Want it delivered daily to your inbox?

-

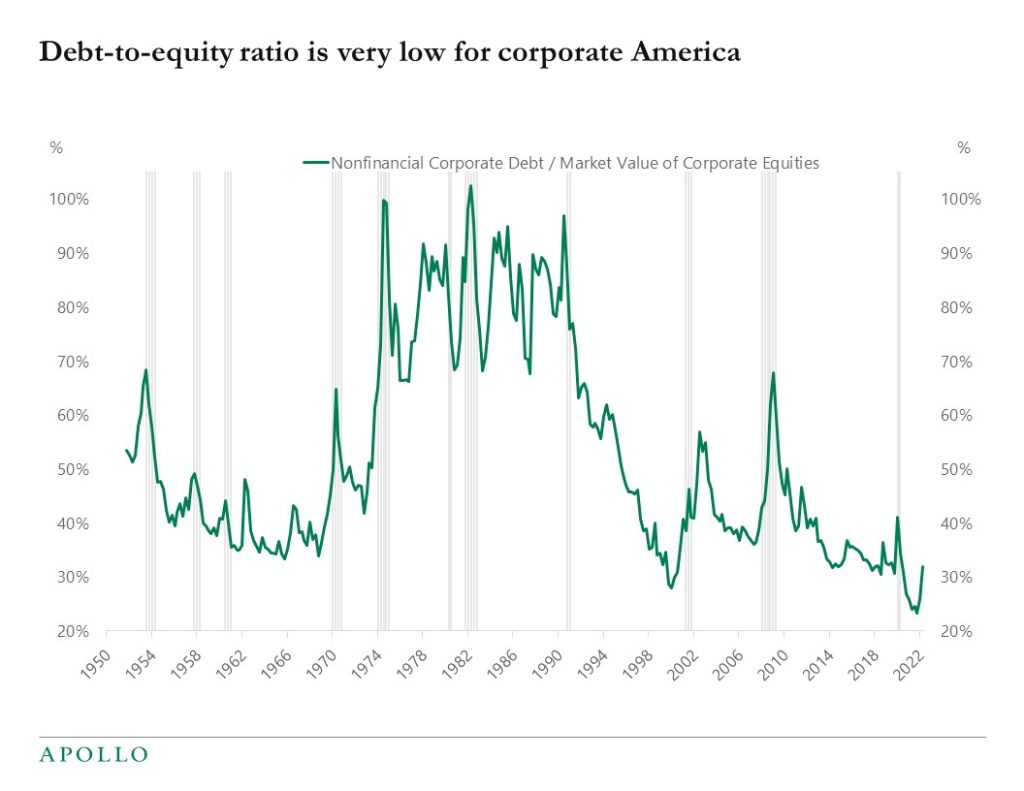

The first chart below shows that the corporate debt-to-equity ratio is low.

