Want it delivered daily to your inbox?

-

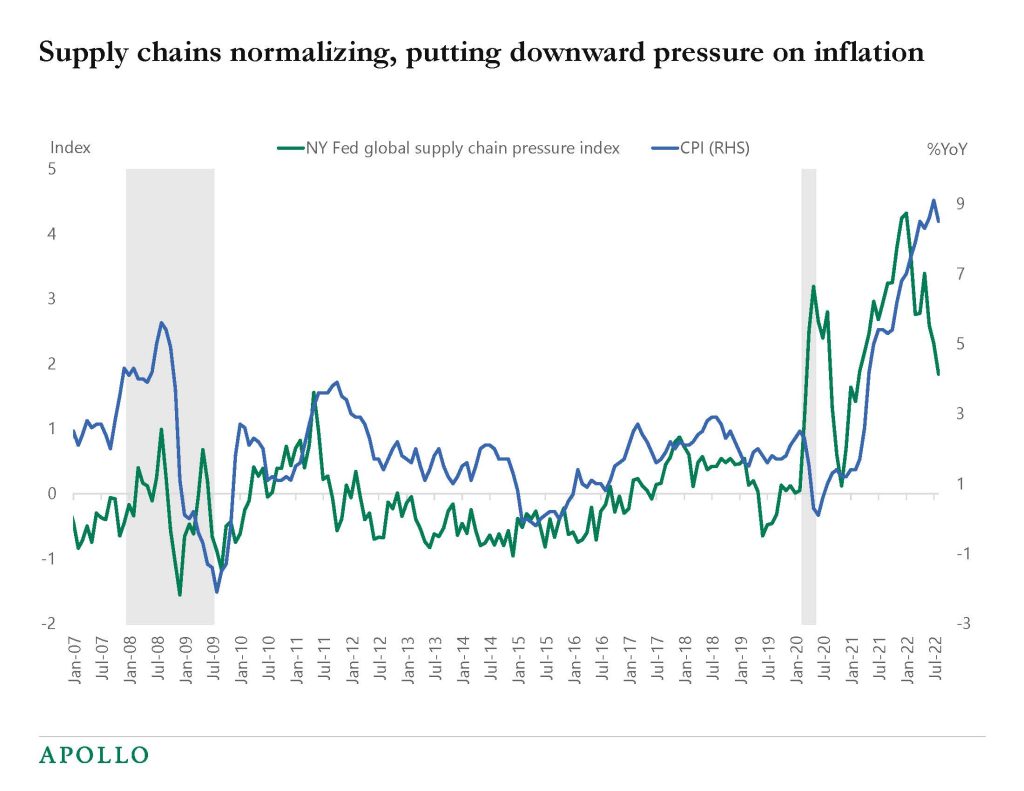

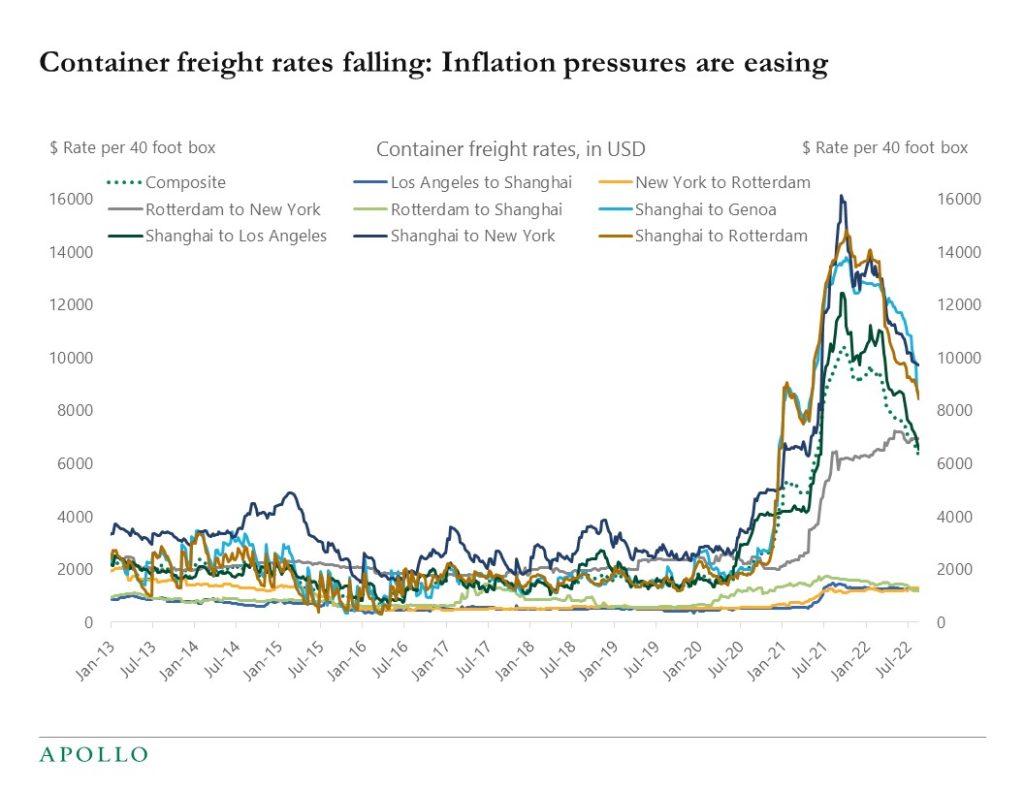

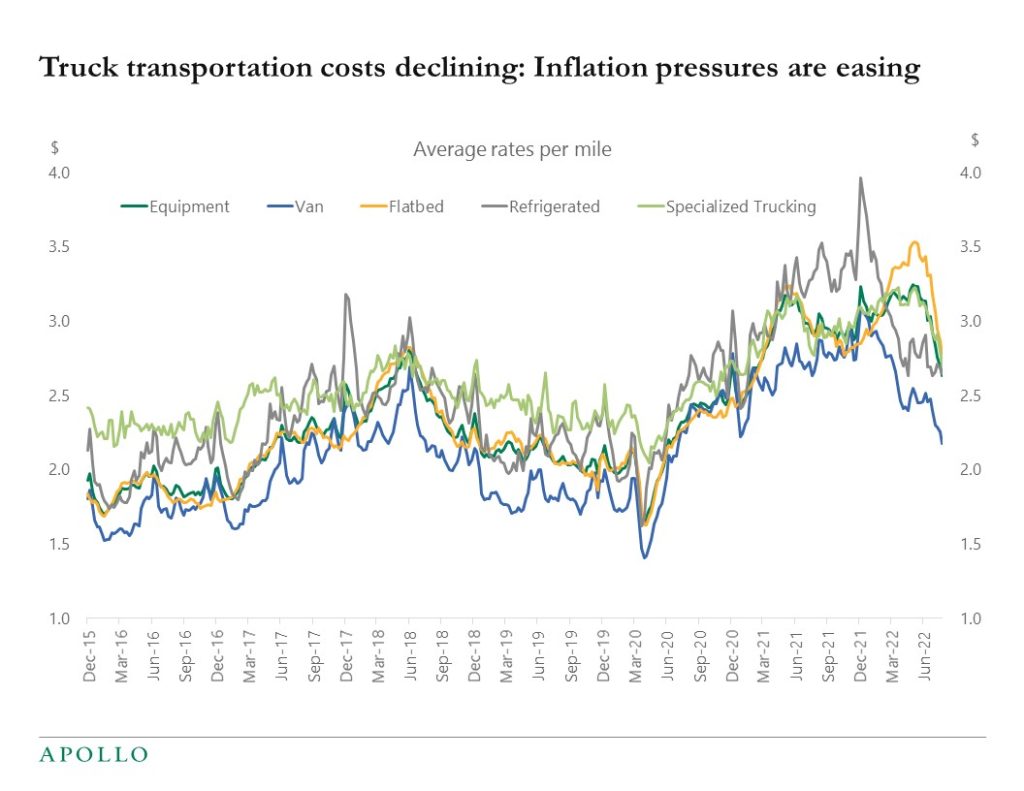

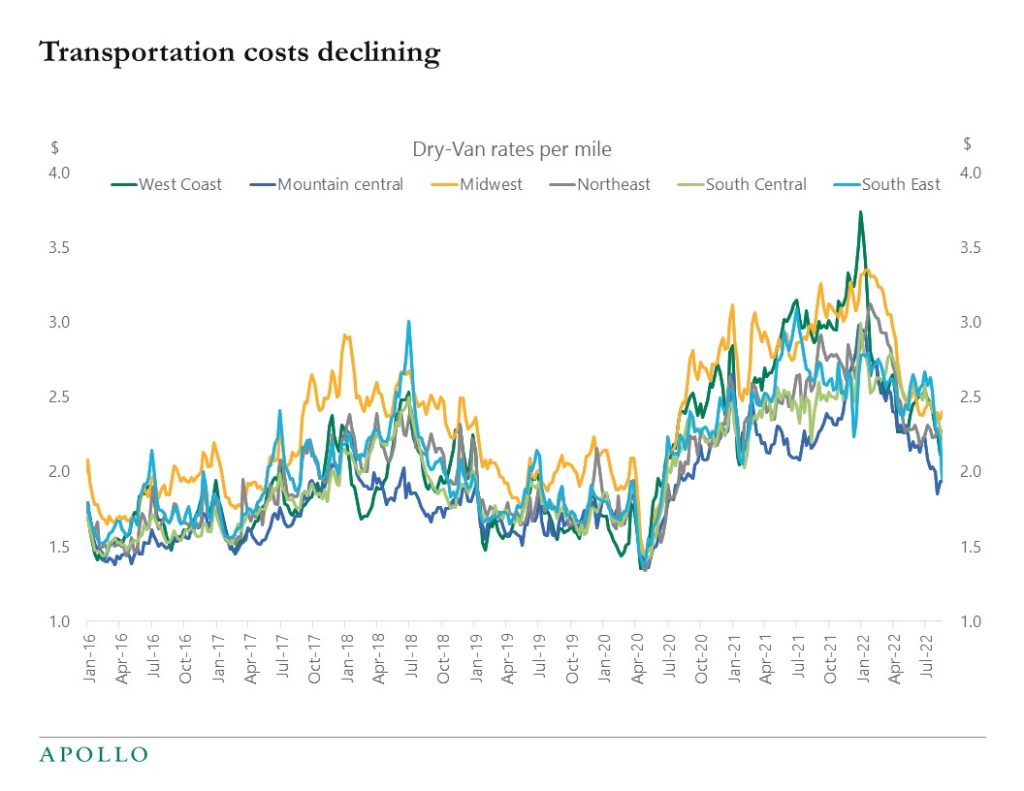

The attached presentation looks at the ongoing normalization of supply chains. Transportation costs are declining across all types (container, truck, train, air), delivery times are normalizing, the average of unfilled orders is normalizing, the New York Fed supply chain pressure index is normalizing, and the number of container vessels at Long Beach/Los Angeles is back at pre-pandemic levels. If supply-side problems drove two-thirds of the increase in inflation, then we could see a quick decline in inflation over the coming quarters.

