Want it delivered daily to your inbox?

-

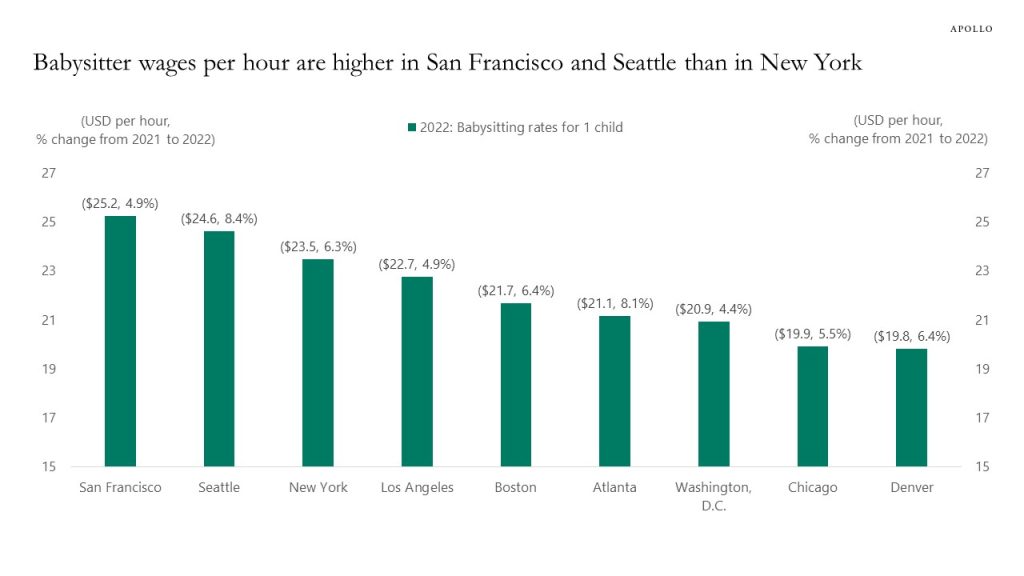

Babysitter wages per hour are $25.2 in San Francisco, $24.6 in Seattle, and $23.5 in New York, and the increase in salaries for babysitters from 2021 to 2022 was more than 8% in Seattle, see chart below.

Source: Urbansitters, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

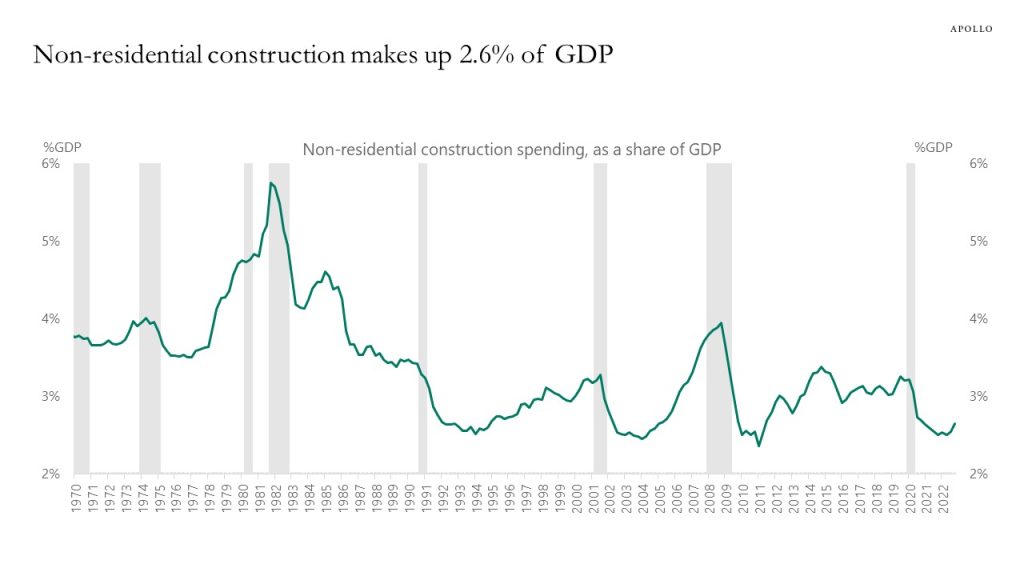

After the housing bubble burst in 2008, construction of new homes declined more than 50%, and residential investment pulled GDP growth down by 1% for three years.

With commercial real estate construction being roughly 75% the size of residential investment, and fewer skyscrapers and shopping malls being built, the bursting CRE bubble could be a drag on GDP growth of around 0.75% over the coming three years. This should be compared with a 2% potential growth rate for the US economy (according to the CBO).

In other words, with the commercial real estate bubble bursting, we are likely to enter three years with low growth, similar to what we saw after the housing bubble burst in 2008. Put differently, once the Fed starts cutting rates later this year, interest rates will likely stay low for several years, and QE is likely to come back in 2024.

