Want it delivered daily to your inbox?

-

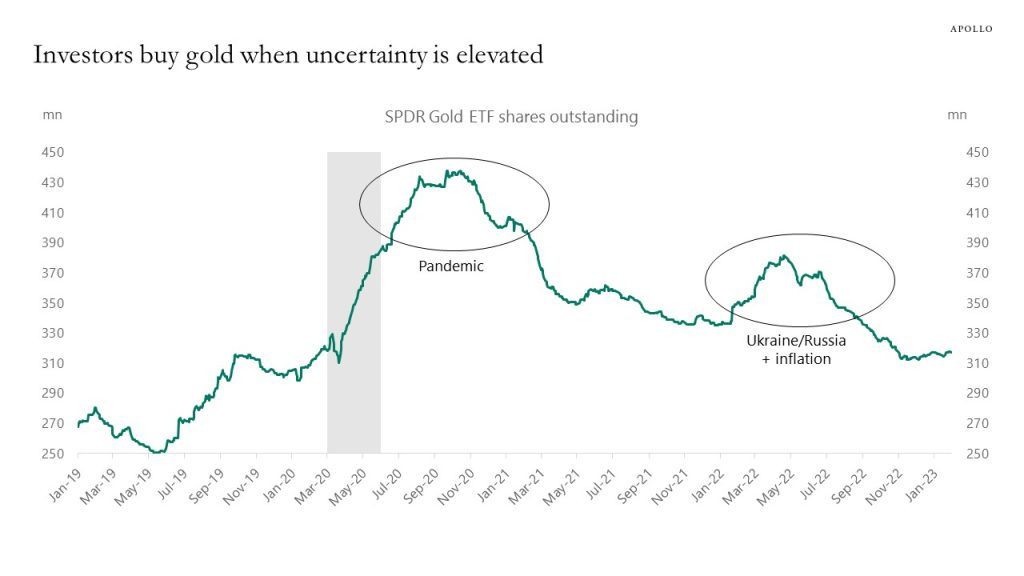

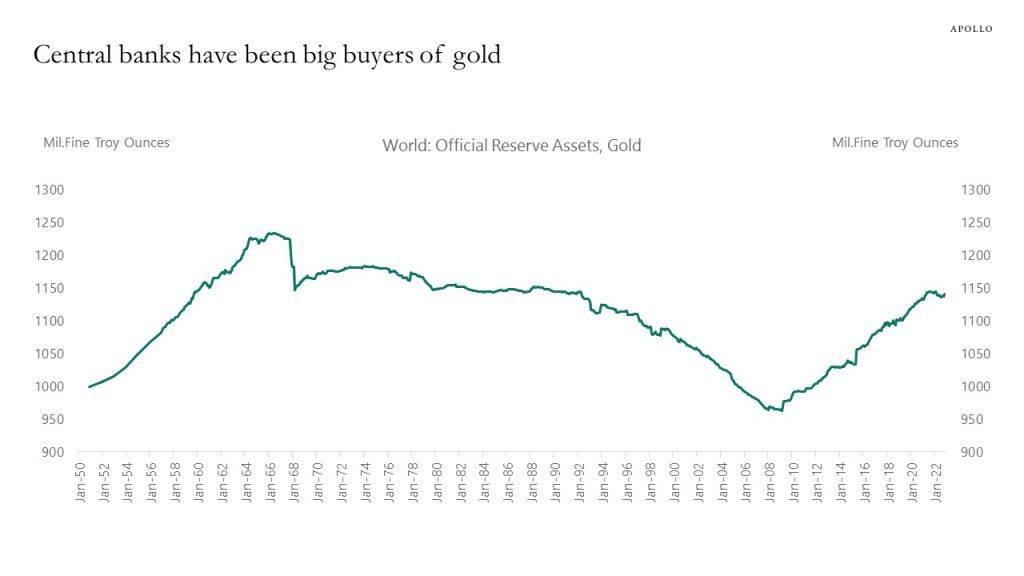

Central banks buy gold to diversify their reserves, for example when some currencies in their portfolios have appreciated significantly, and investors buy gold when uncertainty is high to protect themselves against falling asset prices, high inflation, or geopolitical risks, see charts below.

