Want it delivered daily to your inbox?

-

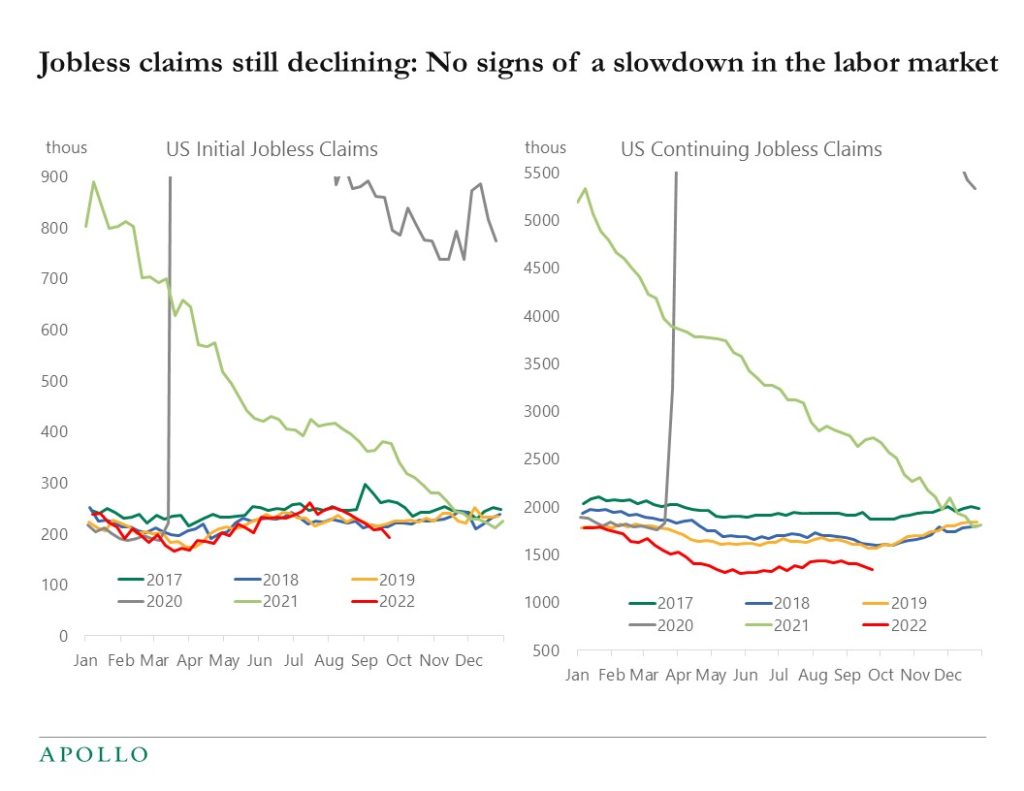

Our weekly slowdown watch PDF is available here, and the incoming data continues to point to an overheating economy, with core PCE inflation in August rising to 4.9% and weekly jobless claims falling to levels not seen since April, see chart below. The interest rate sensitive goods sector of the economy is slowing down, including housing and autos, but the service sector, including restaurants, airline traffic, hotels, concerts, and sporting events, is not showing signs of slowing down. The bottom line is that more Fed hikes are needed to cool down the economy to get inflation back to 2%.

Source: Department of Labor, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

