Want it delivered daily to your inbox?

-

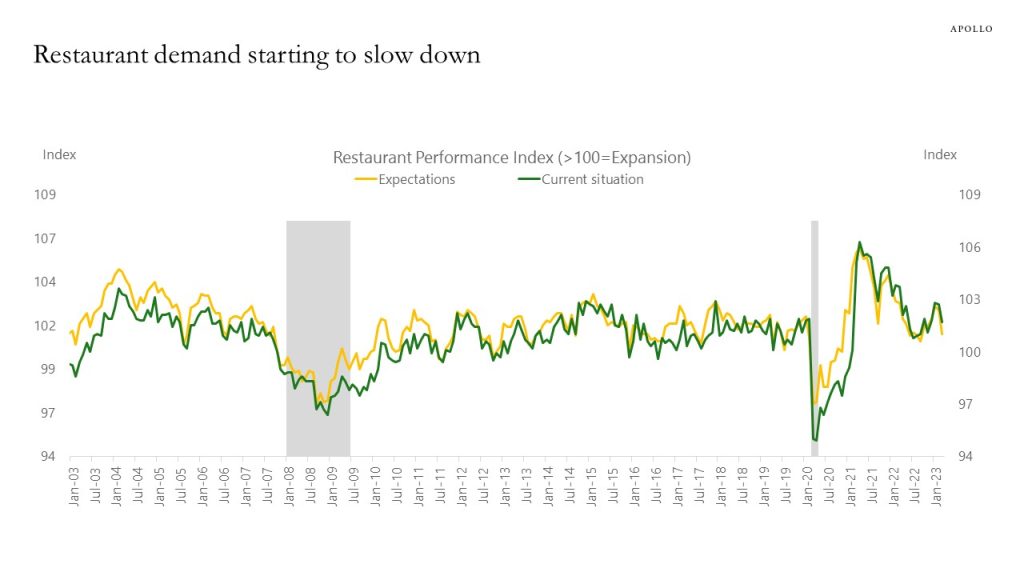

Indicators of restaurant activity are starting to show signs of weakness, see charts below. This is important because consumer services have so far been quite strong.

Source: National Restaurant Association, Haver, Apollo Chief Economist

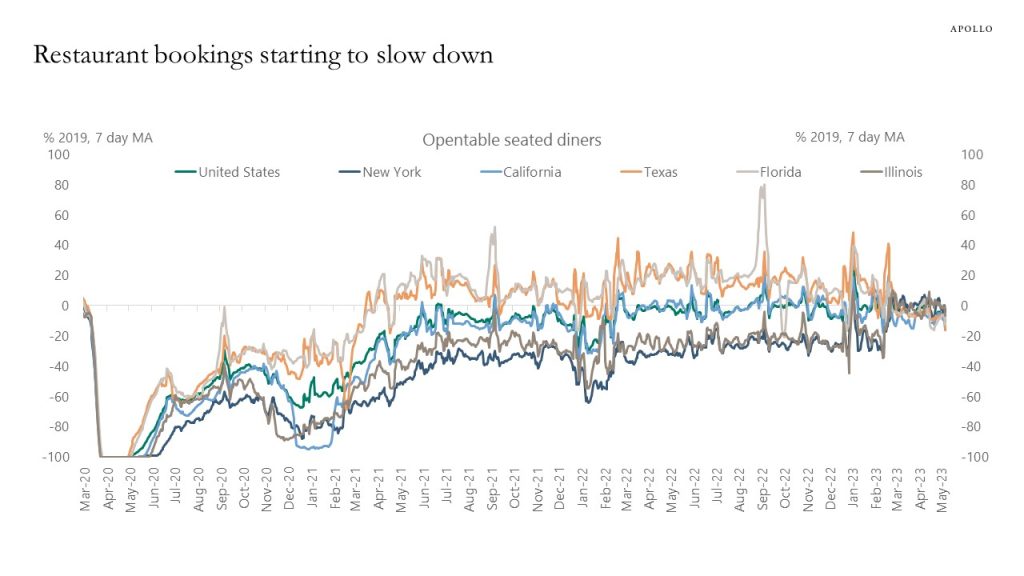

Source: OpenTable, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

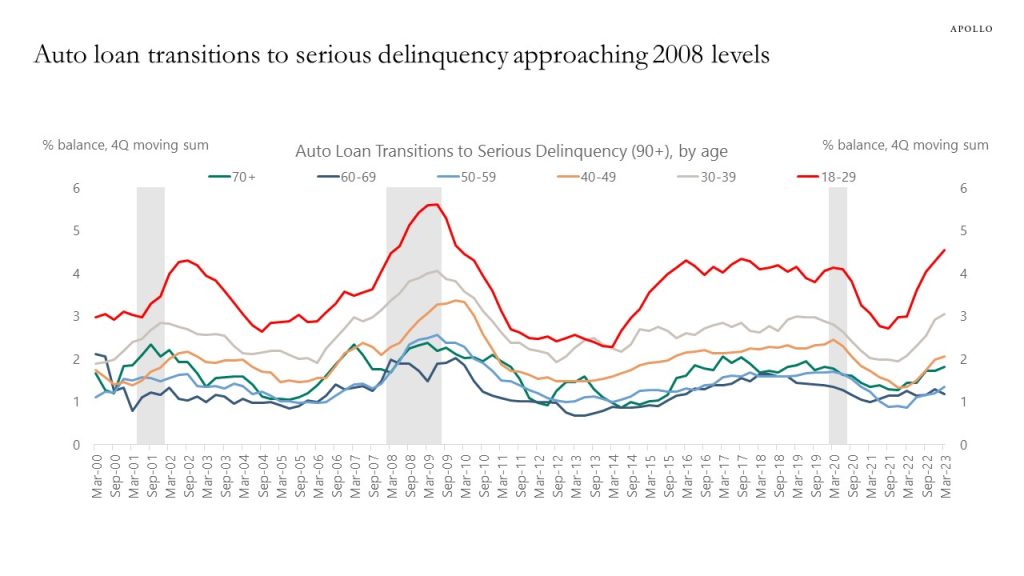

Auto loan transitions to serious delinquency are rising and approaching 2008 levels, in particular for younger borrowers, see chart below.

