Want it delivered daily to your inbox?

-

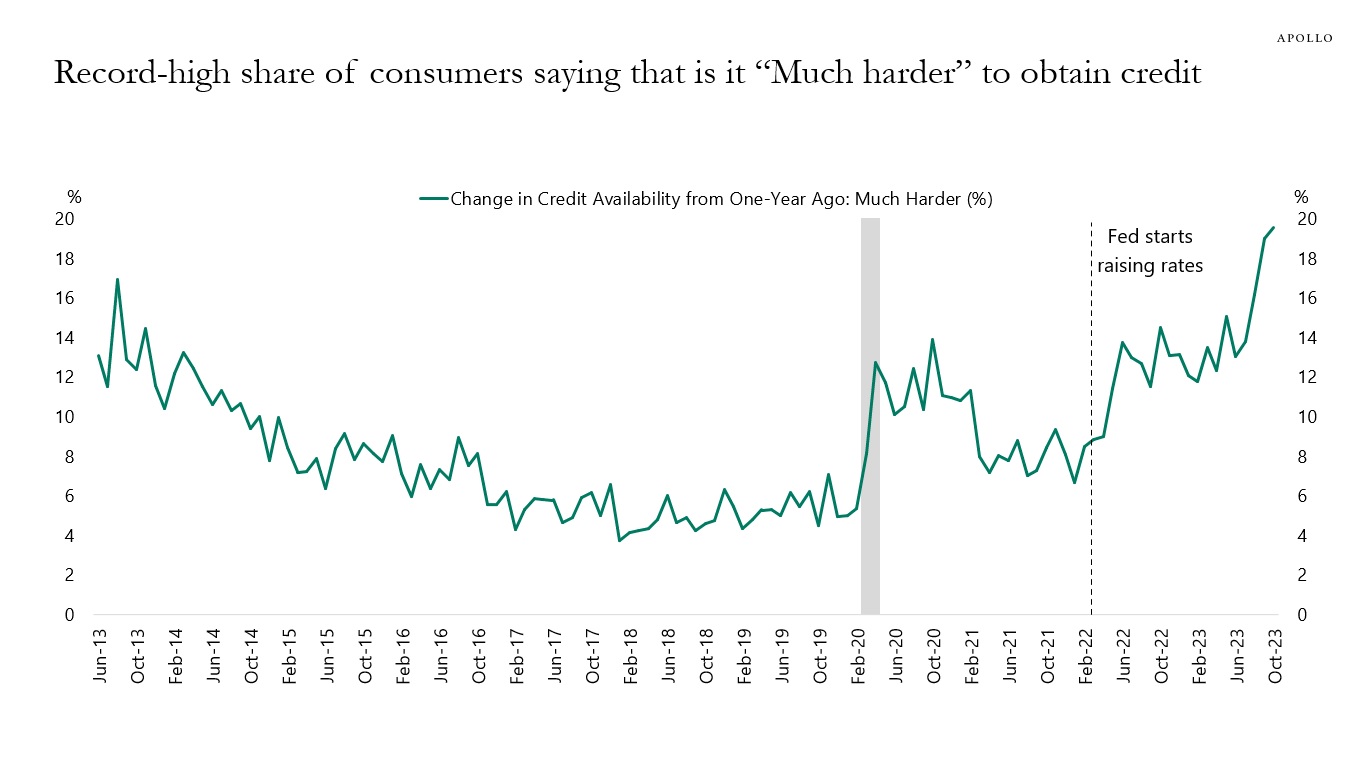

The New York Fed’s latest household survey shows that a record-high share of consumers are saying that it is much harder to obtain credit, see chart below.

This is what the textbook would have predicted. When the Fed raises interest rates, it becomes more difficult for consumers to borrow.

