Want it delivered daily to your inbox?

-

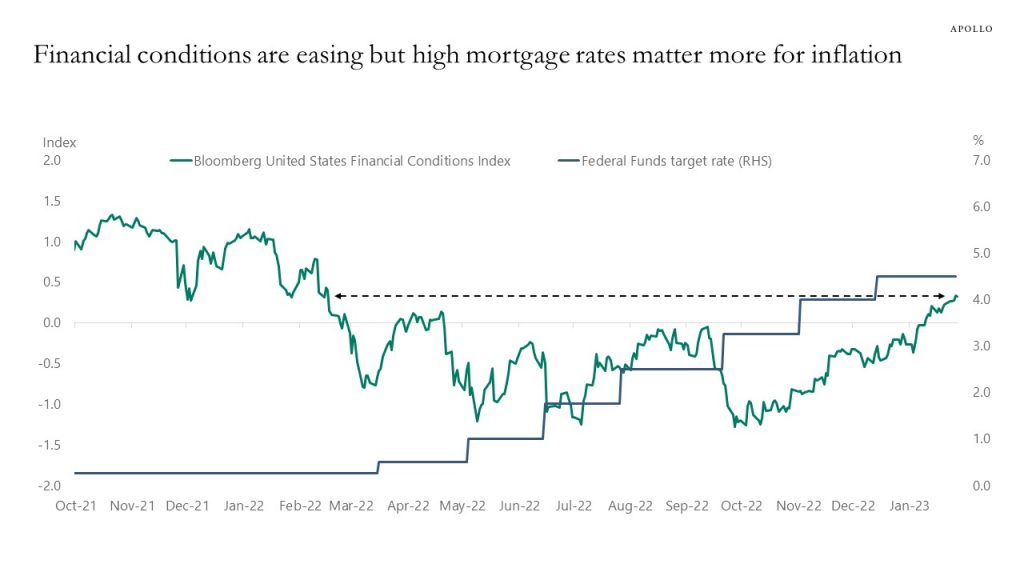

Financial conditions have eased to levels seen before the Fed started raising rates, but the Fed is not going to worry much about the ongoing rise in the S&P500 and tightening of credit spreads because what matters for the inflation outlook is the mortgage rate, which continues to put downward pressure on housing inflation, see charts below.

