Want it delivered daily to your inbox?

-

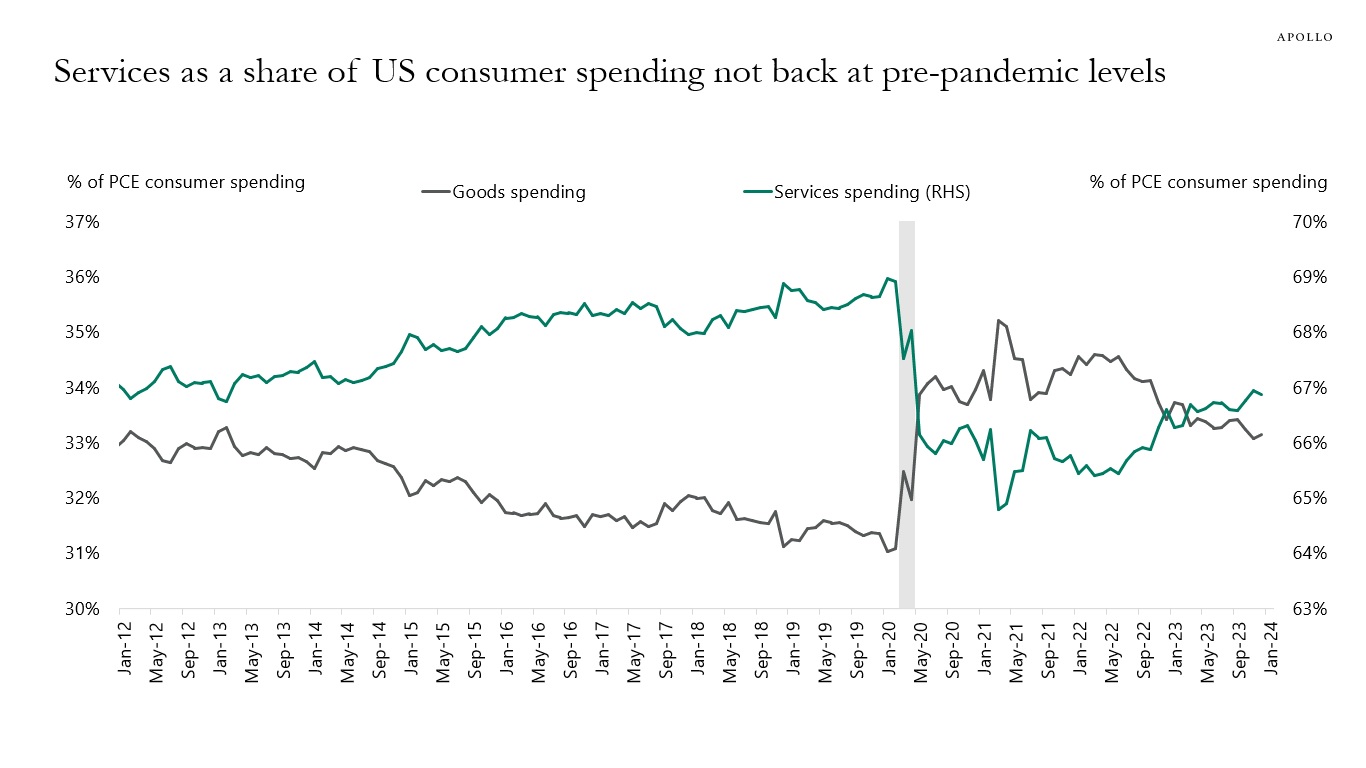

The share of private consumption spent on services is still 2 percentage points below its pre-pandemic level, see chart below.

The implication for markets is that there is still more upside for growth in consumer services, i.e., spending on airlines, hotels, restaurants, concerts, sporting events, etc.

