Looking at the incoming data, the facts are the following:

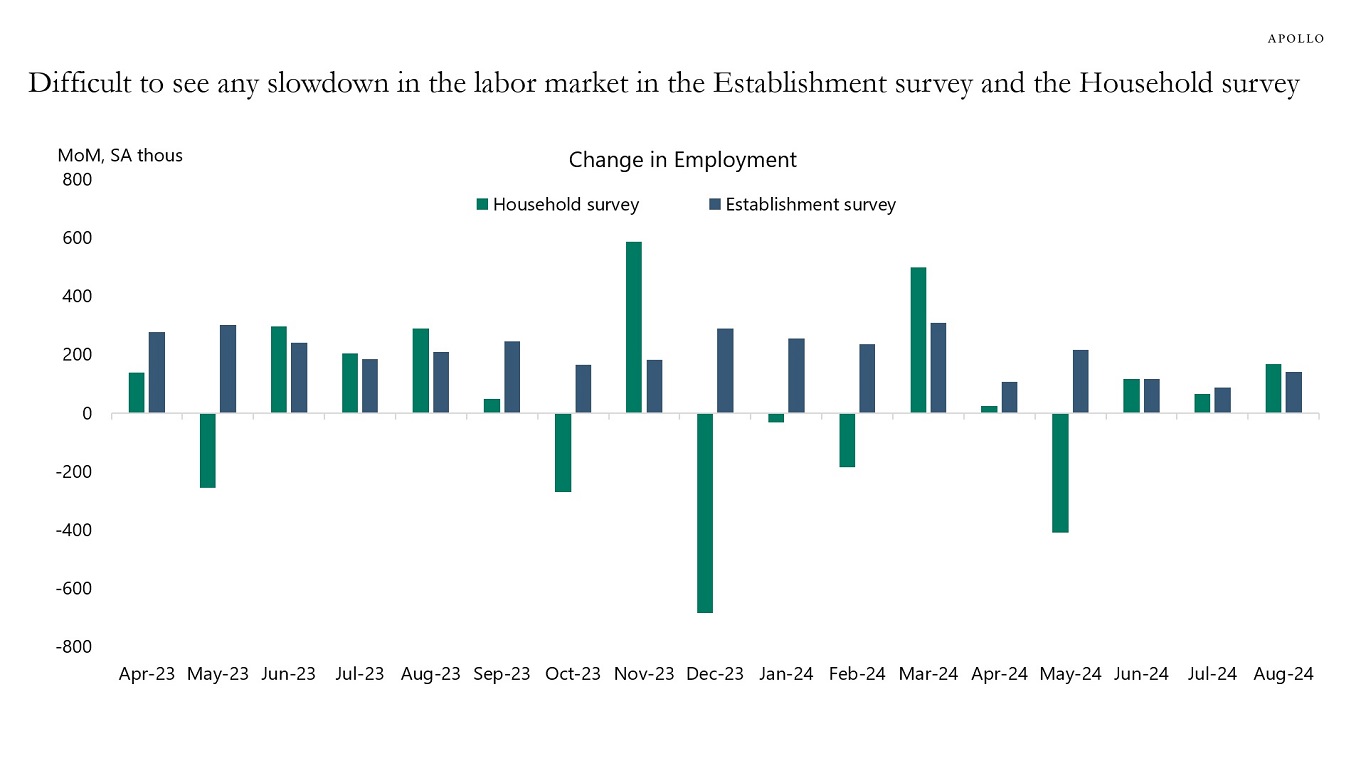

1. The unemployment rate declined in August, and looking at the establishment survey and the household survey, it is difficult to see strong signs of a slowdown in job creation, see chart 1.

