Want it delivered daily to your inbox?

-

Fed cuts and lower costs of capital could boost private markets in 2024. Our latest chart book is available here.

See important disclaimers at the bottom of the page.

-

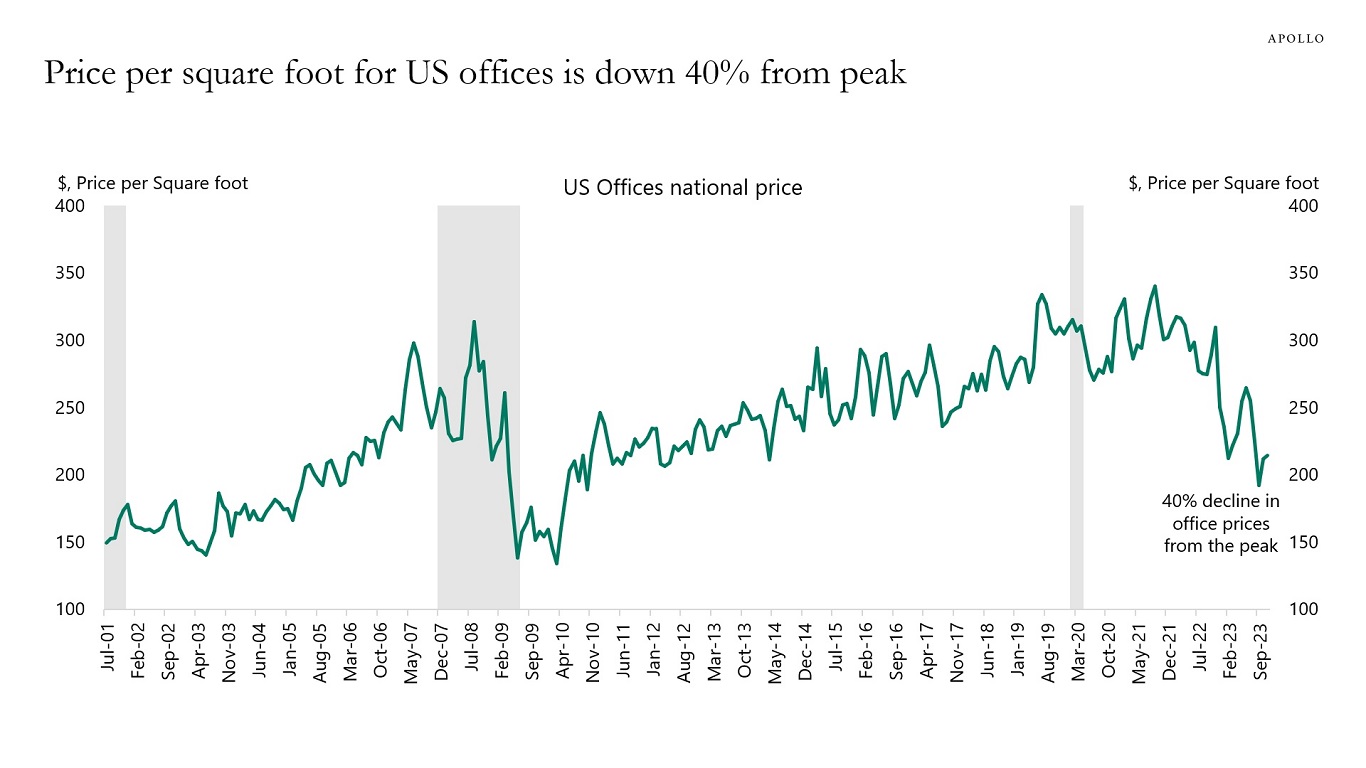

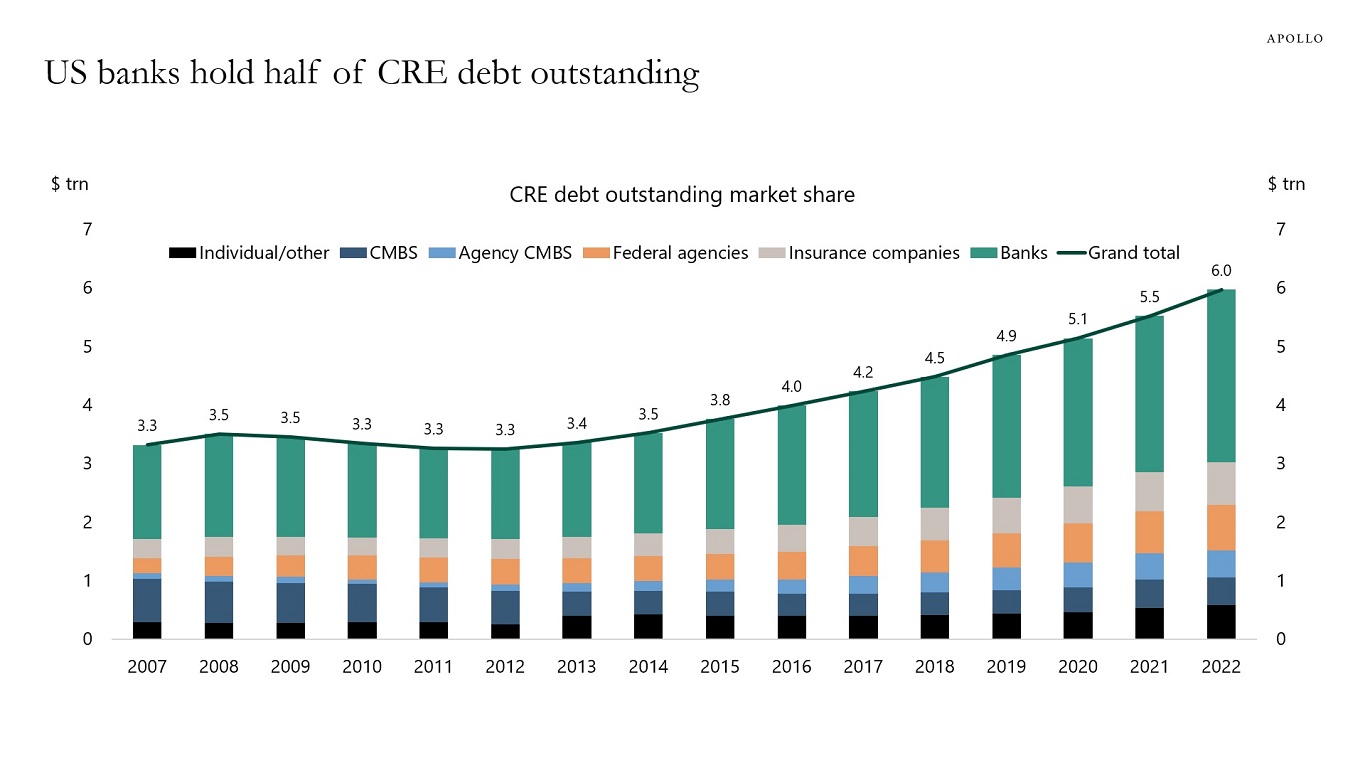

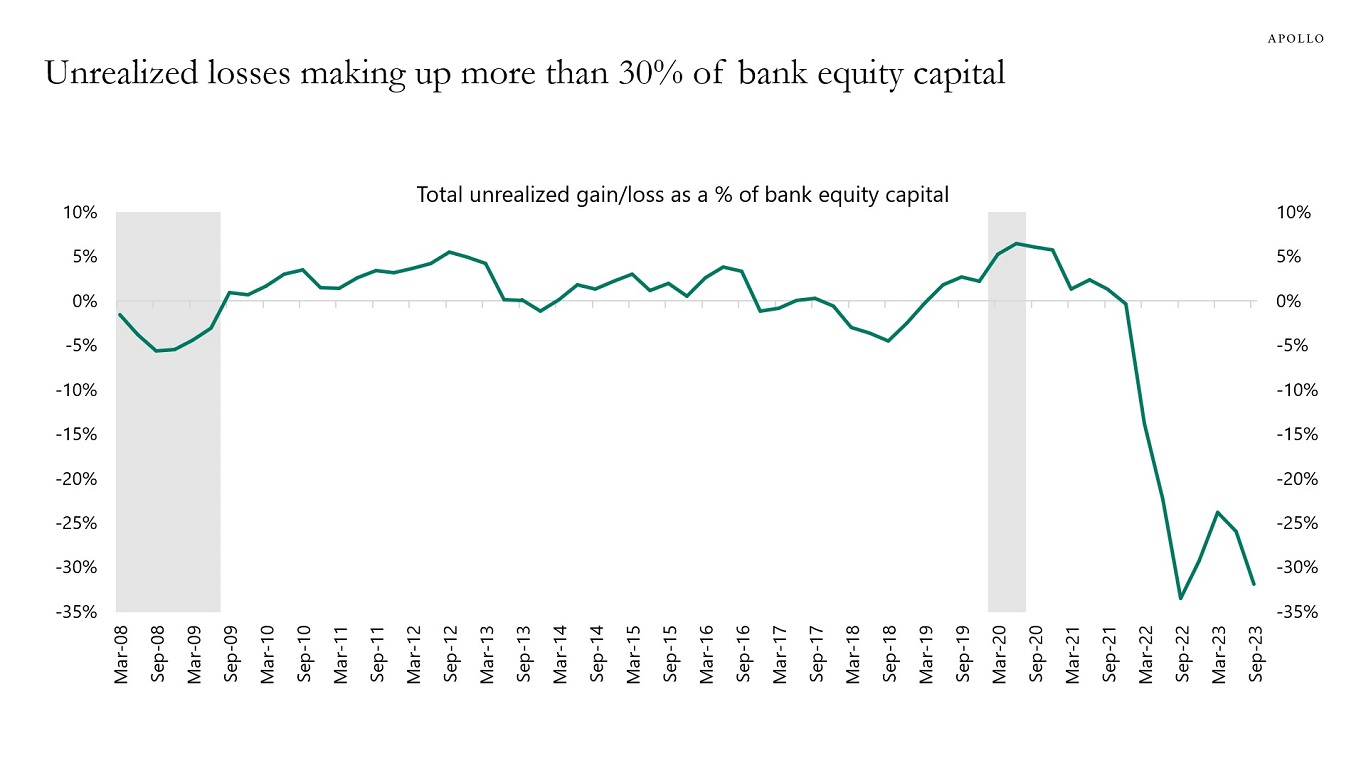

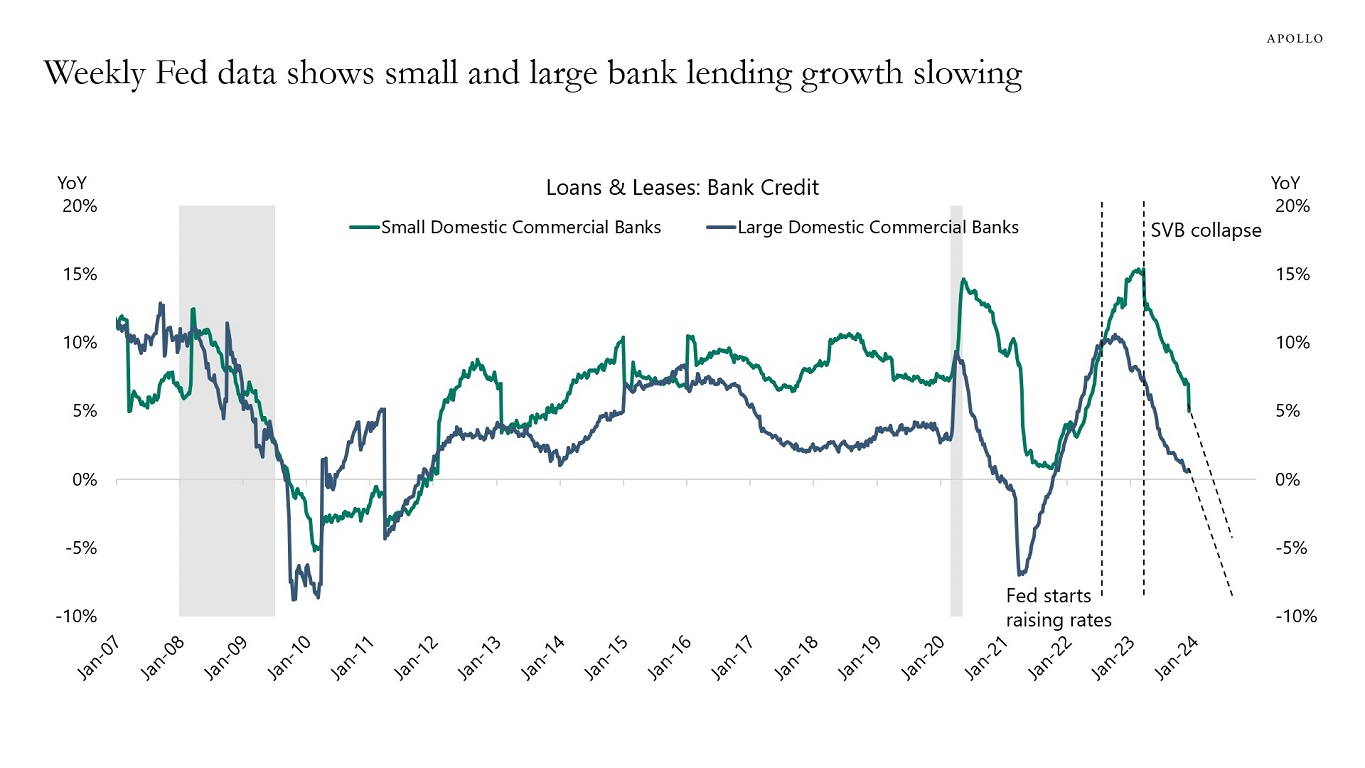

The banking sector is facing a number of headwinds from a 40% decline in the price per square foot for office because of higher interest rates and more people working from home, $3 trillion in CRE holdings, and $684 billion in unrealized losses on Treasuries and mortgages, see charts below. The net result is a continued decline in the weekly data for bank lending, see the last chart below.

Our latest banking sector chart book is available here.

Source: Apollo Chief Economist

Source: RCA, Bloomberg, Apollo Chief Economist

Source: REITS, BLS, Bloomberg, Apollo Chief Economist (Note: Office using employment includes professional and business services, Information and Financial activities)

