Want it delivered daily to your inbox?

-

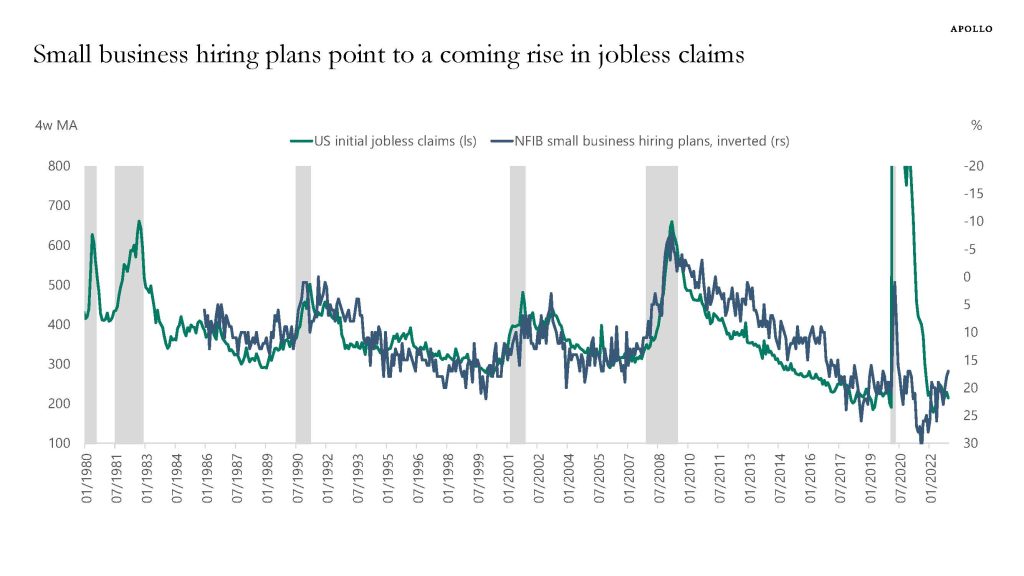

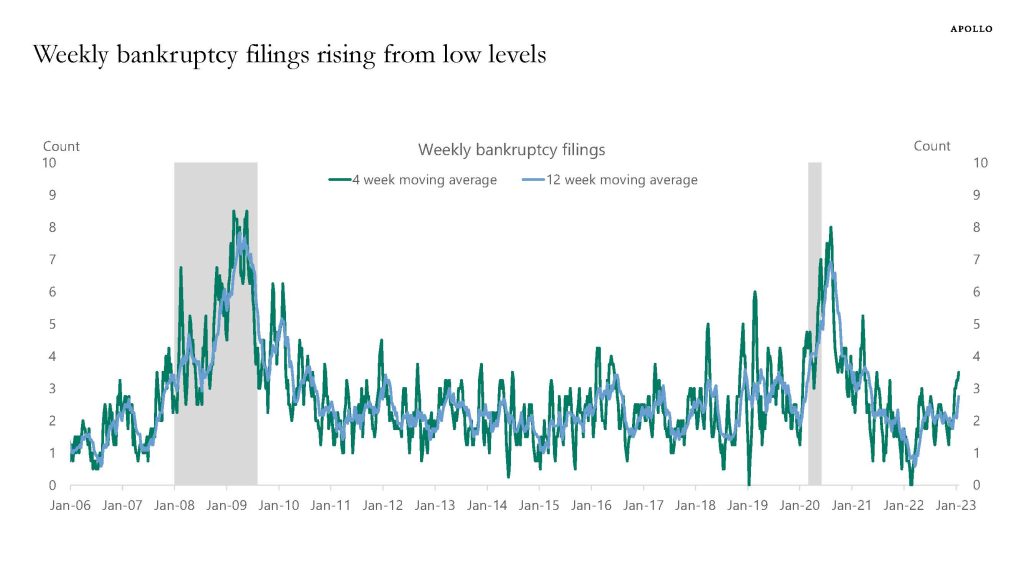

Attached here is our collection of daily and weekly indicators for the US economy, and the data shows some weakening in recent weeks with weaker retail sales, risks of higher jobless claims, and a rise in bankruptcies, see charts below. To be sure, the latest employment report was very strong, with 223,000 jobs created in December and the unemployment rate falling to 3.5%, but the daily and weekly high-frequency indicators are beginning to show some signs of weakness in the US economy.

Source: Department of Labor, NFIB, Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist. Note: Filings are for companies with more than $50mn in liabilities. For week ending on Thursday, January 12, 2023. See important disclaimers at the bottom of the page.