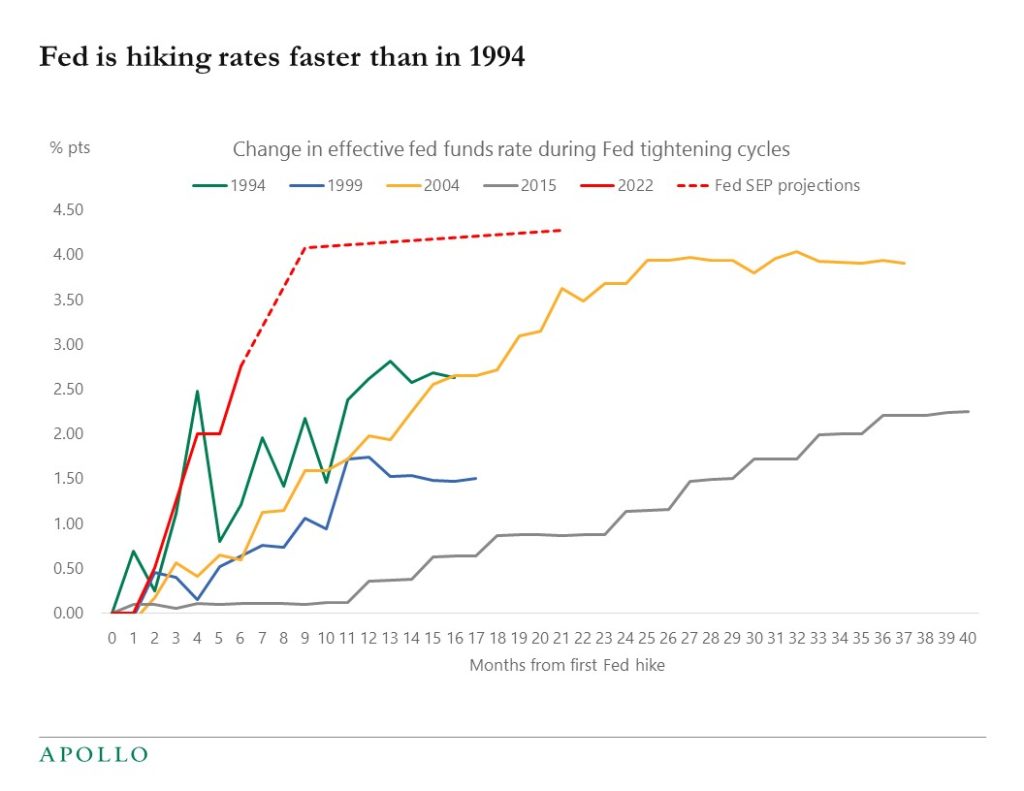

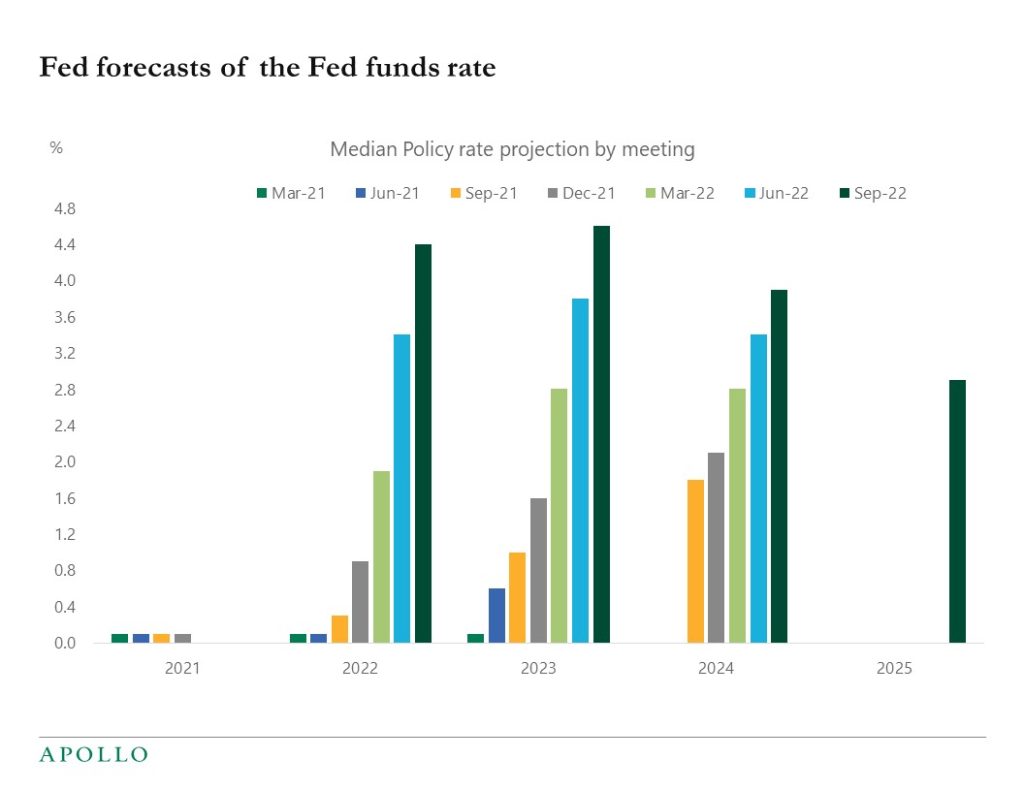

The 1994 Fed hiking cycle is often mentioned as a very unusual period, but in 2022 the FOMC has increased interest rates faster and more than during the 1994 episode, and the FOMC expects this to be the biggest percentage point increase in the Fed funds rate in recent history, see chart below. Inflation is 8.3% and the FOMC’s inflation target is 2%. The Fed is trying to cool down the economy by tightening financial conditions, i.e. by pushing rates higher, credit spreads wider, and stocks lower. Investors should be positioned accordingly.