Source: S&P Capital IQ, Apollo Chief Economist

Source: FDIC, Apollo Chief Economist

Source: FDIC, Haver Analytics, Apollo Chief Economist

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

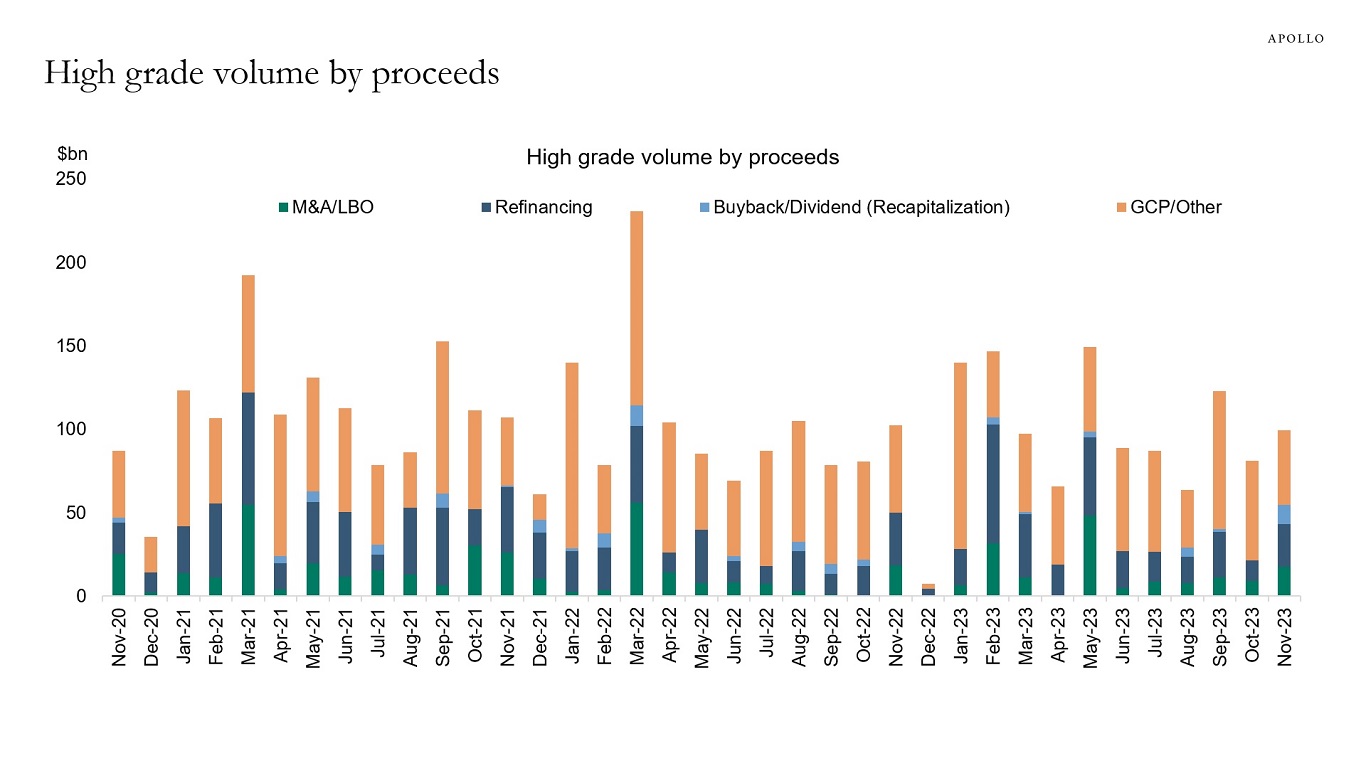

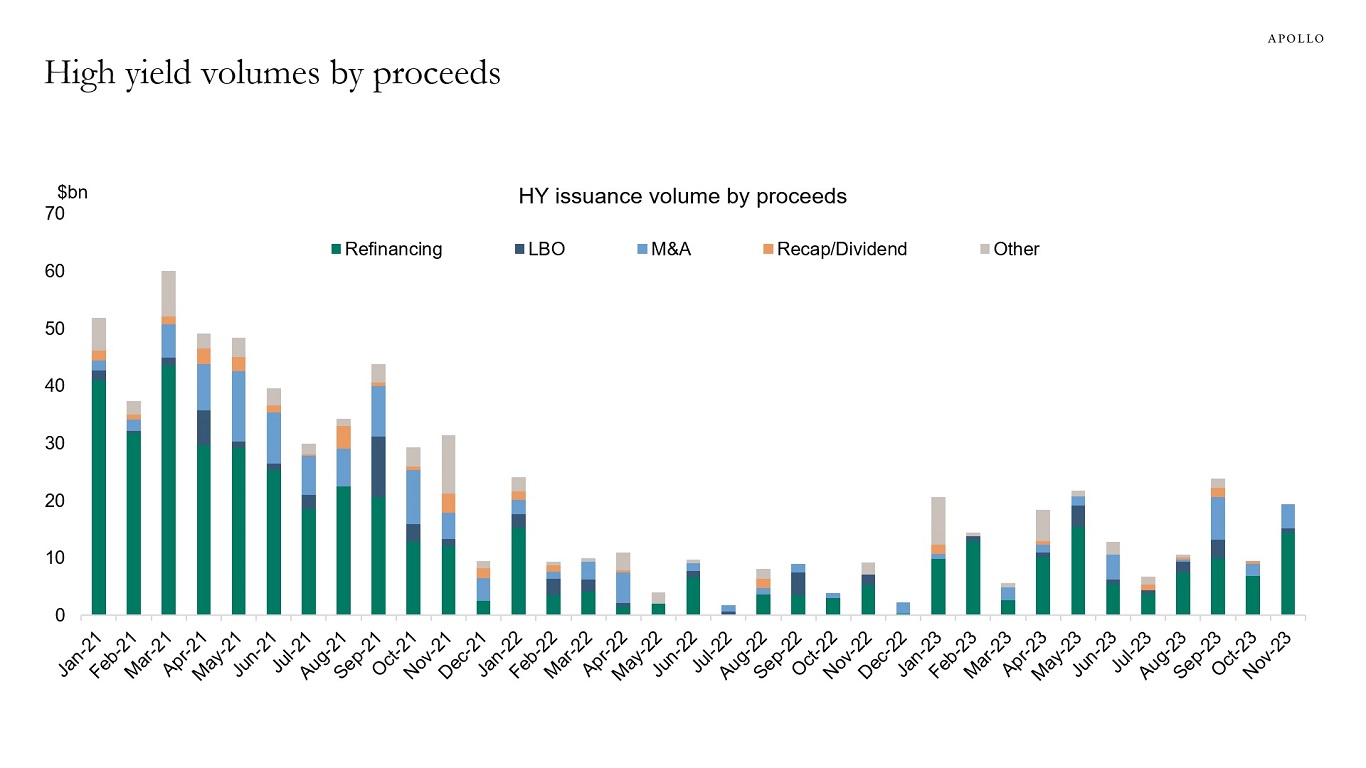

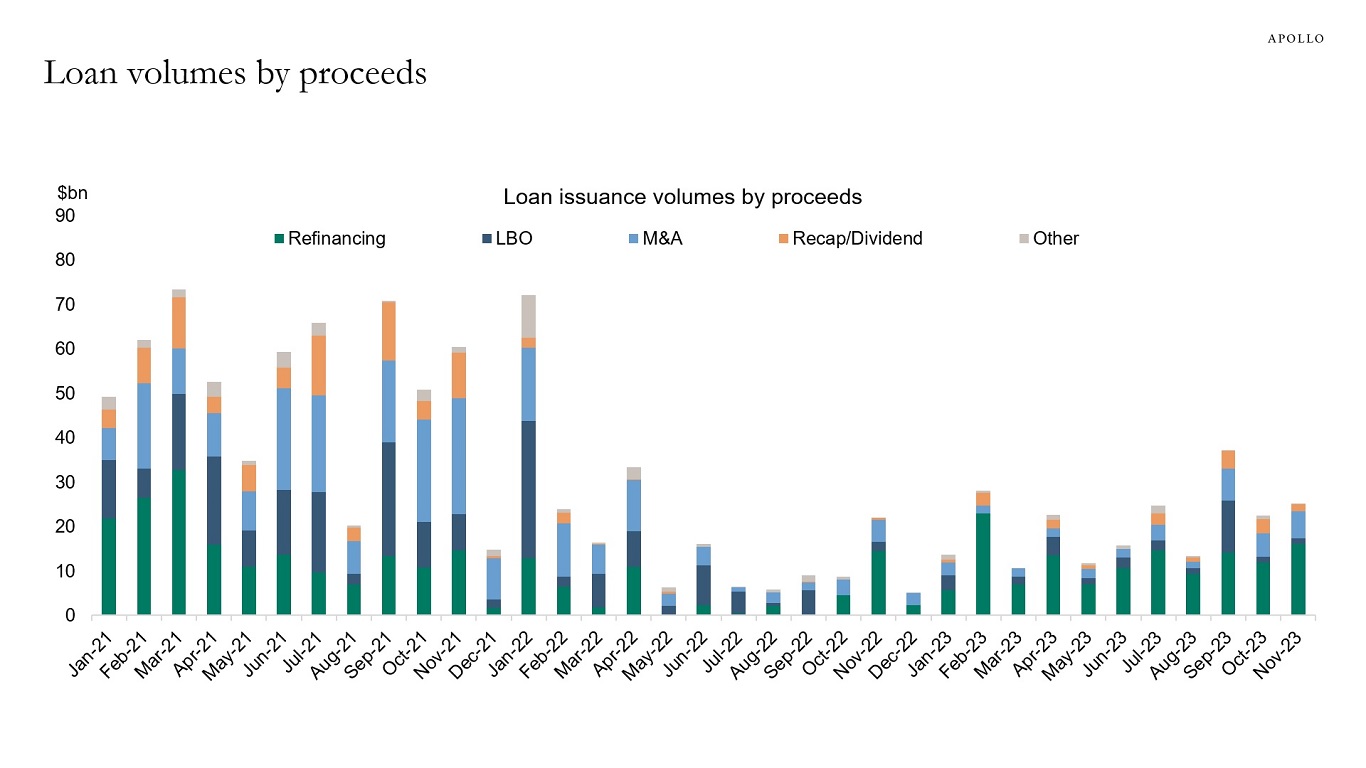

Recent issuance in IG, HY, and loans has focused on refinancing and general corporate purpose (GCP), but after the Fed pivot, we are likely to see an increase in M&A activity in 2024 driven by lower cost of capital and pent-up M&A, see charts below. Our latest credit market outlook is available here.

