Want it delivered daily to your inbox?

-

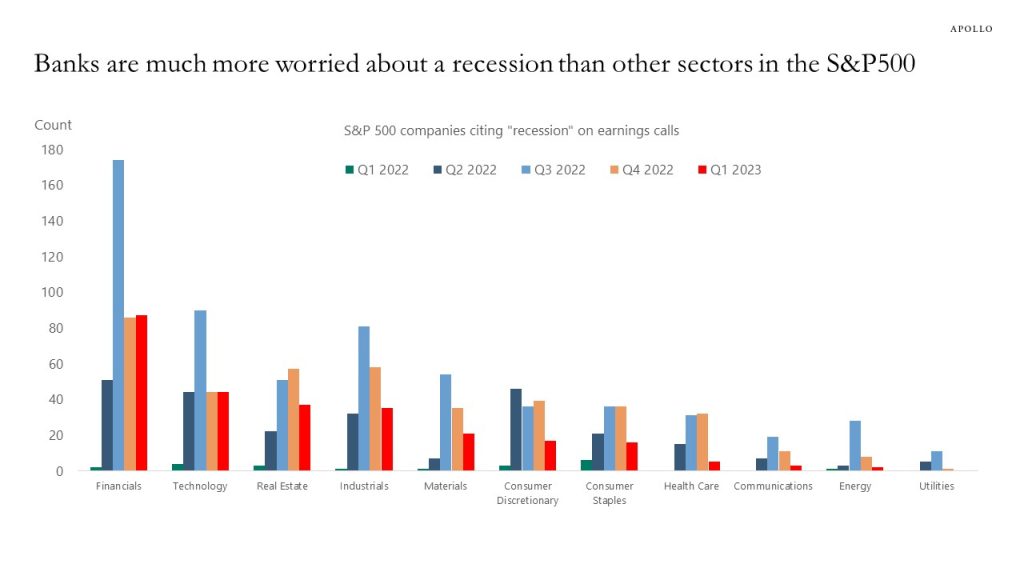

Looking at transcripts of earnings calls show that banks remain more worried about a recession than other sectors in the S&P500, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

