Want it delivered daily to your inbox?

-

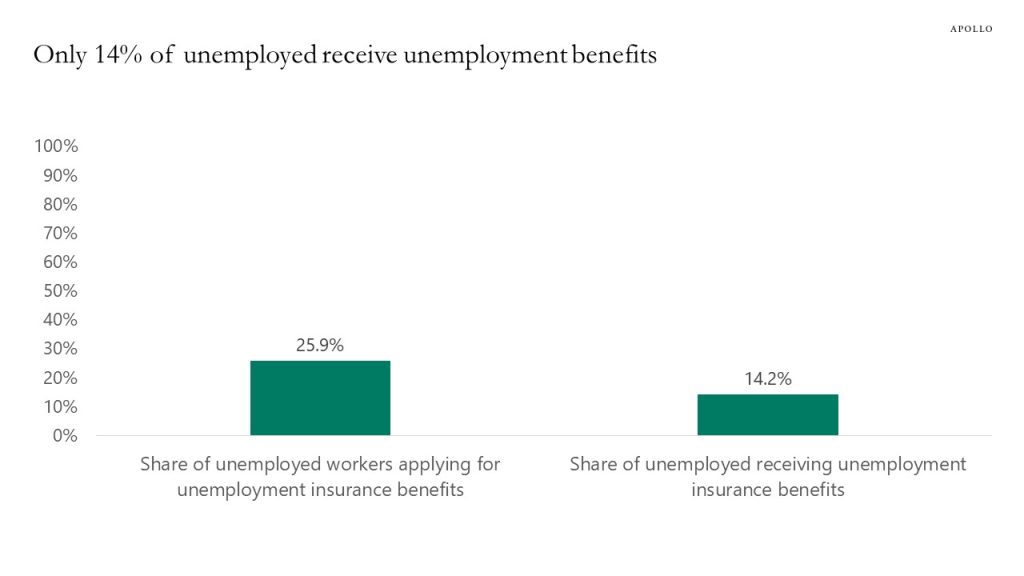

With hiring in the service sector and layoffs in the tech sector, jobless claims may underestimate the ongoing slowdown in the labor market because only 14% of unemployed receive unemployment insurance benefits, see chart below. In other words, with a strong service sector and a weak tech sector, jobless claims may not be a good reflection of what is happening in the labor market.

Source: BLS, Apollo Chief Economist. Note: Among unemployed persons who had worked in the past 12 months. BLS link here: https://www.bls.gov/news.release/uisup.t01.htm See important disclaimers at the bottom of the page.

