Want it delivered daily to your inbox?

-

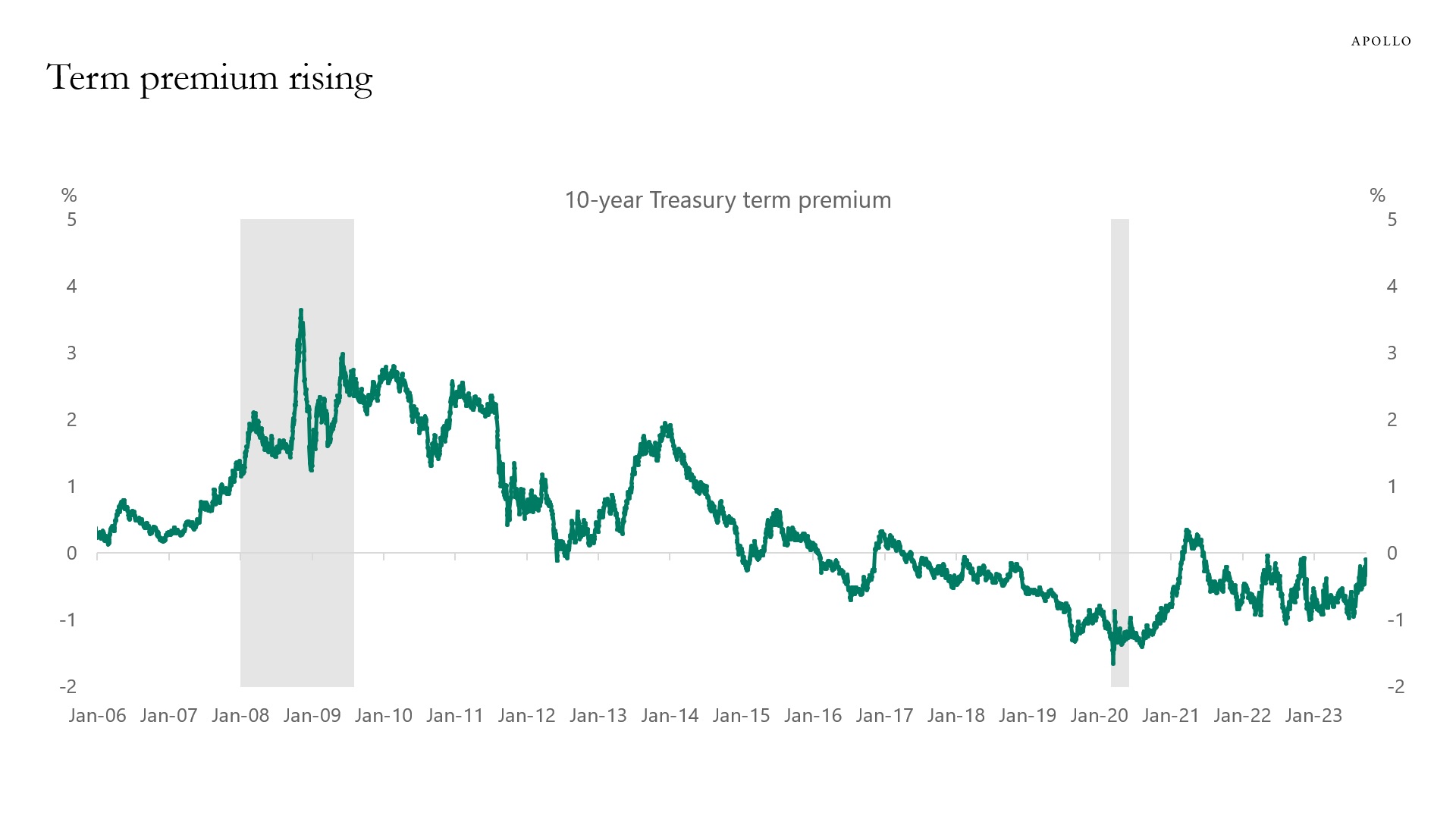

There is something weird going on in US government bond markets, and the relentless increase in long-term interest rates is quite ominous for the economy, and perhaps also for financial stability.

We are late in the cycle, and Fed hikes are biting harder and harder on consumers and firms. Stock markets see the negative effects of tighter monetary policy, and equities are trading lower. But long-term interest rates should be going down, not up.

So what is going on?

With the term premium accounting for the entire move in long rates since July, we know that the source of higher long-term interest rates is not Fed expectations.

If the move is not driven by changing Fed expectations, what are then the reasons why long rates are moving higher? There are several potential explanations:

1) First, with declining repo it could be an unwind of the basis trade that is pushing long rates higher, somewhat similar to what happened in March 2020. This has been getting a lot of attention, and maybe conditions for getting repo are tightening.

2) Another potential explanation is the slowing growth in China, which means that China is recycling fewer dollars into Treasuries because of declining Chinese exports.

3) Rates may also be moving higher because of the Fed still doing QT. Remember, the entire goal with QT is to put upward pressure on government bond yields.

4) The US budget deficit remains big at 6% of GDP, which requires more Treasury issuance today and in the future, and investors may be reacting to that.

5) The US sovereign downgrade has likely had a negative impact.

6) Japan exiting YCC has put upward pressure on JGB yields, which, despite high hedging costs, makes US yields less attractive.

7) There is a large stock of T-bills outstanding, and the Treasury intends over the next six months to increase auction sizes across the Treasury curve.

No matter which explanation is more important, it is clear that the spike in rates is having a very negative impact on consumers and firms, and the risks of a hard landing are intensifying.

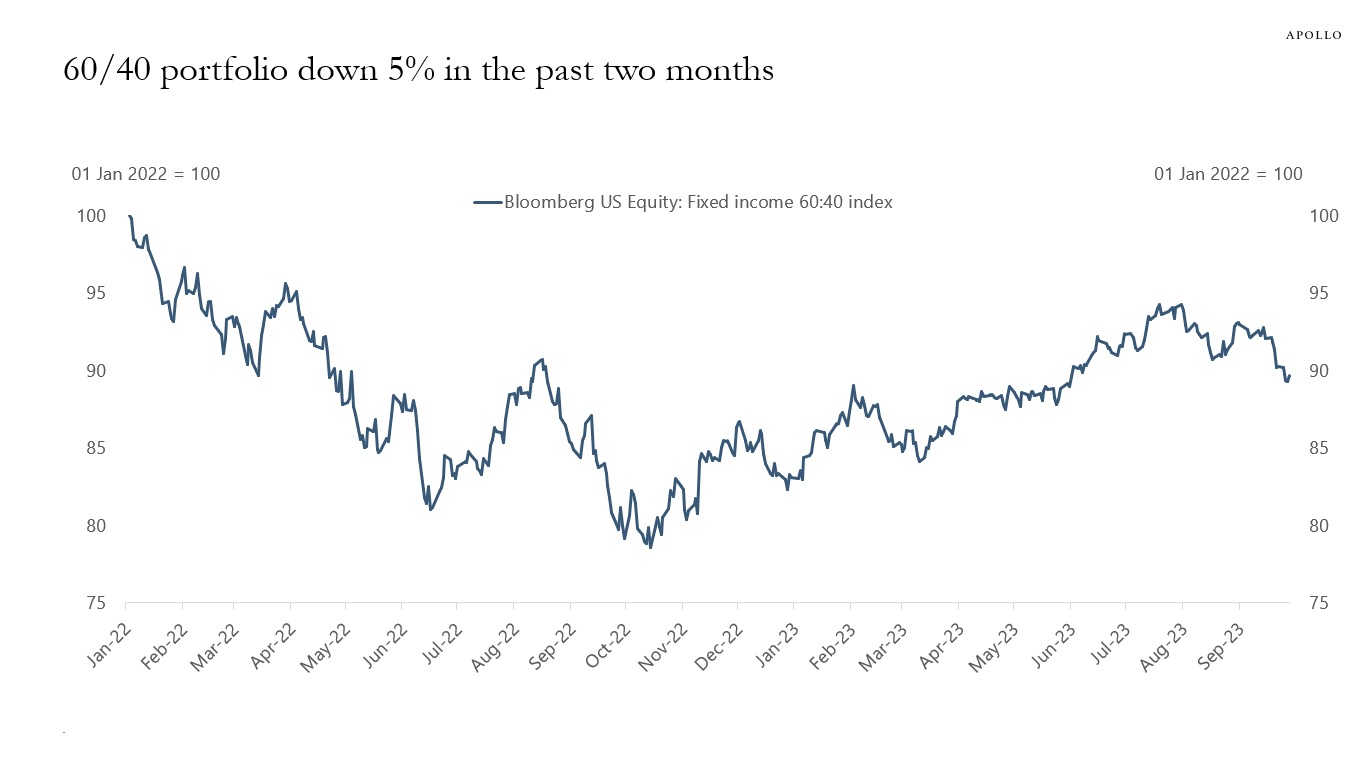

For investors in the 60/40 portfolio, the ongoing volatility in a high rates environment is stomach-churning, see chart below. Over the past two months, the 60/40 portfolio has lost 5%, and with an outlook of high rates and slowing earnings—which is needed to get inflation under control—the outlook for the 60/40 portfolio remains negative.