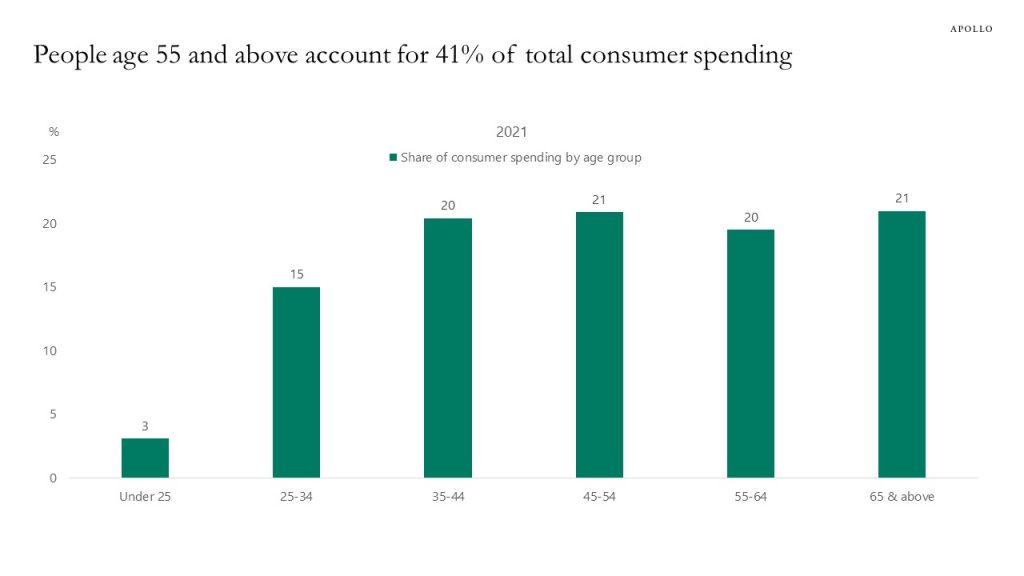

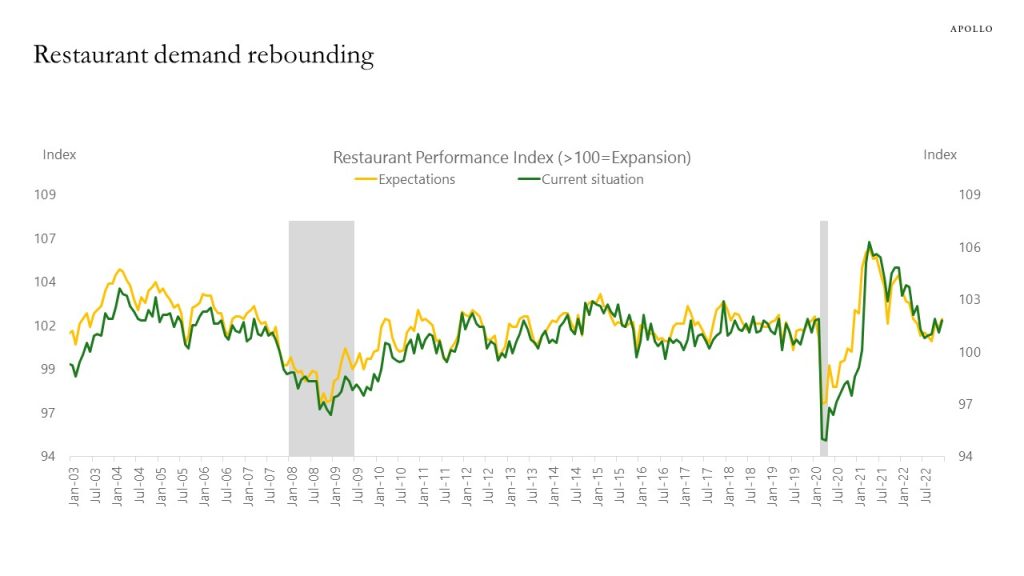

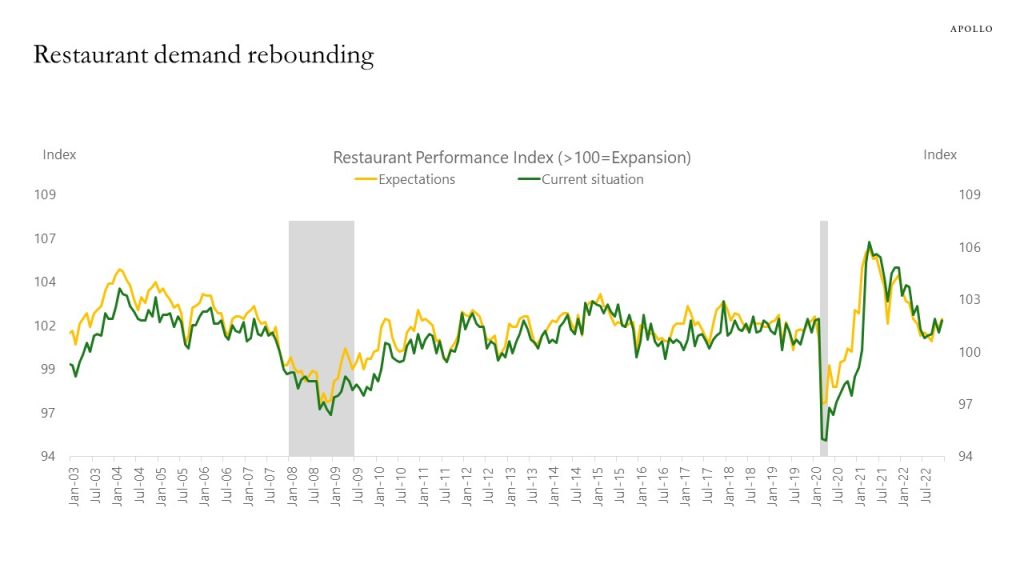

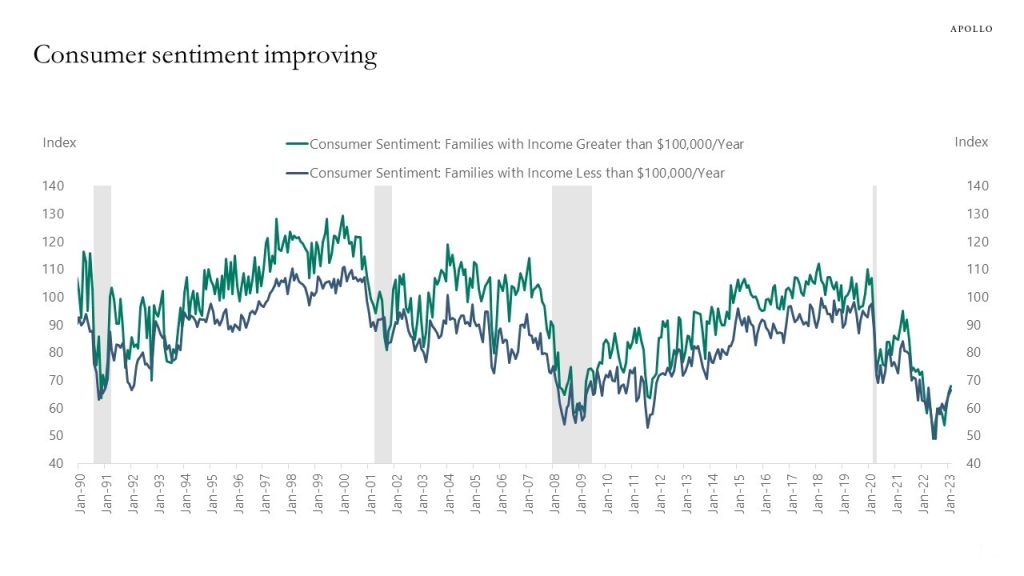

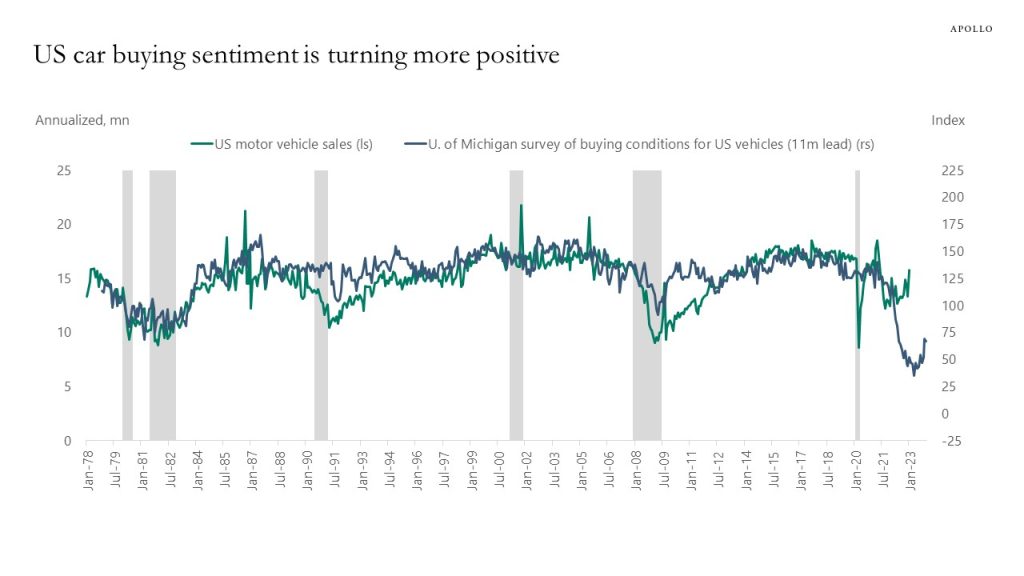

Our latest US consumer outlook is available here. Consumer spending continues to be supported by strong job growth, high wage growth, and plenty of savings across the income distribution. A few key charts below.

Source: BLS, Haver, Apollo Chief Economist

Source: National Restaurant Association, Haver, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

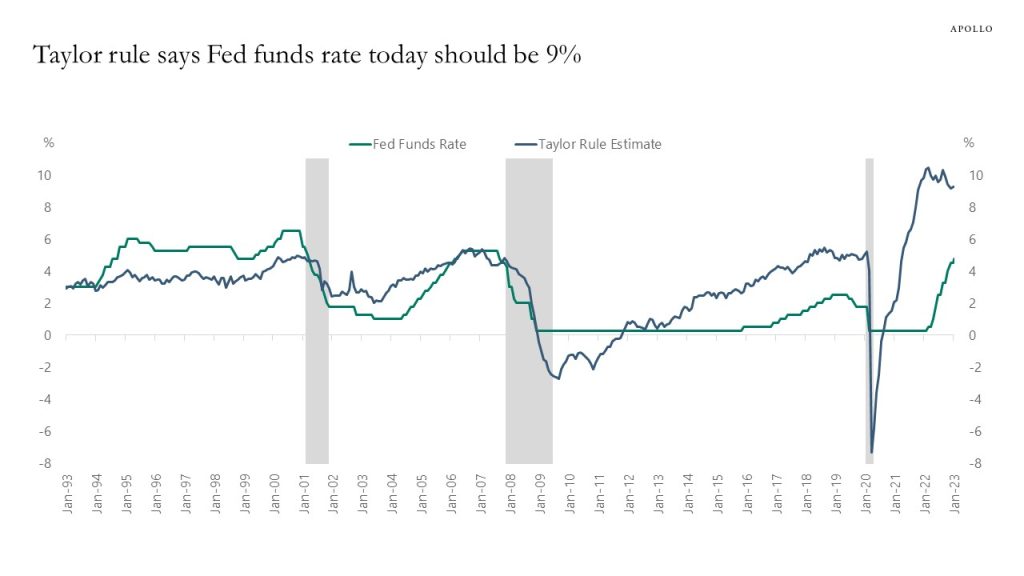

In 1993, Stanford Professor John Taylor published a paper where he showed that the Fed funds rate has historically been equal to the sum of deviations from the Fed’s target for inflation and unemployment. For example, if inflation is above the Fed’s 2% target, the Fed funds rate will be higher. And if unemployment is above the Fed’s target, the Fed funds rate will be lower.

