Want it delivered daily to your inbox?

-

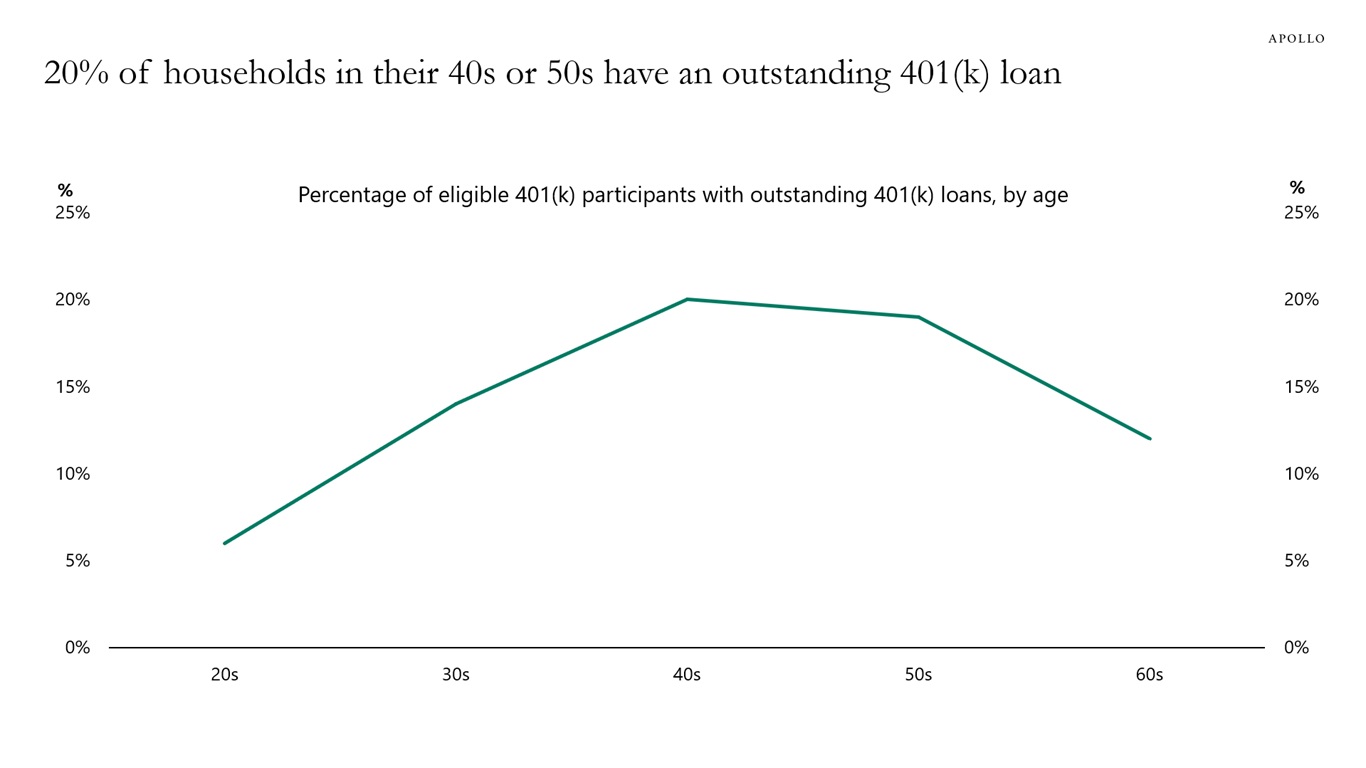

Twenty percent of households in their 40s and 50s have borrowed money from their 401(k) retirement account, see chart below.

Note: Data as of 2022. Sources: EBRI/CI Participant-Directed Retirement Plan Data Collection Project, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Tariffs can be used to boost the size of the US manufacturing sector.

But tariffs, unfortunately, have two short-term negative effects on the economy:

- Elevated uncertainty has a negative impact on household and corporate spending decisions.

- Tariffs have a negative impact on corporate earnings as companies experience higher production costs.

Uncertainty may have declined modestly in recent weeks, but the next step is for tariffs to begin to have a negative impact on corporate earnings over the coming quarters. Combined with the risk of retaliation, this is negative for the S&P 500.

The bottom line is that the incoming data remains solid, but the soft data is deteriorating. With tariffs not going away, the observed weakness in the soft data should be expected to spill over to weakness in the hard data over the coming months. The next important data point is the March employment report, which will be released on Friday, April 4. The survey week for the employment report was the week of March 12, when tariff uncertainty was very elevated.

