Want it delivered daily to your inbox?

-

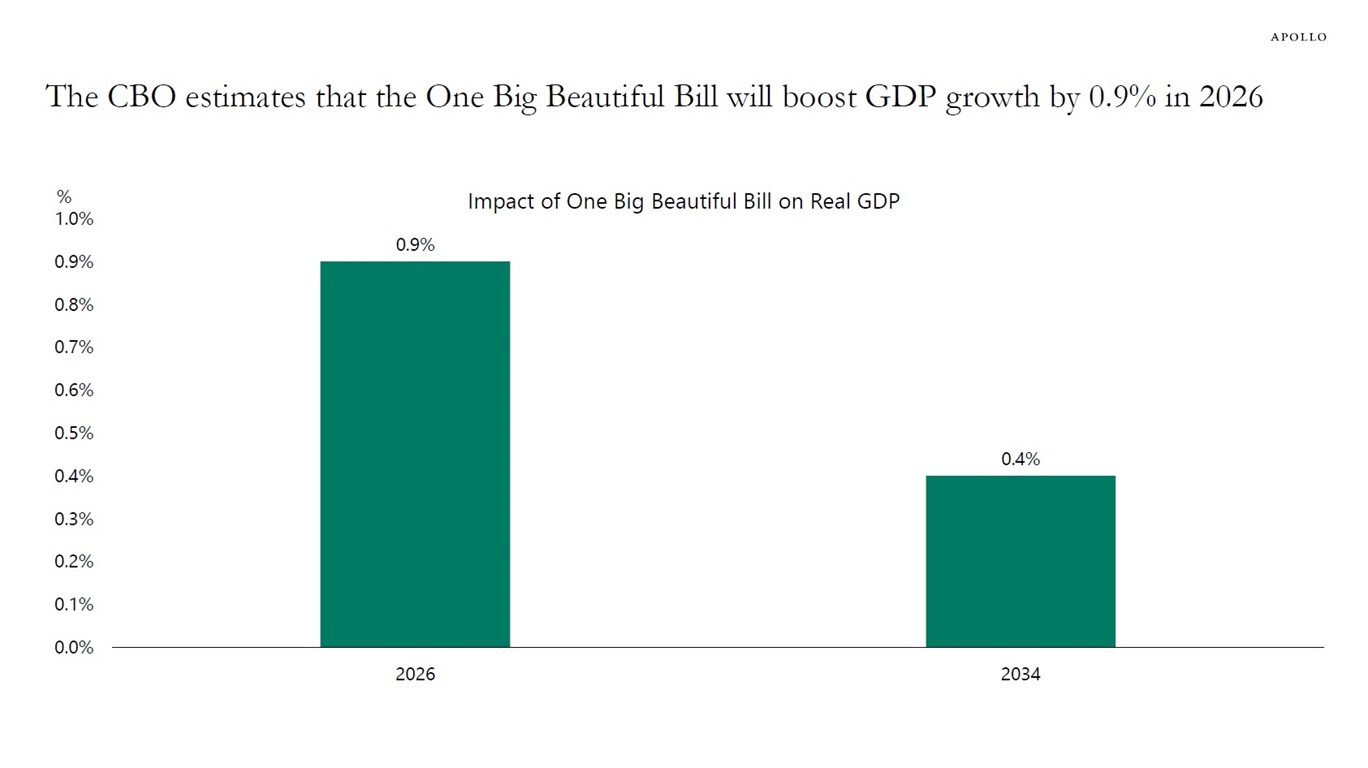

The CBO estimates that the One Big Beautiful Bill will boost GDP growth next year by 0.9%, see chart below. The main factor in the bill is that, starting January 1, 2026, businesses can immediately deduct capital expenses, such as investments in equipment and R&D. This is a major tailwind for the economy in 2026.

Sources: CBO, H.R. 1, One Big Beautiful Bill Act, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