-

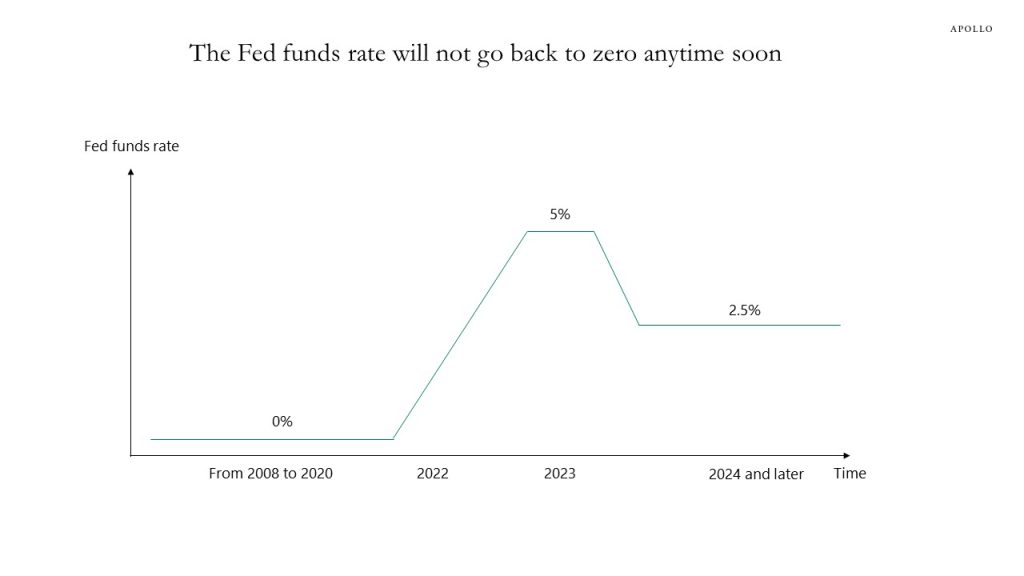

We are going through an asset price recession and not an economic recession. Why? Because we should expect the Fed funds rate to decline from the peak at 5% in June toward the equilibrium interest rate which keeps the economy at full employment and inflation at 2%. The Fed estimates that this so-called r-star is around 2.5%, see also the Fed’s latest dot plot. The implication for investors is that the level of the risk-free rate is resetting higher than where it was before the pandemic, see chart below. And this permanent increase in the costs of capital has a wide range of consequences for corporate America and financial markets, including how to think about credit spreads and stock prices, in particular tech and growth.

Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

-

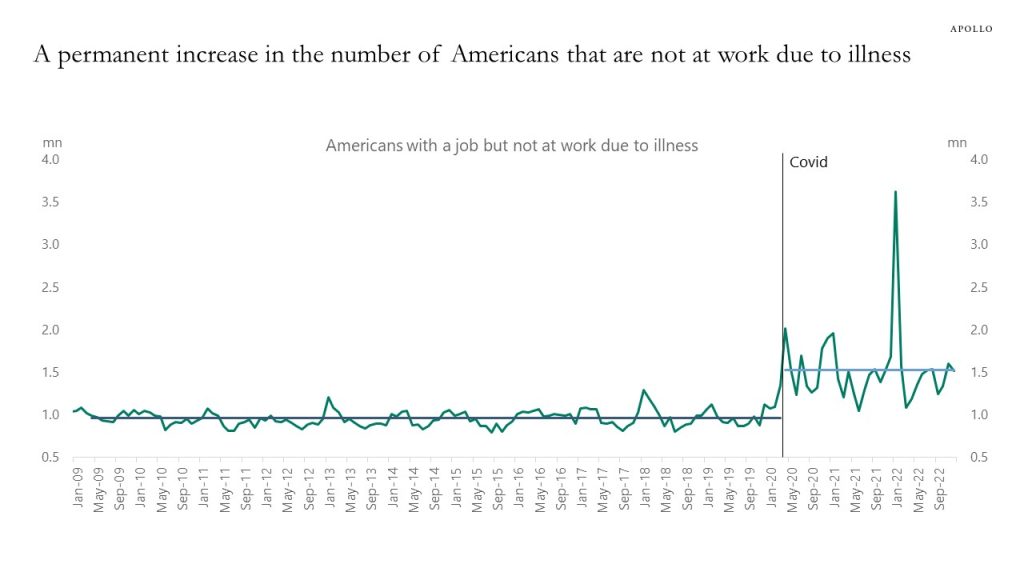

Since the pandemic began, there has been a structural increase in the number of people who are sick, see the chart below, which shows a significant jump in the number of people with a job who are not at work due to illness. The permanent change in the number of people who are ill since the pandemic began is consistent with studies here, here, and here that find that Covid is a key reason workers are still missing in the workforce, and hence why the labor force participation rate remains subdued. Immigration growth is rising steadily, but the bottom line is that it will take time before wage inflation is back at pre-pandemic levels, and, as a result, the Fed will keep rates higher for longer.