Source: NY Fed, BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

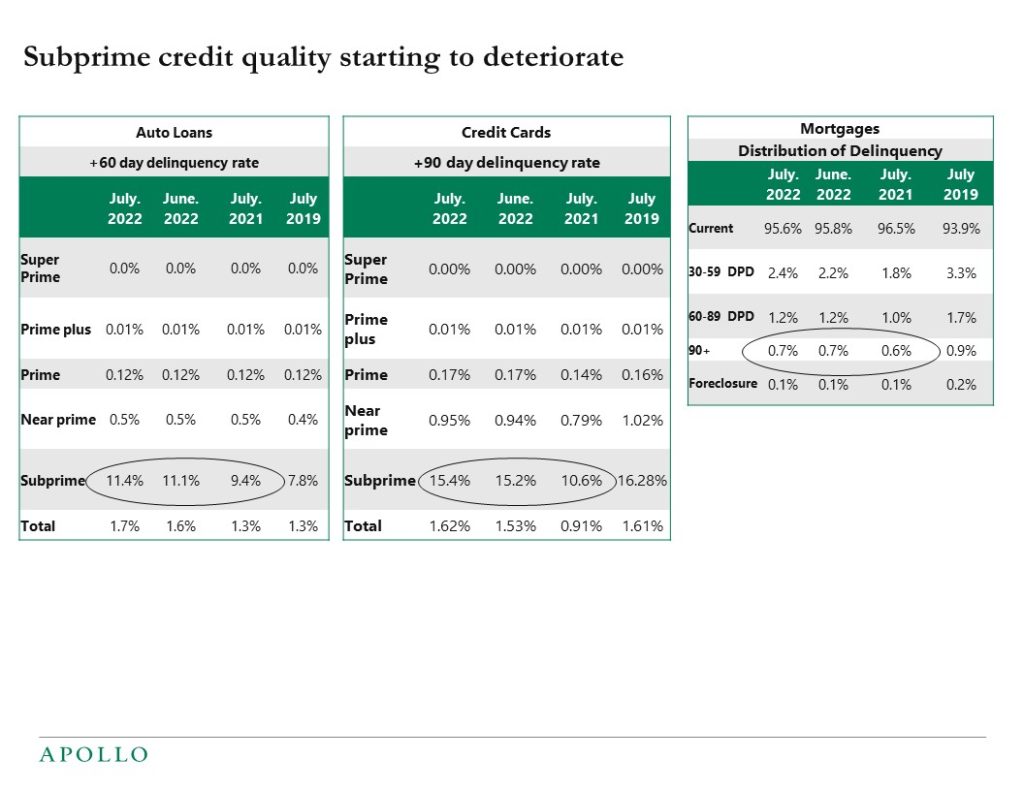

Delinquency rates for subprime borrowers are starting to rise, see chart below.

Source: Transunion Monthly Industry Snapshot July 2022 See important disclaimers at the bottom of the page.