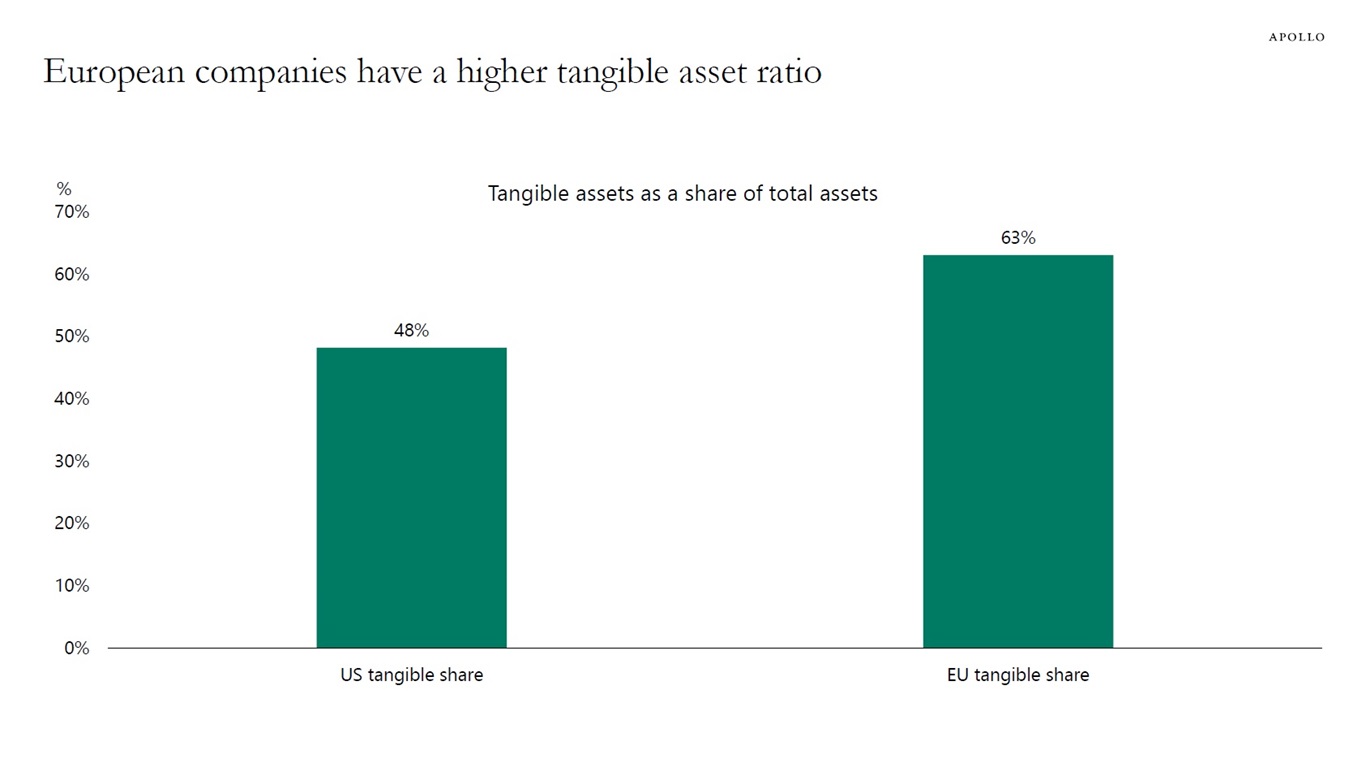

European companies typically allocate more of their resources to tangible assets, such as property, plant and equipment, resulting in a higher tangible asset ratio than US companies. In contrast, US firms invest more heavily in intangible assets like software, brand value and intellectual property rights, see chart below.

Note: Tangible assets include fixed tangible assets like plants, equipment and property. Sources: Financial accounts of United Sates, FRB, Haver Analytics, EIB Investment Survey 2024, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

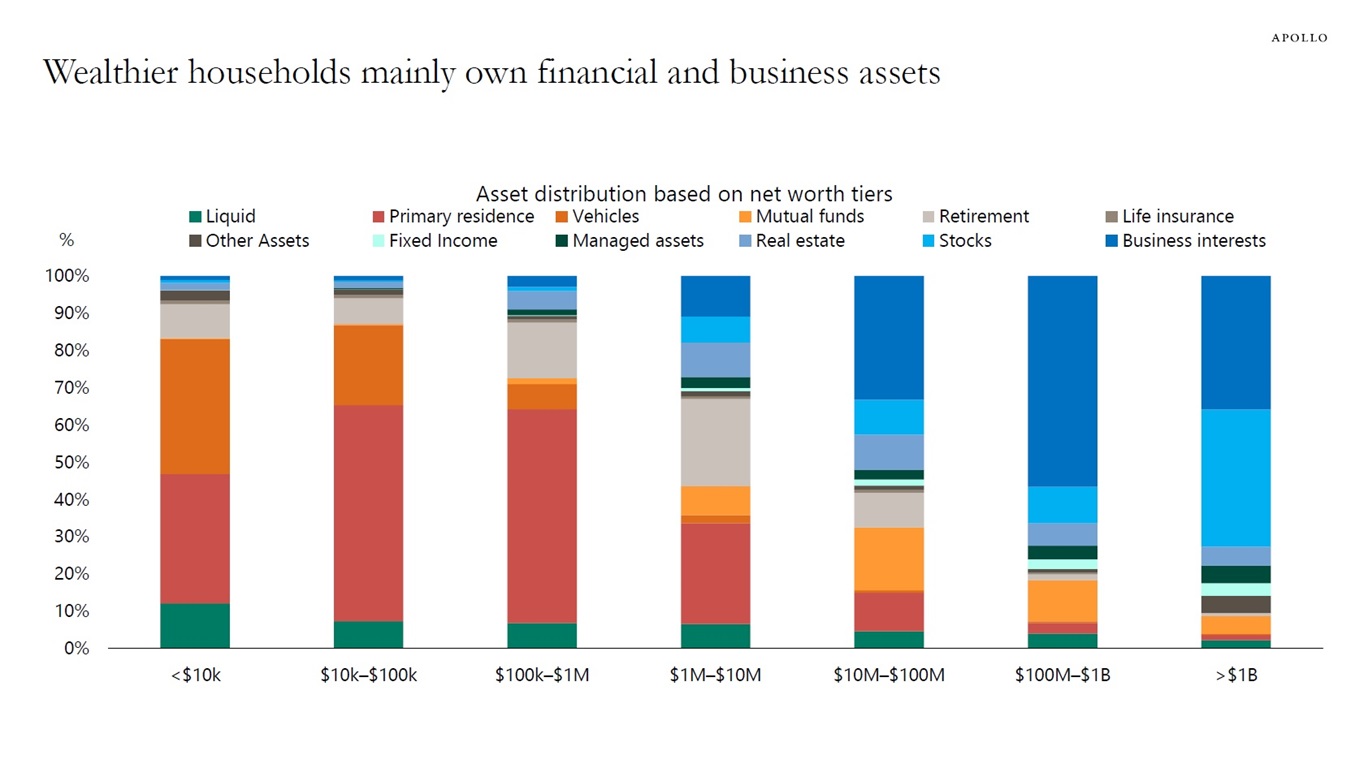

The chart below shows what types of assets households own across the wealth distribution.