This relationship where the Fed funds rate can be predicted by inflation and unemployment is called the Taylor rule, and John Taylor’s contribution was to come up with the weights to inflation and unemployment that the Fed has used historically to give the best explanation of the actual Fed funds rate. The logic with using inflation and unemployment is that those two variables capture the Fed’s dual mandate of price stability and full employment.

The Fed has used this framework for decades for understanding what the Fed funds rate should be, and inserting the current level of inflation and unemployment into the Taylor rule shows that the Fed funds rate today should be 9%. Significantly above the current level of the Fed funds rate at 4.5%, see chart below.

The bottom line is that the Taylor rule framework normally used by the Fed for evaluating the stance of monetary policy is saying that the Fed is still significantly behind the curve.

Source: Bloomberg, Apollo Chief Economist. Note: (Taylor Rule (9.23) = Neutral real rate (2.00) + Core PCE (4.42) + [alpha(0.5)*{(inf (4.42) – target (2.00)}]+[beta(0.5)*{factor (2.0)} *{(NAIRU (5.0) – Unemployment (3.40)}] See important disclaimers at the bottom of the page.

-

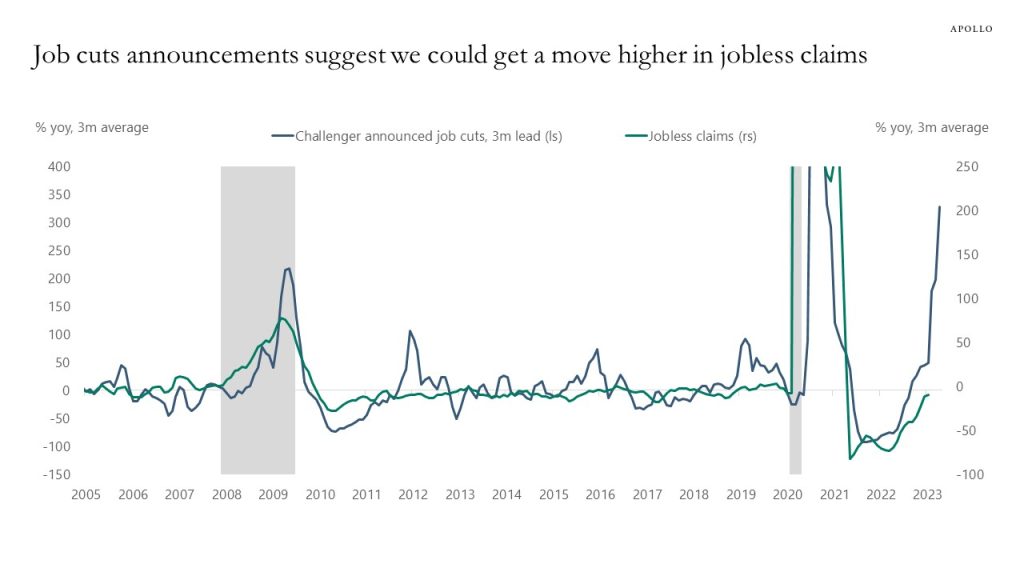

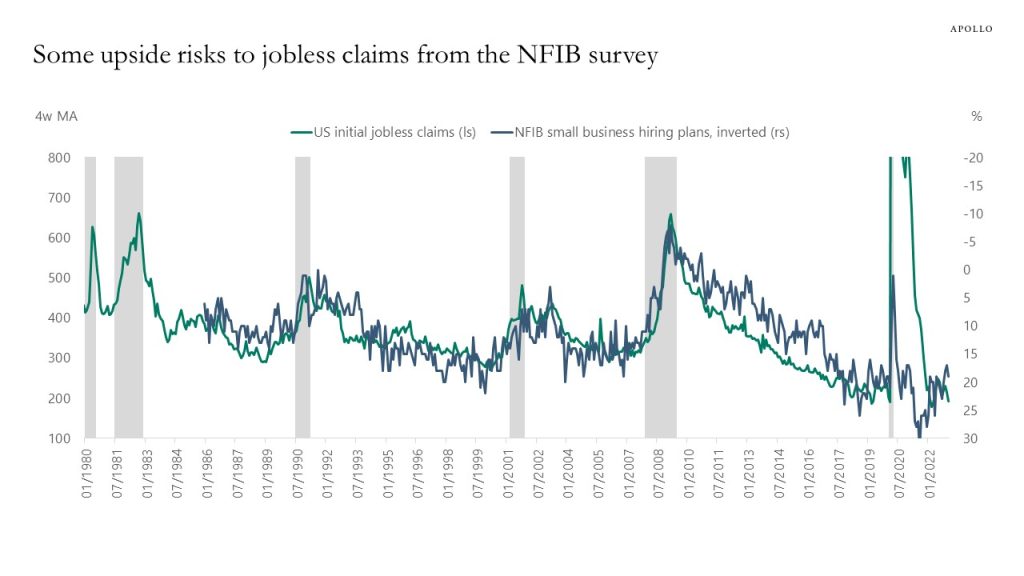

We are carefully watching the labor market for signs that we are transitioning from a no landing scenario to a hard landing scenario, and some leading indicators for jobless claims suggest that the labor market could weaken going forward, see charts below. But so far, the incoming data shows that we remain firmly in the no landing scenario where the Fed needs to raise rates more to slow the economy down and get inflation under control. Our daily and weekly indicators for the US economy are available here.