-

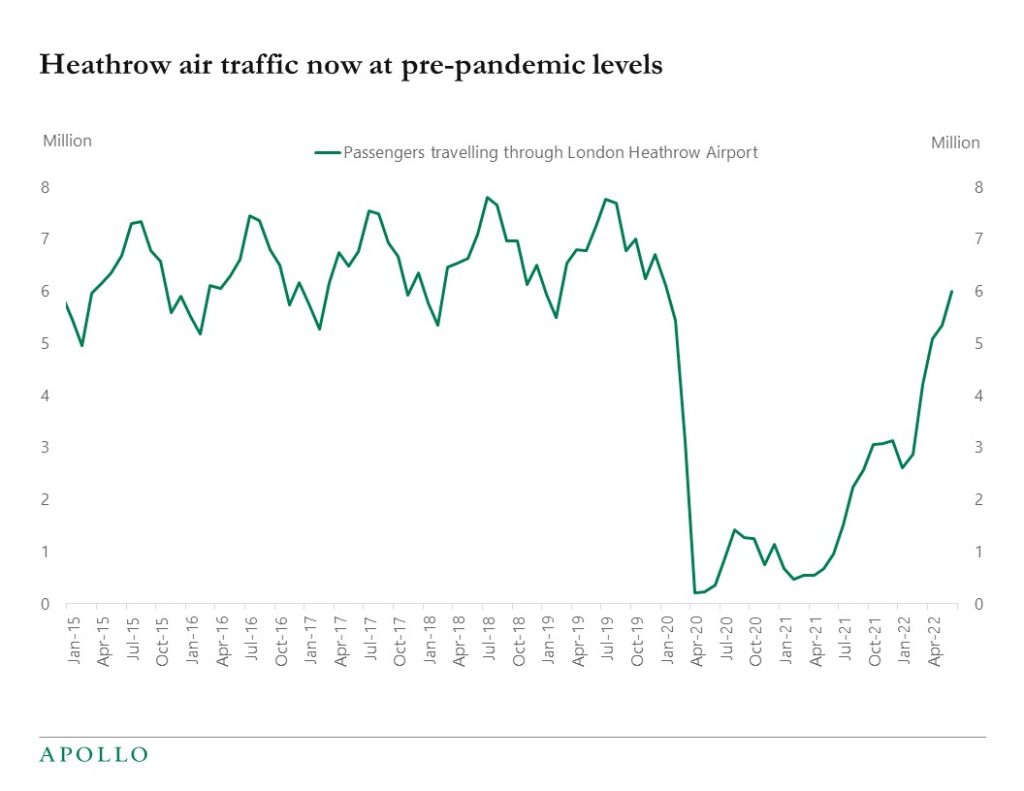

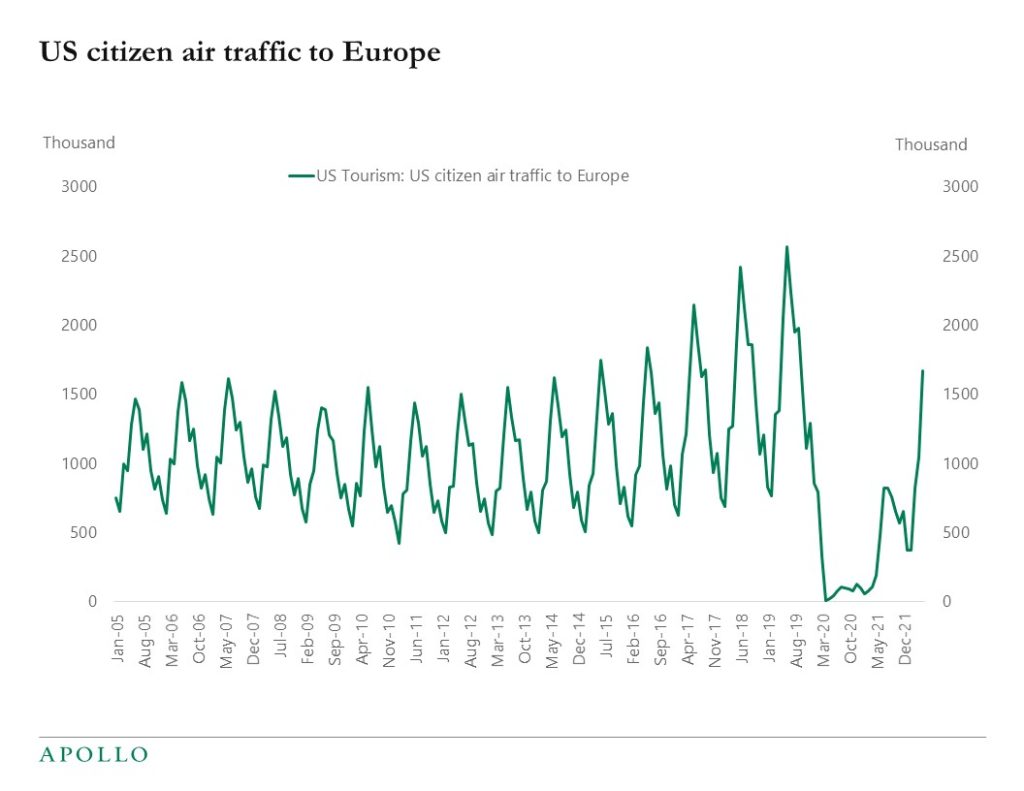

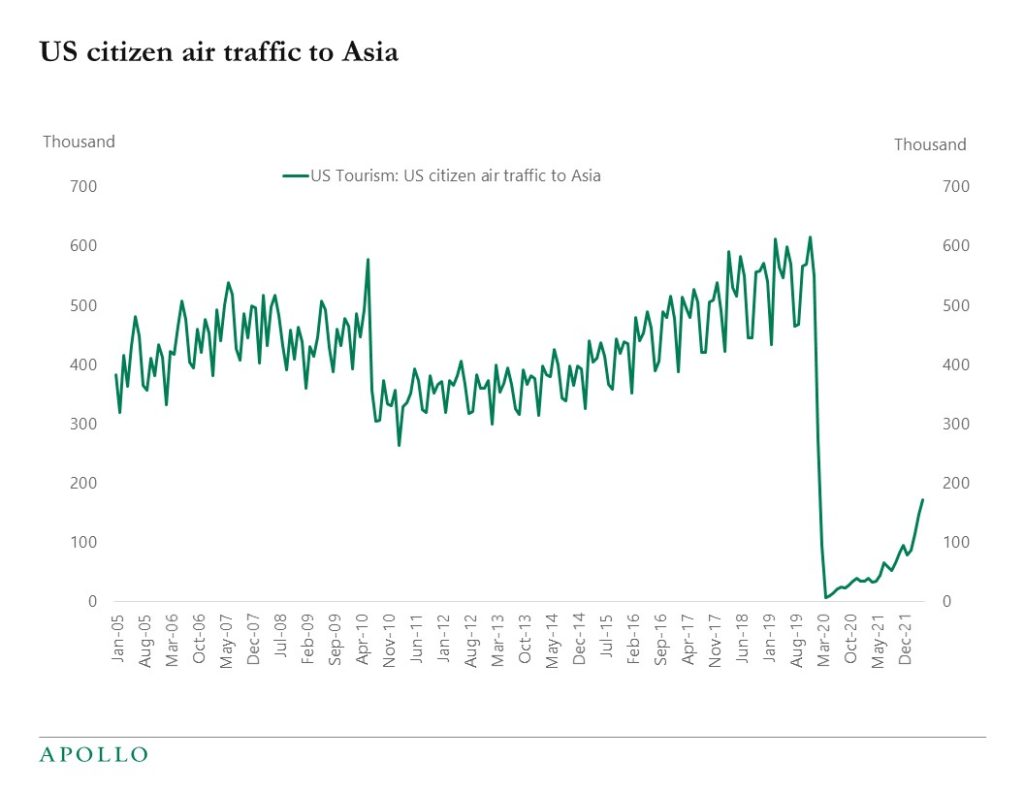

Air traffic in London’s Heathrow airport is back at pre-pandemic levels, and US air traffic to Europe is also at pre-pandemic levels, but US air traffic to Asia is still significantly below 2019 levels, see charts below.