Households with lower asset holdings mainly own their home and their car. Wealthier households mainly own business assets and stocks.

Sources: Federal Reserve Survey of Consumer Finances, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

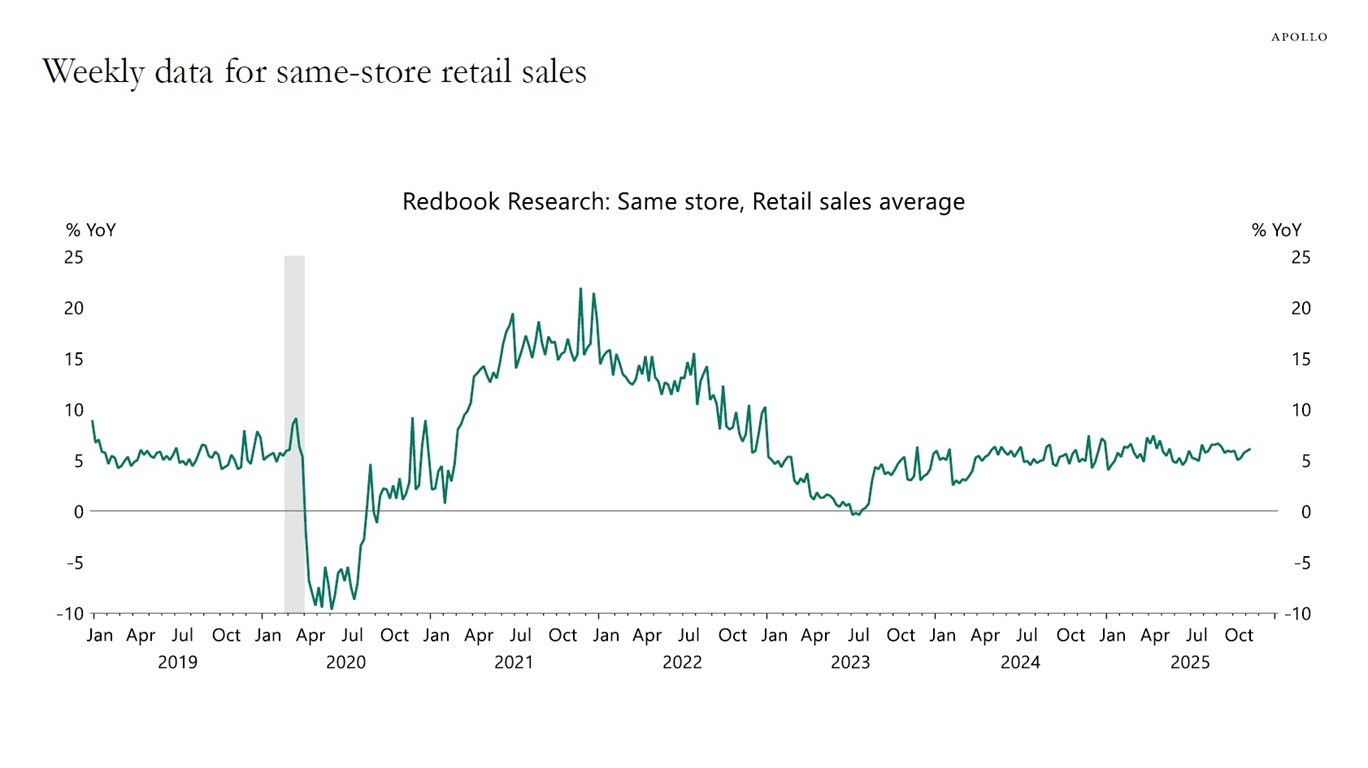

The weekly data for US consumer spending continues to show solid growth in private consumption, see chart below.

In other words, there is no need for the Fed to cut rates to boost consumer spending.