Source: BEA, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

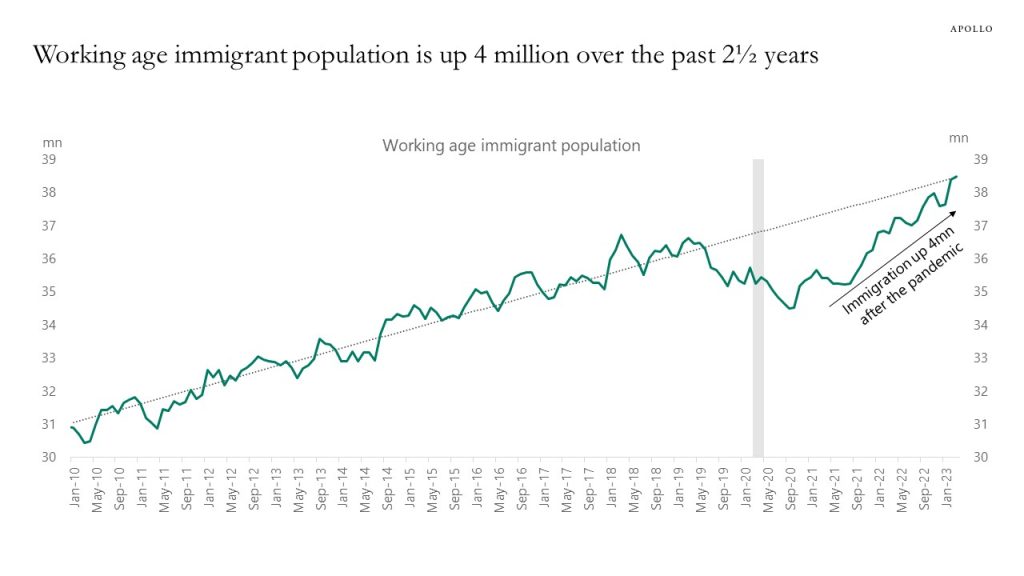

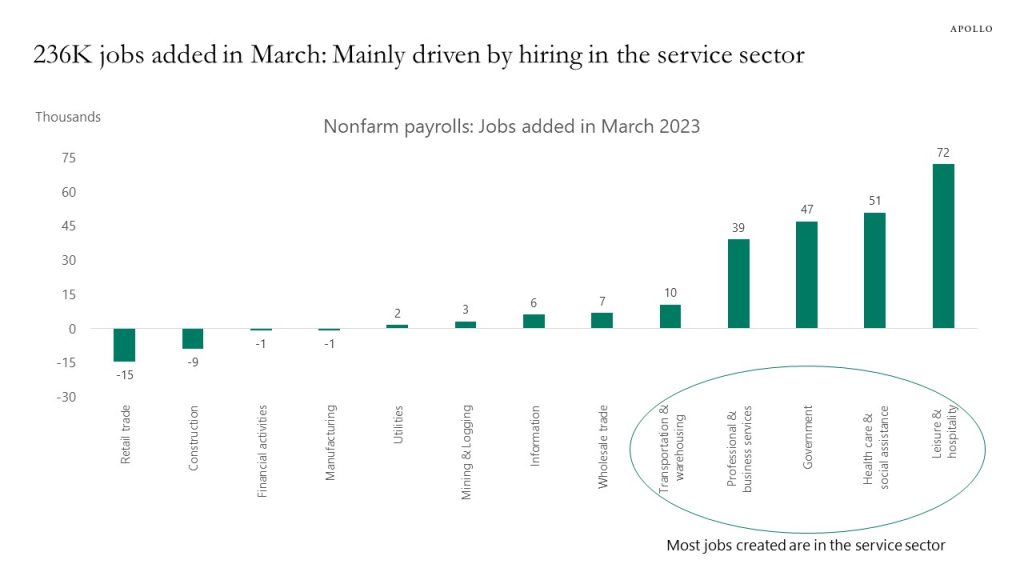

Immigration is a key reason the labor market is gradually moving from very overheated to less overheated.

Over the past 2½ years, immigration into the US labor market has increased by 4 million workers, and the working age immigrant population is now back at its pre-pandemic trend, see the first chart below.

High immigration contributes not only to solid job growth, including in leisure and hospitality, but also to increasing the participation rate and limiting the upside pressures on wages, see the second chart.

The bottom line is that high immigration is helpful for the Fed as it tries to cool down the labor market and slow down inflation.

Our employment outlook chart book is available here.

