Want it delivered daily to your inbox?

-

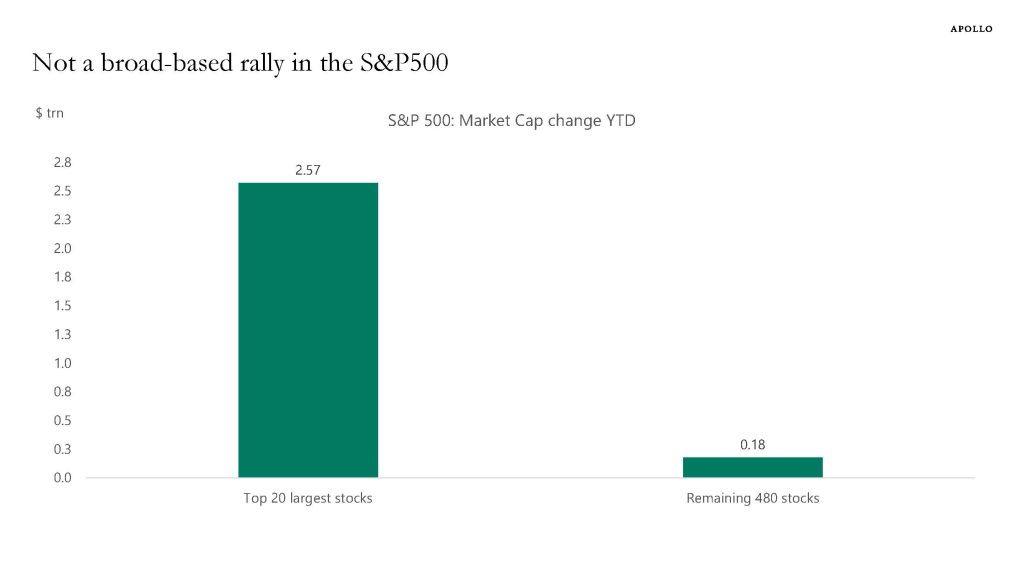

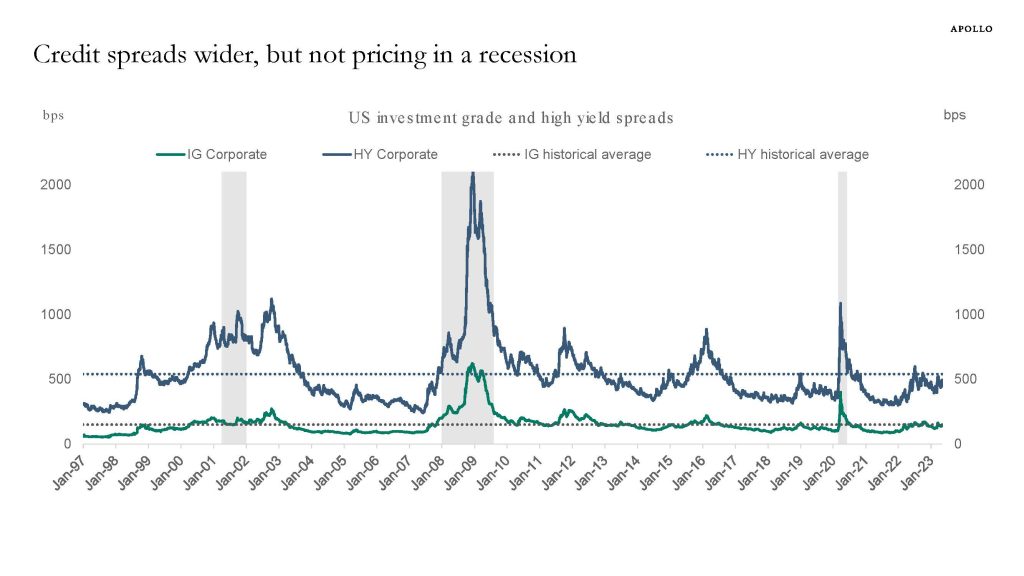

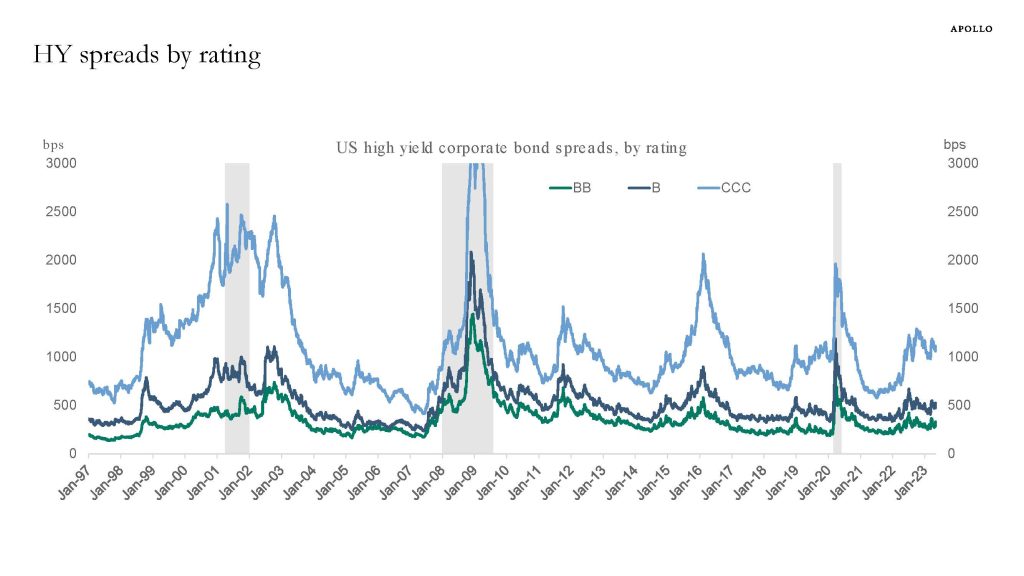

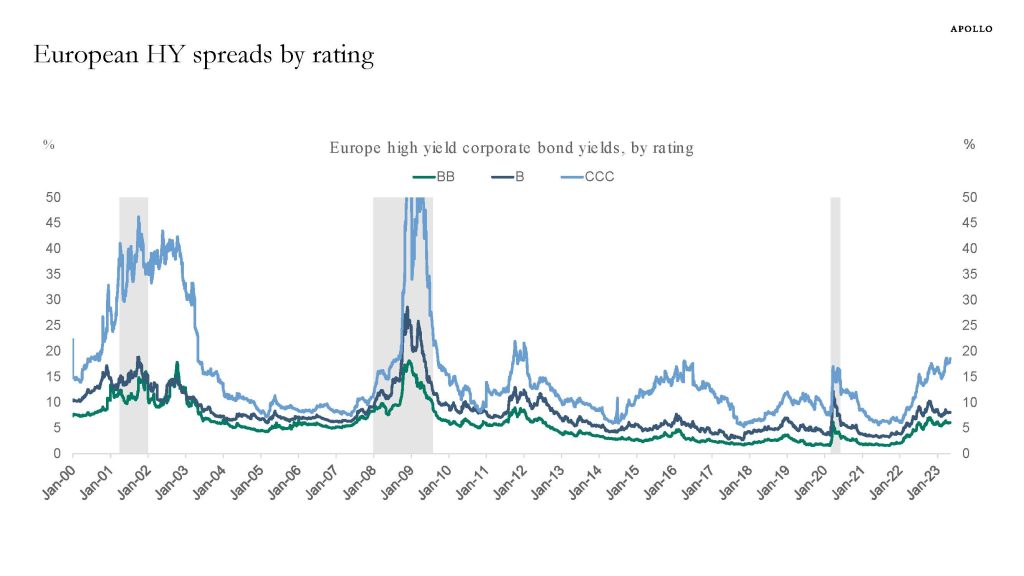

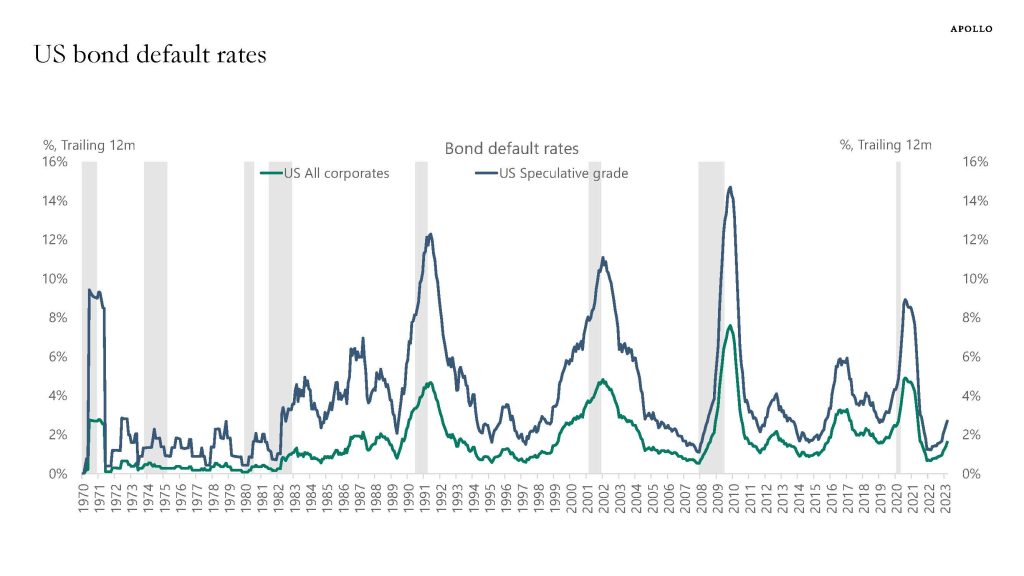

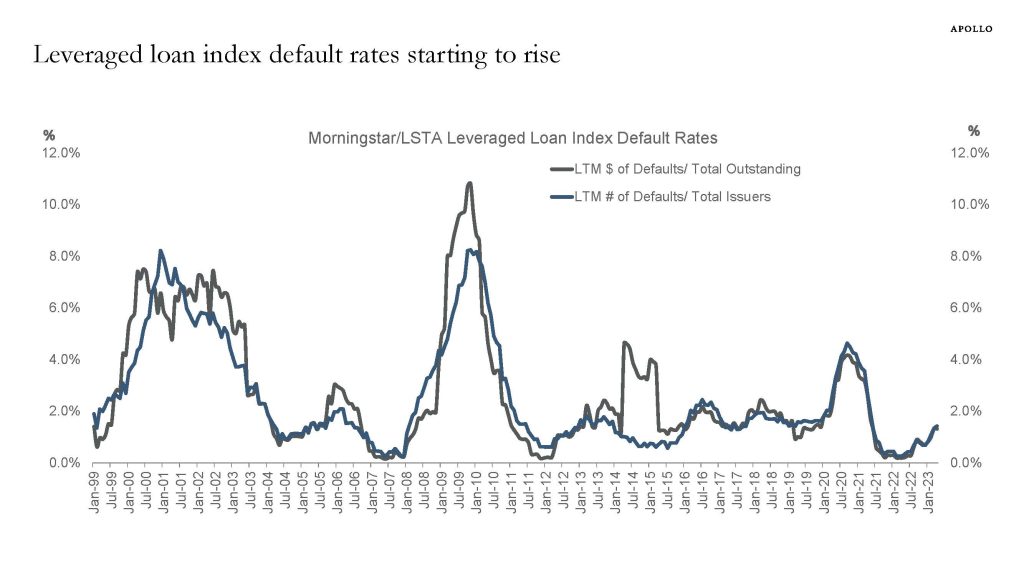

There is an ongoing banking crisis, the consensus expects a recession, and a default cycle has started. But markets are pricing that this will only have a mild negative impact on lower-rated credits and small and medium-sized companies. Our monthly credit market outlook is available here.

