Want it delivered daily to your inbox?

-

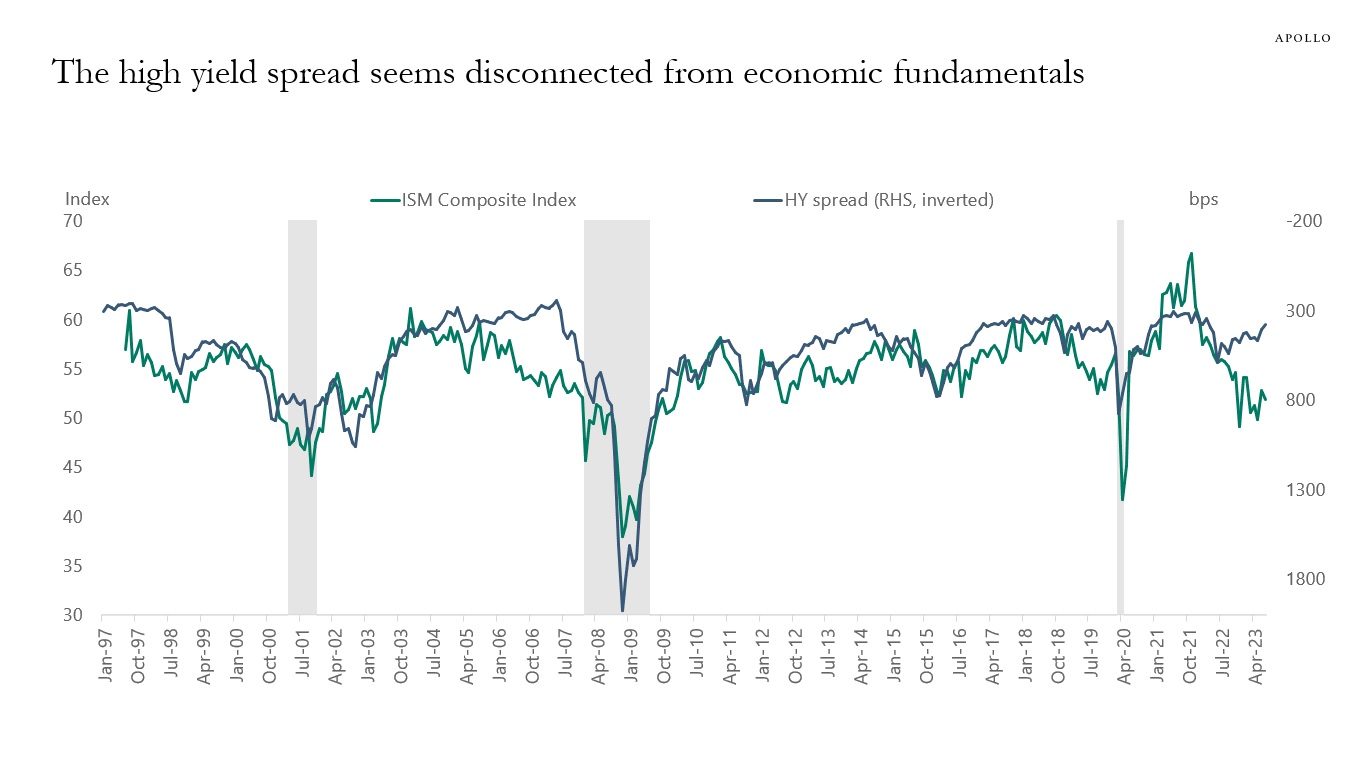

Fed hikes had an immediate negative effect on the manufacturing sector because the goods sector is more sensitive to interest rates.

With interest rates remaining high and consumers running out of excess savings, the next shoe to drop in 2023H2 is the service sector.

The divergence between manufacturing and services is likely why high yield spreads have not yet widened the way they usually do, see chart below.

