Want it delivered daily to your inbox?

-

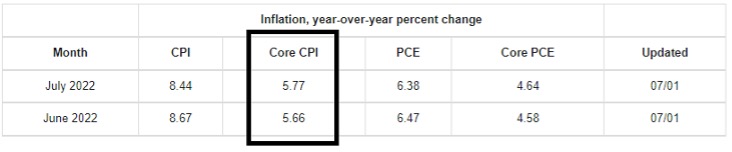

Core CPI inflation for May was 6.0%, and the Cleveland Fed expects core inflation over the coming months to decline to 5.7% and 5.8%, see link here and the first table below.

The Fed’s forecasts for month-over-month inflation are also expected to decline over the coming months, in particular for headline inflation, see the second table below.

The June CPI release will come out on Wednesday, July 13.

See important disclaimers at the bottom of the page.

-

Fed: What Is Corporate Bond Market Distress?

https://libertystreeteconomics.newyorkfed.org/2022/06/what-is-corporate-bond-market-distress/The Subjective Inflation Expectations of Households and Firms: Measurement, Determinants, and Implications

https://docs.iza.org/dp15391.pdfECB: Organisational structure as a driver of mergers and acquisitions in the European banking sector

https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2674~ebe571e288.en.pdfSee important disclaimers at the bottom of the page.

-

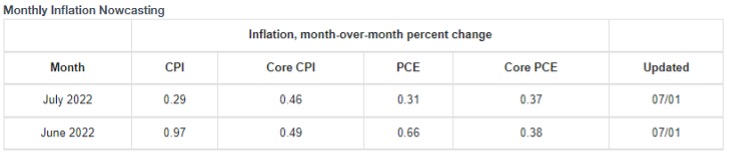

Our slowdown watch is available here, and a major theme in markets this week continues to be the divergence between rates markets and equity markets. Rates investors have been downgrading growth expectations, whereas equity investors have been upgrading earnings expectations. Either rates investors are right, and we will have a recession, and then earnings will come down. Or equity investors are right, and we will have a soft landing, and GDP growth expectations will be revised higher.

See important disclaimers at the bottom of the page.

-

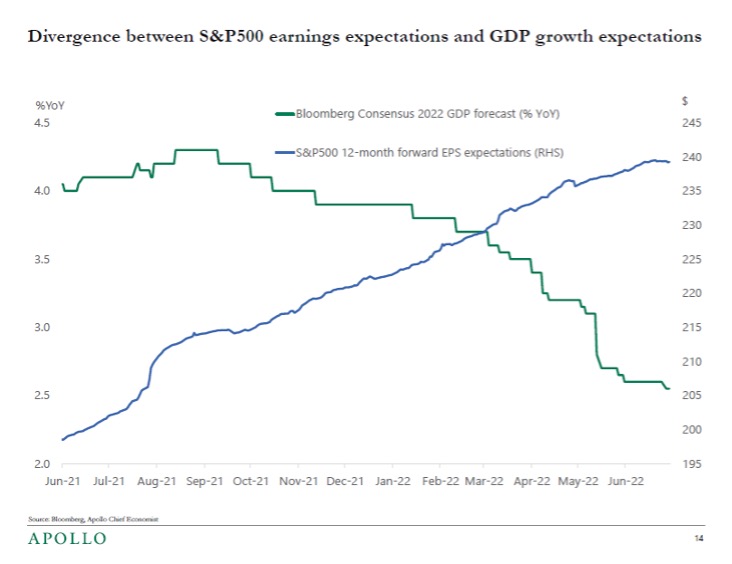

Looking at ETF flows shows that retail investors are taking money out of IG, HY, and loan ETFs but adding money to long crypto ETFs, see charts below.

Source: Bloomberg, Apollo Chief Economist (Note: bito US equity: Crypto ETF flows, BFFUEBK Index: US Bank loans ETF flows, BFFUEHY Index: HY ETF flows; BFFUEIG Index: US IG ETF flows) See important disclaimers at the bottom of the page.