Source: Bloomberg, Apollo Chief Economist

Source: IMF, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

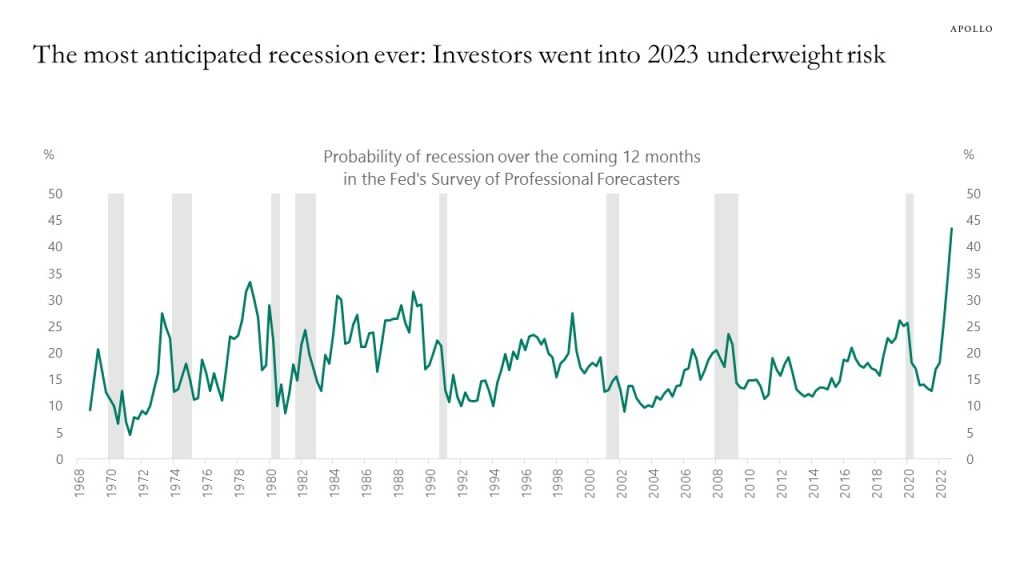

Investors have been underperforming their benchmarks because they entered 2023 underweight equities, expecting a slowdown that still hasn’t happened, see chart below.

Source: Federal Reserve Bank of Philadelphia, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