Source: Pitchbook LCD, Apollo Chief Economist. Note: GCP means General Corporate Purpose, which means making or financing any payment for working capital, capital expenditures, or any other general corporate purpose.

Source: Pitchbook LCD, Apollo Chief Economist

Source: Pitchbook LCD, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

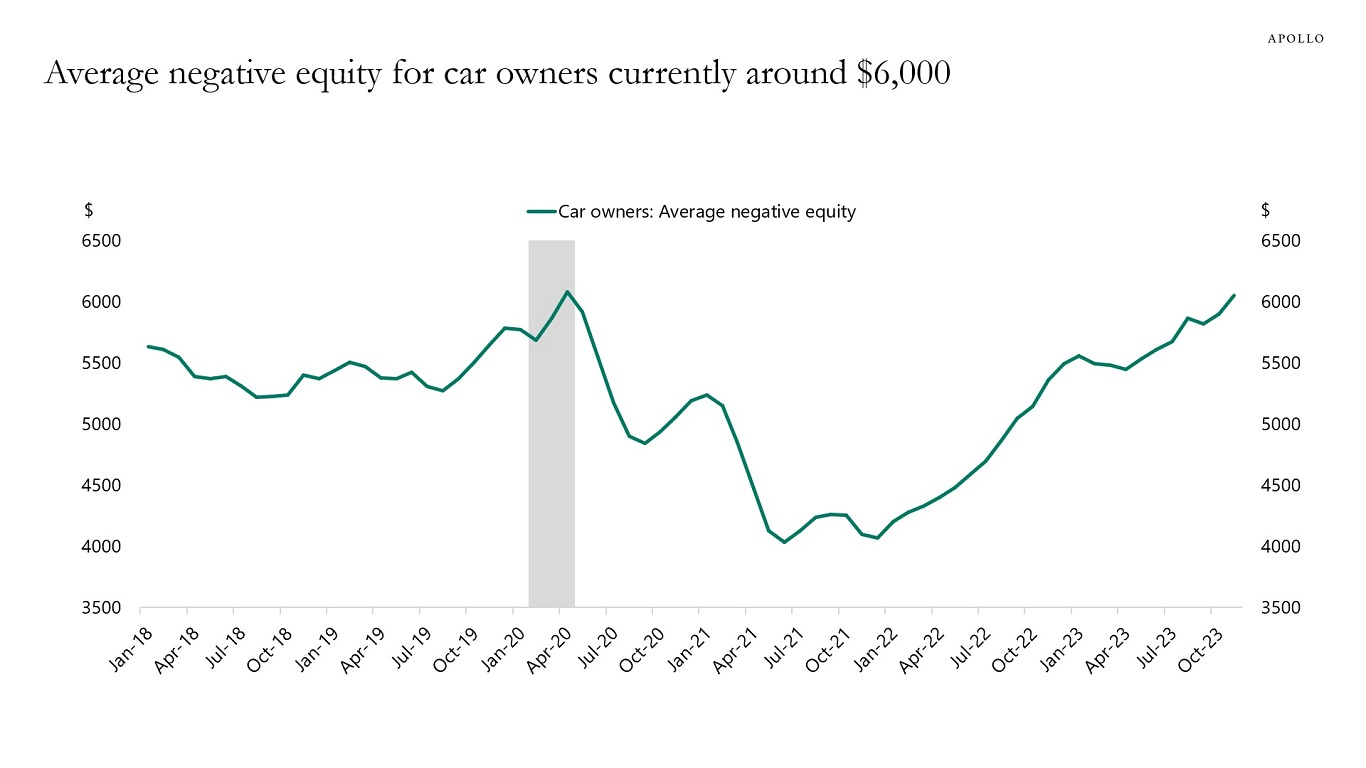

The average negative equity for car owners has continued to increase and is now higher than in 2019, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