Bloomberg, Apollo Chief Economist

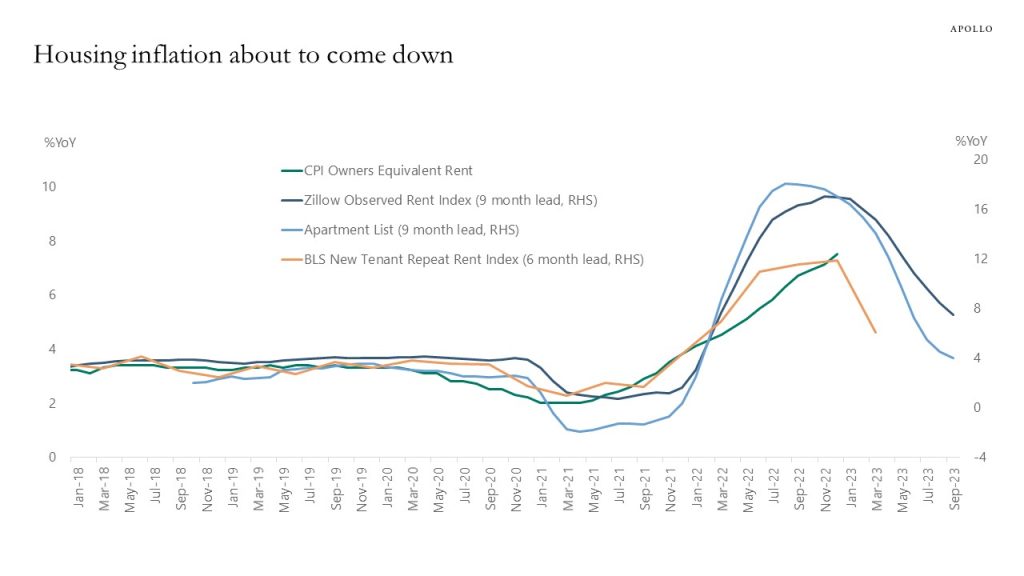

Zillow, BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

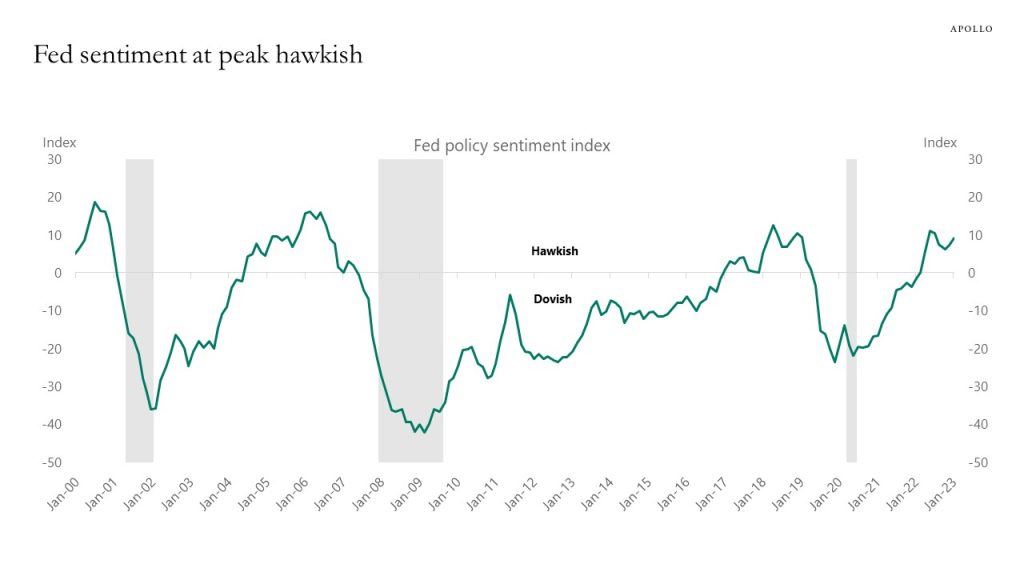

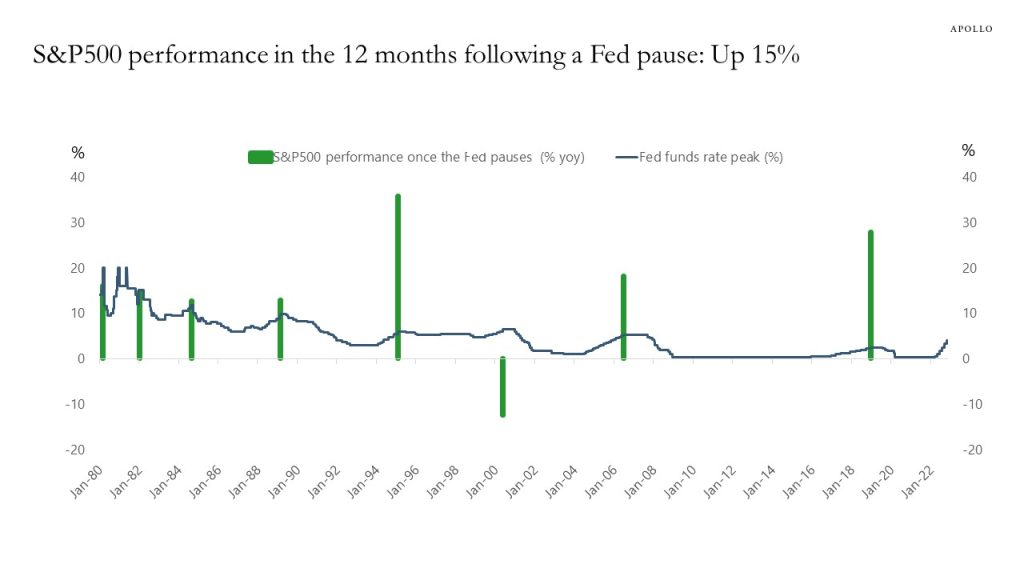

Running the Fed minutes through a natural language processing model shows that Fed sentiment is currently at peak hawkish at levels last seen in 2019, 2006, and 2000, see the first chart below. With inflation trending lower and growth slowing, we should expect the Fed to turn more dovish after their meeting on Wednesday. And a Fed pause is good for credit and equities because then markets know that we are at the end of the rate hiking cycle, see the second chart.