-

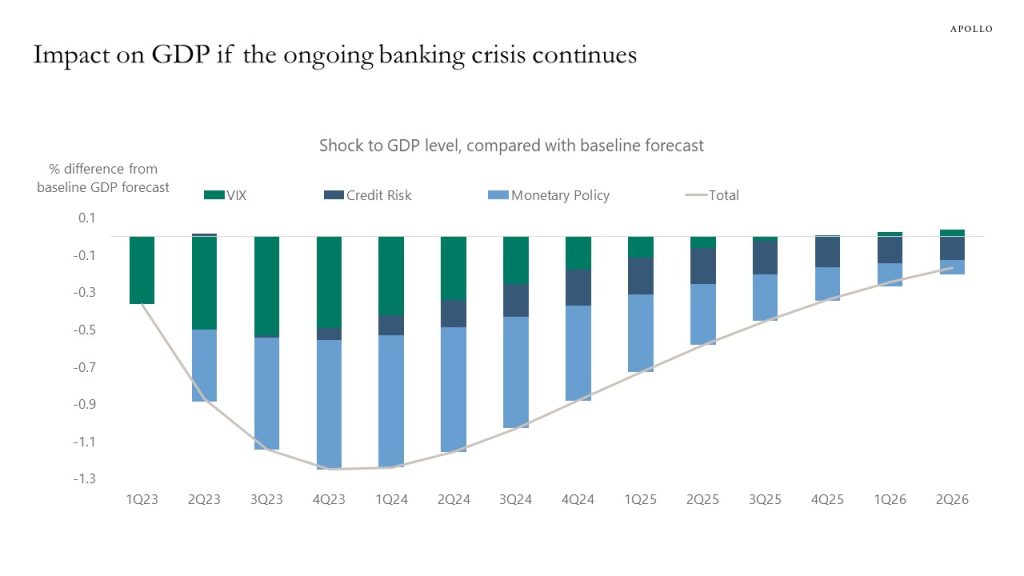

It is difficult to assess the duration of this banking crisis but assuming IG credit spreads stay at their current level around 150bps, VIX is two standard deviations higher than normal, and the Fed funds rate is 150bps higher because of tighter credit conditions, show how serious this shock can be if bank funding costs remain elevated and banks tighten lending standards over the coming quarters, see chart below.

The negative impact on GDP at around 1.25% would be only a third of the roughly 4% decline in GDP during the 2008 financial crisis, and to be sure, this quantification shows the impact on GDP if the current levels of stress continue.

But under the baseline assumption of growth already slowing because of the lagged effects of Fed hikes, the bottom line is that if the ongoing banking crisis results in tighter bank lending standards over the coming quarters, it increases the risks of a harder landing.

Source: Bloomberg, Apollo Chief Economist. Note: The chart shows difference in baseline forecast adding a 150bps shock to Fed funds rate and 30 bps to credit risk and a two standard deviation shock to VIX, all starting in 1Q23. VIX is currently two standard deviations from its mean since 2010. See important disclaimers at the bottom of the page.

-

At the peak in 2013, China held $1.3trn in US Treasuries. Today they hold $850bn, and the selling has accelerated over the past two years, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

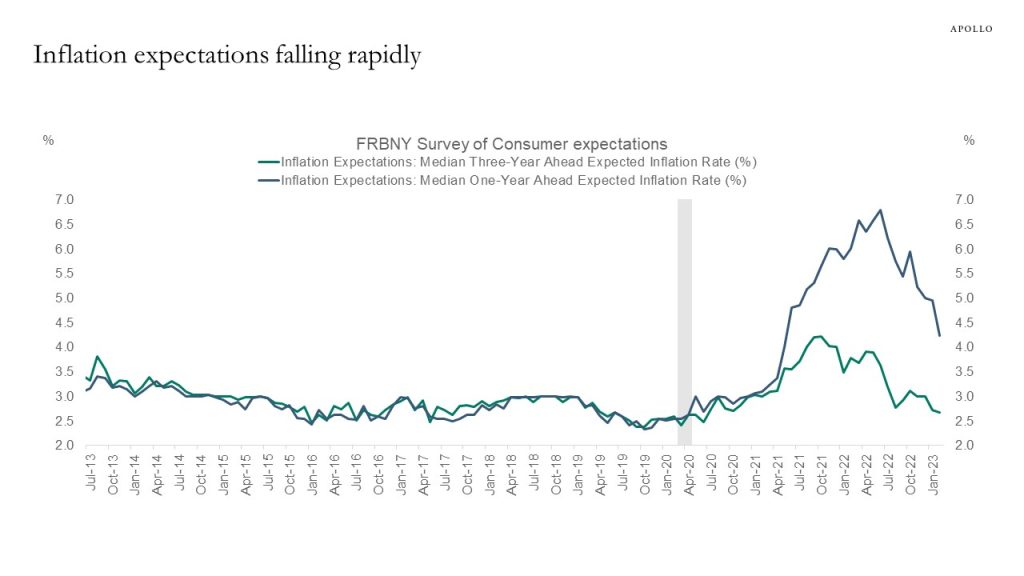

Both survey-based and market-based measures of inflation expectations are falling quickly, and the Fed will soon be talking about this as an important reason why they can allow themselves to be more dovish and ultimately start cutting rates, see chart below.