Source: Challenger, Gray & Christmas Inc., Bloomberg, Apollo Chief Economist

Source: Department of Labor, NFIB, Bloomberg, Apollo Chief Economist

Source: National Restaurant Association, Haver, Apollo Chief Economist

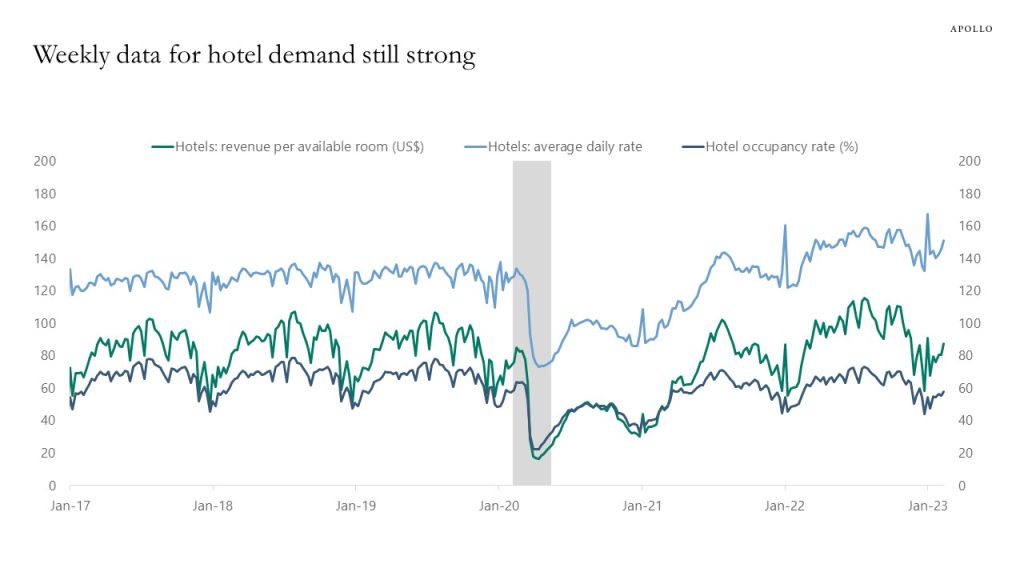

Source: STR, Haver Analytics, Apollo Chief Economist

Source: NAR, Haver Analytics, Apollo Chief Economist

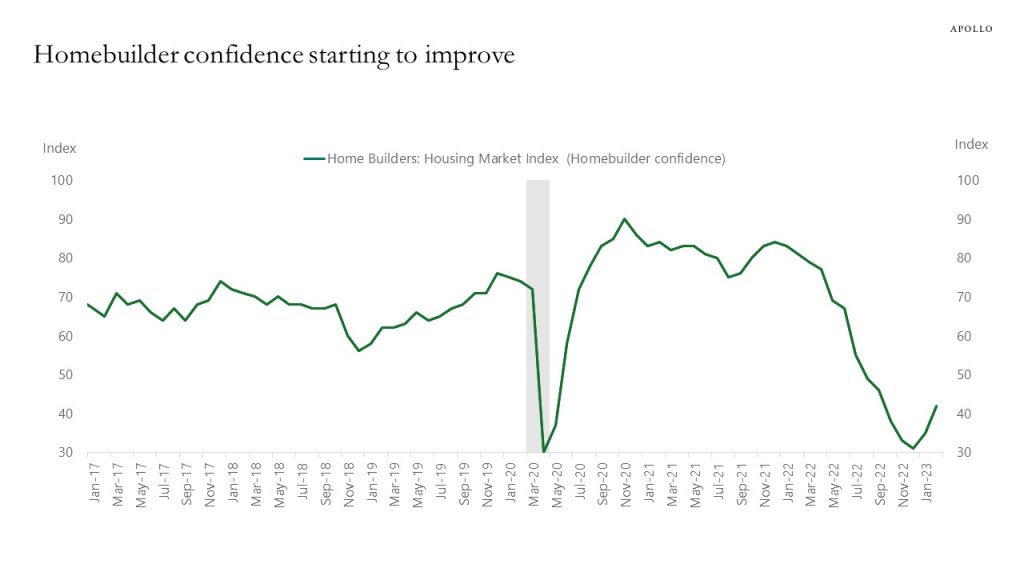

Source: National Association of Homebuilders, Bloomberg, Apollo Chief Economist

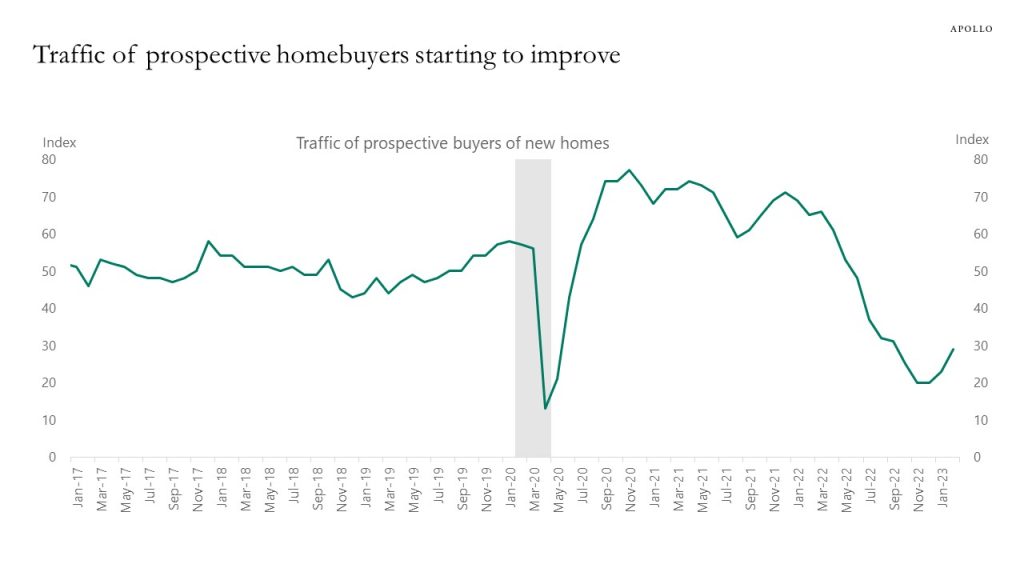

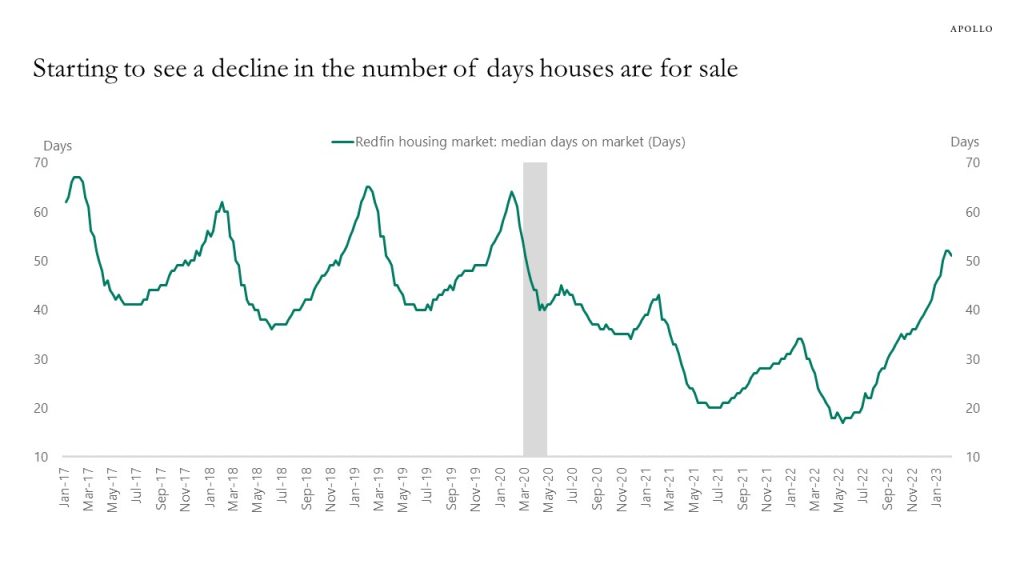

Source: Redfin, Haver, Apollo Chief Economist

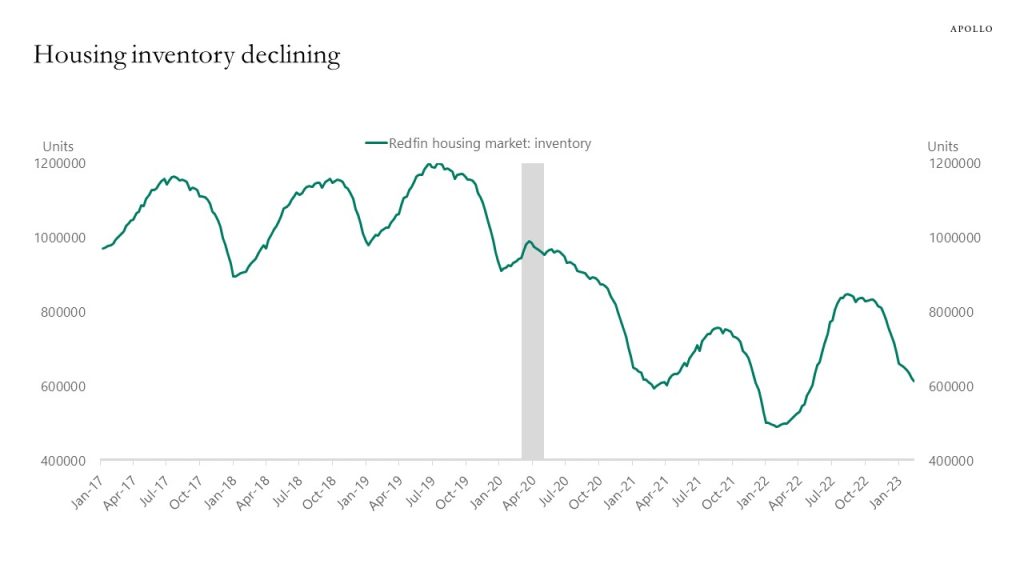