Source: FRBNY Consumer Credit Panel, Equifax, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

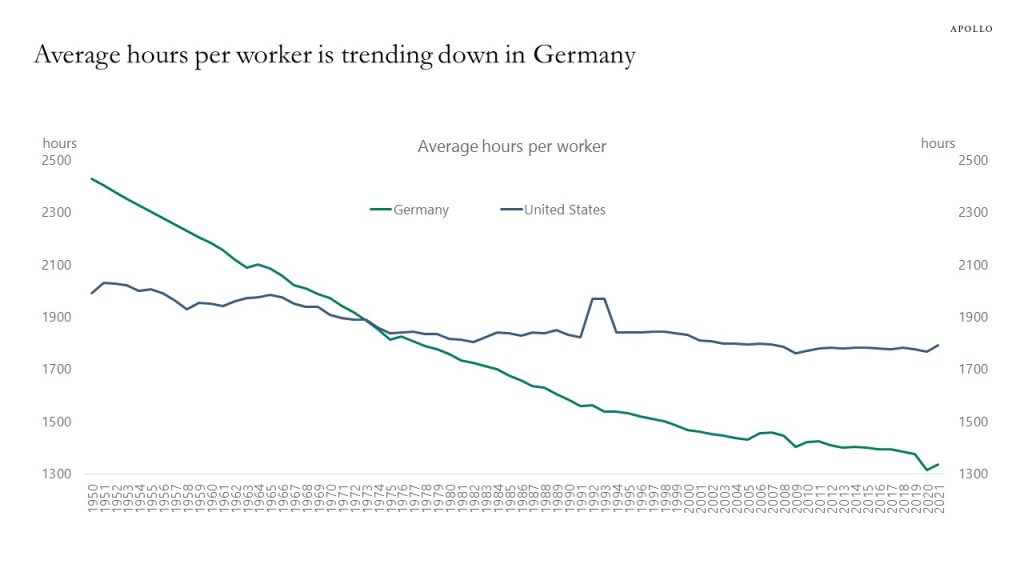

The average number of working hours per year has for decades been declining in Germany and moving sideways in the US, see chart below.

Source: Penn World Tables, OECD, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