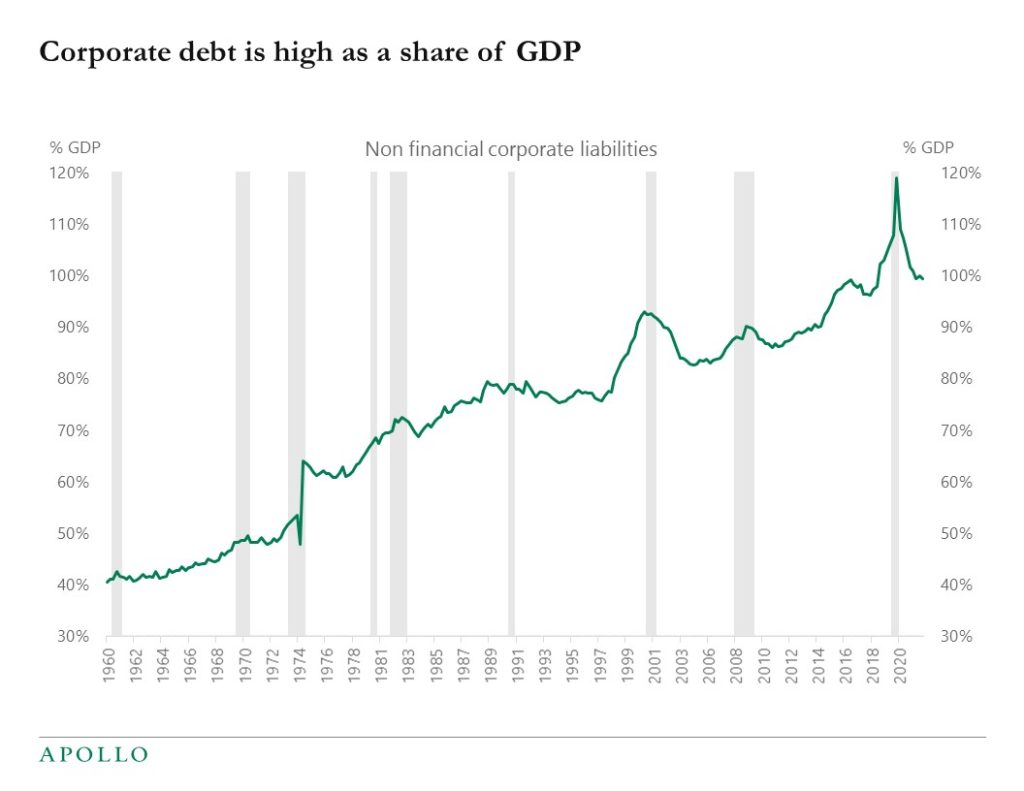

The second chart shows that corporate debt is high as a share of GDP.

In other words, corporate debt levels are low relative to equity prices. But corporate debt levels are high as a share of GDP.

A different way of looking at this is that a decade of low interest rates and QE boosted both debt levels and equity valuations. But easy monetary policy did not boost GDP by nearly as much.

One important conclusion is that there is more financial engineering, i.e. debt and equity outstanding, in the economy than ever before. And this increase in debt and equity outstanding has not yielded a corresponding boost to GDP.

The bears see high levels of debt and equity outstanding as a future risk to financial stability, in particular in a situation where inflation is high and interest rates are rising. The bulls argue that a more developed financial system is positive for growth and risk management in the economy for households, firms, and investors.

Source: FRB, Haver Analytics, Apollo Chief Economist

Source: FRB, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

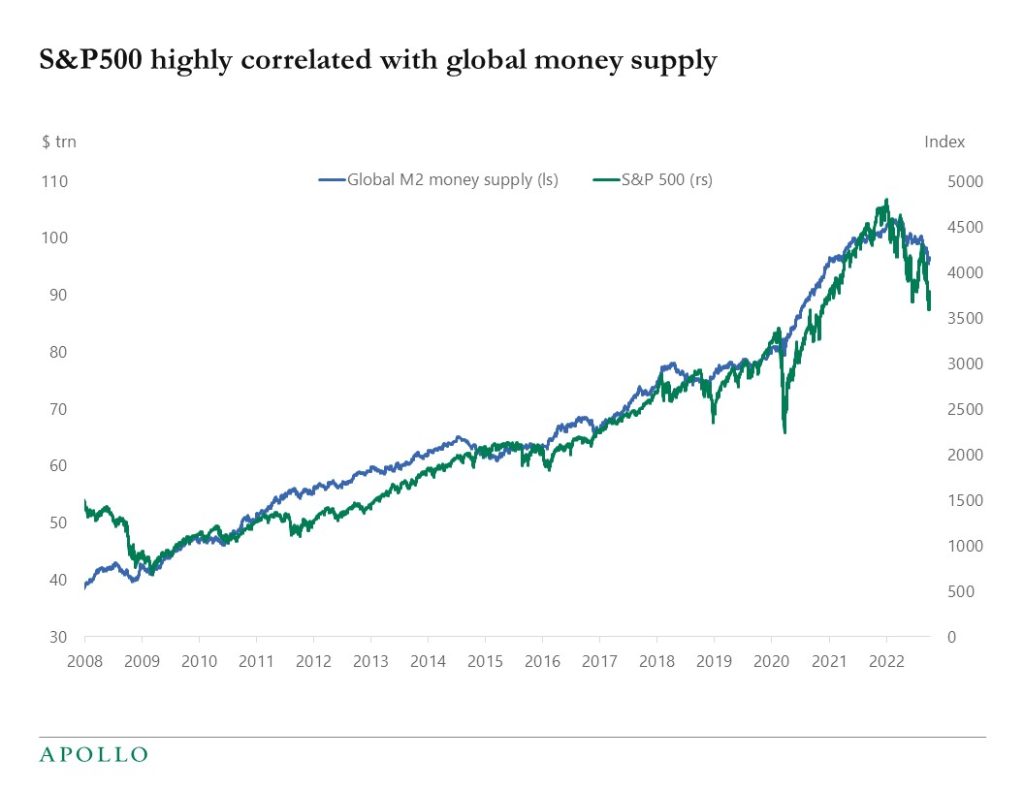

Central banks are withdrawing liquidity, and it is having a negative impact on credit and equity markets, see chart below.