Source: Bloomberg, Apollo Chief Economist

Source: ICE BofA, Bloomberg, Apollo Chief Economist

Source: ICE BofA, Bloomberg, Apollo Chief Economist

Source: ICE BofA, Bloomberg, Apollo Chief Economist

Source: Moody’s Analytics, Apollo Chief Economist

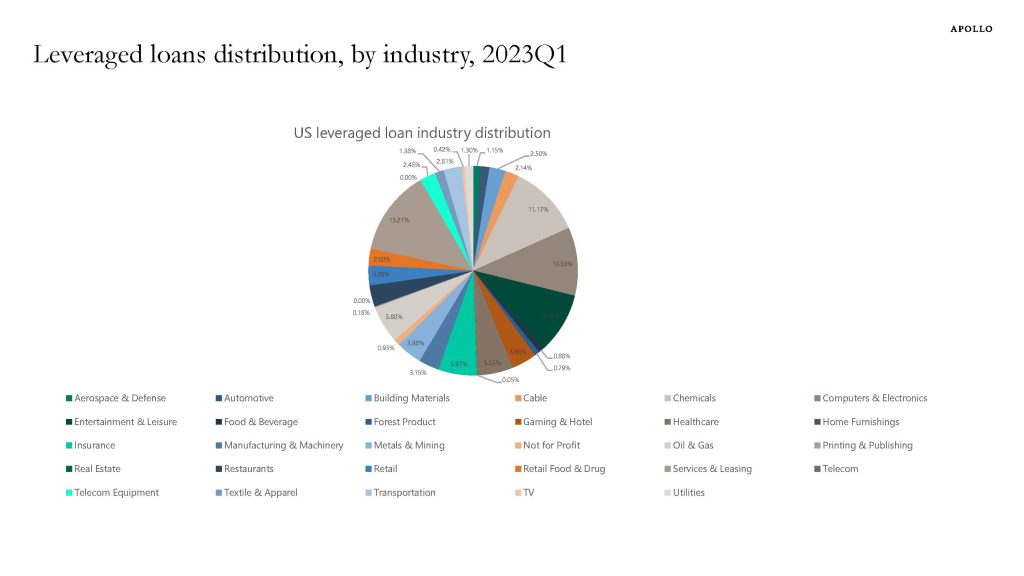

Source: Pitchbook LCD, Apollo Chief Economist

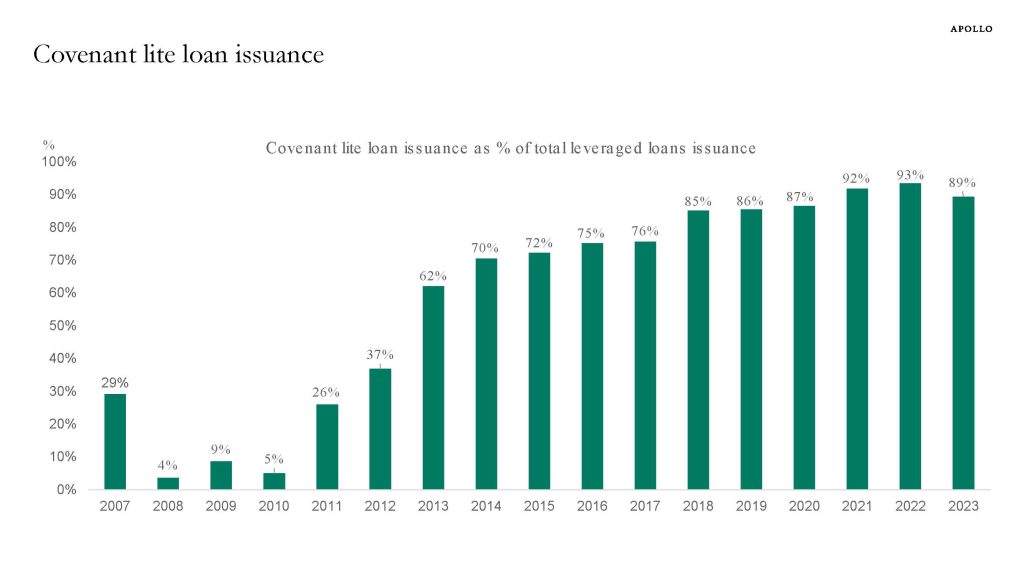

Source: Pitchbook LCD, Apollo Chief Economist. Note: A covenant-lite loan is a type of financing with fewer restrictions on the borrower and fewer protections for the lender, often used in leveraged buyouts. Data as of 31st March 2023.

