The US dollar is the global reserve currency because America is the most dynamic economy in the world, and the US provides stability and security. As a result, there is upward pressure on the US dollar because everyone wants to own the world’s safest asset.

This safe-haven upward pressure on the dollar overwhelms the negative impact on the dollar coming from the US current account deficit.

With safe asset flows putting constant upward pressure on the dollar, there is a need for a deal—a Mar-a-Lago Accord—to put downward pressure on the US dollar to increase US exports and bring manufacturing jobs back to the US.

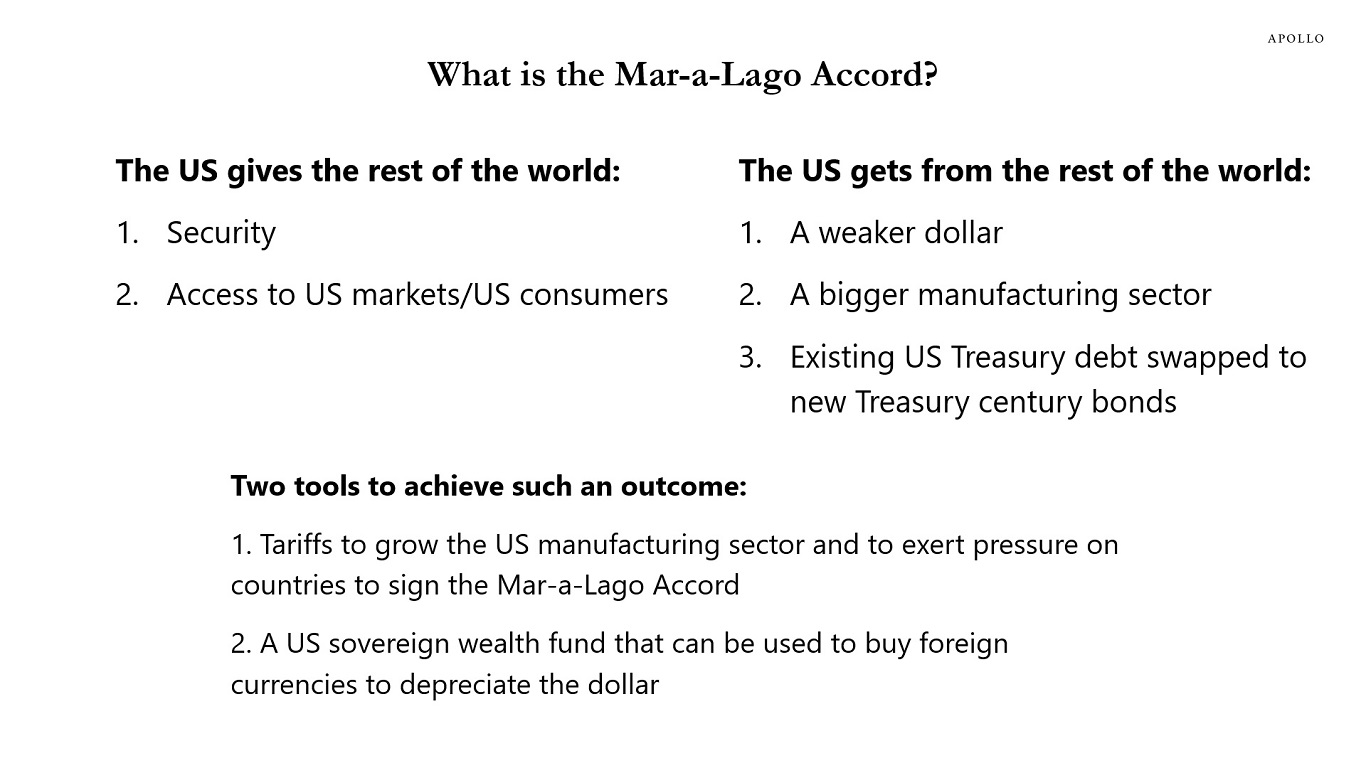

The Mar-a-Largo Accord is the idea that the US will give the G7, the Middle East, and Latin America security and access to US markets, and in return, these countries agree to intervene to depreciate the US dollar, grow the size of the US manufacturing sector, and solve the US fiscal debt problems by swapping existing US government debt with new US Treasury century bonds.

In short, the idea is that the US provides the world with security, and in return, the rest of the world helps push the dollar down in order to grow the US manufacturing sector.

There are two instruments for the US to achieve this goal. The first tool is tariffs, which also have the benefit that tariffs raise the tax revenue for the US government. The second tool is a sovereign wealth fund to likely accumulate foreign currencies such as EUR, JPY, and RMB to intervene in FX markets to help put additional downward pressure on the US dollar.

For markets, this raises three questions:

1) The changes that are required to existing US manufacturing production, including eliminating Canada and Mexico from all auto supply chains, will take many years. Can the US achieve the long-term gain without too much short-term pain?

2) Globalization has for decades put downward pressure on US inflation. Will a more segmented global economy with a much bigger manufacturing sector in the US put too much upward pressure on US inflation, given the higher wage costs in the US than in many other countries?

3) With tariffs being implemented, the rest of the world may over time begin to decrease its reliance on US markets and also increase their own defense spending. Under such a scenario, what are the incentives for the rest of the world to sign a Mar-a-Lago Accord?