Source: FRB, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

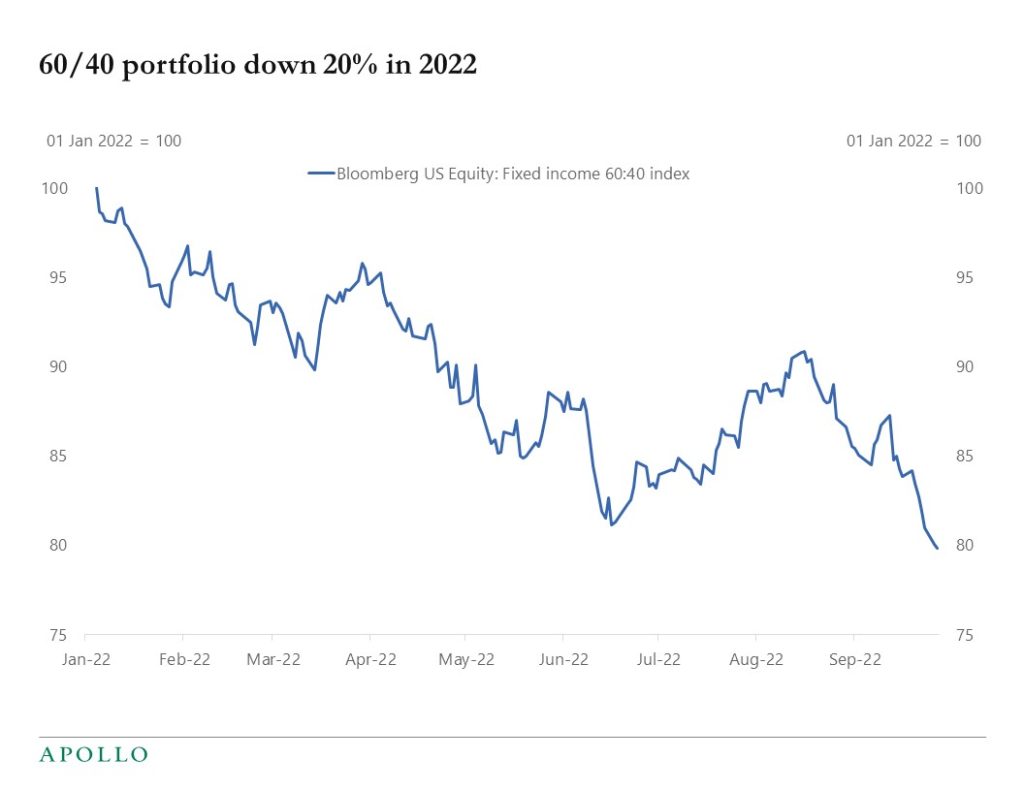

If you had entered 2022 with a portfolio of 60% stocks and 40% fixed income, you would be down 20% so far, see chart below. With inflation still at more than 8% in the US, EU, and the UK, central banks will continue to push rates higher and stocks lower to cool down the economy and slow down earnings growth until inflation moves closer to the central banks’ 2% inflation target.