Source: FRBNY, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

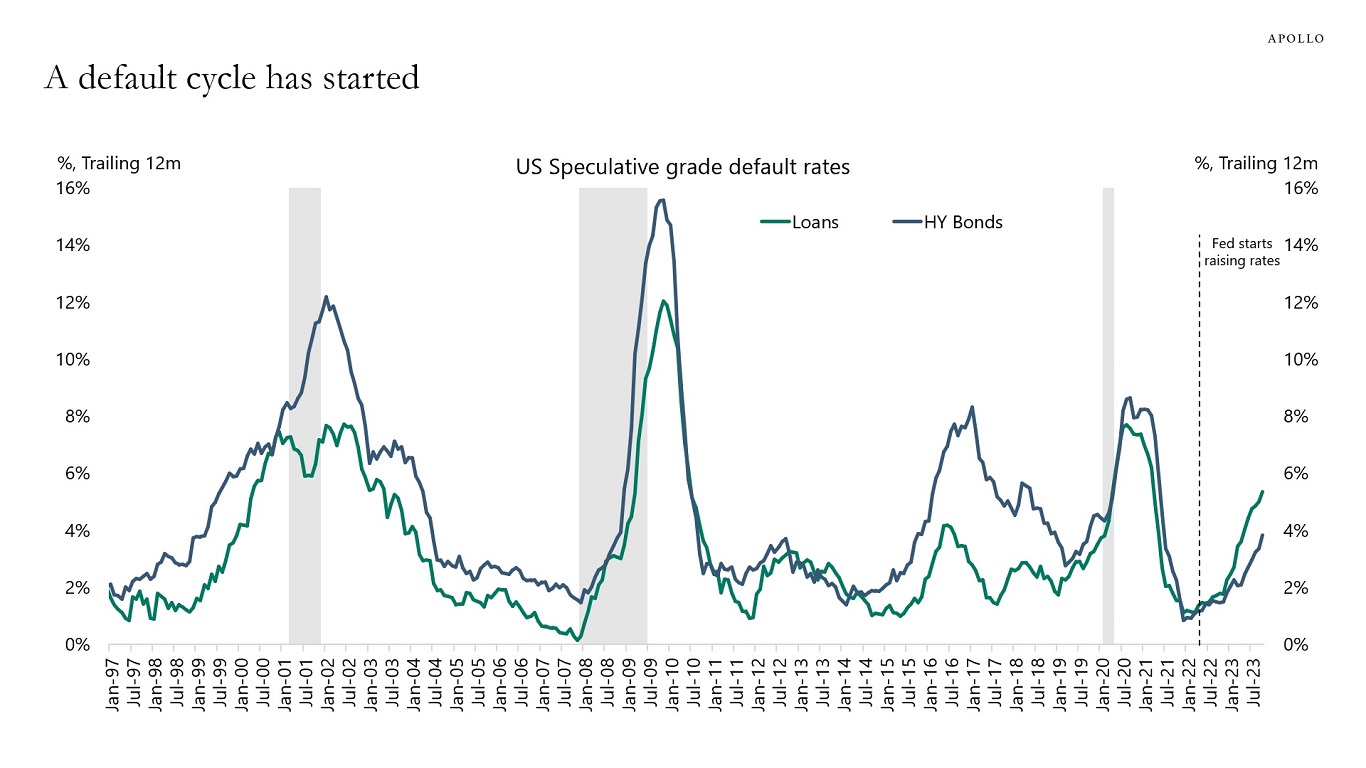

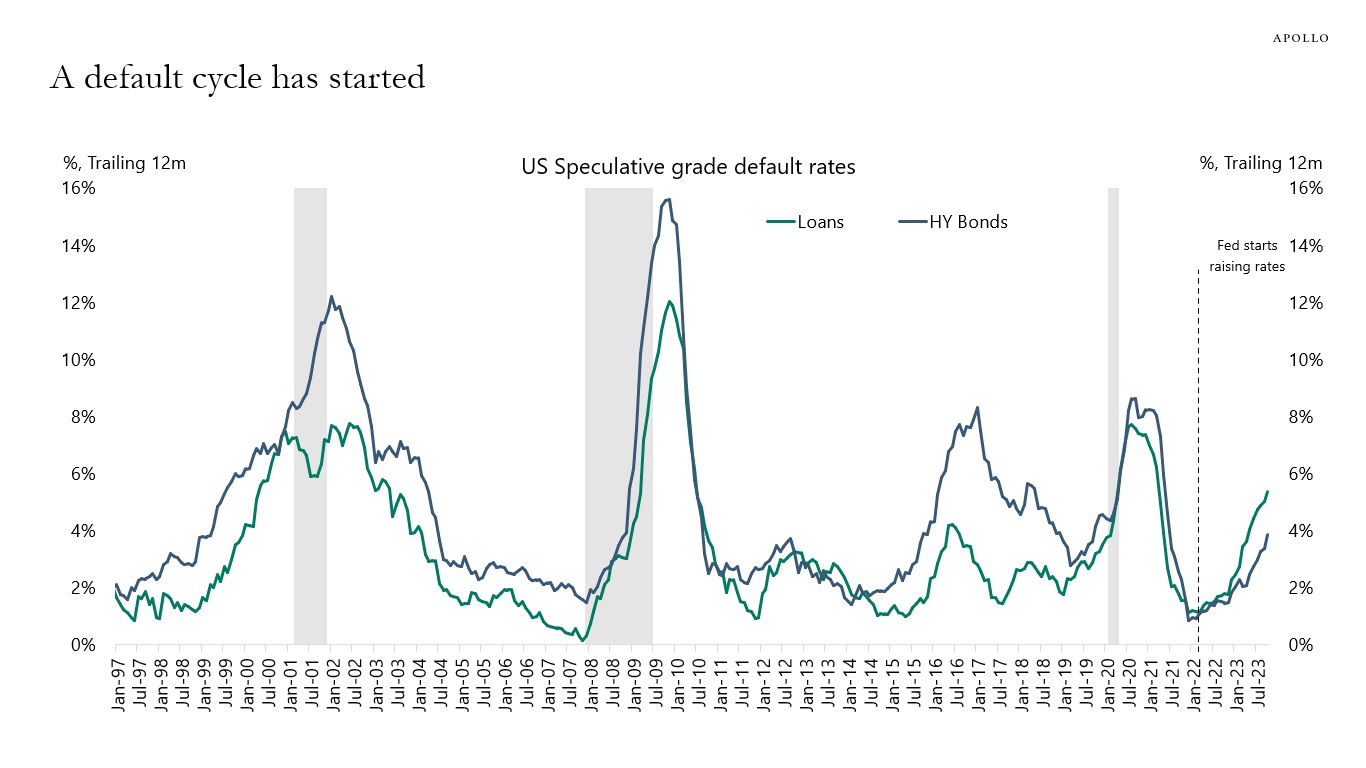

Moody’s data for October shows that default rates continue to increase, see the first chart below.

This is not surprising. Default rates will continue to trend higher. Why? Because the rise in default rates is engineered by the Fed. The Fed is in the process of slowing down the economy with the goal of getting inflation back to the FOMC’s 2% target.

In other words, the ongoing rise in default rates is not just a “normalization.” It is the direct consequence of Fed hikes. The Fed is trying to slow the economy down.

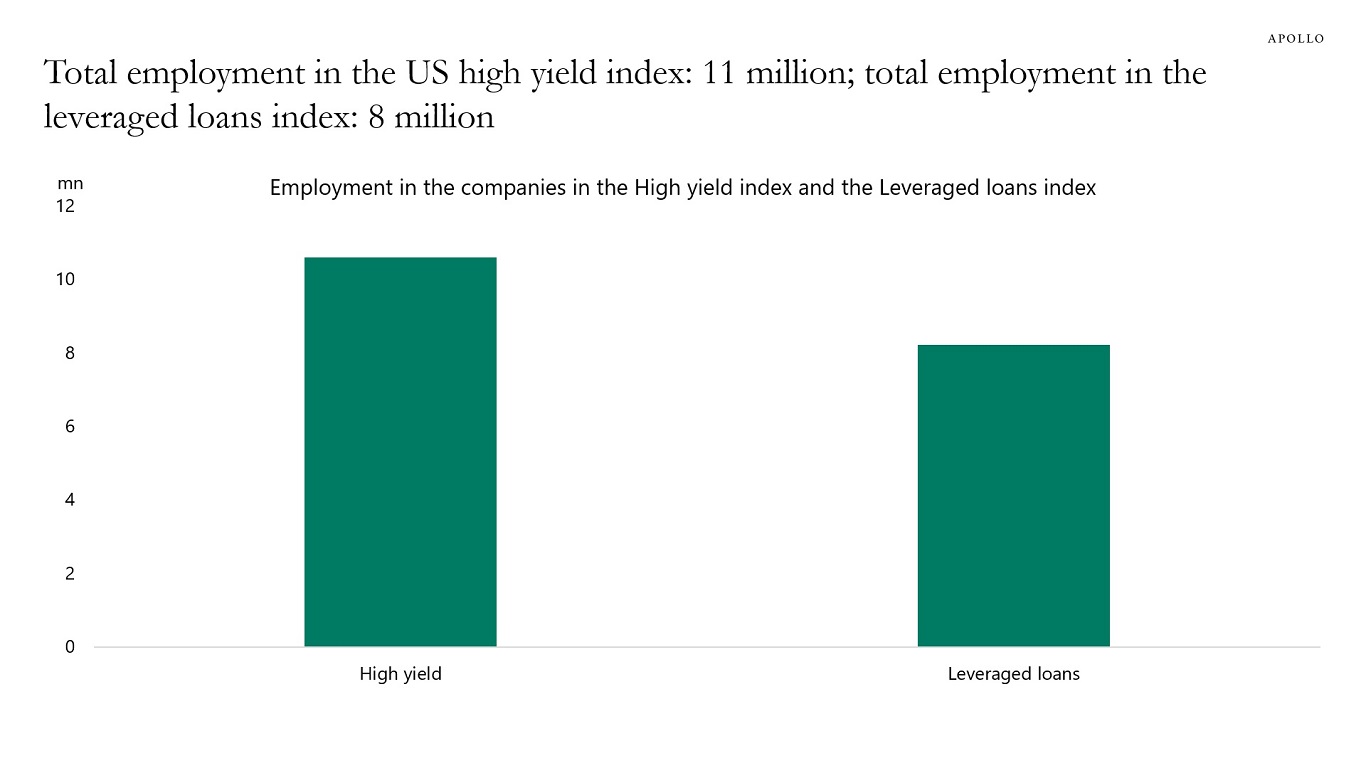

Total employment of companies in the high yield index is 11 million, and total employment of companies in the leveraged loans index is 8 million, see the second chart below.