Source: FRBNY, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

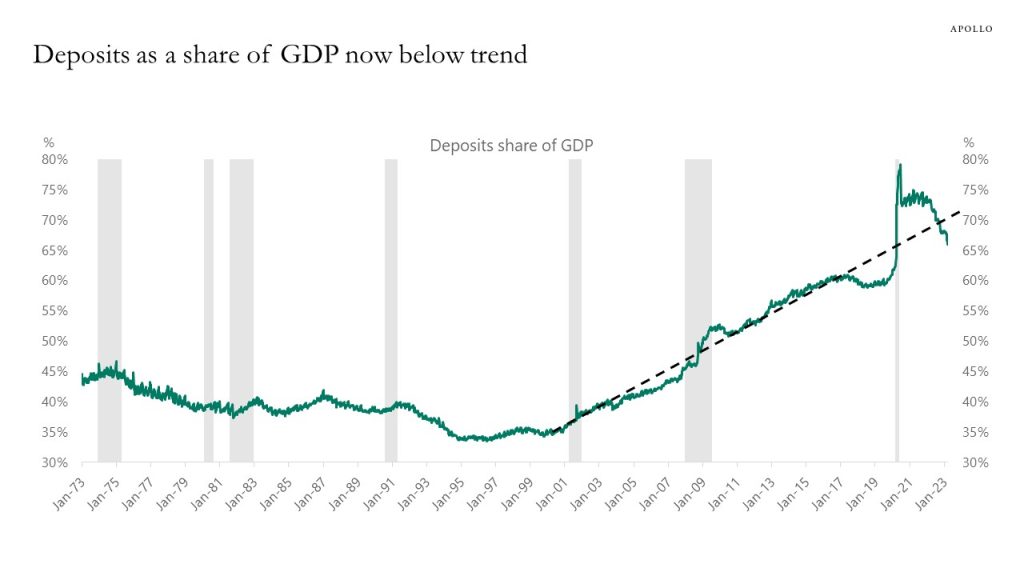

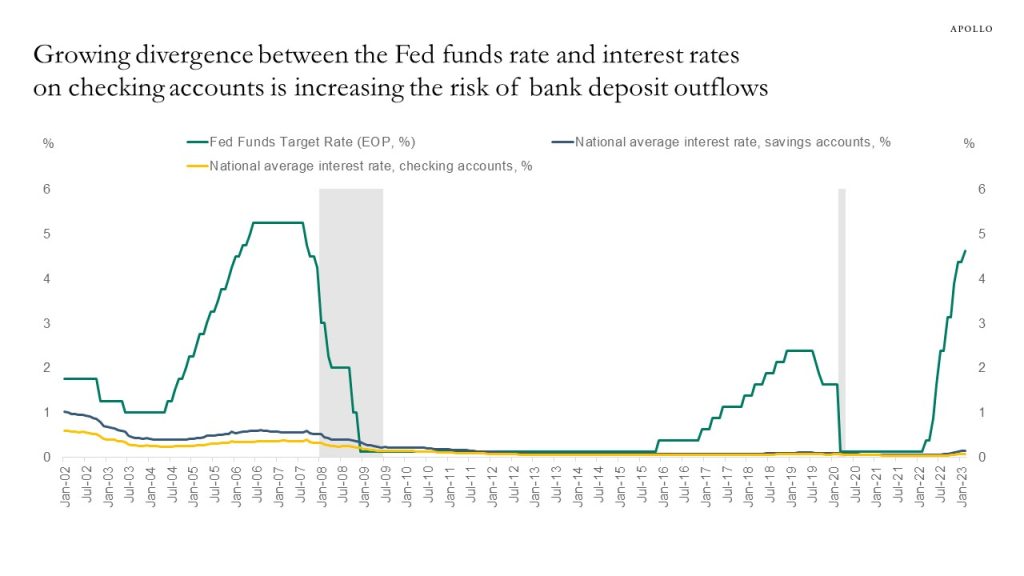

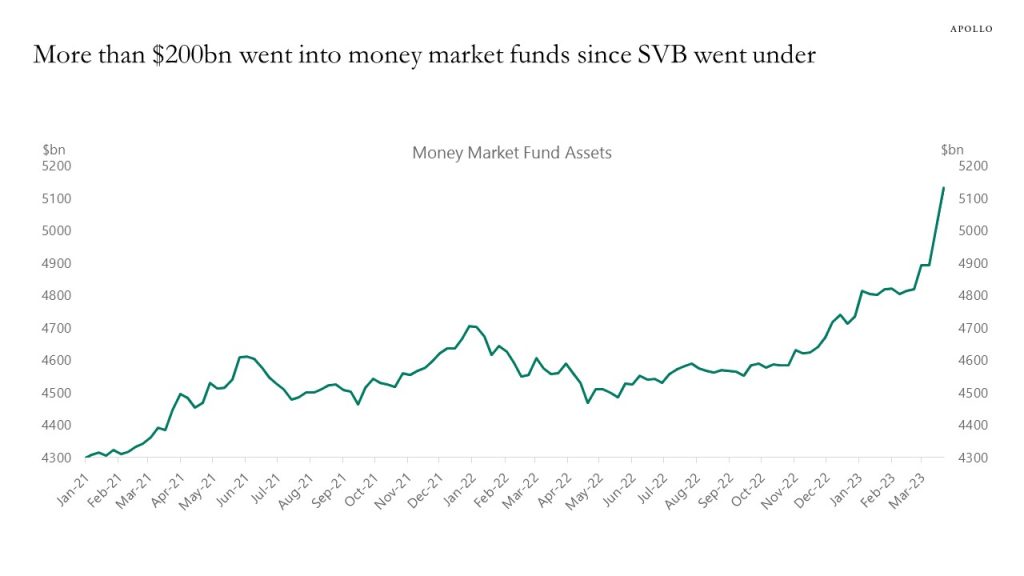

Excess savings in checking accounts are not only being used for consumer spending, they are also being moved into money market accounts.

In fact, the level of deposits as a share of GDP is now below its pre-pandemic trend, suggesting that households now have lower levels of liquid cash available than they did just a few months ago.

Not only do consumers have less cash readily available, but the movement of money from checking accounts to money market accounts likely has negative implications for consumer spending going forward, given the marginal propensity to consume out of money market holdings is likely to be lower than the marginal propensity to consume of money held in a checking account.

Source: Federal Reserve Board, BEA, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Our updated banking sector chart book is available here, three conclusions:

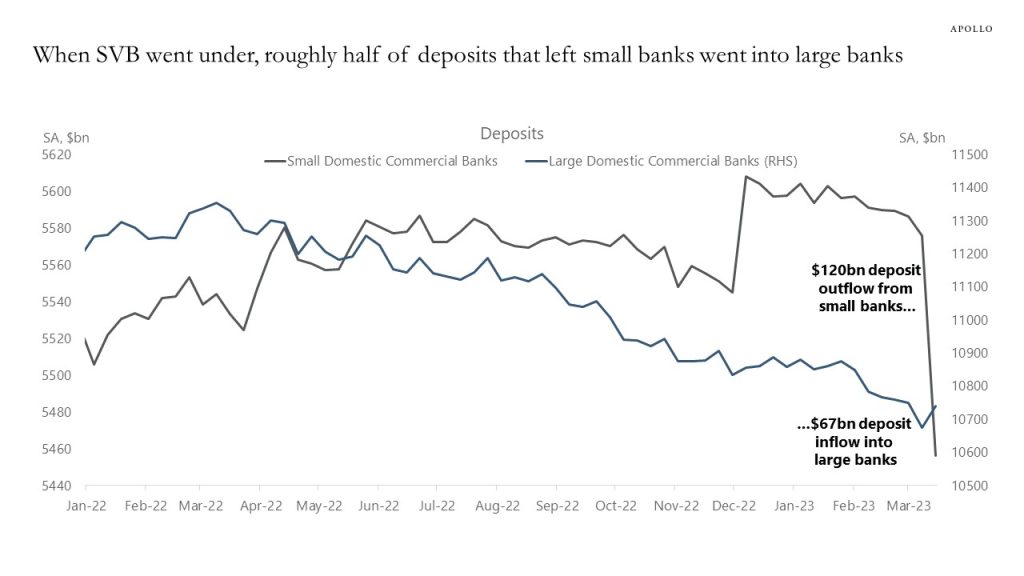

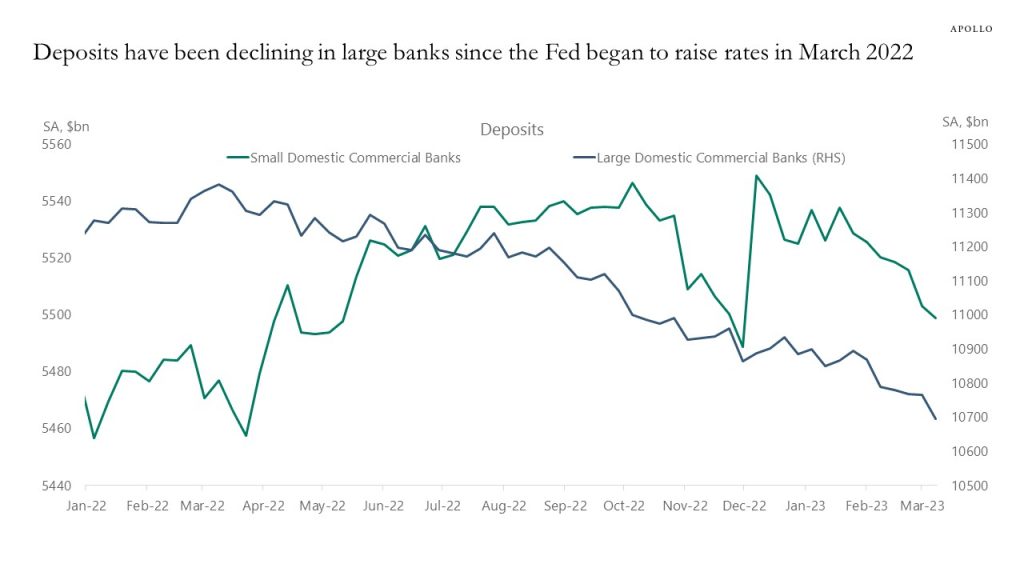

1) Data covering the week SVB failed suggests that roughly half of the deposit outflow from small banks went into large banks, see the first chart below. The other half probably went into higher-yielding investments, including money market funds.

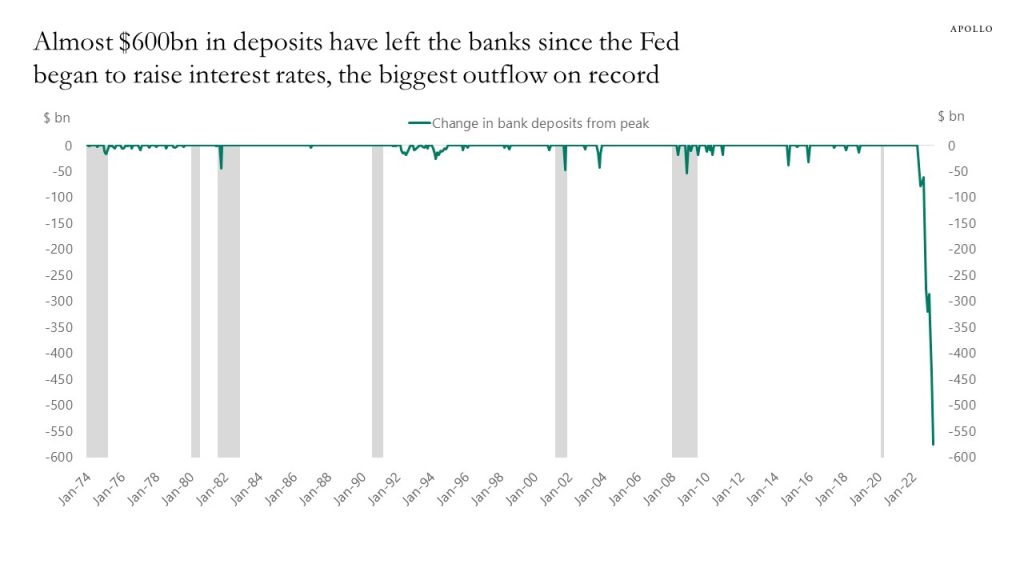

2) Deposits in the banking sector have declined by almost $600bn since the Fed began to raise interest rates, the biggest banking sector deposit outflow on record, see the second chart below.