Source: Bloomberg (ticker BIFIFEDM), Apollo Chief Economist. Note: Methodology: Bloomberg’s Federal Reserve natural language processing model calculates a score for the opening statement of the FOMC meeting starting in April 2011. The model uses a neural network to predict the dovishness vs. hawkishness of a sentence. Weights are applied for more or less participant consensus (e.g. “some participants” vs “all participants”). The final score is a weighted ratio of dovish vs. hawkish sentences. Positive scores are hawkish and negative scores are dovish.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

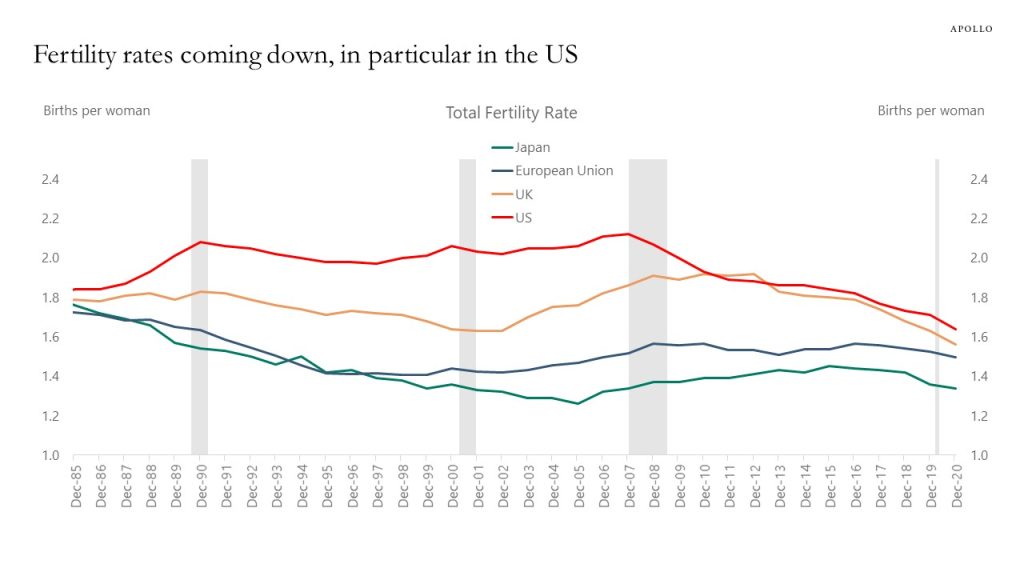

Since the financial crisis in 2008, the fertility rate has declined more in the US than in other countries, see chart below and here. Lower population growth leads to secular stagnation, and it has significant consequences for the level of interest rates, Fed behavior, and expected returns for investors, see also here and here.