Source: BLS, Haver Analytics, Apollo Chief Economist

Source: BLS, Haver, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

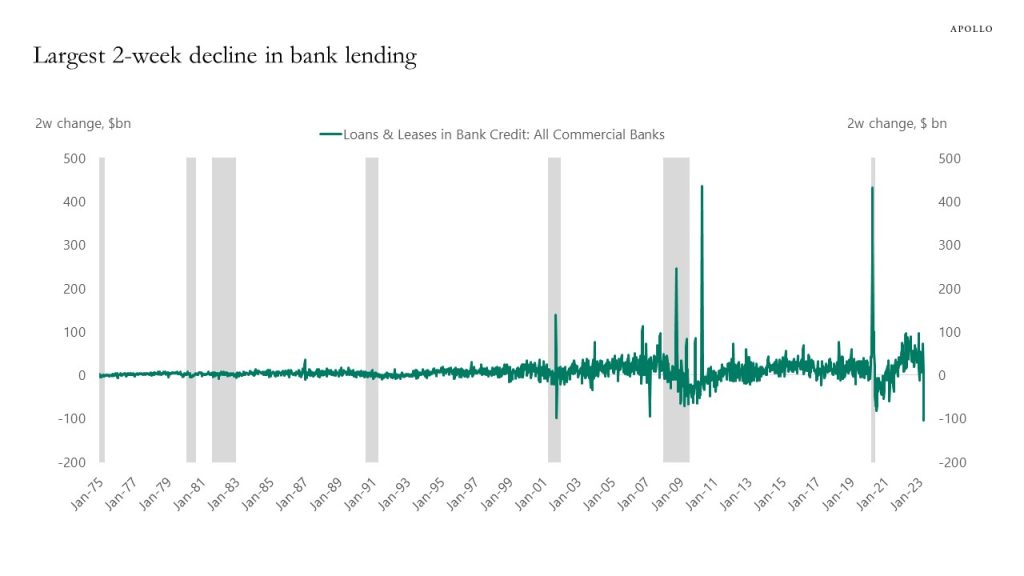

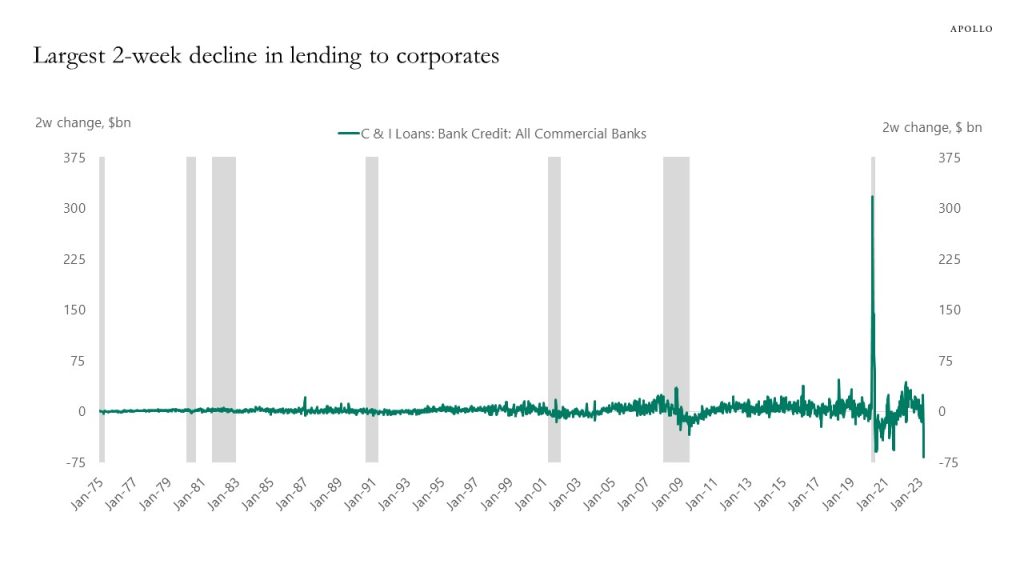

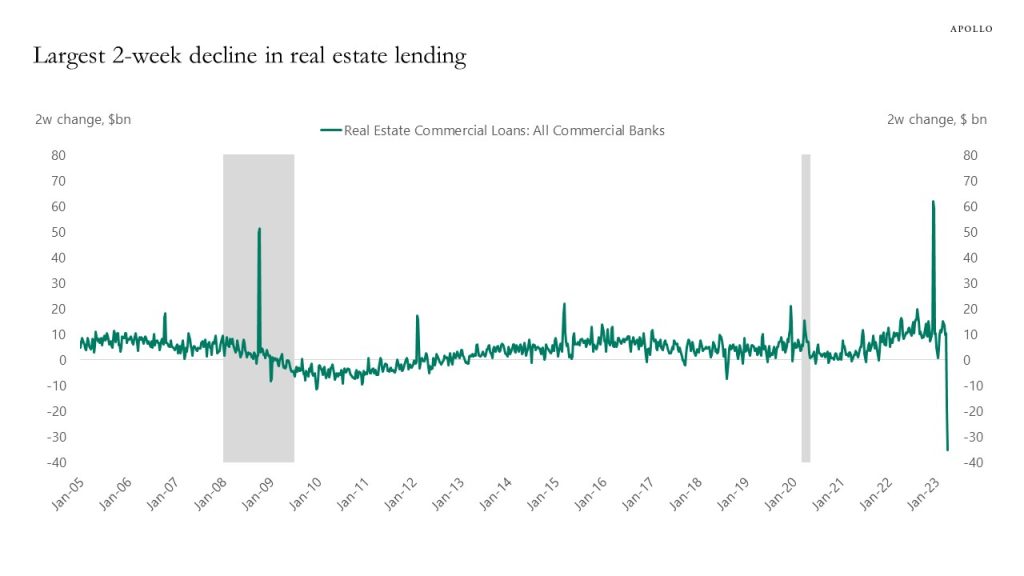

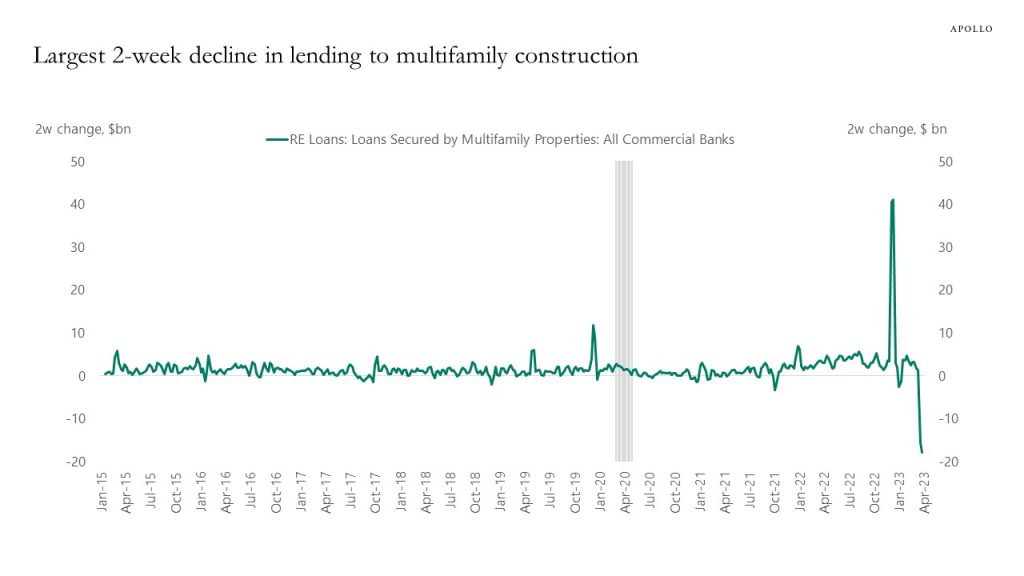

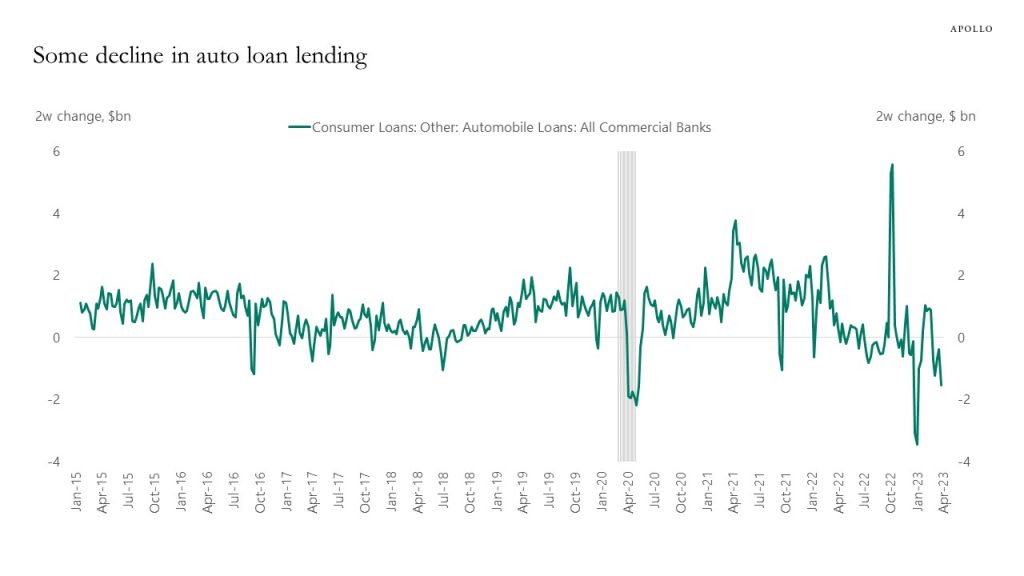

