Want it delivered daily to your inbox?

-

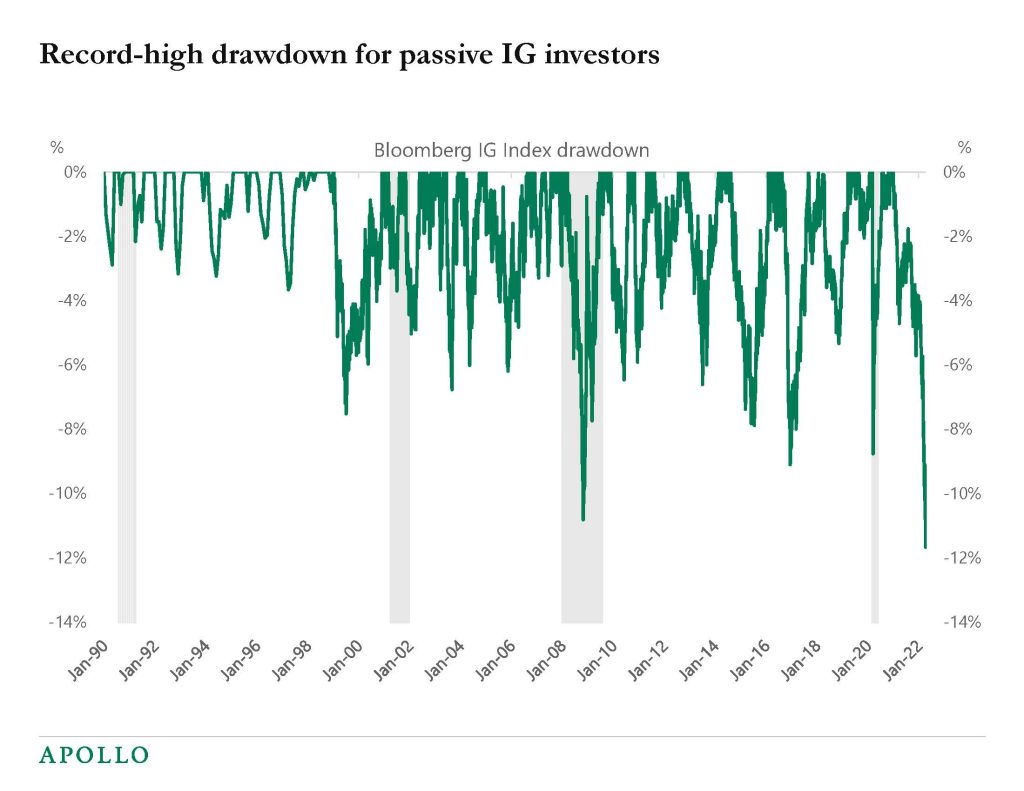

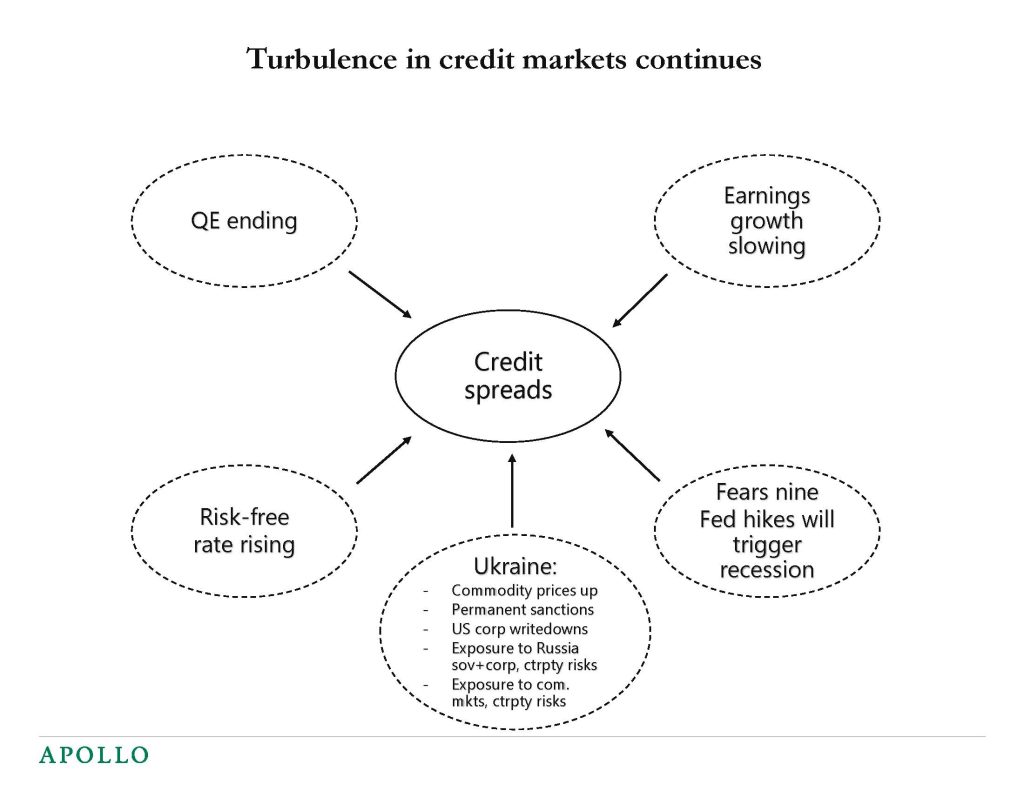

Our latest credit market outlook is available here. Turbulence is likely to continue driven by inflation uncertainty, rising rates, and emerging fears of a hard landing.

Source: Bloomberg, Apollo Chief Economist. Note: Index used LEGATRUU Index.

