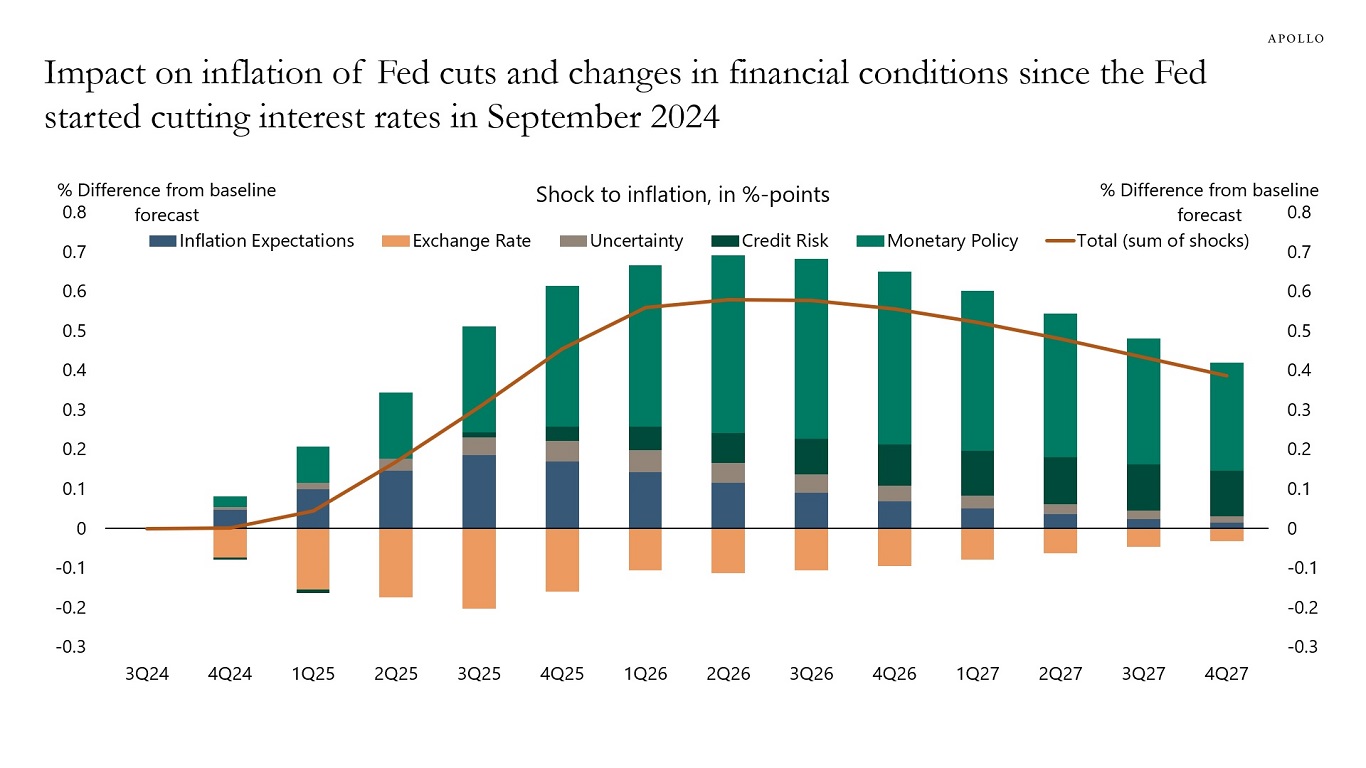

Combined with the latest Atlanta Fed GDP estimate at 3.0% and a boost coming to growth and inflation because of the Fed cutting interest rates since September and higher animal spirits since the election, the bottom line is that the US economy is entering 2025 with some really strong tailwinds, and the market is underestimating the risk that the Fed will have to hike interest rates later this year.

Our chart book with daily and weekly indicators for the US economy is available here.

Source: Challenger, Gray & Christmas, Haver Analytics, Apollo Chief Economist

Note: The Worker Adjustment and Retraining Notification (WARN) Act helps ensure 60 to 90 days advance notice in cases of qualified plant closings and mass layoffs. WARN factor is the Cleveland Fed estimate for WARN notices. Source: Department of Labor, Haver Analytics, Federal Reserve Bank of Cleveland, Apollo Chief Economist

Source: BLS, Haver Analytics, Apollo Chief Economist

Source: TSA, Bloomberg, Apollo Chief Economist

Note: Consists largely of debit card transactions. Source: Bloomberg, Apollo Chief Economist

Source: Redbook, Haver Analytics, Apollo Chief Economist

Note: Some data not shown in chart due to significant variances in scale. Source: US Department of Labor, Apollo Chief Economist

Note: Some data not shown in chart due to significant variances in scale. Source: US Department of Labor, Apollo Chief Economist