Source: Bloomberg, Apollo Chief Economist. The Bloomberg US BMA6040 Index rebalances monthly to 60% equities and 40% fixed income. See important disclaimers at the bottom of the page.

-

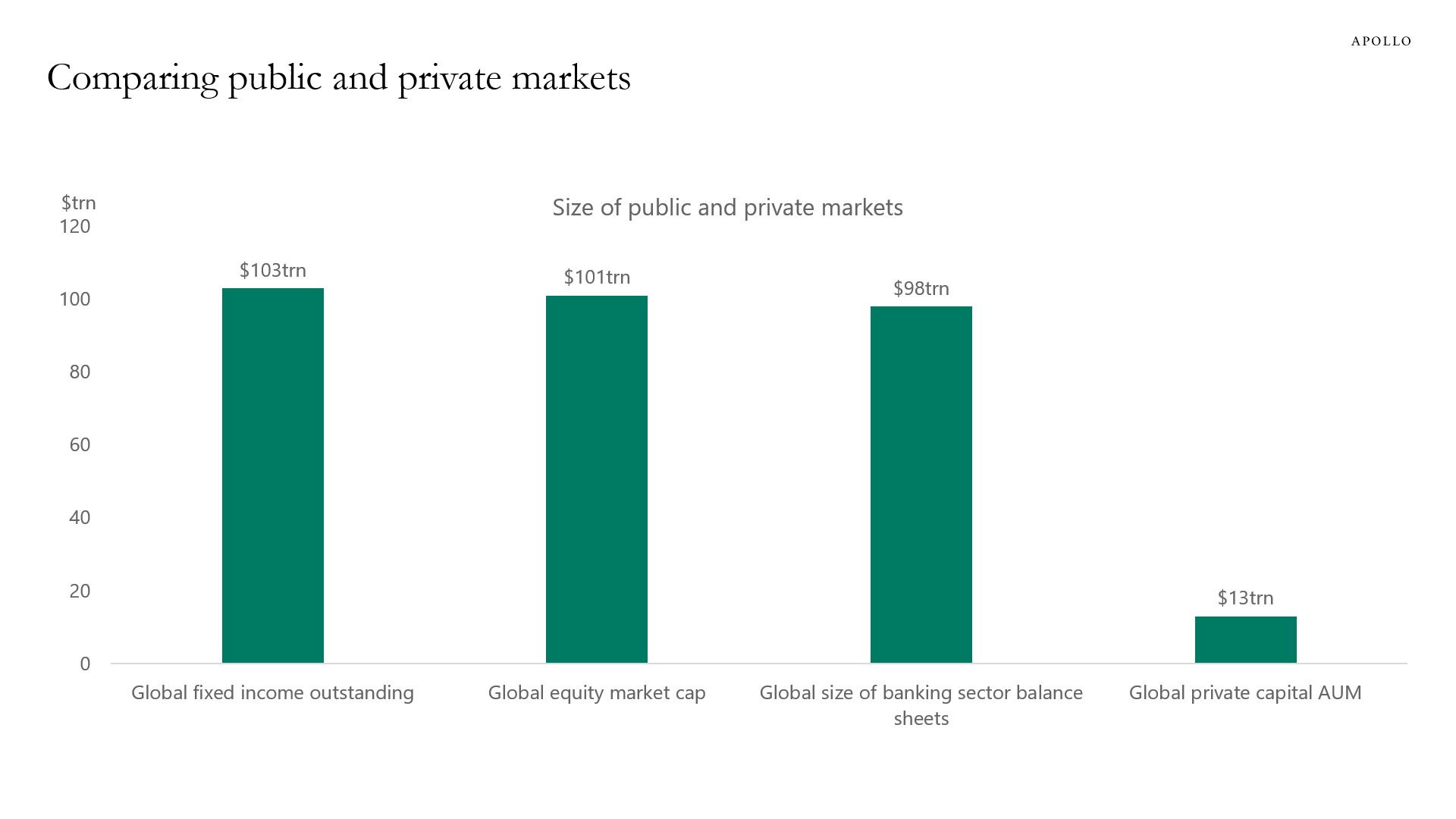

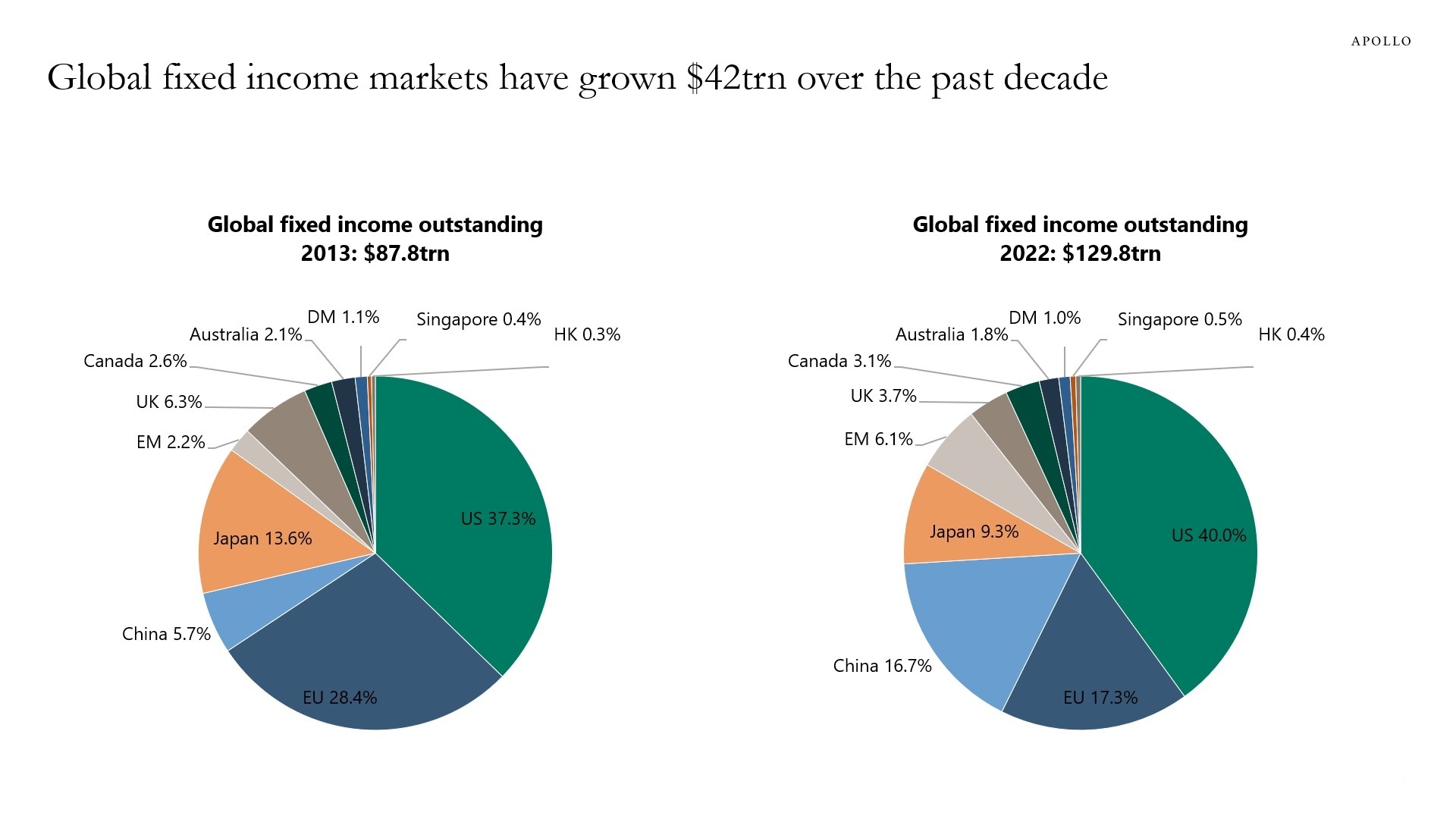

There is $130 trillion in global fixed income outstanding, see chart below.