Sources: Redbook Research Inc., Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

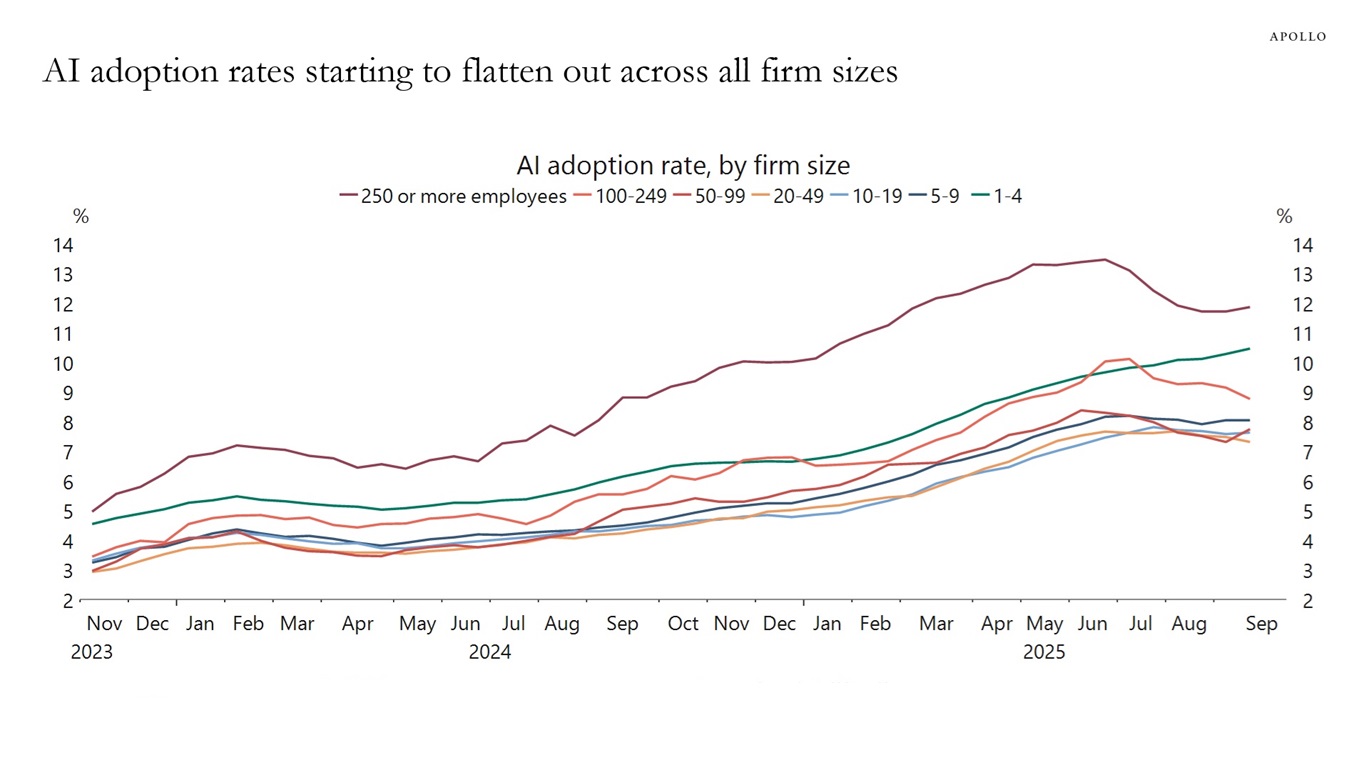

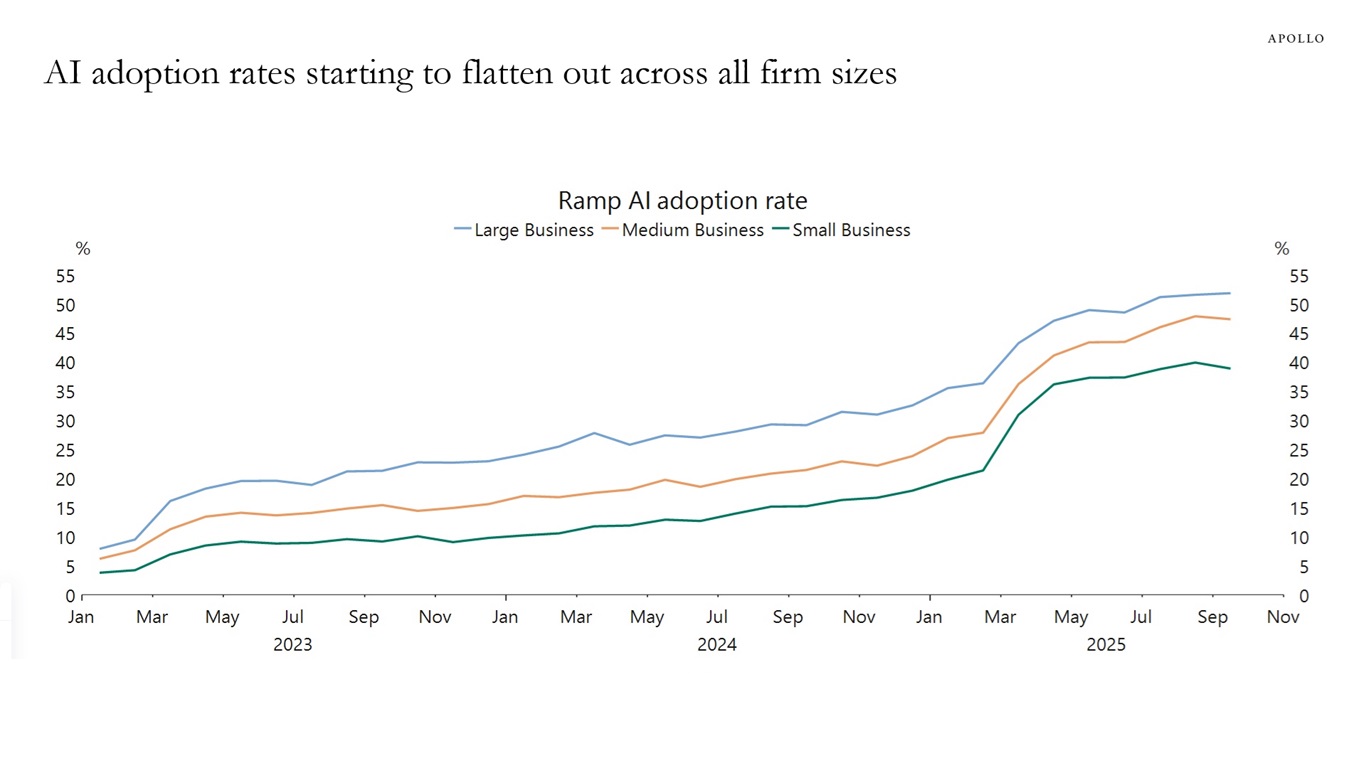

Data from the Census Bureau and Ramp shows that AI adoption rates are starting to flatten out across all firm sizes, see charts below.

Note: Data is six-survey moving average. The survey is conducted bi-weekly. Sources: US Census Bureau, Macrobond, Apollo Chief Economist

Note: Ramp Al Index measures the adoption rate of artificial intelligence products and services among American