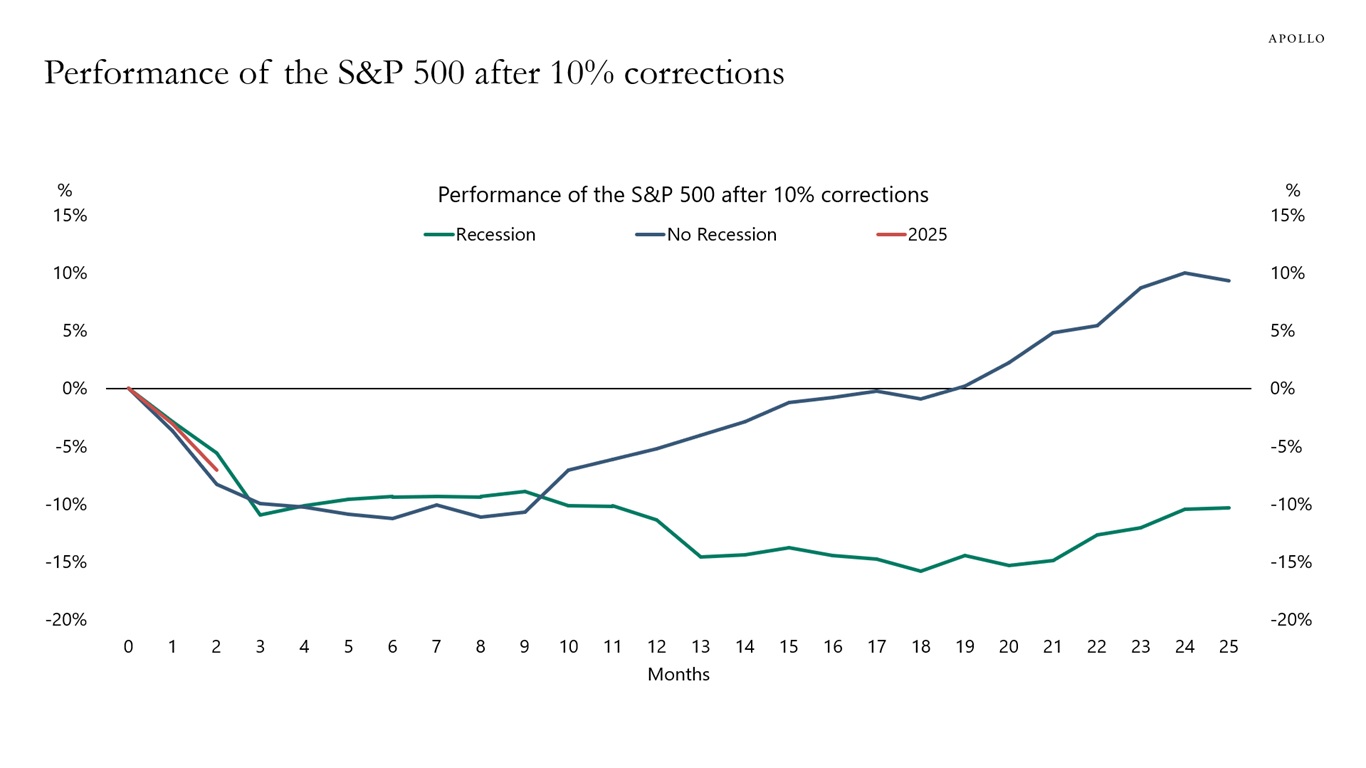

The performance of the S&P 500 will depend on the size of the adjustment costs as companies adjust to a new situation with permanently higher tariffs, see chart below.

Note: Using periods with 10% correction and categorizing them if they were followed by a recession. Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

