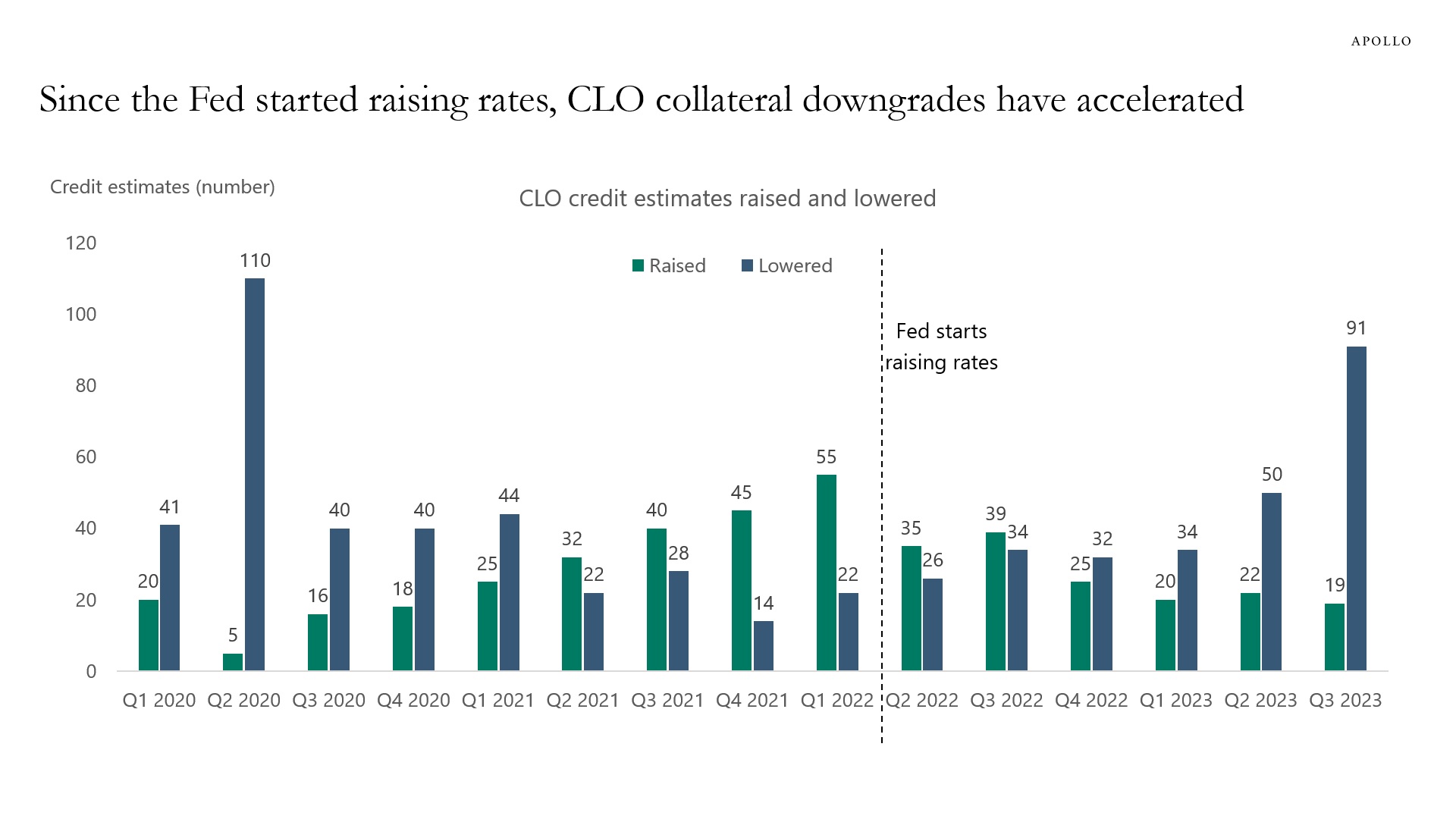

Fed hikes are having a more and more negative impact on companies with higher leverage, lower coverage ratios, and weaker cash flows. Specifically, the latest data for the third quarter shows that downgrades by S&P of CLO collateral have surpassed upgrades by a ratio of 4:1, see the first chart below.

