Want it delivered daily to your inbox?

-

Home prices have increased significantly across countries, and it is ultimately a political decision in each country if homeowners are able to tap into the high value of their house.

Home equity release products allow homeowners, including retirees, to access their equity to improve their standard of living and have the potential to help households through significant financial shocks.

These products are broadly categorized as reverse mortgages, home reversion, and sell and rent back.

The US and UK are the largest markets for reverse mortgages; home reversion is popular in France, Germany, Italy, and Poland; and sell and rent back is prevalent in Australia, the Netherlands, and the UK.

Source: OECD, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

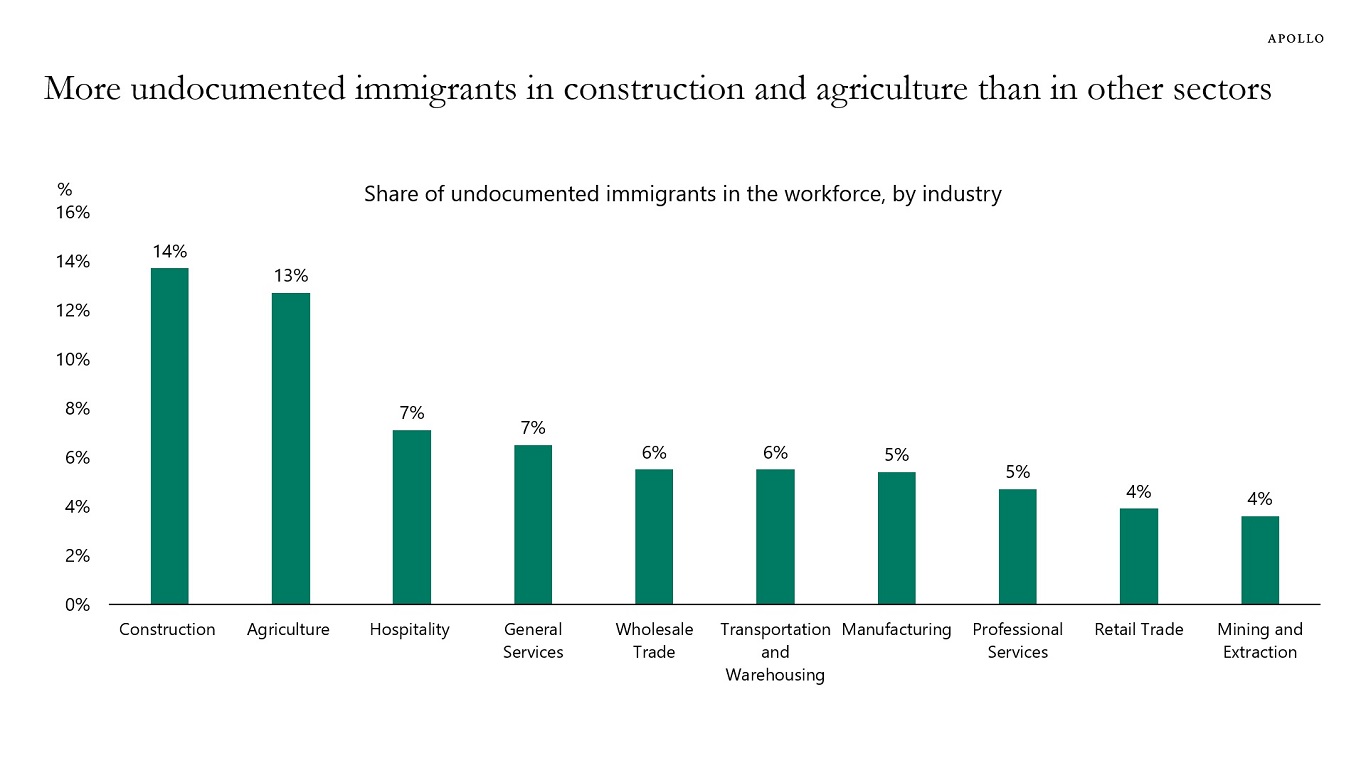

The two industries with the largest percentage of undocumented workers are construction (14%) and agriculture (13%), see chart below.

Source: American Immigration Council analysis of the 2022 1-year American Community Survey, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

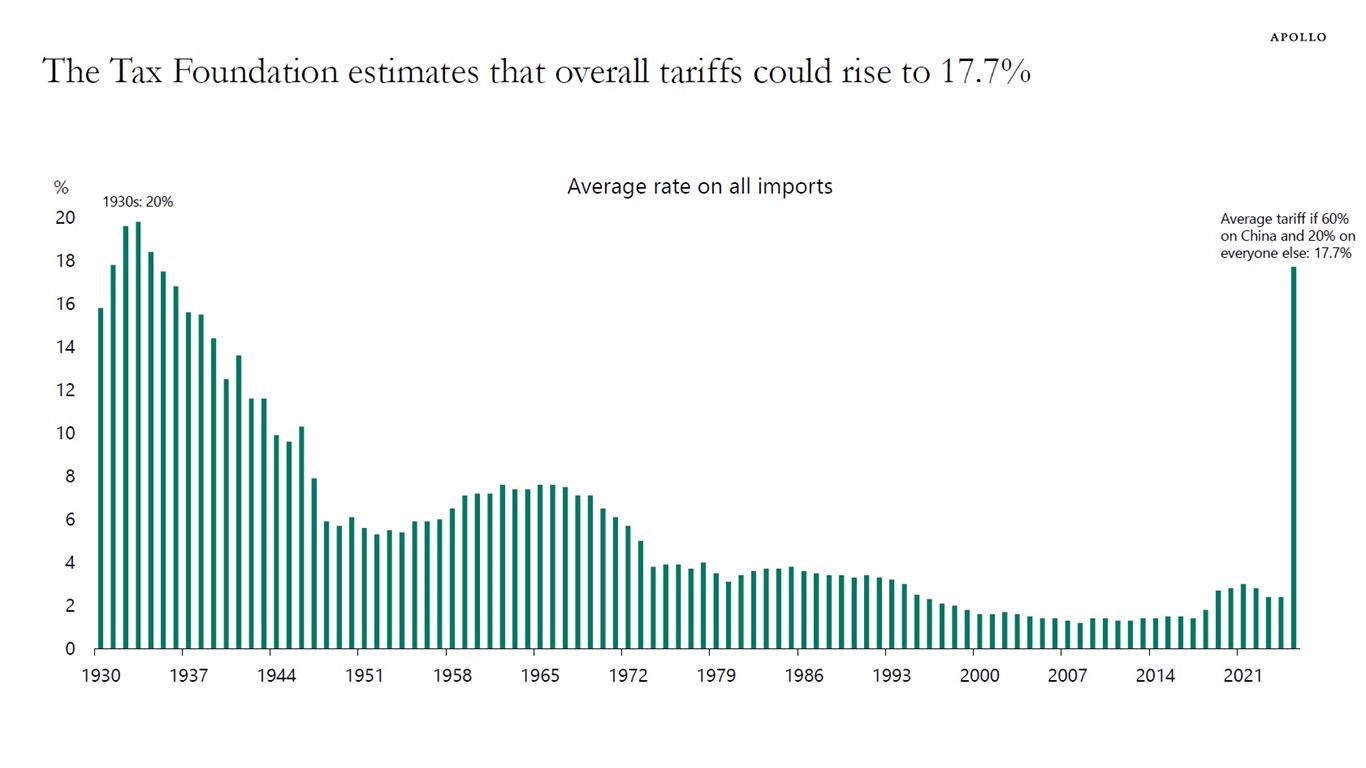

The Tax Foundation estimates that if 60% tariffs are imposed on China and 20% on everyone else, the average tariff rate will increase to 17.7%, see chart below.

With imports making up 14% of GDP, the impact will be a jump in inflation, potentially as high as 0.5 percentage points.

With core PCE inflation already too high at 2.8%, significantly above the Fed’s 2% inflation target, this could force the Fed to raise interest rates again.