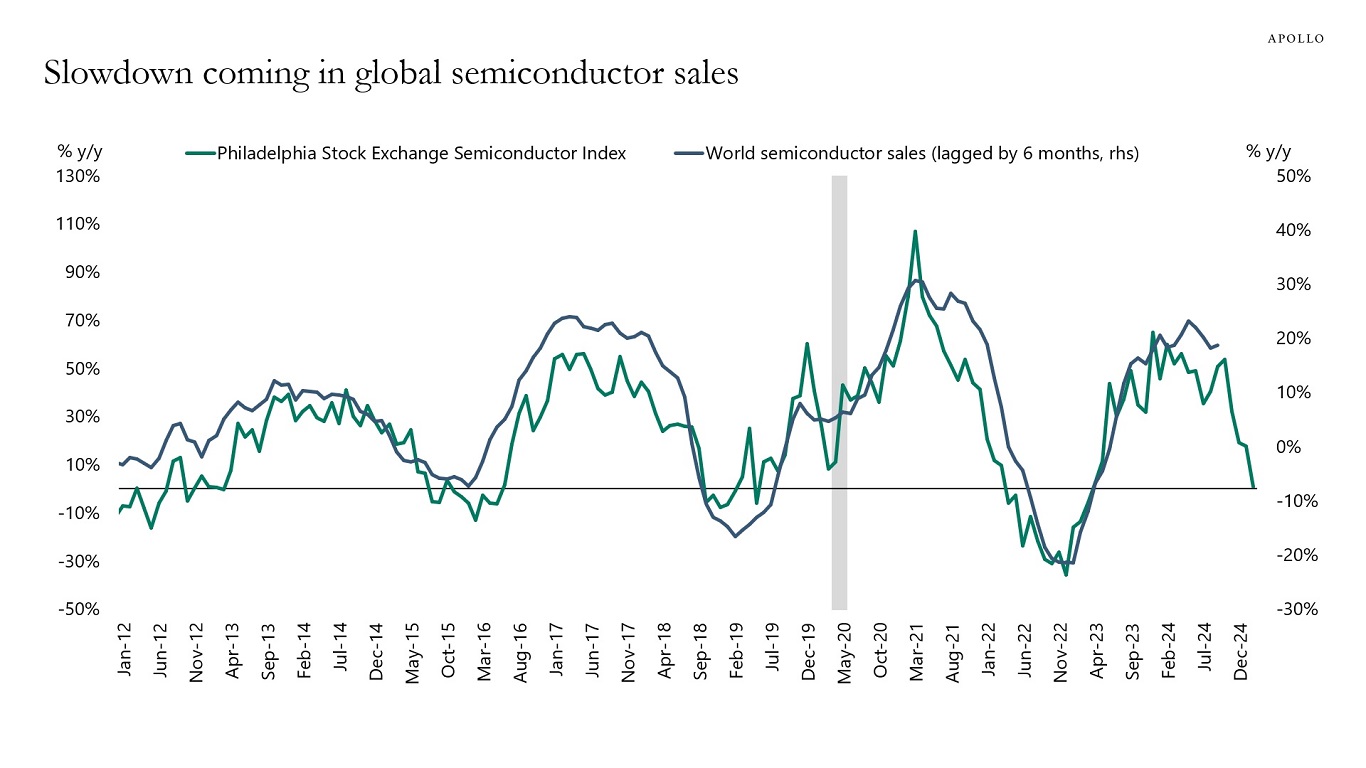

The recent decline in semiconductor stocks points to a coming slowdown in semiconductor sales, see chart below.

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

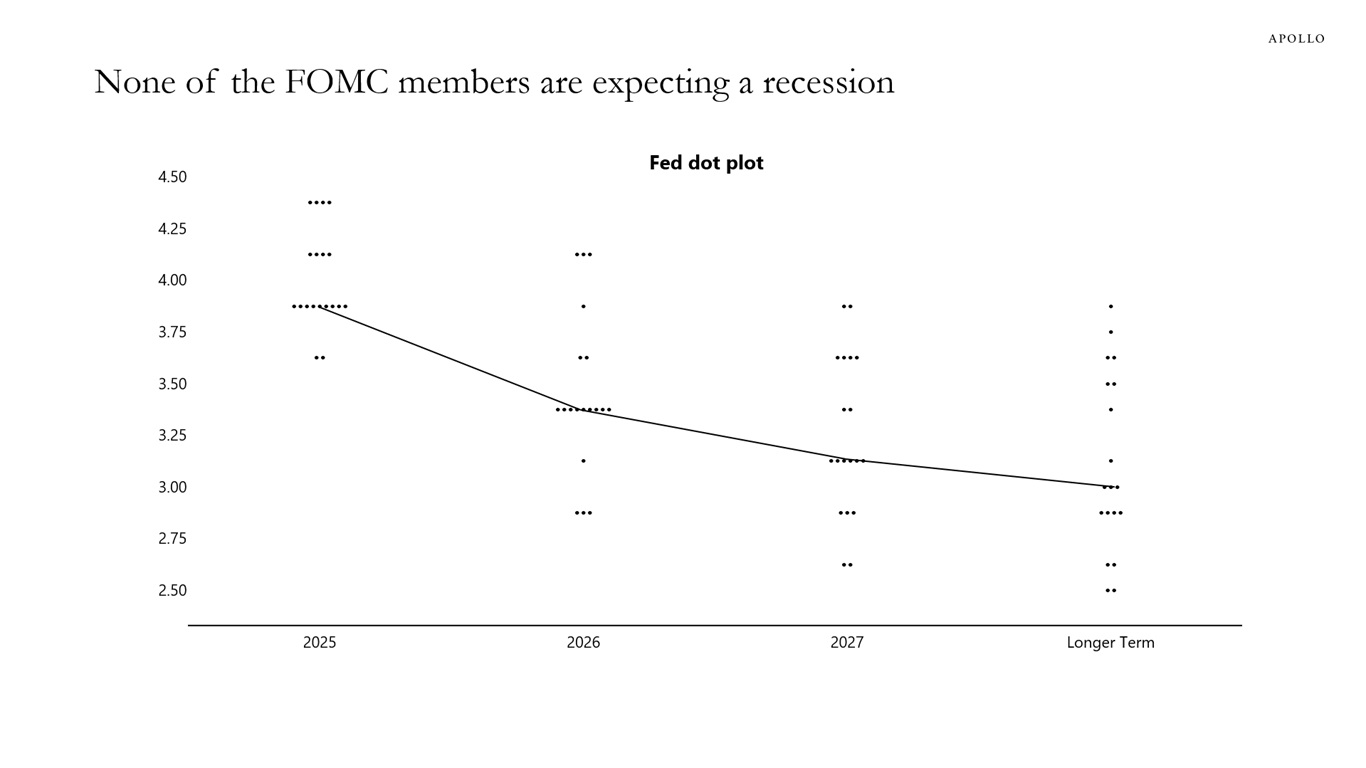

The chart below shows individual FOMC members’ forecast of where they think interest rates will be over the coming years. The degree of disagreement on the committee is remarkable, with one FOMC member saying that in 2026, the Fed funds rate will be almost 4%, and other FOMC members saying that they think interest rates in 2026 will be just above 2.5%.

The dot plot also shows that there is debate about where the Fed funds rate will be in the long run, also with a range between 2.5% and 4%. Perhaps most importantly, none of the FOMC members are predicting a sharp decline in the Fed funds rate to zero, telling the market that nobody on the FOMC is expecting a recession.