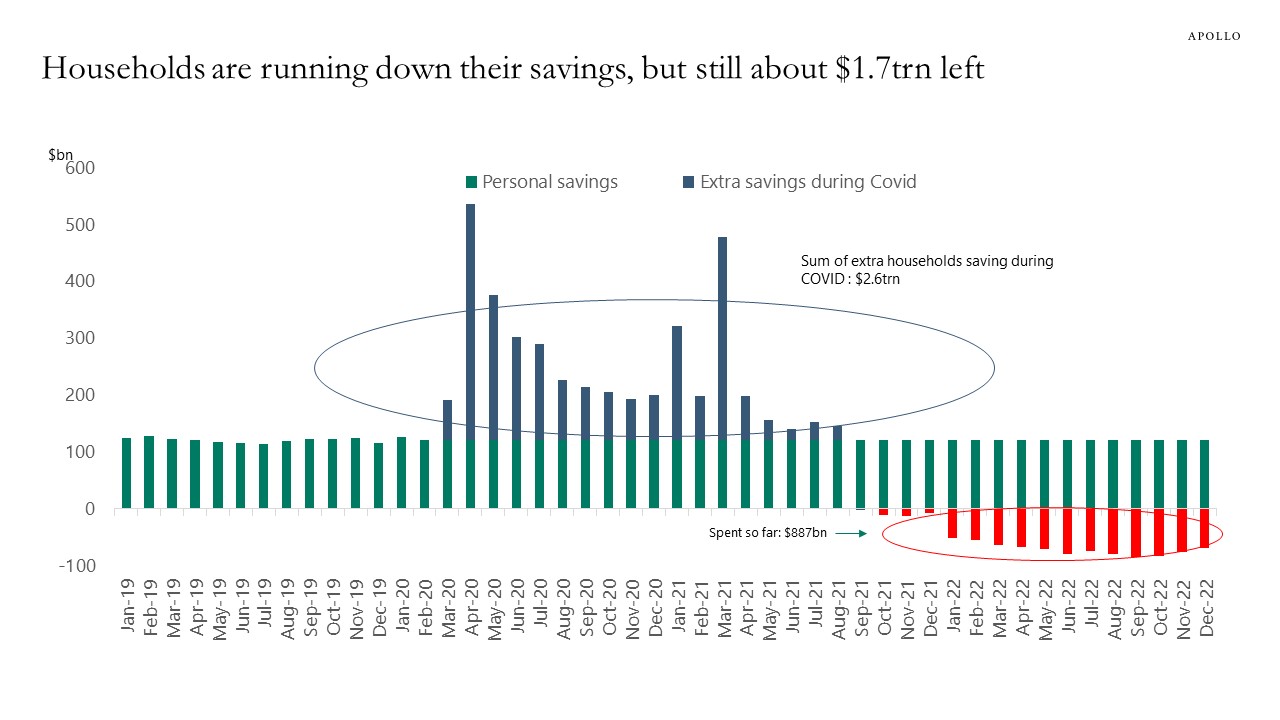

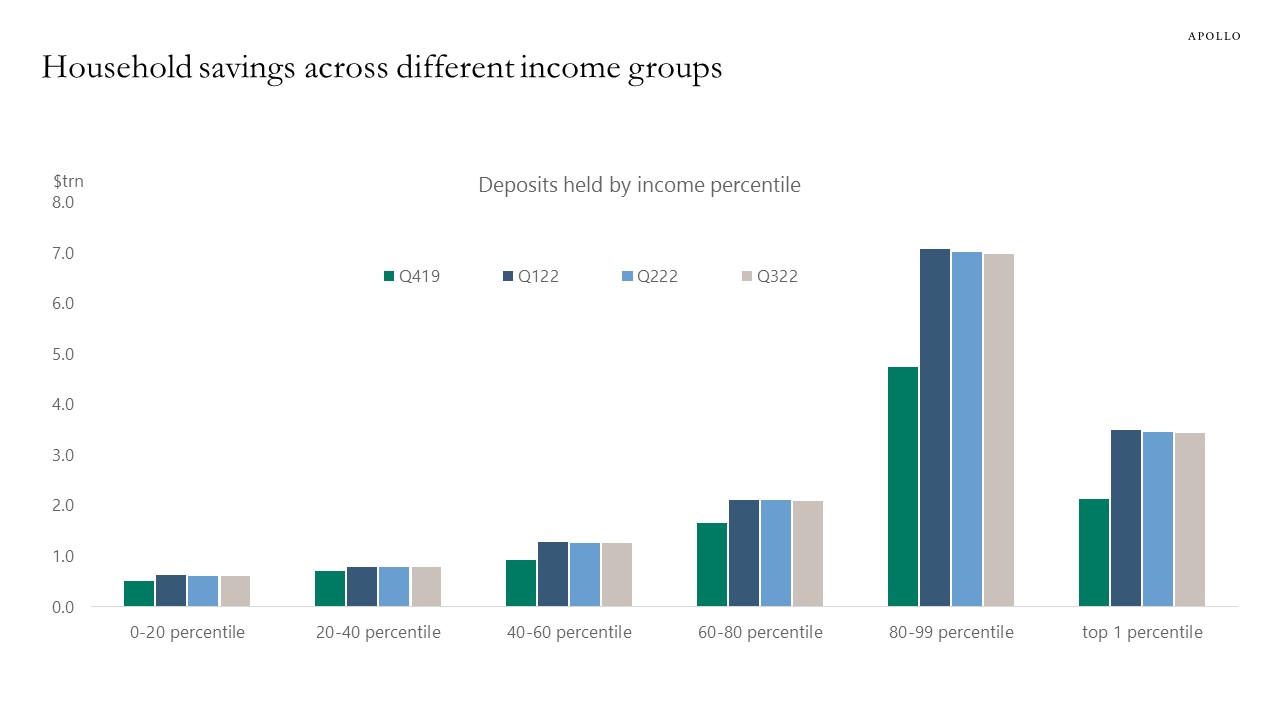

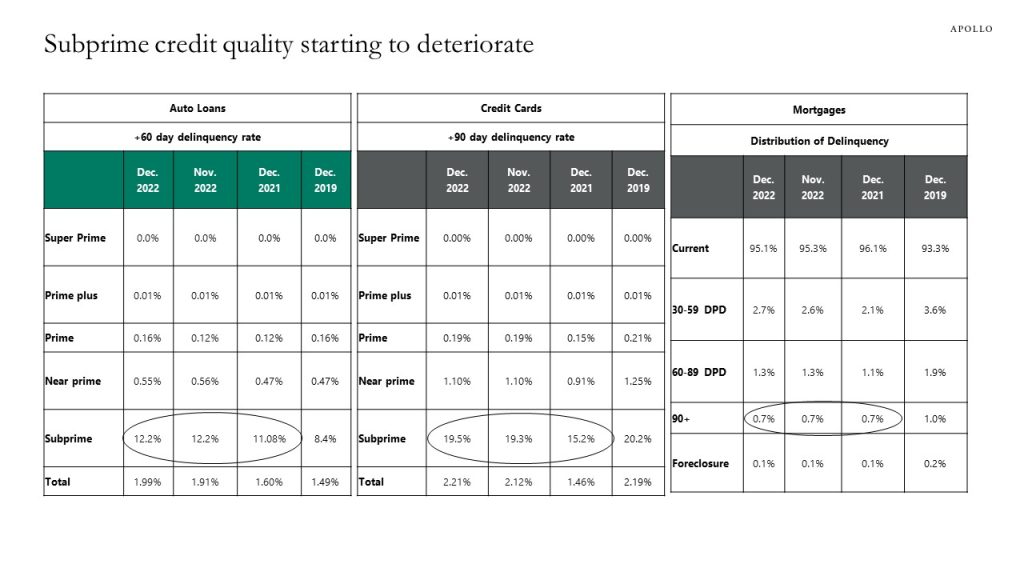

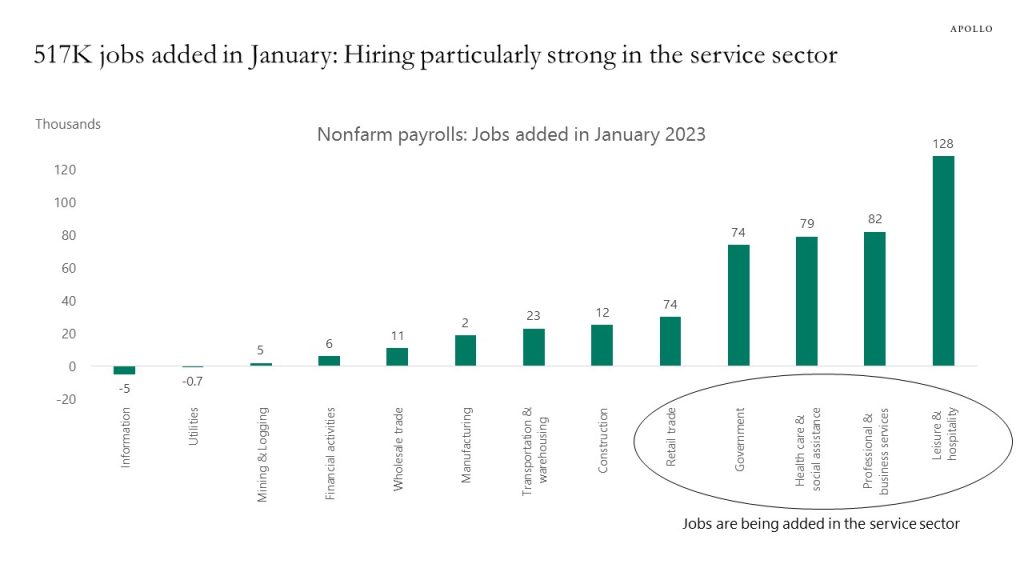

Subprime credit quality is starting to deteriorate, but the big picture is that wage growth is high, and job growth is strong, particularly in service sector jobs in leisure and hospitality. Combined with a high level of savings in the household sector, this continues to support consumer spending, see charts below. These strong tailwinds to consumer spending increase the risk that inflation will become more persistent. Expect Fed Chair Powell’s speech today at noon to be very hawkish.

Source: Bloomberg, Apollo Chief Economist

Source: FRB, Haver Analytics, Apollo Chief Economist

Source: Transunion Monthly Industry Snapshot December 2022

Source: BLS, Haver, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

With the risk of a no landing scenario rising, the Fed will remain hawkish for longer, and that will keep credit markets volatile over the coming quarters, see also our credit market outlook available here.

See important disclaimers at the bottom of the page.