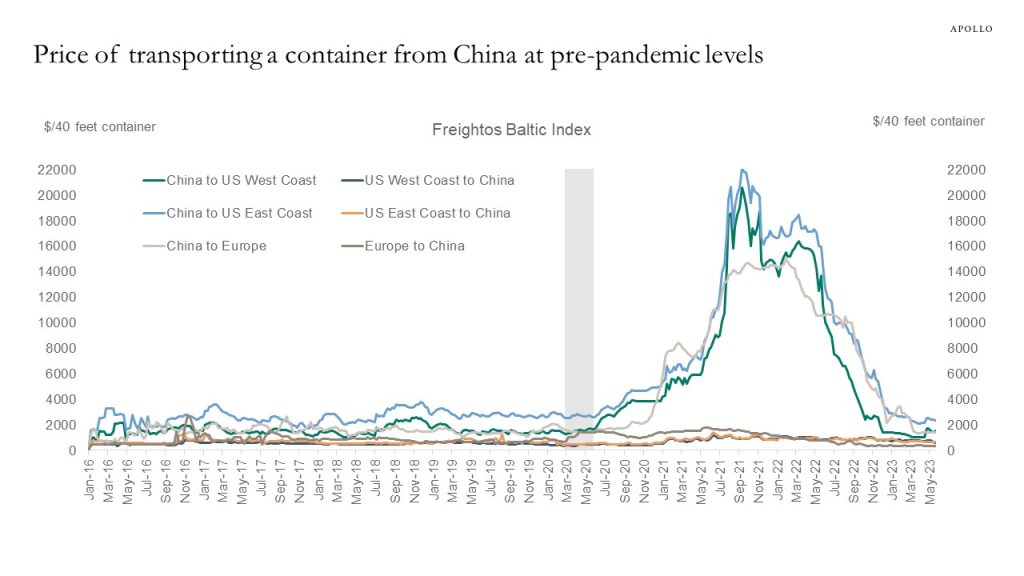

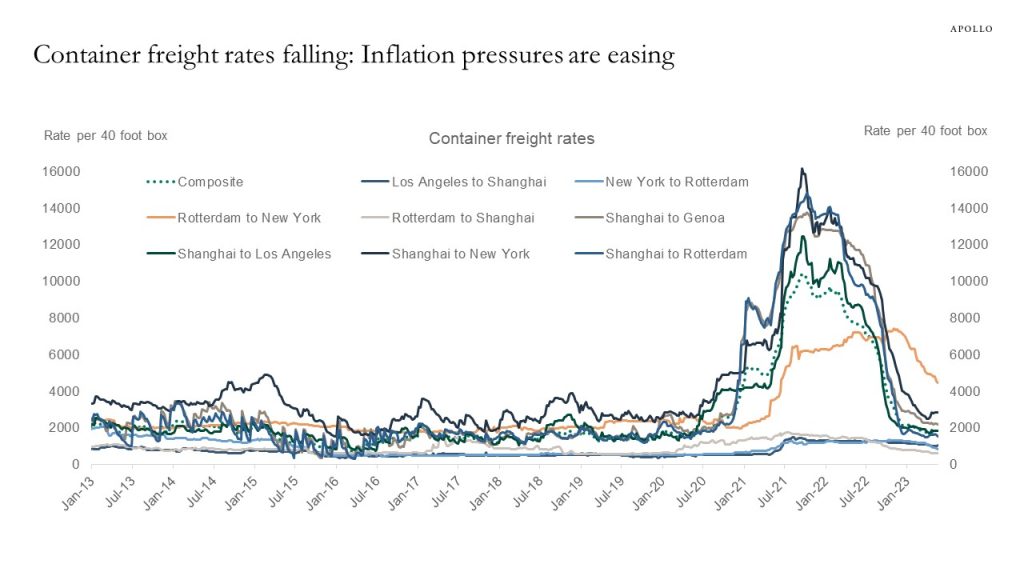

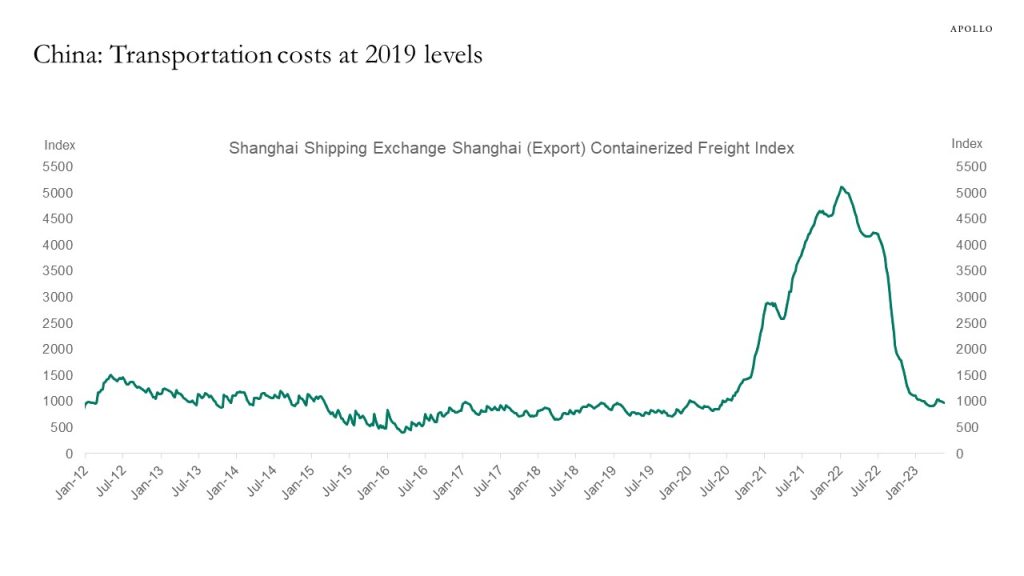

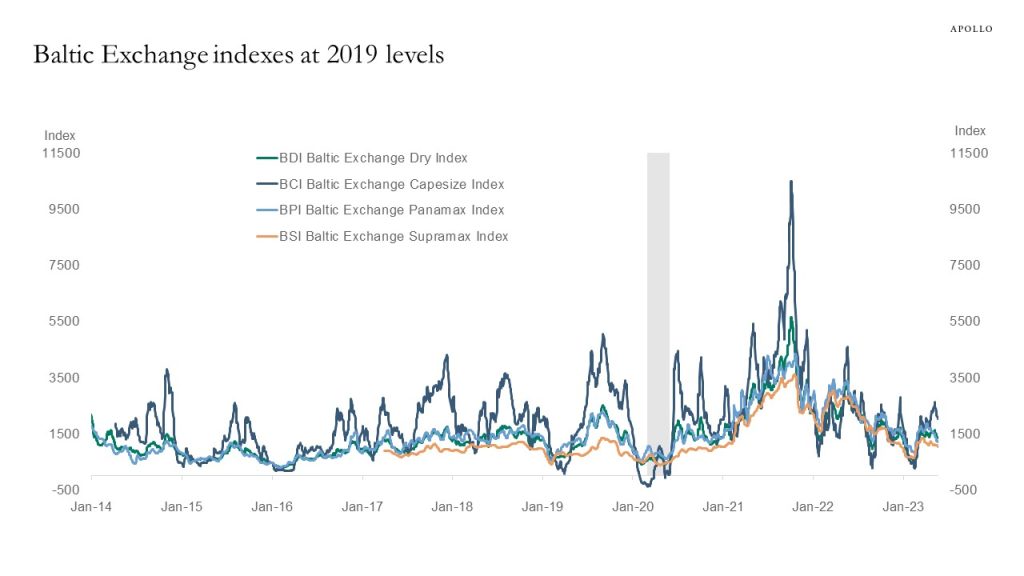

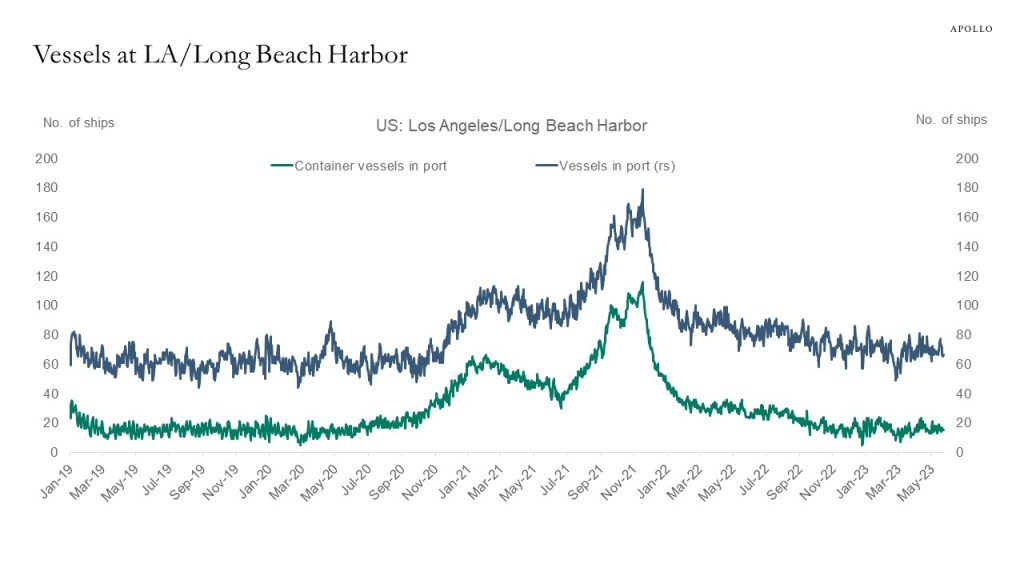

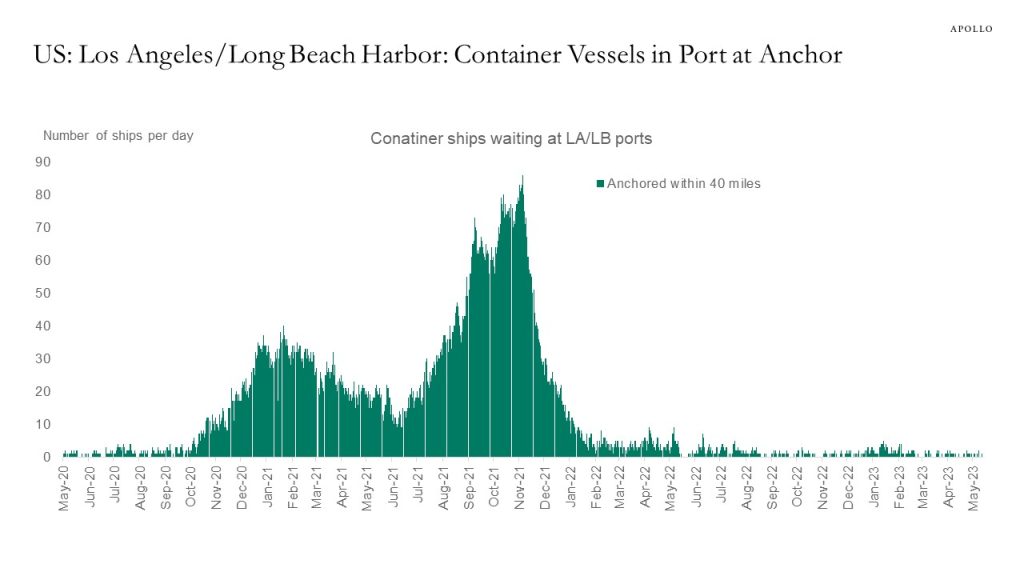

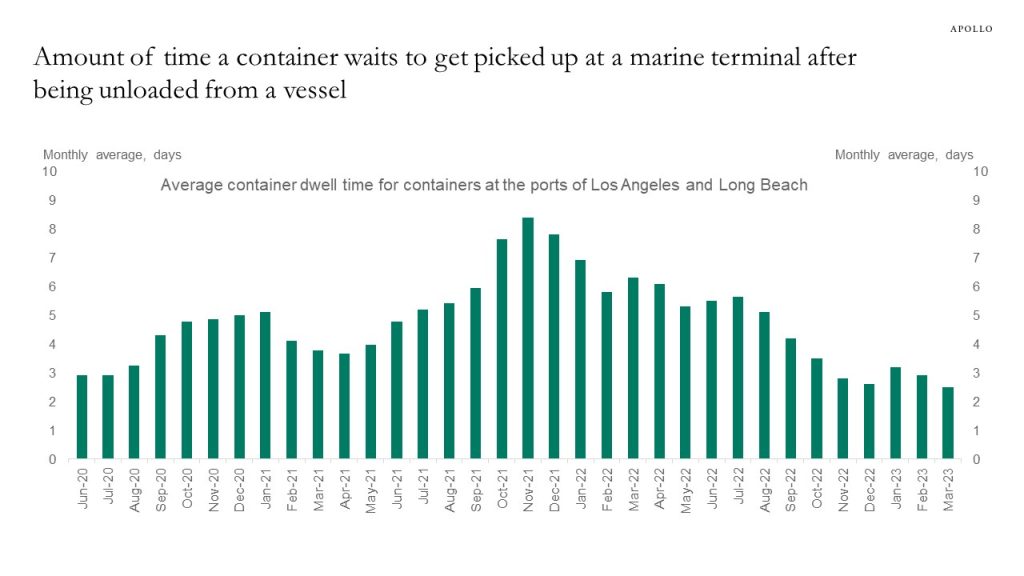

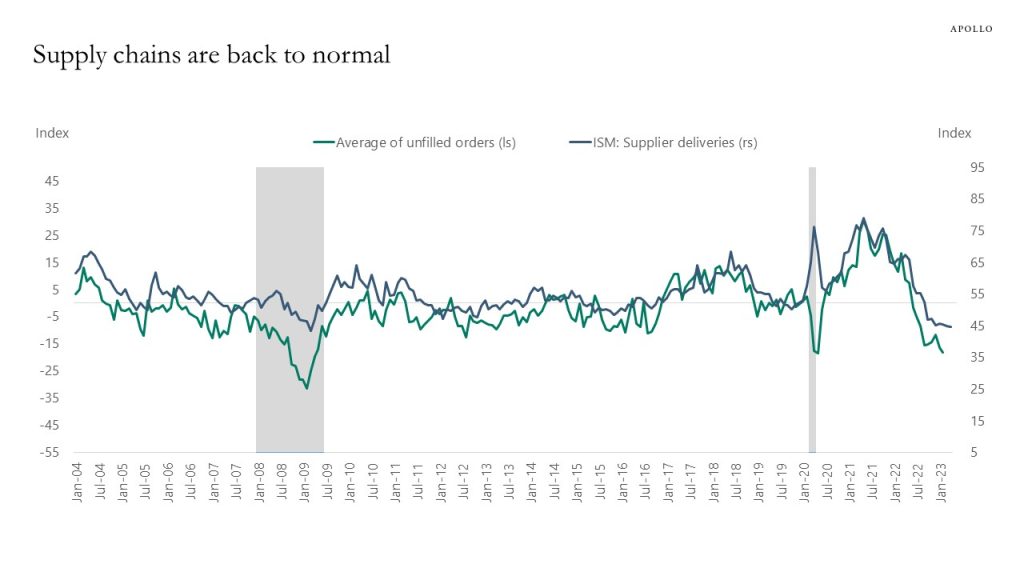

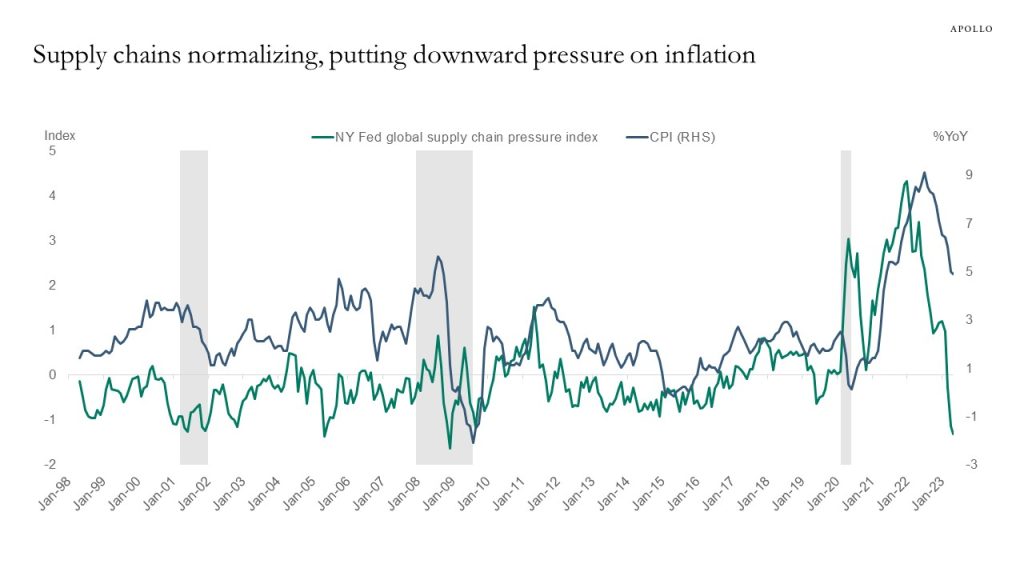

Key supply chain indicators are now fully back at 2019 levels, see charts below and in this presentation.

Source: Freightos, Bloomberg, Apollo Chief Economist

Source: WCI, Bloomberg, Apollo Chief Economist

Source: Shanghai Shipping Exchange, Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist

Source: The Marine Exchange of Los Angeles and Long Beach Harbors, Haver, Apollo Chief Economist

Source: Haver, Apollo Chief Economist

Source: Pacific Merchant Shipping Association, Apollo Chief Economist

Source: Haver, Apollo Chief Economist (Note: Average of unfilled orders is average of Richmond Fed Mfg Survey: Current Manufacturing Order Backlogs, Philly Fed Mfg Business Outlook: Current Unfilled Orders, Empire State Mfg Survey: Delivery Time)