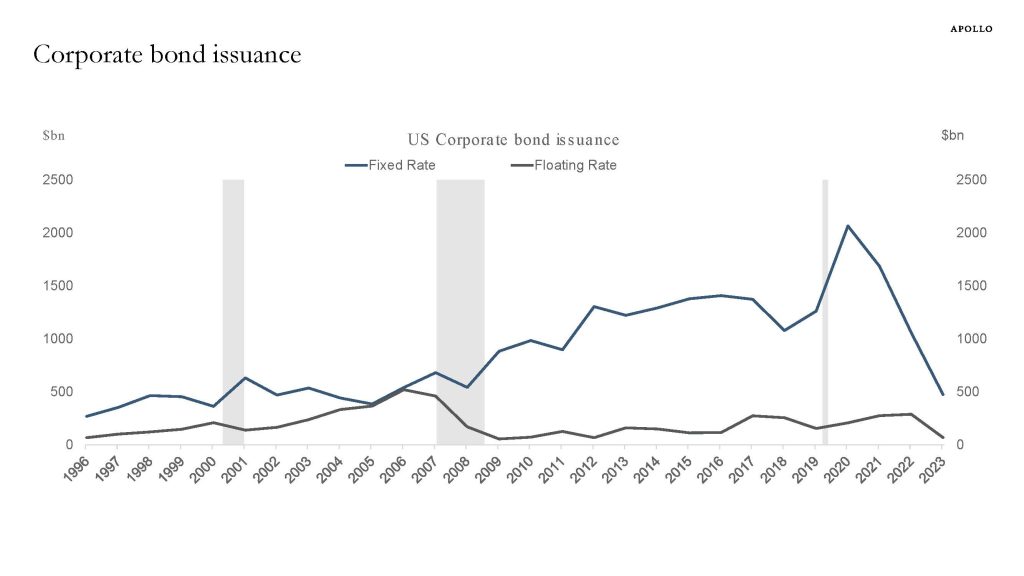

Source: SIFMA, Apollo Chief Economist

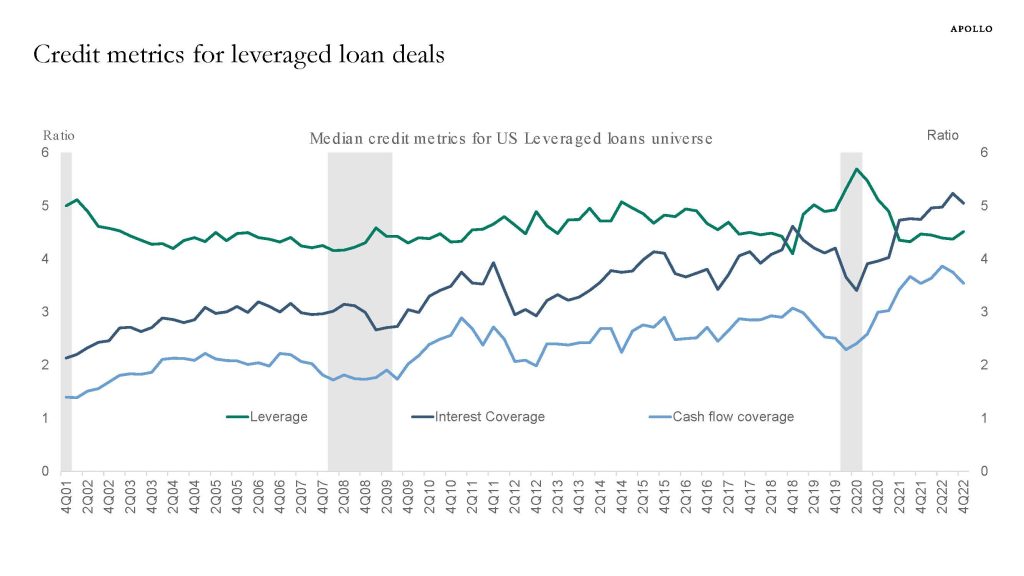

Source: Pitchbook LCD, Apollo Chief Economist

Source: Pitchbook LCD, Apollo Chief Economist

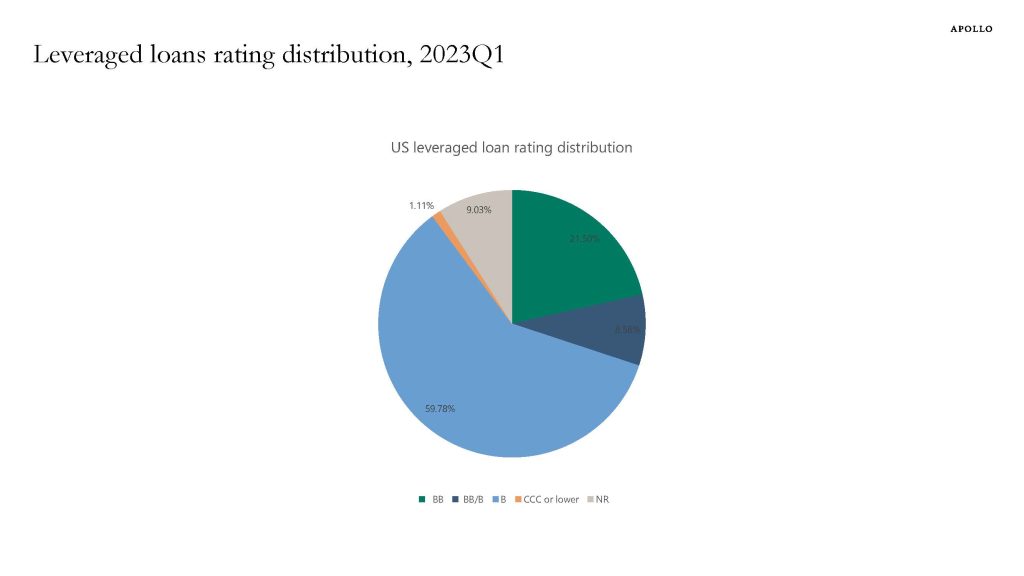

Source: Pitchbook LCD, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

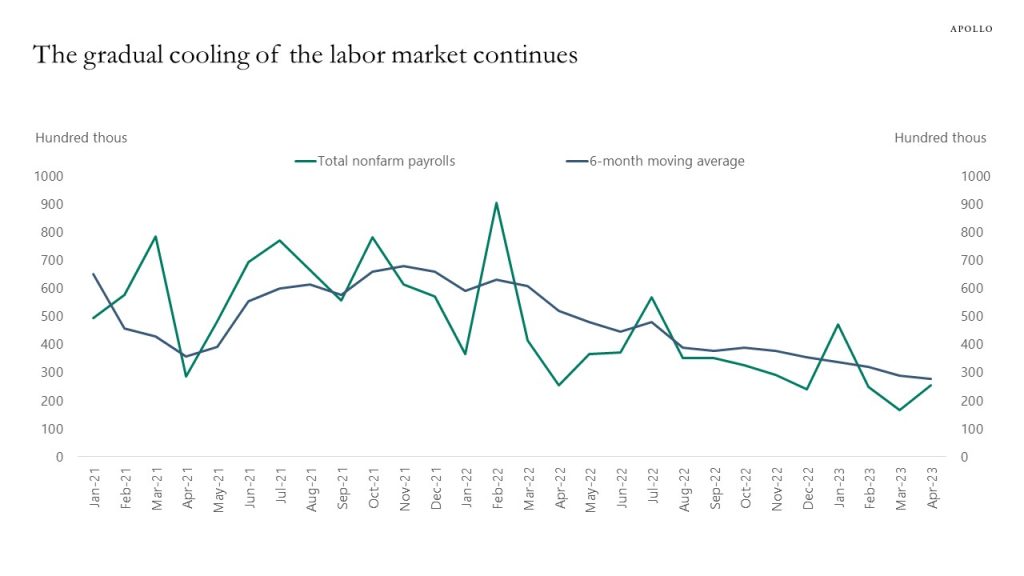

The labor market continues to soften, but the speed of the cooling is slower than expected, driven by increased labor force participation and higher immigration, see chart below and our chart book available here.