Source: Federal Reserve Bank of Atlanta, Haver Analytics Apollo Chief Economist

Note: The following shocks are applied to Q4 2024: A 0.2%-point rise in inflation expectations, 7% appreciation in the exchange rate, 0.5 standard deviation fall in VIX, 30 bps tightening of credit spreads, -100 bps rate cuts and -50 bps forward guidance. Source: Bloomberg SHOK model, Apollo Chief Economist

Note: The following shocks are applied to Q4 2024: A 0.2%-point rise in inflation expectations, 7% appreciation in the exchange rate, 0.5 standard deviation fall in VIX, 30 bps tightening of credit spreads, -100 bps rate cuts and -50 bps forward guidance. Source: Bloomberg SHOK model, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

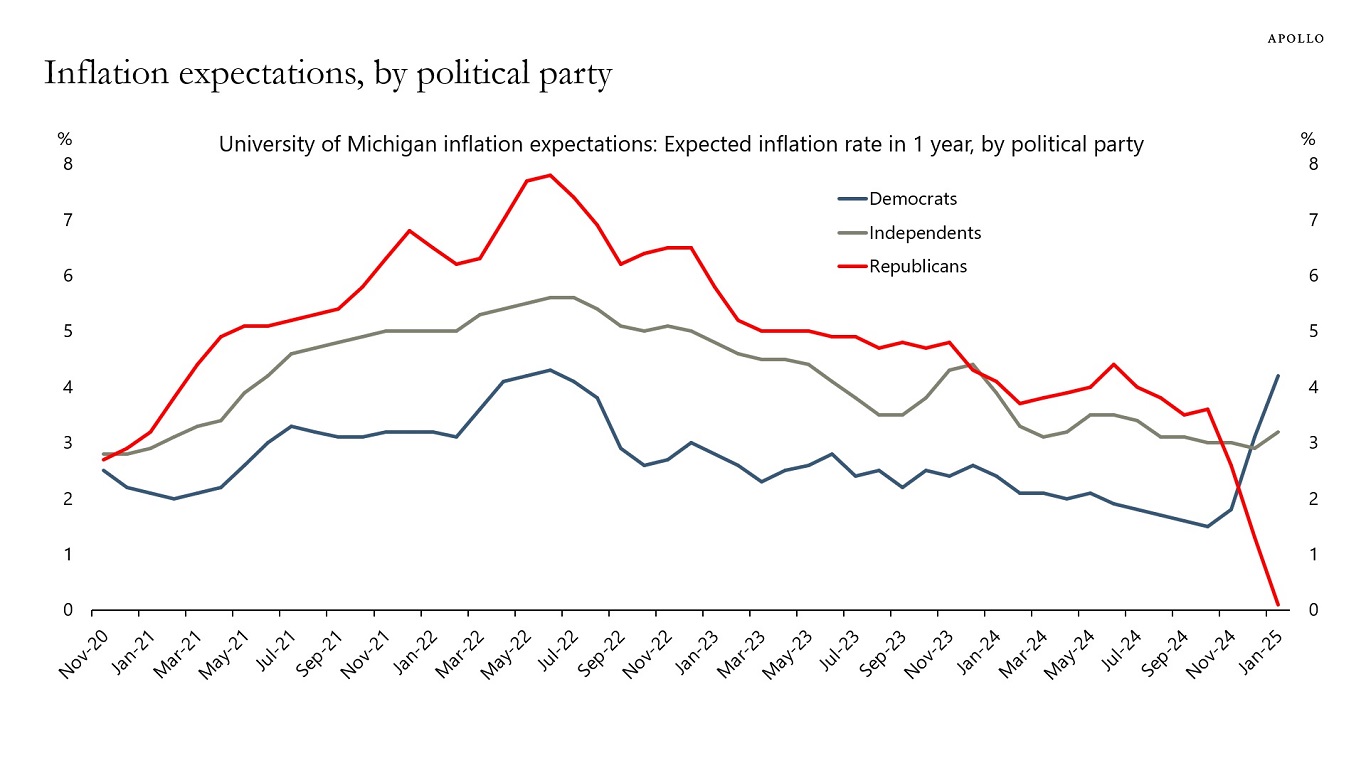

Household inflation expectations have shifted completely after the election, see the chart below.

Source: University of Michigan, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Following the strong performance of 2024, credit markets are entering 2025 in a solid position. While at first glance, it may appear that risks are one-sided, given that spreads are near multi-year tights across several segments of the credit market, we expect the fundamental and technical backdrop to remain strong.

Still, we believe there could be some headline risk associated with the implementation of the incoming US administration’s policies—from tariffs, immigration, and fiscal policy—which could potentially inject more volatility into markets.