Source: ISM, ICE BofA, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

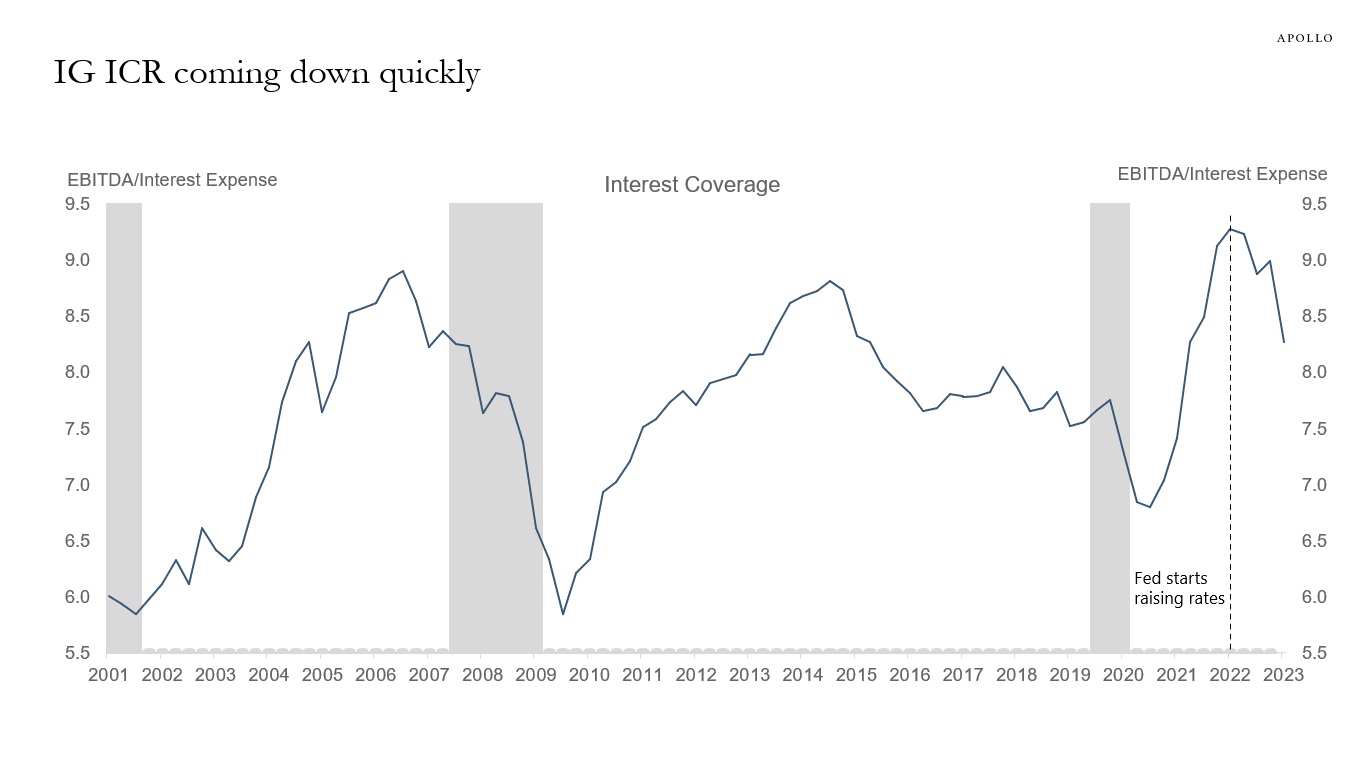

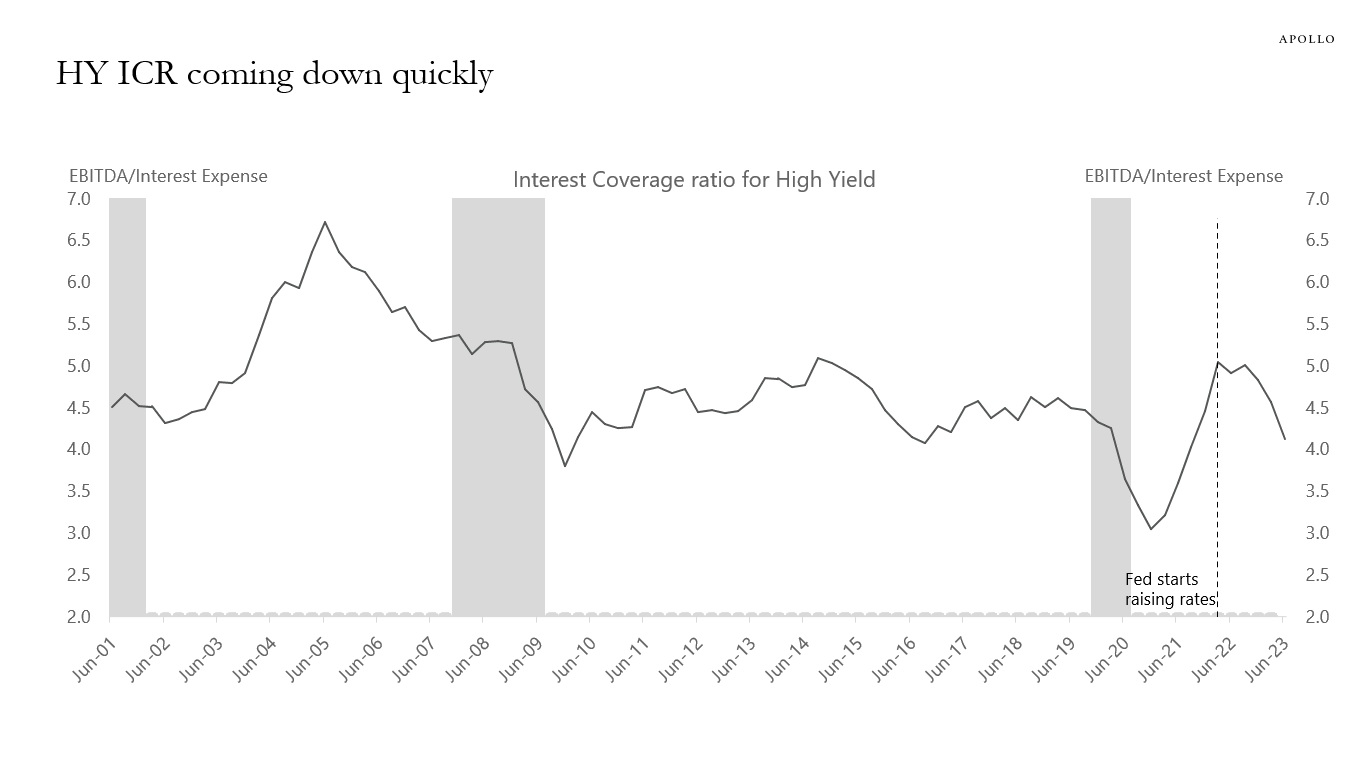

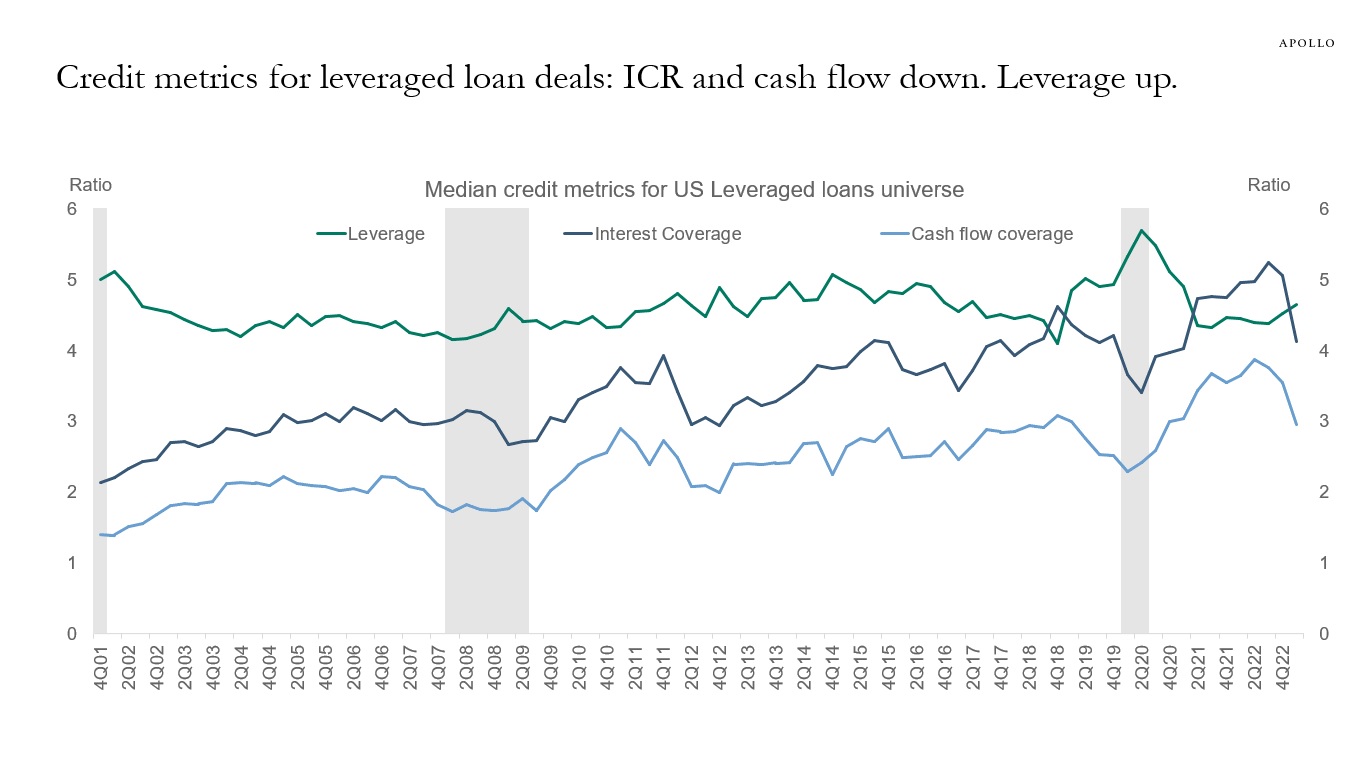

Since the Fed started raising rates, credit fundamentals have continued to deteriorate. The higher cost of capital is putting significant downward pressure on interest coverage ratios across IG, HY, and loans. Cash flow coverage is declining, and leverage is rising, see charts below.

The pressure on corporate balance sheets is the direct result of the Fed keeping the costs of capital at high levels, and with rates staying high for a couple of years, the ongoing deterioration in credit fundamentals will continue to have a negative impact on employment growth and capex spending, and ultimately GDP.

Our credit market outlook is available here.

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: Pitchbook LCD, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