Source: Bloomberg, Apollo Chief Economist. The Bloomberg US BMA6040 Index rebalances monthly to 60% equities and 40% fixed income. See important disclaimers at the bottom of the page.

-

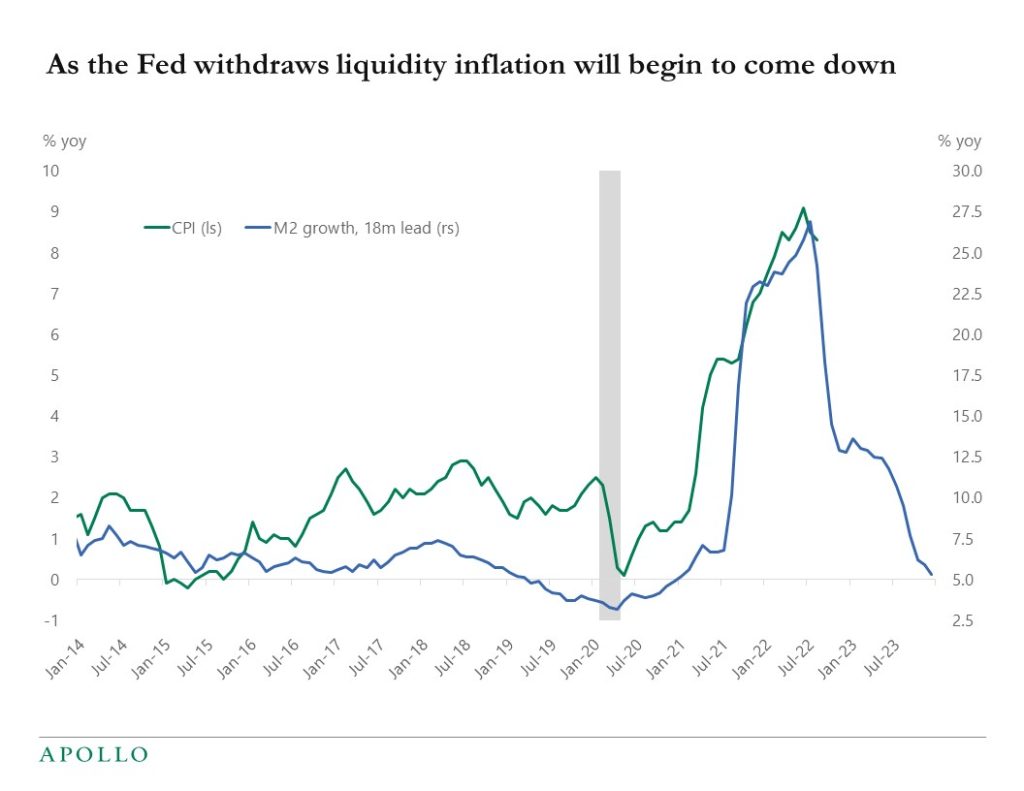

Monetary theory points to a sharp decline in inflation over the coming months, see chart below.