Source: World Bank, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

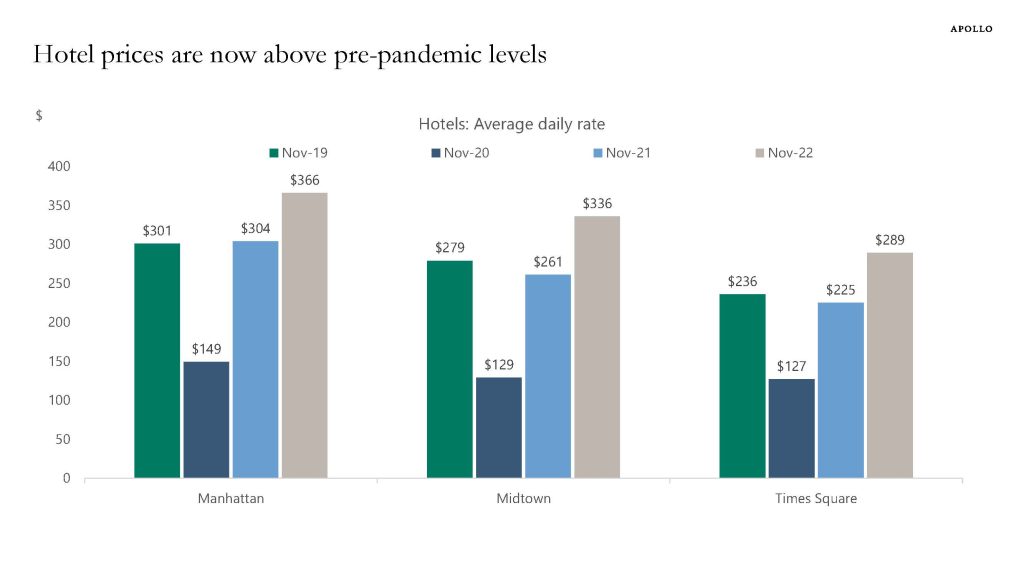

The chart below shows the price of staying at a hotel in Manhattan, Midtown, and Times Square, and the average daily rate is now above its pre-pandemic level. Looking across a broad range of daily and weekly indictors the consumer is still doing fine. The interest rate-sensitive components of GDP are softer, but the overall picture continues to look like a soft landing, see also our chart book here.

Source: Timessquarenyc.org, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

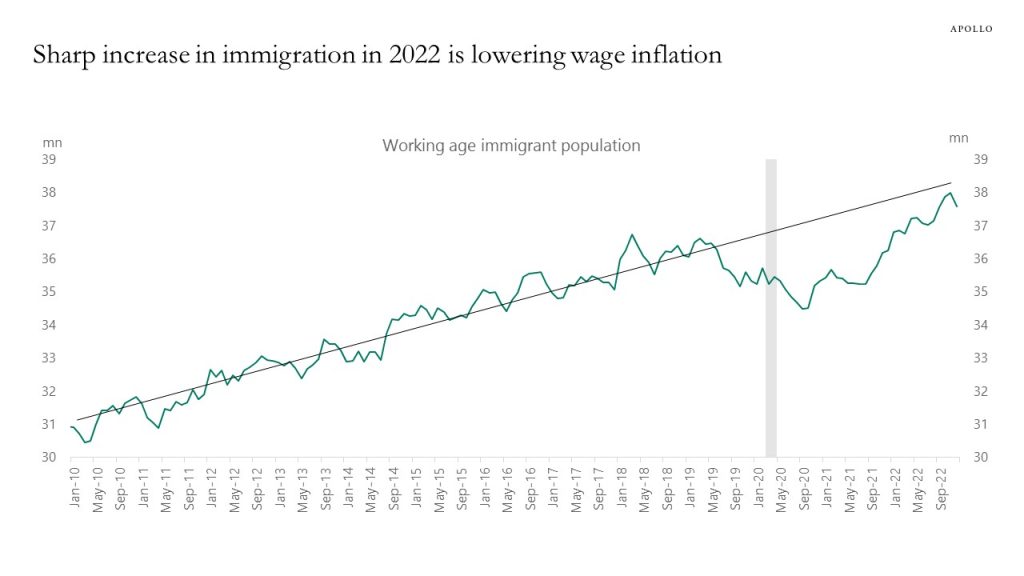

I will be on CNBC today at 1pm with Kelly Evans to discuss the outlook for the Fed and markets, and one key issue is the overheated labor market and the outlook for wage inflation.

Immigration declined during Covid, contributing to significant labor shortages and high wage inflation across many industries.

But over the past 12 months, immigration has increased significantly, and the working age immigrant population is returning to its pre-pandemic trend, see chart below.

This ongoing increase in immigration is the reason why wage inflation continues to come down from the significantly elevated levels we saw during the pandemic.