Source: BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

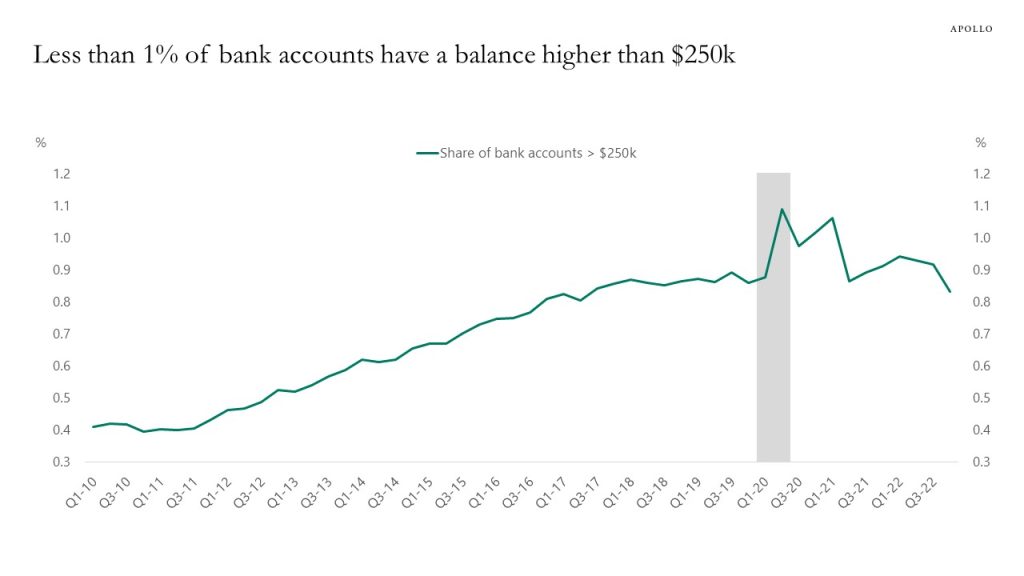

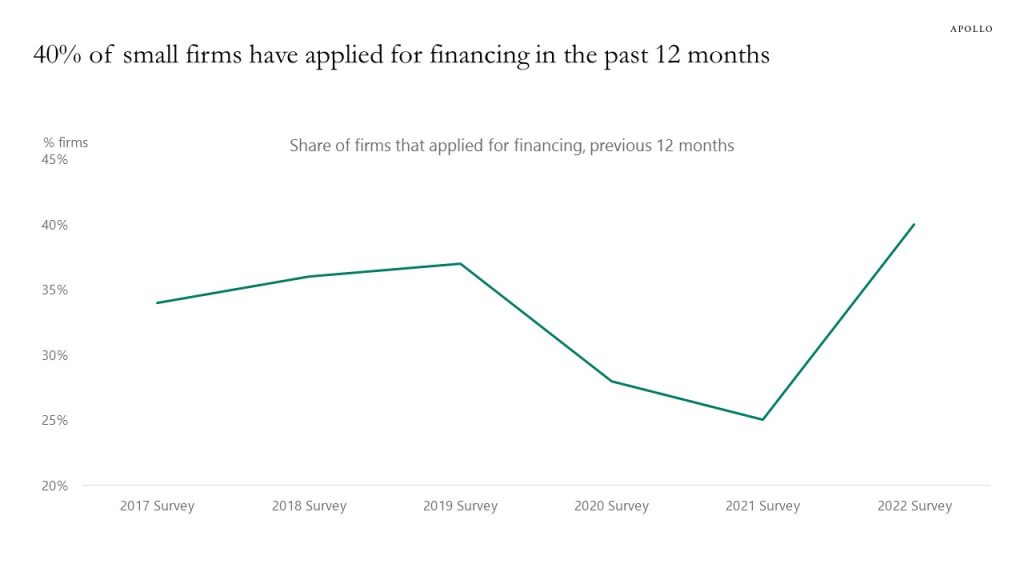

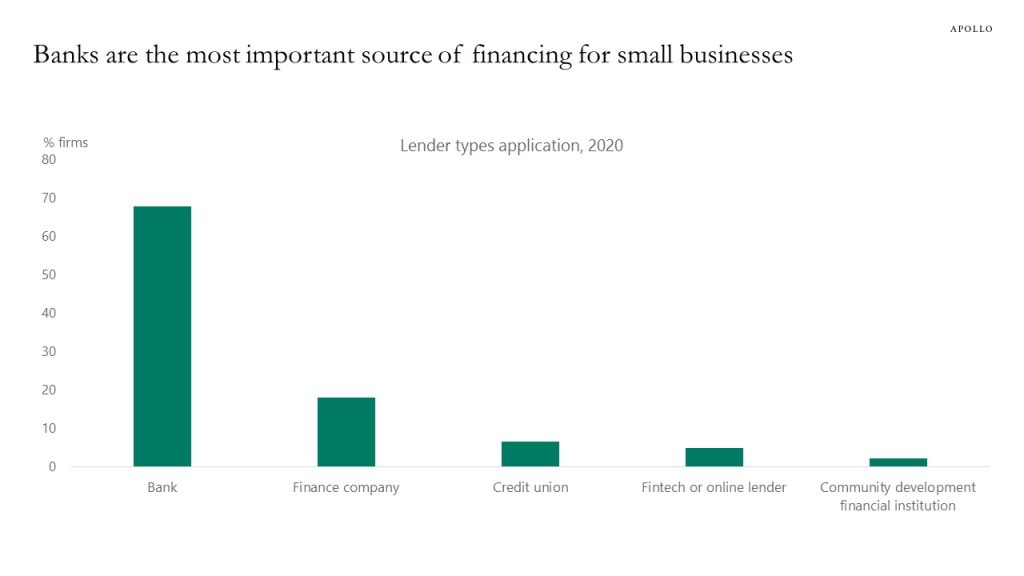

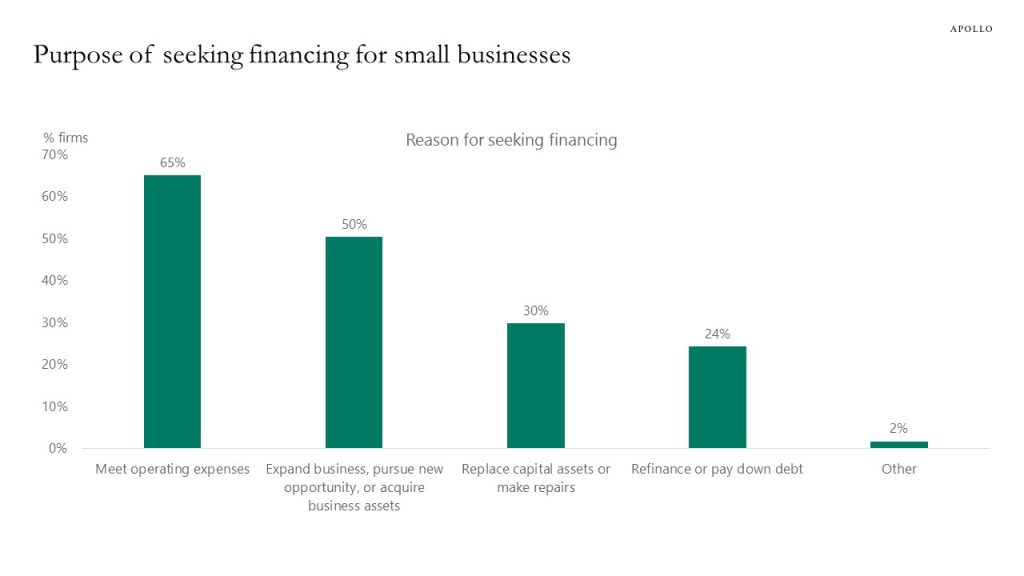

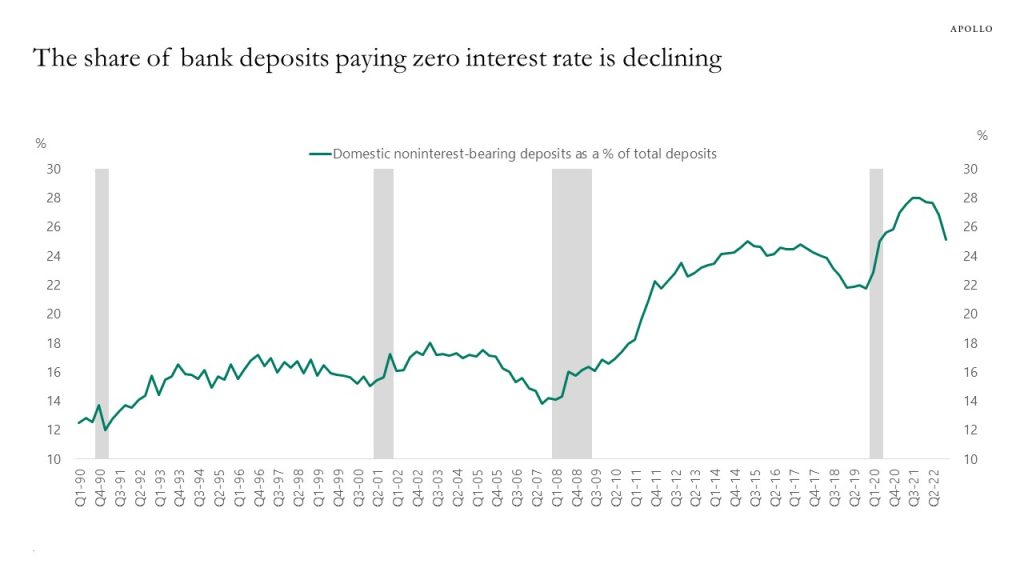

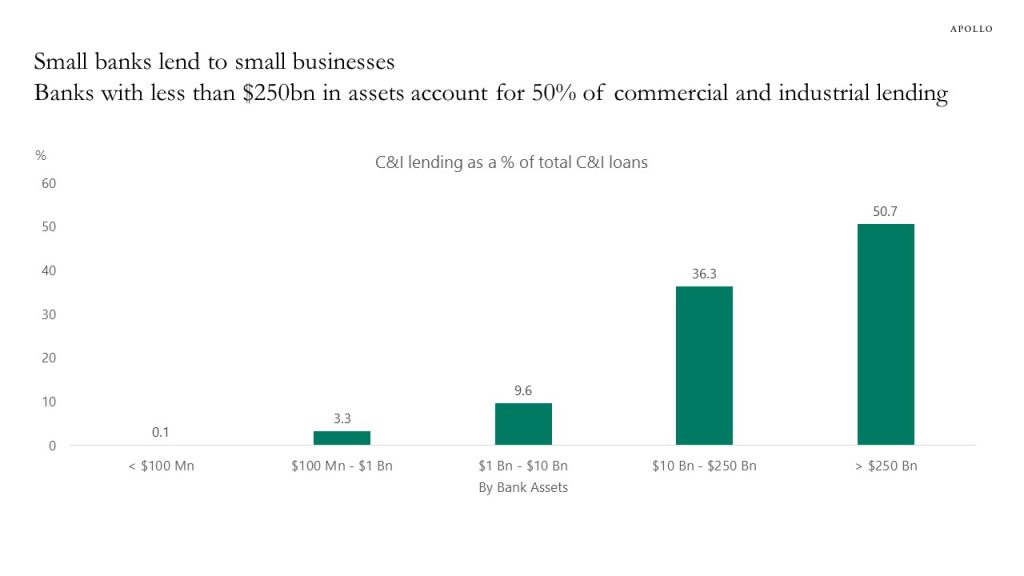

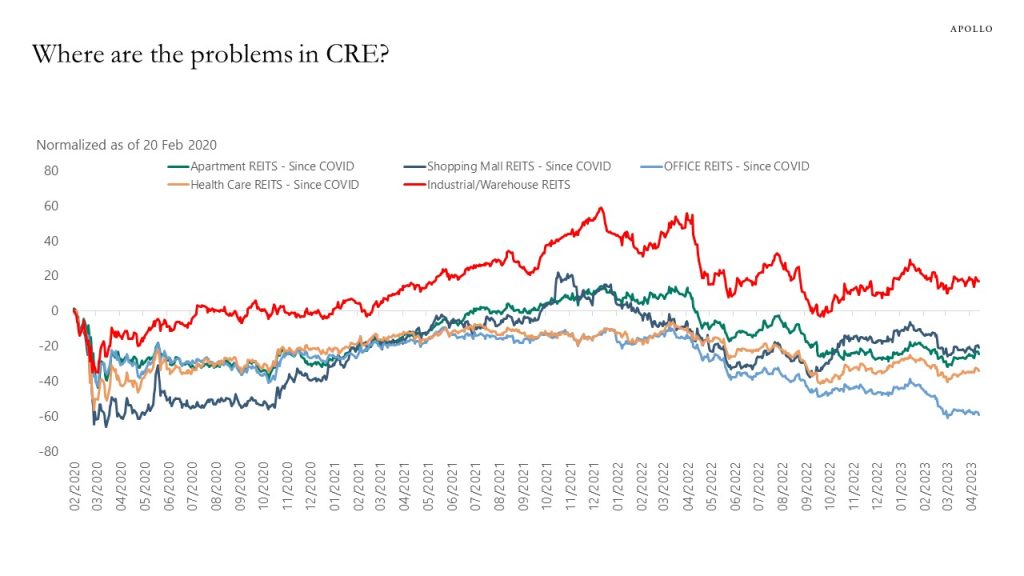

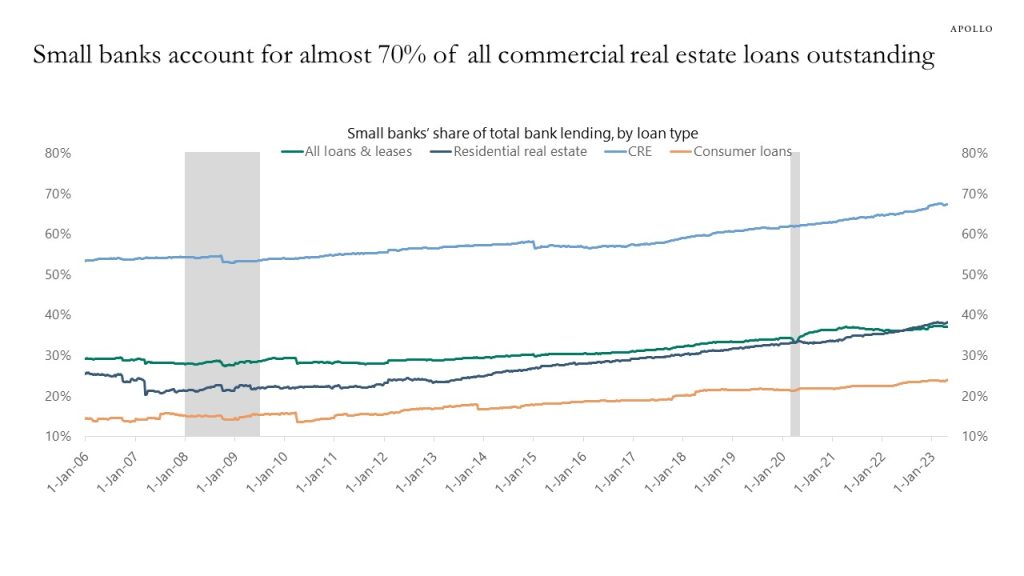

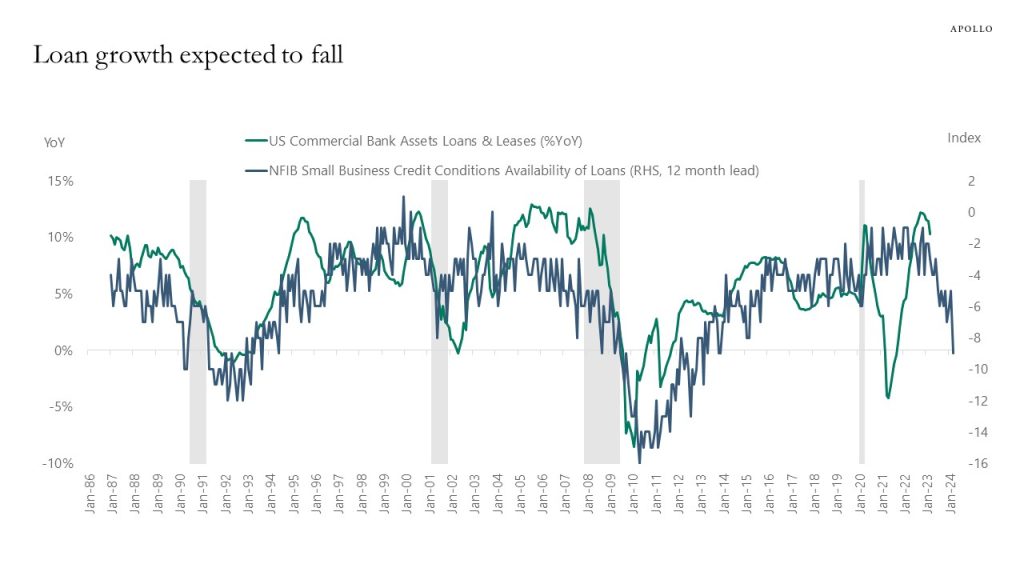

Bank credit conditions are tightening, and the negative impact on the economy from the ongoing banking crisis is going to be significant because small banks account for 30% of assets in the banking sector and 40% of lending, and small banks are facing three headwinds from 1) higher funding costs, 2) lower asset prices because of higher interest rates, and 3) more regulatory scrutiny. Our banking sector outlook is available here, key charts inserted below.

Source: FDIC, Haver Analytics, Apollo Chief Economist

Source: Small Business Credit Survey, Federal Reserve, Apollo Chief Economist. Note: 2022 survey, prior to 12 months of survey year

Source: 2021 Annual Business Survey, U.S. Census Bureau, Apollo Chief Economist

