Want it delivered daily to your inbox?

-

Our outlook for China is available here, and there are three conclusions:

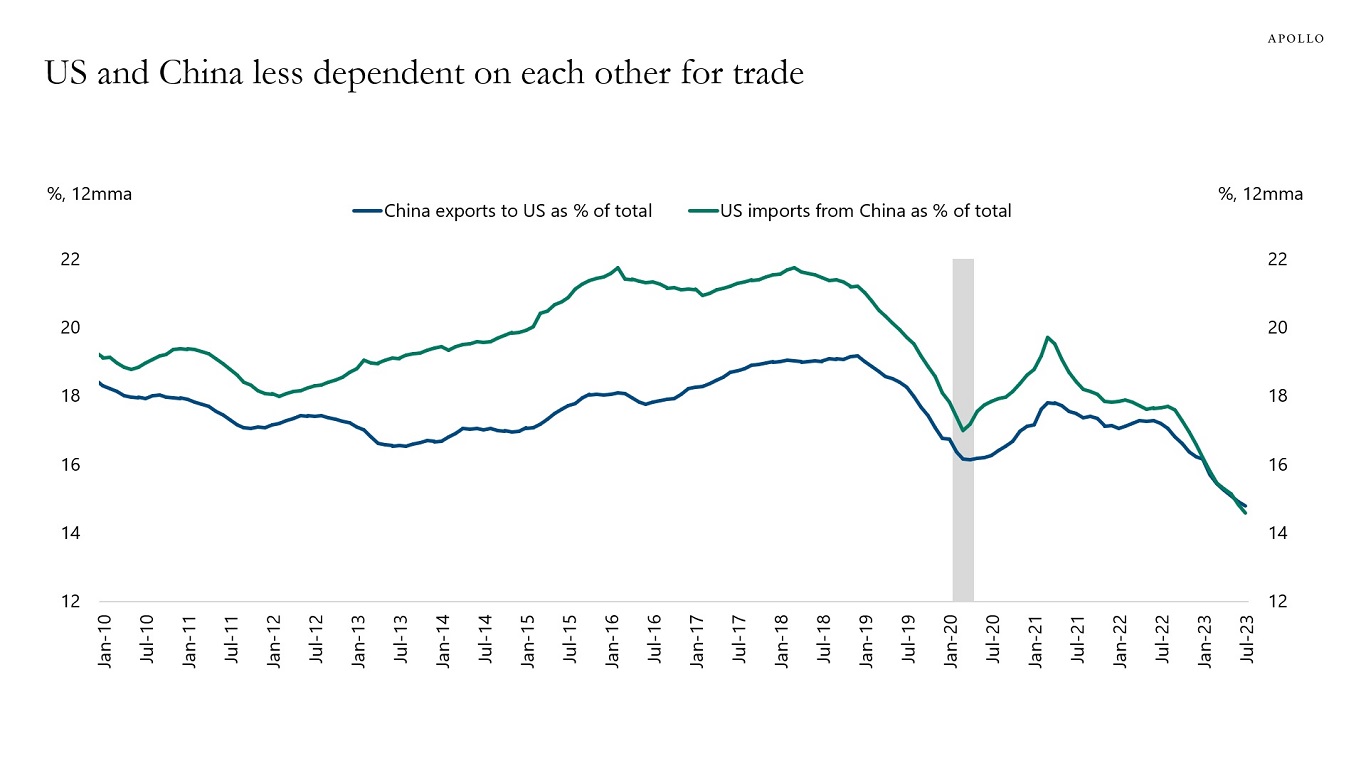

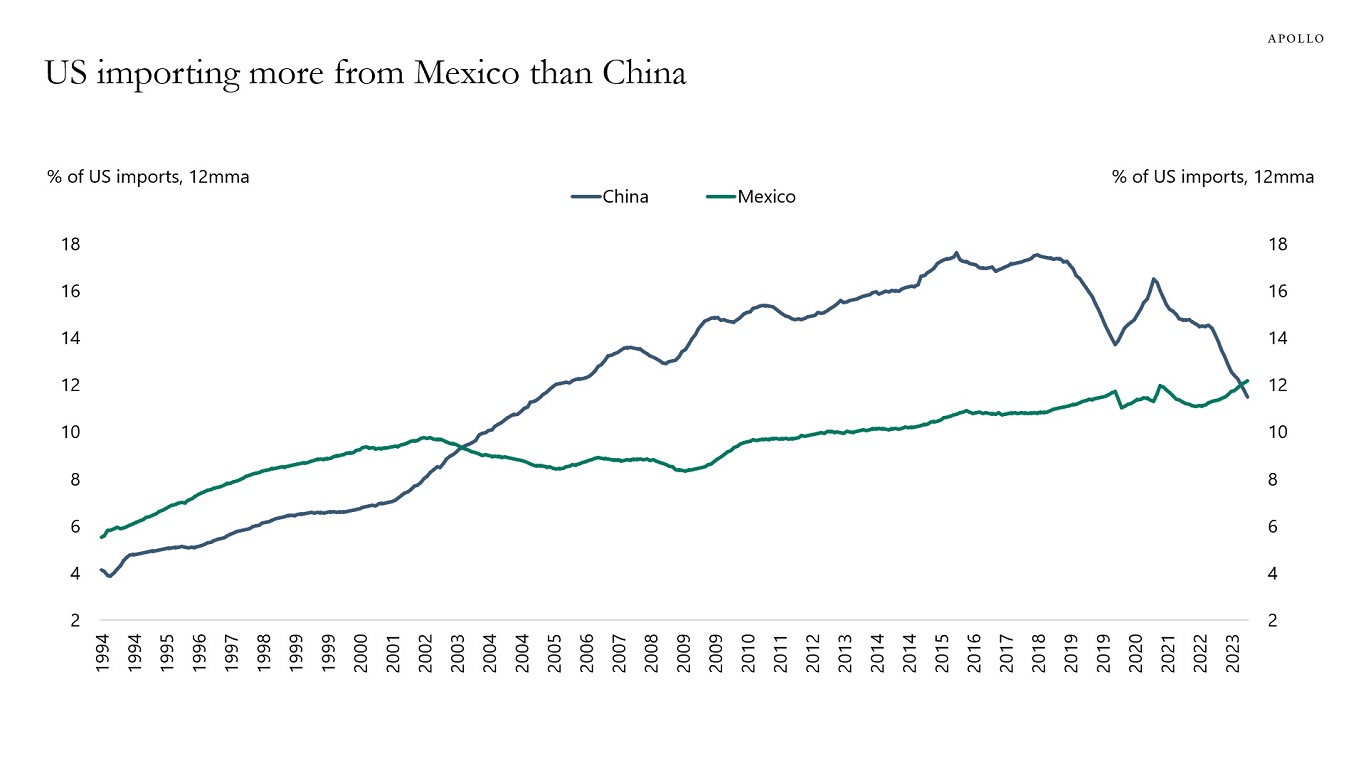

1) Data for Chinese exports and US imports show that China and the US are now less dependent on each other, and the US is now importing more from Mexico than from China, see the first and second chart.