Source: BLS, FRB, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

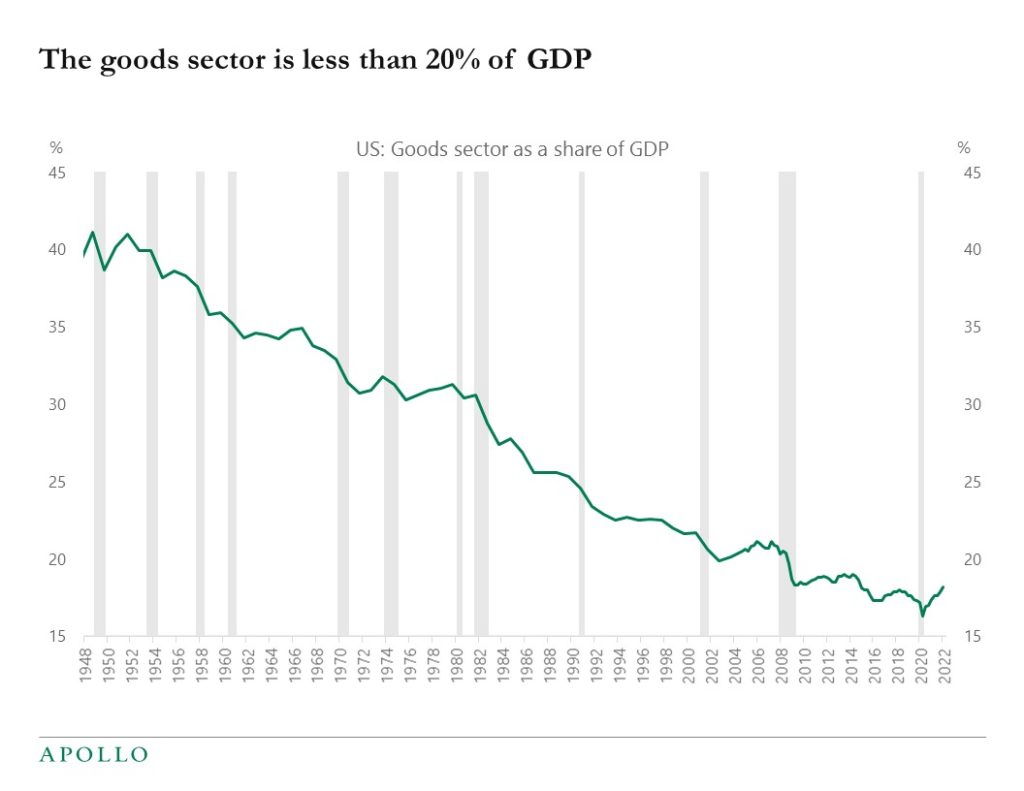

The FedEx results don’t tell us much about the broader economy because goods only make up 18% of GDP, and consumer services such as air travel, hotels, restaurants, sporting events, and concerts are not slowing down. The bottom line is that the goods sector in the economy continues to cool down, and consumer services continue to overheat, see chart below. For markets, the implication is that the Fed will continue to slow down the interest-rate sensitive goods sector, including housing and autos, while we wait for the service sector to show signs of cooling down.

Source: BEA, Apollo Chief Economist. Note: Chart shows share of value added of goods producing industries which cconsists of manufacturing, construction, agriculture, forestry, fishing, and hunting; and mining. See important disclaimers at the bottom of the page.