Source: Apollo Chief Economist

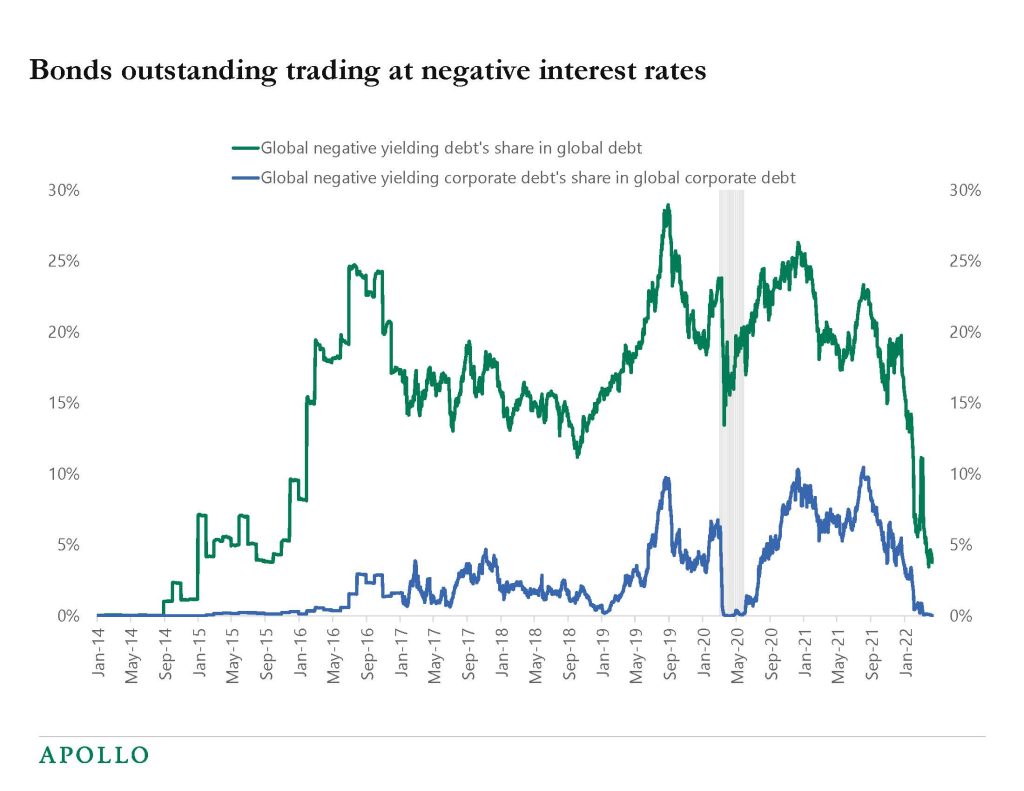

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

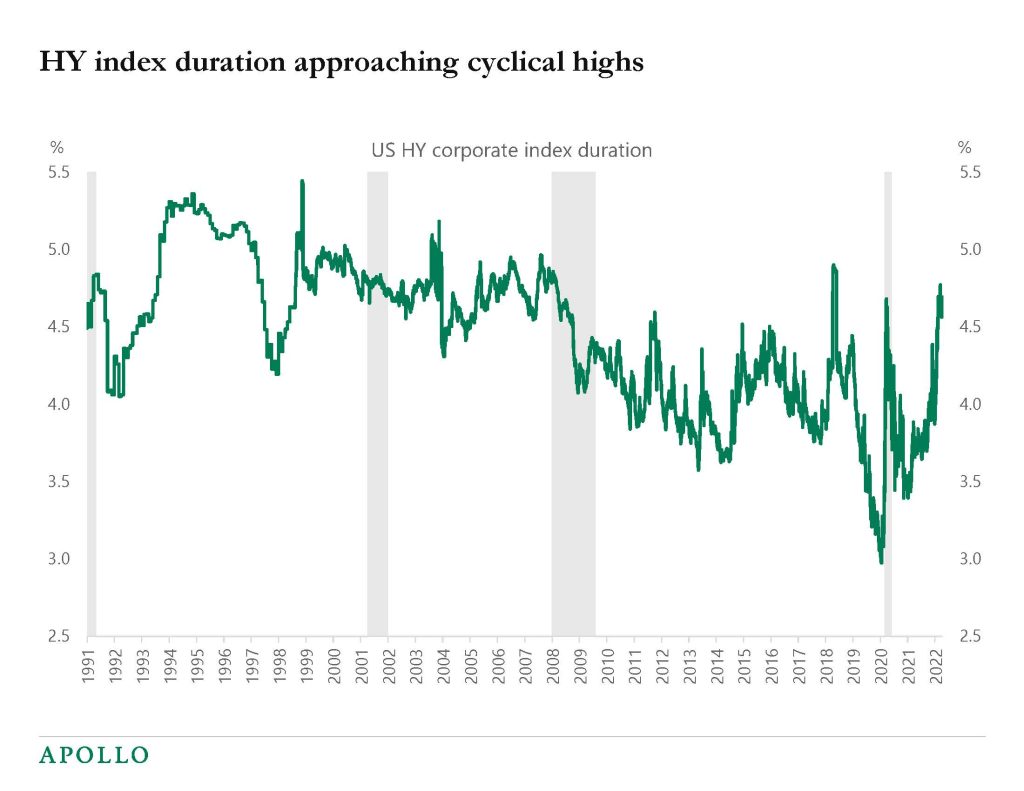

Source: Bloomberg, Apollo Chief Economist. Note: The measure used is modified duration, which measures the expected change in a bond’s price to a 1% change in interest rates.

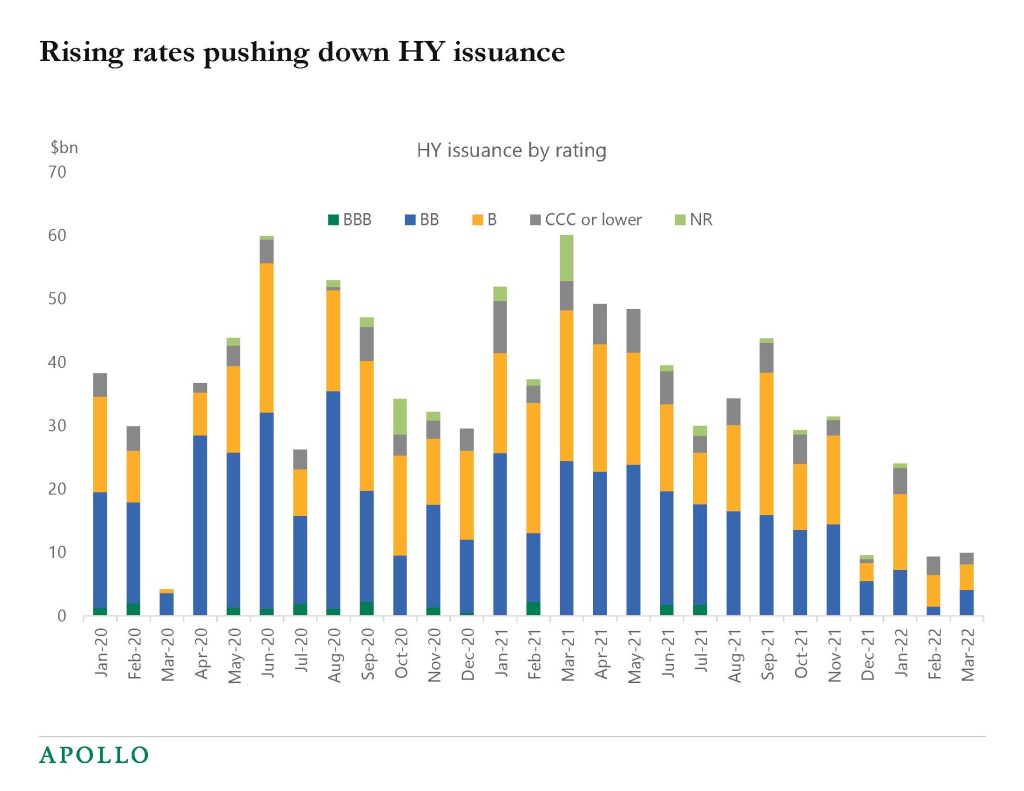

Source: S&P LCD, Apollo Chief Economist. Note: Data as of 31st March 2022.