Source: Bloomberg, Apollo Chief Economist

Source: Haver, Apollo Chief Economist

Source: Haver, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

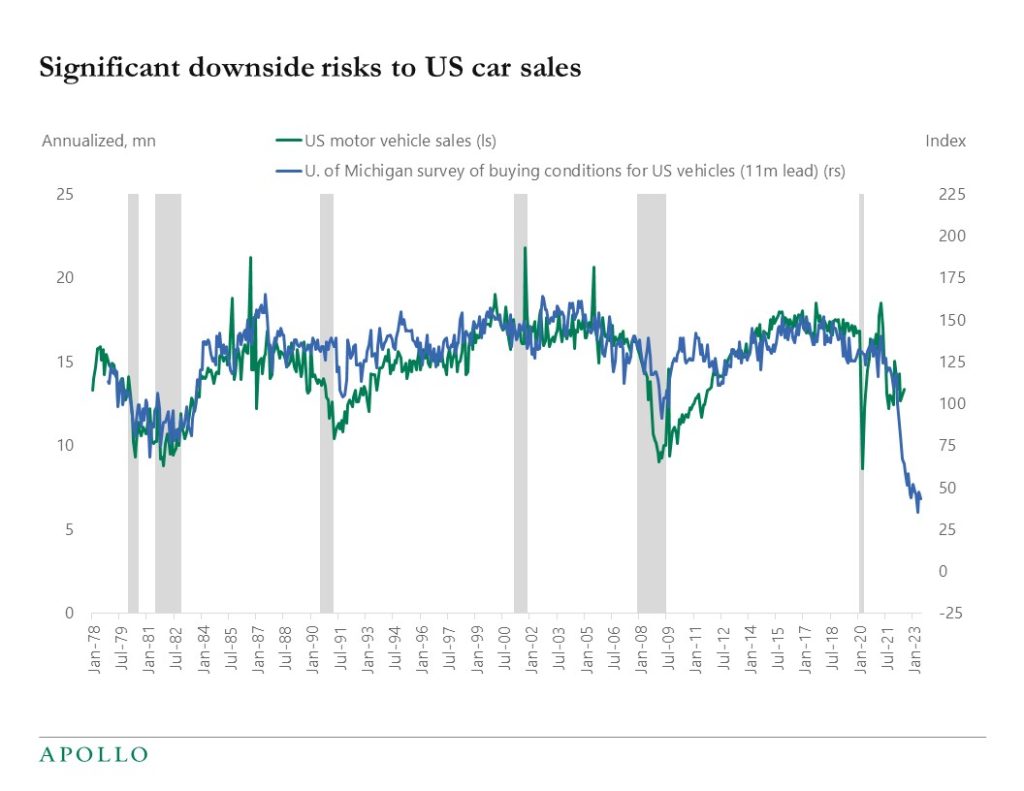

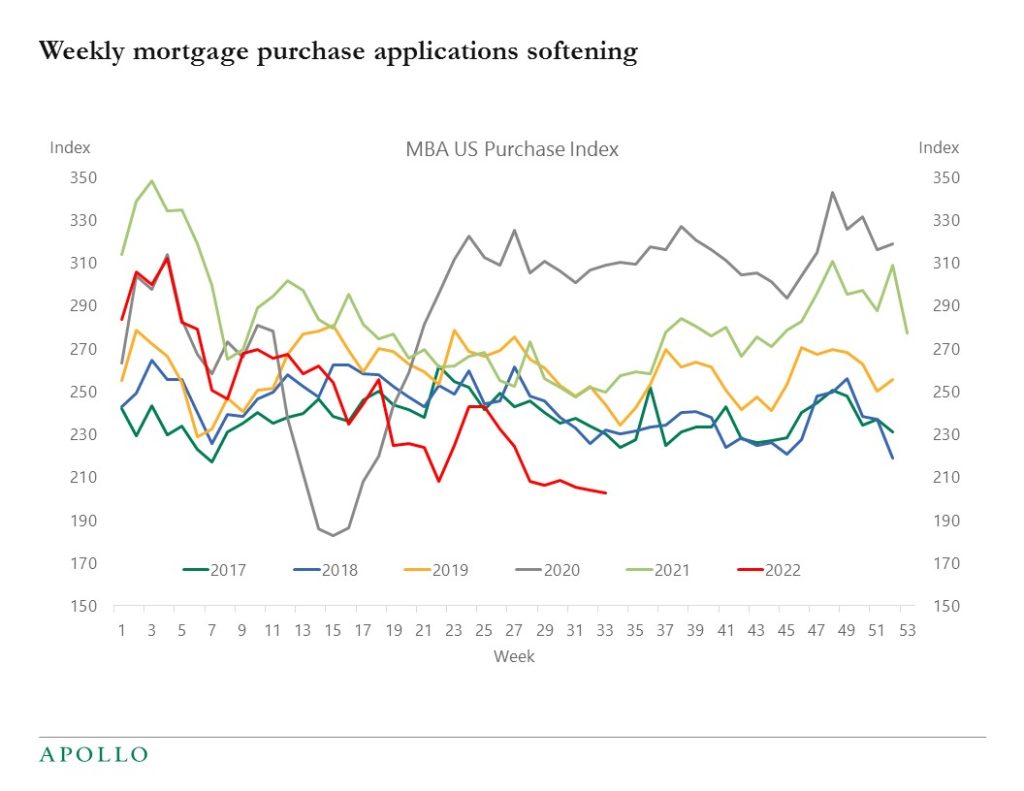

The interest-rate sensitive components of GDP are starting to respond to higher rates and recession worries, see charts below

Source: Bloomberg, Apollo Chief Economist

Source: Mortgage Bankers Association, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