businesses. The sample includes more than 40,000 American businesses and billions of dollars in corporate spend using data from Ramp’s corporate card and bill pay platform. Sources: Ramp, Bloomberg, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

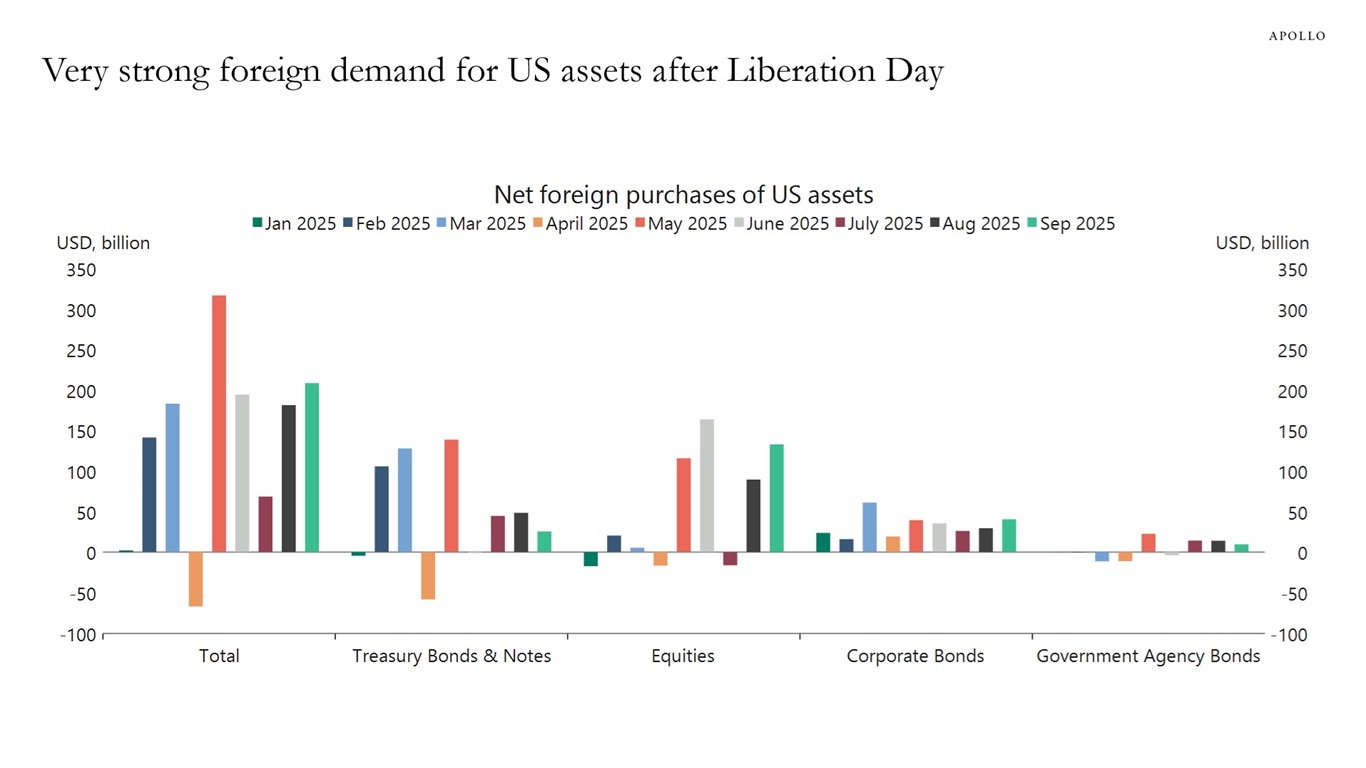

The chart below shows that foreigners come to the US to earn higher yields and invest in AI.

Since Liberation Day, foreign appetite for US assets has been robust. This is the reason why the US dollar has been trending higher over the past six months.