Note: The 17.7% figure represents a weighted average of the proposed tariffs, a universal 20% tariff on all imports and an additional 60% tariff on Chinese goods. These tariffs are applied to the current import values, and considering the share of imports from China, the average rate for 2025 has been estimated. Source: Tax Foundation, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

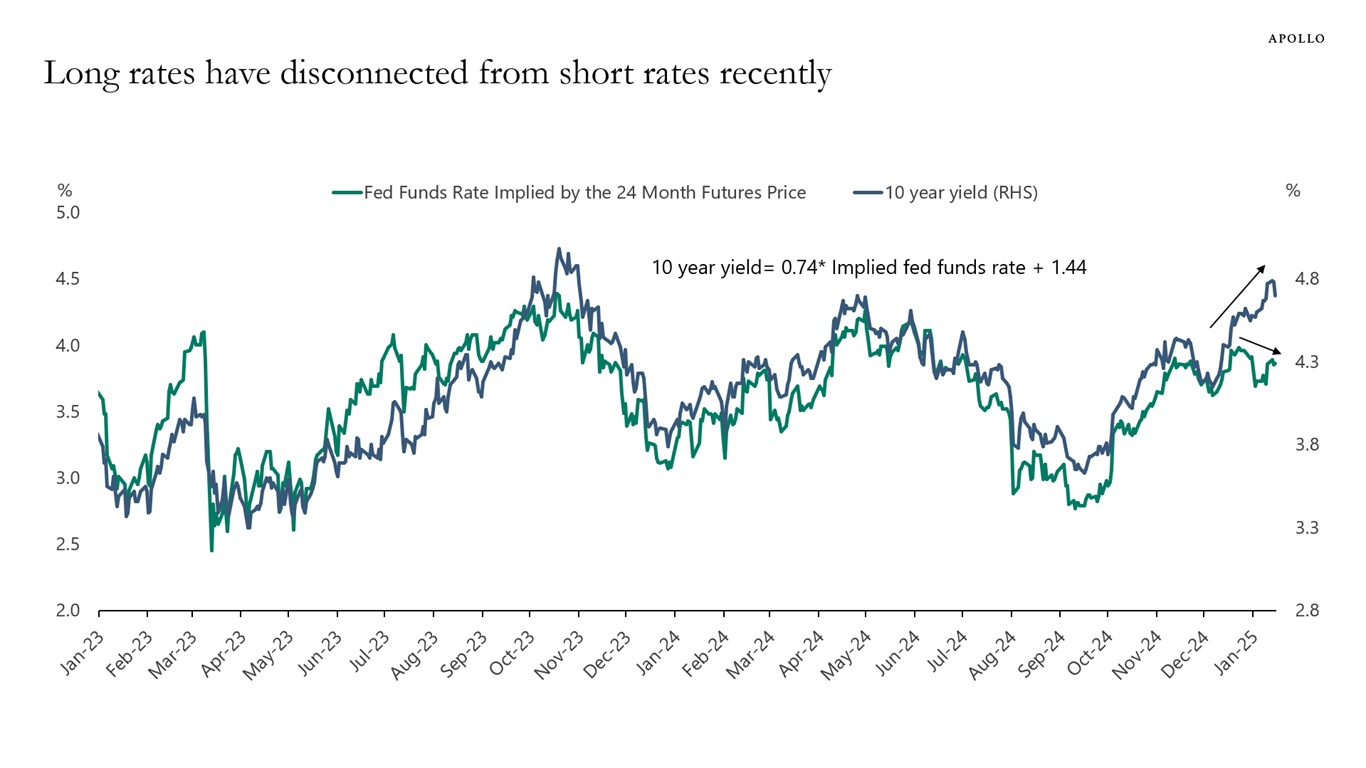

Long-term interest rates have disconnected from Fed expectations, and a simple model of the relationship shows that 10-year rates are now 40 basis points higher than what Fed expectations would have predicted, see chart below.

The rise in long rates above and beyond what has happened with Fed expectations is consistent with the observed increase in both the New York Fed’s measure of the term premium and the San Francisco Fed’s measure of the term premium.

The worry in markets is that the additional premium in long-term interest rates is driven by fears about fiscal sustainability.