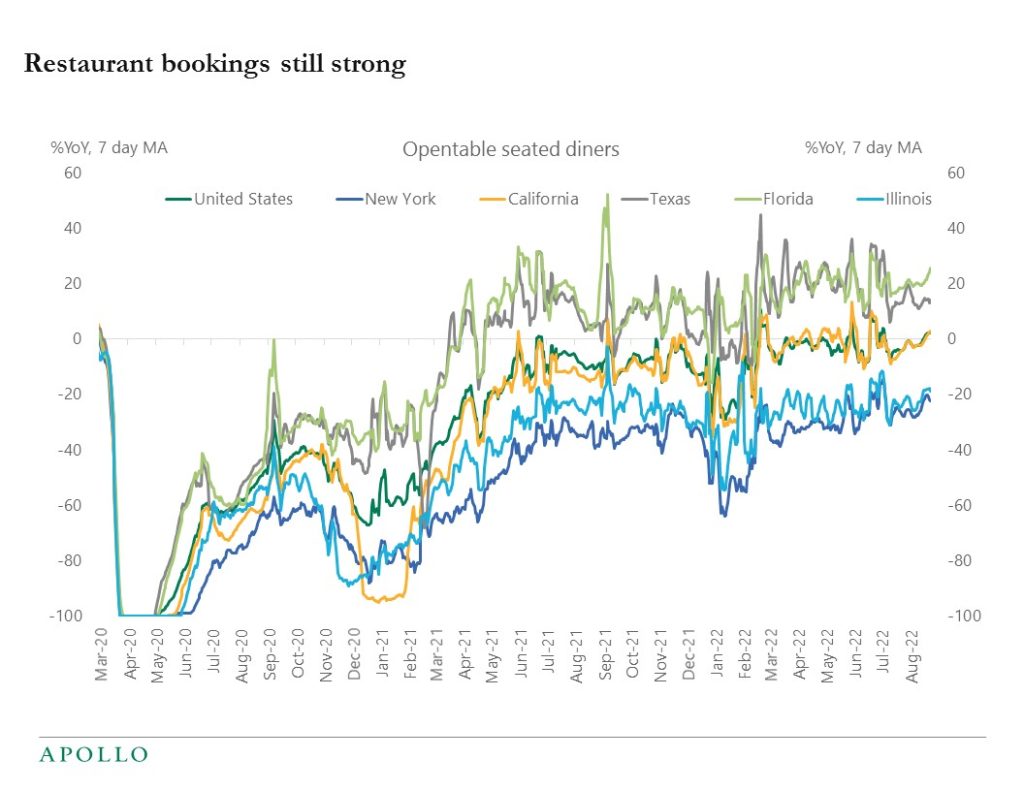

Weekly jobless claims declined this week and US indicators for air travel, hotel bookings, and restaurant visits continue to show no signs of slowing down, see chart below. Inflation at 8.5% is too high, and the labor market is overheated, with unemployment at 3.5%. The only part of the economy slowing down is housing. Our weekly Slowdown Watch is available here.

Source: OpenTable, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

A new Brookings piece looks at Census data and finds that about 4 million workers are out of work because of long covid.

For comparison, the total number of unemployed is about 6 million, and total employment is 153 million.

The bottom line is that long covid is a key reason why there are labor shortages and hence why wage inflation remains so high.

It is difficult for the Fed to increase the labor supply, but by raising interest rates, the FOMC can lower labor demand and increase the unemployment rate to get wage and price inflation down to the Fed’s target.

The challenge for the Fed is that the unemployment rate has not increased yet, so the Fed will likely have to raise rates more than the market currently expects to get the softening in the labor market that is needed to get inflation down to sustainable levels.

See important disclaimers at the bottom of the page.

-

The costs of transporting goods are normalizing across all types of transportation, see charts below. For example, the dry van spot rate per mile has declined over the past six months from $3 to $2. This is all putting downward pressure on inflation and costs of production.