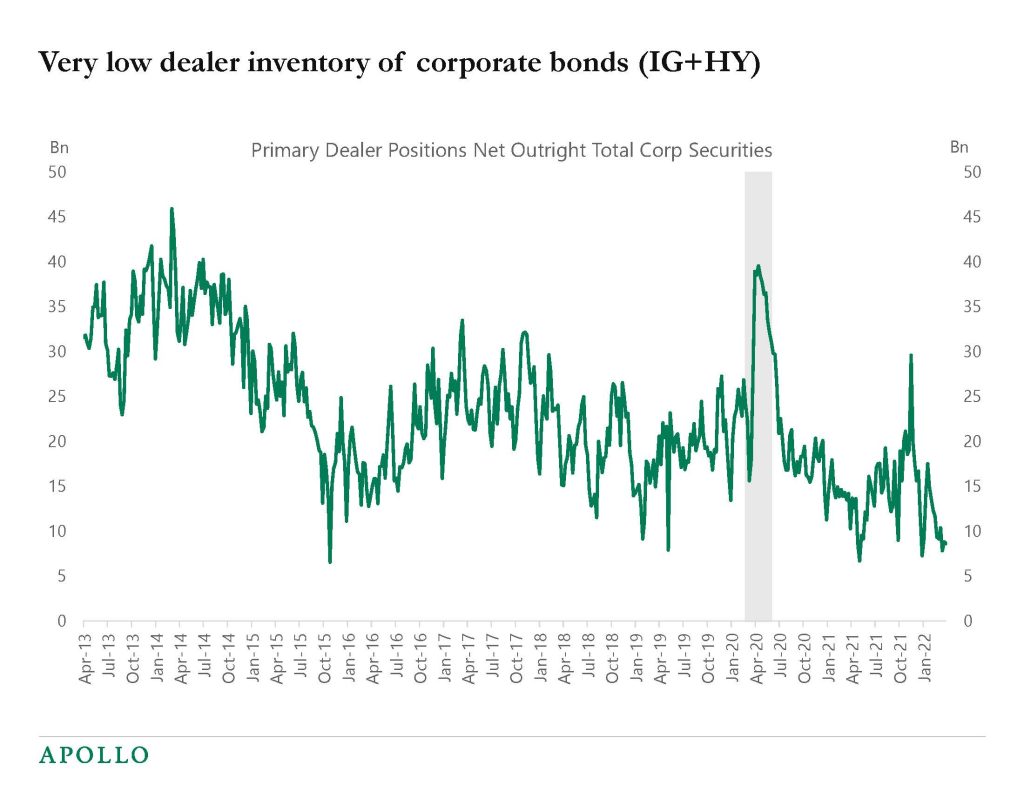

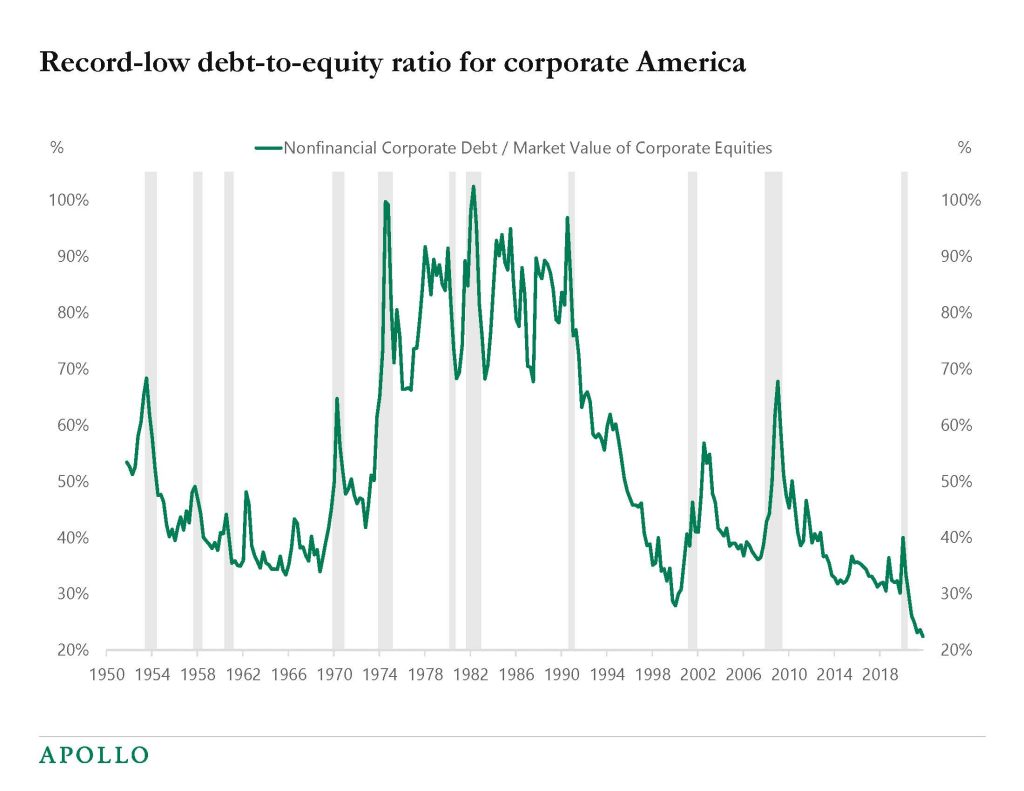

Source: FRB, Haver Analytics, Apollo Chief Economist

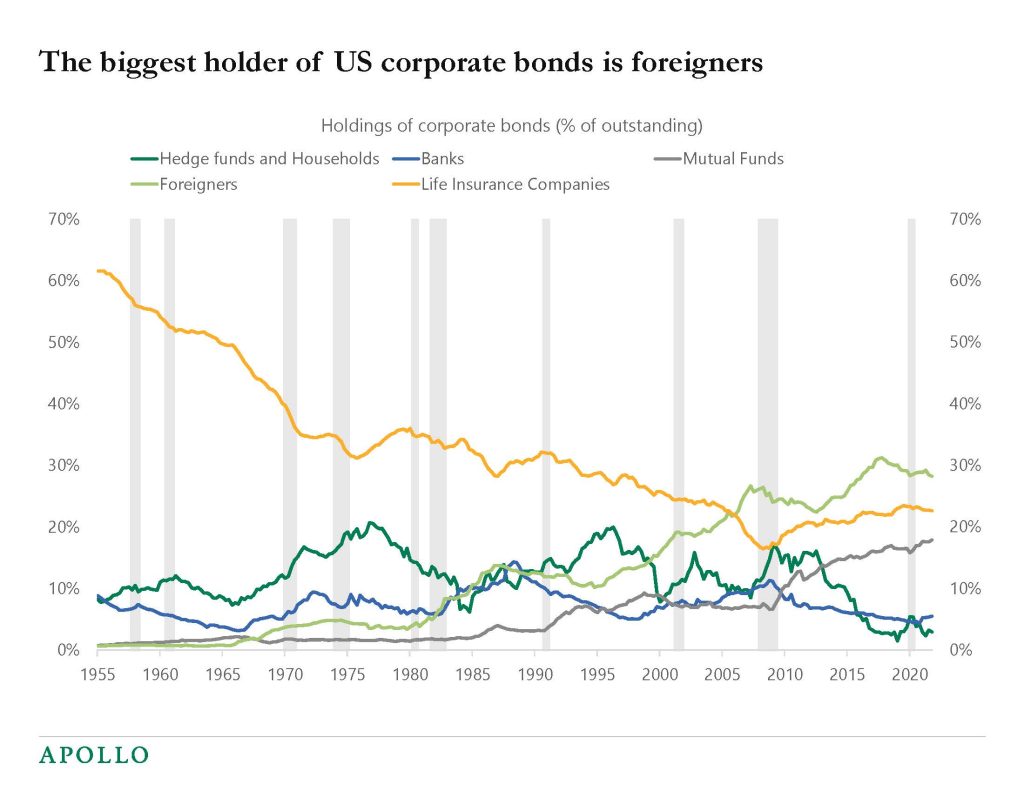

Source: FRB, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

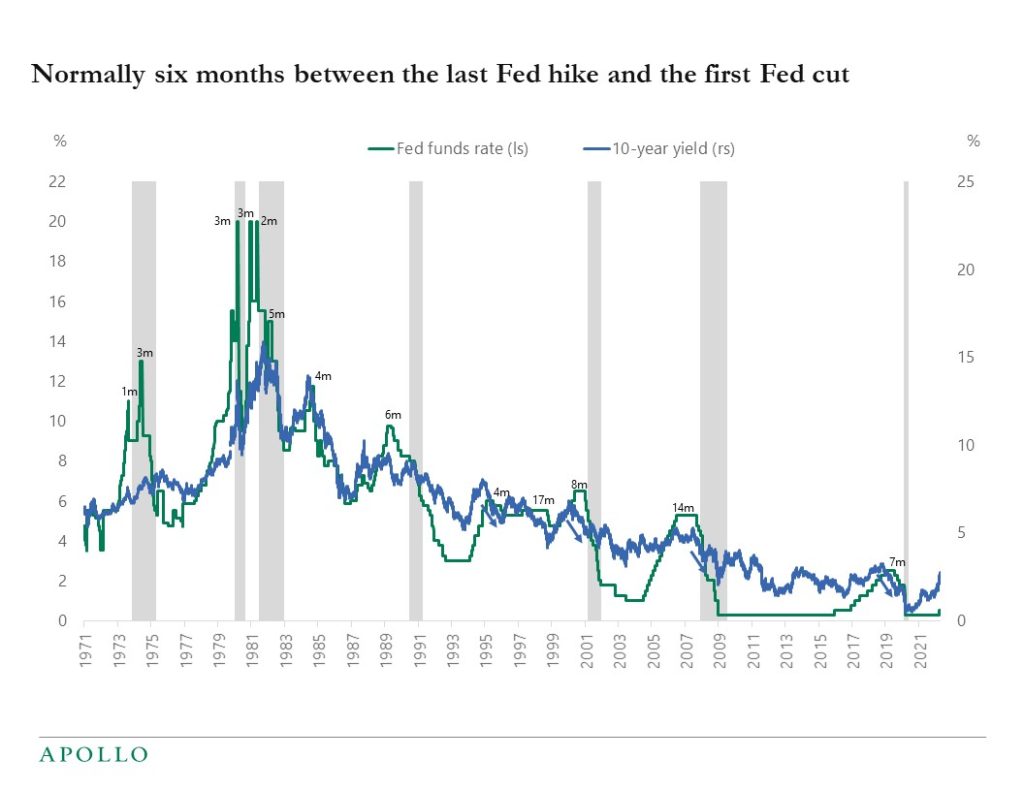

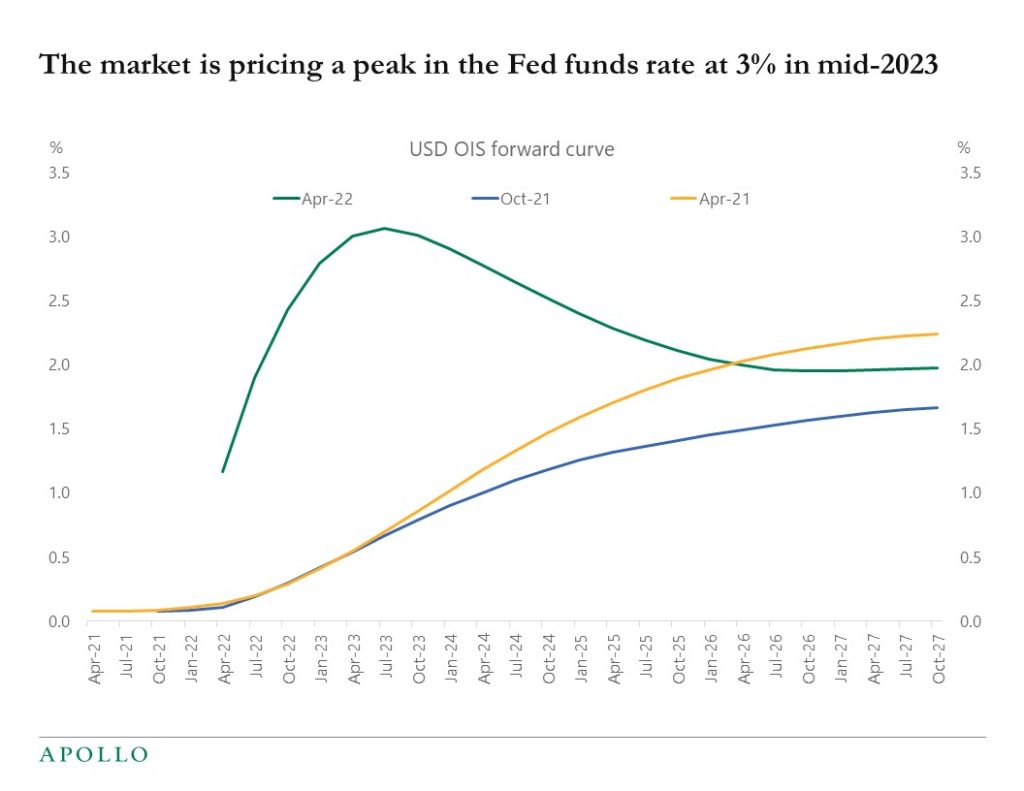

The market is currently pricing that the Fed funds rate will peak at 3.25% in mid-2023. On average, the Fed began cutting rates six months after the Fed funds rate peaks. And 10s typically peak around the time of the last Fed hike see chart below.

Source: FRB, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

The consensus forecast is that inflation will soon peak.

With inflation soon peaking, the question in rates markets is when the Fed will turn more dovish because there is less need for the Fed to be as hawkish once inflation begins to trend lower.

If the Fed starts to sound more dovish because of inflation trending lower, then long rates will likely peak and begin to move down in anticipation of fewer Fed hikes and slower growth coming.