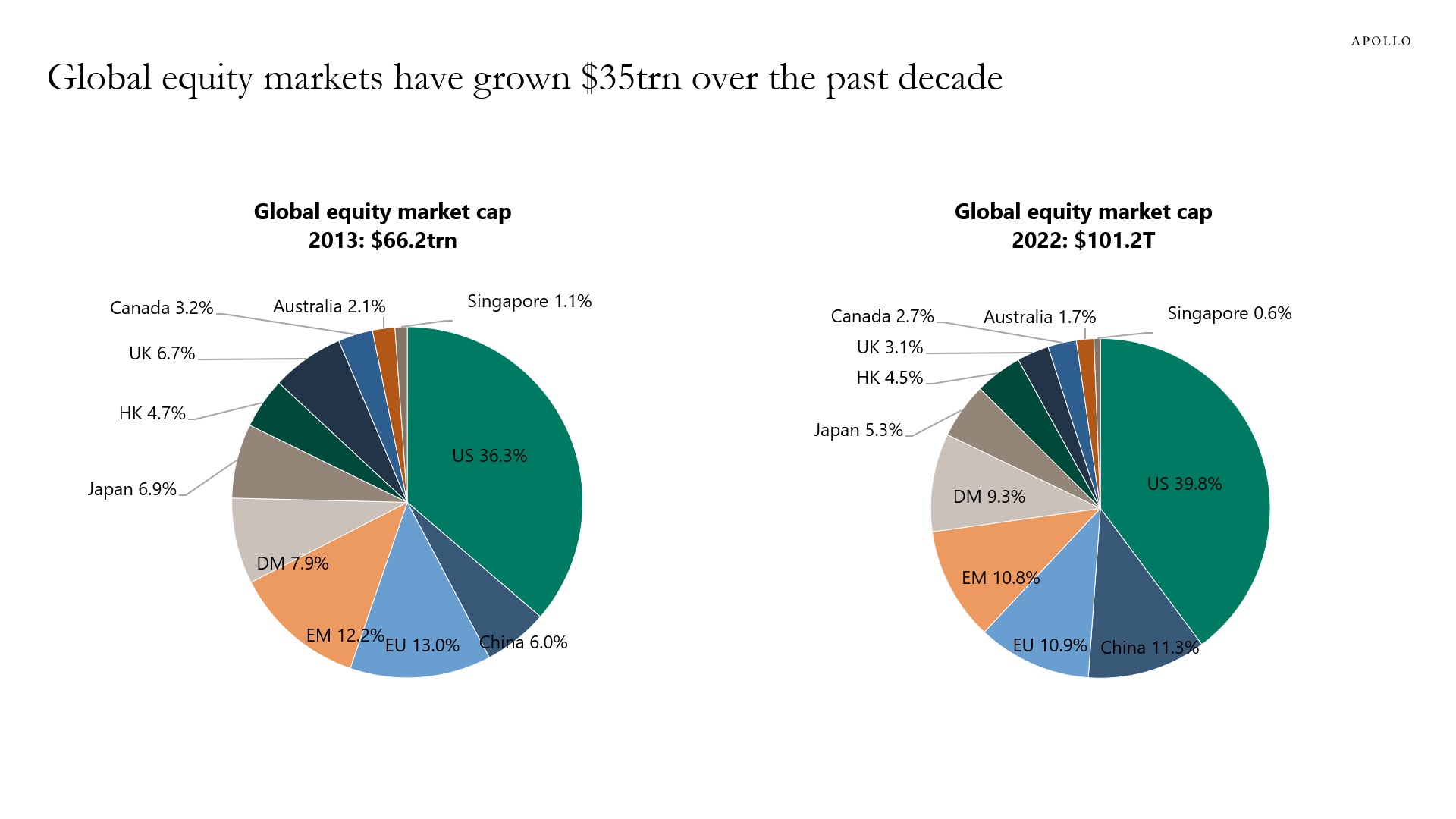

The total market cap of global equity markets is $101 trillion.

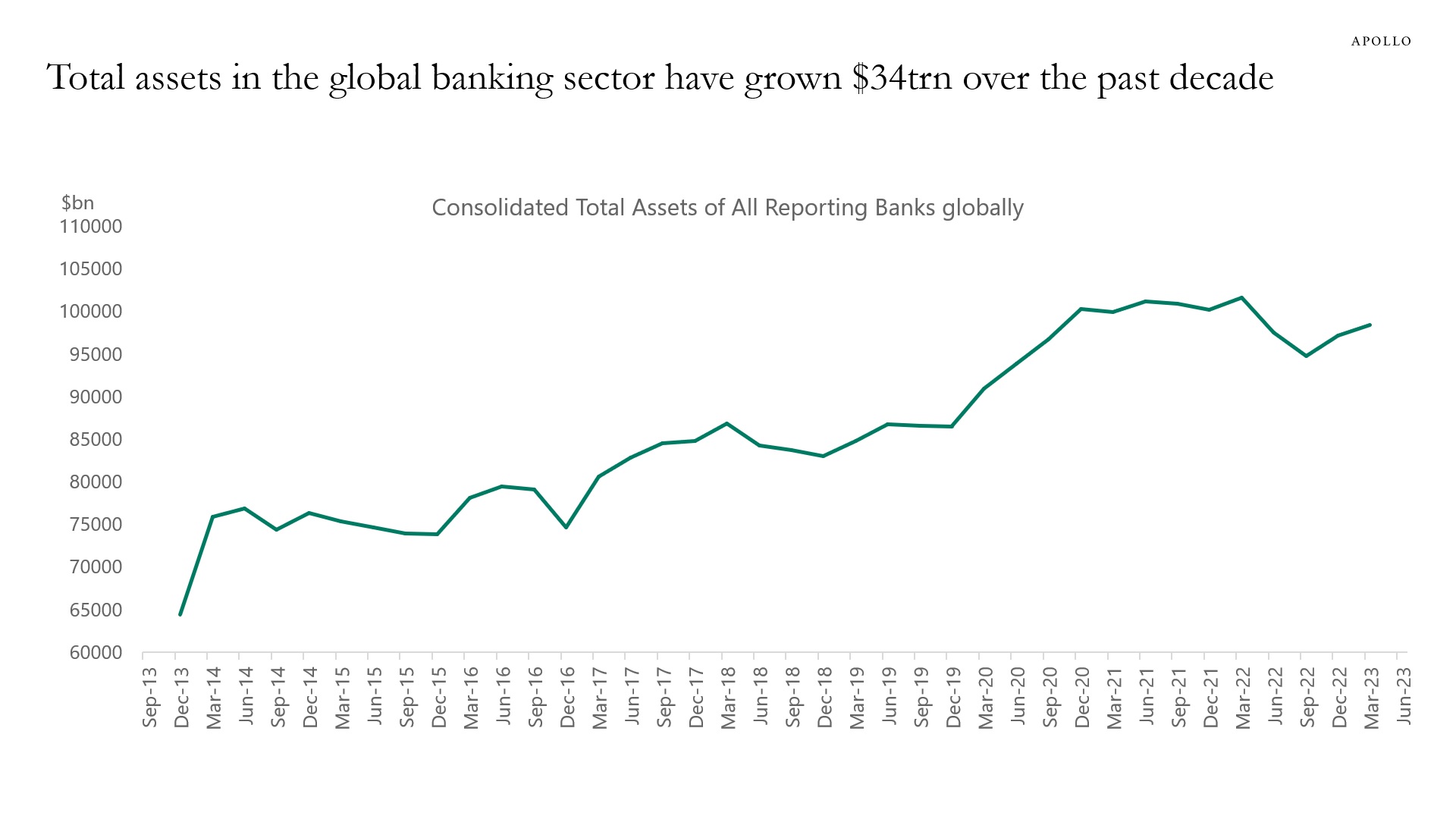

The total value of all assets in the global banking sector is $98 trillion.

