Want it delivered daily to your inbox?

-

Our latest US housing outlook is available here.

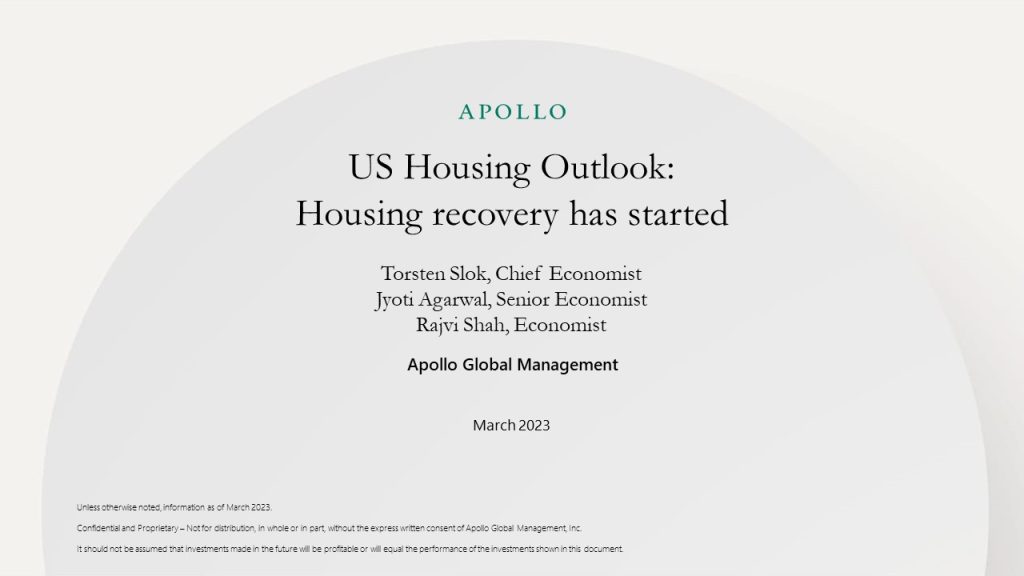

Source: Census, Haver Analytics, Apollo Chief Economist. Note: Single family homes are 1 unit buildings. See important disclaimers at the bottom of the page.

-

The ongoing no landing is not just about waiting for the lagged effects of Fed hikes, it is also about the level of the Fed funds rate not being high enough to cool the economy down.

The no landing scenario is playing out because the Fed has not raised interest rates enough, and as a result, even the interest rate-sensitive components of GDP are now starting to recover because of continued strong job growth, high wage growth, and high excess savings across the income distribution. As time goes by, the economy begins to adjust to a new higher level of inflation and a new higher level of interest rates.

