Want it delivered daily to your inbox?

-

My latest outlook presentation is available here.

See important disclaimers at the bottom of the page.

-

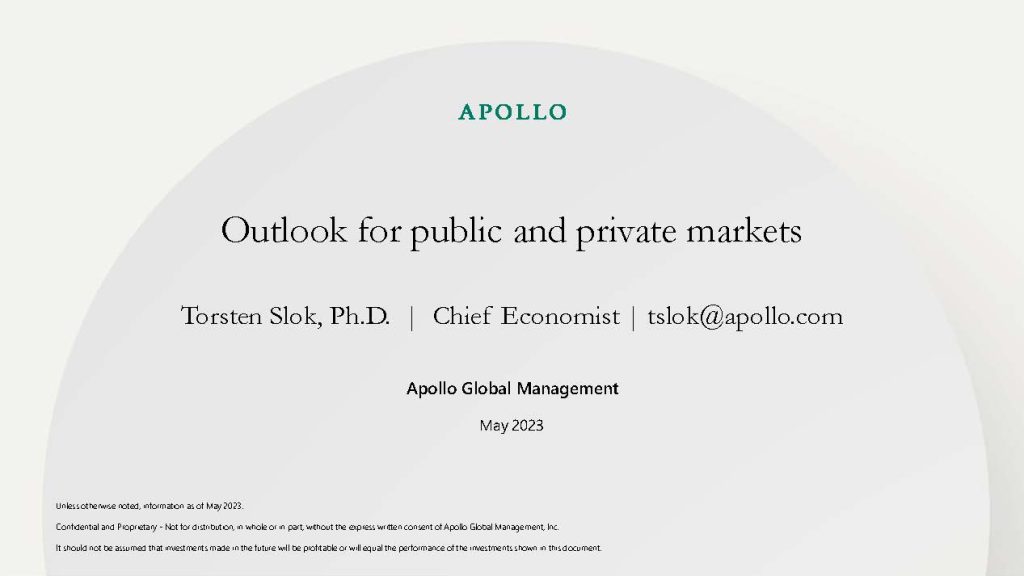

The interest coverage ratio for the investment grade index is currently near all-time high levels, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

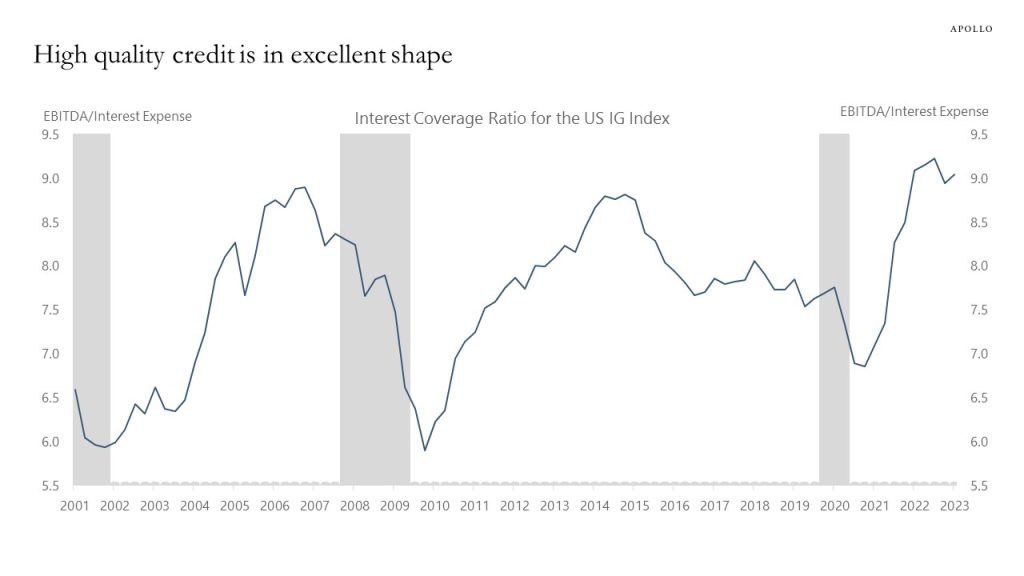

What makes the coming recession so unusual is that it is happening after almost 15 years of money printing, which never really had any major positive effect on GDP growth. Instead, the 15 years of money printing created a significant bubble in asset prices.

As a result, the big correction during this recession will not be in the economy but in asset prices as the Fed continues to deflate the buy-everything bubble created due to global easy money.