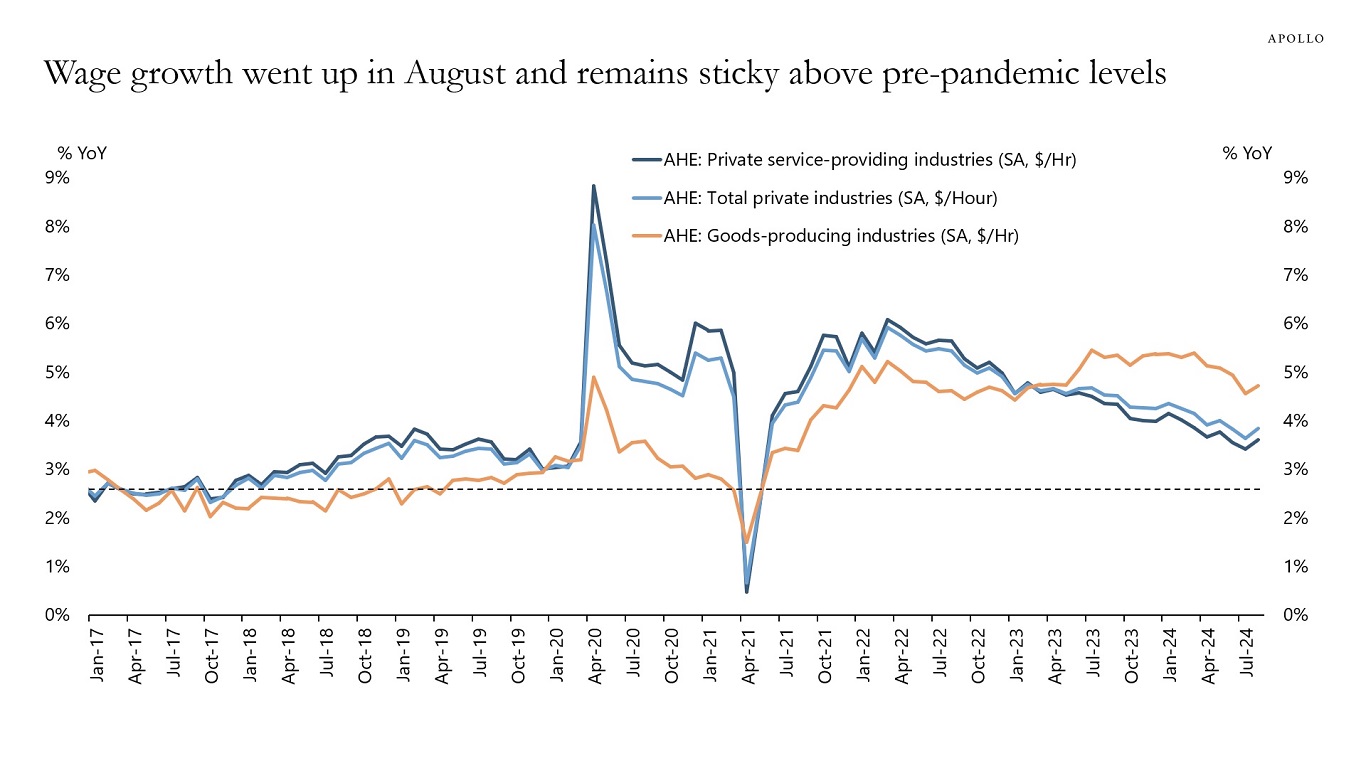

2. Wage growth accelerated to 3.8% in August and wage growth remains sticky well above pre-pandemic levels, see chart 2.

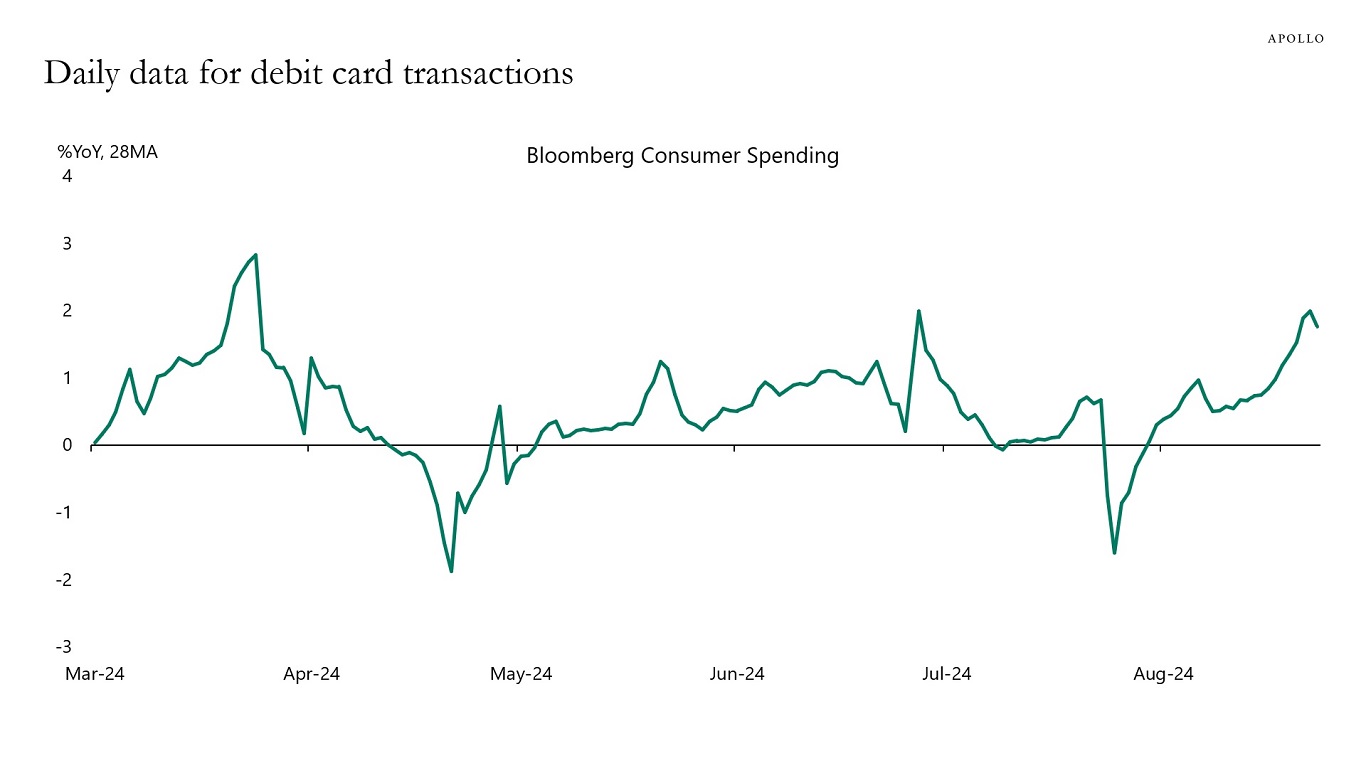