Source: Small Business Credit Survey, Federal Reserve, Apollo Chief Economist. Note: 2022 survey, prior to 12 months of survey year

Source: FDIC, Apollo Chief Economist

Source: FDIC, Apollo Chief Economist. Data as of Q3 2022

Source: Bloomberg, Apollo Chief Economist

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist

Source: NFIB, FRB, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

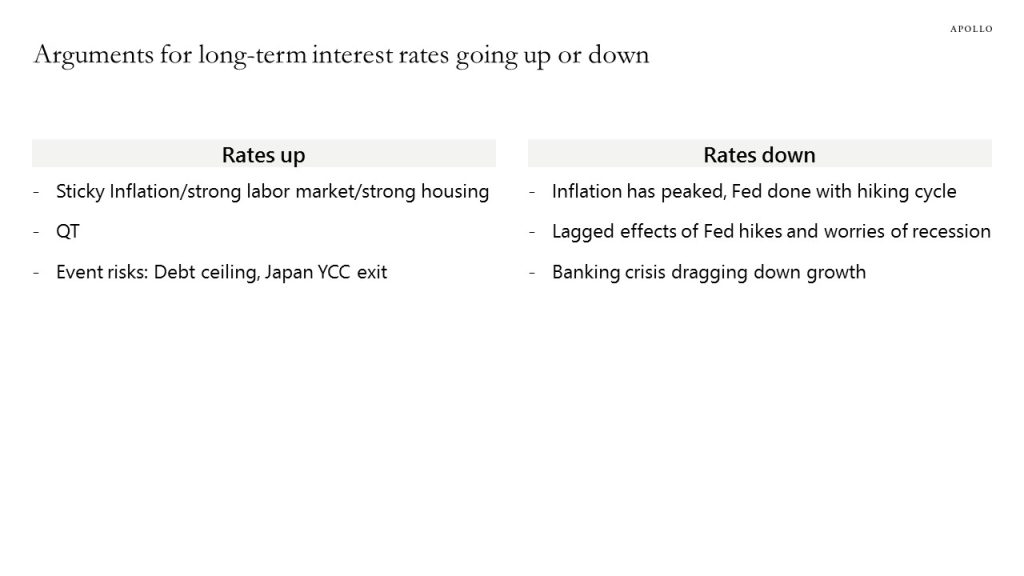

The arguments for long rates moving higher are sticky inflation, QT, debt ceiling, and Japan exiting yield curve control.

The arguments for long rates moving lower are lagged effects of Fed hikes, the ongoing banking crisis dragging down growth, and that the Fed is done raising rates.

Incoming information on any of these fronts will continue to keep fixed income volatility elevated.

Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

-

See important disclaimers at the bottom of the page.

-

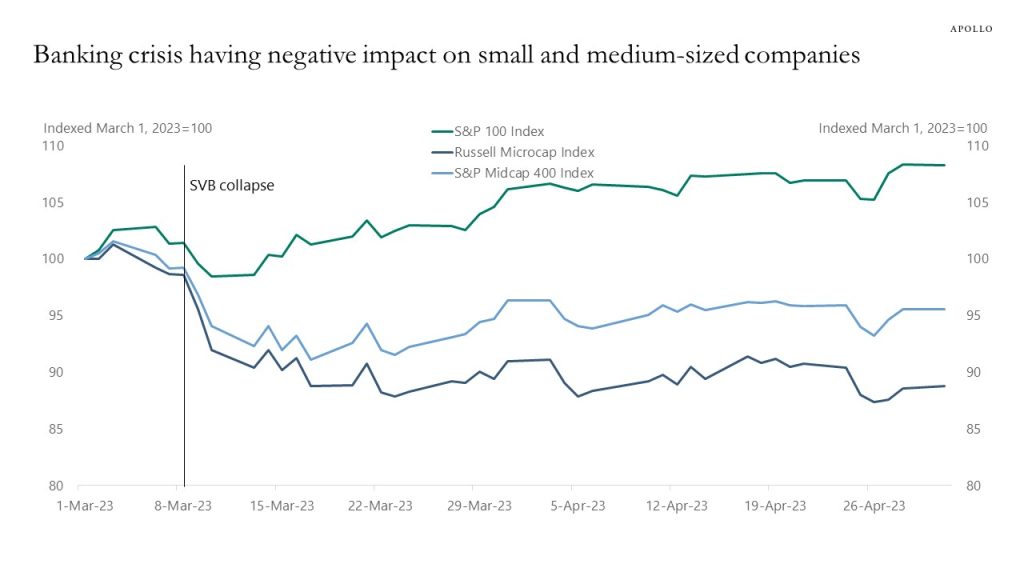

Small and medium-sized businesses have been underperforming in the stock market since the SVB collapse, suggesting investors are worried about the negative impact of the ongoing credit crunch on middle market companies, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