A mild economic recession with a big recession in asset prices is what we call a non-recession recession.

With inflation currently at 5%, well above the Fed’s 2% inflation target, the ongoing correction in asset prices will continue as the costs of capital will stay elevated well into 2024.

Source: BEA, Haver Analytics, Apollo Chief Economist. Note: Estimates shown for real GDP and nominal GDP are for the period covering the peak-to-trough decline in real GDP. Unemployment rate is trough to peak. See important disclaimers at the bottom of the page.

-

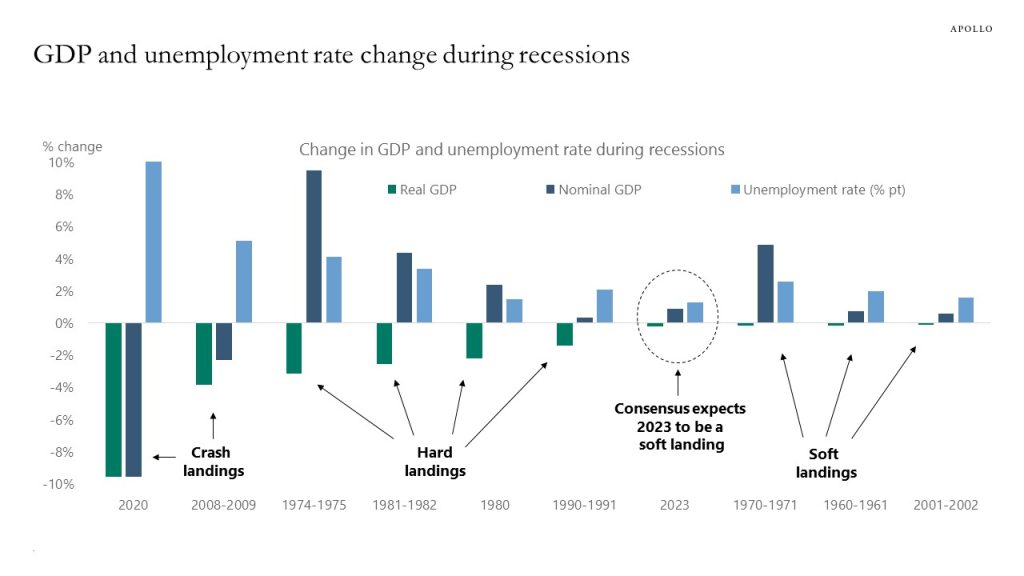

The stock of CRE debt outstanding today is significantly smaller than the stock of residential mortgage debt outstanding in 2007, see chart below.

As a result, this recession will be milder than in 2008, but it will likely be longer because the required correction in CRE prices will be spread out over a longer period.

Source: BEA, FRB, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

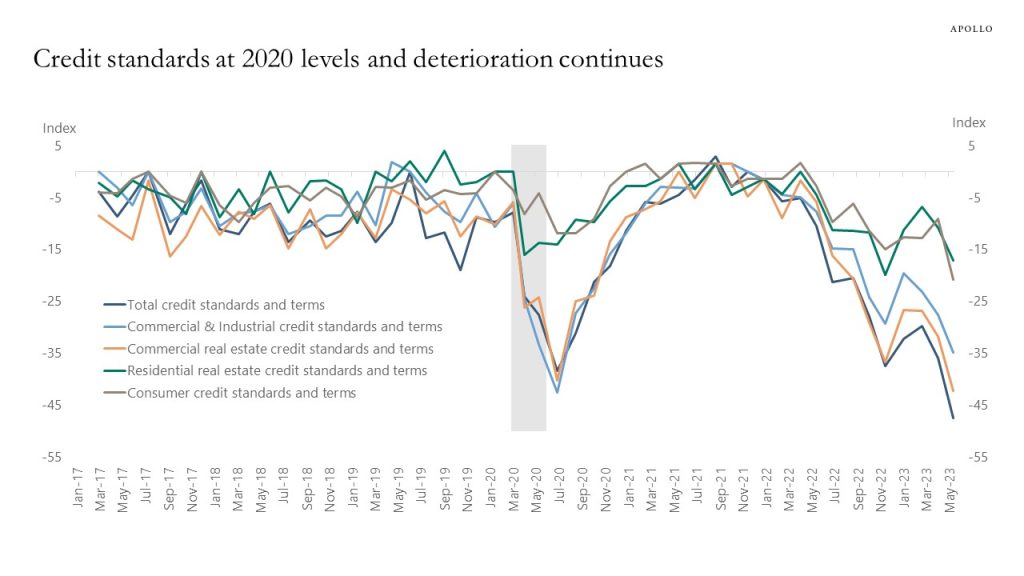

A survey of 67 banks in the Dallas Fed district carried out in early May shows that credit standards have tightened significantly since SVB collapsed, and bank credit conditions are now at 2020 levels, and the deterioration continues, see chart below.