Source: Haver Analytics, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

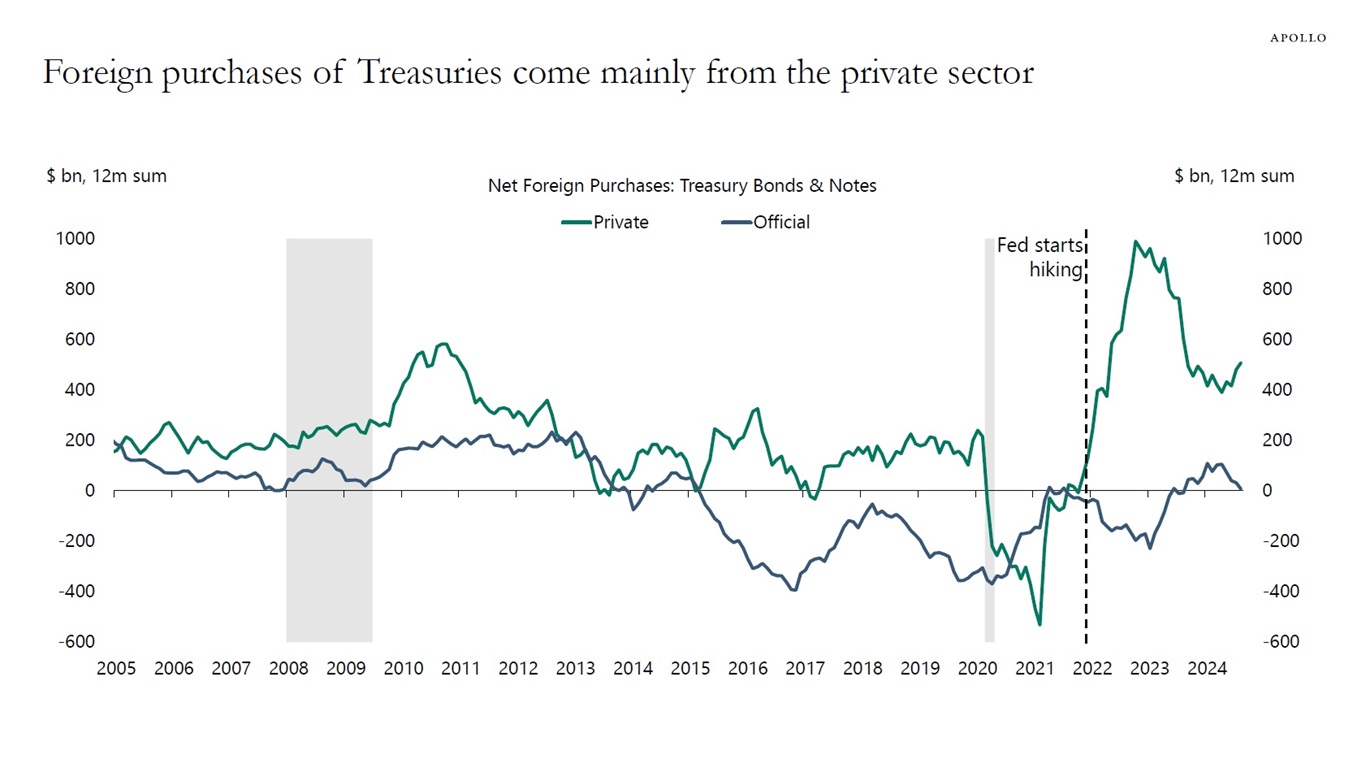

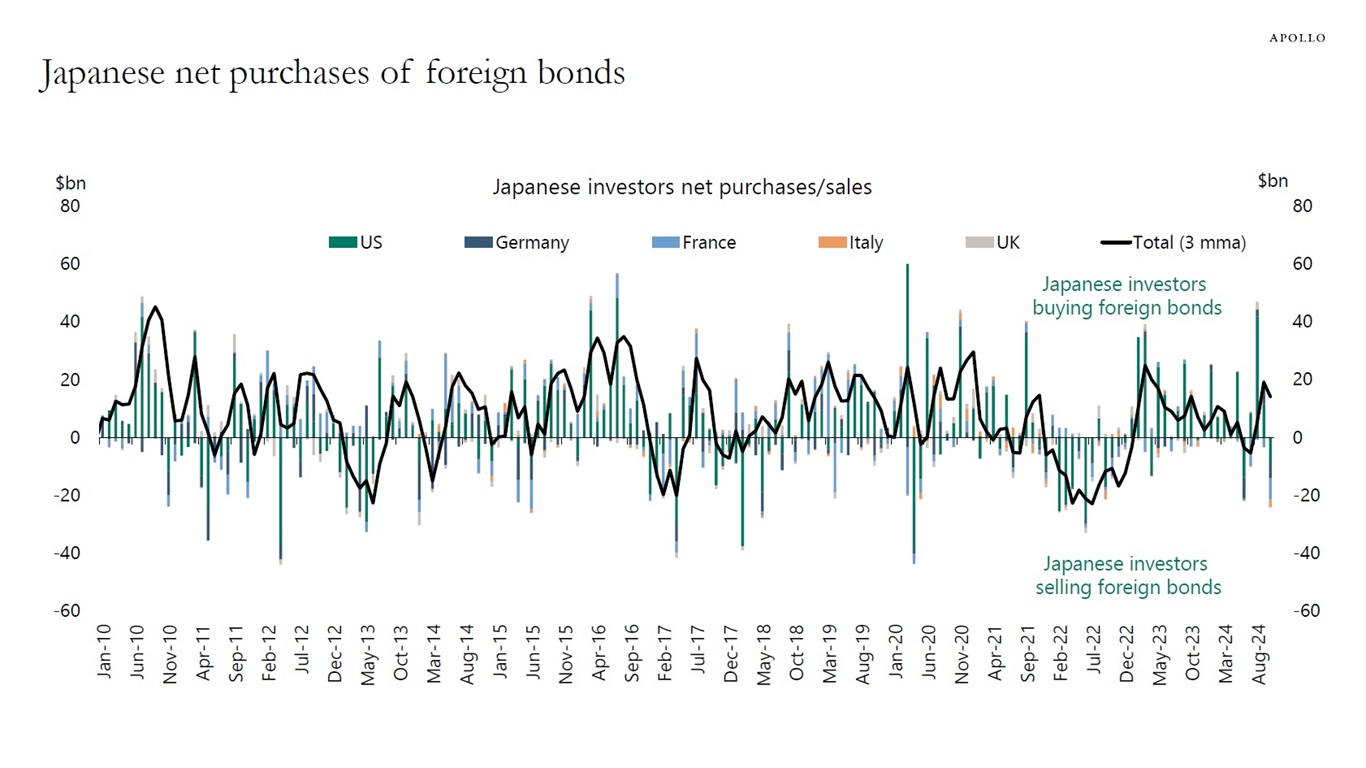

When the Fed started raising interest rates in March 2022, foreign private investors started buying a lot more Treasuries because they liked the higher level of yields, see the first chart below.

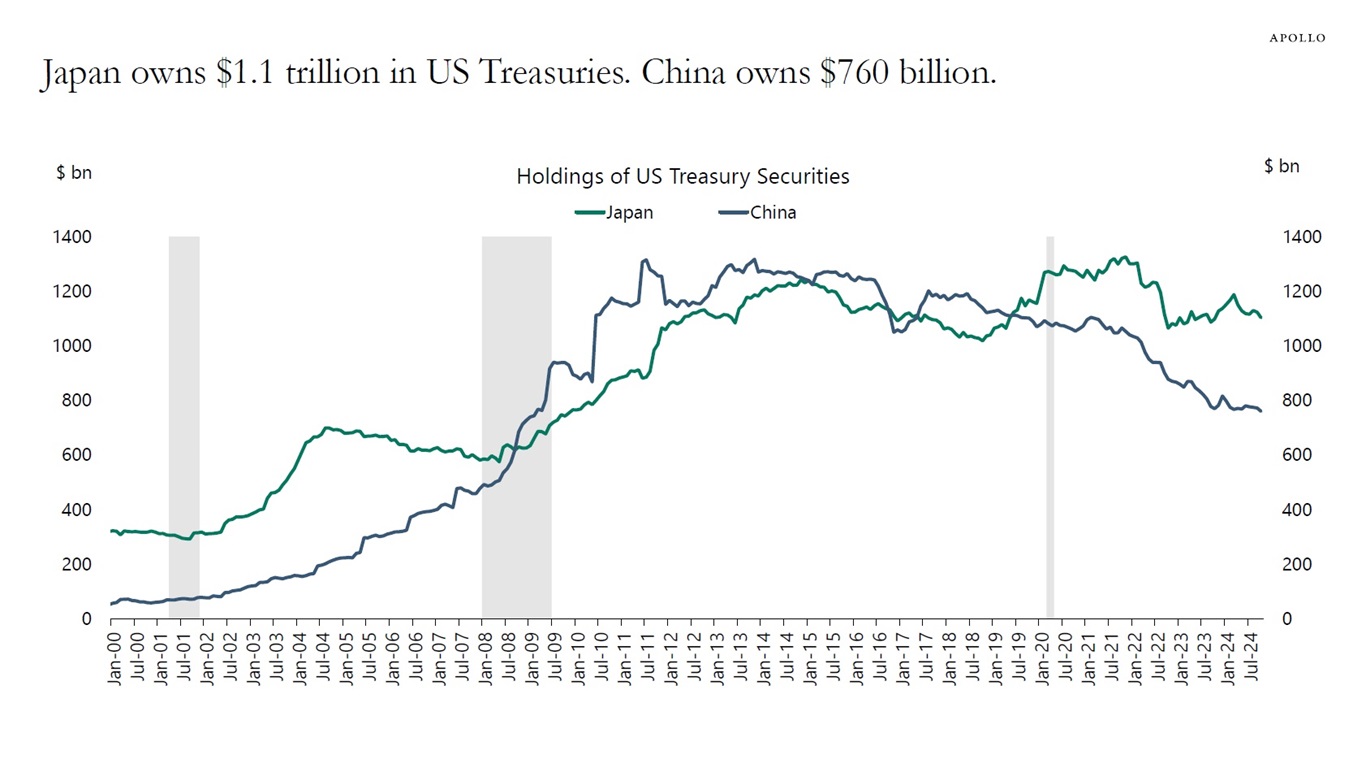

Japan is the biggest foreign holder of US Treasuries. With rates higher for longer, the latest data shows continued strong demand from Japan.

Our updated chart book looking at Japanese demand for US Treasuries is available here.