We expect the relationship between banks and private credit firms will continue to turn more symbiotic through strategic alliances. Initially targeted at the sub-investment grade market, we expect these partnerships will eventually extend to investment grade (IG) companies as well: While public IG funding is widely accessible, the lack of flexible financing solutions available today can create an opportunity for private credit providers.

Another key theme for the new year will likely be the rising demand for data center capacity and associated infrastructure, which we estimate will require more than $2 trillion over the next five years. Given the sheer size and unique characteristics of many of these projects, we think that bespoke, privately originated IG financing will be part of the capital solution to finance this investment.

As 2025 progresses, we expect investors will turn their attention to the next sub-investment grade maturity wall, with over $620 billion of high yield bonds and loans set to come due in 2026 and 2027. We saw some notable differences in the way many of the 2024/25 maturities were addressed, which could suggest a large opportunity for private credit to reprise its role as an alternative financing option for companies with upcoming maturities.

Our 2025 Credit Outlook is available here.

See important disclaimers at the bottom of the page.

-

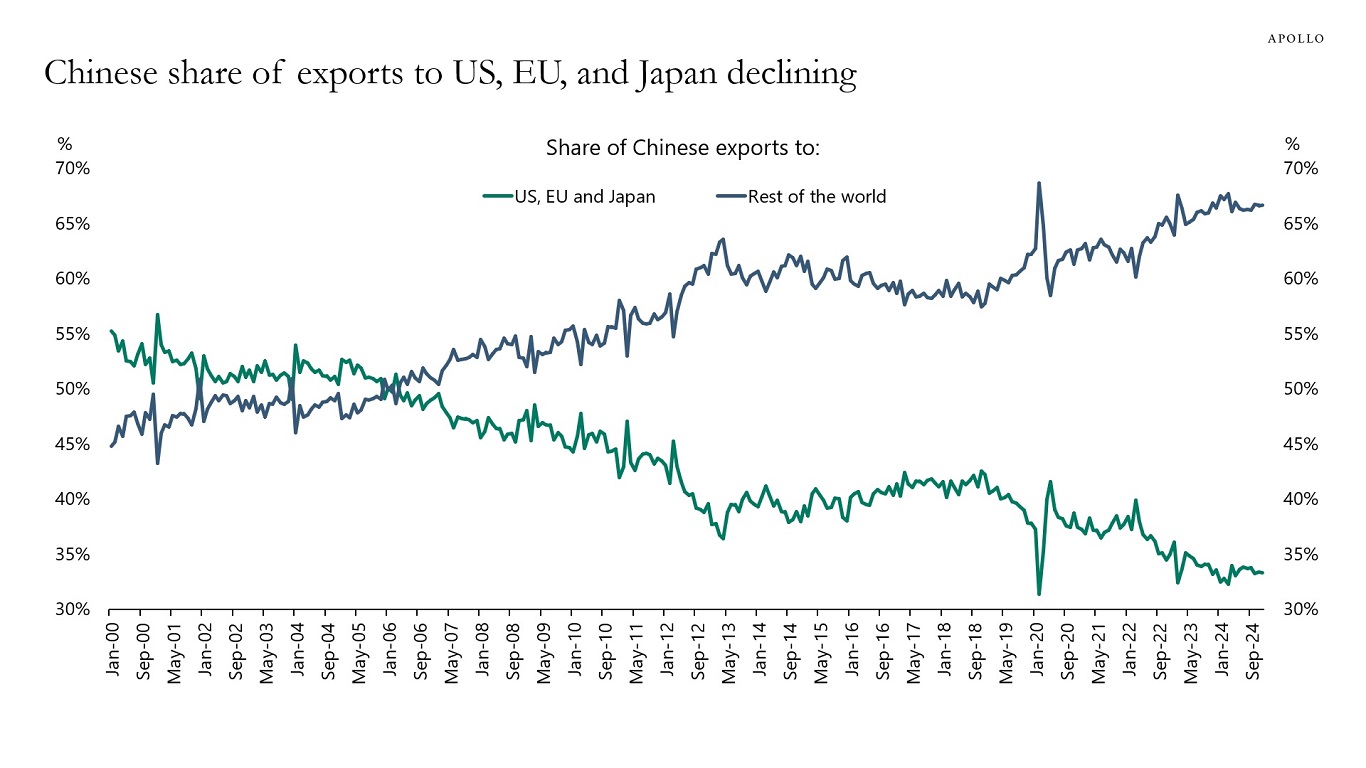

China’s business cycle used to be highly correlated with the US business cycle because of Chinese exports to the US.