-

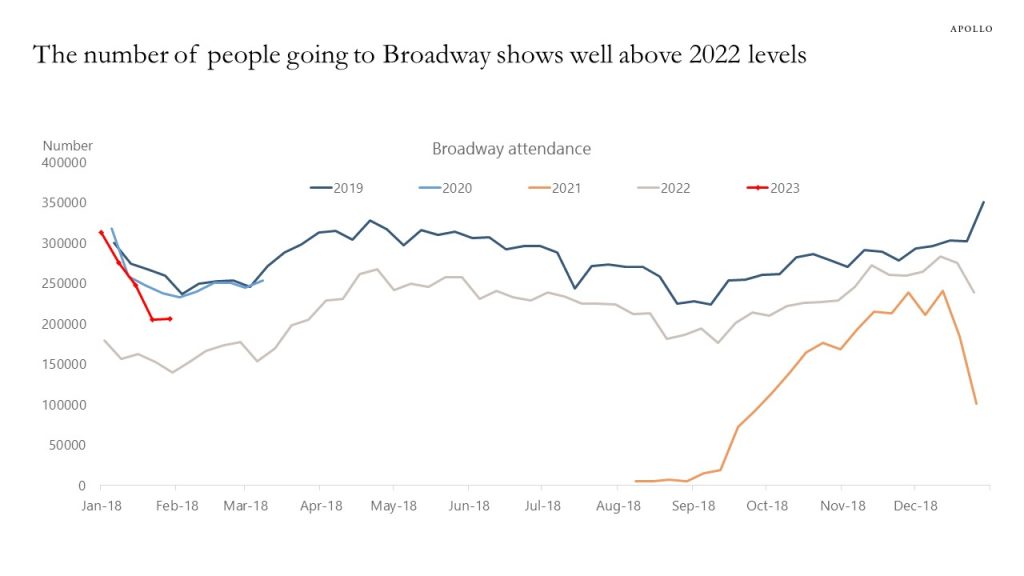

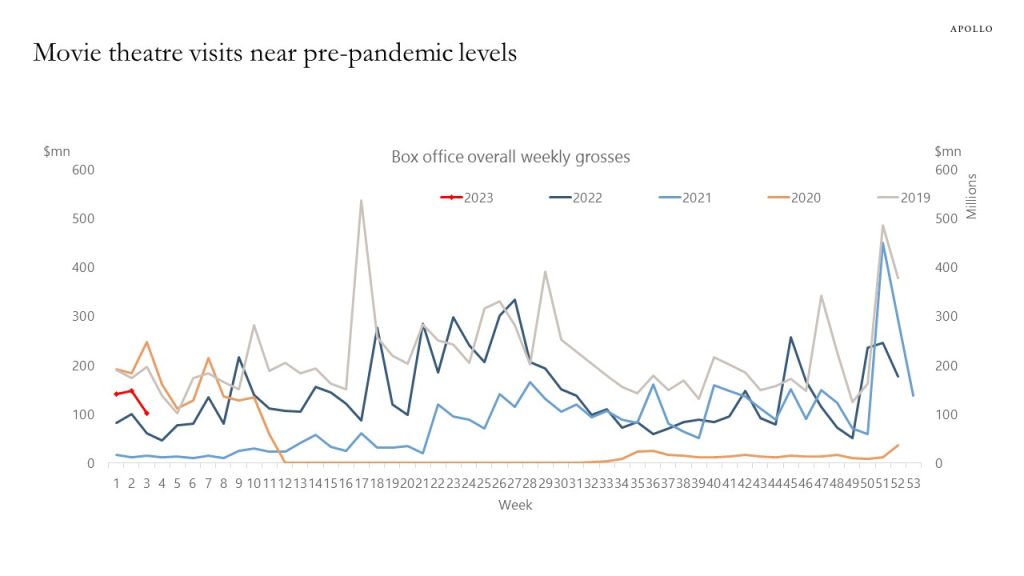

Fed rate hikes have impacted the interest rate sensitive components of GDP (housing, autos, capex), but the service sector is 80% of GDP and services continues to be strong. For example, the weekly data for the number of people going to Broadway shows and movie theatres is well above 2022 levels and not too far from the levels seen in 2019, see charts below. Our daily and weekly indicators for the US economy are available here

.