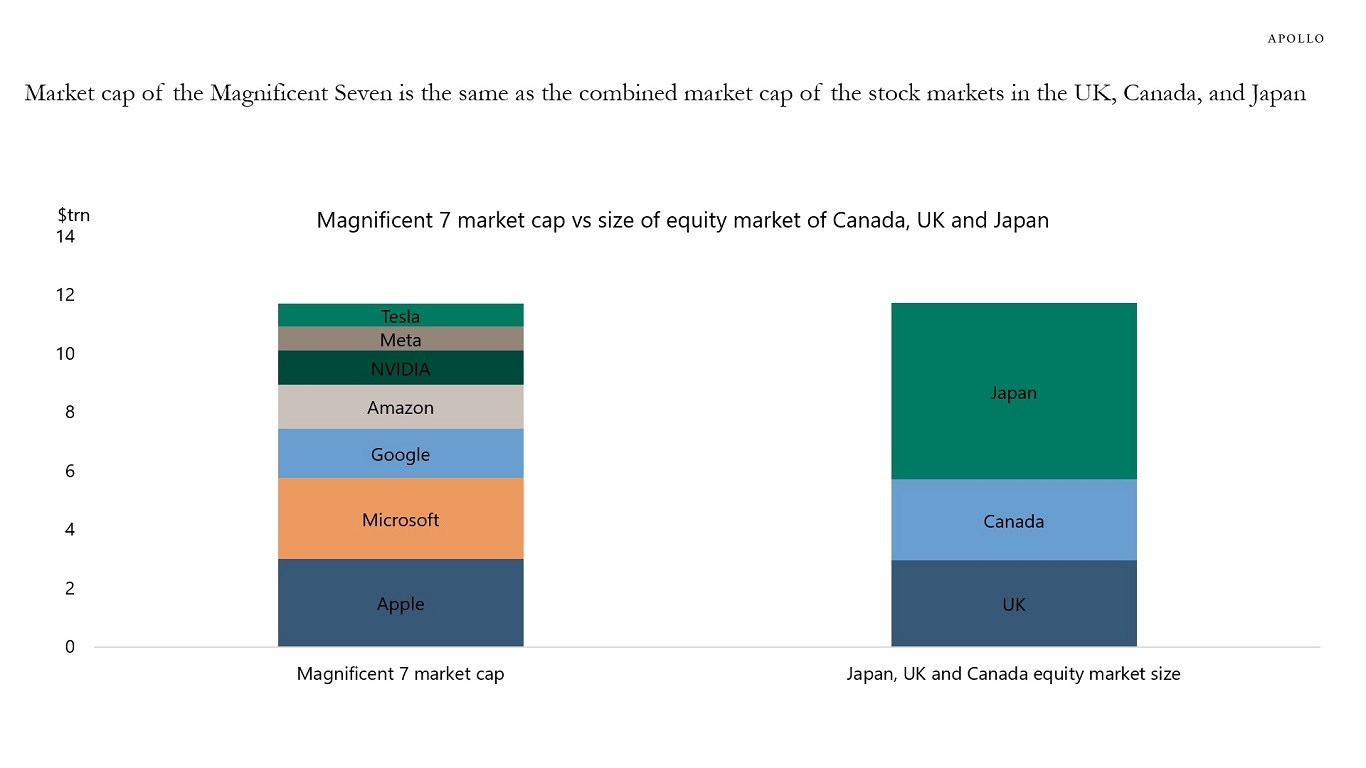

The market cap of the Magnificent Seven is now the same size as the combined market cap of the stock markets in Japan, Canada, and the UK, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

The Fed pivot in December parallels what happened a decade ago.

In 2013, the taper tantrum triggered a quick tightening in financial conditions due to a modest change in Fed communication.

Today, we are seeing a similar significant change in financial conditions on the back of a modest shift in Fed communication, but with the opposite sign.

The Fed pivot in December was a modest change in Fed communication, but the subsequent easing in financial conditions has been dramatic.

As a result, 2024 will be the year of the lagged effects of Fed hikes versus the Fed pivot. If the Fed pivot continues to push mortgage rates lower, stock prices higher, and credit spreads tighter, we could get a solid rebound in the economy over the coming months, particularly in housing, which will trigger a rebound in employment growth, see chart below.

Source: BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

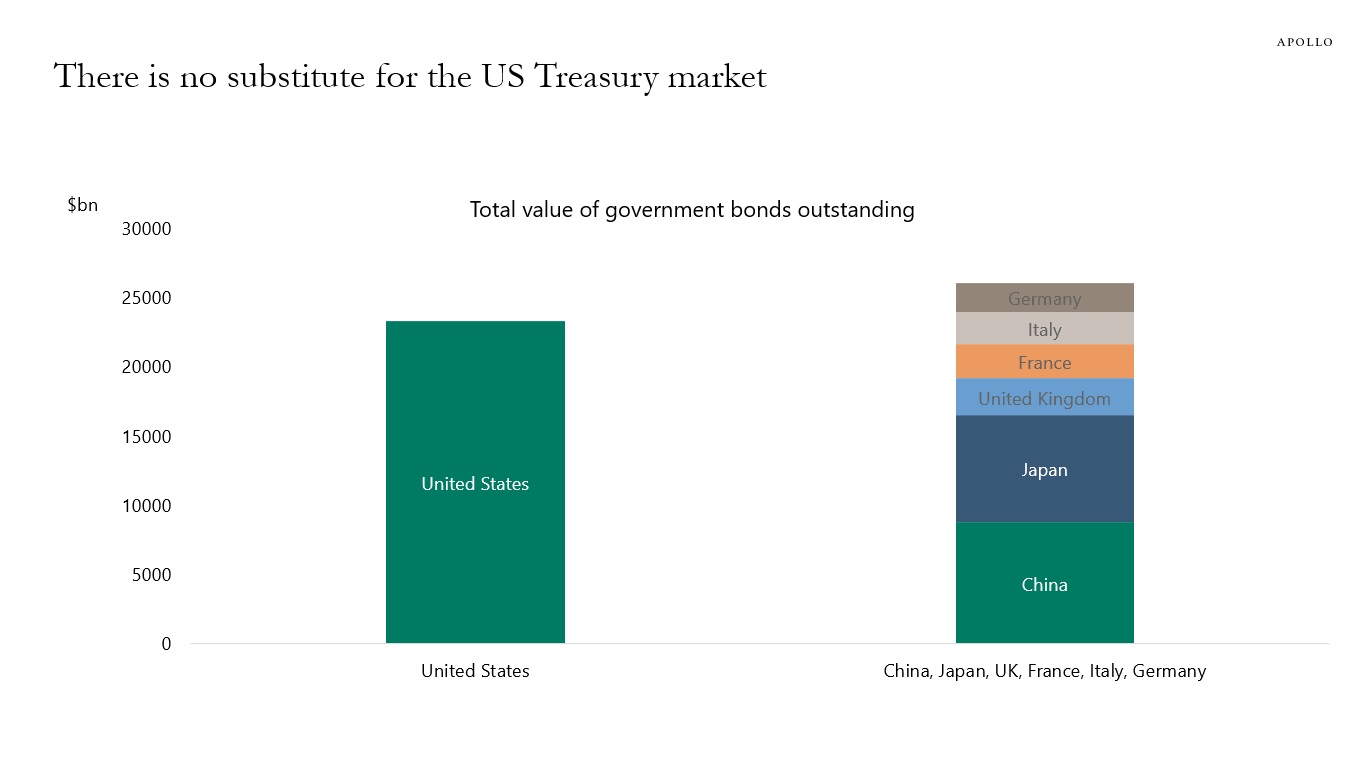

The US Treasury market is the same size as the combined government bond markets of China, Japan, UK, France, Italy, and Germany, see chart below.

The bottom line is that there is no substitute for the US Treasury market.