But the business cycles in China and the US have decoupled for three reasons:

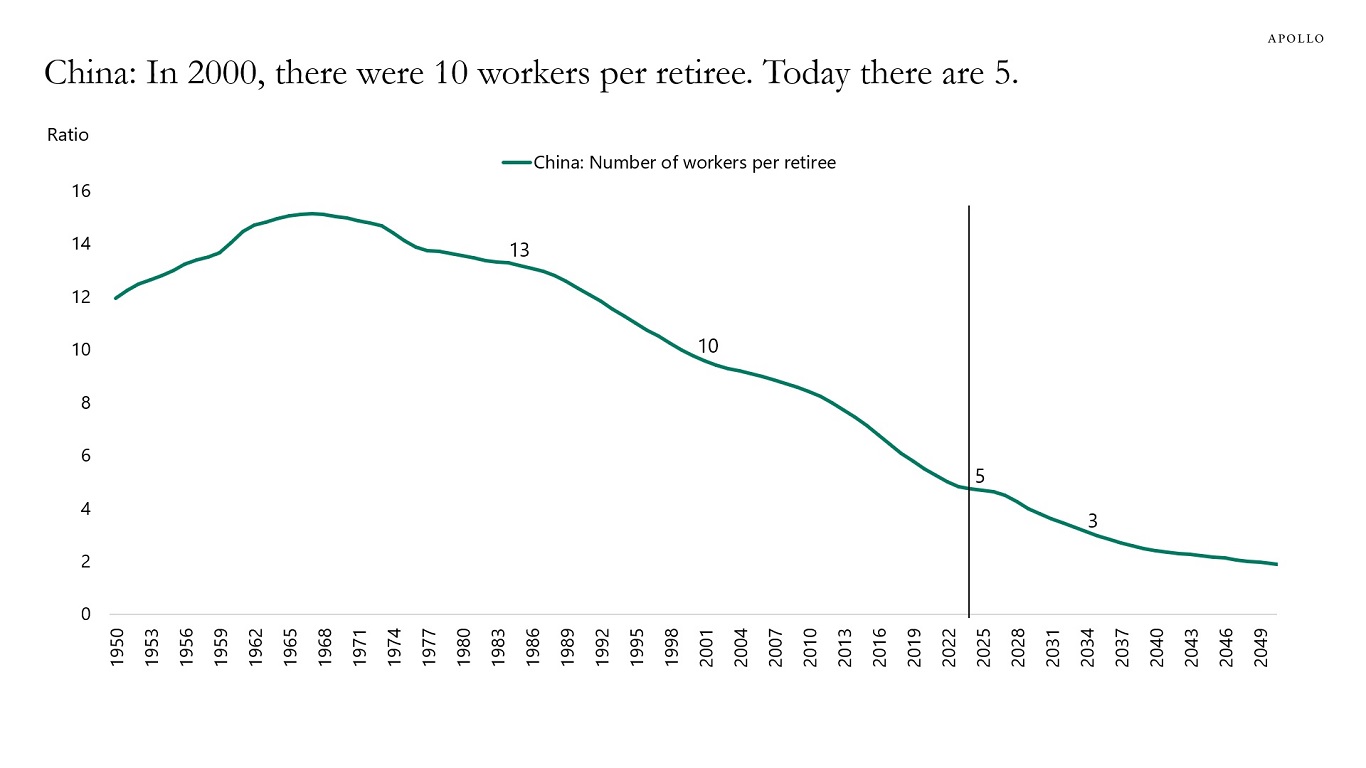

1) China’s working-age population is declining. The US working-age population is growing.