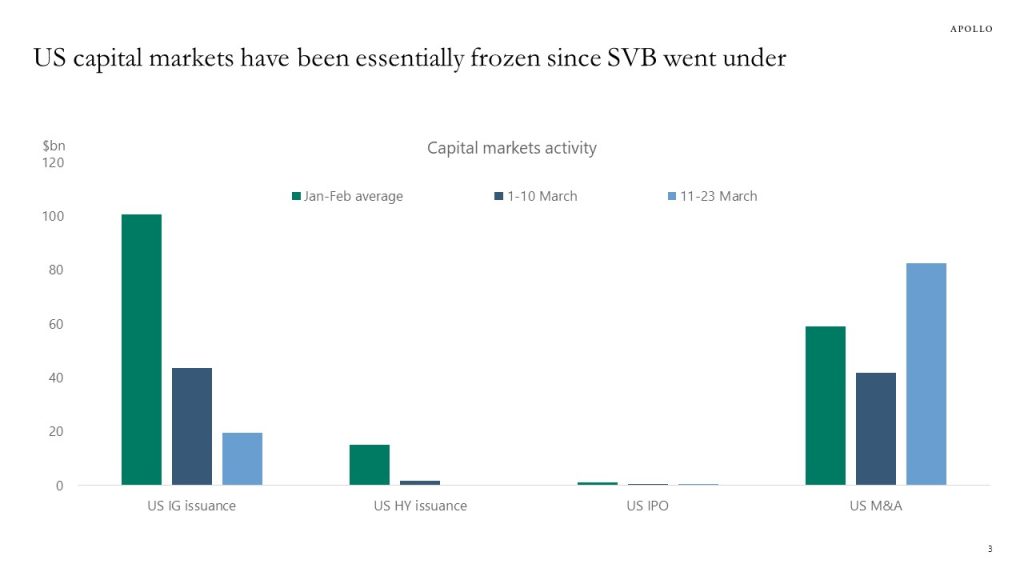

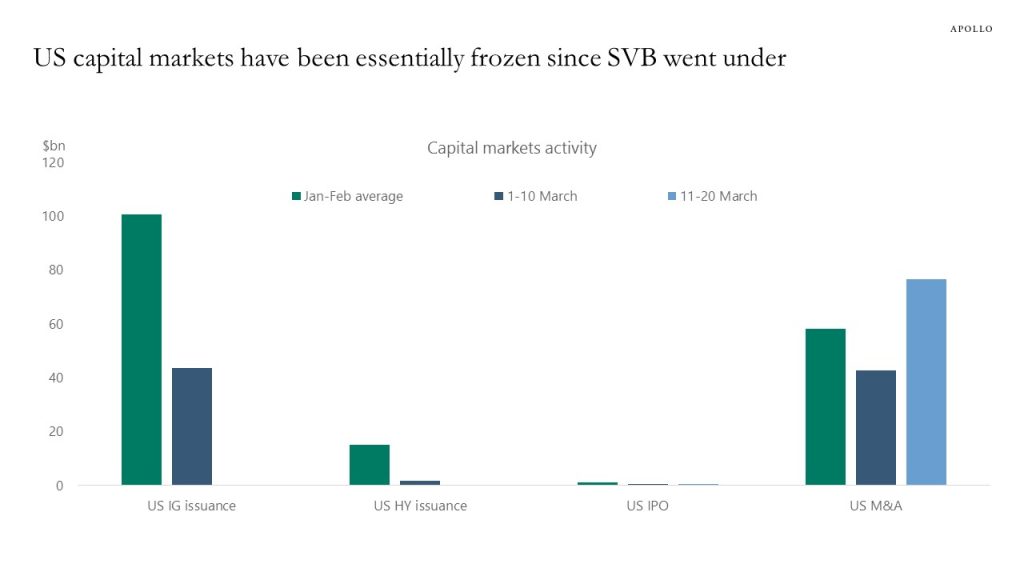

3) Capital markets have remained essentially closed since SVB went under, and the longer the current stresses persist, the more harmful it will be for the economy.

