The Fed is in the process of cooling the economy down. The whole idea with raising interest rates is for us to buy fewer cars, spend less on our credit cards, and to build fewer factories.

The Fed’s ultimate goal is to get inflation back to their 2% inflation target. But with core PCE inflation currently at 3.9%, we are not there yet.

The desired slowing of the economy could come this Friday when we get the employment report for September.

The consensus expects 165,000 jobs in September, which is down from 400,000 jobs a year ago and 600,000 when the Fed started raising rates in March 2022.

What will happen in credit markets over the coming months once nonfarm payrolls finally move below the level consistent with population growth, namely, 100,000 jobs created each month?

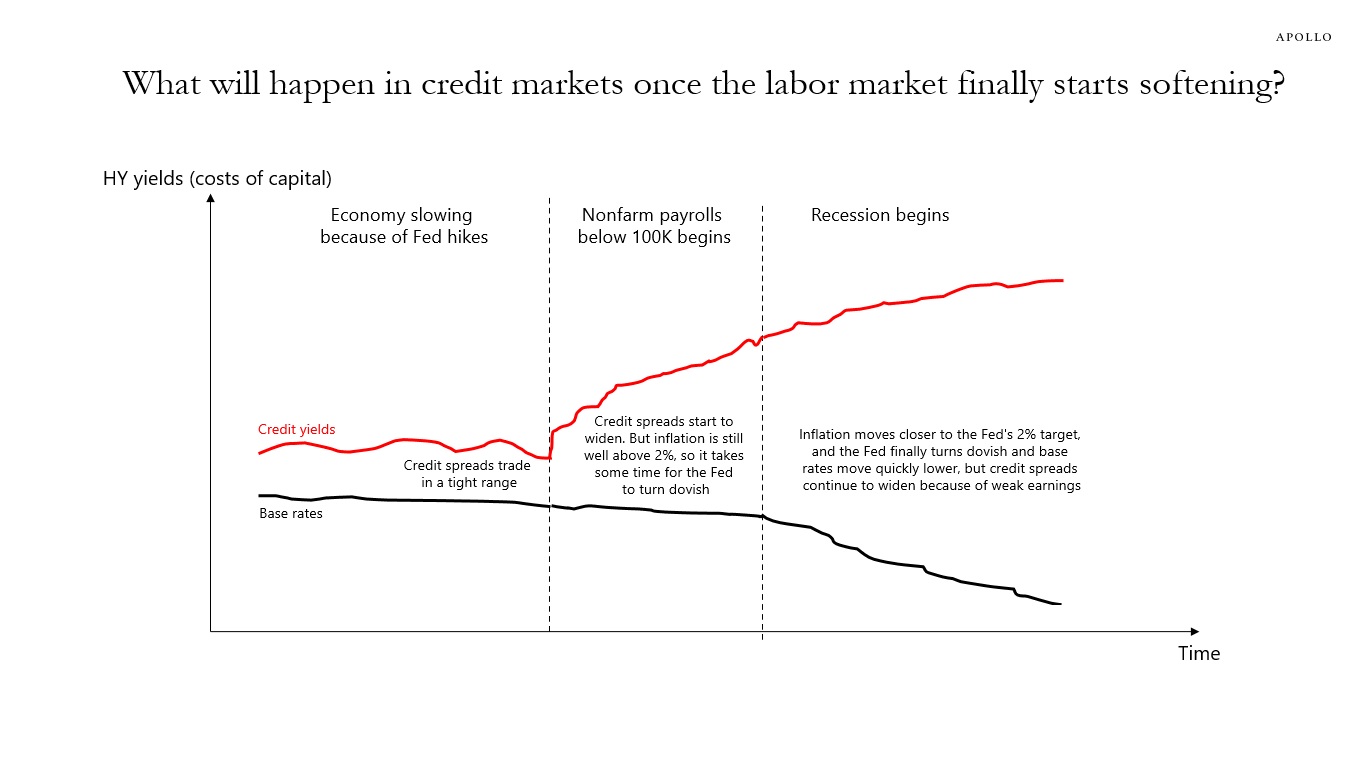

Once nonfarm payrolls start moving below 100,000, credit spreads will widen because investors will take it as a sign that corporate earnings are about to slow down, see illustration below.

But with core PCE inflation at 3.9%, the Fed cannot turn dovish because it will look like the Fed no longer cares about inflation, which raises the risk of inflation expectations becoming unanchored. As a result, the Fed will continue to be hawkish even as the unemployment rate starts moving higher.

Once the recession finally begins, the Fed can turn dovish and start to lower base rates. But the costs of capital will not decline because at that time corporate earnings will be slowing, and therefore, credit spreads will likely be widening further.

The bottom line is that even if we get weak data and the Fed, after a few soft prints in nonfarm payrolls, starts turning dovish, the costs of capital will move higher. In short, the Fed controls the base rate but doesn’t control credit spreads, and that is the reason why a soft landing is unlikely.