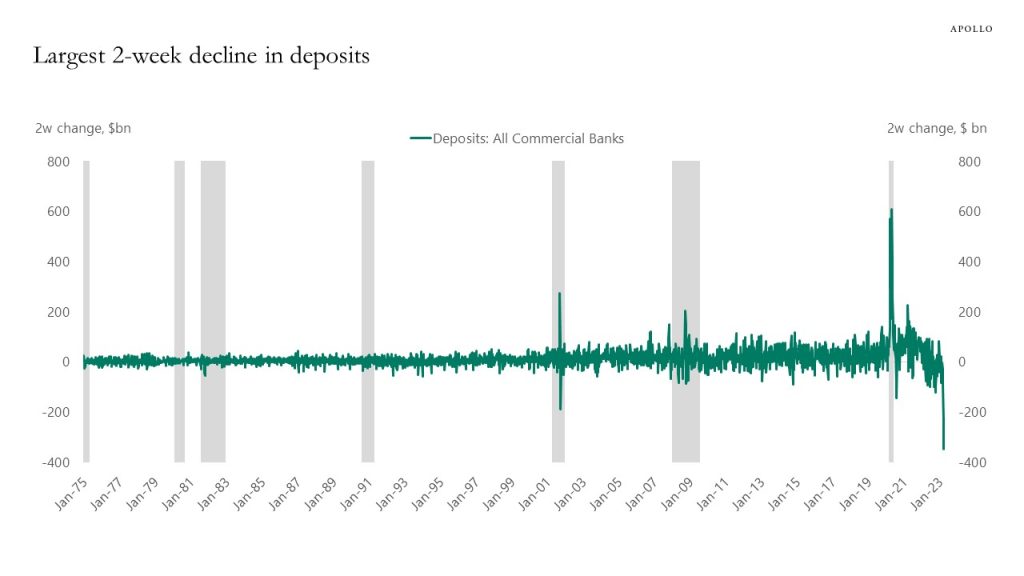

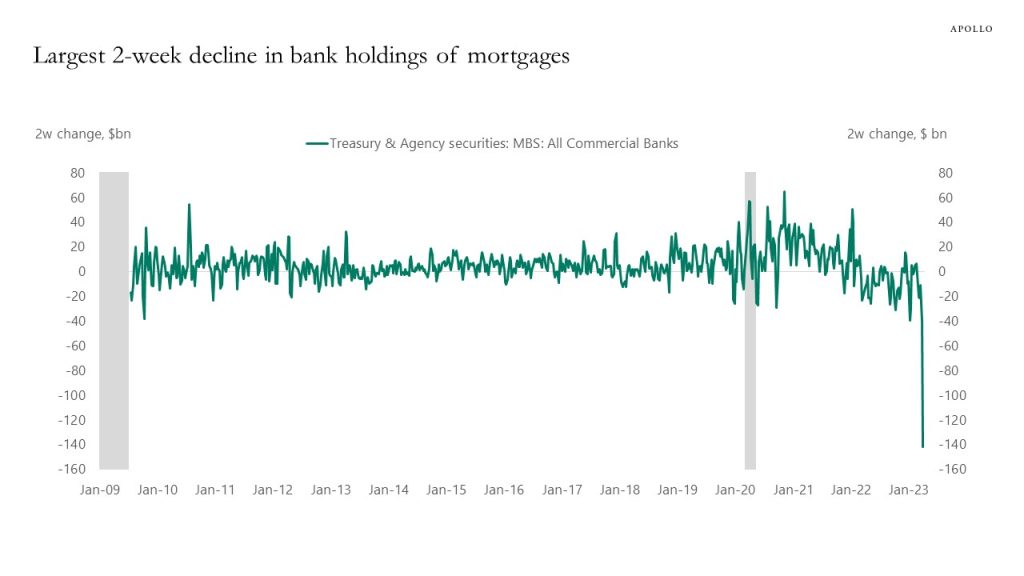

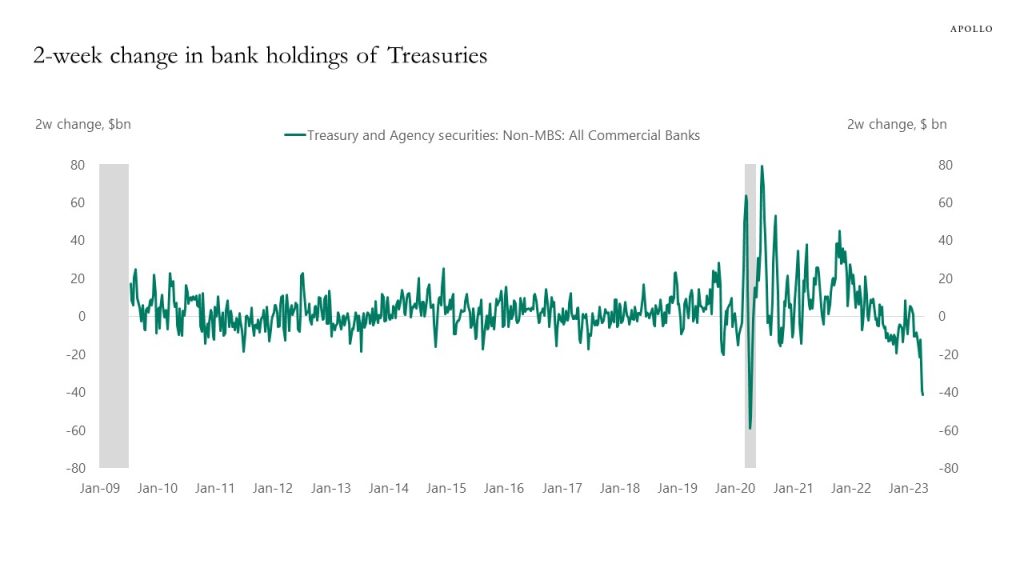

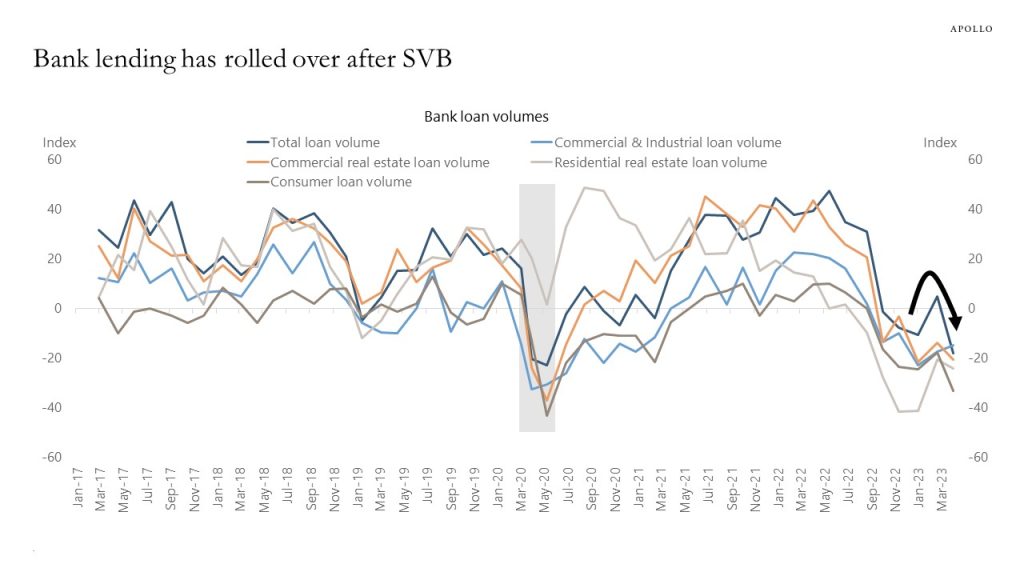

Weekly Fed data released every Friday at 4:15 pm shows how banks are responding to the SVB collapse and subsequent deposit outflows:

- The largest 2-week cutback in bank lending in US history (Chart 1)

- The largest 2-week cutback in bank lending to corporates in US history (Chart 2)

- Largest decline in lending to real estate on record (Chart 3)

- Largest decline in lending to multifamily construction on record (Chart 4)

- Cut back auto lending to consumers (Chart 5)

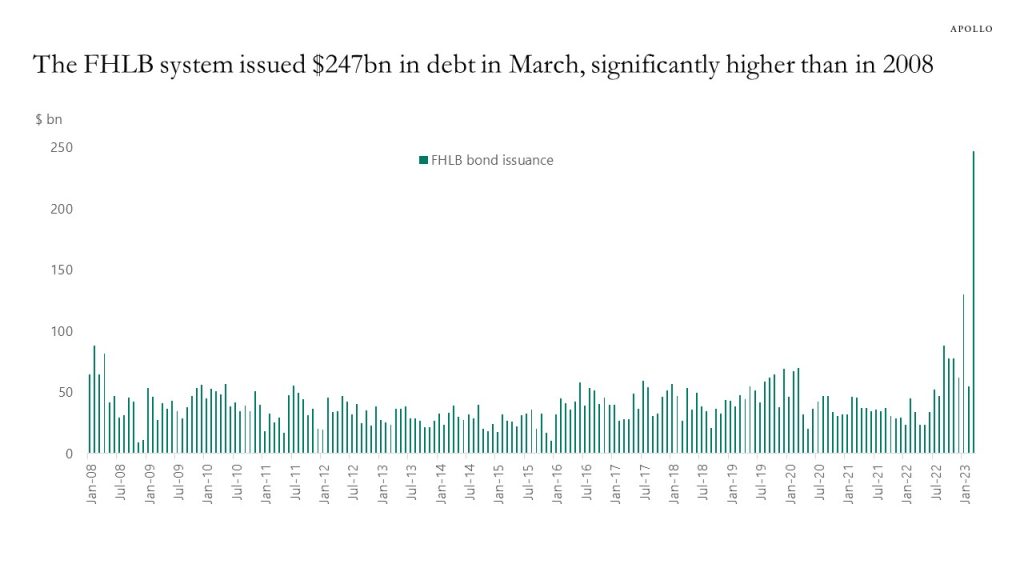

- Banks are selling mortgages and drawing on the Fed and FHLB system to meet immediate deposit demand (Charts 6 to 9)

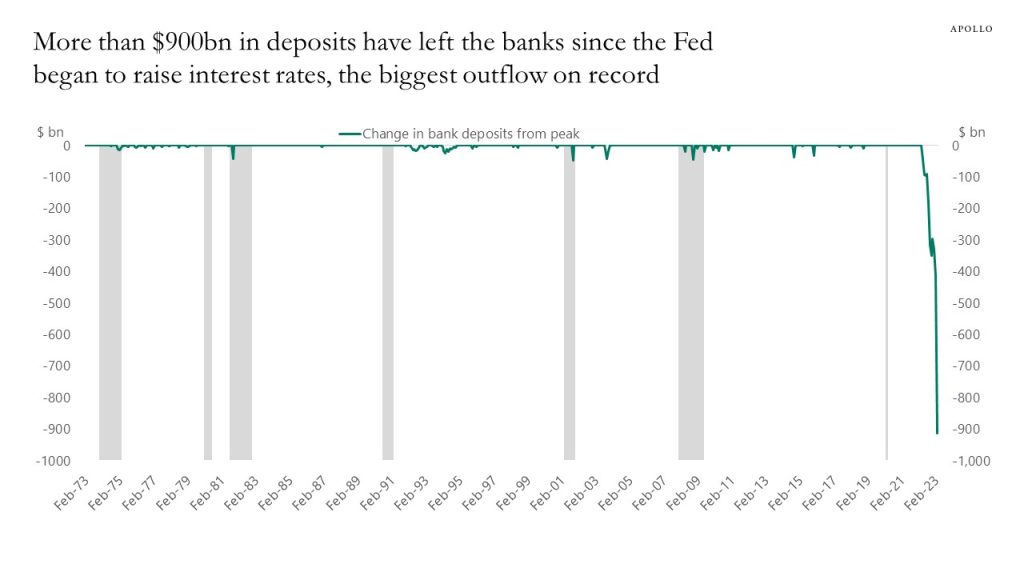

- Since the Fed began to raise rates, total deposit outflows from the banking sector is now almost $1trn (Chart 10)

Fed hikes were already cooling the economy, and the latest weekly Fed data shows that the banking sector response since SVB is magnifying the speed of the slowdown.

Our banking sector chart book is available here, and the bottom line is that the immediate risks in the banking sector are starting to fade, but the behavioral change in the banking sector is beginning to weigh on the economic outlook. In short, the credit crunch has started.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist.

Source: FHLB, Haver, Apollo Chief Economist.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist. Note: March data as of 22nd March 2023. Peak is defined as the month before monthly outflows turn negative. See important disclaimers at the bottom of the page.