With interest rates staying high at least until mid-2024, the downside risks to employment continue to be meaningful because the goal of the Fed is to soften the labor market and lower inflation. And the only tool they have is to keep interest rates high until they get what they want, namely inflation back at 2%.

Our latest credit market outlook is available here. Investors should be up in quality and stay away from small-cap highly leveraged companies with low coverage ratios and weak cash flows because those companies will be particularly vulnerable to high costs of capital and slowing earnings growth.

Source: Moody’s Analytics, Apollo Chief Economist

Source: Bloomberg, ICE BofA H0A0 Index, Morningstar LSTA Index, Apollo Chief Economist. Note: Data includes 842 companies in the HY index with employment data available for 584 companies and median employment assumed for the rest. Similarly, there are 1,073 companies in the leveraged loans index with employment data available for 450 companies and median employment assumed for the rest.

See important disclaimers at the bottom of the page.

-

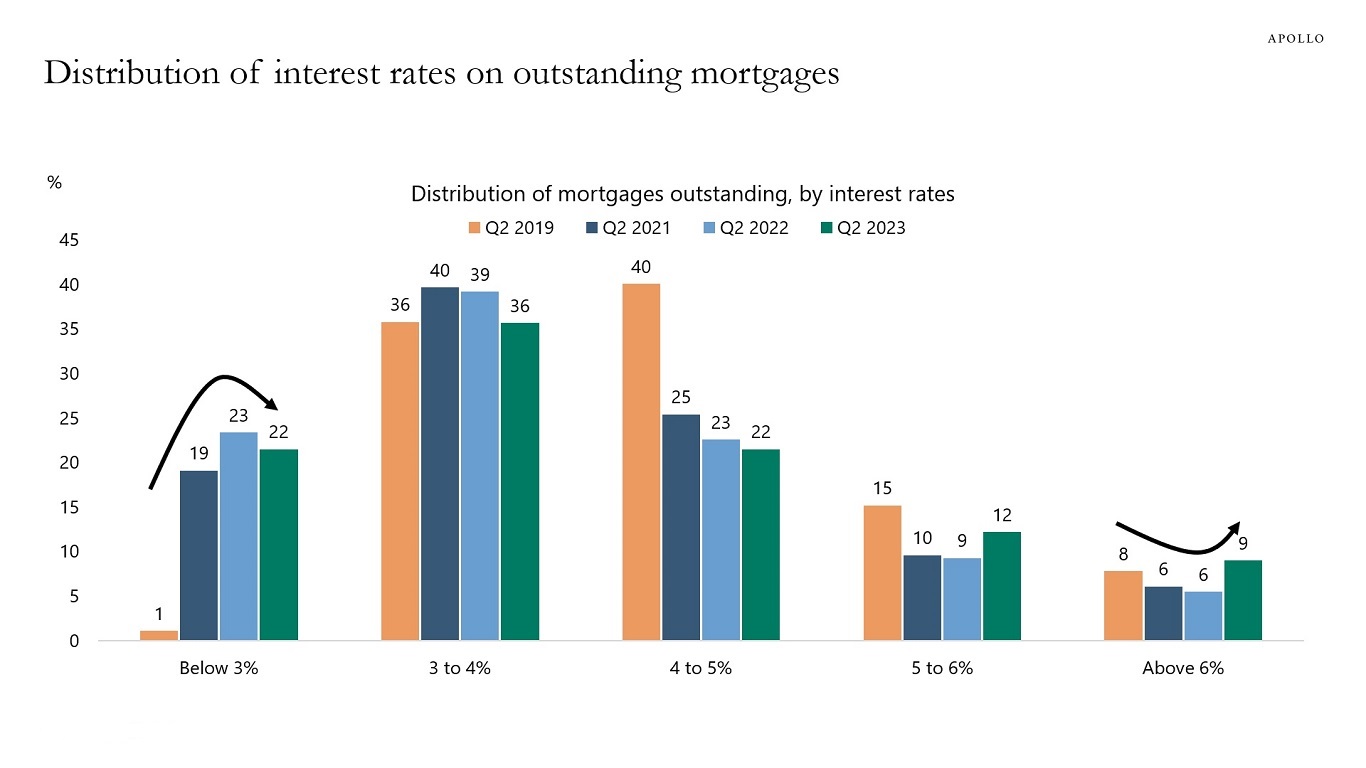

During the pandemic, many households refinanced their mortgages at lower interest rates. As a result, 22% of mortgages today have an interest rate below 3%, up from 1% of all mortgages in 2019, see chart below.

The locking in of lower mortgage rates has weakened the transmission mechanism of monetary policy, and it is the reason why Fed hikes have not had a more significant negative impact on the housing market.

The bottom line is that Fed hikes are not having the desired effect because households have locked in low levels of mortgage rates during the pandemic. As a result, the Fed will have to keep interest rates higher for longer to slow down the economy and get inflation back to 2%.

Our latest housing outlook is available here.