The chart below shows that since May, foreigners have been strong buyers of AI and US fixed income, including credit.

With rates higher for longer and the AI story continuing, foreign demand for US assets will remain strong.

Sources: US Department of Treasury, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

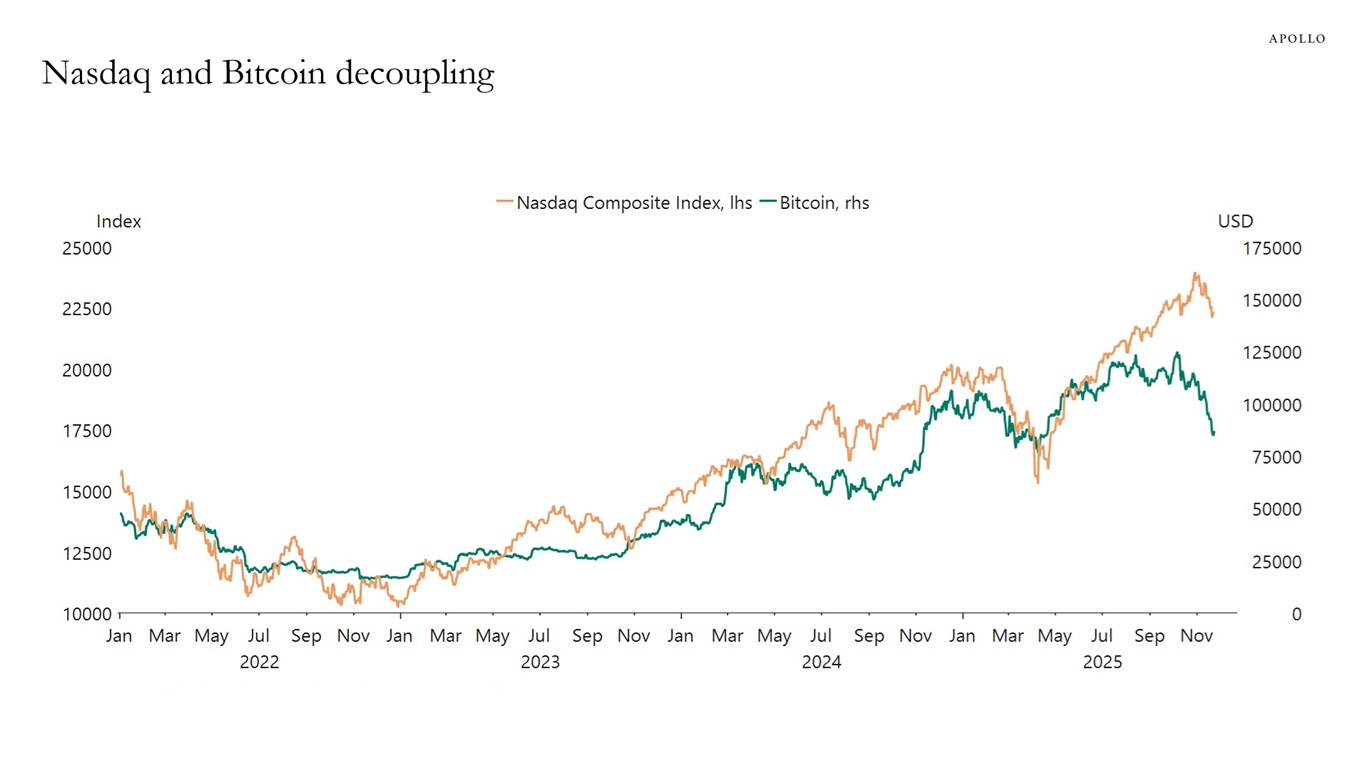

Bitcoin and the Nasdaq Composite are normally highly correlated, but that correlation has broken down in recent weeks with a much sharper drop in the price of Bitcoin, see chart below.