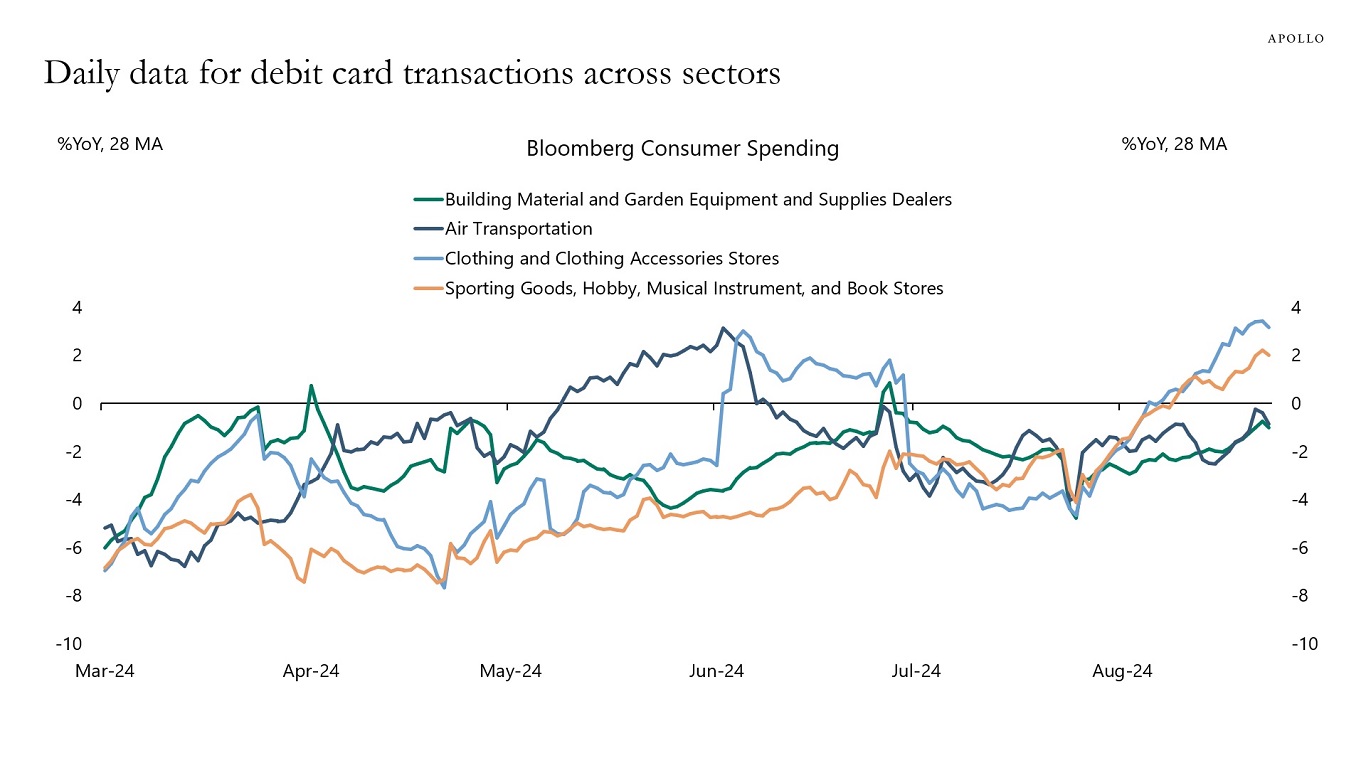

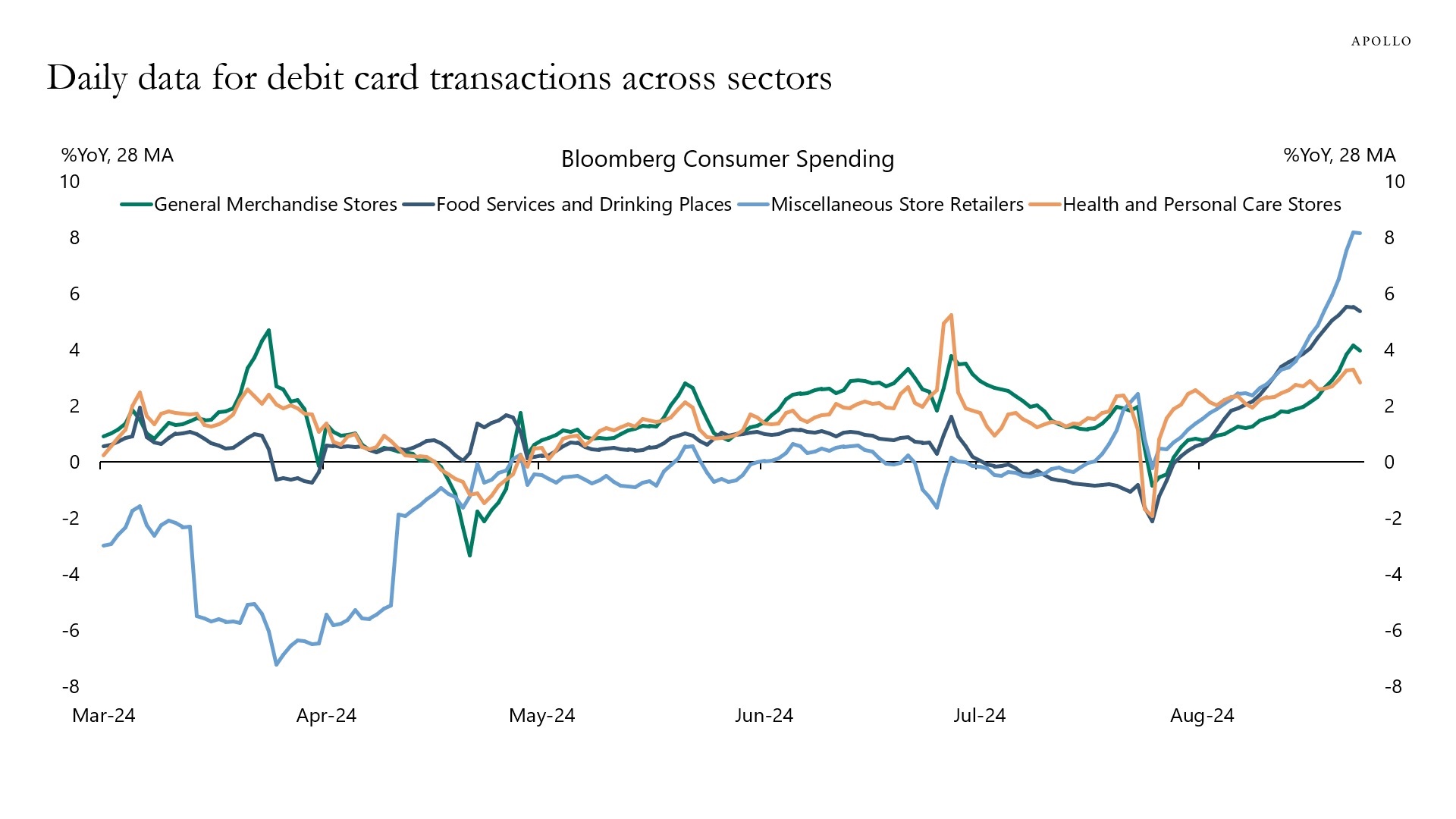

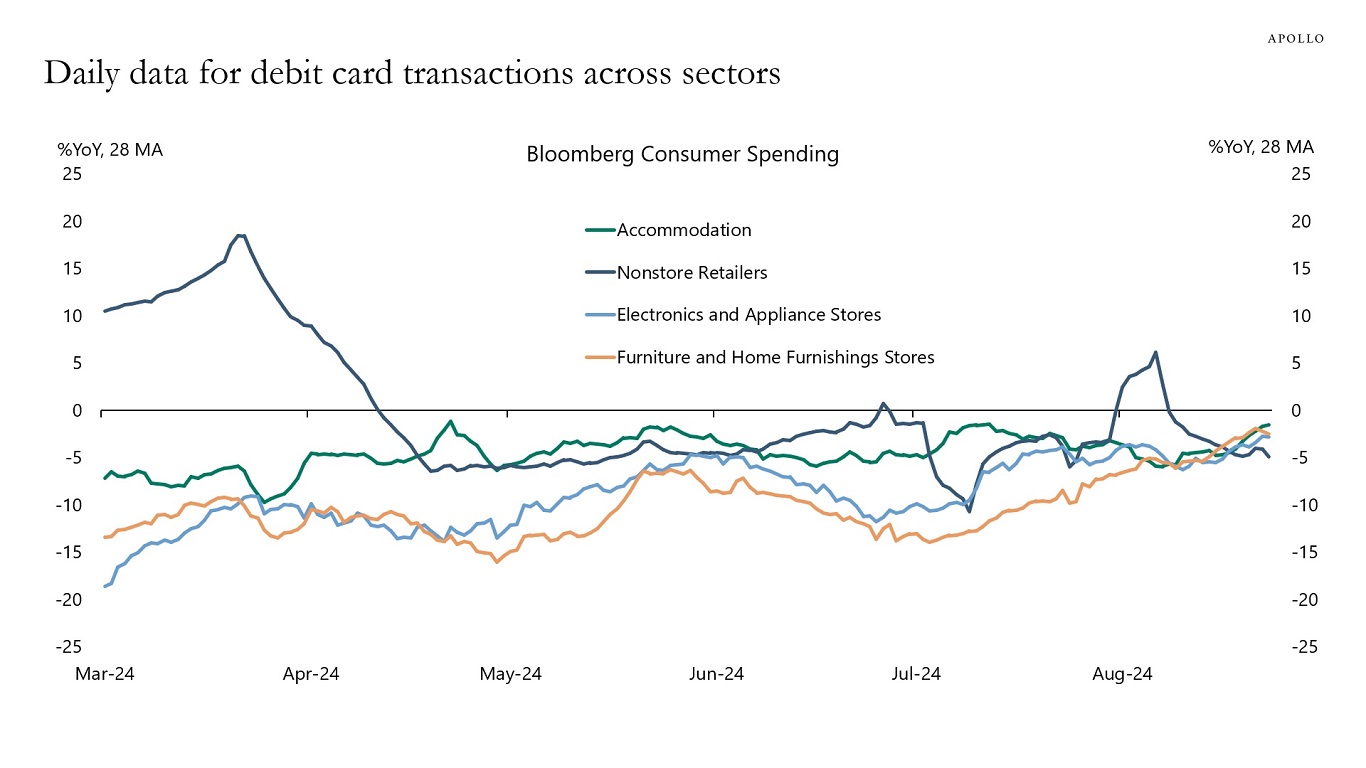

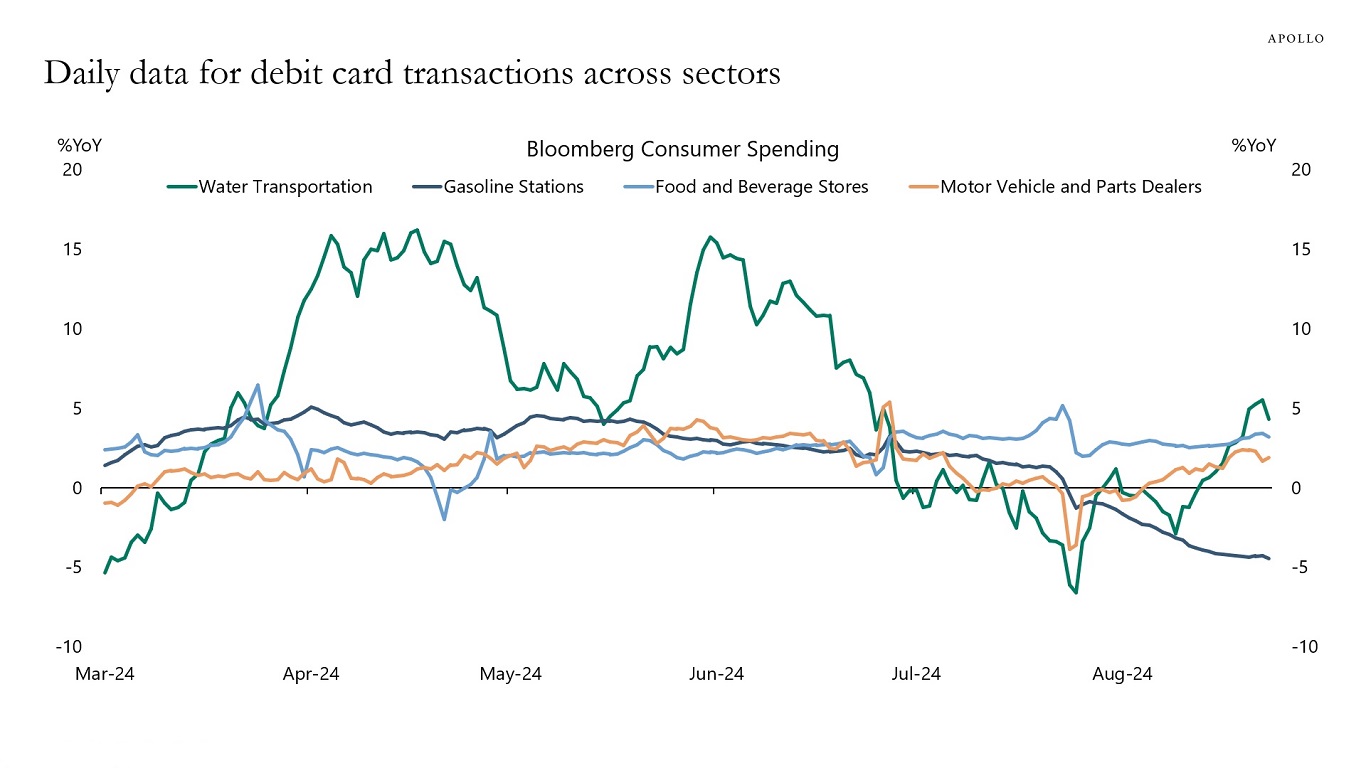

3. Daily data for debit card transactions shows that consumer spending has been accelerating in recent weeks, driven by spending on clothing, food services and drinking places, sporting goods, and motor vehicle and parts dealers, see the following five charts.