Source: Bloomberg, Apollo Chief Economist (BBG ticker: .GLMOSUPP G Index, SPX index See important disclaimers at the bottom of the page.

-

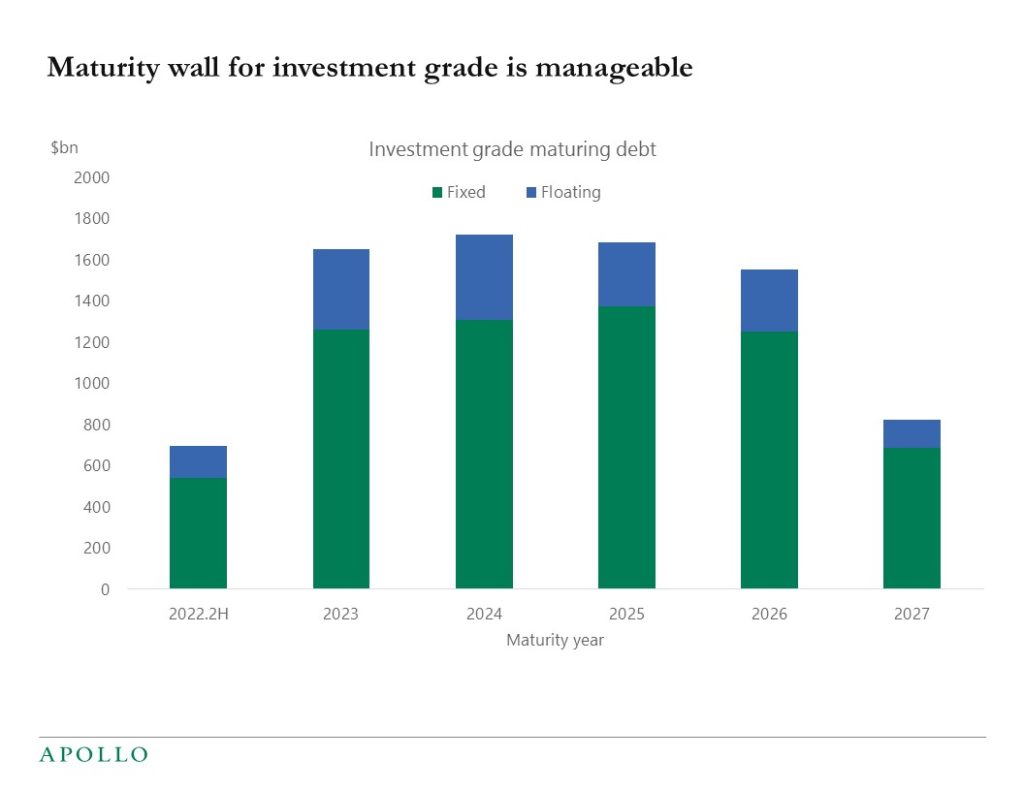

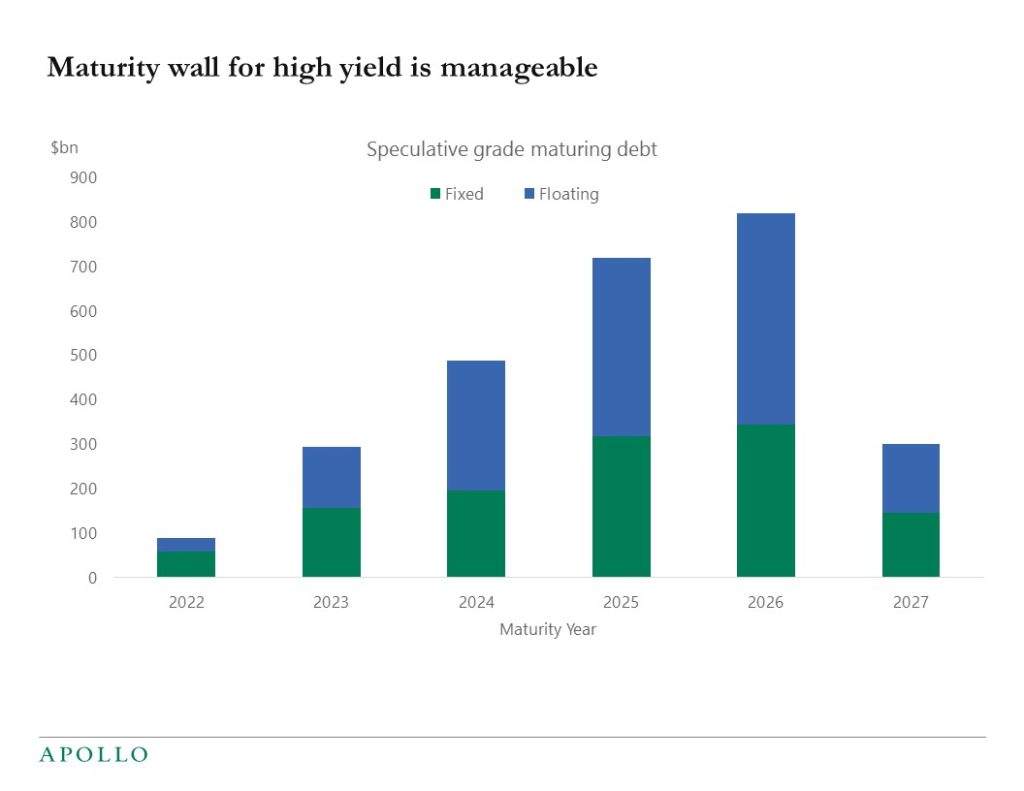

As the Fed raises rates, companies with floating rate debt have higher debt servicing costs, and companies refinancing their debt will pay higher interest rates, see charts below.

The good news is that many companies during the pandemic have termed out their debt into later years, and just 9% of fixed-rate debt is scheduled to mature by the end of 2023.

High yield debt usually is more vulnerable to rising interest rates, but high yield only makes up 19% of US corporate debt maturing by the end of 2023.

With the consensus expecting and the market pricing that Treasury yields will peak by the middle of 2023, the bottom line is that the maturity wall looks manageable for both IG and HY.

Source: S&P Global Ratings Research, Apollo Chief Economist. Note: Data as of July 1, 2022. Includes issuers’ investment-grade bonds, loans, and revolving credit facilities that are rated by S&P Global Ratings

Source: S&P Global Ratings Research, Apollo Chief Economist. Note: Data as of July 1, 2022. Includes issuers’ speculative-grade bonds, loans, and revolving credit facilities that are rated by S&P Global Ratings. See important disclaimers at the bottom of the page.