-

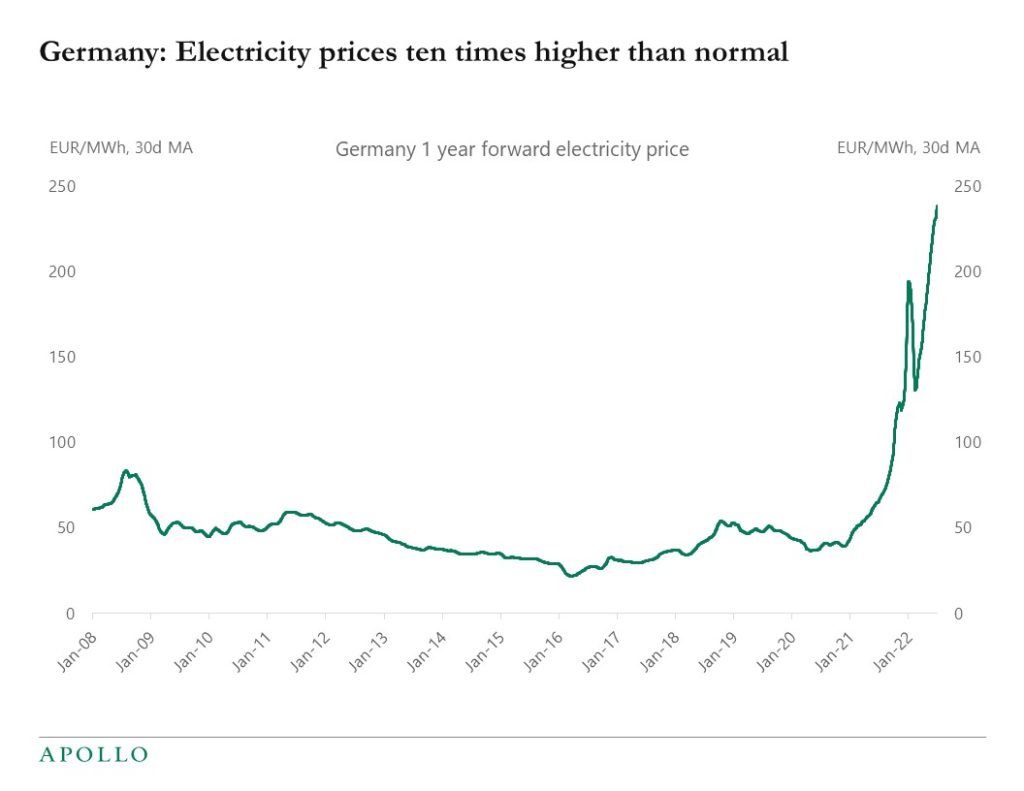

Electricity prices in Germany are ten times higher than pre-pandemic levels, and the strong increase in European power prices is driven by less wind than expected, worries about the winter balance, and Germany trying to fill the Russia supply gap for natural gas, see chart below. This stagflation theme of higher inflation and lower growth is more pronounced for Europe than the US.