Source: Internet Broadway Database, Apollo Chief Economist

Source: Boxofficemojo.com, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

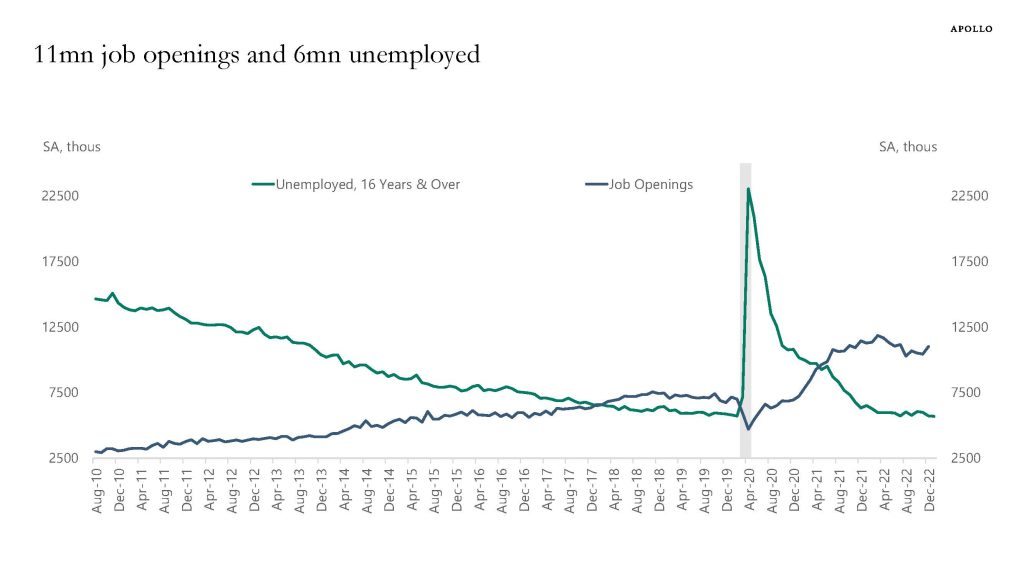

With very strong job growth, a higher labor force participation rate, and a decline in the unemployment rate to the lowest level since 1969, it is beginning to look more like a “no landing” scenario.

Under the no landing scenario the economy does not slow down, and upside risks to inflation are coming back after the initial decline in inflation driven by supply chain improvements. And under the no landing scenario the Fed will need to raise rates more and keep rates higher for longer to get inflation all the way back to the Fed’s 2% target.

The no landing scenario is negative for markets because higher rates for longer increases the downside risks for equities and credit, particularly for tech and highly levered companies that will see higher interest payments for longer. In short, the no landing scenario brings back the volatile market action we saw in 2022 because it reintroduces uncertainty about inflation and about the Fed.

Our employment outlook presentation is available here.

Source: BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

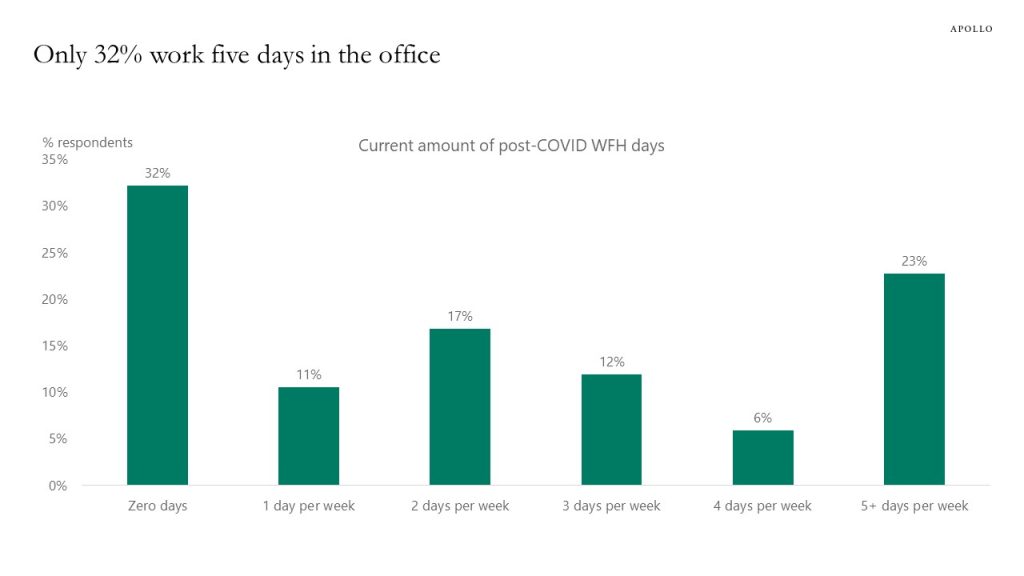

About 2/3 of US workers work from home at least one day a week, see chart below.

For more, see Stanford Professor Nick Bloom’s WFH homepage and research library here.

Source: Nick Bloom, Stanford, WFH Research, Apollo Chief Economist. Figures may not sum to 100% due to rounding. See important disclaimers at the bottom of the page.

