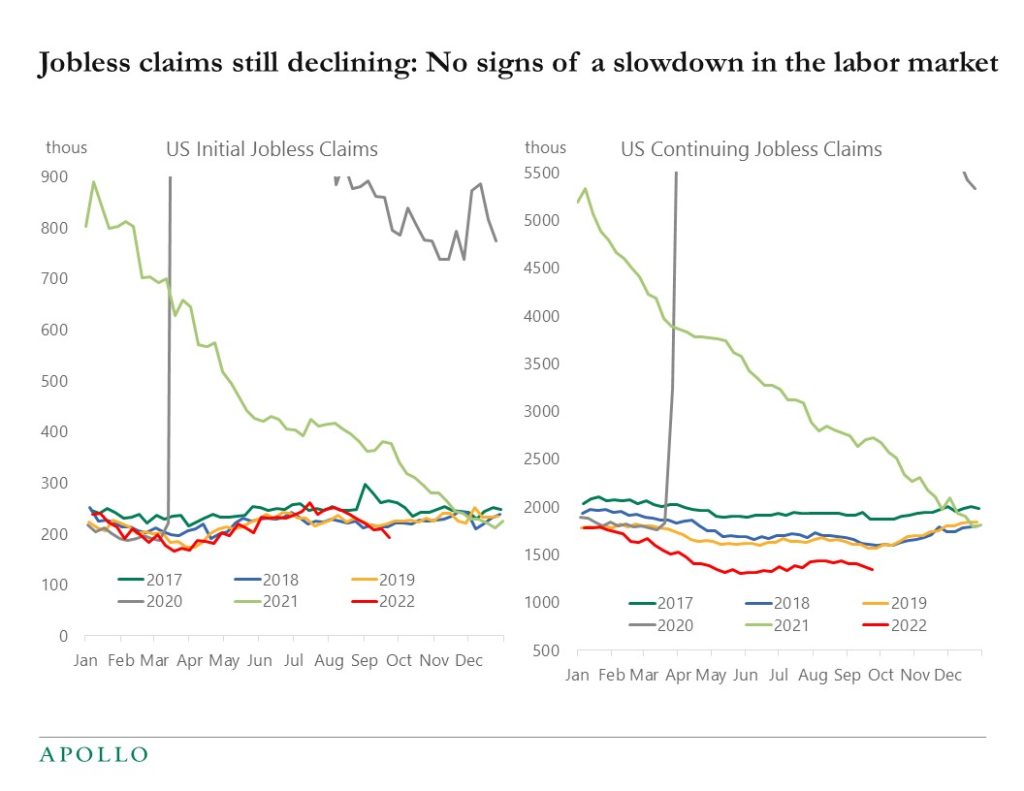

The Fed is not going to pivot anytime soon because if the Fed pivots to dovish with inflation at 8%, it will push up inflation even more. The FOMC wants to lower inflation from 8% to 2%, and it has to happen through a tightening of financial conditions via higher rates, wider credit spreads, and lower equities. Our latest credit market outlook is attached.

It should not be assumed that investments made in the future will be profitable or will equal the performance of the investments shown in this document.