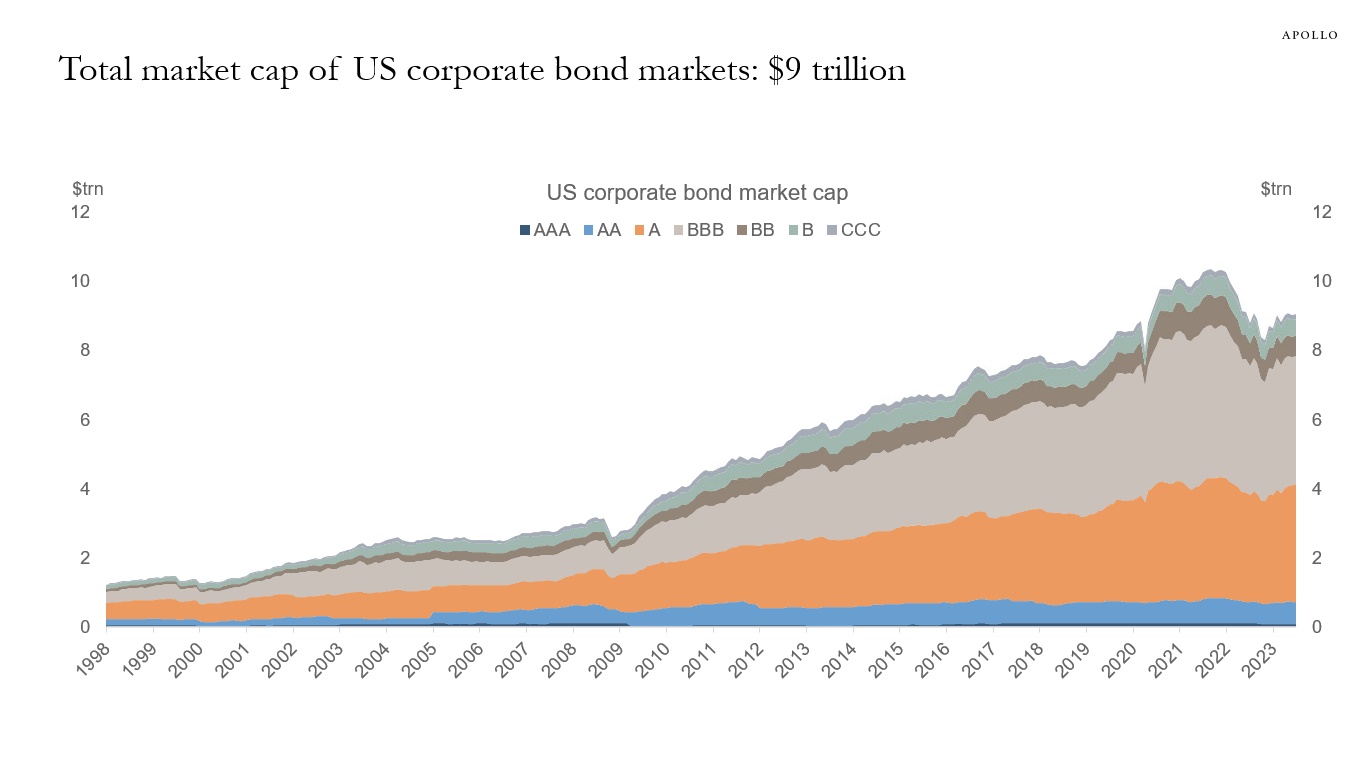

The total market cap of US corporate bond markets is now at $9 trillion. BBB market cap is currently at $3.7 trillion, and single-A is at $3.4 trillion, see chart below.

Source: ICE BofA, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

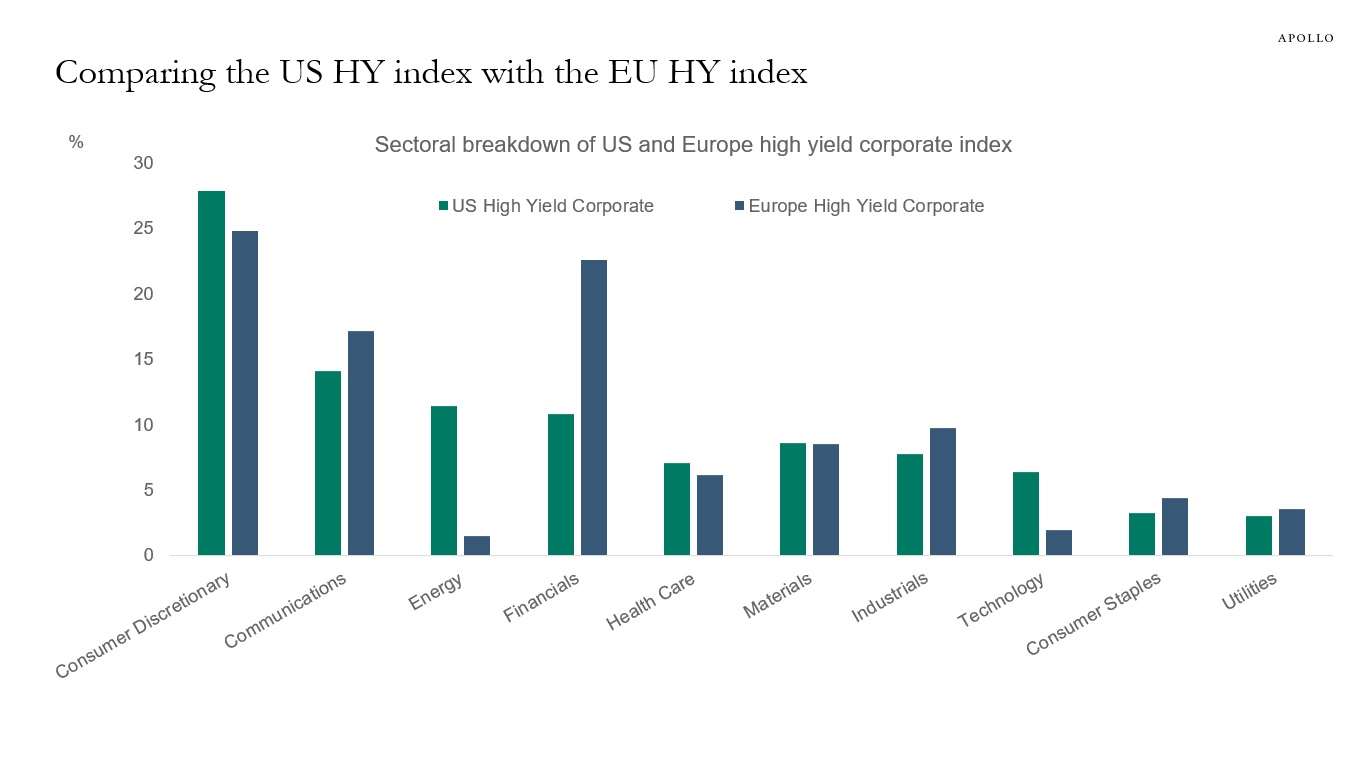

Financials have a weight of almost 50% in the European IG index and 33% in the US IG index, see chart below. For the high yield index, financials also have a higher weight in Europe than in the US. For the US, the sectors with the biggest weight in the HY index are consumer discretionary, communications, and energy.