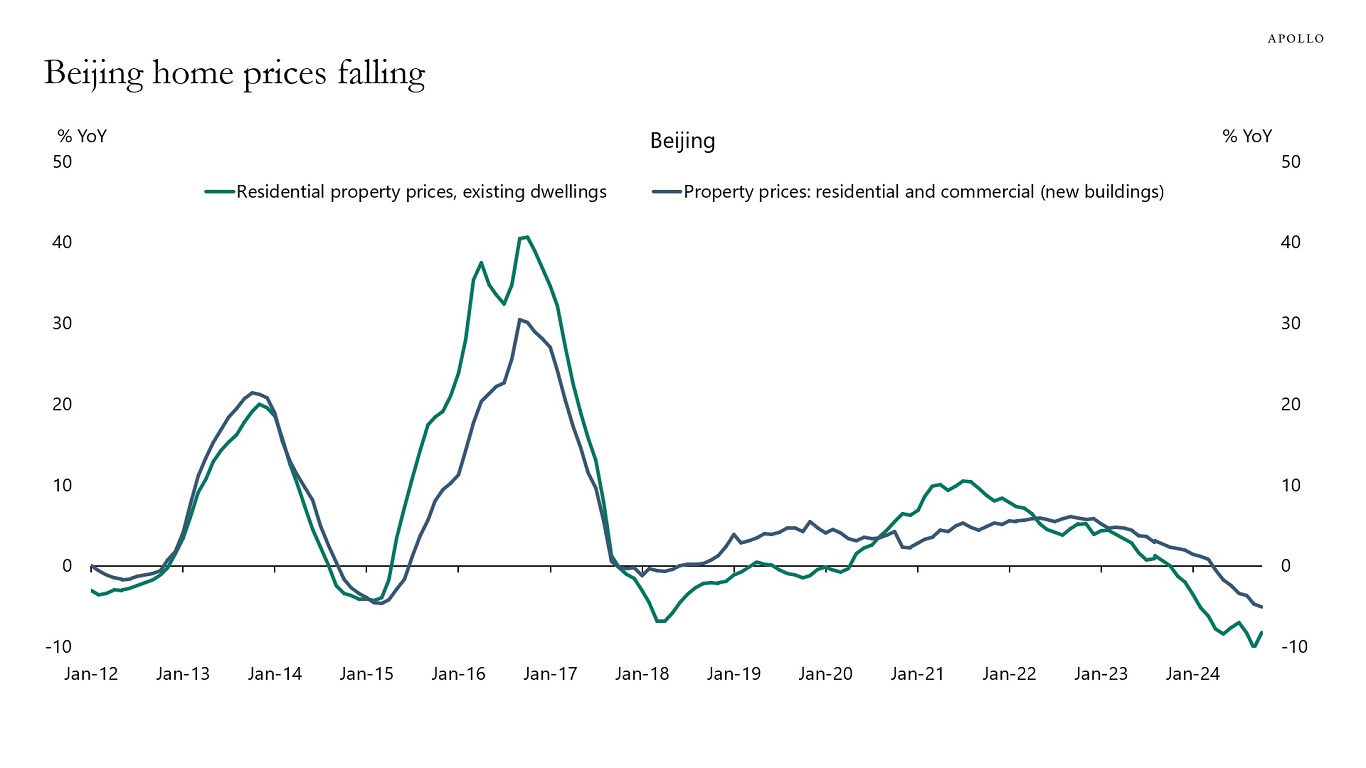

2) Chinese home prices are falling. US home prices are rising.

3) The US and Europe have imposed tariffs and want to produce more goods at home. This is negative for Chinese exports.

The bottom line is that the Chinese economy is facing three significant headwinds from demographics, housing, and trade that are weighing on growth.

Our latest outlook for China is available here.

Source: General Administration of Customs, China; Haver Analytics; Apollo Chief Economist