Source: BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

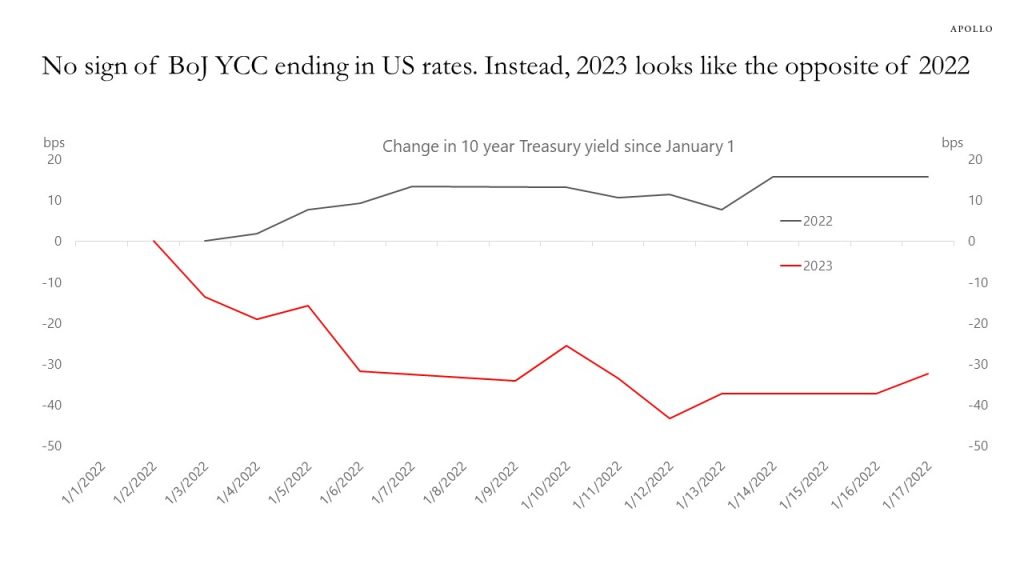

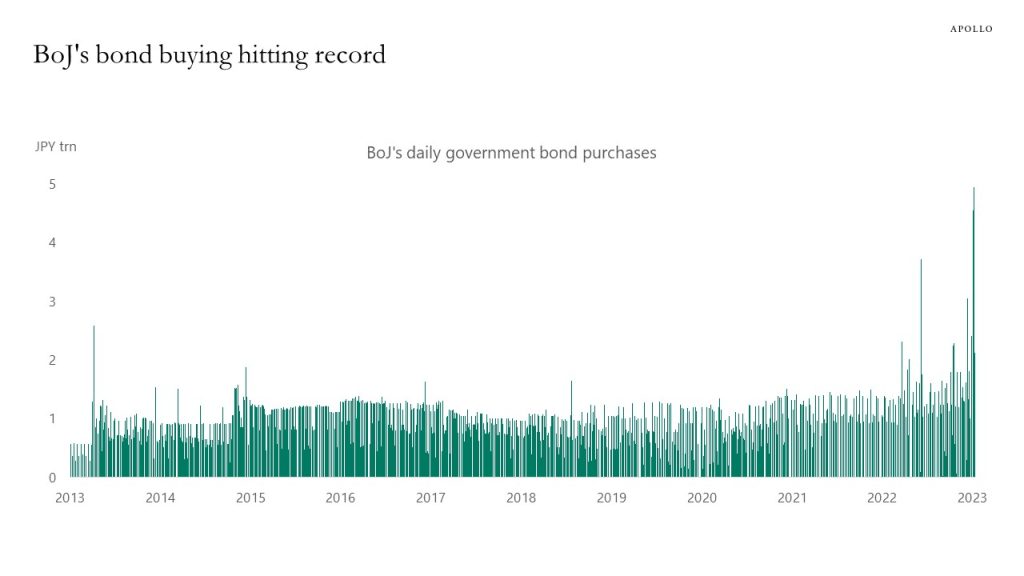

The BoJ is carefully preparing markets for the end of YCC, and that is likely the reason why the impact on US rates is so muted, see the first chart. But gradually higher yields in Japan will likely continue to push the yen higher, see the second chart.

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

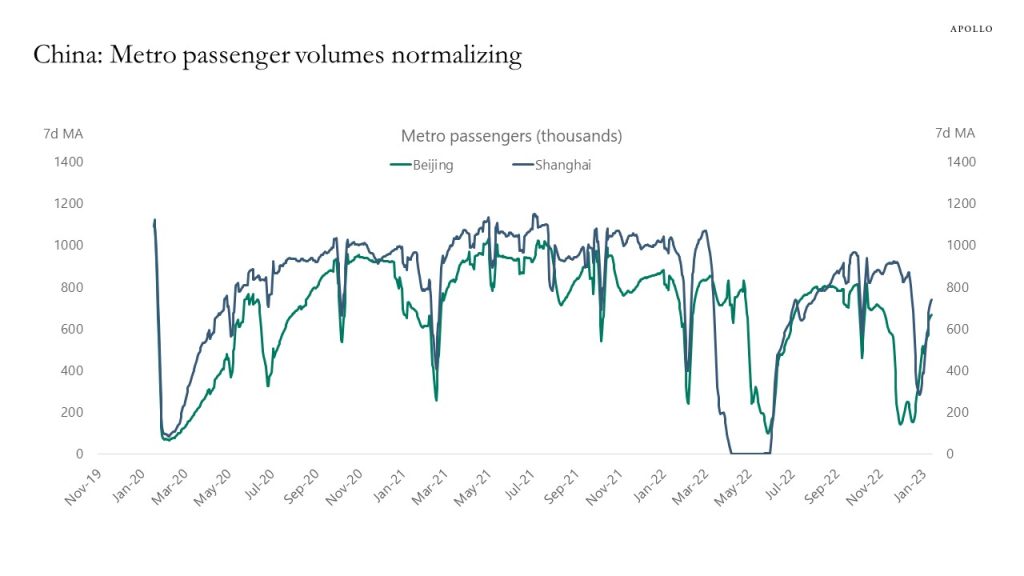

China is reopening, and this will be positive for global growth, see chart below. But because of the virus, commodity prices are not quite yet moving higher, and the impact on US inflation is likely to be modest and drawn out over time.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