Sources: Nasdaq, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

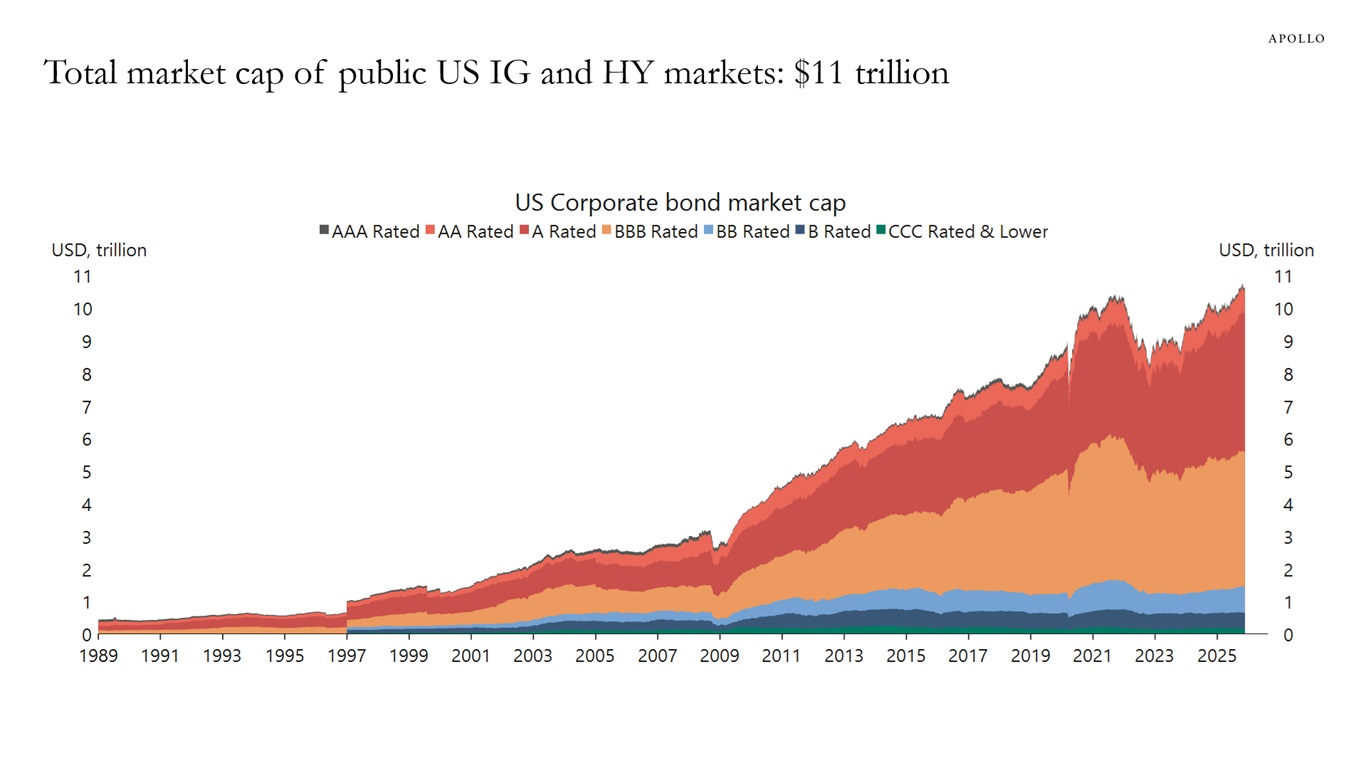

Since 2009, the total amount of public IG and HY bonds outstanding has grown from $3 trillion to $11 trillion, see chart below. Most of the growth has been in BBB and A-rated corporate bonds, and those two ratings combined now account for 79% of all corporate bonds outstanding by market value.

These numbers have to be compared with the roughly $2 trillion outstanding in private credit, up from $1.2 trillion in 2009.

The bottom line is that public credit markets have grown much faster than private credit markets both in percent and in dollars.