Source: NY Fed, BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

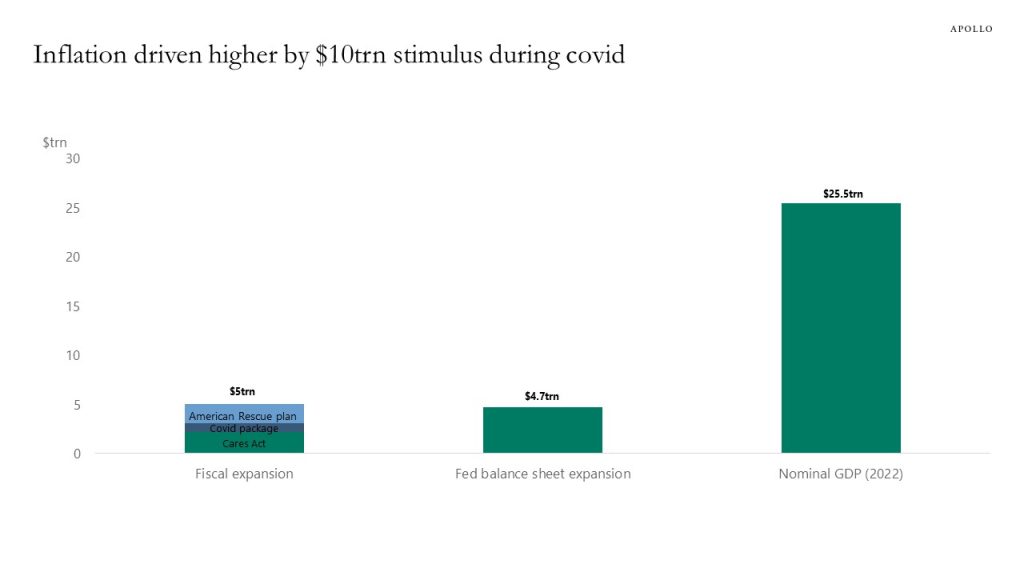

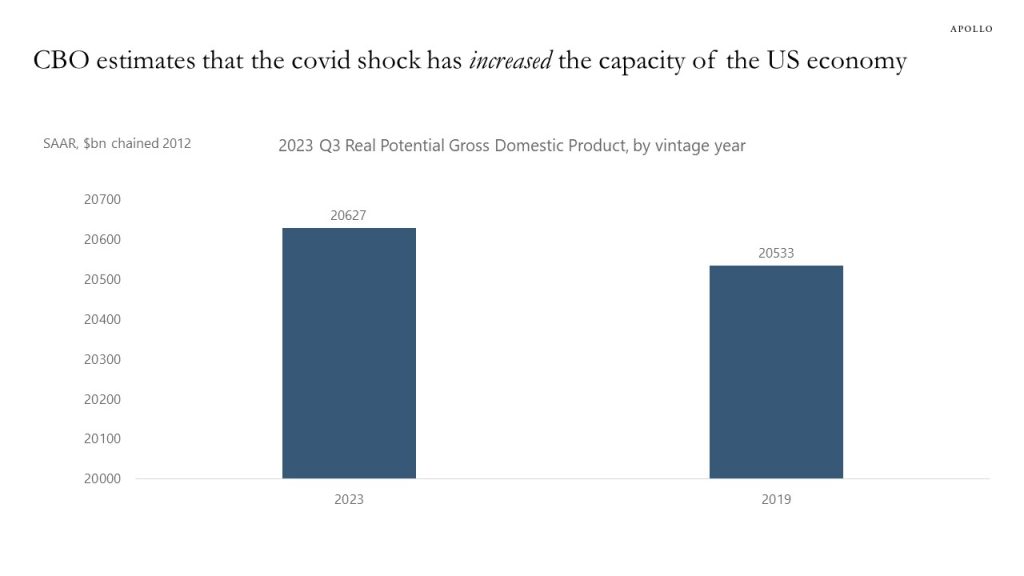

There is an ongoing debate about whether the current high levels of inflation are the result of aggressive monetary and fiscal policy or supply chain problems and lower labor supply.

A straightforward way to analyze this question is to look at what happened to aggregate demand and aggregate supply during covid.

Demand: The size of the fiscal and monetary policy response to covid at $10trn was very significant, or about 40% of 2022 GDP, see the first chart. The magnitude of these numbers suggests that demand is playing a key role as a driver of inflation.

Supply: The CBO estimates that the covid shock, combined with the fiscal and monetary response, has increased the overall capacity of the US economy, see the second chart which shows that the CBO’s current estimate of potential GDP in 2023 is higher than the estimate for potential GDP in 2023 they had in 2019. In other words, the covid shock did not lower the capacity of the US economy.

The bottom line is that while supply chain problems initially boosted inflation, the current high level of inflation is the result of easy money and fiscal policy, not because of a decline in the capacity of the US economy.

Source: FRB, BEA, Haver Analytics, Apollo Chief Economist

Source: CBO, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

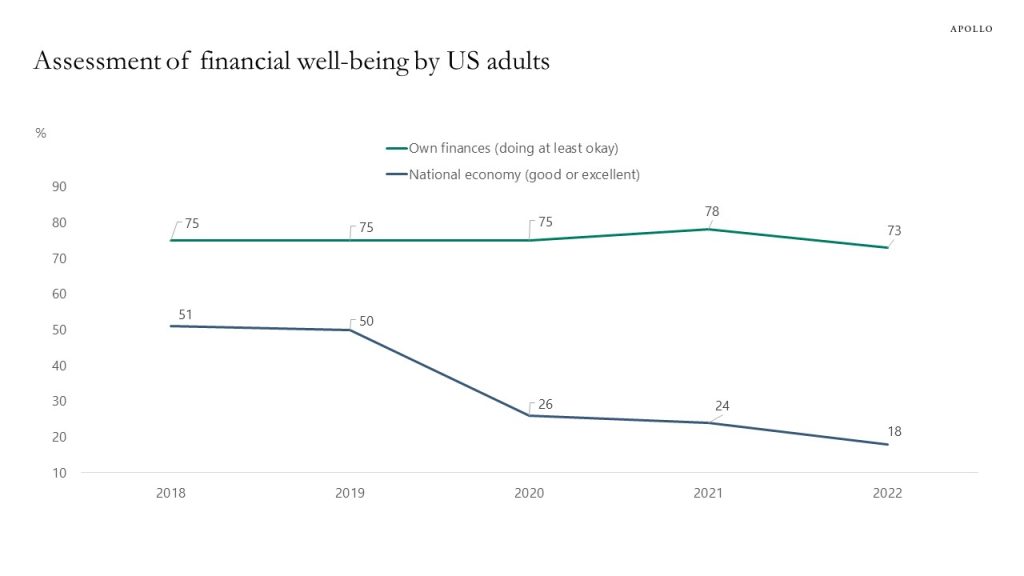

The Fed conducts an annual survey of the financial well-being of US households, and the latest survey shows that consumers are happy with their own finances. But they are unhappy with the national economy, which is consistent with households facing high inflation yet still have jobs and plenty of savings.

Source: FRB, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

There are two downside risks to the outlook for the economy and markets.

The first is rates higher for longer because of sticky inflation driven by high wage inflation and the ongoing recovery in the housing market.