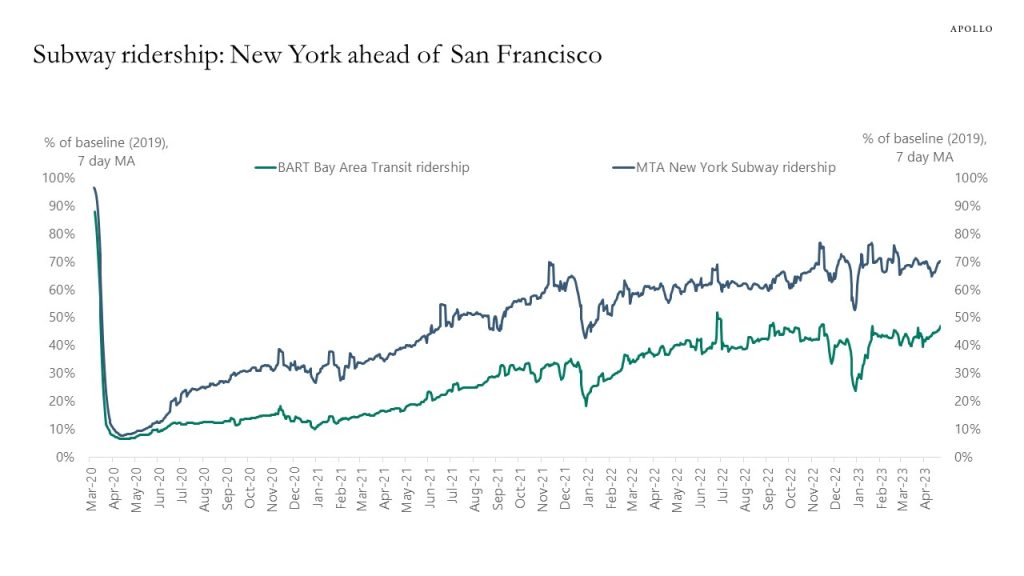

New York City subway use is at 70% of 2019 levels, and San Francisco is at 47%, see chart below.

Source: BART, MTA, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

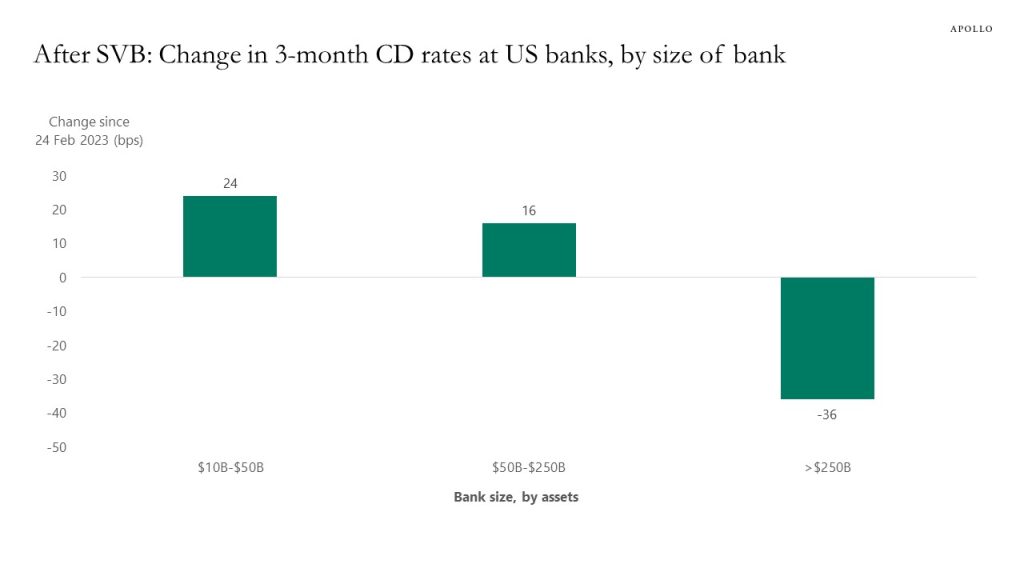

Since SVB collapsed, the interest rate on a 3-month CD has increased at small banks and declined at large banks, see chart below.

Source: S&P Global Market Intelligence, for a $10K 3-month CD, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

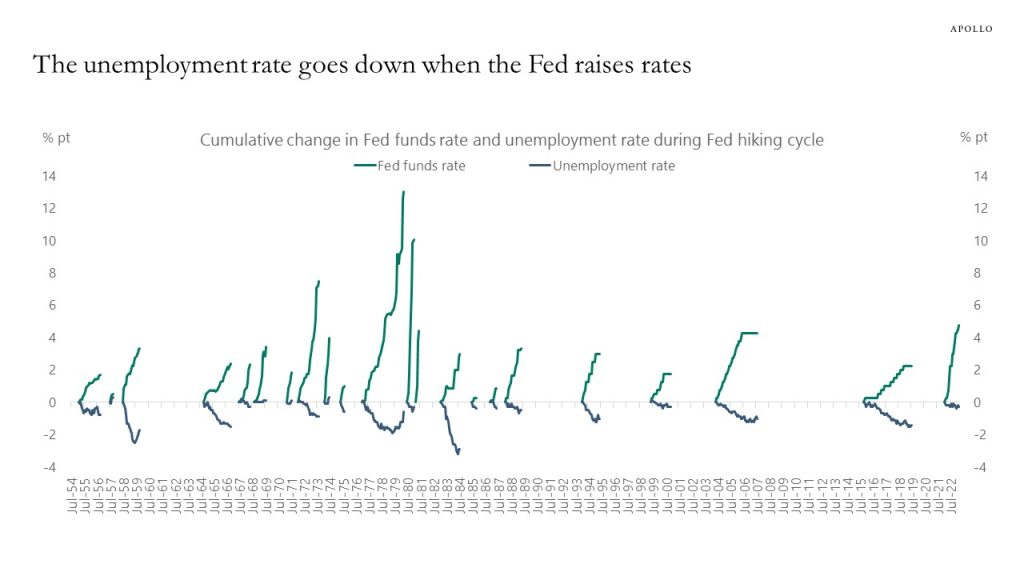

The unemployment rate falls when the Fed hikes rates, see chart below.

In fact, the declining unemployment rate is precisely the reason why the Fed is raising interest rates. And the chart below suggests that when the unemployment rate starts moving higher is when the Fed stops hiking.

Looking back in history, the median time it takes from when the Fed starts hiking until the unemployment rate bottoms and moves higher is 14 months, and using this historical pattern as a guide, with the first Fed hike in March 2022, we should begin to see the unemployment rate increase within the next couple of months.

The bottom line is that it usually takes 12 to 18 months for the Fed to soften the labor market, and today is no different.