Sources: ICE BofAML, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

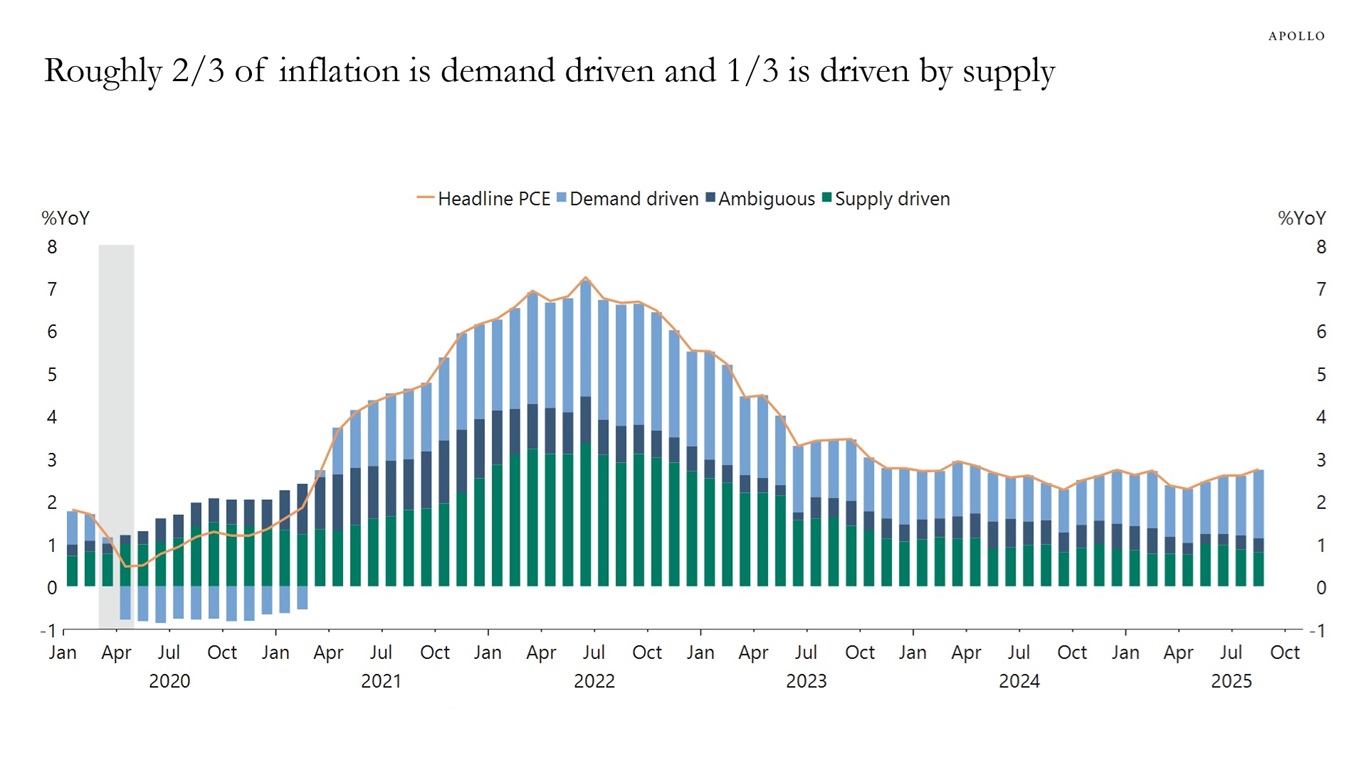

The debate over the Federal Reserve’s policy trajectory hinges on the underlying drivers of inflation. A decomposition by the San Francisco Fed reveals that the current inflationary environment is largely a demand-side story, with strong economic activity accounting for the majority of price growth. This has direct implications for monetary policy: as long as demand-pull inflation keeps the headline rate above the 2% target, a higher-for-longer interest rate stance is required to bring the economy back into balance.

Conversely, if inflation were primarily a function of supply shocks, the case for demand destruction via high rates would be moot, likely creating space for policy easing. Ultimately, the source of inflation is the critical variable determining the need for further Fed action.

Sources: Federal Reserve Bank of San Francisco, US Bureau of Economic Analysis (BEA), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

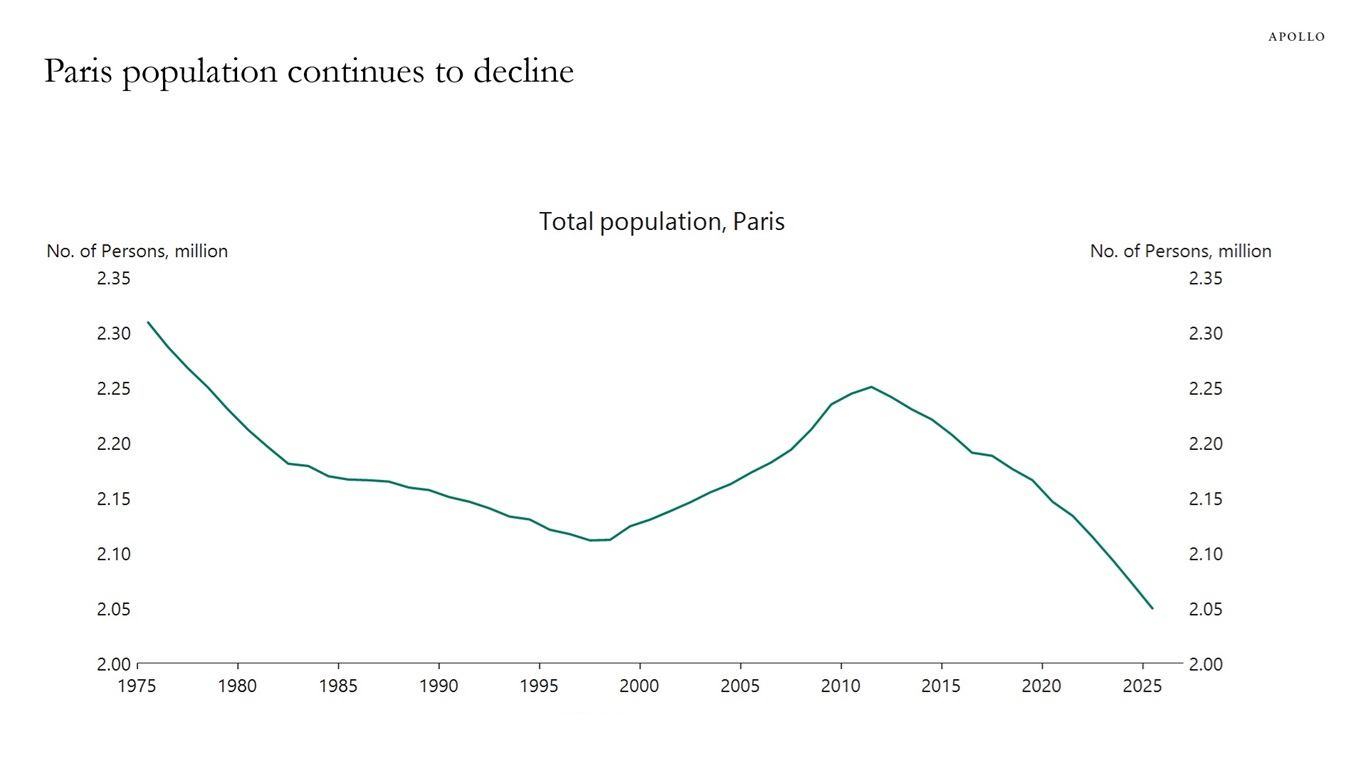

The number of people living in Paris continues to decline. This trend is driven by several factors, including affordability, limited new construction, the proliferation of short-term rentals, the conversion of residential units into office space, and the rise of second homes often owned by international buyers, see chart below.

Sources: French National Institute of Statistics & Economic Studies (INSEE), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.