-

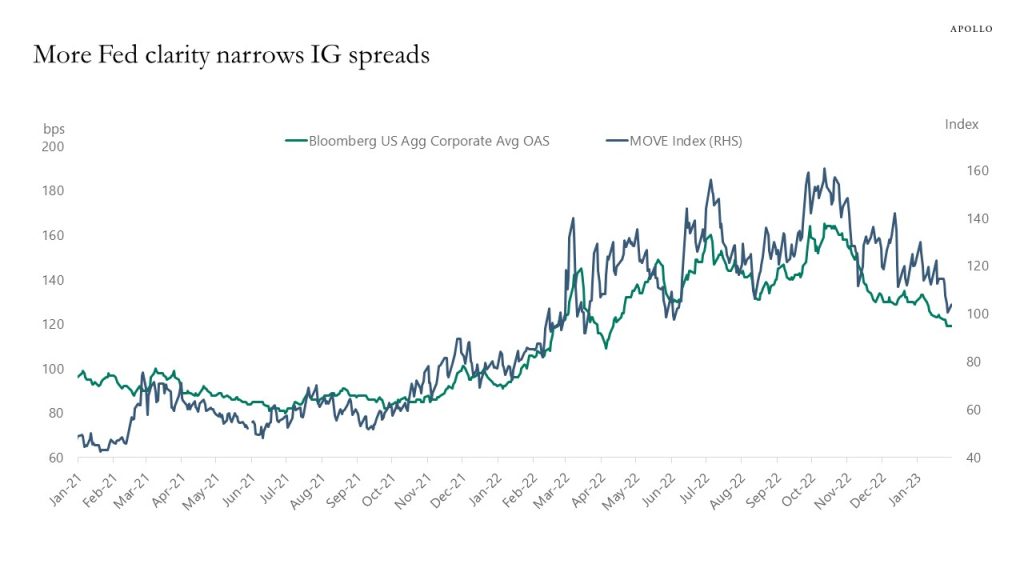

With Fed hikes coming to an end and more clarity about what the Fed will do, we should continue to expect lower implied vol in rates.

And lower rates vol and more macro certainty is good news for credit, and it should continue to narrow IG credit spreads, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

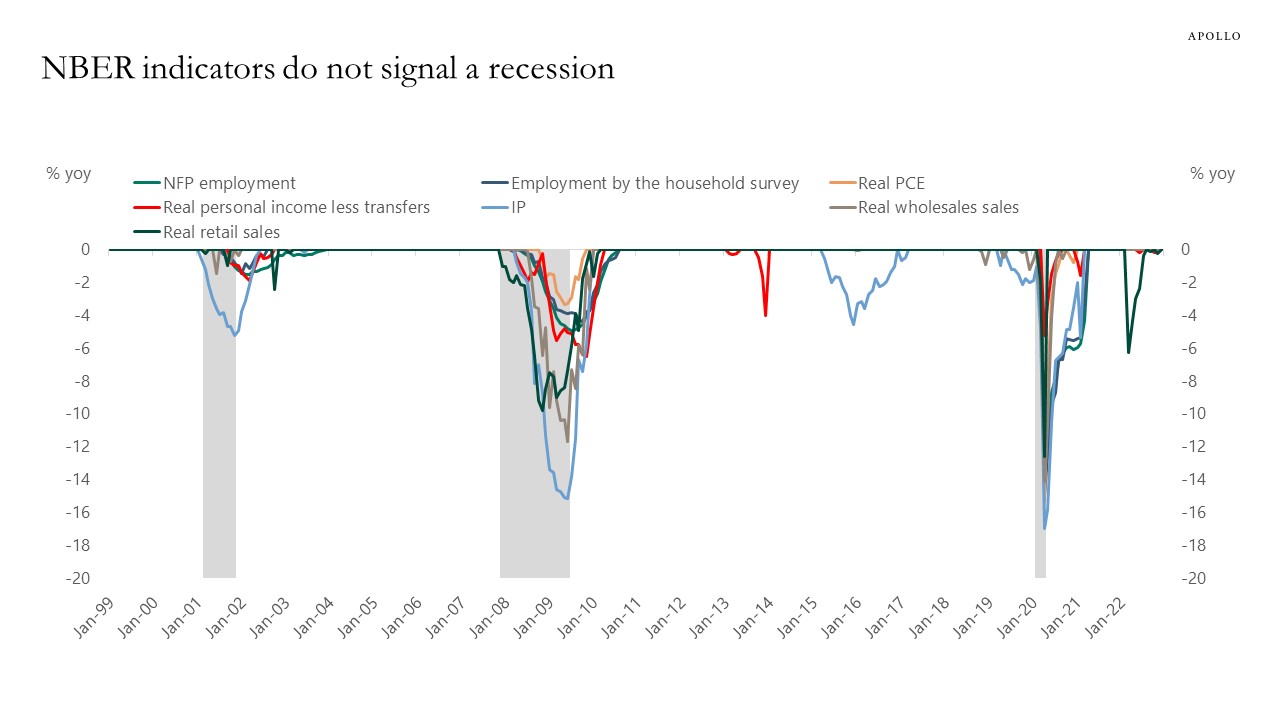

ECI wage inflation is coming down, and the consensus is expecting nonfarm payrolls on Friday to come in at 190K, and none of the indicators the NBER recession committee normally looks at suggest that we are in a recession at the moment, see chart below and here. It continues to look like a soft landing.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