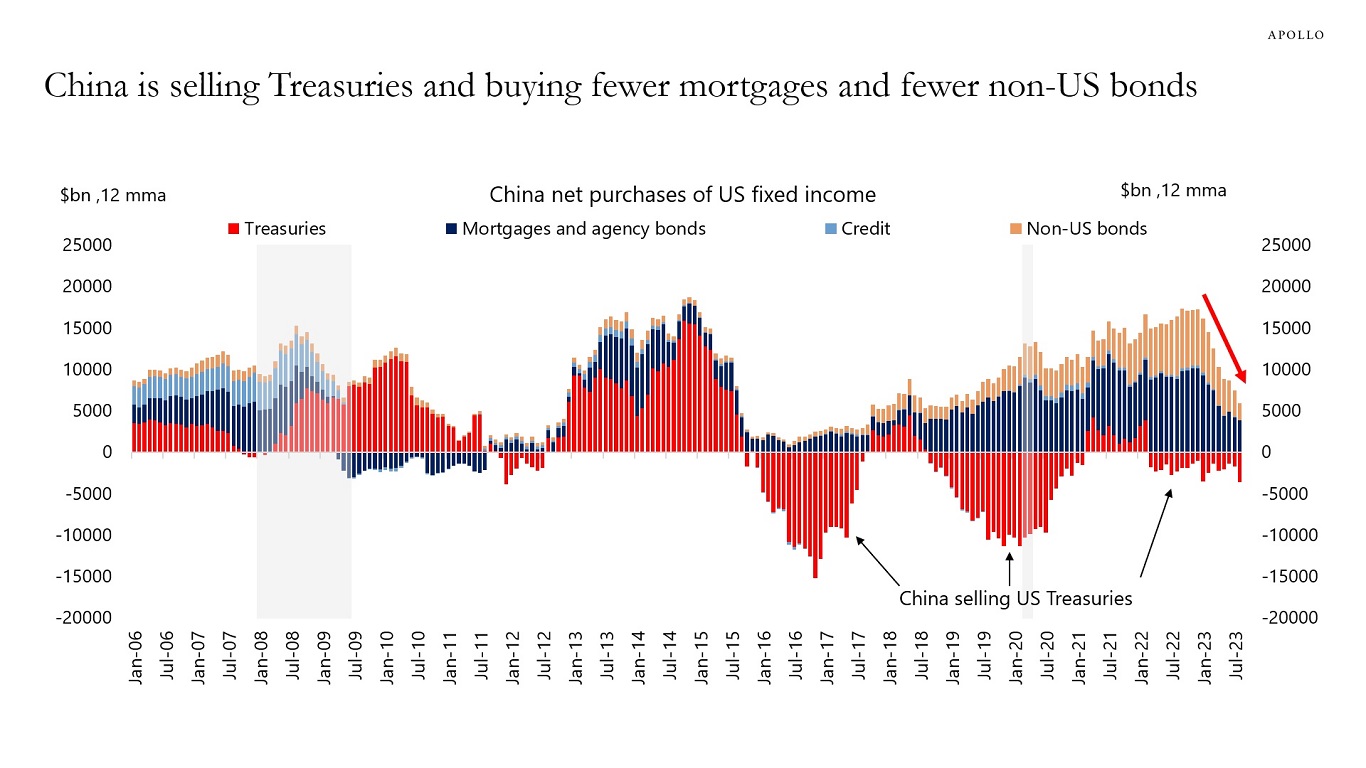

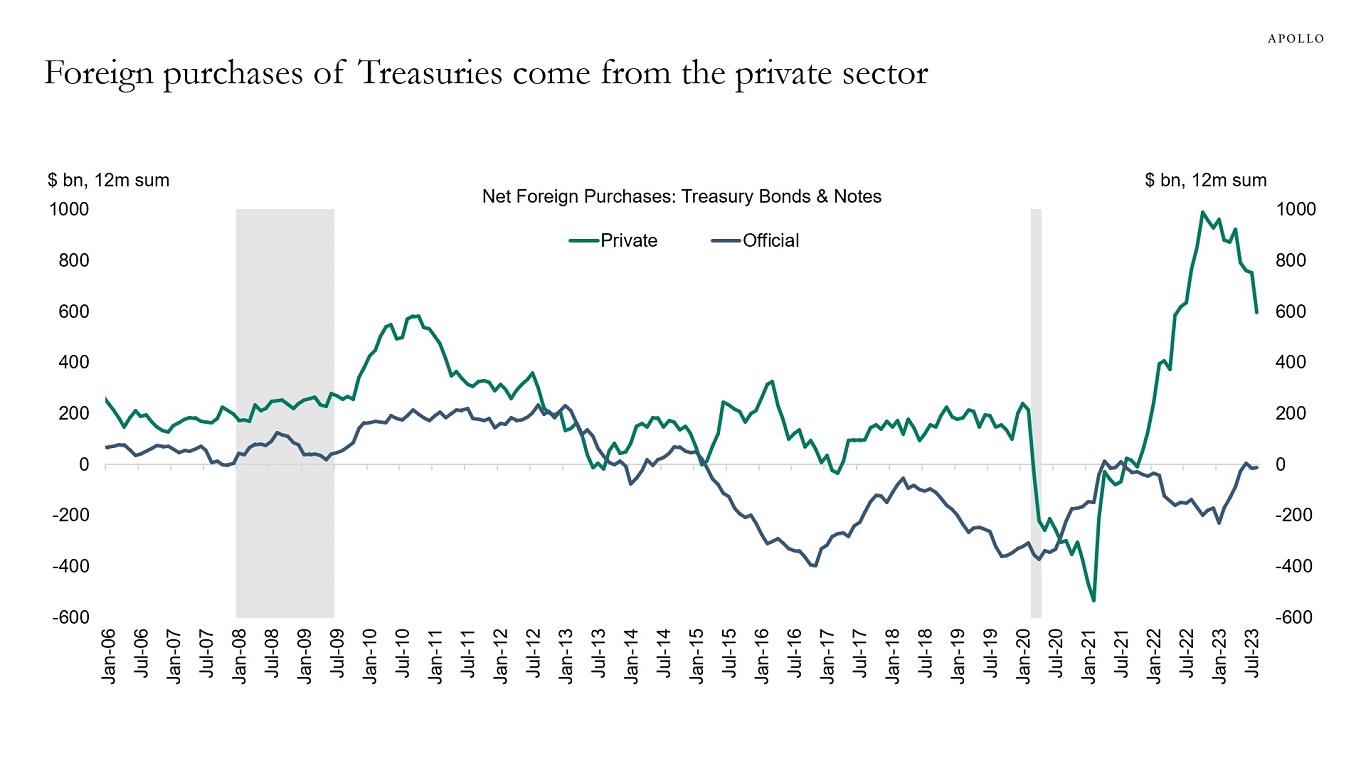

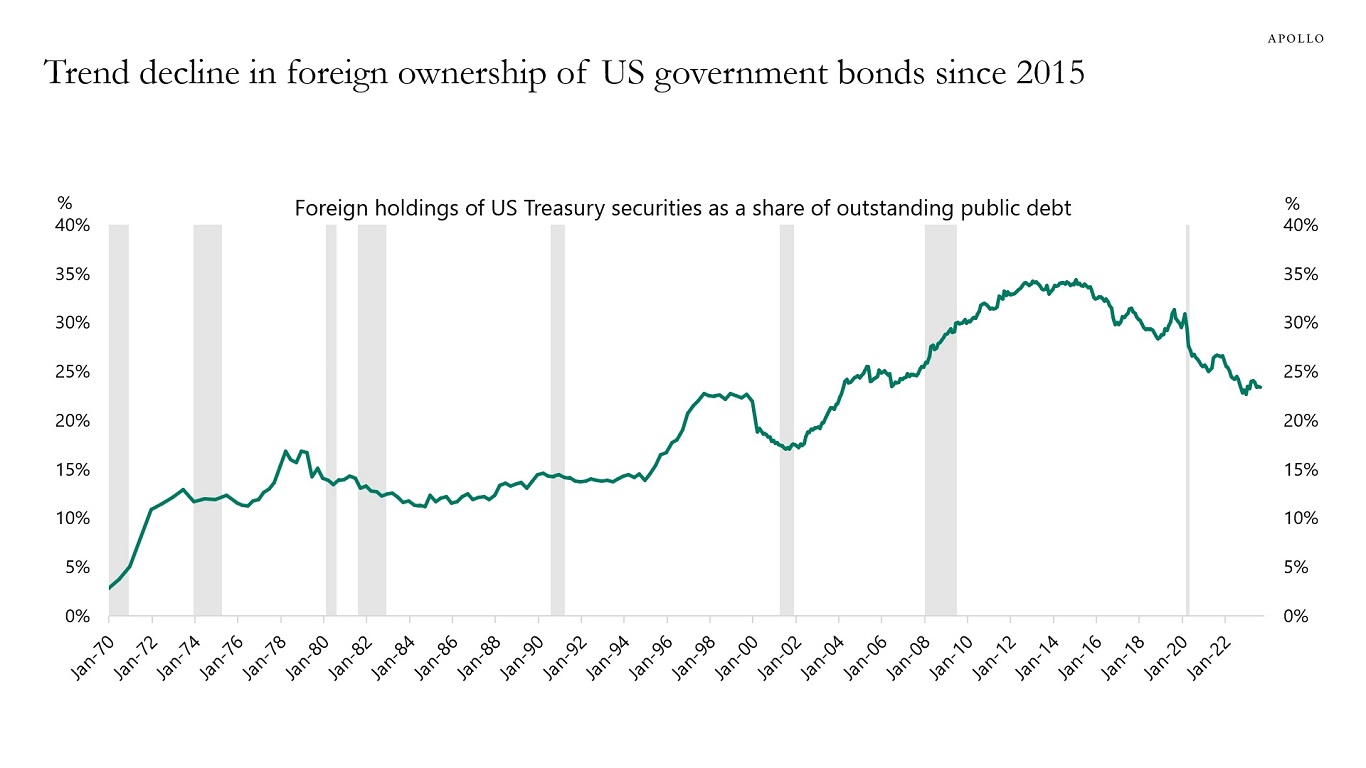

2) China continues to sell US Treasuries, and foreign purchases of US Treasuries are coming from the foreign private sector and not from the foreign official sector, suggesting that recent demand for US Treasuries has come from yield-sensitive buyers, see the third and fourth chart.