Combined with still tight IG and HY spreads, the Fed will look at this and conclude that tighter credit conditions are needed to get inflation down from currently 5% to the Fed’s 2% inflation target. In particular in a situation where households are still sitting on plenty of cash, see also this new Fed working paper, which finds that consumers have plenty of excess savings left at least until the end of the year.

Source: Banking Conditions Survey, Federal Reserve Bank of Dallas, Apollo Chief Economist. Note: Data were collected May 2–10, and 67 financial institutions responded to the survey headquartered in the Eleventh Federal Reserve District. See important disclaimers at the bottom of the page.

-

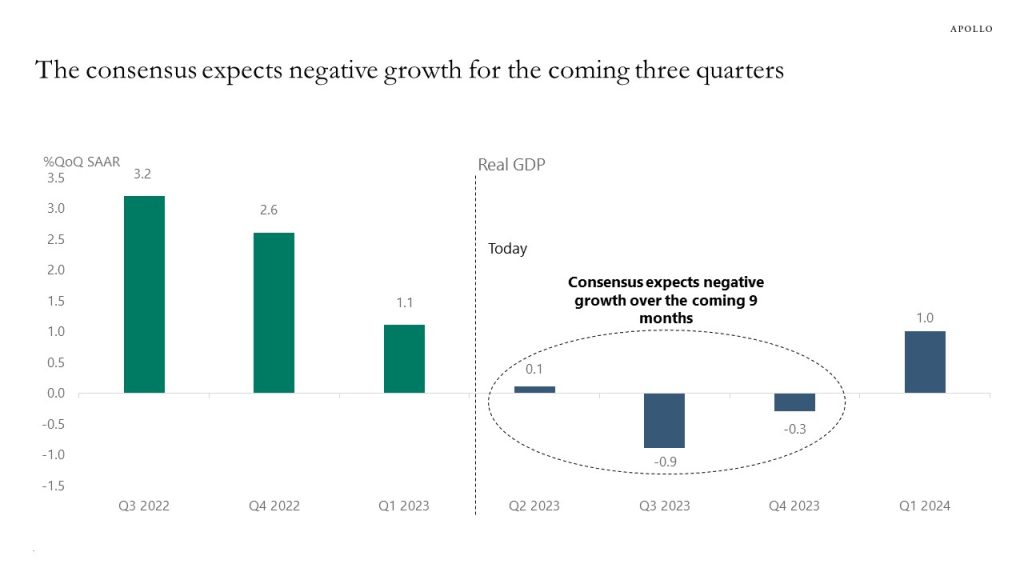

The consensus expects a recession starting next quarter, but the upside risk to this negative forecast is that consumers still have plenty of savings left, see also this new Fed paper, which finds that households will not run out of excess savings before the fourth quarter of 2023.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