Source: FHFA, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

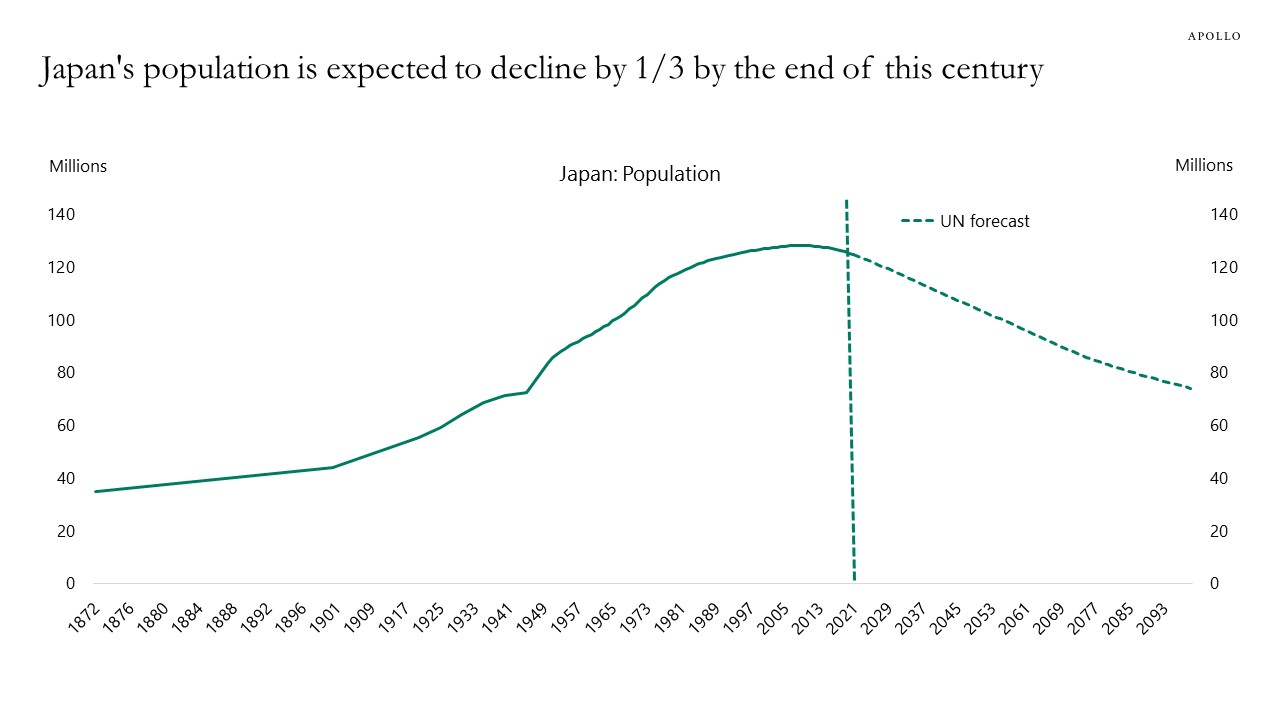

The United Nations forecasts that by the end of this century, Japan’s population will have declined from 120 million to 80 million, see chart below.

Source: Ministry of Health and Welfare, Japan; UN; Haver; Apollo Chief Economist See important disclaimers at the bottom of the page.

-

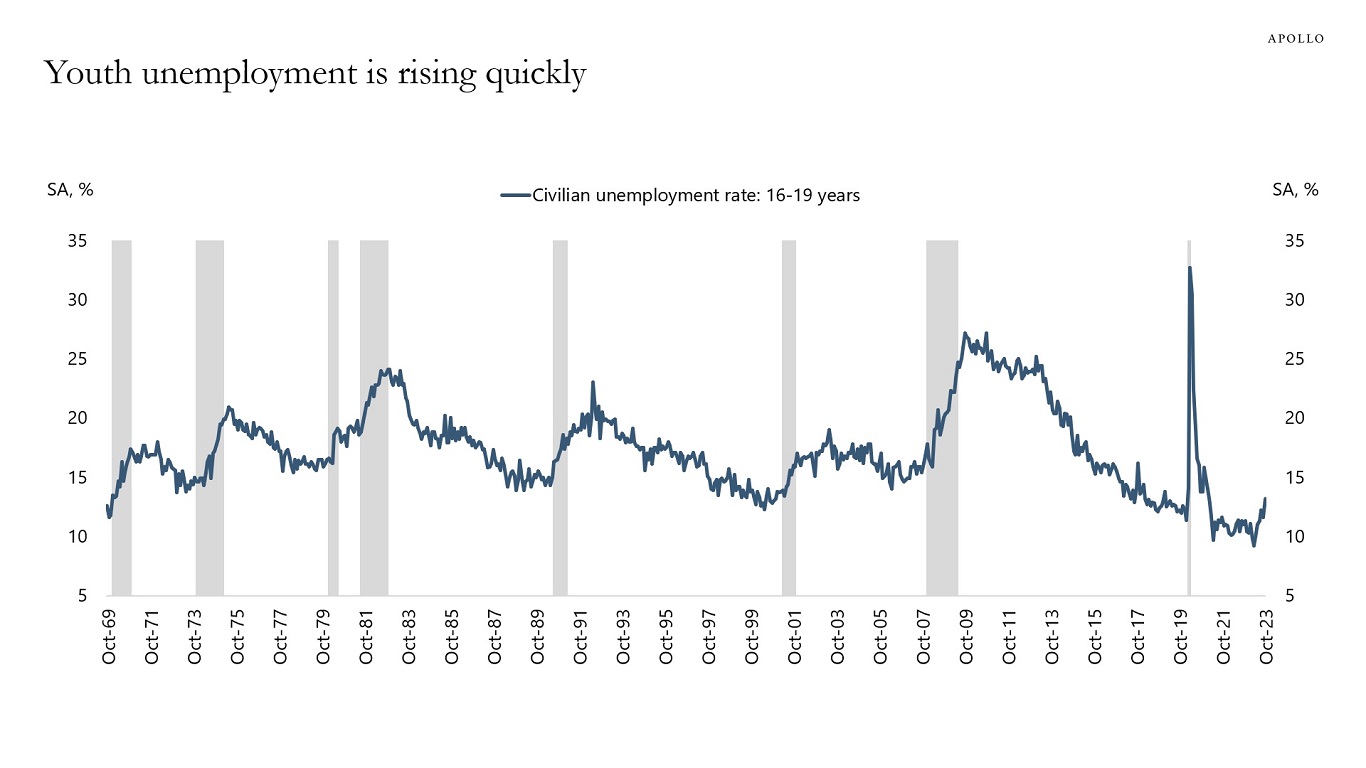

The unemployment rate for 16- to 19-year-olds has increased from 9.2% in April to 13.2% in October, see chart below.

We are monitoring closely if the sharp decline in demand for young workers is a leading indicator of broader labor market weakness.