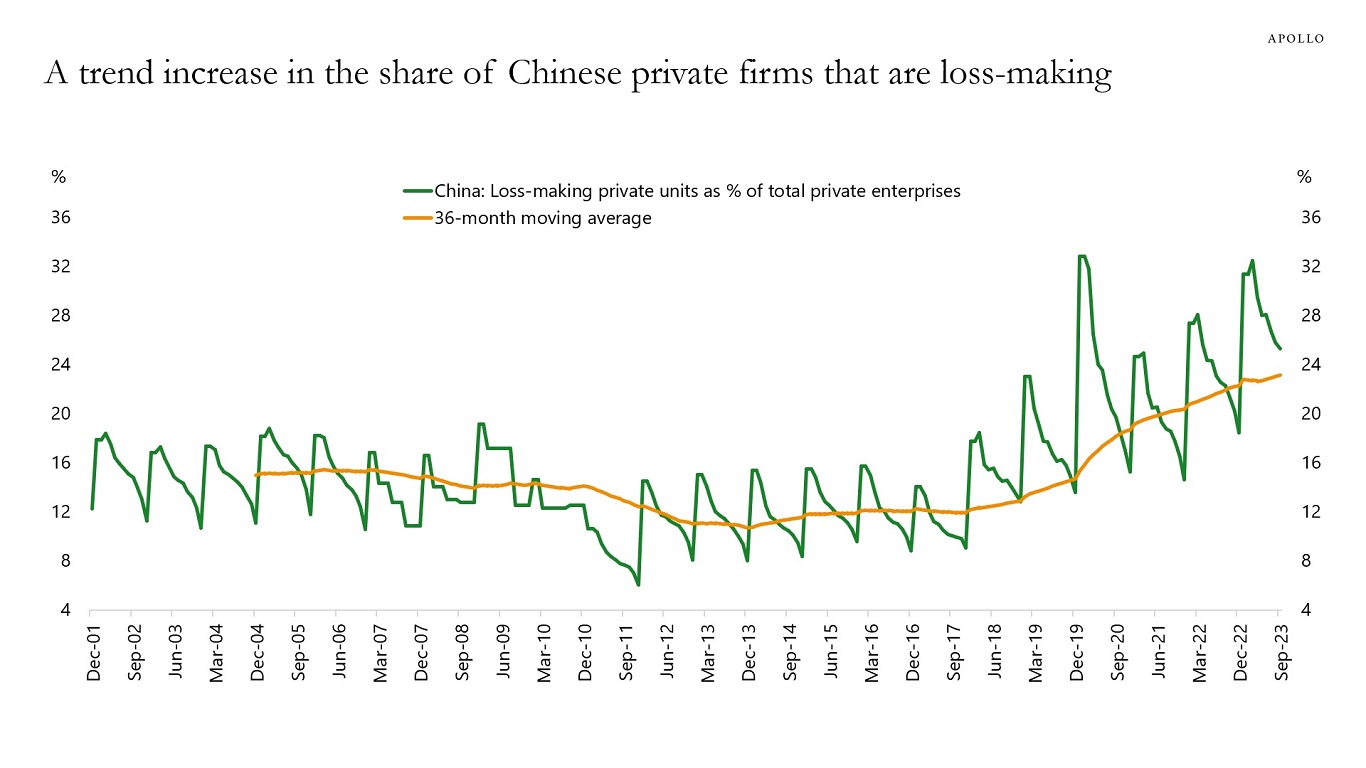

3) China has recently seen a trend increase in the share of private sector firms with negative earnings, see the fifth chart.

Source: IMF, Bloomberg, Apollo Chief Economist

Source: Census Bureau, Bloomberg, Apollo Chief Economist

Source: Treasury, Haver Analytics, Apollo Chief Economist

Source: Treasury, Haver Analytics, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist. Note: CNBUPRTD Index, CNLBPRTD Index used. See important disclaimers at the bottom of the page.

-

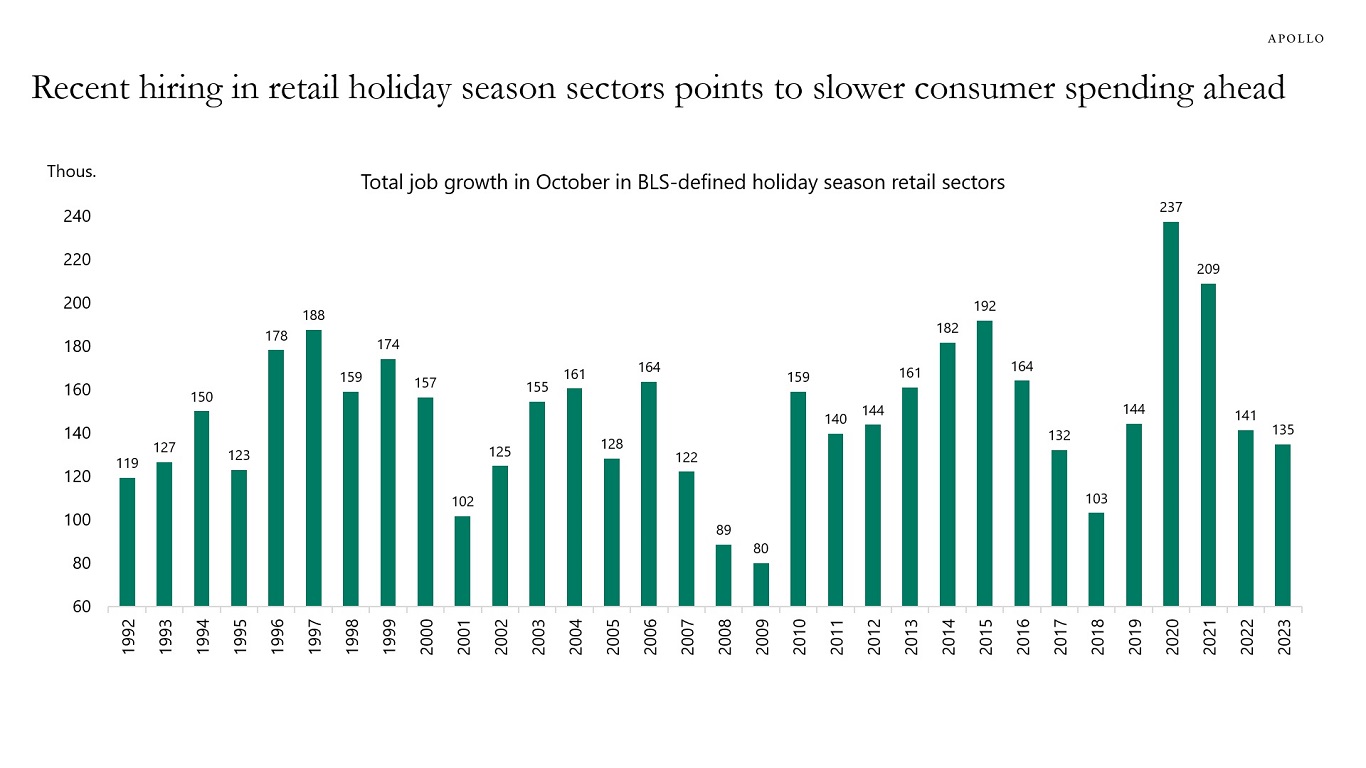

Hiring for the holiday season is generally done in October, and adding up new jobs created in the BLS-defined holiday season retail sectors in the latest employment report shows that retailers expect a weaker holiday season, see chart below. This soft outlook is consistent with growing inventories at many retailers. The BLS defines holiday sectors as furniture, electronics, personal care, clothing, sporting goods, general merchandise stores, miscellaneous store retailers (e.g., florists, office supply stores, gift shops, and pet shops), and non-store retailers (e.g., online shopping and mail-order houses, vending machine operators, and direct store establishments).

Source: BLS, Apollo Chief Economist. Note: Non-seasonally adjusted data shown. Holiday season sectors defined by BLS is available here. See important disclaimers at the bottom of the page.

-

A decade ago, foreigners owned 33% of US government debt. That number has now declined to 23%, see chart below.

Source: Treasury, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

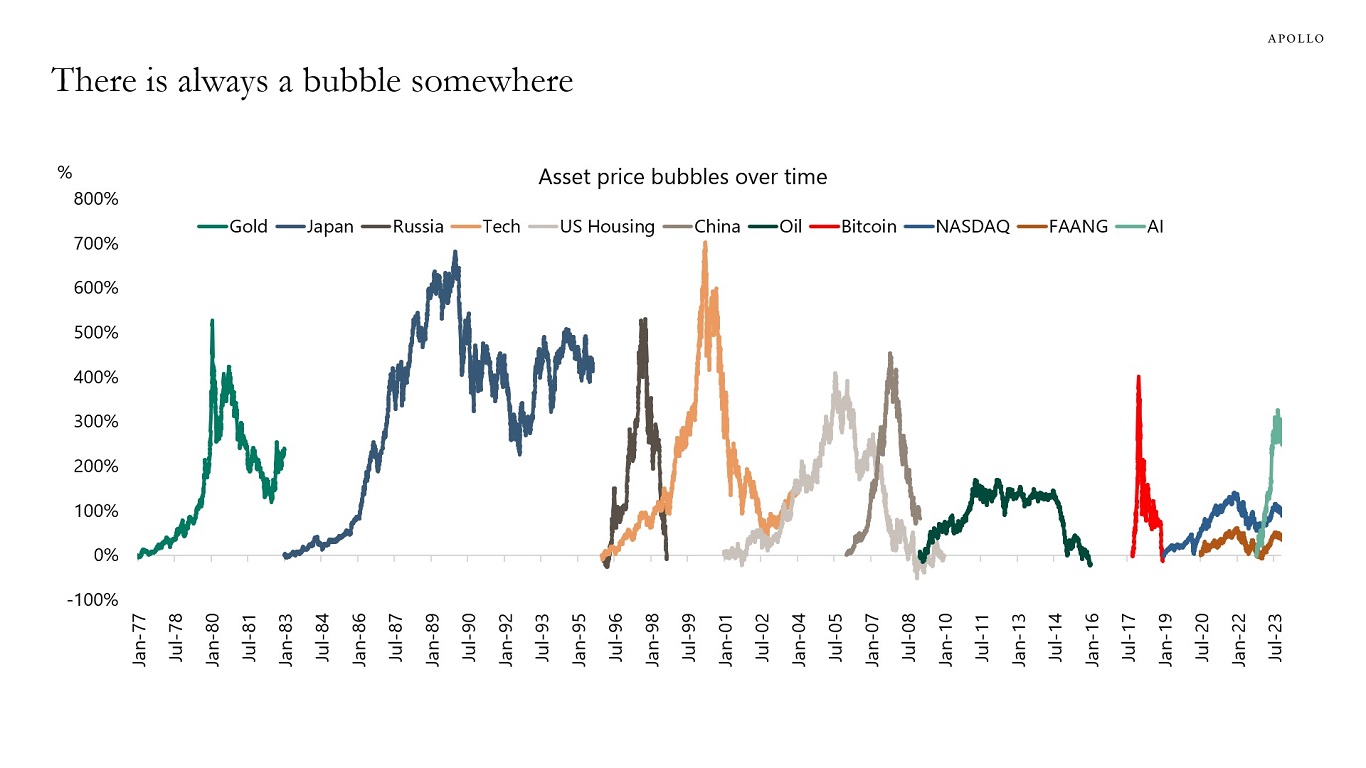

There is always a new fad somewhere, see chart below. But for investors, it is challenging to figure out when bubbles start, when they peak, and when they end.