Source: BEA, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

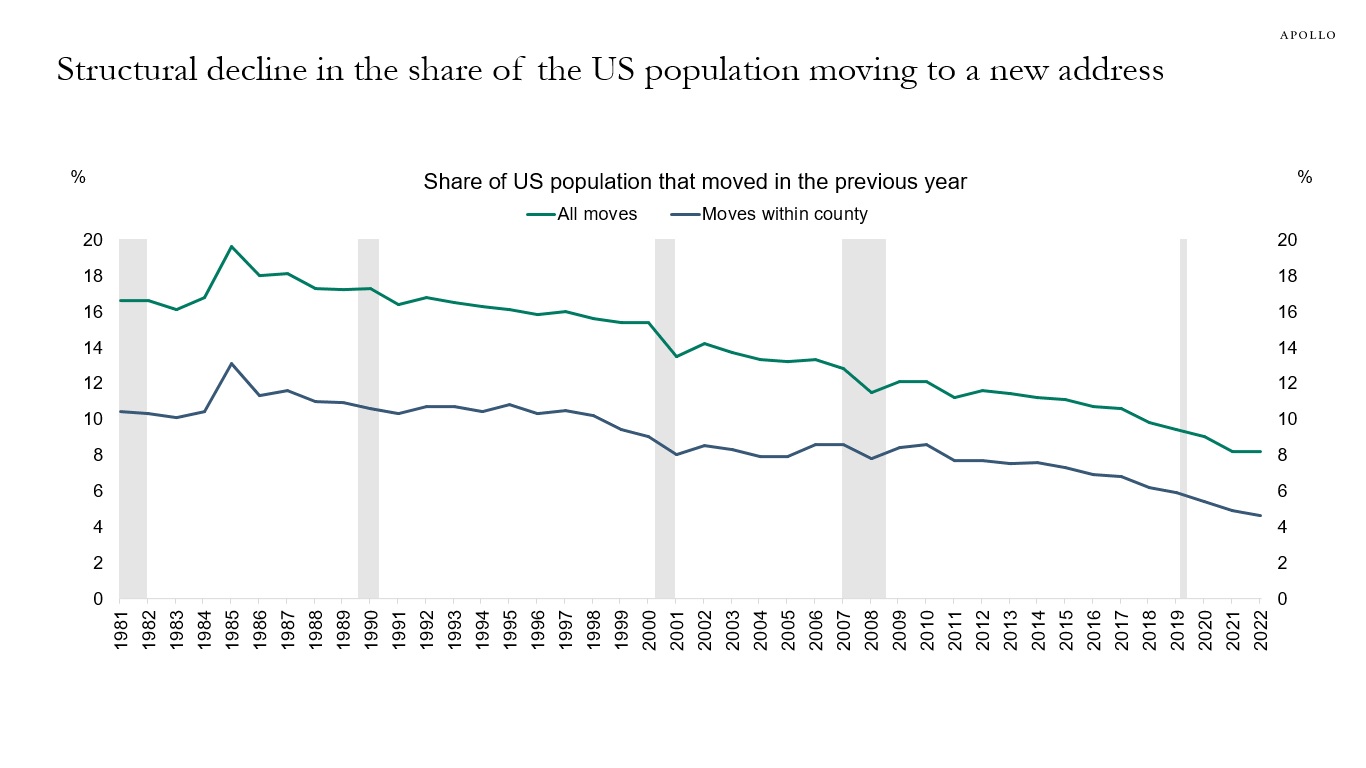

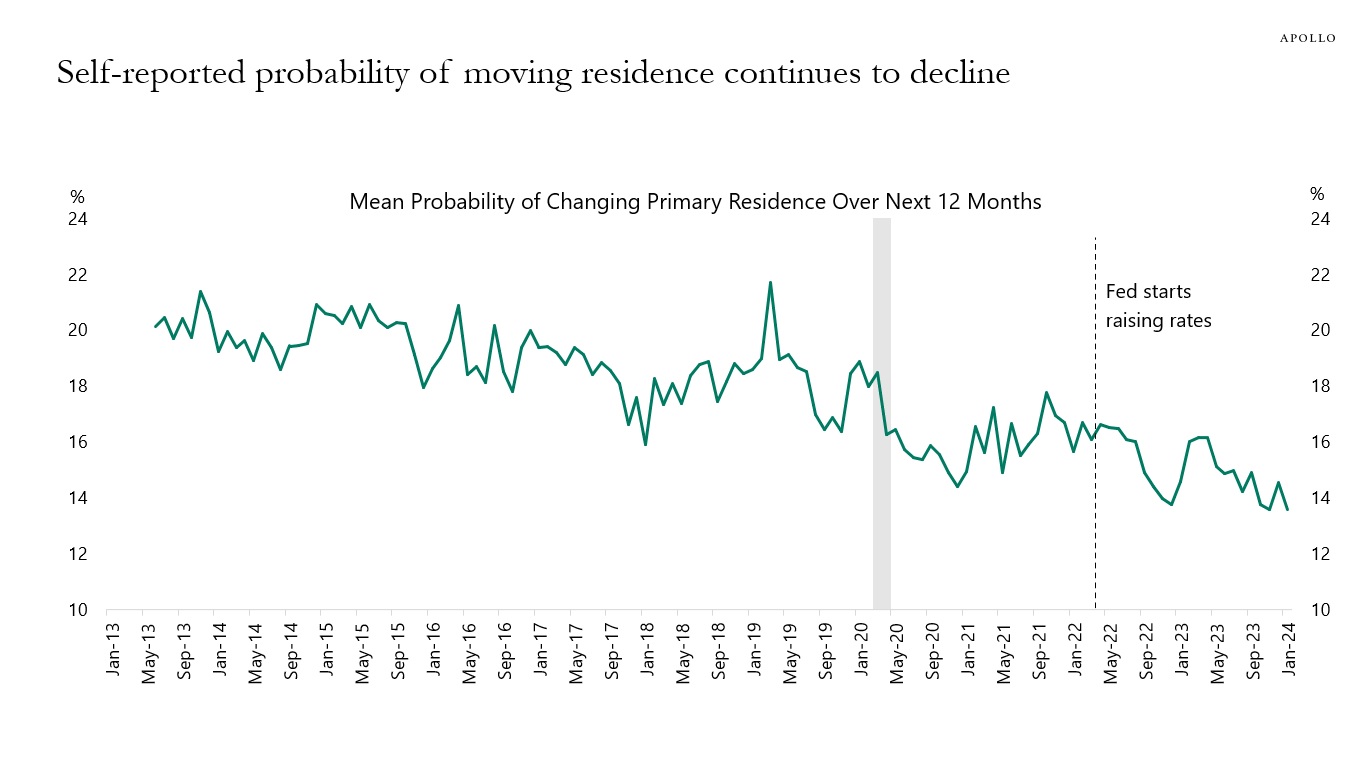

US households are less and less mobile, and after the Fed started raising rates, the self-reported probability of moving residence started trending down again, see charts below.

A less mobile labor force will ultimately have negative consequences for GDP growth because workers with relevant skills do not move to regions with job growth. This is what we see in Europe, where language barriers limit mobility between regions in the euro area.

Source: Census CPS, Apollo Chief Economist

Source: FRBNY, Haver Analytics, Apollo Chief Economist. Note: Data is “self-reported” about the expectation from households. See important disclaimers at the bottom of the page.