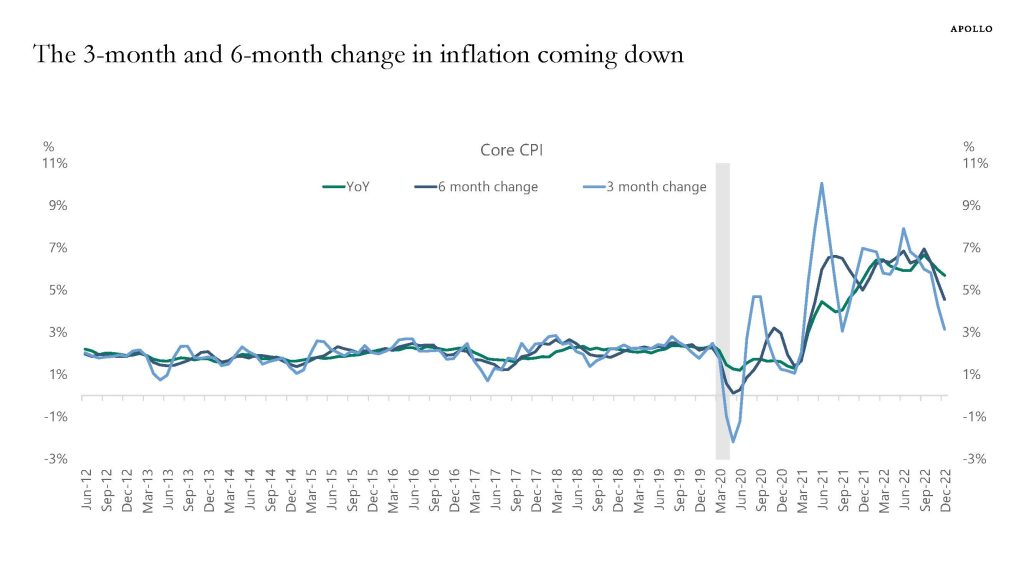

The 3-month and 6-month annualized change in inflation show some significant downside momentum in inflation in recent months, see chart below. Our daily and weekly economic indicators for the US economy are available here.

Source: BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

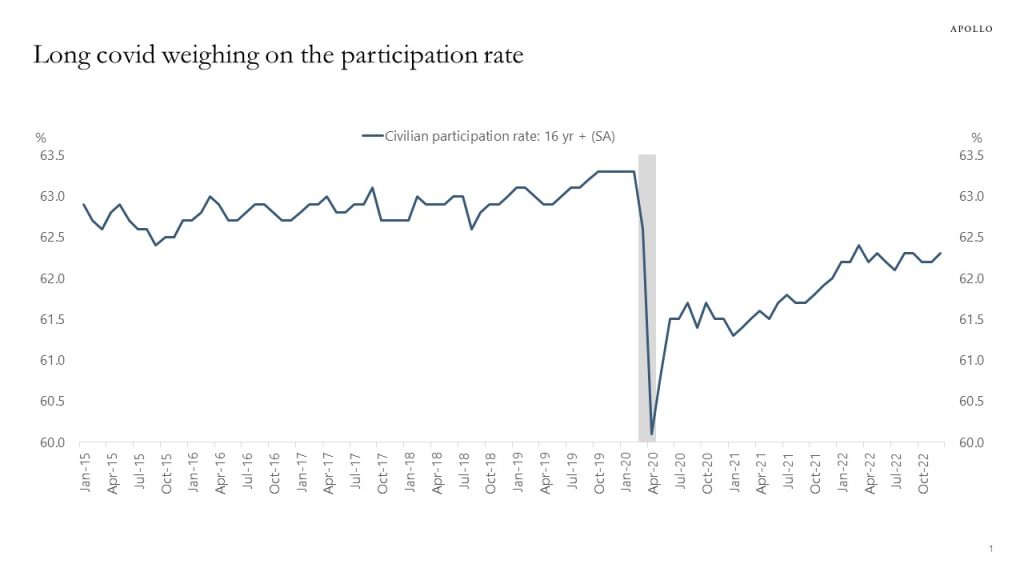

This new academic paper finds that about 7% of US adults, or around 19 million people, still suffer from long covid. And of those with long covid, 25%, or about 5 million people, report that their day-to-day activities are impacted ‘a lot’.

The bottom line is that long covid is why the labor force participation rate has not recovered to pre-pandemic levels, even in a situation with solid wage growth, see chart below. In other words, people are staying outside the labor market for health reasons and are unlikely to come back in the near term.

These “missing” workers are why companies continue to report labor shortages and why wage inflation remains so high. This continues to be a challenge for the Fed as the FOMC tries to get inflation quickly back to the Fed’s 2% inflation target. Immigration is starting to increase, but ultimately long covid is a key reason why the Fed will have to keep the Fed funds rate elevated for an extended period.