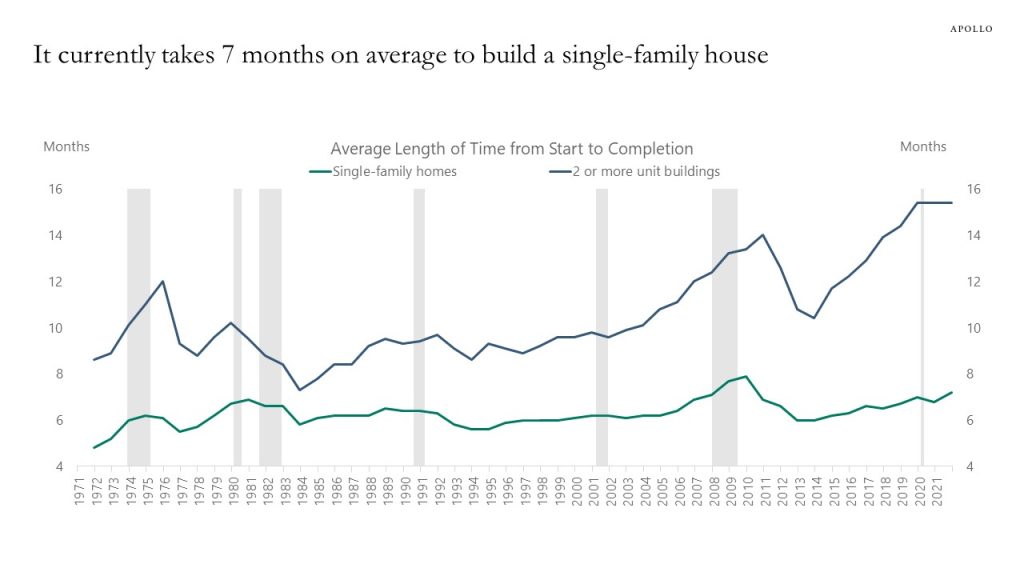

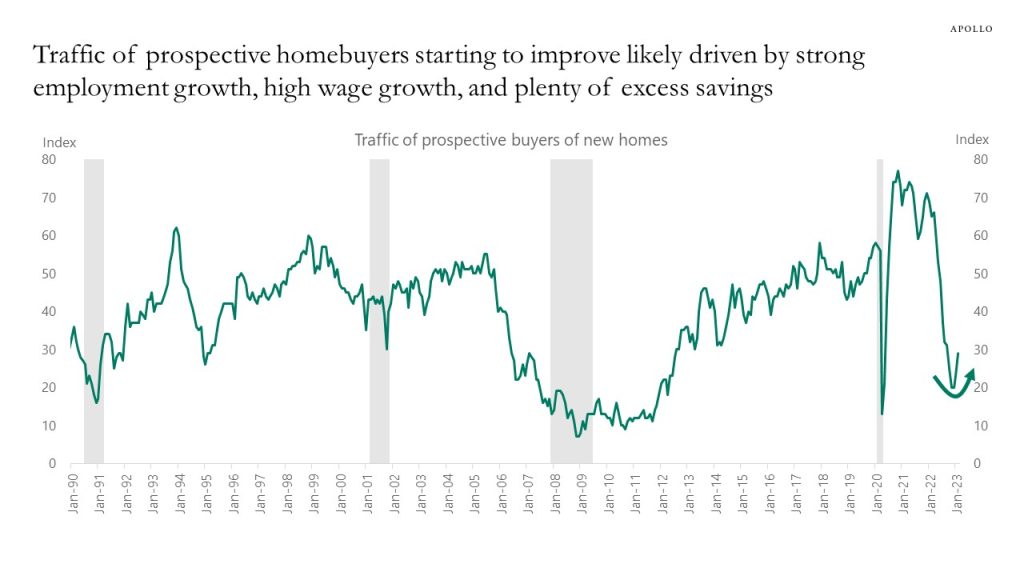

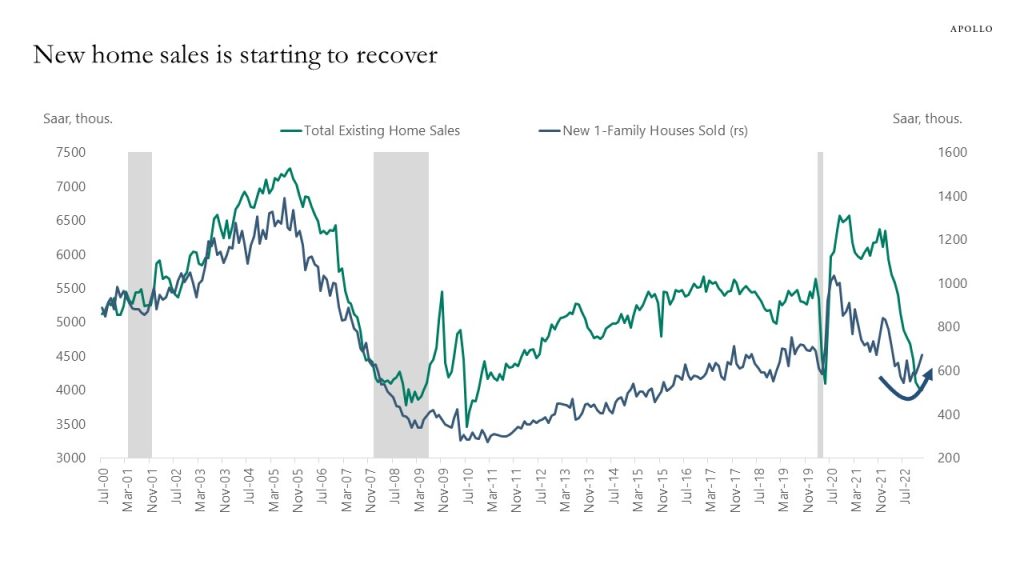

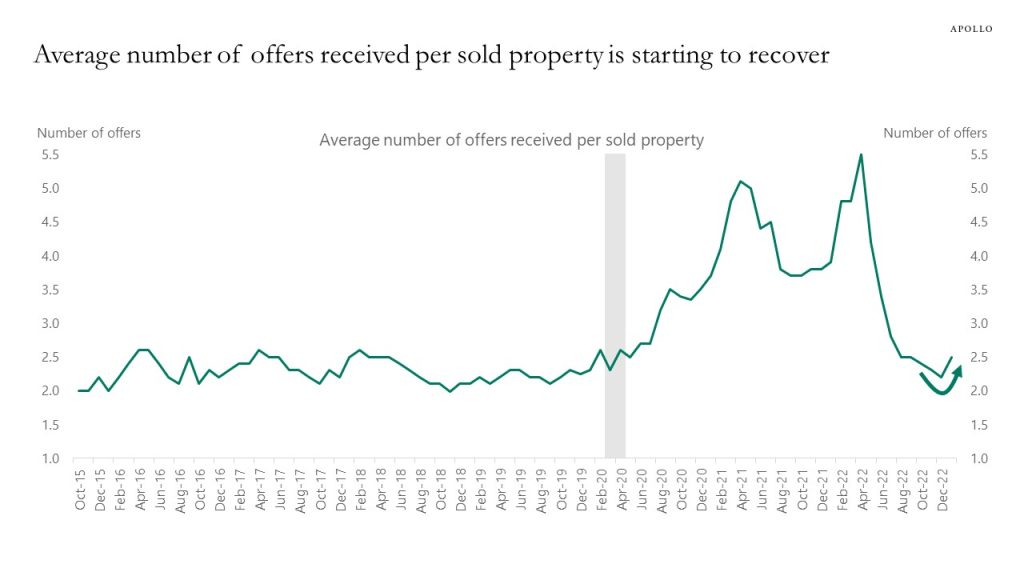

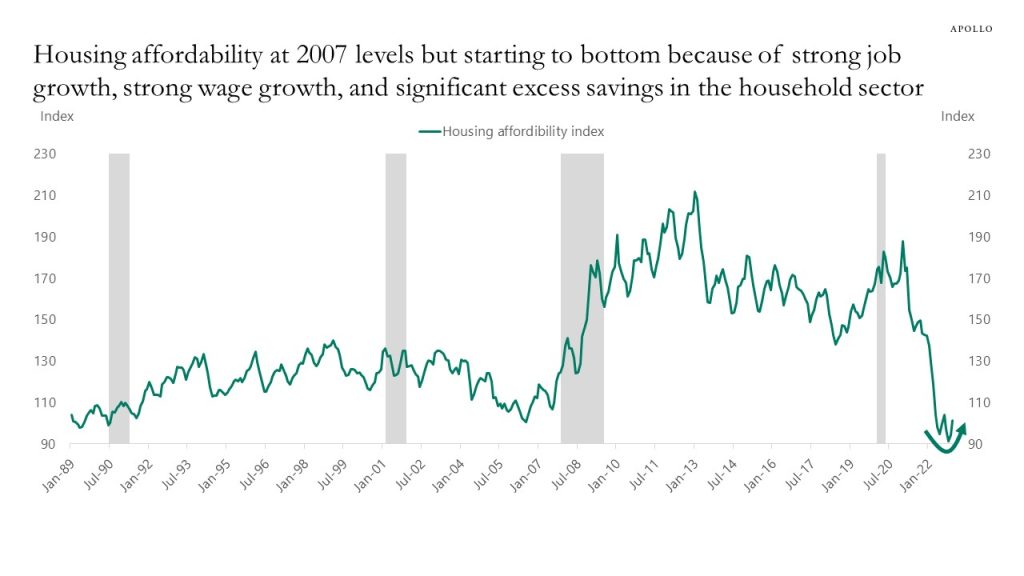

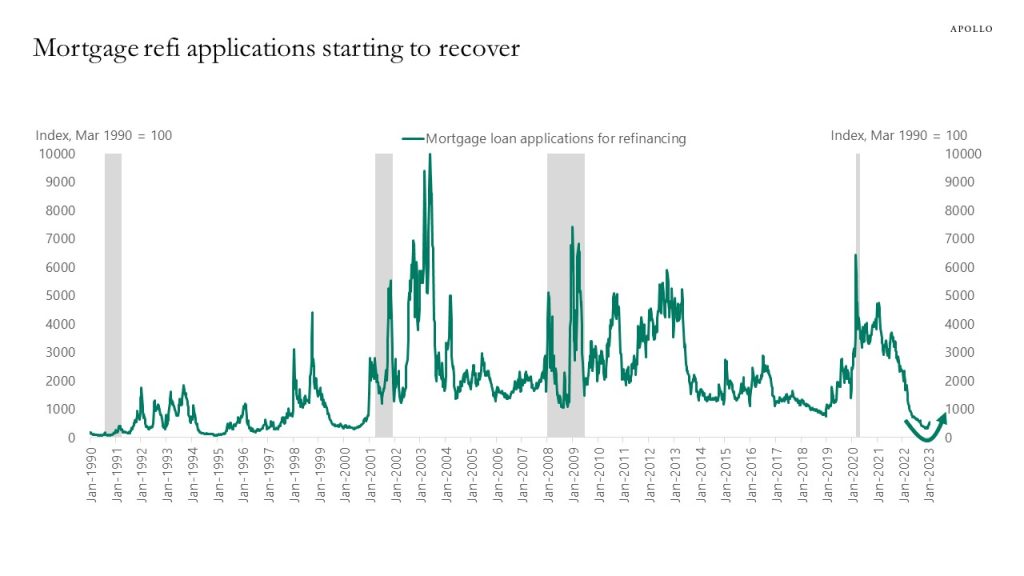

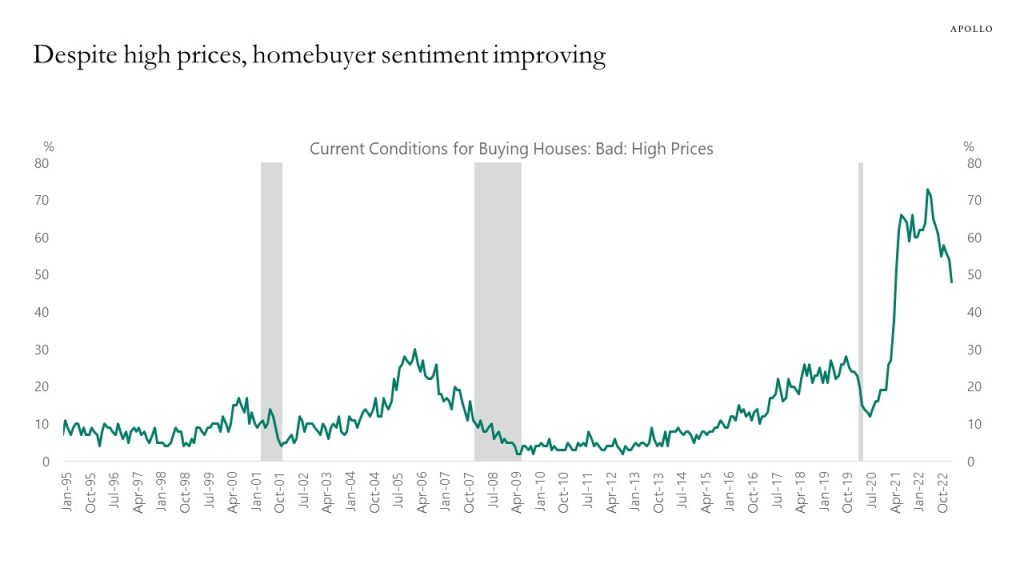

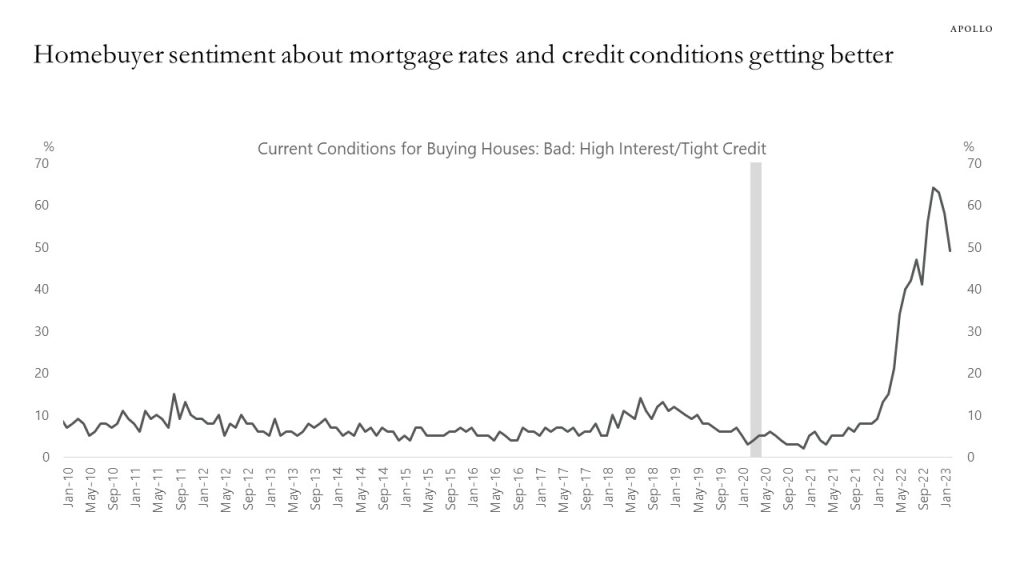