-

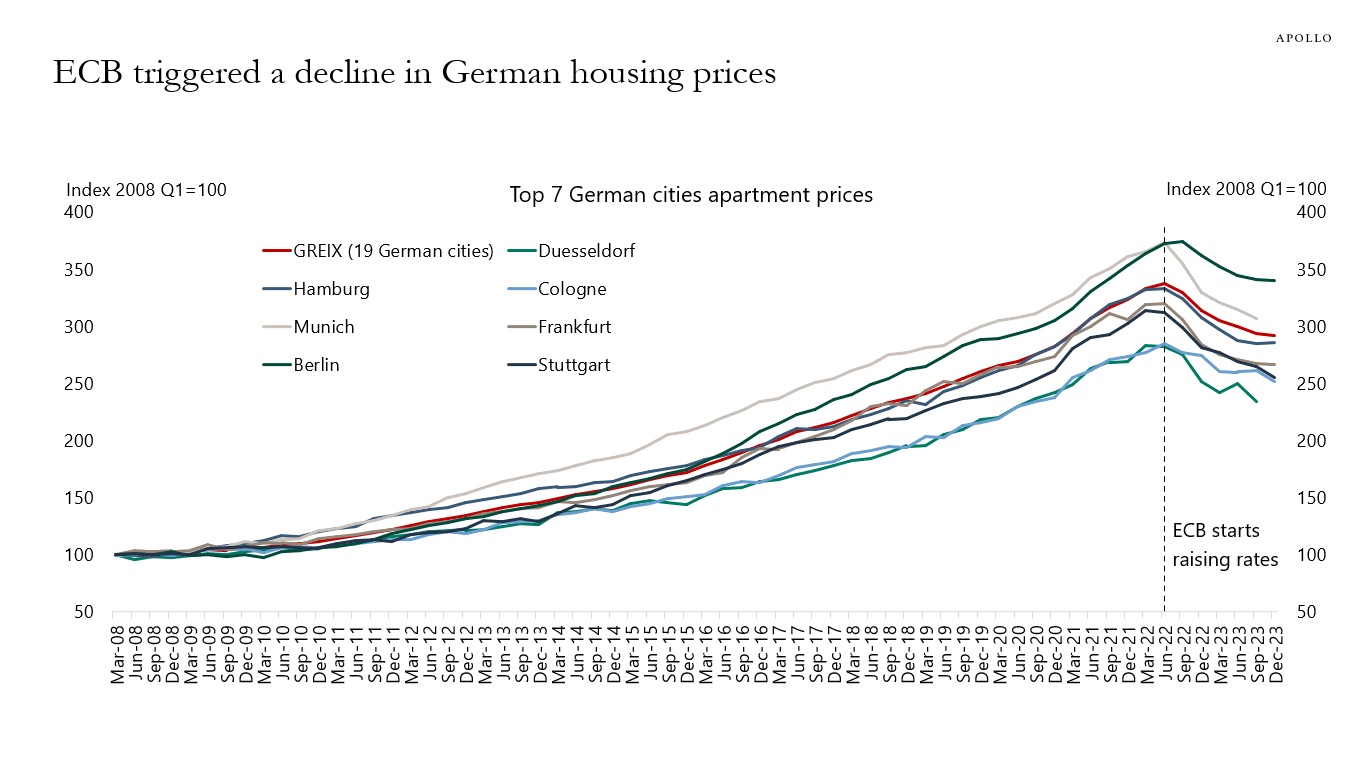

While there are many headwinds to the German economy at the moment, such as lower exports to China, energy transition, and geopolitical risks, it looks like the key driver of falling housing prices in Germany is rate hikes by the ECB, see chart below.

Source: Bonn-Cologne Cluster of Excellence ECONtribute, The Kiel Institute for the World Economy, Apollo Chief Economist. Note: The Greix is a real estate price index for Germany based on the sales price collections of the local expert committees, which contain notarized sales prices. It tracks the price development of individual cities and neighborhoods. See important disclaimers at the bottom of the page.