-

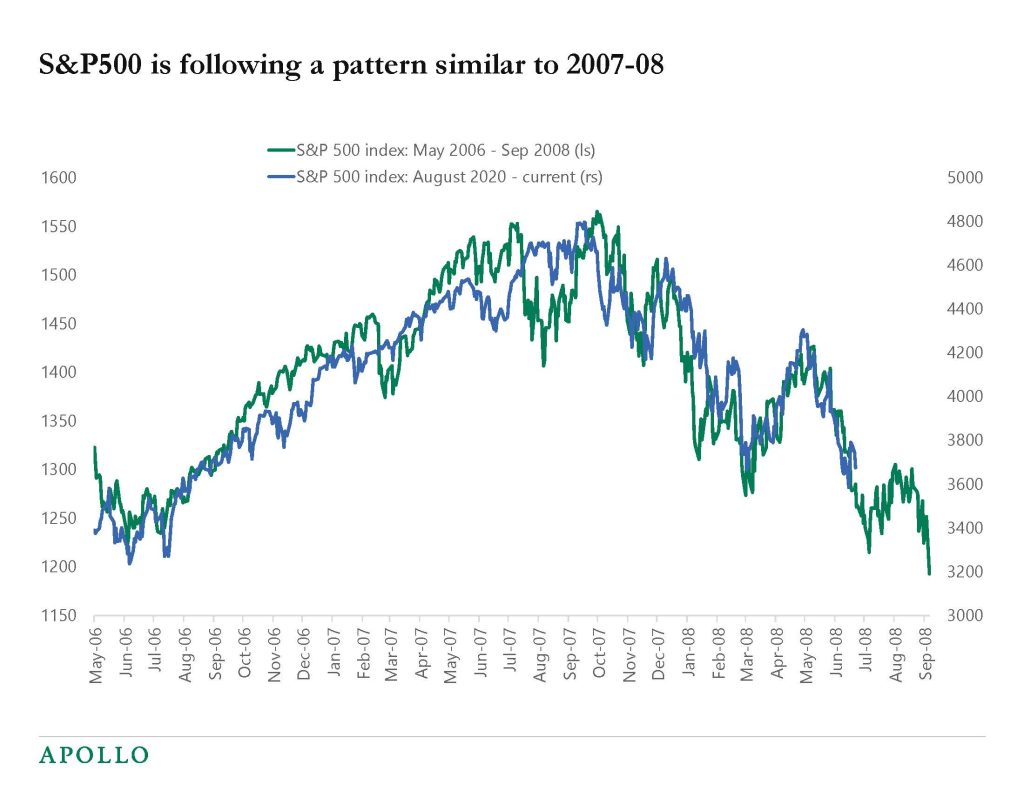

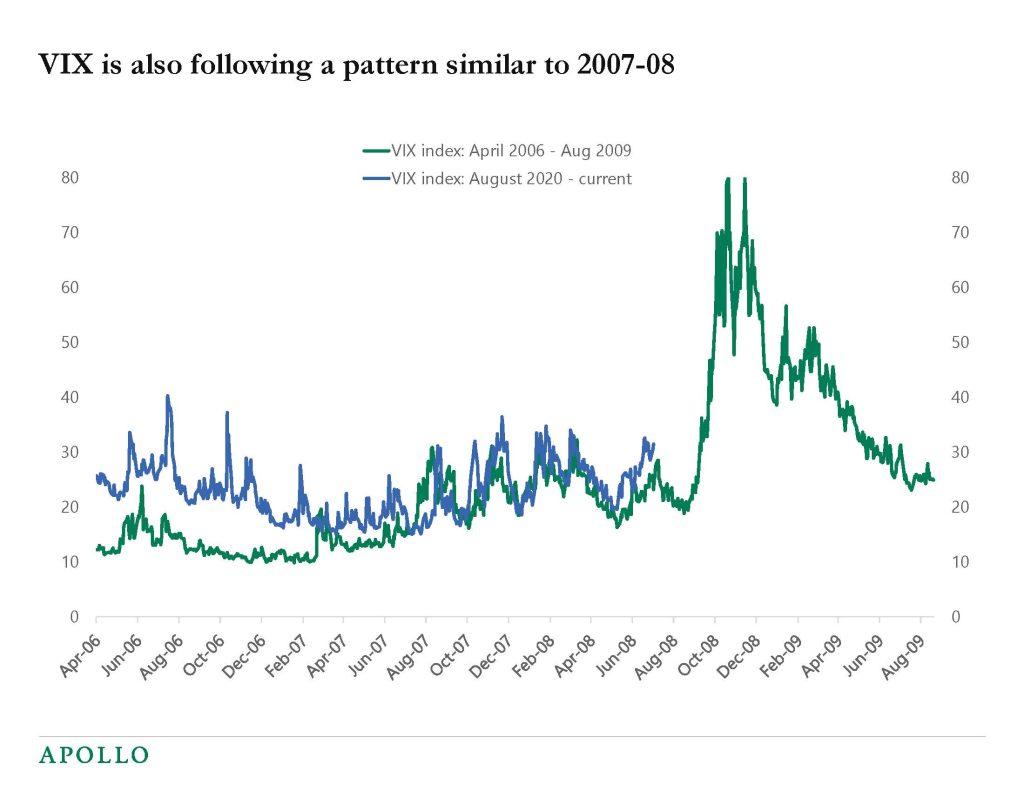

The current trading pattern seen in the S&P500 and VIX is very similar to the pattern seen in 2007-08, see charts below. Our weekly Slowdown Watch with daily and weekly economic indicators is attached.