Source: BLS, FRB, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

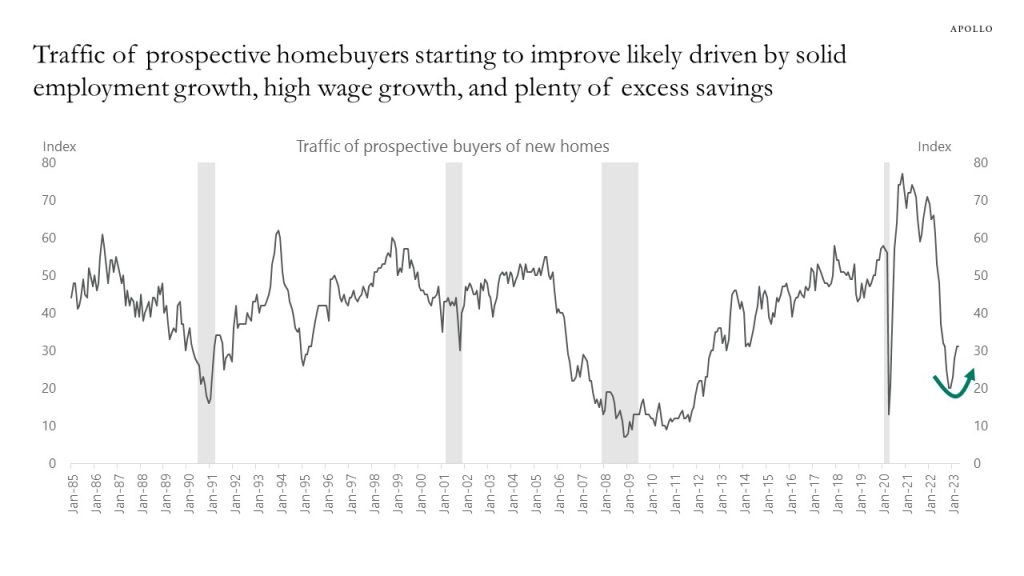

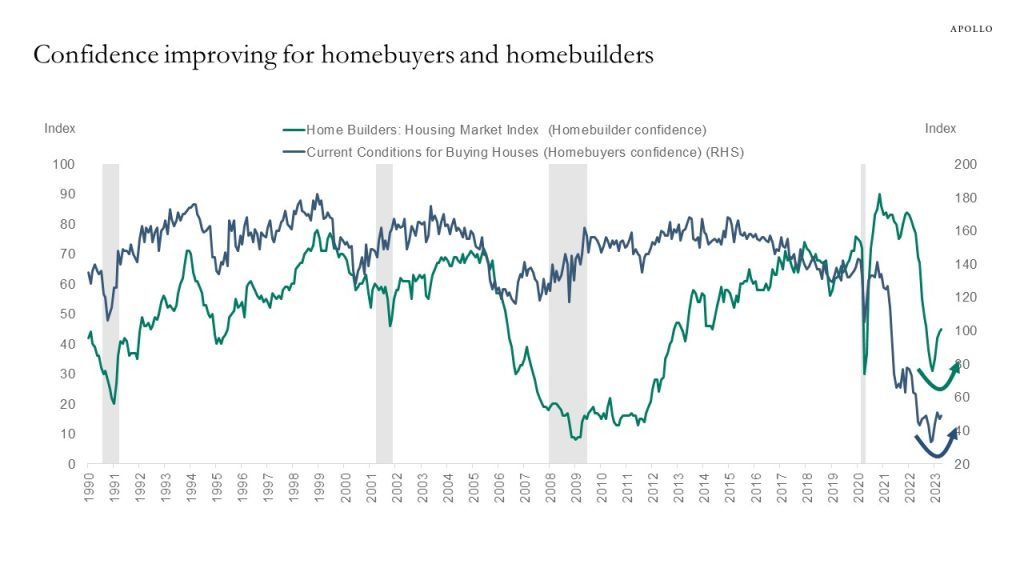

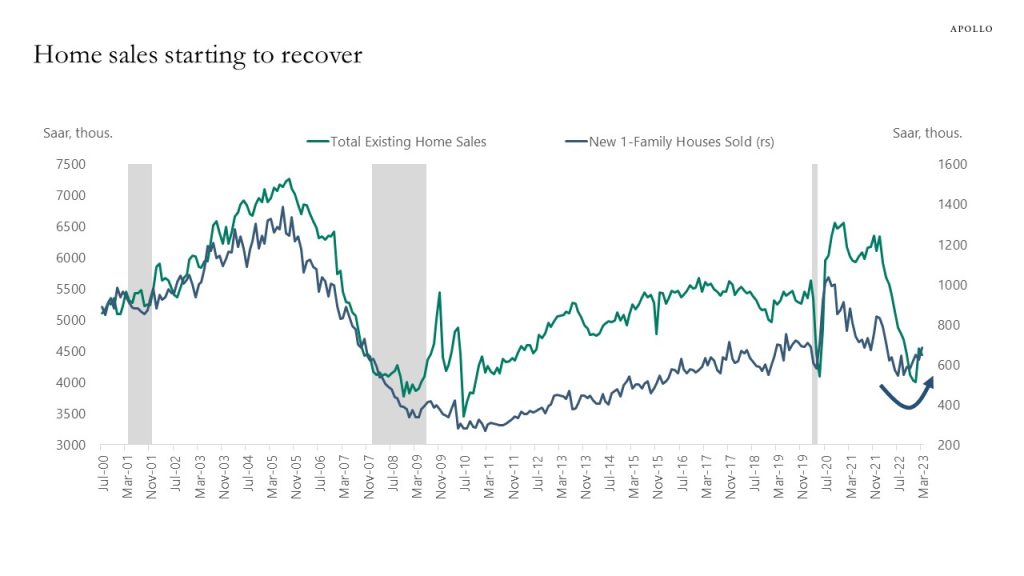

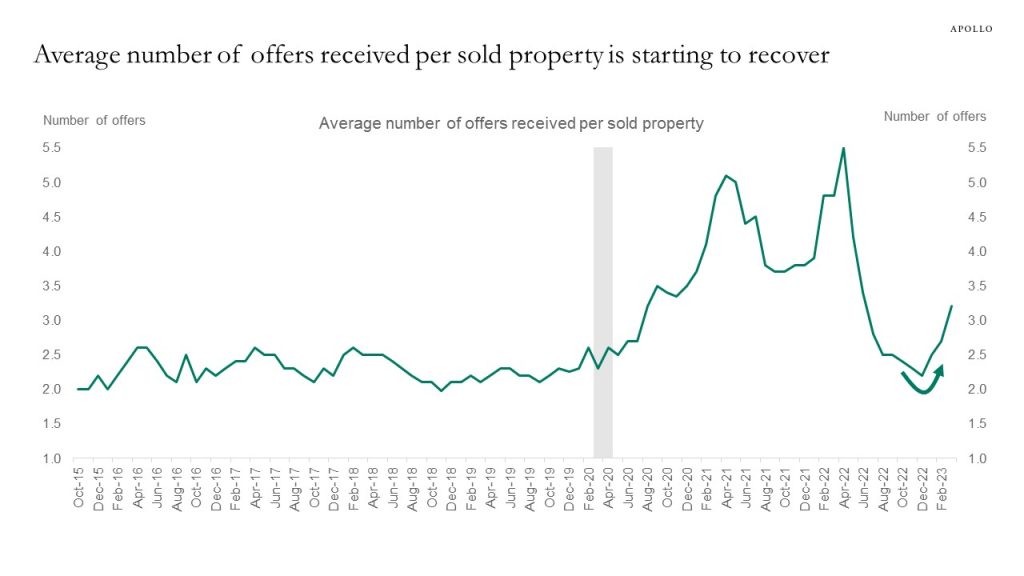

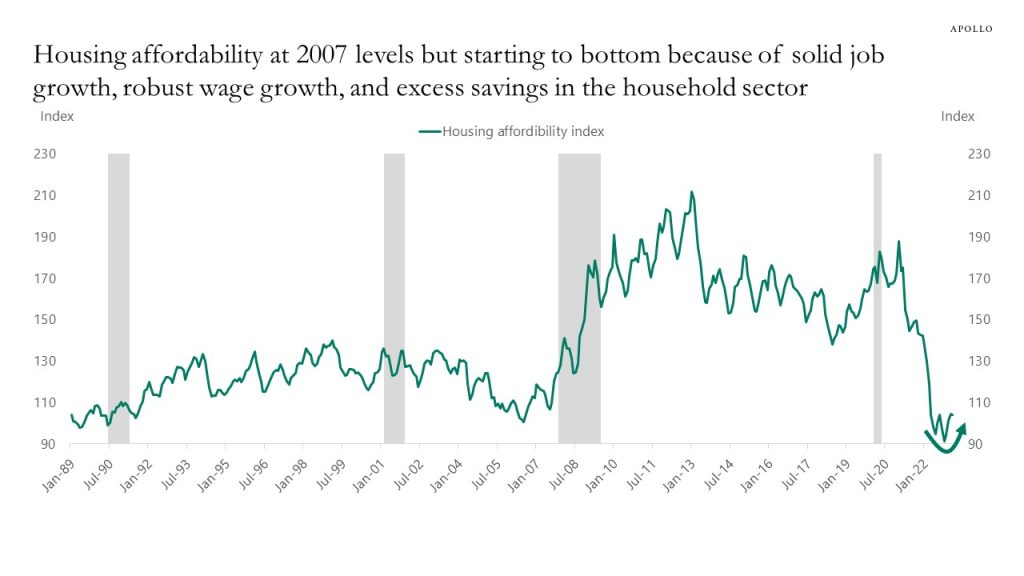

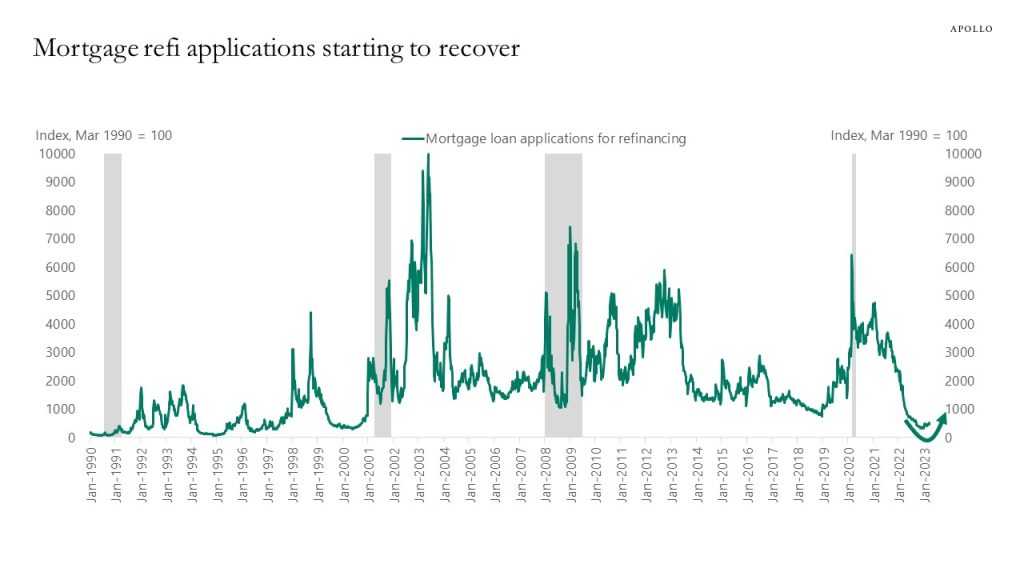

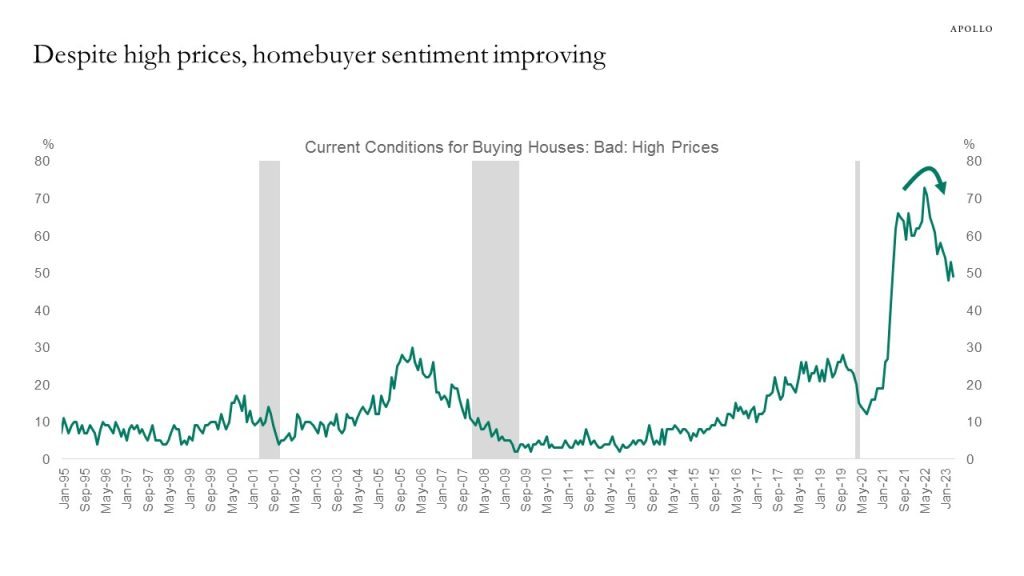

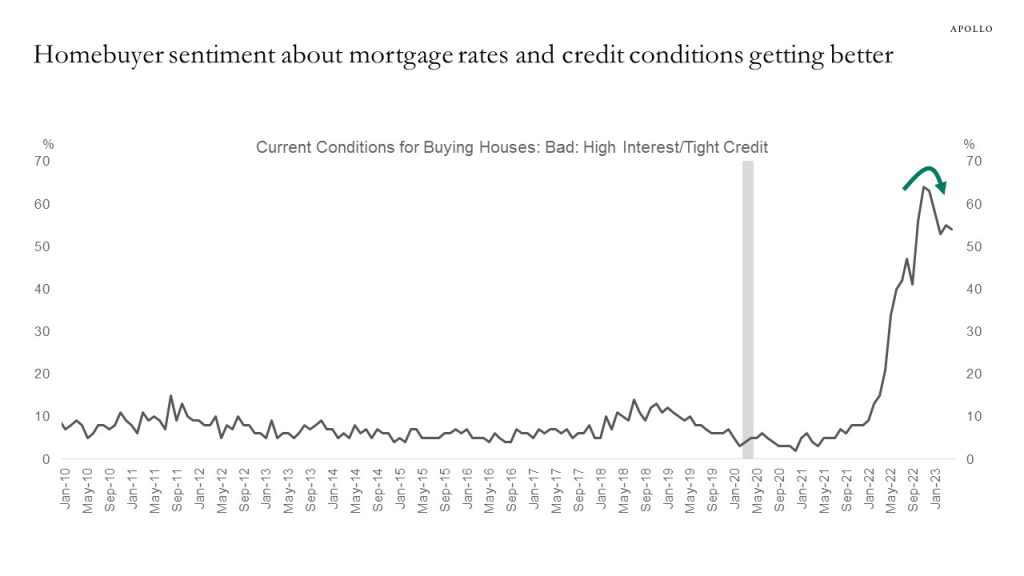

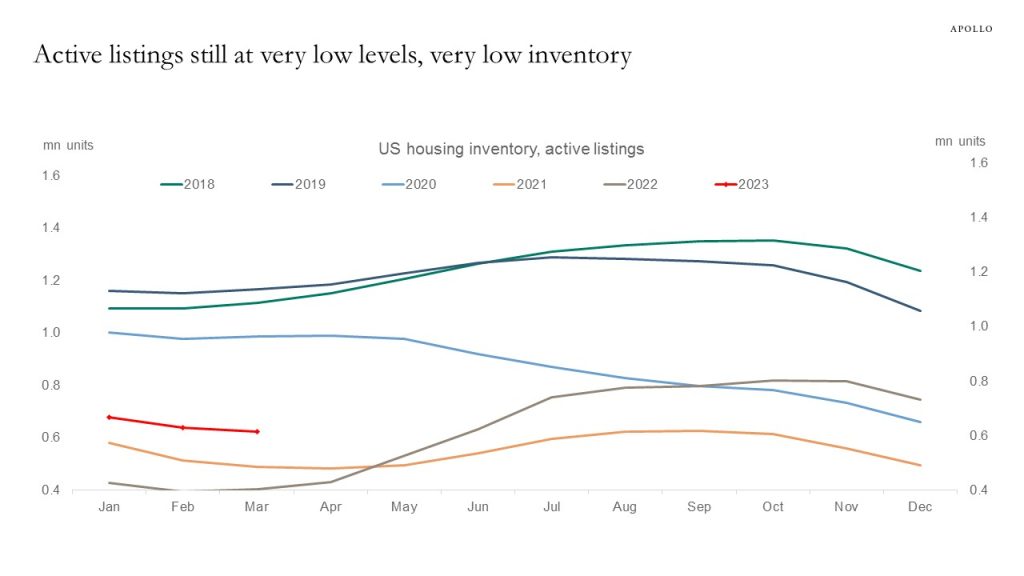

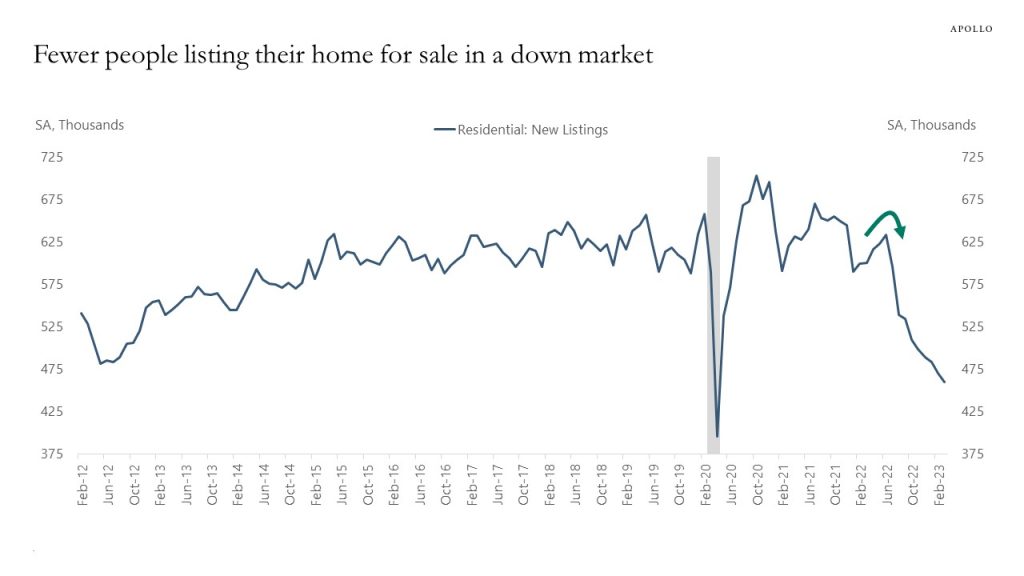

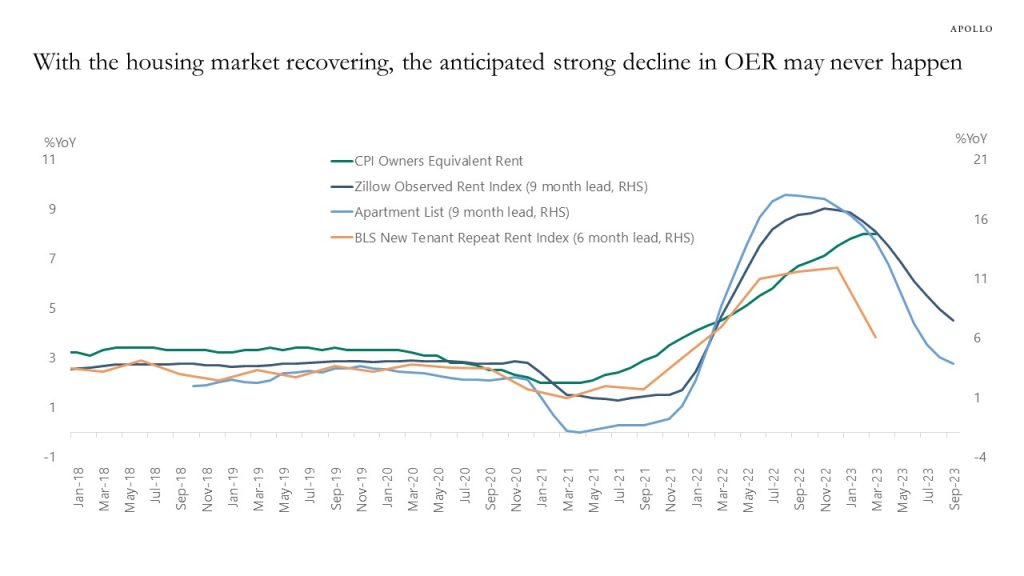

A US housing recovery has started, and this is a problem for the Fed because home prices have a weight of 40% in the CPI basket, and rising house prices will make inflation more sticky and make it more difficult for the Fed to get inflation down from currently 5% to the FOMC’s 2% inflation target. Our US housing outlook is available here.

Source: National Association of Homebuilders, Bloomberg, Apollo Chief Economist

Source: University of Michigan, NAHB, Haver Analytics, Apollo Chief Economist

Source: Census Bureau, NAR, Haver, Apollo Chief Economist; Forecast is Bloomberg consensus

Source: NAR, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: Mortgage Bankers Association, Bloomberg, Apollo Chief Economist

Source: University of Michigan, Apollo Chief Economist

Source: University of Michigan, Apollo Chief Economist

Source: Realtor.com, Apollo Chief Economist

Source: Redfin, Haver Analytics, Apollo Chief Economist

Source: Zillow, BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.