-

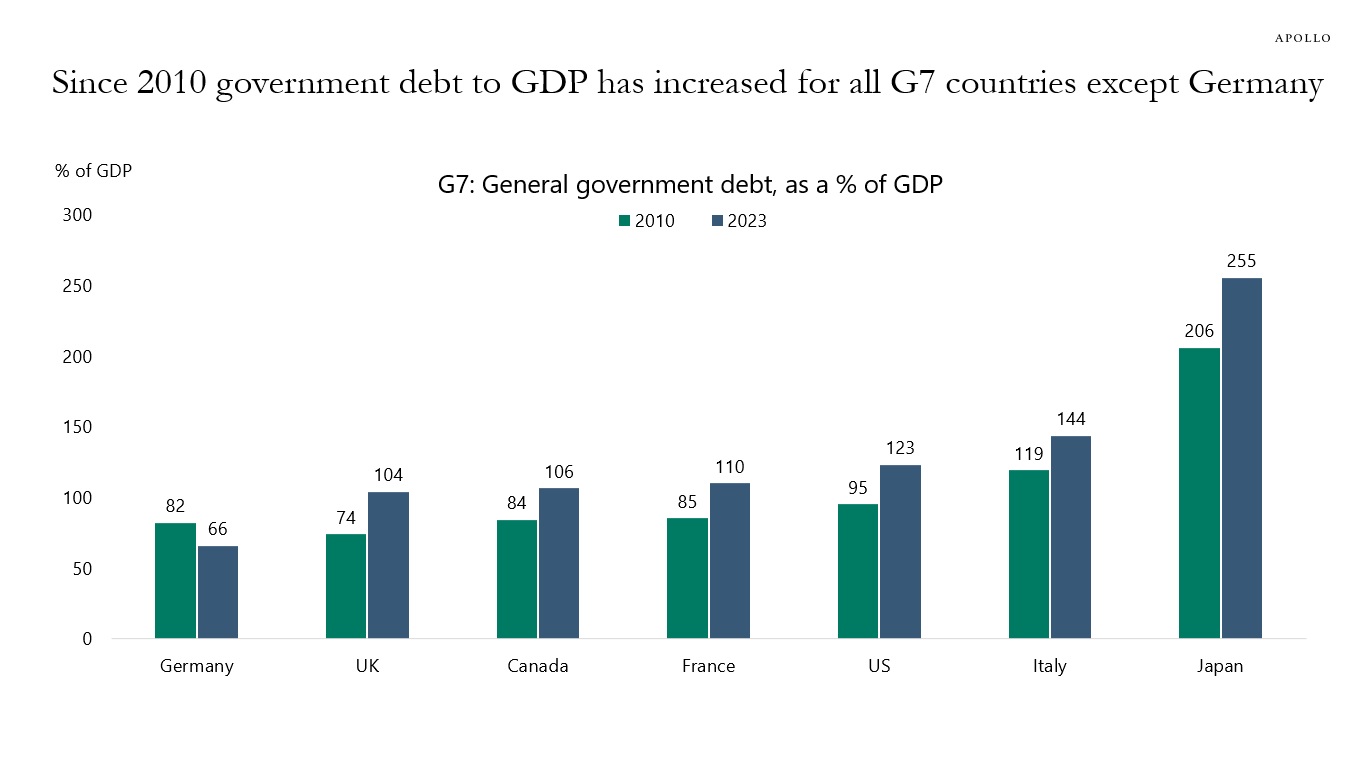

Government debt levels continue to increase in all G7 countries except Germany, and your finance textbook will tell you that when the stock of risk-free assets grows, it will attract dollars, euros, and yen from other asset classes, including credit and equities, see chart below.

The rapid growth in the stock of risk-free assets outstanding has consequences not only for risky assets. The probability is rising of a fiscal accident with significant implications for markets. Such a crisis could start with a sovereign downgrade, a bond auction with weak demand, or a significant increase in the term premium.

Source: IMF, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

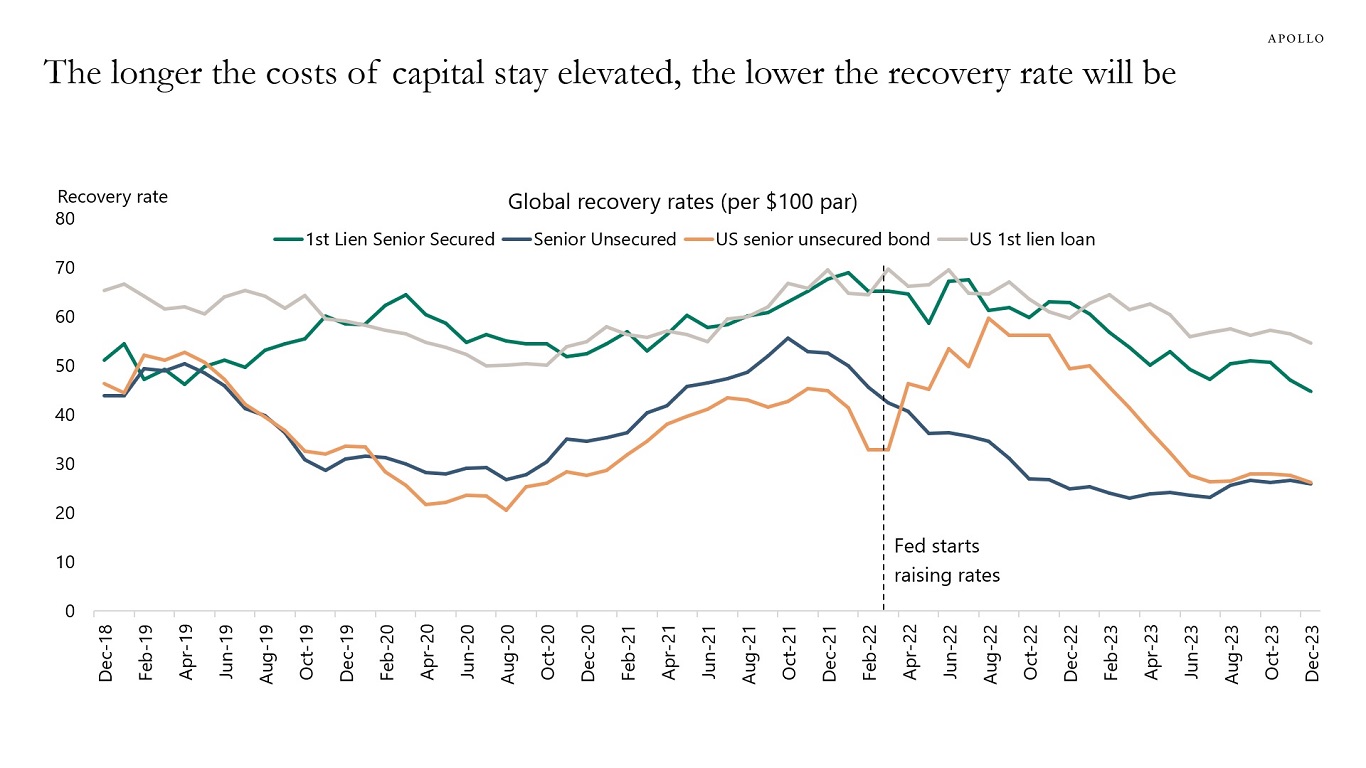

Recovery rates decline when the costs of capital stay higher for longer, see chart below. This dynamic argues for wider credit spreads when rates stay higher for longer.