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

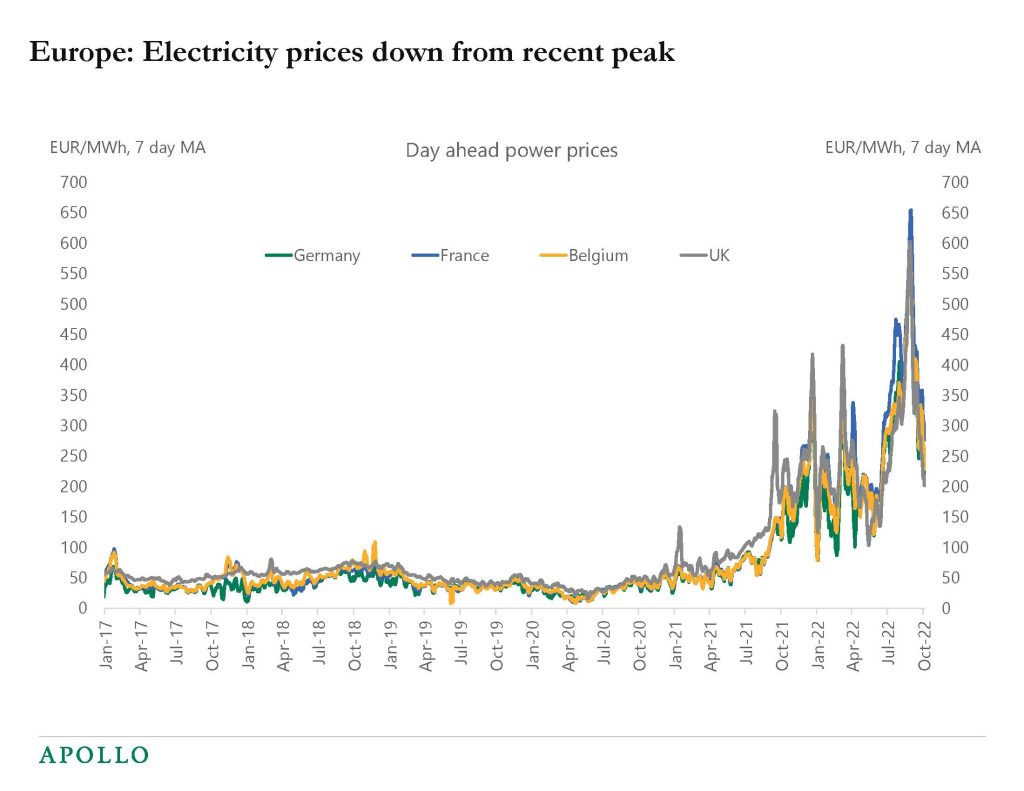

European energy prices continue to decline, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