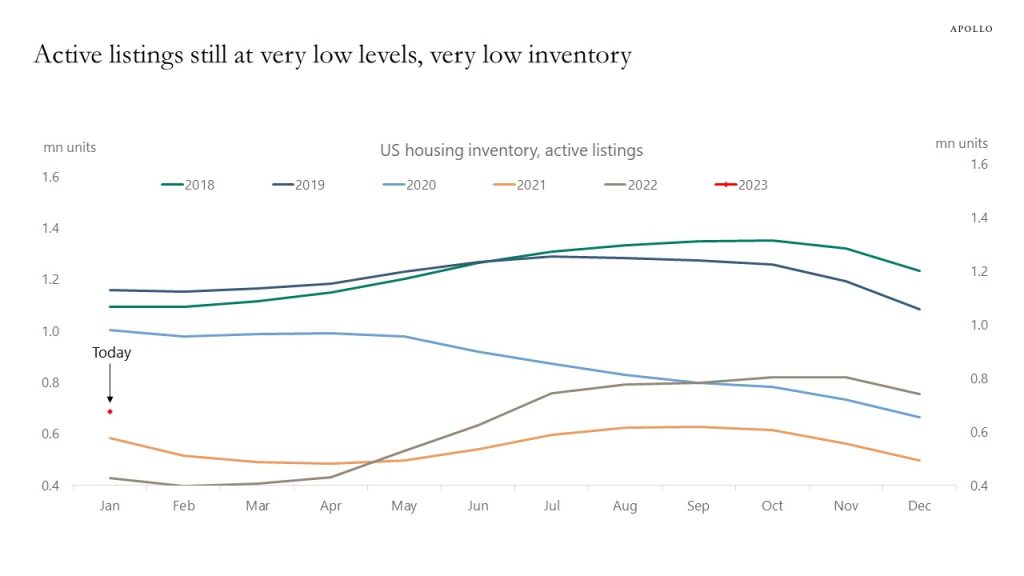

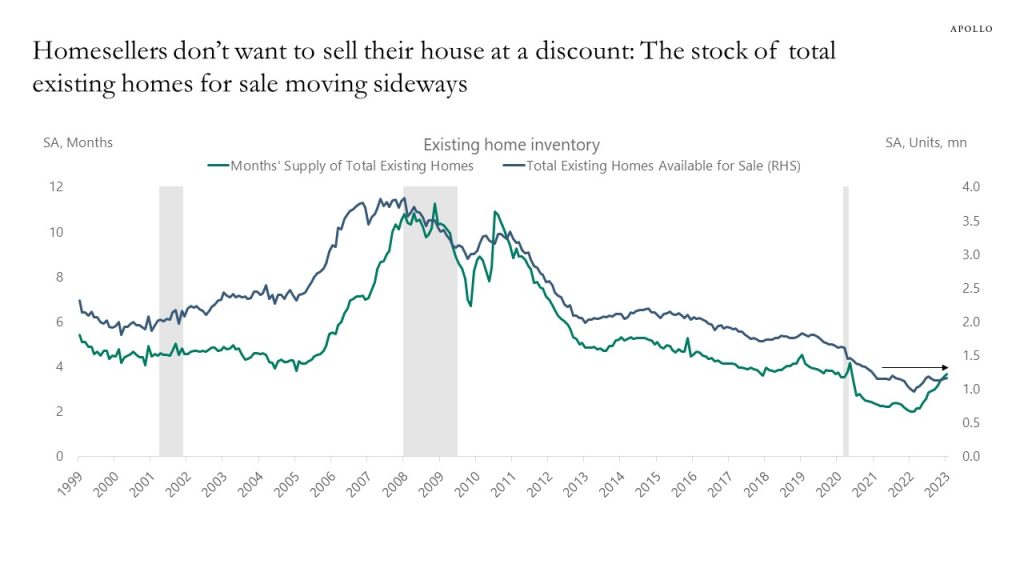

Most notably, the housing market is starting to rebound, see charts below. Traffic of prospective buyers of new homes is rebounding, homebuilder sentiment and homebuyer sentiment are rebounding, new home sales are beginning to recover, the average number of offers received per sold property is starting to recover, active listings are still very low, and indicators suggest that homesellers are simply not selling their home if they don’t like the price they are being offered. This makes sense with continued strong job growth, strong wage growth, and high household savings.