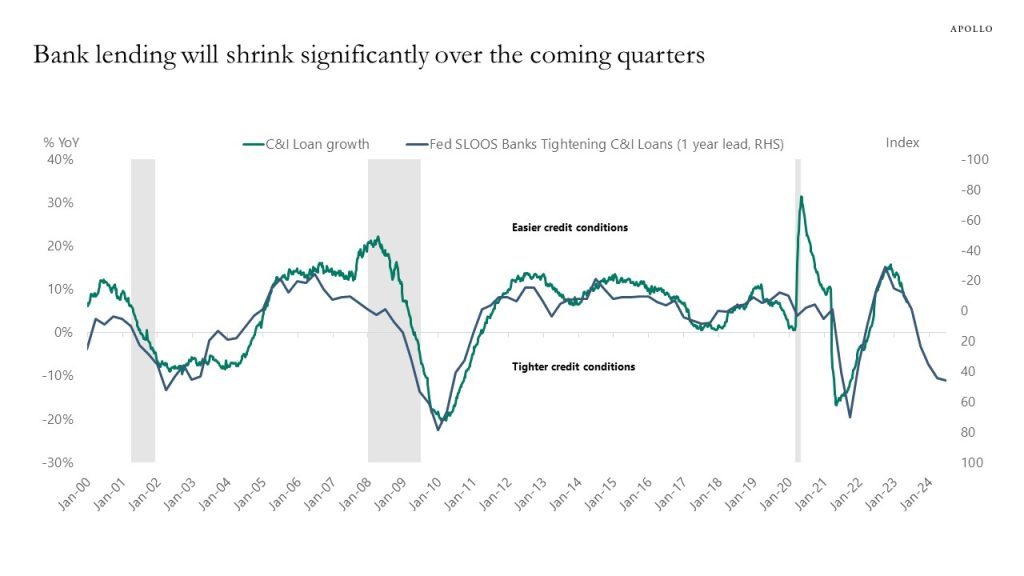

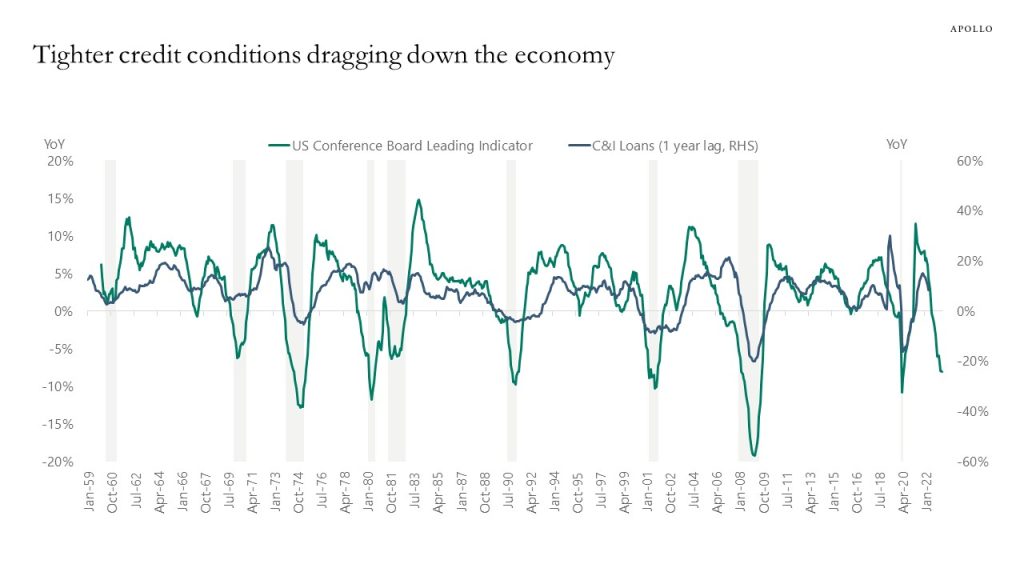

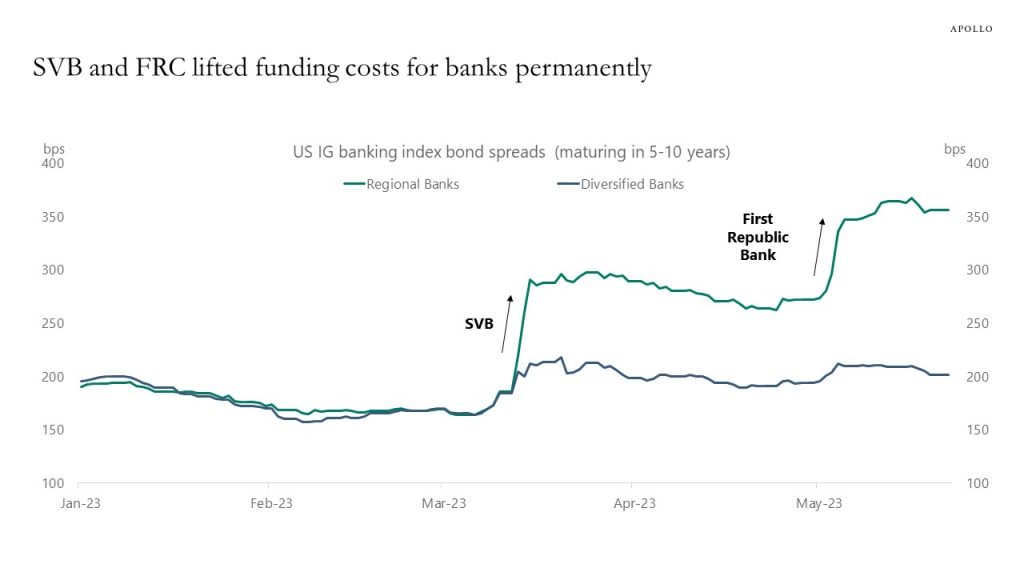

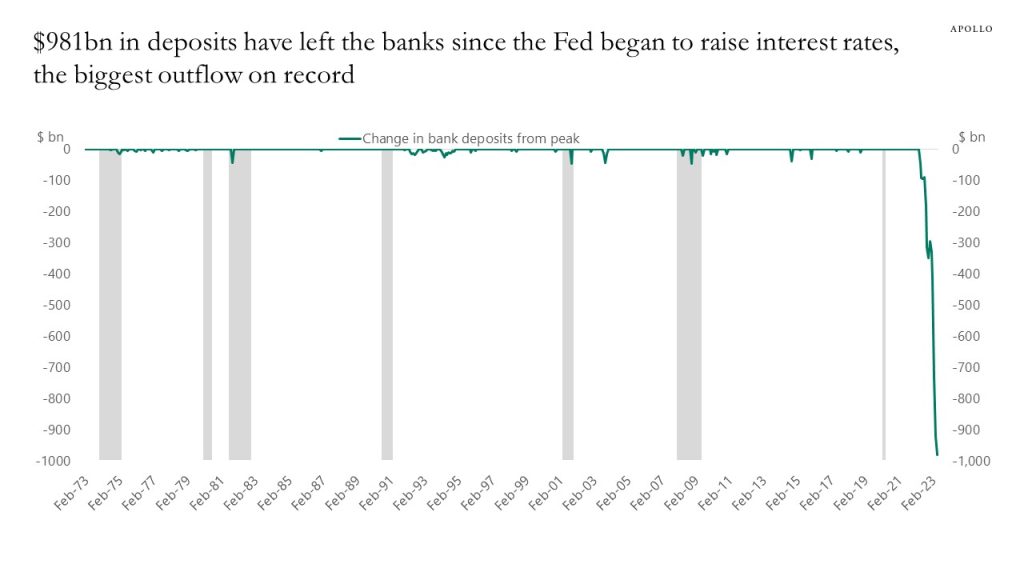

The second is the ongoing tightening in credit conditions with banks holding back lending.