The bottom line is that Fed policy is working exactly as the textbook would have predicted. Higher rates are biting harder and harder on middle-market corporates with poor credit metrics.

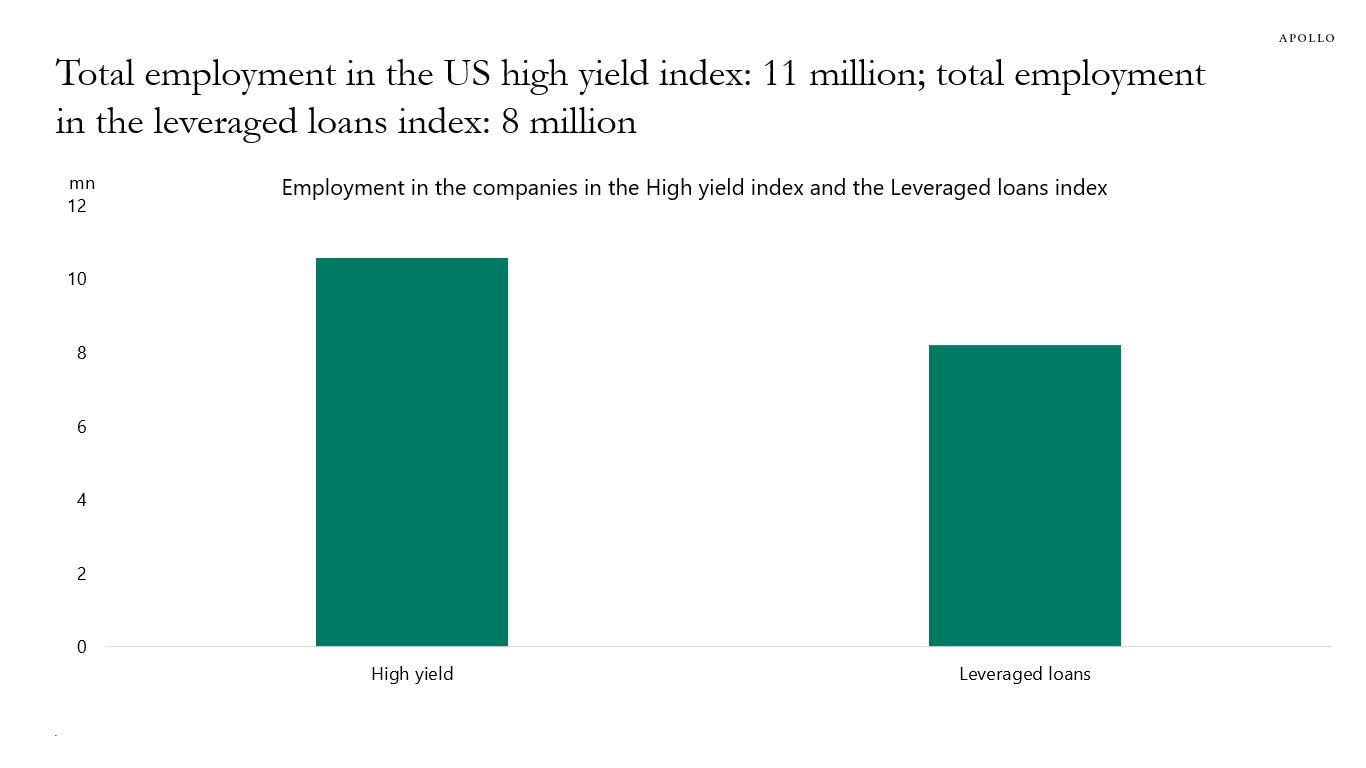

With total employment in high yield-issuing companies at 11 million and total employment in loan-issuing companies at 8 million, higher rates will ultimately have a negative impact on employment, see the second chart.