-

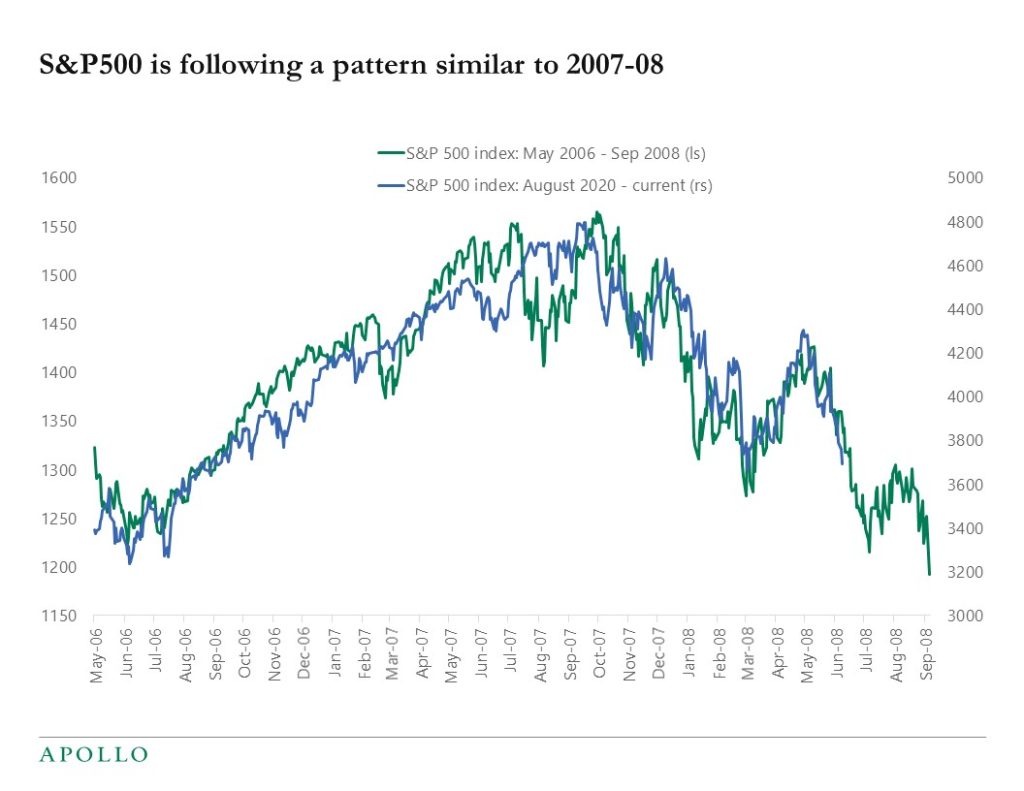

Last week, the S&P500 continued to follow the pattern seen in 2008, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Quantifying the Role of Interest Rates, the Dollar and Covid in Oil Prices

https://www.bis.org/publ/work1040.pdf

Labor Force Exiters around Recessions: Who Are They?

https://s3.amazonaws.com/real.stlouisfed.org/wp/2022/2022-027.pdf

Dollar Reserves and U.S. Yields: Identifying the Price Impact of Official Flows

See important disclaimers at the bottom of the page.

-

In March 2021, the FOMC thought the Fed funds rate would be zero at the end of 2023. Now they think the Fed funds rate at the end of next year will be 4.5%, see chart below.

Our attached Slowdown Watch PDF shows that the US economy is still overheating, with unemployment at 3.7% and inflation at 8.3%.