Source: BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

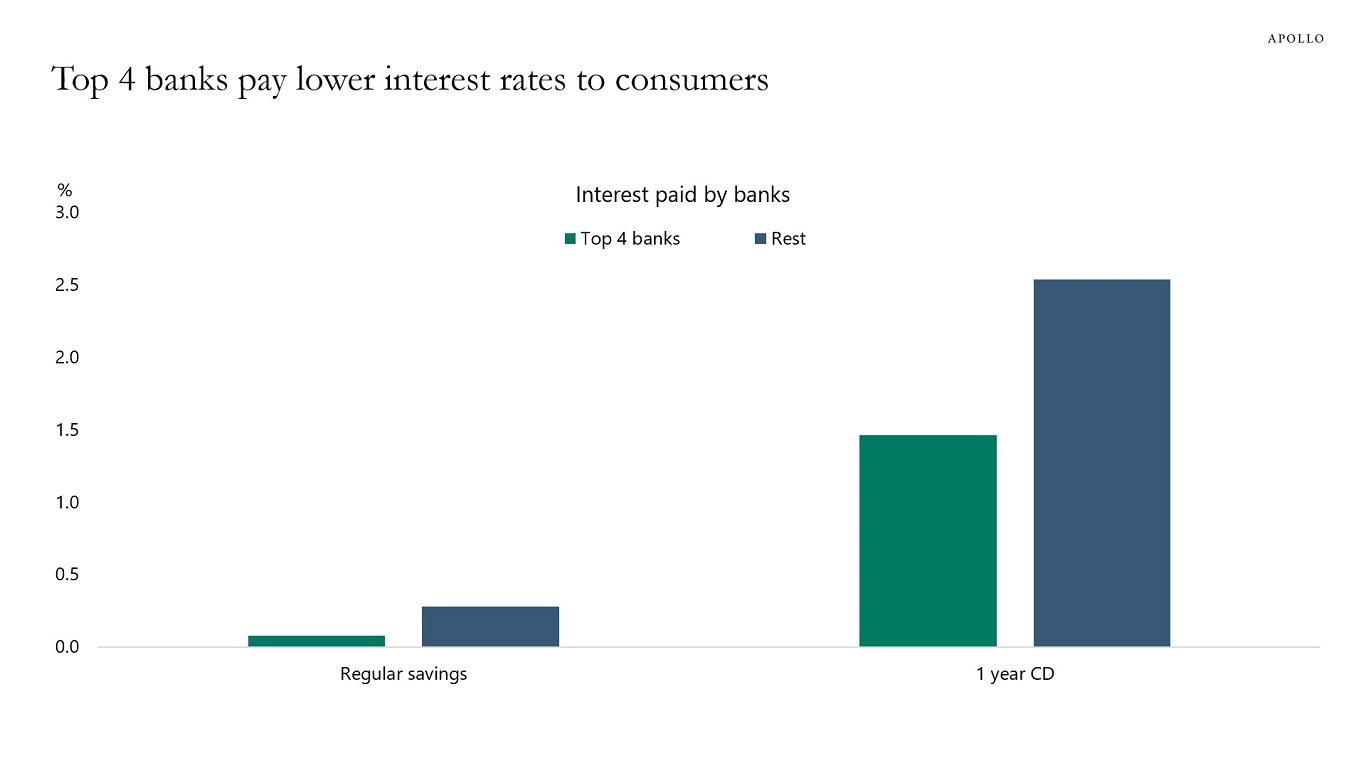

Eight months after the SVB collapse, large banks continue to enjoy significantly lower funding costs and, hence, higher profit margins than regional banks, see the first chart below.

With ongoing headwinds from CRE holdings, the held-to-maturity book, and regulatory uncertainty, it is going to take some time for regional banks to repair their balance sheets.