-

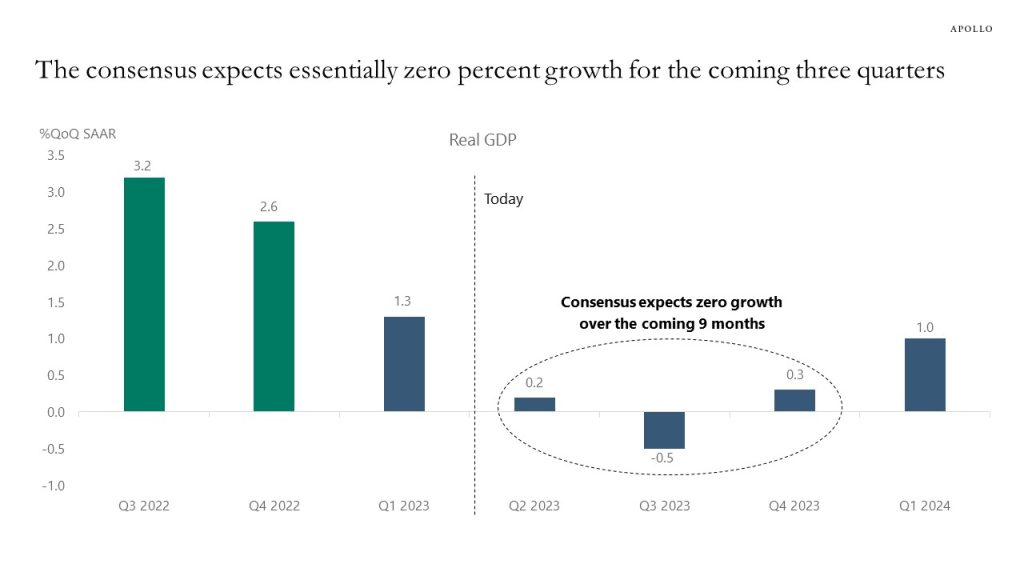

We just entered Q2, and the consensus expects essentially zero percent growth in GDP and earnings over the coming three quarters, see chart below. In other words, the consensus is saying that over the next 9 months, we will see no real growth in consumer spending, capex spending, and hiring. Nonfarm payrolls could be a bit higher than zero because of demographics, including immigration, but with the consensus expectation of negative growth in the third quarter, we could soon start to see nonfarm payroll prints around -100K to -200K.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