Source: FRB, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

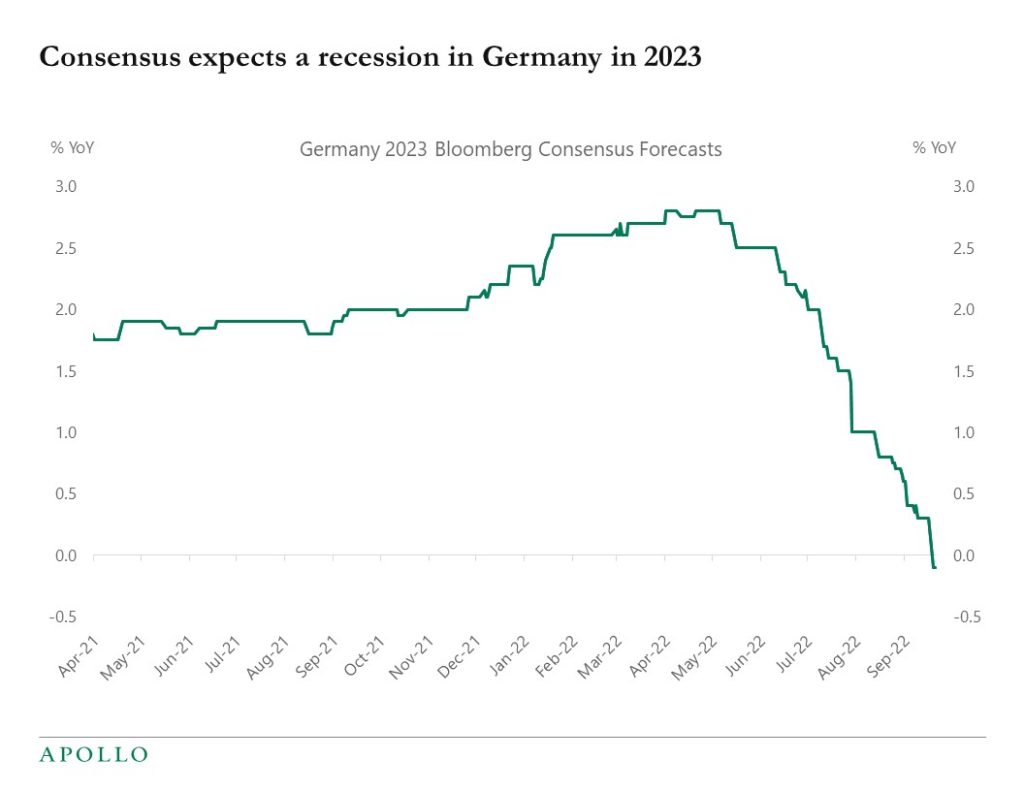

The consensus is now expecting a recession in Germany in 2023, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

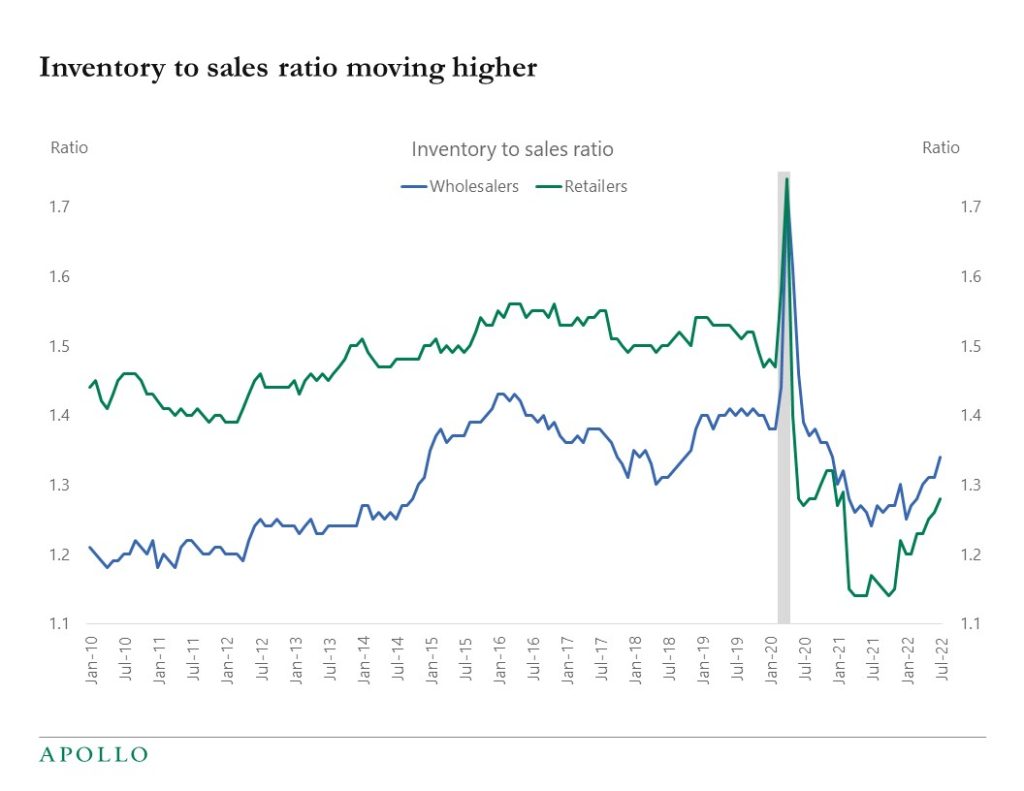

Although services make up 80% of GDP, fluctuations in the goods sector are still important. Inventory levels are normalizing as a result of the supply chain improving and the goods sector of the economy slowing down, see chart below. Inventories for wholesalers are back to pre-pandemic levels, but inventories for retailers are still substantially below 2019 levels.

Source: Census Bureau, Haver, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.