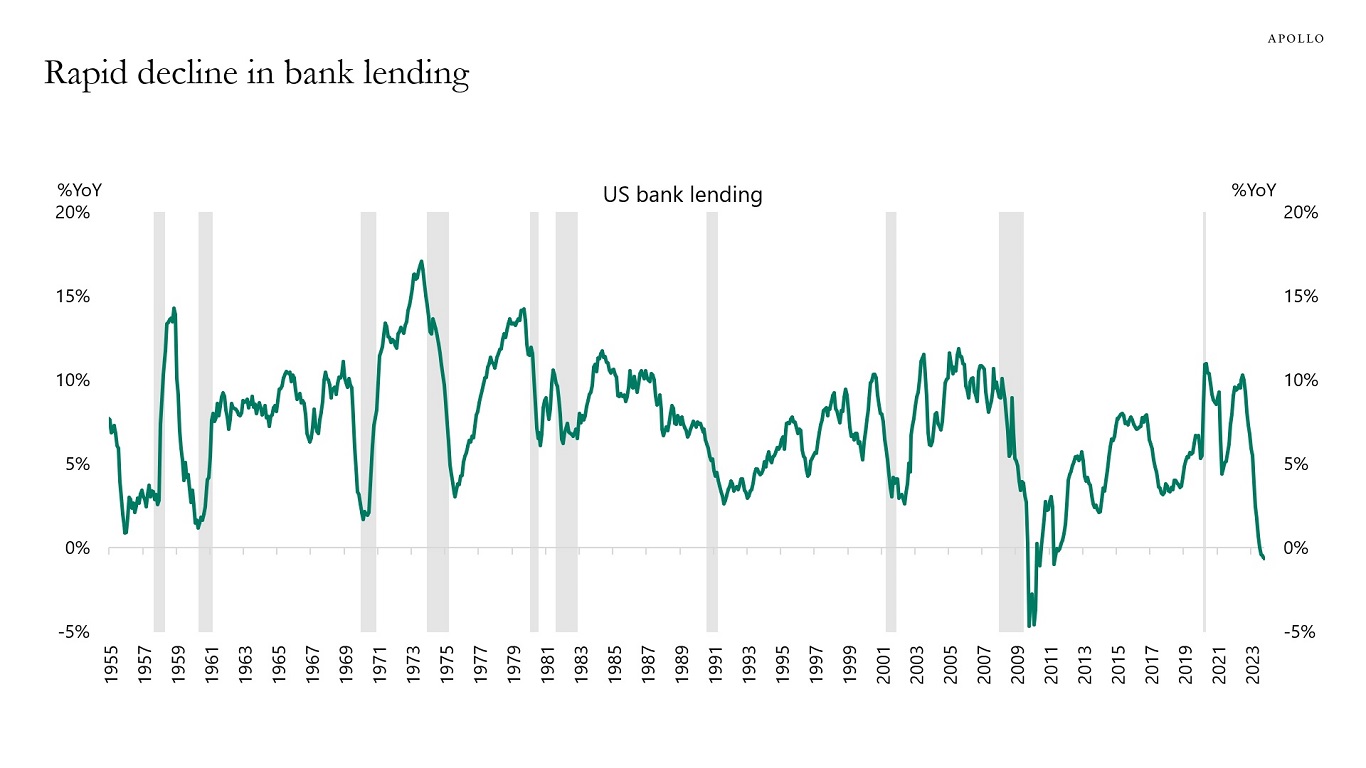

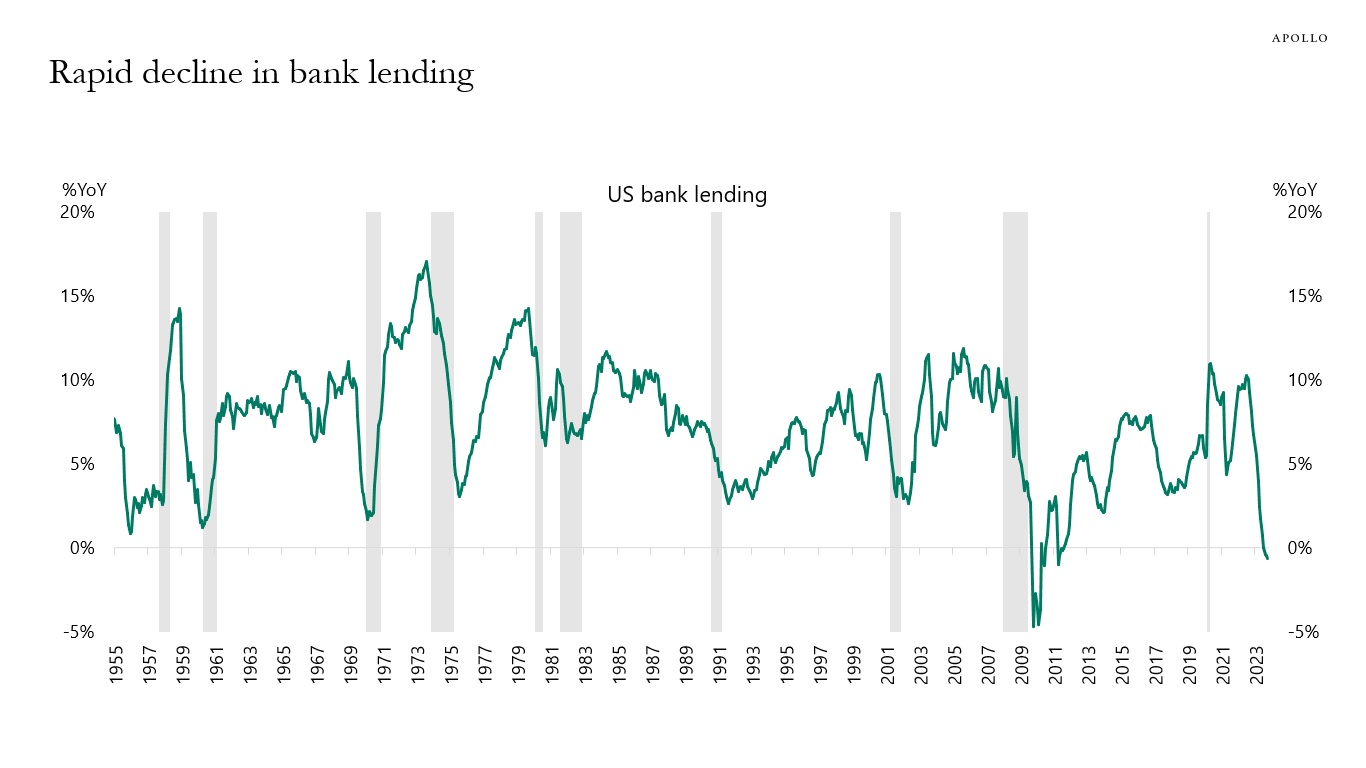

This continues to be a macro problem, because banks No. 5 to No. 4,000 by assets make up 60% of all assets in the banking sector, see also the second chart showing the ongoing sharp slowdown in bank lending.

Source: S&P Capital IQ Pro, Apollo Chief Economist

Source: FRB, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

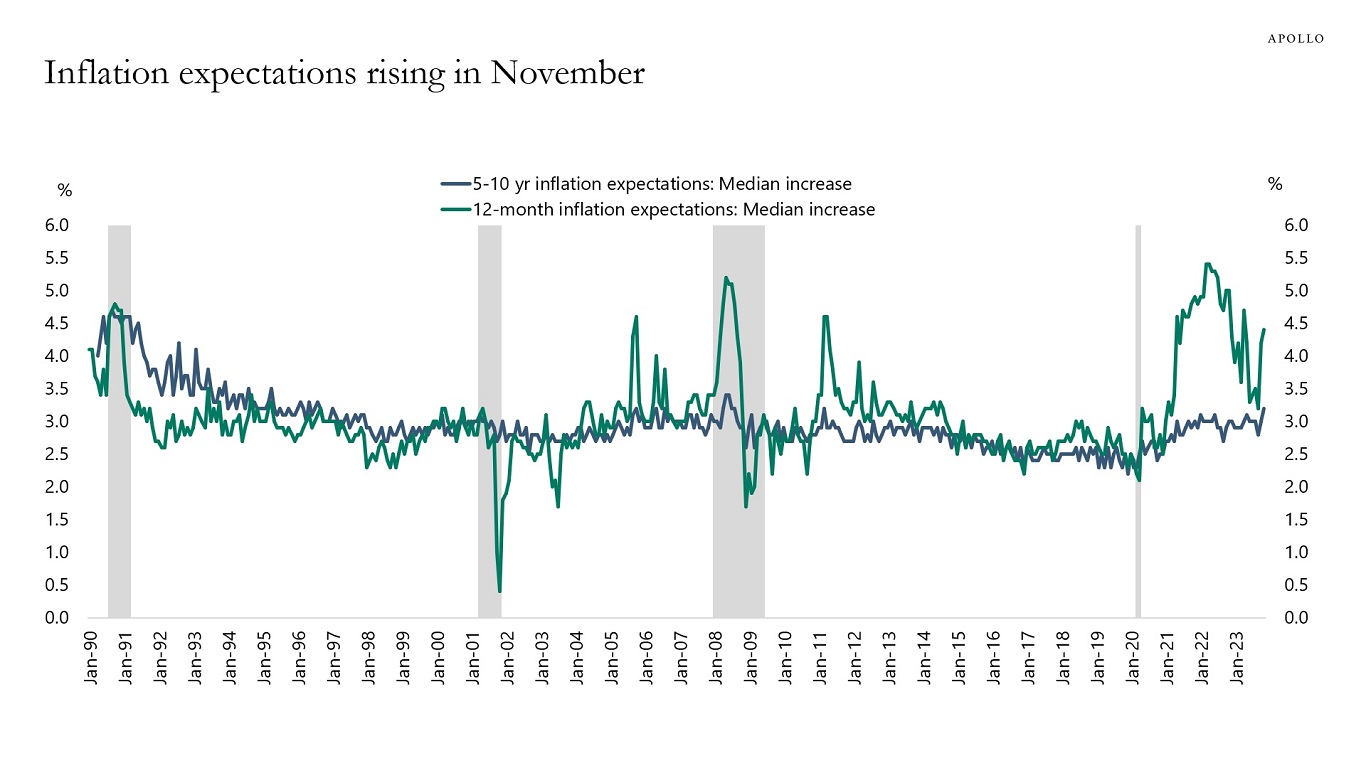

The Fed cannot begin to send dovish signals when inflation expectations jump higher the way they have done recently, see chart below.

Source: University of Michigan, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

There is a lot of discussion in markets about the implications of the US fiscal situation.

Three areas to watch for investors are 1) debt ceiling and shutdown risk, 2) Treasury auctions, and 3) US downgrade risk. The complication for markets is that the debt ceiling and shutdown come and go with months between, but Treasury auctions happen every week, and a notice from a rating agency about the US fiscal situation can come with no warning.

In other words, for investors, the fiscal situation is not like watching quarterly earnings but instead a topic constantly lingering in the background that can impact markets with little or no warning—if, for example, a Treasury auction tails or rating agencies issue a statement.