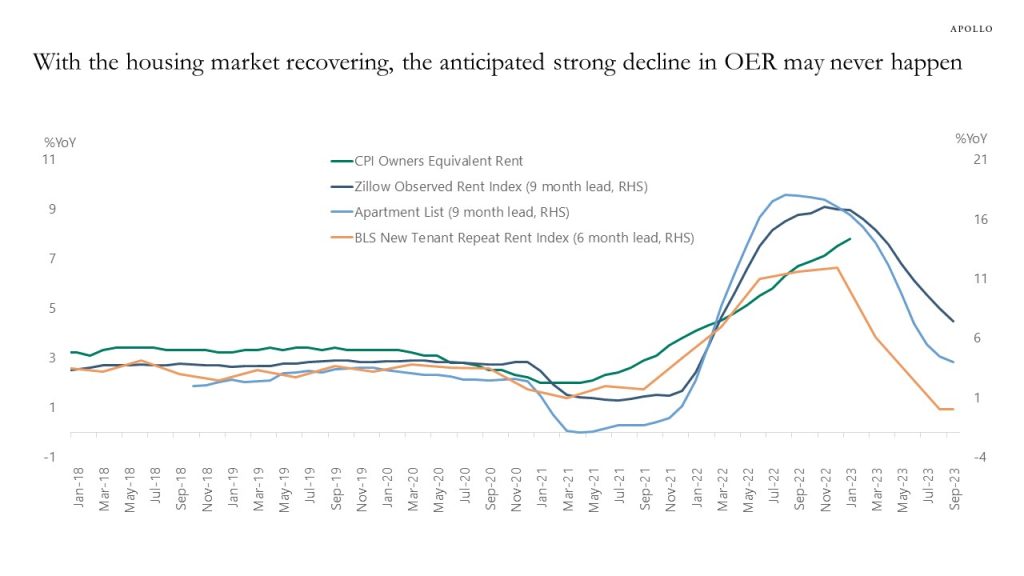

With the housing market recovering, the risks are rising that the expected strong rollover in the shelter component of the CPI index may never happen, see the last chart.

Source: National Association of Homebuilders, Bloomberg, Apollo Chief Economist

Source: University of Michigan, NAHB, Haver Analytics, Apollo Chief Economist

Source: Census Bureau, NAR, Haver, Apollo Chief Economist; Forecast is Bloomberg consensus

Source: NAR, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: Mortgage Bankers Association, Bloomberg, Apollo Chief Economist

Source: University of Michigan, Apollo Chief Economist

Source: University of Michigan, Apollo Chief Economist

Source: Realtor.com, Apollo Chief Economist

Source: NAR, Apollo Chief Economist

Source: Zillow, BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

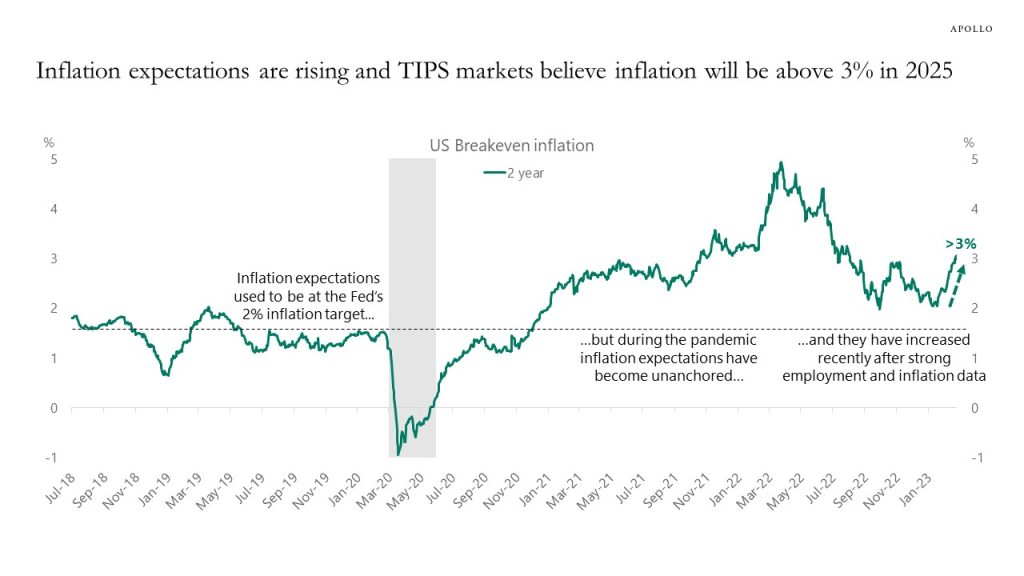

With core PCE inflation in January rising to 4.7%, the unemployment rate at the lowest level since the 1960s, and 2-year breakeven inflation expectations becoming unanchored, the Fed is about to turn significantly more hawkish.

Based on the latest data for inflation and unemployment, the Taylor Rule is now suggesting that the Fed funds rate today should be almost 10%, and it is becoming clear for the Fed that a sharper slowdown in the economy is needed to get inflation under control, in particular with the housing market showing signs of rebounding.

A generation of investors has since 2008 been taught that they should buy on dips, but today is different because of high inflation, and credit markets and equity markets are underestimating the Fed’s commitment to getting inflation down to 2%.

The Fed is now so far away from its dual mandate that the FOMC may not only consider using more hawkish forward guidance and raising the Fed funds rate but they could also accelerate the rundown of their balance sheet. The no landing scenario continues and the consequence is that we will continue to have high volatility in markets.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