Source: Bloomberg Barclays, Bloomberg, Apollo Chief Economist

Source: Bloomberg Barclays, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Ninety-one percent of US investment grade bonds are trading below par, see chart below.

Source: Bloomberg, Apollo Chief Economist. Note: Data used for members in the LBUSTRUU Index. See important disclaimers at the bottom of the page.

-

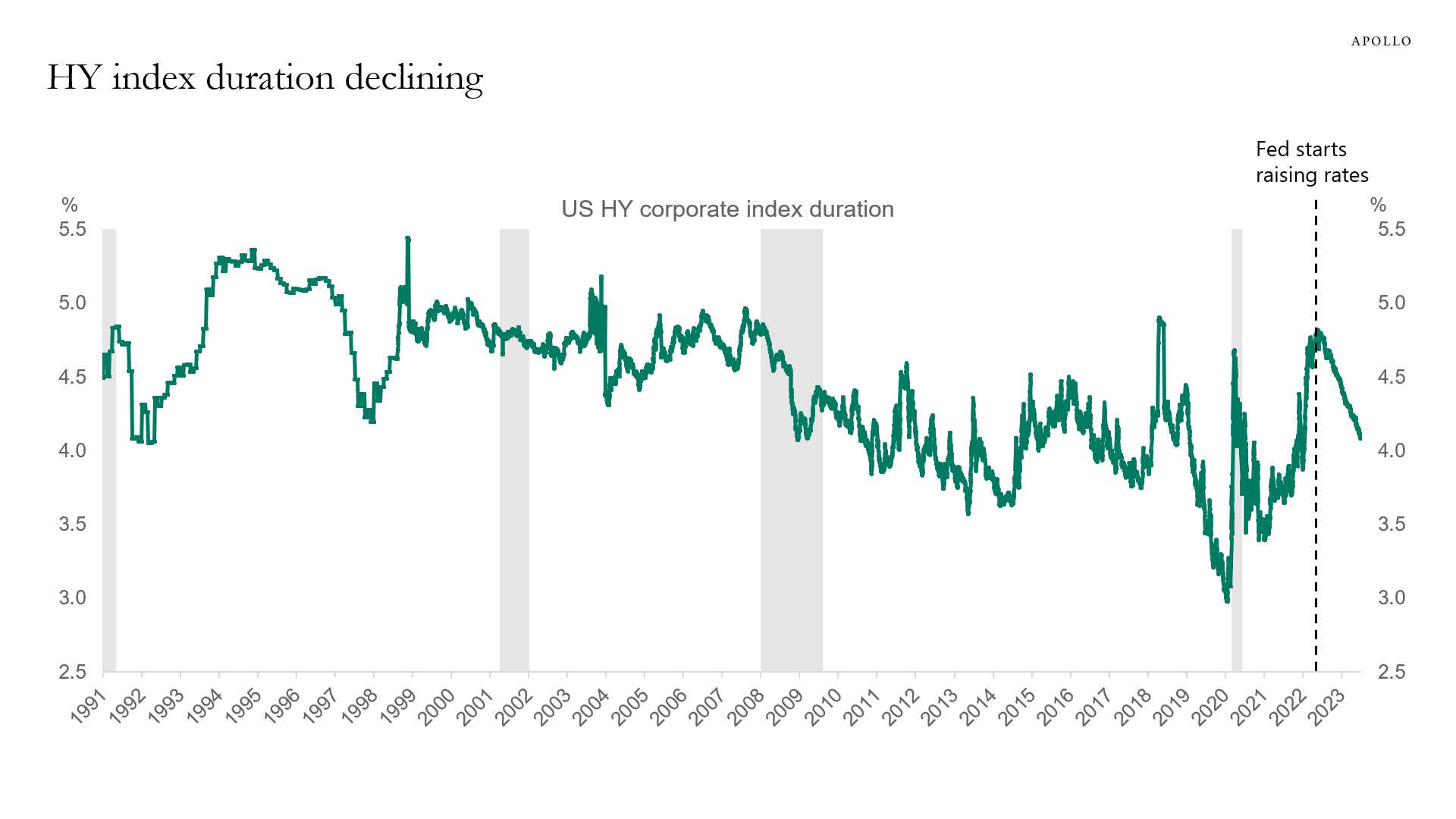

Modified duration measures the expected change in a bond’s price to a 1% change in interest rates. The charts below show that since the Fed started raising rates, index duration has declined both for high yield and investment grade, with high yield duration currently standing at 4% and investment grade duration at 7.5%.

Source: Bloomberg, Apollo Chief Economist. Note: The measure used is modified duration, which measures the expected change in a bond’s price to a 1% change in interest rates.

Source: Bloomberg, Apollo Chief Economist. Note: The measure used is modified duration, which measures the expected change in a bond’s price to a 1% change in interest rates. See important disclaimers at the bottom of the page.