Source: Moody’s Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

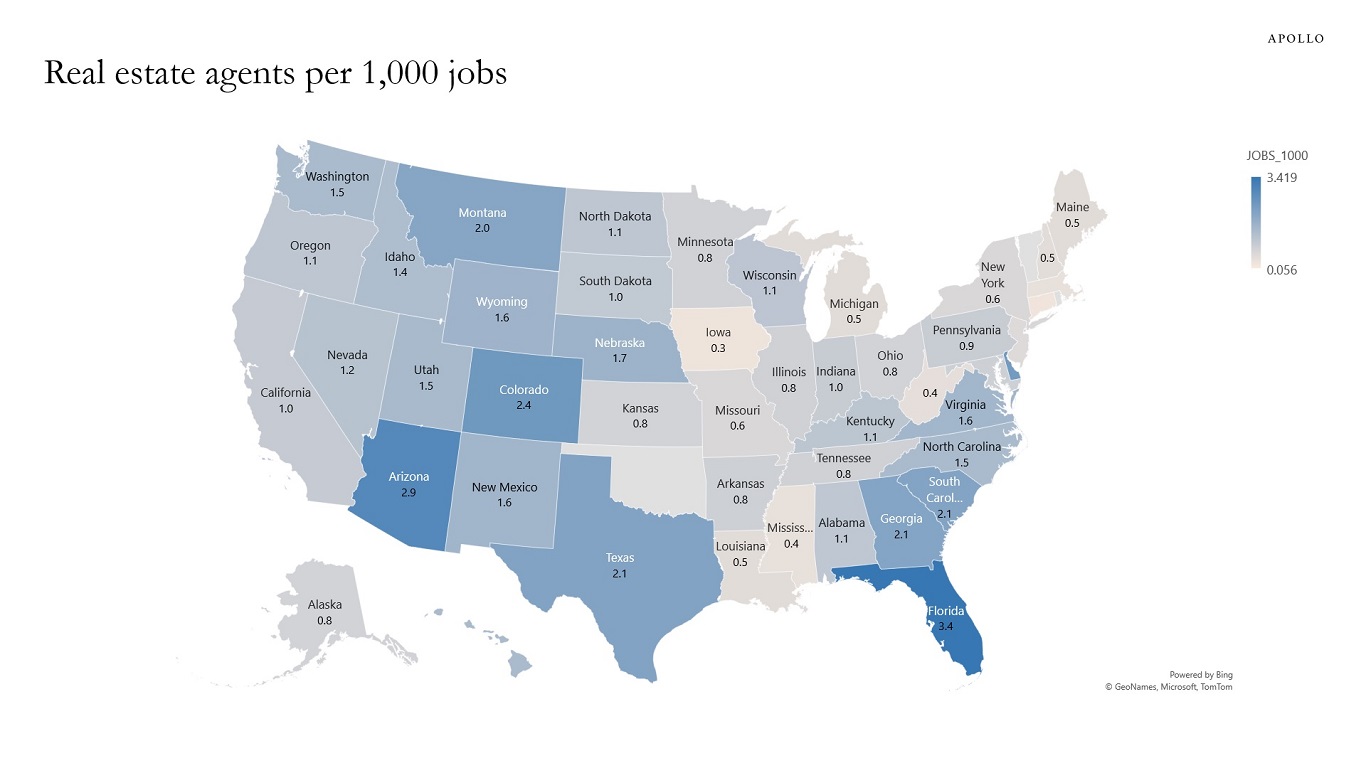

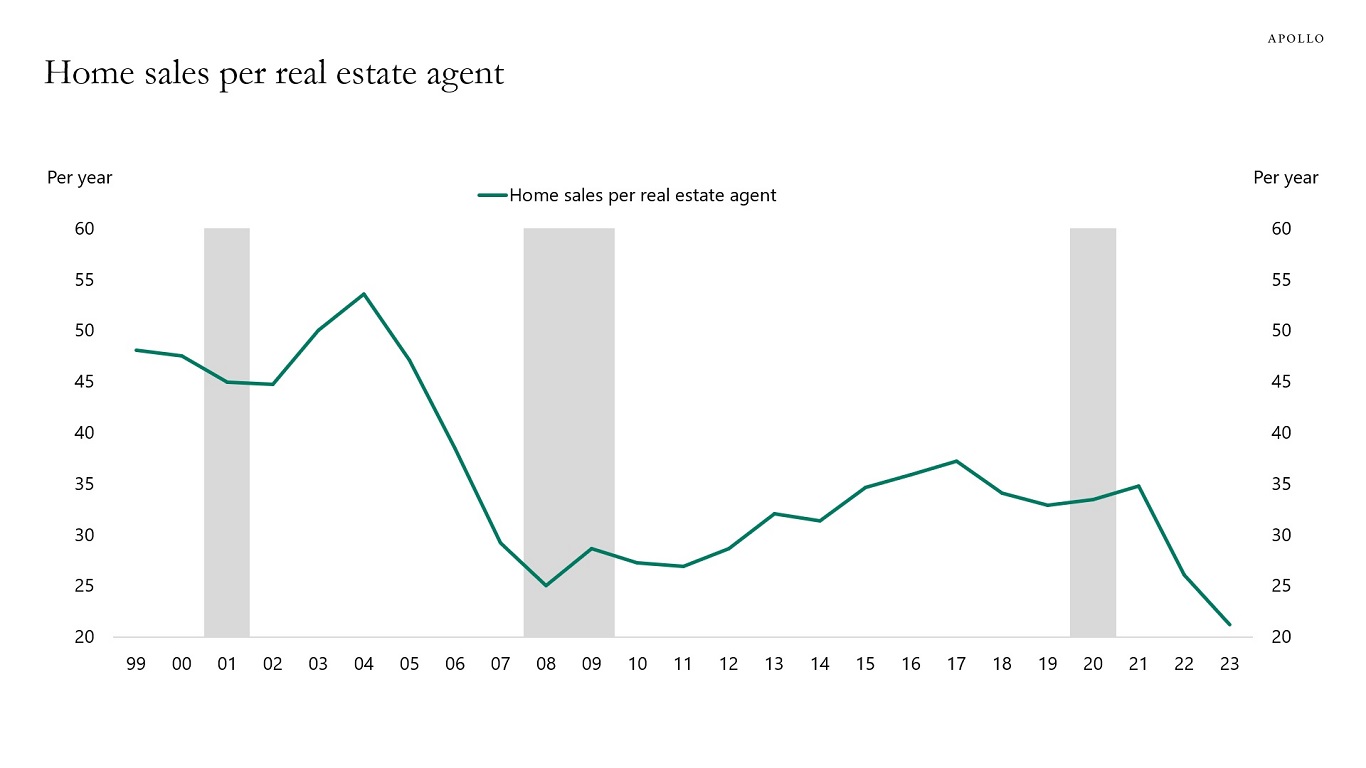

There are more real estate agents per 1,000 jobs in Florida, Texas, Colorado, and Arizona, see the first chart. With many homeowners locked into sub-4% mortgage rates, existing home sales are at the lowest level since 2010, and