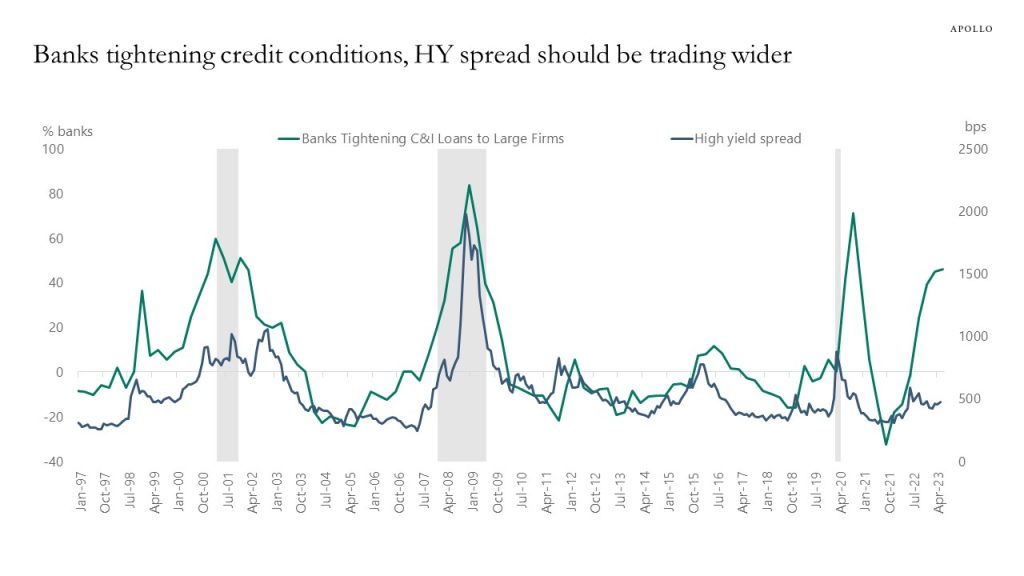

It is surprising how narrow high yield credit spreads are given the ongoing tightening in credit conditions in the banking sector, see chart below.

Source: FRB, Haver Analytics, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

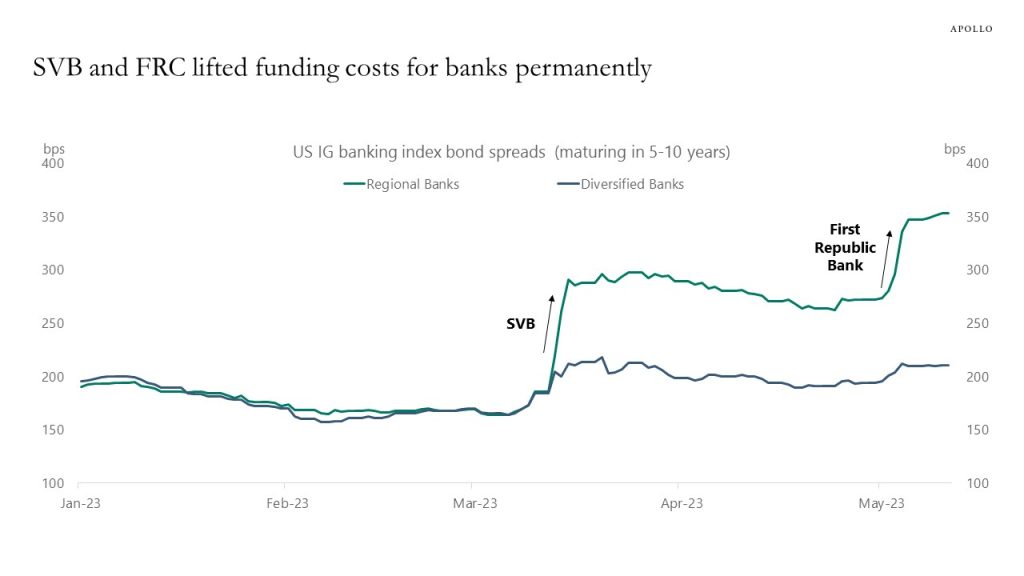

One way to calculate how much the ongoing banking crisis corresponds to in Fed hikes is to look at how much borrowing costs have increased for regional banks and money center banks since Silicon Valley Bank collapsed.

The chart below shows that since SVB failed, IG credit spreads for regional banks have widened 200bps and for diversified banks 50bps.

And for all banks, the spread widening has stayed at a new higher level because many banks have been downgraded. Spreads first moved up to a higher level after SVB and then another higher level after FRC, showing that the ongoing banking crisis is having a permanent negative effect on the economy.

Put differently, the increase in borrowing costs since SVB failed corresponds to a 200bps permanent Fed hike for regional banks and 50bps permanent Fed hike for large banks. Weighing these estimates together using the shares of loans and leases accounted for by small and large banks, respectively, gives an economy-wide Fed tightening of a bit more than 100bps for the entire banking sector.

In short, the jump in funding costs for banks is permanent, and it has become a lot more expensive for many banks to run their business, and the banking crisis is not over.

Source: ICE BofA, Bloomberg, Apollo Chief Economist. Note: Unweighted average spreads of bonds from ICE 5-10 Year US Banking Index, C6PX Index for bonds issued before 1st Jan 2023. There are 8 banks in the Regional index and 41 banks in the Diversified index. Regional banks include BankUnited, Citizens Financial, Huntington, and Zions. Diversified banks include JP Morgan, Citibank, and Bank of America. See important disclaimers at the bottom of the page.