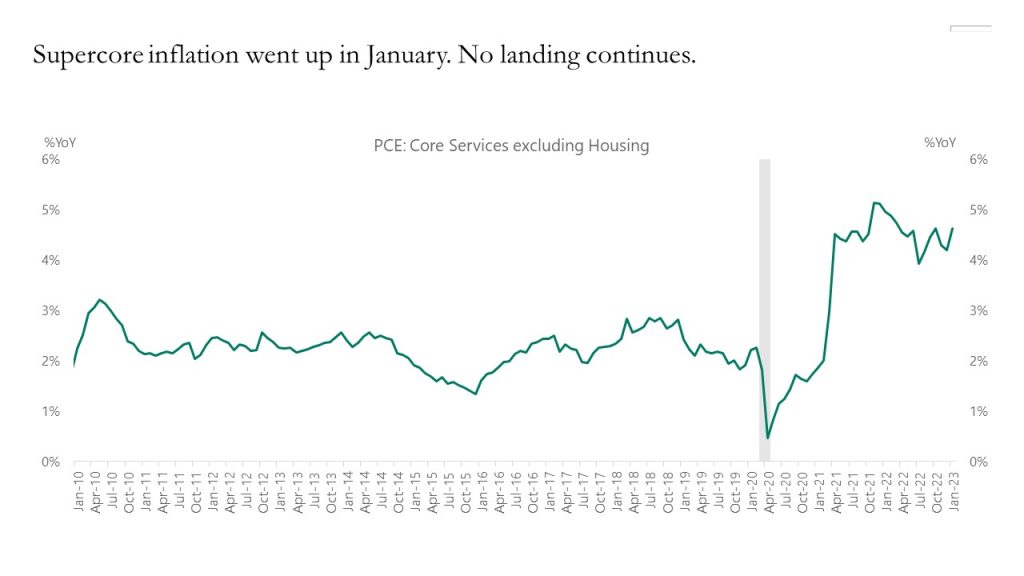

The PCE inflation data that came out on Friday shows that the Fed’s preferred measure of inflation, namely core inflation excluding housing, also known as supercore inflation, increased in January to 4.6%, dramatically above the Fed’s 2% inflation target. The economy outside the interest rate-sensitive components – which only make up 20% of GDP – is simply not slowing down.

Even the housing market is starting to show signs of a rebound, driven by strong job growth, high wage growth, and high levels of savings across the income distribution, which is particularly problematic given the consensus expectation that OER should be declining over the coming quarters. As a result, the Fed has to raise interest rates more, and this continues to be a downside risk to equity and credit markets.

A Fed-driven tightening in financial conditions with higher rates, lower equities, and wider credit spreads increases the probability that no landing will be followed by a hard landing.

Source: BEA, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

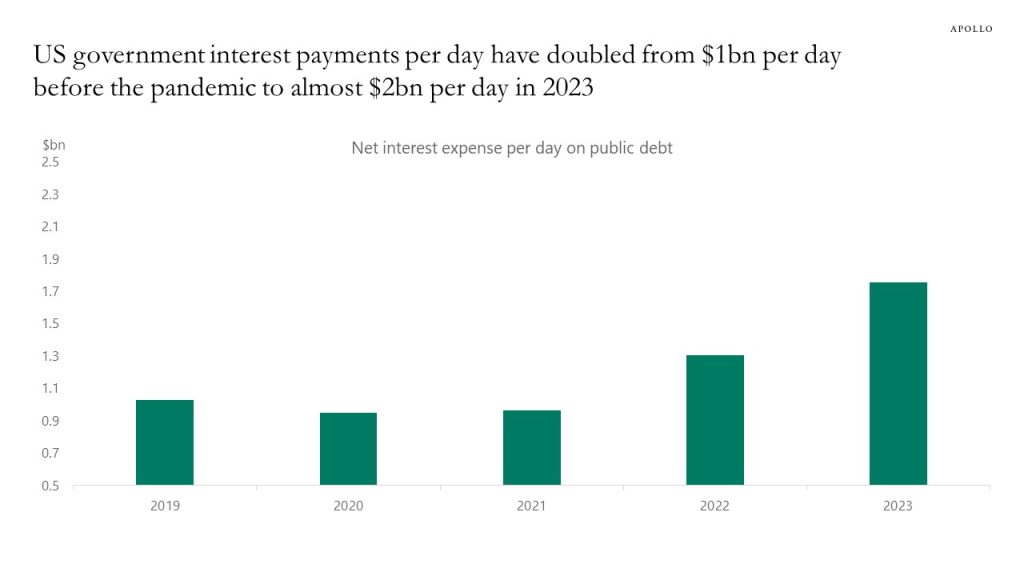

With interest rates rising and debt levels going up, debt servicing costs are rising. Using CBO data shows that interest payments on US government debt have doubled from $1bn per day before the pandemic to now $2bn, see chart below.

Source: CBO, Haver Analytics, Apollo Chief Economist. Note: Interest rate assumption by CBO: 2.1% in 2022 and 2.7% in 2023. Annual CBO data divided by 365. See important disclaimers at the bottom of the page.

-

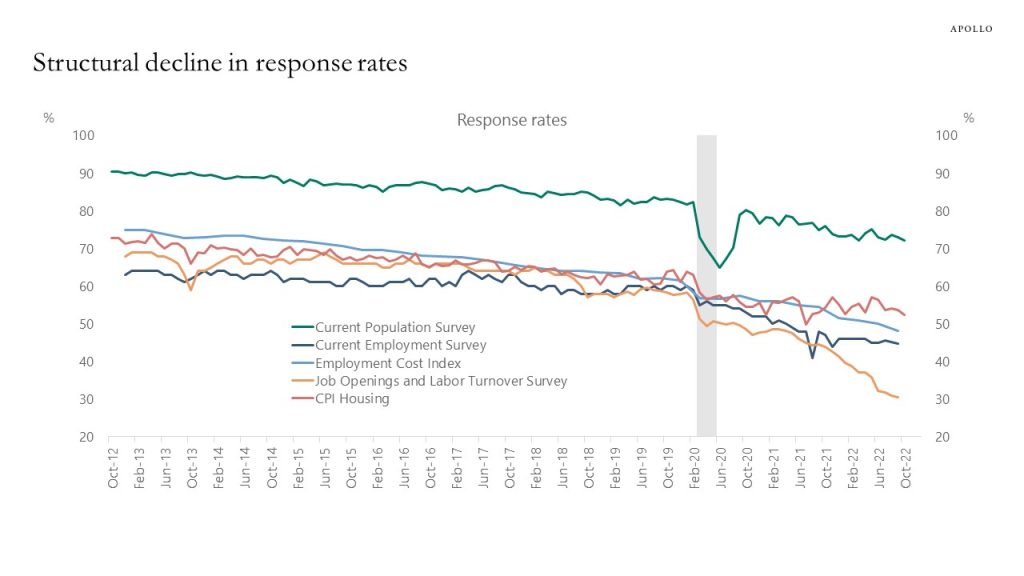

The Fed’s dual mandate is full employment and inflation at 2%, but response rates to both labor market surveys and inflation surveys continue to decline, see chart below. Measurement problems are particularly problematic when both inflation and unemployment are not near the Fed’s desired goals of 2% inflation and 4% unemployment.