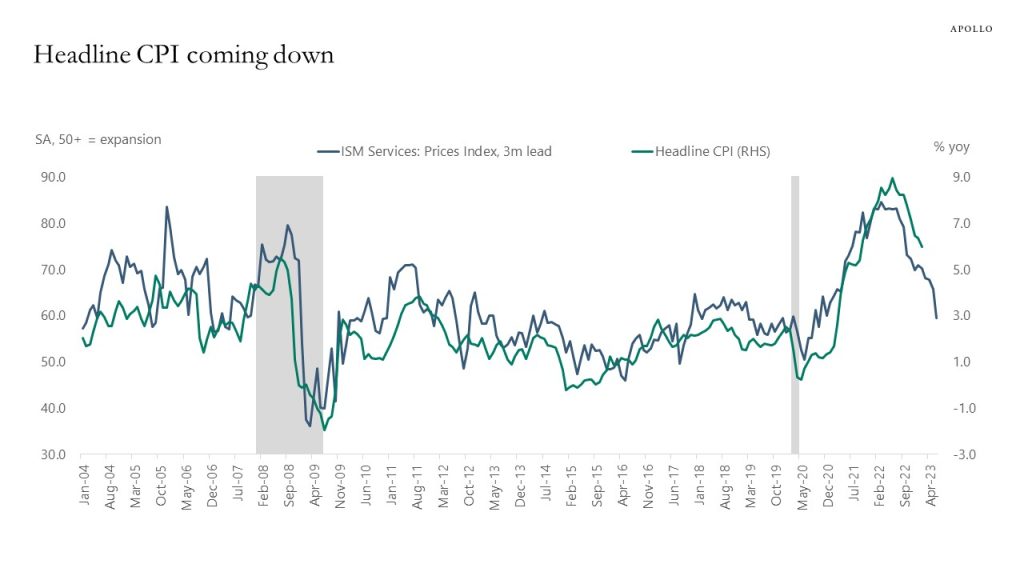

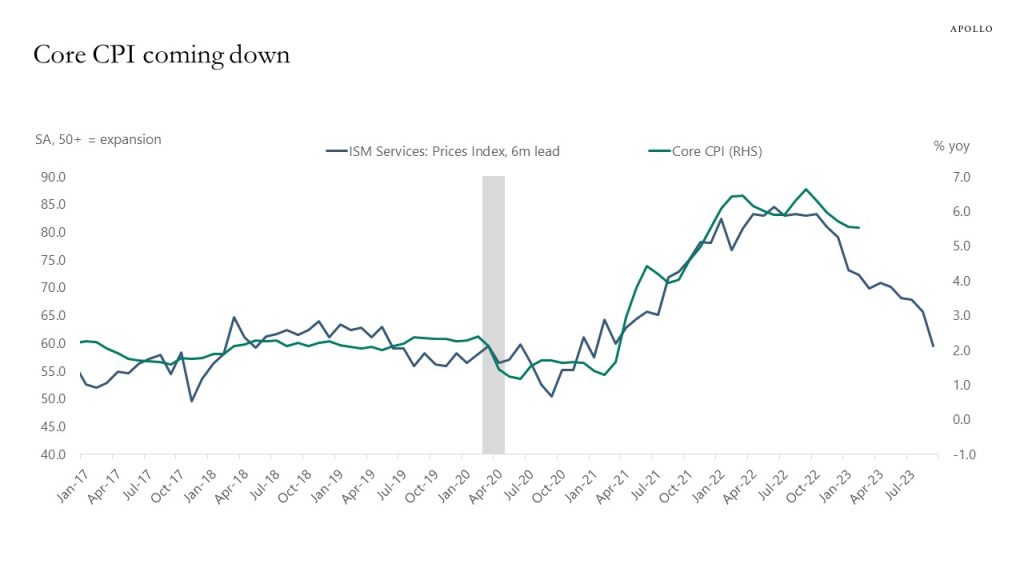

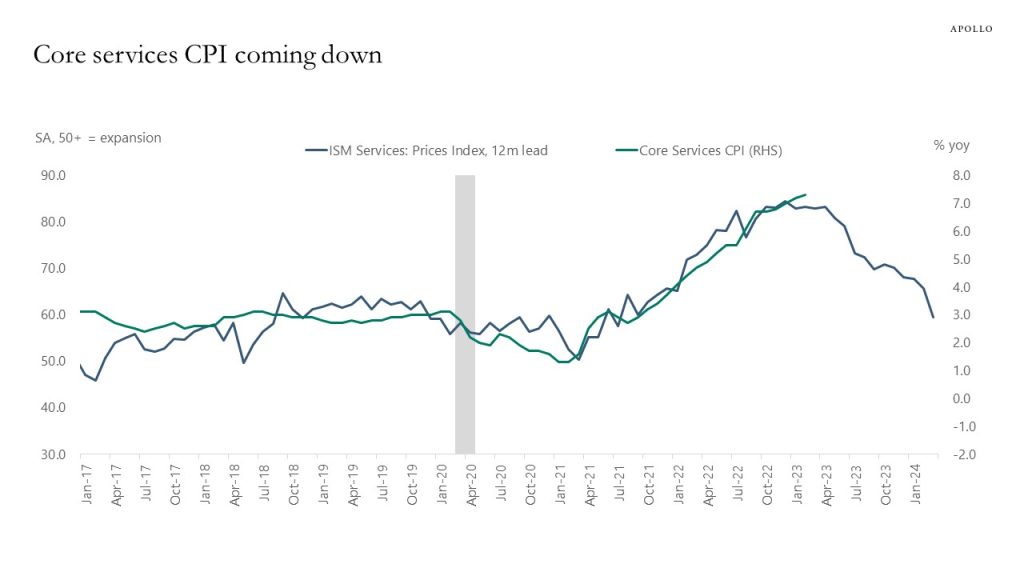

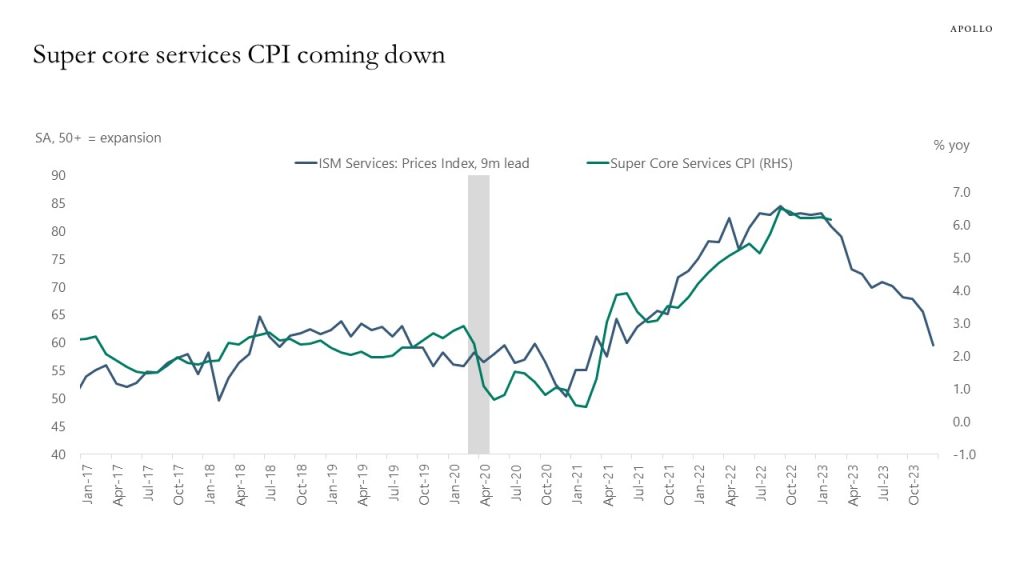

During the pandemic, we were all at home buying things online and supply chains were constrained, and goods inflation went up.

Then, when the pandemic was over, goods inflation came down, and service sector inflation went up as we started spending money on restaurants, hotels, and airline tickets.

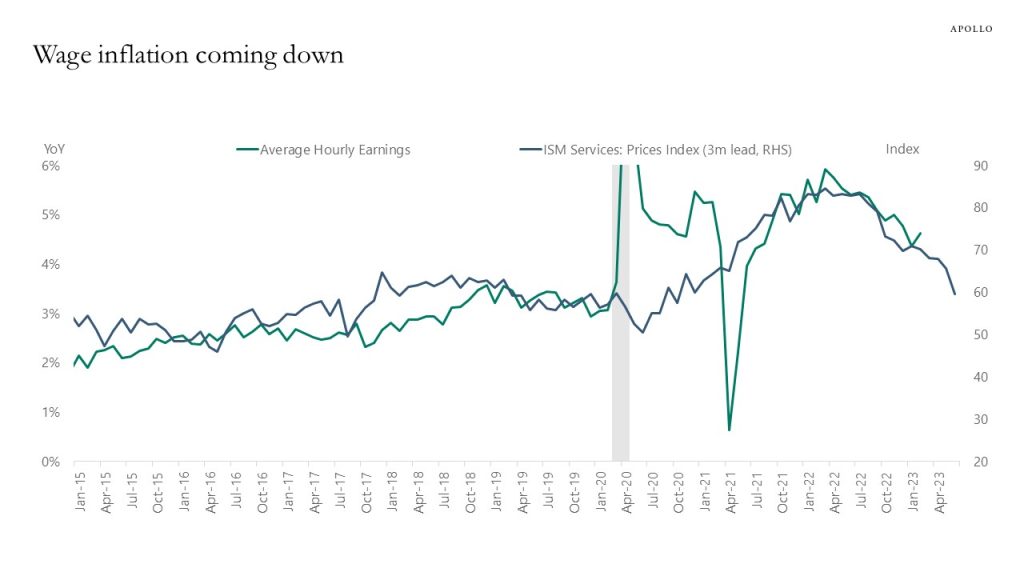

Now the service sector is in the process of cooling down, and as a result, service sector inflation is declining. Specifically, ISM services prices paid is a leading indicator for headline inflation, core inflation, core services inflation, super core services inflation, and average hourly earnings, see charts below.

In other words, goods inflation normalized in 2022. And service sector inflation is normalizing in 2023.