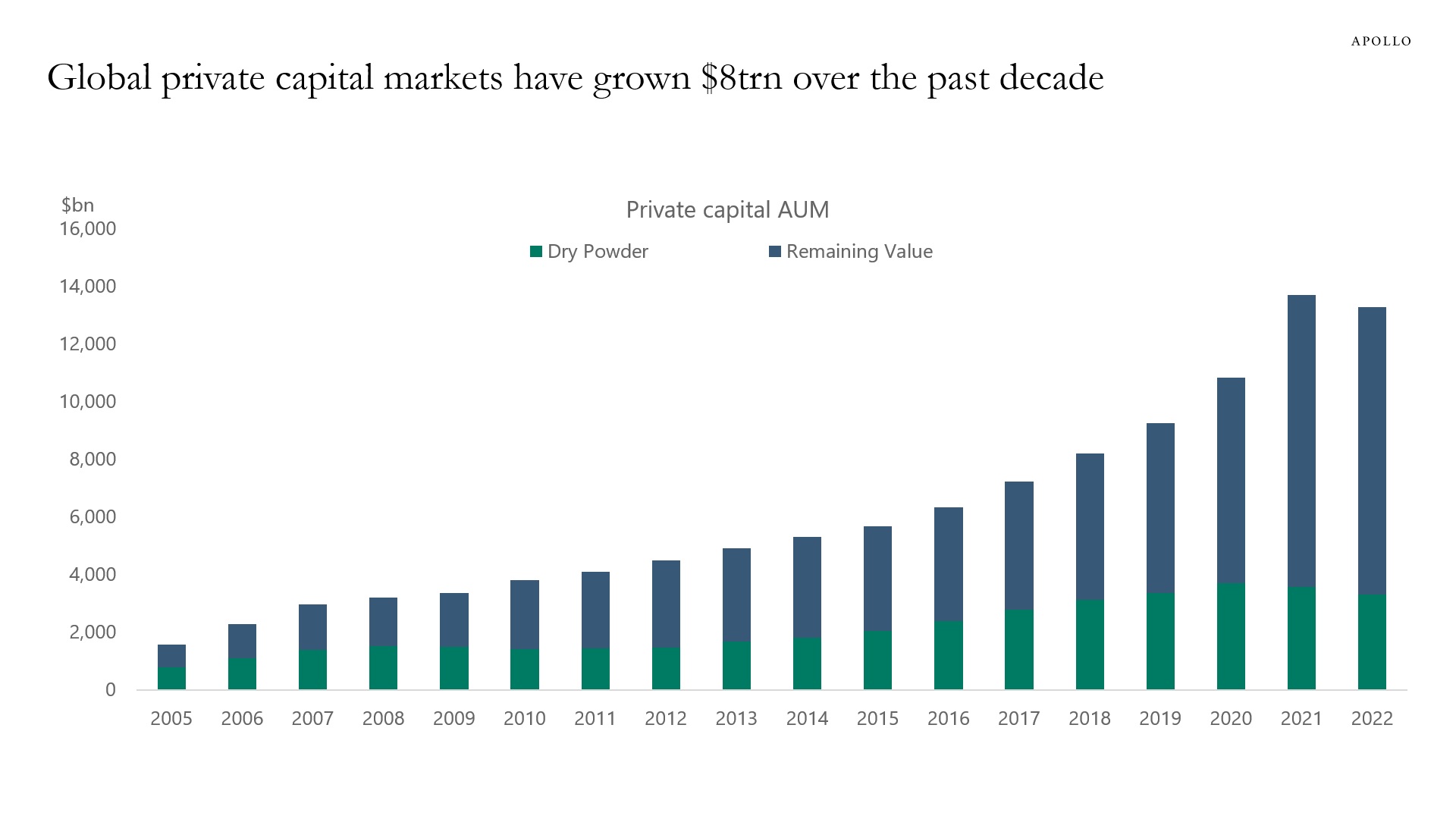

And total global private capital AUM is $13 trillion.

The first conclusion is that private capital makes up less than 5% of global financing markets.

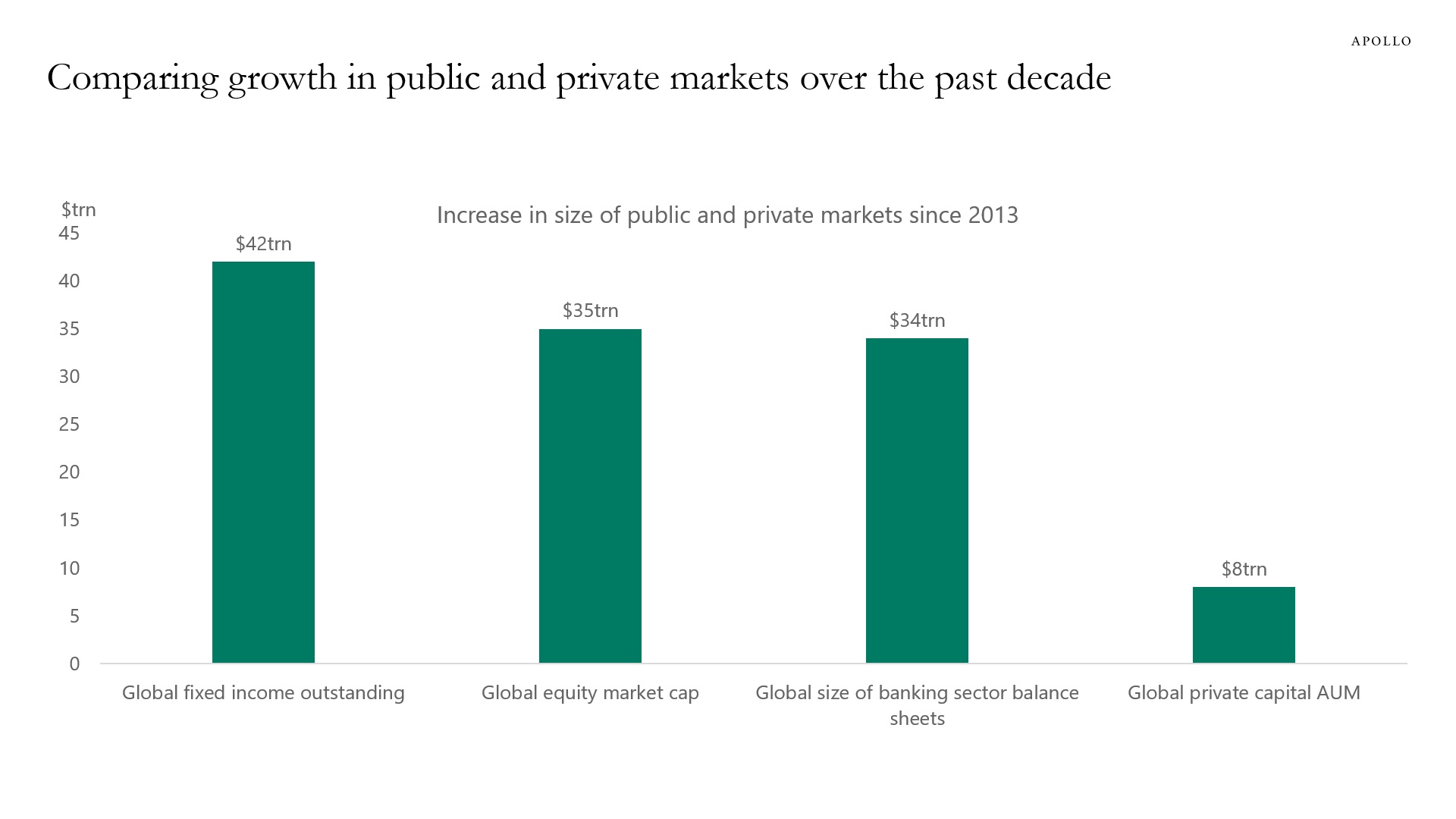

Over the past decade, global fixed income markets have increased $42 trillion, the global equity market cap has increased $35 trillion, global assets on banking sector balance sheets have increased by $34 trillion, and the global amount of private capital AUM has increased $8 trillion, see charts below.

The second conclusion is that private capital has over the past decade grown much slower than global financing markets.

The bottom line is that the alternatives industry is small, and has over the past decade grown much slower than the rest of the financial system.

Our latest outlook for private markets is available here.

Source: SIFMA, BIS, Pitchbook, Apollo Chief Economist. Note: Data as of 2022 and 2023Q2 (BIS data).

Source: SIFMA, BIS, Pitchbook, Apollo Chief Economist

Source: SIFMA, Apollo Chief Economist

Source: SIFMA, Apollo Chief Economist

Source: BIS, Haver Analytics, Apollo Chief Economist

Source: Pitchbook, Apollo Chief Economist. Note: Data as of 31st December 2022. See important disclaimers at the bottom of the page.

-

The term premium is up one percentage point since late July, see chart below showing that the ongoing rise in long rates is driven less by changing Fed expectations and more by:

1) The US sovereign downgrade

2) Japan exiting YCC

3) Fed QT

4) Fewer dollars for China to recycle in a falling exports environment

5) The US budget deficit

6) The large stock of T-bills and the Treasury’s intention to increase auction sizes.