Sources: FOMC, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

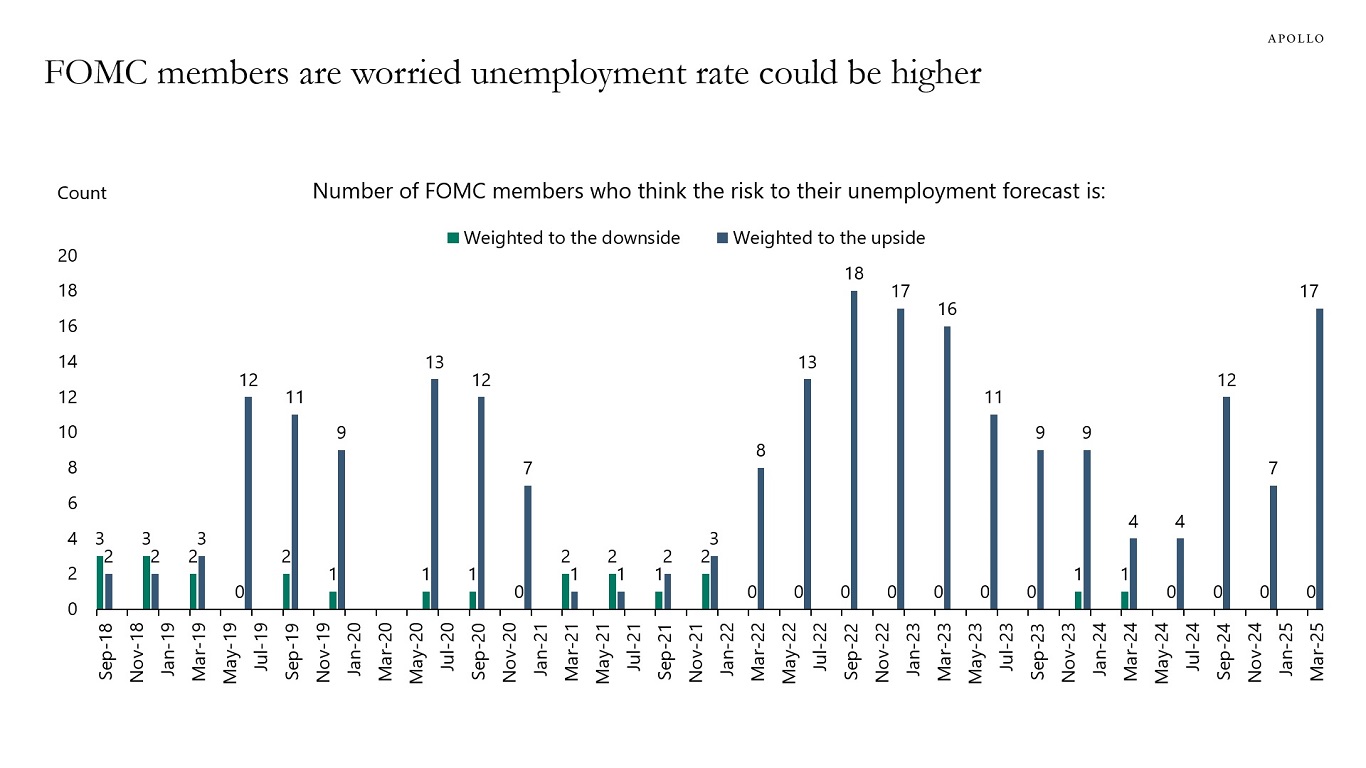

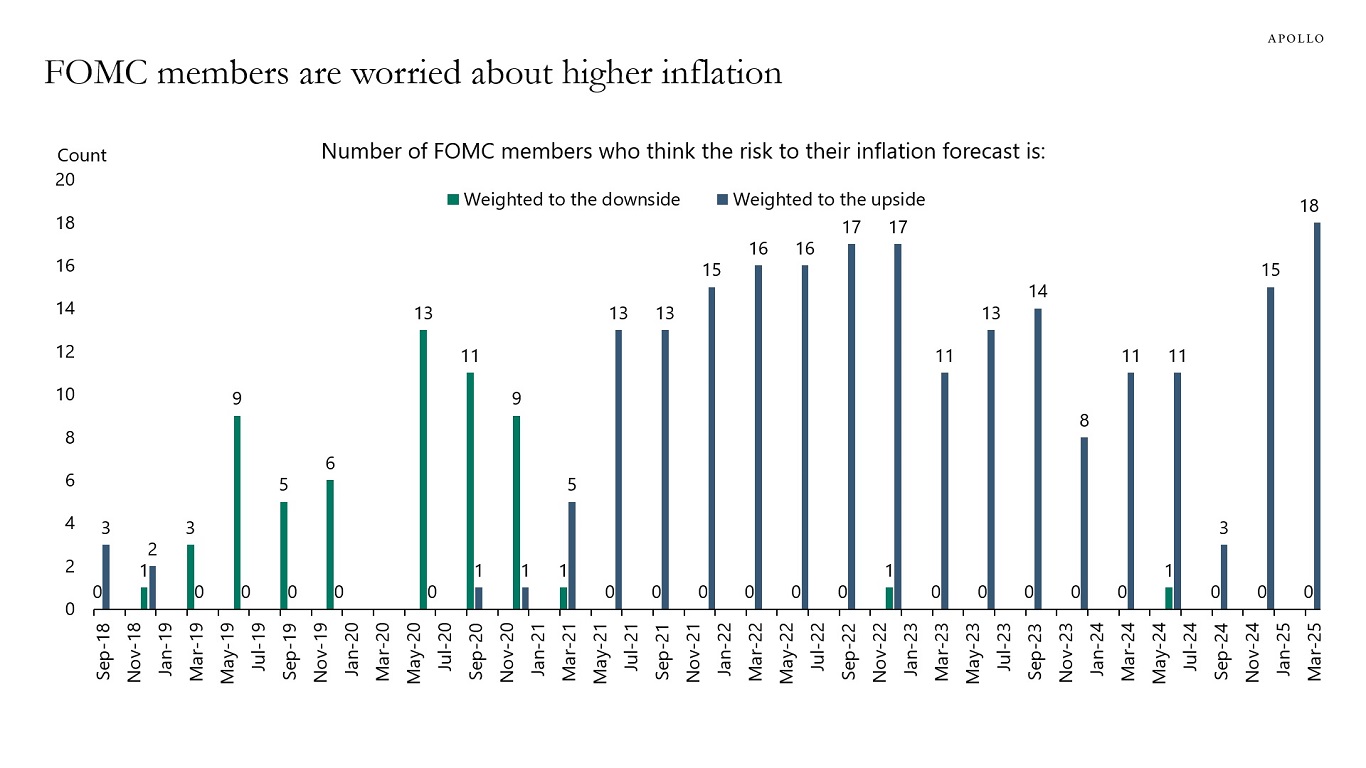

When FOMC members are asked about the risks to their outlooks, they respond that they are worried about upside risks to unemployment and inflation, see charts below.

In other words, the Fed is worried that the ongoing stagflation shock is going to intensify further.

