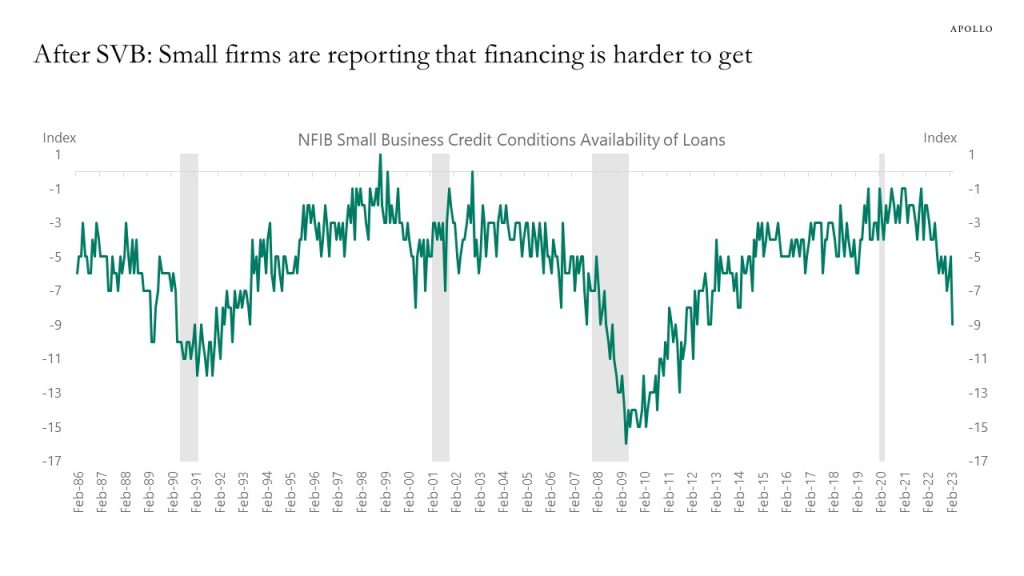

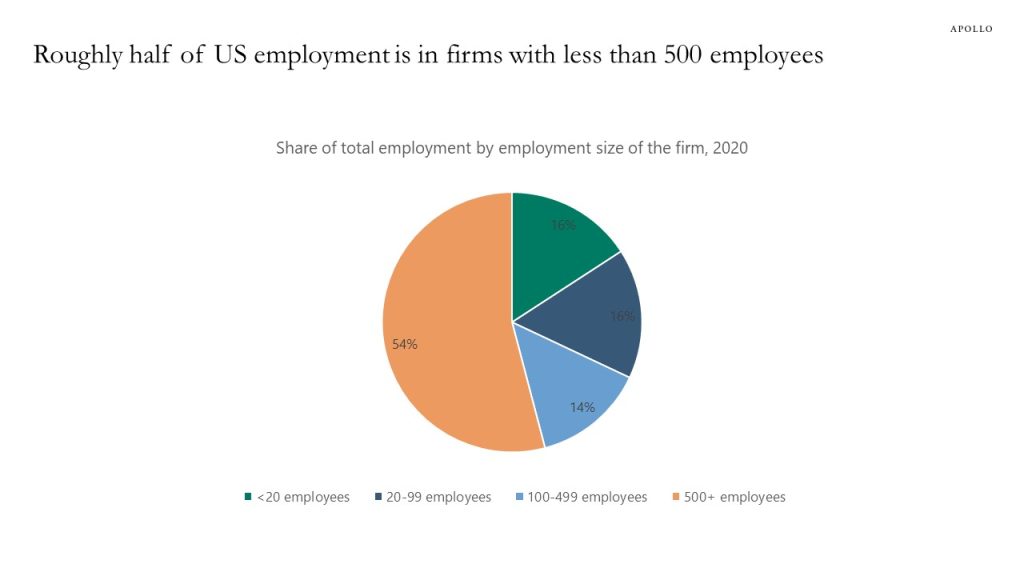

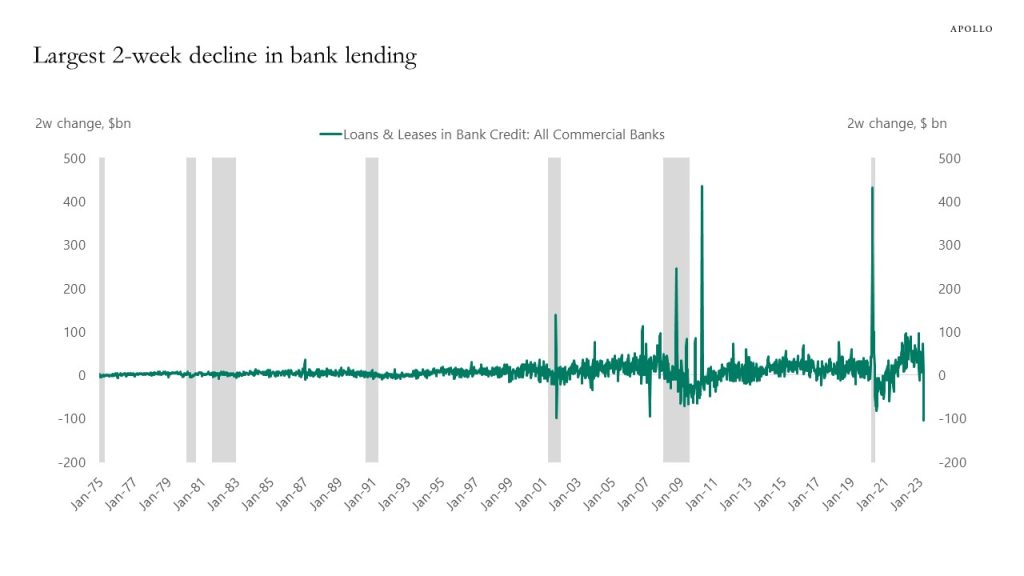

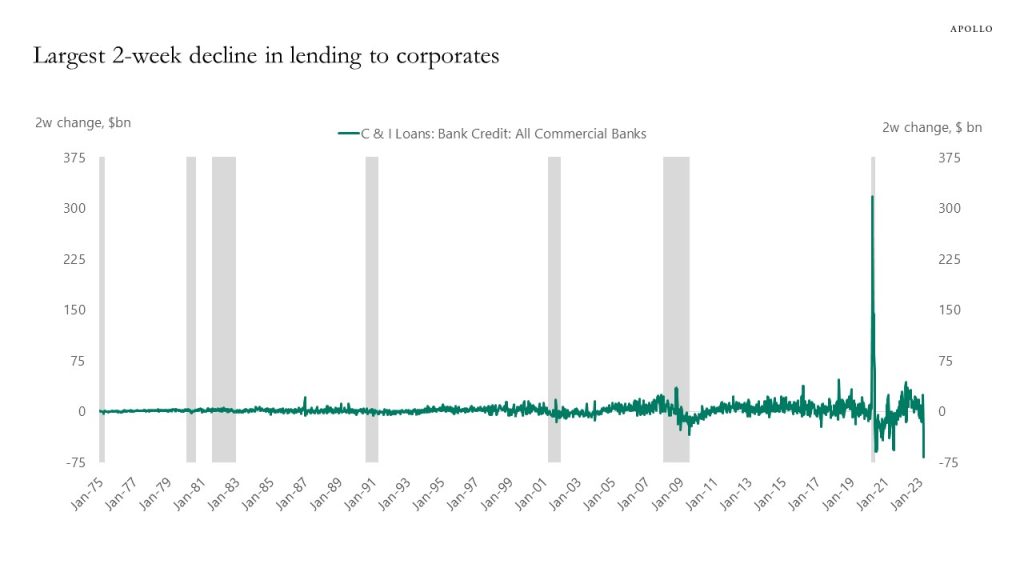