Looking ahead, the real risk to the economy, including financial stability, is if weak economic data doesn’t result in falling long-term interest rates. The Treasury market’s reaction to the employment report next week will be very important and likely set the tone for markets in Q4.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

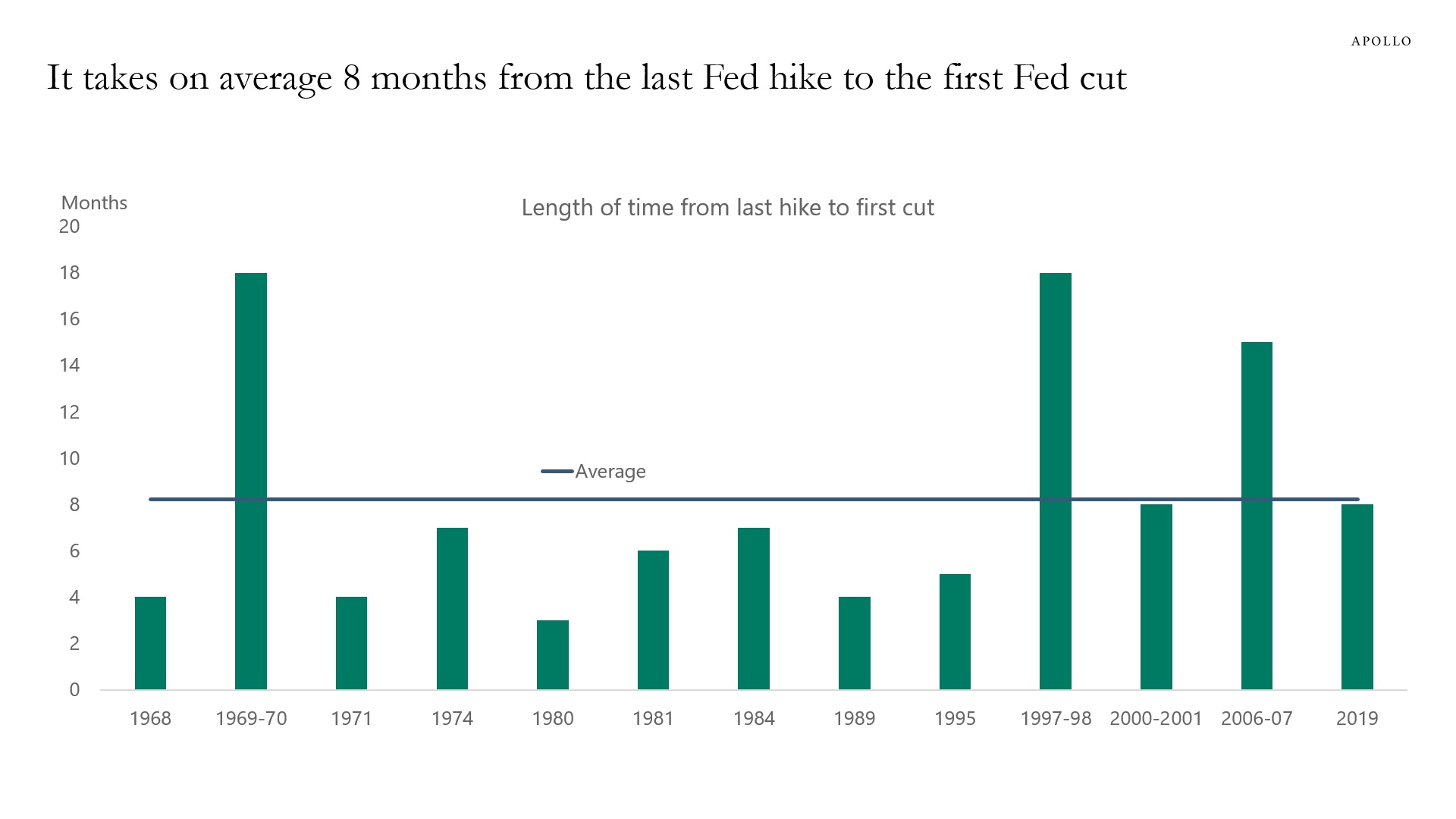

The last Fed hike was in July.

If this was the last Fed hike during this cycle, and assuming it takes on average eight months from the last Fed hike to the first Fed cut, then the Fed will start cutting rates in March 2024, see chart below.

The big difference today is that inflation remains significantly above the FOMC’s 2% target. This may lead the Fed to keep rates high, even if the economic data starts to slow down more meaningfully.

Source: FRB, Haver Analytics, Apollo Chief Economist. Note: Discount rate used before 1988. See important disclaimers at the bottom of the page.

-

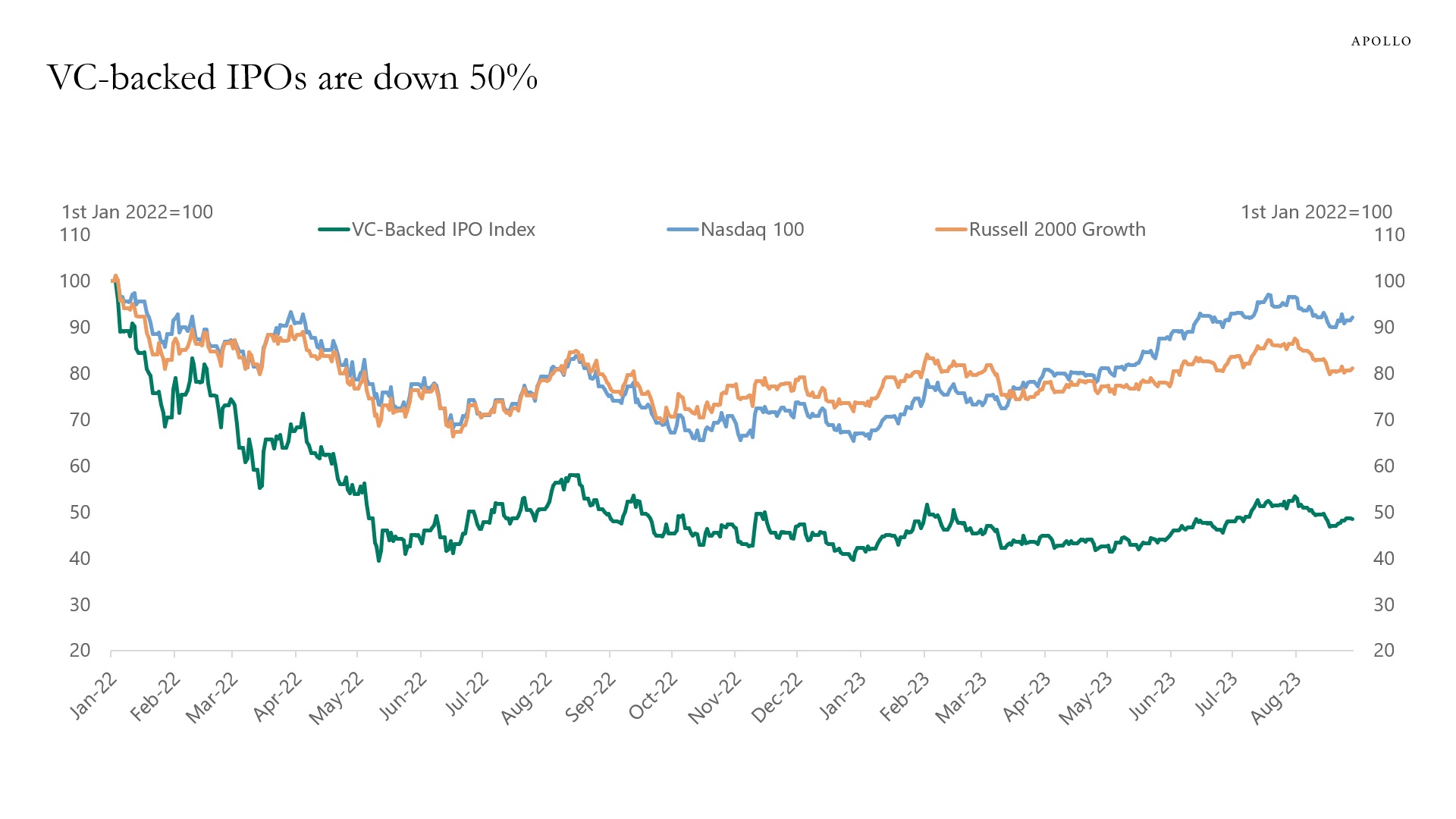

The index of VC-backed IPOs is down 50% since last year when the Fed started raising interest rates, see chart below.

Similarly, Nasdaq 100 and Russell 2000 Growth are down 10% and 20%, respectively.

With interest rates permanently higher, venture capital and growth will likely continue to underperform.