With this asymmetric setup, the pain trade in markets this week is if we get an inflation print lower than the expected 8.4%. In that case, rates are likely to move lower across the curve quickly.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

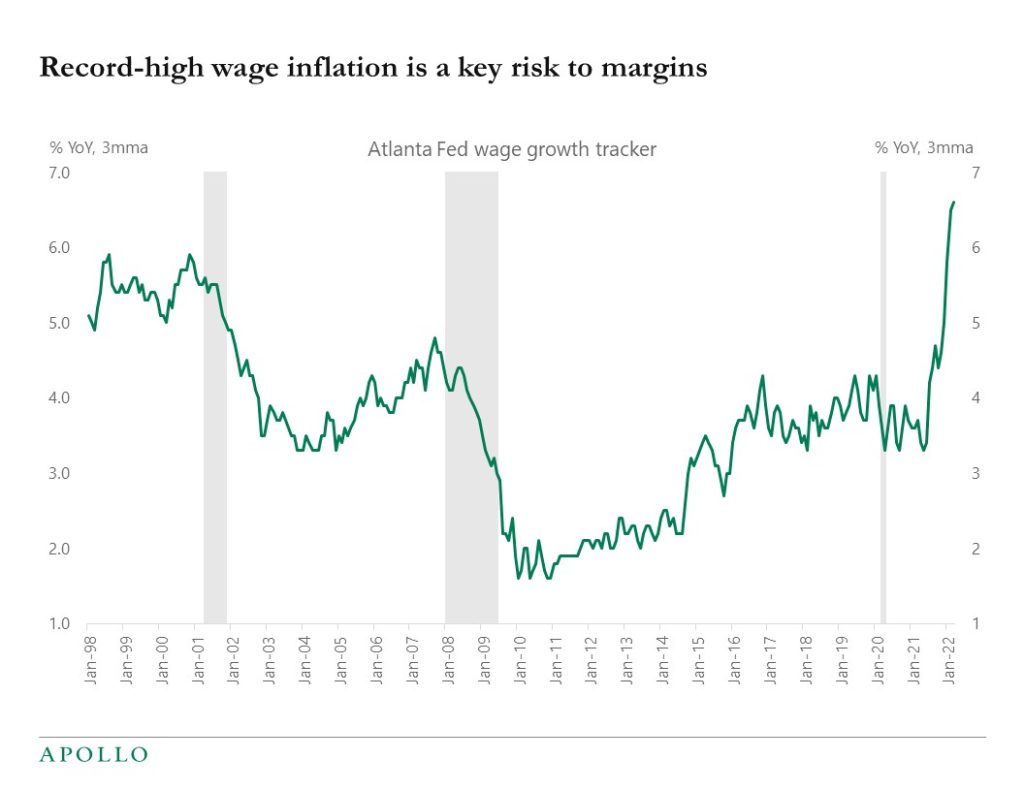

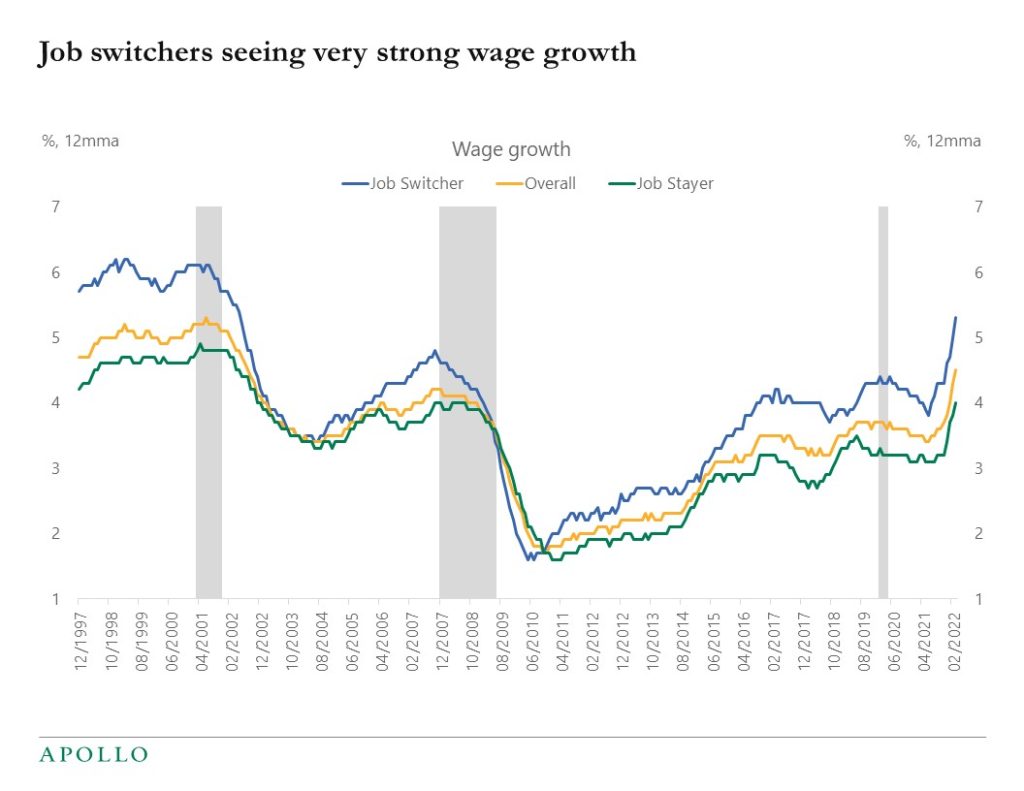

The latest wage data from the Atlanta Fed is out, and it shows the highest growth in wages on record. Job switchers are seeing particularly strong increases in compensation, see charts below.

The Fed will look at these trends and conclude that the labor market is overheating and financial conditions have to be tightened immediately. Either via higher rates, wider credit spreads, lower equities, or some combination. The goal now is demand destruction to get inflation under control, and the market should not underestimate the Fed’s commitment to make this happen.