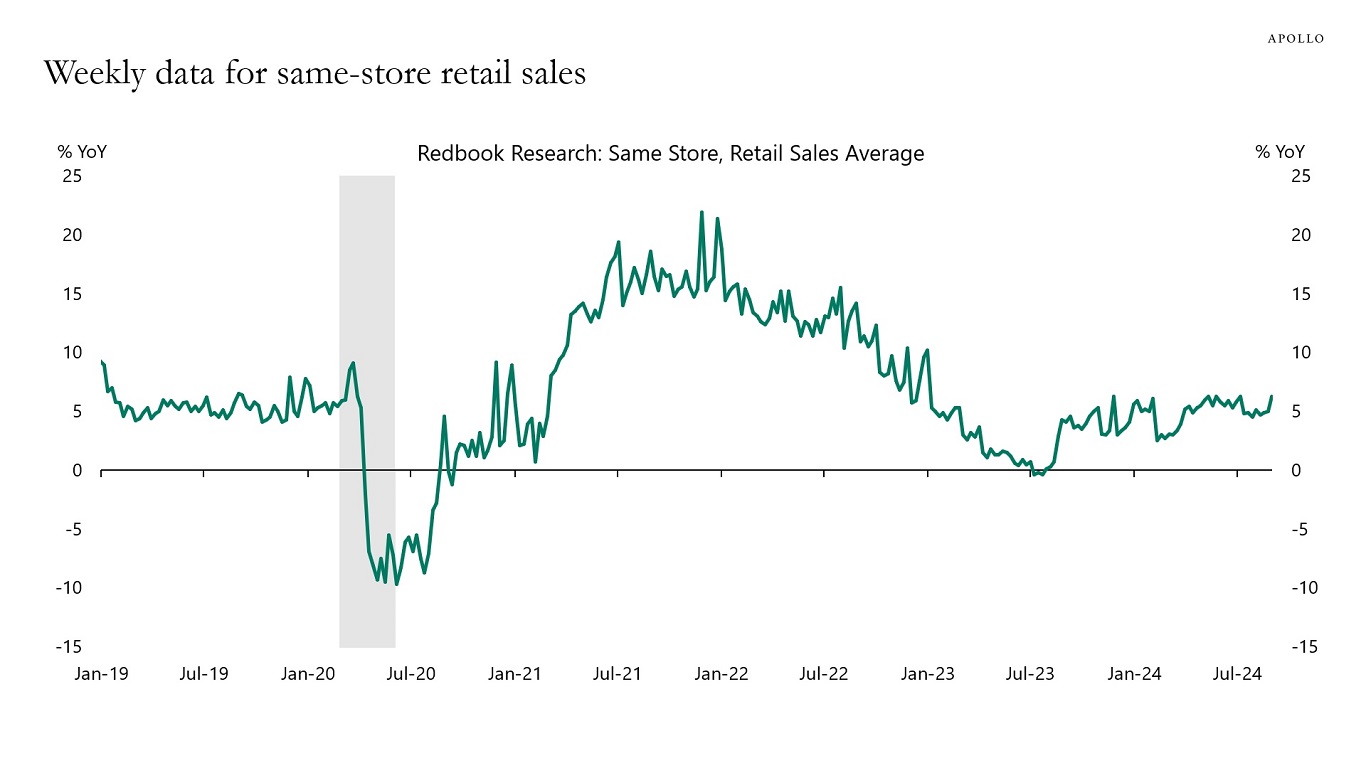

4. Weekly data for retail sales went up last week and remains solid, see chart 8.

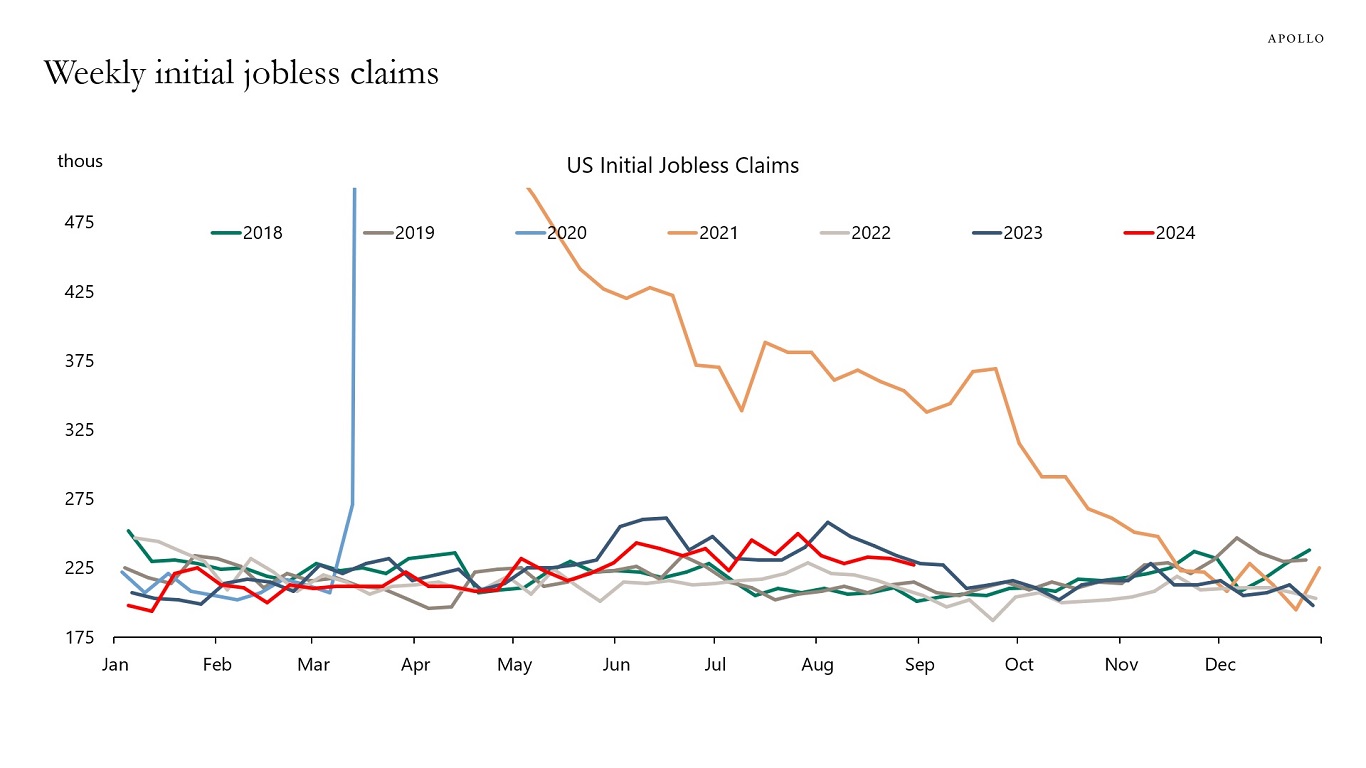

5. Jobless claims have declined for several weeks, see chart 9.