We are carefully monitoring both of these risks.

Our banking sector outlook is available here.

Source: FRB, Haver Analytics, Apollo Chief Economist

Source: Conference Board, FRB, Haver Analytics, Apollo Chief Economist

Source: ICE BofA, Bloomberg, Apollo Chief Economist. Note: Unweighted average spreads of bonds from ICE 5-10 Year US Banking Index, C6PX Index for bonds issued before 1st Jan 2023. There are 8 banks in the Regional index and 41 banks in the Diversified index, and Regional banks include BankUnited, Citizens Financial, Huntington, and Zions, and Diversified banks include JP Morgan, Citibank, and Bank of America.

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist. Note: March data as of 10th May 2023. Peak is defined as the month before monthly outflows turn negative.

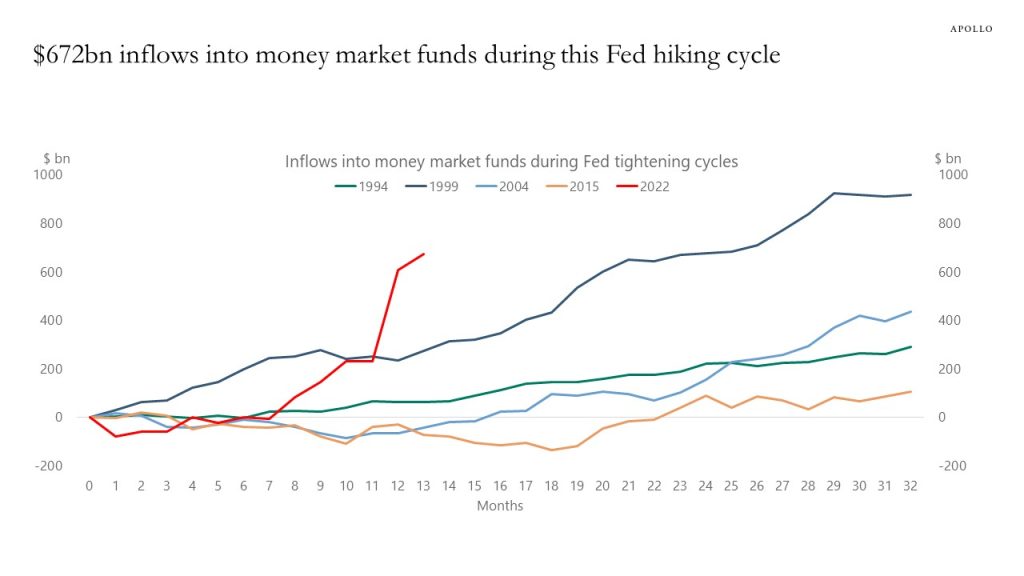

Source: FRB, ICI, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

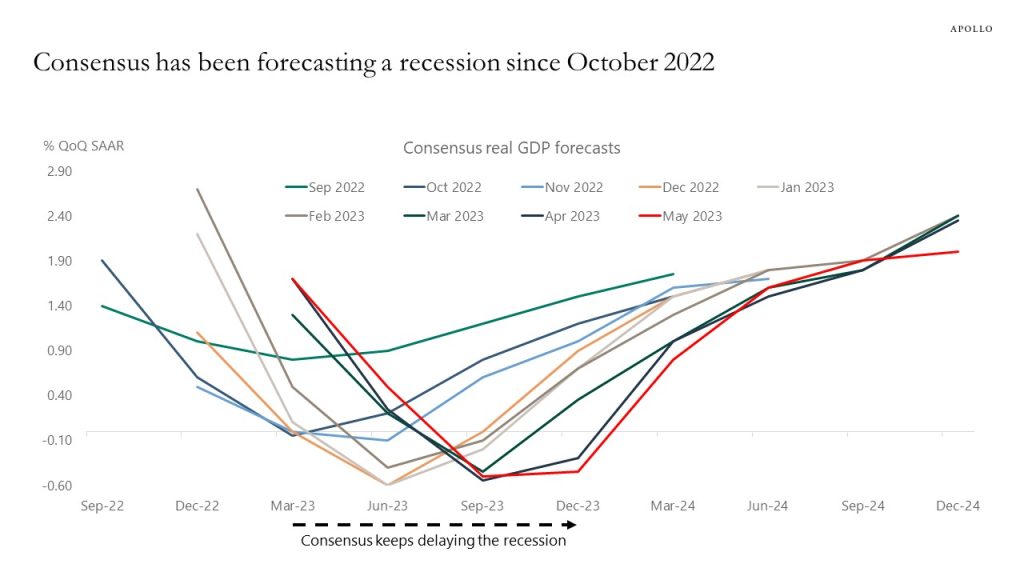

The consensus has been forecasting negative growth since October 2022, and the recession has yet to arrive because it has taken longer to run down excess savings in the household sector, see chart below.

Put differently, it is taking longer to remove from the economy the $5trn fiscal and $5trn monetary expansion done during covid.

On the back of stronger-than-expected growth, the correction in stock markets and credit spreads has been relatively limited despite the rapid increase in short rates.

With inflation still at 5%, far above the Fed’s 2% inflation target, the Fed will keep the costs of capital high, and the recession will come as households eventually run out of excess savings.

The implication for markets is that the Fed will continue to put downward pressure on earnings growth and employment growth until they get what they want, namely lower inflation.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

The BoJ will likely exit yield curve control later this year. This presentation looks at what the consequences will be for USDJPY, US credit, and US rates.

See important disclaimers at the bottom of the page.

-

My latest outlook presentation is available here.

See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.