The homework for markets is to compare the outcome of different surveys such as the Employment report with Jobless claims and JOLTS data, where all data at the moment tell the same story of significant overheating in the labor market.

The bottom line is that the economic data is becoming more unreliable, causing more volatility in the incoming data and hence more volatility in markets.

Source: BLS, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

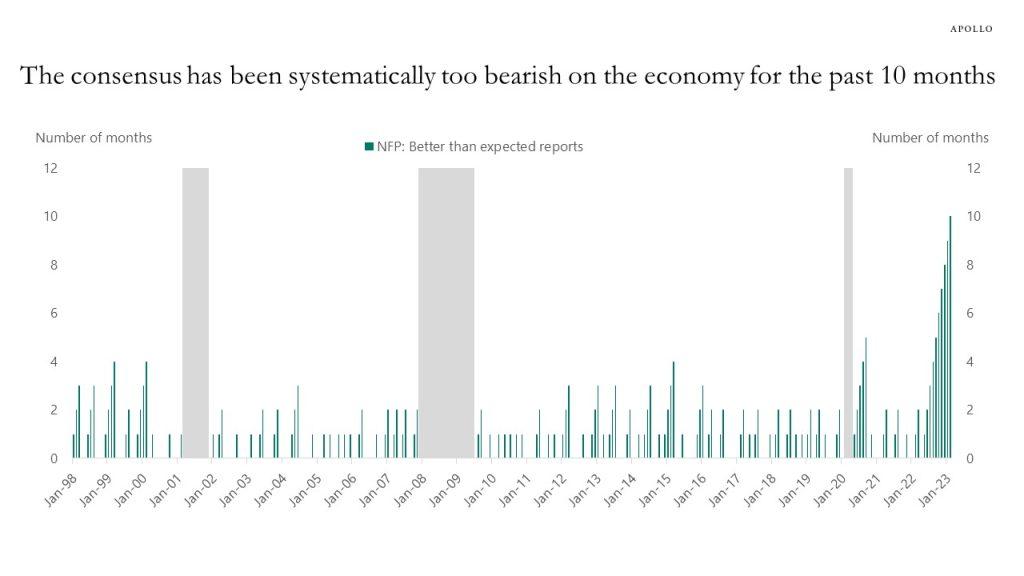

For the past 10 months, the consensus has expected a slowdown in the labor market, but every month the data has come in better than the consensus expected, see chart below.

This all-time high in being consistently too bearish since 1998 is noteworthy, and investors should reevaluate whether the ongoing bearishness on the economic outlook is justified, in particular in a situation with nonfarm payrolls at 517,000, the unemployment rate at the lowest level since the 1960s, and very strong retail sales.

The bottom line is that the no landing scenario continues, and the Fed has to increase interest rates more than the market expects to slow the economy down and get inflation back to the FOMC’s 2% inflation target.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

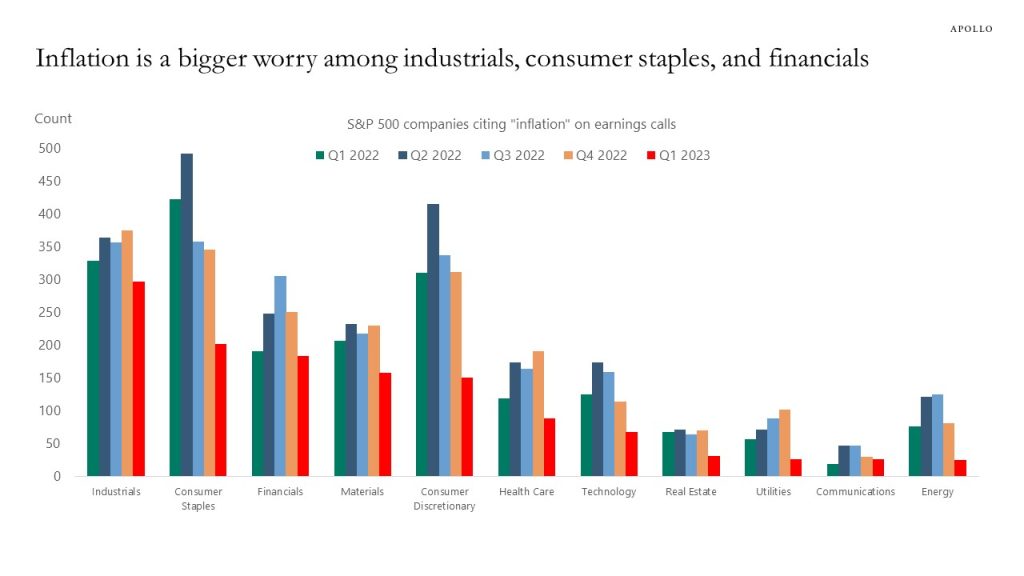

Looking at transcripts of earnings calls shows that industrials, consumer staples, and financials are more worried about inflation than other sectors in the S&P500, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