-

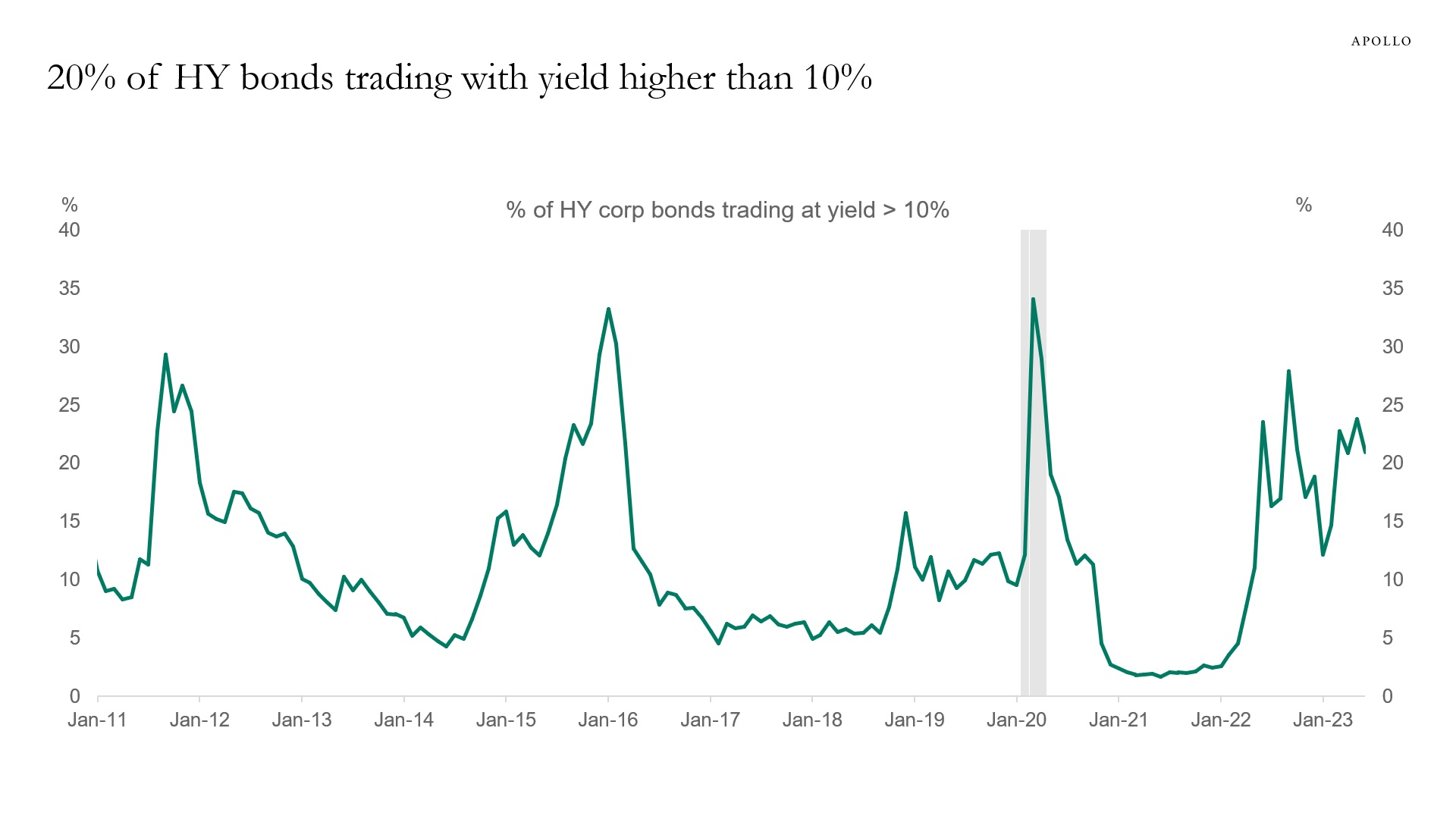

Twenty percent of the high yield index trades with yields higher than 10%, see chart below.

Source: Bloomberg, Apollo Chief Economist. Note: HY bond universe is H0A0 Index. See important disclaimers at the bottom of the page.