This is good news for the Fed and markets because a less overheated labor market will accelerate inflation’s return to the Fed’s 2% target.

Source: BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

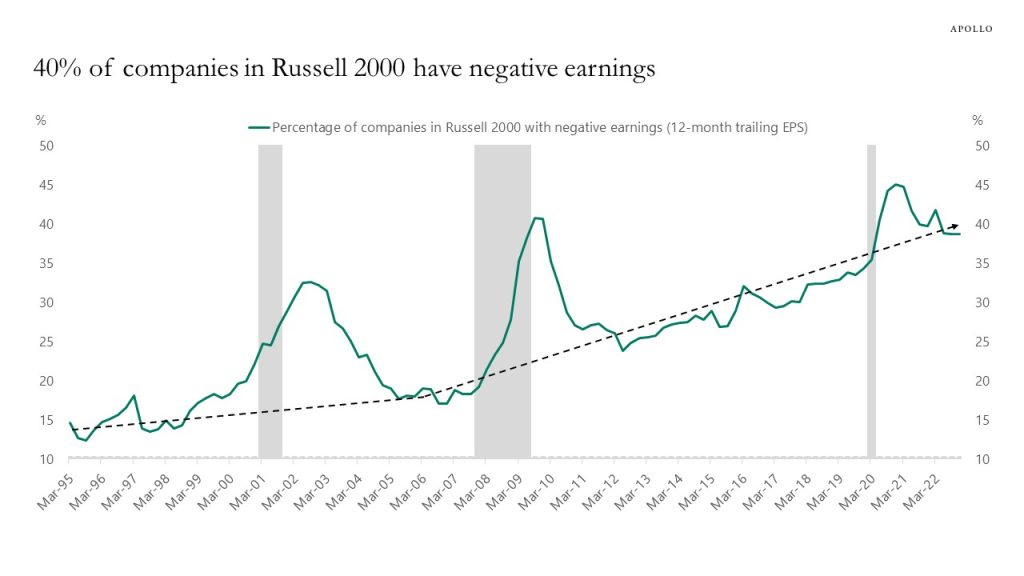

In the 1990s, 15% of companies in the Russell 2000 had negative 12-month trailing EPS. Today that share is 40%, see chart below.

As the chart shows, during recessions, the share of unprofitable firms rises. This is not surprising.

But if the underlying uptrend continues, more than 50% of firms in the index will have negative earnings by the end of this decade.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

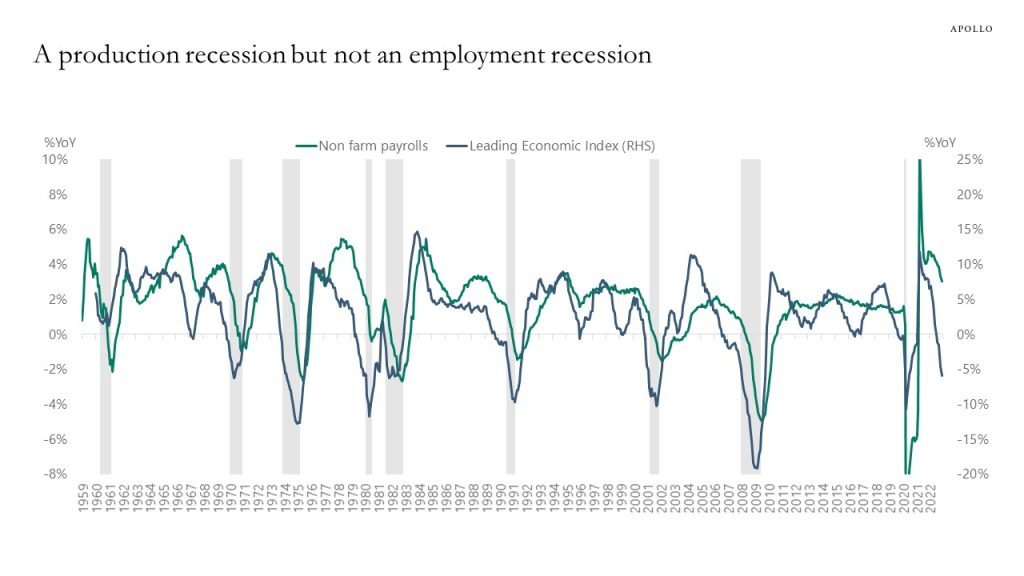

Companies are hoarding labor because during the pandemic they laid off many workers, and firms have since had significant difficulties hiring workers back again.