Source: Redfin, Haver, Apollo Chief Economist

Source: University of Michigan, Haver Analytics, Apollo Chief Economist

Source: The Conference Board, Haver, Apollo Chief Economist

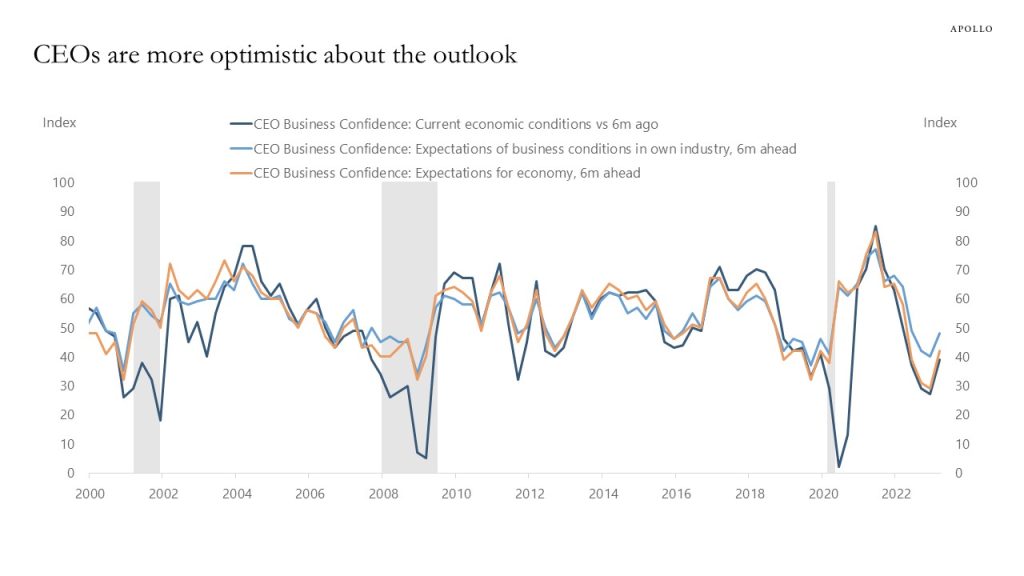

Source: Bloomberg, Apollo Chief Economist

Source: BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

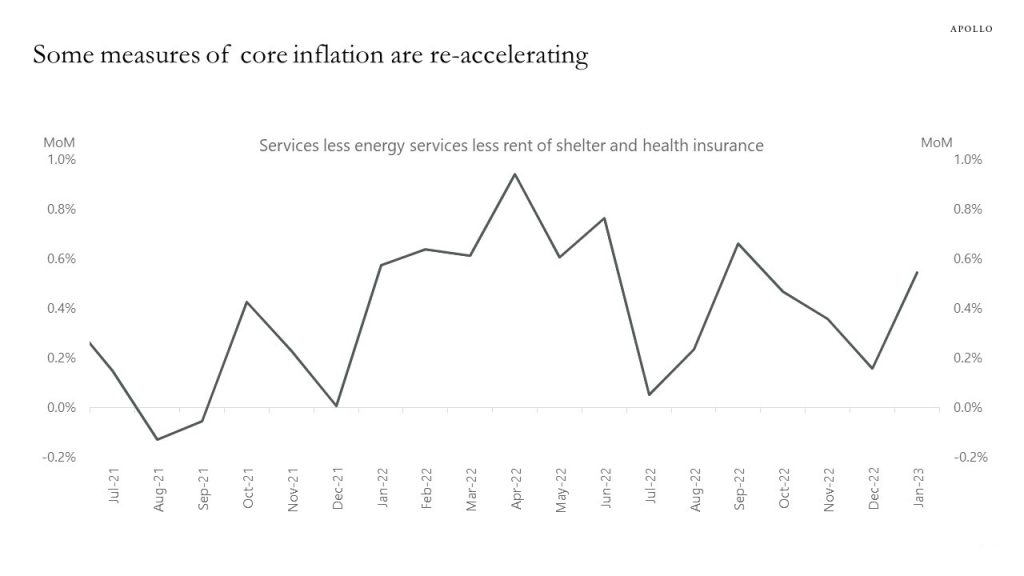

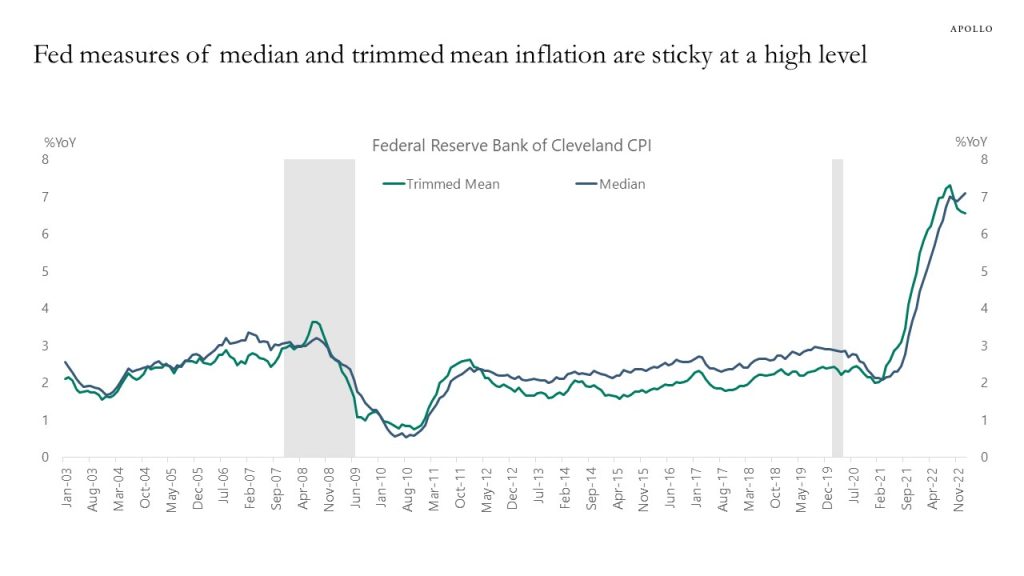

A key feature of the no landing scenario is sticky inflation at high levels, and Fed-calculated measures of inflation persistence are not showing signs of inflation coming down quickly to the Fed’s 2% inflation target, see chart below.