Source: Pitchbook, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

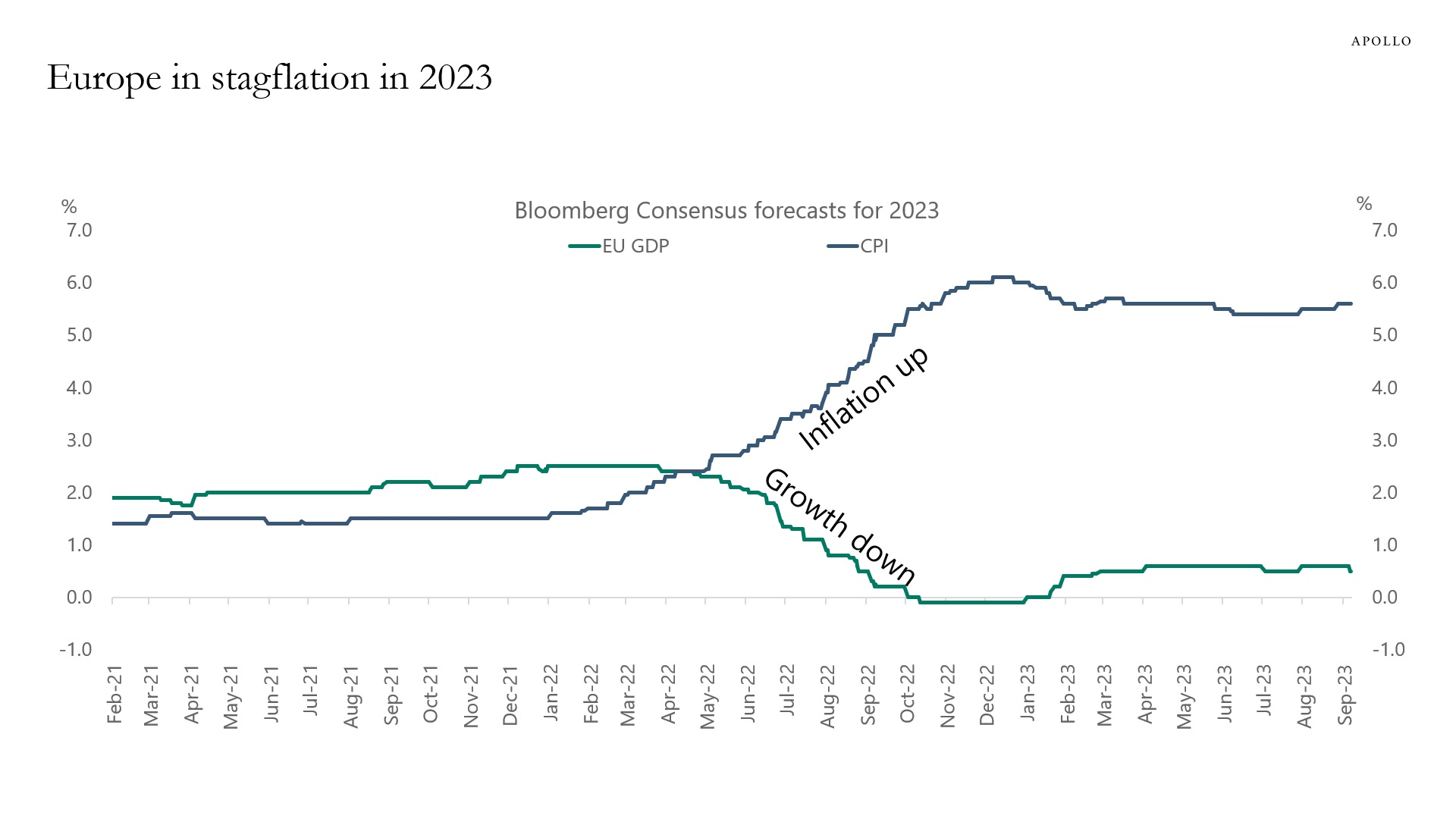

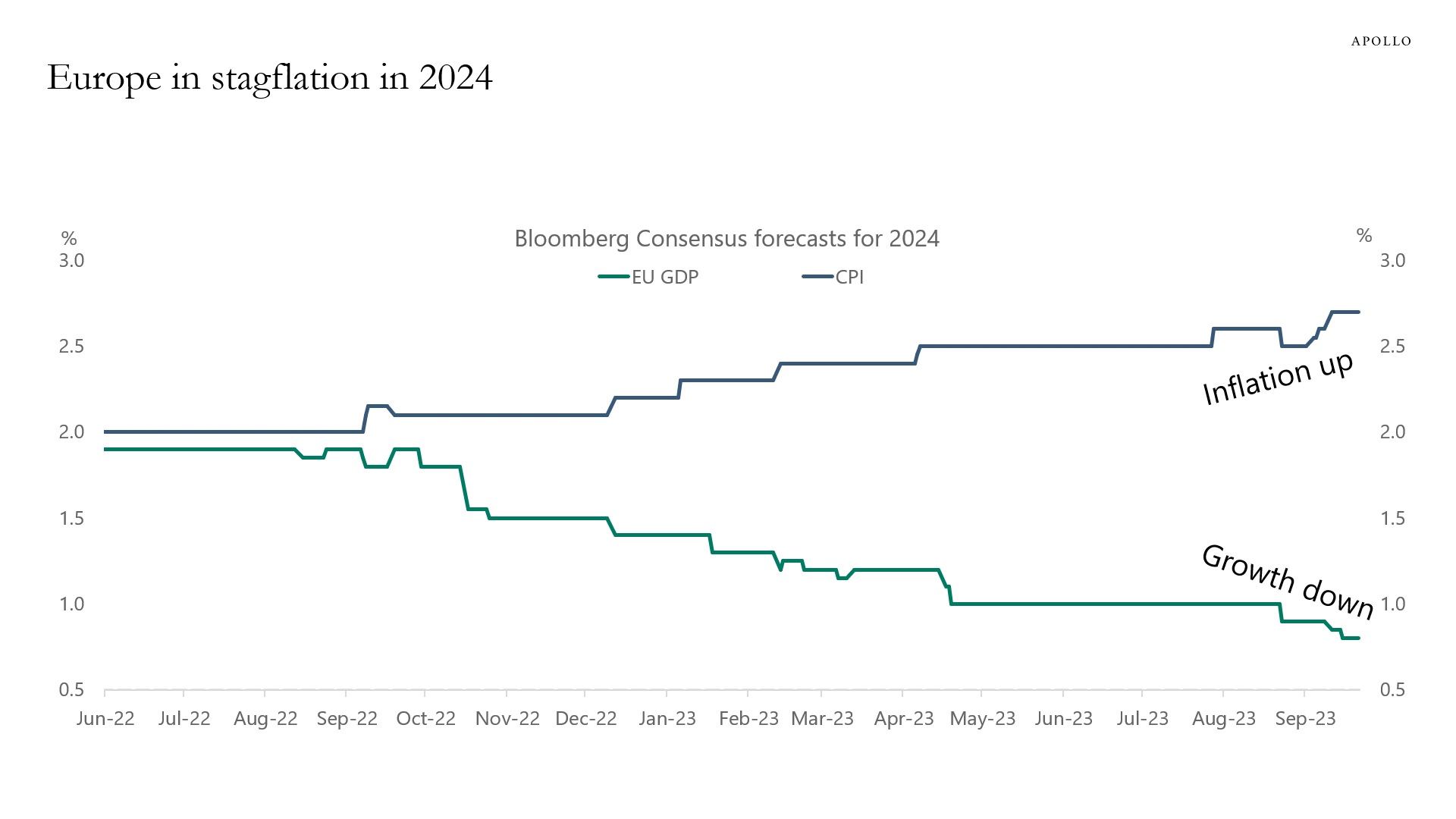

Consensus expectations show that the market is expecting Europe to be in stagflation in 2023 and in 2024, see charts below.

The classic textbook response to stagflation by the central bank is to keep interest rates high until inflation is under control and then wait for growth to eventually restart.

This is also what we should be expecting from the ECB. The implication for markets is high short rates and low growth in earnings.