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

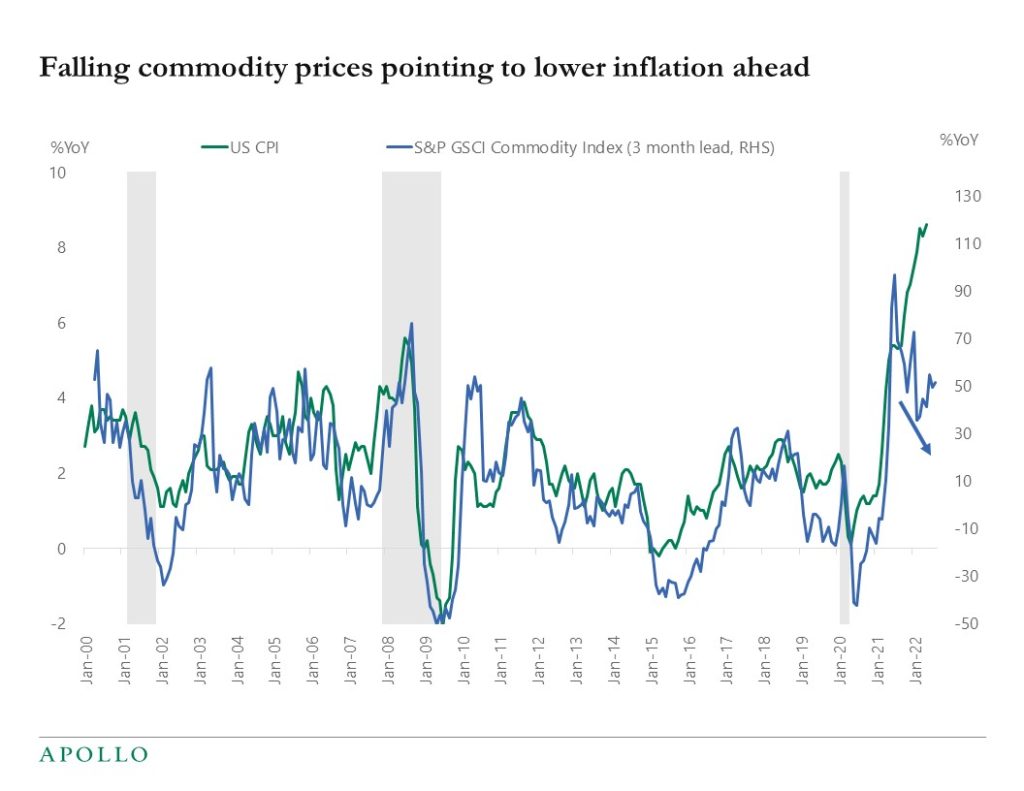

Inflation is the number one worry for markets and any signs of inflation coming down could trigger a rally in the stock market and credit markets. The arguments for inflation coming down are accumulating:

1) Commodity prices are trending lower

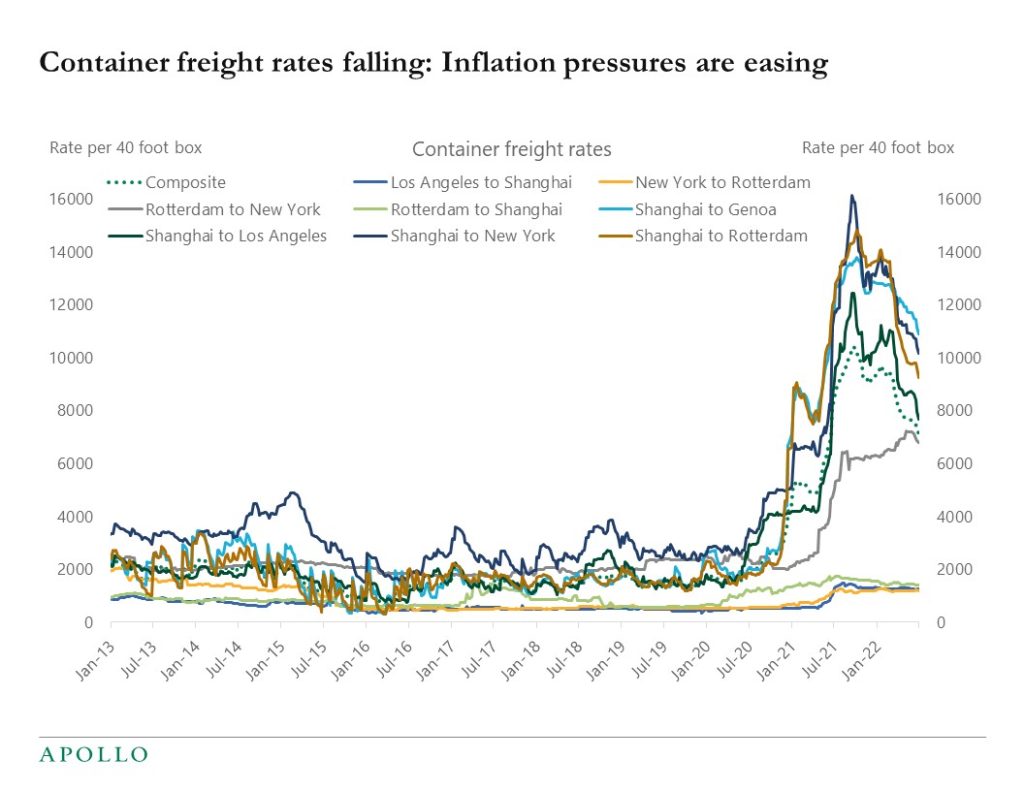

2) With China reopening and supply chains normalizing, transportation costs for goods are coming down