Source: WCI, Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

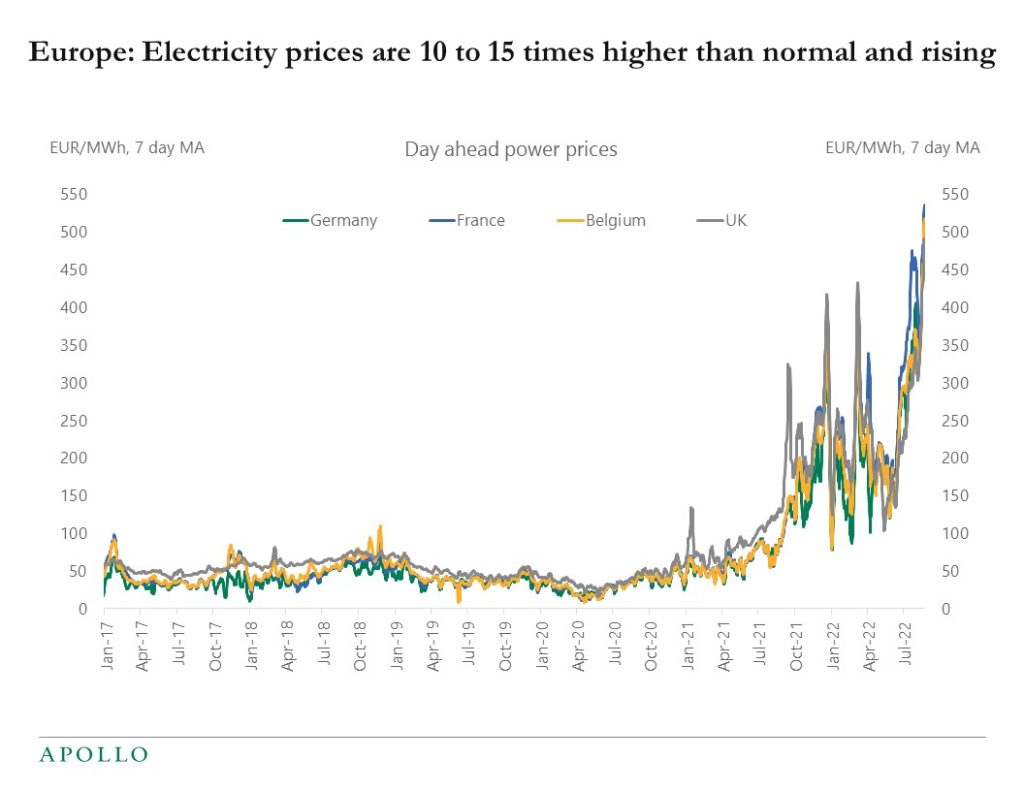

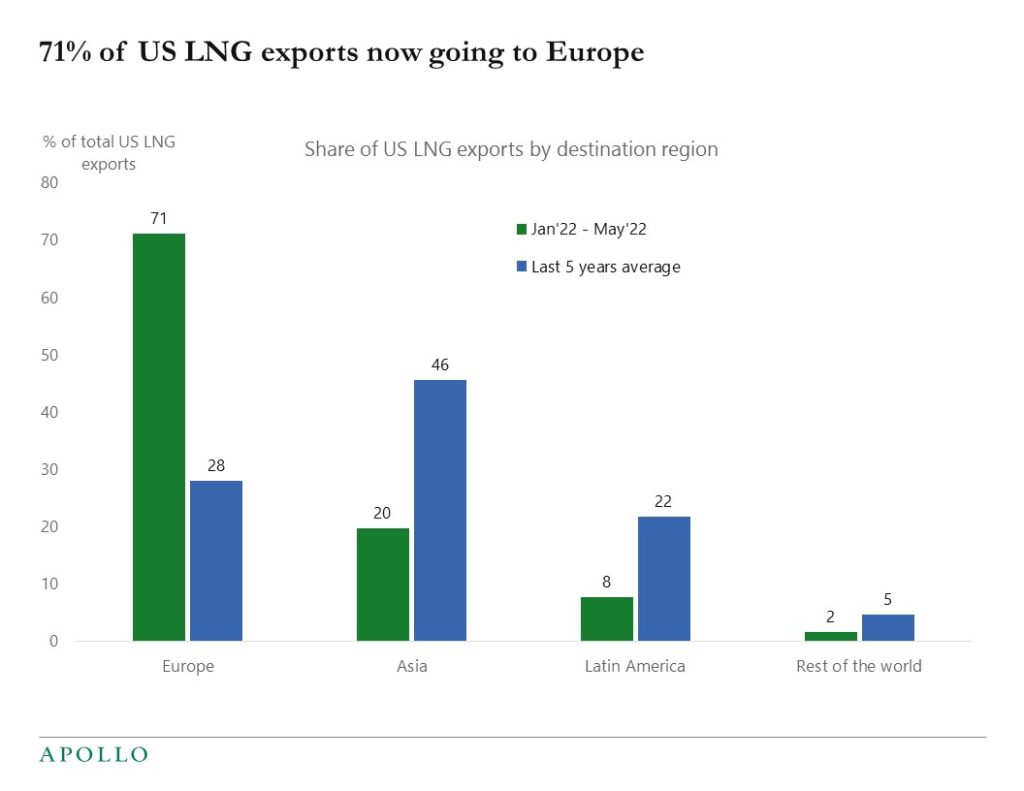

The energy crisis is intensifying in Europe, and the significant increase in natural gas prices and electricity prices is starting to spill over to the US economy. Once a week we will update this outlook.

Source: Bloomberg, Apollo Chief Economist

Source: EIA, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

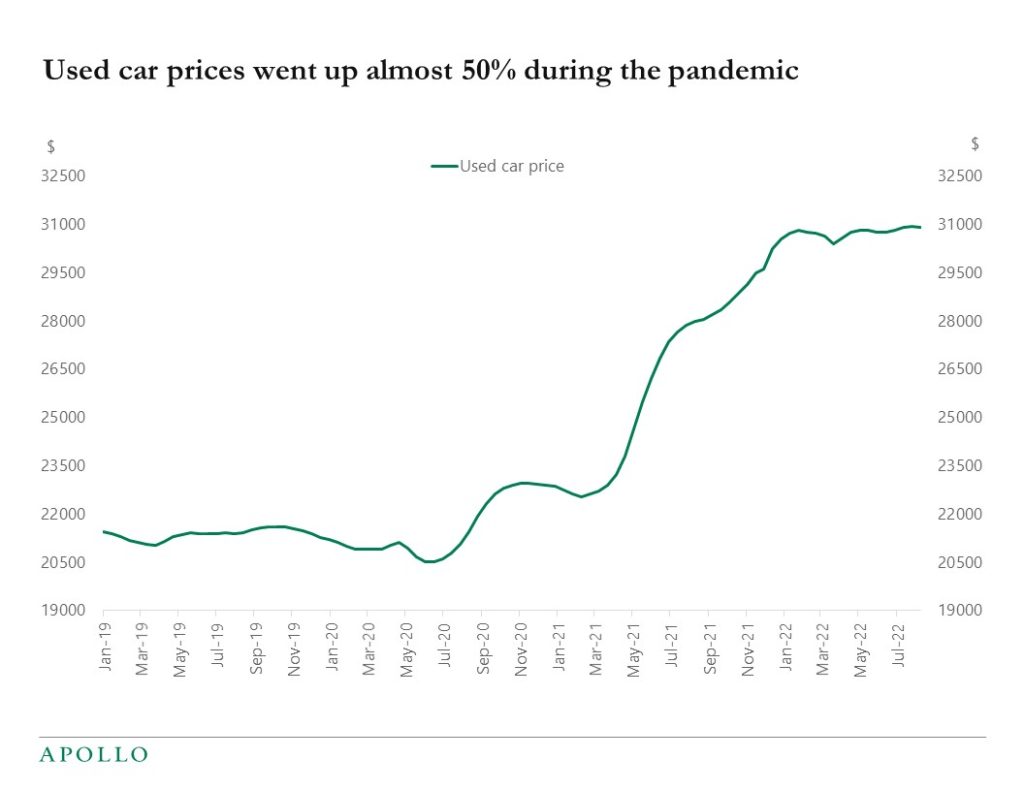

Why did used car prices go up 50% during the pandemic, was it because of more demand for vehicles, or was it because of supply chain problems with semiconductors? The answer to this question will determine where the Fed funds rate will peak during this cycle.

Specifically, identifying the sources of the increase in inflation is essential for understanding how quickly inflation will return to the Fed’s 2% target. A recent Fed working paper suggested that only 1/3 of the inflation increase during the pandemic was due to demand. If that is the case, the Fed today will not need to destroy much demand, and inflation will automatically come down to 2% again.