the number of home sales per real estate agent is at the lowest level in decades, see the second chart.

Source: BLS, Apollo Chief Economist. Note: Data for May 2022.

Source: NAR, BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

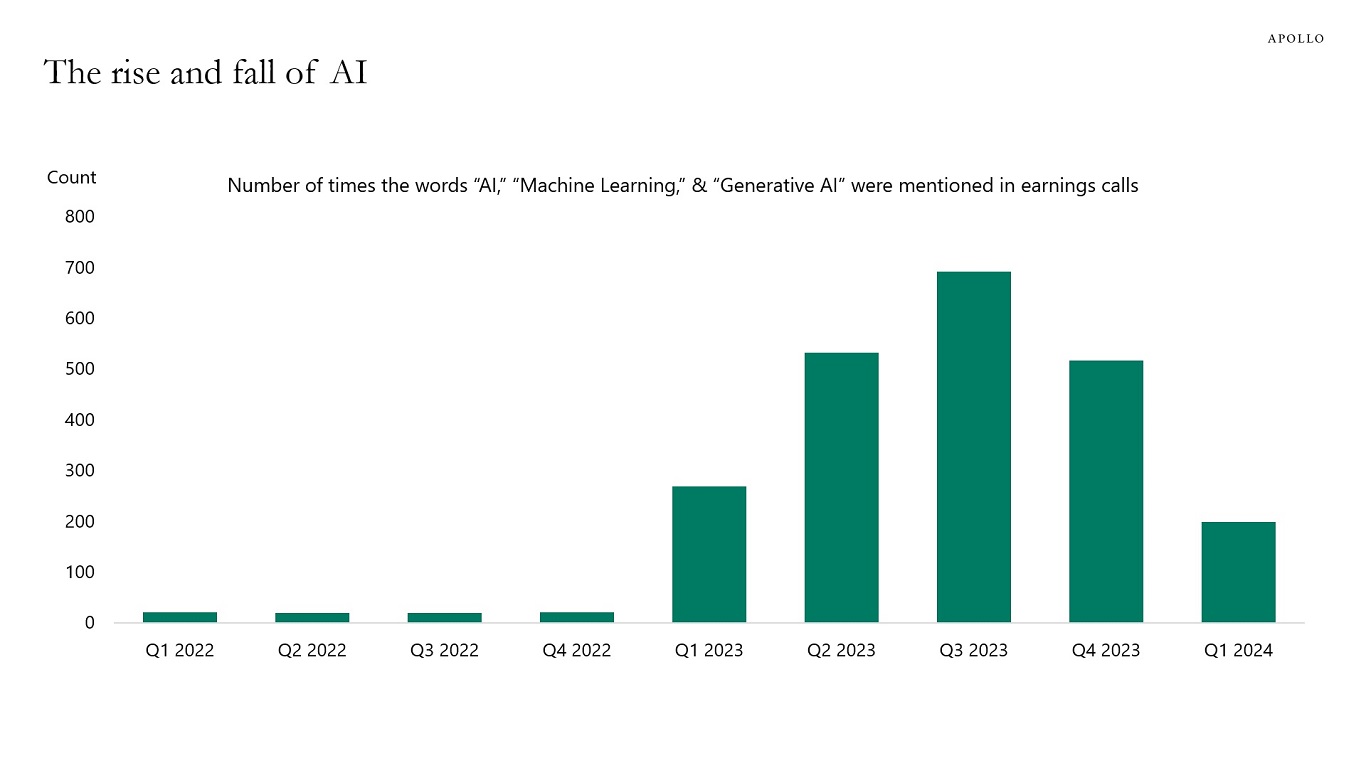

The hype around AI is starting to fade, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