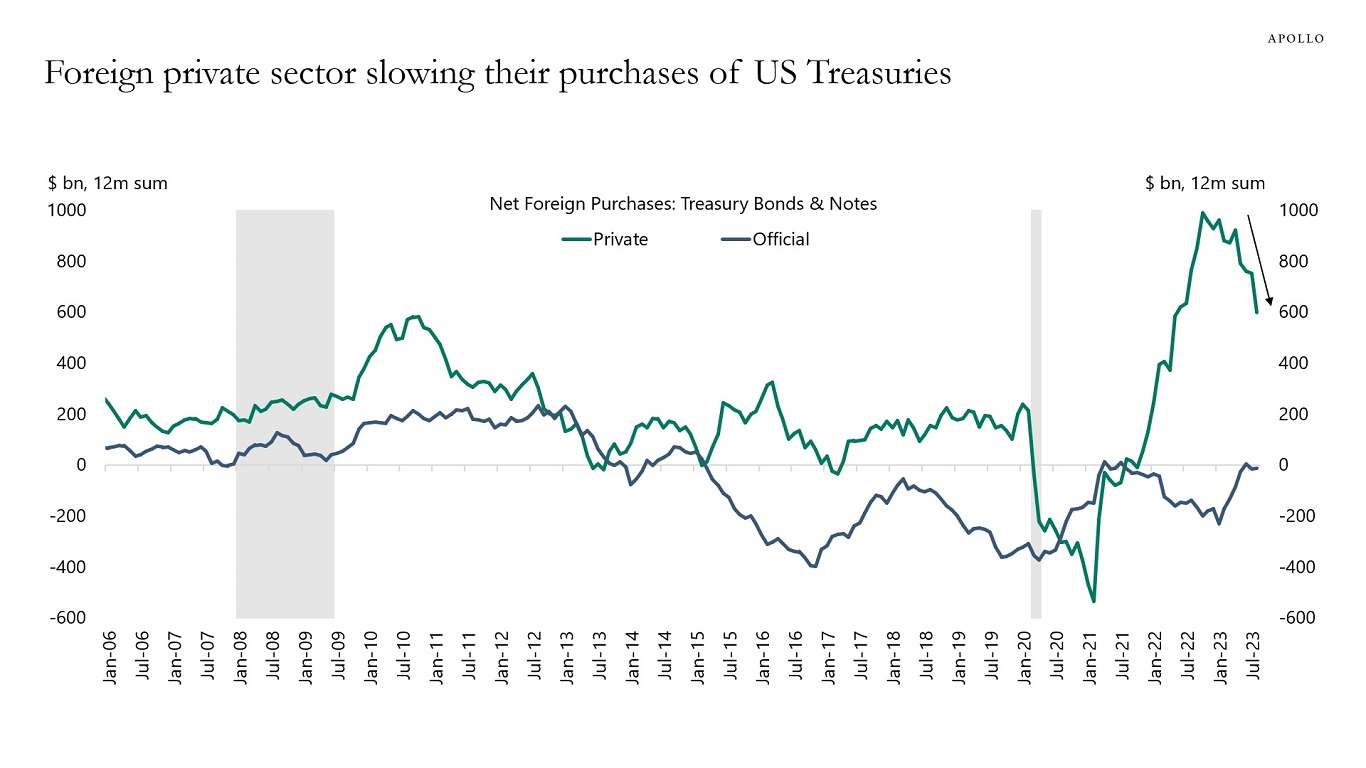

The fundamental question remains: Who is going to buy the growing supply of Treasuries, and at what price?

Looking at net foreign purchases of Treasuries shows that foreign official institutions, i.e., central banks and sovereign wealth funds, have been net sellers of Treasuries since 2015, see chart below.

Foreign private buyers, on the other hand, stepped up purchases when the Fed raised interest rates in 2022. But in 2023 with rates peaking, they have been slowing their purchases, see again the chart below.

The bottom line is that investors across all asset classes need to spend some time not only on who is buying Treasuries—including whether it is yield-sensitive or yield-insensitive buyers—but also on Treasury auction metrics and what the rating agencies are saying and doing.

Source: Treasury, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Stocks are driven by stories. Stories such as AI, weight-loss medication, or CRE being a headwind for regional banks.

The bond market, on the other hand, is different. Bonds and credit are contracts. Contracts are formal and legally binding agreements about delivering future cash flows to investors.

The most remarkable difference between stocks and bonds is how unquantifiable stories are, how stories come and go, and how stories involve selecting certain facts and ignoring other facts.