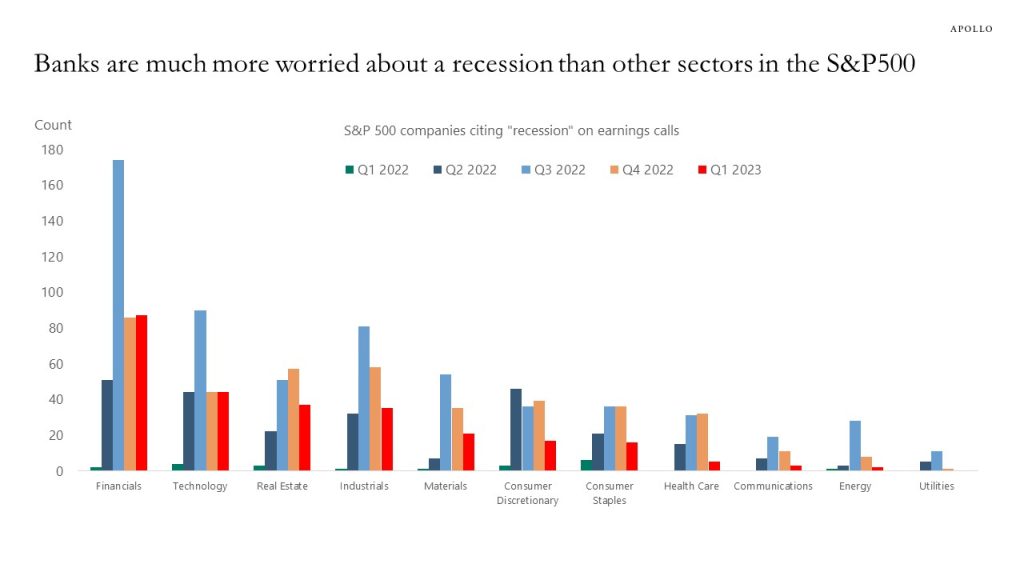

Looking at transcripts of earnings calls show that banks remain more worried about a recession than other sectors in the S&P500, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

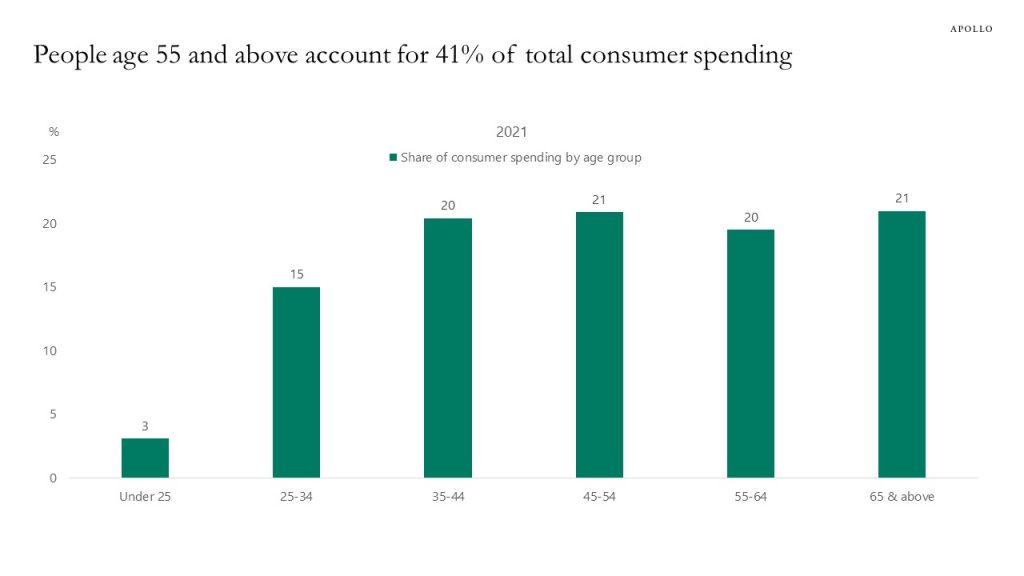

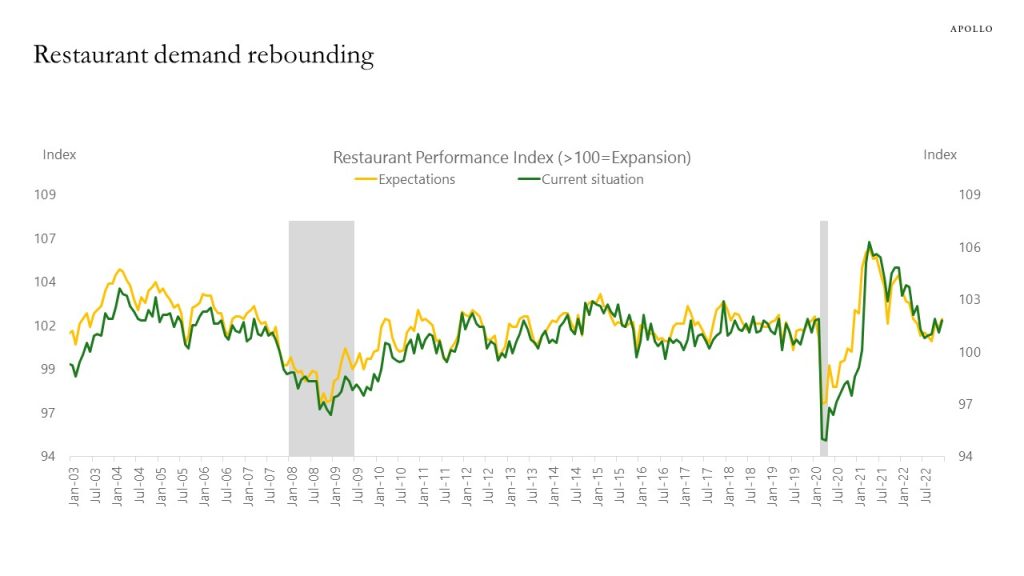

Our latest US consumer outlook is available here. Consumer spending continues to be supported by strong job growth, high wage growth, and plenty of savings across the income distribution. A few key charts below.

Source: BLS, Haver, Apollo Chief Economist

Source: National Restaurant Association, Haver, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.