Source: Treasury, Haver Analytics, Apollo Chief Economist

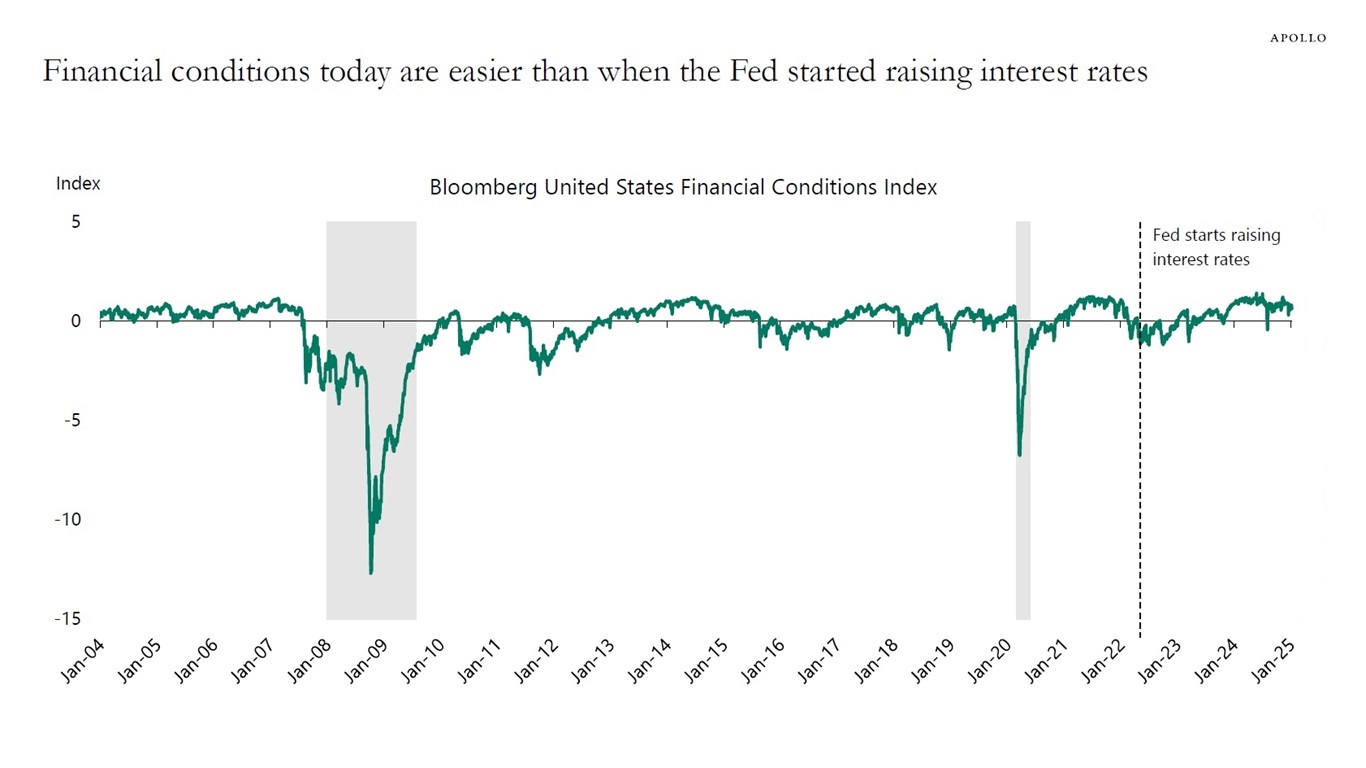

Source: Bloomberg, Apollo Chief Economist

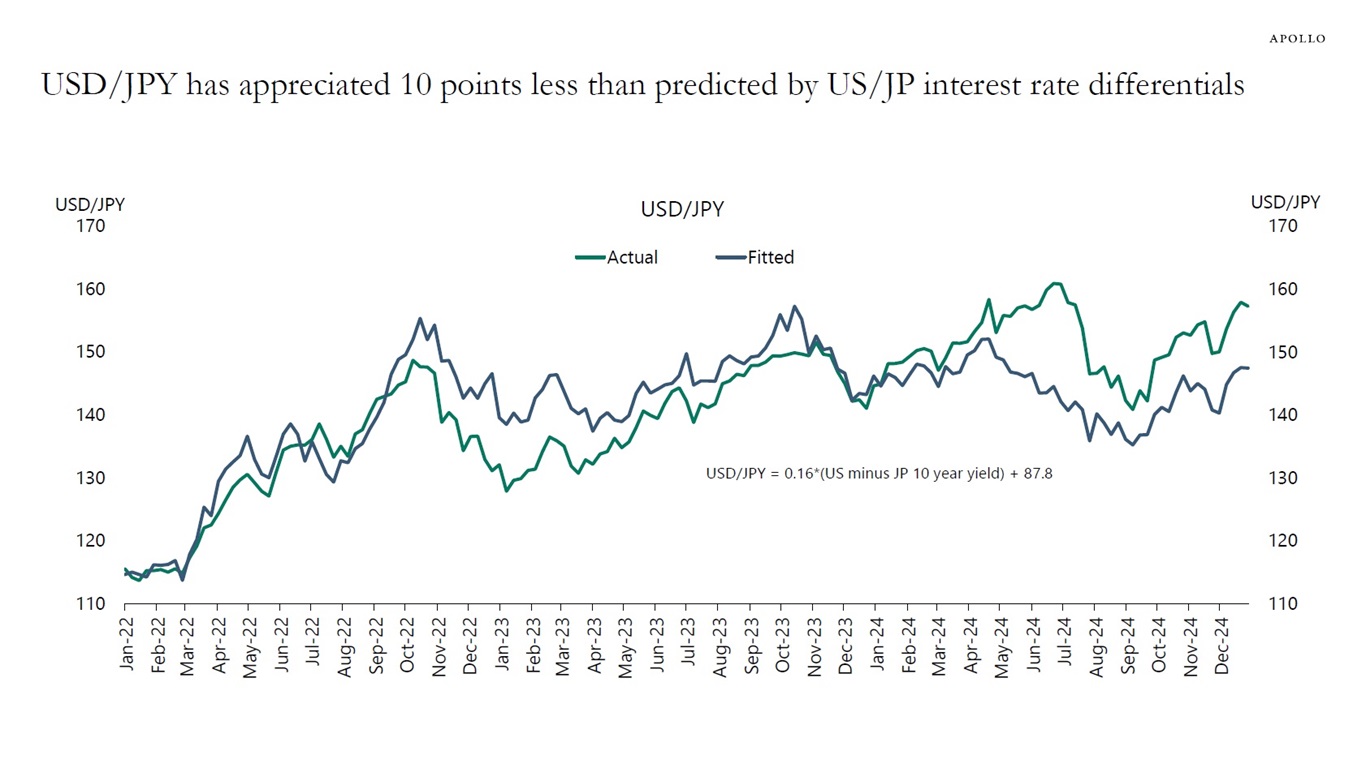

Source: Bloomberg, Apollo Chief Economist

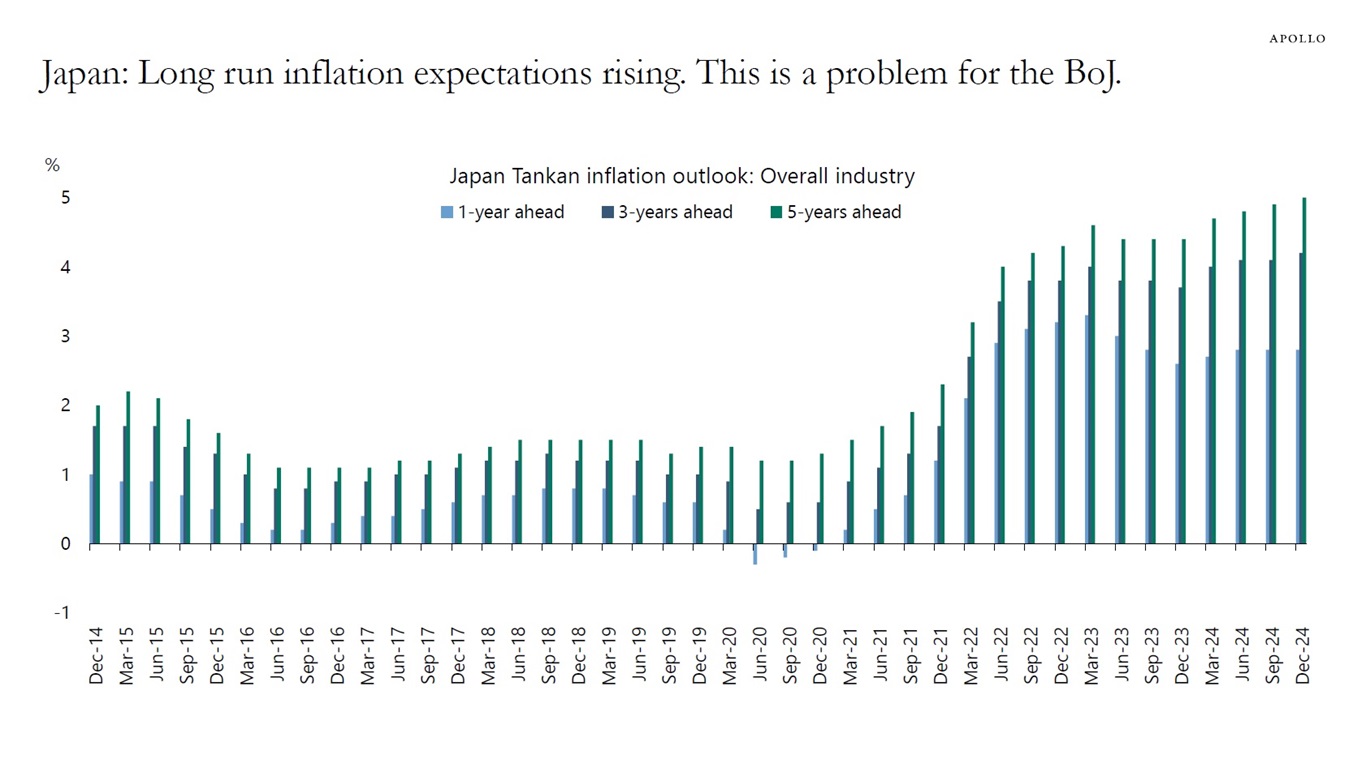

Source: Bureau of Labor Statistics, Haver Analytics, Ministry of Health, Labor and Welfare Japan, Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: Ministry of Finance Japan, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