3) Inventories are growing at many retailers and this is putting downward pressure on goods prices

4) Rising car production is putting downward pressure on new and used vehicle prices

5) Airline ticket prices have been falling during June, see also here

6) Increases in rents and home prices are moderating

7) A higher dollar is lowering import pricesInflation rolling over would also dampen recession worries because lower inflation would mean that the Fed doesn’t have to increase interest rates as much.

The bottom line is that inflation may stay elevated for another month or two, but given the trends listed above, the probability is rising that inflation going into the second half of this year could come down faster than the market currently expects.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

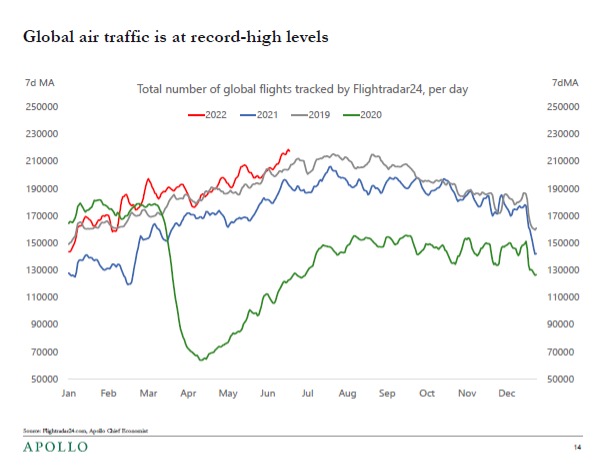

Despite central banks globally raising rates, there are still no signs of a slowdown in daily global flight activity, see chart below.

See important disclaimers at the bottom of the page.

