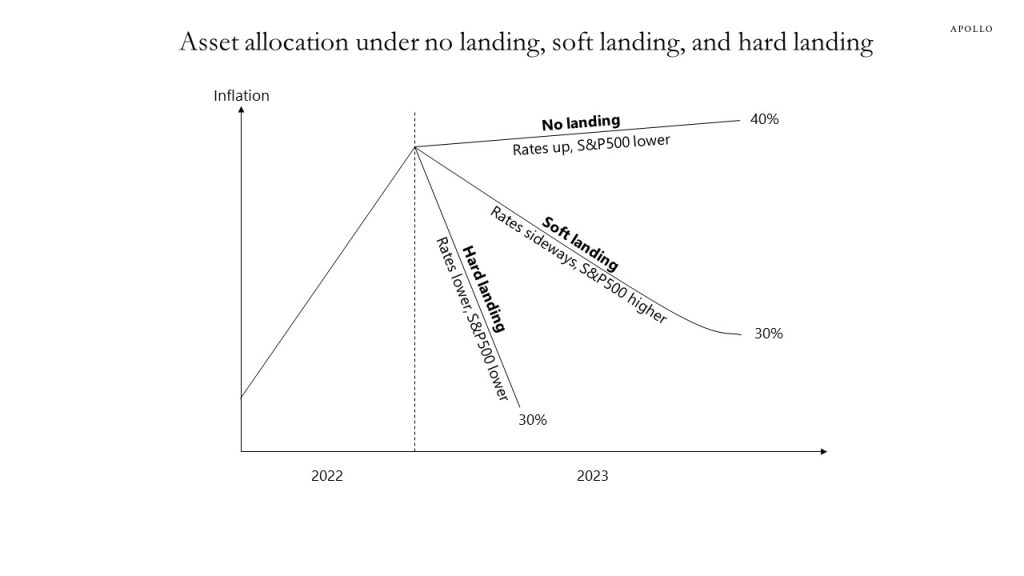

The asset allocation implications of no landing, soft landing, and hard landing are very different, see chart below.

Under the no landing scenario, the economy will remain strong and the Fed will hike rates faster. A higher discount rate and the Fed stepping harder on the brakes to tighten financial conditions will be negative for equities.

Under the soft landing scenario, inflation comes down to 2% by the end of 2023, rates move sideways because there is no need for the Fed to raise rates when inflation is coming back to 2%, and equities will move higher.

Under the hard landing scenario, the economy enters a recession, which means a significant decline in earnings and growth, which pushes rates lower and equities lower.

The bottom line is that the investment implications for equity and bond markets are very different depending on which scenario we are in, and at the moment, it is clear that we are firmly in the no landing scenario.

Once the Fed has raised interest rates enough to get inflation under control we will find out if we are transitioning to a soft or hard landing. It could be that we have to wait until 2024 before we find out what comes after no landing.

Investors today can decide to say: “But we will get a hard landing,” or “We will get a soft landing”. But if that view turns out to be wrong, it will be costly for performance.

In short, with the economy still strong and inflation still high, it is too early for asset allocation to be positioned for a soft landing or a hard landing. For now, investors should be positioned for no landing.