Looking into 2024, the list of upside risks to yields in the long end is long, with a big budget deficit, increasing Treasury issuance, the risk of a sovereign downgrade, the Fed doing QT, falling foreign demand for Treasuries, and a shift in issuance away from bills to coupons.

These forces are pushing long rates higher. But a dovish Fed pulls in the other direction.

Even if the Fed starts cutting rates, a steepener in the first half of 2024 seems most likely, with upside risks to long-term interest rates coming from factors unrelated to what the Fed will do.

In particular, if we get a soft landing in 2024, then both economic and non-economic forces could, by the end of 2024, push long-term interest rates higher than where they are today.

Source: BIS, Apollo Chief Economist. Note: Data for general government debt outstanding. Data for 2022. See important disclaimers at the bottom of the page.

-

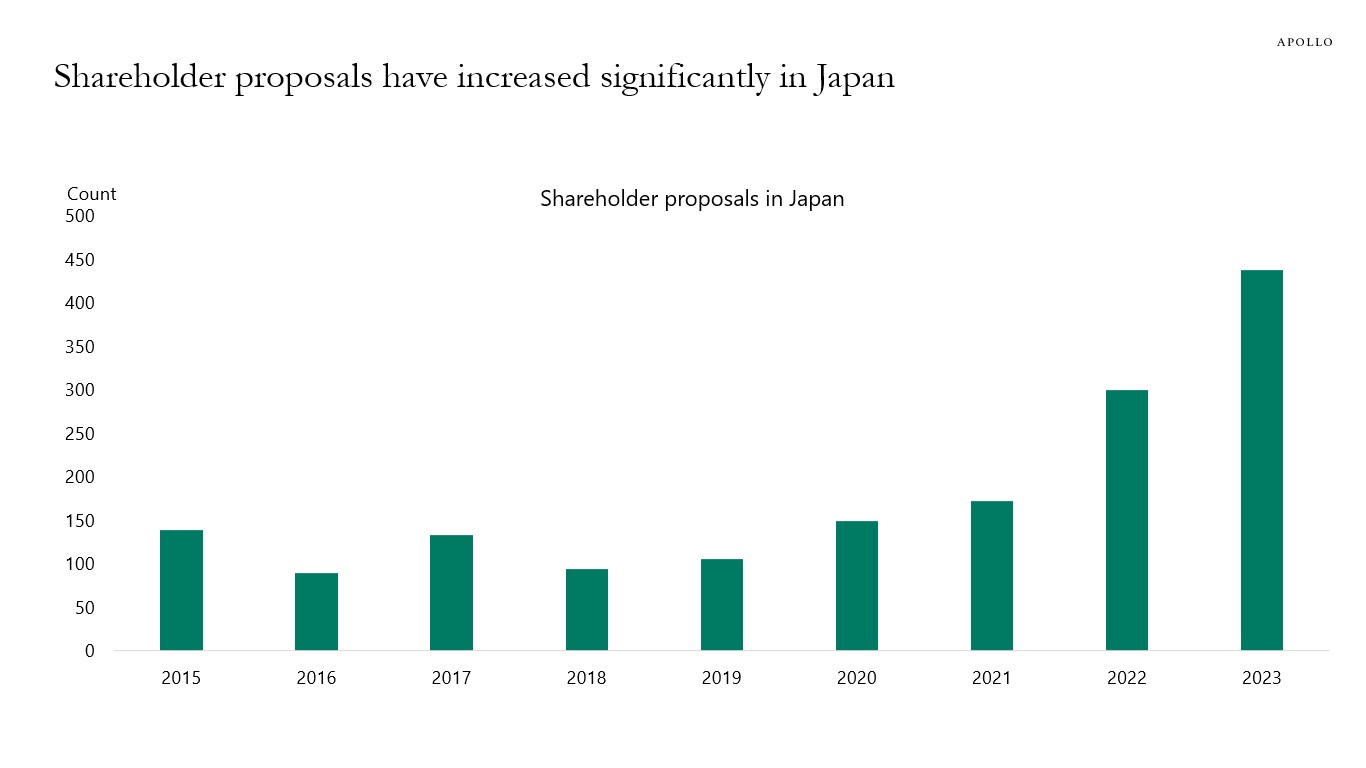

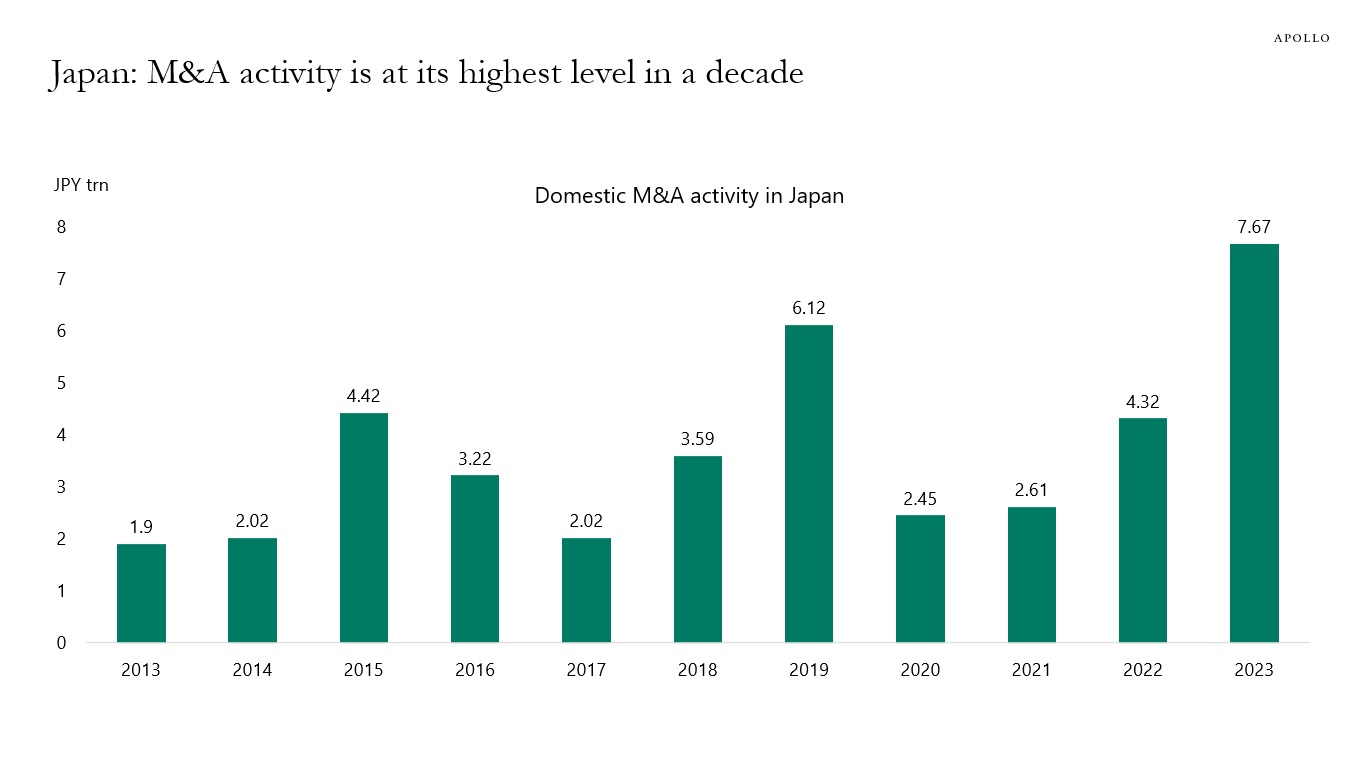

The Japanese economy has become more dynamic in 2023 with more shareholder proposals and higher M&A activity, see charts below.

Source: Bloomberg, Apollo Chief Economist. Note: Shareholder proposals include Approve Name Change, Approve Statutory Auditor, Business Operations, Charter/Bylaw Amendment, Climate Change Risk, Decrease Authorized Stock, Director Compensation, Discharge Directors, Dividend/Profit Distribution, Elect Director, Extend Poison Pill (Shareholder Rights Plan), Methane/Greenhouse Gas Emissions, Other Auditor Related, Other Board Related, Other Capital Structure, Other Compensation, Other Governance, Remove Director, Remove Poison Pill (Shareholder Rights Plan), Share Repurchase Related Proposals.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