Source: FRB Atlanta, Haver Analytics, Apollo Chief Economist

Source: FRB Atlanta, Apollo Chief Economist

Source: FRB Atlanta, Apollo Chief Economist

Source: FRB Atlanta, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

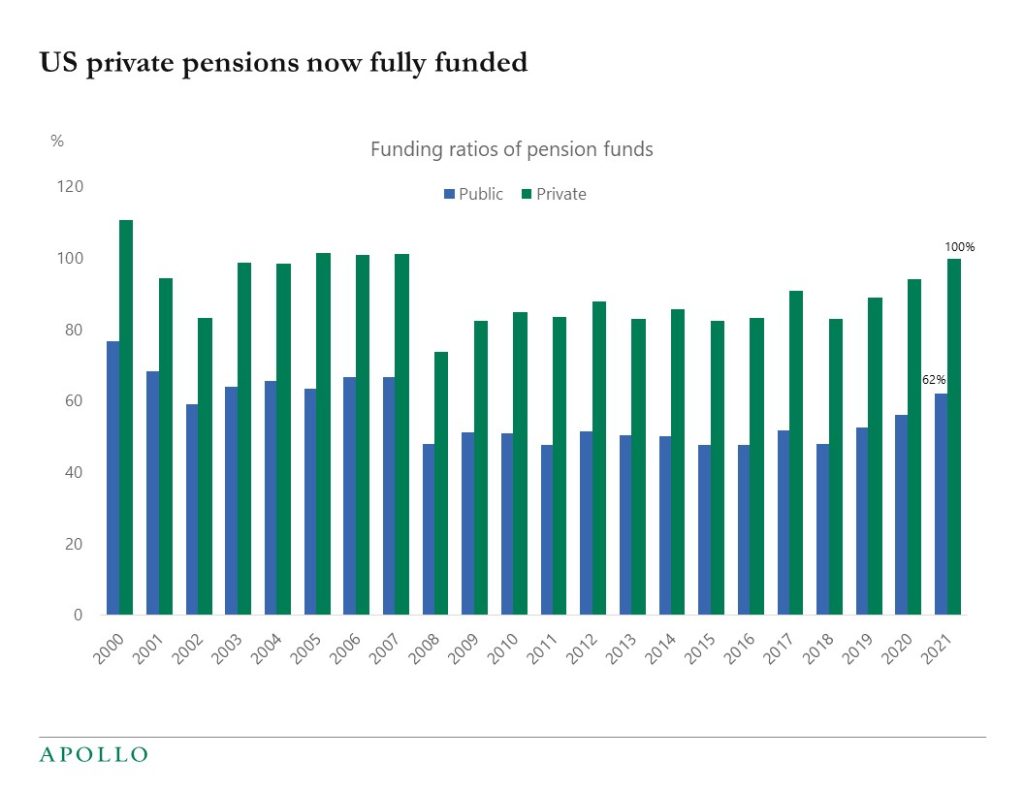

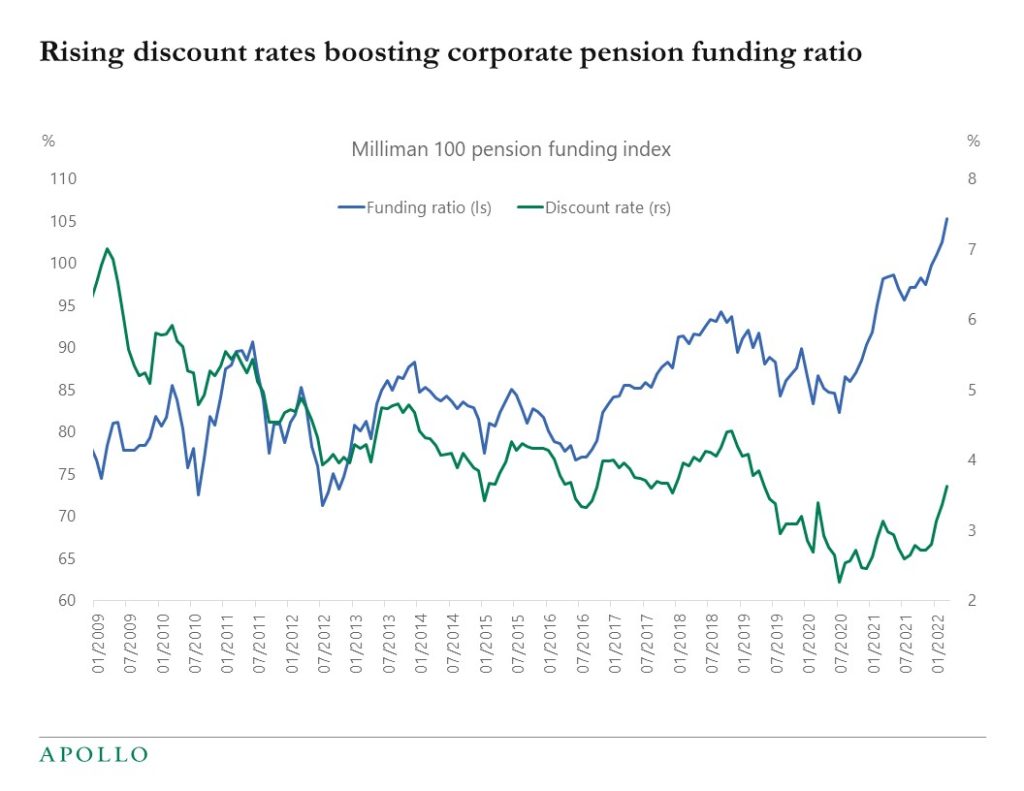

Rising stock prices and rising discount rates have increased the funding ratio of private and public pension funds, see charts below.

For the first time in 15 years, private pension funds have assets and expected cash flows matching future liabilities.

With the funding ratio reaching 100%, pension funds are de-risking and locking in gains in stock prices and buying rates and also high-grade credit to lock in yields.

The bottom line is that rising funding rates are creating significant demand for fixed income as yields move higher.

A different way to look at it is that as the Fed stops doing QE, another buyer, namely pensions, is stepping in to buy fixed income.

And such significant structural buying makes it harder for the Fed to achieve the desired tightening in financial conditions.

Source: Apollo Chief Economist, Federal Reserve Financial Accounts

Source: Milliman, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

A labor market view on the risks of a U.S. hard landing by Larry Summers and Alex Domash

https://www.nber.org/papers/w29910This paper uses historical labor market data to assess the plausibility that the Federal Reserve can engineer a soft landing for the economy. We first show that the labor market today is significantly tighter than implied by the unemployment rate: the vacancy and quit rates currently experienced in the United States correspond to a degree of labor market tightness previously associated with sub-2 percent unemployment rates. We highlight that the super-tight labor market coincides with current wage inflation of 6.5 percent –the highest level experienced in the past 40 years –and that firm-side slack measures predict further increases in wage inflation over the coming year. Finally, we show that high levels of wage inflation have historically been associated with a substantial risk of a recession over the next one to two years. We argue that periods that historically have been hailed as successful soft landings have little in common with the present moment. Our results suggest a very low likelihood that the Federal Reserve can reduce inflation without causing a significant slowdown in economic activity.

See important disclaimers at the bottom of the page.