-

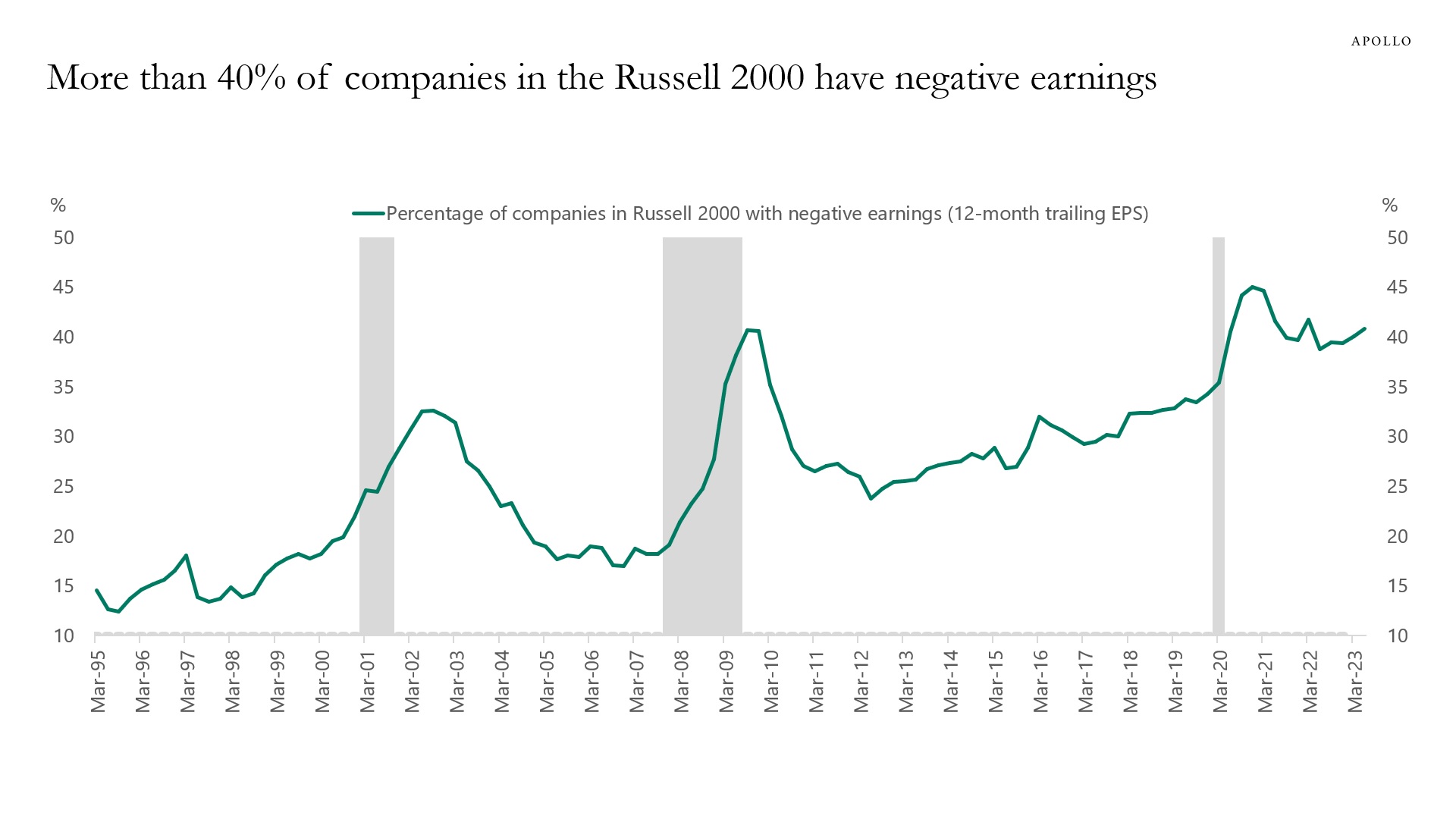

The high and rising share of small-cap companies with negative earnings makes middle-market companies more vulnerable as the Fed keeps interest rates higher for longer, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