With this experience in mind, employers are reluctant to let workers go. And with margins near all-time highs, there is room to hold on to workers. That is why jobless claims keep falling, and the unemployment rate remains at its lowest level in more than 50 years.

This labor hoarding effect can be seen in many sectors of the economy, even in the construction sector. There are some layoffs in tech, but even tech firms must be wondering what the right staffing levels are.

The bottom line for markets is that labor hoarding combined with high margins is a crucial reason this is likely to be a soft landing. In other words, we are in a production recession but not an employment recession, see chart below.

With inflation soon back near the Fed’s target, the Fed can over the coming months, again focus on consumer spending, capex spending, and earnings. Instead of focusing entirely on too high inflation.

In short, if the economy enters a mild recession later this year as the consensus expects, the Fed will have room to respond because, by that time, inflation will no longer be a problem.

Source: BLS, Conference Board, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

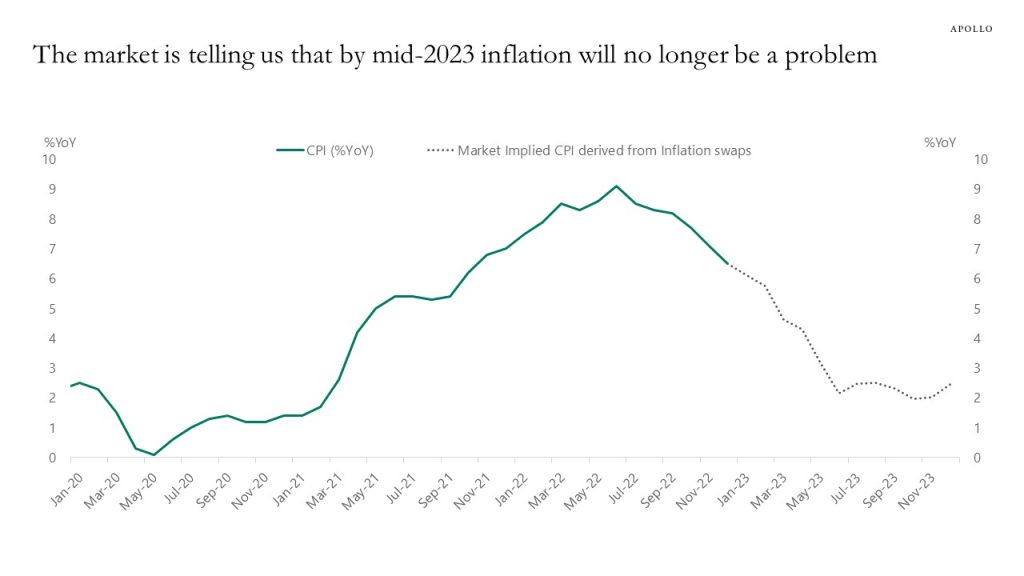