Put differently, a bubble is a narrative. And the latest shiny narrative is AI. However, a lot of questions remain unanswered, such as how useful will AI be, how long will it last, will it significantly change our lives, are the AI companies worth buying when they have already increased 50% in 2023 and have P/E ratios around 50?

The bottom line is that bubble chasing is not a good investment strategy.

Source: Bloomberg, Apollo Chief Economist. Note: Nikkei for Japan’s real estate crisis of 1989; 1998 Moscow large-cap index; NVIDIA as a proxy for AI; 2005-07 China property bubble; and stock price of US homebuilders. See important disclaimers at the bottom of the page.

-

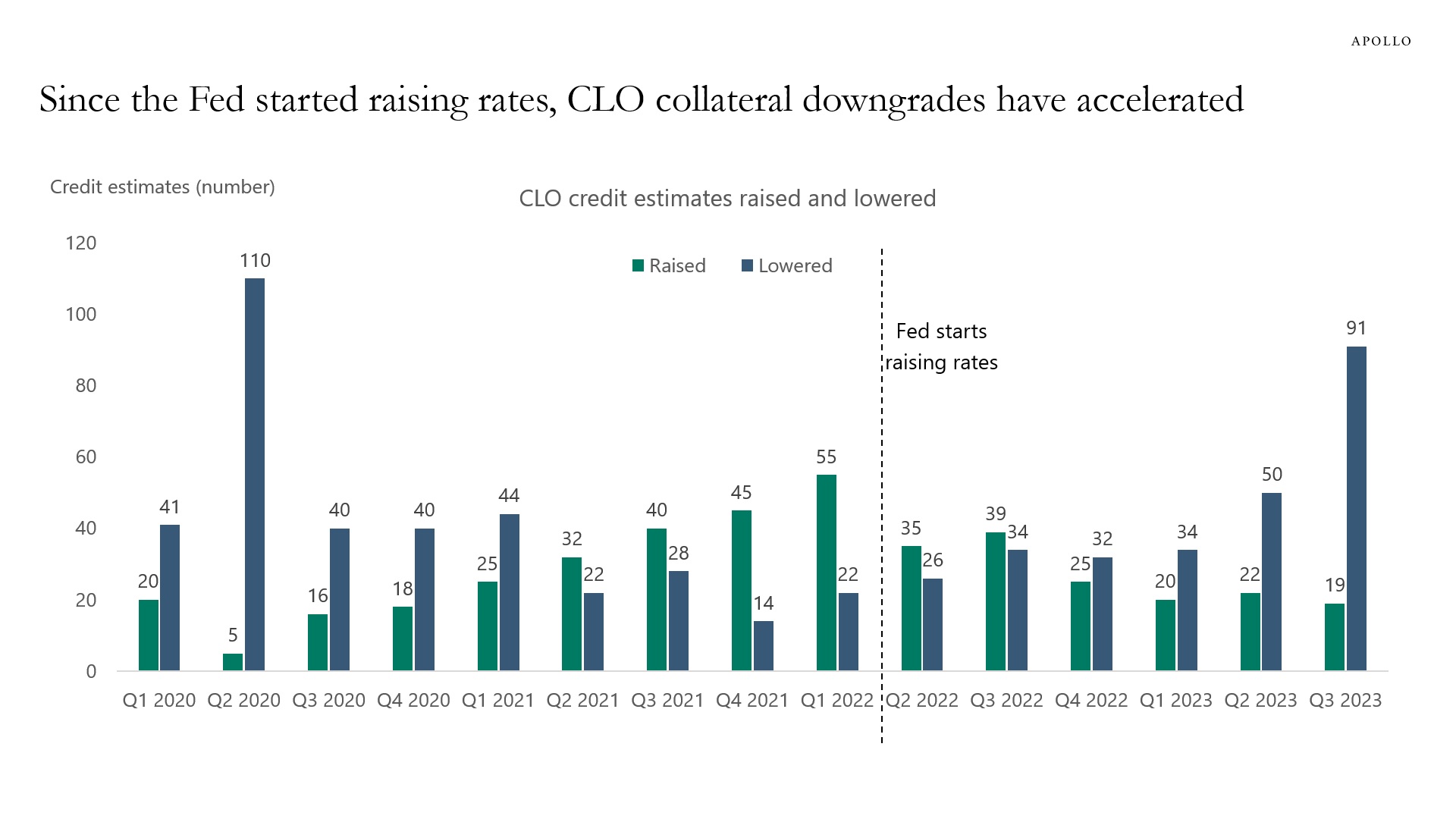

Fed hikes are having a more and more negative impact on companies with higher leverage, lower coverage ratios, and weaker cash flows. Specifically, the latest data for the third quarter shows that downgrades by S&P of CLO collateral have surpassed upgrades by a ratio of 4:1, see the first chart below.

The bottom line is that Fed policy is working exactly as the textbook would have predicted. Higher rates are biting harder and harder on middle-market corporates with poor credit metrics.

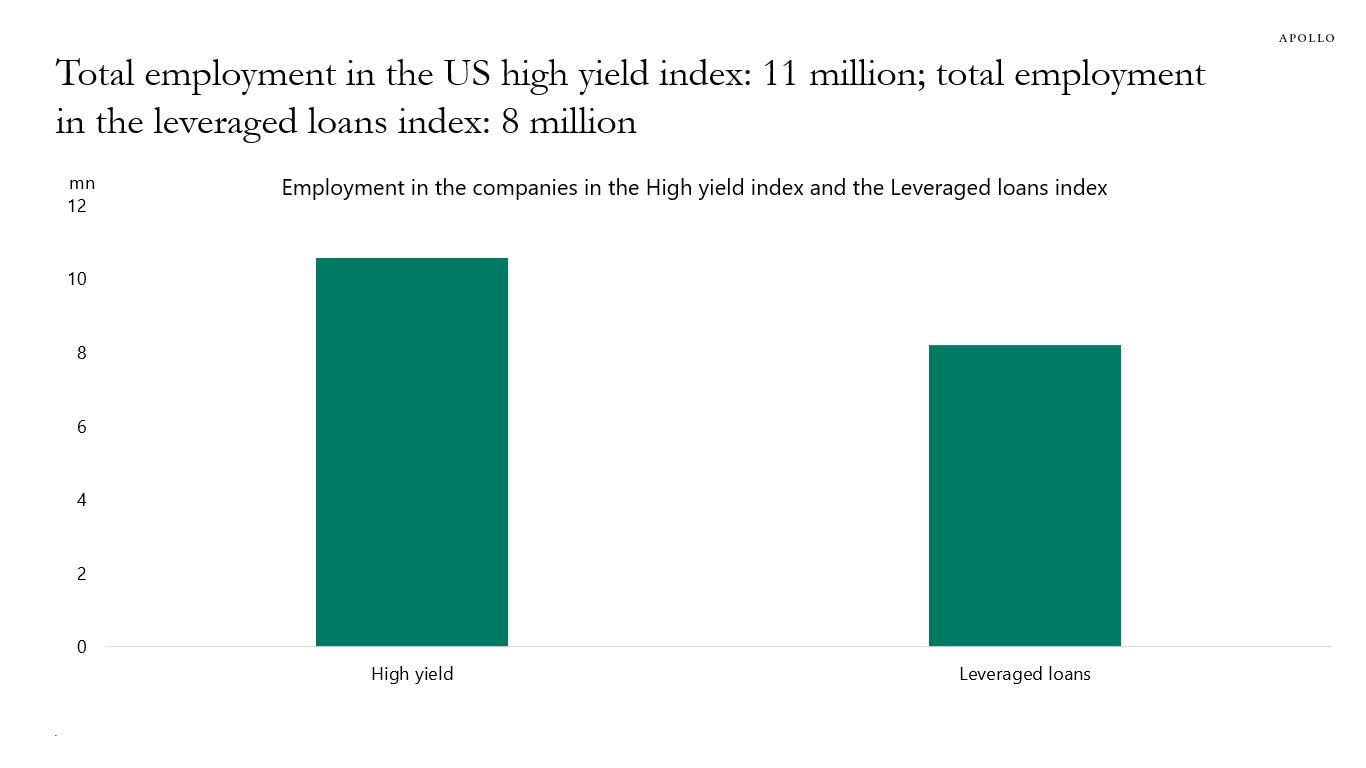

With total employment in high yield-issuing companies at 11 million and total employment in loan-issuing companies at 8 million, higher rates will ultimately have a negative impact on employment, see the second chart.

Source: S&P Global Ratings, Apollo Chief Economist

Source: Bloomberg, ICE BofA H0A0 Index, Morningstar LSTA Index, Apollo Chief Economist. Note: Data includes 842 companies in the HY index with employment data available for 584 companies and median employment assumed for the rest. Similarly, there are 1,073 companies in the leveraged loans index with employment data available for 450 companies and median employment assumed for the rest. See important disclaimers at the bottom of the page.