-

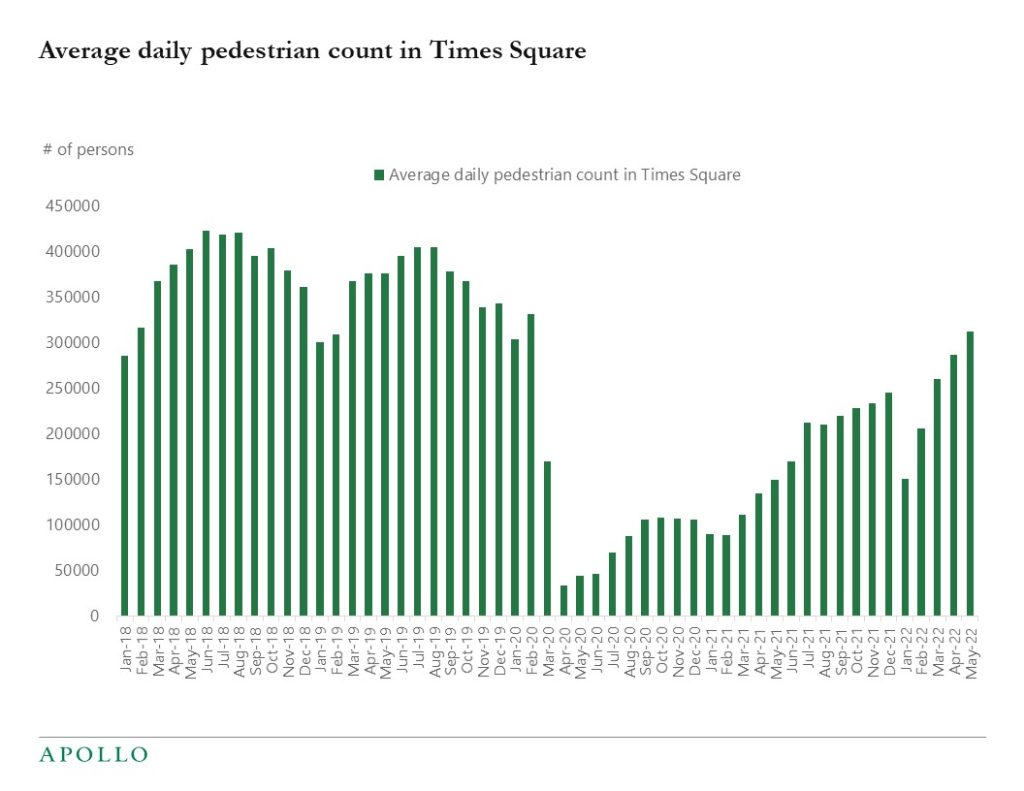

Pedestrian traffic in Times Square is now 94% of pre-pandemic levels, see chart below.

Source: timessquarenyc.com, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

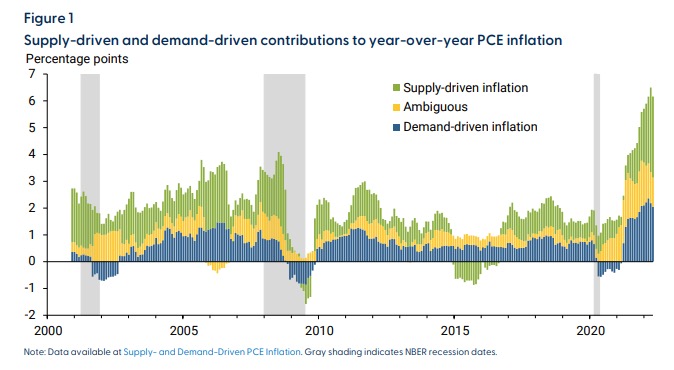

This new Fed paper looks at the sources of inflation and finds that demand factors are responsible for only one-third of the increase in inflation. With supply disruptions easing, we should, over the coming months, begin to see a meaningful decline in inflation even if aggregate demand remains solid. Note also in their chart below how demand-driven inflation (=the blue bar) has already peaked. This is very important for credit and equities because what we are waiting for in markets is for inflation to start to decline from its current peak at 8.6%.

Fed: How Much Do Supply and Demand Drive Inflation?

https://www.frbsf.org/wp-content/uploads/sites/4/el2022-15.pdf

See important disclaimers at the bottom of the page.

-

Our chart book with daily and weekly indicators for the US economy is available here, and the bottom line is that there are still no signs of the US consumer slowing down.

Most importantly, container freight rates continue to decline, and combined with falling commodity prices, this will put downward pressure on inflation over the coming months. With this backdrop, the probability is rising that we will soon have the peak in inflation behind us.