Source: BIS, Haver, Apollo Chief Economist

Source: UN, Haver, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

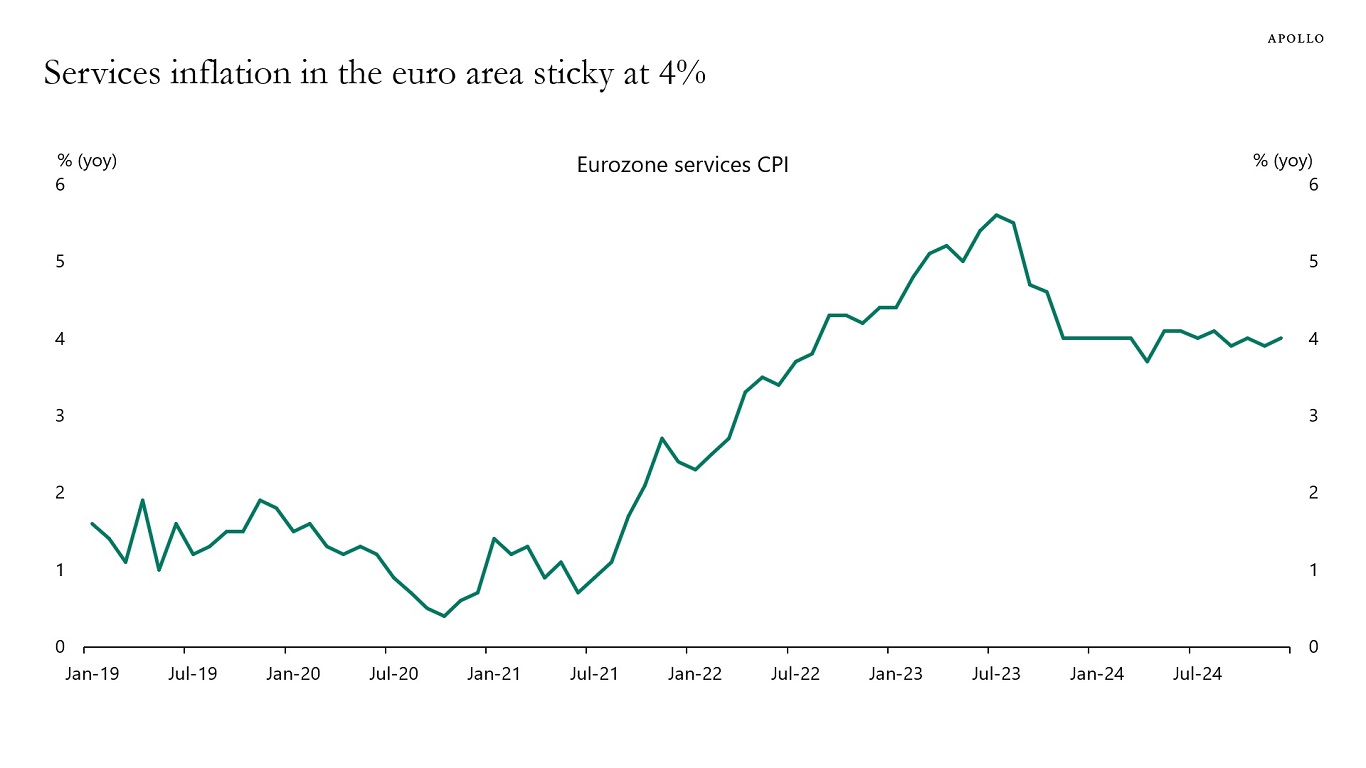

Services inflation in the euro area is sticky, driven by labor shortages, solid wage growth, and low productivity. This limits how much the ECB can lower interest rates, even with weaker overall growth, see chart below.

Source: Eurostat, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

The incoming data continues to show a strong US economy with tailwinds from data center spending, AI spending, defense spending, and government spending via the CHIPS Act, the IRA, and the Infrastructure Act.

Combined with additional tailwinds to growth from high stock prices, high home prices, high crypto prices, Fed cuts, higher animal spirits, and potential Trump policies, the bottom line is that the US economy is entering 2025 on a firm footing.

With GDP currently at 3.1% and core inflation at 3.2%, we continue to worry more about upside risks to growth and inflation.

Our latest chart book with daily and weekly indicators for the US economy is available here.

Note: Filings are for companies with more than $50 million in liabilities. For week ending on January 16, 2025.

Source: Bloomberg, Apollo Chief Economist

Source: Challenger, Gray & Christmas; Haver Analytics; Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Home prices have increased significantly across countries, and it is ultimately a political decision in each country if homeowners are able to tap into the high value of their house.

Home equity release products allow homeowners, including retirees, to access their equity to improve their standard of living and have the potential to help households through significant financial shocks.

These products are broadly categorized as reverse mortgages, home reversion, and sell and rent back.

The US and UK are the largest markets for reverse mortgages; home reversion is popular in France, Germany, Italy, and Poland; and sell and rent back is prevalent in Australia, the Netherlands, and the UK.