Sources: Federal Reserve Board, Bloomberg, Apollo Chief Economist

Sources: Federal Reserve Board, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

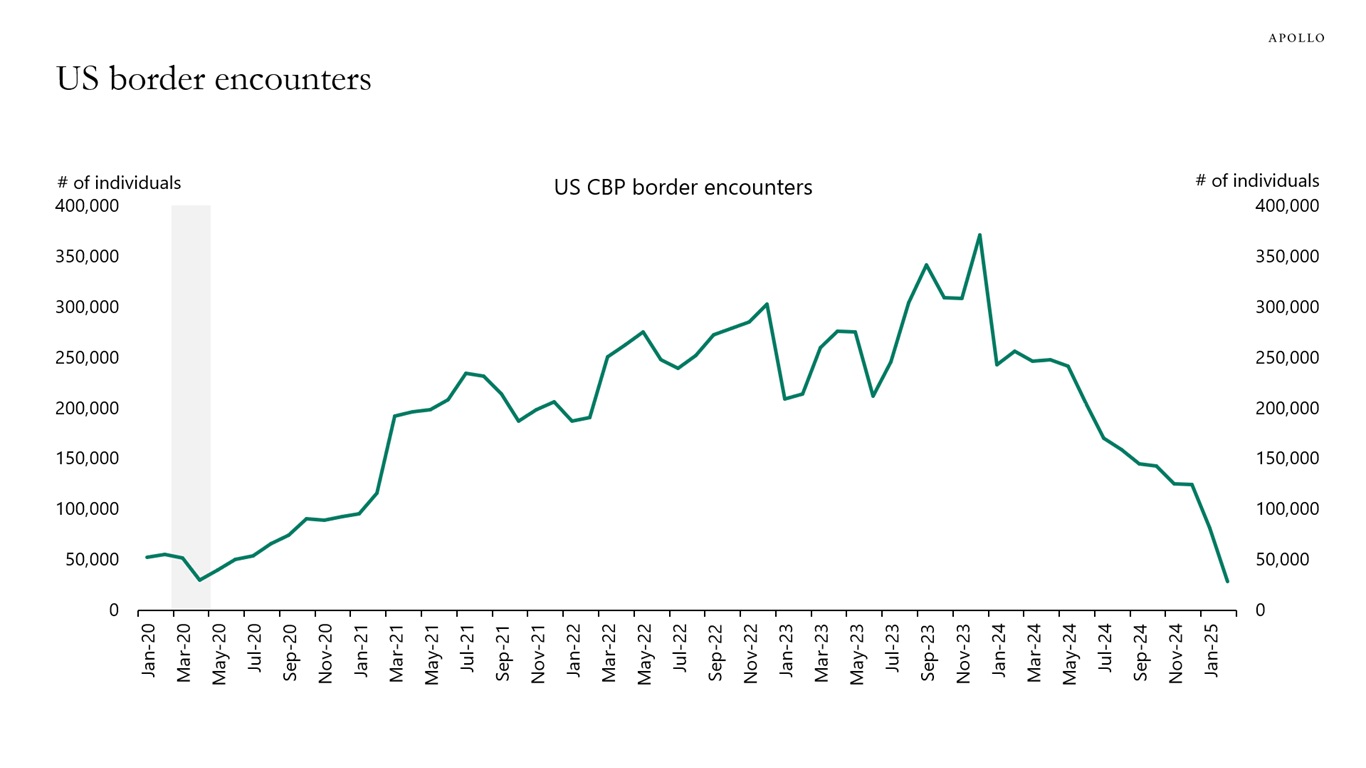

A US border encounter is defined as a law enforcement encounter with a person who unlawfully crossed the border between ports of entry or a person who entered at a port of entry but is inadmissible.