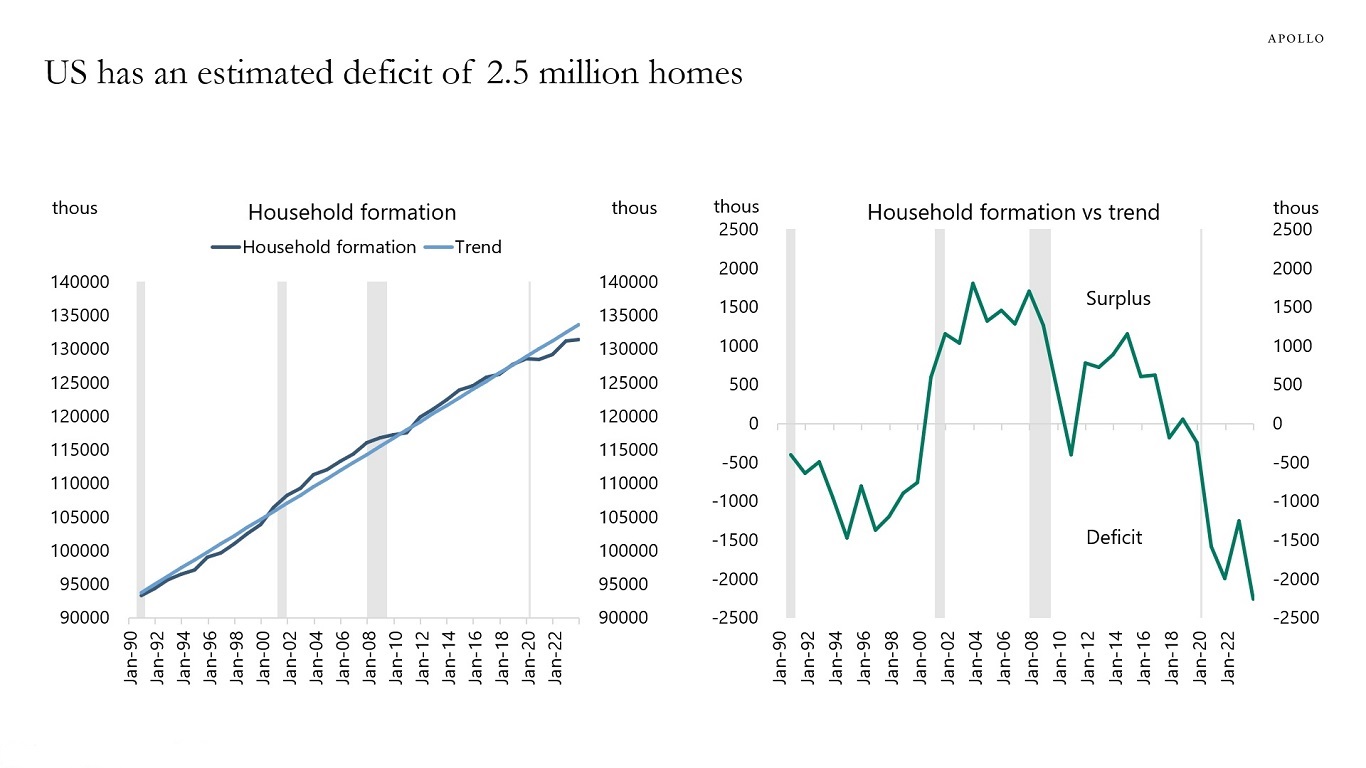

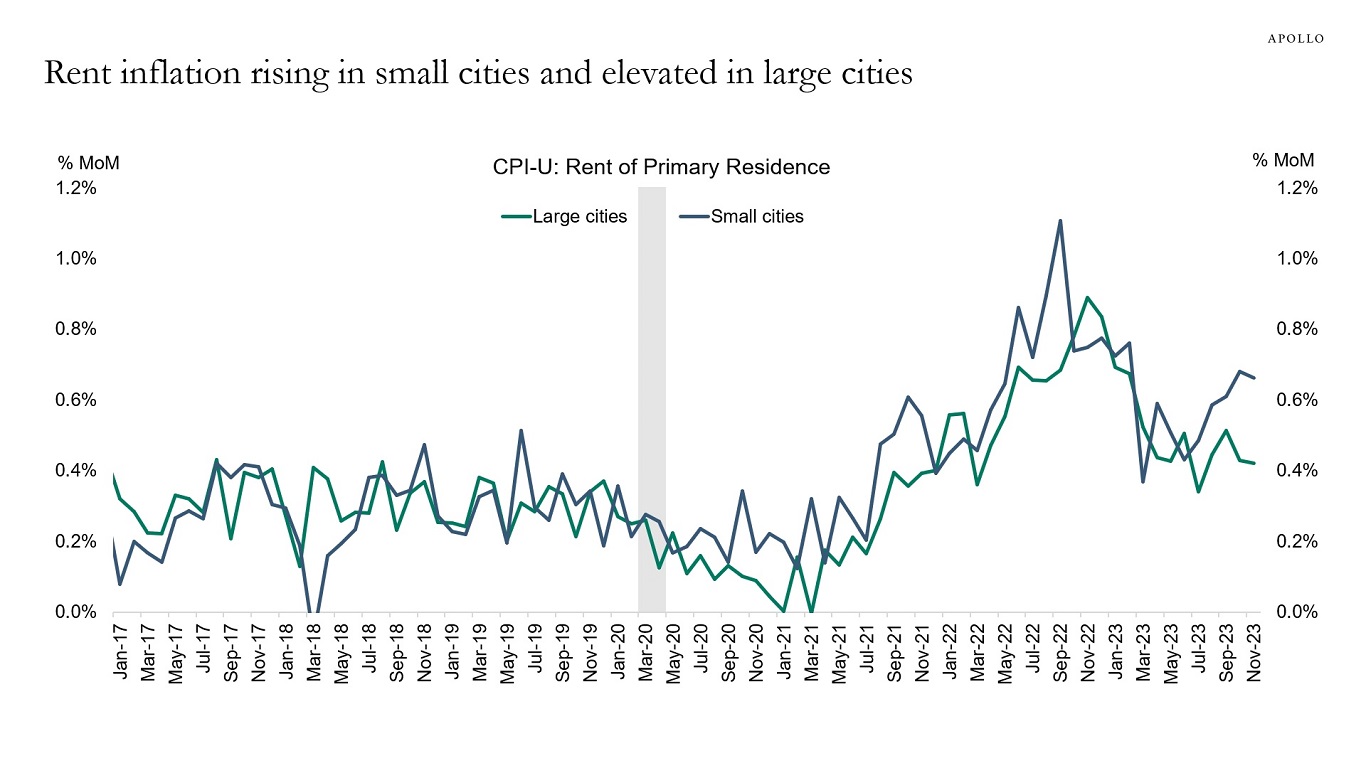

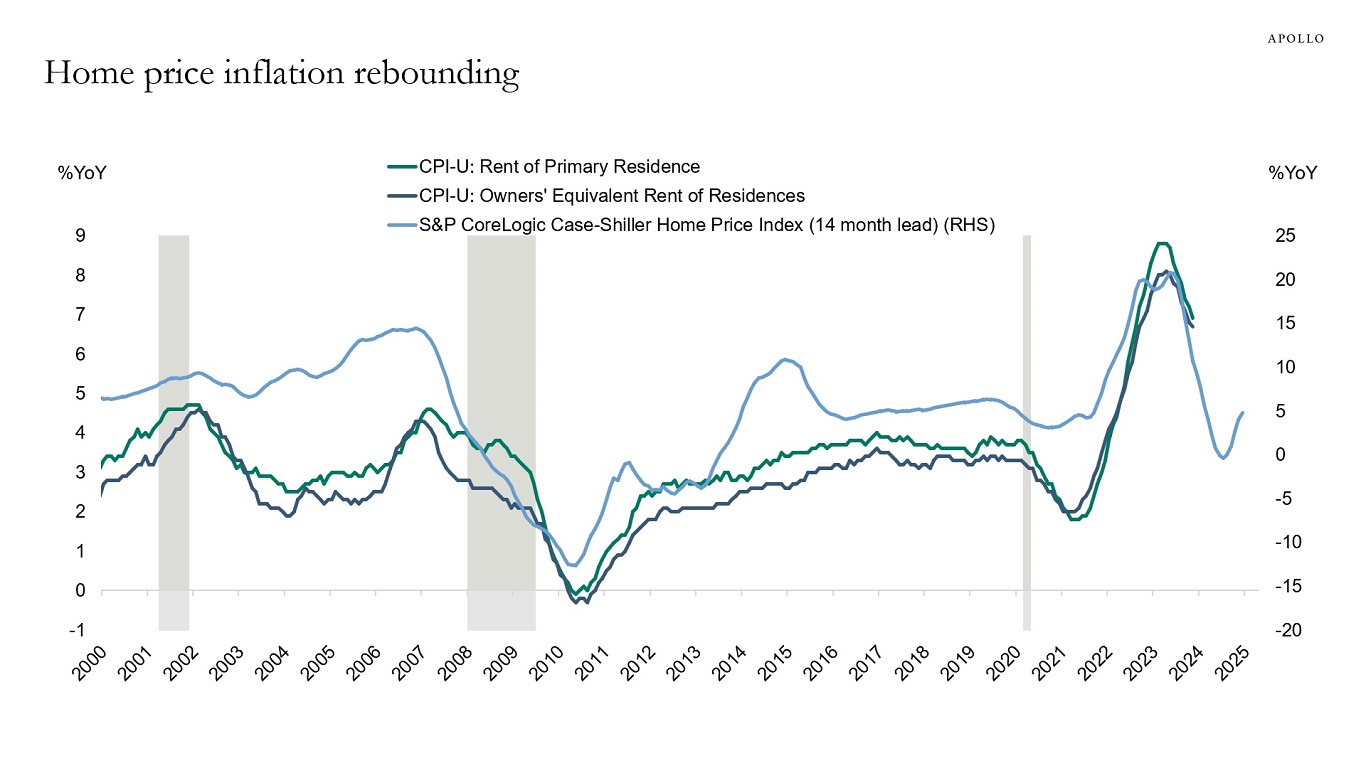

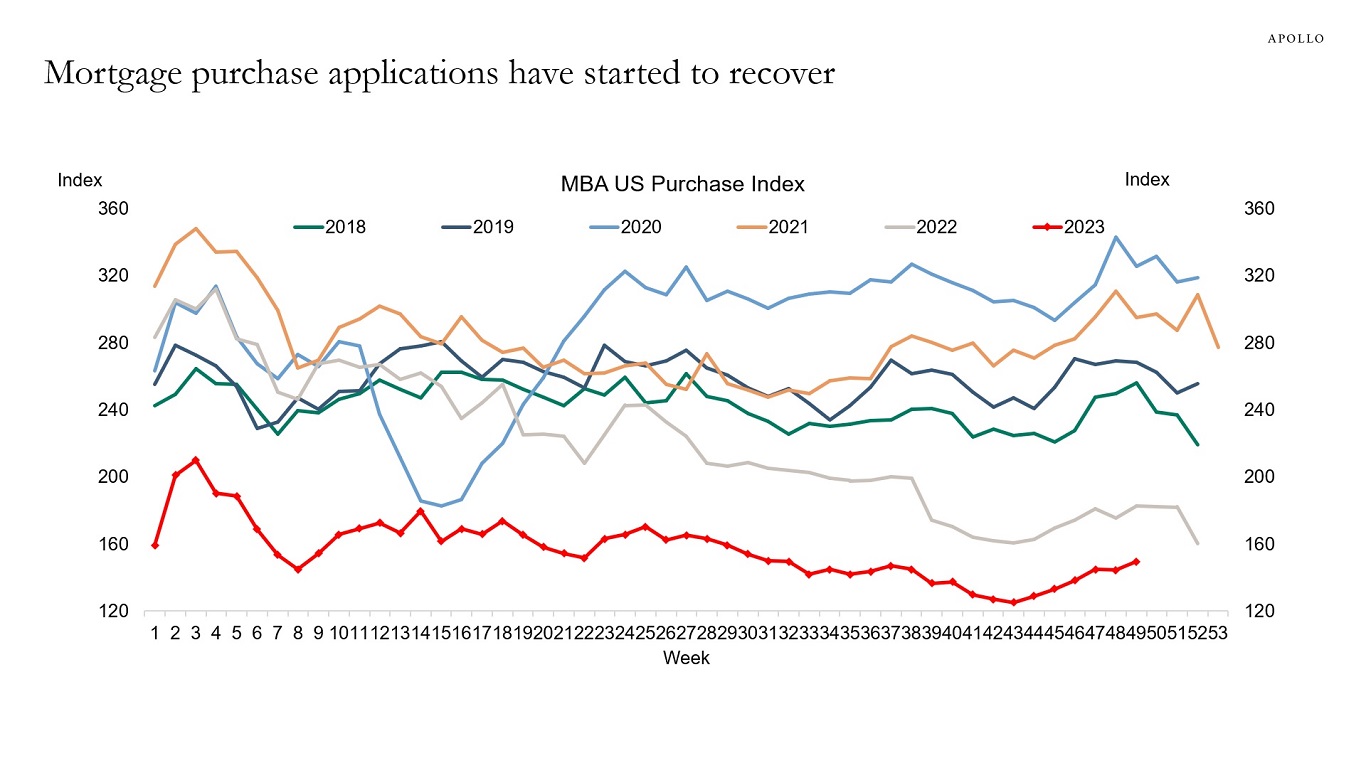

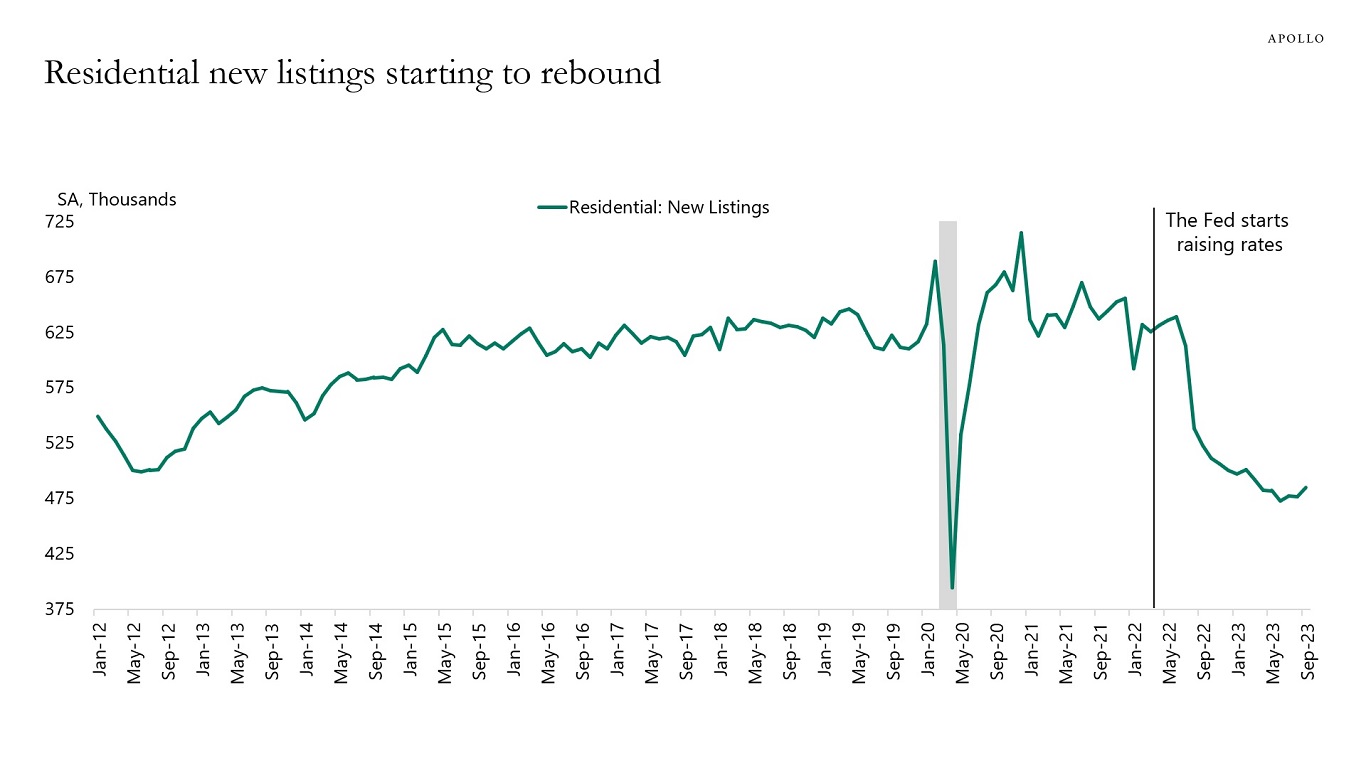

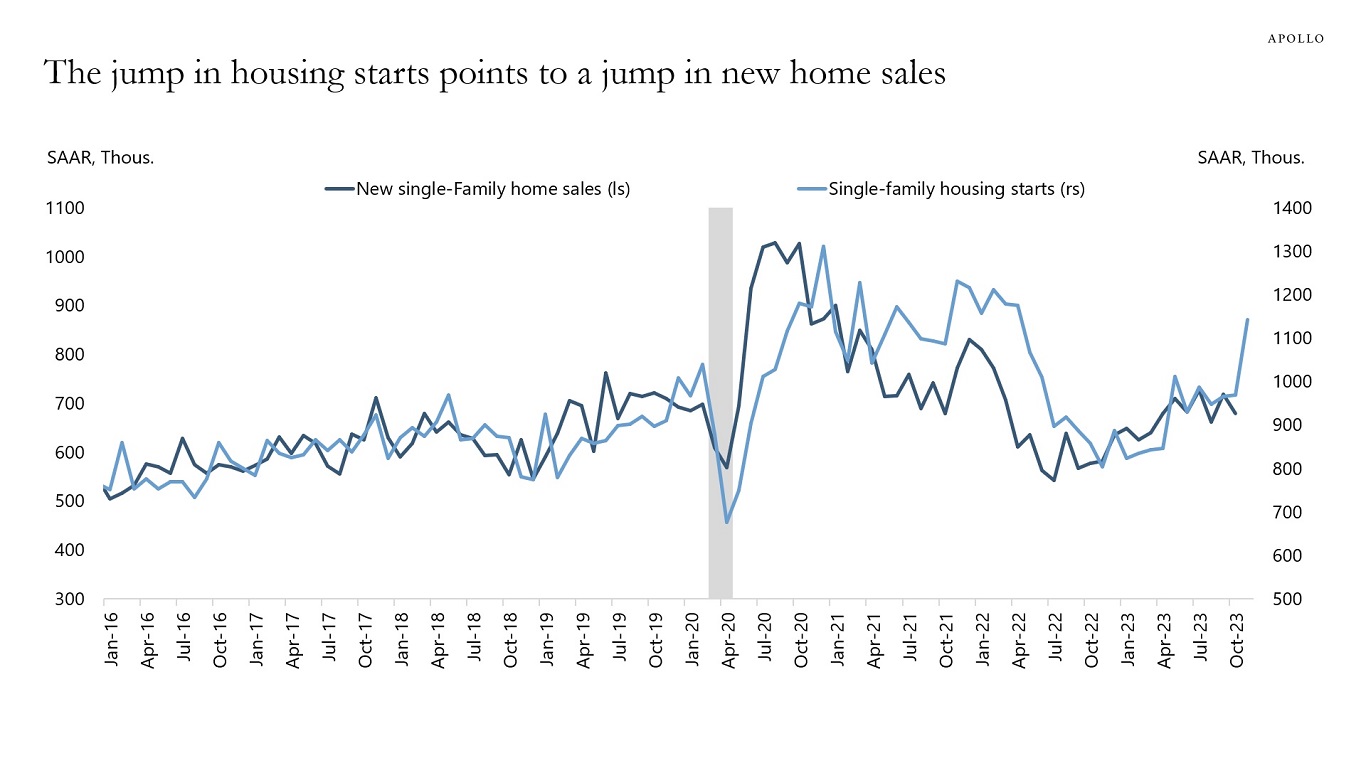

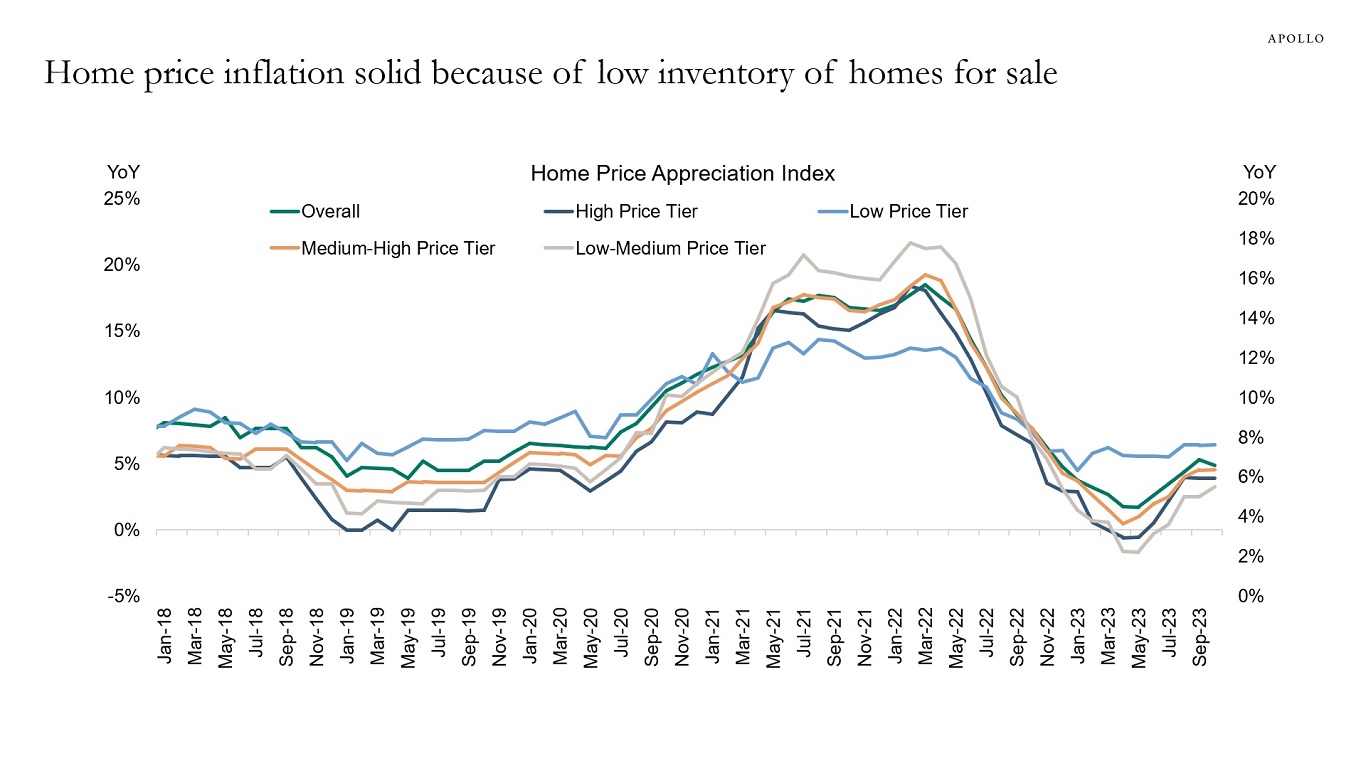

A recovery in the housing market has started, driven by the Fed’s pivot, rising consumer confidence, falling mortgage rates, solid job growth, solid wage growth, and pent-up demand. The Fed will soon be forced to reverse course and be more