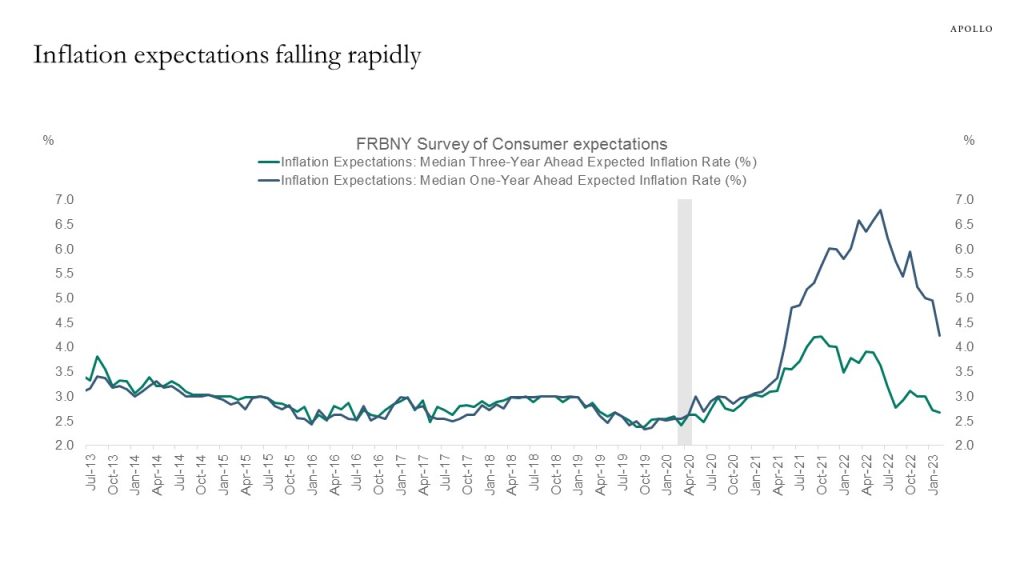

Combined with rapidly falling inflation expectations, see the last chart, the bottom line is that inflation is coming down to the Fed’s 2% inflation target, and the Fed can later this year begin to move the Fed funds rate down to the r-star level around 2.5%.

In short, this inflation episode will soon be over.

Source: ISM, BLS, Haver Analytics, Apollo Chief Economist

Source: ISM, BLS, Haver Analytics, Apollo Chief Economist

Source: ISM, BLS, Haver Analytics, Apollo Chief Economist

Source: ISM, BLS, Haver Analytics, Apollo Chief Economist

Source: ISM, BLS, Haver Analytics, Apollo Chief Economist

Source: FRBNY, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

A survey of 71 banks in the Dallas Fed district done after SVB went under shows a dramatic reversal in loan volumes, see chart below. This Fed survey was carried out from March 21 to 29.

Source: Banking Conditions Survey, Federal Reserve Bank of Dallas, Apollo Chief Economist. Note: Data collected March 21–29, and 71 banks and credit unions headquartered in the Eleventh Federal Reserve District responded to the survey. See important disclaimers at the bottom of the page.

-

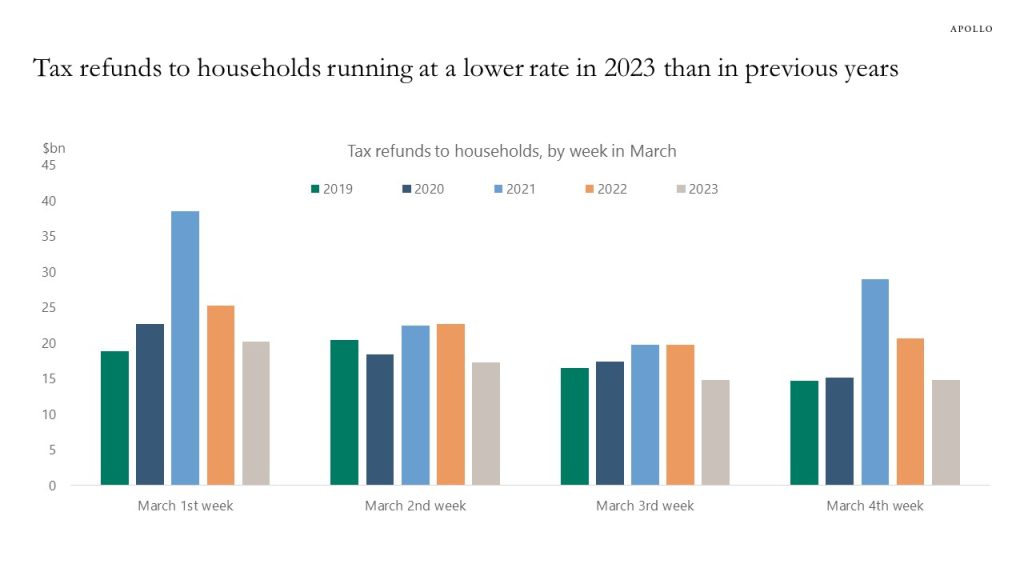

The US Treasury publishes daily data for tax refunds, and the level of tax refunds to households tells us something about how much support there is to consumer spending, and the chart below shows that tax refunds in recent weeks have been running at a lower rate in 2023 than in previous years. Adjusting for inflation would lower the 2023 numbers even further.

Source: US Treasury, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

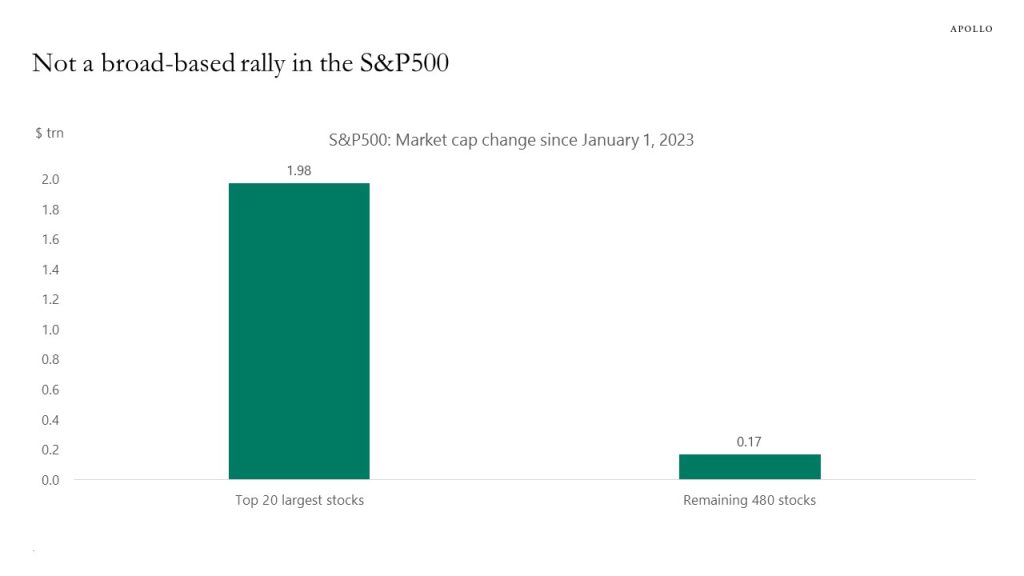

The rally in the S&P500 since the beginning of the year has been driven by 20 stocks, the market cap of the remaining 480 stocks has basically not gone up, see chart below.

The implication for investors is that this market is not driven by broad-based higher growth expectations but instead by what has happened with rates, in particular after SVB went under.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

European inflation is likely to move sharply lower over the coming months, see chart below.

Source: European Commission, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.