-

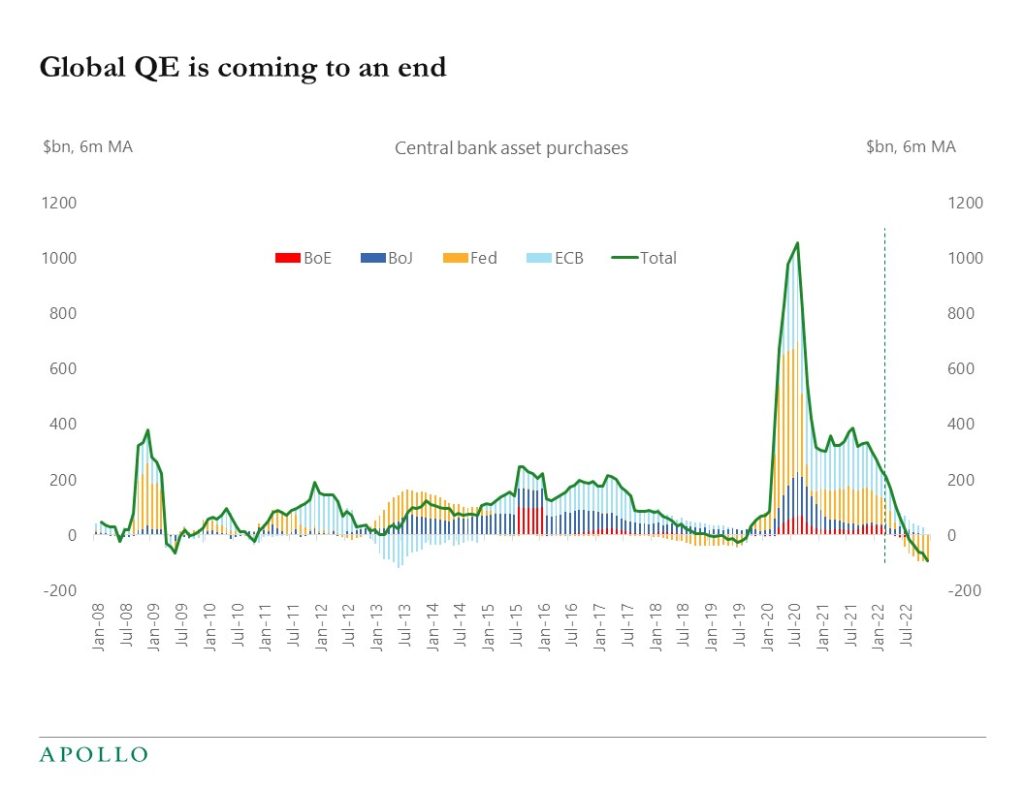

The Fed is going to shrink its holdings of Treasuries by $60bn a month and using the estimates in this Fed working paper, quantifying the stock effect shows that this decline in the Fed’s balance sheet is expected to increase the level of 10-year rates by 50bps by the end of this year. The rule of thumb from the Fed’s work is that for every $100bn in QT 10-year rates will rise by 10bps. The bottom line is that QE pushed rates down and markets should expect QT to push rates higher.

Source: Bloomberg, Apollo Chief Economist. Pace of purchases for 2021: BOE: £3.4bn per week till mid December 2021, FED: USD120bn per month with wind down from December with purchases ending in March 2022, ECB: Euro 90bn per month (20 bn APP + 60 bn PEPP), PEPP till March 2022, Euro 40bn in April, Euro 30bn in May and Euro 20bn in June, and euro 20bn per month onwards. BOJ:: USD 70bn per month. For 2022: All programs are expected to wind down linearly from January 2022 to December 2022. Fed QT $ 95 per month from May 2022. See important disclaimers at the bottom of the page.