The chart below shows that there were almost zero border encounters in February 2025. The sharp decline in immigration in recent months will have very significant implications for nonfarm payrolls in March, April, and May because it could lower the population growth-consistent nonfarm payroll estimate to 60,000, down from as much as 200,000 in 2024.

Put differently, the ongoing sharp decline in immigration will automatically result in a sharp decline in nonfarm payrolls over the coming months.

Source: US Customs and Border Protection (CBP), Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

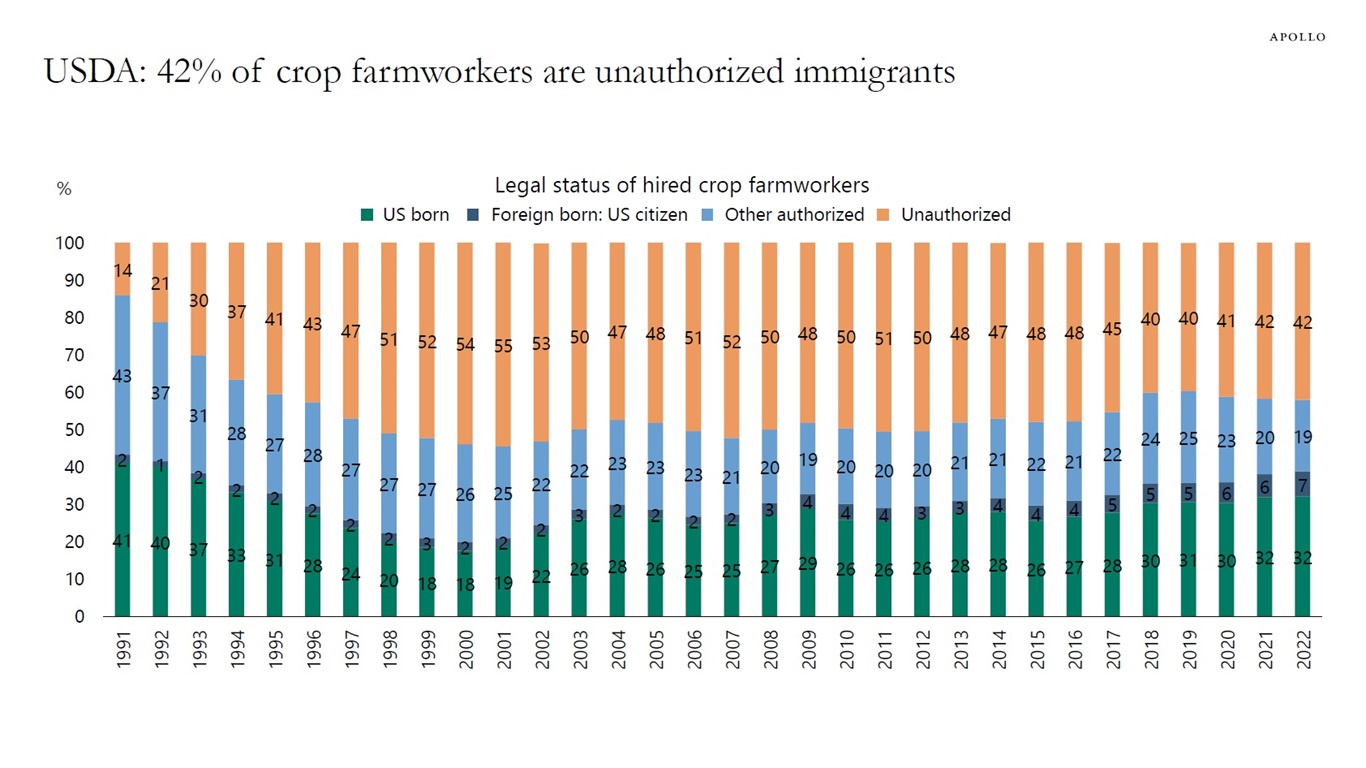

USDA data shows that 42% of crop farmworkers are not authorized to work in the US, see chart below and here. A crop farmworker is an agricultural laborer who performs tasks involved in growing and harvesting crops like vegetables, fruits, grains, and nuts, including planting seeds, weeding, irrigating, harvesting, sorting, and packing the produce.