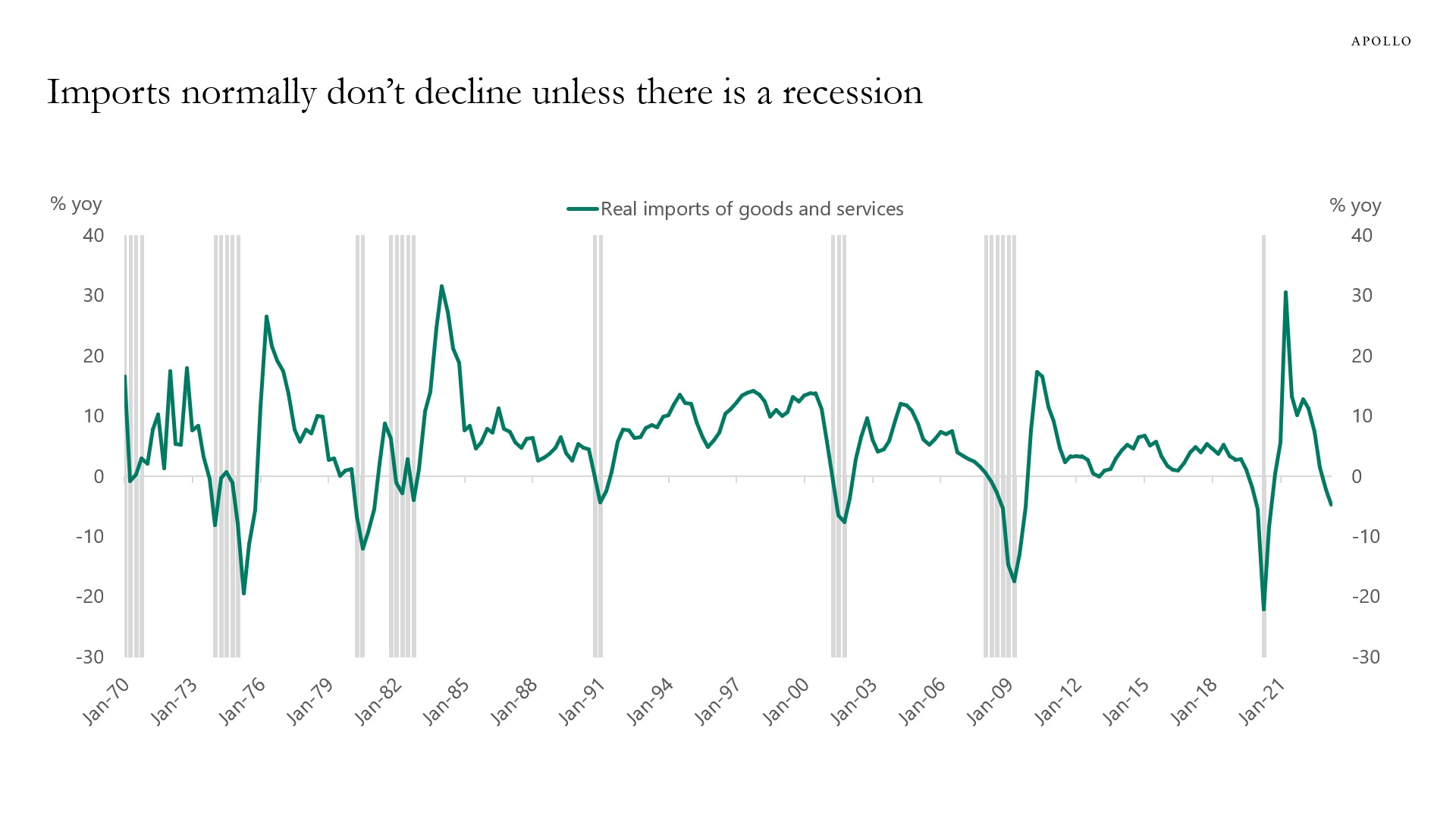

Imports are falling, and this normally only happens when the economy is in a recession, see chart below.

The weakness in the goods sector is offset by continued strength in the less interest rate-sensitive service sector, which makes up 80% of GDP.

Source: BEA, FRED, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

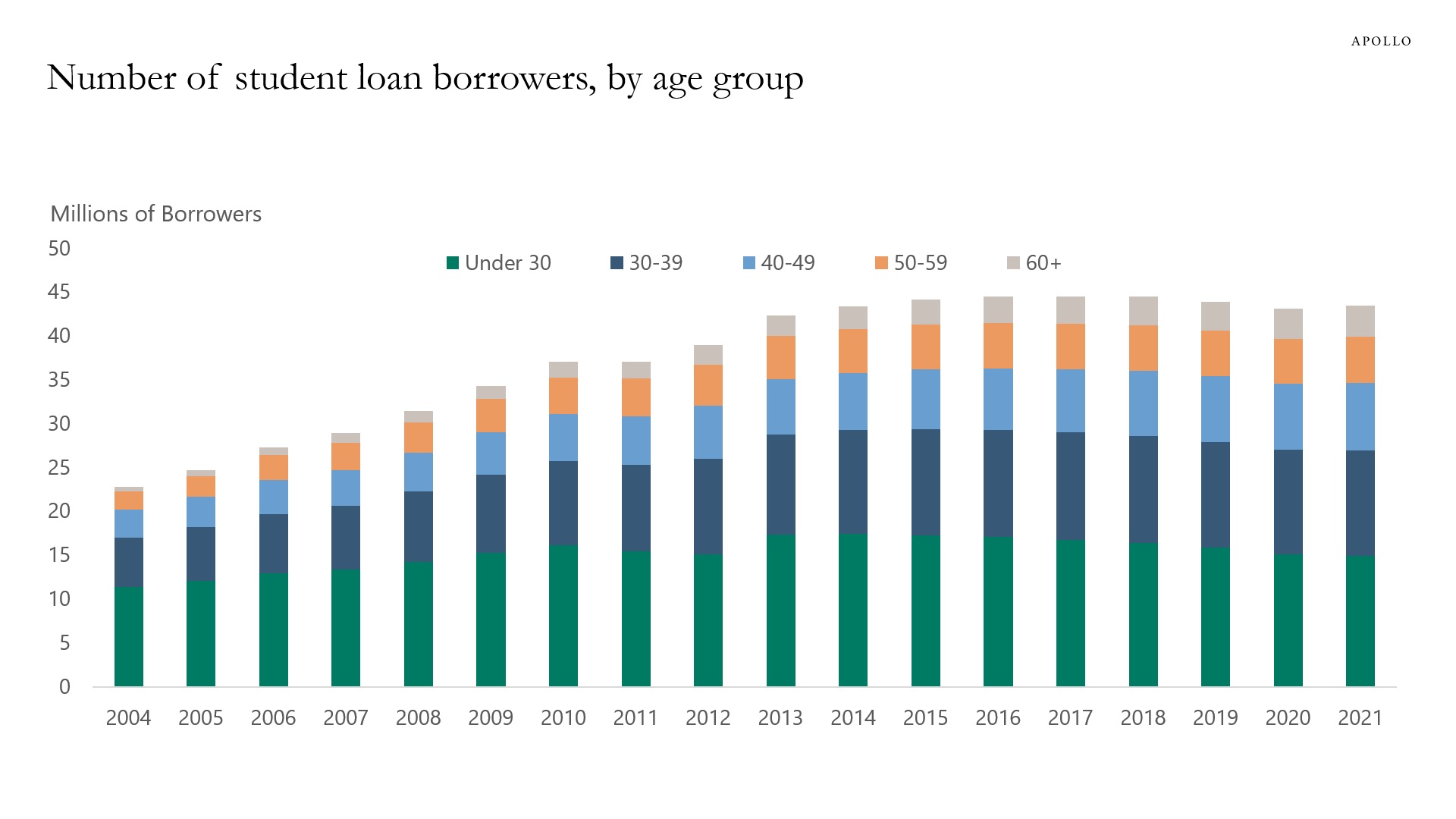

There are a total of 45 million people with student loans, and the average monthly student loan payment is around $200. So resuming student loan payments in October will subtract roughly $9 billion from consumer spending every month, or roughly $100 billion a year, and this will mainly have an impact on younger households, see chart below.

Source: FRBNY, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.