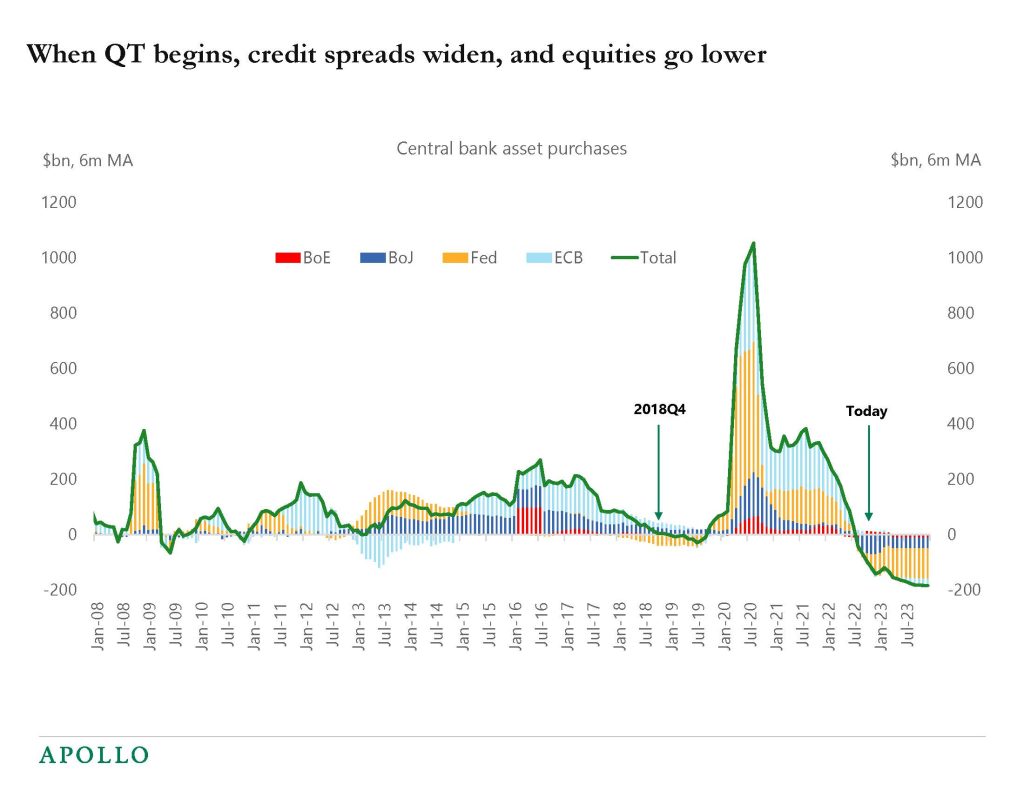

The idea with QE was to lower rates and create a rally in stock markets and credit markets. The idea with QT is the opposite: To push long rates higher, widen credit spreads, and lower stock prices. As QT gears up over the coming months, see chart below, investors should be positioned accordingly.

Source: Bloomberg, Apollo Chief Economist. Pace of purchases for 2021: BOE: £3.4bn per week till mid December 2021, FED: USD120bn per month with wind down from December with purchases ending in March 2022, ECB: Euro 90bn per month (20 bn APP + 60 bn PEPP), PEPP till March 2022, Euro 40bn in April, Euro 30bn in May and Euro 20bn in June, and only redemptions reinvested from August. BOJ: USD 70bn per month. For 2022: All programs are expected to wind down linearly from January 2022 to December 2022. Fed QT $ 95bn per month from May 2022. BoE starts to sell GBP80 bn in the next 12 months and ECB starts QT in 2Q23. See important disclaimers at the bottom of the page.