hawkish. Our latest US housing outlook is available here, key charts inserted below.

Source: Census, Haver Analytics, Apollo Chief Economist

Source: BLS, Haver Analytics, Apollo Chief Economist

Source: Haver Analytics, BLS, S&P, Apollo Chief Economist

Source: Mortgage Bankers Association, Bloomberg, Apollo Chief Economist

Source: Redfin, Haver Analytics, Apollo Chief Economist

Source: Census Bureau, Haver Analytics, Apollo Chief Economist

Source: American Enterprise Institute, Haver, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

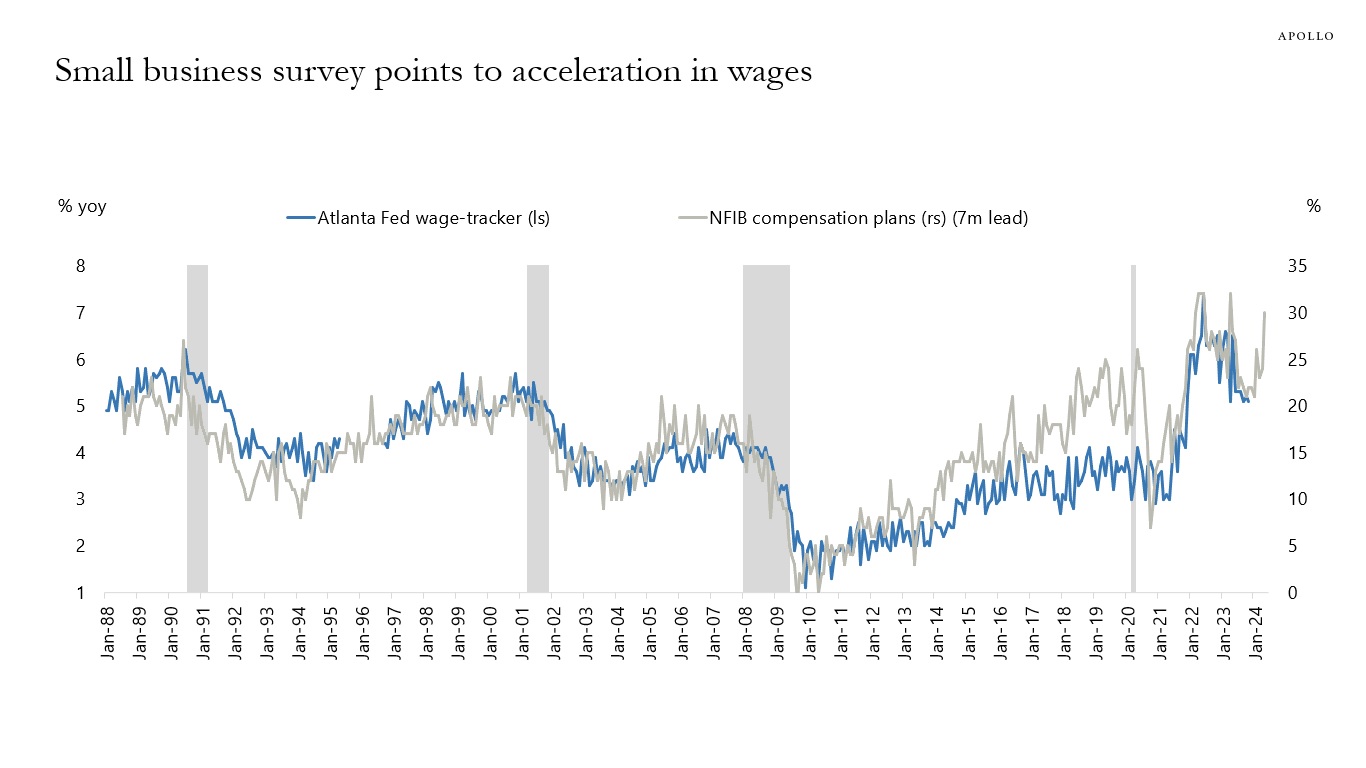

The NFIB survey of small businesses asks 10,000 firms if they plan to increase wages over the next three months. The recent acceleration in the share of firms saying yes suggests that wage growth could increase in the first half of 2024, see chart below.

Source: FRB of Atlanta, NFIB, Haver Analytics, Apollo Chief Economist. Note: NFIB: Net Percent Planning to Raise Worker Compensation in Next Three Months (SA, %). See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.