-

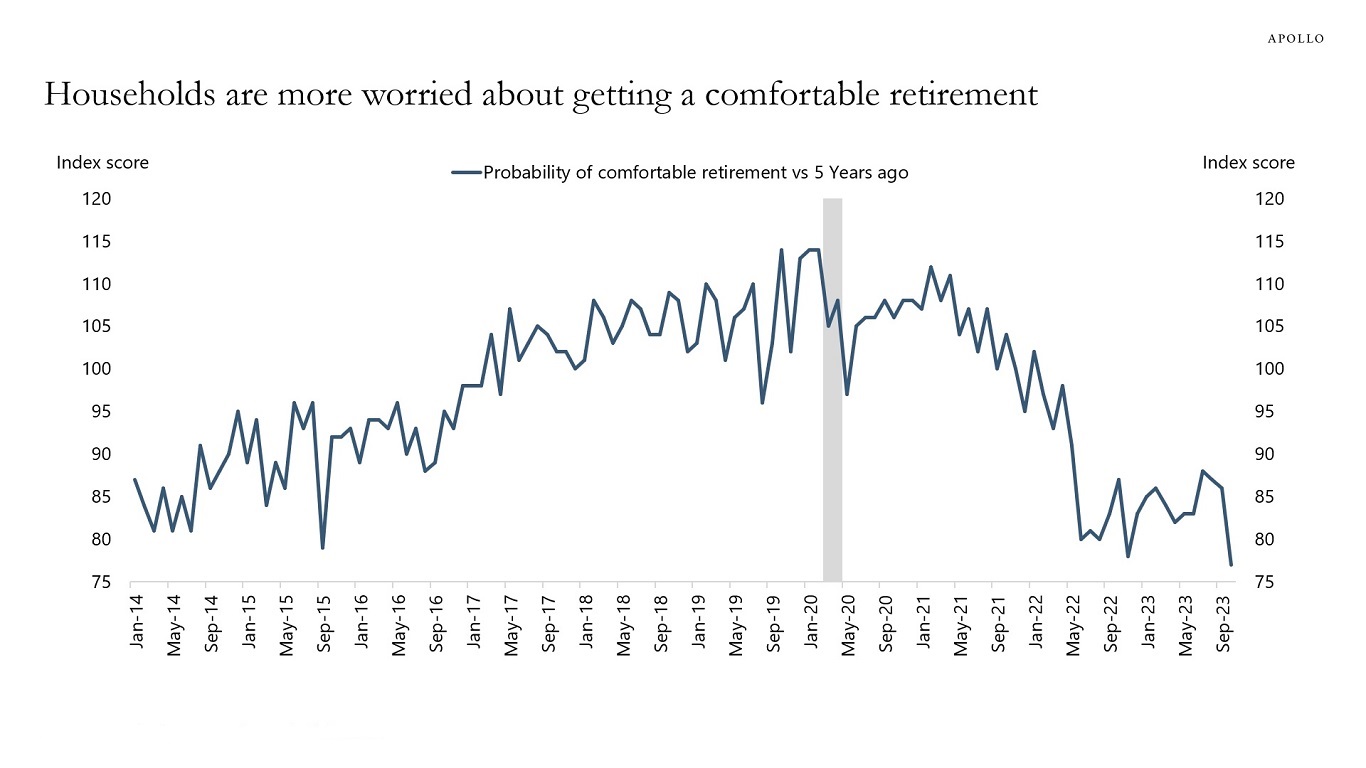

The 60/40 portfolio continues to underperform, and households are getting more worried about their retirement, see chart below.

Source: University of Michigan, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

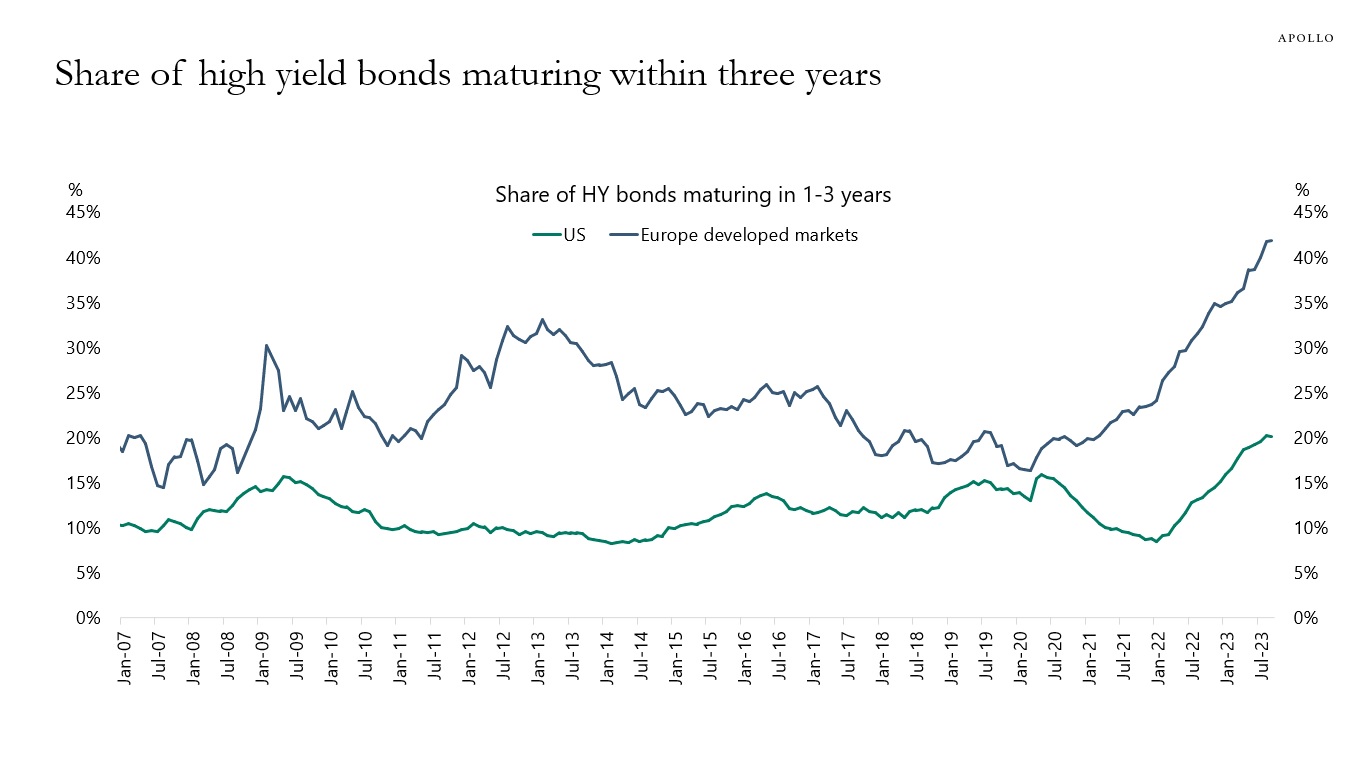

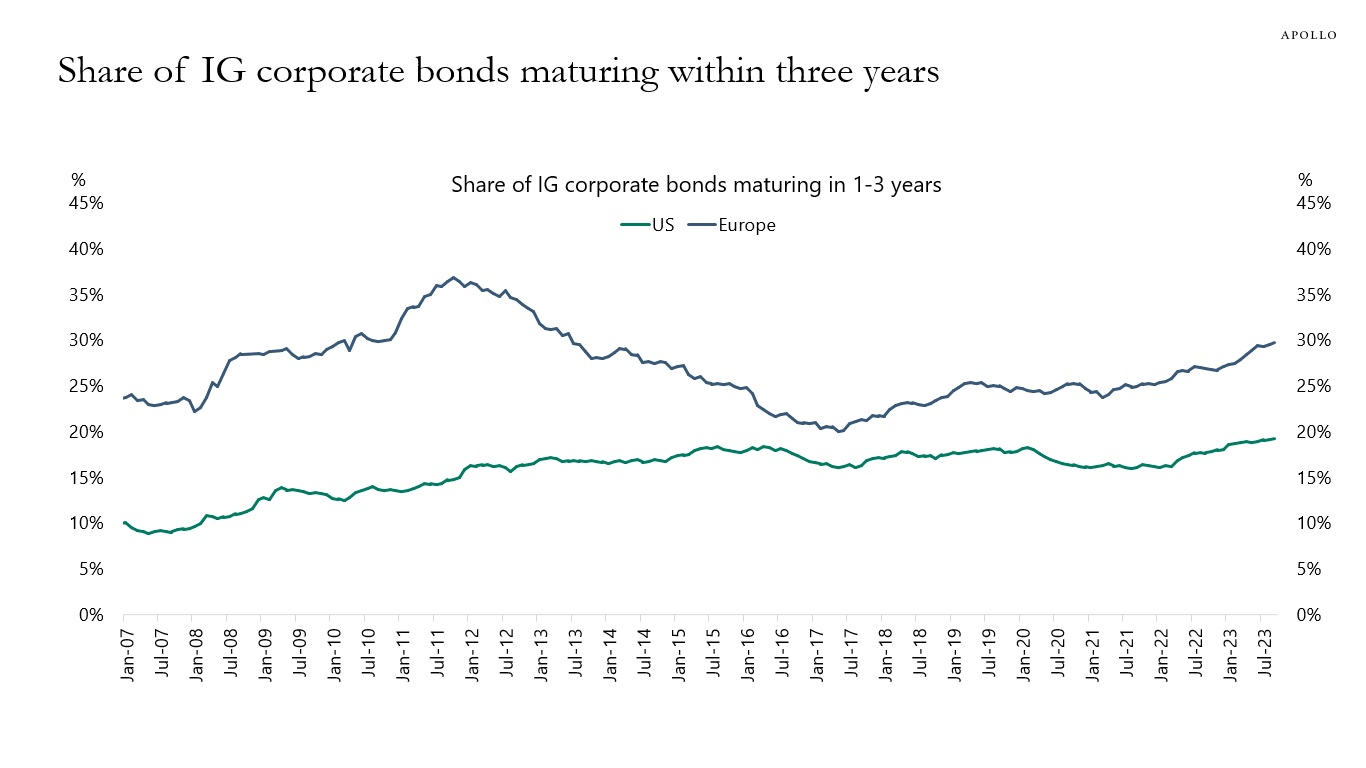

European credit is more vulnerable to higher rates because the share of IG and HY bonds maturing within three years is higher in Europe than in the US, see charts below.

For US IG, the share has, for the past decade, been stable between 15% and 20%.