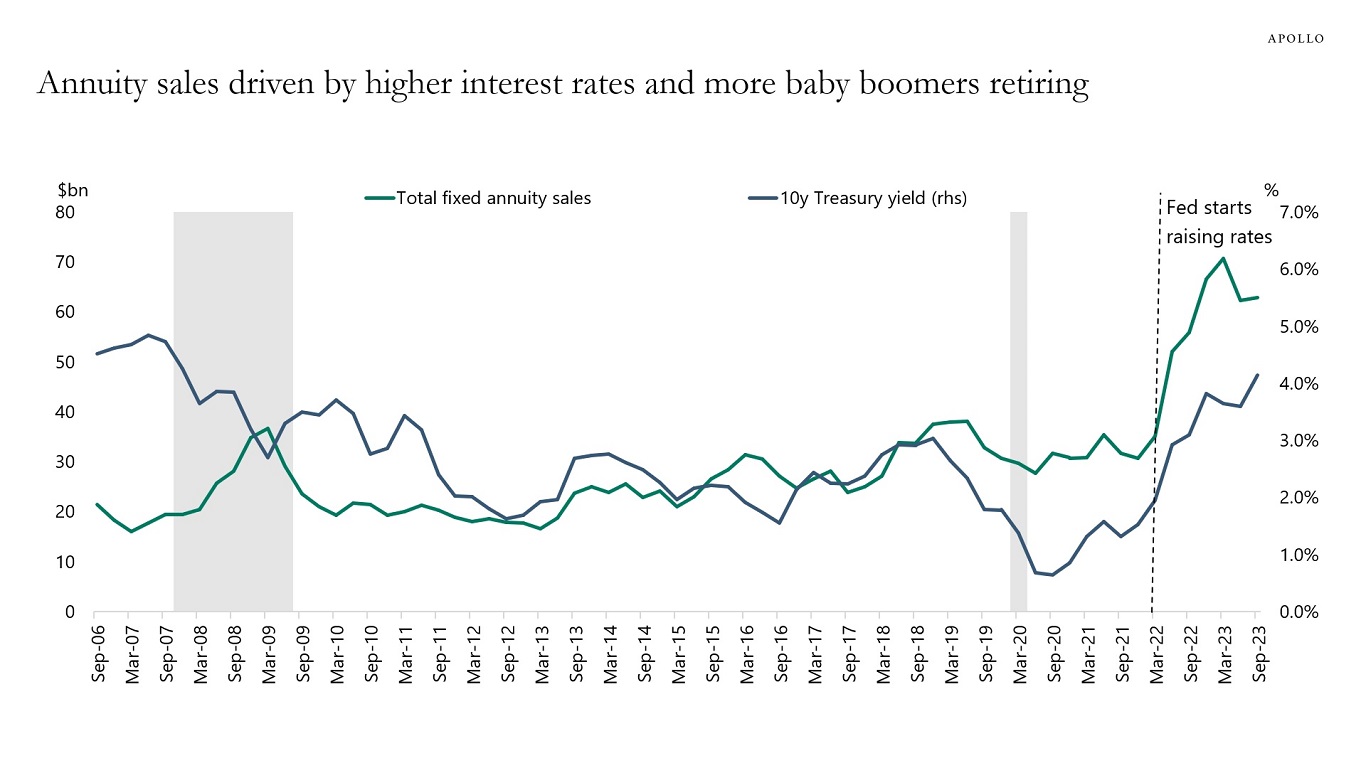

Current drivers of credit demand are retail and pensions seeking higher all-in yields, and annuity sales driven by more baby boomers retiring and by a higher level of interest rates giving policyholders higher monthly payments, see chart below. For more, see also our latest credit market outlook here.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