-

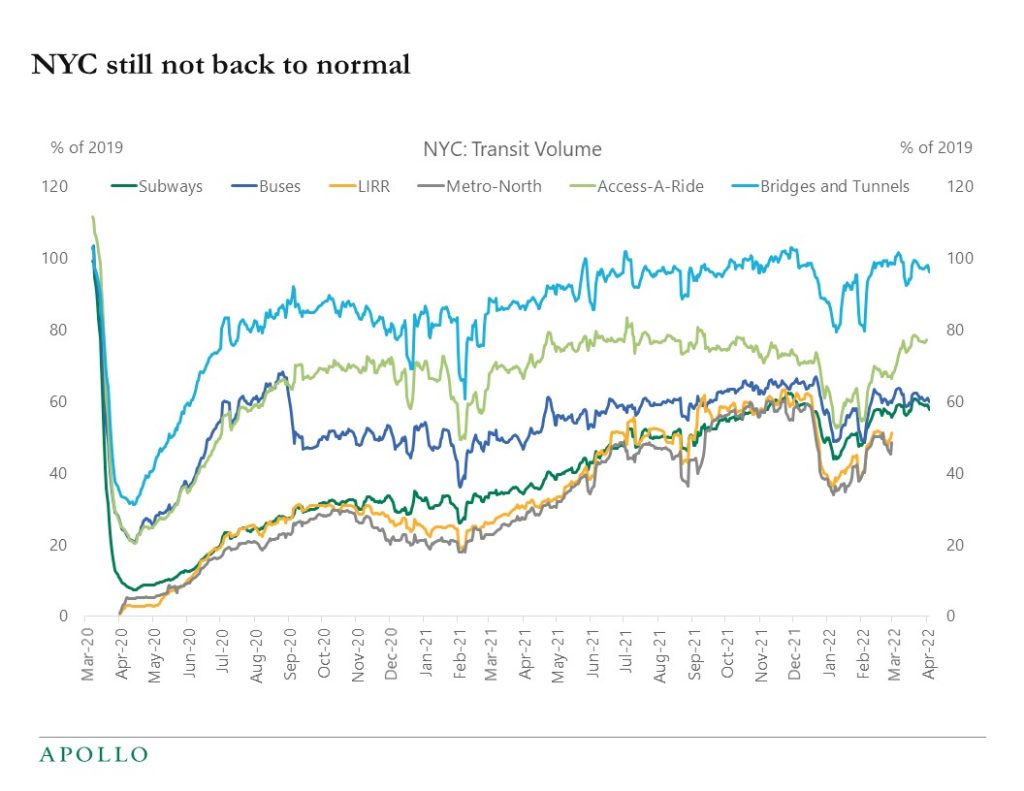

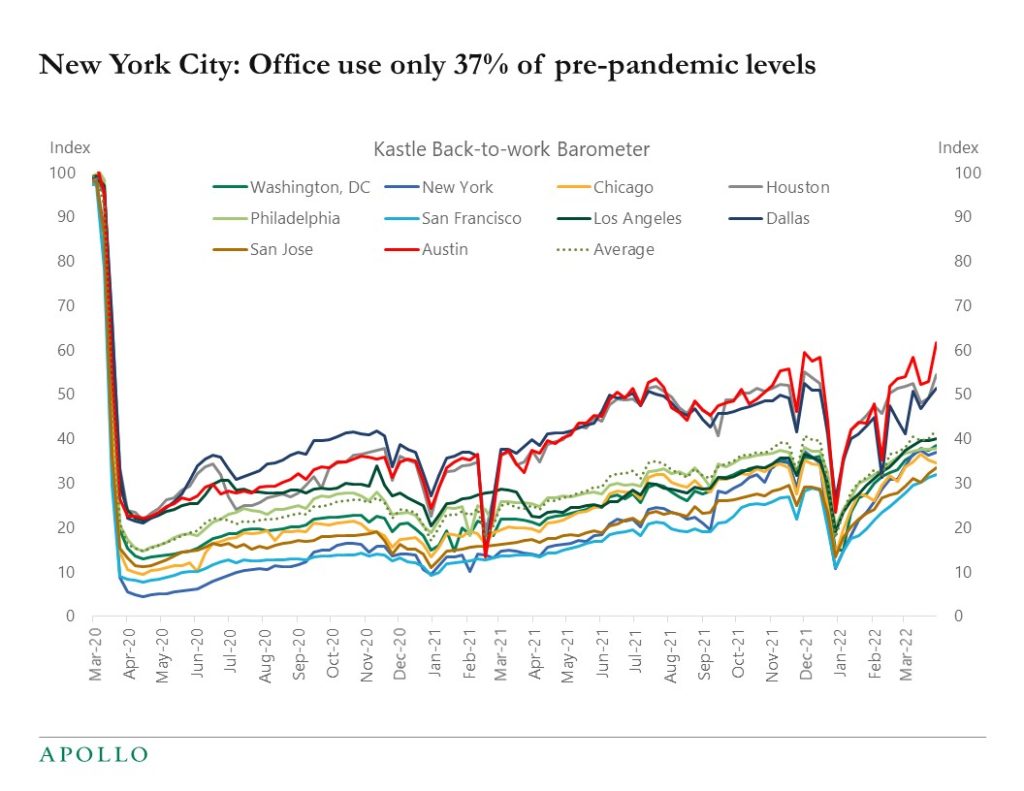

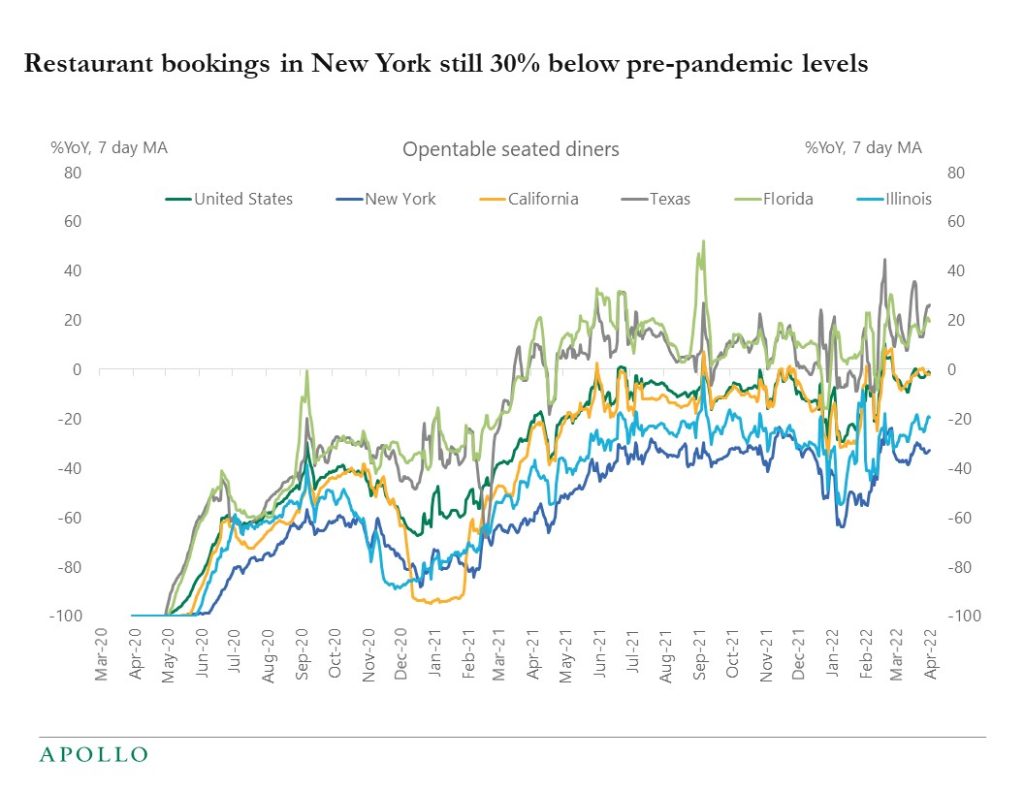

In New York City, subway use is at 60% of pre-pandemic levels office use is only 37% of pre-pandemic levels and restaurant bookings are more than 30% below pre-pandemic levels; see charts below.

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: OpenTable, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

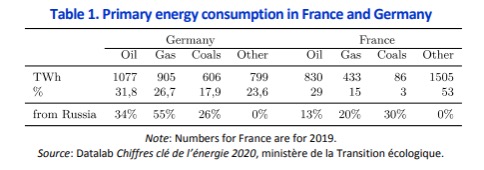

This focus provides an estimation of the effect of a Russian stop of energy imports. The main results are as follows:

- The impact for France would be modest with a decline of around 0,15 to 0,3% in gross national income.

- For Germany, the negative impact on gross national income is real (around 0.3% and up to 3% in the most pessimistic scenarios) but overall moderate and can be absorbed.

- The same is true for the EU as a whole although there is significant heterogeneity in the magnitude of the shock across countries.

- For some EU countries, the consequences are much greater: Lithuania, Bulgaria, Slovakia, Finland, or the Czech Republic may experience national income drops of between 1 and 5%.

- These estimates take into account cascading effects along production value chains in a model with 30 sectors and 40 countries. Despite the imprecision of this type of simulation exercise, the orders of magnitude appear very robust: we can rule out with a high degree of confidence a scenario of a GDP collapse of more than 1% for France for example.

- The relatively low impact of an embargo (except for the aforementioned countries) can be explained by the fact that even in the short term companies and the economy as a whole can substitute (even very partially) sources of energy to others and intermediate or final goods to others. The analysis of historical experiences of very strong shocks (Fukushima in Japan or COVID in China) with potential effects along production value chains also shows that individual companies and the economy are able to minimize the impact of the shock. This substitution even though it is very partial helps to very significantly mitigate the impact of the shock compared to a scenario where the entire production and consumption structure is fixed.

The Economic Consequences of a Stop of Energy Imports from Russia

https://www.cae-eco.fr/staticfiles/pdf/cae-focus084.pdfSee important disclaimers at the bottom of the page.

-

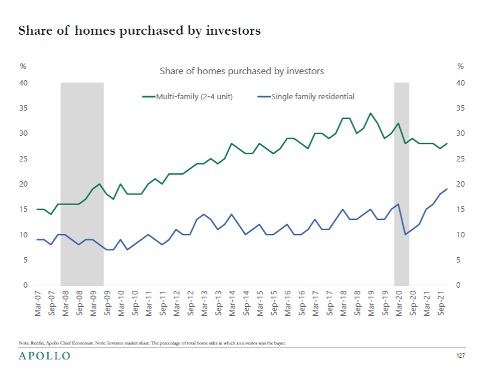

A record-high 20% of single-family homes sold are sold to investors, see chart below.

This part of the housing market is less sensitive to the Fed hiking rates and to higher mortgage rates. In that sense, a higher investor share weakens the transmission mechanism of monetary policy to the housing market.

With a high investor share combined with a high level of excess savings in the household sector, the Fed has to raise rates even more and even faster to cool the economy and inflation down. Which increases the likelihood of a harder landing.

See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.