Source: USDA, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

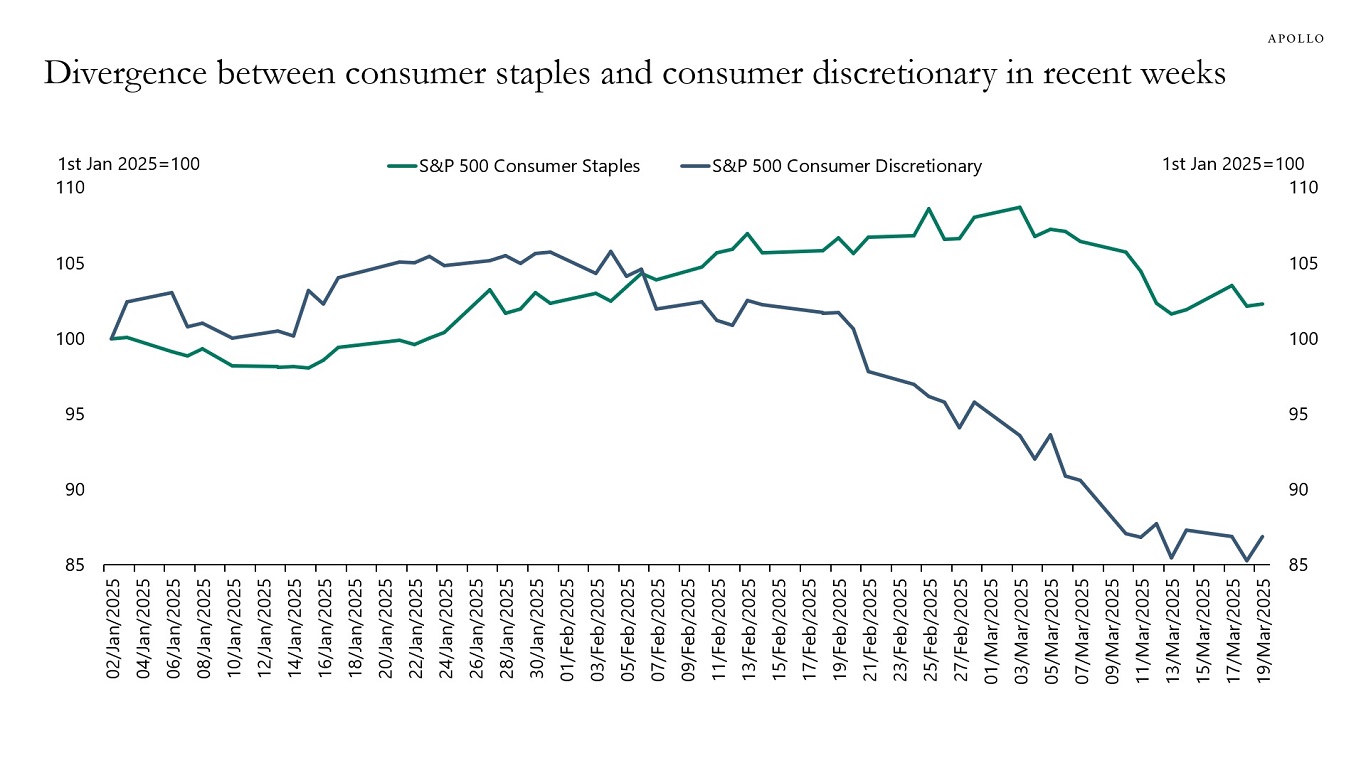

The S&P 500 basket of stocks for consumer discretionary companies has declined significantly in recent weeks, suggesting that investors are starting to worry about future consumer spending on big-ticket items such as cars, washing machines, and mobile phones, see chart below.