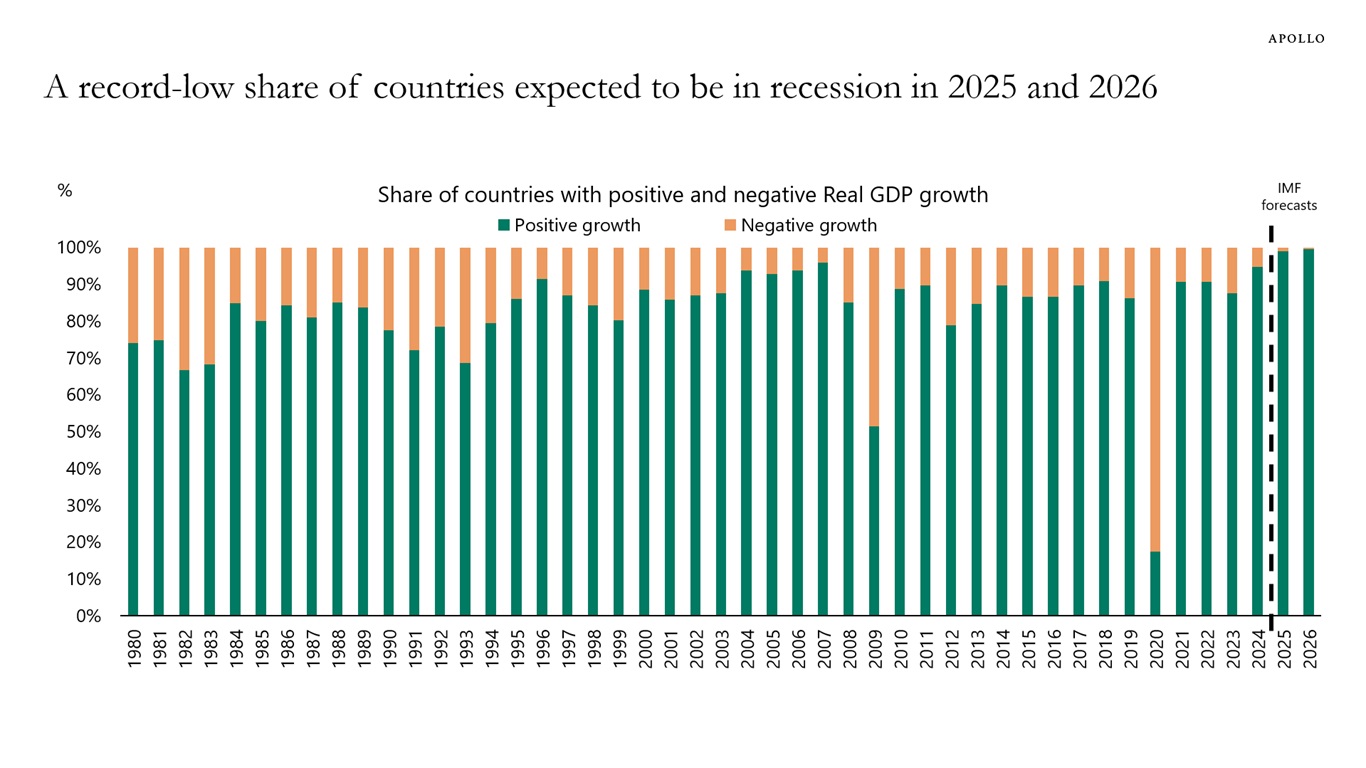

The IMF produces forecasts for 196 countries in the world, and their latest forecast shows that a record-low share of countries are expected to be in recession in 2025 and 2026, see chart below.

Note: Sample includes 196 countries in the IMF WEO database. Source: IMF WEO, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

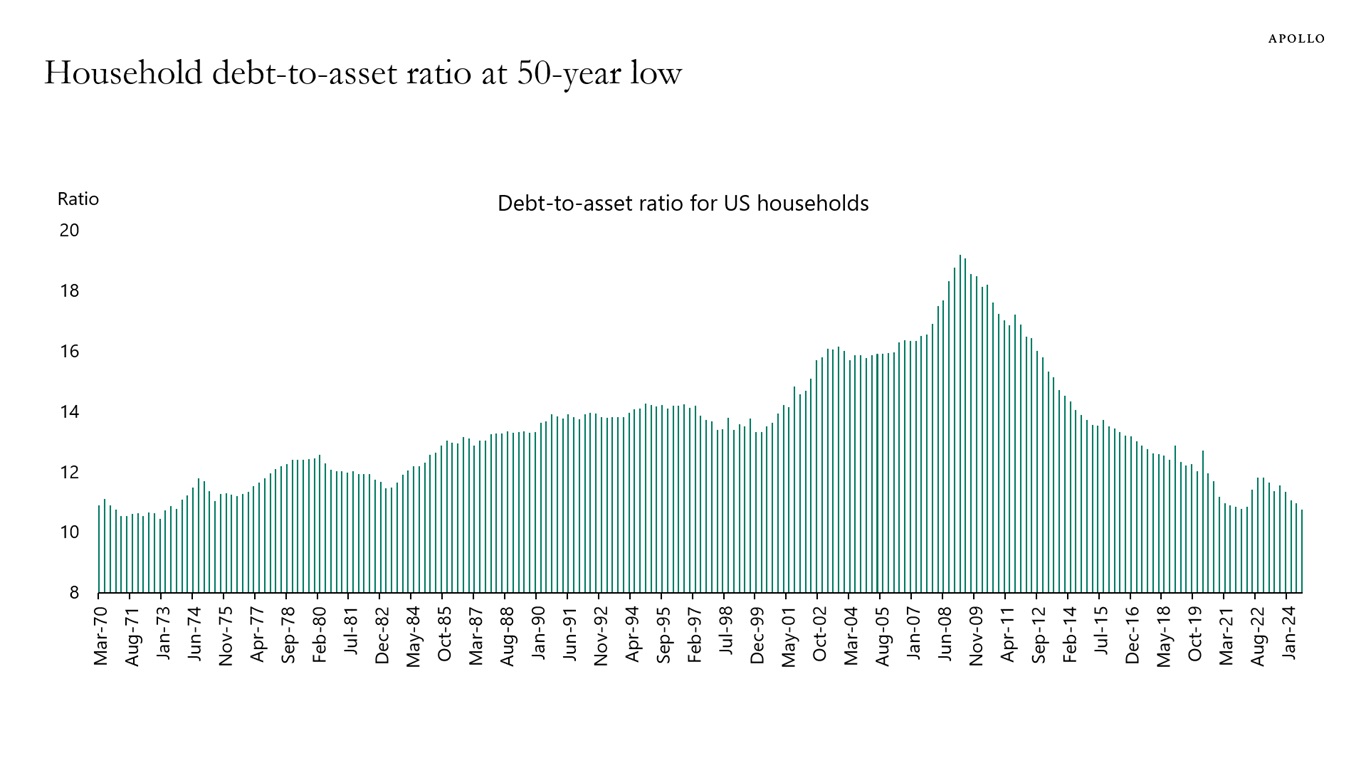

US stock prices and home prices have increased much faster than US household debt over the past 15 years, see chart below.

As a result, debt in the US household sector is at the lowest level in 50 years relative to assets.

In other words, US households benefit tremendously from the exceptional performance in US financial markets and the continued rise in US home prices.

Source: Federal Reserve, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

The narrative in markets is that the outlook for the US is great, and the outlook for Europe, UK, and China is not good.

For markets, the problem with this narrative is that 41% of revenues in the S&P 500 come from abroad. If we have a recession in Europe and a continued slowdown in China, it will have a significant negative impact on earnings for S&P 500 companies.