-

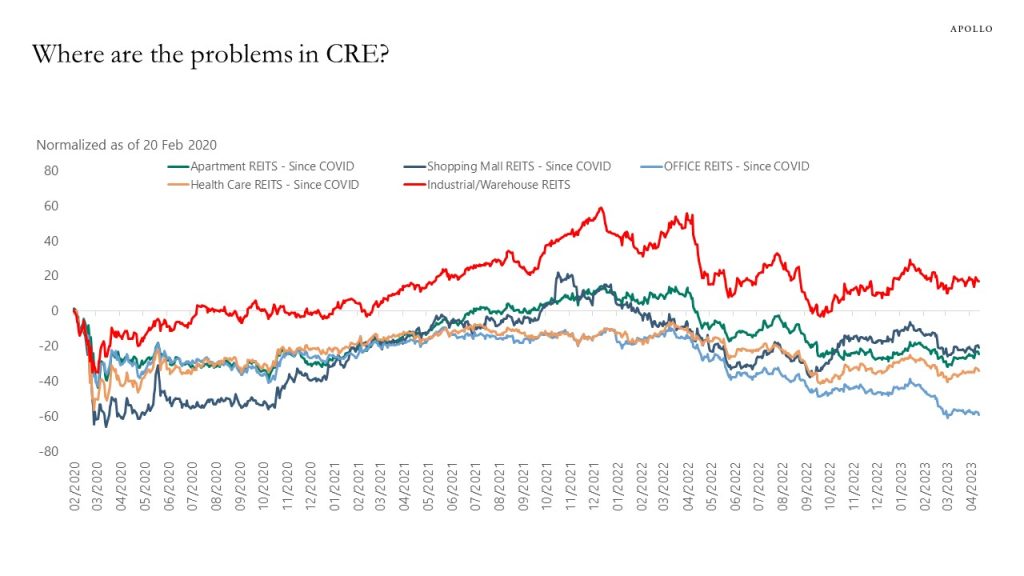

There are some important differences in CRE, with some sectors such as office having negative performance and industrial and warehouses showing positive performance, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

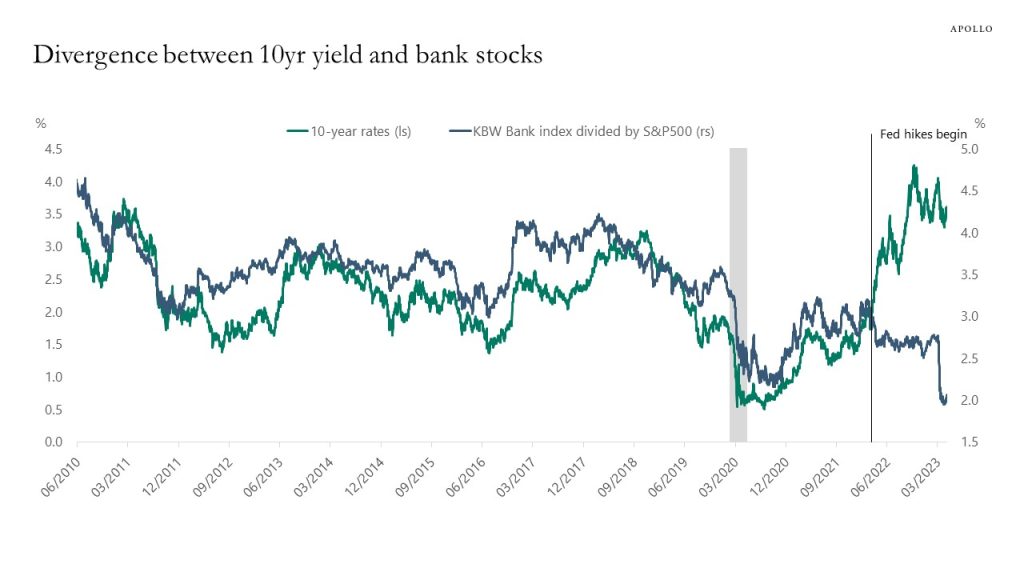

It used to be the case that higher long-term interest rates were positive for banks because higher long rates meant wider net interest margins.

But since the Fed started hiking rates last year, this correlation has broken down, see chart below.

Now higher rates are negative for banks because it has a negative impact on their assets, and higher rates and an inverted yield curve increase the risks of a recession and hence credit losses.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.