The bottom line: The near-term risks to banks combined with uncertainty about deposit outflows, bank funding costs, asset price turbulence, and regulatory issues, all argue for tighter lending conditions and slower bank credit growth over the coming quarters. The economy continues to move from no landing to a hard landing, driven by the lagged effects of Fed hikes, magnified by the adverse effects of the ongoing banking crisis.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist. Note: March data as of 15th March 2023. Peak is defined as the month before monthly outflows turn negative.

Source: Pitchbook LCD, S&P Capital IQ, Bloomberg, Apollo Chief Economist. See important disclaimers at the bottom of the page.

-

The divergence between the Fed funds rate and interest rates on checking accounts is the fundamental reason why money is being moved out of bank deposits and into higher-yielding investments, including money market accounts, see charts below. Higher rates as a source of instability for deposits and Treasury holdings are highly unusual compared to previous banking crises, where the source of instability has typically been credit losses putting downward pressure on the illiquid side of banks’ balance sheets.

Source: FRB, RateWatch, Haver Analytics, Apollo Chief Economist

Source: Bloomberg See important disclaimers at the bottom of the page.

-

Today at 4:15 pm, we get data from the Fed showing what happened to deposits and lending in small banks the week after SVB went under. The weekly H8 data can be found here, and it shows that deposits were already declining for both small and large banks in the weeks leading up to SVB’s failure, see chart below. Once the data is out we will update our weekly banking sector chart book and send it out over the weekend.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Since SVB went under, there has been basically no HY issuance, IG issuance, or IPO activity, see chart below. And completed M&A activity since Friday, March 10 reflects long-time planned M&A rather than new risk-taking. The longer capital markets are closed, and the longer funding spreads for banks remain elevated, the more negative the impact will be on the broader economy.

Source: Pitchbook LCD, S&P Capital IQ, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

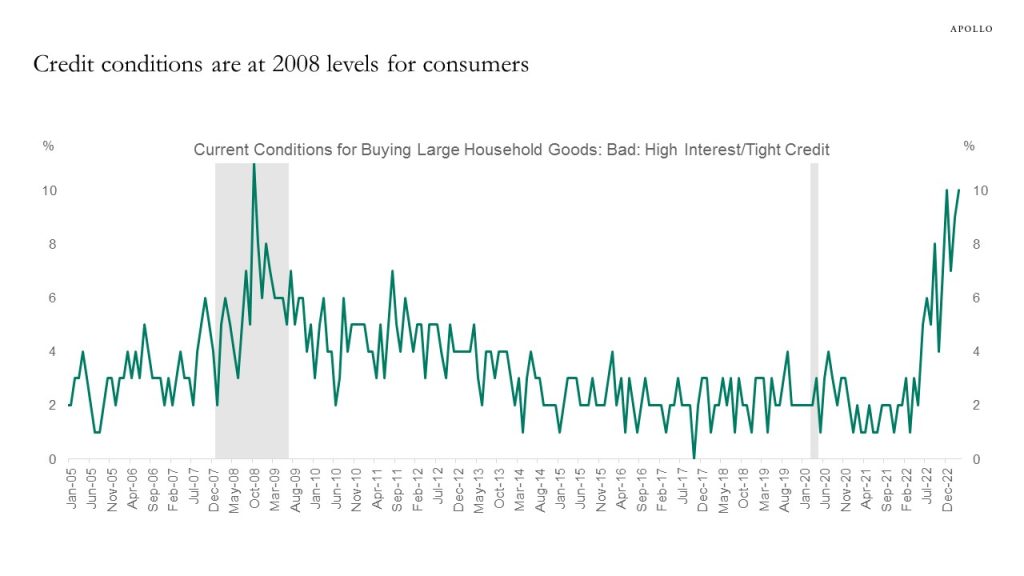

The University of Michigan asks consumers about credit conditions, and the chart below shows that even before the SVB situation, credit conditions had tightened to levels last seen in 2008, see chart below.

Source: University of Michigan, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.