-

The Fed is not going to pivot anytime soon because if the Fed pivots to dovish with inflation at 8%, it will push up inflation even more. The FOMC wants to lower inflation from 8% to 2%, and it has to happen through a tightening of financial conditions via higher rates, wider credit spreads, and lower equities. Our latest credit market outlook is attached.

Unless otherwise noted, information as of October 2022. Confidential and Proprietary – Not for distribution, in whole or in part, without the express written consent of Apollo Global Management, Inc.

It should not be assumed that investments made in the future will be profitable or will equal the performance of the investments shown in this document.See important disclaimers at the bottom of the page.

-

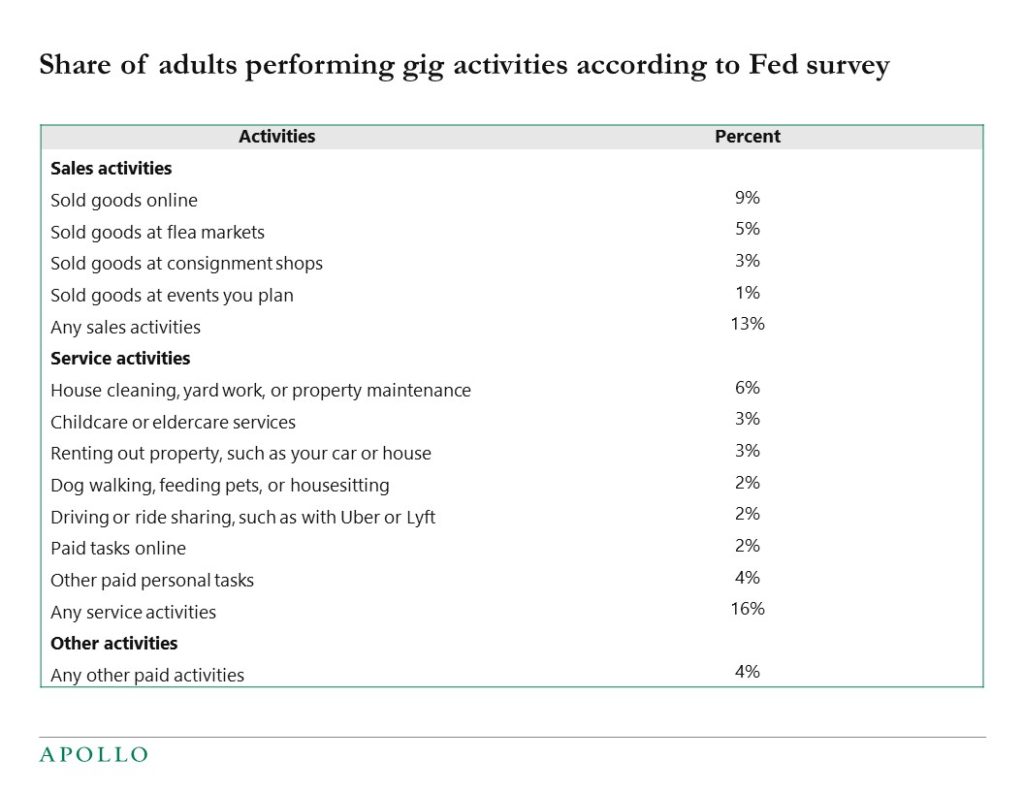

During the pandemic, more people earned income doing TikToks, selling things online, and, more recently, driving Uber, and the growth of the gig economy over the past decade has been very significant.