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

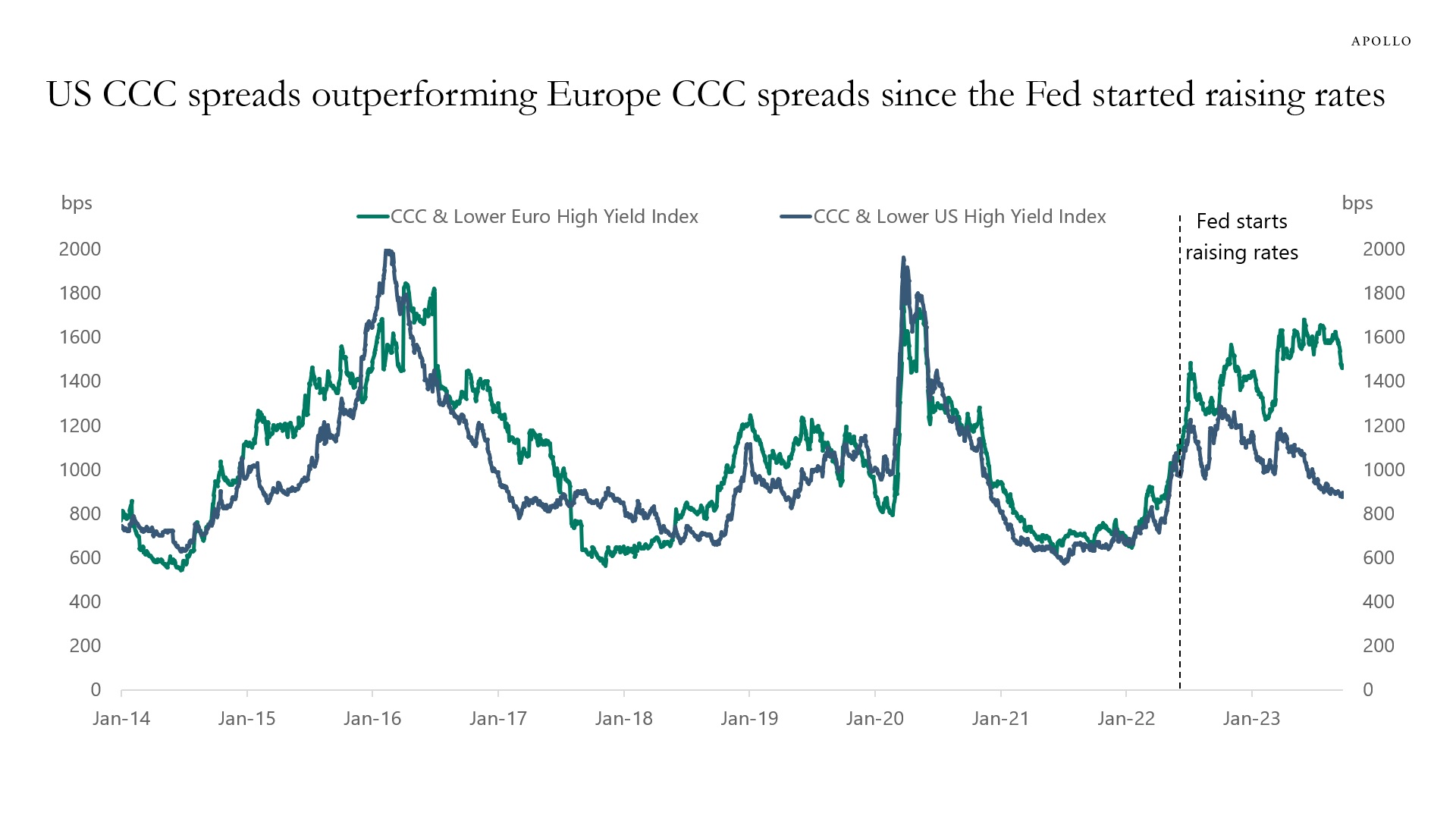

The CCC spread in Europe is normally very highly correlated with the CCC spread in the US. But this relationship has changed after the Fed started raising rates, see the first chart below.

Spreads are currently pricing that Europe will have a recession with many defaults, but in the US, everything is fine.

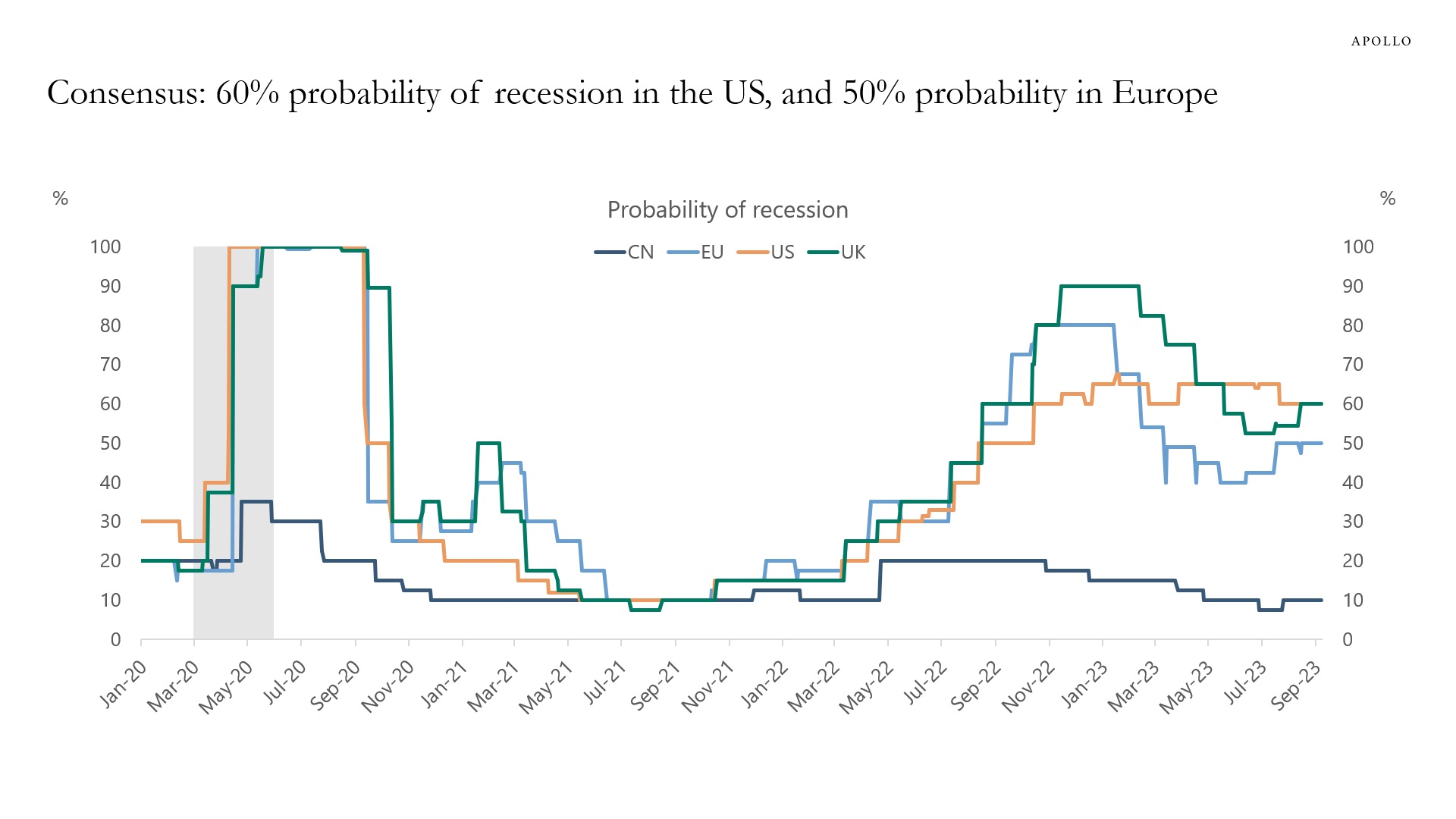

The rally in the US relative to the EU has happened despite the consensus seeing a 60% probability of a recession in the US over the next 12 months and only a 50% probability in Europe, see the second chart.

The bottom line is that there is an inconsistency in pricing of lower-rated corporate credit in the US and Europe. We cannot both have that everything is fine and at the same time we are going into a recession.

The key question is why US credit has rallied so much despite the high recession probability. Given the relationship changed after the Fed started raising rates maybe the reason is what could be called a yield level illusion in US lower-rated credit, where investors focus more on the levels of yields than on the underlying fundamental credit risks of Fed hikes and permanently higher costs of capital.

In short, credit investors today should be asking themselves if spreads are focusing on yield levels or on credit fundamentals.

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

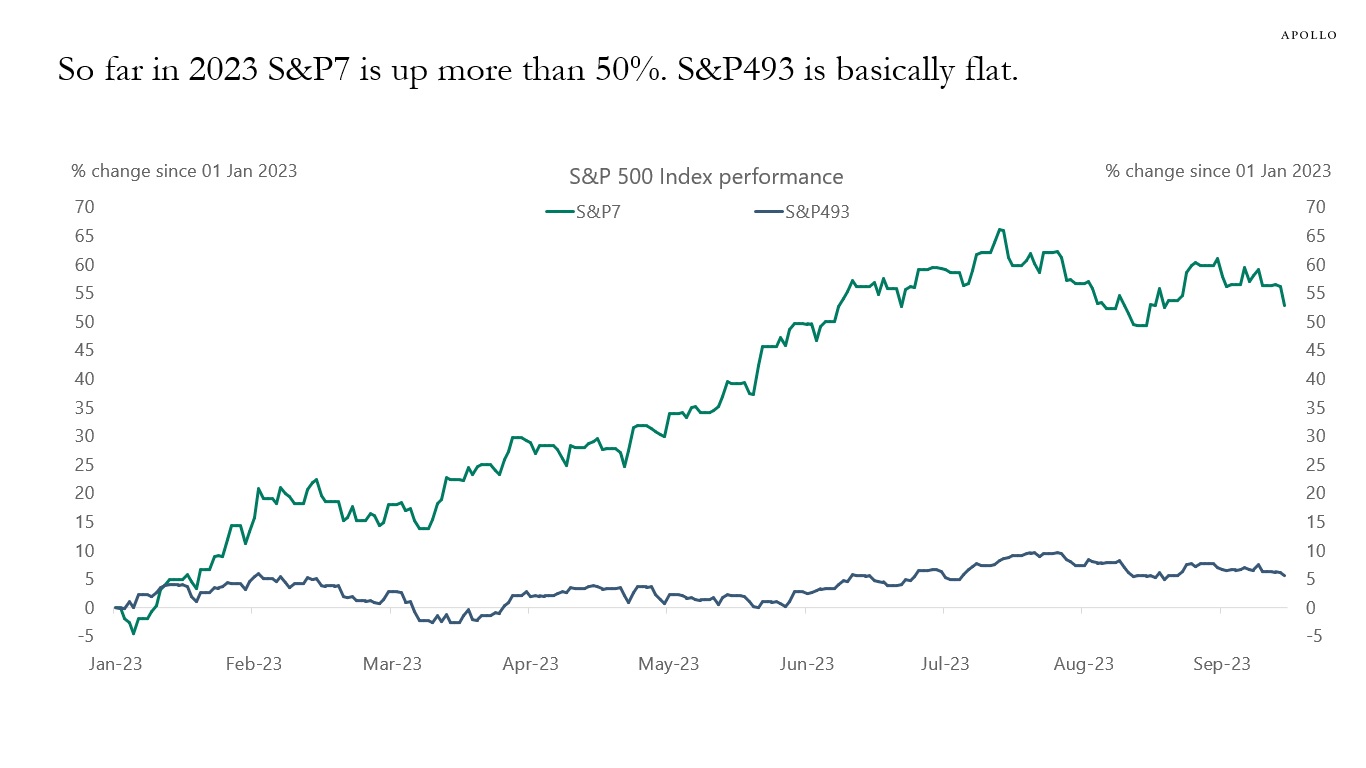

The seven biggest stocks in the S&P500 are up more than 50% in 2023, see chart below.