Persistent high inflation at 7% is a problem because it means that the Fed needs to do more demand destruction to get inflation back to 2%. The bottom line is that higher interest rates for longer is negative for consumer spending, capex spending, and corporate earnings.

In short, under the no landing scenario, high inflation is a problem, and the Fed is not done raising rates, which means that the trading environment from 2022 will be coming back, and the 60/40 portfolio will perform poorly.

Source: Federal Reserve Bank of Cleveland, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

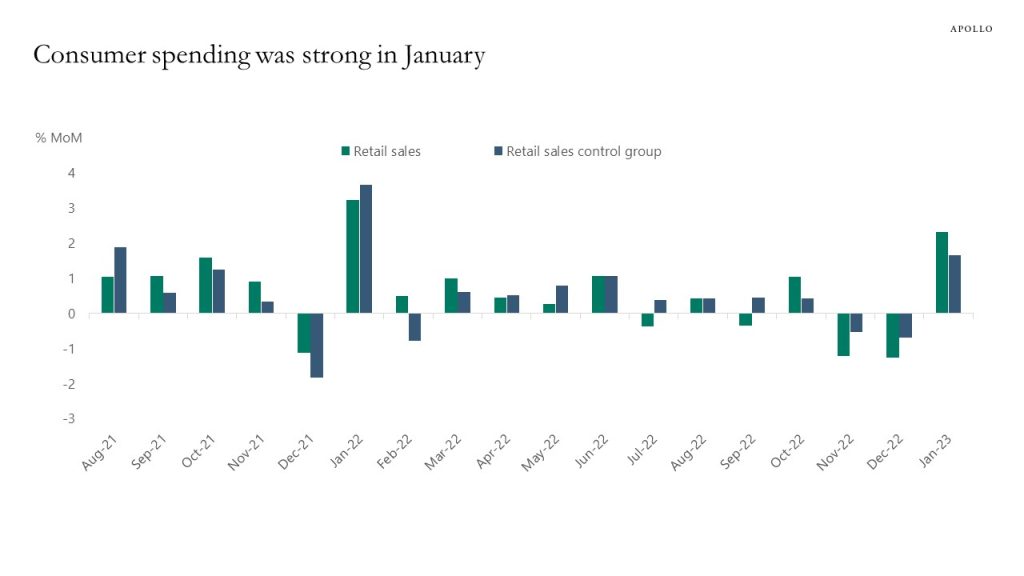

The retail sales data for January was strong and shows that the US consumer is not slowing down, see charts below. This is not surprising with a strong labor market, strong wage growth, and high savings across all income groups.

Incoming data for airlines, hotels, restaurants, movie theatre visits, and Broadway shows continue to be strong, and consumer services are not slowing down. And with retail sales mainly measuring goods consumption, the bottom line is that even consumer spending on goods continues to do well.

The no landing scenario continues, and the risks are significant that inflation will stay sticky around 5%, well above the Fed’s 2% inflation target.

Source: Census Bureau, Haver Analytics, Apollo Chief Economist

Source: Census Bureau, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

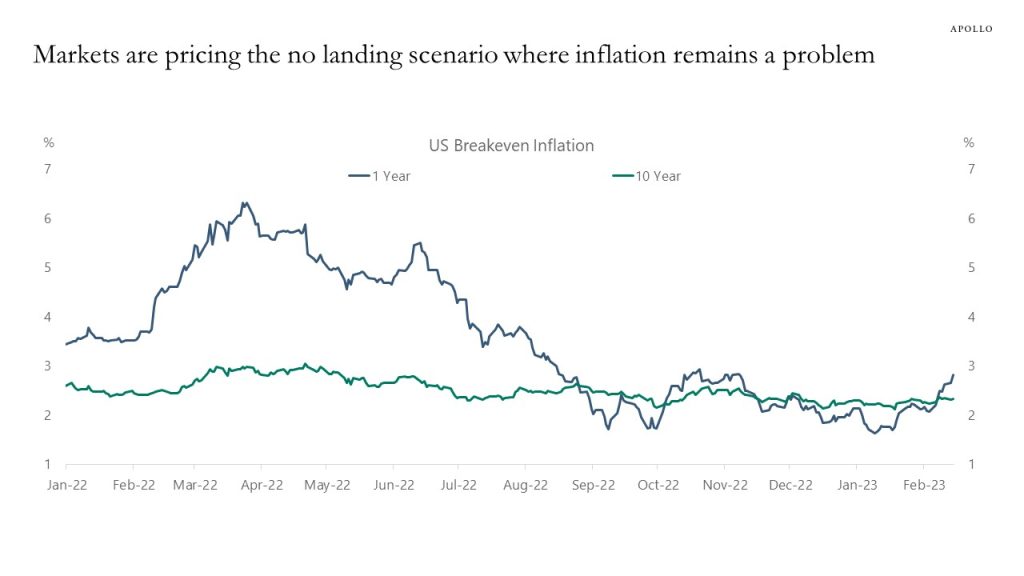

There are more and more signs of the market pricing the no landing scenario where the economy remains strong, and inflation remains sticky and persistent.

Not only are short rates increasing, but one-year breakeven inflation expectations are rising and approaching 3%, driven higher by the strong January employment report and yesterday’s CPI report.

In other words, the market is saying that inflation will be significantly higher in a year’s time than the Fed’s 2% inflation target. Put differently, instead of expecting a recession and lower inflation, short-term inflation expectations are rising and becoming unanchored.

In response to this, the Fed will have to be more hawkish to ensure that inflation expectations do not drift too far away from the FOMC’s 2% inflation target.