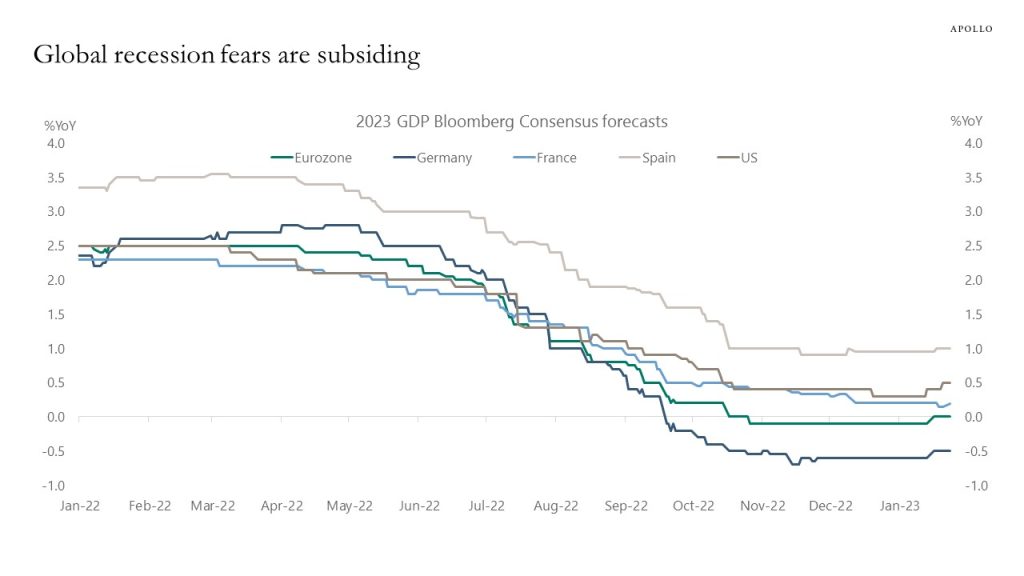

Recession fears are subsiding, and inflation swaps are pricing that inflation will be at the FOMC’s 2% target in July, see charts below. This has very significant implications for markets.

Most importantly, with inflation back at 2% within a few months, the Fed will soon stop being so hawkish. In other words, the market is telling us that the soft landing will be accomplished over the coming six months. And, if inflation in six months is no longer a problem, then the Fed put is coming back. Because then the Fed will again have the flexibility to focus on unemployment, growth, and earnings instead of focusing entirely on too high inflation.

This is all good news for credit, equity, and capital markets.

Source: DTCC, Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

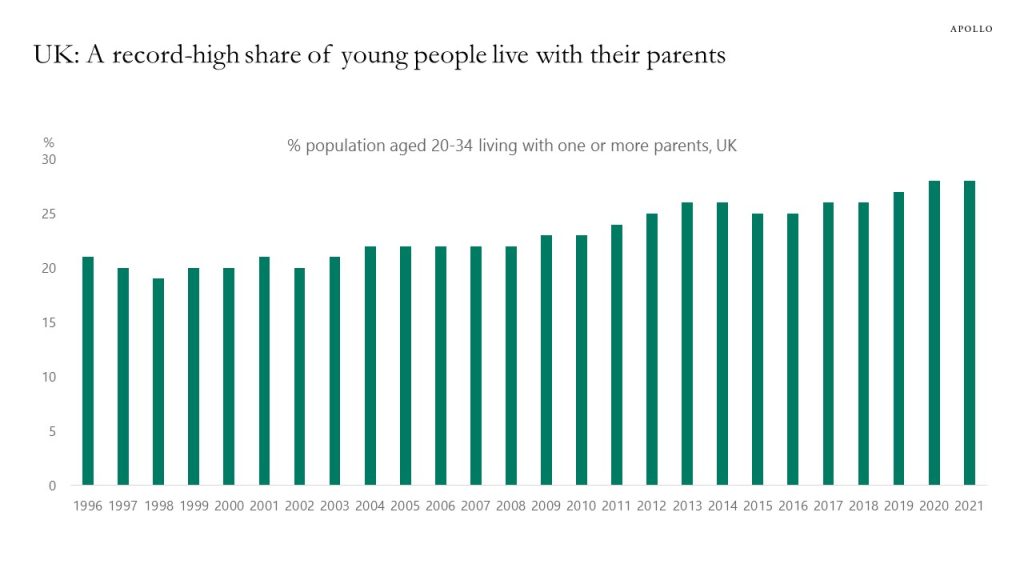

28% of 20- to 34-year-olds in the UK live with their parents, the highest share on record, see chart below.

Source: ONS, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Our latest housing outlook for Europe is available here, covering the euro area, Germany, Spain, France, and UK.

See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.