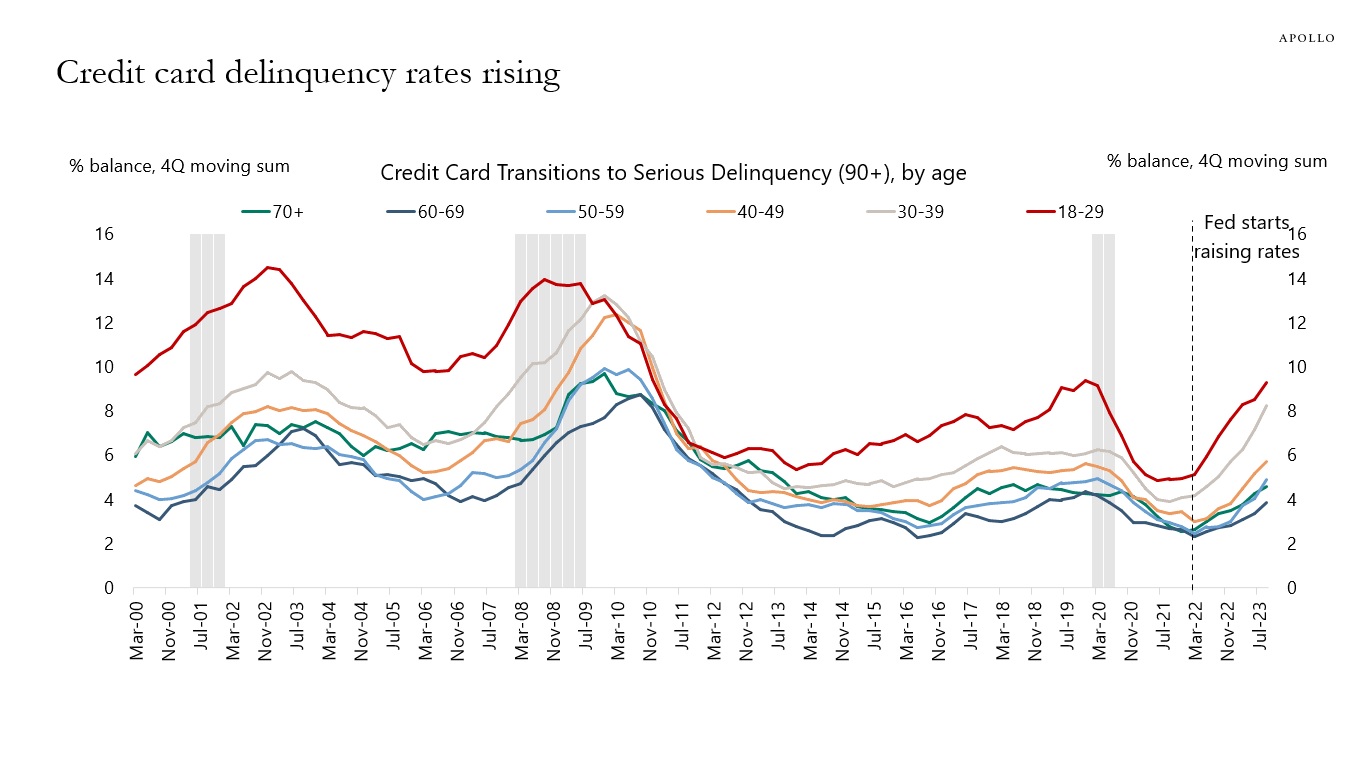

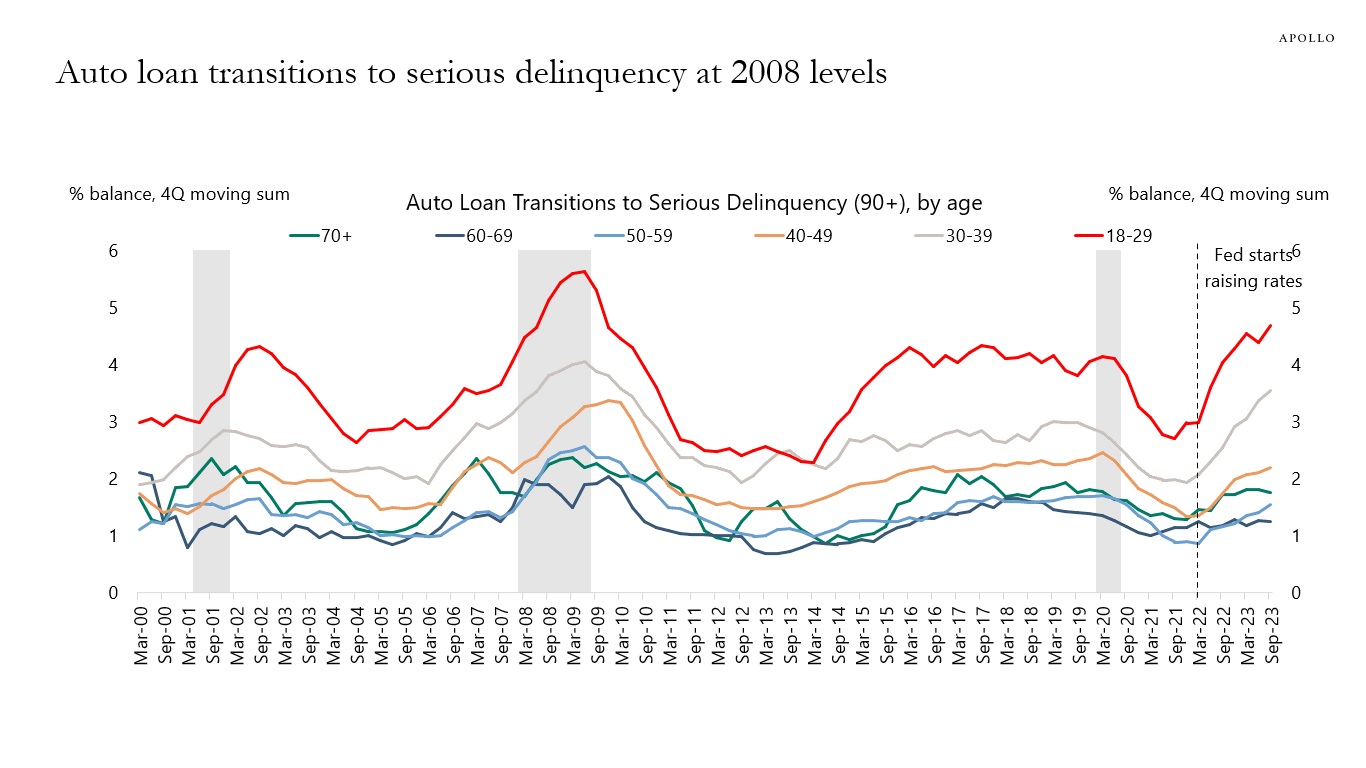

At the moment, stocks are focusing on the rapid decline in inflation. But stocks could also have chosen to focus on rising delinquency rates on credit cards and auto loans, the rise in HY default rates, or the rapid decline in bank lending, see charts below. But these facts are complicated. So, for now, the stock market is holding on to the simple story that inflation is falling. Without the nuance that a rapid decline in inflation would often be driven by a rapid decline in the economy.

With Fed hikes every day biting harder and harder on consumers, firms, and banks, and rates staying high at least until the middle of 2024, the risks are rising that we over the next six months will get a soft landing in inflation and a hard landing in the labor market.

Source: FRB, Haver Analytics, Apollo Chief Economist

Source: New York Fed Consumer Credit Panel / Equifax, Apollo Chief Economist

Source: FRBNY Consumer Credit Panel, Equifax, Haver Analytics, Apollo Chief Economist

Source: Moody’s Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

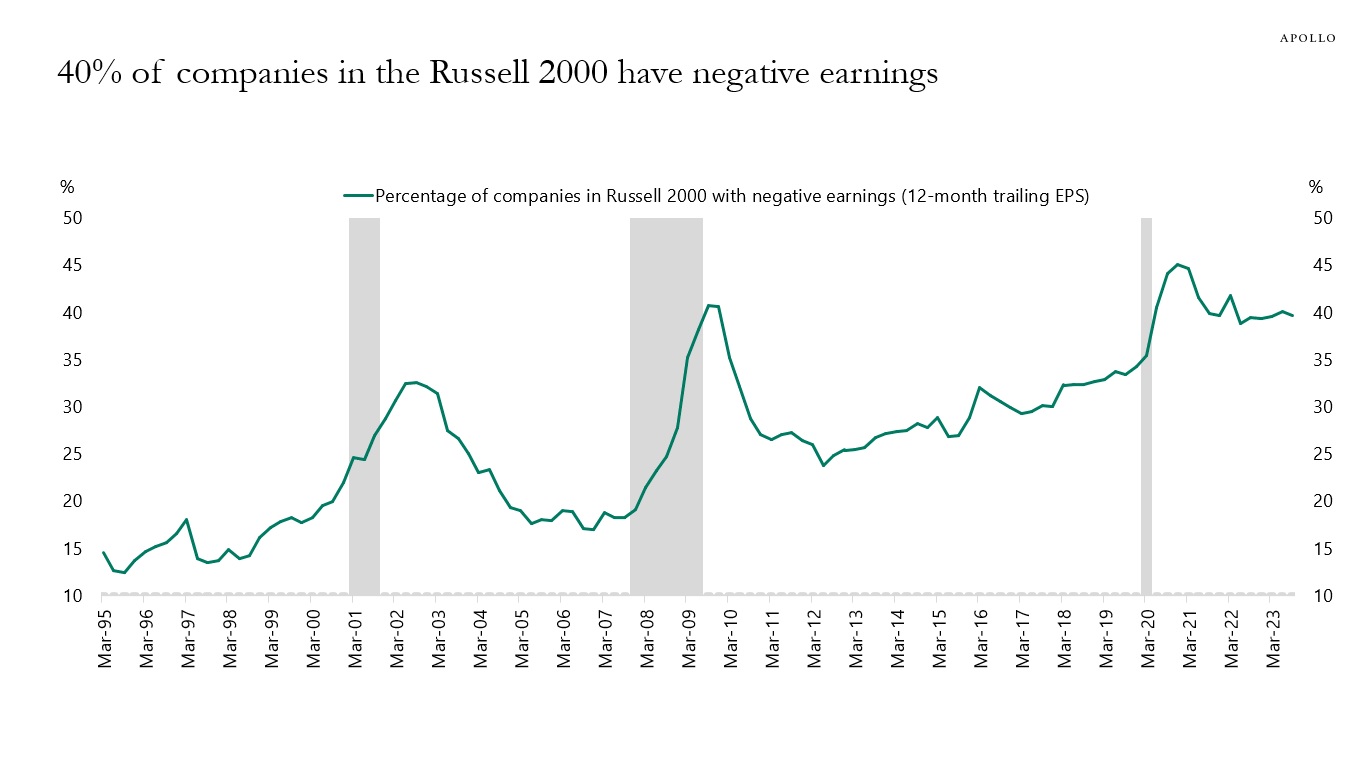

During recessions, the share of unprofitable firms rises. This is not surprising.

But even before the economy has entered a recession, the share of companies in the Russell 2000 with no earnings is at 40%, see chart below.

The bottom line is that if the economy enters a recession, a lot of middle-market companies will be vulnerable to the combination of high rates and slowing growth.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.