There is something weird going on in US government bond markets, and the relentless increase in long-term interest rates is quite ominous for the economy, and perhaps also for financial stability.

We are late in the cycle, and Fed hikes are biting harder and harder on consumers and firms. Stock markets see the negative effects of tighter monetary policy, and equities are trading lower. But long-term interest rates should be going down, not up.

So what is going on?

With the term premium accounting for the entire move in long rates since July, we know that the source of higher long-term interest rates is not Fed expectations.

If the move is not driven by changing Fed expectations, what are then the reasons why long rates are moving higher? There are several potential explanations:

1) First, with declining repo it could be an unwind of the basis trade that is pushing long rates higher, somewhat similar to what happened in March 2020. This has been getting a lot of attention, and maybe conditions for getting repo are tightening.

2) Another potential explanation is the slowing growth in China, which means that China is recycling fewer dollars into Treasuries because of declining Chinese exports.

3) Rates may also be moving higher because of the Fed still doing QT. Remember, the entire goal with QT is to put upward pressure on government bond yields.

4) The US budget deficit remains big at 6% of GDP, which requires more Treasury issuance today and in the future, and investors may be reacting to that.

5) The US sovereign downgrade has likely had a negative impact.

6) Japan exiting YCC has put upward pressure on JGB yields, which, despite high hedging costs, makes US yields less attractive.

7) There is a large stock of T-bills outstanding, and the Treasury intends over the next six months to increase auction sizes across the Treasury curve.

No matter which explanation is more important, it is clear that the spike in rates is having a very negative impact on consumers and firms, and the risks of a hard landing are intensifying.

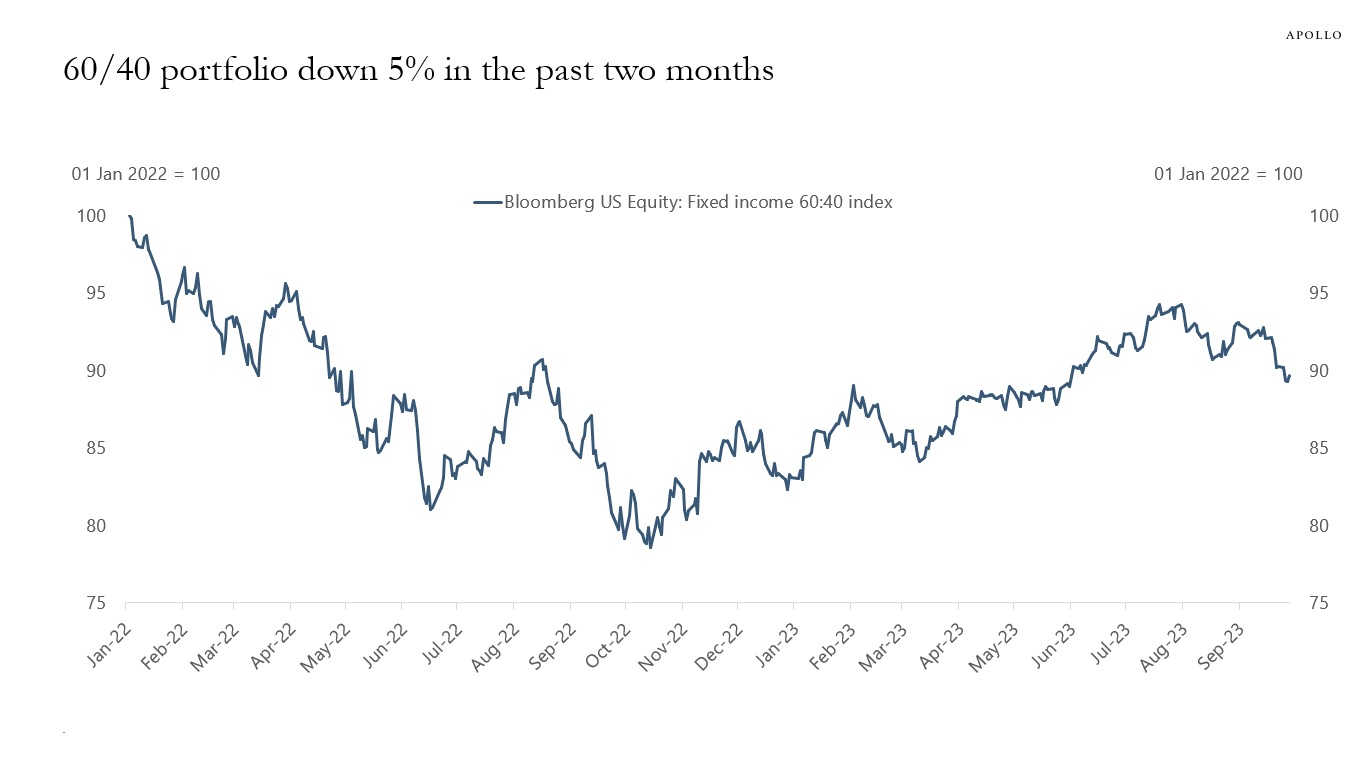

For investors in the 60/40 portfolio, the ongoing volatility in a high rates environment is stomach-churning, see chart below. Over the past two months, the 60/40 portfolio has lost 5%, and with an outlook of high rates and slowing earnings—which is needed to get inflation under control—the outlook for the 60/40 portfolio remains negative.