The bottom line is that Fed hikes and ECB hikes are having a negative impact on credit, but the impact is going to be more significant in Europe, which increases the likelihood of a harder landing in Europe.

Source: ICE BofA, Bloomberg, Apollo Chief Economist

Source: ICE BofA, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

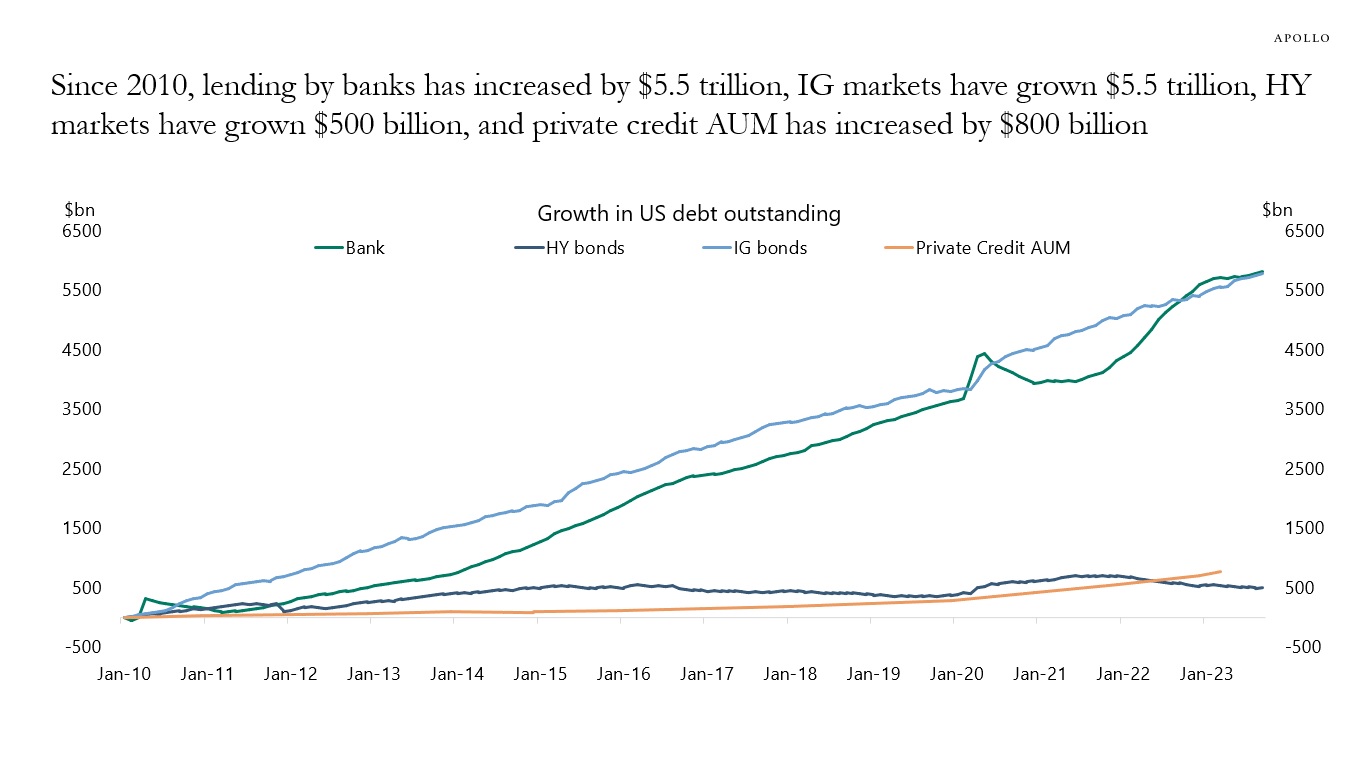

Since 2010, private credit has grown much slower than bank lending and IG markets, see chart below.

Our monthly outlook for private markets is available here.