The remaining 493 stocks are basically flat.

The bottom line is that if you buy the S&P500 today, you are basically buying a handful of companies that make up 34% of the index and have an average P/E ratio around 50.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

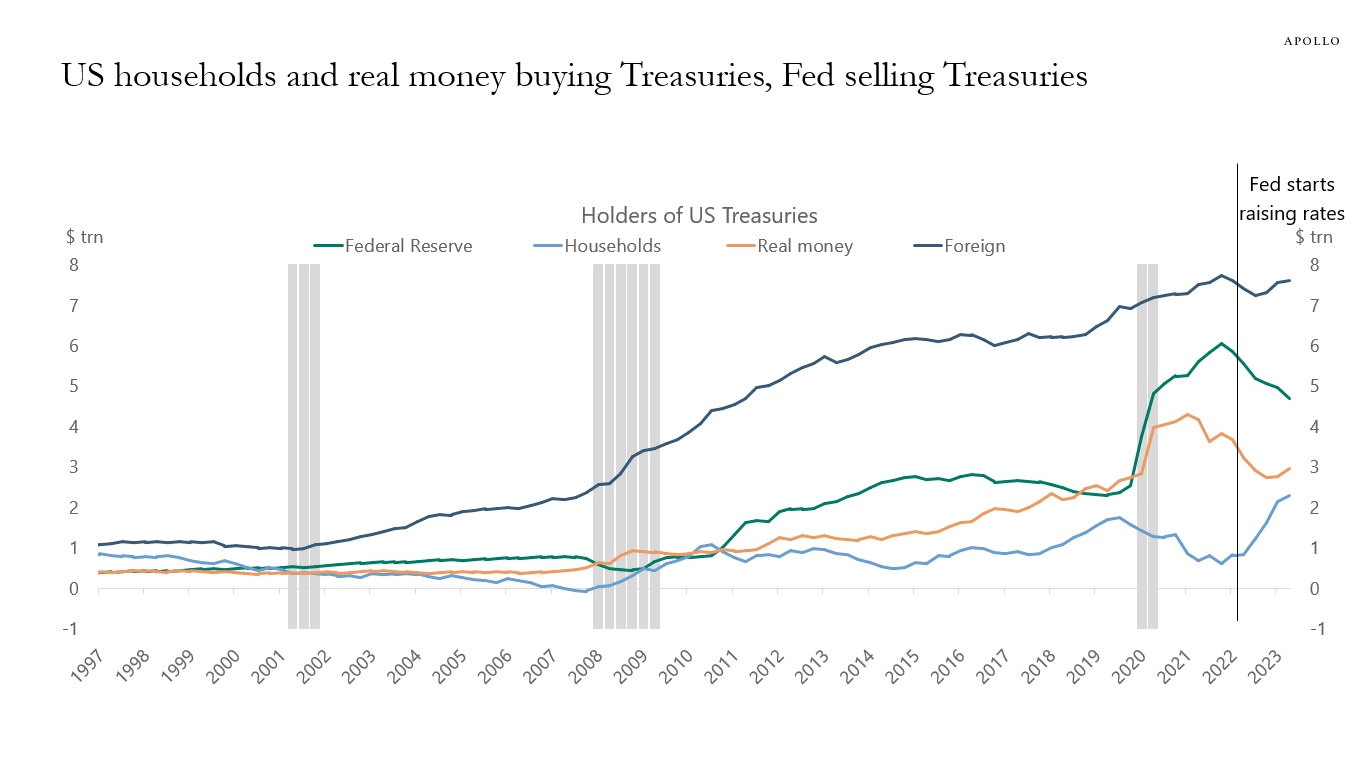

Since the Fed started hiking rates last year, US households have bought $1.5 trillion in Treasuries, and over the past six months, US pension and insurance have also emerged as a buyer, see chart below. Over the same period, the Fed has been doing QT and been a net seller of Treasuries. The bottom line is that US households and real money are finding current levels of US yields attractive.

Source: FFUNDS, Haver, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

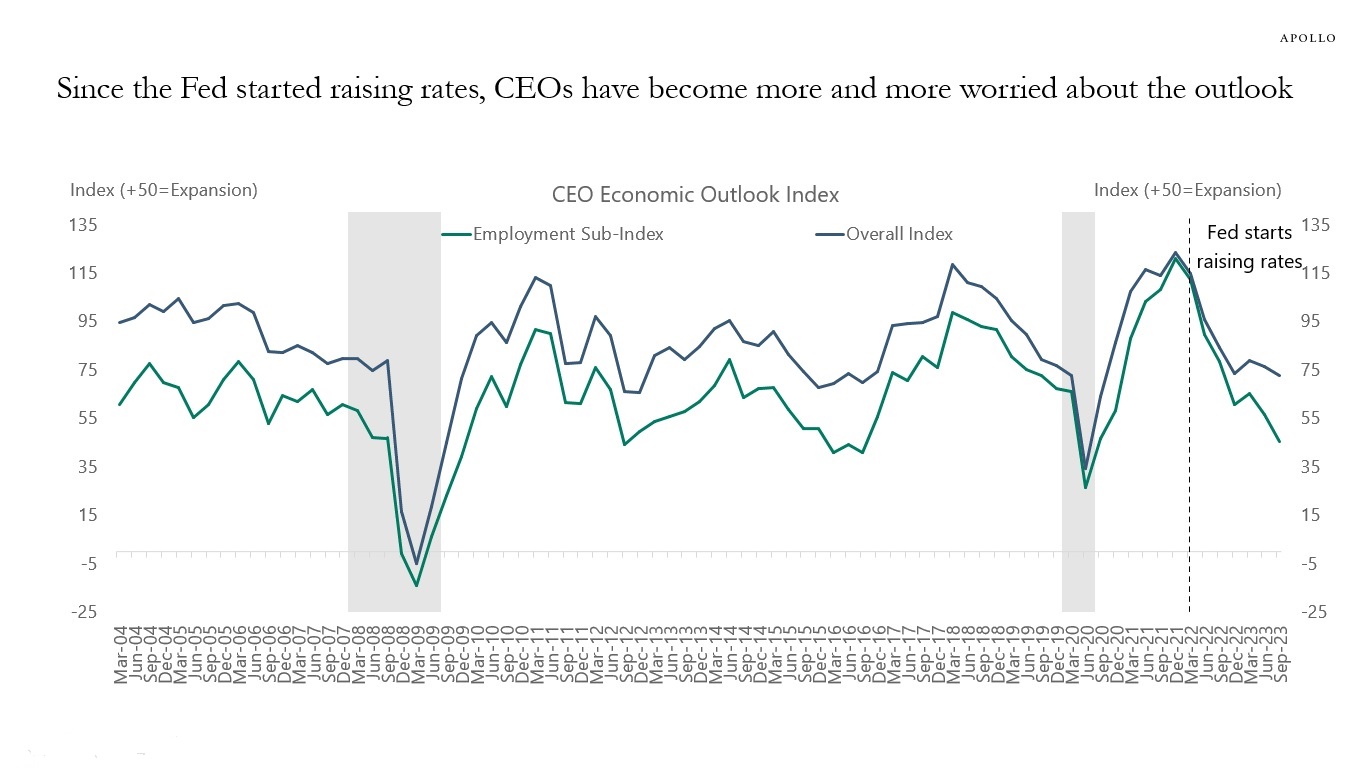

The Business Roundtable CEO survey is designed to provide a picture of the future direction of the US economy by asking CEOs to report their company’s expectations for sales and plans for capital spending and hiring over the next six months.

Since the Fed started raising rates in March 2022, CEOs have gradually worried more and more about the economy slowing, see chart below.

This is how monetary policy works. Higher cost of capital slows down business spending. The decline in the employment sub-index to 2020 levels is particularly noteworthy.

Source: Business Roundtable, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.