The bottom line is that high inflation and associated Fed hawkishness continue to be a downside risk to credit markets and equity markets.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

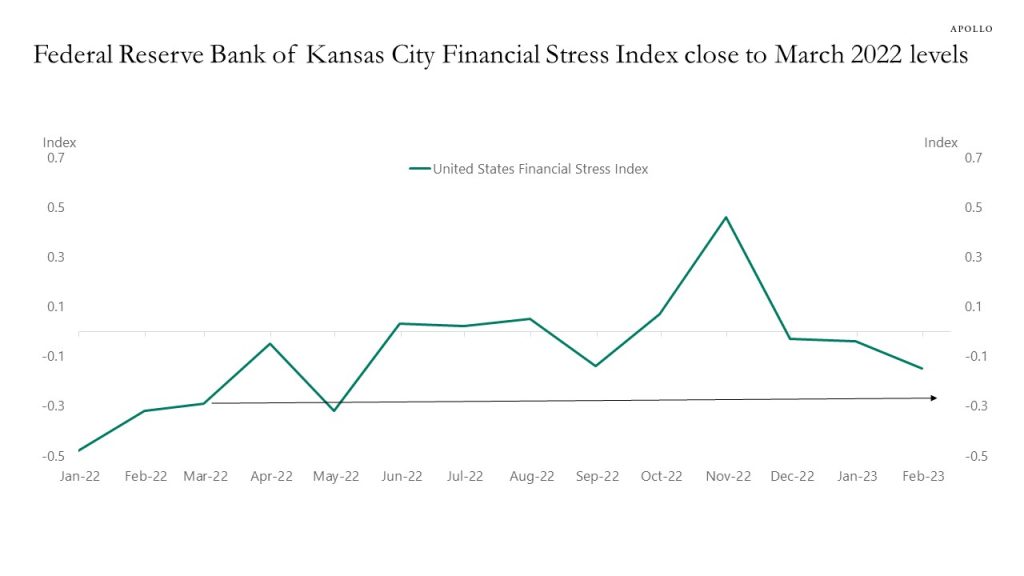

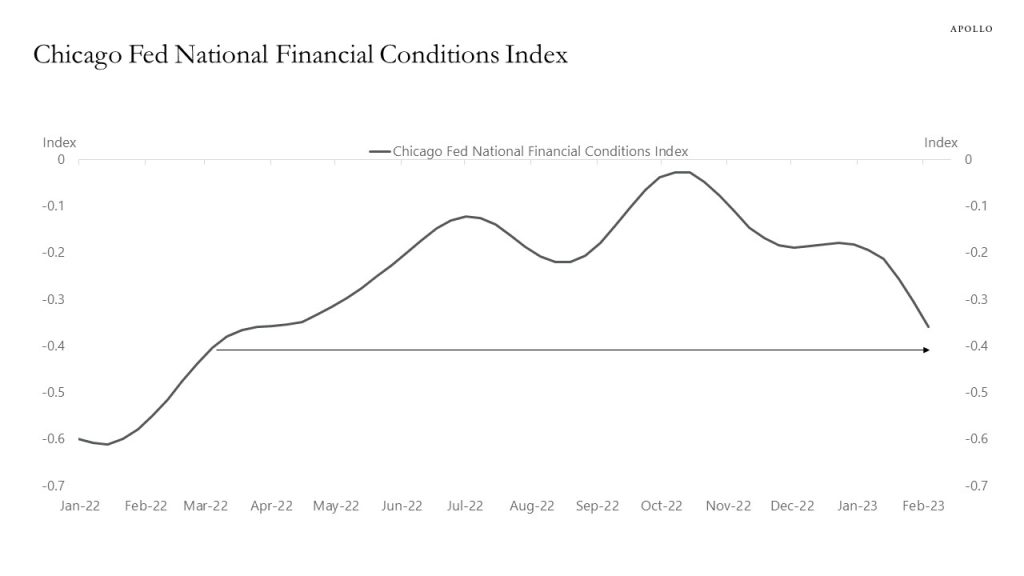

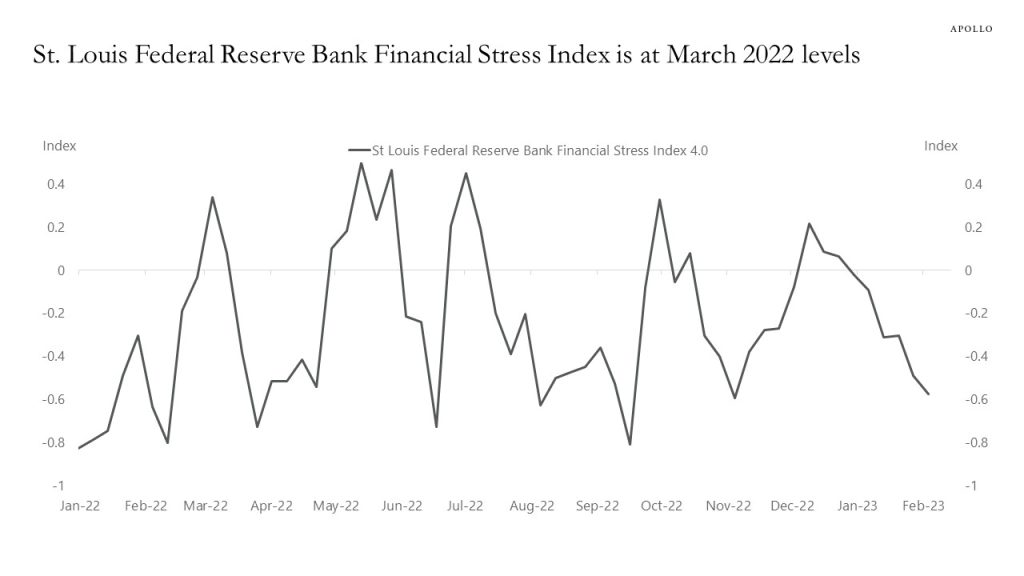

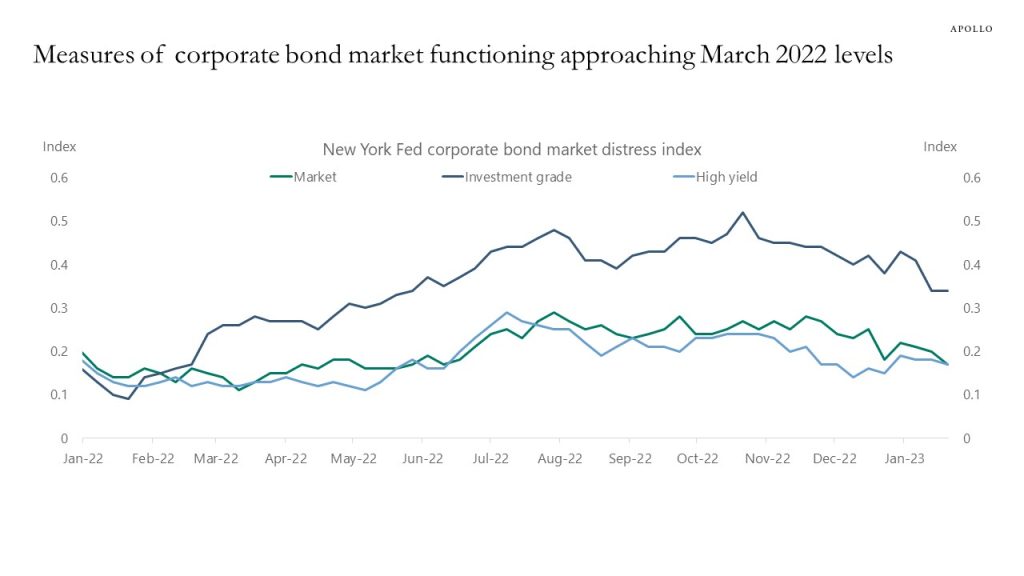

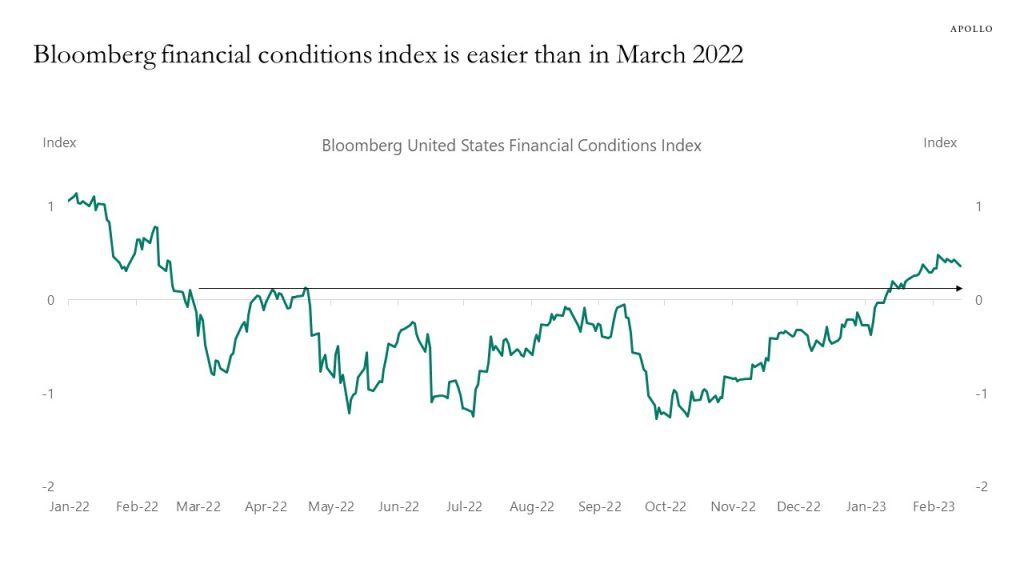

Fed measures of financial conditions show that Fed hikes since March 2022 have been offset by a rising S&P500, tighter IG spreads, and tighter HY spreads, and overall financial conditions are now as easy as they were before the Fed started raising interest rates, see charts below.

With inflation still in the 4% to 6% range, the risks are rising that easy financial conditions will boost consumer spending, capex spending, and ultimately inflation. In other words, it looks like more Fed hikes are needed to get inflation all the way back to the Fed’s 2% inflation target.

Source: Federal Reserve bank of Kansas City, Bloomberg, Apollo Chief Economist. Note: A positive value indicates that financial stress is above the long-run average, while a negative value signifies that financial stress is below the long-run average. Variables included are Treasury REPO Spread (spread between GCF REPO rate and three-month Treasury bill rate), Two-year swap spread (spread between two-year US interest rate swap rate and two-year Treasury yield), Spread between off-the-run 10-year Treasury yield and on-the-run 10-year constant maturity Treasury yield, Spread between Aaa corporate bond yield and 10-year constant maturity Treasury yield, Spread between Baa and Aaa corporate bond yields, Spread between High-yield Bond and Baa spread, Spread between fixed-rate credit card ABS yield and five-year constant maturity Treasury yield, Negative value or correlation between total return on S&P500 and total return on two-year Treasury bonds, Implied volatility of overall stock prices, Idiosyncratic volatility of bank stock prices, Cross-sectional dispersion of bank stock returns.