Source: FRB, ICE BofA, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

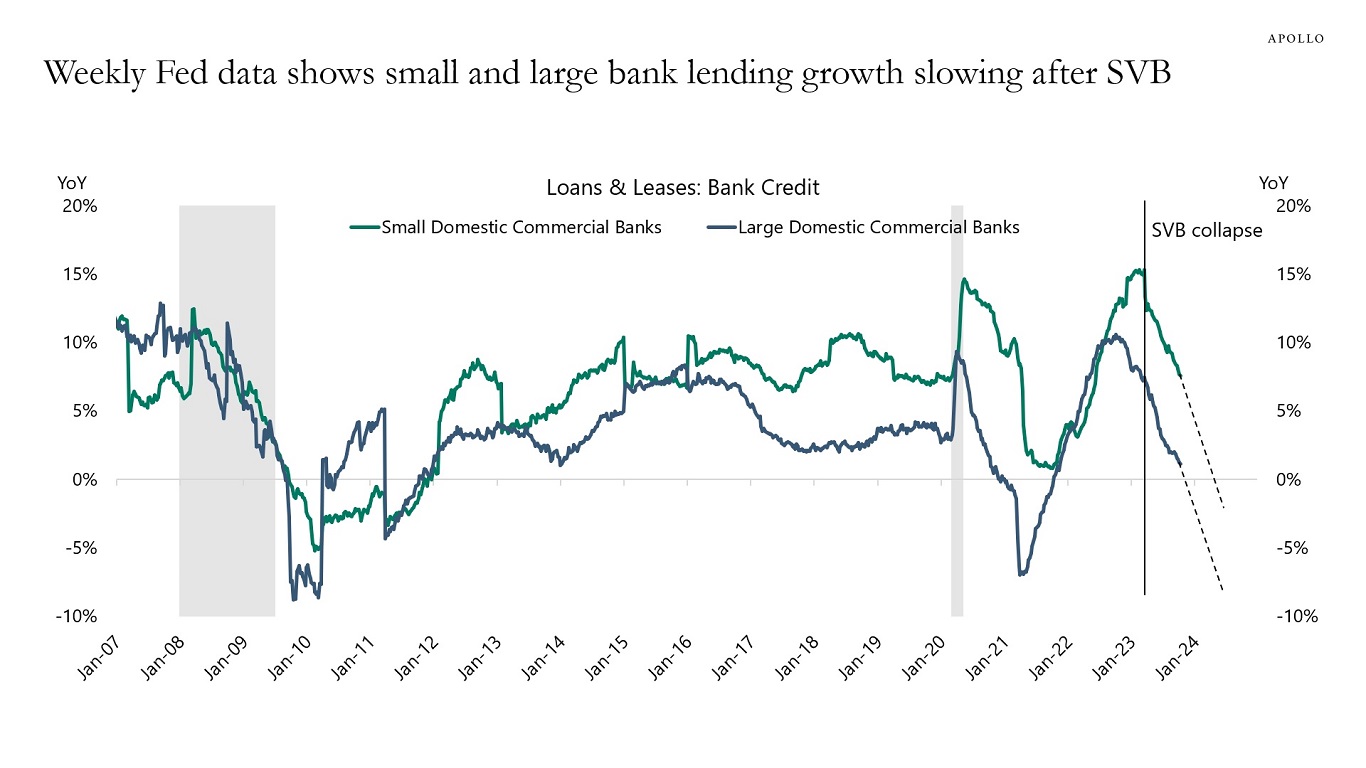

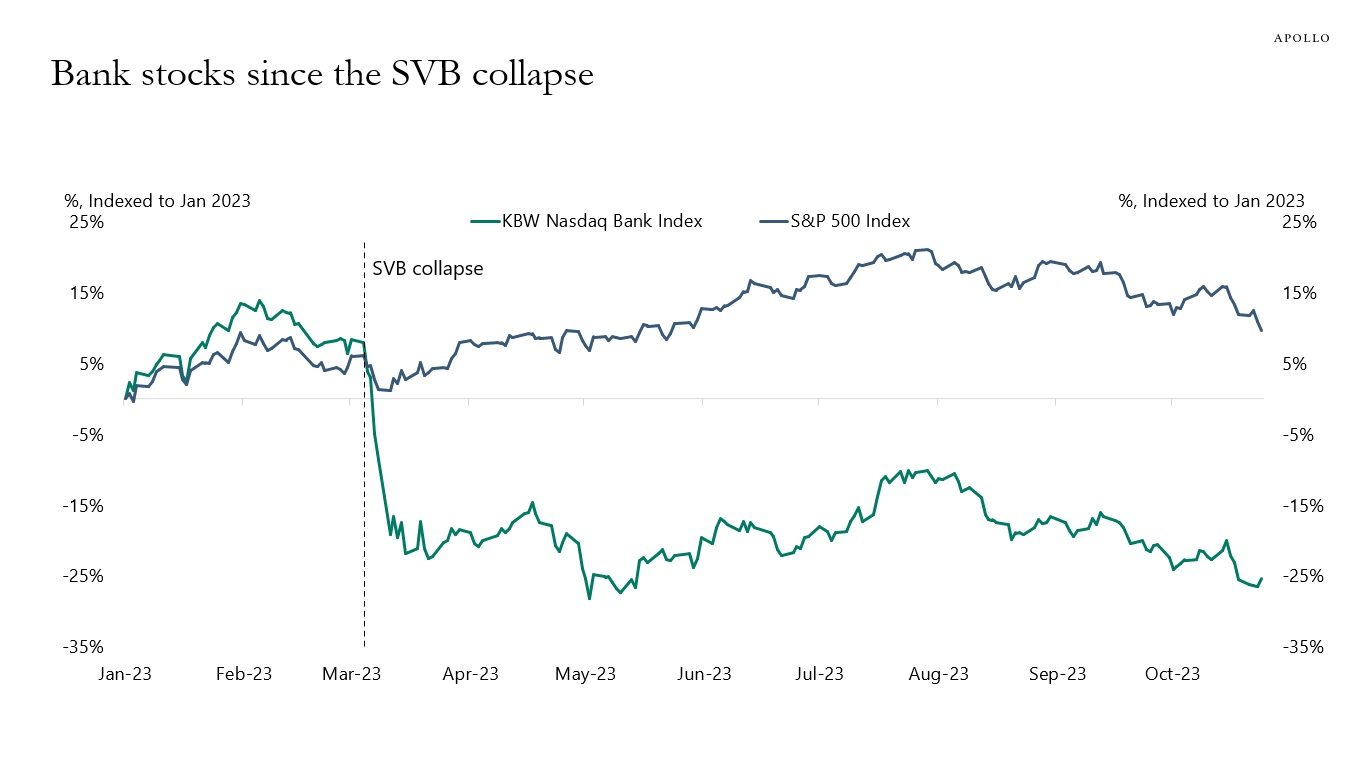

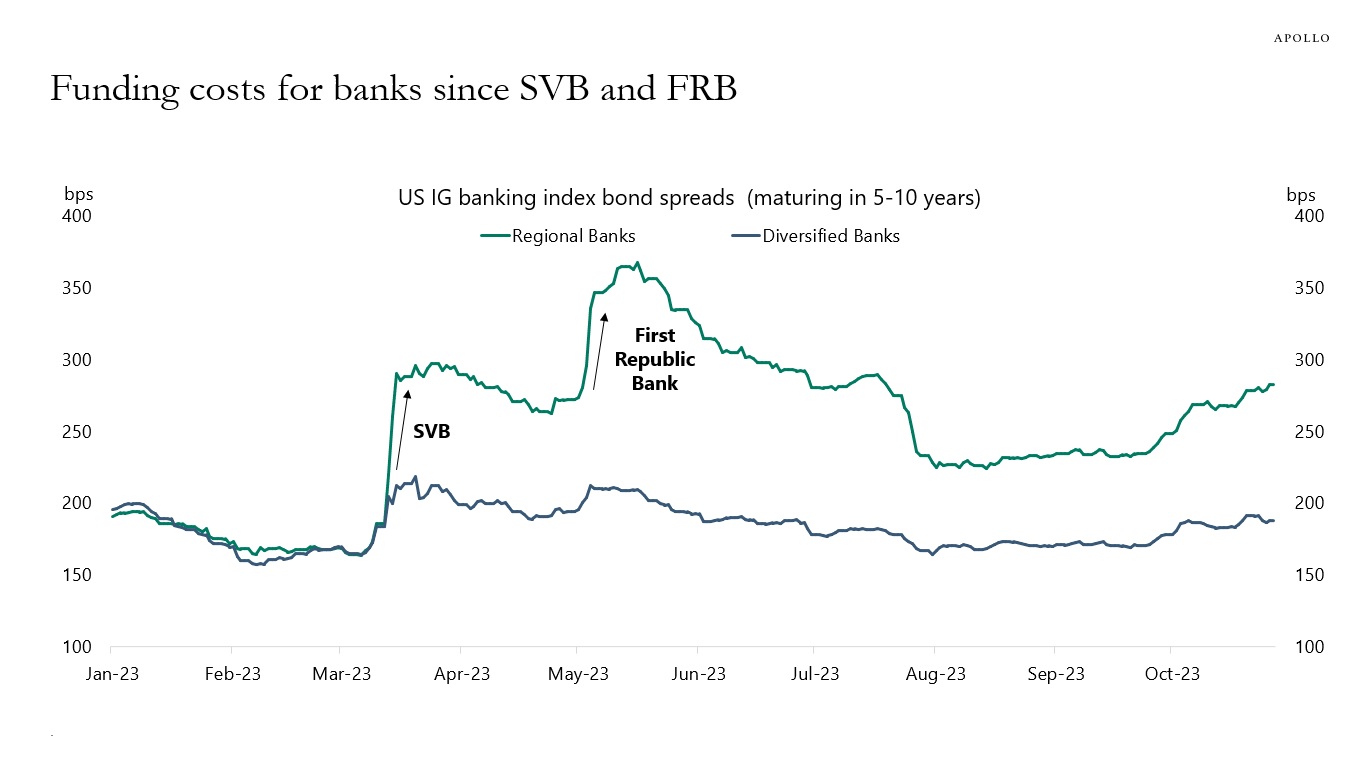

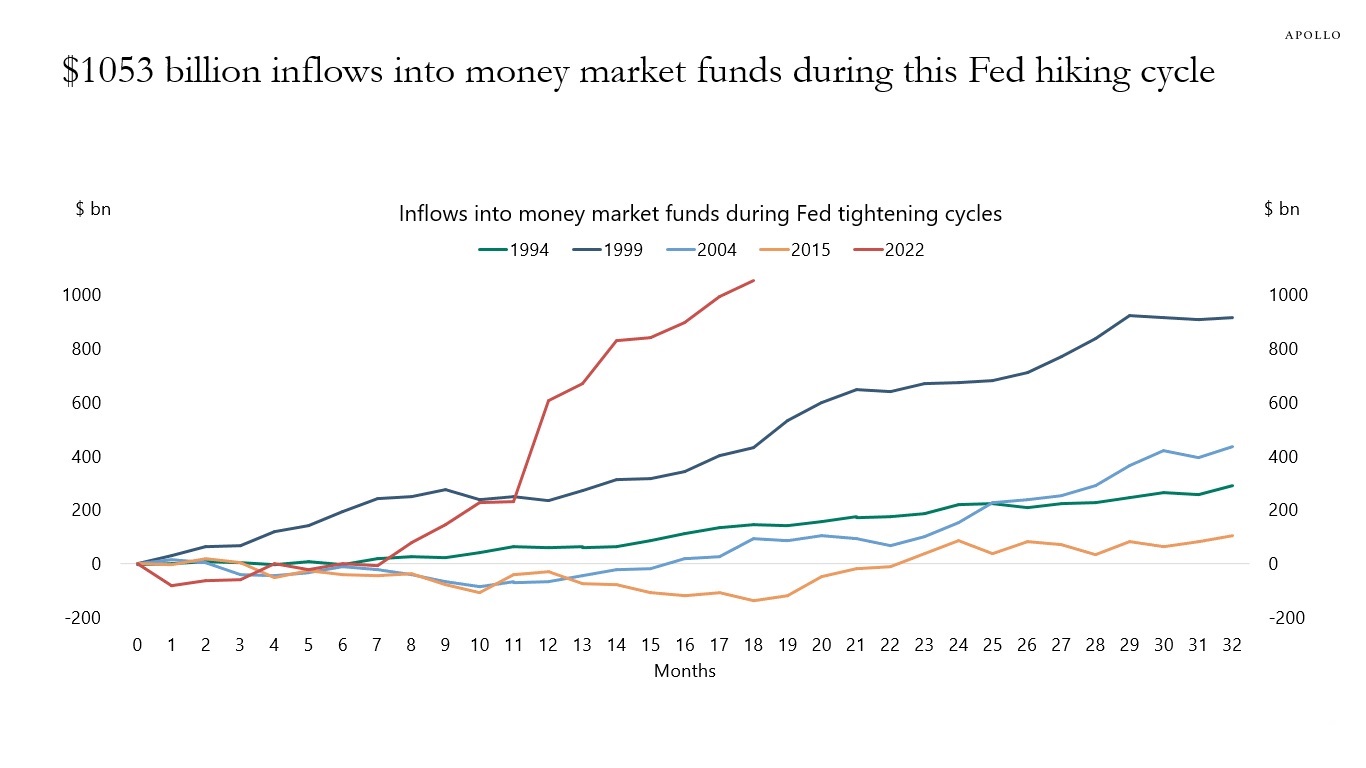

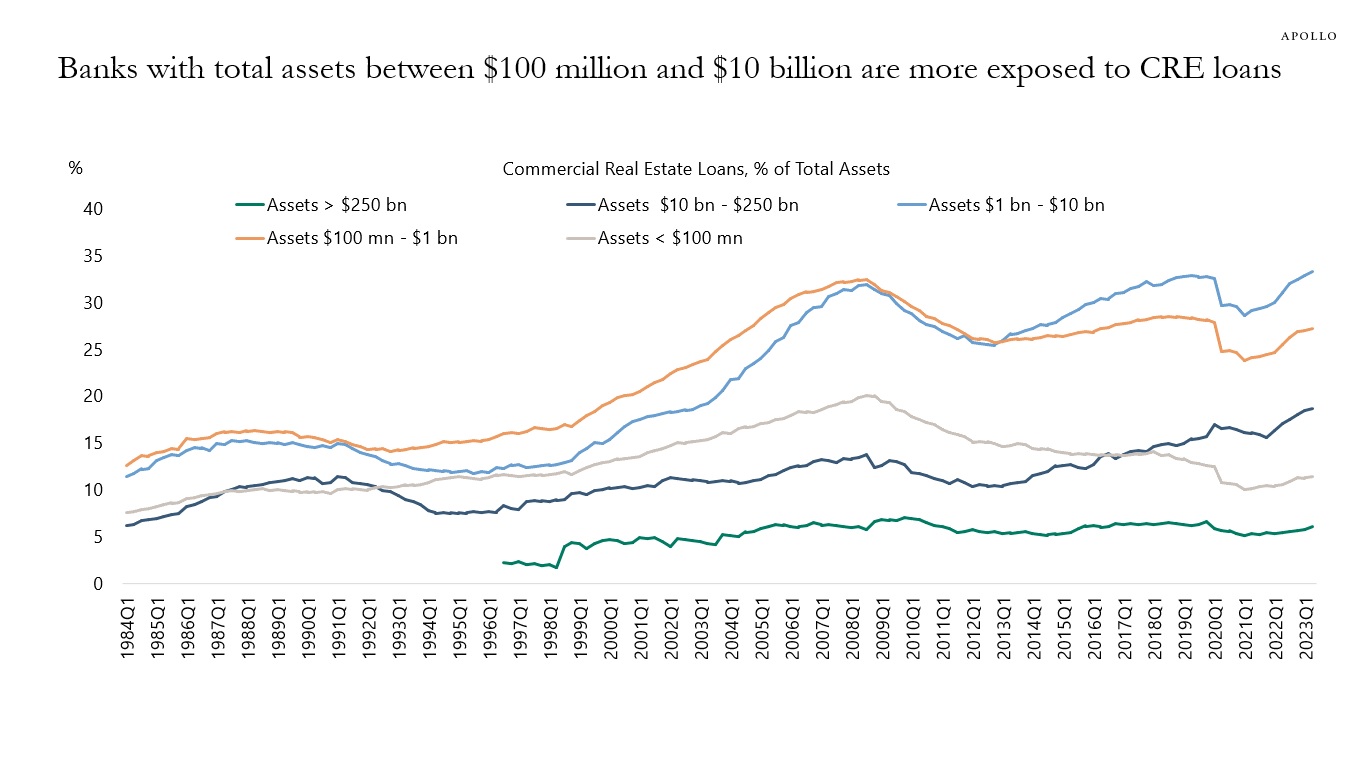

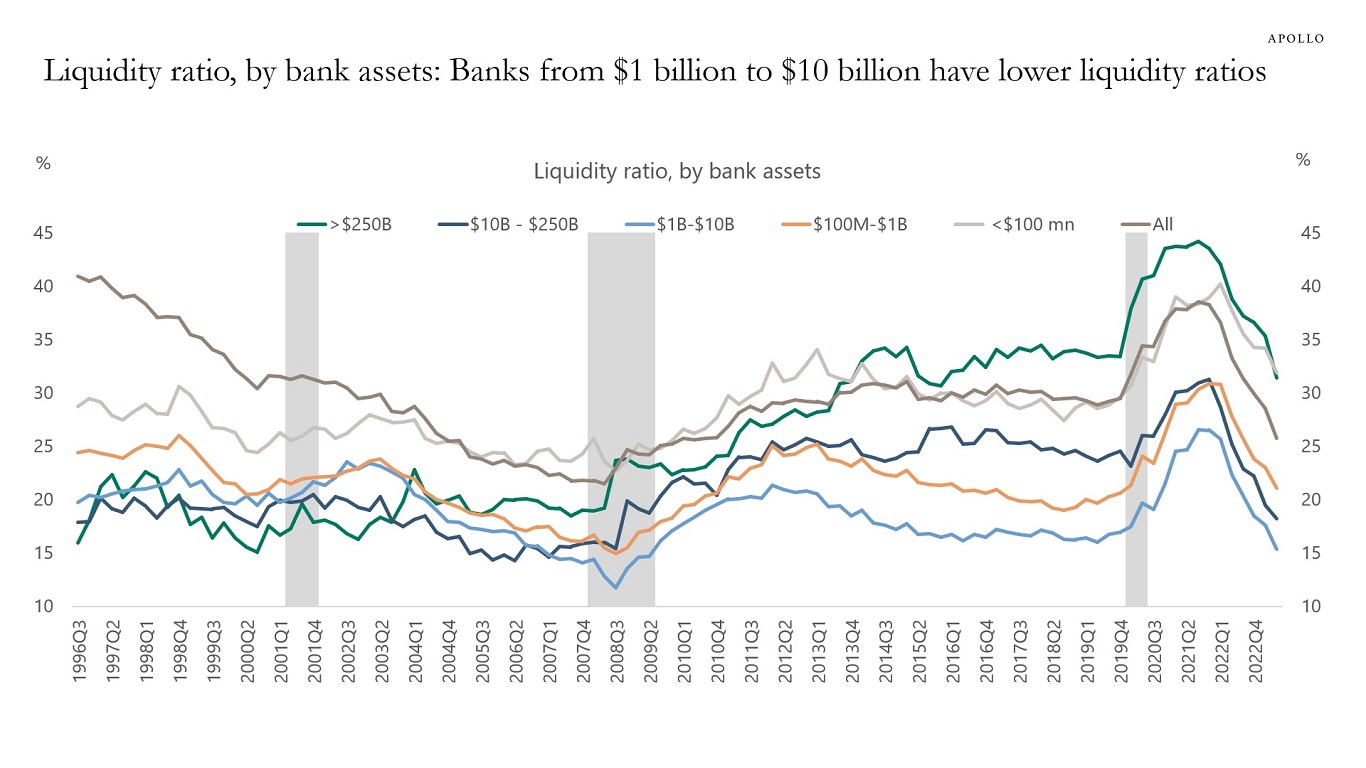

Our updated regional banking sector outlook is available here, and the weekly data shows a continued decline in loan growth in small and large banks, see the first chart.

The slowdown in loan growth is driven by Fed hikes and tighter lending standards following the SVB collapse.

With the Fed on hold until the middle of next year, these trends are likely to continue, and loan growth will soon turn negative.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist. Note: The KBW Bank Index consists of Bank of NY Mellon, Bank of America, Capital One Financial, Citigroup, Citizens Financial Group, Comerica, Fifth Third Bank, First Horizon, Huntington, JP Morgan Chase, Keycorp, M&T Bank, Northern Trust, PNC, People’s United Financial, Regions, State Street, Truist, US Bancorp, Wells Fargo, and Zions.

