Something very unusual happened in financial markets yesterday. Long-term interest rates went up 20 basis points despite stocks going down. One potential reason for the move higher in rates is an unwind of the basis trade.

The basis is the difference in price between a Treasury security and a Treasury futures contract with similar characteristics.

The source of this price difference is demand and supply imbalances in Treasury markets, or arbitrage limitations for regulatory reasons.

In the basis trade, hedge funds put on leveraged bets, sometimes up to 100 times, with the goal of profiting from the convergence between the futures price and the bond price, as the futures contract approaches expiry.

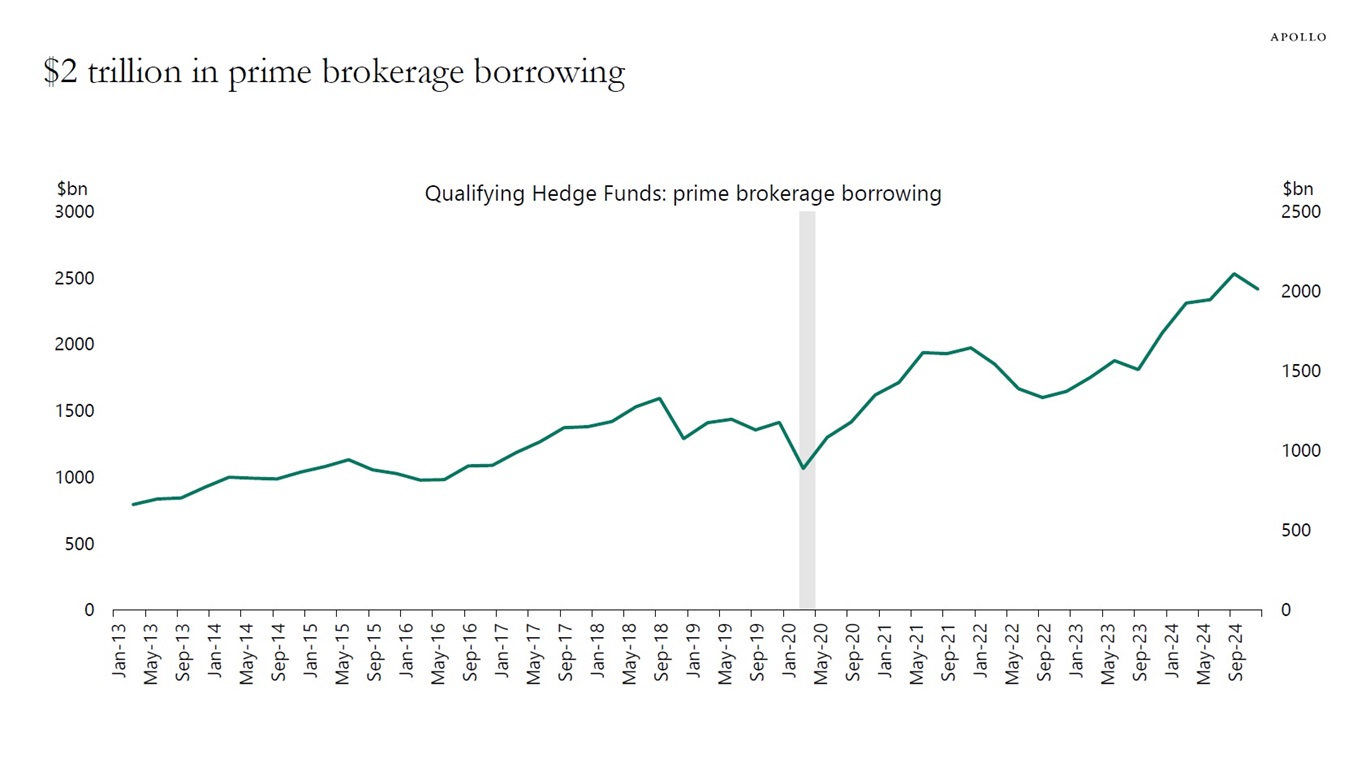

How big is the basis trade? It is currently around $800 billion and an important part of the $2 trillion outstanding in prime brokerage balances. It will continue to expand as US government debt levels continue to grow, see charts below.

Why is this a problem? Because the cash-futures basis trade is a potential source of instability. In case of an exogenous shock, the highly leveraged long positions in cash Treasury securities by hedge funds are at risk of being rapidly unwound. Such an unwind would have to be absorbed, in the short run, by a broker-dealer that itself is capital-constrained. This could lead to a significant disruption in market functions of broker-dealer firms, such as providing liquidity to the secondary market for Treasuries and intermediating the market for repo borrowing and lending. For example, during Covid, the Fed was at the peak buying $100 billion in Treasuries every day.

In addition, if the supply of Treasuries grows further, for example, because of a growing budget deficit or the Fed doing quantitative tightening, it will potentially depress Treasury prices, hurting the long leg of the trade, and stress repo funding, as dealers have limited balance sheet capacity.

The bottom line is that the large and growing cash-futures basis trade, driven by leveraged hedge fund positions in Treasuries, poses a risk due to potential market disruptions and liquidity issues, especially in the event of an exogenous shock or increasing Treasury supply.