Source: Federal Reserve bank of Chicago, Bloomberg, Apollo Chief Economist. Note: The NFCI provides a comprehensive weekly update on US financial conditions in money markets, debt and equity markets, and the traditional and “shadow” banking systems. The National Financial Conditions Index (NFCI) is a weighted average of a large number of variables (105 measures of financial activity) each expressed relative to their sample averages and scaled by their sample standard deviations.

Source: Federal Reserve bank of St. Louis, Bloomberg, Apollo Chief Economist. Note: The index measures the degree of financial stress in the markets and is constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress.

Source: FRB of New York, Apollo Chief Economist (Note: Corporate bonds are a key source of funding for US non-financial corporations and a key investment security for insurance companies, pension funds, and mutual funds). Distress in the corporate bond market can thus both impair access to credit for corporate borrowers and reduce investment opportunities for key financial sub-sectors. CMDI offers a single measure to quantify joint dislocations in the primary and secondary corporate bond markets. Ranging from 0 to 1, a higher level of CMDI corresponds with historically extreme levels of dislocation. CMDI links bond market functioning to future economic activity through a new measure.

Source: Bloomberg, Apollo Chief Economist. Note: The Bloomberg Financial Conditions Index includes Ted Spread, Commercial Paper/T-Bill Spread, Libor-OIS Spread, Baa Corporate/Treasury Spread, Muni/Treasury Spread, High Yield/Treasury Spread, Swaption Volatility Index, S&P500 Share Prices, VIX Index. See important disclaimers at the bottom of the page.

-

Weekly data for global air traffic is at the highest level in five years, see chart below.

Source: Flightradar24.com, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

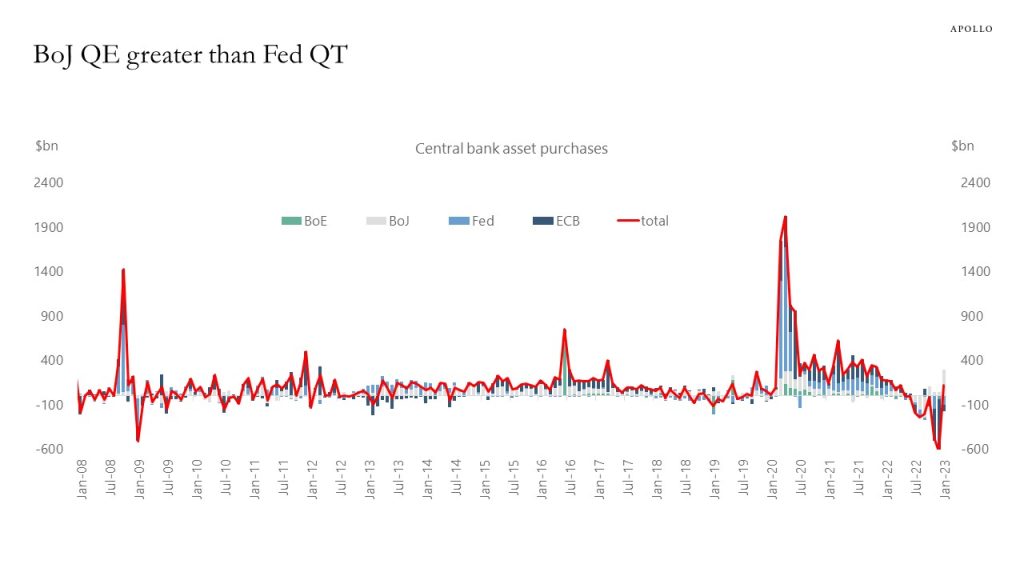

BoJ purchases of JGBs to keep yields low are now bigger than Fed QT, and the result is that central banks are once again adding liquidity to global financial markets, which was likely contributing to the rally in equities and credit in January, see chart below. With YCC still in place in Japan, QE will continue to support global financial markets.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.