Source: BLS, Haver, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

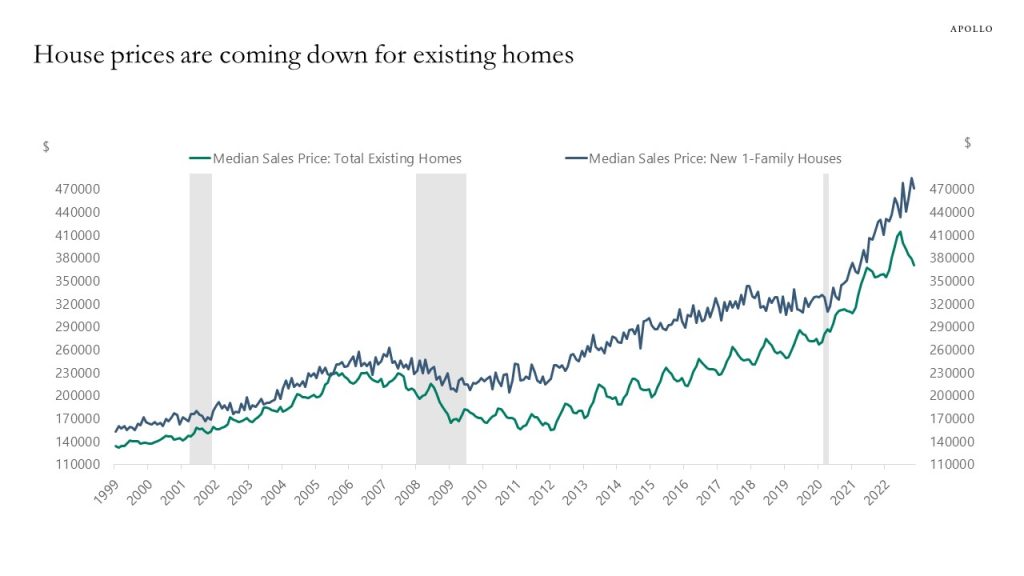

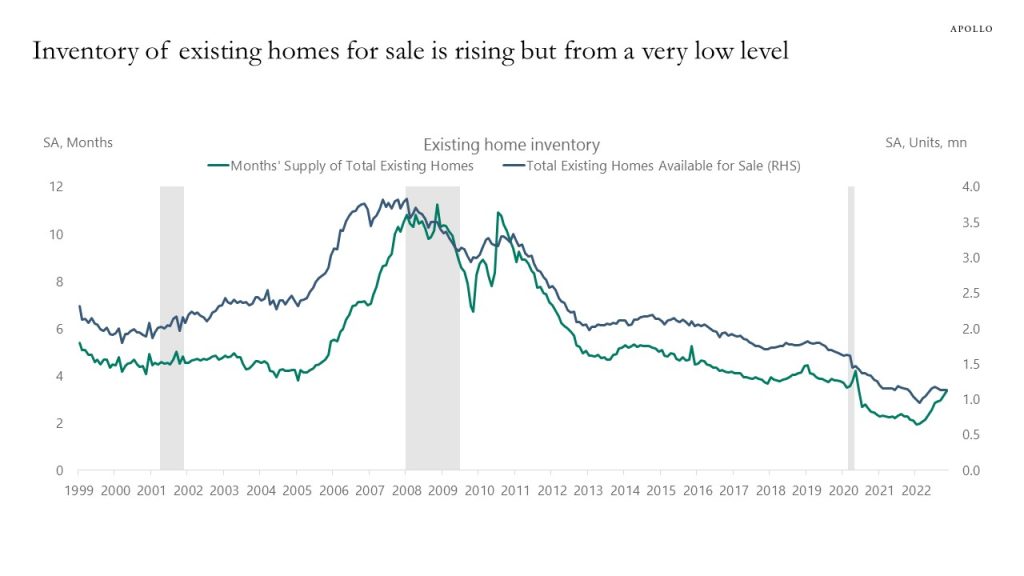

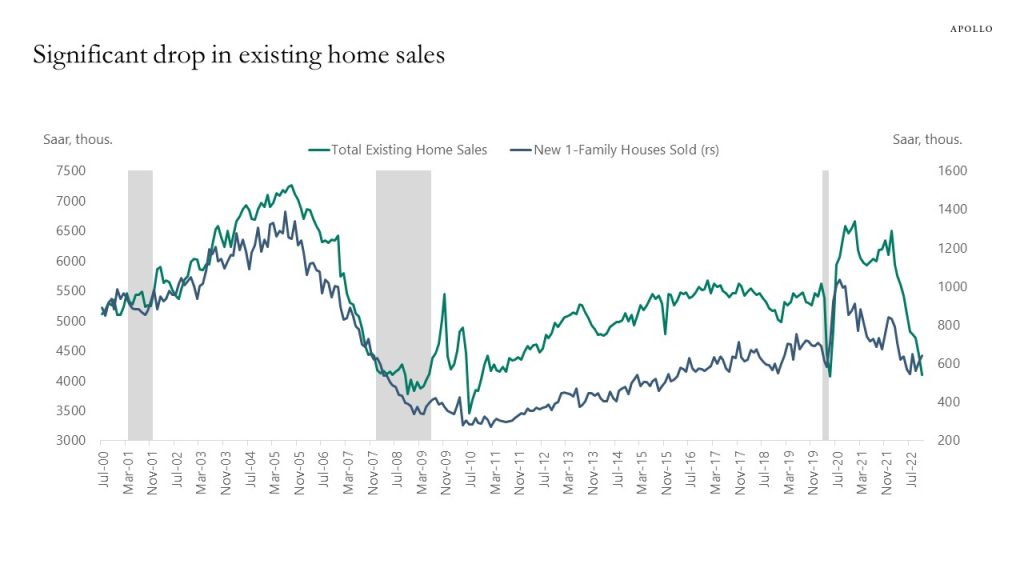

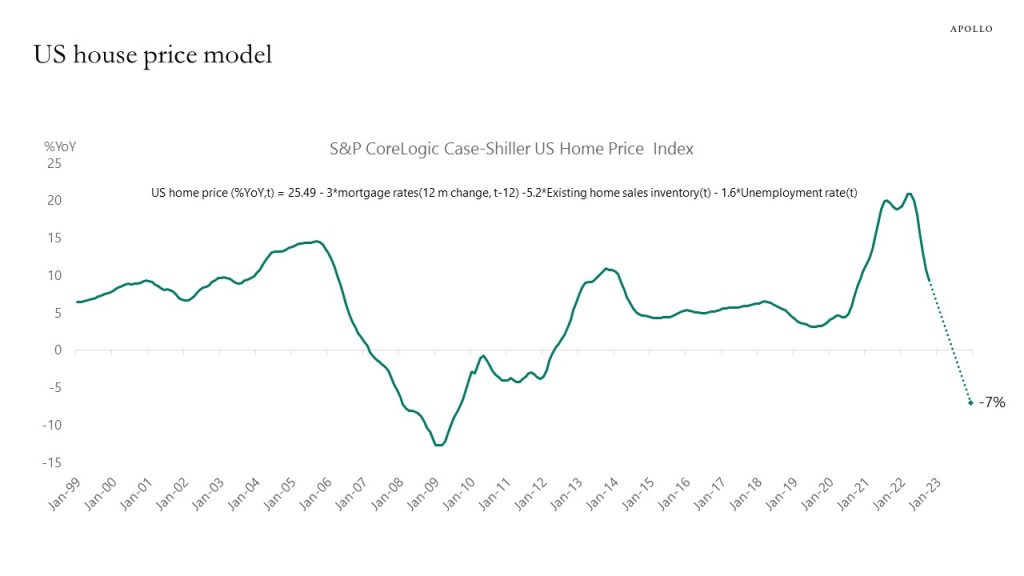

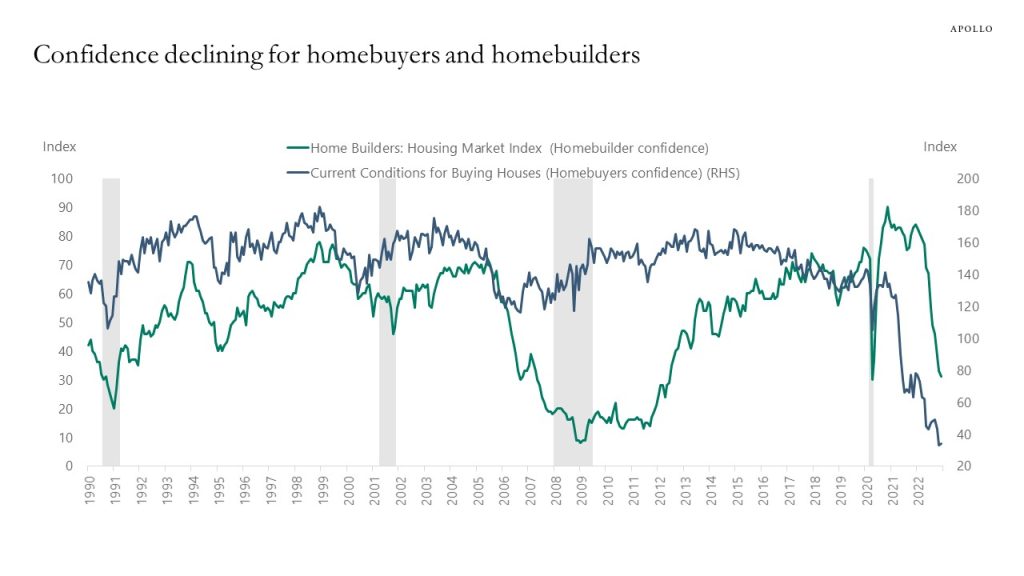

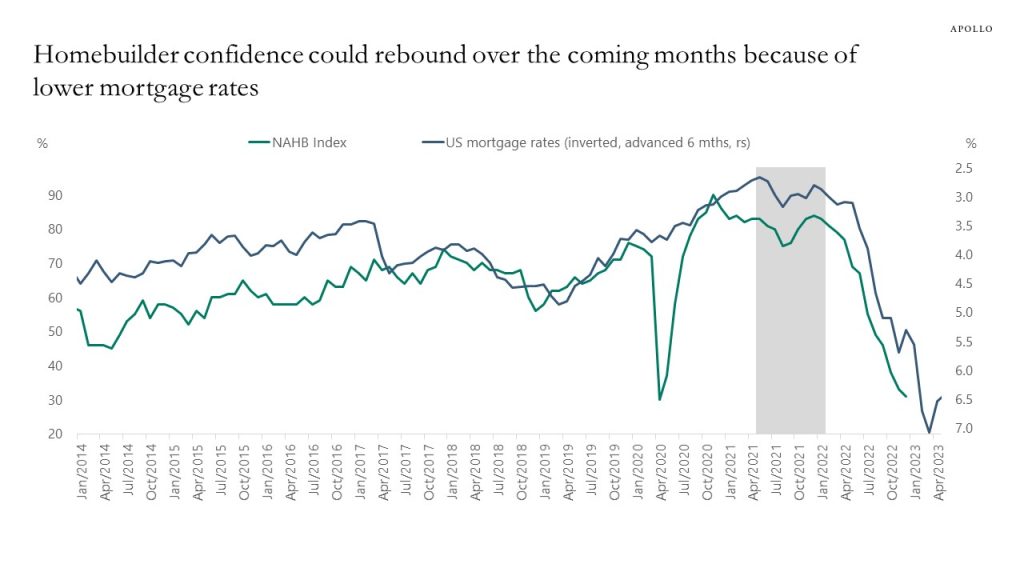

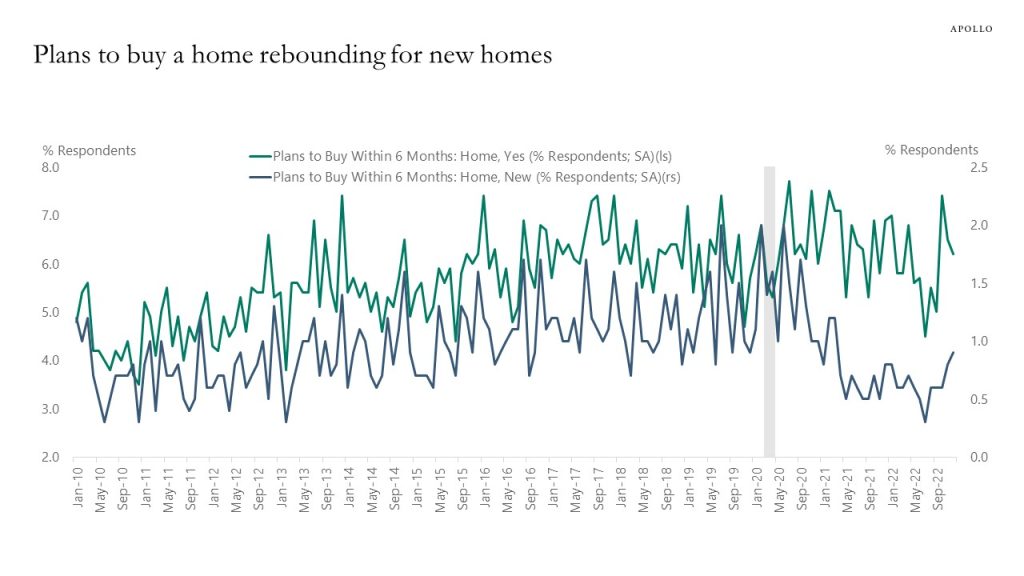

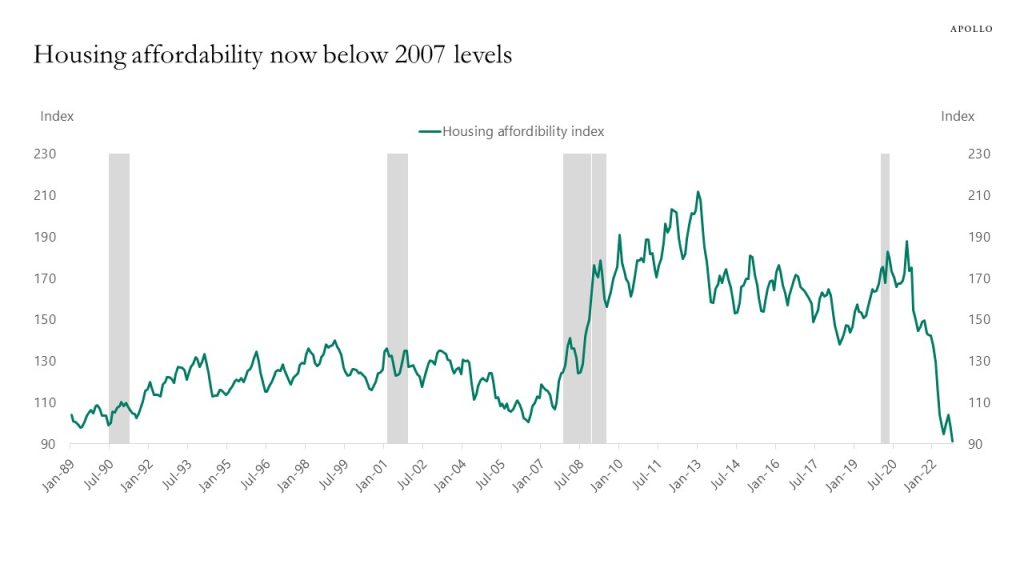

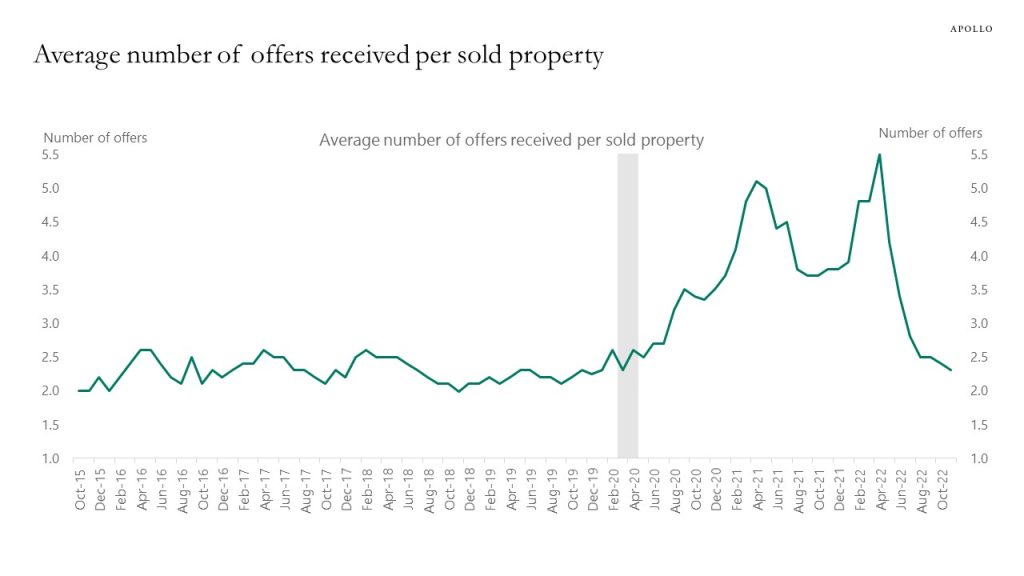

Our latest housing outlook is available here, key charts inserted below.

Source: Census, Apollo Chief Economist

Source: NAR, Apollo Chief Economist

Source: Census Bureau, NAR, Haver, Apollo Chief Economist; Forecast is Bloomberg consensus

Source: Bloomberg, Apollo Chief Economist