Source: FactSet, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

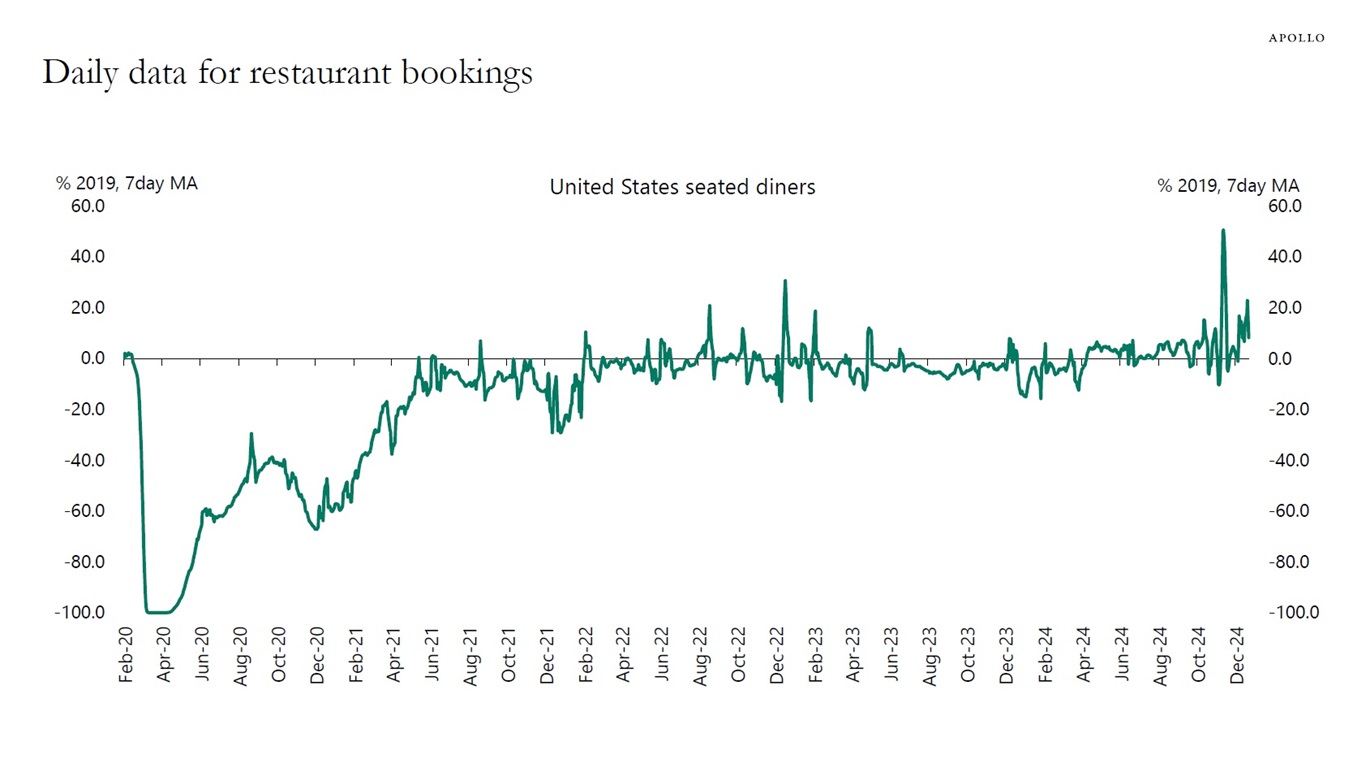

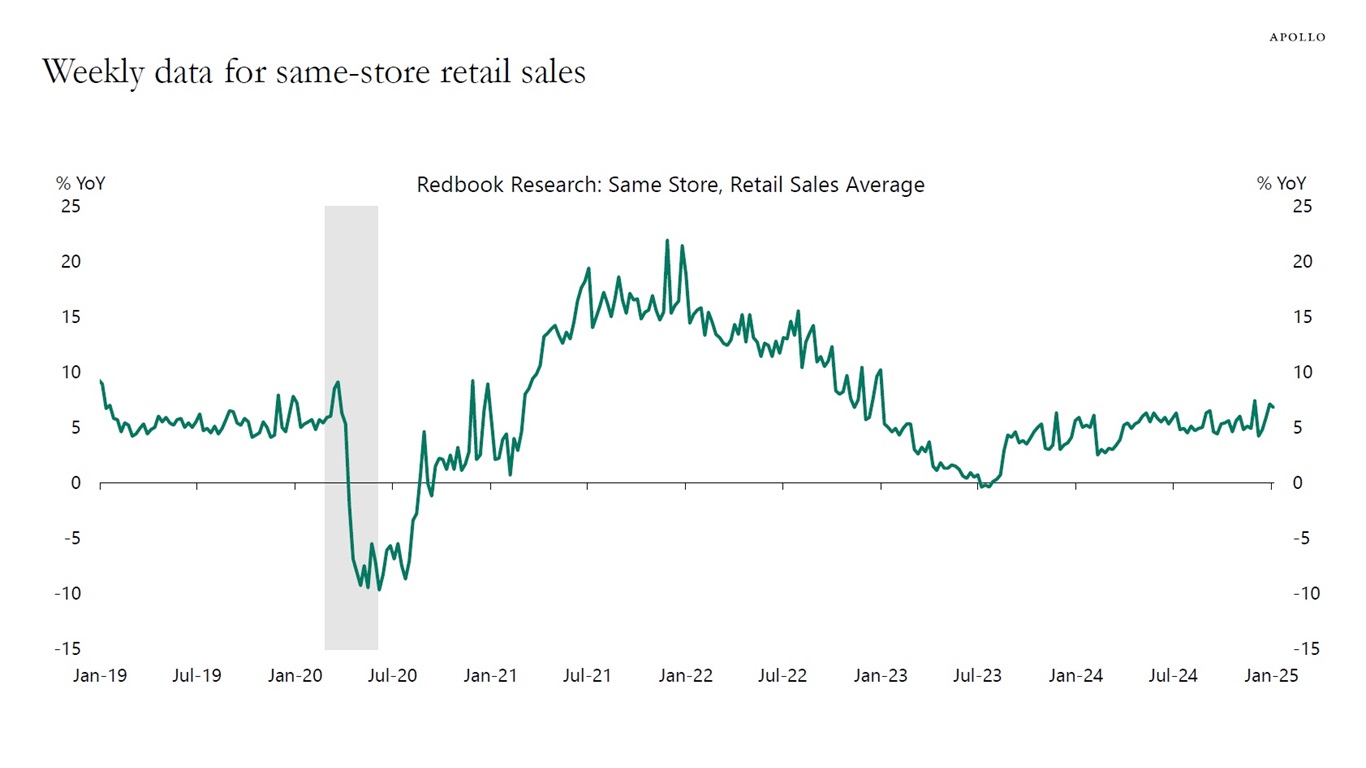

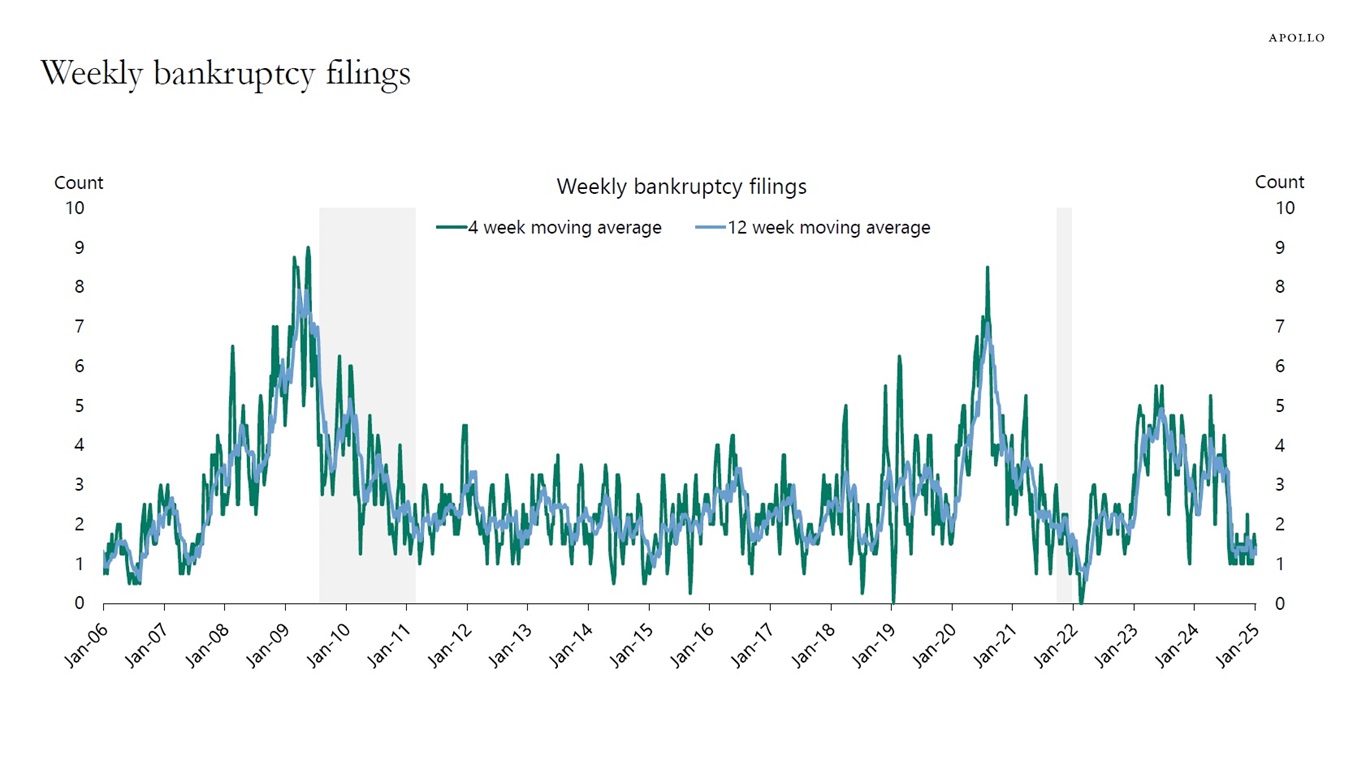

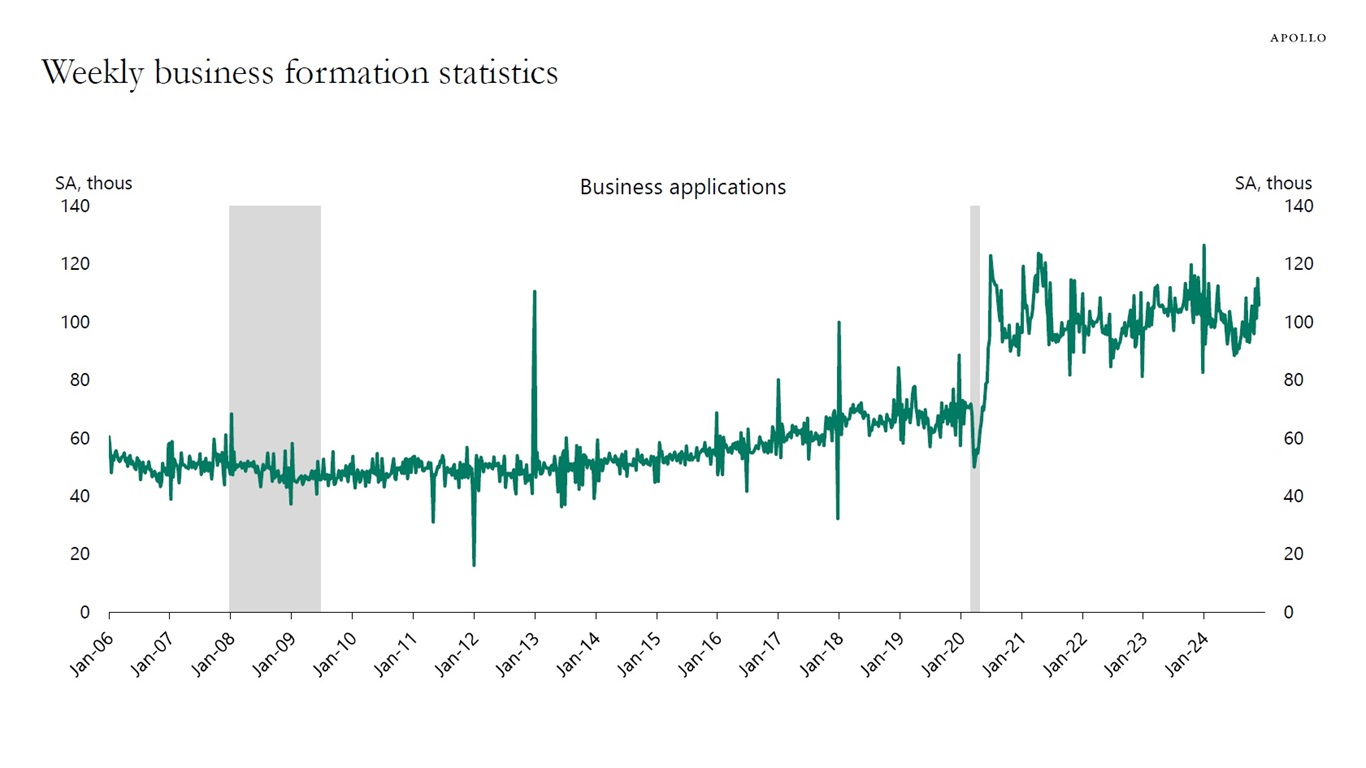

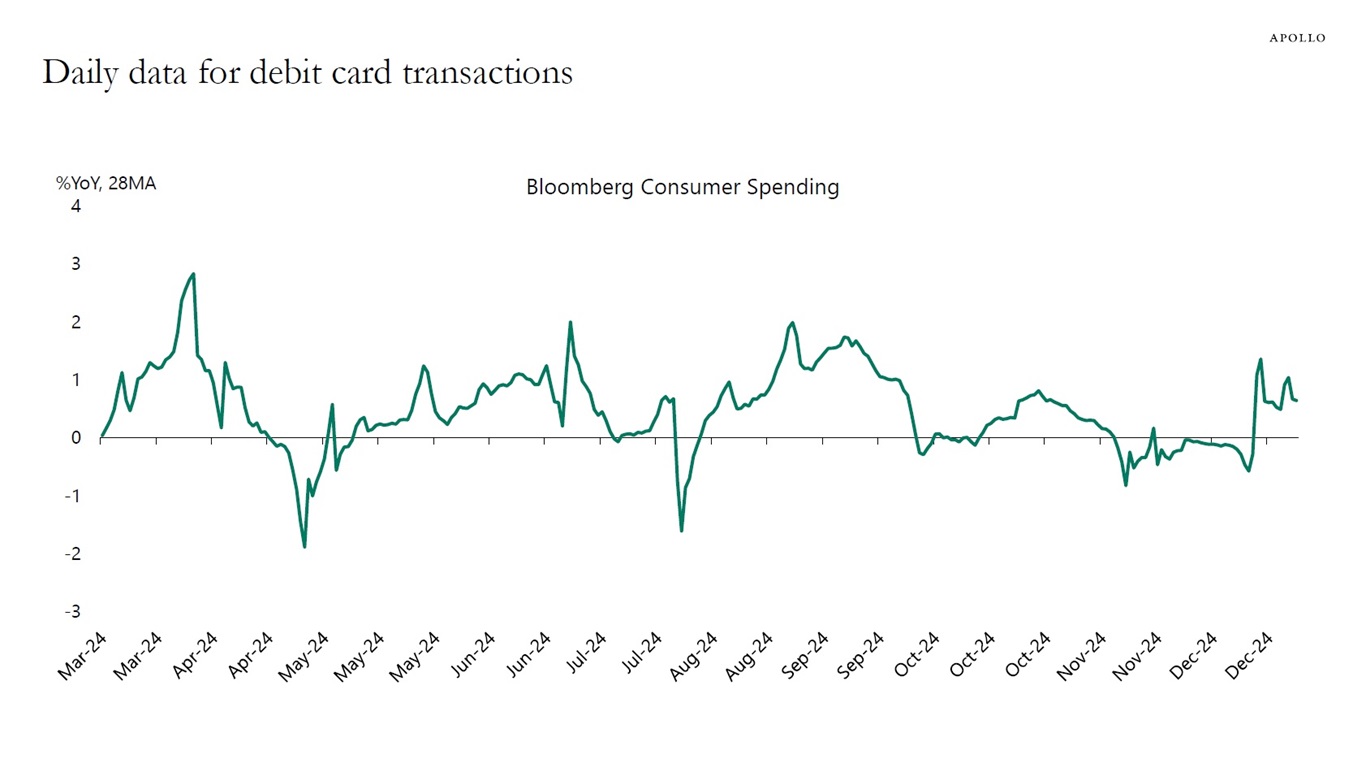

This week, the employment report came in stronger than expected, weekly same-store retail sales were better than expected, and Prices Paid for ISM Services came in higher than expected.

The bottom line is that momentum in the economy is strong, and the narrative that monetary policy is restrictive is wrong.