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

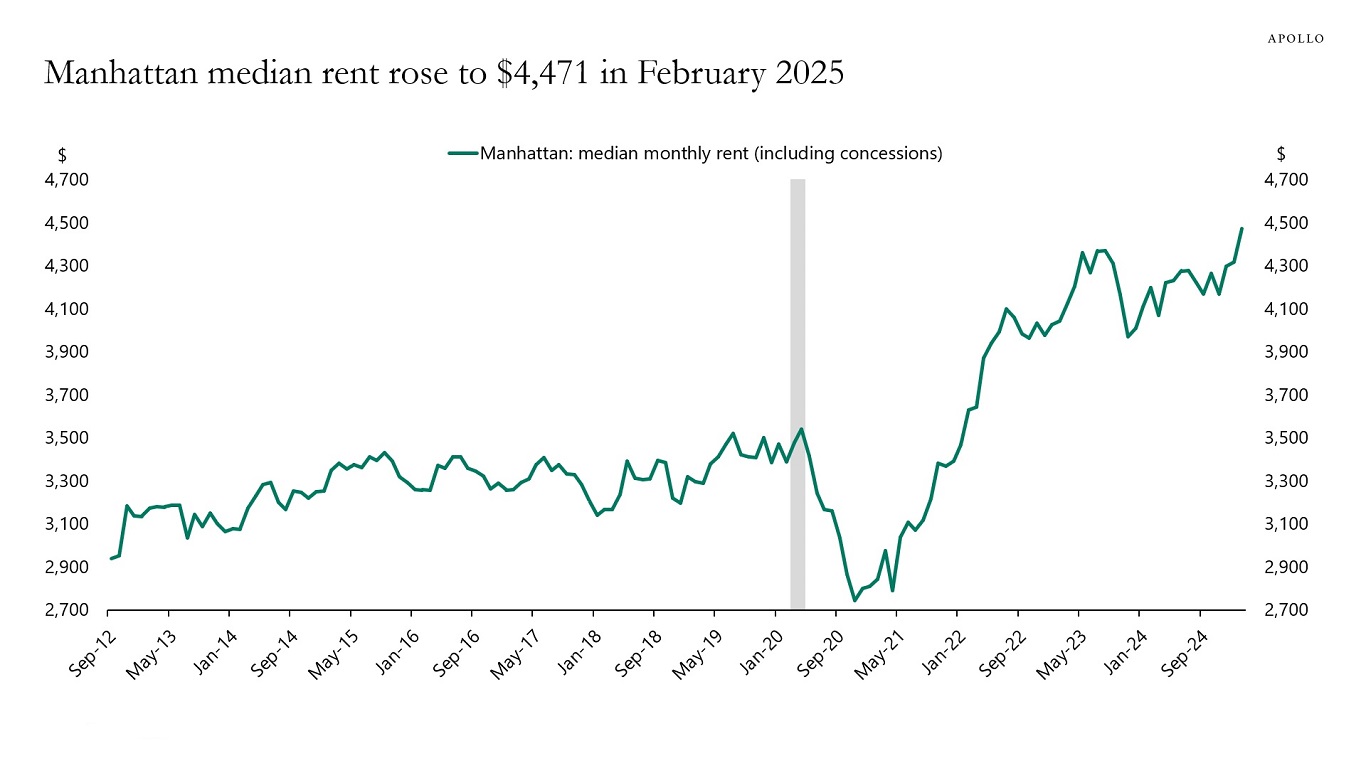

Apartment rents in Manhattan have started to increase again, with the median rent reaching a record high of $4,471 in February, see chart below.

Sources: Elliman, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

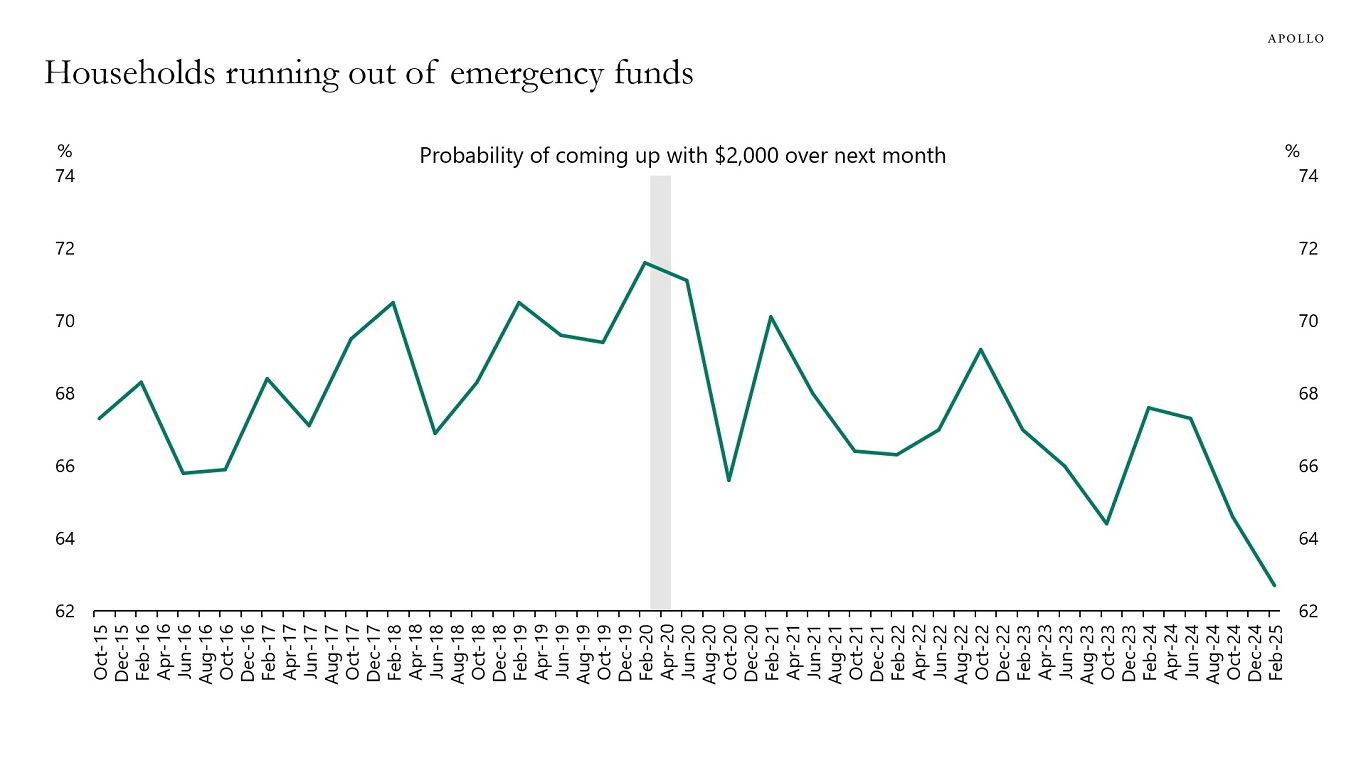

Data from the Fed shows that households’ ability to come up with $2,000 for an emergency expense within the next month is at the lowest level since the survey started in Q4 of 2015. Taking into account that the CPI level today is 35% higher than in 2015, the situation is even worse.

Sources: SCE, Federal Reserve Bank of New York, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.