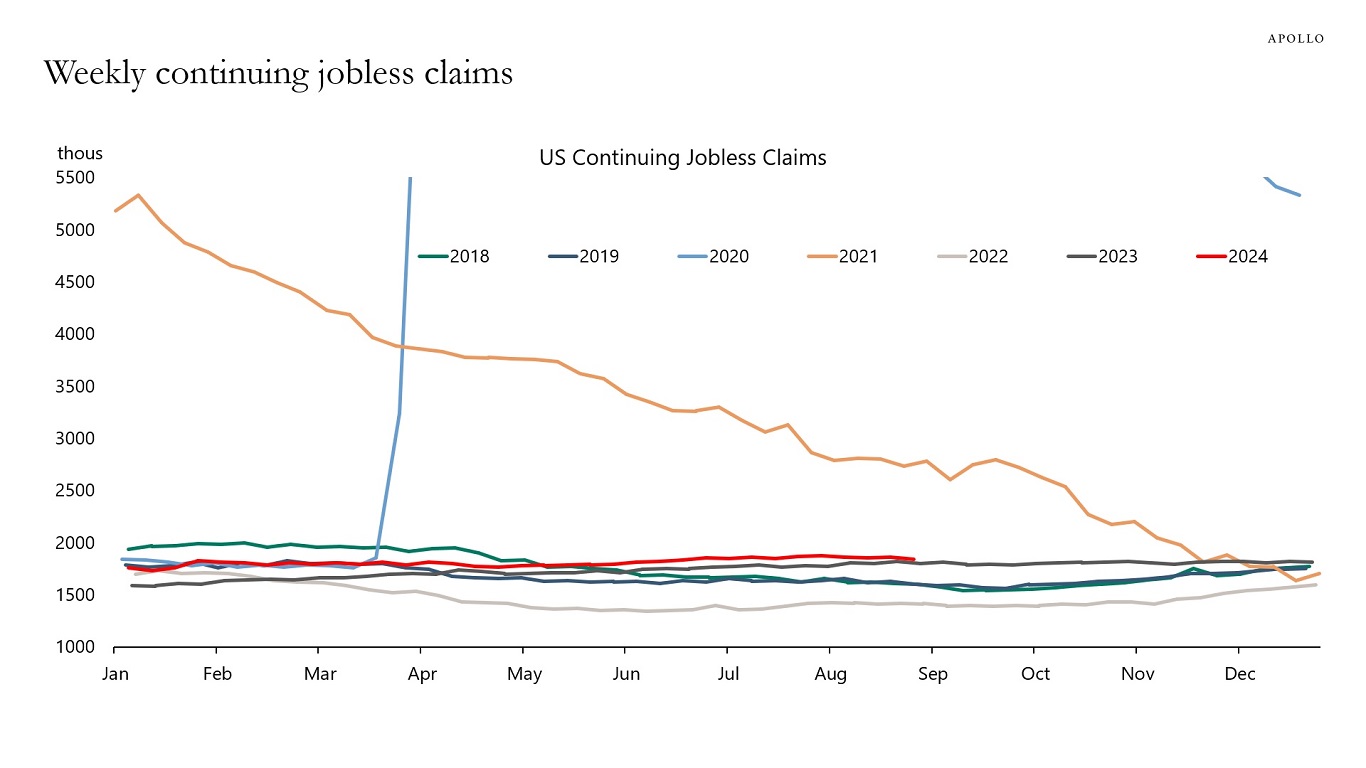

6. Continuing claims have declined for several weeks, see chart 10.

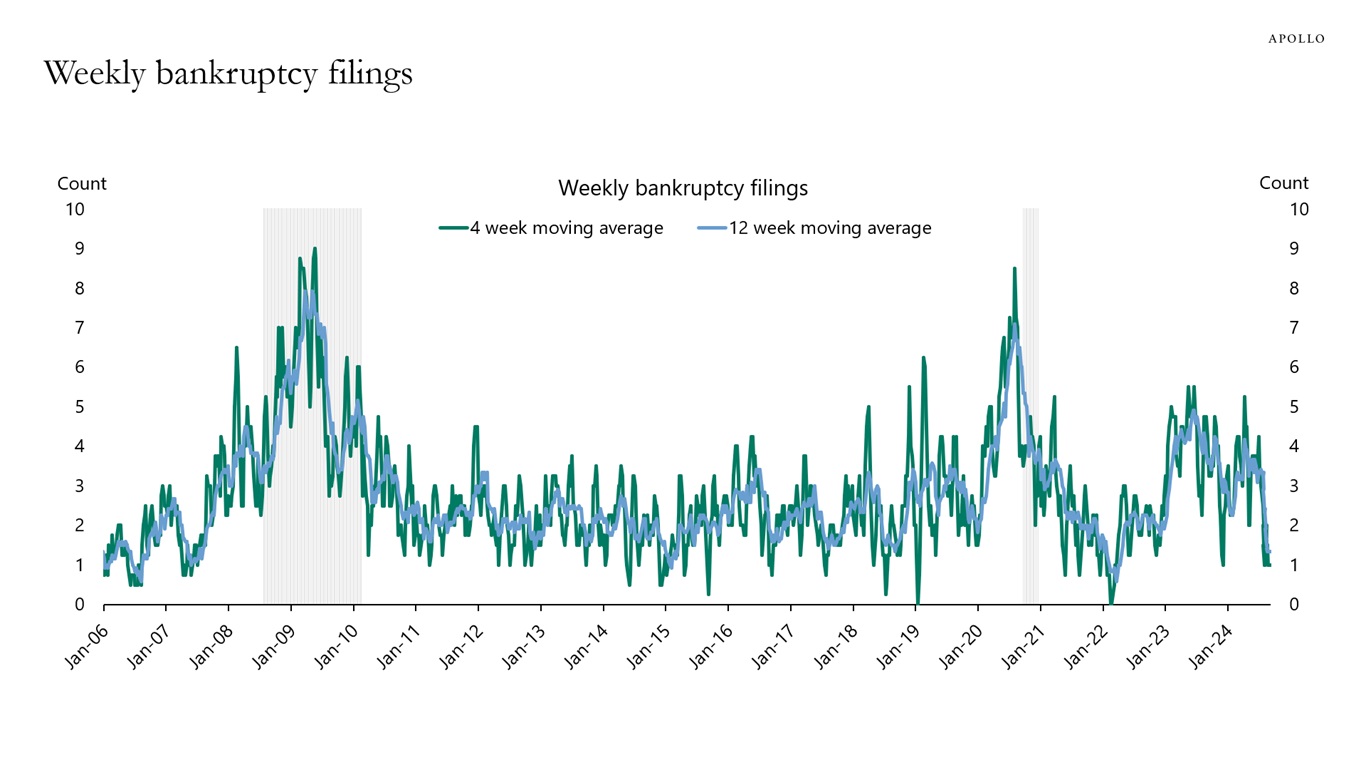

7. Default rates and weekly bankruptcy filings are trending down, see chart 11.