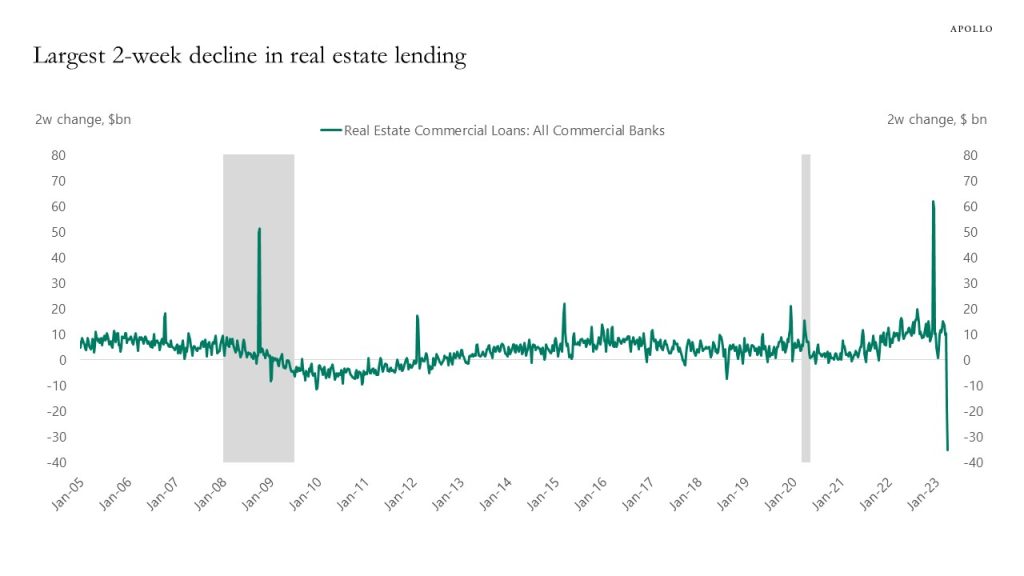

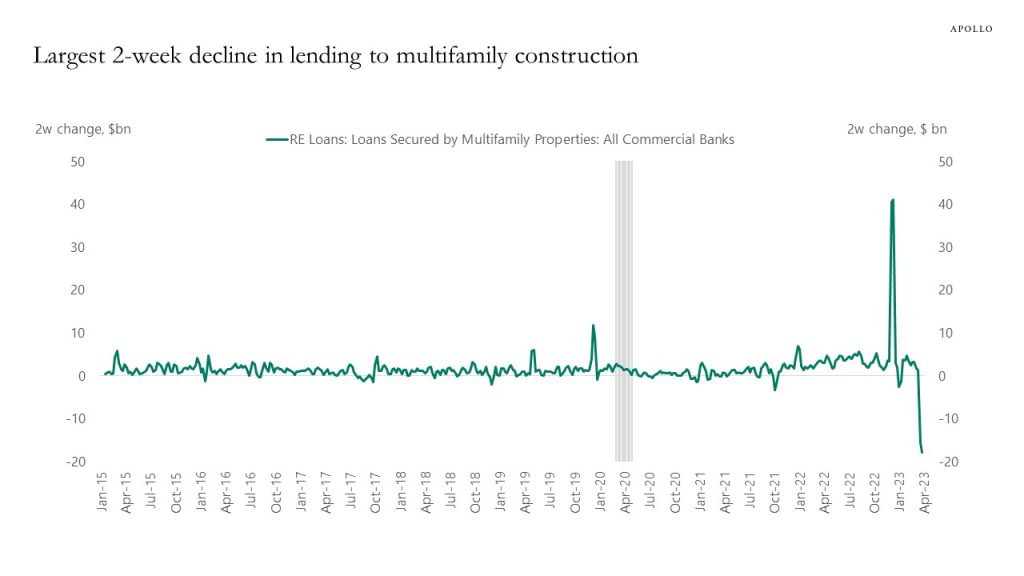

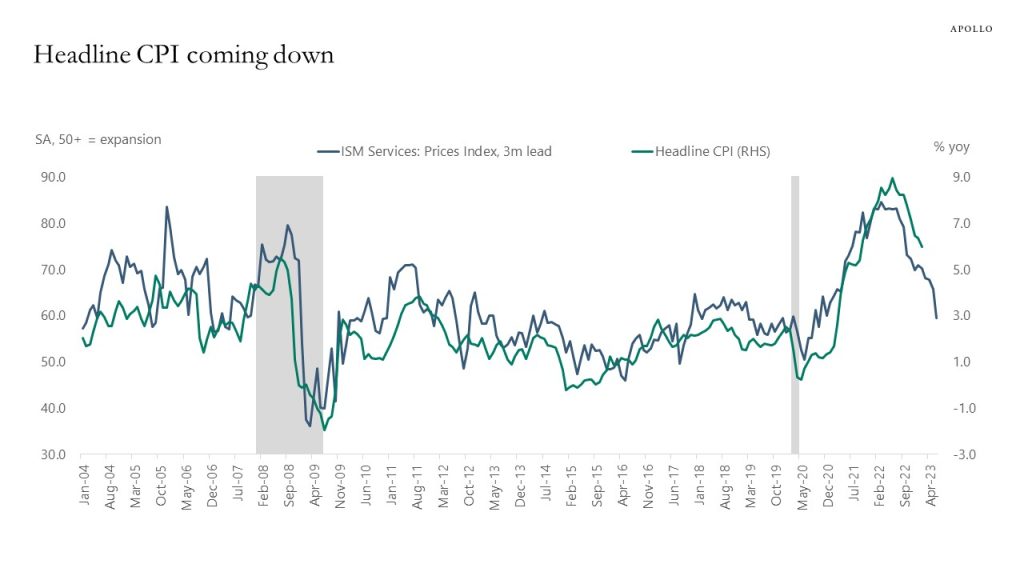

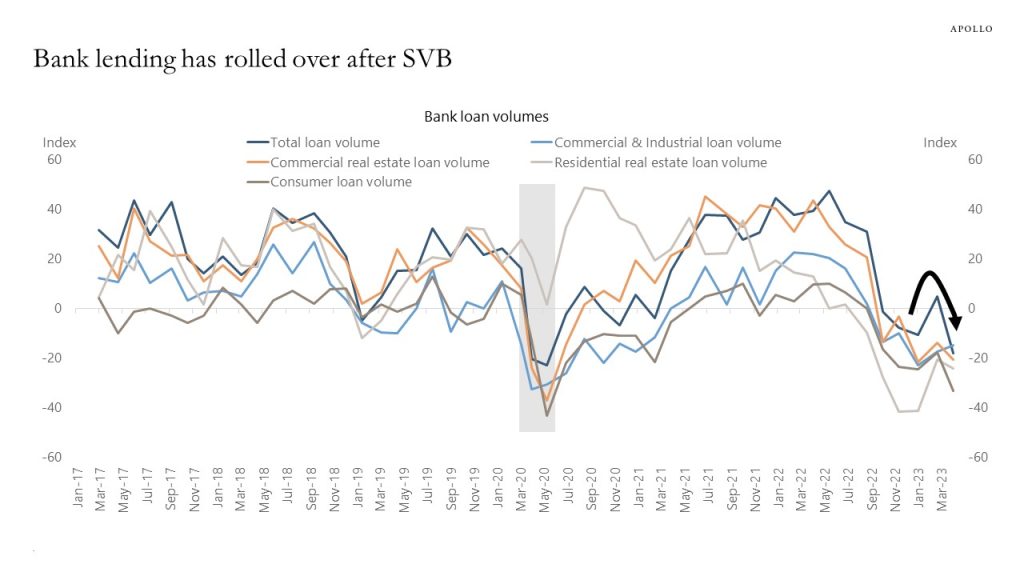

Credit conditions have tightened significantly for small businesses after SVB failed, and firms with less than 500 employees account for almost 50% of total employment in the US economy, see charts below. Small businesses borrow from small banks, and it is getting more difficult to argue that the banking crisis is not having a negative impact on the economy.