Source: University of Michigan, NAHB, Haver Analytics, Apollo Chief Economist

Source: NAHB, Bloomberg, Apollo Chief Economist

Source: Conference Board, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: NAR, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

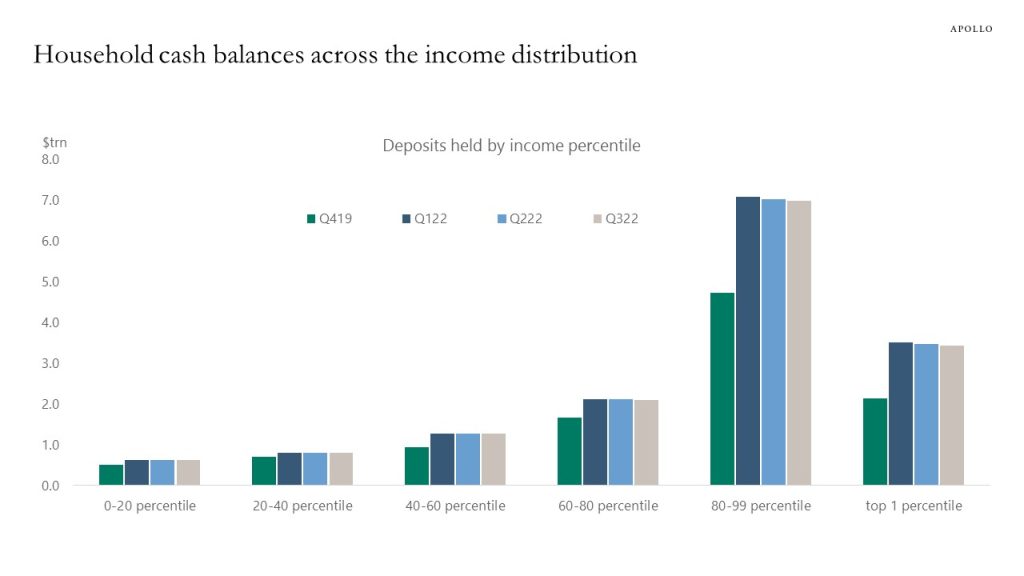

The Fed just released new data for the amount of money households have in their checking accounts and short-term deposits, and it shows that households across the income distribution continue to have a higher level of cash available than before the pandemic, and the speed with which households are running down their cash balances in recent quarters has been very slow. Combined with continued solid job growth and robust wage inflation, the bottom line is that there remains a powerful tailwind in place for US consumer spending.

Source: FRB, Haver Analytics, Apollo Chief Economist. Note: The two Financial Accounts instruments “Checkable deposits and currency” and “Time deposits and short-term investments” have been combined into a single instrument “Deposits” for the Distributional Financial Accounts. See important disclaimers at the bottom of the page.

-

I will be on Bloomberg TV today at 7:30 am to preview the December CPI data, and the key question for the Fed and markets is if a recession is needed to get inflation all the way back to the FOMC’s 2% inflation target. Economic models, such as the Phillips curve, would say that a much higher unemployment rate is needed to get inflation down to 2%. But maybe economists are too wedded to their models? What if inflation is mainly driven by supply shocks that are going to sort themselves out over time without any need for additional demand destruction (as suggested by Fed papers here, here, and here).

So far, inflation has been trending lower without any increase in the unemployment rate, suggesting that we are in the soft landing scenario. A continued solid economy with falling inflation and steady corporate earnings is good news for both IG and HY credit. But with inflation at 7.1%, the Fed will continue to be hawkish, and as a result, markets will likely remain volatile as we go through 2023.

Download our latest credit market outlook here.

See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.