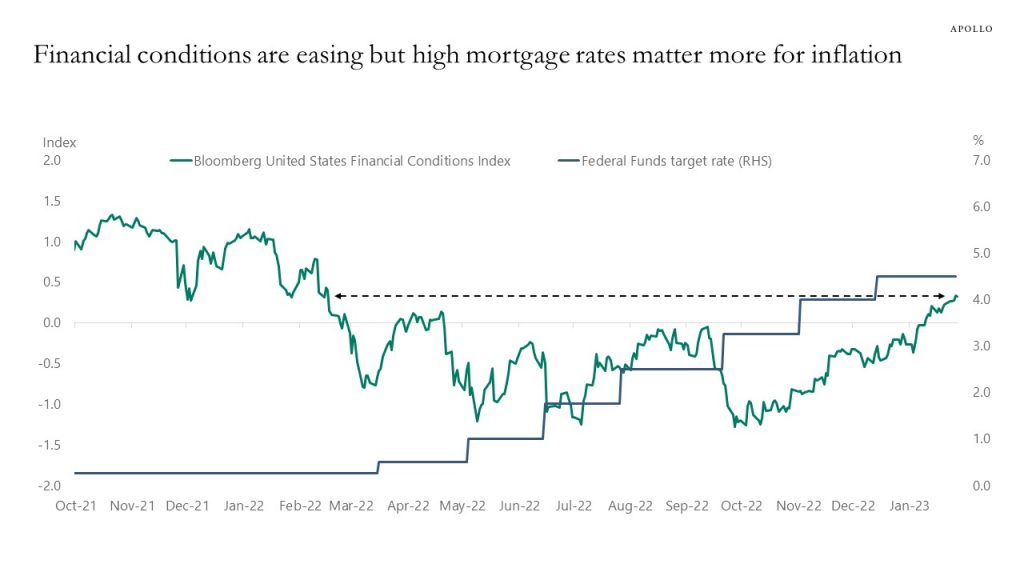

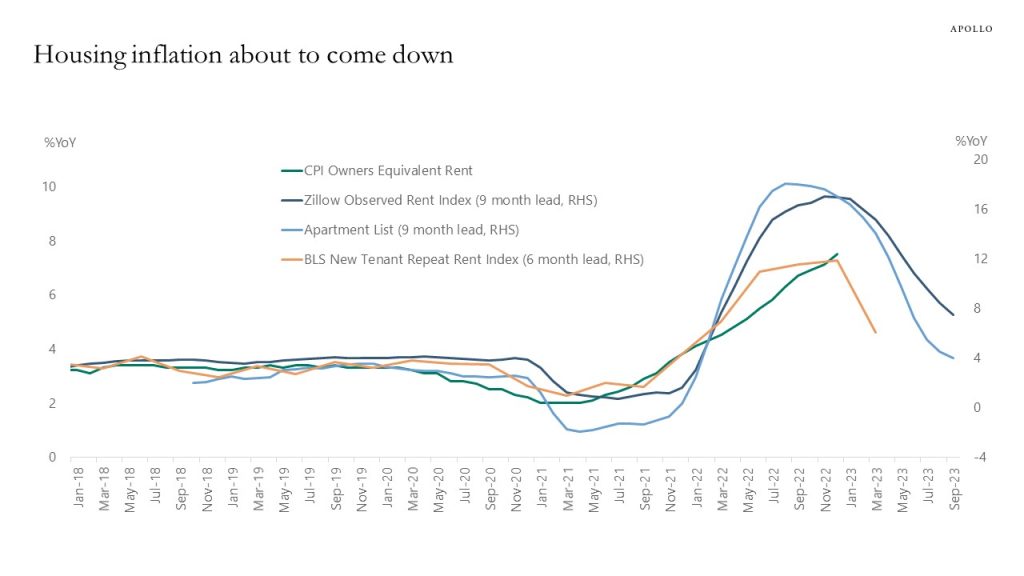

Financial conditions have eased to levels seen before the Fed started raising rates, but the Fed is not going to worry much about the ongoing rise in the S&P500 and tightening of credit spreads because what matters for the inflation outlook is the mortgage rate, which continues to put downward pressure on housing inflation, see charts below.

Bloomberg, Apollo Chief Economist

Zillow, BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.