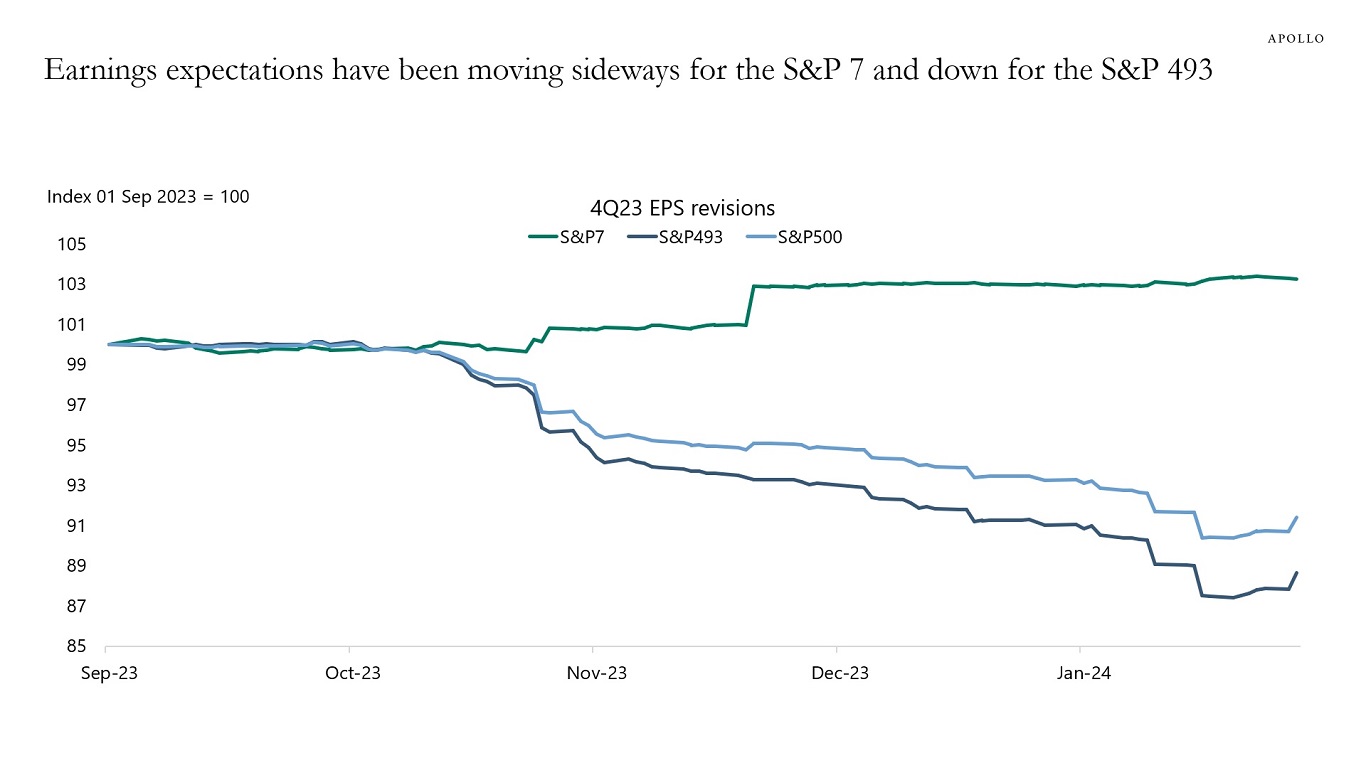

Earnings expectations have diverged for the S&P 7 and the S&P 493, see chart below.

Source: FactSet, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

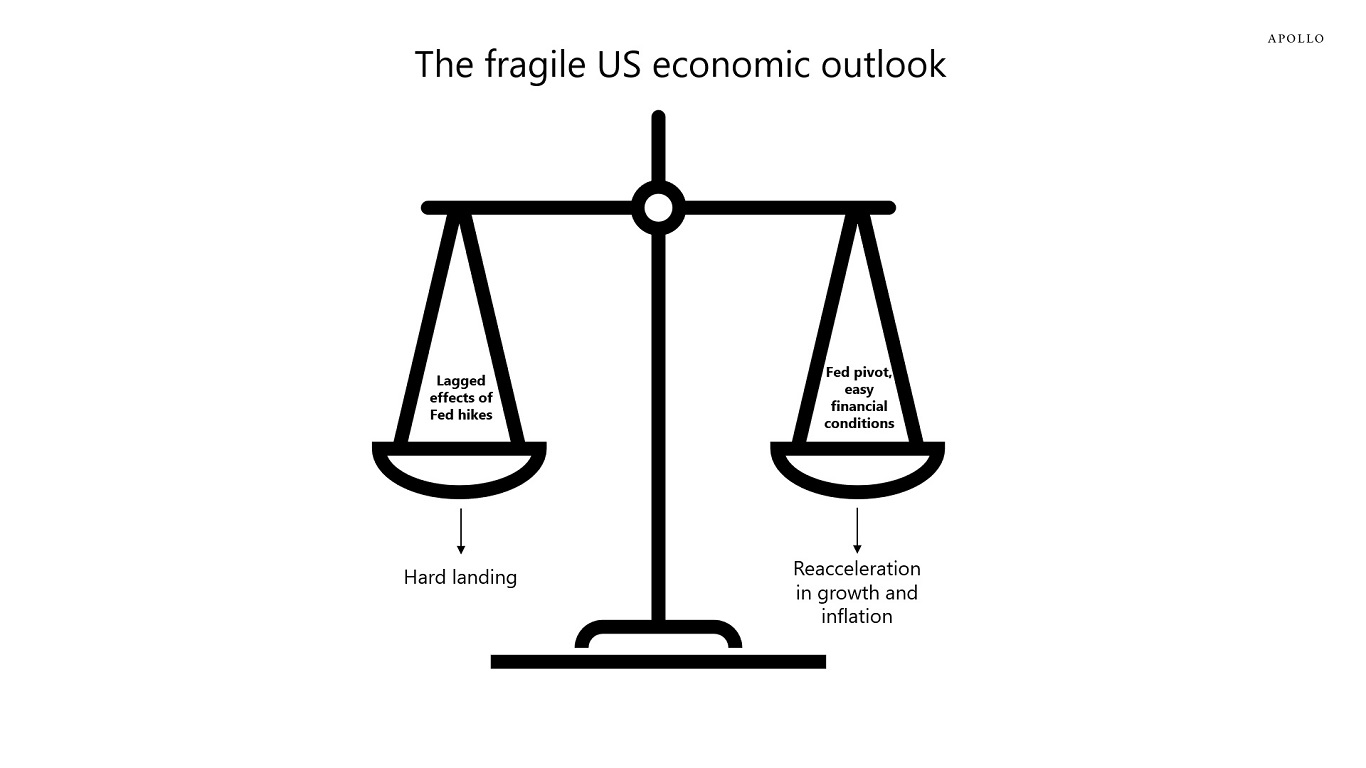

Markets fluctuate between the “lagged effects of Fed hikes are slowing down consumers, firms, and bank lending,” and “the easing of financial conditions since the December Fed pivot has boosted growth, including January hiring,” see chart below.

The bottom line is that what currently looks like a soft landing is a fragile equilibrium, and there is still more than 50% chance we will end up in either a hard landing scenario where the Fed cuts faster than the market expects or a no landing scenario where the Fed has to raise rates again. It makes sense that rates volatility and swaption volatility are high relative to VIX.

Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.