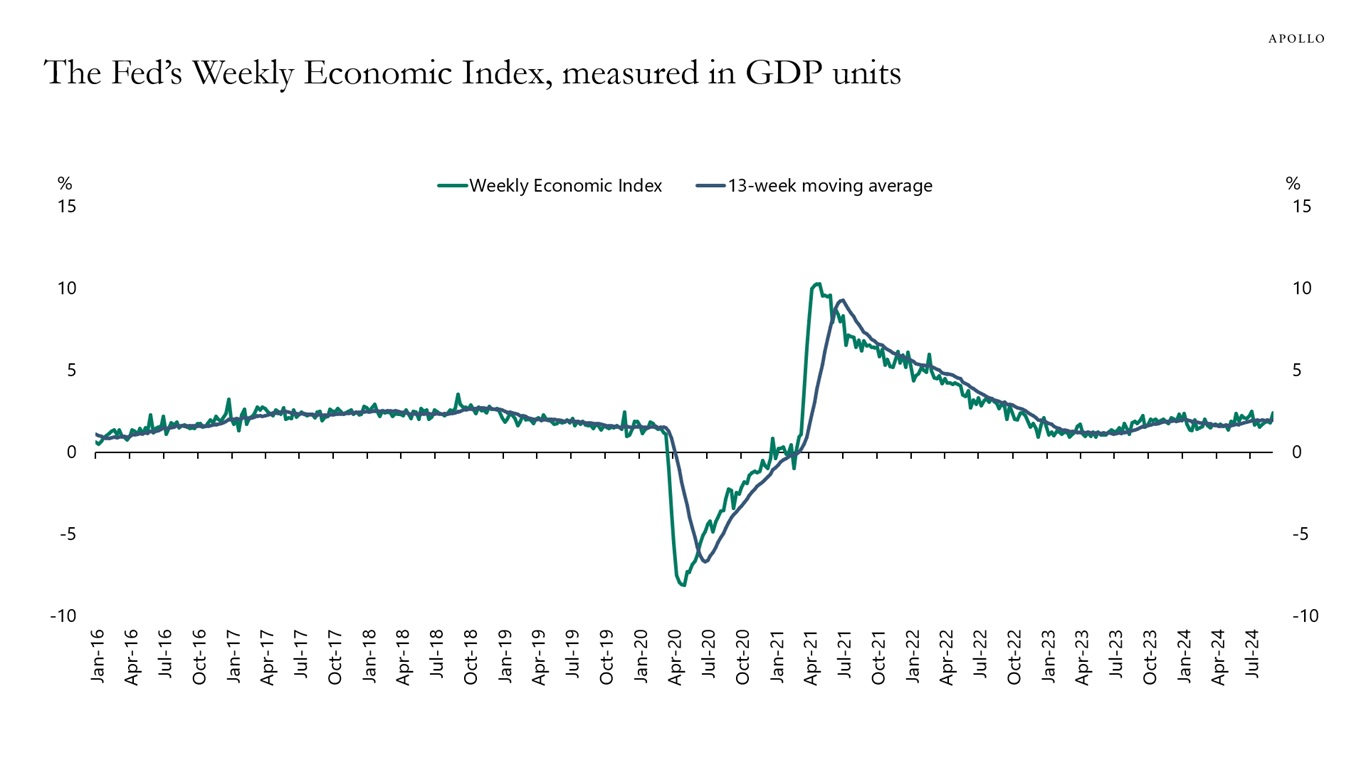

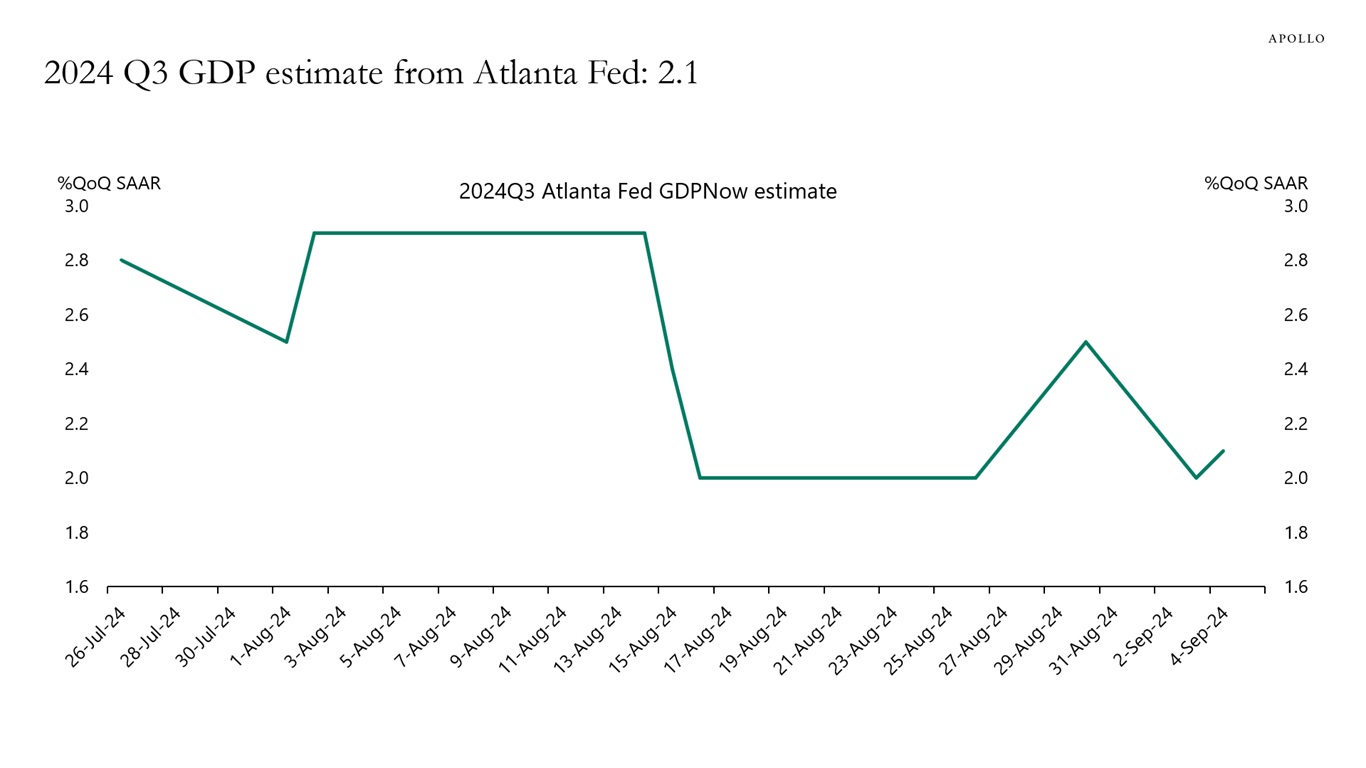

8. The Fed’s weekly GDP model suggests GDP is 2.4% and the Atlanta Fed GDP Now says GDP this quarter will be 2.1%, see charts 12 and 13.