Data from the Fed shows that 27% of US adults earned some money from gigs, and 8% were regular gig workers, in that they spent 20 or more hours in the prior month on gigs. The Fed survey also shows that gig work frequently supplements earnings from a traditional job, nearly half of gig workers also have full-time jobs, while 22% have part-time jobs.

This gradual shift towards more and more gig workers is complicating the Fed’s efforts at cooling down the economy. The more flexibility workers have with alternative work arrangements, the harder it is for the Fed to slow down aggregate demand because having a job is no longer a binary decision, which is a problem when the FOMC is trying to quickly slow down growth and income in the economy.

Source: Fed: Economic Well-Being of U.S. Households. Apollo Chief Economist, https://www.federalreserve.gov/publications/2021-economic-well-being-of-us-households-in-2020-executive-summary.htm. Note: Among all adults. Respondents could select multiple answers. See important disclaimers at the bottom of the page.

-

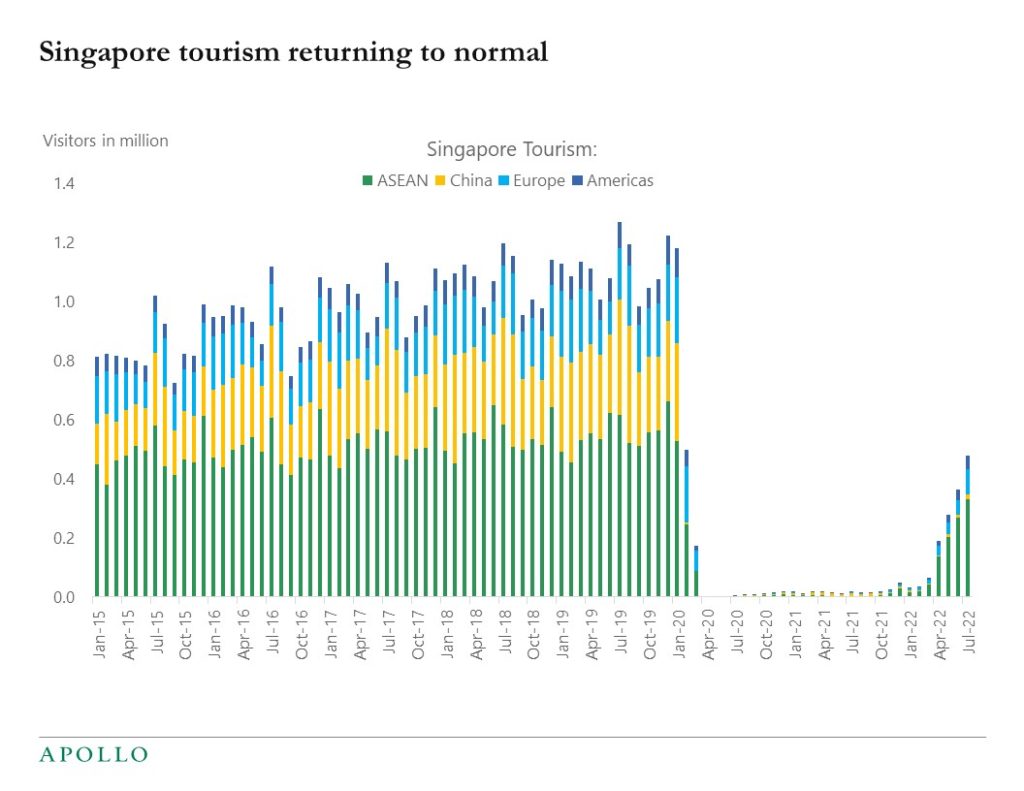

Tourism in Singapore is starting to come back to normal, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

The Fed is increasing interest rates, and this is starting to have an impact on the housing market. Rising mortgage rates, high home prices, a strong supply pipeline, and high building costs are risks to this housing cycle. Our updated US Housing Outlook is attached.

See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.