Source: OECD, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

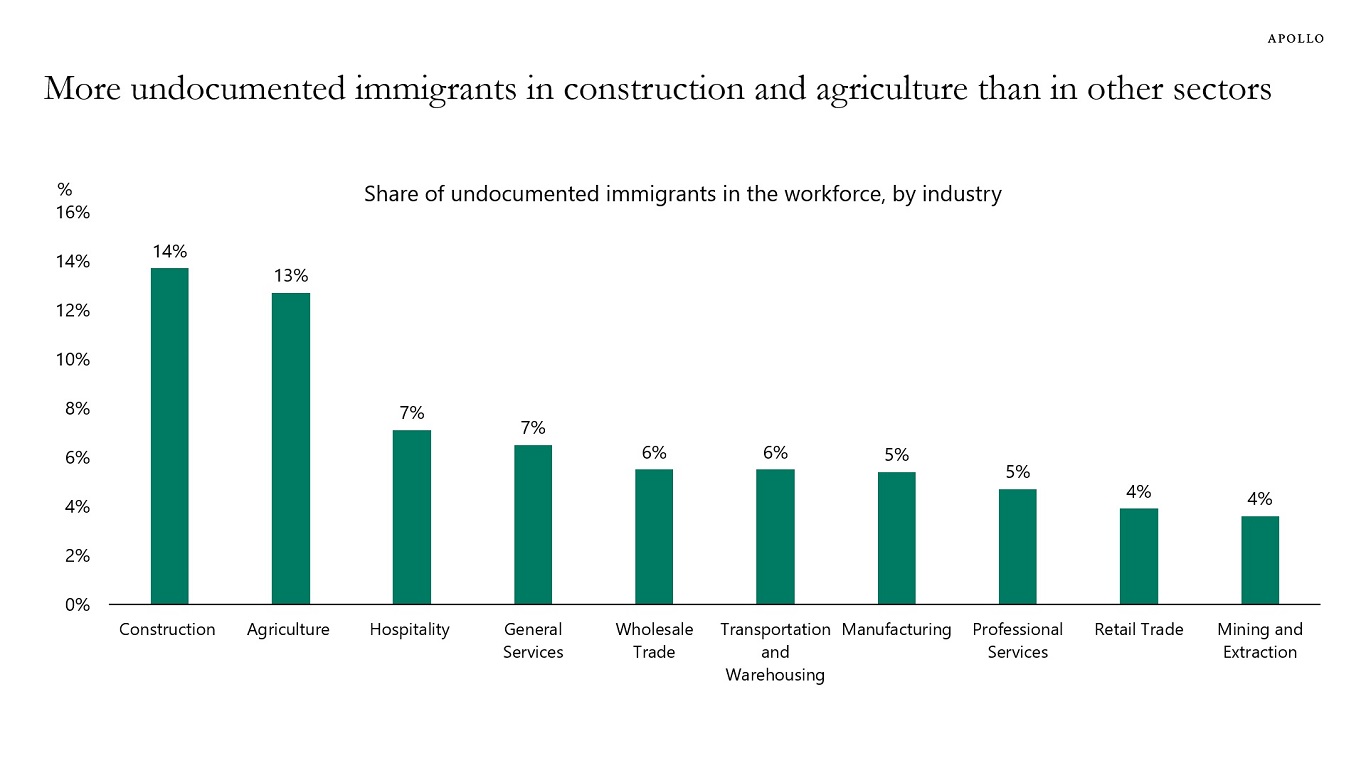

The two industries with the largest percentage of undocumented workers are construction (14%) and agriculture (13%), see chart below.

Source: American Immigration Council analysis of the 2022 1-year American Community Survey, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

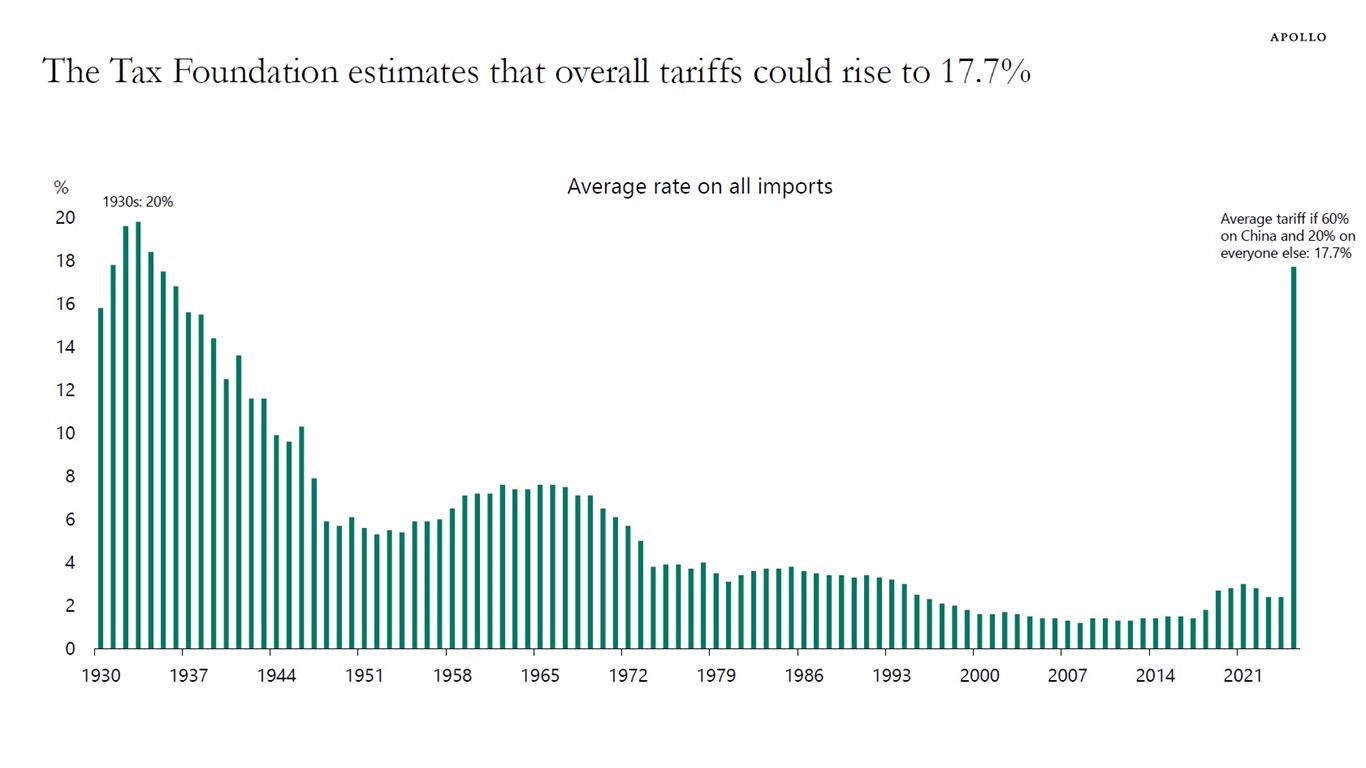

The Tax Foundation estimates that if 60% tariffs are imposed on China and 20% on everyone else, the average tariff rate will increase to 17.7%, see chart below.