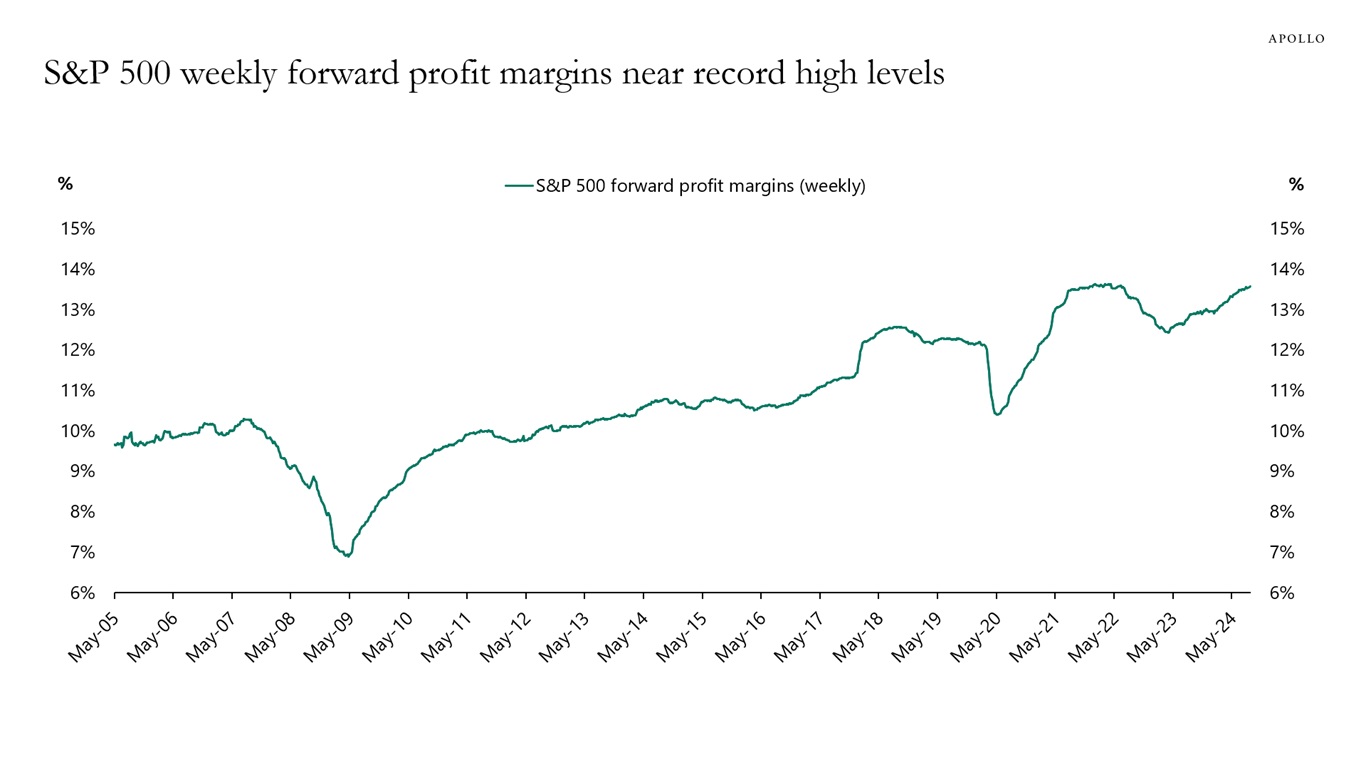

9. Weekly data for S&P 500 forward profit margins shows that profit margins are near all-time high levels, see chart 14.

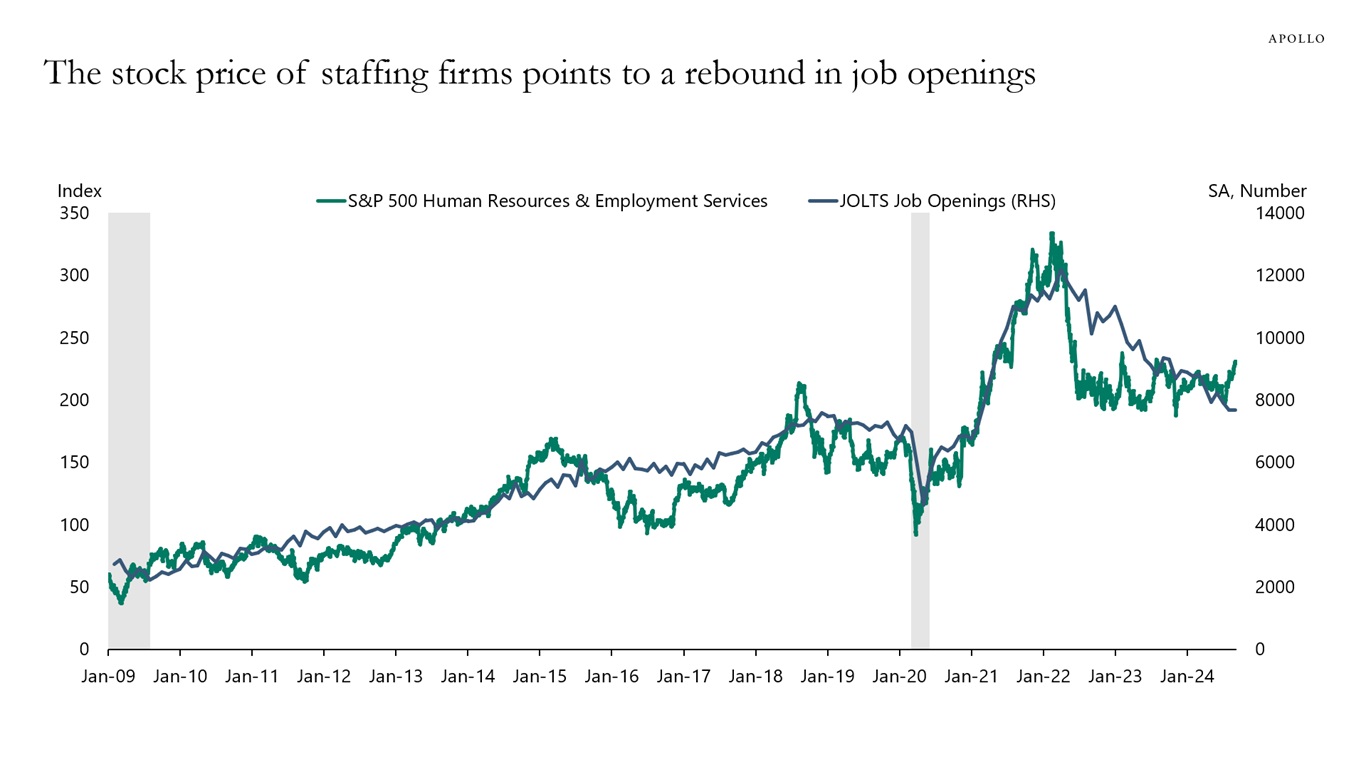

10. The stock price of staffing firms is rebounding, which suggests that we could get a rebound in job openings, see chart 15.

The bottom line is that the US economy is not in a recession, and there are no signs of a recession on the horizon. Our chart book with daily and weekly data is available here.