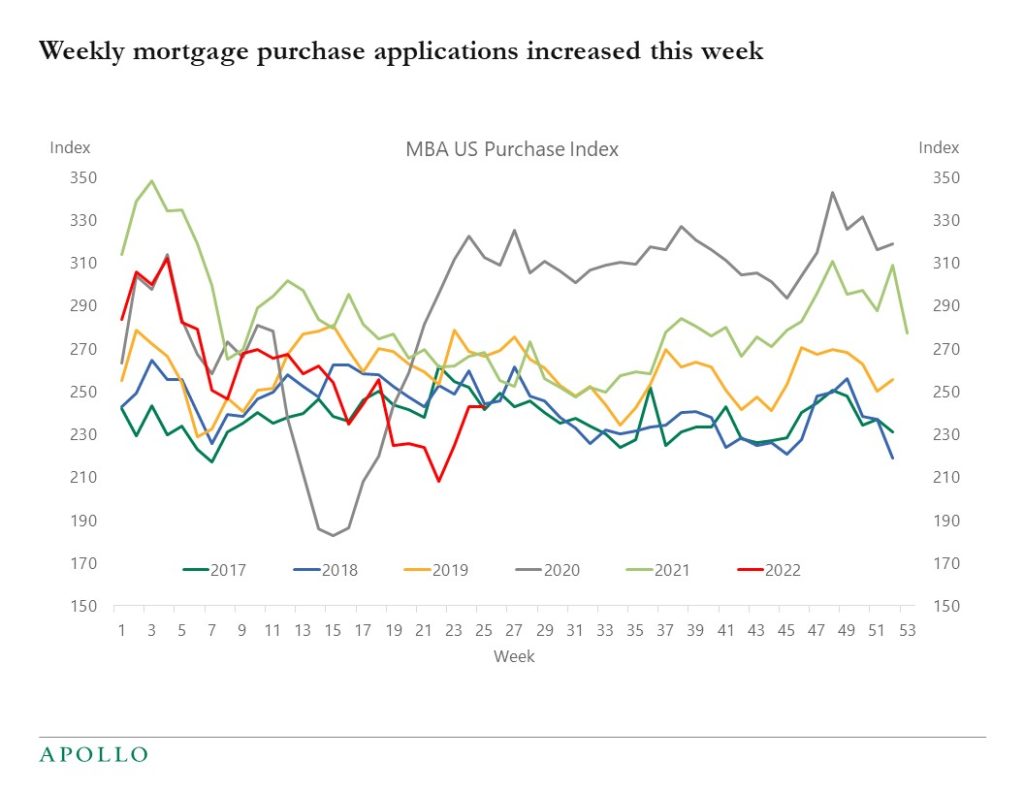

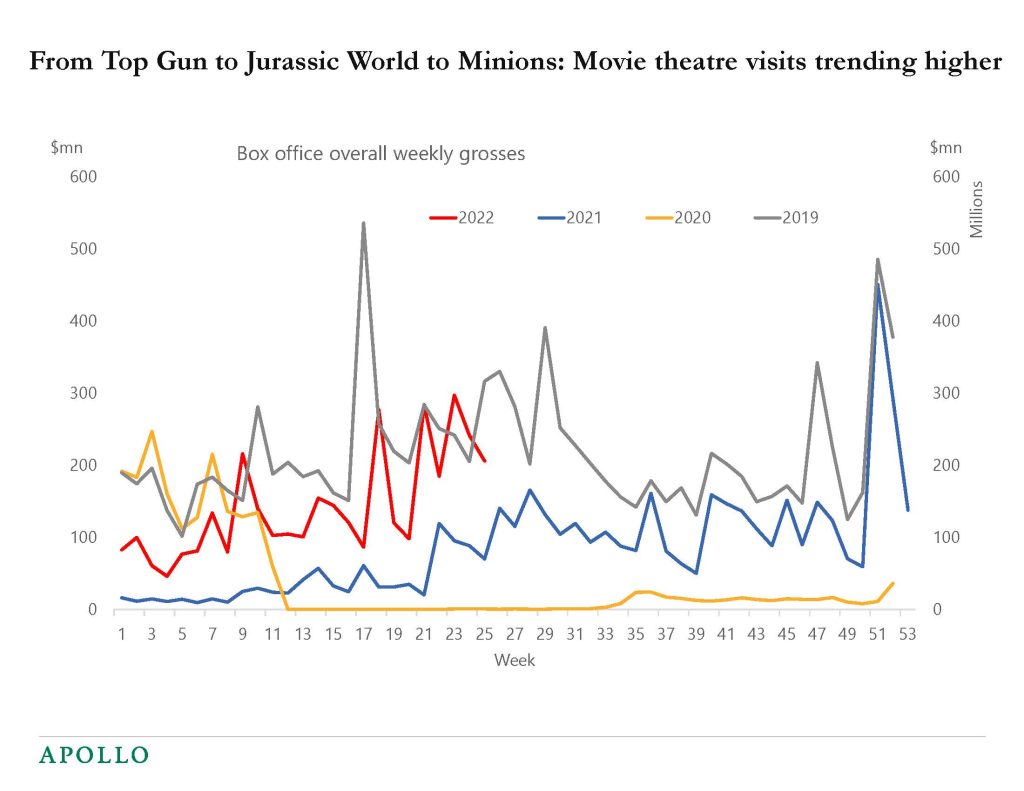

Other noteworthy charts this week are the increase in mortgage purchase applications and the trend increase in movie theatre visits driven by Top Gun and Jurassic World Dominion.

Source: WCI, Bloomberg, Apollo Chief Economist

Source: Mortgage Bankers Association, Bloomberg, Apollo Chief Economist

Source: Boxofficemojo.com, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.