With supply chains improving every day and growth slowing, the trend in inflation should be lower. If supply problems mainly drove the run-up in inflation, then inflation could come back to 2% faster than the market currently thinks. In that case, a soft landing is likely, and equities and credit should be trading higher.

Source: Cargurus.com, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

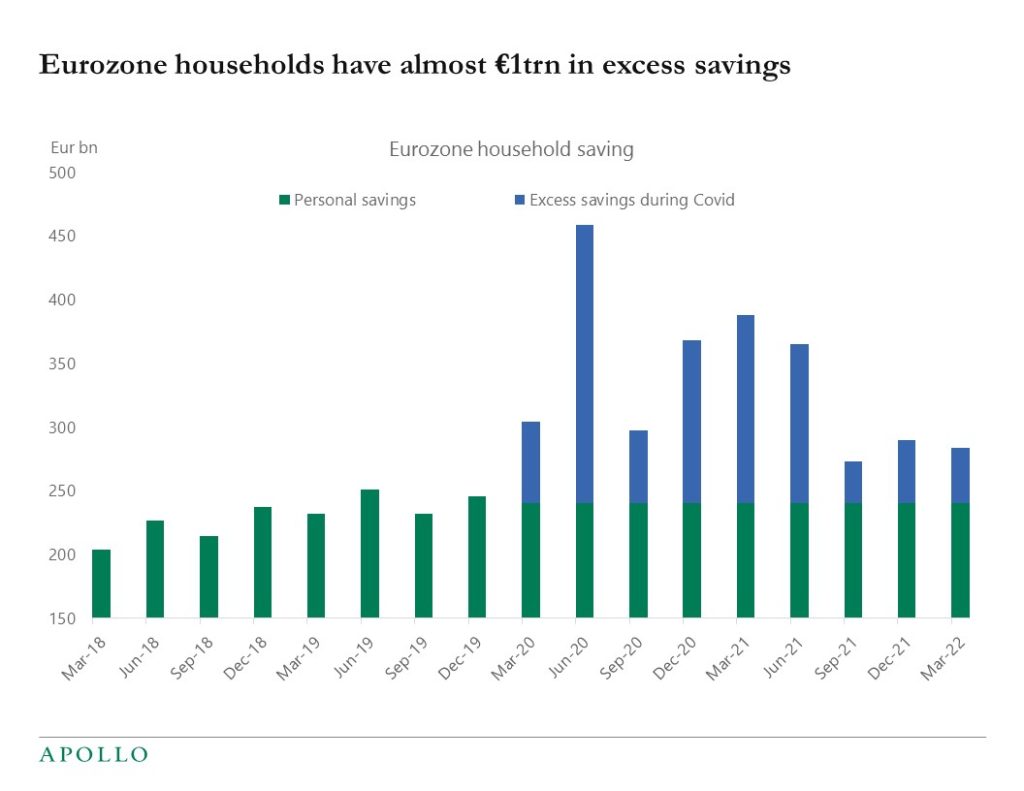

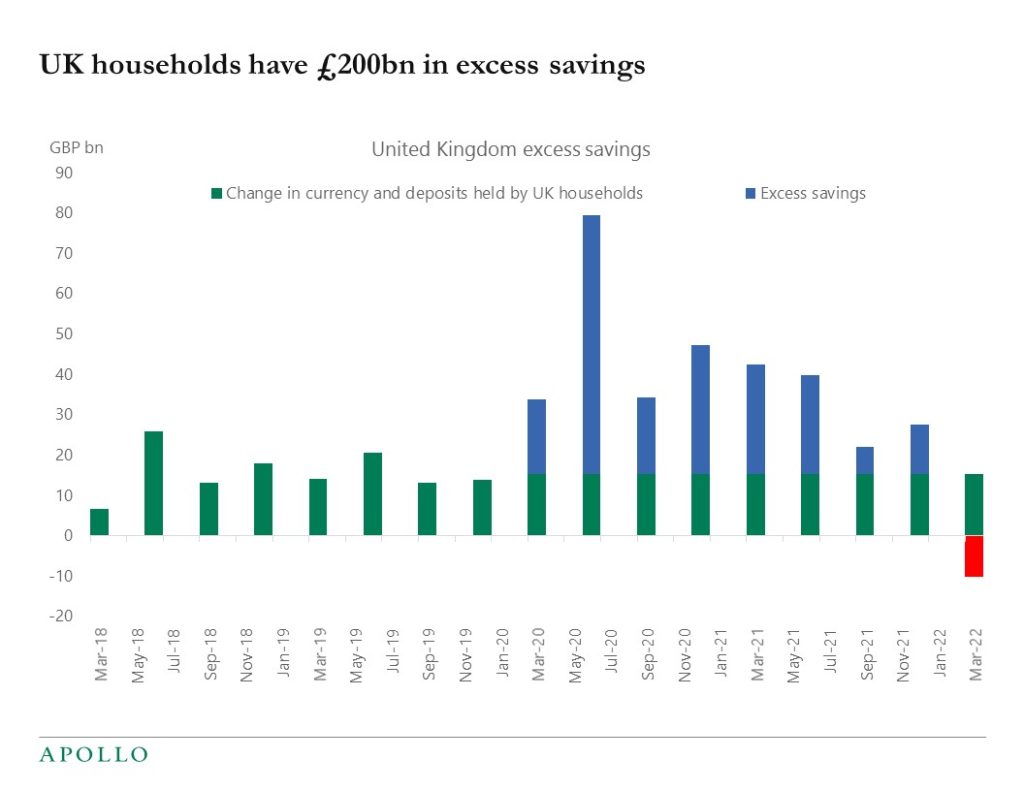

A high level of savings in the household sector during covid can also be seen in the Eurozone and in the UK, see charts below. This is a tailwind for the outlook for consumer spending across Europe. The headwinds to European private consumption include slowing growth, sanctions, and higher inflation, including higher energy prices.

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.