With imports making up 14% of GDP, the impact will be a jump in inflation, potentially as high as 0.5 percentage points.

With core PCE inflation already too high at 2.8%, significantly above the Fed’s 2% inflation target, this could force the Fed to raise interest rates again.

Note: The 17.7% figure represents a weighted average of the proposed tariffs, a universal 20% tariff on all imports and an additional 60% tariff on Chinese goods. These tariffs are applied to the current import values, and considering the share of imports from China, the average rate for 2025 has been estimated. Source: Tax Foundation, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

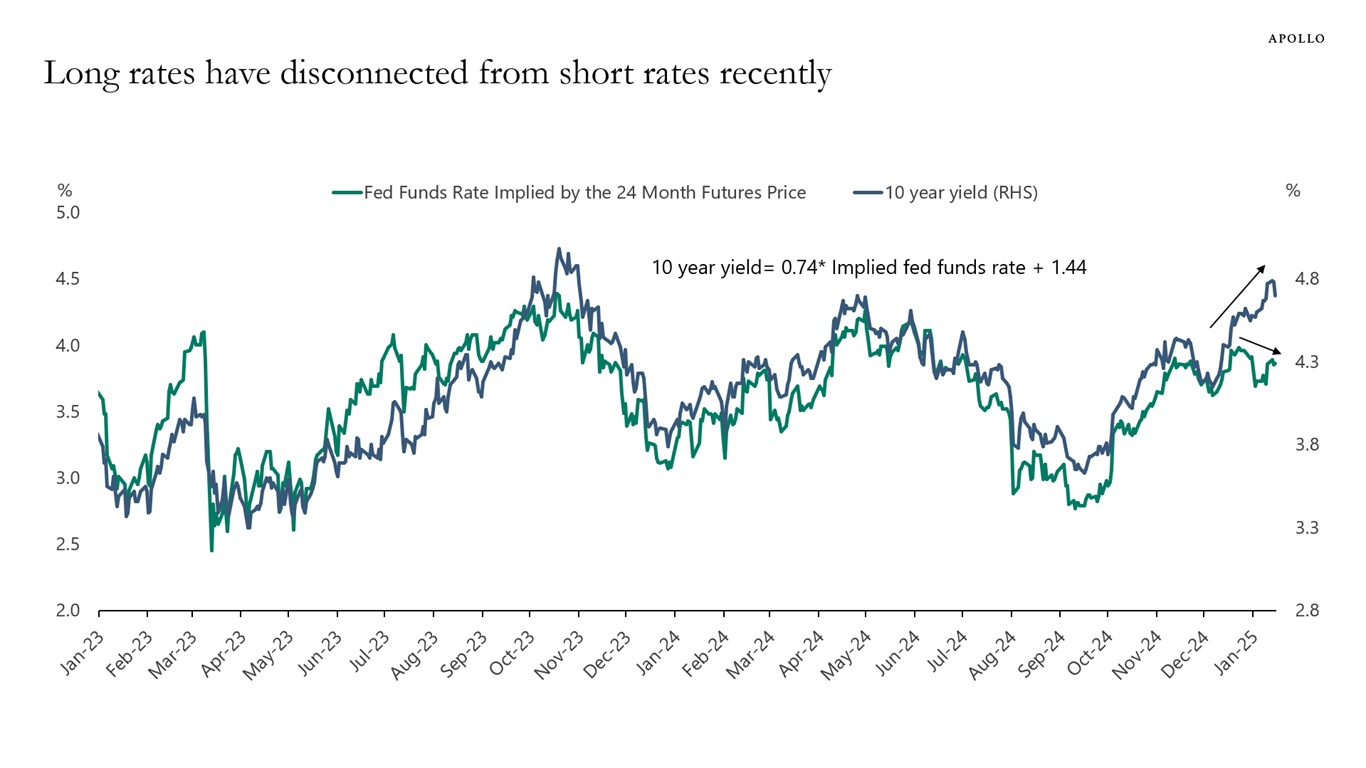

Long-term interest rates have disconnected from Fed expectations, and a simple model of the relationship shows that 10-year rates are now 40 basis points higher than what Fed expectations would have predicted, see chart below.

The rise in long rates above and beyond what has happened with Fed expectations is consistent with the observed increase in both the New York Fed’s measure of the term premium and the San Francisco Fed’s measure of the term premium.

The worry in markets is that the additional premium in long-term interest rates is driven by fears about fiscal sustainability.

Source: Haver Analytics, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.