Source: ICE BofA, Bloomberg, Apollo Chief Economist. Note: Unweighted average spreads of bonds from ICE 5-10 Year US Banking Index, C6PX Index for bonds issued before January 1, 2023. There are eight banks in the Regional index and 41 banks in the Diversified index. Regional banks include BankUnited, Citizens Financial, Huntington, and Zions. Diversified banks include JP Morgan Chase, Citibank, and Bank of America.

Source: FRB, ICI, Bloomberg, Apollo Chief Economist

Source: FDIC, Apollo Chief Economist

Source: FDIC, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

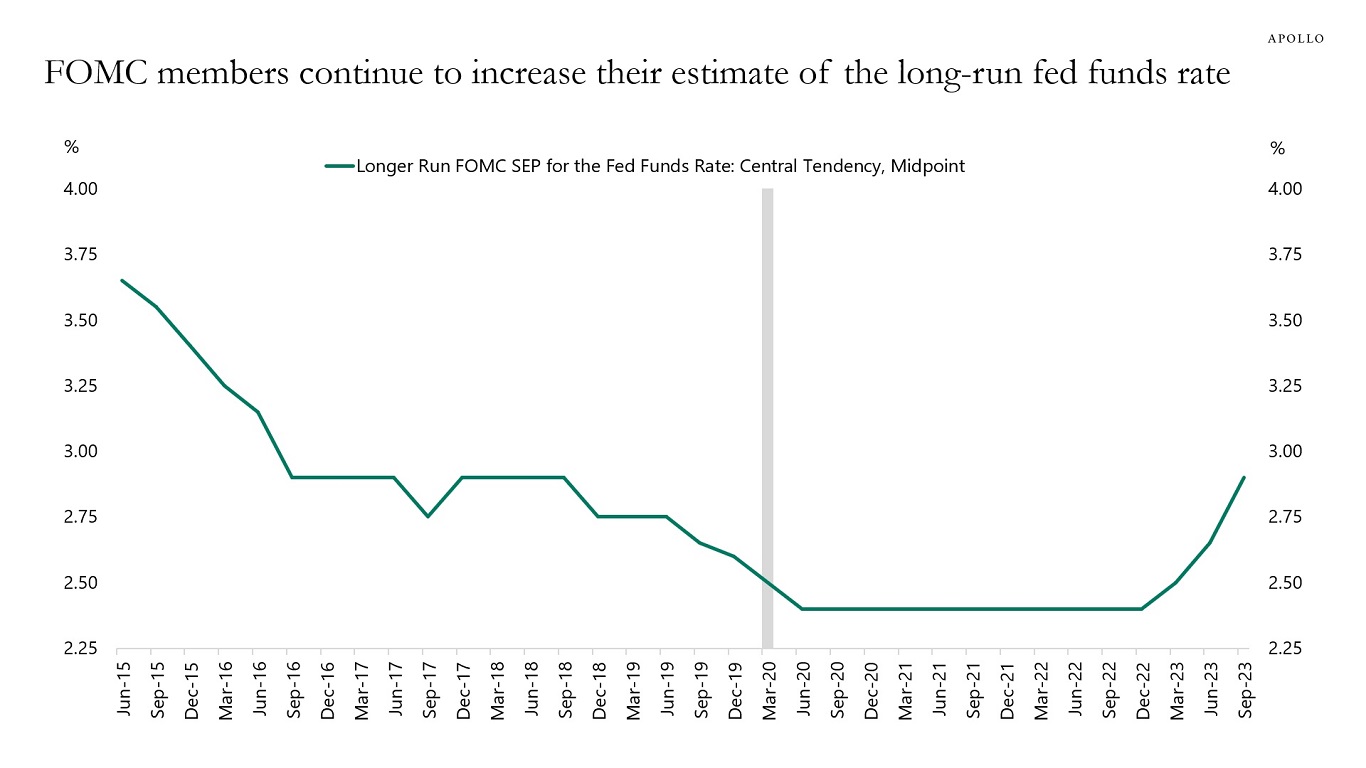

The Fed has since the beginning of 2023 steadily increased its estimate of the long-run fed funds rate, see chart below. The implication for investors is that the Fed is beginning to see the costs of capital as permanently higher. A permanent increase in the risk-free rate has important implications for firms, households, and asset allocation across equities and fixed income.

Source: FRB, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.