Combined with higher animal spirits and the latest Atlanta Fed GDP estimate at 2.7%, we see a 40% probability that the Fed will hike rates in 2025.

Our latest chart book with daily and weekly indicators for the US economy is available here.

Source: OpenTable, Apollo Chief Economist

Source: Redbook, Haver Analytics, Apollo Chief Economist

For week ending on January 10th, 2025. Note: Filings are for companies with more than $50 million in liabilities. Source: Bloomberg, Apollo Chief Economist

Source: Census, Haver Analytics, Apollo Chief Economist

Note: The economic conditions indices are computed with mixed-frequency dynamic factor models with weekly, monthly, and quarterly variables that cover multiple dimensions of state economies. The indices are scaled to 4-quarter growth rates of U.S. real GDP and normalized such that a value of zero indicates national long-run growth. Source: Baumeister, Christiane, Danilo Leiva-Leon, and Eric Sims (2024), “Tracking Weekly State-Level Economic Conditions,” “Review of Economics and Statistics, 106(2), 483-504,” Apollo Chief Economist

Note: Consists largely of debit card transactions. Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

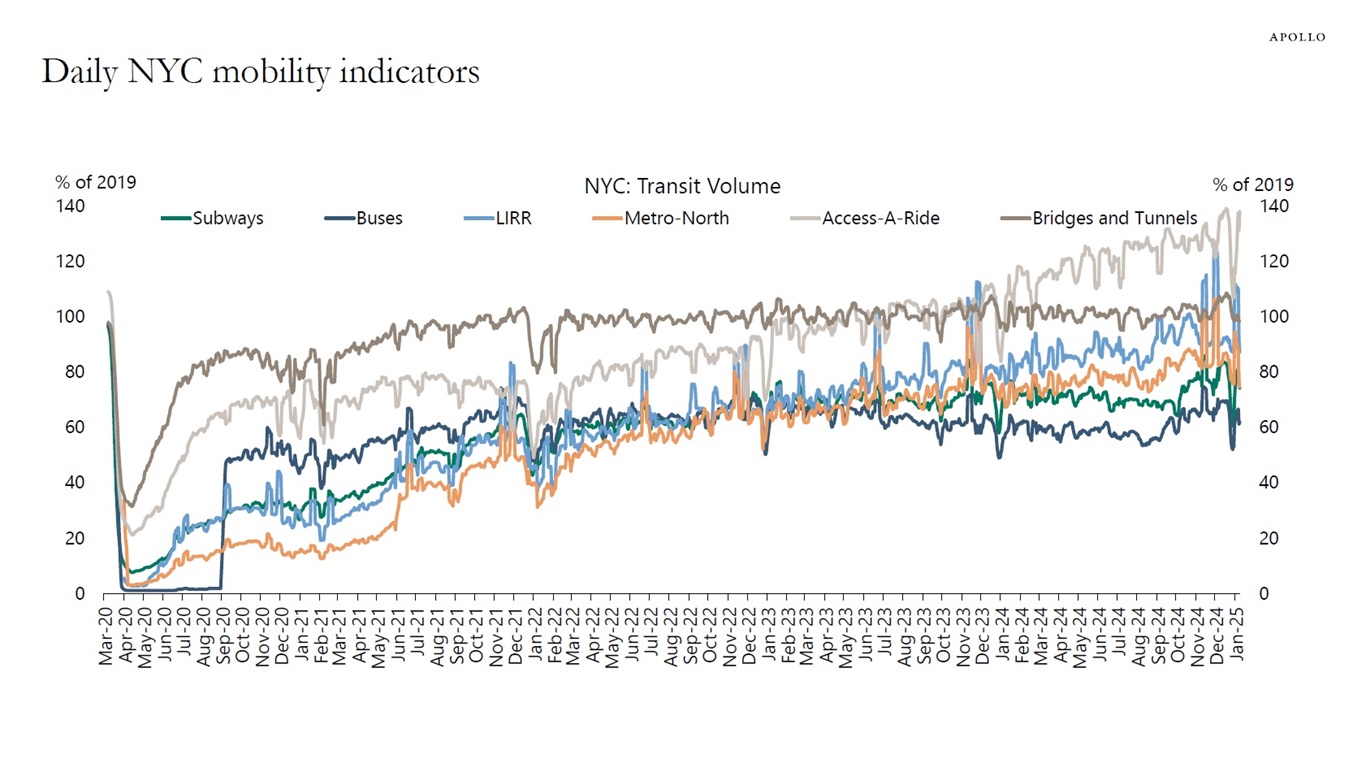

Source: MTA, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

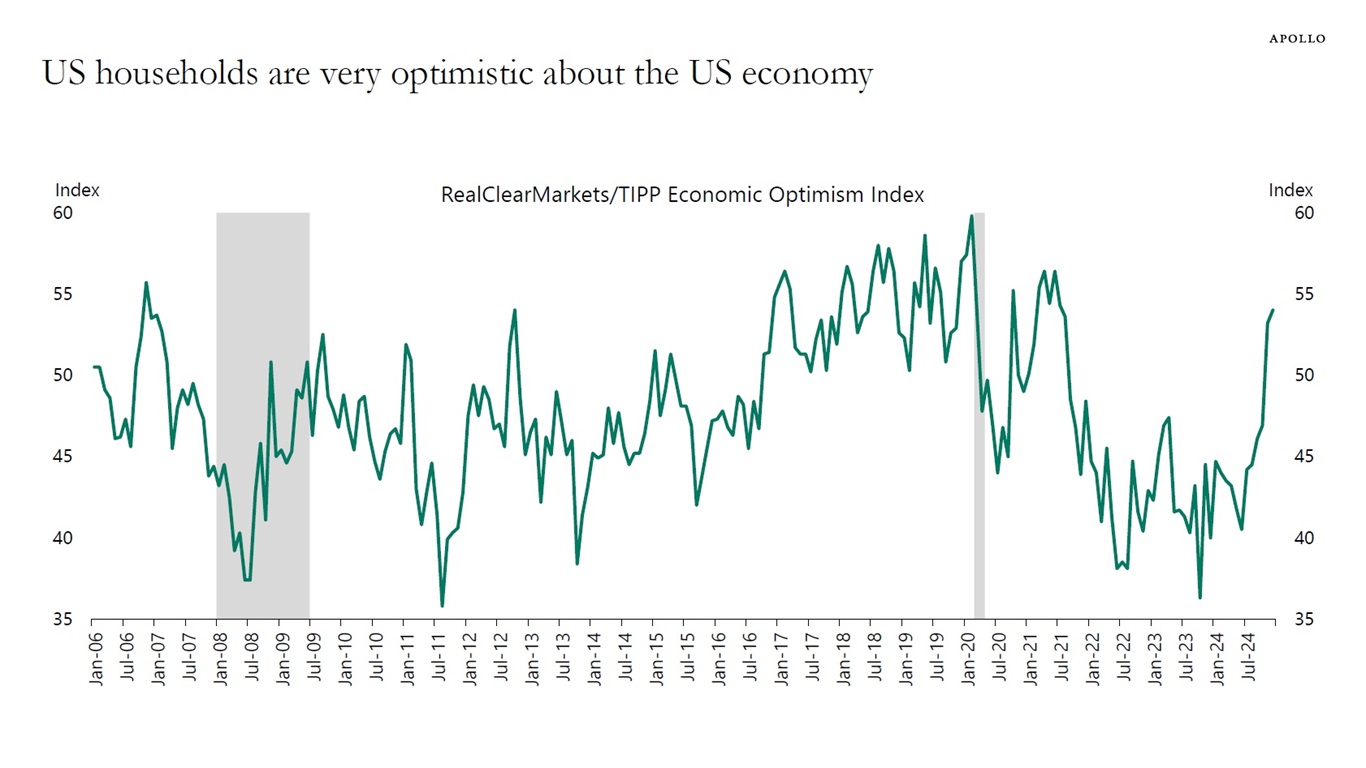

The RealClearMarkets/TIPP Economic Optimism Index measures Americans’ optimism about the US economy.

Specifically, the index is based on a nationwide survey of 1,300 adults and is made up of three subindexes, including one for the respondent’s economic outlook six months into the future, the respondent’s personal financial outlook, and how the respondent views current federal policies.

The latest data shows that US households have turned very optimistic about the US economic outlook in recent months, see chart below.

Source: Technometrica Market Intelligence/RealClearMarkets, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.